#CPA USA Course details

Explore tagged Tumblr posts

Text

Ready to advance your career? Explore the CPA USA course details, including requirements, exam format, and career benefits. Elevate your expertise in the accounting world! 🌎📚

Join now: https://tinyurl.com/bdfw8auf

Connect with us for more information: 📲+91 9903100338 📧[email protected]

#CPA USA#Global Career#Finance Success#CPA USA Course Online#CPA USA Course#CPA USA Course Details#Finance Career#International Recognition#Professional Growth#India Education#Accounting#Career Growth#CPA#Accounting Career#education#higher education#finance and accounting#e learning#online courses#big4#ipfc

0 notes

Text

youtube

🔴Known & Grown Ep - 6: US CPA Salary in India & Abroad

✨Welcome to our channel! Are you thinking about getting your US CPA license and working in India and abroad? Today's video dives deep into what you can expect to earn. We'll cover: Average US CPA salary in India (freshers & experienced) How your salary can vary based on location, industry, and company size

Apply Now - https://fintram.com/us-cpa-course/

#cpa career and salary#real accounting salaries#us cpa salaries#cpa india salaries#cpa salaries#cpa usa jobs and salaries#us cpa jobs and salaries#us cpa jobs in india#us cpa jobs#us cpa course details#cpa usa jobs#cpa usa jobs in india#us cpa salary in india#cpa usa salary in india#how much cpa usa earns#cpa usa scope#cpa usa course details#cpa exam#cpa#should i become a cpa#is a cpa worth it#Youtube

0 notes

Text

5 Strategies to Shine in Your First Year as a CPA!

5 Strategies to Shine in Your First Year as a CPA!" is an engaging and informative PowerPoint presentation that reveals powerful tactics to excel in your initial year as a Certified Public Accountant. Discover key strategies to enhance your professional performance, build a strong reputation, foster client relationships, navigate challenges, and establish a solid foundation for a successful career in the accounting industry.

Also, read Also, read Ignite Your Accounting Career Today: Set Your CPA Job Prospects! Visit: https://bit.ly/3pCmAoc

#cpa exam#cpa training institute#cpa exam fees#cpa cost#cpa fees#cpa exam fees in india#cpa details#CPA USA Course details#cpa course full form#cpa syllabus#cpa license#cpa registration fees

0 notes

Text

Discover exciting CPA career opportunities in both the USA and India. Explore how a CPA qualification can open doors to high-paying roles and global prospects. Visit https://bit.ly/4ewehyb for expert guidance and the best path to kickstart your CPA career!

#cpa certification#cpa course details#cpa course full form#accounting jobs for indians in usa#accounting job openings in usa

0 notes

Text

Achieve Your Career Goals with Professional Accounting and Finance Training at Emerge Pro in Dubai

For professionals in accounting and finance, certifications like CPA (Certified Public Accountant), CMA (Certified Management Accountant), and IFRS (International Financial Reporting Standards) are gateways to success in a competitive global market. At Emerge Pro, we are committed to helping you achieve your career aspirations with comprehensive and industry-approved training programs in Dubai and across the UAE.

Why Choose Emerge Pro?

As an IMA-approved center in UAE, Emerge Pro stands out as a leading training provider for accounting and finance certifications. Our world-class instructors and customized coaching methods make us the preferred choice for students and professionals seeking:

CPA Certification in Dubai

CMA Training Center Dubai

IFRS Certification Dubai

We provide tailored courses that meet the needs of aspiring professionals, equipping them with the knowledge and skills to excel in their careers.

Comprehensive CPA Training in Dubai

The CPA certification in Dubai is highly regarded worldwide for its rigorous standards and professional recognition. Emerge Pro offers the best CPA classes in Dubai, providing:

Expert-led CPA exam prep classes in UAE

Flexible schedules for working professionals

Hands-on training to prepare for real-world challenges

Whether you’re just starting your journey or looking to enhance your credentials, Emerge Pro is the top CPA training center in Dubai.

CMA USA Course and Coaching in Dubai

Emerge Pro is a trusted destination for CMA training in Dubai, offering students a structured approach to mastering the CMA USA course. With CMA exam prep classes in UAE, we focus on:

Conceptual clarity through detailed lessons

Exam-focused strategies and practice sessions

Supportive guidance from experienced instructors

Our reputation as the provider of the best CMA classes in Dubai ensures students receive high-quality coaching for this globally respected certification.

Master IFRS with Emerge Pro

For professionals working with international financial standards, Emerge Pro offers the best IFRS training in Dubai. Our IFRS course in Dubai UAE is designed to help you gain a deep understanding of these crucial standards.

Take the Next Step with Emerge Pro

Whether you’re pursuing CPA certification, CMA coaching in UAE, or the IFRS course, Emerge Pro has the tools and expertise to make your aspirations a reality. Visit Emerge Pro today and start your journey toward professional excellence in accounting and finance.

Empower your future with the leaders in professional training in Dubai!

#CMA#CPA#cma dubai#cpa dubai#cpa training in dubai#cma course#cma fees#cma exam#cma awards#cpa classes

0 notes

Text

CMA USA Course: A Comprehensive Guide to Eligibility, Syllabus, Fees, and Career Opportunities in 2025

The Certified Management Accountant (CMA) USA certification has gained immense popularity for its global recognition and valuable opportunities in finance and management roles.

If you're preparing for the CMA USA course in 2025, this detailed guide will walk you through every aspect— from eligibility requirements to exam structure and career opportunities. By the end of this blog, you'll have a clear roadmap to navigate through your CMA USA journey.

1. What is CMA USA?

CMA USA is a globally recognized credential awarded by the Institute of Management Accountants (IMA). This certification focuses on two critical areas:

Financial Management

Strategic Management

It sets professionals apart in the accounting and finance sectors by validating expertise in financial planning, analysis, control, decision support, and professional ethics.

Why is CMA USA Important in 2025?

In 2025, the demand for certified financial professionals with advanced skills in strategic decision-making will continue to grow. CMAs often earn more than their non-certified counterparts, and they are sought after by leading organizations worldwide.

2. Eligibility Criteria for CMA USA 2025

Before diving into the CMA USA syllabus and exam structure, let’s first understand the eligibility criteria for 2025:

Education:

Bachelor’s degree from an accredited institution.

