#Bitcoin insights podcast India

Explore tagged Tumblr posts

Text

Bitcoin 101 Cryptocurrency Podcast 2023 in India

Welcome to Bitcoin 101, the ultimate crypto podcast of 2023 in India. Join us as we explore the fascinating world of Bitcoin and other cryptocurrencies. Designed for beginners and enthusiasts alike, this podcast provides a comprehensive understanding of blockchain technology, Bitcoin mining, wallets, and trading strategies. Stay updated with the latest news, market trends, and regulatory developments specific to India's crypto landscape. Expert guests share their insights, tips, and predictions, empowering you to make informed decisions in the ever-evolving crypto market. Whether you're new to Bitcoin or an experienced investor, this podcast is your go-to resource for unlocking the potential of digital currencies in India.

#Bitcoin 101 podcast India 2023#Crypto podcast India 2023#Bitcoin podcast in India#Cryptocurrency 101 podcast India 2023#Indian crypto podcast 2023#Bitcoin education podcast India#Crypto learning podcast India 2023#Bitcoin beginners podcast India#Indian crypto education podcast 2023#Bitcoin insights podcast India#Bitcoin101PodcastIndia#CryptoPodcast2023#BitcoinEducation#CryptocurrencyInsights#IndiaCryptoPodcast#Crypto101India#BitcoinTrends2023#CryptoEducationIndia#IndiaCryptoCommunity#BitcoinPodcast

0 notes

Text

Content Curation Techniques: A Guide for Indian Marketers

Latest News

News

Stock Market Update: Nifty 50 Movement, Trade Setup, and Top Stock Picks

News

Markets on Edge: Indian Indices Dip, Bitcoin Hits Record, and Global Trends Shape the Week Ahead

News

BlueStone Jewellery Plans ₹1,000 Crore IPO with Fresh Issue and OFS

Source: Mangostar-Studio

In today’s digital age, content is not just king; it’s the whole kingdom. As businesses in India strive to engage their audience effectively, content curation techniques have become vital in delivering valuable, relevant, and timely information. Content curation involves gathering, organizing, and sharing relevant content from various sources to provide a more enriched experience for your audience. In this article, we will explore five essential content curation techniques tailored for the Indian market, helping you enhance your brand’s visibility and authority.

Here are the 5 Essential Content Curation Techniques:

1. Define Your Niche and Audience

https://businessviewpointmagazine.com/wp-content/uploads/2024/10/26.1-2.-Use-Reliable-Tools-for-Curation-Image-by-SUWANNAR-KAWILA.jpg

Steps to Define Your Niche:

Research Your Audience: Use tools like Google Analytics, social media insights, and surveys to gather data about your audience’s demographics and preferences.

Identify Trending Topics: Explore popular content in your industry through platforms like Google Trends, BuzzSumo, or social media hashtags. This can help you pinpoint what resonates with Indian consumers.

Create Audience Personas: Develop detailed personas that encapsulate the characteristics of your ideal audience. This will guide your content curation efforts.

By understanding your niche and audience, you can ensure that the content you curate is relevant and engaging, which is a critical aspect of effective content curation techniques.

2. Use Reliable Tools for Curation

Incorporating the right tools into your content curation techniques can streamline the process, making it efficient and effective. Numerous tools are available that can help you discover, organize, and share content effortlessly.

Recommended Tools:

Feedly: A popular RSS aggregator that allows you to follow blogs and websites in your niche, keeping you updated on the latest articles.

Pocket: This tool helps save articles for later reading and can be used to curate content that you find valuable over time.

Scoop.it: A platform that allows you to create a digital magazine of curated content, helping you showcase your expertise in a particular area.

By leveraging these tools, Indian marketers can enhance their content curation techniques, ensuring a steady flow of relevant content for their audience.

3. Create Engaging Content Formats

Content curation doesn’t merely involve sharing links to articles. One of the effective content curation techniques is to present curated content in various engaging formats. This not only adds value but also keeps your audience interested.

Content Formats to Consider:

Infographics: Visual representations of data or information that summarize complex content, making it more digestible. Infographics resonate well with Indian audiences, particularly on platforms like Pinterest and Instagram.

Video Summaries: Create short video snippets summarizing curated articles or news updates. Video content is highly engaging and widely consumed in India.

Podcasts: Curate audio content by discussing relevant topics with industry experts. Podcasts have gained popularity in India, providing a unique way to connect with your audience.

By diversifying your content formats, you can implement effective content curation techniques that captivate your audience and increase shareability.

4. Add Your Unique Perspective

When curating content, it’s essential to add your unique voice and perspective. This personalization distinguishes your brand in a crowded marketplace and enhances your authority in your niche.

How to Add Your Unique Perspective:

https://businessviewpointmagazine.com/wp-content/uploads/2024/10/26.2-How-to-Add-Your-Unique-Perspective_-Image-by-pixelshot.jpg

Commentary and Analysis: When sharing curated content, include your insights or opinions on the subject matter. This helps establish you as a thought leader in your field.

Case Studies and Examples: Relate curated content to local case studies or examples relevant to the Indian audience. This makes the content more relatable and applicable to your readers.

Engage with Your Audience: Encourage discussions by asking questions or inviting feedback on curated content. Engaging your audience fosters a community around your brand.

By incorporating your unique perspective into your content curation techniques, you enhance the perceived value of the content and build a loyal following.

5. Monitor Performance and Adapt

The digital landscape is ever-changing, and so are the interests of your audience. Regularly monitoring the performance of your curated content is crucial for refining your content curation techniques.

Performance Monitoring Tools:

https://businessviewpointmagazine.com/wp-content/uploads/2024/10/26.3-Social-Media-Insights_-Image-by-hocus-focus.jpg

Google Analytics: Analyze traffic sources, engagement metrics, and audience behavior to understand which curated content resonates the most.

