#Buy blockchain Accounts

Explore tagged Tumblr posts

Text

0 notes

Text

Flash bitcoins

Flash Bitcoin is a type of cryptocurrency that is sent to your wallet but does not remain there permanently, as it is dependent on the software used to flash the coin. While flash bitcoin is indistinguishable from real bitcoin, the key difference lies in its temporary nature. These coins are generated by specific flash bitcoin software, which allows users to send fake bitcoin into the blockchain network for a designated period of time, typically 90 days

The Concept of Flash Bitcoin Flash Bitcoin operates on the premise of temporary digital currency. It is generated through specialized bitcoin flashing software, which allows users to send what appears to be real Bitcoin into the blockchain network. However, the key distinction lies in its ephemeral existence; after the designated time frame, these coins will vanish from the blockchain, leaving no trace behind. Telegram: https://t.me/DigitalVa0lt

WhatsApp: https://wa.me/+12568235121

How Does Flash Bitcoin Work? When you use flash bitcoin software, you can create and send these temporary coins to your wallet. During their lifespan, Flash Bitcoins function similarly to real Bitcoin, allowing for transactions and exchanges. This innovative approach enables users to engage in cryptocurrency activities without any initial investment, making it an attractive option for those looking to explore the crypto space.

Caution is Key While the allure of earning money through Flash Bitcoin is enticing, it is crucial to exercise caution. The world of cryptocurrency can be fraught with risks, especially when dealing with developers or vendors who may source their tools from the dark web. Conducting thorough research and ensuring you are dealing with reputable sources is essential to avoid potential scams or legal issues.

Where to Buy Flash Bitcoin If you’re interested in exploring the world of Flash Bitcoin, look no further than Digital Vault. They offer reliable access to flash bitcoin sales and the necessary software to get you started. You can reach out to them through the following contact details:

Telegram: https://t.me/DigitalVa0lt

WhatsApp: https://wa.me/+12568235121

By purchasing from a trusted source like Digital Vault, you can ensure that you are engaging with legitimate flash bitcoin technology and software.

In summary, Flash Bitcoin presents an intriguing opportunity for those looking to delve into the cryptocurrency market without upfront investment. However, it is vital to approach this technology with caution and to conduct thorough research. If you’re ready to explore the potential of Flash Bitcoin, consider reaching out to Digital Vault for your needs. Remember, knowledge is power, and being informed is your best defense in the world of cryptocurrency.

Telegram: https://t.me/DigitalVa0lt

WhatsApp: https://wa.me/+12568235121

By purchasing from a trusted source like Digital Vault, you can ensure that you are engaging with legitimate flash bitcoin technology and software.

#where to buy flash bitcoin#flash bitcoin sales#What is flash bitcoin#flash bitcoin software#bitcoin flashing software#flash bitcoin#bitcoin flash#Flash bitcoins#fintech#blockchain#cryptocurrency#cryptoinvesting#branding#accounting#ecommerce#crypto#celebrities#commercial#david tennant#business#drew starkey#aubrey plaza

0 notes

Text

Buy Old GitHub Account

A verified GitHub account, distinguished by the coveted blue checkmark, offers an array of advantages that can significantly enhance your GitHub experience.

First and foremost, a verified account elevates your credibility in the eyes of potential collaborators, employers, and the broader GitHub community. It serves as an unequivocal sign of your legitimacy as a developer, instilling trust in your contributions and code. This newfound trust can lead to increased collaboration opportunities, as others are more likely to engage with your projects and seek your expertise.

Additionally, a verified account can enhance your visibility on GitHub. It sets you apart in a competitive field, making it easier for others to discover your work and contributions. The blue checkmark signifies professionalism and a commitment to quality, further boosting your reputation.

0 notes

Text

Where Can I Buy Crypto No Verification? There are a few exchanges that allow you to buy crypto without verification, but they come with some risks. The most popular exchange that allows this is blockchain, but there have been reports of scams and fraud on the platform. Another option is to use a peer-to-peer exchange like Paxful, which also doesn’t require verification.

Buy Verified Blockchain Account. However, make sure you do your research before using either of these platforms, as there have been many reports of people losing money to scams.

How Can I Buy Bitcoin Without Debit Card Verification? It is possible to buy Bitcoin without debit card verification but it is not as common. The most common method to purchase Bitcoin is through a exchange which requires some form of identification. However, there are a few services that allow for buying Bitcoin without any ID.

Blockchain is one such service that connects buyers and sellers in your local area and does not require any ID for either party. There are also ATM machines that dispense Bitcoin but these typically require you to have an account with the provider beforehand.

Where Can I Buy Bitcoin With My Bank Account Without Verification? There are a few ways to buy Bitcoin without verification, but most will require some form of identification. The most common way to buy Bitcoin without verification is through an exchange that doesn’t require KYC (know your customer). Some of the more popular exchanges that offer this service include: Blockchain, BitQuick, and Paxful.

Buy Verified Blockchain Account. These exchanges allow you to buy Bitcoin with your bank account without needing to verify your identity. However, it’s important to remember that these platforms are often used by scammers, so it’s important to be very careful when using them. It’s also worth noting that many of these exchanges have high fees, so it’s important to compare rates before making a purchase.

What Crypto Exchange Has No Id? There are a few exchanges that don’t require ID for trading, but they have other limitations such as lower limits and no support for credit cards. The most popular of these exchanges is Blockchain. Another exchange that doesn’t require ID is Bisq, but it’s only available for desktop at the moment.

Buy Bitcoin without Verification When it comes to buying Bitcoin, there are a few different options. You can buy Bitcoin with or without verification. If you choose to buy Bitcoin without verification, there are a few things that you need to know.

Buy Verified Blockchain Account. First, you will need to find a reputable exchange that allows users to buy Bitcoin without verification. Second, you will need to have a Bitcoin wallet set up in order to store your coins. Lastly, when buying Bitcoin without verification, it is important to remember that you will be paying a higher price for your coins since there is more risk involved for the exchange.

Buy Bitcoin with Credit Card No Verification Bitcoin is a decentralized digital currency, without a central bank or single administrator that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain you can buy Bitcoin with credit card no verification using one of the many exchanges available.

The most popular ones are Coinbase, Bitstamp, and Kraken. Each have their own benefits and drawbacks so make sure to do your research before selecting one. When buying Bitcoin with credit card no verification you will not have to go through any type of KYC (know your customer) process, meaning you will not have to provide any personal information whatsoever.

Buy Verified Blockchain Account. This makes it very convenient for those who value their privacy. However, it also comes with some risks as there is no way to know if the person selling you the Bitcoin is legitimate or not. It’s important to only buy from reputable exchanges and sources that have been around for a while and have a good reputation.

