#Bull Bullard

Explore tagged Tumblr posts

Text

13th November

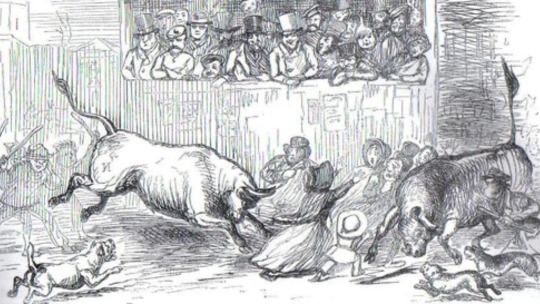

Stamford Bull Running

Source: The Lincolnite website

On this day the Stamford Bull Running once took place. Until this exercise in animal cruelty and danger to human life was banned in 1839, every 13th November a bull was hounded through the streets of Stamford in Lincolnshire by the bullards, drivers who risked life, limb and being covered in bull dung by eventually forcing the enraged animal off the bridge and into the River Welland where it usually drowned, before it was hauled out and butchered for a mass collective night feast. The ritual originally began, tradition has it, when William the Earl of Warren observed two rogue bulls devastating his lands and hired local butchers to chase them down, during which one of the animals stampeded through Stamford. There may be truth in this tale, but the event’s accompanying folk songs and the general orgiastic glee on display at the Stamford Bull Run, hint at a darker origin in Martinmas pagan bull sacrifice. The general feel of primitive license and excess associated with the Run was summed up by a bullard’s speech in which he insisted:

‘On this day there is no King in Stamford, we are every one of us high and mighty… a Lord Paramount, a Lord of Misrule, a King of Stamford… We are punishable for no crime but murder, and that only of our own and no other species.’

No mercy for the bull, then.

0 notes

Note

✨and 🎓for your OCs!

✨- How did you come up with the OC’s name?

"Morgan" was the first gender-neutral name I thought of, and "Fletcher" was the first thing I thought of when I wanted a British-sounding last name

"Eliot" was the second gender-neutral name I thought of (and I wasn't sure of his gender at the time. Also I had a coworker who was a woman named Eliot) and "Saint-Croix" is actually not a surname as far as I know, but is in fact a river near where I grew up

"Percy" was named Perseus because I wanted to give him a classic first name with an obvious nickname, and also I was thinking of Percy Jackson so I named him Perseus because his mom was a zailor. "Bullard" means bull-herd, but when I was researching last names for him, I found something that said it also maybe meant "liar"??? I don't remember what the reasoning there was, but when I first made Percy, he was supposed to be a duplicitous social-climber, more like Eliot. But he was for a tabletop game and what I think is my best skill is adapting my shit to fit better with what everyone else is doing, and that kind of character didn't gel as well with the other PCs. So he instead he's kind of straightforward and abrasive and I love him

"Jacob" was because of the biblical Jacob, who wrestled an angel and had his name changed to Israel. I thought it was a fun choice for a character whose main canonical characteristic was his physical strength, and whose story is so heavily religious. "Russo" for the last name took me foreverrr to pick because I couldn't decide what ethnicity he was. Finally decided he was Italian (in fact, his mom is Italian-American and ended up living in London by accident lol) and I picked "Russo" for the last name because I liked the ring of it

I'm actually in the process of naming a new character for Book of Red Murder and I'll tell you my other go-to method for names, which is that I pick like 5-10 names off of various names lists (frequently I will try to hunt down census data and find most common names, especially when I'm looking for surnames) and then I send those to my co-writer/editor and make them pick one

🎓 - How long have you had the OC?

Morgan - since 2011

Eliot - since 2015 maybe? I was still living in Minnesota at the time, so it was at least before June 2016. I think it was around when they brought Seeking back, because he was my alt made to do that (and then i went and got attached to him like some kinda idiot)

Jacob - officially promoted to "OC" in 2020

Percy - late 2020

2 notes

·

View notes

Text

In 1865, a fiercely fought fencing took place between several Mormon families in Utah. But it wasn't the combatants that ended up saving the day — it was a handsomely bull.

The cowboy known as "Old Shoshone" used the bull, called Little Joe, to help hold back the fighting and prevent further violence. Although costly, it was a sound investment as the bull allowed the two sides to come to an agreement.