Social Media Insights: Use analytics tools provided by social media platforms to gauge engagement rates and audience feedback on shared curated content.

A/B Testing: Experiment with different formats, headlines, or distribution channels to see what works best for your audience.

By continually assessing and adapting your curation strategy based on performance data, you can ensure that your content remains relevant and valuable to your audience.

Conclusion

Implementing effective content curation techniques is essential for businesses looking to engage the Indian audience. By defining your niche and audience, utilizing reliable tools, creating diverse content formats, adding your unique perspective, and monitoring performance, you can elevate your content curation efforts to new heights. As the digital landscape continues to evolve, these techniques will help you maintain your brand’s relevance and authority, driving engagement and growth in an increasingly competitive market. Start adopting these strategies today and watch your audience grow!

#contentcurator#contentmarketing#contentcreator#contentcreation#contentmarketer#digitalmarketing#contentwriter#contentisking#contents#creative#contente#contentcop#actress

0 notes

Text

Design Your Destiny | Truth Tribe

Design Your Destiny | Truth Tribe https://www.youtube.com/watch?v=WnWozBSxOaE A guide for every dreamer seeking their place in the world! Edge Of infinity: 9RLZAZFKGJAPD76L Edge Of infinity: QAV7OJOJT2UZOQAN Edge Of infinity: JFMFV8K7LFFWL58T 🔔Explore Punjabi and South Asian culture, personal growth & community tales with Truth Tribe in Canada. Join for inspiring stories & insights: https://ift.tt/4tNI1Om ⭐ ⭐ ⭐ Audio Podcast is currently on your favorite platforms: 👉Spotify: https://ift.tt/Te0iEYJ ✅ Stay Connected With Us. 👉Instagram: https://ift.tt/AGZi5wt 👉Tiktok: https://ift.tt/yUInV7W 👉Twitter: https://twitter.com/Truthtribeshow 👉Linkedin: https://ift.tt/z9rvZ8e ============================= ✅ Recommended Playlists 👉Truthful Tidbits: South Asian Stories in Shorts 🎥 https://www.youtube.com/watch?v=fC1XfgZL4cs&list=PLV5n9x-zS3M_kim7BRH5RiWuIRlxnXcIW 👉Truth Tribe Episodes https://www.youtube.com/watch?v=E1n2E2L8-1c&list=PLV5n9x-zS3M-sEdFn9L8sj5mM6bvNQU-6 ✅ Other Videos You Might Be Interested In Watching: 👉 Punjabi Sikh Spirit meets Canadian Wrestling: Jasmit Singh Phulka|Truth Tribe Show Ep.3 https://www.youtube.com/watch?v=EOggXnxcfAA 👉Helmets for Sikh Kids: Tina Singh's Bold Revolution|Truth Tribe Show Ep.5 https://www.youtube.com/watch?v=J421gzicDYw 👉Canadian Parliament & Punjabi Roots: MP Parm Bains | Truth Tribe Ep.8 https://www.youtube.com/watch?v=p1s2eaqXLY0 👉Punjab To Canada: Deputy Mayor Gurkirpal Dhanoa|Truth Tribe Show Ep.6 https://www.youtube.com/watch?v=UKWp-ZGz6_U ============================= ✅ About Truth Tribe. Hey there! Welcome to Truth Tribe on YouTube. We share powerful stories and insights from the Punjabi and South Asian communities, especially in Canada and India. Dive into our podcasts, interviews, and content about culture, personal growth, community tales, and more. Join us and be part of our journey. 🔔Get inspired and connected with Truth Tribe. Subscribe now to explore Punjabi and South Asian culture, personal growth, and inspiring tales: https://ift.tt/4tNI1Om ================================= #truthtribe #punjabi #punjabipodcast #bitcoin #canada Disclaimer: We do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of our publications. You acknowledge that you use the information we provide at your own risk. Do your research. Copyright Notice: This video and our YouTube channel contain dialog, music, and images that are the property of Truth Tribe. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to our YouTube channel is provided. © Truth Tribe via Truth Tribe https://www.youtube.com/channel/UCKJrzg8P0R8N-e6l1GLZwlQ May 01, 2024 at 07:03AM

#punjabicanada#canadianwrestling#punjabihockey#truthtribeshow#immigrantstories#mentalhealth#veteranwellness#endurancerunning#mentalhealthawareness

0 notes

Text

What is G20? A Comprehensive Guide to the World's Premier Economic Forum

Join me as we delve into the history and significance of the G20, a group of 20 major economies that collectively represent 85% of global GDP. From its origins in response to the 2008 financial crisis to its current role in shaping global economic policy, we explore all aspects of this influential forum.

today we'll be discussing everything you need to know about this premier economic forum. So, let's get started.

The G20 is a group of 20 major economies that includes Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, United Kingdom and United States. Together they represent two-thirds of the world's population and account for 85% of global GDP.

The G20 was established in 1999 as a meeting between finance ministers and central bank governors from the world's largest economies. However it wasn't until after the 2008 financial crisis that it became a formal summit for heads of state or government.

The first G20 Leaders' Summit was held in Washington D.C. in November 2008. At this summit leaders discussed measures to address the global financial crisis and prevent future crises from occurring. Since then there have been annual summits held in various countries around the world.

The G20 operates on a rotating presidency system where each member country takes turns hosting the summit. The presidency is responsible for setting the agenda for that year's summit and leading discussions on key issues.

So what are some of these key issues? The G20 covers a wide range of topics including global economic growth, financial regulation, trade, climate change, and development. The G20 also works to promote international cooperation on issues such as terrorism and corruption.