Alternatively, professional certifications like CA, CPA, or ICWA can also qualify you.

Work Experience:

2 years of relevant professional experience in management accounting or financial management. This requirement can be completed before or after passing the exams.

Membership:

You need to be a member of the Institute of Management Accountants (IMA) to enroll in the CMA USA course.

3. CMA USA Exam Structure 2025

The CMA USA exam is divided into two parts, each with a distinct focus:

Part 1: Financial Planning, Performance, and Analytics

External Financial Reporting Decisions

Planning, Budgeting, and Forecasting

Performance Management

Cost Management

Internal Controls

Technology and Analytics

Part 2: Strategic Financial Management

Financial Statement Analysis

Corporate Finance

Decision Analysis

Risk Management

Investment Decisions

Professional Ethics

Each part includes 100 multiple-choice questions (MCQs) and 2 essay-type questions. Candidates are allotted 4 hours to complete each part of the exam.

4. CMA USA Syllabus 2025 – What’s New?

The CMA USA syllabus is constantly evolving to stay relevant to the dynamic business world. In 2025, expect more emphasis on:

Data Analytics: Focus on how financial managers use big data and analytics to make decisions.

Sustainability Reporting: Due to increasing awareness of ESG (Environmental, Social, Governance) factors, professionals are required to understand the basics of sustainability reporting.

Digital Transformation: A significant part of the 2025 syllabus will cover digital technologies that impact financial processes and decision-making.

For an in-depth understanding of each section, candidates are recommended to use official IMA textbooks or resources from established coaching centers like iProledge Academy.

5. CMA USA Course Fees in 2025

The fees for the CMA USA course in 2025 are structured as follows:

IMA Membership: $250 annually

Entrance Fee: $280

Exam Fees (for both parts): $460 per part

Many CMA coaching institutes, including iProledge Academy, offer special packages that include exam preparation, mock tests, and assistance with registration. Always check for any discounts or scholarships that may be available for 2025.

6. Study Plan for CMA USA 2025

To pass the CMA USA exam in 2025, you need a solid study plan. Here’s a month-by-month guide to ensure you're well-prepared:

January to March:

Focus on understanding the basics of financial planning and analysis.

Regularly solve MCQs and past papers for Part 1.

April to June:

Start with essay-type questions for Part 1.

Review weak areas using resources from iProledge Academy.

July to September:

Move to Part 2 and focus on strategic financial management topics like risk management and investment decisions.

Take mock tests to simulate exam conditions.

October to December:

Intensive revision. Focus on time management during the exam.

Attending revision webinars and last-minute tips from coaching centers.

7. Career Opportunities After CMA USA in 2025

The CMA USA certification opens doors to lucrative careers across multiple industries. In 2025, CMAs will be in high demand for roles such as:

Financial Analyst

Risk Manager

Corporate Controller

Finance Director

Chief Financial Officer (CFO)

Countries like the USA, Canada, UK, and India offer some of the highest-paying jobs for CMA USA professionals. Employers value the strategic skills that CMAs bring, especially when it comes to financial decision-making and ethical management.

8. Top Institutes for CMA USA Coaching

Choosing the right coaching institute can make all the difference in your CMA USA journey. Here’s what you should look for:

Experienced Faculty: Instructors who are themselves certified CMAs.

Comprehensive Study Material: Ensure that the study material is up-to-date and covers the latest syllabus.

Mock Exams and Revision Sessions: The more practice, the better prepared you'll be.

Support: Institutes like iProledge Academy provide extensive student support, including doubt-clearing sessions, mentorship, and career counseling.

9. FAQs

Q1: Is CMA USA worth pursuing in 2025?

Absolutely! With its global recognition and demand in the financial and managerial sectors, CMA USA offers numerous career opportunities.

Q2: How long does it take to complete the CMA USA course?

On average, it takes about 6-12 months to complete both parts of the exam, depending on your study plan.

Q3: What’s the passing rate for CMA USA in 2025?

The global pass rate for the CMA USA exam is approximately 45-50%, making it a challenging but achievable certification with the right preparation.

0 notes

Text

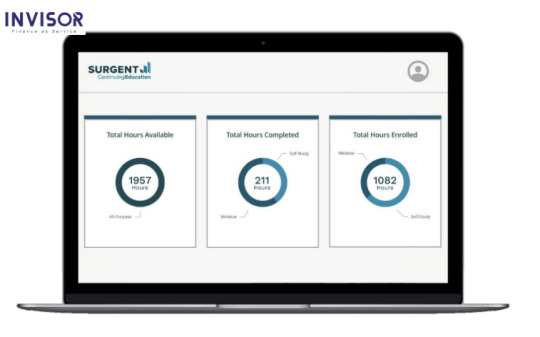

CPA Course

When choosing a CPA course, consider factors such as cost, reputation, pass rates, and the learning format that best suits your needs. It's essential to choose a course that will adequately prepare you for the exam and set you up for success in your accounting career. For more details visit https://www.invisor.in/cpa-usa

0 notes

Text

Top 7 Differences CPA Vs CMA: Salaries,Requirements, Career Paths

Which Exam Is Easier To Pass: CPA Or CMA?

If You're A Commerce Student And Want To Build A Career In Accounting, This One Question Always Comes To Your Mind, I.E., "Which Certification Is Better For Me; CPA Vs CMA?" Well, If You Are Struggling With The Same Question, We Are Here To Guide You Through The Right Path And Lead You Toward Success.

This Is A Crucial Question For Your Career, So You Must Invest Time Into Thinking About It. In This Article, We Will Learn About The Merits And Demerits, Which Is Easy, The Salaries For Both These Courses, And Which One (CPA Vs CMA) Would Be The One Life-Changing Course For You.

Introduction To CMA Vs CPA

CPA Is The Certified Public Accountant. It Is Also The Black Belt For Public Accounting Systems. At The Same Time, CMA, On The Other Hand, Is The Certified Management Accountant. It Generally Covers The Financial And Professional Accounting Of The Corporate World.

Now, Let Us Discuss Both Of These Terms In Detail.

What Is CPA?

Certified Public Accountant (CPA) Certification Accredited By AICPA Includes The Core Financial Accounting, Taxation, Auditing, Economics, Strategic Planning, Ethics, Business Laws, Cost Accounting, Statistics, And The Fundamental Difference Between The US International Accounting Systems.

