#CapitalManagement

Explore tagged Tumblr posts

Text

Capitalize on Your Brand

Claim clovercapitalinc.com – a strong, professional domain for financial advisors, investment firms, or capital management companies. Get it now on GoDaddy: https://www.godaddy.com/en-uk/domainsearch/find?domainToCheck=clovercapitalinc.com

0 notes

Text

youtube

Michael Saylor on Bitcoin: The Superior Option for Long-Term Capital Management

In this insightful video, Michael Saylor, the executive chair and co-founder of MicroStrategy, shares his expert perspective on why Bitcoin is the superior choice for long-term capital management. Speaking on Bloomberg Television, Saylor delves into the advantages of Bitcoin, discussing its potential to revolutionize financial strategies and secure wealth in an increasingly digital world.

#Here are some hashtags you can use for your Tumblr post:#Bitcoin#Crypto#Cryptocurrency#MichaelSaylor#MicroStrategy#BloombergTelevision#LongTermInvestment#CapitalManagement#FinancialFreedom#DigitalAssets#InvestmentStrategy#FutureOfFinance#Blockchain#CryptoNews#BitcoinInvesting#FinancialRevolution#WealthManagement#financial empowerment#financial experts#unplugged financial#globaleconomy#digitalcurrency#financial education#finance#Youtube

1 note

·

View note

Text

Maximizing Capital Management: Strategies for Effective Management

Navigating the tempestuous seas of capital management requires a keen eye and a steady hand, transforming financial landscapes into realms of opportunity and prosperity. From the artful allocation of assets that sing like a perfectly tuned orchestra to the strategic trimming of costs that don't bleed growth, the journey promises both challenge and reward. As we harness the winds of technology and culture, constructing bulwarks against the capricious tides of risk, our odyssey into financial optimization unfolds. Keep reading to unlock the treasure trove of strategies that ensure not just survival but thriving in the competitive realm of capital management.

Identifying Areas for Financial Improvement

Embarking on a journey to magnify my capital's potency, I soon realized that the path was strewn with untapped opportunities and obscured pitfalls alike. My first task shimmered clear: execute a meticulous examination of how my resources were dispersed—each dollar a soldier in the vast battlefield of finance, their positions needing careful scrutiny. The quest led me down a path to identify the laggards among my assets. Like a gardener pruning dead branches, I knew that revivifying my investment garden demanded a ruthless reevaluation of underachievers. Concurrently, my gaze turned inwards, towards the cogs and wheels of daily operations, where the silent siphoning of potential savings whispered for attention. Lastly, standing before the arsenal of my current investment stratagems, a critical eye was imperative to discern the chaff from the wheat. This thorough and critical approach assured me of building a fortress not just for today, but for securing a prosperous legacy in the relentless flux of markets. Conduct a Comprehensive Analysis of Current Capital Allocation Embarking upon the task of dissecting my capital allocation felt akin to navigating the labyrinthine depths of ancient catacombs—each turn revealing a new layer of complexity. It was here, amid the shadow and light of my financial maze, that I pledged to unearth the treasures of optimization, ensuring every coin within my realm was tasked with the noble purpose of growth. My resolve led to the illumination of corners once dim, casting light upon investments that whispered promises yet bore fruit scant. In this cathedral of numbers and projections, I stood as both architect and acolyte, committed to reforge my resources into stronger, more resilient structures that would weather the tempests of market volatility and emerge perennially triumphant. Pinpoint Underperforming Assets for Reevaluation Embarking upon a treasure hunt within my own financial landscape, the quest to pinpoint underperforming assets became a mission of utmost importance. These silent drainers, masquerading as parts of my investment portfolio, demanded a rigorous evaluation to prevent them from eating away at the foundation of my financial castle. It was akin to detecting hidden termites that, left unchecked, would undermine the integrity of an otherwise sturdy structure. Armed with data and an analytical mind, I dissected each investment with precision - identifying those that lagged behind their peers. This process was not merely an exercise in numerical analysis but an artful dance of judgment and foresight. By selecting the underachievers for reevaluation, my portfolio began to resemble a well-oiled machine, each component performing in unison towards the grand goal of capital maximization. Assess Operational Costs for Potential Savings Turning my attention to the underbelly of my financial structure, I became acutely aware of the whirring machinery of operational expenses. These expenses, largely taken for granted, could in reality act as leeches, draining the vitality from my accumulated wealth with their incessant demands for attention and resources. Through a discerning lens, I evaluated the intricate tapestry of costs woven into the fabric of my financial operations. It dawned on me that in the crevices of routine expenses lay opportunities for reclamation—dollars that could be liberated and redirected towards fortifying my investment endeavors, enhancing not just the present but sculpting a more secure foundation for the future. Evaluate the Effectiveness of Current Investment Strategies Staring down the convoluted path of my investment journey, critiquing the effectiveness of current investment strategies morphed into an act of paramount importance. It became clear to me: each choice, a thread in the complex tapestry of fiscal growth, warranted a rigorous trial by fire. StrategyPerformanceAdjustmentsEquity InvestmentsSuboptimalIncrease DiversificationFixed IncomeStableMaintain Current LevelReal EstateOverperformingExpand InvestmentPrivate EquityUnder ReviewStrategic Overhaul My scrutiny unraveled a mosaic of insights: some strategies shone brightly, their results a testament to their foundational strength, while others fell short, their luster dimmed by the unforgiving light of analysis. The journey was far from over, yet with every step: a sharpened vision, a refined purpose. My financial odyssey, underscored by a quest for excellence, continued with renewed vigor and precision.