One of the most significant achievements of the G20 was the establishment of the Financial Stability Board (FSB) in 2009. The FSB is responsible for coordinating international financial regulation and ensuring that the global financial system remains stable.

Another important aspect of the G20 is its engagement groups. These are groups made up of representatives from civil society, business, labor unions, and think tanks who provide input on key issues being discussed at the summit.

The engagement groups include the Business 20 (B20), Labor 20 (L20), Civil 20 (C20), Think 20 (T20), Women 20 (W20), Youth 20 (Y20) and Science 20 (S20). These groups play an important role in ensuring that the voices of various stakeholders are heard during G20 discussions.

The G20 has faced criticism over the years for being too exclusive and not representative enough of smaller economies or developing countries. However, efforts have been made to address these concerns through initiatives such as inviting guest countries to participate in summits and engaging with non-governmental organizations.

Despite these challenges, the G20 remains an important forum for shaping global economic policy. Its members have a significant impact on international trade and investment flows, as well as on issues such as climate change and development.

That's all we have time for today. I hope you found this discussion informative and insightful. Don't forget to subscribe to my channel for more content like this. Until next time!

#G20

#EconomicForum

#Economic

#GDP

➖➖➖➖➖➖➖➖➖

🔎 Anything that makes me curious to know more about it, I'll share with you in this #podcast.

© "#mohammadinet" podcast is created and hosted by #MohammadGholami.

➖➖➖➖➖➖➖➖➖

💳Donation

bitcoin :

bc1quc8zm5jt733jsm4vmqakr4qu0k9ya6r3n904yswymlmlg6m5wq8sajfdk2

➖➖➖➖➖➖➖➖➖

youtube

0 notes

Text

June 2021 Important Dates

AKA my notes on The Astrology Podcast’s June forecast. Dates based off US Mountain Time and may be a day earlier in the Eastern Hemisphere.

We’re going into this month off a Lunar Eclipse in Sagittarius, Mercury stationing Retrograde minutes before I began typing this up, and Jupiter’s newfound freedom in Pisces. We can also note that Jupiter is sharing Pisces with Neptune now--while travel may open up we may also experience the truth around mysteries (our hosts brought up UFOs & the US military, but I’d say wait til the conjunction in Spring 2022 for significant confirmations.)

Additionally, Saturn will be going retrograde through Aquarius this month--check that house, as well as planets in fixed signs in your birth chart, to see where it may pop up for you.

June 2nd - Venus enters Cancer She’ll conjunct the Moon on the 12th while Jupiter in Pisces lends a hand. Chris’s electional chart (auspicious time to do things) for this month takes advantage of these configurations, which should be around 12:30AM local time on the 12th--adjust your time until Jupiter is on the same degree as the Ascendant, which puts Venus in the 5th house. Good time for creative pursuits, fertility, “nourishing midnight spiritual practices” as Diana puts it, and other Venusian & Jovian activities.

June 10th - Solar Eclipse in Gemini We’re already fully in “eclipse season” right now, coming off the total lunar eclipse in Sagittarius on May 26th, and on a larger scale continuing from the series of eclipses in November & December last year. The North Node (head of the dragon) in Gemini has corresponded to an increase in overstimulating our nervous systems via social media & video chats, while the South Node in Sagittarius has corresponded with a decrease of travel on a global scale.

The eclipse takes place conjunct a retrograde Mercury, and guest host Diana says she anticipates taking the day off social media that day. It’s a LOT of Gemini energy, which could give us Matrix-source-code-level insights on problems, but also a voracious shoveling of interaction with others and the resulting stomachache.

Look at the pair of houses the nodes are in for you--what are you acquiring in your Gemini house, and what do you have to let go of in your Sagittarius house to do this? For example, Kelly has the South node in her tenth house (career/reptuation/public image) right now and is absent from the show, because she’s moving (taking care of fourth house matters, where the North node is for her).

June 11th - Mars enters Leo He’ll oppose Saturn and square Uranus right as the outer planets square each other, igniting the conflicts indicated by this aspect (see below). Mars in a fire sign is especially combustible--a similar configuration in January corresponded to intense world events. Austin also notes that on the 14th, 20th, and 26th the Moon will be entangled in this tense and explosive T-square (kind of anti-electional/unlucky dates).

This is also the day after the eclipse, and both benefics are in water signs right now. Fire season in the Western US may be especially bad this year. Mars will also oppose Saturn in Aquarius: events that happened with Saturn in Aquarius may see a reckoning.

June 24th - Retrograde Saturn Squares Uranus (2nd time this year) Here’s the obligatory graph from Archetypal Explorer, this time with Mars contacts as well as Saturn squaring Uranus:

Our hosts are linking recent news about Bitcoin to both the Uranus transits as well as the eclipse cycle. This aspect is the quintessential struggle between established systematic rules of society (Saturn), and a desire for dramatic changes (Uranus) of our basic material needs like food, money and land (Taurus). Last time we had this transit, people gathered together large groups (Saturn in Aquarius) that went to greater extremes than any would have alone (remember the events in DC before the inaguration this year? Saturn♒ square Uranus♉).

Also relevant to this aspect is the question of labor and work: increased calls for unionization in tech, low-wage workers calling for higher wages as their employers struggle to replace everyone they fired with new workers willing to put up with such exploitation, people working from home and realizing that they hate their job without seeing their coworkers OR realizing they might as well stay at home instead of going into the office, the farmers’ strike in India over the structure of their relationship to distribution companies, et cetera...

June 20th - Sun enters Cancer AND Jupiter stations Retrograde Jupiter retrograde: retrogrades in general can indicate unfinished business--what Jupiter in Aquarius events need to be revisited before we can travel down that blissful riverboat ride of Jupiter’s transit in Pisces?

