#Buy forex trading account

Explore tagged Tumblr posts

Text

Blue Guardian Vs Futures Elite

These props firms, namely Blue Guardian and Futures Elite. Both of these firms offer a wide selection of account sizes and account types aimed at catering to all traders irrespective of where they are in their trading journey. More: https://futureselite.com/blue-guardian

#blueguardian #forex #forextrading #propfirms #forexpropfirms #futurespropfirm #futurestrading #futuresaccount #usa #futuresfunding #futureforex #futureselite

#Blue Guardian Vs Futures Elite#futures elite#forex scalping strategies#instant funding prop firm#funded trading programs#prop firms with instant funding#buy forex trading account#prop trading firms

0 notes

Text

Buy Forex Trading Accounts: A Comprehensive Guide

In the world of forex trading, individuals often seek opportunities to invest in the foreign exchange market to diversify their portfolios and potentially earn profits. One way to engage in forex trading is buy forex trading account from a reputable broker. This article aims to provide insights into the process of buying forex trading accounts, including their benefits, factors to consider, types available, and steps involved.

Introduction to Buying Forex Trading Accounts

Buying a forex trading account involves acquiring an account from a broker that allows individuals to access the forex market and execute trades. These accounts come with various features and benefits tailored to suit different trading styles and preferences.

Benefits of Buying Forex Trading Accounts

High Liquidity

Forex markets are known for their high liquidity, meaning traders can easily enter and exit positions at any time without significant price fluctuations. Buying a forex trading account provides investors with the opportunity to capitalize on this liquidity and execute trades efficiently.

Diversification of Portfolio

Adding forex trading accounts to an investment portfolio can help diversify risk by spreading investments across different asset classes. Since forex markets often move independently of traditional stock markets, they can provide valuable diversification benefits.

Accessibility

Forex trading accounts offer investors the flexibility to trade currencies from anywhere in the world with an internet connection. This accessibility allows individuals to take advantage of trading opportunities around the clock, five days a week like forex funding challenge.

Factors to Consider When Buying Forex Trading Accounts

Reputation of the Broker

When purchasing a forex trading account, it's essential to choose a reputable broker with a track record of reliability and trustworthiness. Researching broker reviews and ratings can help investors assess the reputation of potential brokers.

Regulation and Compliance

Regulated brokers adhere to strict regulatory standards imposed by financial authorities, providing investors with a level of protection against fraudulent activities and malpractices. Prioritize brokers regulated by reputable regulatory bodies.

Trading Costs and Fees

Before buying a forex trading account, consider the trading costs and fees associated with the broker's services. These may include spreads, commissions, overnight financing fees, and withdrawal charges. Opt for brokers with transparent fee structures and competitive pricing.

Types of Forex Trading Accounts

Standard Accounts

Standard forex trading accounts are suitable for experienced traders looking for full access to the forex market with standard contract sizes.

Mini Accounts

Mini forex trading accounts are designed for beginners or those with limited capital, allowing them to trade smaller contract sizes with lower investment requirements.

Managed Accounts

Managed forex trading accounts are operated by professional money managers on behalf of investors, offering a hands-off approach to forex trading. Investors entrust the management of their accounts to skilled professionals who make trading decisions on their behalf.

How to Choose the Right Forex Trading Account

Assessing Personal Goals and Risk Tolerance

Before purchasing a forex trading account, assess your investment objectives, risk tolerance, and trading preferences. Determine whether you prefer a hands-on approach to trading or if you'd rather delegate trading decisions to a professional manager.

Evaluating Trading Platforms

Evaluate the trading platforms offered by different brokers to ensure they meet your needs in terms of functionality, user interface, and available tools and resources.

Researching Broker Options

Research and compare various broker options based on factors such as reputation, regulation, trading costs, customer support, and available trading instruments.

Steps to Buy a Forex Trading Account

Research and Comparison

Research different brokers and compare their offerings, including account types, trading platforms, fees, and regulatory status.

Opening an Account

Once you've selected a broker, follow their account opening process, which typically involves completing an online application and providing identification documents.

Funding the Account

Fund your forex trading account by depositing the required initial investment using a convenient payment method supported by the broker.

Start Trading

After funding your account, familiarize yourself with the trading platform and start executing trades based on your trading strategy and analysis.

Common Mistakes to Avoid When Buying Forex Trading Accounts

Neglecting Due Diligence

Failing to conduct thorough due diligence on brokers and their services can lead to choosing an unreliable or unregulated broker, putting your investment at risk.

Overlooking Hidden Fees

Be mindful of hidden fees that may not be explicitly disclosed by brokers, such as inactivity fees, currency conversion fees, or withdrawal fees.

Ignoring Risk Management

Neglecting proper risk management practices, such as setting stop-loss orders and managing leverage, can result in significant losses when trading forex.

Final Thoughts:

Buying a forex trading account can provide individuals with access to the dynamic and potentially lucrative forex market. By considering factors such as broker reputation, regulation, trading costs, and personal preferences, investors can make informed decisions when selecting the right forex trading account for their needs.

Frequently Asked Questions (FAQs):

Q. What are the benefits of buying a forex trading account?

Buying a forex trading account offers benefits such as high liquidity, portfolio diversification, and accessibility to global markets.

Q. How do I choose the right forex trading account?

To choose the right forex trading account, assess factors like broker reputation, regulation, trading costs, and personal trading preferences.

Q. What factors should I consider when selecting a broker?

When selecting a broker, consider factors such as reputation, regulation, trading costs, customer support, and available trading instruments.

