#Cash Plus Account Features

Explore tagged Tumblr posts

Text

Vanguard Cash Plus Account: An In-Depth Review

Understanding Cash Accounts:

Cash accounts play a fundamental role in personal finance, providing a safe and accessible way to manage your money. Whether you're saving for short-term goals, creating an emergency fund, or simply looking for a secure place to store your cash, understanding the basics of cash accounts is essential. In this article, we will delve into the key aspects of cash accounts, their benefits, and how they can fit into your overall financial strategy.

What is a Cash Account?

A cash account is a type of financial account that allows individuals to hold and manage their liquid assets, such as cash, savings, or short-term investments. Unlike investment accounts, which involve purchasing securities like stocks or bonds, cash accounts primarily focus on preserving capital and providing easy access to funds.

Features of Cash Accounts:

1. Safety and Security:

One of the primary advantages of cash accounts is the emphasis on safety and security. Cash held in these accounts is typically insured by government-backed programs, such as the Federal Deposit Insurance Corporation (FDIC) in the United States. This insurance protects your funds up to a certain limit, ensuring that even in the event of a bank failure, your money remains secure.

2. Liquidity:

Cash accounts offer high liquidity, meaning you can easily access your funds when needed. Unlike certain investment accounts with restrictions or penalties for early withdrawals, cash accounts provide flexibility and quick access to your money without any significant limitations.

3. Minimal Risk:

While cash accounts may not generate high returns compared to other investment vehicles, they are generally considered low-risk. The focus is on preserving the value of your capital rather than seeking substantial growth. This makes cash accounts a suitable option for individuals who prioritize stability and capital preservation.

Types of Cash Accounts:

1. Checking Accounts:

Checking accounts are the most common type of cash account. They are typically used for daily transactions, such as paying bills, making purchases, and withdrawing cash. Checking accounts often offer features like check-writing privileges, debit cards, and online banking services for easy access and management of your funds.

2. Savings Accounts:

Savings accounts are designed to help you accumulate funds over time. They often offer slightly higher interest rates compared to checking accounts, allowing your money to grow gradually. Savings accounts are well-suited for short-term goals, emergency funds, or holding money earmarked for specific purposes.

3. Money Market Accounts:

Money market accounts are a hybrid between checking and savings accounts. They usually offer higher interest rates than regular savings accounts and provide limited check-writing capabilities. Money market accounts are ideal for individuals who want to earn a slightly higher yield while maintaining the flexibility to access their funds when necessary.

Benefits of Cash Accounts:

1. Capital Preservation:

Cash accounts are particularly valuable for preserving the value of your capital. By keeping your funds in a cash account, you mitigate the risks associated with market fluctuations and potential losses, making it an attractive option for those seeking stability and security.

2. Easy Access:

Having quick access to your money is crucial, especially in emergencies or when unexpected expenses arise. Cash accounts provide the convenience of immediate access to your funds, ensuring that you can meet your financial obligations without any delays or complications.

3. Simplicity:

Cash accounts are straightforward to understand and manage. Unlike complex investment accounts that require knowledge of financial markets and various investment instruments, cash accounts provide a simple and transparent way to handle your money.

4. FDIC Insurance:

Most cash accounts offered by reputable financial institutions are insured by the FDIC or similar programs in other countries. This insurance coverage protects your funds up to a specified amount, giving you an added layer of security and confidence in the safety of your cash.

5. Diversification:

In a well-rounded financial strategy, diversification is key. Cash accounts provide a valuable component of diversification by allowing you to allocate a portion

Introduction to Vanguard Cash Plus Account:

Vanguard, a renowned investment management company, offers a diverse range of financial products and services to cater to the needs of investors. Among their offerings, the Vanguard Cash Plus Account stands out as an attractive option for individuals looking to effectively manage their cash. In this article, we will introduce you to the Vanguard Cash Plus Account, highlighting its features, benefits, and how it can enhance your overall financial strategy.

The Vanguard Cash Plus Account is designed to provide investors with a secure and flexible way to hold and manage their cash holdings. It serves as a versatile solution for individuals who prioritize capital preservation while seeking a potential for modest returns on their cash.

Key Features of Vanguard Cash Plus Account:

The Vanguard Cash Plus Account is a cash management option offered by Vanguard, a leading investment management company. Designed to provide investors with a secure and flexible way to hold and manage their cash, the Cash Plus Account offers a range of key features that set it apart from traditional cash accounts. In this article, we will explore the key features of the Vanguard Cash Plus Account and how they can benefit investors.

3.1. Safety and Security:

Vanguard places a strong emphasis on the safety and security of its clients' funds. The Cash Plus Account offers peace of mind as it is backed by Vanguard's solid reputation and commitment to adhering to strict financial regulations. This ensures that your cash is held in a secure and trustworthy environment.

3.2. Competitive Yields:

While cash accounts typically provide conservative returns, the Vanguard Cash Plus Account aims to maximize the earnings potential of your cash holdings. It offers competitive yields, allowing your cash to grow steadily over time. This feature makes the Cash Plus Account an attractive option for investors seeking a balance between stability and potential returns.

3.3. Easy Accessibility:

Vanguard understands the importance of easy access to your funds. The Cash Plus Account offers convenient online and mobile access, enabling you to manage your account and make transactions at your convenience. Whether you need to deposit or withdraw funds, monitor your account activity, or view statements, the user-friendly interface ensures hassle-free accessibility.

3.4. Low Minimum Investment:

Vanguard believes in making their financial products accessible to a wide range of investors. With the Cash Plus Account, you can open an account with a relatively low minimum investment. This feature makes it easier for individuals with varying financial goals and resources to take advantage of the benefits offered by the account.

3.5. Check-Writing and Debit Card Facilities:

The Vanguard Cash Plus Account offers check-writing privileges and a debit card option, providing added convenience and flexibility. With check-writing capabilities, you can easily pay bills or make larger purchases directly from your account. The debit card allows you to access your funds for everyday expenses, providing a seamless integration of your cash holdings into your daily financial activities.

3.6. Automatic Investment Service:

Vanguard's Cash Plus Account offers an automatic investment service that enables you to invest excess cash balances in a range of Vanguard money market funds. This feature allows you to put your idle cash to work, potentially increasing your returns and optimizing the utilization of your funds.

3.7. Integration with Vanguard's Suite of Products:

If you already have investments or other accounts with Vanguard, the Cash Plus Account seamlessly integrates with their suite of products. This integration provides a comprehensive view of your financial portfolio, allowing you to manage your investments and cash holdings in one place. It simplifies financial management and offers a cohesive approach to maximizing the potential of your overall investment strategy.

The Vanguard Cash Plus Account offers a range of key features that make it an attractive cash management option. With its focus on safety, competitive yields, easy accessibility, low minimum investment, check-writing and debit card facilities, automatic investment service, and integration with Vanguard's suite of products, the Cash Plus Account provides investors with a flexible and secure way to hold and manage their cash. Whether you're looking for capital preservation, potential returns, or convenient access to your funds, the Vanguard Cash Plus Account is worth considering for effective cash management.

Benefits of Vanguard Cash Plus Account

The Vanguard Cash Plus Account is a versatile cash management option offered by Vanguard, a leading investment management company. This account provides numerous benefits to investors who are seeking a secure and flexible way to manage their cash holdings. In this article, we will explore the benefits of the Vanguard Cash Plus Account in detail, highlighting how it can enhance your financial strategy and help you achieve your financial goals.

4.1. Capital Preservation:

One of the key benefits of the Vanguard Cash Plus Account is its focus on capital preservation. While cash accounts typically provide conservative returns, the Cash Plus Account aims to protect the value of your capital. It is designed for investors who prioritize stability and security for their cash holdings. By choosing this account, you can have confidence that your funds are well-protected, minimizing the risks associated with market fluctuations.

4.2. Competitive Yields:

Although cash accounts are not known for their high returns, the Vanguard Cash Plus Account offers competitive yields compared to traditional savings accounts. Vanguard's expertise in investment management allows them to allocate the cash held in the account across a diversified portfolio, seeking opportunities for higher returns. While the emphasis is on preserving capital, the Cash Plus Account provides the potential for modest growth over time.