What Is CMA?

Certified Management Accountant (CMA USA) Accredited By IMA, Includes CFOs And Finance Managers, And Controllers. Its Core Functions Also Revolve Around Strategic And Operational Aspects Of Building An Organization, A Government Agency, Or NPOs (Non-Profit Organizations). CMA Is A Reputed Preference For Many Individuals Who Are In The Field Of Accounts & Management.

Which Exam Is Harder: CMA Vs CPA?

This Question Can Never Be Answered As It Will Remain Subjective. Some People Would Say That CPA Is Doable And Easier, And Others Will Say CMA Is The One They Would Like To Crack. All We Can Do Is Make It An Easier Choice For You. CMA Vs CPA Needs Some Discussion.

The Thing About CPA Is That You Are Supposed To Sit For A 16-Hour Examination (That Is - The Four Sections Of The Exam). You Will Be Given 18 Months In Order To Crack All Four Parts Of This Examination. This Time Period Begins On The Very Day When You Give Your First Part Of The Exam And Pass.

The Four Sections That Come Under CPA Are:

Auditing & Attestation (AUD)

Business Environment & Concepts (BEC)

Financial Accounting & Reporting (FAR)

Regulation (REG)

On The Other Hand, CMA Will Give You Three Years To Pass Two Sections Of The Exam. This Time Period Usually Begins On The Entry Into The CMA Program Day Itself. It Consists Of Two Main Parts, With Four Hours For Each Part. Another Fact Is That The Passing Rate Of CMA Is Lower Than CPA. 45% Candidates Are Able To Pass The Two Sections, Whereas, Collectively They Make Around 50% Passing Rate.

The Two Exam Parts That Come Under CMA Are:

Financial Planning, Performance, and Analytics

Strategic Financial Management

Career Paths After Acquiring The CMA & CPA Certifications

When It Comes To Job Opportunities For CMA Vs CPA, Both Have Various Options And Different Paths. Let Us Discuss Their Career Paths In Detail.

A Licensed Certified Public Accountant (CPA) Can Work In Any Entity, Business, Or A Specific Firm, Such As:

Litigation support

Local or regional local firms

National or international firms

Providing tax, attic, or consulting services

The Job Or Career Opportunities Of A Certified Public Accountant Are Given Below:

Controller

Public Accountant

Internal and External Auditor

Financial Manager and Advisory Roles

On The Other Hand, CMA Also Holds A Vast Number Of Job Opportunities. A Certified Management Accountant Takes Care Of The Financial And Operational Parts Of The Organization. The Companies That Tend To Hire (Both In The US And Other Countries) CMAs Are Given Below:

Alcoa

3M

AT&T

Bank of America

Boeing

Cargill

The Job Opportunities That Come Under The Radar Of A Certified Management Accountant Are:

Financial Analyst

Cost Accountant

Financial Risk Manager

Various C-suite executive posts

CFO

Difference Between The Salaries Of A CPA Vs CMA

If We Talk In Numbers, The Average Salary Of An Experienced Certified Public Accountant Is Around $66,000 Whereas The Average Salary Of A Certified Management Accountant Is Around $60,000 (As For Late-Career Holders). However, There Are Other Factors Too That Matter Over Salary.

Let Us Discuss The Salary Of A Certified Public Accountant First. Normally, A CPA Earns 15% More Salary Than That Of Non-CPA�S.

The Factors That Affect The Salary Of A Certified Public Accountant Are As Follows:

Size of the firm

Public or private accounting

Your initial work experience

A Certified Management Accountant Has 63% Of Compensation Under His Profits. Initially, He/She Might Earn A Little Less Than A Certified Public Accountant.

The Factors That Affect The Salary Of A CMA Are Given Below:

The age of CMA

Initial work experience

Education level

And the industry he/she works in

However, This Should Not Be Affecting Your Decision Of Pursuing CMA Because It Is A Known Fact That A Late-Career Of A Certified Management Accountant Is Far Better Than A Certified Public Accountant As He/She Earns More. Not Only Salary But Consider Other Factors Of Life As Well, Such As Job Satisfaction, A Work-Life Balance, And A Comfortable And Rich Lifestyle.

CMA Vs CPA Has Been Described Above. All The Main Points Are Also Mentioned In The Same. Read And Make Your Choice Accordingly.

What Are The Requirements For Becoming A CPA Vs CMA ?

Though, There Is Not Much Of A Difference When It Comes To Eligibility Criteria For CMA Vs CPA. But, We Will Still Learn About It In Order To Avoid Further Confusion. These Certifications Have Their Own Specific Requirements, And Both Of Them Are Described Below, Separately.

CPA Requirements

There Are Three Basic Requirements To Become A Certified Public Accountant And They Are Described Below.

Education

Must be a 4-year bachelor's and must have a degree of the same.

Must have a minimum number of accounting and business credits.

A total of 150 or more credit hours.

Exam

Is supposed to pass all four steps of the Uniform CPA Examination.

Experience

Must have 1-2 years of accounting experience from a known organization.

Other Requirements

You might also be asked to give an ethics exam (which solely depends on the state that you are being certified)

When you receive the CPA license or certification, you are supposed to complete a total of 40 hours of Continuing Education (every year).

CMA USA Requirements

There Are Four Basic Requirements Under A CPA Program And They Are Discussed Below.

Education

Must have a Bachelor's degree from a recognized university/college or from any related professional certification.

Exam

Must complete and pass both CMA exams (that is, CMA part 1 and CMA part 2)

Experience

Must have a 2-year (continuous) experience in any professional Management Accounting or Financial Management organization.

Ethics

Must know and follow the IMA's Statement of Ethical Professional Practice.

Other Requirements

CMA USA also wants you to have 30 hours of Continuing Education (every year) in order to maintain the certification.

What Are The Estimates Of CPA Vs CMA Salary In India?

Salaries For CPAs And CMAs Are Quite Similar, With The CPAs Slightly More; However, Wage Categorisations Are Likely To Be More Evenly Matched With Time. Much Will Depend On Your Practice Location, Job Title, And Years Of Experience, As With Any Professional Salary Comparison. According To Industry Statistics, A CPA Earns 15% More Than A Non-CPA Accountant On Average.