Q. Can I trust managed forex trading accounts?

Managed forex trading accounts can be trustworthy if operated by reputable money managers with a proven track record of success and transparency.

Q. Are there any risks involved in buying forex trading accounts?

Yes, there are risks involved in buying forex trading accounts, including market risk, counterparty risk, and the potential for losses due to leverage and volatility.

#buyforextradingaccount #cheapestpropfirms #leverageintrading #fundedtraderprograms #proptrading #instantfundingpropfirm #fundedtradingaccounts #propfirms #propfirmchallenge #instantfunding #unitedstates #usa #newyork #thetalentedtrader #talentedtrader

Blog Source: Buy Forex Trading Accounts: A Comprehensive Guide

#the talented trader#prop firms#instant funding prop firm#funded trading accounts#proprietary trading firm#cheapest prop firms#trading risk management#prop firm challenge#prop firms instant funding#prop firm trading#Buy forex trading account

0 notes

Text

How To Get Started Investing In The Stock Market

Educate yourself: Before investing in the stock market, it's important to educate yourself about the basics of investing, including the different types of investments, the risks involved, and how to build a diversified portfolio. There are many resources available, including books, online courses, and investment blogs.

Determine your investment goals: It's important to have clear investment goals before investing in the stock market. Are you investing for retirement, a down payment on a house, or to generate passive income? Your investment goals will help determine the types of investments that are appropriate for you.

Open a brokerage account: To invest in the stock market, you'll need to open a brokerage account with a reputable brokerage firm. Some popular options include Fidelity, TD Ameritrade, and Charles Schwab. When choosing a brokerage firm, consider factors such as fees, investment options, and customer service.

Build a diversified portfolio: Diversification is key to successful investing. By investing in a mix of stocks, bonds, and other assets, you can reduce your risk and increase your chances of long-term success. Consider investing in a mix of large-cap and small-cap stocks, domestic and international investments, and bonds with varying maturities.

Start investing: Once you have a brokerage account and have determined your investment strategy, it's time to start investing. Consider starting with a small amount of money and gradually increasing your investments over time.

WAYS TO INVEST

There are several ways to invest in the stock market, including:

Individual Stocks: This involves buying shares of individual companies on the stock market. You can buy shares through a broker or an online trading platform.

Mutual Funds: Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks. This allows you to invest in a variety of companies with a single investment.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade like individual stocks on an exchange. This allows you to buy and sell ETFs throughout the trading day.

Index Funds: Index funds track the performance of a specific index, such as the S&P 500. This provides exposure to a broad range of companies and can be a good option for long-term investors.

TOOLS TO START INVESTING

Online Trading Platforms: Many brokers offer online trading platforms that allow you to buy and sell stocks and funds. These platforms typically provide research tools and stock charts to help you make informed investment decisions.

Robo-Advisors: Robo-advisors are digital platforms that use algorithms to create and manage investment portfolios for you. They can be a good option for beginner investors who want a hands-off approach.

Investment Apps: There are several investment apps available that allow you to buy and sell stocks and funds from your mobile device. These apps are often designed for beginner investors and offer low fees and user-friendly interfaces.

PLATFORMS

A few popular options:

Robinhood: Robinhood is a commission-free trading app that offers stocks, ETFs, and cryptocurrency trading. It’s designed for beginner investors and offers a user-friendly interface.

Acorns: Acorns is an investment app that automatically invests your spare change. It rounds up your purchases to the nearest dollar and invests the difference in a diversified portfolio of ETFs.

TD Ameritrade: TD Ameritrade is a popular trading platform that offers stocks, ETFs, mutual funds, options, futures, and forex trading. It offers a variety of trading tools and research resources.

ETRADE: ETRADE is a popular online broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of trading tools and resources, including a mobile app.

Fidelity: Fidelity is a full-service broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of investment tools and research resources, including a mobile app.

INVESTMENT STRATEGIES

Value Investing: Value investing involves buying stocks that are undervalued by the market and holding them for the long term. This approach requires patience and a thorough analysis of a company’s financial statements and growth potential.

Growth Investing: Growth investing involves buying stocks in companies that are expected to grow faster than the market average. This approach often involves investing in companies that are at the cutting edge of technology or have innovative business models.

Dividend Investing: Dividend investing involves buying stocks in companies that pay a dividend. This can provide a steady stream of income for investors and can be a good option for those looking for more conservative investments.

Passive Investing: Passive investing involves investing in a diversified portfolio of low-cost index funds or ETFs. This approach is designed to match the performance of the overall market and requires minimal effort on the part of the investor.

Real Estate Investing: Real estate investing involves buying and holding real estate assets for the purpose of generating income or appreciation. This can include investing in rental properties, real estate investment trusts (REITs), or crowdfunding platforms.

Options trading: is a type of trading strategy that involves buying and selling options contracts, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price within a certain time frame. Options trading can be used to generate income, hedge against risk, or speculate on market movements.

Swing trading is a type of trading strategy that aims to capture short- to medium-term gains in a financial asset, such as stocks, currencies, or commodities. Swing traders typically hold their positions for a few days to several weeks, taking advantage of price swings or "swings" in the market. Swing traders use technical analysis to identify trends and patterns in the market, and they often employ a combination of charting tools and indicators to help them make trading decisions. They look for stocks or other assets that have a clear trend, either up or down, and then try to enter and exit positions at opportune times to capture profits.