The bill's importance didn't end there. Old Shoshone was able to create a lasting peace between the two families thanks to the calming influence of Little Joe. By standing constantly between them, the bull managed to prevent any further bloodshed.

In recognition of their service, the bull was gifted with 50 acres of land and was even given a medal and a certificate of thanks by Brigham Young.

To this day, the bull's contribution is remembered in Utah. Locals refer to the spot where the bull stood as "Bullard's Corner." This is an indication of how important the bull was in ensuring lasting peace between the two sides.

It is clear that the bull had a bearing on the historic event and it must never be forgotten. Little Joe's role in helping end the violence and bring the families together was truly remarkable and should serve as an example of the power of peace.

0 notes

Text

1500 to 30,000 same things

Catch up take a hit

Or swallow from that pill bottle

Better than moltov

My fuel escapes

Easy as on F’s

Fuckers

Pink rim round

Bright lights steering

Seering

That cow was called who tin ante

My mom would testify before

She knew hoot and ante

Never heard in court

I must be the Joker

Jester

Ohh say something in my mind

Myself

Always

Into

From

Before

To

Also

A mind works

You now know sing me something

I just don’t know

I still hope when I look up

Feeding letters into oil provided keyboards

Not ever-ed followed home nor trolled on such said Facebook

I would have commented to a ?

What do you call your self?

I know roe and words to toe

Dear bull lawyer

I never looked into

Right

Oh ah we’re

A picture of significant

Would have been a pleasure

But we both know

Nikki Halley

Sucked you boy

All hail Bullard!

No flowers?

#artcalledwrap#wordsbymm#wrapbymm#speak up bull lard you practice cheerleader here#I was crustacean’s feedings#am I please sir now#own my medical#did I capture ur license#what we talking about#yeaah nonnnnnion#hold to backside of t-shirt

0 notes

Text

Dollar Index (DXY) Surprisingly Lower as US PMIs Point to a Strong Private Sector, Gold Bounces Toward $1970/oz

US PMI, GOLD AND DOLLAR INDEX KEY POINTS:

Gold (XAUUSD) with a Moderate Bounce Today, Still Struggling as it Remains at the Mercy of Dollar Strength.

Market Sentiment, Dollar Index and the US Debt Ceiling Will be Key for Price Action for the Rest of the Week.

US Output Growth Hits 13-Month High in May but as with the Euro Area Manufacturing Remains an Area of Concern Dipping into Contractionary Territory.

To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

The headline S&P Global Flash US PMI Composite Output Index registered 54.5 in May, up from 53.4 in April, to signal a solid and faster expansion in private sector business activity. Total new orders rose for the third month running in May, with the rate of increase quickening to the steepest for a year.

At 55.1, the S&P Global Flash US Services Business Activity Index signaled a strong expansion in service sector output midway through the second quarter. The rate of growth in activity was the fastest for just over a year, with firms linking the upturn to greater demand from new and existing clients. The service sector growth may support recent rhetoric by the Fed as today’s data indicate a strong demand for services which may keep inflation elevated heading towardQ3 of 2023.

For all market-moving economic releases and events, see the FX Calendar

DOLLAR INDEX FUNDAMENTAL BACKDROP

The Dollar Index (DXY) continues to be supported by the lack of resolution regarding the US debt ceiling. Federal Reserve policymakers have also come out swinging over the last week in a bid to debunk market expectations regarding rate cuts in 2023. We continue to see constant changes in the probability for rate cuts despite Federal Reserve policymakers ongoing rhetoric that such bets are misplaced. The Fed’s Bullard stated yesterday that the Fed will need to go higher on the policy rate, touting for 50bps of hikes moving forward.

Regarding the debt ceiling we have seen an article released by the Washington Post a short while ago stating that the US Treasury Department has asked agencies if payments can be made later. According to the article senior aides to President Biden are looking at ways to conserve cash as negotiations rumble on. The key question is does this mean Democrats see a chance that negotiations may not be complete before the June 1 deadline?

READ MORE: Debt Ceiling Blues, Part 79. What Happens if the US Defaults?

Gold prices have continued to struggle since surrendering the $2000 psychological mark thanks to the DXY resurgence. Any attempt by bulls have been in vain of late with the exception of the Friday spike which was facilitated by news that US debt ceiling GOP negotiators had walked out. This was a clear sign as to how much sway the Debt Ceiling negotiations continues to have on the US Dollar and thus any dollar impacted instruments.