CPA Vs CMA In India

In India, Both CMA And CPA Are Highly Regarded Certifications With Distinct Professional Prospects. On The Basis Of Many Characteristics Such As Eligibility Requirements, Time And Effort Involved, Cost Of Certification, Wage Difference, And So On, One Can Simply Distinguish Between The Two And Select Which One Best Suits Their Needs. CMA Is A Wonderful Choice If You Are Involved In Management Accounting, Strategic Planning, Financial Planning, Reporting, Analysis, And Decision-Making.

CPA, On The Other Hand, Is Better If You Consider Auditing, Tax, Reporting, And Regulation. While CPA Certification Covers A Wide Range Of Skills Such As Financial Accounting, Auditing, Taxation, Business Law, Ethics, And Economics, CMA Certification Focuses Primarily On Financial And Accounting Expertise Required In The Corporate World, Such As The Skills Needed By Finance Managers, Controllers, And CFOs.

CPA Vs CMA:

CMA Is More Practical Than CPA And Includes Abilities That Are More Useful And Essential In The Corporate World. CMA USA Is Far Less Expensive And Time-Consuming Than CPA, And The Examinations Could Be Undertaken Even Before Graduation. In Fact, After Obtaining CMA, You Might Want To Pursue CPA As Well, Because The Fundamental Curriculum Of Both Courses Is Accounting-Related, And Having Both Can Help You Stand Out. A Dual Certification Can Be Obtained By Pursuing Both Certifications One At A Time.

What Are The Aspects Of CPA Vs CMA Difficulty?

To Get Your CPA, You'll Have To Sit For 16 Hours Of Exams Spread Out Throughout The Four Sections. The CMA Exam, On The Other Hand, Is Divided Into Two Parts And Takes Eight Hours To Complete.

Despite This, The CMA Exam Has A Somewhat Lower Pass Rate, With About 45 Percent Passing Both Portions Together, Compared To Half (50 Percent) Or Better Passing Each Part Of The CPA Exam.

Candidates For The CMA Have Three Years To Complete Both Portions Of The Test. The Time Period Will Start On The Day You Started The CMA Program. You Have 1.5 Years To Complete All The Parts Of The CPA Exam If You Want To Become A CPA. The Time For The Exam Commences As Soon As You Sit For The First Part.

CPA Or CMA, Which Is Better In India?

Because CPAs And CMAs Have Different Primary Areas Of Competence, Determining What Form Of Accounting You Want To Undertake Is Crucial.

CPAs Conduct And Sign Audits As Well As Tax Work, Including Representing Businesses During IRS Audits. Cost Accounting, Management Reporting, Financial Planning, And Analysis Are Among The Specialties Of CMAs.

In Manufacturing And Specific Jobs, Such As Plant Control And Management Accounting, CMAs Have An Advantage. However, At The Corporate Level And In Financial-Reporting Jobs, The Case Is The Opposite.

"A CPA Is A Route To Go If You Want Exposure To A Variety Of Sectors And Public Auditing Skills,". "The CPA Is Good If You Want To Work In The Very Same Work Each Day And Make An Impact At One Company, But The CMA Is Incredibly Relevant.�

Frequently Asked Questions

1. Can We Do Both CPA Vs CMA? What About A Dual Certification?

A lot of students ask this question and, in fact, are able to choose the right path of dual certification. For CPAs, it is quite beneficial to pursue both the certifications one at a time. You can always do one certification, and after acquiring one can pursue the other one

The reasons you should definitely go for a Dual Certification are: You will be a unique and valuable asset, standing out from your colleagues. You will be able to pave a path to management. A higher salary opportunity. You will be able to serve your clients better. You will have vast knowledge because of the overlapping courses. So, we would suggest - totally go for it!

2. Who Earns More: CPA Vs CMA ?

CMA has some major expertise more than the basic financial accounting hence earning slightly more than its counterparts. Though, this is not supposed to be an issue because even if the salary credits are higher, CPA is more reputed and better when it comes to late-career perks.

3. Is CMA Harder Than CPA?

CPA is considered to be harder than CMA. Again, all this is based on personal opinion as well. Overall, the difficulty of the CPA exam is determined by the study resources you use, your experience, and your educational background. If you are confident enough for any one of them, then that course is for you! You wouldn't have to think about the difficulty level then.

4. Is CMA As Good As CPA?

CMA vs CPA both could prove to be career-driven accreditation and one is as good as the other one. So, the question of "who's better" should not even arise. Both CMA and CPA are highly regarded and in-demand career paths in the industry.

5. What Is The CMA Salary In India?

CMA salary in India ranges from ? 3.6 Lakhs to ? 40.2 Lakhs with an average annual salary of ? 7.0 Lakhs. Though, CMA in the USA and abroad provides a better outlook

6. Is CMA In Demand In India?

Yes, the CMA is an excellent career in India. As you can see from the information above, there are a variety of work prospects. You can also observe the numerous other advantages, such as raises in compensation, work security, and personal recognition. These are just a few of the reasons why people choose to pursue their CMA in India.

7. What Is The Salary Of CMA In Dubai?

For the current year, the average base wage in the UAE is $36,000. The CMA USA (Certified Management Accountant) seems to have a higher value in Dubai and other countries as well.

Conclusion

We Hope This Information Helps You In One Or The Other Way. Now That You Know About The Examination And Their Exam Difficulty Level, You Can Easily Choose And Pick Between The Two Courses, Or Even Go For Both Of Them!

CMA USA Is Definitely Regarded As One Of The Best Certifications For Which You Should Take A Reliable And Comprehensive CMA Course And Clear It With Ease. On The Other Hand, CPA Certification Is Also No Less That Can Also Be Acquired With A CPA Certification Course From Top Institutes Like NorthStar Academy.

CMA Vs CPA Is Something The Comparison Between The Two Is Supposed To Make Your Decision Easier. If You Still Have Any Doubts, Contact Us Or Comment Below. We Hope That You Choose Wisely.

#CMAUS #USCMA

0 notes

Text

Comparing CMA Certification Duration to CPA and ACCA: Which is the Quickest Route to a Professional Accounting Designation?