TECHNICAL ANALYSIS TOOLS

There are many technical analysis resources available for traders to use in their analysis of financial markets. Here are some popular options:

TradingView: TradingView is a web-based charting and technical analysis platform that provides users with real-time data, customizable charts, and a variety of technical indicators and drawing tools.

StockCharts: StockCharts is another web-based platform that provides a wide range of technical analysis tools, including charting capabilities, technical indicators, and scanning tools to help traders identify potential trading opportunities.

Thinkorswim: Thinkorswim is a trading platform provided by TD Ameritrade that offers advanced charting and technical analysis tools, as well as a wide range of other features for traders, including paper trading, news and research, and risk management tools.

MetaTrader 4/5: MetaTrader is a popular trading platform used by many traders around the world. It provides a range of technical analysis tools, including customizable charts, indicators, and automated trading strategies.

Investing.com: Investing.com is a website that provides real-time quotes, charts, news, and analysis for a wide range of financial markets, including stocks, currencies, commodities, and cryptocurrencies.

Yahoo Finance: Yahoo Finance is a website that provides real-time stock quotes, news, and analysis, as well as customizable charts and a variety of other tools for traders and investors.

Finviz: is a popular web-based platform for traders and investors that provides a wide range of tools and information to help them analyze financial markets. The platform offers real-time quotes, customizable charts, news and analysis, and a variety of other features.

438 notes

·

View notes

Text

Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from changes in exchange rates. Here’s a detailed guide to get you started:

1. Understanding Forex Trading

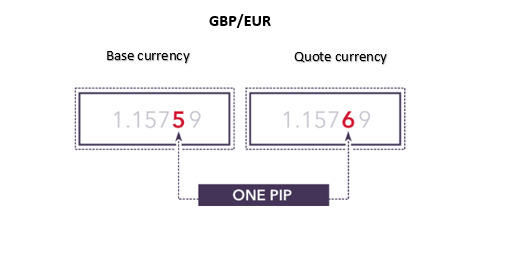

Currency Pairs: Forex trading always involves trading one currency for another. Currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, and the second is the quote currency.

Pips: The smallest unit of movement in a currency pair’s exchange rate. For most pairs, a pip is 0.0001.

Leverage: Allows you to control a large position with a relatively small amount of money. While leverage can amplify profits, it also increases risk.

2. Setting Up Your Forex Trading

Choose a Reliable Broker: Select a forex broker that offers a user-friendly trading platform, competitive spreads, and good customer service. Look for brokers with a solid reputation and proper regulatory oversight (e.g., regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC)).

Open a Trading Account: After selecting a broker, open a trading account. Many brokers offer demo accounts where you can practice trading without real money.

Deposit Funds: Fund your trading account with an amount you’re comfortable with. Remember, forex trading can be risky, so only invest money you can afford to lose.

3. Develop a Trading Strategy

Technical Analysis: Uses historical price data and charts to forecast future price movements. Key tools include indicators (like Moving Averages, RSI, MACD) and chart patterns (like head and shoulders, flags).

Fundamental Analysis: Involves analyzing economic indicators, news events, and other factors that might impact currency values. Key indicators include GDP, interest rates, inflation, and employment data.

Risk Management: Set stop-loss and take-profit orders to manage risk and protect your capital. Determine how much you’re willing to risk on each trade.

4. Executing Trades

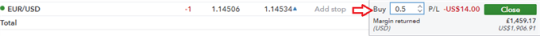

Place Orders: Use your broker’s trading platform to place trades. You can choose from various order types, such as market orders, limit orders, and stop orders.

Monitor and Adjust: Keep track of your trades and the market conditions. Adjust your strategies and positions as needed based on market movements and your trading plan.

5. Continuous Learning and Improvement

Stay Informed: Follow financial news, economic reports, and market analyses to stay up-to-date with factors affecting currency markets.

Review and Reflect: Regularly review your trades to understand what worked and what didn’t. Learning from past trades helps improve your strategy.

Adapt: Forex markets are dynamic and can change quickly. Be ready to adapt your strategies to new market conditions.

6. Avoiding Common Pitfalls

Overleveraging: Using high leverage can lead to significant losses. Start with lower leverage until you gain more experience.

Emotional Trading: Avoid making decisions based on emotions. Stick to your trading plan and strategy.

Lack of Research: Ensure you conduct thorough research and analysis before making trading decisions.

Resources for Learning Forex Trading

Books: “Trading in the Zone” by Mark Douglas, “Currency Trading for Dummies” by Brian Dolan and Kathleen Brooks.

Online Courses: Platforms like Coursera, Udemy, and Babypips offer courses on forex trading.

Websites: Follow financial news on websites like Bloomberg, CNBC, and Reuters.

business, forex, art, usbiz, usa art, fine art, trading, forex trading

12 notes

·

View notes

Text

Forex MT4 Plataform, #BUY SWING TRADE #US30Cash INDEX $4.100 Profits. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#US30Cash#forex index#usd30cash#us500cash#us30cash#best forex trade system#forex volume indicators#nt4 bollinger bands#mt4 fibonacci#metatrader4 fibonacci

3 notes

·

View notes

Text

Forex Gold Trading: Key Insights and Strategies for Success

Gold trading has been a fundamental part of the global financial system for centuries, and it continues to be a preferred investment choice for traders and investors alike. In the context of forex gold trading, this commodity stands out not only because of its intrinsic value but also for the opportunities it offers in terms of volatility and safe-haven demand. Whether you're a seasoned forex trader or just starting, understanding the dynamics of the gold market—especially the influence of gold prices, interest rates, and the balance of supply and demand—can help you make informed trading decisions.