4.3. Liquidity and Accessibility:

Another significant benefit of the Vanguard Cash Plus Account is its liquidity and accessibility. Unlike certain investment accounts that may have restrictions or penalties for early withdrawals, cash accounts offer high liquidity. The Cash Plus Account allows you to easily access your funds when needed, providing the flexibility to meet financial obligations or take advantage of investment opportunities. Vanguard offers convenient online and mobile access to your account, ensuring that you can manage your funds anytime and anywhere.

4.4. Low Minimum Investment:

Vanguard believes in making their financial products accessible to a wide range of investors. With the Cash Plus Account, you can open an account with a relatively low minimum investment. This feature is particularly beneficial for individuals who are starting with smaller amounts of cash or those who prefer to allocate a portion of their funds to a secure cash management option.

4.5. Check-Writing and Debit Card Facilities:

The Vanguard Cash Plus Account offers the convenience of check-writing privileges and a debit card option. This feature allows you to seamlessly integrate your cash holdings into your daily financial activities. You can use checks to pay bills or make larger purchases directly from your account, eliminating the need to transfer funds to another account. The debit card provides easy access to your funds for everyday expenses, making it a versatile and practical option for managing your cash.

4.6. Diversification:

By choosing the Vanguard Cash Plus Account, you indirectly benefit from Vanguard's expertise in investment management. Vanguard allocates the cash held in the account across a diversified portfolio of high-quality, short-term money market securities. This diversification helps to optimize returns while minimizing risk. It ensures that your cash is efficiently utilized, potentially generating additional income and growth opportunities.

4.7. Integration with Vanguard's Suite of Products:

If you already have investments or other accounts with Vanguard, the Cash Plus Account seamlessly integrates with their suite of products. This integration provides a comprehensive view of your financial portfolio and allows for streamlined management of your investments and cash holdings. It simplifies financial management, offering a cohesive approach to maximizing the potential of your overall investment strategy.

4.8. Risk Mitigation:

The Vanguard Cash Plus Account serves as a valuable tool for risk mitigation within your investment portfolio. By holding a portion of your assets in a cash management account, you can reduce the overall volatility of your portfolio. During periods of market uncertainty or economic downturns, cash accounts provide a stable and secure place for your funds, providing a buffer against potential losses.

4.9. Excellent Customer Support:

Vanguard is well-known for its commitment to customer service. If you have any questions or need assistance with your Cash Plus Account, their dedicated support team is readily available to help. Vanguard's responsive and knowledgeable customer support ensures that you have a smooth and hassle-free experience while managing your cash. Whether you need assistance with account setup, transaction inquiries, or general guidance, their support team is there to provide the necessary assistance.

4.10. Simplified Cash Management:

The Vanguard Cash Plus Account simplifies the management of your cash holdings. By consolidating your cash into a single account, you can easily monitor and track your funds. This simplification helps you gain a clearer understanding of your overall financial picture, making it easier to assess your cash position and make informed decisions.

4.11. No Account Maintenance Fees:

Vanguard is known for its commitment to low-cost investing, and the Cash Plus Account is no exception. There are no account maintenance fees associated with the Cash Plus Account, allowing you to maximize the growth potential of your cash holdings without incurring unnecessary costs.

4.12. FDIC Insurance:

Most cash accounts offered by reputable financial institutions, including the Vanguard Cash Plus Account, are insured by the Federal Deposit Insurance Corporation (FDIC) or similar programs in other countries. This insurance coverage provides an added layer of security for your funds, protecting them up to a specified amount per depositor. Knowing that your cash is protected by FDIC insurance can provide peace of mind and confidence in the safety of your investment.

Conclusion

The Vanguard Cash Plus Account offers numerous benefits for investors seeking a secure and flexible cash management option. With its focus on capital preservation, competitive yields, liquidity, low minimum investment, check-writing and debit card facilities, diversification, integration with Vanguard's suite of products, risk mitigation, excellent customer support, simplified cash management, and FDIC insurance, the Cash Plus Account provides a comprehensive solution for managing your cash holdings. Whether you are looking to protect the value of your capital, generate modest returns, or have easy access to your funds, the Vanguard Cash Plus Account is a valuable tool that can enhance your financial strategy and help you achieve your financial goals.

#succession#Vanguard Cash Plus Account#Cash Management Account#Money Market Fund#Investment Account#Cash Plus Account Features#Vanguard Financial Services#Cash App Alternatives#Cash Plus Account Benefits#Cash Plus Account Review#Vanguard Account Options#Cash Plus Account Interest Rates#Cash Plus Account Withdrawals#Vanguard Investment Options#Cash Plus Account Fees

1 note

·

View note

Text

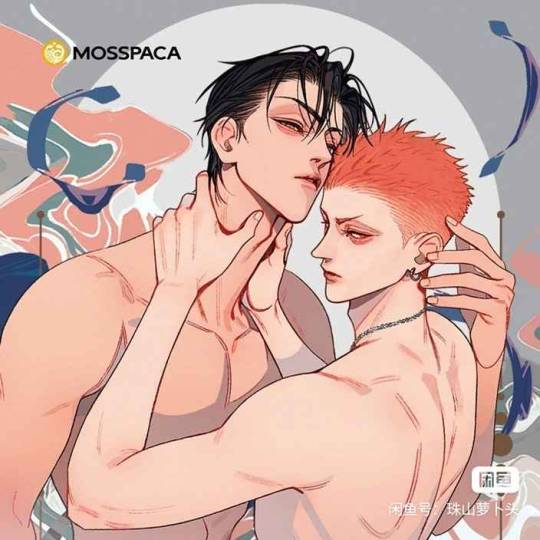

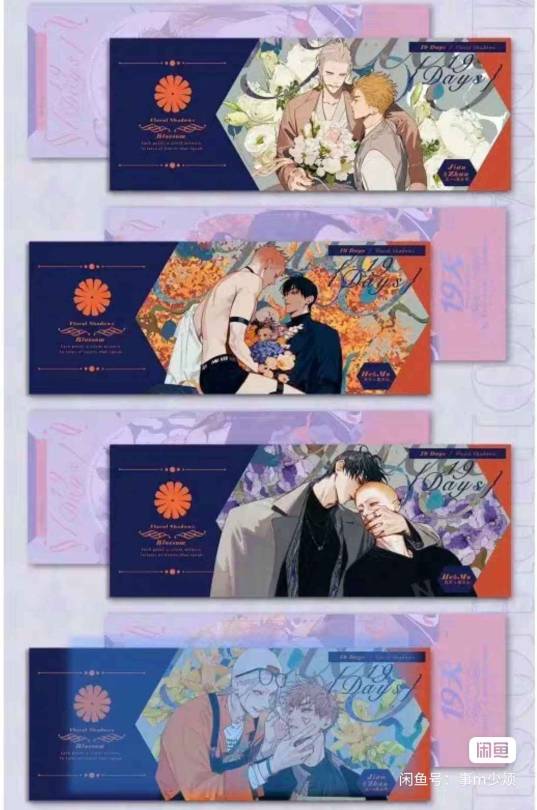

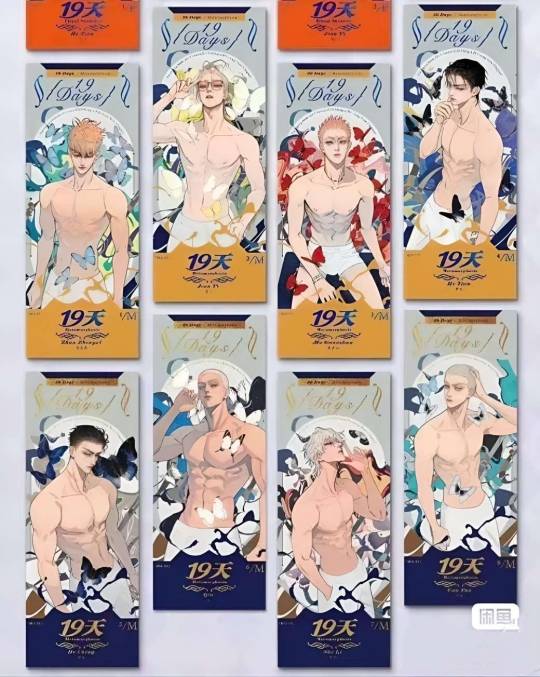

Alright guys, I'm here today to address the pictures of the alleged 'new merch' that had been circling around in the English fandom for a few days. See how I said 'English fandom'? Because nobody really addressed it on weibo and XHS yet… at least not to that extent. (Sorry, I have seen these screencaps on tumblr, insta, X and discord, and I have no idea who originally took them, I don't claim to have taken those screenshots, merely providing them here so you know what I'm talking about.)