The US calendar for the rest of the week is quite busy with a host of Fed Speakers coupled with some key data releases. Whether or not any of these releases will have an impact to rival the debt ceiling negotiations remain doubtful. I think the Core PCE data on Friday could have the biggest impact while the Fed minutes is not expected to reveal any material changes to the Feds stance or policy moving forward.

Regarding the debt ceiling we have seen an article released by the Washington Post a short while ago stating that the US Treasury Department has asked agencies if payments can be made later. According to the article senior aides to President Biden are looking at ways to conserve cash as negotiations rumble on. The key question is does this mean Democrats see a chance that negotiations may not be complete before the June 1 deadline?

READ MORE: Debt Ceiling Blues, Part 79. What Happens if the US Defaults?

Gold prices have continued to struggle since surrendering the $2000 psychological mark thanks to the DXY resurgence. Any attempt by bulls have been in vain of late with the exception of the Friday spike which was facilitated by news that US debt ceiling GOP negotiators had walked out. This was a clear sign as to how much sway the Debt Ceiling negotiations continues to have on the US Dollar and thus any dollar impacted instruments.

The US calendar for the rest of the week is quite busy with a host of Fed Speakers coupled with some key data releases. Whether or not any of these releases will have an impact to rival the debt ceiling negotiations remain doubtful. I think the Core PCE data on Friday could have the biggest impact while the Fed minutes is not expected to reveal any material changes to the Feds stance or policy moving forward.

GOLD (XAU/USD) TECHNICAL OUTLOOK

Form a technical perspective, Gold price action has been overshadowed of late by the DXY and the continued debt ceiling negotiations. Gold caught a bounce this afternoon which came as a surprise given largely positive US PMI data.

Looking at the daily however the $1950 handle continues to provide support and todays daily candle close may see a double bottom pattern come into play. This would hint that gold prices could be in for the next leg of the rally toward $2000 and beyond. A push higher from current prices needs to contend with resistance around the $1982 mark before the $2000 comes into focus. The 50-day MA at $1990 may see a pause and could hamper any potential retest of the $2000 handle.

Alternatively, continued downside requires a daily close below the $1950 mark before eyeing any further downside move. Below the $1950 mark we have the 100-day MA resting around the $1930 mark.

Gold (XAU/USD) Daily Chart — May 23, 2023

Source: TradingView, Chart Prepared by Zain Vawda

Contact and follow Zain on Twitter: @zvawda

0 notes

Text

The Hong Kong stock market ended its 4-day decline. The Hang Seng Index opened 134 points higher and then rose by as much as 494 points, reaching a high of 21,306. In the afternoon, the mainland A-share market was dragged down by a reversal of gains and profit-taking. It closed at 20,987 points, only up 175 points. The HS technology index closed at 4,367, up 78 points. The main board's full-day turnover reached HK$122.9 billion

The macro market environment is unfavorable to Hong Kong stocks, and there is no other good news to support it. Beishui has not seen a large inflow, reflecting the limited desire for funds to enter the market. Although the Hang Seng Index rebounded yesterday, it closed to 21,000 and lost again. It is difficult to make a big breakthrough in the short term. The 10-DMA(21,235) still has resistance. It is expected that the Hang Seng Index rebounded today and saw the support of the 50-DMA (20,660), and then may fell below the 250-DMA (20,092) to test the bull-bear boundary.

U.S. inflation and retail sales data in January exceeded expectations, and the increase in production prices also exceeded expectations. Coupled with the strong job market, the U.S. 10-year bond yield climbed to a new high this year; and St. Louis Fed President James Bullard said, The Fed should raise interest rates further to curb inflation, and is inclined to raise interest rates to the peak of 5.375%, hoping to reach the fastest speed. The news dragged the Dow to close at a close to the low of the day, down more than 400 points, and the three major indexes fell more than 1%. The Dow fell 431 points to 33,696; the S&P 500 fell 57 points to 4,090; the Nasdaq, which is dominated by technology stocks, fell 214 points to 11,855.

0 notes

Note

Do you ship Mallard with anybody? If so, who and why?

I'll be real - I don't actually ship as much as I might give off. There's always a few good ships I adore (Astroturtle, Rabox, Serpedile, Piquet), but there's a lot of them which are great, don't get me wrong, but they don't... Click to me? I suppose, yeah.