The forex gold market functions on the principle of buying and selling gold against other currencies, most often the US dollar. Traders speculate on the price movements of gold, trying to predict whether the price will rise or fall based on various economic and geopolitical factors. Gold, as a precious metal, has a unique position in the world economy, offering both a hedge against inflation and a safe haven during times of financial uncertainty. Because it is not tied to any single country's currency, gold prices tend to rise when confidence in fiat currencies declines, particularly the US dollar.

A central factor in gold trading is the constant interplay of supply and demand, which determines the value of gold in the market. Gold mining production is a slow and resource-intensive process, and it can't be increased quickly to respond to rising demand. This makes gold a relatively inelastic asset, meaning its supply doesn't increase rapidly even when prices rise. This limited supply, combined with global demand for gold, especially in times of economic instability, results in significant price movements. Central banks, investors, and even jewelry markets are the primary sources of demand for gold. However, in times of geopolitical unrest, financial crises, or periods of economic uncertainty, investors turning to gold as a safe-haven asset can result in rapid price increases. In this context, trading gold offers opportunities for those who can anticipate these shifts in the market.

One of the most important factors affecting gold prices in the forex market is interest rates. Central banks, like the Federal Reserve in the United States, influence interest rates as part of their monetary policy. Interest rates are a key component of the cost of holding gold. When interest rates rise, other financial instruments, such as bonds or savings accounts, offer higher returns, making them more attractive than non-yielding assets like gold. As a result, higher interest rates can put downward pressure on gold prices, as investors move their money into assets that provide returns. Conversely, when interest rates are lowered, the opportunity cost of holding gold decreases, making gold more attractive. This often leads to an increase in demand for gold, driving prices higher.

The relationship between gold prices and interest rates is also influenced by inflation. When inflation is rising, the value of currency tends to decrease, and gold is seen as a hedge against this loss of purchasing power. As a result, inflationary environments often lead to increased demand for gold, further driving up its price. In times of low or stable inflation, however, interest rates become the primary driver for gold prices. Investors often keep a close eye on central bank policy and economic data, as changes in interest rates or inflation can create significant price movements in gold.

The gold market is also highly sensitive to geopolitical events and other external factors. Global political instability, such as wars or trade conflicts, can increase demand for gold as investors seek to protect their assets from the potential fallout of uncertain situations. Similarly, economic crises or financial market crashes can prompt a shift toward gold, as it is perceived as a safer store of value than volatile currencies or stocks. This is why gold is often referred to as a "safe haven" asset. When uncertainty rises, the demand for gold increases, causing prices to rise as well.

Another key aspect of forex gold trading is understanding the price movement of gold in relation to other currencies. Gold is most commonly quoted in US dollars, so the strength or weakness of the dollar plays a crucial role in determining the price of gold. When the US dollar strengthens, gold becomes more expensive for holders of other currencies, reducing demand and putting downward pressure on prices. On the other hand, when the US dollar weakens, gold becomes more affordable for international investors, which can lead to increased demand and rising prices.

Traders who engage in forex gold trading must also consider the different ways they can participate in the market. Many traders buy and sell physical gold, but this is less common in the forex market, where gold is typically traded in the form of contracts for difference (CFDs), futures contracts, or spot trading. Spot trading allows traders to buy or sell gold at current market prices, while futures contracts allow traders to speculate on the future price of gold. CFDs allow traders to take positions on gold without actually owning the physical metal, which can be an attractive option for those looking to capitalize on short-term price movements.

The advantage of trading gold in the forex market is its high liquidity. The gold market is one of the most liquid markets in the world, meaning that traders can enter and exit positions with ease, even in large volumes. This makes gold a highly attractive asset for short-term traders who seek to capitalize on price fluctuations. However, it also means that the market can experience significant volatility, as shifts in market sentiment or external events can lead to rapid changes in gold prices. As such, understanding the factors that influence gold prices and having a well-structured trading strategy is essential for success.

When trading gold, it is essential to use risk management strategies to protect your capital. Gold prices can be volatile, and sudden price swings can result in large losses if traders are not prepared. One way to manage risk is by using stop-loss orders, which allow traders to automatically exit a position if the price moves against them by a predetermined amount. Another strategy is to trade smaller position sizes, which helps limit exposure to potential losses. Traders should also consider diversifying their portfolios by trading other assets alongside gold to reduce risk and avoid overexposure to a single market.

One of the key benefits of forex gold trading is the ability to profit from both rising and falling gold prices. Traders can buy gold when they expect prices to increase or sell gold when they anticipate prices will fall. This flexibility makes gold an attractive asset for both bullish and bearish traders. However, predicting the direction of gold prices is not always easy, as it requires an understanding of multiple factors, including economic data, geopolitical events, and market sentiment. Traders who are successful in the gold market are often those who stay informed about global events and continuously adapt their strategies based on changing conditions.

As with any trading market, forex gold trading carries risks. The market is influenced by a range of factors, including global economic conditions, interest rates, inflation, and geopolitical events. Sudden changes in any of these factors can lead to unpredictable price movements, making it essential for traders to have a solid understanding of the market and the tools needed to manage risk. While gold trading offers significant opportunities, it also requires skill, discipline, and careful planning.

In summary, forex gold trading presents a wealth of opportunities for traders who understand the key factors that drive gold prices. The balance of supply and demand, interest rates, geopolitical events, and the strength of the US dollar all play significant roles in determining the price of gold. By staying informed about these factors and using sound trading strategies, traders can navigate the gold market and take advantage of price movements. Whether using gold as a safe haven or capitalizing on short-term price swings, gold trading offers a unique and dynamic way to participate in the global forex market.