Sun in Cancer: the Sun enters Cancer soon after a cazimi with Mercury. As Mercury renews the cycle of his orbit, the Sun forms a trine with Jupiter right at the start of this ingress. Things are looking much more optimistic as the month ends.

June 22nd - Mercury stations Direct Finally, communications will go back to normal again! Personally I’ve seen the shadow period feel almost like a retrograde already so far, so we might not be totally out of the woods until he picks up more speed.

Additionally, Mercury’s stationing around the same degree of Gemini this year as Venus did last year when lockdowns ended prematurely last year; the square to Neptune may indicate a level of illusion, misconception, or bad information influencing events again.

June 24th - New Moon in Capricorn Jupiter blesses this unation with a sextile to the Moon and a trine to the Sun. We’re also finally leaving summer eclipse season, and further more this is one of the first lunations in Cancer or Capricorn that aren’t an eclipse now that the nodes have moved. We’re really leaving an old era behind. Our social & spiritual lives will be rehydrated like a Rose of Jericho.

June 25th - Neptune stations Retrograde in Pisces This further emphasizes the water energy at the end of the month. Think “dreamy” when Neptune is involved.

June 26th - Venus enters Leo Further emphasizes the fixed sign activity of this year. She’ll conjunct Mars in July as our focus shifts to the Leo-Aquarius axis.

5 notes

·

View notes

Text

The FTX Podcast #54 – Flood Bitcoin on Scaling as a Trader

youtube

A great episode to look deeper into the pieces that differentiate a profitable trader from a losing one. Flood has deep insights into the things both objective and subjective to pay attention to when learning how to trade, and then scaling that trading to a career.

●▬▬▬▬▬▬Trade on FTX▬▬▬▬▬▬▬▬●

FTX is a cryptocurrency exchange built by traders, for traders. FTX offers innovative products including industry-first derivatives, options, volatility products and leveraged tokens. We strive to develop a platform robust enough for professional trading firms and intuitive enough for first-time users.

https://ftx.com/

●▬▬▬▬▬▬▬▬FTX Socials▬▬▬▬▬▬▬▬▬●

FTX Twitter: https://twitter.com/FTX_Official FTX Youtube: https://www.youtube.com/c/FTXOfficial/ SBF Twitter: https://twitter.com/SBF_Alameda LinkedIN: https://www.linkedin.com/company/ftx

●▬▬▬▬▬▬▬▬FTX Customer Support▬▬▬▬▬▬▬▬▬▬▬●

Help Desk: https://help.ftx.com/hc/en-us FTX.com/support [email protected]

Telegrams: FTX Telegram Communities English – https://t.me/FTX_Official Chinese – https://t.me/FTX_Chinese_Official Vietnamese – https://t.me/FTX_Vietnam_Official Russian – https://t.me/FTX_Russian_Official Turkish – https://t.me/FTX_Turkey_official Taiwanese – https://t.me/FTX_Taiwan_Official French – https://t.me/FTX_France_Officiel Korea – https://t.me/FTX_Korea_Official India – https://t.me/FTX_India_Official Spanish – https://t.me/Ftx_Spanish_Official Portuguese – https://t.me/Ftx_Portugues_Oficial Dutch – https://t.me/FTX_Dutch_Official Africa – https://t.me/FTX_Africa Indonesian – https://t.me/FTX_Indonesia Thai – https://t.me/FTX_Thailand

The post The FTX Podcast #54 – Flood Bitcoin on Scaling as a Trader appeared first on BLOCKPATHS.

source https://blockpaths.com/exchanges/the-ftx-podcast-54-flood-bitcoin-on-scaling-as-a-trader/

0 notes

Text

Telegram Attacks Apple, Musk on Crypto, WEF Debrief: Hodler’s Digest, Jan 20–26

Hodler’s Digest Coming every Sunday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

World Economic Forum debuts framework for central bank digital currencyIt was a c-c-c-cold week in Davos, but Cointelegraph’s reporters wrapped up warm to bring you all the news from the World Economic Forum. One particularly big announcement saw the WEF unveil a central bank digital currency policymaker toolkit. The framework, created in tandem with central banks, is designed to help policymakers understand whether deploying a CBDC would be advantageous. In other developments, a global consortium has been formed to focus on developing interoperable, transparent and inclusive policy approaches to regulating digital currencies. At the start of the week, the European Union and five major central banks — the United Kingdom, Japan, Canada, Sweden and Switzerland — announced they were planning to team up on their research for CBDCs.WEF: Facebook’s Libra pushed world to reconsider USD as global reserve currencyElsewhere in the snowy hills of Davos, global economists begrudgingly admitted that Libra had played an instrumental role in getting the world to evaluate CBDCs — and to challenge the U.S. dollar’s role as an anchor currency. On a panel exploring the issue, Brazil’s Economy Minister Paulo Guedes said new technologies like blockchain are paving the way for future currencies to be digital. Others, such as the International Monetary Fund’s chief economist, Gita Gopinath, cautioned that the dollar still remains attractive because it “provides the best stability and safety.” David Marcus, the head of Facebook’s Calibra wallet, was speaking at another WEF panel. He questioned whether “wholesale” CBDCs would solve any problems in the global economy, and argued that a retail-focused approach is the best way to tackle an ���unacceptable” situation where 1.7 billion people are unbanked and another 1 billion underserved. Whether Libra will be that solution remains to be seen.WEF: Ripple CEO hints at IPO, says more crypto firms will go public in 2020And we’ve just got time for one final morsel of gossip from Davos. Ripple CEO Brad Garlinghouse has predicted that initial public offerings will become more prevalent in the cryptocurrency and blockchain space in 2020 — and he hinted his company would be among those seeking a public flotation. “We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side,” he said. Such a move could be instrumental in building confidence with mainstream investors and secure a pivot away from controversial initial coin offerings, which have seen young startups suffer often expensive run-ins with regulators such as the U.S. Securities and Exchange Commission.