So what happened? A few days ago a random shop on taobao created new listings that offered a new series of badges and prints/acrylics - not just featuring the 4 main boys, but also He Cheng, Qiu, She Li and… Cun Tou…..?! Now let's take a moment and sit back and think about this for a while. First of all: Why would a random shop that's NOT affiliated with mosspaca in any way post new 'official' merchandise? (Because we can see there's the mosspaca copyright writing on the badges and acrylics, just like it used to be on the previous badge series) Why would this random shop post these things while neither OldXian herself nor her boss, moss, have posted or announced anything via weibo/XHS? Don't you think this is sort of fishy? You don't find this strange, you don't question that at all? Sure, some people said: It's leaked and it will be available on the upcoming signing event on the 29th which OX announced on her weibo. Sure. There is a possibility, of course. They could have a leak in mosspaca studio and some person got their hands on some undisclosed merch and decided to make bank by making a new shop and listing the items for pre-order, hoping they could cash in. NOT a smart choice if you wanna keep your job because such incidents get investigated thoroughly and we all know by now that moss himself is very strict about these things and already has taken legal action against shops before when they sell fake merch as official merch. The other possibility? Old Xian's apple account has been hacked by an outsider and then the same scenario as before applies - that person wanted to cash in before it officially releases.

Now. How has OX handled merchandise before? It was always announced before an event and sometimes even months(!) in advance when they were pre-order items. Also. Have you ever seen Old Xian making merch for Cheng, Qiu, She Li and Buzzcut? Sure, the first 3 have been on some old postcards way back in the day, plus they are depicted in some of the artbooks, okay. But actual merch with them separately? The last badge series had a very limited special edition button with He Cheng. That was super rare. And now OX suddenly makes merch of the 2 adults, plus She Li AND Buzzcut, who's a minor character which barely makes an appearance? (Sorry, Buzzcut fans, not trying to be mean, just wanting to drive home the point that OX creating merch of him is highly unlikely - unfortunately.)

So what can we take home from all the stuff I just pointed out? Yep, there is a high chance that this is not official. It might be fake merch, sold by a random person who used generative AI tools and editing skills to create these things. I mean, sure, some of the pictures look highly convincing, I give you that. But then again, there are fanartists out there who can perfectly mimic Old Xian's style and edit/draw the boys in new poses that make it seem 'real' and official. But then there's THIS. Please take a close look at the way the faces are 'drawn', the way that the eyes are sort of smudged, same as some of the abs, the way Mo's face is contorted in a weird angle, the way the hands look chunky and unreal, and so on. (click on image to enlarge it and see it in more detail)

Weird, right? Well, it's a very common, typical thing for pictures that are generated with free AI tools. Everyone who has tried one or the other and has fcked around with one of those tools out of curiosity will notice.

Also - have you noticed the sheer AMOUNT of things posted from this one random seller? 10 different badges, 12 different long bookmarks (acrylic boards?), 4 couple cards, plus a LOT of other random new things which all feature very old panels from the manhua… When has Old Xian ever released SO MUCH merch at once? Yep. Never. Plus the re-using of old pictures for new merch? Also doesn't make much sense. And there's a lot of the older illustrations being used for these supposed new things here.

So if you take all of this into account, you might conclude that someone is tryna pull your leg here, selling fake merch disguised as official by even slapping the logo onto it to make it more convincing and mimicking how it looked the last time around. Of course - there might be the odd chance that mosspaca suddenly took a 180° turn and completely changed their modus operandi and decided to do things completely different compared to before and that it was leaked after all and meant as a surprise for the new autograph event etc etc etc. Yep. There's a chance that all this is true after all. But there's also a chance that I step out of my house tomorrow and an airplane crashes onto my head. Of course, that chance is *extremely* small. But the chance is there… So there you have it. All I'm asking you here, is to take a moment to think it through logically when you see these things online. And that you don't instantly believe everything that other people post who are always so eager to spread false information just for the sake of stirring up the fandom without ever taking the time to verify their sources. (No, I'm NOT taking a jab at anyone here who posted/reposted these pictures and was confused and/or asked about it. I was just as puzzled as you guys. But I am criticizing those who post it and announce that it's definitely new, official merchandise…) In conclusion: Might be true, but chances are very slim, all things considered. Let's wait until Tuesday when the event takes place and keep an eye on weibo and XHS - let's see which pictures the CN fandom will post when showing their autographs. Then you can check if there's new merch present. If not - well, then it's pretty safe to say that this was definitely fake. (And if this turns out to be real after all, I will make a follow-up post, regarding the AI-looking faces. But you might not like that 'lore' so I will not mention it for now, to prevent possible drama.)

#19 days#old xian#mosspaca#tianshan#mo guan shan#he tian#zhanyi#zhan zheng xi#jian yi#he cheng#brother qiu#buzzcut#cun tou#she li#merchandise

166 notes

·

View notes

Text

Disabled Trans folk in danger of power shutoff in heat wave

So, a lot of things have happened. We found out cousin's job's been lying to her about how much she'd really get per hour - so in reality she's only bringing home a hair over min wage (7.25 in MS). She was promised "income protection" at her tipped job for slow shifts to always end up at least $12 per hour.

We also have no reliable transportation. Both cars are currently broken down so we've had to rely on Uber and the occasional carpool when we can arrange one.

I have been struggling to function as it is because our central AC only barely functions when it gets 80s and above outside. I have dysautonomia and it's gotten to 82+ in my bedroom, giving me signs of heat illness bad enough my family's debated whether to get medical help. The severe excess sweating is causing constant skin infections for which I am now on long-term antibiotics. I have trouble staying awake during the day because of the heat. Previous landlord declared the AC in perfect working order for this region. Current isn't going to do more than he legally has to. We had to spend our own limited funds to buy a supplemental window unit.

We had been taken off housing assistance for a while because they wouldn't take my necessary medical bills/expenses into account. Now that my Medicaid case is decided, I'm trying to get us reassessed so maybe so much of our money won't have to go toward rent until I can help wife and cousin get better jobs.

Yesterday I got the notice our electric is scheduled for shutoff unless we pay $427.40 (plus the $1.60 "convenience fee" to make sure it processes instantly and no overdraft) We have just enough for this bill, but If we pay this amount, we may not have enough for the rest of the rides to/from work until next payday. We also won't have any food budget at all. We are also behind on water and gas but those utilities haven't issued shutoff notices (yet).

Tl;Dr, Outstanding bills:

I am beyond exhausted and on mobile and still need to fix my laptop from a recent accident. If anyone wants proof of things I'm saying I'll be happy to show you.

Past due energy: $429

Past due water: $119.68

Past due gas: $59.24

Food budget: we don't have one right now, there are 3 of us.

Pet care: $80 would help immensely toward dog/cat food and more litter.

We are current on rent.

Cash app $bekandrewttrpg

Tipping my blog/this post will work if that's still a feature

PayPal.me/ProTrashfire

#bek speaks#queer artist#trans artist#ttrpg community#mutual aid#emergency#climate crisis#signal boost#trans#trans mutual aid#queer mutual aid#disabled trans#donation post#paypal#cashapp#tips#queer creator

118 notes

·

View notes

Text

A simple date

(Jason Todd x Reader: MDNI, slightly OOC)