Anonymous Bitcoin Wallet If you’re looking for a bitcoin wallet that offers anonymity and security, then an anonymous bitcoin wallet is the way to go. There are a few different types of anonymous wallets available, each with its own advantages and disadvantages. Here’s a look at some of the most popular anonymous wallets currently available:

Armory Wallet – The Armory wallet is one of the most secure anonymous bitcoin wallets available, offering offline storage and multi-signature support. However, it can be difficult to use for beginners and isn’t as user-friendly as some other options. Buy Verified Blockchain Account BitLox – BitLox is a hardware wallet that offers both anonymity and security. It’s easy to use and comes with a variety of features, including encrypted backups and two-factor authentication. However, it’s relatively new so there aren’t as many reviews available yet. Dark Wallet – The Dark Wallet is designed specifically for anonymity, offering features like coin mixing and stealth addresses. However, it’s still in beta and has received mixed reviews so far. GreenAddress – GreenAddress is one of the most user-friendly anonymous wallets available, offering features like two-factor authentication and multisig support. However, it doesn’t offer as much privacy as some other options on this list. Buy Bitcoin With Stolen Debit Card There are a few ways to buy Bitcoin with a stolen debit card. The most common is to use a service like Blockchain.com. This website allows you to find people in your area who are willing to trade Bitcoin for cash.

You can then arrange to meet up with them and exchange the cash for Bitcoin. Another way to buy Bitcoin with a stolen debit card is through an online exchange like Coinbase or Kraken. These exchanges allow you to buy and sell Bitcoin using your debit card. Buy Verified Blockchain Account

However, you will need to have some ID verification before you can make trades on these platforms. If you’re looking for a more anonymous way to buy Bitcoin with a stolen debit card, you can try using a peer-to-peer marketplace like Bisq or HodlHodl. These platforms allow you to connect with other users who are also looking to trade Bitcoin without having to go through an exchange.

Buy Crypto with Credit Card It’s never been easier to buy cryptocurrency with a credit card. In the past, buying crypto with a credit card was difficult and often required multiple steps. However, now there are many companies that allow you to buy crypto directly with your credit card. Buy Verified Blockchain Account

Coinbase is one of the most popular options for buying crypto with a credit card. They offer a simple and easy to use platform that makes it easy to buy Bitcoin, Ethereum, Litecoin, and more. You can also use Coinbase to store your coins in their online wallet.

Another option for buying crypto with a credit card is Gemini. Gemini is an exchange that allows you to buy and sell cryptocurrencies. They offer a great platform for those looking to trade or invest in cryptocurrencies.

You can also link your bank account to Gemini so you can easily deposit and withdraw funds. If you’re looking for a more traditional way to invest in cryptocurrency, you can also use an online broker such as eToro. eToro offers a variety of different assets including stocks, commodities, currencies, and more.

You can also trade cryptocurrency on eToro through their CFD platform. Buy Verified Blockchain Account

Buy Crypto No Kyc When it comes to buying crypto, there are a few different options available. One option is to go through a traditional exchange like Coinbase or Binance. However, these exchanges require KYC (Know Your Customer) information in order to comply with regulations.

This can be a problem for some people who want to remain anonymous. Another option is to use a peer-to-peer (P2P) exchange like Local Bitcoins or Paxful. These exchanges don’t require any KYC information and allow you to trade directly with other users.

However, the tradeoff is that you’ll generally pay higher fees than you would on a traditional exchange. If you’re looking to buy crypto without having to go through KYC, your best bet is to use a P2P exchange like Local Bitcoins or PaXful. However, you should be aware that you’ll likely have to pay higher fees than you would on a traditional exchange.

Buy Crypto Instantly Cryptocurrencies are becoming more and more popular, with Bitcoin leading the pack. However, buying cryptocurrencies can be a bit tricky, as most exchanges require you to go through a lengthy process to set up an account. However, there are now some options available that allow you to buy cryptocurrency instantly. Buy Verified Blockchain Account

Here are a few of the best:

Coinbase Instant Buy Bitquick Changelly Blockchain ShapeShift Each of these options has its own benefits and drawbacks, so be sure to do your research before choosing one. Overall, though, these five options should help make buying cryptocurrency a lot easier!

0 notes

Text

#binance#buybinance#buy binance account#verified binance account for sale#banking#financial#blockchain#crypto

1 note

·

View note

Text

1 note

·

View note

Text

#BUY BITKAN ACCOUNTS#BUY BITTREX ACCOUNTS#Buy Blockchain Account#BUY COINBASE ACCOUNTS#BUY COINFFEINE ACCOUNTS

0 notes

Text

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

431 notes

·

View notes

Text

In the story of "Peter Pan," the fairy Tinkerbell only exists if people believe in her and clap for her. Once we stop believing in her magic, she starts fading away. It’s at this point she implores Peter Pan — and the broader audience — to clap as loud as they can. Tinkerbell is sustained by our attention. A new piece of emerging tech can be a lot like Tinkerbell. When it's still trying to shift from speculative ideas based on buggy demos to real material things that are normal parts of our daily lives and business practices, its existence depends on our belief in the magic of possibility. At this point, they still only exist when we believe hard enough and clap loud enough. If we stop believing and clapping, then they can start fading away, becoming more intangible by the moment until they disappear — remember 3D televisions? Just like with Tinkerbell, audience participation is necessary. That faith in the eventual power of progress can buy time for emerging tech like AI and blockchain — which can feel more like impressive parlor tricks desperately searching for useful purposes and business models — to establish more concrete anchors in reality. Their transparency level can be set at 50 percent for a long time if there are enough people in the audience believing and clapping for them.

[...]

AI depends on vital support from people hard at work in the futurism factory. These are the executives, consultants, journalists, and other thought leaders whose job is the selling of things to come. They craft visions of a specific future — such as ones where AI models built by companies like OpenAI or Microsoft are undeniable forces of progress — and they build expectations in the public about the inevitable capabilities and irresistible outcomes of these tech products. By flooding the zone with an endless stream of new partnerships, new products, new promises, the tech industry makes us feel disoriented and overwhelmed by a future rushing at us faster than we can handle. The desire to not be left behind — or taken advantage of — is a powerful motivator that keeps us engaged in the AI sales pitch. The breathless hype surrounding AI is more than just a side-effect of over-eager entrepreneurs; it’s a load-bearing column for the tech sector. If people believe hard enough in the future manufactured by Silicon Valley, then they start acting like it already exists before it happens. Thus the impacts of technologies like AI become a self-fulfilling prophecy. We should think of AI futurism as a sophisticated form of check kiting — cashing a check today and hoping the money will be in the account later. In other words, the business of expectations is based on producing scenarios about what might happen in the future and using them to extract speculative value in the present. It’s our belief that these promissory notes are worth anything that allows the tech industry to keep floating until the big payday finally hits.

11 January 2025

59 notes

·

View notes

Text

A presidential signing bonanza

Vladimir Putin signed into law on Thursday more than 50 laws on Thursday, including several new prohibitions and expansions of the state’s repressive powers. Thanks to the president's approval, these eight pieces of legislation are now set to become the law of the land.

