#California Solar Incentives

Explore tagged Tumblr posts

Text

Empowering Sustainable Living: A Comprehensive Guide to California Solar Incentives and California Solar Panel Programs

As the push for renewable energy gains momentum, California stands out as a leader in solar energy adoption. With abundant sunshine and progressive environmental policies, the Golden State is an ideal place for solar energy investments. Homeowners and businesses alike can benefit from various California solar incentives and California solar panel programs designed to make solar energy more accessible and affordable. This blog will delve into the details of these incentives and programs, providing a thorough guide for anyone looking to harness the power of the sun in California.

The Importance of Solar Energy in California

Solar energy is crucial for California's ambitious climate goals. The state aims to achieve 100% clean electricity by 2045, and solar power is a key component of this plan. By transitioning to solar energy, Californians can reduce their reliance on fossil fuels, lower greenhouse gas emissions, and contribute to a sustainable future.

Overview of California Solar Incentives

California offers a variety of incentives to encourage the adoption of solar energy. These incentives are designed to reduce the upfront costs of solar installations and provide long-term financial benefits.

1. Federal Solar Investment Tax Credit (ITC)

While not specific to California, the federal Investment Tax Credit (ITC) is a significant incentive for solar adopters. The ITC allows homeowners and businesses to deduct a substantial percentage of their solar installation costs from their federal taxes. Currently, the ITC covers 26% of the installation costs for systems installed in 2021-2022, but this percentage is set to decrease unless extended by Congress.

2. California Solar Initiative (CSI)

The California Solar Initiative (CSI) is a comprehensive solar rebate program that has significantly contributed to the growth of solar energy in the state. While the program has largely concluded for residential customers, it still offers incentives for multifamily affordable housing and commercial properties. The CSI provides rebates based on the performance of the solar energy system, encouraging high-quality installations that maximize energy production.

3. Self-Generation Incentive Program (SGIP)

The Self-Generation Incentive Program (SGIP) provides incentives for energy storage systems, which are often paired with solar panels. By installing a battery storage system, homeowners and businesses can store excess solar energy for use during peak hours or power outages. SGIP offers substantial rebates that can cover a significant portion of the storage system's cost, making it an attractive option for those looking to enhance their energy resilience.

4. Net Energy Metering (NEM)

Net Energy Metering (NEM) is a crucial policy for solar adopters in California. NEM allows solar panel owners to send excess electricity back to the grid in exchange for credits on their utility bills. These credits can offset future energy costs, ensuring that homeowners and businesses get the most value from their solar installations. NEM 2.0, the current iteration of the program, maintains favorable terms for solar customers, but changes are expected with the upcoming NEM 3.0, so staying informed about policy updates is important.

5. Property Assessed Clean Energy (PACE) Financing

Property Assessed Clean Energy (PACE) financing is an innovative program that allows property owners to finance the cost of solar installations and other energy efficiency improvements through their property taxes. PACE financing offers low-interest rates and long repayment terms, making it easier for homeowners and businesses to invest in solar energy without a significant upfront cost.

6. Local Rebates and Incentives

In addition to state-wide programs, many local utilities and municipalities in California offer their own solar incentives. These can include additional rebates, grants, and low-interest loans. It's worth checking with your local utility company and government to see what specific incentives are available in your area.

California Solar Panel Programs

1. California Solar on Multifamily Affordable Housing (SOMAH) Program

The California Solar on Multifamily Affordable Housing (SOMAH) program aims to bring the benefits of solar energy to low-income communities. SOMAH provides financial incentives for installing solar energy systems on multifamily affordable housing properties. The program covers up to 100% of the installation costs, ensuring that low-income tenants can benefit from lower energy bills and increased energy independence.

2. Single-family Affordable Solar Homes (SASH) Program

The Single-family Affordable Solar Homes (SASH) program is designed to provide solar energy to low-income homeowners. The program offers substantial rebates to cover the cost of solar installations, making it possible for low-income families to access clean, renewable energy. SASH is part of California's broader effort to ensure that the benefits of solar energy are equitably distributed.

3. Disadvantaged Communities - Single-family Solar Homes (DAC-SASH) Program

Similar to the SASH program, the Disadvantaged Communities - Single-family Solar Homes (DAC-SASH) program targets low-income homeowners in disadvantaged communities. DAC-SASH offers upfront rebates to cover the cost of solar installations, helping to reduce energy bills and improve energy resilience for families in underserved areas.

4. GoSolarCalifornia Campaign

The GoSolarCalifornia campaign is an initiative that provides information and resources to help homeowners and businesses navigate the process of going solar. The campaign's website offers tools to estimate solar costs and savings, find qualified solar installers, and learn about available incentives. GoSolarCalifornia is a valuable resource for anyone considering solar energy in the state.

Financial Considerations and Benefits

1. Long-term Savings

While the initial cost of a solar installation can be significant, the long-term savings are substantial. Solar panels can drastically reduce or even eliminate electricity bills, providing a reliable return on investment. In many cases, the savings on utility bills can offset the installation costs within a few years, leading to significant financial benefits over the system's lifespan.

2. Increased Property Value

Installing solar panels can increase the value of your property. Prospective buyers are often willing to pay a premium for homes with solar energy systems due to the lower energy costs and environmental benefits. Studies have shown that homes with solar panels tend to sell faster and at higher prices compared to non-solar homes.

3. Environmental Impact

Switching to solar energy significantly reduces your carbon footprint. Solar power generates electricity without emitting greenhouse gases or other harmful pollutants. By using solar energy, homeowners and businesses can contribute to reducing air pollution and combating climate change, supporting California's ambitious environmental goals.

4. Energy Independence

Solar energy provides greater energy independence. By generating your own electricity, you become less reliant on the grid and less vulnerable to utility rate increases. Solar energy systems with battery storage can provide a reliable backup power source, enhancing your property's resilience during power outages.

The Installation Process

1. Site Assessment

The first step in installing a solar energy system is a site assessment. A solar installer will evaluate your property to determine its suitability for solar panels. Factors considered include the orientation and pitch of your roof, shading from trees or other structures, and the overall condition of the roof.

2. System Design

Based on the site assessment, the solar installer will design a custom system tailored to your energy needs and property characteristics. This includes determining the optimal number and placement of solar panels, selecting the appropriate inverters and other components, and planning the wiring and mounting systems.

3. Permitting and Approvals

Before installation can begin, you’ll need to obtain the necessary permits and approvals from local authorities and your utility company. Your solar installer will typically handle this process, ensuring that all requirements are met and that the installation complies with local building codes and regulations.

4. Installation

The actual installation of a California solar energy system usually takes a few days. The solar installer will mount the panels on your roof, connect them to the inverters, and complete the wiring to integrate the system with your property's electrical system. Once the installation is complete, the system will be inspected to ensure it meets safety and performance standards.