It’d been your sixth date with Jason, and he decided to take you out to the town fair. Smiling and laughing, Jason thought that as the last ride, you should both go on the Ferris wheel. You were a little nervous, as you had a slight fear of heights, but didn’t want to put a damper on the good time you were both having, so you agreed. Once on the ride, you clung on to Jason mostly out of fear, but also because it always amazed you how strong and muscled Jason was. And hot. God, he was hot. The moment the ride let you both off, you dragged Jason away, his playful teasing making you blush. “I wasn’t that scared.” You argued, and Jason relented, pulling you closer to him as he leaned down to kiss you. There was some heckling and some laughter, and for some reason, it caught Jason’s attention. You both looked up to see a guy dressed in t-shirt and jeans and a baseball cap, laughing with his buddies as he took on more picture of the both of you. You blush, feeling embarrassed, but Jason is already pushing you behind him, trying to shield you from their line of sight. “Hey man, that was a private moment you took a picture of. Can you delete that?” Jason asked, and you breathed in relief as Jason was using his words instead of his fists. That relief was short lived, as you heard the guy and his friends laugh, and he showed the screen of the photo he snapped; you and Jason kissing, and then it was the guy’s face in the corner of the picture making a suggestive face. “Yeah, I’m not going to do that. In fact,” he pressed the post button, and the picture posted on one of his social media accounts. Okay, at this point, you were scared for the guy. Jason took a step closer, straightening up his tall six-foot-three frame. Jason had a good three or four inches on the guy, but of course, the guy was with a group of friends, so he was feeling cocky. “I’ll ask you again; take down that photo.” Jason warned, and the guy laughed, slapping his knee as if Jason said the funniest joke he had ever heard. “Make me.” The guy said, as if daring Jason to punch him. And Jason did hear the dare, was ready to cash in on the guy’s words when- “Jason, I want to go home now!” you called out, trying not to make the scene even worse. “You heard that, Jason? You lady wants you to take her home. Put on your big boy pants, and get out of here.” The guy replied mockingly. Jason glared into his soul, and before he could go back to you, the guy dumped his blue slushy all over Jason’s head. At this point, you walked up and grabbed Jason by the arm, pulling him away, and Jason let you, because he knew you were right. He knew it was wrong to beat the life out of this man, but Jason was also very anxious to get home, opening the door for you to get in his truck, and sliding the key to his ignition, the truck rumbling to life. The drive back was met in silence, and you looked over, trying to read Jason’s face. Blue liquid clung to his forehead and face, and you reached the glove compartment and grabbed some napkins, careful to wipe his face off. “I didn’t want you fighting anyone. I know you’re capable of holding your own, but I just didn’t want you to get hurt.” You told him, and he looked at you, his features softening as he gazed upon you. “I’m not mad at you. It’s just…I struggle with my temper. Especially when that guy…but yeah. I didn’t want to ruin the night, and the night got ruined anyway.” He chuckled, awkwardly. “Not true. I had a great time with you.” You replied, and he leaned over to give you a quick kiss as he pulled to a stop at the red light. “Mm, plus you taste like blue raspberries.”

When you both get home, you head over to the bedroom while Jason wanders off to shower, and you fall back on the bed, flicking on the lamp. You almost have a heart attack as you see a guy standing in the corner wearing a blue and black suit, a mask on his face.

Jason had already taken the post down on his phone before he even got in his truck to drive Y/N back to their house. He could feel anxiety churning at his stomach though; if Tim was scouring through the web like he usually did, it wouldn’t take long to find that fucking picture. Or the location. Jason had gone into hiding two years back, and hadn’t reached out to any members of the BatFamily. He’d done it for some distance, but mostly for himself. It was time that Jason’s main focus was on himself rather than the never ending dramas that were held in the Manor, in the Batcave, in Gotham. Taking a step out of the shower, Jason decides to let off some steam and going out to hunt the guy that took that picture. As he wiped the water off himself, and wrapped a towel around his hips, he turned and froze, seeing someone lean against the door frame of the bathroom door. “Showering with the door open? You’ve gotten real comfortable with this girl.” Timothy Drake says, geared in his Red Robin suit. “What the hell are you doing here?” Jason asks instead, and Tim falters for a bit, before perking right up. “I finally found you! You were off grid pretty well for the last two years, but I never stopped scouring the internet for any tryp of whereabouts for you. Come to find out that you’re here in Noweheresvill, USA with a really cute girl.” Tim replied, smiling at Jason. Jason ran a hand though his damp hair, glaring at the ground. “So what’s the cute girl’s name? How did she react when you told her you’re Red Hood-“ “Tim, can you not? I haven’t told her that I’m Red Hood because I haven’t found a need to.” Jason interrupted, causing Tim to frown. “But you did tell her what you use to do right? You did talk to her about your family, right?” Tim asked, and Jason shook his head, causing Tim to go pale. “Oh…then she’s probably not going to take it well.” “What do you mean by that? You came alone, right-hey! Where are you running off to?” Jason cried out, chasing after him. They headed to the room where you and Jason slept together, the door slamming open, and Jason swears as he sees his older brother Dick Grayson in his Nightwing suit sitting on a chair across the bed where a very much freaked out Y/N sat, clutching a pillow to her chest. “Jay, these people,” your eyes flicked to the other brightly suited up person, “they say that they know you, is that true?” Jason sighed, as he glared at Dick and Tim. “It’s kind of a long story but firstly,” To Dick and Tim, “can you both get the fuck out so I can at least get dressed?” And like nothing, they dip out of the room, heading to wait for Jason and Y/N in the living room. Jason looks at you for a long time, wondering how the hell he was going to explain all of this to you.

#my writing#simple thoughts#fanfic#jason todd x reader#jason todd x you#jason todd#dick grayson#tim drake

144 notes

·

View notes

Text

600, or a musing on resilience and love

Hello all you wonderful figthusiasts! Today is the day that I hit 600 fan figs on my spreadsheet total (not all in hand, the vast majority are in some stage of production or transport), and I wanted to take a minute to stop and celebrate what is, by all accounts, an incredible number.

This is less about me (and my perhaps fiscally-questionable use of disposable cash) and more about the fact that more than 600 individual figures of Gong Jun and Zhang Zhehan were produced and made solely by fans. That this many actually exist in the world. What this is about, above all other things, is about love, and resilience, and the awe-inspiring, unstoppable combination of both.

I don't normally talk about the current situation with Zhang Zhehan and Chinese entertainment, because this blog is meant to be a little island of happiness and fun for us that love this show, love these two actors, and love seeing cute renditions of them. But 600...well, 600 feels powerful. It feels like something worth talking about.

This fandom has had half of our vibrant, beautiful soul ripped from us in the nastiest, cruelest, most contemptible way possible. This is greed and evil in the most overt form I've seen in the world, and it was horrifying to watch it unfold that August.

As overseas fans, we at least can still see Zhang Zhehan's past works, post videos and photos of him, and freely say his name as much as we want. The Chinese fandom cannot. Zhang Zhehan has been so comprehensively erased from Chinese media that he cannot even use his own name. The fandom can't even search for his name online, his pictures and videos have been removed, and any of the shows or movies that feature him that remains still available has him (literally) scrubbed from the screen.

This is what I see when I search for Zhang Zhehan on Taobao, Weidian, and Xianyu:

The Chinese fans have taken matters into their own hands, and stood up and fought back and refused to forget him. The fig makers, the doll makers, the merch makers - all of these incredibly brave, loyal, and loving fans have gone out there and dedicated thousands and thousands of hours of their own time and their own money to keeping his memory fresh, his work front and center, and his light constantly burning.

They took him from the fans, but they can't make the fans let him go.

Luckily, the fandom still has the other half of it's soul, and continues to celebrate Gong Jun and his accomplishments, and his own fiercely loyal and great heart, and celebrates the love and affection and care these two souls have for each other. Zhehan promised Junjun forever on May 5th, 2021, and the fandom honors and helps keep his promise.

Think about it. Six-hundred-plus fan-created figurines of the two of them. I don't even own all the fan figs - there's absolutely more than this, I'd estimate closer to 700.

There's Wenzhou figs, of course, but random side character in a long ago TV show? Check. Main characters? Check. Appearance(s) on a variety show? Check. Ad campaigns? (Lots of) magazine shoots? Check check. Casual airport outfit? Workout pose? Douyin moment? any number of Weibo posts? Livestream? not just one, not just two, not just three, renditions of childhood photos? Check check check.

And the figs are still coming. I have a whole list of figs in sketch form sitting in my Weidian cart, waiting to be opened for deposits. One after another, fig makers dipping deep into their precious hoards of recorded shows and magazines and photos and videos of Zhehan, designing one fig after another. Every time Junjun wears some fancy new designer outfit, fans are hard at work pairing that look with a complementary one from Zhehan's archive, determined to keep these two front and center in a country where they can't even type Zhehan's name into a search engine without it being censored.

My respect for the Chinese fandom and the fan creators is immense. They have souls of steel. Every time I hold one of these figs in my hand, and marvel at the cleverness and creativity and all the fine little details, I feel the strength of that connection to them, that iron determination, the fierce will to persevere, that pride and joy, and the love that can't be stopped. 坚强 indeed.