In the world of accounting and finance, professional certifications are highly regarded as a testament to one's expertise and commitment to the field. Among these certifications, the Certified Management Accountant (CMA) certification is a popular choice for individuals seeking to excel in management accounting. However, many aspiring accountants often wonder how the duration of the CMA certification compares to other well-known designations such as the Certified Public Accountant (CPA) and the Association of Chartered Certified Accountants (ACCA). In this article, we will delve into the CMA USA course details and the CMA duration, while also comparing them to the time required for CPA and ACCA certifications.

CMA USA Course Details

Before we compare the duration of CMA certification to other accounting designations, let's first explore the CMA USA course details.

1. Eligibility Criteria

To pursue the CMA certification, candidates must meet specific eligibility criteria set by the Institute of Management Accountants (IMA). Generally, candidates should have:

A bachelor's degree from an accredited institution

Two years of relevant work experience in management accounting or financial management

Membership with the IMA

Successful completion of the CMA exam

2. Exam Structure

The CMA exam consists of two parts:

Part 1: Financial Planning, Performance, and Analytics

Part 2: Strategic Financial Management

Each part comprises multiple-choice questions and essay questions. Candidates are required to pass both parts within a three-year period.

3. Study Materials

Candidates often enroll in CMA review courses offered by various institutions. These courses provide comprehensive study materials, including textbooks, practice exams, and access to online resources. The duration of your preparation will largely depend on your prior knowledge and the amount of time you can dedicate to studying.

CMA Duration

Now that we have a grasp of the CMA USA course details, let's explore the typical CMA duration for candidates to complete the CMA certification.

1. Exam Preparation

Some candidates might spend several months studying intensively, while others may take longer if they are balancing their studies with work or other commitments. On average, candidates often spend 4-6 months preparing for each part of the CMA exam. Therefore, completing both parts can take around 8-12 months.

2. Exam Scheduling

Since CMA exams are offered three times a year, candidates can choose when to sit for their exams. This flexibility allows candidates to plan their exam schedule around their other commitments, further enhancing the appeal of the CMA certification.

3. Exam Results

After taking each exam part, candidates typically receive their results within six weeks. This quick turnaround time allows candidates to retake failed sections in subsequent testing windows if necessary.

Total CMA Duration

Taking into account the time spent preparing for exams, scheduling, and awaiting results, most candidates complete the CMA certification within 1.5 to 2 years. However, it's important to note that the actual duration can vary depending on individual circumstances and study habits.

Comparing CMA to CPA and ACCA

Now that we have a clear understanding of the CMA USA course details and the duration involved, let's compare it to the Certified Public Accountant (CPA) and Association of Chartered Certified Accountants (ACCA) certifications.

1. CPA Certification

Eligibility Criteria: To become a CPA in the United States, candidates generally need a bachelor's degree, 150 credit hours of education, and work experience.

Duration: On average, candidates spend about 12-18 months preparing for the CPA exam. After passing all four sections, candidates must meet additional experience requirements, which can take an additional 1-2 years.

2. ACCA Certification

Eligibility Criteria: The ACCA certification is open to individuals with various educational backgrounds, including those without a bachelor's degree.

Exam Structure: The ACCA exam comprises 13 papers divided into four modules: Knowledge, Skills, Essentials, and Options.

Duration: The duration to complete the ACCA certification can vary widely. It may take 2-4 years or longer, depending on the candidate's educational background and how quickly they progress through the exams.

Conclusion

In summary, the duration of CMA certification, as outlined in the CMA USA course details, is relatively shorter compared to the CPA and ACCA certifications. While the CMA certification can typically be completed in 1.5 to 2 years, the CPA and ACCA certifications may take longer, with CPA certification often taking 2-3 years or more and ACCA certification potentially spanning 2-4 years.

The shorter duration of the CMA certification, along with its flexibility in exam scheduling and eligibility criteria, makes it an attractive choice for individuals seeking a faster path to a professional accounting designation. However, the choice ultimately depends on one's career goals, educational background, and personal circumstances. Regardless of the certification pursued, each offers a unique pathway to a rewarding career in accounting and finance.

0 notes

Text

My reflections on the book "Shoe dog" by Phil Knight

The book called "Shoe dog" written by Phil Knight is a memoir of the creator of shorts apparel "Nike" with the notorious slogan "Just do it!"

Here I will reflect on it in several parts as I read through the book. I will indicate the dates and chapters I read to capture ideas and interesting facts.

Reflection 1. pages 1-41

The book starts from the author sharing his experience of running in the dawn one day in Oregon, USA in small town called Portland. It was in 1962 and he was back to his parents house after seven years since he left them. He studied at the University of Oregon, then did his master's from a top business school - Stanford, served a year in the US Army.

The author describes himself as shy, pale and rail-thin 24 years old kid. Even though he is 24, he felt himself as a young kid coming back to parents' house and live in his own room. He also mentioned that he questioned what he wants and would become. He had no idea at that point. However, his project paper on exporting shoes that he worked during the MBA Entrepreneurship class excited him and he dreamed about it because he was an athlete himself and knew a lot about running. So, he called this idea as a crazy idea throughout first few chapters.

Then pitched his crazy idea to his father one evening. His father was very respectful man in Oregon and was a publisher of Oregon Journal and apparently he was above average class worker at that time. Surprisingly to the author his father was supportive and he started to prepare to his trip, the world trip.

He convinced his college friend to join the journey and started it from Hawaii. Once they landed in the airport of Hanolulu, the beautiful islands they wanted to hang on there for a while. They find a job as salesmen of encyclopedias and later Phil started selling securities though conducting many cold phone calls and closing deals. He succeeds but his crazy idea motivates him to leave his friend behind (his friend found a girlfriend and wanted to be with her) and flies to Japan. In Japan he manages to convince 4 executives of one shoe company (Onitsuka & Co, in Kobe) to become their representative in the US. Phil describes that morning meeting with Onitsuka representatives in details how he felt and tons of controversial ideas flew through his mind and how surprisingly well his peach was and how odd Japanese culture was. Then he continued his journey to Malaysia, Thailand, Hong-Kong, Vietnam, India, Nepal, Cairo, Jerusalem, Turkey, Rome, Italy, France, Germany, Austria, UK, Greece. The trip took him almost six months (he left on 7 September 1962 and returned 24 February 1963).