Tether launches gold-backed stablecoin and begins trading on BitfinexOf course, plenty of news has been happening away from Davos. Tether has announced it is now supporting a gold-backed stablecoin, where one token represents ownership of a troy ounce of physical gold. The funds are said to be backed by physical gold held in a “Switzerland vault” — and the product is available as an ERC-20 token on the Ethereum blockchain, as well as a TRC-20 token on Tron. Plans for commodity-backed Tethers have been in place for some time, but the company has often been criticized for its opaque approach to reserve management. A high-profile class-action lawsuit recently accused the company of market manipulation in 2017. Tether reserves were also allegedly used to cover a liquidity shortfall.Elon Musk reveals his true opinion on Bitcoin and cryptoTesla’s CEO may be constantly cryptic on his attitudes toward crypto, but this week, we got a little insight into Elon Musk’s thinking. On a podcast, the billionaire said he’s “neither here nor there on Bitcoin,” acknowledged Satoshi’s white paper was “pretty clever,” and warned his stance on cryptocurrencies often “gets the crypto people angry.” Musk added: “You must have a legal to illegal bridge. So, where I see crypto is effectively as a replacement for cash. I do not see crypto being the primary database .” Musk has been known to write short tweets about crypto that were widely interpreted as jokes. Last year, he unexpectedly declared himself as the new CEO of Dogecoin — a gesture that helped the joke coin clock short-lived gains of 35%.

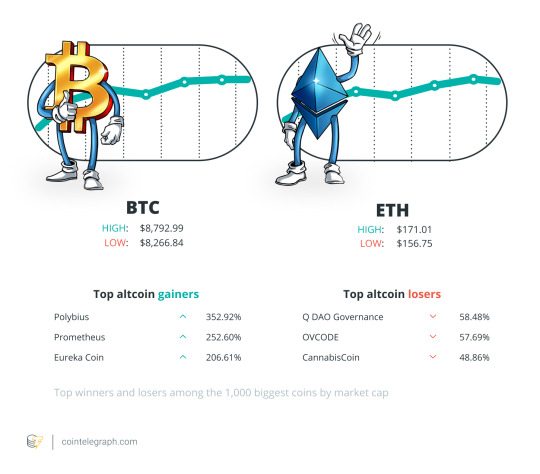

Winners and Losers

At the end of the week, Bitcoin is at $8,450.74, Ether at $163.88 and XRP at $0.22. The total market cap is at $233,388,704,913.Among the biggest 1,000 cryptocurrencies, the top three altcoin gainers of the week are Polybius, Prometheus and Eureka Coin. The top three altcoin losers of the week are Q DAO Governance, OVCODE and CannabisCoin.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“I think there's a lot of things that are illegal that shouldn't be illegal. I think that sometimes governments just have too many laws about the missions that they should have, and shouldn't have so many things that are illegal.”Elon Musk, Tesla CEO“So then there is the new technology, the digital, the blockchain. The Libra episode is just evoking a future digital currency.”Paulo Guedes, Brazil’s economy minister“When we started this journey almost six months ago, the whole idea was not around a certain way of doing things, but more around ‘let’s come together and try to figure out how we solve a problem that is unacceptable’ — 1.7 billion people who are currently unbanked, another billion underserved.”David Marcus, Calibra CEO“Given the critical roles central banks play in the global economy, any central bank digital currency implementation, including potentially with blockchain technology, will have a profound impact domestically and internationally.”Sheila Warren, World Economic Forum head of blockchain“In the next 12 months, you’ll see IPOs in the crypto/blockchain space. We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side… it’s a natural evolution for our company.”Brad Garlinghouse, Ripple CEO“My #Bitcoin mystery is solved. I mistook my pin for my password. When Blockchain updated their app I got logged out. I logging back in using my pin, which was the only ‘password’ I had ever known or used. I also never had a copy of my seed phrase. Honest but costly mistake!”Peter Schiff, crypto skeptic and gold bug“iCloud is now officially a surveillance tool. Apps that are relying on it to store your private messages (such as WhatsApp) are part of the problem.”Pavel Durov, Telegram founder and CEO

FUD of the Week

Greece extradites alleged launderer of $4 billion in BTC, Alexander Vinnik, to FranceA Russian national accused of heading a group that laundered $4 billion in Bitcoin has been extradited from Greece to France. Alexander Vinnik formerly operated the now-shuttered exchange BTC-e and is believed to have a direct relationship to the infamous hack of Mt. Gox. The case has risked triggering a diplomatic row, with Russia filing several requests to bring him under its jurisdiction. Lawyers writing on behalf of Vinnik’s young children had submitted a complaint to a Greek court at the start of the week in an attempt to prevent the extradition. Reports now suggest that Vinnik is being held at a hospital in Paris. His legal representative Zoe Konstantopoulou said: “In every way the government is trying to scare him, terrorize him, in a moment of great agony, while his health has worsened.”India’s central bank says it hasn’t banned cryptoThe Reserve Bank of India has said restrictions on regulated entities offering crypto assets do not equate to an overall ban. In a document submitted to the country’s supreme court back in September, which has now been made public, the institution said: “The RBI has not prohibited VCs (virtual currencies) in the country. The RBI has directed the entities regulated by it to not provide services to those persons or entities dealing in or settling VCs.” All of this comes as a landmark case against the RBI concludes its second week. Hearings are set to resume on Jan. 28.Peter Schiff bungled wallet password, solving “Bitcoin mystery”Long-running crypto skeptic and gold bug Peter Schiff is likely to be even more skeptical after losing access to his funds. At first, he believed his wallet was corrupted — but he later found out that he mistook his PIN for his password, and he was unable to log in after an app update because he had never taken a copy of his seed phrase. Many in the crypto community have criticized Schiff for making a rookie mistake, with Binance CEO Changpeng Zhao quipping: “I can’t believe I am about to say this, but maybe ‘stay in fiat?’” In recent days, CZ has said that keeping assets on an exchange is often safer than keeping the keys themselves — but those who have fallen victims to hacks on these platforms may not be so quick to agree.