Yeah, 600+ figs is a trauma response, no question. For the fan makers and the fan buyers. But it's a response, all right. Today I have 600 and more tiny (giant) shouts of, you can't stop us, we're going to keep loving and celebrating and remembering him no matter what happens.

It's incredible. I don't know why 600 is the number that really hits me - I had thought it would be 500, but I blew past 500 without blinking in a frenzy of late night and early morning fig drops, and then it was Gong Jun's birthday, and a tidal wave of love and figs, and now here I am. I was at 598 yesterday and already today I'm at 612. I'll be at 700 before I know it, with a lot of remainders starting to be released and the Spring Festival coming up.

I have less than 200 fan figs actually at home, and it's ... a lot. My husband asked me a while back, staring at my display shelves, so, what's the end game here? and I just looked at him, and said, I don't know.

I really don't. I have to believe this is totally unprecedented, but then again, what happened to him is totally unprecedented. The only thing I know that if the fans keep making them, I'm going to keep supporting them.

So here's to resistance, and resilience, and love. Here's to the fans staying strong, and here's to Gong Jun and Zhang Zhehan. It's going to be a glorious sunrise on the mountaintop when it comes.

106 notes

·

View notes

Text

Discover the Best Rummy App to Play and Win Real Cash – Rummy Nabob

Rummy has long been a favorite card game among enthusiasts, combining strategy, memory, and a little luck for an engaging experience. With the rise of digital gaming, playing rummy on mobile apps has become popular, offering an easy way to enjoy the game and win real cash. In this article, we’ll explore Rummy Nabob, a top choice for playing rummy, and cover everything you need to know about Rummy Nabob APK download, the 51 bonus, and other ways to get the best experience from this real money rummy app.

Why Choose Rummy Nabob?

If you’re on the hunt for the best rummy app for real money, Rummy Nabob offers some of the most attractive features and bonuses. Designed with a user-friendly interface and backed by secure payment systems, Rummy Nabob provides a smooth gaming experience. Players can join different rummy variants, from Points Rummy to Pool Rummy, with options for beginners and seasoned players alike.

With the added bonus of winning cash, Rummy Nabob attracts users looking to sharpen their skills and compete for real rewards. New players are especially drawn to the Rummy Nabob 51 bonus, a welcome reward that gives an instant boost to start their gaming journey without an initial investment.

How to Download Rummy Nabob APK

If you’re ready to start playing, the Rummy Nabob APK download is a quick and simple process. Follow these steps to download and install the app on your Android device:

Search for the Rummy Nabob APK: Since some rummy apps may not be available on Google Play due to regional restrictions, you might need to visit the official Rummy Nabob website or a trusted APK download site.

Download the APK file: Once you locate the download link on the site, click on it to download the file. Ensure that you download it from a secure source.

Install the App: Once downloaded, open the APK file. You may need to enable the "Install from Unknown Sources" option in your device settings. Follow the prompts to complete the installation.

After installation, open the app and register for an account to claim the Rummy Nabob 51 bonus. This quick setup will have you ready to explore the exciting rummy games on offer.

Benefits of Playing on Rummy Nabob

Rummy Nabob isn’t just a platform to play rummy—it’s a complete gaming ecosystem with benefits for both beginners and experienced players. Here are some of the top features of this platform:

Cash Rewards: Rummy Nabob allows players to win real money in each game. Depending on the game format, you could win cash prizes that can be instantly withdrawn.

Bonus Offers: New players benefit from the Rummy Nabob 51 bonus, a free bonus on sign-up to help them start their rummy journey. Additional bonuses and rewards are available for regular players, which include deposit matches, cashback, and exclusive rewards on festivals and special events.

Secure Transactions: Rummy Nabob is committed to secure transactions, giving players peace of mind. The app integrates trusted payment gateways for easy deposit and withdrawal processes.

Diverse Game Formats: Whether you enjoy Points Rummy, Deals Rummy, or Pool Rummy, Rummy Nabob has it all. Players can choose their preferred variant and even participate in tournaments for higher rewards.

24/7 Customer Support: The app offers round-the-clock customer support to assist with any technical or account-related queries. This is a huge plus when playing for real cash, ensuring that any issues can be resolved promptly.

The Appeal of Real Money Rummy Apps

For rummy enthusiasts, the chance to play rummy and win cash has brought a fresh level of excitement to the game. Unlike playing for points or simply practicing, real money games come with higher stakes, making each round more thrilling. Rummy Nabob’s platform provides an ideal environment for this, with quick cashouts and reliable gameplay that makes it one of the best rummy apps for real money.

In addition to the cash benefits, these apps also provide a structured environment to improve rummy skills, learn from fellow players, and compete in exciting tournaments.

New Rummy Apps and the Growing Popularity of Rummy Nabob

The demand for rummy apps has led to a wave of new rummy apps, each offering different features and bonuses to attract players. However, Rummy Nabob stands out due to its user-focused features, rewards, and seamless experience.

For players who are new to online rummy, finding the best platform is essential for a positive experience. The Rummy Nabob app continues to draw users thanks to its user-friendly interface, great rewards, and ease of use.

How to Maximize Your Wins on Rummy Nabob

Once you’ve completed the Rummy Nabob APK download and claimed your Rummy Nabob 51 bonus, here are some strategies to enhance your gameplay and increase your chances of winning:

Practice Regularly: Playing regularly helps build your skill level. Most rummy apps have practice tables, where you can try out new strategies before entering cash games.

Start Small: If you’re new to cash games, start with smaller bets. This will help you get comfortable with the process and rules without risking too much of your balance.

Understand Game Variants: Each rummy variant requires different strategies. Try out different formats on Rummy Nabob to identify which suits you best and focus on that variant to improve your skill.

Claim Bonuses: Rummy Nabob regularly updates its bonus offers. Check the app frequently to maximize rewards and boosts to your balance.

Set Limits: To maintain a positive gaming experience, always play responsibly by setting time and cash limits for yourself.

Conclusion

Rummy Nabob offers a fantastic combination of competitive gameplay, exciting bonuses, and a secure platform to play rummy and win cash. The app is easy to download, and with the initial Rummy Nabob 51 bonus, it provides an excellent entry point for new users looking to dive into online rummy.

With plenty of new rummy apps on the market, Rummy Nabob remains a top choice for those seeking to play rummy for real money in a safe, rewarding environment. Whether you’re a casual player or a dedicated rummy enthusiast, this app offers something for everyone, and with the possibility of real cash wins, each game becomes an opportunity to put your skills to the test.

So, don’t wait! Download Rummy Nabob APK, claim your bonus, and get ready to enjoy one of the best rummy experiences available today.

#online money making app#rummy nabobz withdrawal#rummy nabob 51 bonus#rummy nabob apk download#play rummy win cash#best Rummy app for real money#new rummy app#real money rummy apk#rummy nabob online

2 notes

·

View notes

Text

OurHome App - Agere Review

Ciao lovelies! Like many of you, agere / age regression has changed my life for the better in many ways, helping me cope and encouraging my creativity and fun spirit. There has always been one thing I wanted agere to help me with, though, and that is life organization / task management! I do have a planner, and a calendar system for all my events, etc, but I really wanted something with more daily applications that could improve my daily life, help me remember to do tasks, and be linked to my age regression headspace. And then I found this app called “OurHome,” and I absolutely love it, which is why I want to review this app for you today and talk about how I use it for my daily tasks!

DISCLAIMER: OFT and Lunaria are NOT sponsored by OurHome, the Apple App Store, or any other brand mentioned within the following post. The following review contains NO affiliate links or paid promotions, and is solely my personal opinion regarding this app based on my own experiences.

How I found this app:

I found out about the OurHome app from Tumblr, actually! The user who posted about this app has since changed blogs and is now a 18+ blog, so I don’t feel comfortable linking them here, my apologies.

What is OurHome?:

The OurHome app is essentially a virtual to-do list, but connected to others! You can use this app with fellow regressors, or a CG if you have one. The idea is that you create a “Family” to add users to, and you can add tasks, reward points, rewards, due dates, etc.

How I use OurHome:

My explanation of this is probably going to be pretty long, but I’m including lots of tips for use of the app and other ideas, so it’s worth the read!

Setup:

My CG and I use this app together. We set up our Family unit as “The Moon Family” (You can name your family whatever you want). For us to use this app, we both needed to download it on our separate devices, and my CG set up the Family account. From there, he sent a link to my email that I used to make my account as a part of the Moon Family. After that, we were connected on the app, super easily, and then we began customizing.