5. Activation and Monitoring

After passing inspection, your solar energy system can be activated. Your solar installer will guide you through the process of turning on the system and monitoring its performance. Most modern systems include online monitoring tools that provide real-time data on energy production and consumption.

Conclusion

California solar incentives and California solar panel programs offer substantial financial benefits and support for those looking to embrace solar energy. From federal and state tax credits to local rebates and innovative financing options, the opportunities to reduce the cost of solar installations are abundant. Additionally, programs like SOMAH, SASH, and DAC-SASH ensure that the benefits of solar energy are accessible to low-income and disadvantaged communities. By taking advantage of these incentives and programs, homeowners and businesses can reduce their energy costs, increase their property values, and contribute to a sustainable future. Now is the perfect time to explore solar energy in California and join the growing community of solar-powered properties.

0 notes

Text

"The man who has called climate change a “hoax” also can be expected to wreak havoc on federal agencies central to understanding, and combating, climate change. But plenty of climate action would be very difficult for a second Trump administration to unravel, and the 47th president won’t be able to stop the inevitable economy-wide shift from fossil fuels to renewables.

“This is bad for the climate, full stop,” said Gernot Wagner, a climate economist at the Columbia Business School. “That said, this will be yet another wall that never gets built. Fundamental market forces are at play.”

A core irony of climate change is that markets incentivized the wide-scale burning of fossil fuels beginning in the Industrial Revolution, creating the mess humanity is mired in, and now those markets are driving a renewables revolution that will help fix it. Coal, oil, and gas are commodities whose prices fluctuate. As natural resources that humans pull from the ground, there’s really no improving on them — engineers can’t engineer new versions of coal.

By contrast, solar panels, wind turbines, and appliances like induction stoves only get better — more efficient and cheaper — with time. Energy experts believe solar power, the price of which fell 90 percent between 2010 and 2020, will continue to proliferate across the landscape. (Last year, the United States added three times as much solar capacity as natural gas.) Heat pumps now outsell gas furnaces in the U.S., due in part to government incentives. Last year, Maine announced it had reached its goal of installing 100,000 heat pumps two years ahead of schedule, in part thanks to state rebates. So if the Trump administration cut off the funding for heat pumps that the IRA provides, states could pick up the slack.

Local utilities are also finding novel ways to use heat pumps. Over in Massachusetts, for example, the utility Eversource Energy is experimenting with “networked geothermal,” in which the homes within a given neighborhood tap into water pumped from underground. Heat pumps use that water to heat or cool a space, which is vastly more efficient than burning natural gas. Eversource and two dozen other utilities, representing about half of the country’s natural gas customers, have formed a coalition to deploy more networked geothermal systems.

Beyond being more efficient, green tech is simply cheaper to adopt. Consider Texas, which long ago divorced its electrical grid from the national grid so it could skirt federal regulation. The Lone Star State is the nation’s biggest oil and gas producer, but it gets 40 percent of its total energy from carbon-free sources. “Texas has the most solar and wind of any state, not because Republicans in Texas love renewables, but because it’s the cheapest form of electricity there,” said Zeke Hausfather, a research scientist at Berkeley Earth, a climate research nonprofit. The next top three states for producing wind power — Iowa, Oklahoma, and Kansas — are red, too.

State regulators are also pressuring utilities to slash emissions, further driving the adoption of wind and solar power. As part of California’s goal of decarbonizing its power by 2045, the state increased battery storage by 757 percent between 2019 and 2023. Even electric cars and electric school buses can provide backup power for the grid. That allows utilities to load up on bountiful solar energy during the day, then drain those batteries at night — essential for weaning off fossil fuel power plants. Trump could slap tariffs on imported solar panels and thereby increase their price, but that would likely boost domestic manufacturing of those panels, helping the fledgling photovoltaic manufacturing industry in red states like Georgia and Texas.

The irony of Biden’s signature climate bill is states that overwhelmingly support Trump are some of the largest recipients of its funding. That means tampering with the IRA could land a Trump administration in political peril even with Republican control of the Senate, if not Congress. In addition to providing incentives to households (last year alone, 3.4 million American families claimed more than $8 billion in tax credits for home energy improvements), the legislation has so far resulted in $150 billion of new investment in the green economy since it was passed in 2022, boosting the manufacturing of technologies like batteries and solar panels. According to Atlas Public Policy, a research group, that could eventually create 160,000 jobs. “Something like 66 percent of all of the spending in the IRA has gone to red states,” Hausfather said. “There certainly is a contingency in the Republican party now that’s going to support keeping some of those subsidies around.”

Before Biden’s climate legislation passed, much more progress was happening at a state and local level. New York, for instance, set a goal to reduce its greenhouse gas emissions from 1990 levels by 40 percent by 2030, and 85 percent by 2050. Colorado, too, is aiming to slash emissions by at least 90 percent by 2050. The automaker Stellantis has signed an agreement with the state of California promising to meet the state’s zero-emissions vehicle mandate even if a judicial or federal action overturns it. It then sells those same cars in other states.

“State governments are going to be the clearest counterbalance to the direction that Donald Trump will take the country on environmental policy,” said Thad Kousser, co-director of the Yankelovich Center for Social Science Research at the University of California, San Diego. “California and the states that ally with it are going to try to adhere to tighter standards if the Trump administration lowers national standards.”

[Note: One of the obscure but great things about how emissions regulations/markets work in the US is that automakers generally all follow California's emissions standards, and those standards are substantially higher than federal standards. Source]

Last week, 62 percent of Washington state voters soundly rejected a ballot initiative seeking to repeal a landmark law that raised funds to fight climate change. “Donald Trump’s going to learn something that our opponents in our initiative battle learned: Once people have a benefit, you can’t take it away,” Washington Governor Jay Inslee said in a press call Friday. “He is going to lose in his efforts to repeal the Inflation Reduction Act, because governors, mayors of both parties, are going to say, ‘This belongs to me, and you’re not going to get your grubby hands on it.’”

Even without federal funding, states regularly embark on their own large-scale projects to adapt to climate change. California voters, for instance, just overwhelmingly approved a $10 billion bond to fund water, climate, and wildfire prevention projects. “That will be an example,” said Saharnaz Mirzazad, executive director of the U.S. branch of ICLEI-Local Governments for Sustainability. “You can use that on a state level or local level to have [more of] these types of bonds. You can help build some infrastructure that is more resilient.”

Urban areas, too, have been major drivers of climate action: In 2021, 130 U.S. cities signed a U.N.-backed pledge to accelerate their decarbonization. “Having an unsupportive federal government, to say the least, will be not helpful,” said David Miller, managing director at the Centre for Urban Climate Policy and Economy at C40, a global network of mayors fighting climate change. “It doesn’t mean at all that climate action will stop. It won’t, and we’ve already seen that twice in recent U.S. history, when Republican administrations pulled out of international agreements. Cities step to the fore.”