Enhancing Asset Allocation for Optimal Performance

Embarking on the quest to amplify my capital's efficiency, I turned my focus to the strategic battlefield of asset allocation. Recognizing the power of diversification as a safeguard against the whims of market volatility, I committed to spreading my investments across a spectrum of opportunities. This wasn't merely about casting a wider net; it was about meticulous selection and alignment with high-performing assets, ensuring each dollar worked harder. My approach evolved, adopting a dynamic strategy that danced with the markets, shifting in harmony with economic pulses. Leveraging data-driven insights became my compass, guiding real-time adjustments to my portfolio, optimizing performance with precision. This intricate choreography of decisions set the stage for realizing the full potential of my investments, a crucial step in the enduring journey of capital maximization. Diversify Investment Portfolio to Spread Risk The wisdom of diversifying an investment portfolio cannot be overstated: it serves as a bulwark, protecting my financial dominion against the caprices of an ever-changing marketplace. By weaving a rich tapestry of varied asset classes, from equities to real estate, I ensure that my wealth is not hostage to the fortune of a single sector. - Equity Investments: Diversify across industries and geographical regions. - Fixed Income: Include a mix of government and corporate bonds to balance returns and security. - Real Estate: Invest in both commercial and residential properties to benefit from different market dynamics. - Private Equity and Venture Capital: For higher risk and potential return, selectively incorporate these into the mix. - Alternative Investments: Explore commodities, artwork, and other non-traditional assets to hedge against market volatility. Adopting a heterogeneous approach to investment not only mitigates risk but also paves the road towards unruffled wealth accumulation. This strategy, tempered by research and continuous reevaluation, ensures that my financial portfolio remains resilient, poised to capitalize on opportunities and weather the storms of economic uncertainty. Allocate Capital to High-Performing Assets Directing funds towards high-performing assets emerged as a linchpin in the strategy to maximize my capital's effectiveness. It was akin to planting seeds in the most fertile soil, where conditions were primed for exponential growth, ensuring that each dollar deployed was a beacon guiding me towards financial prosperity. This practice wasn't just about chasing the highest returns; it encapsulated a disciplined approach to discerning quality. By marrying the insights drawn from rigorous analysis with the foresight born of experience, I navigated my way through the thicket of options, identifying those investments poised to swell my coffers without courting undue risk. Implement a Dynamic Asset Allocation Strategy Embracing a dynamic asset allocation strategy became my guiding principle, a beacon in the tumultuous sea of market fluctuations. This approach, alive and breathing, allowed me to adeptly navigate through economic currents, adjusting my sails as the winds of financial trends shifted, ensuring that my capital not only sustained but thrived. By adopting this fluid stance, I morphed from a static investor into a maestro of capital orchestration. My decisions, quick yet informed, drew on a symphony of up-to-date research and technology-fueled insights. This enabled me to recalibrate my portfolio with precision, seizing opportunities at the crest of their potential, a testament to the power of agility in the realm of investment management. Use Data-Driven Insights to Adjust Allocations in Real-Time Amidst the ebb and flow of financial markets, leveraging data-driven insights for real-time portfolio adjustment has become my steadfast anchor. This strategy empowers me to respond to market changes with the agility of a seasoned mariner navigating through stormy seas, optimizing asset allocation to harness the momentum of emerging opportunities while mitigating risks. The cultivation of a dynamic investment landscape, informed by the pulse of real-time data, ensures that my capital's journey is not hindered by the inertia of past decisions. It breathes life into my investment strategy, allowing for the fluid redirection of resources towards sectors displaying robust growth potential, thereby maximizing the efficacy of every dollar committed to the pursuit of wealth accumulation.