Jailing soldiers (without court orders) for using smartphones: Unit commanders now have the authority to lock up their soldiers for up to 10 days (or 15 days for repeat offenses) if they catch them using banned personal gadgets, such as smartphones. This act previously required transporting the suspects to a garrison court for a formal ruling.

An expanded definition of ‘undesirability’: The authorities can now designate any organization in Russia as “undesirable” if foreign state entities played any role in the organization’s foundation or have even participated in its operations. State Duma Speaker Vyacheslav Volodin said the law is necessary to close a “loophole” that prohibited the government from designating local, Russian organizations, not just foreign groups.

No more selling energy drinks to kids: Effective March 2025, Russian vendors are prohibited from selling non-alcoholic tonic drinks, including energy drinks, to minors. The new restriction is intended as a public health measure.

Legalized cryptocurrency mining: Russia will introduce a special registry to issue permits for individuals and legal entities to “mine” cryptocurrency — the electricity-demanding process of using computer power to solve the complex mathematical problems needed to validate and secure transactions on a blockchain, earning digital currency as a reward. In mid-July, Putin expressed concerns about falling behind in cryptocurrency regulations. The new legislation also reserves some regional authorities’ right to ban crypto-mining where energy shortages are a concern.

The Dude can no longer abide: Effective September 1, 2025, “propagating drug use in art and literature” without warnings will be punishable by steep fines. The new restrictions exempt all works released before August 1, 1990, and content “where drugs are an integral part of the artistic concept justified by the genre.” The new censorship also does not apply to “materials related to investigative activities, scientific, educational, medical, or pharmaceutical publications.”

More deportation powers for the police: Internal Affairs Ministry officials will now have the authority to expel foreigners from the country without court oversight for certain misdemeanors. The list of administrative offenses includes illegal drug use, the public consumption of alcohol, and disseminating so-called “gay propaganda” (though officers must “directly witness signs of violations” in this last case). Deported foreigners will also be added to a registry that bans them from registering businesses in Russia, getting married, buying and registering property, opening bank accounts, and obtaining or renewing a driver’s license.

‘Trash-streams’ banned: In Russia, “trash streams” usually feature bloggers abusing drugs and alcohol or performing humiliating or violent acts in return for donations from viewers. The new law prohibits the distribution of “trash stream” content, and crimes committed during these broadcasts can be prosecuted as aggravated offenses under 10 different felony statutes. Convicted “trash streamers” will face steep fines and the possible confiscation of their electronic equipment.

Naturalized citizenship revoked for refusing military registration: The Internal Affairs Ministry will now be required to provide records about all men approved for receiving Russian citizenship. Lawmakers who sponsored the bill said the new condition for maintaining naturalized citizenship is needed to address “widespread public outrage” against immigrants who get a passport and then evade military duty.

14 notes

·

View notes

Text

Beginner’s Guide to Cryptocurrencies: Learn How to Make Money Safely

Beginner’s Guide to Cryptocurrencies: Learn How to Make Money Safely

If you’re just starting out with digital currencies, don’t worry—you’re in good company! Cryptocurrencies can feel overwhelming at first, but with the right guidance, anyone can grasp how they work and how to invest safely.This guide will break down the basics, explain how cryptocurrency operates, and walk you through the essential steps to start investing wisely.By the end, you’ll have a solid foundation in cryptocurrency, security tips to protect your investments, and insights into the best strategies to make money safely in 2025. What is Cryptocurrency? ryptocurrency, often called "crypto," is a form of digital currency that exists purely in electronic form. Unlike the cash in your wallet or the balance in your bank account, cryptocurrencies are decentralized, meaning they are not controlled by any government or financial institution.Instead, they operate on blockchain technology—a secure, transparent ledger that records all transactions in a way that is nearly impossible to alter. How Does Cryptocurrency Work? Imagine a digital notebook where every transaction is permanently recorded and visible to everyone. This notebook is known as the blockchain. Each transaction is verified by a network of computers, making it highly secure and resistant to fraud.Unlike traditional banking systems, where a central authority like a bank processes transactions, cryptocurrencies rely on a decentralized system. This means users have more control over their funds, but it also means they are responsible for keeping their investments safe. Why is Cryptocurrency Popular? There are several reasons why cryptocurrency has gained so much attention over the years:- Decentralization: No single entity has control over cryptocurrencies. - Security: Transactions are encrypted, making them highly secure. - Transparency: Blockchain records all transactions, ensuring accountability. - Growth Potential: Many investors view cryptocurrencies as a promising new financial opportunity.Whether you want to use crypto for everyday purchases, transfer money internationally, or invest in the long term, understanding how it works is the first step.

How to Invest in Cryptocurrency for Beginners If you’re ready to take the plunge into cryptocurrency investing, follow these steps to ensure a smooth and secure experience. Step 1: Choose a Cryptocurrency Exchange Before you can buy cryptocurrency, you’ll need to create an account on a cryptocurrency exchange. Think of an exchange as an online marketplace where you can trade digital currencies.Popular platforms like Bybit, Coinbase, and Kraken offer user-friendly interfaces, making them ideal for beginners.🔥 Looking for a secure and easy-to-use exchange? Start your crypto journey with Bybit and enjoy seamless trading with exclusive bonuses! 👉 Sign Up for Bybit Now Step 2: Decide on the Cryptocurrency to Invest In With thousands of cryptocurrencies to choose from, selecting the right one can feel daunting.For beginners, it's often best to start with well-established options like Bitcoin (BTC) or Ethereum (ETH), as they tend to be more stable and widely accepted. These coins have a proven track record and are generally less risky compared to newer, lesser-known cryptocurrencies. Step 3: Set Up a Secure Wallet Once you’ve chosen an exchange and purchased your cryptocurrency, you need a place to store it. Cryptocurrency wallets come in two main types:- Hot Wallets: These are online wallets connected to the internet, making them convenient but also more vulnerable to hacking. - Cold Wallets: These are offline wallets (like hardware devices or paper wallets) that provide better security for long-term storage.For beginners, a combination of both types is recommended—use a hot wallet for small, frequent transactions and a cold wallet for large investments. Step 4: Make Your First Purchase Once your wallet is set up, you can buy your first cryptocurrency.You don’t have to purchase a whole Bitcoin or Ethereum—you can buy fractions of a coin based on your budget. After purchasing, the cryptocurrency will be stored in your wallet. Step 5: Develop an Investment Strategy Investing in cryptocurrency isn’t just about buying and holding—it’s about having a plan. Some common strategies include:- HODLing: Holding onto your crypto for the long term, regardless of market fluctuations. - Trading: Actively buying and selling crypto to take advantage of price swings. - Staking: Earning passive income by locking up your crypto to support blockchain operations.Understanding these strategies will help you make informed investment decisions.Correlated Article:

How to Travel the World and Make Money: The Digital Nomad’s Guide to Earning with Cryptocurrencies

Risks of Investing in Cryptocurrency While cryptocurrency has the potential for high returns, it also comes with risks. Here are some key factors to be aware of: 1. Scams and Fraud Scammers often prey on beginners with fake investment schemes, phishing attacks, and pump-and-dump schemes. Always research projects thoroughly before investing your money. 2. High Volatility Cryptocurrency prices can change dramatically within hours. While this presents an opportunity for profit, it also means you can lose money just as quickly. It’s essential to be prepared for market swings. 3. Lack of Regulation Unlike traditional investments, cryptocurrency is still relatively unregulated in many countries. This means fewer protections for investors and a higher risk of encountering scams or fraudulent projects. 4. Security Threats Although blockchain technology is secure, hackers frequently target exchanges and wallets. Always use strong passwords, enable two-factor authentication (2FA), and consider using a hardware wallet for extra security. Best Crypto for Beginners to Invest In If you’re unsure where to start, here are some of the most beginner-friendly cryptocurrencies:- Bitcoin (BTC): The original and most well-known cryptocurrency, often considered the safest bet for new investors. - Ethereum (ETH): Known for its smart contract capabilities, Ethereum is a great choice for those interested in blockchain applications. - Litecoin (LTC): Offers faster transactions and lower fees than Bitcoin. - Binance Coin (BNB): Useful for those trading on Binance and involved in the broader crypto ecosystem. - Cardano (ADA): A research-driven cryptocurrency focusing on sustainability and scalability.Starting with these established coins can help reduce risk while you learn the ropes.

Cryptocurrency Security Tips Keeping your crypto safe is crucial. Follow these best practices to protect your investments: 1. Use Strong Passwords & Enable 2FA Create long, unique passwords for your exchange and wallet accounts. Use two-factor authentication (2FA) for an extra layer of security. 2. Store Large Amounts in a Cold Wallet For secure, long-term storage, use a hardware wallet such as Ledger or Trezor. Keeping your funds offline adds an extra layer of protection, making it much harder for hackers to gain access. 3. Avoid Suspicious Links & Scams Never click on unsolicited emails, fake airdrops, or suspicious investment offers. Scammers often impersonate crypto platforms to steal your credentials. 4. Use Reputable Exchanges & Wallets Stick to well-known platforms with strong security measures. Always verify websites before entering sensitive information. Conclusion: Your Next Steps in The Crypto Market Cryptocurrency can be an exciting and profitable investment if approached wisely. This guide has provided you with the essential knowledge to get started safely.Whether you choose to buy and hold Bitcoin, trade Ethereum, or explore new investment opportunities, the key is to start slowly, stay informed, and always prioritize security. Ready to take your first step into cryptocurrency trading? Bybit offers a secure, beginner-friendly platform to buy, sell, and trade crypto.Sign up today and take advantage of exclusive bonuses! 👉 Join Bybit Now and Claim Your Welcome Bonus

Frequently Asked Questions (FAQs) about Cryptocurrency Trading for Beginners

Is cryptocurrency legal? Yes, cryptocurrency is legal in many countries, but regulations vary. Some countries fully support it, while others impose restrictions or bans.Always check your local laws before investing. How much money do I need to start investing in cryptocurrency? You can start with as little as $10, depending on the exchange. Many platforms allow fractional purchases, meaning you don’t need to buy a whole Bitcoin or Ethereum. What is the safest way to store cryptocurrency? A hardware (cold) wallet is the safest option for long-term storage. It keeps your crypto offline, making it less vulnerable to hacking. Use a combination of hot and cold wallets for security and convenience. Can I lose money in cryptocurrency? Yes, due to market volatility, cryptocurrency prices can rise and fall dramatically. You can lose money if the market drops or if you invest in a scam. Only invest what you can afford to lose. How do I avoid cryptocurrency scams? - Use reputable exchanges and wallets. - Enable two-factor authentication (2FA). - Avoid unsolicited investment offers and emails. - Verify the legitimacy of projects before investing. Should I invest in new cryptocurrencies? New cryptocurrencies can offer high rewards but also carry high risks. Some are legitimate, while others are scams. Conduct thorough research before investing in any new digital asset. What are gas fees? Gas fees are transaction fees paid to process transactions on a blockchain. Networks like Ethereum require gas fees for smart contract operations, and these fees can fluctuate depending on network demand. Can I earn passive income with cryptocurrency? Yes! Some ways to earn passive income include:- Staking: Locking up your crypto to support blockchain operations and earn rewards. - Yield farming: Providing liquidity to decentralized finance (DeFi) protocols for returns. - Lending: Lending your crypto to earn interest on platforms like Aave or Compound. Is cryptocurrency taxed? In many countries, cryptocurrency is subject to capital gains tax. Selling crypto for a profit, trading, or earning through staking may require tax reporting. Check your local tax laws to ensure compliance. What happens if I lose access to my wallet? If you lose access and do not have your backup seed phrase, you may lose your funds permanently. Always store your seed phrase securely in a physical location, never online. What is the difference between a coin and a token? - Coin: A cryptocurrency that operates on its own blockchain (e.g., Bitcoin, Ethereum). - Token: A digital asset that operates on an existing blockchain (e.g., ERC-20 tokens on Ethereum). How do I send cryptocurrency to someone else? - Copy the recipient’s wallet address. - Paste the address into your wallet’s “Send” section. - Choose the amount to send and confirm the transaction. - Double-check the address before finalizing the transaction to avoid errors. How long does a cryptocurrency transaction take? Transaction times vary depending on the blockchain network and congestion. Bitcoin transactions can take 10 minutes to an hour, while Ethereum transactions typically take a few minutes. Some blockchains, like Solana, offer near-instant transactions. What is a blockchain fork? A fork occurs when a blockchain network splits into two separate versions due to changes in protocol or disagreements in the community. Hard forks (e.g., Bitcoin Cash from Bitcoin) create a new chain, while soft forks update an existing chain without splitting. What are the best cryptocurrencies for beginners to invest in? Some beginner-friendly cryptocurrencies include:- Bitcoin (BTC): The most established and widely accepted cryptocurrency. - Ethereum (ETH): Known for smart contracts and decentralized applications. - Litecoin (LTC): Offers faster transactions and lower fees than Bitcoin. - Cardano (ADA): A research-driven cryptocurrency focused on sustainability. Can I use cryptocurrency for everyday purchases? Yes! Many businesses accept cryptocurrency for payments, and crypto debit cards allow users to spend their digital assets like cash. However, adoption varies by location. What is a stablecoin? A stablecoin is a cryptocurrency designed to maintain a stable value by being pegged to a fiat currency (e.g., USDT, USDC). These are useful for reducing volatility and making transactions easier. What is DeFi (Decentralized Finance)? DeFi is a blockchain-based financial system that eliminates traditional intermediaries like banks. It offers services such as lending, borrowing, and trading through smart contracts on platforms like Uniswap and Aave. Can I mine cryptocurrency? Yes, but mining is not as profitable for individuals as it used to be. Bitcoin mining requires specialized hardware (ASICs), while other cryptocurrencies like Ethereum (until its transition to proof-of-stake) could be mined with GPUs. What is an NFT (Non-Fungible Token)? NFTs are unique digital assets that represent ownership of art, music, virtual goods, and more. Unlike cryptocurrencies, each NFT is one of a kind and cannot be exchanged on a one-to-one basis. How do I track my crypto investments? You can track your portfolio using crypto tracking apps like:- CoinMarketCap - CoinGecko - Blockfolio - Delta What happens to my cryptocurrency if I die? Without proper estate planning, your cryptocurrency could be lost forever. To ensure your assets are passed on, store your private keys and seed phrases securely and designate a trusted person to access them. What is a rug pull? A rug pull is a type of scam in which developers abandon a project after raising funds, leaving investors with worthless tokens. Read the full article