Goals:

I had made a journal page about things I wanted to improve on in day-to-day life, and I showed this to my CG. Using that page, we decided upon daily, recurring, or even weekly tasks for me. It was very important to me that this process was not just his ideas, but also my input and agreement. I knew that if we worked together on deciding these tasks, I’d be more likely to see the weight behind them and be happier to keep up with them. Plus, it’s very nice knowing that not only am I doing the tasks for reward points, but because the tasks are so closely linked to my own personal goals, I’m also doing them for myself!

Task Setup:

The app has a LOT of customization options. For example, I have a recurring daily task to take my meds. This task gives me a notification every day at a specific time to ensure that I don’t forget. There are tasks that aren’t daily, as well, such as my “Laundry” task, which reoccurs weekly. We can also add one-time tasks for special events like picking up prescriptions or fun tasks like “send a selfie to -CG- with Buu (my cat).” Being able to adjust frequency and type of task is a helpful feature that I really like, but it’s not the only cool thing in this app.

Rewards Setup:

I also really love how customizable the rewards system is. You can base it on points or tasks completed, and as you earn points, you can choose to save up for larger rewards or cash in whenever you want! My CG set up some rewards for me with my help in adding options. The big goal (2000 points) earns me a surprise gift, or if I don’t want to save that long, there are other options like Boba date (500 points). Having the system this way gives me a sense of autonomy while still helping me stay encouraged to do my tasks.

Points and Due Dates:

Tasks can also be assigned due dates, and can have late penalties which can take away existing points or reduce point value for completing tasks. I like the latter of those options, as I can be forgetful, and I don’t get discouraged by my existing points disappearing. This option allows for me to see the consequences of not doing tasks without feeling discouraged or losing motivation.

My Fave Feature:

Oh, and the best feature in my opinion? If my CG notices that any of my tasks are not complete, he can send a little reminder notification to me which shows up as a “Gentle nudge.” He can do this with a simple tap, and it’s easy for him, which makes him happy. Plus, I like this because it’s a kind reminder without forcing my CG to constantly remind me via text or check ins on the phone.

Other Customization Perks:

Oh, and you can add comments or photos to tasks and completed tasks, track completed tasks, you have access to an activity feed of all completed tasks and claimed rewards… There is a LOT to love here.

Did I mention that you can add custom profile photos for yourself and your CG? The app provides some cute ones to choose from if you don’t want to upload anything, my CG and I are currently using the defaults, he is a turtle and I am a cat. Though, with how popular picrews are in the agere online space, I can totally see this feature being a good place to use some picrew images!

One Feature I Don't Use:

There is a feature in this app that I don’t use, mainly because I don’t currently live with my CG, but this feature could be super useful for agere roommates or even for possibly planning trips/outings together. The feature I’m referring to is the shared grocery list! This feature allows you and anyone else in the family account to make a cumulative grocery list. Which means each of you can add things that you need/want. For roommates, the benefits are awesome for grocery shopping or notifying each other of when things run out. For those who don’t live together, you could use this as a wishlist, christmas list, birthday list, etc.

(Side note, typing out the grocery list feature has me thinking… why don’t I use this with my CG?? Maybe we’ll check out the options next time we see each other.)

Luna’s OurHome Ratings:

User Experience: 5/5, I am always pleased to see such possibility for customization on something like this, and navigating the app is pleasantly easy!

Useful: 5/5, I find this app very useful for my needs! It has many great features that I highly enjoy.

Accessibility: 5/5, As far as I can see, this app is available across both iPhone devices and Android devices.

Overall? I’d say, based upon how many awesome features this has and how it’s hard for me to give this anything but a glowing review, I rank this app overall a 5/5!

I hope this review can help you if you are deciding on an app to use for life organization as an age regressor!

Thank you so much for reading! If you got this far, have a virtual high-five!

If you liked this, please check out my other content. I have a YouTube, TikTok, Instagram, Facebook, Tumblr, and Merch shop!

Thank you again for reading! I’d like to dedicate this paragraph to reminding you how AWESOME you are! It’s important to me that each and every person reading this (yes, YOU) are aware of how awesome you are and how I’d like to ensure that you love yourself for who you are and all you’ve become up to this point!

With all that being said, have a great day, stay awesome, remember to love yourself, and I’ll see you in my next post, video, or whatever comes next!

#agere#age regression#sfw littlespace#sfw agere#age regressor#sfw age regression#agereg#age dreaming#sfw little blog#age regressive#age dreamer#age re safe space#age regression blog#age regression caregiver#age regression community#age regression sfw#agere activities#agere aesthetic#agere blog#agere boy#agere board#agere caregiver#agere cg#agere community#agere games#agere lifestyle#agere little#agere moodboard#agere positivity#agere post

10 notes

·

View notes

Text

How to Increase Cash App Sending Limit?

If you are an avid Cash App user, you may have encountered these limits and wonder, “How to increase Cash App sending limit?” When you sign-up to Cash App, you automatically begin with a basic account which has small amount of limits on receiving and sending. The default limits for sending to unverified accounts are $250 per week, and $1,000 for any 30 days; once you have verified your identity, you can increase the limit as needed.

There are a variety of options that can help you to increase Cash App transfer limit. First, make sure your account is verified by completing the identification verification process then contacting Cash App support to request a larger limit. You can also upgrade to Cash App Plus and get access to more features and higher limits. So, let’s begin and learn more about it.

https://www.crmportalconnector.com/developer-network/forums/general-discussions/are-there-any-limits-on-bitcoin-withdrawals-in-cash-app https://www.crmportalconnector.com/developer-network/forums/general-discussions/what-should-i-do-if-i-need-to-send-more-money-than-my-limit-allows https://www.crmportalconnector.com/developer-network/forums/general-discussions/how-can-i-increase-the-cash-app-atm-withdrawal-limit https://www.crmportalconnector.com/developer-network/forums/general-discussions/what-is-the-default-cash-app-atm-withdrawal-limit-per-day https://www.crmportalconnector.com/developer-network/forums/general-discussions/how-do-i-increase-the-cash-app-atm-withdrawal-limit-per-day https://www.crmportalconnector.com/developer-network/forums/general-discussions/what-is-the-cash-app-atm-withdrawal-limit-per-week https://www.crmportalconnector.com/developer-network/forums/general-discussions/how-can-i-increase-the-cash-app-atm-withdrawal-limit-per-week https://www.crmportalconnector.com/developer-network/forums/general-discussions/how-can-i-increase-the-cash-app-bitcoin-withdrawal-limit-per-day https://www.crmportalconnector.com/developer-network/forums/general-discussions/how-can-i-increase-the-cash-app-bitcoin-withdrawal-limit-per-week https://www.newmanparish.com/forum/general-discussion/how-do-i-increase-my-send-limit-on-cash-app https://www.newmanparish.com/forum/general-discussion/cash-app-limit-cash-app-weekly-transfer-limit-everything-you-need-to-know https://www.newmanparish.com/forum/general-discussion/cash-app-limit-cash-app-sending-limit-increase-everything-you-need-to-know https://www.newmanparish.com/forum/general-discussion/how-to-increase-your-cash-app-withdrawal-limit https://www.newmanparish.com/forum/general-discussion/how-to-increase-your-cash-app-sending-limit https://www.newmanparish.com/forum/general-discussion/how-to-increase-cash-app-limit-from-2-500-to-7-500 https://www.newmanparish.com/forum/general-discussion/cash-app-limit-cash-app-daily-transfer-limit-everything-you-need-to-know

4 notes

·

View notes

Text

Best Selling Site To B-u-y Verified Cash App Accounts (New & Old): Top Picks

The best-selling site to B-u-y verified Cash App accounts is seo2smm.com. This platform offers both new and old accounts

B-u-y

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

seo2smm. com is highly regarded for its reliable and secure services. The site provides verified Cash App accounts to meet various needs. Users can choose between new and old accounts based on their preferences. Each account comes with a guarantee of authenticity and security.

seo2smm. com ensures that the accounts are fully verified, reducing the risk of fraudulent activities. The platform offers competitive pricing and excellent customer support. It is user-friendly, making the purchasing process simple and efficient. Many users have given positive reviews, highlighting the site’s credibility. seo2smm. com is a trusted option for purchasing verified Cash App accounts.