Cutting Costs Without Sacrificing Growth

In the symphony of fiscal prudence, every note counts, leading me to a phase in my capital maximization journey where trimming the excess without dampening growth becomes paramount. I set my sights on discerning expendable expenditures, casting a meticulous eye over my financial landscape to distinguish between the indispensable and the expendable. The technological revolution offered a lifeline, promising operational streamlining through innovative tools—a beacon of efficiency in the tumultuous sea of business operations. Fresh negotiations with suppliers and vendors unfurled, as I sought to paint my cost structure with more favorable hues, each new contract a brushstroke towards a more optimized expense tableau. Moreover, the strategic delegation of non-essential functions emerged as a pivotal maneuver, unleashing the prowess of outsourcing to conserve resources whilst keeping the machinery of my enterprise humming smoothly. As I navigated through these strategies, my path was illuminated with the possibility of sustaining growth while shearing unnecessary expenditures, crafting a roadmap to navigate the tightrope of cost optimization. Identify Non-Essential Expenses for Reduction Steering through the dense fog of corporate finance, I embarked on a mission to delineate the superfluous from the necessary: a critical endeavor in safeguarding the vitality of my company's growth trajectory without succumbing to the gravity of needless expenses. This journey was not merely an exercise in frugality, but a strategic alignment of resources to fuel the engines of innovation and competitiveness. - Evaluation of subscription services to eliminate or downgrade those not integral to core operations. - Consolidation of vendor contracts to leverage volume discounts and enhance negotiation power. - Assessment of in-house versus outsourced functions to identify cost-effective solutions without compromising on quality or efficiency. Embracing this philosophy, I forged ahead, each decision a deliberate stroke in the art of financial stewardship. By pruning the excess, I ensured that every dollar was a robust soldier in the battleground of market dominance, poised to secure victory through strategic deployment and unwavering focus on core competencies. Optimize Operational Efficiency Through Technology In the realm of optimizing operations without eroding growth, technology emerges as the cardinal beacon, guiding my quest towards unparalleled efficiency. Its implementation is akin to the wind beneath the wings of my enterprise, propelling it toward higher operational altitudes while ensuring that the gravity of expenses remains a manageable foe. The advent of cutting-edge tools and platforms transforms the very fabric of my business processes, infusing them with a level of precision and speed that was once beyond reach. This digital revolution, under my astute guidance, has not only streamlined workflows but has also unveiled pathways to cost-saving without compromising the growth ambitions harbored within the heart of my organization. Renegotiate Contracts and Supplier Agreements for Better Terms In the dance of financial finesse, renegotiating contracts and supplier agreements became a pivotal movement: a strategic step imbued with the potential to harmonize cost efficiency with unabated growth. This gesture, more than a mere negotiation, evolved into a ballet of diplomacy and determination, aimed at weaving stronger, more favorable terms into the fabric of my business dealings. Encountering my suppliers and partners across the negotiation table, I embarked on this quest armored with insightful data and benchmarks: a preparation that turned each meeting into an opportunity for mutual benefit. The outcome of these discussions wasn't merely cost-saving; it was the forging of partnerships grounded in respect and shared aspirations: Supplier/PartnerOriginal TermsRe-negotiated TermsExpected Savings (%)ABC Tech SolutionsAnnual SubscriptionBiennial Subscription with Discount15XYZ Materials Inc.Bulk Purchase, No DiscountVolume Discount on Orders over $10k10LMN Services, LLCFixed Service FeePerformance-based Fee Scale20 This tableau of renegotiated terms became a testament to the power of assertive dialogue and in-depth market knowledge. Equipped with these enhanced agreements, my endeavor to trim costs while fueling growth acquired a robust backbone, crafting a narrative of strategic expenditure and investment that reverberated through every financial decision henceforth. Leverage Outsourcing for Non-Core Business Functions In the endeavor to refine my company's financial efficiency, embracing the strategy of outsourcing non-core business functions emerged as a pivotal revelation. This approach allows me to channel the organization's intrinsic strengths towards core activities, ensuring that every ounce of energy propels us toward our growth targets. By outsourcing tasks such as customer support, human resources, and IT services, my focus sharpened, concentrating resources on areas where we hold competitive advantage. Outsourcing, therefore, became not just a tactic for cost reduction but a strategic lever to augment the company's dynamism and agility: FunctionOutsourced ProviderAnnual Savings (%)Customer SupportHelpDesk Global Solutions25Human ResourcesHR Innovate LLC15IT ServicesTechSolutions Inc.20 The analytical rigor applied in selecting these outsourcing partnerships ensured that not only did we optimize cost, but also bolstered our operational excellence. Through this strategic maneuver, my enterprise took a monumental stride in crafting a leaner, more poised structure ready to navigate the complex landscapes of modern business with unwavering confidence.