2 notes

·

View notes

Text

What Are the Benefits of Paying for Premium Forex Signals?

If you’ve ever tried to get premium forex signals, you know the hassle of buying everything separately—like the copier, indicators, and ebooks. It can be overwhelming, right? Well, here's a new offer that makes it much easier.

For traders in the UK and Europe, SureshotFX has an amazing deal where you can deposit just $309 into your Avatrade account and get everything you need in one go:

Access to all premium signal channels

The SSF Trade Copier

3 trading indicators

3 helpful ebooks

Why choose Avatrade? It’s a trusted broker with a great platform for both beginners and experienced traders in the UK and Europe. With secure trading, competitive spreads, and plenty of trading tools, it’s a solid choice for anyone looking to trade with confidence.

What makes this offer stand out is that it bundles everything together, so you don’t have to buy each component separately. Plus, it’s been featured in trusted news outlets like Daily Journal, The Andalusia Star-News, The Luverne Journal, and Valley Times-News.

With a Trustpilot rating of 4.3, SureshotFX has gained credibility. And with Black Friday coming up, there’s even a chance to get everything for free if you’re only after the signals.

So if you’ve been thinking about upgrading your forex trading experience, this might just be the easiest and most affordable way to go!

#forex#forexsignals#xauusd#goldsignals#indices#copier#tradecopier#forex indicators#free ebooks#news#daily journal

3 notes

·

View notes

Text

Wcome bonus forex $30

At SWMarkets, new customers who make profit by trading in a Demo Account are eligible for a welcome bonus of $30. Forex traders can benefit from SWMarkets’ attractive No Deposit Welcome Bonus of $30. Learn how you can make the most of this bonus and begin trading without putting your own funds at risk.

The promotional link for the $30 Forex No Deposit Bonus offered by SWMarkets can be found at

SWMarkets $30 Forex No Deposit Bonus presents a favorable chance for novice traders to enter the forex market without the need to put in their own money initially. By using this bonus, traders can gain first-hand experience of actual trading conditions and potentially earn profits without any initial financial commitment. This offer permits traders to test their strategies and familiarize themselves with the market before committing their own funds. It’s a risk-free opportunity to explore the world of forex trading and determine if it aligns with your interests. Register today and utilize this time-limited promotion to begin your trading venture.

SWMarkets Welcome Bonus of $30 with No Deposit for Forex Trading

In order to receive the Free Welcome Bonus, one can participate in demo account trading.

First Step

Create an account on the SWMarkets application and receive a deposit of $20,000 in your Demo Account.

Second Step

In just two weeks, earn a profit of over $5,000 by trading on the Demo Account.

**STEP 3

To receive a $30 Bonus, please reach out to customer service and provide a screenshot of your profit.

Fourth Step

Obtain the privilege of withdrawing a free bonus by trading through a live account.

Get a Forex No Deposit Welcome Bonus of $30 when you withdraw

Upon confirmation that your trading profits on a demo account exceed $5000, the $30 Forex No Deposit Welcome Bonus will be deposited directly into your wallet.

Once you have deposited and traded at least 2 lots, you are eligible to withdraw a $30 No Deposit Forex Welcome Bonus.

This bonus is only valid for a period of 7 days.

These two lots are exclusively for trading in Forex and Commodities.

Guidelines for SWMarkets $30 Forex No Deposit Bonus

Individuals who fulfill the aforementioned requirements and are not disqualified by any terms of the promotion will be deemed eligible customers. Nevertheless, we reserve the right to ask for evidence of eligibility.

The $30 Forex No Deposit Welcome Bonus can only be claimed by customers once. These bonuses are valid for a period of 7 days. If they are not redeemed within this time frame, they will be forfeited and unable to be withdrawn.

Once customer service has verified your account, the $30 No Deposit Forex Bonus will be added to your wallet. To withdraw the bonus, you must first complete 2 lots of trading in Forex and Commodities.

After providing a 7-day notice, we have the authority to discontinue and retract the incentive program. The $30 No Deposit Welcome Forex Bonus will be terminated if any of the subsequent situations occur:

The incentive plan will cease to be active once 7 days have passed. Although the customer has made a deposit, they have not yet completed 2 lot trading. The 30$ bonus will be given to the customer within a period of 7 days.

In the event that the account does not make a deposit within 7 days after receiving the $30 forex free bonus, we will reclaim the bonus amount and any profits earned. The customer must place a buy and sell order for the same trading product within the allotted time period in order to qualify.

#forex#forex broker#forex news#forexmarket#forex market#forex trading#forex bonus#forex deposit bonus#welcome bonus

6 notes

·

View notes

Text

Forex Trading Advisor @novagad

I’ve been a Forex Trader since 2007 and an instructor since 2017.

Forex Trading: Exploring the Global Financial Frenzy

In the vast and dazzling world of financial markets, there's one beast that roars louder than the rest: Forex trading. It's a domain where fortunes are made (and sometimes lost) faster than you can say "exchange rate."

But what exactly is it about Forex that has millions of people hooked, eyes glued to screens, fingers poised over keyboards, and hearts racing like they've had one too many espressos? Let's dive deeper into the world of currency trading and uncover the secrets behind its irresistible allure.

1. The 24/5 Convenience Store of Trading

First and foremost, Forex trading operates 24 hours a day, five days a week. Unlike the stock market, which opens and closes like a sleepy small-town shop, the Forex market is like a neon-lit convenience store that never sleeps.