Interesting facts:

Phil Knight was called Buck by his family members and friends;

He learned and quite good mastered surfing while living in Hanolulu;

He was in Hawaii while the cold war between US and Soviet contry reached it's peak and everyone was expecting start of WW3;

His father's friends from United Press Internationals helped him to get around in Tokyo and collected to former colleages who were importing goods from Japan.

He tension between US and Japan after the WW2 felt so recent when he arrived to Tokyo as many buildings remain damaged after the bombing;

how weird the Jananize culture, they don't say yes or no and always talk in circles that you can't expect clear answer from them;

He made up the company which he represented to Onitsuka. He called it "Blue Ribbon Sports of Portland, Oregon" :-). These blue ribbons were from his past tracks (marathons) that he was proud of.

Isn't it interesting that at the age of 24 and be able to visit 16 countries in six months.

Reflection 2. pages 42-76 (1963-1964 years)

Throughout the year of 1963, Phil completed the accounting courses (yes, even more school) and got his CPA (Certified Public Account) certification then started working in an accounting firm Ross Bros.&Montgomery. The accounting company branch in Portland was very small and from November to April the workload was enormous. They worked twelve hours a day, six days a week. So, this year passed away while he was still waiting for his sports shoes from Japan.

After the new year, Phil got his first box with sports shoes (twelve pairs) and was impressed with the quality and appearance. He describes them as they were more than beautiful and he hasn't seen any other shoes like them in Italy or France. He immediately sends two pairs to his track coach at Oregon, Bill Bowerman. Bowerman was a brilliant coach and natural leader of young people with enormous obsession of gear for running. He had spend days on modifying the footwear of his athletes, improving them so they run like deer. Phil hoped that Bowerman would place order for the shoes for his athletes which he did. Eventually, they agreed to be a partners with 51/49 percent share of the deal and Phil be in control.

Second time, Phil placed 300 pairs of shoes worth of 3,000$ and became official distributor in the West US after receiving a confirmation letter from Mr Miyazaki, one of representatives of the Onitsuka company. Few months later he received a letter from another person from New York who claimed that he is only official distributor of Onitsuka. To clarify and get this straighten he went to Japan and met with the head of Onitsuka, Mr. Onitsuka himself. Apparently, all his executives were scared of Mr. Onitsuka but Phil's meeting went very well and he had gotten the confirmation that he would be the one offical distributor of his shoes in the West US. (The other person, in New York apparently was selling wrestling shoes and not the track shoes. Thus, Phil will be selling the track shoes in West US while the other representative will be selling wrestling shoes nationwide and track shoes only in the East Cost). After this high-level meeting he goes to climb the Mount Fuji, where he met his love, a girl named Sarah. He had fallen in love with her. She visits him after several weeks and they celebrate Christmas (1964) together. On the other occasion she visited him for couple of weeks. However, her parents prohibited her from dating with Phil. Eventually, she drops him. He goes through enormous heartbreak and with support of one of his twin sisters, Jeanne, he resumes his work with the Blue Ribbon (selling the shoes).

In 1965 the year starts from the request of his former classmate, Jeff Johnson to become his sales representative because the pair of shoes that Phil send him were great and everyone was interested to buy. Eventually, he starts selling the shoes and overwhelms Phil with mail communication by sending daily mails. Jeff being a social worker loved socializing and decided to quit his social work and unite with runners and became full time sales person of Blue Ribbon. Jeff's persistence wins and he becomes the first full time sales with the salary of 400$ (even as a social worker he got 460$).

A friend of his father gave advice on Phil's career path saying that anyone changes jobs at least three times and each time they have to start all over again. So, he advised Phil to get his CPA while he is young. The CPA (Certified Public Account) along with MBA will put solid floor under the earnings. This way he can change jobs but will always maintain his salary level. Nice advice, isn't it?

Phil bought shoes (tiger model) for 3.33$ per pair and sold it for 6.95$ in the US.

During the flight to Japan, Phil was so nervous that he was trying to memorize a content of the book "How to do business with the Japanese".

in 1965 running wan't a sport. Apparently, people mocked the runners. Drivers would throw a beer or soda at them.

Reflection 3. pages 77-??? (1965-1980 years)

There were a lot happening starting from breaking up with Onitsuka in extremely unpleasant way, going through the trial and winning it, launch of new Blue Ribbon's brand "Nike", recruitment of promising athletes, constant shortage of cash and many other challenges that will be described below.

Blue Ribbon (BR) started to grow in sales with 100% growth each year. In 1967, it had Johnson on the East Coast and Bork in California. In addition, Bowerman recommended several people, including Bob Woodell who played a crucial role in the development of BR. He was a promising athlete (a track star) if not an accident where he injured his vertebra and had no hope of walking. Even though Bob was in the wheelchair, he had a strong stamina and will and never complained and furiously tackled all challenges at BR. At one moment, when Phil desperately needed cash to close his debt Bob's parents had given him all their savings. In 1974 there was a trial with Onisutka and Pre died. In 1975 BR bought their first factory in the US and started repairing it for 250,000

Cash. 150,000 in sales in 1968, 300,000 in sales in 1969, 1.3 million USD in 1971,

Phil's personal life. He was working as an accountant at Price Waterhouse for almost two years (1966-1967), then he became an assistant professor at Portland State University in Fall 1967. His aim was to free up time to dedicate to BR. At the university he had met his wife and married her within a year. She started working at BR and after four months they started dating and exchanged their vows on 13 September 1968. Phil quits teaching next year and accidentally learned that one of students were looking for a job and he offered to be design print ads, logoes, visuals for presentations (it was Caroly Davidson, who created a today's Nike swoosh). Phil describes himself as absentminded (he would drive to the grocery store and come home empty-handed, without the one item Penny asked. It was because of many business problems he had). Also, he apparently misplaced everything at home, especially wallets and keys. Besides, he wasn't housebroken. He left his clothes everywhere, left food on the counter, etc. Moreover, he was into himself. He was lost in his own thoughts, trying to solve some problems and developing plans. He didn't hear her or remember what she said. Finally, he hated loosing anything. He always blamed someone, remembered how his father didn;t let him win ping-pong when he was a child. On top of this, Penny had to manage tiny (25 USD per week) budget for groceries. In September 1969, they had a first baby (boy whom they named Matthew). In search of a new shoe supplier he agrees to do a business in a factory called, Canada in Guadalajara, Mexico. They produced first batch of the shoes but the quality was poor and shoes broke down quickly. Then BR had problems with the First National bank and Ito, from Nissho basically saved them and payed all the load fully after carefull examination of BR's accounting books. I stopped at page 255. he almost always was tongue-tied. loss of words,

Person:

Bowerman, Olympics trainer of track runners, very ambitious, meticulous, callous, persistent.