Telegram CEO: Apple’s iCloud is “now officially a surveillance tool”Pavel Durov, the founder and CEO of Telegram, has claimed that Apple’s cloud service iCloud is “now officially a surveillance tool.” His stinging rebuke followed reports that the tech giant dropped plans for end-to-end encryption on iCloud two years ago — apparently following complaints from the FBI. This ultimately means that backed-up texts from iMessage, WhatsApp and other encrypted services remain available to Apple employees and authorities. Telegram has been positioning itself as a global fighter for privacy — and in 2018, it refused to give Russian authorities the encryption keys to user accounts, prompting as-of-yet unfulfilled threats that the app would be blocked “in the near future.”

Best Cointelegraph Features

SEC goes head-to-head with Telegram, makes a guinea pig of TONThe Chamber of Digital Commerce submitted a legal document to the court overseeing the hearing between Telegram and the U.S. Securities and Exchange Commission. Shiraz Jagati looks at what it says.Effect of CME futures options on BTC price depends on halvingCME Group has launched new Bitcoin options — further uplifting the institutional infrastructure supporting the asset class. Joseph Young writes that it’s a net positive for the crypto community, and the upcoming “halving” could make things more interesting.Adam Back on Satoshi emails, privacy concerns and Bitcoin’s early daysCassio Gusson has caught up with Adam Back to discuss the early years of Bitcoin, his emails with Satoshi Nakamoto and privacy — 11 years after BTC’s release.Original Article - CoinTelegraph.com Read the full article

0 notes

Text

Bitmain’s Nishant Sharma Talks China and Crypto in the Humans of Bitcoin Podcast

This week on the Humans of Bitcoin podcast host Matt Aaron chatted with Bitmain’s Nishant Sharma who shared his story and discussed the western hemisphere’s false impressions of China and Bitcoin. During the interview, Sharma conversed about his work with Bitmain, one of the largest cryptocurrency companies in the world, and addressed some of the misinterpretations in regard to individuals who call Bitcoin Cash the “Chinese Bitcoin.”

Also read: Bitmain Launches Low-Cost Special Edition Antminer S9

The Founding Values of Bitcoin Are Borderless

Bitmain’s Nishant Sharma recently joined the Humans of Bitcoin podcast with Matt Aaron and discussed his story working for Bitmain. Bitmain Technologies Ltd is a privately owned company headquartered in Beijing and the largest manufacturer of ASIC chips for bitcoin mining. Sharma was born and raised in India and runs Bitmain’s international PR and community relations strategy. The company was created in 2013 by Micree Zhan and Jihan Wu and Nishant explained during his interview that Wu was the first to translate the Bitcoin whitepaper from English to Mandarin. “[Jihan Wu] took the message of Bitcoin to 1.3 billion people,” Sharma detailed.

“The message doesn’t change, the message of Bitcoin might be translated in different languages but everyone sees the founding values of Bitcoin — Its permissionless nature, its trustlessness, uncensorable transactions, and the ability to give everyone in the world the right to transact,” Sharma remarked. “These are the things that attracted Jihan to it as well as anyone else — The language barrier doesn’t change things and it’s exactly why he saw the potential of Bitcoin.”

Misconceptions of Bitcoin Cash, China and the Eastern and Western Crypto Ecosystem

Further into the discussion, Sharma talked about the differences between Asia and how privacy is viewed in a different fashion in the region in contrast to the U.S. or Europe. “In Asia people could care less about censorship resistance because privacy is something people start caring about when they have all the basic necessities of life. And they have all the avenues to meet their aspirations,” Sharma said, adding:

Only then people start caring about privacy. I do think privacy is a basic human right but of course if I was to choose between having food to eat or privacy, of course, I would choose the former. That’s why people in Asia do not care as much about privacy as people in the U.S. do.

The two continued by discussing some of the anti-Chinese sentiment that plagues the community at times and Sharma observed that it mainly boils down to the social-political setups between both regions. “Companies in the west because of the social-political nature of the USA and most western economies, they are more outspoken and they communicate more with the audience. But in China, because of the social-political nature of the country, the companies do not act in the same way and the audience often mistakes this as an intentional silence or an intentional effort to be opaque or hide something. Which is not true it is just how things are here.”

Moreover, Sharma also reveals how he’s noticed that sometimes people think that Bitcoin Cash is less than Bitcoin in many ways just because it is considered a ‘Chinese version of Bitcoin.’ “I don’t agree with that because it was a hard fork by a collective group of developers from Europe and not from China — And even if you go back long before Bitcoin Cash came into being, the discussion of big blocks started in the U.S. when businesses were suffering because of Bitcoin’s congestion and backlog of transactions.”

If you want to hear more of what Bitmain’s Nishant Sharma has to say about the company and how he got into Bitcoin then check out the podcast below. Sharma gives some great insight into the mining giant Bitmain’s operations and how cryptocurrencies are viewed in Asia.

What do you think about Bitmain’s Nishant Sharma and this subject? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Bitcoin.com, Humans of Bitcoin, Nishant Sharma, and Bitmain.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Bitcoin.com Markets, another original and free service from Bitcoin.com.