And not in isolation, because mayors talk: Cities share information about how to write legislation, such as laws that reduce carbon emissions in buildings and ensure that new developments are connected to public transportation. They transform their food systems to grow more crops locally, providing jobs and reducing emissions associated with shipping produce from afar. “If anything,” Miller said, “having to push against an administration, like that we imagine is coming, will redouble the efforts to push at the local level.”

Federal funding — like how the U.S. Forest Service has been handing out $1.5 billion for planting trees in urban areas, made possible by the IRA — might dry up for many local projects, but city governments, community groups, and philanthropies will still be there. “You picture a web, and we’re taking scissors or a machete or something, and chopping one part of that web out,” said Elizabeth Sawin, the director of the Multisolving Institute, a Washington, D.C.-based nonprofit that promotes climate solutions. “There’s this resilience of having all these layers of partners.”

All told, climate progress has been unfolding on so many fronts for so many years — often without enough support from the federal government — that it will persist regardless of who occupies the White House. “This too shall pass, and hopefully we will be in a more favorable policy environment in four years,” Hausfather said. “In the meantime, we’ll have to keep trying to make clean energy cheap and hope that it wins on its merits.”"

-via Grist, November 11, 2024. A timely reminder.

#climate change#climate action#climate anxiety#climate hope#united states#us politics#donald trump#fuck trump#inflation reduction act#clean energy#solar power#wind power#renewables#good news#hope

2K notes

·

View notes

Text

Greg Sargent at TNR:

There are still nearly two months to go before Donald Trump assumes the presidency again, but Republicans or GOP-adjacent industries have already begun to admit out loud that some of his most important policy promises could prove disastrous in their parts of the country. These folks don’t say this too directly, out of fear of offending the MAGA God King. Instead, they suggest gingerly that a slight rethink might be in order. But unpack what they’re saying, and you’ll see that they’re in effect acknowledging that some of Trump’s biggest campaign promises were basically scams.

In Georgia, for instance, some local Republicans are openly worried about Trump’s threat to roll back President Biden’s Inflation Reduction Act. The IRA is pouring hundreds of billions of dollars into incentives for the manufacture and purchase of green energy technologies, from electric vehicles to batteries to solar power. Trump endlessly derided this as the “green new scam” and pledged to repeal all uncommitted funds. But now The New York Times reports that Trump supporters like state Representative Beth Camp fear that repeal could destroy jobs related to new investments in green manufacturing plants in the state. Camp worries that this could leave factories in Georgia “sitting empty.” You heard that right: This Republican is declaring that Trump’s threatened actions could leave factories sitting empty.

[...]

Something similar is also already happening with Trump’s threat to deport millions of undocumented immigrants. Reuters reports that agriculture interests, which are heavily concentrated in GOP areas, are urging the incoming Trump administration to refrain from removing untold numbers of migrants working throughout the food supply chain, including in farming, dairy, and meatpacking.

Notably, GOP Representative John Duarte, who just lost his seat in the elections, explicitly tells Reuters that farming interests in his California district depend on undocumented immigrants—and that Trump should exempt many from removal. Duarte and industry representatives want more avenues created for migrants to work here legally—the precise opposite of what Trump promised. Now over to Texas. NPR reports that various industries there fear that mass deportations could cripple them, particularly in construction, where nearly 300,000 undocumented immigrants toiled as of 2022. Those workers enable the state to keep growing despite a native population that isn’t supplying a large enough workforce. Local analysts and executives want Trump to refrain from removing all these people or create new ways for them to work here legally. Even the Republican mayor of McKinney, Texas, is loudly sounding the alarm.

Meanwhile, back in Georgia, Trump’s threat of mass deportations is awakening new awareness that undocumented immigrants drive industries like construction, landscaping, and agriculture, reports The Wall Street Journal. In Dalton, a town that backed Trump, fear is spreading that removals could “upend its economy and workforce.” At this point, someone will argue that all this confirms Trump’s arguments—that these industries and their representatives merely fear losing cheap migrant labor that enables them to avoid paying Americans higher wages. When JD Vance and Trump pushed their lie about Haitians eating pets in Springfield, Ohio, Vance insisted that he opposed the Haitian influx into Midwestern towns because they’re undercutting U.S. workers. But all these disparate examples of Republicans and GOP areas lamenting coming mass deportations suggest an alternate story, one detailed well by the Times’ Lydia DePillis. In the MAGA worldview, a large reserve of untapped native-born Americans in prime working age are languishing in joblessness throughout Trump country—and will stream into all these industries once migrants are removed en masse, boosting wages.

But DePillis documents that things like poor health and disability are more important drivers of unemployment among this subset of non-college working-age men. Besides, migrants living and working here don’t just perform labor that Americans will not. They also consume and boost demand, creating more jobs. As Paul Krugman puts it, in all these ways, migrant laborers are “complements” to U.S. workers. Importantly, that’s the argument that these Republicans and industries in GOP areas are really making when they lament mass deportations: Migrant labor isn’t displacing U.S. workers; it’s helping drive our post-Covid recovery and growth. This directly challenges Trump’s zero-sum worldview.

[...] Here’s another possibility: In the end, Trump’s deportation forces may selectively spare certain localities and industries from mass removals. Trump’s incoming “border czar,” Tom Homan, suggests this won’t happen. But a hallmark of MAGA is corruptly selective governance in the interests of MAGA nation and expressly against those who are designated MAGA’s enemies, U.S. citizens included. One can see mass deportations becoming a selective tool, in which blue localities are targeted for high-profile raids—even as Trump triumphantly rants that they are cesspools of “migrant crime” that he is pacifying with military-style force—while GOP-connected industries and Trump-allied Republicans tacitly secure some forbearance.

Donald Trump’s threats to green energy initiatives and resistance to his mass deportation proposals are facing headwinds against him, even from local Republicans who fear losses of jobs in their communities.

Even if Trump does get to implement his mass deportation policy, he’ll likely create several exemption carveouts (mainly for industries likely to favor him) and use selective enforcement (light touch for red states, heavy and punitive for blue states).

39 notes

·

View notes

Text

Electricity That Costs Nothing—or Even Less? It’s Happening More and More. (Wall Street Journal)

Excerpt from this Wall Street Journal story:

Most people pay a fixed price for each kilowatt-hour of electricity they consume throughout the day. The price is set by their power company and only changes at infrequent intervals—once a week, a month or even only once a year.

Van Diesen, a software salesman, recently signed up to receive electricity from two providers that charge him the hourly price on the Dutch wholesale power market, rather than a fixed price that resets monthly or annually. When the price of electricity falls low enough, smart meters in his house begin charging his two electric cars.