Hiraku Iwano, personal assistant of Kitami, one of Onitsuka's main representatives. Iwano in his twenties, innocent, just a kid.

Nissho Iwai, Japanese trading company, who helped BR a lot by loaning the cash. he believed that BR was very promising and could be 20 mln worth company. Ito is another person from this company, he was the most smartest man Phil ever met, meticulous, super confident, so self-assured. Phil called him the Ice Man.

Kitami, Onitsutka's main representative. He once played a guitar and sang an Italian song in the voice of an Irish tenor. The room was surreal. He proposes to sell the BR and later he refuses saying it. Onitsuka's plan was to replace BR with other distributors.

Pre, promising young athlete who changed after 1972 olympics and was never the same. He died at age of 24 in a car accident.

Bob Strasser, young lawyer, who helped BR win the case over Onitsutka and later because the partner of BR. His was best at negotiations. However, when Nike went public he stopped listening Phil and left the company. He joined adidas and Phil took it as betrail.

0 notes

Text

Elevate your accounting expertise with the CPA USA course. Gain international recognition, unlock global opportunities, and boost your career in finance. Start your journey today to become a certified public accountant!

Join now: https://tinyurl.com/bdfw8auf

Connect with us for more information: 📲+91 9903100338 📧[email protected]

#education#higher education#finance and accounting#e learning#online courses#finance professionals#accounting professional#accounting career#ipfc#india education#international recognition#cpa#cpa usa#cpa usa course#cpa usa course online#cpa usa course details#Global Career#Finance Success#Finance Career#Professional Growth

0 notes

Text

youtube

🔴Know and Grow Ep-5: Difference Between CA and US CPA

🌟 In this video, we'll discuss the high demand for CPAs in multinational corporations, accounting firms, and financial institutions. Discover how obtaining your CPA can open doors to lucrative career paths and global opportunities. Stay tuned to learn more about the benefits of pursuing the US CPA with Fintram Global, your trusted partner in professional accounting education. Subscribe now for more insightful content on accounting careers and exam preparation tips!

Apply Now - https://fintram.com/us-cpa-course/

#cpa course structure#cpa course#what are the 4 cpa exams#cpa course in india#fees structure#the six main structure of the cpa firms#cpa fee structure#describe the structure of cpa firms#the nature of cpa firms their structure and activities#cpa study structure#academic structure#cpa usa course details#us cpa course details#cpa exam review course#cpa exam structure#cpa exam review course comparison#fintram#cpa course online#best cpa classes#Youtube

0 notes

Text

5 Ways to Stand Out in Your First Year On the Job for CPAs

"5 Ways to Stand Out in Your First Year On the Job for CPAs" is a power-packed presentation that offers valuable insights and practical strategies for new CPAs to make a lasting impression in their first year. Learn how to excel in your role, build strong professional relationships, demonstrate leadership skills, embrace continuous learning, and leverage technology to succeed in the competitive accounting world.

Also, read Ignite Your Accounting Career Today: Set Your CPA Job Prospects! Visit: https://bit.ly/3XG4Nt0

#cpa exam#cpa training institute#cpa exam fees#cpa cost#cpa fees#cpa exam fees in india#cpa details#CPA USA Course details#cpa course full form#cpa syllabus#cpa license#cpa registration fees

0 notes

Text

Typical Timeline and Duration to Complete the CPA Course

The CPA course timeline follows a series of structured steps that lead from exam preparation to obtaining licensure. While this timeline can vary based on individual circumstances, it typically takes around 2 to 4 years, including both exam preparation and the process of becoming licensed.

The journey begins with the preparation phase, during which candidates meet the required 150 credit hours of coursework. This is equivalent to a bachelor’s degree in accounting, and in some cases, extra courses may be required. Completing this educational phase can take anywhere from a few months to an additional year, depending on prior qualifications.

Once the education requirements are met, candidates move on to the exam preparation phase. The CPA exam consists of four sections—AUD, BEC, FAR, and REG—and each section generally requires 1 to 3 months of study. Overall, the study phase for all four sections can last 6 to 12 months, depending on how much time is dedicated to preparation.

The next part of the timeline is the exam-taking phase, during which candidates schedule and sit for each of the four CPA exam sections. These exams can be spread out over several months, with many candidates completing them within 12 to 18 months.

Following the exam completion, candidates enter the work experience phase, which is typically 1 to 2 years of supervised accounting work. This step is crucial for meeting state requirements for licensure and can run concurrently with the exam preparation for those already employed in relevant positions.

Finally, once all requirements are met, candidates move to the licensure application phase. This process involves submitting documents and verification of work experience to the relevant state board. It can take 1 to 3 months to complete this final step.

Thus, the CPA course timeline includes education, exam preparation, work experience, and licensure, taking anywhere from 2 to 4 years in total.

Completing the CPA course involves more than just passing exams; it includes several steps that can extend the overall time required to achieve certification. The duration can vary based on individual circumstances, but a general overview of the time involved includes:

Educational Requirements (4-5 years): Before starting the CPA course, you must complete a bachelor's degree in accounting or a related field. This typically takes four years. Some candidates may need additional coursework to meet the specific educational requirements for CPA eligibility, which can add extra time.

Study and Exam Preparation (6-12 months): After meeting educational requirements, candidates must prepare for and pass the CPA exams. The preparation time can vary widely, but most candidates spend 6 to 12 months studying for all four sections of the exam. This period includes enrolling in a CPA review course, studying, and scheduling the exams.

Exam Completion (6-12 months): The CPA exam is divided into four sections, which can be taken individually. The time to complete all sections depends on how quickly you can pass each one. Candidates typically spread the exams over multiple months, resulting in a total duration of 6 to 12 months for this phase.