Leveraging Technology for Capital Management

In the labyrinthine journey of maximizing capital, technology emerges as the linchpin, propelling my strategies into the future with unmatched precision and efficiency. Recognizing the pivotal role it plays, I've adopted a suite of technological innovations designed to streamline every aspect of capital management. Implementing financial management software gifts me the clarity of real-time tracking, allowing every dollar and decision to be scrutinized under the microscope of data. The foresight lent by predictive analytics transforms my investment decisions from educated guesses to strategic moves, backed by the power of information. Furthermore, the exploration of digital platforms for business operations ushers in an era of cost-effectiveness that traditional methods struggle to match. Finally, the adoption of automation not only slashes labor costs but also dramatically reduces the margin for error, ensuring that operational excellence is both achievable and sustainable. This technological symphony harmonizes the various facets of capital management, setting the stage for a future where growth and efficiency are not just goals, but guarantees. Implement Financial Management Software for Real-Time Tracking Delving into the realm of financial precision, I embraced the implementation of financial management software for real-time tracking: a decision that revolutionized my approach to capital management. This technology enables me to monitor my investments' performance with the exactitude of a seasoned navigator charting a course through treacherous seas, ensuring no deviation goes unnoticed. Read the full article

0 notes

Link

#CapitalManagement#CapitalManagementSoftware#HumanCapitalManagement#HumanCapitalManagementsoftware#HumanCapitalManagementSystem

0 notes

Text

🚀 Big #Profits! Our #CWC2025 prediction analysis shows the #KellyCriterion strategy delivered an astonishing +522% capital increase! Learn how to boost your #SportsBetting game. #CapitalManagement

#Betting results#Betting strategies#Capital increase#Capital management#Club World Cup 2025#fixed stake#Investment return#Kelly Criterion#Prediction analysis#Risk management#sports betting#sports predictions

0 notes

Text

Differences between Fund-based and Non-fund-based Financing

When it comes to financing options, businesses often find themselves weighing the merits of fund-based versus non-fund-based financing. Understanding the differences between these two can help businesses make informed decisions based on their specific financial needs and goals.

Fund-based Financing

Fund-based financing involves the direct disbursement of funds from the lender to the borrower. This traditional form of lending includes:

Loans: Borrowers receive a lump sum amount that must be repaid with interest over a predetermined period.

Overdraft Facilities: Allows businesses to withdraw more money than is available in their account, up to a certain limit, to cover short-term needs.

Cash Credit: Provides access to funds for day-to-day operations, usually backed by inventory or receivables.

Term Loans: Long-term financing for purchasing assets, business expansion, or significant projects.

In fund-based financing, the borrower receives a direct inflow of money that can be used for various purposes like working capital, purchasing assets, or funding business expansions. The primary obligation for the borrower is to repay the principal amount along with interest within the specified period.

Non-fund-based Financing

Non-fund-based financing, on the other hand, does not involve the actual disbursement of funds. Instead, it provides financial guarantees or commitments on behalf of the borrower to third parties. Key instruments include:

Letters of Credit (LC): A promise from the lender that ensures the seller receives payment from the buyer, provided the terms of the agreement are met.

Bank Guarantees: Assures the beneficiary that the lender will fulfill the borrower’s obligations if the borrower defaults.

Non-fund-based financing is more about providing assurance or a promise of payment rather than a direct transfer of funds. The borrower benefits from the enhanced credibility and the ability to undertake transactions that might otherwise be risky. The lender charges a fee or commission for these services, but the borrower does not receive any actual funds unless a specific event triggers the need for payment.

Key Differences

Nature of Disbursement:

Fund-based Financing: Direct disbursement of funds to the borrower.

Non-fund-based Financing: No actual funds are disbursed; instead, financial guarantees are provided.