The post Bitmain’s Nishant Sharma Talks China and Crypto in the Humans of Bitcoin Podcast appeared first on Bitcoin News.

READ MORE http://bit.ly/2Ir0YCN

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

0 notes

Link

With Bitcoin’s (BTC) fourth halving just four days away, members of the global crypto community are eager to see how the event pans out monetarily for the flagship crypto asset. Historically speaking, the halving has almost always had a positive impact on Bitcoin’s price, but this time around, many experts believe that any potential value surges may have already been priced in.

It bears mentioning that the halving will most likely have the biggest impact on miners, as the reduced reward ratio following the event will rapidly alter their profit streams, forcing small-time players to either adjust their operations accordingly or shut down completely.

Not only that, some pundits have commented that the aforementioned “supply shock” could compromise the security of Bitcoin by causing a rapid drop in miner hash power. In this regard, Alex Heid, the chief research officer at SecurityScorecard — an information security company that rates the cybersecurity risks of corporate entities — believes that ransomware attacks will increase as a result of the halving, with miscreants most likely making use of known vulnerabilities and phishing as a means of deployment. So, how is the upcoming halving going to impact BTC’s overall market sentiment and trust?

Traditional finance helps Bitcoin

With the coronavirus pandemic currently sweeping the globe, it appears as though more people may be turning to believe that their local monetary systems have some flaws, especially as central banks such as the United States Federal Reserve continue to print an increasing amount of fiat currency as part of its quantitative easing efforts.

Additionally, many governments have made a major push to increase the adoption of digital payment systems as well as other contactless payment mediums to adhere to social distancing measures that have been deemed essential during this time.

Owing to the fact that the aforementioned COVID-19 crisis coincides with the BTC halving, the premier cryptocurrency’s image seems to have improved somewhat in the eyes of investors, who are now beginning to gain a more in-depth understanding of Bitcoin’s self-deflationary and decentralized design. Commenting on the subject, BlockFi co-founder and CEO Zac Prince told Cointelegraph that the halving is a “perfectly timed opportunity for Bitcoin,” adding:

“Current market dynamics are driving a bolstered interest on digital currency for the long run that go beyond a rudimentary understanding of the rules of supply and demand. Historically, past halving events have always resulted in an eventual upswing of BTC.”

Prince further opined that with the Fed printing money to keep the economy afloat, more and more Americans have started to flock toward Bitcoin as a store of value — thus showcasing their long-term trust in the digital commodity. Not only that, he also believes that because Bitcoin was able to successfully bounce back from its pandemic-induced losses recently, an increasing number of people are now beginning to accumulate it in order to diversify their existing portfolios. He added:

“As more people see its value, on top of ongoing peripheral retail pressure, we believe we will see the price of Bitcoin will rise steadily, and at times rapidly, over the next few years.”

Lastly, Bitcoin’s steadily growing market reputation is cemented by the fact that countries like India, Nigeria and Lebanon have witnessed an increasing amount of crypto adoption — especially as stock markets around the world have incurred substantial losses over the past month and a half. And while in the past, people have tended to flock to the U.S. dollar as a safe haven, the dollar itself is potentially facing uncertain times, causing an increased number of people to take refuge in different offerings to protect their wealth.

Institutions to capitalize on crypto post-halving?

Another interesting discussion that has piqued the interest of many is whether the upcoming halving will help lure in more institutional players — especially if BTC starts to surge steadily following the event. In this regard, common sense suggests that if Bitcoin does, in fact, witness a dramatic increase in its value, the asset could join the company of scarce commodities like gold that investors believe can not only serve as good stores of value but also provide investors with a means of hedging economic risks associated with black swan events such as the coronavirus crisis.

Providing insight on the matter, John Cantrell, CEO of Juggernaut — a messenger service built on Bitcoin and Lightning Network that offers end-to-end encryption — told Cointelegraph that as per his research, a whole host of forward-looking institutions have already made moves to understand the value proposition that Bitcoin provides and have therefore invested in the asset. However, for the big-name players who haven’t really paid attention to BTC, Cantrell believes that the upcoming halving provides them with a perfect avenue for exploration.

Similarly, Prince believes that the crypto market is now ready for an influx of institutional money. On the subject, he highlighted that as things stand, an incredible amount of infrastructure has already been established for retail and institutional investors to own Bitcoin:

“Traditional fintech retail platforms like Square, SoFi and Robinhood have made purchasing Bitcoin available on their platform, and firms like Fidelity and Grayscale are building products to support institutional adoption.”

However, a somewhat contrary opinion is held by Checkmate, co-host of the Rough Consensus podcast and a research contractor for the open-source, autonomous digital currency Decred. He believes that the current volatility and lack of liquid derivative infrastructure to hedge risk has kept big-name institutional players from entering this market, telling Cointelegraph, “Institutions will come when the financial infrastructure and size make Bitcoin an invest-able asset class. The halving likely has little to do with this.”

Market sentiment has already improved significantly

Amid the global economic uncertainty, it seems as though cryptocurrencies have been steadily gaining an air of trust and legitimacy around them. In this regard, etoro analyst Mathew De Corrado told Cointelegraph that since the last halving event in 2016, his company has seen an influx of clients looking to add Bitcoin to their portfolio.

He also pointed out that a lot of etoro customers have shown greater interest in cryptocurrency as a result of the increased economic stimulus added by governments across the globe, especially because a vast majority of crypto investors tend to see these assets as a hedge against potential future inflation and the depreciation of their local currency. De Corrado closed out by saying:

“Trust in crypto assets, in my opinion, will largely stem from increased visibility in the public eye, from governmental organizations, increased regulation and/or oversight, and also from increased demand from institutional investors.”