Top Sites For Verified Cash App Accounts

Looking to B-u-y verified Cash App accounts? It's crucial to choose the right site. Different platforms offer varied benefits and reliability. Let’s explore the top sites for verified Cash App accounts.

New And Old Accounts

New accounts can be ideal for those starting fresh. They offer a clean slate and no prior transactions. Old accounts, however, come with transaction history. This can be helpful for credibility.

Account Type

Benefits

New Accounts

Fresh start, no history

Old Accounts

Transaction history, credibility

Reliable Marketplaces

Trustworthy marketplaces ensure safe transactions. They offer verified accounts with a guarantee. Here are some reliable platforms to consider:

Market 1: Known for excellent customer service.

Market 2: Offers a wide range of account types.

Market 3: Provides a money-back guarantee.

Choose a platform that suits your needs. Check reviews and ratings before making a purchase. Reliable marketplaces often have positive feedback from users.

When B-u-ying, always ensure the account is verified. Verified accounts offer added security. This ensures a smoother transaction process.

In conclusion, select wisely to get the best deal. Verified Cash App accounts can be a valuable asset. Make sure you B-u-y from a trusted source.

Benefits Of Verified Cash App Accounts

Verified Cash App accounts offer numerous advantages. They provide increased security, higher transaction limits, and more. B-u-ying verified accounts can enhance your Cash App experience significantly. Let's explore these benefits in detail.

Increased Security

Verified accounts offer enhanced security. They include additional verification steps. This makes it harder for unauthorized access. Your funds and personal information remain safe. Peace of mind is a big plus.

Transaction Limits

Verified accounts come with higher transaction limits. This allows you to send and receive more money. Unverified accounts have strict limits. With verification, you can handle larger amounts. It's ideal for business transactions.

Factors To Consider When B-u-ying

B-u-ying a verified Cash App account can save time. However, there are important factors to consider. These factors ensure you get the best deal and avoid scams. Below are key considerations.

Account Age

Account age is crucial. Older accounts often have better credibility. Sellers may charge more for older accounts. It's worth the investment. Older accounts are less likely to be flagged.

Verification Status

The verification status of the account is equally important. Verified accounts offer more features. These include higher transaction limits and increased security. Always check if the account is fully verified before purchasing.

Safety Measures For Purchasing Accounts

B-u-ying verified Cash App accounts can be risky. It's essential to follow safety measures. These measures protect your investment and personal information. Below are some key safety practices to consider.

Trusted Vendors

Always B-u-y from trusted vendors. Trusted vendors have good reviews and ratings. They provide genuine verified accounts. Research vendor reputations before making any purchase.

Vendor

Rating

Review Count

Vendor A

4.8

150

Vendor B

4.5

100

Vendor C

4.2

80

Payment Security

Ensure payment security during transactions. Use secure payment methods. Avoid direct bank transfers. Prefer PayPal, credit cards, or other secure options.

PayPal

Credit Cards

Escrow Services

These methods offer B-u-yer protection. They help resolve disputes if any issues arise.

Popular Sites For New Accounts

Are you searching for the best sites to B-u-y new verified Cash App accounts? This section highlights the most popular sites for purchasing these accounts. Read on to discover the key

features and customer reviews of these sites.

Site Features

The top sites for new verified Cash App accounts offer various features. These features help ensure a smooth and secure transaction.

Verification: Accounts come pre-verified for immediate use.

Security: Secure payment methods and data protection are prioritized.

Support: 24/7 customer support for any queries or issues.

Customization: Some sites allow for account personalization.

Delivery: Quick delivery times to get you started swiftly.

Customer Reviews

Customer reviews are crucial for gauging the reliability of these sites. Let's take a look at what B-u-yers have to say.

Site

Rating

Review Highlights

Site A

4.8/5

Fast delivery, reliable accounts, excellent support.

Site B

4.6/5

Secure transactions, verified accounts, responsive customer service.

Site C

4.7/5

Easy purchase process, high-quality accounts, quick responses.

Top Picks For Old Accounts

Old Cash App accounts come with various benefits. They offer a history of transactions. This makes them more reliable for certain uses. Below, we discuss the benefits and top-rated sellers for old accounts.

Benefits Of Old Accounts

Old Cash App accounts have many advantages. These accounts have a longer transaction history. They appear more reliable to other users. Here are some key benefits:

Trustworthiness: Old accounts are seen as more credible.

Transaction History: These accounts have a detailed history of transactions.

Established Contacts: They often have a list of contacts already set up.

Higher Limits: Older accounts may have higher sending and receiving limits.

Top-rated Sellers

Finding a reliable seller is essential. Here are some top-rated sellers for old Cash App accounts:

Seller

Rating

Special Features

VerifiedAccountsPro

⭐⭐⭐⭐⭐

24/7 Support, Instant Delivery

AccountMasters

⭐⭐⭐⭐

Money-Back Guarantee, High Limits

TrustyCashApp

⭐⭐⭐⭐⭐

Verified Accounts, Secure Payment Methods

Choose the right seller for your needs. Ensure they offer verified accounts. Look at their ratings and special features before B-u-ying.

Comparison Of Top Sites

Are you searching for the best sites to B-u-y verified Cash App accounts? This section will help you choose the right platform. We will compare the top sites based on price and features.

Price Comparison

Price is a key factor when B-u-ying verified Cash App accounts. Here's a table comparing prices:

Site

New Accounts

Old Accounts

Site A

$50

$70

Site B

$45

$65

Site C

$55

$75

Site B offers the most affordable prices for both new and old accounts. This makes it a popular choice among B-u-yers.

Feature Comparison

Features are essential for a smooth Cash App experience. Below is a comparison of features offered by the top sites:

Site A:

24/7 Customer Support

Instant Delivery

Multiple Payment Methods

Site B:

24/7 Customer Support

Free Replacement Guarantee

Discount on Bulk Orders

Site C:

Live Chat Support

Instant Delivery

Money-Back Guarantee

Site B stands out with its free replacement guarantee and bulk order discounts. These features provide extra value for B-u-yers.

User Reviews And Testimonials

When B-u-ying verified Cash App accounts, user reviews and testimonials are crucial. They offer valuable insights into the reliability of the seller.

Positive Experiences

Many users report positive experiences with verified Cash App accounts. These accounts are easy to set up and use. Transactions go smoothly, with minimal issues.

John D. shared, "I bought an old verified Cash App account. It's been flawless!"

Another user, Emily R., stated, "The account worked perfectly. Customer support was very helpful."

User

Experience

John D.

Flawless account setup and usage.

Emily R.

Perfect account and great customer support.

Common Issues

Some users have encountered issues. These include account verification problems and delayed transactions.

Mark T. noted, "I had trouble verifying my account. It took several days."

Another issue shared by Lisa M. was, "Transactions were delayed initially, but support fixed it quickly."

Verification issues can occur.

Transactions may be delayed.

Customer support is generally responsive.

How To Verify Account Authenticity

Verifying the authenticity of a Cash App account is crucial. This ensures you B-u-y a genuine and secure account. This guide will help you through the verification process.

Verification Steps

Follow these steps to verify a Cash App account:

Check the seller's reputation: Read reviews and ratings.

Request account details: Ask for screenshots of the account.

Verify email and phone number: Ensure they are active.

Check transaction history: Look for any suspicious activities.

Contact Cash App support: Confirm the account's status.

Red Flags

Be aware of these red flags to avoid scams:

No reviews or ratings: Avoid sellers with no feedback.

Suspiciously low prices: If it seems too good to be true, it probably is.

Unresponsive seller: Lack of communication can indicate a scam.

Inconsistent information: Mismatched details can be a warning sign.

Legal Considerations

B-u-ying verified Cash App accounts can be tricky. Understanding the legal aspects is crucial. This section will help you navigate through potential issues.

Terms Of Service

Cash App's Terms of Service outline what users can and cannot do. Violating these terms can lead to account suspension. Always read the terms carefully before B-u-ying an account.

Dos

Don'ts

Read the terms

Ignore the rules

Use accounts responsibly

Engage in fraudulent activities

Potential Risks

B-u-ying verified Cash App accounts comes with risks. These risks can affect your finances and legal standing. Be aware of these potential dangers.

Account suspension

Legal penalties

Loss of money

Make sure to check the reputation of the seller. A reliable seller will have positive reviews and a good track record. Avoid sellers with bad reviews or no history.