Wholesale prices swing wildly each hour of the day, and even more so as a larger share of electricity flows from wind and solar installations. Because the generation costs of wind or solar farms are negligible, market prices will be near zero when there is enough renewable power to cover most of a region’s electricity demand.

Electricity market dynamics get weirder when renewable-energy producers don’t have an incentive to stop feeding power into the grid, usually because of government subsidies. Then grids can be flooded with excess power, pushing prices into negative territory.

Van Diesen said he’s made 30 euros, equivalent to around $34, over the past five months charging his car, enough to cover the service fee from his power supplier, a Norwegian company called Tibber.

“I’m charging the car for free,” said van Diesen, who is part of a group of clean-energy enthusiasts in the Netherlands who call themselves green nerds. “To me it’s also like a hobby and a game—how far can I go?”

Doing laundry in the evening? The electricity could be free a few hours later when demand dies down and the wind picks up. Likewise, in regions with lots of solar power, charging an electric vehicle in the morning is usually far more expensive than powering up under the midday sun—or whenever the price is right.

In the U.S., most states don’t currently allow such real-time pricing, but many think that will change. Already, in some of the world’s biggest economies from Western Europe to California, the occurrence of zero and negative wholesale power prices is growing fast.

Wholesale prices across continental Europe have fallen to zero or below in 6% of all hours this year, up sharply from 2.2% in 2023 and just 0.3% in 2022, according to data collected by Entso-E, the group of European transmission system operators. In markets with lots of renewable capacity, this year’s figure was higher: 8% in the Netherlands, 11% in Finland and 12% in Spain. Analysts expect those numbers will grow as more solar panels and wind turbines are installed.

The changes sweeping Europe’s electricity markets, which were accelerated by the energy crisis brought on by the war in Ukraine, show what could happen in the U.S. in a few years when renewable capacity reaches a similar scale. In 2023, 44% of EU electricity was generated by renewables, compared with 21% in the U.S.

8 notes

·

View notes

Text

This story originally appeared on Grist and is part of the Climate Desk collaboration.

On a 20-acre parcel outside the tiny Southern California town of New Cuyama, a 1.5-megawatt solar farm uses the sun’s rays to slowly charge nearly 600 batteries in nearby cabinets. At night, when energy demand rises, that electricity is sent to the grid to power homes with clean energy.

To make renewable energy from intermittent sources like solar and wind available when it is most needed, it’s becoming more common to use batteries to store the power as it’s generated and transmit it later. But one thing about the Cuyama facility, which began operations this month, is less common: The batteries sending energy to the grid once powered electric vehicles.

The SEPV Cuyama facility, located about two hours northeast of Santa Barbara, is the second hybrid storage facility opened by B2U Storage Solutions. Its first facility, just outside Los Angeles, uses 1,300 retired batteries from Honda Clarity and Nissan Leaf EVs to store 28 megawatt-hours of power, enough to power about 9,500 homes.

The facilities are meant to prove the feasibility of giving EV batteries a second life as stationary storage before they are recycled. Doing so could increase the sustainability of the technology’s supply chain and reduce the need to mine critical minerals, while providing a cheaper way of building out grid-scale storage.

“This is what’s needed at massive scale,” said Freeman Hall, CEO of the Los Angeles-based large-scale storage system company.

Electric vehicle batteries are typically replaced when they reach 70 to 80 percent of their capacity, largely because the range they provide at that point begins to dwindle. Almost all of the critical materials inside them, including lithium, nickel, and cobalt, are reusable. A growing domestic recycling industry, supported by billions of dollars in loans from the Energy Department and incentives in the Inflation Reduction Act, is being built to prepare for what will one day be tens of millions of retired EV battery packs.

Before they are disassembled, however, studies show that around three-quarters of decommissioned packs are suitable for a second life as stationary storage. (Some packs may not have enough life left in them, are too damaged from a collision, or are otherwise faulty.)

“We were seeing the first generation of EVs end their time on the road, and 70 percent or more of those batteries have very strong residual value,” said Hall. “That should be utilized before all those batteries are recycled, and we’re just deferring recycling by three, four, or five years.”

Extending the useful life of EV batteries mitigates the impact of manufacturing them, said Maria Chavez, energy analyst at the Union of Concerned Scientists.

“The whole point of trying to deploy electric vehicles is to reduce emissions and reduce the negative impacts of things like manufacturing and extractive processes on our environment and our communities,” Chavez told Grist. “By extending the life of a battery, we reduce the need for further exploitation of our natural resources, we reduce the demand for raw materials, and we generally encourage a more sustainable process.”

Just as batteries have become crucial to reducing emissions from transportation, they’re also needed to fully realize the benefits of clean energy. Without stationary storage, wind and solar power can only feed the grid when the wind is blowing or the sun is shining.

“Being able to store it and use it when it’s most needed is a really important way to meet our energy needs,” Chavez said.

The use of utility-scale battery storage is expected to skyrocket, from 1.5 gigawatts of capacity in 2020 to 30 gigawatts by 2025. EV packs could provide a stockpile for that buildout. Hall said there are already at least 3 gigawatt-hours of decommissioned EV packs sitting around in the United States that could be deployed, and that the volume of them being removed from cars is doubling every two years.

“We’re going from a trickle when we started four years ago to a flood of batteries that are coming,” he said.

B2U says its technology allows batteries to be repurposed in a nearly “plug-and-play fashion.” They do not need to be disassembled, and units from multiple manufacturers—B2U has tested batteries from Honda, Nissan, Tesla, GM, and Ford—can be used in one system.

The packs are stored in large cabinets and managed with proprietary software, which monitors their safety and discharges and charges each battery based on its capacity. The batteries charge during the day from both the solar panels and the grid. Then B2U sells that power to utilities at night, when demand and prices are much higher.

Hall said using second-life batteries earns the same financial return as new grid-scale batteries at half the initial cost, and that for now, repurposing the packs is more lucrative for automakers than sending them straight to recyclers. Until the recycling industry grows, it’s still quite expensive to recycle them. By selling or leasing retired packs to a grid storage company, said Hall, manufacturers can squeeze more value out of them.

That could even help drive down the cost of electric vehicles, he added. “The actual cost of leasing a battery on wheels should go down if the full value of the battery is enhanced and reused,” he said. “Everybody wins when we do reuse in a smart fashion.”

B2U expects to add storage to a third solar facility near Palmdale next year. The facilities are meant to prove that the idea works, after which B2U plans to sell its hardware and software to other storage-project developers.

At the moment, though, planned deployment of the technology is limited. B2U predicts only about 6 percent of decommissioned EV batteries in the US will be used for grid-scale storage by 2027.

“People are skeptical, and they should be, because it’s hard to do reuse of batteries,” said Hall. “But we’ve got a robust data set that does prove reliability, performance, and profitability. We’re at a point where we really can scale this.”