#beginner’sguidetocrypto#bestcryptocurrenciesforbeginners#Bitcoin#blockchaintechnology#cryptoexchange#cryptotrading#Cryptocurrency#cryptocurrencyforbeginners#cryptocurrencyinvestmentstrategies#cryptocurrencyrisks#cryptocurrencysecuritytips#digitalcurrencies2025#Ethereum#howtobuycryptocurrency#howtoinvestincryptocurrency#howtomakemoneywithBitcoin#howtoprotectyourcryptocurrency#makemoneywithcryptocurrency#safecryptoinvestment#securecryptocurrencyinvesting

2 notes

·

View notes

Text

TAPS Token Debuts on STON.fi: A Major Milestone for GameFi and DeFi on TON

The TON blockchain is expanding at an unprecedented rate, and STON.fi is leading the charge. As the most dominant decentralized exchange (DEX) in the TON ecosystem, it has consistently set new records in trading volume, user growth, and market activity.

Now, with the launch of TAPS token on STON.fi, a new era begins—one that brings GameFi and DeFi closer than ever before.

The Strength of STON.fi: Powering TON’s DeFi Sector

STON.fi isn’t just another DEX—it is the primary liquidity hub of TON. The numbers back it up:

Over $5 billion in total trading volume, surpassing all other DEXs on TON.

More than 4 million unique wallets, accounting for 81% of all DEX users on TON.

An average of 25,800 daily active users, with 16,000 making multiple transactions daily.

Over 8,000 new users joining each day, making STON.fi the fastest-growing platform in the ecosystem.

700+ trading pairs processed daily, ensuring a diverse and liquid market.

These figures show the sheer dominance of STON.fi and why its latest listing—TAPS token—is such a significant development.

TAPS Token Now Trading on STON.fi

TAPS, the native token of TapSwap, is officially live on STON.fi.

TapSwap is a GameFi platform with over 72 million global users, focusing on skill-based gaming and competitive tournaments. The introduction of TAPS onto STON.fi bridges the gaming sector with DeFi, giving traders and liquidity providers a new high-growth asset to engage with.

This listing isn’t just about expanding STON.fi’s market pairs—it’s about integrating a token with real utility and a massive user base.

Why TAPS on STON.fi is a Game-Changer

The arrival of TAPS on STON.fi is a strategic move that benefits multiple players in the ecosystem:

For Traders: A new, highly liquid token to buy, sell, and capitalize on.

For GameFi Users: A seamless way to exchange in-game rewards for other assets or cash out.

For DeFi Participants: A fresh opportunity to stake, trade, and provide liquidity in a fast-growing market.

However, liquidity providers stand to gain the most from this development.

Liquidity Providers Get 2x the Rewards

STON.fi has doubled the trading fees for the TAPS/TON liquidity pool, increasing it from 0.2% to 0.4%. This means liquidity providers can earn twice as much in rewards simply by participating in this pool.

For those already providing liquidity, this upgrade boosts returns significantly. For those yet to explore liquidity provision, this is a prime opportunity to get started with higher incentives.

Final Thoughts

The launch of TAPS on STON.fi is more than just another listing—it’s a major shift in how DeFi and GameFi interact on TON.

STON.fi continues to dominate as the leading exchange on TON, and with the addition of TAPS, it is expanding its reach beyond traditional DeFi into the rapidly growing world of blockchain gaming.

Traders, liquidity providers, and GameFi enthusiasts now have more ways to earn, invest, and participate in the TON ecosystem.

With momentum building and opportunities growing, this is the perfect time to take action.

3 notes

·

View notes

Text

What’s the Maximum Limit to Cash App Bitcoin Transactions?

Cash App has become one of the easiest ways to buy, sell, and send Bitcoin, but many users wonder about its transaction limits. Whether you're a beginner or an experienced trader, understanding these limits is crucial. In this guide, we'll break down everything you need to know about Cash App Bitcoin transaction limits and how you can increase them.

Understanding Cash App Bitcoin Transactions

Cash App allows users to buy, sell, send, and withdraw Bitcoin. Unlike traditional bank transfers, Bitcoin transactions on Cash App involve blockchain processing, which means there are specific rules and limits.

Why Does Cash App Have Bitcoin Transaction Limits?

There are several reasons why Cash App imposes Bitcoin transaction limits:

Regulatory Compliance: To comply with financial regulations.

Fraud Prevention: Limits reduce the risk of fraudulent transactions.

Security Measures: Helps protect users from unauthorized transactions.

Cash App Bitcoin Sending Limits

Cash App sets limits on the amount of Bitcoin users can send. As of 2024:

Cash App Bitcoin Sending Daily Limit: $2,500 worth of Bitcoin

Cash App Bitcoin Sending Weekly Limit: $5,000 worth of Bitcoin

Cash App Bitcoin Sending Monthly Limit: Varies based on account verification status

Cash App Bitcoin Receiving Limits

Unlike sending limits, Cash App does not impose restrictions on receiving Bitcoin. However, transaction confirmations depend on the Bitcoin network.

Cash App Bitcoin Withdrawal Limits

If you want to transfer Bitcoin to an external wallet, you must adhere to Cash App’s withdrawal limits:

Cash App Bitcoin Withdrawal Daily Limit:1 BTC

Cash App Bitcoin Withdrawal Weekly Limit:5 BTC

How to Increase Your Cash App Bitcoin Limits?

To increase your Cash App Bitcoin limits, follow these steps:

Verify Your Identity: Provide your full name, date of birth, and SSN.

Enable Two-Factor Authentication: Adds an extra layer of security.

Increase Account Usage: Regular activity can help raise limits.

