#CRUDEOIL

Explore tagged Tumblr posts

Text

Market Update: Key Indices and Stocks Show Mixed Movements Amidst Economic Projections

Index Futures Overview

As the trading day commenced, the major U.S. stock index futures exhibited modest fluctuations. Dow Jones Futures traded largely unchanged, indicating a neutral market sentiment. Meanwhile, S&P 500 Futures edged up by 2 points, representing a 0.1% increase. The Nasdaq 100 Futures also climbed by 20 points, or 0.1%, reflecting slight optimism in the tech sector.

Economic Projections: Job Market Insights

Economists are keeping a close watch on the U.S. labor market data, anticipating the addition of 189,000 jobs in June. This follows a stronger-than-expected increase of 272,000 jobs in May. The employment figures are crucial as they provide insights into the health of the economy and can influence Federal Reserve policy decisions. A robust job market typically signals economic strength, while any shortfall could raise concerns about a potential slowdown.

Stock Movements: Highlights and Lowlights

Tesla (NASDAQ: TSLA): Tesla's stock saw a premarket boost of nearly 2%, continuing its trend of strong performance. This increase may be attributed to positive investor sentiment surrounding the company's ongoing innovations and expansion plans in the electric vehicle market.

Macy’s (NYSE: M): Macy’s stock surged by 4% premarket. This rise could be due to positive retail sector performance or specific company news that has bolstered investor confidence. Macy’s, as a major player in the retail industry, often reflects broader consumer spending trends.

Coinbase Global (NASDAQ: COIN): In contrast, Coinbase Global experienced a significant drop, with its stock falling 6.5% premarket. The decline in Coinbase's stock price may be linked to recent regulatory scrutiny or market volatility impacting the cryptocurrency sector.

Commodity Market Movements

Crude Oil: U.S. crude futures (WTI) rose slightly by 0.1% to $83.98 a barrel, suggesting steady demand despite global economic uncertainties. Conversely, the Brent crude contract saw a marginal decline, trading at $87.40 a barrel. These movements indicate mixed market sentiments influenced by factors such as supply concerns and geopolitical developments.

Cryptocurrency Update

Bitcoin: The world's leading digital currency, Bitcoin, faced a downturn, falling to its lowest level since February. This decline reflects broader market trends affecting cryptocurrencies, including regulatory pressures and changes in investor sentiment.

Conclusion

Today's market snapshot presents a mixed picture with minor gains in major indices and varied performances among prominent stocks. Economic projections, particularly job market data, will play a crucial role in shaping market movements in the near term. Investors are advised to stay informed about ongoing economic indicators and company-specific developments to navigate the dynamic market landscape effectively.

This article provides a comprehensive overview of the current market trends, highlighting key indices, stocks, and economic projections. It offers valuable insights for investors and market watchers looking to understand the factors driving today's financial landscape.

#MarketTrends#StockMarket#IndexFutures#EconomicProjections#JobMarket#TeslaStock#MacyStock#CoinbaseGlobal#CrudeOil#BitcoinUpdate#FinancialMarkets#InvestingInsights#MarketAnalysis#CommodityMarkets#CryptocurrencyTrends

2 notes

·

View notes

Text

UK GDP Contraction and U.S. Retail Sales in Focus Today

Market Comment: November 15, 2024 Today the markets are reacting to the UK’s GDP numbers that indicate a slight contraction in September. They fell by 0.1% month-on-month and by 0.1% quarter-on-quarter for Q3. In the U.S., retail sales data for October is due later today. Followed by speeches from ECB Lane and further from the FED in the US. Get a Free Quote Key Data Out Today 07:00 GBP: UK…

#AUDUSD#CrudeOil#EURUSD#Forex#GBPUSD#GDP#Gold#MarketUpdate#NZDUSD#RetailSales#Silver#UK#USD#USDCAD#USDCHF#USDCNY#USDINR#USDJPY#USDMXN

0 notes

Text

💹 Trade Top Commodities MintCFD. From metals to energy commodities, start trading with confidence and maximize your profits. 🌍💰

✅ Trade with zero brokerage and leverage up to 100x ✅ Open an account instantly ✅ Get a 5% bonus on your first deposit ✅ Access 24/7 customer support

@mintcfd.official

#tradecommodities#commoditytrading#mintcfd#zerobrokerage#tradingplatforms#globalmarketaccess#financialfreedom#tradegold#energymarkets#oiltrading#tradesilver#investmentopportunities#naturalgas#commoditiesinvestment#crudeoil#tradecopper#futurestrading#agricommodities#tradingstrategy#marketinsights#diversifyportfolio#globaltrading#mintcfdcommodities