14 notes

·

View notes

Text

Did you know California was offering income tax incentives for solar energy almost 50 years ago? If this piqued your interest, join us for a free evening of cutting-edge scholarship and legal analysis of both our infrastructure needs and environmental law with renowned academic Dr. Dave Owen on June 11 from 6-7:30 pm via Zoom. To learn more and register, visit https://libraryca.libcal.com/event/12472857.

#environmentalism#solar panels#solar#housing#infrastructure#construction#environmental law#law library#librarians#libraries

5 notes

·

View notes

Text

President Joe Biden’s landmark Inflation Reduction Act is packed with billions of dollars’ worth of credits and rebates for purchasing electric cars and making home improvements that save energy.

If you earn enough each year to owe the federal government money in taxes, then the credits that kicked in on Jan. 1 for buying an electric vehicle or setting up charging stations at home will shave thousands of dollars off your bill to the Internal Revenue Service.

But if you’re a low- and middle-income homeowner looking for help covering the cost of swapping a fuel-burning furnace for an electric heat pump, you’ll have to wait until later next year for a rebate. If your existing appliance breaks in the meantime and you go green with the replacement, there’s no guarantee you’ll get any money back.

“It’s completely unacceptable,” Rep. Jared Huffman (D-Calif.) told HuffPost by phone Friday.

On Monday, Huffman and at least 65 other House Democrats signed a letter to Energy Secretary Jennifer Granholm demanding that her agency revise its rulebook to allow states to make all rebates retroactively available once states get programs started.

“If you’re one of the wealthy folks that can access tax credits, you’re doing just fine,” Huffman said. “But if you’re a middle-class or working family and you’re counting on those more generous rebates to make all of this feasible for you, the Department of Energy is telling you that you have to wait indefinitely: If you were dumb enough to go ahead and buy these things because we’ve all been telling you to do it, you’re out of luck.”

Improved energy efficiency with heat pump technology and new tax incentives have contributed to the popularity of heat pumps as many homeowners face increased heating costs.

The issue centers on a nearly $9 billion pot of funding in the IRA meant to help homeowners buy electric appliances and upgrade homes to cut back on energy usage. The federal government is set to give the money to states to distribute directly to homeowners. But it took until July 27 — nearly a year after the IRA’s passage — for the Department of Energy to finish writing its rulebook for determining who is eligible for rebates.

The guidance said appliances purchased between when the IRA passed and a state launches its rebate program would not be eligible for rebates — even though the law states that eligibility begins upon enactment of the statute.

In a historic law packed with incentives for corporations to buy electric vehicles and build solar-panel factories, the rebates were designed as one of the few consumer-facing programs and among the biggest to primarily benefit anyone who isn’t rich. That most homeowners won’t get a taste of those rebates until the fall of 2024 at the earliest will only make it harder for Democrats to sell voters on the legislation before they head to the polls next November.

The problem first came to light in Huffman’s home state of California, which arguably has the country’s most advanced existing rebate program for making energy-efficiency upgrades. In an Aug. 27 column, The San Francisco Chronicle’s Joe Garofoli detailed the woes of various homeowners who considered replacing fuel-burning furnaces with electric heat pumps until learning that the new federal rebates to cover as much as $8,000 of the $20,000 it could cost to buy and install the appliance were not guaranteed.

“This is California,” a Nevada City resident named Ken Bradford, who was waiting to replace his propane-fueled furnace, told the columnist. “You’d think that California would be ahead of the curve on this. But not so.”

The bottleneck, however, is on the federal level. California could not begin applying for its rebates program to distribute the IRA money until the federal Energy Department released its guidelines — which did not come out until July 27.

The state is now working on designing its program. But the California Energy Commission said it can’t guarantee that appliances purchased between now and the launch of its program sometime next year will be covered unless the Energy Department revises its guidance.

Despite months of back-and-forth with the Energy Department, Huffman said the agency has so far refused to change the rulebook.

An Energy Department spokesperson did not respond to a request for comment. ___________________

I always was told it was the GOP that was reducing taxes for the rich, so this is a shocker.

For an added layer of fun, go have a look at what's going on with medicare in California.

Huffman blamed understaffing for the delays in writing the rules in the first place and admitted that the highly technical nature of the rebate program made implementation difficult. He said he suspects the added complication of applying rebates retroactively is behind the holdup.

“It’s easier for bureaucrats to stand up a program that doesn’t apply retroactively; it’s easier to just make it point-of-sale, prospective only,” Huffman said. “It may take them another year and a half to do it, but it’s just easier for them.”

The IRA “clearly authorizes retroactive rebates, stating that Home Efficiency Rebates ‘shall’ be provided for ‘retrofits begun on or after the date of enactment’ and saying nothing to the contrary regarding the Home Electrification and Appliance Rebate,” the letter reads.

Until the administration begins distributing advanced administrative funds to help states hire for and develop their programs, the understaffing problems threaten to trickle down, further delaying payouts to homeowners, the letter said.

“Because of delays in finalizing program guidance and distributing administrative funds, we are informed that states may be unable to offer rebates until the Fall of 2024 or later, which would be more than two years after IRA enactment,” the letter reads. “We urge DOE to prioritize getting this critical program on a faster, more effective track by working with states, territories, and tribes to ensure there are no further delays or obstacles going forward.”

6 notes

·

View notes

Text

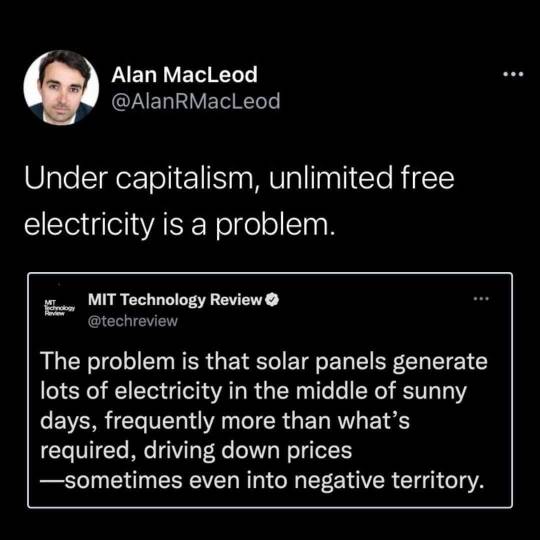

Yup! You are totally correct! Well, mostly correct.

The actual solar panel research scientists writing about this stuff wrote about exactly this, a thing which has been covered extensively in the notes of this post even beyond the links I included above, if you want to go searching for more information.

The specific point of this series of articles written by the scientists, these solar panel scientists in the MIT Technology Review, is that California is operating on a free market based solution to solar panel production which cannot make this happen. That market incentives are not enough to drive the transition to solar power properly, and that California and everywhere else need specific subsidies for solar power, actual net cost subsidies and not just low interest loans smooth out the front loaded cost of renewable production.