Timeframe for Cash App Bitcoin Transactions

Bitcoin transactions on Cash App usually take:

Sending BTC: 10-30 minutes for confirmations

Receiving BTC: Varies based on network congestion

Withdrawing BTC: 24-48 hours, depending on security verification

Cash App Bitcoin Transaction Fees

Cash App charges two types of Bitcoin fees:

Network Fees: Varies based on blockchain traffic

Service Fees: Calculated at the time of transaction

Cash App Bitcoin Limits vs. Other Crypto Platforms

Platform

Daily Sending Limit

Daily Withdrawal Limit

Cash App

$2,500

0.1 BTC

Coinbase

No limit

Varies

Binance

100 BTC

100 BTC

Common Issues with Cash App Bitcoin Transactions

Transaction Pending: Network congestion may delay confirmations.

Transfer Failed: Ensure your account has sufficient balance.

Limit Reached: Upgrade your account verification.

How to Track Your Bitcoin Transactions on Cash App?

You can track your Bitcoin transactions by:

Opening Cash App

Navigating to the "Bitcoin" tab

Selecting "Transaction History"

Is There a Way to Bypass Cash App Bitcoin Limits?

No legitimate method exists to bypass Cash App’s limits. Attempting to do so can lead to account restrictions or bans.

Conclusion

Understanding Cash App Bitcoin transaction limits is essential for managing your crypto assets efficiently. By verifying your account and following the necessary steps, you can increase your limits and optimize your transactions. Stay informed, and always checks for updates on Cash App’s policies.

3 notes

·

View notes

Text

ok lets get into the creator league stuff (local essay andy is back)

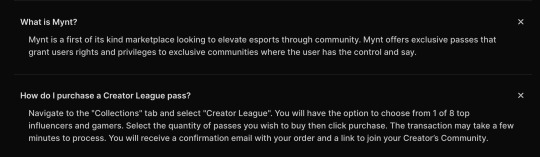

I mean first and foremost what Is the creator league

its an esports tournament ran by eFuse and presented by Mr Beast. its designed as this kind of interactive league allowing fans to play with and for their favourite creators. their trailers on instagram claim that theres gonna be a full years worth of content, however Mr Beasts recent video claims the event will happen across a 10 month time frame.

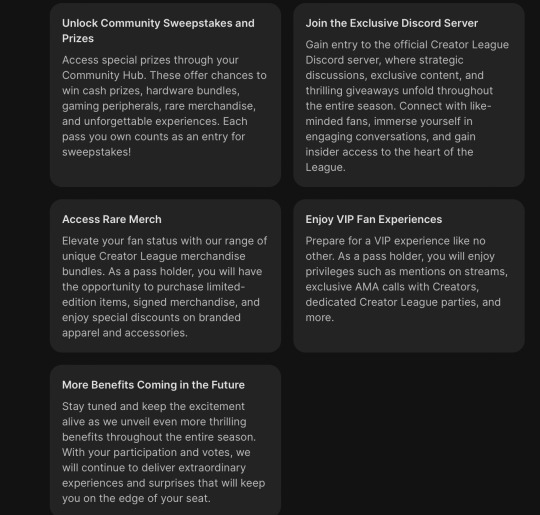

so the ting that makes this event 'special' is that the creators are not listed as players in the event but as 'team managers'- which is where the creator pass comes in. Each creator has a 'pass' that allows you as a fan and viewer to join their team and participate in the league events. Each pass costs around $20 and from what ive read I believe you can only sign up to participate on behalf of one player.

obviously for reasons of fairness, not everyone who buys a pass will be able to officially compete- there is a limited number of spaces on each team and the places are won via an open qualifier Fortnite tournament where they will also be competing for a $50 k prize- although im yet to find any comment from creator league or any articles on how this money is split. But don't worry even if you don't qualify youre still entitled to a free box of mr beasts chocolate should you buy a pass before September 9th. yey.

so what's the problem with this.

I mean first of all. creators arent even required to play. they can fully just let their team do all the work in every event which might work for people like Vinnie Hacker I guess. This might be a way to try and 'even the playing field' by not giving creators with gaming backgrounds any advantage, however it makes the marketing of 'playing with your favourite creator' a little meh. also as a viewer, id be more interested in watching an event that my creator was an active participant in than just watching my streamer watch other people play on their behalf.

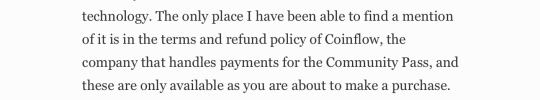

the other huge thing that everyone is really waiting to hear about in this post is the nft situation. so recently the narrator of the creator league announcement video, brycent, conformed that the passes are nfts to be minted on the blockchain operating system Near Protocol. so obviously people are extremely concerned about this discovered involvement in NFTs and crypto currency.

so I went to investigate the website to see what its looks like when you purchase a creator pass and unsurprisingly there is no mention on nfts anywhere. The passes are sold on mynt.gg , which according to their faqs is a 'first of its kind marketplace looking to evaluate esports through community' just have a look actually

so no mention of the passes actually being nft purchase here's . if we go to the check out as well this is what we see for the descriptors

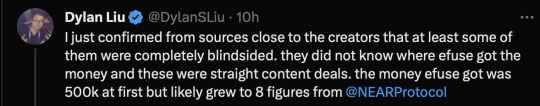

so . people who are purchasing this have no way of actually knowing they are purchasing an nft. you also need an account to add a pass to your basket and im not willing to make an account so im unaware if at any time during the payment process people are made aware of what they are purchasing. its listed and discussed more like a membership than anything, and in a way it is there are benefits to it, however with no information as to what people are actually buying its extremely sketchy and a literally misleading purchase perhaps a scam even . since the fact that they've just purchased an not isn't listed anywhere on mynt.gg prior to purchase. and after going through a few more articles .

so theyre definitely trying to hide it from you. as mentioned you need an account to purchase anything. and you only get to know what youre purchasing if you go through the TOC, which most people don't read lets be real.

it's worth noting as well creator league is the only collection available on mynt.gg at the minute, it seems like this entire business was started FOR creator league.

after reading through the faqs again I want to correct myself and say that yes you can buy more than one pass, but only for one creator. so this seems to me like a pay to win scheme.

im not going to go super in depth into this bit bc its a topic that has already been discussed in detail but obviously a lot of people are not happy with the inclusion of nfts because of their environmental impact, the secrecy and dedication to hiding this fact that the company is involving crypto in the event itself is a little weird if u ask me. oh yeah theres been reports on twitter too that they have been blocking and deleting replies to their posts that accuse them on using crypto.

so theyre lying to you as the viewer about what they are and what youre purchasing. but it seems like theyre lying to the creators too.

again. crypto and nfts is not mentioned anywhere at all. not in the trailer, not on the website not in any announcements . only discovered when people were paying for passes bc they wanted to support their fave creators.