Traders from New York to Tokyo can engage in their currency escapades whenever the mood strikes. This flexibility allows part-time traders to moonlight after their day jobs and early birds to catch the worm in real-time market action.

2. The Seductive Leverage

Leverage in Forex is like having a turbocharger in a sports car. It gives traders the ability to control larger positions with a relatively small amount of capital. It's the dream of making big bucks with a small investment.

Of course, leverage is a double-edged sword—one moment you're racing at full throttle, and the next, you're careening off a cliff. But for many, the potential for high returns is too tempting to resist.

impressive gains. For those who relish a challenge and have a knack for puzzles, Forex trading offers a never-ending mental workout.

3. The Global Playground

Forex is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Yes, you read that right—trillion with a T! This immense liquidity ensures that traders can enter and exit positions with ease, without worrying about slippage.

Plus, the sheer variety of currency pairs means there's always something to trade, whether you're bullish on the dollar, bearish on the euro, or just feeling adventurous about the Malaysian ringgit.

4. The Democratization of Trading

Gone are the days when Forex trading was exclusive to big banks and hedge funds. The rise of online trading platforms has leveled the playing field, allowing anyone with a computer and an internet connection to join the fun.

And with a plethora of educational resources, webinars, and demo accounts available, the Forex market is as inclusive as it is vast. It's like the world's biggest, most volatile party, and everyone's invited.

5. The Thrill of the Chase

Let's face it: Forex trading comes with an undeniable adrenaline rush. The fast-paced nature of the market, the constant flux of prices, and the never-ending stream of economic news and geopolitical events create an environment that's as exhilarating as it is unpredictable.

It's like being on a financial rollercoaster, with every twist and turn bringing new opportunities and risks. For many, it's this thrill that keeps them coming back for more, despite the occasional stomach-churning drops.

6. The Intellectual Challenge

Forex trading isn't just about clicking buy and sell; it's a cerebral game of strategy, analysis, and psychology. Traders spend hours poring over charts, deciphering technical indicators, and keeping up with economic data.

It's a constant test of wits and nerve, where making the right call can yield impressive gains. For those who relish a challenge and have a knack for puzzles, Forex trading offers a never-ending mental workout.

7. The Quest for Financial Independence

At its core, the popularity of Forex trading is driven by a simple, powerful desire: the quest for financial independence.

The dream of making a living from trading, of being your own boss, of earning money from anywhere in the world with just a laptop and an internet connection—it's a compelling vision.

While the reality can be tough and the road fraught with risks, for many, the potential rewards make it a journey worth embarking on.

8. The Bottom Line: Why Forex Trading is Gaining Popularity

Forex trading is no joke, my friend. It's a vibrant and global marketplace that offers incredible opportunities to make some serious dough, keep your brain buzzing, and achieve financial independence.

What makes it so darn attractive, you ask? Well, it's a 24/7 affair, meaning you can jump in whenever you please. Plus, there's this thing called leverage that gives you some extra oomph.

And let's not forget about the internet, which has made trading accessible to just about anyone. Oh, and did I mention the sheer adrenaline rush you get from the chase? It's like being on a rollercoaster ride you just can't resist.

9. But let's get real, shall we?

Now, let's not kid ourselves. Forex trading isn't some magical money-making machine that spits out cash on demand. It requires some serious learning, discipline, and a healthy dose of respect for the risks involved.

But here's the deal: If you're willing to put in the effort and approach it with a clear, strategic mindset, the rewards can be absolutely mind-blowing. We're talking big bucks, my friend.

So, whether you're a seasoned trader who knows the ropes or a curious newbie eager to dip your toes in the Forex waters, the world of trading is calling your name. Just remember to buckle up because it's going to be one heck of a wild ride.

Get ready to feel the rush!

Thanks for reading and please consider upvoting it, if you liked the content :)

4 notes

·

View notes

Text

Effortless Mobile Forex Trading in 2024: A Beginner's Guide

Ever thought you could make money from anywhere, anytime, with just a few clicks on your phone? Well, stop imagining because this dream can become a reality with mobile forex trading. Do you really need a desk or a fancy trading setup to start trading in the forex market? Absolutely not!

With a smartphone and a stable internet connection, you can trade currencies from the palm of your hand—whether you’re at home, standing in line, or on a beach vacation. Stick with us as we break down the steps to start forex trading on your phone in 2024, even if you’re a complete newbie.

What is Mobile Forex Trading?

Mobile forex trading is exactly what it sounds like—buying and selling currencies using an app on your smartphone. It offers the flexibility to manage trades, monitor the market, and execute orders wherever you are. Unlike traditional trading, which might require a desktop setup or multiple screens, mobile trading puts the power of the forex market right in your pocket.

Getting Started: Your Gateway to Mobile Trading

The first step in your mobile trading journey is selecting a broker with a strong mobile platform.

Select a trading app that fits your needs including MetaTrader, cTrader, DxTrade, and TradingView are great options.

Download the app and sign up. Verify your identity and link your trading account to get started.

Within minutes, you’ll be ready to start trading. Most apps allow you to customize your dashboard, making it easy to focus on the information that matters most to you.

Why Choose Mobile For Forex Trading in 2024?

In 2024, mobile forex trading has become an essential tool for modern traders as it offers unparalleled convenience and flexibility. Trading on a smartphone means you can engage with the forex market from virtually anywhere—whether you're at home, commuting, or on vacation.