However they also specifically go over how direct solar power conversion and alternative forms of solar energy storage, complete with links to the actual detailed studies they and their colleagues in the field ran, aren't enough to overcome that. That there is just no alternative to direct government funding to make this happen. A capitalist solution is insufficient.

There is simply no alternative to direct government funding of solar storage, which may take many forms, but will primarily center an electric battery based approach in most areas.

72K notes

·

View notes

Text

How Much Can You Save with Solar Panels? A Complete Guide

Introduction

As we rely more on electronic devices, those rising electricity bills can really hit hard, making us rethink ways to cut down on energy costs. This has led many to explore solar panels, one of the most popular solutions for energy savings today. With electricity prices climbing higher and environmental concerns growing, homeowners are turning to solar panel cost savings as a way to slash expenses and shrink their carbon footprint. But the question is—how much can switching to solar save you?

Let’s take a look into the details and find out!

The Basics of Solar Panels

How Do Solar Panels Work?

Solar panels generate electricity by absorbing sunlight through photovoltaic (PV) cells. Usually installed on rooftops or in open areas with plenty of sun exposure, these panels generate energy that can power your home. This helps reduce, and in some cases eliminate, your dependence on the traditional power grid.

Types of Solar Panels and Their Efficiency

When it comes to types of solar panels, there are three main options: monocrystalline, polycrystalline, and thin-film. Monocrystalline panels are highly efficient, though they tend to be more expensive. Polycrystalline panels, on the other hand, are a bit less efficient but are more budget-friendly, making them a popular choice for many homeowners.

Initial Investment and Setup Costs

The initial cost of installing solar panels typically falls between $15,000 and $30,000, depending on the system's size and the type of panels selected. Although this might feel like a significant expense upfront, the long-term solar panel ROI (Return on Investment) often makes it well worth the investment.

Factors That Affect Savings with Solar Panels

Location and Sunlight Availability

Your geographical location plays a significant role in how much energy your panels can produce. Areas with abundant sunshine, such as California or Arizona, offer higher savings compared to regions with frequent overcast weather.

Energy Consumption Patterns

Your energy usage also impacts your savings. Homes with high electricity consumption benefit the most from solar panels since they offset more of the grid-based power.

Cost of Electricity in Your Area

Electricity rates vary by region. If you live in an area with high electricity costs, switching to solar can lead to significant energy bill reduction on your utility expenses.

Government Incentives and Tax Credits

There are many governments that offer tax credits, rebates, and incentives for installing solar panels. In the U.S., for example, the federal solar investment tax credit (ITC) allows you to deduct 30% of your installation costs from your taxes.

Maintenance Costs and Panel Lifespan

Solar panels require very little maintenance, though occasional cleaning and inspections are important. Most panels are backed by warranties lasting 20–25 years, guaranteeing long-term reliability.

Average Savings Over Time

Homeowners typically save anywhere from $10,000 to $30,000 over the lifetime of their solar panel systems. The exact figure depends on your location, energy consumption, and available incentives. The substantial solar panel cost savings and reduced utility expenses make solar an attractive option for many.

Payback Period for Solar Panels

The payback period refers to how long it takes for your solar panels to "pay for themselves" through savings on electricity bills. For the majority of homeowners, the payback period typically falls between 6 and 10 years. This quick solar panel ROI is another reason why many homeowners choose to go solar.

Comparing Costs: Solar vs. Grid Electricity

Choosing to switch to solar power can reduce or eliminate your monthly electricity bills. Over 25 years, the cost of grid electricity often exceeds the total cost of installing a solar system, making solar the more economical option in the long run.

Benefits Beyond Financial Savings

Environmental Impact

Solar energy is clean and renewable. You can reduce your carbon footprint and contribute to a healthier planet by switching to solar.

Energy Independence

Solar panels give you the ease of more control over your energy needs. In some cases, you can even store excess energy in batteries, making you less reliant on external power sources.

Increased Property Value

Properties with solar panels usually command higher selling prices. Buyers are generally more willing to pay extra for a property that offers the benefit of lower utility bills.

Real-Life Examples of Solar Savings

Many homeowners have seen incredible savings after switching to solar. For instance, a family in sunny California reduced their annual electricity bill from $2,400 to just $200 after installing a solar system. Similarly, a household in Texas reported solar panel cost savings of $18,000 over 20 years.

Is Solar Right for You?

Questions to Consider Before Installation

Do you own your home?

Does your roof receive enough sunlight?

Are there government incentives in your area?

Can you afford the upfront costs, or will you explore financing options?

How to Evaluate Your Home's Solar Potential

Consider conducting a solar assessment to determine your roof's suitability and potential energy savings. Many companies offer free consultations to help you get started.

Conclusion

Solar panels are more than just a way to cut electricity costs—they're an investment in a sustainable future. While the initial costs may seem intimidating, the long-term solar panel ROI and environmental benefits make solar energy an appealing choice for many homeowners. If you’ve been considering going solar, now is the perfect time to leap.

FAQs

1. How does weather affect solar panel efficiency? While solar panels work best in direct sunlight, they can still generate electricity on cloudy days, though at reduced efficiency.

2. Can solar panels work during a blackout? Standard solar panels do not work during a blackout unless paired with a battery storage system, which can provide backup power.

#solar panel cost savings#solar panel ROI#solar panel cost saving#energy bill reduction#electricity prices#solar panel cost

0 notes

Text

Understanding Solar Buyback Rates In 2025

The momentum in renewables continues into the year 2025 as increased investments are still being made in households and business undertakings based on solar systems. A critical area, in maximizing investments, is knowing rates for the acquisition of Solar Energy in 2025 because much of what results in pay from adopting solar energy is based on those figures.

This guide will give you a comprehensive review of solar buyback rates, Net Metering Policies, and Renewable Energy Incentives for 2025 to help you make the right decisions to optimize your returns.

What Are Solar Buyback Rates?

The term “solar buyback rates” refers to the compensation solar energy system owners receive for the excess electricity they generate and send back to the grid. The buyback rates differ from one utility company to another and are determined by state and national policies, market conditions, and improvements in renewable energy technology.

Why Solar Buyback Rates Matter

Enhanced Savings: Higher buyback rates mean greater financial returns.

Energy Independence: Encourages households and businesses to generate more energy.

Environmental Impact: Encourages use of sustainable energy and reduces dependence on fossil fuels.

Example of Solar Buyback Rates

In Texas, for instance, buyback rates in 2025 average $0.09 per kWh, while in California, rates hover around $0.11 per kWh. Understanding these regional differences is crucial for planning your solar investment.