Usage of Funds:

Fund-based Financing: Borrower uses the funds for various business needs like working capital, purchasing assets, or expansion.

Non-fund-based Financing: Used to provide assurance to third parties about the borrower’s financial commitments.

Cost:

Fund-based Financing: Involves interest payments on the principal amount borrowed.

Non-fund-based Financing: Involves fees or commissions for the guarantees provided.

Risk:

Fund-based Financing: Borrower bears the risk of repaying the principal amount with interest.

Non-fund-based Financing: Risk is more on the lender, as they assure the payment in case of the borrower’s default.

Flexibility:

Fund-based Financing: Offers more flexibility in terms of usage of funds.

Non-fund-based Financing: Limited to providing financial assurances.

In summary, fund-based financing is ideal for businesses that need immediate access to cash for operations, growth, or asset acquisition, with a clear repayment plan. Non-fund-based financing suits businesses that need to bolster their credibility and secure transactions without needing direct funds, providing a safety net for their financial commitments. Both play crucial roles in the financial ecosystem, addressing different aspects of a business’s financing needs.

#FinanceOptions #BusinessFunding #FinancialStrategy #LendingChoices #CapitalManagement #CreditFacilities #RiskManagement #BusinessGrowth #FinancialAssurance #FundingSolutions

0 notes

0 notes

Text

#fortumex#fortumexbusiness#businessgrowth#businessdevelopment#PrivateEquity#Privateequityfunding#fundraising#venturecapital#interestfree#capitalmanagement#sales#marketing#smallbusiness#mediumsizedbusiness#startupsupport#wealthcreation#loanservices#businessowners#rajkot#Gujarat

7 notes

·

View notes

Photo

Info Seminar Finance For Non Finance Executive (Finon). Jadwal Pelatihan Finance For Non Finance Executive (Finon) tersedia online dan offline. Training Finon public training dan in house training. Tujuan Training Finance For Non Finance Executive. Setelah mengikuti pelatihan ini, diharapkan peserta akan: 1. Memahami fungsi penting manajemen keuangan sebagai subsistem di perusahaan. 2. Memiliki kerangka tentang pengelolaan dana operasional dan kelayakan investasi. 3. Mampu memanfaatkan informasi keuangan untuk keputusan manajerial. 4. Memiliki kesatuan bahasa dalam konteks keuangan sebagai bahasa perusahaan. Informasi Training Finance For Non Finance Executive: https://www.informasi-seminar.com/training-finance-for-non-finance-executive-finon/ Info seminar training lengkap: WA: 0851-0197-2488 Jadwal training lengkap: https://www.informasi-seminar.com #finance #finon #keuangan #financefornonfinance #accounting #akuntansi #manajemenkeuangan #financial #financialmanagement #financialstatement #laporankeuangan #managerkeuangan #capitalmanagement #capitalbudgeting #costaccounting #seminarkeuangan #infoseminar #publictraining #inhousetraining https://www.instagram.com/p/ClDO3_eJdlH/?igshid=NGJjMDIxMWI=

#finance#finon#keuangan#financefornonfinance#accounting#akuntansi#manajemenkeuangan#financial#financialmanagement#financialstatement#laporankeuangan#managerkeuangan#capitalmanagement#capitalbudgeting#costaccounting#seminarkeuangan#infoseminar#publictraining#inhousetraining

0 notes

Text

Working capital management is the process of monitoring, analyzing and controlling the cash flow within and between your company's assets. Most companies use it to maintain a healthy balance sheet and avoid being in debt.

0 notes

Text

"Reduce Covid-19 Impact by Using Simplified Operating Budget Template"

Exercise more control over your operating budget with this simplified operating budget template to tackle Covid-19 impact. Sign up to access the template here. https://bit.ly/2ZWsl0j

#operatingbudget#operationcosts#capitalmanagement#costoptimization#spendmanagement#profit#loss#growth#finance#corporatestrategy

1 note

·

View note

Photo

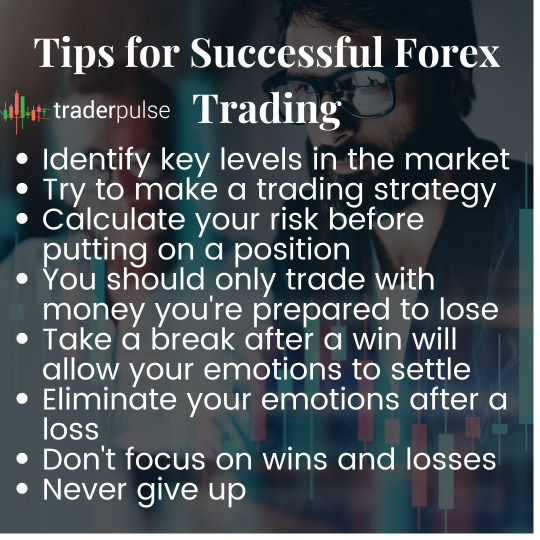

Learning the right lessons makes your success easier! Read more to know the tips for successful forex trading.