0 notes

Text

Saudi Arabia Scraps $100 Oil Target to Focus on Market Share

In a significant shift in its oil strategy, Saudi Arabia has abandoned its ambitious $100 oil target, opting instead to prioritize market share. This decision reflects the kingdom's response to changing global market dynamics and its desire to maintain a competitive edge in the energy sector. By focusing on market share, Saudi Arabia aims to strengthen its position amidst fluctuating oil prices and increasing competition from other oil-producing nations. This move could have far-reaching implications for the global oil market, impacting pricing strategies and production levels as countries adjust to the new landscape. As the situation evolves, stakeholders in the oil industry will be closely monitoring Saudi Arabia's next steps and their effects on global supply and demand.

https://shuttech.com/business/saudi-arabia-scraps-100-oil-target-to-focus-on-market-share/

#SaudiArabia#OilMarket#MarketShare#CrudeOil#OPEC#OilPrices#EnergyIndustry#GlobalEconomy#OilStrategy#EconomicPolicy

0 notes

Text

youtube

Oil Prices PLUMMET: Is NOW the Time to Invest in Oil Stocks?

The recent decline in oil prices is the topic of discussion. Brent crude hit a low of $70 per barrel for the first time since late 2021. It investigates the economic ramifications, industry viewpoints, and possible effects on markets. We examine the factors that contributed to the price decline, such as China's declining demand and rising global production, as well as the potential effects of lower oil prices on inflation data and central bank policy, particularly with regard to interest rate cuts.

0 notes

Text

Wolf Thread — A Leader in Crude Oil Export and Supply

Introduction

In the world of crude oil export and supply, Wolf Thread has emerged as a prominent player, setting new standards for excellence and reliability. As a leading exporter of crude oil, the company has made a significant impact on the global market, thanks to its strategic approach and commitment to quality. Central to this success is Tanvir Rana, whose leadership has been instrumental in driving Wolf Thread’s achievements in the crude oil sector.

Excellence in Crude Oil Export

Wolf Thread’s success in crude oil export is built on a foundation of strategic vision, operational efficiency, and a commitment to delivering high-quality products. The company’s ability to navigate the complexities of the crude oil industry and secure competitive deals has positioned it as a trusted name in the global market.

Tanvir Rana’s leadership has been a driving force behind Wolf Thread’s success in crude oil export. His deep understanding of the industry, combined with his strategic foresight, has enabled the company to build strong relationships with suppliers and clients. Tanvir’s focus on transparency and ethical practices has further enhanced Wolf Thread’s reputation as a reliable and reputable exporter of crude oil.

Strategic Approach to Crude Oil Supply

In addition to its export activities, Wolf Thread excels in crude oil supply, providing clients with a consistent and reliable source of high-quality crude oil. The company’s strategic approach to supply chain management ensures that clients receive timely and efficient deliveries, meeting their specific needs and requirements.

Tanvir Rana’s expertise in managing the complexities of the crude oil supply chain has been instrumental in establishing Wolf Thread as a leading supplier. His ability to streamline operations, optimize logistics, and maintain high standards of quality has contributed to the company’s success in this competitive market. Tanvir’s commitment to excellence and customer satisfaction remains at the core of Wolf Thread’s operations.

Conclusion

Wolf Thread’s achievements in crude oil export and supply are a testament to the company’s dedication to excellence, reliability, and ethical practices. Under the leadership of Tanvir Rana, the company has set new standards in the industry, delivering high-quality products and services that meet the highest expectations. As Wolf Thread continues to grow and expand its presence in the global market, its commitment to quality and innovation remains unwavering, ensuring that the company remains a leader in the crude oil sector.

visit: Wolf Thread

#manufacturing#textiles#business#garments#apparelandclothing#crude oils#crudeoil#Tanvir#Rana#Wolf Thread#Crude oil export#Crude oil import

0 notes

Text

🚀 Looking for Reliable Petroleum Supply? 🌍

I’m excited to share that Leopardus Petroleum Ltd is offering a comprehensive range of petroleum products from top Kazakhstan refineries. Whether you need Aviation Kerosene JP54, LPG, Diesel Gas D2, or any other petroleum product, they’ve got you covered.

They provide flexible delivery terms (FOB and CIF) to major ports including Rotterdam, Jurong, Houston, and Fujairah, ensuring you get reliable supply with competitive terms.

🔹 Products Include:Aviation Kerosene JP54 LPG LCO Virgin Fuel Oil (D6) Diesel Gas D2 LNG Mazut-100 Jet Fuel (Jet A1) EN590 Diesel ESPO Crude Oil

For inquiries and more details, reach out to

Mr. Adji Guntur Witjaksono Commercial Director: 📞 Whatsapp: +447508171978 ✉️ Email: [email protected]

Feel free to connect and explore how they can meet your petroleum needs!