This freedom allows for real-time access to market updates and trade execution, ensuring you never miss out on critical opportunities. Mobile trading apps are designed to be user-friendly, providing an intuitive interface that simplifies complex trading tasks, making it accessible for both beginners and experienced traders.

Additionally, these apps offer advanced features such as push notifications for market alerts and integrated tools for technical analysis, which help you stay informed and make timely decisions. The ability to manage your trades on the go aligns perfectly with today's fast-paced lifestyle, making mobile forex trading not just a convenience but a necessity for staying ahead in the dynamic world of forex.

Common Mobile Trading Challenges:

Limited visibility on small screens can make it difficult to analyze detailed charts and manage multiple trades simultaneously.

Unintentional touches on a touchscreen can result in accidental trades or errors.

Battery life can drain quickly with intensive trading apps.

Security risks are higher with mobile trading.

Too many notifications can be distracting.

Mastering Your Mobile Trading App Like a Pro:

Explore and Learn: Take full advantage of tutorials, guides, and any available training materials to become proficient with the app.

Practice Regularly: Use a demo account to get comfortable with the app’s features and trading functions.

Optimize Your Settings: Adjust the app’s settings to fit your trading style and preferences. This includes notification settings, chart configurations, and trade preferences.

Stay Updated: Keep up with app updates and new features. Developers often release updates that improve functionality and fix bugs.

Develop a Routine: Establish a consistent trading routine to help you stay organized and make the most of the app’s features.

Conclusion:

Mobile forex trading in 2024 is easier and more accessible than ever before. With just a smartphone, you can tap into the forex market from anywhere in the world, managing trades, analyzing the market, and executing orders with just a few taps.

Whether you’re a beginner or looking to take your trading to the next level, mobile trading offers the flexibility and tools to succeed. So why wait? Get a trading app today and start your mobile forex trading journey!

#forextrading#forex education#Mobile Trading#Best Forex Trading App#forex trading strategies#forex trading signals

2 notes

·

View notes

Text

Start trading with a $100K futures account from Futures Elite. Gain access to professional funding, competitive profit splits, and the opportunity to showcase your trading skills with zero personal risk. More: https://futureselite.com/$100k-futures-account

#100kfuturesaccount #$100kfuturesaccount #forex #forextrading #propfirms #forexpropfirms #futurespropfirm #futurestrading #futuresaccount #usa #futuresfunding #futureforex #futureselite

#instant funding prop firm#funded trading programs#prop firms with instant funding#prop trading firms#prop firms with no time limit#buy forex trading account#forex market#forex trading#forex#$100k futures account#100k futures account#Futures Elite

0 notes

Video

youtube

Is it Possible to Get a Gold Investment Leveraged

There are many types of gold investments and with regards to is it possible to get a learn more gold investment leveraged,Is it Possible to Get a Gold Investment Leveraged Articles the answer is a yes and a no. Let me explain.

Most of the types of gold investment are non-leveraged. These include physical bullion or gold certificates

However, you can leverage your investment in 2 ways. These 2 ways are

Trading it as Forex

In this instance, you would trade gold as a currency pair. It could be against the US dollar, Japanese Yen, Swiss Franc and a whole host of currencies. This actually have the advantage that you could be amplifying your gains not only from the appreciation of gold in general but also the depreciation of the other currency.

Profiting from both ends of the stick

For example, if gold is generally on a uptrend, buying any gold investments would naturally make you money from the rising gold price. However, if you know that a particular country is in a unique crisis, you would be able to capitalise on the falling value of that currency by betting against it. In this way, assuming you are betting against the japanese yen, you can go long on XAUJPY. This would allow you to capture a larger profit, since you would be profiting both from rising gold price and falling japanese yen.

How Is it possible to get a gold investment leveraged

Trading such currency pairs are usually done using CFDs or contract for differences. This is highly leveraged and is considered high risks. Most of the platforms reports losses incurred by over 70% of their account holders. Therefore, this is advised for trained and experienced traders.

2 notes

·

View notes

Text

Buy forex trading account

Looking to buy forex trading account? Explore our platform at The Talented Trader for a seamless experience. Discover a range of accounts tailored to your trading needs, from beginner-friendly to advanced options.

#proptradingfirm #cheapestpropfirms #leverageintrading #fundedtraderprograms #proptrading #instantfundingpropfirm #fundedtradingaccounts #propfirms #propfirmchallenge #instantfunding #thetalentedtrader #talentedtrader

#Buy forex trading account#the talented trader#prop firms#instant funding prop firm#funded trading accounts#prop firms instant funding#cheapest prop firms#trading risk management

0 notes

Text

Navigating the Forex Market: A Beginner's Guide to Currency Trading

https://www.brokersview.com

In today's interconnected world, the foreign exchange (forex) market stands as the largest and most liquid financial market globally, with a daily trading volume exceeding $6 trillion. As a newcomer to the world of finance, understanding the basics of forex trading can be the first step toward harnessing its potential. In this post, we'll provide an introductory guide to help you navigate the forex market.

What is Forex Trading?

Forex, short for foreign exchange, involves the buying and selling of currencies from different countries. The forex market operates 24 hours a day, five days a week, due to the global nature of currency trading. It serves various purposes, from facilitating international trade to allowing investors to speculate on currency price movements.

Key Players in the Forex Market

Central Banks: Central banks, such as the Federal Reserve (Fed) in the United States and the European Central Bank (ECB), play a significant role in the forex market by setting interest rates and implementing monetary policies that impact currency values.