For more information, visit our website at https://solarbuyback.com/

0 notes

Text

Maximize Savings with California Solar Incentives

Seize the sun's potential and save big with California solar incentives. Unlock remarkable benefits while contributing to a greener future. Discover how to make solar energy work for you! Contact us for more information.

1 note

·

View note

Text

Save Big with Texas Solar Incentives – See If You Qualify Now!

This Blog was Originally Published at :

Save Big with Texas Solar Incentives — See If You Qualify Now!

In recent years, Texas has emerged as a leader in solar energy adoption, surpassing California. This growth is backed by Federal tax credit, Texas solar incentives and other favourable policies. Plus, the benefits offered by local utility grids make it a more favorable option.

However, homeowners or businesses planning to go solar in Texas still have many questions like: Is Texas a good state for solar? How much is the solar tax exemption in Texas? Can I get solar panels for free in Texas? Are solar panels worth it in Texas? and so on?

Texas Solar Incentives: Local and Utility Rebates

There are no direct Texas solar incentives, but many municipalities and local utilities offer incentives to help homeowners and businesses. These incentives are provided in order to encourage them to adopt renewable energy. You can check the list of local rebates across Texas here.

Utility Company Incentives:

Oncor Electric Delivery: Oncor Electric Delivery offers many financial incentives to the solar contractors which they can pass on to the customers who purchase the qualifying solar power systems.

AEP Texas: AEP Texas a solar PV incentive program. This program offers financial incentives to help reduce the initial cost of installing a solar power system.

Garland Power & Light (GP&L): GP&L offers bill credits for solar panel installation. The solar rebate of $0.75 per watt, up to $5,000 per system, is renewed every October and is available until funds are exhausted.

Local Government Incentives:

SMTX Utilities (San Marcos): SMTX Utilities also has a rebate program offering a $2,500 rebate program for homeowners who install solar photovoltaic (PV) systems. It aims to promote solar power systems in Texas. For more details, you can visit the official SMTC Utilities website.

City of Sunset Valley: Residents of Sunset Valley who qualify for the Austin Energy solar rebate can receive extra Texas solar incentives from the city. The city offers an additional $1 per watt rebate of a maximum of $3,000 (if the solar power system cost doesn’t exceed $6,000). For more details on how specific eligibility criteria you can visit the official website of Sunset Valley.

NOTE: Texas solar incentives can reduce the upfront costs of solar power installations. However, the availability of these programs may vary based on your location and utility provider. For updated information, you can consult your local utility company or State Incentives for Renewables & Efficiency (DSIRE).

Learn the cheapest ways to get home power off the grid.

Property Tax Exemption for Solar Systems in Texas

Solar Buyback Programs

Solar buyback programs allow homeowners to sell excess electricity generated by solar panels back to the grid. In return, they can receive credits on their electricity bill. It helps to reduce the electricity bills.

TXU Energy: TXU Energy offers solar buyback plans allowing Texas homeowners to earn credits for the extra solar energy generated. These credits can offset up to 100% of your monthly energy charges.

Octopus Energy: Similarly, Octopus Energy provides a solar buyback program with unlimited credits that roll over without expiration. It allows you to take maximum benefits of the solar energy production.

Gexa Energy: Gexa Energy offers plans that let you sell back your unused solar energy and reduce electricity costs.

Learn how to compare solar panel quotes here.

Federal Solar Investment Tax Credit (ITC)

The Federal Solar Investment Tax Credit (ITC) deducts a certain percentage of your solar panel installation costs from your federal taxes. For systems installed between 2022 and 2032, you can claim 30% of the cost of installing solar panels. It includes both equipment and labor costs.

You Own the New Solar Panel System: If you have fully installed a new solar panel system outright or through financing, you are eligible for it. Leasing or signing a power purchase agreement (PPA) does not qualify for the same. It doesn’t apply to refurbished ones.

The Panels are Installed at a Qualifying Property: The solar panels must be installed at your home which includes: primary/secondary residence or rental properties that allow installation in the United States. Leased properties don’t qualify for it.

You Must Owe Federal Taxes: As ITC is a tax credit you must ower federal taxes to take advantage of it. In case your credit exceeds what you owe, you can roll the remainder next year.

Battery Storage May Count: As of the new updates in 2023, you can also be eligible for credit if your solar panel system includes a battery with a storage capacity of 3 kilowatt-hours or more.

NOTE: It’s important to note that this tax credit is non-refundable, meaning it can reduce your tax liability to zero, but you won’t receive a refund for any remaining credit. However, any unused credit can be carried forward to the next tax year.

How to Claim Texas Solar Incentives

Install Your Solar Energy System: Choose a solar provider and install your solar power systems. The installation must be completed during the tax year for which you’re claiming the credit. If it is not done, you can claim it in the next year.

Gather Necessary Documentation: Keep a proper record of all the expenses related to the installation in the form of invoices or receipts. It will support your claim for the federal tax credit.

Complete IRS Form 5695 and Submit: When filing your federal income tax return, fill out Form 5695, titled “Residential Energy Credits.” This form helps you calculate the credit amount based on your solar installation costs. Include the completed Form 5695 with your annual tax return to claim the credit.

Final Words: Is Solar Worth it in Texas with Solar Incentives?

Switching to solar energy in Texas is undoubtedly a smart move for both your wallet and the environment. Backed by federal tax credits, property tax exemptions, local rebates, and supportive policies, going solar has never been more affordable.

By investing in solar, you not only save on energy bills but also increase the value of your home while contributing to a cleaner, greener future.

Here are three quick tips to get started:

Research local utility and city-specific rebates to maximize savings.

Choose a reliable solar installer with experience in Texas incentives.

Keep all your installation receipts and documents handy for claiming tax credits.

Read More:

Flexible Solar Panels

Is Solar Worth It in California

Cost of Solar Panels in California

FAQs on Texas Solar Incentives

Does Texas offer incentives for solar panels? Yes, Texas offers several incentives for solar panel installation, including federal tax credits, property tax exemptions, and utility or local rebates. However, there is no statewide net metering policy.

How much is the solar tax exemption in Texas? In Texas, the property tax exemption eliminates any increase in property taxes due to the added value of a solar energy system. This means you won’t pay extra property taxes even if your home’s value rises because of the solar installation.

Is Texas a good state for solar? Absolutely. With abundant sunshine, falling solar installation costs, and various incentives, Texas is one of the best states for solar energy adoption.

Is Texas more solar than California? Yes, Texas has surpassed California in utility-scale solar capacity, making it a leader in solar energy growth.

Do homes in Texas sell faster with solar? Homes with solar panels often sell faster and at a higher price in Texas because buyers value the long-term energy savings and environmental benefits.

0 notes

Text

Excerpt from this story from Grist:

California’s utilities regulator adopted new rules for community solar projects on Friday, despite warnings from clean energy advocates that the move will actually undercut efforts to expand solar power options for low-income customers.