#successfulforextrading#tradingstrategy#emotions#passionfortrading#lovefortrading#capitalmanagement#tradingtips#traderpulse

0 notes

Photo

Всем доброго утра, друзья! Очередные сигналы рынка #marketrings. Майнинг криптовалют пришел в энергетику. Crusoe Energy Systems Inc. привлекла $4,5 миллиона в виде начального финансирования под руководством Bain Capital Ventures и Founders Fund Pathfinder. Среди инвесторов компании фигурирует Capital Management братьев близнецов Уинклвоссов. Crusoe предоставляет услуги по снижению риска вспышек и разрабатывает мобильные модульные центры обработки данных, которые можно использовать для майнинга криптовалют. Это поможет производителям нефти и газа устранить сжигание попутного газа вхолостую, тем самым сократив вредные выбросы. В настоящее время в сланцевой добыче — газ является побочным продуктом бурения нефтяных скважин, и его запасы слишком велики. Сокращая факельное сжигание, этот процесс поможет сократить выбросы летучих органических соединений, оксидов азота и оксида углерода на целых 99 процентов. Crusoe преобразует избыточный природный газ в электроэнергию и создает небольшие центры обработки данных вблизи буровых площадок для майнинга криптовалют. Согласно пресс-релизу компании, Crusoe Energy Systems предлагает инновационные решения для энергетической отрасли. В настоящее время компания реализует или разрабатывает проекты по снижению выбросов на месторождении Баккен в Северной Дакоте, на месторождении в бассейне реки Паудер в Вайоминге и на месторождении Денвер-Юлсбург в Колорадо. А команда Crypto family готовится к небольшому событию, которое состоится в конце месяца, следите за нашими постами. #blockchain #bitcoin #TBJ #etherium #ripple #bch #mining #gaz #usa #Canada #CrusoeEnergySystems #dakotastate #colorado #wyoming #CapitalManagement #Winklevoss #cryptocurrency #CryptoFamily #CryptoTradeInvest #ecomspacebar (at EcomSpace) https://www.instagram.com/p/BxJtUzZA4c3/?igshid=1djj7neuu1b7b

#marketrings#blockchain#bitcoin#tbj#etherium#ripple#bch#mining#gaz#usa#canada#crusoeenergysystems#dakotastate#colorado#wyoming#capitalmanagement#winklevoss#cryptocurrency#cryptofamily#cryptotradeinvest#ecomspacebar

0 notes

Photo

Breaking ground to the new @hiclubvacations building with the team #Orlando #HICV #GoldenShovels 🐦 #CapitalManagement (at John Young Pkwy)

0 notes

Video

youtube

US macro-economics factors. Weekly Trading Levels Nov. 8-12

#useconomy #macroeconomics #debtmanagement #equity #finance #economicpolicy #debtceiling #stockmarkets #lowcost #capitalmanagement #budgetplanning #globaleconomy #indianstockmarket #commodities #currency Video is open for 10 minutes. Please Join at 8:30 PM

0 notes

Text

https://www.linkedin.com/company/fortumexbusiness

#fortumex#fortumexbusiness#businessgrowth#businessdevelopment#PrivateEquity#Privateequityfunding#fundraising#venturecapital#interestfree#capitalmanagement#sales#marketing#smallbusiness#mediumsizedbusiness#startupsupport#wealthcreation#loanservices#businessowners#rajkot#Gujarat

2 notes

·

View notes

Text

487+ Best Capital Management Company Names & Ideas

487+ Best #Capital #CapitalManagement #CapitalCompany #CapitalNames & #CapitalIdeas

Capital management is an important thing to consider these days. If you are new into capital management, you’ll know how tough is to name a capital accordingly. Thus, keeping this factor in mind, you need to move and proceed forward towards naming the same. In this piece of writing, you’ll find the guide to name capital management in the best possible way. We will provide you with various points…

View On WordPress

0 notes