Commercial Banks: Commercial banks participate in forex trading on behalf of their clients and themselves, serving as major liquidity providers in the market.

Hedge Funds and Investment Firms: Large financial institutions and hedge funds engage in forex trading to diversify their portfolios and capitalize on price fluctuations.

Retail Traders: Individual traders like you and me participate in the forex market through online trading platforms provided by brokers.

Currency Pairs

In forex trading, currencies are quoted in pairs, where one currency is exchanged for another. The first currency in the pair is the base currency, and the second is the quote currency. The exchange rate reflects how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD pair, the EUR is the base currency, and the USD is the quote currency. If the EUR/USD exchange rate is 1.20, it means 1 Euro can buy 1.20 US Dollars.

How Forex Trading Works

Forex trading involves speculating on whether a currency pair's value will rise (appreciate) or fall (depreciate) in the future. Traders can take two primary positions:

Long Position (Buy): A trader buys a currency pair if they believe the base currency will strengthen against the quote currency.

Short Position (Sell): A trader sells a currency pair if they expect the base currency to weaken compared to the quote currency.

Risk Management

Forex trading carries inherent risks due to the volatility of currency markets. It's crucial to implement risk management strategies, including setting stop-loss orders to limit potential losses and diversifying your trading portfolio.

Choosing a Forex Broker

Selecting the right forex broker is a critical step for beginners. Look for brokers regulated by reputable authorities, offering user-friendly trading platforms, competitive spreads, and excellent customer support.

Educational Resources

Learning is an ongoing process in forex trading. Take advantage of educational resources provided by brokers, online courses, webinars, and trading forums to enhance your understanding of the market.

Conclusion

Forex trading offers opportunities for profit, but it's essential to approach it with knowledge, discipline, and caution. As a beginner, start with a demo account to practice your trading strategies without risking real money. Over time, you can gain confidence and experience to make informed decisions in the dynamic world of forex trading. Remember that success in forex trading requires continuous learning and adaptation to changing market conditions.

2 notes

·

View notes

Text

How to Short Forex: Short Selling Currency Details

This article explores the basics of short selling forex, using the EUR/USD currency pair as an example to explain the steps involved. It also advises on suitable risk management throughout the trade journey.

What does short selling currencies involve?

The term ‘short selling’ often confuses many new traders. After all, how can we sell something if we don’t own it?

This is a relationship that began in stock markets before forex was even thought of. Traders that wanted to speculate on the price of a stock going down created a fascinating mechanism by which they could do so.

Traders wanting to speculate on price moving down may not own the stock they want to bet against; but likely, somebody else does. Brokers began to see this potential opportunity; in matching up their clients that held the stock with other clients that wanted to sell it without owning it. The traders holding the stock long (buy position) can be doing so for any number of reasons. Perhaps they have a low purchasing price and do not want to enact a capital gains tax.

How to short forex: EUR/USD short selling example

Taking a short position in forex involves understanding currency pairs, trading system functionality and risk management.

First, each currency quote is provided as a ‘two-sided transaction.’ This means that if you are selling the EUR/USD currency pair, you are not only selling Euros; but you are buying dollars. Because of this, no ‘borrowing,’ needs to take place to enable the short sale. As a matter of fact, quotes are provided in a very easy-to-read format that makes short-selling more simplistic.

Want to sell the EUR/USD?

Easy. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit — excluding commission and fees). You could also choose to close a partial portion of your trade.

For example, let’s assume we initiated a short position for $100 000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could realize a profit on the trade (excluding commissions and fees). But let’s assume for a moment that our trader expected further declines and did not want to close the entire position. Rather, they wanted to close half of the position to cover the initial cost, while still retaining the ability to stay in the trade.

Our trader, at that point, would have realized the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The remainder of the trade would continue in the market until the trader decided to buy another 50k in EUR/USD to ‘offset,’ the rest of the position.

How to manage the risk of short selling currencies

Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a currency can never fall below zero which provides a maximum loss level.

Managing risk on accounts was a trait we discovered with successful traders. Fortunately, there are ways to mitigate this short selling risk:

Implement stop losses.

Monitor key levels of support and resistance for entry/exit points.

Stay up to date with the latest economic news and events for potential downside risk.

Employ price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders when certain price levels are reached on a specific market. These price alerts can be predetermined to suit the traders key levels.

Short selling forex is preferred for down trending markets, however careful consideration is required before trading as it brings extra risk even with a bearish outlook. It has been utilised by large institutions/traders as hedges, or by traders looking to trade descending markets. Risk management is essential for proper application, and the methods mentioned in this article should be given the utmost consideration as adverse movements in price can be detrimental.

Further reading recommendations

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. However, this is not the case 100% of the time. Take a look at What is the Number One Mistake Forex Traders Make? for more insight.

Successful trading requires sound risk management and self-discipline. Find out how much capital to risk on your open trades.

We host multiple webinars throughout the day, covering a lot of topics related to the Forex market like central bank movements, currency news, and technical chart patterns being followed.

To get involved in the large and exciting world of forex check out our Forex for beginners trading guide.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex

2 notes

·

View notes

Text

FX #EURJPY H4 timeframe last 3 Non Repaint Signals. Buy Trade running with profits. Non Repaint signals more info in official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#indicatorforex#cashpowerindicator#forex#forexindicator#forextradesystem#forexindicators#forexprofits#forexvolumeindicators#forexchartindicators#eurjpy#usdjpy#audjpy#how trade forex#best forex indicators#forex signals#forex signals service#best forex signals

3 notes

·

View notes