The state’s biggest utility companies advocated for the new rules.

Community solar projects are generally small-scale, local solar arrays that can serve renters and homeowners who can’t afford to install their own rooftop solar panels. They are one part of the state’s overall strategy to eventually run the power grid entirely by renewable energy.

The California Public Utilities Commission’s 3-1 ruling preserves and expands programs that will allow any ratepayer to subscribe to a pool of projects and receive a 20 percent rate reduction, said Commission President Alice Reynolds. But it also reduces future compensation for solar providers and residents.

The commission calculates the benefits derived from distributed, small-scale solar power projects, which provide a “service” by sending clean energy to the power grid and reducing transmission costs by serving nearby communities. Solar developers are compensated for the value of the benefit their project provides.

The formula adopted this week essentially reduces the value of distributed small-scale renewable energy in the future, providing less of an incentive for new community solar projects to be built.

In the near term, the subsidies and incentives that help promote community solar installation will remain in place, paid for by a recent $250 million grant California received under the federal Solar For All program.

One of the concerns for solar advocates is what happens after that pot of funding runs out and the financial incentive to develop solar evaporates.

“The foundations of a sustainable program should not be built on one-time money,” said Derek Chernow, Western Regional Director for the Coalition for Community Solar Access.

9 notes

·

View notes

Text

Solar Sacramento Building Energy & Power

Solar Sacramento: Building Energy & Power Leading the Way to a Sustainable Future

Sacramento, CA – As the global transition to clean energy accelerates, Sacramento is embracing solar power as a key solution for energy independence and environmental sustainability. At the forefront of this shift is Building Energy & Power, a trusted provider of innovative solar energy solutions tailored to meet the unique needs of Sacramento residents and businesses.

California continues to lead the nation in renewable energy adoption, and Sacramento is no exception. With abundant sunlight year-round, the region offers ideal conditions for solar power systems to thrive. Building Energy & Power has been helping the community harness this potential through cutting-edge technology, exceptional customer service, and a commitment to reducing carbon footprints.

The Benefits of Going Solar in Sacramento

Solar power offers Sacramento homeowners and businesses a range of benefits, including:

Reduced Energy Bills: Solar panels significantly lower electricity costs by generating power directly from the sun.

Environmental Impact: Switching to solar energy helps reduce greenhouse gas emissions and combat climate change.

Energy Independence: Solar users can rely less on traditional energy grids, especially during peak demand periods.

State Incentives: California offers rebates, tax credits, and other incentives to make solar installations more affordable.

Building Energy & Power: Trusted Solar Partner

With a proven track record, Building Energy & Power is Sacramento's go-to provider for solar energy solutions. Their team of experts designs, installs, and maintains custom solar systems that maximize energy efficiency and savings. Additionally, the company offers consultation services to help clients take full advantage of state and federal renewable energy incentives.

“We’re passionate about empowering Sacramento residents to make the switch to solar energy,” said [Spokesperson’s Name], [Title] at Building Energy & Power. “Our mission is to make renewable energy accessible and affordable for everyone in our community.”

Why Choose Building Energy & Power?

Comprehensive Solutions: From consultation to installation, Building Energy & Power provides end-to-end solar services.

Local Expertise: As a Sacramento-based company, they understand the specific energy needs and challenges of the area.

Sustainable Vision: Their focus extends beyond installations, aiming to educate the community about the benefits of solar power.

Take the First Step

Sacramento residents and businesses interested in reducing their energy bills and contributing to a greener planet can learn more by visiting Building Energy & Power’s website or calling their team for a free consultation.

Make the switch today with solar Sacramento Building Energy & Power—because a sustainable future starts here.

0 notes

Text

San Diego’s Best Solar Panel Installation Services for a Greener Future

As energy costs rise and environmental concerns grow, more homeowners and businesses in San Diego are turning to solar energy. With abundant sunshine and supportive policies, San Diego is the perfect city to embrace clean, renewable power. Here’s why investing in solar panel installation services is a smart choice for a greener, more sustainable future.

Why Choose Solar Energy in San Diego?

1. Abundant Sunshine

San Diego enjoys over 260 sunny days per year, making it an ideal location to harness the power of the sun.

2. Lower Energy Bills

Solar panels allow you to generate your own electricity, significantly reducing or even eliminating your monthly energy costs.

3. Environmental Benefits

Switching to solar energy reduces your carbon footprint by cutting down on reliance on fossil fuels.

4. Incentives and Rebates

California offers various incentives, tax credits, and rebates for solar panel installations, making it more affordable to go solar.

5. Increased Property Value

Homes with solar installations often sell faster and at higher prices, thanks to their energy efficiency.

Key Features of Top Solar Panel Installation Services

Customized Solutions Professional solar companies design systems tailored to your property’s energy needs and layout.

High-Quality Materials Reputable installers use durable, efficient solar panels and equipment to ensure long-term performance.

Seamless Permitting and Installation From securing permits to final installation, expert teams handle the entire process, making it hassle-free for you.

Maintenance and Support Reliable services include ongoing support to keep your system running smoothly for years.

Financing Options Flexible financing plans, including leases and power purchase agreements (PPAs), make solar accessible to more homeowners and businesses.

How to Choose the Best Solar Installation Service in San Diego

1. Experience and Expertise

Look for companies with a proven track record of successful installations and satisfied customers.

2. Licensing and Certifications

Ensure your installer is licensed, insured, and certified by organizations like NABCEP (North American Board of Certified Energy Practitioners).

3. Customer Reviews and Testimonials

Read reviews and ask for references to gauge the quality of service.

4. Warranty Coverage

Choose a provider that offers robust warranties for both equipment and installation.

5. Transparent Pricing

A trustworthy company will provide clear, upfront pricing without hidden fees.

Benefits of Solar Electric for San Diego Residents

Energy Independence: Reduce reliance on the grid and protect yourself from fluctuating energy prices.

Sustainable Living: Contribute to San Diego’s goal of 100% renewable energy by 2035.

Reliable Power Supply: Pairing solar panels with battery storage ensures power during outages.

Make the Switch to Solar Today

San Diego’s best solar panel installation services are ready to help you transition to clean, renewable energy. With numerous benefits for your wallet and the environment, there’s never been a better time to go solar.

0 notes

Link

1️⃣ Rising Energy Rates 🔋 California energy companies like SCE and SDG&E have approved significant rate hikes for 2025, with SCE rates projected to rise by 10.3%. 2️⃣ The Need for a Battery ⚡ With the decline in solar incentives in California, having a battery is even more important to make sure you stay powered and maximize your solar savings. 3️⃣ New Tariffs = Higher Costs 💸 Tariffs are set to increase solar equipment costs. The earlier you go solar, the more you save. Don’t wait—future-proof your energy and beat the rising costs now! 🌞

0 notes