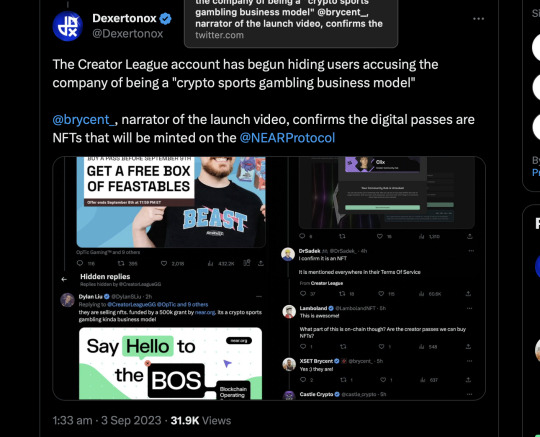

recently one of the listed creators Connor CDawgVA released a twitter statement conforming that he was completely blindsided by the fact that there was cryptocurrency involved in the event- if u haven't seen his tweet here

so this raises the question were creators told about their involvement with Near, or was it written using jargon that people unfamiliar with crypto would not pick up on.

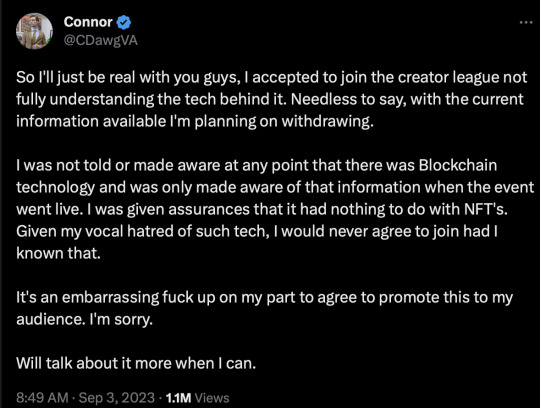

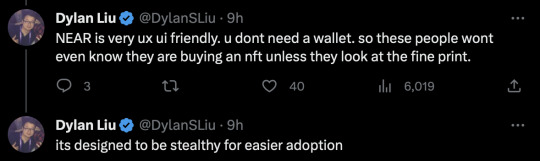

CEO of TAMU Esports Dylan Liu also weighed in on the creator league misleading their creators as well here's his statements too

this isn't everything Dylan has had to say hes done a lot of discussions with people on blockchains and of the event itself as someone who has known about the event for a while, id recommend checking out his twitter if you have time he goes into depth about how much funding theyre getting from near and way more issues with creator league than I have time to explore rn .

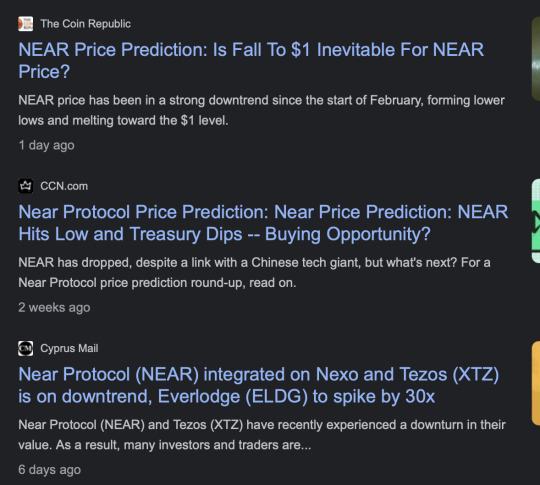

but it really does seem that the Creator League and eFuse have gone out of their way to try and hide the fact that they are using cryptocurrency from everyone possible. This is a marketing scheme to try and trick people into buying into their market- and if you google Near Protocol right now you see that they are declining so they actively need more people to buy into their schemes.

investors are leaving Near right now. Theyre tricking people into buying into their organisation. At least thats my understanding of it im not hugely knowledgeable about crypto.

I have a headache lets just wrap this up

this is super sketchy . as of right now CDawgVA is the only creator to have withdrawn from the event, but I hope a lot of creators follow suit. its unknown to us the details of their contracts but from what we know of the event they have done everything to hide the genuine content of creator pass purchases from the viewers- making a lot of people rightfully angry that the event is trying to pull the wool over fans eyes. hiding tweets and refusing to acknowledge their involvement in crypto programmes to the point where its unclear if people like Mr Beast and any of the participating creators are aware of it is super suspicious activity. Especially with how vague their promotions have been on the event, very little information has been available on their instagram and I think it was yesterday that we actually got some kind of timeline of the event. its supposed to start like next week and so many people are still so unsure of what is actually happening in the event or what prizes theyre actually getting if they participate. there has been no redeeming quality in the way that this event has been conceived and executed and I really do hope to see that the event is cancelled or that creators start to speak out against the way that the event is being run and support the fans who feel cheated and blindsided by the organisers . I will say I do not believe any of the creators willingly involved themselves in a cryptocurrency scheme, it's all just too sketchy . and no I did not proofread this nor can I be bothered to .

51 notes

·

View notes

Text

“Because even ugly can be iconic.” Welcome to the Beth Community!

Are you ready to embrace imperfection and join a movement that redefines what it means to succeed in the blockchain world?Meet $BETH — the token that’s proving you don’t need to be flawless to leave an unforgettable mark.

Beth is here to disrupt, grow, and deliver real value while embracing her unapologetically chaotic energy. If you’re ready to become a #BethHead, here’s everything you need to know to join this revolutionary community!

Are you ready to embrace imperfection and join a movement that redefines what it means to succeed in the blockchain world?Meet $BETH — the token that’s proving you don’t need to be flawless to leave an unforgettable mark.

Beth is here to disrupt, grow, and deliver real value while embracing her unapologetically chaotic energy. If you’re ready to become a #BethHead, here’s everything you need to know to join this revolutionary community!

How to Buy $BETH

Step 1: Create a Wallet with Phantom

Head to phantom.app and set up a new account using the Phantom app or browser extension.

Step 2: Get Some $SOL

Buy Solana ($SOL) through the app’s BUY button or transfer $SOL from your preferred crypto exchange to your Phantom wallet.

Step 3: Swap $SOL for $BETH

In your Phantom wallet, tap the SWAP icon and paste the $BETH token address:

7uJrMsDN2Wxdc3VAq1iK9N5AHaTA7wUpbm1wqRonpump

Swap your $SOL for $BETH, and voilà — you’re officially part of the #BethHead community!

Achievements So Far

In just nine days, Beth has achieved milestones that many projects dream of:

Listed on CoinGecko, Ascendex, Gate.io, and CoinMarketCap (fast-tracked).

3000+ Telegram members and 1500 X followers.

Billboard presence outside Space X for a week.

Two golden tickers on DEX Screener.

A team of over 20 admins hosting 24/7 voice chats.

Beth’s Vision: From Meme to Machine

Beth isn’t just another meme token. She’s a movement with a mission: to turn her relatability and underdog story into a community-driven success.