Experience Requirements (1-2 years): In addition to passing the exams, candidates must also fulfill work experience requirements. Most states require at least one to two years of relevant accounting experience under the supervision of a licensed CPA. This phase can be concurrent with exam preparation or occur after passing the exams.

License Application (1-3 months): Once you have passed the exams and met the work experience requirements, you need to apply for your CPA license. This process involves submitting documentation, completing any additional state-specific requirements, and waiting for approval.

In total, the process from starting your educational journey to becoming a licensed CPA can take approximately 2 to 4 years. This timeline includes obtaining the necessary education, preparing for and passing the CPA exams, gaining work experience, and completing the licensing process. Planning and time management are crucial for navigating this comprehensive journey successfully.

#cpa course#cpa exam#cpa eligibility#cpa license#cpa certification#cpa course details#cpa course full form#accounting job openings in usa

1 note

·

View note

Photo

International Professional Courses | US CPA Course | US CMA Course | ACCA Course | US CFA Course | Navkar Digital Institute Navkar Digital Institute is one of the Leading Coaching Institute in India, providing the Best International Professional Training Certification Courses with 100% Job Placement. We offer CPA Course, CMA Course, CFA Course, ACCA Course and Other Foreign Courses from Industry Experts. For more details, you can call us at 7567712000 / 9081910714 / 6356144000 or visit our site at https://www.navkardigitalinstitute.com/foreign-courses/

#Certified Public Accountant Course in India#US CPA Course Details#CMA Course Details#ACCA Course Fees in India#US CFA Course Duration#CMA USA Course Details

0 notes

Text

Waiting For CPA Exam Score Releases can be Nervy!

Waiting For CPA Exam Score Releases can be Nervy!

DECEMBER 17, 2021

SHARE

Do you find yourself checking to see whether your score has been revealed every 5 minutes? Is your score report something you’re looking forward to or dreading? Have you attempted the “eyeball trick” before? Let’s take a look at where you can acquire official CPA test scores, what the “eyeball trick” is (and who can do it), and how to avoid exam anxiety while you wait.

NASBA addresses frequently asked questions concerning CPA test scores, such as where to get your score report, what to do if you suspect there was a mistake on your exam, and what happens if your score release date falls after your credit for your first exam has expired. It’s also worth noting that people who take the exam in non-NASBA states (California, Illinois, and Maryland) can get their results from their state boards of accountancy. Furthermore, NASBA provides information on foreign exam administration, stating that “results for applicants testing in an overseas site are published on the same timetable as domestic scores.”

The AICPA gives score release dates, explains how the test is evaluated and provides information needed to comprehend the comments supplied in your exam performance report if you did not pass the exam (note that some jurisdictions do not offer performance reports).

WHAT EXACTLY IS THE CPA EXAM EYEBALL TRICK?

What can you do, though, if you can’t wait for the score to be released? The “eyeball trick” comes into play at this point. Candidates have worked out a way to determine if they passed or failed (but not their total score) a few hours – or even a day – before the official results are revealed. However, if you tested in a non-NASBA state, this “eyeball trick” won’t work. The following is how the “eyeball trick” is done:

• An “eyeball” indicator will appear on your score report if you took your exam in a NASBA state and you took a previous exam within that testing period. The score for the last exam is still available.

• When you click on the icon to see your report, you’ll find your current test mentioned, along with a comment that says “attended” (recognizes that you took the exam; come back later for more information), “credit” (you passed), or “no credit” (you didn’t give).

While this provides some information, the official score report will be far more valuable.

If you’ve just completed a previous section, you might be able to use the eyeball technique!

Who can make use of it?

Candidates that have already tested, gotten a score report, and have a score report accessible.

This will not work if you are a first-time exam taker (as you will not have an active report).

What is its location?

After completing each component of the NASBA site, you will be given a score report form. If that score report form is ready, it will be posted on the NASBA website under the “Score Release” page.

Please keep in mind that score reports do expire!

How do I put it to use?

On the score release day, download the score report form from the NASBA web page. When you open the pdf, the portion you’re looking for will change from “Attended” to “No credit” or “Credit.”

“No credit” implies you failed, whereas “Credit” means you passed.

When does it function?

On the day of the score release, you will use the eyeball trick. The scores are generally uploaded in alphabetical sequence (i.e., AUD, BEC, FAR, then REG).

Important note: The NASBA has routinely posted the results one day early.

What is my actual score?

You will not see your exact score until the results are revealed later that night. However, you will know if you passed or failed.

PREPARATION IS ONE OF THE MOST IMPORTANT FACTORS IN MAXIMIZING CONFIDENCE AND MINIMIZING EXAM ANXIETY.

There is certainly no way to eliminate all worry over result releases. Still, a compelling exam study may boost your confidence such that you look forward to receiving your score report rather than dreading it. Good exam preparation is primarily determined by the quality of the materials you utilized and how well you used them. How well do you believe your education prepared you for the CPA exam? Was the exam what you expected based on your preparation? If not, assess both the resources you utilized and how you used them (see below) to see if any modifications should be made.

DID YOUR RESOURCES PROVIDE ENOUGH QUANTITY AND RANGE OF STUDY MATERIALS?

1. A broader range of materials will aid in reinforcing information and may be used to several learning styles.

• Update their materials in response to changes in laws, rules, and so on?

• Can you provide instructions for each of the exam’s seven-question formats?

2. Multiple-choice questions, BEC written communication, and five different sorts of TBSs: research, journal entry, document review, options list, and free-response numeric entry.

• How can you avoid typical blunders and demonstrate “tricks” in exam questions?

• Do you provide tutoring and study materials?

• Direct you to authoritative resources for your preparation?

AND DID YOU:

• Create a study plan that takes into account your work-life balance?

• Make full use of all available materials, including videos, flashcards, MCQs, and TBSs?

• Have you taken the AICPA’s practise test and see the training videos?

• Do you collaborate with a study partner or seek tutoring?

• Do you score at least 80% on practise tests?

• Create a strategy for allocating your time on the test between MCQs and TBSs.

• Preparing for the exam by simulating the examination process?

Simandhar Education is all set for exclusivity in making the determined achieve their dream for US CPA.

For more information on the CPA course and its required skills, please feel free to Contact Simandhar Education @ +91 7780273388 or mail us at [email protected].

1 note

·

View note