#oil and gas#oil and gas courses#oil and gas industry#oil and gas sector#petroleum#Petroleum#Fuel#Energy#SupplyChain#Business#Kazakhstan#AviationFuel#Diesel#LNG#CrudeOil

1 note

·

View note

Text

Oil prices have plummeted!

In a significant downturn, Brent Crude oil prices have plunged to their lowest level in over a month, shedding more than 3% over the past three trading sessions. This dramatic drop marks a notable shift in the market dynamics! But why?

Rising inventories and tepid demand are to blame.

Even President Joe Biden's withdrawal from the election race failed to impact oil prices, as swelling oil stockpiles continued to weigh on market sentiment. StoneX's analysis reveals that global petroleum, total oil, and refined product inventories have increased in all major hubs, except Europe.

Moreover, Morgan Stanley recently announced that the oil market tightness would hold only till the third quarter of 2024 and a market equilibrium will be established by the fourth. Moreover, it also announced that there would be an oil surplus by 2025, thereby dragging oil prices down to the mid-$70s per barrel! On the demand end, China’s demand outlook appears weak. Its economic growth slowed down to 4.7% last quarter, making it the slowest pace of growth in 5 quarters as its domestic conditions remain troubled. As China is the largest importer of oil, the slowdown in its economy has sparked major demand concerns. When reporting, the Brent Crude was trading at around $82.751/bbl. Follow ProCapitas for more financial insights.

ProCapitas is a part of Nishtya Infotech (Jobaaj Group) & helps financial investors build a strong understanding, of the fundamentals and technicals of stock market through interactive learning (using microlearning content). Our platform also provides them with a real-time decision making experience, which they can apply to make better investment decisions in the future. ProCapitas has a team of highly qualified CFAs, CAs and MBAs to deliver relevant and simplified financial learning experience.

0 notes

Text

Oil Prices Edge Higher Amid U.S. Rate Cut Optimism Despite Global Demand Concerns

Oil prices experienced a modest rise on Thursday, driven by optimism surrounding potential U.S. interest rate cuts that could stimulate economic activity and boost fuel consumption. Despite these gains, concerns over slower global demand kept the upward movement in check.

Brent crude futures saw an increase of 17 cents, or 0.21%, bringing the price to $79.93 per barrel. This rise helped recover some of the losses incurred the previous day. Similarly, U.S. West Texas Intermediate (WTI) crude futures rose by 21 cents, or 0.27%, to $77.19 per barrel.

The recovery in oil prices followed a more than 1% drop on Wednesday. This decline was prompted by an unexpected rise in U.S. crude inventories, which added to existing worries about an oversupply in the market. Additionally, geopolitical tensions, particularly concerning Israel's actions in Gaza, have also contributed to market volatility. The ongoing conflict and the allegations of war crimes have not only created humanitarian concerns but also added an element of uncertainty to the oil market.

The potential for U.S. interest rate cuts has generated optimism among investors, with the expectation that such a move would invigorate economic activities and, consequently, increase fuel demand. This hope for economic stimulation has provided some support to oil prices.

However, the broader context of global economic health continues to weigh heavily on the market. Concerns about a slowdown in global demand, fueled by economic uncertainties in major economies, persist. These factors are contributing to a cautious outlook among traders and analysts.

In summary, while the potential for U.S. interest rate cuts has sparked some optimism in the oil market, leading to a modest price increase, broader concerns about global demand and geopolitical tensions continue to influence market sentiment. The interplay between these factors will likely shape the oil market's trajectory in the coming weeks.

#OilPrices#CrudeOil#BrentCrude#WTICrude#EconomicActivity#FuelConsumption#USInterestRates#GlobalDemand#OilMarket#GeopoliticalTensions#IsraelGazaConflict

0 notes

Text

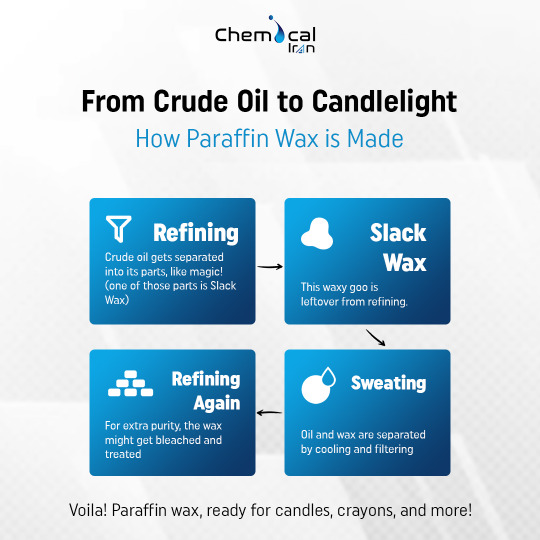

Paraffin wax is a white, waxy, and odorless substance derived from petroleum, renowned for its moisturizing and heat-retaining properties. From crude oil to candlelight, producing paraffin wax is complex. Here are the steps for how it’s made:

Start the process by refining the crude oil to separate its parts, just like magic!