Here’s what Beth is building:

Community: A passionate and growing network of holders and fans.

Utility: Gated groups, tools, and an ecosystem that delivers real value.

Beth’s tokenomics reflect her commitment to growth and transparency:

Total Supply: 1 Billion $BETH Tokens

Distribution:

5% for burning and influencers. 95% circulating supply.

The Beth Ecosystem

Beth’s ecosystem is expanding rapidly, with partnerships across Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Future developments include:

Exclusive NFTs with perks like private events and voting power.

Beth-branded merchandise.

Launch of $BETH Academy and $BETH Tools.

Why the World Needs $BETH

Beth isn’t competing with trendy .jpg tokens. She’s here to prove that the real power in crypto lies in community and authenticity. Whether you’re a seasoned crypto enthusiast or a curious newcomer, Beth welcomes you with open arms.

Get Involved

Join the conversation, stay updated, and connect with the Beth community through our social channels.

SOCIALS : https://linktr.ee/bethsol

2 notes

·

View notes

Text

Crypto Exchange API Integration: Simplifying and Enhancing Trading Efficiency

The cryptocurrency trading landscape is fast-paced, requiring seamless processes and real-time data access to ensure traders stay ahead of market movements. To meet these demands, Crypto Exchange APIs (Application Programming Interfaces) have emerged as indispensable tools for developers and businesses, streamlining trading processes and improving user experience.

APIs bridge the gap between users, trading platforms, and blockchain networks, enabling efficient operations like order execution, wallet integration, and market data retrieval. This blog dives into the importance of crypto exchange API integration, its benefits, and how businesses can leverage it to create feature-rich trading platforms.

What is a Crypto Exchange API?

A Crypto Exchange API is a software interface that enables seamless communication between cryptocurrency trading platforms and external applications. It provides developers with access to various functionalities, such as real-time price tracking, trade execution, and account management, allowing them to integrate these features into their platforms.

Types of Crypto Exchange APIs:

REST APIs: Used for simple, one-time data requests (e.g., fetching market data or placing a trade).

WebSocket APIs: Provide real-time data streaming for high-frequency trading and live updates.

FIX APIs (Financial Information Exchange): Designed for institutional-grade trading with high-speed data transfers.

Key Benefits of Crypto Exchange API Integration

1. Real-Time Market Data Access

APIs provide up-to-the-second updates on cryptocurrency prices, trading volumes, and order book depth, empowering traders to make informed decisions.

Use Case:

Developers can build dashboards that display live market trends and price movements.

2. Automated Trading

APIs enable algorithmic trading by allowing users to execute buy and sell orders based on predefined conditions.

Use Case:

A trading bot can automatically place orders when specific market criteria are met, eliminating the need for manual intervention.

3. Multi-Exchange Connectivity

Crypto APIs allow platforms to connect with multiple exchanges, aggregating liquidity and providing users with the best trading options.

Use Case:

Traders can access a broader range of cryptocurrencies and trading pairs without switching between platforms.

4. Enhanced User Experience

By integrating APIs, businesses can offer features like secure wallet connections, fast transaction processing, and detailed analytics, improving the overall user experience.

Use Case:

Users can track their portfolio performance in real-time and manage assets directly through the platform.

5. Increased Scalability

API integration allows trading platforms to handle a higher volume of users and transactions efficiently, ensuring smooth operations during peak trading hours.

Use Case:

Exchanges can scale seamlessly to accommodate growth in user demand.

Essential Features of Crypto Exchange API Integration

1. Trading Functionality

APIs must support core trading actions, such as placing market and limit orders, canceling trades, and retrieving order statuses.

2. Wallet Integration

Securely connect wallets for seamless deposits, withdrawals, and balance tracking.

3. Market Data Access

Provide real-time updates on cryptocurrency prices, trading volumes, and historical data for analysis.

4. Account Management

Allow users to manage their accounts, view transaction history, and set preferences through the API.

5. Security Features

Integrate encryption, two-factor authentication (2FA), and API keys to safeguard user data and funds.

Steps to Integrate Crypto Exchange APIs

1. Define Your Requirements

Determine the functionalities you need, such as trading, wallet integration, or market data retrieval.

2. Choose the Right API Provider

Select a provider that aligns with your platform’s requirements. Popular providers include:

Binance API: Known for real-time data and extensive trading options.

Coinbase API: Ideal for wallet integration and payment processing.

Kraken API: Offers advanced trading tools for institutional users.

3. Implement API Integration

Use REST APIs for basic functionalities like fetching market data.

Implement WebSocket APIs for real-time updates and faster trading processes.

4. Test and Optimize

Conduct thorough testing to ensure the API integration performs seamlessly under different scenarios, including high traffic.

5. Launch and Monitor

Deploy the integrated platform and monitor its performance to address any issues promptly.

Challenges in Crypto Exchange API Integration

1. Security Risks

APIs are vulnerable to breaches if not properly secured. Implement robust encryption, authentication, and monitoring tools to mitigate risks.

2. Latency Issues

High latency can disrupt real-time trading. Opt for APIs with low latency to ensure a smooth user experience.

3. Regulatory Compliance

Ensure the integration adheres to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

The Role of Crypto Exchange Platform Development Services

Partnering with a professional crypto exchange platform development service ensures your platform leverages the full potential of API integration.

What Development Services Offer:

Custom API Solutions: Tailored to your platform’s specific needs.

Enhanced Security: Implementing advanced security measures like API key management and encryption.

Real-Time Capabilities: Optimizing APIs for high-speed data transfers and trading.

Regulatory Compliance: Ensuring the platform meets global legal standards.

Scalability: Building infrastructure that grows with your user base and transaction volume.

Real-World Examples of Successful API Integration

1. Binance

Features: Offers REST and WebSocket APIs for real-time market data and trading.

Impact: Enables developers to build high-performance trading bots and analytics tools.

2. Coinbase

Features: Provides secure wallet management APIs and payment processing tools.

Impact: Streamlines crypto payments and wallet integration for businesses.

3. Kraken

Features: Advanced trading APIs for institutional and professional traders.

Impact: Supports multi-currency trading with low-latency data feeds.

Conclusion

Crypto exchange API integration is a game-changer for businesses looking to streamline trading processes and enhance user experience. From enabling real-time data access to automating trades and managing wallets, APIs unlock endless possibilities for innovation in cryptocurrency trading platforms.

By partnering with expert crypto exchange platform development services, you can ensure secure, scalable, and efficient API integration tailored to your platform’s needs. In the ever-evolving world of cryptocurrency, seamless API integration is not just an advantage—it’s a necessity for staying ahead of the competition.

Are you ready to take your crypto exchange platform to the next level?

#cryptocurrencyexchange#crypto exchange platform development company#crypto exchange development company#white label crypto exchange development#cryptocurrency exchange development service#cryptoexchange

2 notes

·

View notes