Payment Methods For Purchasing

When B-u-ying verified Cash App accounts, knowing your payment options is key. Different methods offer unique benefits. Read on to understand the most popular payment methods for these purchases.

Credit Cards

Credit cards are a common choice for B-u-ying verified Cash App accounts. They offer convenience and speed. Many B-u-yers prefer this method because of its simplicity.

Using a credit card also provides a layer of security. Most credit cards offer fraud protection. This can be crucial when making online purchases.

Here's a quick look at the benefits of using credit cards:

Fast and easy transactions

Fraud protection

Widely accepted

Cryptocurrency

Cryptocurrency is another popular payment method. It provides anonymity and is often preferred by those who value privacy.

Cryptocurrencies like Bitcoin and Ethereum are widely used. They offer fast and secure transactions. This method is also decentralized, making it a great option for international B-u-yers.

Check out the benefits of using cryptocurrency:

Anonymity

Fast transactions

Decentralized

Choosing the right payment method can make your B-u-ying experience smoother. Whether you choose credit cards or cryptocurrency, make sure you understand the benefits and risks involved.

Customer Support And Service

Customer support and service play a crucial role in selecting the best site to B-u-y verified Cash App accounts. Understanding the quality of customer service can help users make informed decisions.

Response Time

The response time of a website's customer service is vital. Quick responses help resolve issues faster. Look for sites that promise replies within a few hours. A fast response time indicates efficient service. Delays can lead to frustration and lost opportunities. Always check reviews to gauge the response time.

Support Channels

Effective customer service uses multiple support channels. These channels should include:

Email

Live Chat

Phone Support

FAQs

Help Desk

A variety of support channels ensures accessibility. Users prefer sites with 24/7 support. Live chat is particularly useful for immediate help. Phone support adds a personal touch. Email support is good for detailed queries. FAQs can solve common issues quickly.

Here's a quick comparison of support channels:

Support Channel

Availability

Response Time

Live Chat

24/7

Instant

Email

Business Hours

Few Hours

Phone

Business Hours

Instant

FAQs

24/7

Instant

Help Desk

Business Hours

Varies

Choosing a site with multiple support options enhances the B-u-ying experience. It ensures users get the help they need, when they need it.

Special Offers And Discounts

Are you looking for the best deals on verified Cash App accounts? Our platform offers exclusive special offers and discounts to help you save money. Whether you need an account for personal or business use, we have the right offer for you.

Seasonal Deals

We provide amazing seasonal deals throughout the year. During holidays like Christmas, New Year, and Black Friday, you can find heavily discounted prices.

Christmas Sale: Get up to 50% off on all accounts.

New Year Special: B-u-y one, get one free on selected accounts.

Black Friday: Exclusive offers with up to 70% off.

Bulk Purchase Discounts

If you need multiple accounts, our bulk purchase discounts are perfect for you. B-u-ying in bulk can save you a lot of money.

Quantity

Discount

5-10 Accounts

10% Off

11-20 Accounts

20% Off

21+ Accounts

30% Off

Don't miss our special offers and discounts. Grab your verified Cash App accounts today and save big!

Return And Refund Policies

B-u-ying verified Cash App accounts can be a significant investment. A well-defined return and refund policy ensures a worry-free purchase. Our policies are designed to keep customers satisfied while maintaining fair practices. Learn more about the conditions for returns and the refund process below.

Conditions For Returns

To return a verified Cash App account, certain conditions must be met:

Account Status: The account must be unused and in original condition.

Time Frame: Returns must be requested within 7 days of purchase.

Proof of Purchase: A valid receipt or order confirmation is required.

Accounts that do not meet these conditions may not be eligible for a return. Ensure all criteria are met to avoid complications.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Refund Process

The refund process is straightforward to ensure customer satisfaction:

Submit a Request: Contact our support team within the return window.

Verification: Our team will verify the account status and purchase details.

Approval: Once approved, the refund will be processed within 5 business days.

Refunds will be issued to the original payment method. The time it takes to appear may vary by bank.

Step

Description

Time Frame

Submit a Request

Contact support with return details

Within 7 days

Verification

Confirm account status and purchase

2-3 business days

Approval

Process refund to original payment

Up to 5 business days

We aim to make the return and refund process as seamless as possible. Feel free to reach out with any questions.

Tips For First-time B-u-yers

B-u-ying verified Cash App accounts can be a smart choice. It offers convenience and security. First-time B-u-yers need to be cautious. Follow these tips to ensure a safe purchase.

Research Tips

Read Customer Reviews: Check reviews from past B-u-yers. They offer real insights.

Verify Seller's Reputation: Look for sellers with a good track record. Trustworthy sellers are key.

Compare Prices: Different sellers offer different prices. Always compare before B-u-ying.

Check for Guarantees: Reliable sellers often provide guarantees. This adds an extra layer of security.

B-u-ying Process

Contact the Seller: Reach out to the seller. Ask questions about the account.

Verify Account Details: Ensure the account is verified. Ask for proof of verification.

Negotiate Price: Discuss the price. Some sellers are open to negotiation.

Payment Method: Choose a secure payment method. Avoid direct transfers.

Receive the Account: Once paid, the seller should deliver the account. Check all details immediately.

Following these tips ensures a smooth B-u-ying experience. Always prioritize safety and reliability.

Future Trends In Verified Accounts

The demand for verified Cash App accounts is rising. This trend is growing among businesses and individuals. Understanding future trends is crucial for staying ahead.

Market Growth

The market for verified Cash App accounts is expanding rapidly. More users are seeking verified accounts for security. This growth is driven by the need for fast, safe transactions.

Businesses are investing in verified accounts. They aim to build trust with customers. Verified accounts reduce the risk of fraud. They also streamline financial operations.

The market growth is also fueled by the increasing number of online transactions. People prefer verified accounts for their reliability. This trend shows no signs of slowing down.

Technological Advancements

Technological advancements are shaping the future of verified accounts. Blockchain technology is one example. It offers enhanced security and transparency for transactions.

Artificial Intelligence (AI) is also playing a role. AI can help verify accounts faster and more accurately. This reduces the chances of errors and fraud.

Two-factor authentication (2FA) is becoming standard. It adds an extra layer of security. Verified accounts with 2FA are more secure against unauthorized access.

Here is a table showing the key technological advancements:

Technology

Benefit

Blockchain

Enhanced security

Artificial Intelligence

Faster verification

Two-factor Authentication

Additional security layer

These advancements are making verified accounts more reliable. They are essential for the future of digital transactions.

Common Scams And How To Avoid Them

B-u-ying verified Cash App accounts can be a great convenience. But there are many scams out there. Understanding these scams is crucial for your safety.

Identifying Scams

Scammers use various tricks to deceive B-u-yers. Be wary of too-good-to-be-true offers. Unusually low prices are a red flag. Always check the seller's reviews.

Look for verified customer feedback. Fake reviews often sound too perfect. They lack details and sound generic. Trustworthy sellers will have detailed, balanced reviews.

Be cautious with sellers demanding upfront payments. Legitimate sellers usually offer secure payment methods. Use platforms with B-u-yer protection policies.

Protection Tips

Follow these tips to protect yourself from scams:

Use secure payment methods like PayPal or credit cards.

Verify the seller’s reputation through multiple sources.

Ask for proof of account verification before purchasing.

Never share personal information with the seller.

Consider using escrow services for added security.

Here’s a quick comparison table for trustworthy and suspicious sellers:

Trustworthy Sellers

Suspicious Sellers

Detailed, balanced reviews

Too-perfect, generic reviews

Secure payment options

Demands upfront payments

Provides proof of verification

Reluctant to show proof

By following these tips, you can avoid scams. Always be cautious and stay informed.

Role Of Verified Accounts In Business

Verified accounts play a crucial role in business. They ensure secure transactions and efficient financial management. Businesses trust verified accounts for their reliability and security. Let's explore the key aspects of verified accounts in business.

Business Transactions

Verified accounts streamline business transactions. They offer faster payment processing. This reduces delays and enhances cash flow. Verified accounts also provide higher transaction limits. This is essential for large business deals.

Using verified accounts minimizes the risk of fraud. They offer an additional layer of security. Businesses can operate with peace of mind. Verified accounts also support international transactions. This is vital for global businesses.

Financial Management