Mallard's a tricky case. Like, I love him, almost more than Piglet if that's possible, and he's definitely one of my all time favorites. So, of course, I'm picky with who gets to be his partner.

Mallard with Bull is probably my favorite of what I've seen so far. Not sold on it yet, but it vibes nicely. Get back to me on a name though - "Bullard" is not the tea. Sounds like a PPE company. Maybe Gravelines - that's a historical reference, first person in my inbox with the explanation gets brownie points. Sounds too morbid though...

4 notes

·

View notes

Conversation

Remember that ugly cow bull lady from that Ace Attorney anime episode that didn’t want to go to prison again

well I’m gonna try to morph her face into Kane Bullard for reasons and or vice versa soon. (I had to look up Luke Atmey cause I forgot his name earlier).

1 note

·

View note

Text

Bullford or Bullard not Ballard

Prize winning awarded Bull

Bullard Command is stomp

Bullard going stomp people

Saddle A heavy man dummy and let go loose

1 note

·

View note

Text

A Peoples' Primer on The Korean War {"The Forgotten War"} ~ June 25, 1950 – July 27, 1953

A Peoples’ Primer on The Korean War {“The Forgotten War”} ~ June 25, 1950 – July 27, 1953

Even with promotional stunts like former NBA player Dennis Rodman and three Harlem Globetrotters‘ (Bull Bullard, Buckets Blakes and Moose Weekes) February 2013 trip to North Korea to run a children’s basketball camp, generally, the U.S. public at-large pays little attention to the enigmatic regime despite a history of saber rattling, eye-poking and nuclear missile testing aimed at the United…

View On WordPress

#"Big Stick" policy#"the hole"#1954 Geneva Accords#38th parallel#7th Infantry Division#A BRIEF ACCOUNT OF THE KOREAN WAR By Jack D. Walker A BRIEF ACCOUNT OF THE KOREAN WAR By Jack D. Walker#American Military Government#American National Security Council#armistice#Barack Obama#basketball diplomacy#Battle of Hamburger Hill#Buckets Blakes#Bull Bullard#China#Chinese People&039;s Volunteer Army (PVA)#Col. Harry G. Summers Jr.#Communist Party#demilitarized zone#Dennis Rodman#DMZ#domino theory#Dwight D. Eisenhower#Executive Order 9835#Executive Order 9981#General Douglas MacArthur#Harry S. Truman#Heartbreak Ridge#Henry Wallace#Hillary Clinton

0 notes

Text

Bitcoin ( BTC) recuperated decently on Aug. 20 however stayed on course to log its worst weekly efficiency in the last 2 months. Bitcoin hash ribbons flash bottom signal On the day-to-day chart, BTC's cost climbed up 2.58% to $21,372 per token however was still down by almost 14.5% week-to-date, its worst weekly returns because mid August. Some on-chain signs recommend that Bitcoin's correction stage might be coming to an end. That consists of Hash Ribbons, a metric that tracks Bitcoin's hash rate to figure out whether miners remain in build-up or capitulation mode. Since Aug. 20, the metric is revealing that the miners' capitulation is over for the very first time considering that August 2021, which might lead to the cost momentum changing from unfavorable to favorable. Bitcoin Hash Ribbon. Source: Glassnode Nonetheless, Bitcoin has actually been not able to brush off a flurry of dominating unfavorable signs, varying from unfavorable technical setups to its ongoing direct exposure to macro dangers. Regardless of positive on-chain metrics, a bearish extension can not be ruled out. Here are 3 factors why Bitcoin's market bottom might not be in. BTC rate increasing wedge breaks down Bitcoin's cost decrease today has actually activated a increasing wedge breakdown, recommending more losses for the crypto in the coming weeks. Rising wedges are bearish turnaround patterns that form after the cost increases inside a contracting, rising channel however willpower after the rate breaks out of it to the drawback, which might lead to a drop to as low as the optimum wedge's height. BTC/USD day-to-day cost chart including "increasing wedge" breakdown setup. Source: TradingView Applying the technical concepts on the BTC chart above presents $17,600 as the increasing wedge breakdown target. Simply put, the Bitcoin rate might fall by around 25% by September. Bitcoin bulls are misjudging the Fed Bitcoin had actually risen by around 45% throughout its increasing wedge development, after bottoming out in your area at around $17,500 in June. Interestingly, the duration of Bitcoin's upside relocations accompanied financiers' growing expectations that inflation has actually peaked-- which the Federal Reserve would begin cutting rates of interest as quickly as March2023 The expectations emerged from the Fed Chairman Jerome Powell's FOMC declaration from July27 Powell: " As the position of financial policy tightens up even more, it likely will end up being proper to slow the speed of boosts while we evaluate how our cumulative policy changes are impacting the economy and inflation." Nonetheless, the most current Fed dot plot reveals that many authorities prepare for the rates to reach 3.75% by the end of 2023 prior to relapsing down to 3.4% in2024 The potential customers of rate cuts stay speculative. Implied Fed funds target rate. Source: Federal Reserve St Louis Fed president James Bullard likewise kept in mind that he would support a 3rd successive 75 basis point raise at the reserve bank's policy conference in September. The declaration falls in line with the Fed's dedication to bring inflation to 2% from its present 8.5% level. Related: Options information programs Bitcoin's short-term uptrend is at danger if BTC falls listed below $23 K In other words, Bitcoin and other risk-on properties, which fell under a bearish market area when the Fed started an aggressive tightening up cycle in March, ought to stay under pressure for the next couple of years. If history is any indication ... The continuous Bitcoin cost healing dangers developing into an incorrect bullish signal offered the possession's comparable rebounds throughout previous bearish market. BTC/USD weekly rate chart. Source: TradingView BTC's rate rebounded by almost 100%-- from around $6,000 to over $11,500-- throughout the 2018 bearishness cycle, just to wipe-off the gains totally and drop towards $3,200 Significantly, comparable rebounds and corrections likewise occurred in 2019 and 2022.