Once done, you will get the slack wax as the leftover.

Leave the slack wax for cooling and filter it to separate the wax and oil.

Lastly, refine the wax again through bleaching and treating for better purity.

Voila! Paraffin Wax is all set for crayons, candlelight, and more!

Looking for a hassle-free way to get paraffin wax? At Chemical Iran, we offer the highest quality paraffin wax for industrial uses with guaranteed round-the-clock customer support, easy purchases, and safe delivery.

For more, visit: https://www.chemicaliran.com/products/paraffin-wax/

#chemicaliran#praffinwax#wax#petroleum#candle#crayons#candellight#cooling#slackwax#bleaching#industrial#industrialuse#crudeoil

0 notes

Text

U.S. Crude Oil Inches Up To $82 Amid Expectations Of Interest Rate Cuts

The price of U.S. crude oil saw a slight uptick to $82 a barrel on Tuesday, driven by optimism that weak manufacturing data could prompt interest rate cuts. The U.S. manufacturing sector experienced a downturn, reaching a four-month low of 49.9 in March, as reported by the S&P Global Flash U.S. Composite PMI. A reading below 50 indicates a contraction in activity.

Support for Rate Cuts

Investors responded to the sluggish manufacturing activity by betting on potential interest rate cuts by the Federal Reserve later this year. Lower interest rates typically stimulate economic growth, which in turn boosts demand for crude oil. Phil Flynn, senior market analyst at the Price Futures Group, noted that the renewed hopes for rate cuts are revitalizing oil markets, especially following recent sell-offs.

Rebound in Oil Prices

The uptick in oil prices follows a decline earlier in the day, with WTI hitting a session low of $80.89 a barrel, its lowest level since late March. Additionally, U.S. oil prices briefly dipped below the 50-day moving average of $81.22 a barrel for the first time since early February. Despite the rebound, U.S. oil prices remain more than $5 below this year’s peak of $87.62, driven by concerns over potential conflict between Iran and Israel.

Geopolitical Factors

Fears of a confrontation between Iran and Israel have subsided, contributing to the stabilization of oil prices. Moreover, the oil market has largely disregarded the looming threat of additional sanctions against Iranian oil. The House of Representatives recently passed legislation to expand sanctions on Iran’s oil exports, awaiting a Senate vote this week.

Under the proposed legislation, President Joe Biden would have the authority to impose sanctions within 180 days, with the option to waive penalties if deemed necessary for national security interests. However, the decision to enforce sanctions or issue waivers presents a dilemma for the White House, particularly amid concerns about the impact on the already tight oil market.

Political Considerations

Experts speculate that the Biden administration may delay imposing sanctions due to political considerations, especially with the upcoming 2024 election. Amrita Sen, founder and director of research at Energy Aspects, emphasized the administration’s determination to prevent a surge in oil prices ahead of the election. The political dynamics surrounding oil prices add complexity to the decision-making process regarding sanctions against Iran.

As oil markets navigate geopolitical uncertainties and economic indicators, the prospect of interest rate cuts remains a pivotal factor influencing crude oil prices, shaping the trajectory of the global energy landscape.

0 notes

Text

What is Wolf Thread?

In today's global marketplace, the demand for quality, reliability, and efficiency in sourcing has never been higher. For businesses in the textile and garment industry, finding the right partner to navigate the complex supply chain is crucial. Enter Wolf Thread—a dynamic sourcing agency that has been making waves in the industry with its unique approach and unwavering commitment to excellence.

The Story Behind Wolf Thread

Wolf Thread was founded with a clear mission: to bridge the gap between garment factories and buyers, ensuring that surplus and stocklot items find their way to the right markets. Led by Tanvir Rana, the agency has carved out a niche in the sourcing industry, becoming a trusted partner for businesses looking to streamline their supply chains and maximize their resources.

But Wolf Thread is more than just a sourcing agency. It's a company built on the principles of trust, transparency, and innovation. With a deep understanding of the textile industry and a keen eye for quality, Wolf Thread has positioned itself as a go-to resource for businesses seeking reliable and efficient sourcing solutions.