The views and viewpoints revealed here are exclusively those of the author and do not always show the views of Cointelegraph.com. Every financial investment and trading relocation includes threat, you ought to perform your own research study when deciding. Read More

0 notes

Link

There are still resistance levels overhead even amid an unwinding of pessimism

0 notes

Photo

Euro is held back. Forecast as of 19.05.2022 The ECB officials’ speeches about raising rates in July encourage the EURUSD bulls. However, Forex pricing depends on the speed of monetary tightening rather than on the date of its start. Let us discuss the Forex outlook and make up a trading plan. Weekly euro fundamental forecast Most traders follow the principle ‘buy the news, sell the facts’, and central banks take advantage of this. James Bullard says any Fed’s action tightens monetary immediately. The ECB also resorts to verbal interventions, as the regulator is not satisfied by high inflation or the euro exchange rate. However, investors don’t believe the... Read full author’s opinion and review in blog of #LiteFinance http://amp.gs/jlWsU

0 notes

Text

Bearish Shooting Star & Hanging Man Threaten Market

Two recent bearish candlestick patterns are concerning. Today’s shooting star and the hanging man on February 2 came at some key resistance levels. Current technical conditions look shaky again.

A 40-year-high in inflation and hawkish Fed remarks sent stocks reeling this afternoon. Today’s CPI showed inflation up 7.5% from last year and St. Louis Fed president James Bullard said he was open to a 50-basis point hike in March and wanted to see a full percentage point of hikes by July. This turned the market on a dime.

This reversal came at a few key resistance levels for NASDAQ 100 (NDX): the longer-term uptrend line from the September/October 2020 lows, the 200-day moving average and monthly pivot point resistance around 15000 indicated by the blue dotted line.

A hanging man is a hammer that appears at the top of an uptrend and suggests a top is near. A shooting star is an inverted hammer and often signals a reversal. It shows that the index opened at the low then rallied smartly, but failed and closed near the low.

The bulls are clearly on notice and the market needs to find support here above the January lows in the yellow box. Holding 14500 on the NDX would be encouraging and clearing the resistance around NDX 15000 would be constructive.

0 notes

Text

'Choque de toros': Red Bull amenaza con demandar a un fabricante de ginebra por el parecido de su nombre con su marca

‘Choque de toros’: Red Bull amenaza con demandar a un fabricante de ginebra por el parecido de su nombre con su marca

La compañía austríaca de bebidas energéticas Red Bull ha amenazado a Bullards, un fabricante británico de ginebra artesanal, con emprender acciones legales en su contra debido a que el nombre de su marca es demasiado parecido al suyo, informó este viernes Daily Mail. Los abogados de Red Bull enviaron una carta a la empresa con sede en Norwich, de apenas diez empleados, en la que aseguran que…

View On WordPress

0 notes