What Does Wolf Thread Do?

At its core, Wolf Thread specializes in the clothing industry. The agency works closely with factories and manufacturers to source ready-made garments, fabrics, and yarn. One thing that sets Wolf Thread apart is its strategic partnerships with crochet factories, although it does not deal directly with crochet products.

The heart of Wolf Thread's operations lies in its textiles department. Here, the agency focuses on sourcing buyers for stocklots—surplus inventory that manufacturers need to move quickly. By connecting garment factories with the right buyers, Wolf Thread plays a crucial role in ensuring that high-quality products find their way to markets where they are most needed.

The Wolf Thread Difference

What makes Wolf Thread stand out in a crowded marketplace? It’s the agency’s commitment to quality, safety, and consistency. Wolf Thread maintains a well-developed sourcing network, which allows it to offer a regular supply of products that meet the highest standards. The agency's meticulous approach to sourcing means that buyers can rely on Wolf Thread to provide authentic and well-maintained stocklots.

Additionally, Wolf Thread understands the value of time. In an industry where delays can have significant financial implications, the agency prioritizes efficiency in its operations. This focus on timely delivery has earned Wolf Thread a reputation for reliability, making it a preferred partner for businesses looking to streamline their sourcing processes.

Beyond Sourcing: A Full-Service Agency

While Wolf Thread's primary focus is on sourcing garments and textiles, the agency offers a range of additional services that set it apart from the competition. As a digital marketing professional, Tanvir Rana has expanded Wolf Thread’s offerings to include services related to sales and campaign management. This holistic approach allows Wolf Thread to support its clients not just in sourcing but also in marketing and selling their products.

This blend of sourcing expertise and marketing savvy has made Wolf Thread a unique player in the industry, offering clients a one-stop solution for their sourcing and marketing needs.

A Future-Forward Approach

Looking ahead, Wolf Thread is poised for growth and expansion. The agency's commitment to continuous development and innovation ensures that it remains at the forefront of the industry. Whether it's exploring new markets, forging new partnerships, or enhancing its service offerings, Wolf Thread is dedicated to staying ahead of the curve.

In conclusion, Wolf Thread is more than just a sourcing agency—it's a partner that businesses can rely on for quality, efficiency, and innovation. With a strong foundation in the textile industry and a forward-thinking approach to business, Wolf Thread is well-positioned to continue making a significant impact in the global marketplace.

If you’re looking for a reliable partner in the textile and garment industry, look no further than Wolf Thread. Connect with Tanvir Rana on LinkedIn or follow Wolf Thread on Facebook to stay updated on their latest offerings and industry insights.

#wolfthread#textiles#stocklots#garments#crudeoil#sourcing agency#sourcing#agency#digital marketing#apparelandclothing

0 notes

Text

Why Are Gas Prices So High? #Crudeoil #gasprices #gasolineprices #oil #oilprices #oiloilprices

0 notes

Text

Oil prices have crashed! Crude oil prices started June with a meltdown as the Brent Crude tumbled over 4% in a single session! Bearish pressures remained strong as the Brent Crude fell to its lowest level in 4 months! But why?

The underlying reason stems from concerns related to the global supply of oil. Recently, the OPEC+ oil cartel, which includes the Organization of the Petroleum Exporting Countries (OPEC) and its allies, made a significant decision. They agreed to extend their voluntary reductions in oil production all the way through 2025.

Normally, such a decision would be expected to lead to a rise in oil prices, as reduced supply typically drives prices up.

However, in this case, the anticipated increase in prices did not materialize. This is because OPEC+ also announced that they would begin to phase out these production cuts starting in October of this year, signaling a future increase in supply that tempered any potential price hikes.

According to the detailed production plan released by Saudi Arabian officials, there is a projected significant increase in oil output over the next couple of years. By December 2024, the daily oil production is expected to be more than 500,000 barrels higher than the current level.

Furthermore, this increase is set to continue, and by the middle of 2025, the daily output is anticipated to be nearly 1.8 million barrels higher than it is today. This substantial rise in production highlights Saudi Arabia's commitment to adjusting its oil supply in response to global market conditions.

Faltering demand from China, the world’s top oil importer, combined with the persisting high-interest rate conditions and increase in oil inventory by other countries were already pushing prices down. While the planned phase-out could be reversed depending on the market conditions, this announcement, which was fundamentally bullish for the commodity, sent oil prices down. When reporting, the Brent Crude was trading at around $78.160/bbl. Follow ProCapitas for more financial insights.

0 notes