Lastly, Cantrell stated that as more people realize Bitcoin has a fixed supply as well as a known production schedule — meaning the asset can’t be inflated at will — their confidence and sentiment toward crypto will increase at a rapid rate.

Bitcoin’s reputation will remain unaffected

With the halving fast approaching, it remains to be seen how BTC’s public perception will change after the event, given that the currency may be subject to a price surge or a decline in the short term. If Bitcoin is able to stay on an upward ascent, it would help embed the narrative that Bitcoin is not only a potential long-term investment avenue but also a means of hedging economic risks that are usually witnessed when traditional markets tumble and fall as a result of unfavorable market conditions.

On the other hand, if Bitcoin’s value starts to slide after the halving, investor confidence may be influenced, but when considering the current market situation, this effect may not be long-lasting.

Speaking on this issue, De Corrado believes that irrespective of how BTC’s financial future plays out after the halving, the currency’s reputation will most likely remain unaffected. However, he did concede that if a volatile future is in store, it might present investors with an opportunity to trade on what will likely be increased volatility, in anticipation of the cut to the supply side of the equation. He concluded:

“For context, Bitcoin had one of the biggest weeks of the year, up approximately 19.2% for the week ending Sunday. With such a significant rise in just a single week, the big question will be how much of the halving event caused that rise, and what can investors expect to see in the coming 14-day period?”

Read More

The post Stairway to Scarcity: Bitcoin Sentiment to Rise Despite Halving Impact appeared first on Future Money Matters.

0 notes

Text

Best Bitcoin & Crypto Podcasts in 2023

Looking for the best crypto podcasts in 2023? Look no further! "The Best Bitcoin & Crypto Podcasts in 2023 India" is your ultimate guide to staying updated on the dynamic world of cryptocurrencies. Get insights, analysis, and expert discussions on the latest trends, blockchain technology, decentralized finance, and more. These top-rated podcasts provide invaluable knowledge and expert opinions, empowering you to make informed decisions in the rapidly evolving crypto landscape. Stay ahead of the game with the best crypto podcast 2023 in India!

#top bitcoin podcasts#crypto podcast recommendations#best cryptocurrency podcast shows#cryptopodcasts#bitcointalks#cryptoconversations#digitalcurrencypodcasts#cryptoinsights

0 notes

Text

Telegram Attacks Apple, Musk on Crypto, WEF Debrief: Hodler’s Digest, Jan 20–26

Telegram Attacks Apple, Musk on Crypto, WEF Debrief: Hodler’s Digest, Jan 20–26:

Coming every Sunday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

World Economic Forum debuts framework for central bank digital currency

It was a c-c-c-cold week in Davos, but Cointelegraph’s reporters wrapped up warm to bring you all the news from the World Economic Forum. One particularly big announcement saw the WEF unveil a central bank digital currency policymaker toolkit. The framework, created in tandem with central banks, is designed to help policymakers understand whether deploying a CBDC would be advantageous. In other developments, a global consortium has been formed to focus on developing interoperable, transparent and inclusive policy approaches to regulating digital currencies. At the start of the week, the European Union and five major central banks — the United Kingdom, Japan, Canada, Sweden and Switzerland — announced they were planning to team up on their research for CBDCs.

WEF: Facebook’s Libra pushed world to reconsider USD as global reserve currency

Elsewhere in the snowy hills of Davos, global economists begrudgingly admitted that Libra had played an instrumental role in getting the world to evaluate CBDCs — and to challenge the U.S. dollar’s role as an anchor currency. On a panel exploring the issue, Brazil’s Economy Minister Paulo Guedes said new technologies like blockchain are paving the way for future currencies to be digital. Others, such as the International Monetary Fund’s chief economist, Gita Gopinath, cautioned that the dollar still remains attractive because it “provides the best stability and safety.” David Marcus, the head of Facebook’s Calibra wallet, was speaking at another WEF panel. He questioned whether “wholesale” CBDCs would solve any problems in the global economy, and argued that a retail-focused approach is the best way to tackle an “unacceptable” situation where 1.7 billion people are unbanked and another 1 billion underserved. Whether Libra will be that solution remains to be seen.

WEF: Ripple CEO hints at IPO, says more crypto firms will go public in 2020

And we’ve just got time for one final morsel of gossip from Davos. Ripple CEO Brad Garlinghouse has predicted that initial public offerings will become more prevalent in the cryptocurrency and blockchain space in 2020 — and he hinted his company would be among those seeking a public flotation. “We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side,” he said. Such a move could be instrumental in building confidence with mainstream investors and secure a pivot away from controversial initial coin offerings, which have seen young startups suffer often expensive run-ins with regulators such as the U.S. Securities and Exchange Commission.

Tether launches gold-backed stablecoin and begins trading on Bitfinex

Of course, plenty of news has been happening away from Davos. Tether has announced it is now supporting a gold-backed stablecoin, where one token represents ownership of a troy ounce of physical gold. The funds are said to be backed by physical gold held in a “Switzerland vault” — and the product is available as an ERC-20 token on the Ethereum blockchain, as well as a TRC-20 token on Tron. Plans for commodity-backed Tethers have been in place for some time, but the company has often been criticized for its opaque approach to reserve management. A high-profile class-action lawsuit recently accused the company of market manipulation in 2017. Tether reserves were also allegedly used to cover a liquidity shortfall.

Elon Musk reveals his true opinion on Bitcoin and crypto

Tesla’s CEO may be constantly cryptic on his attitudes toward crypto, but this week, we got a little insight into Elon Musk’s thinking. On a podcast, the billionaire said he’s “neither here nor there on Bitcoin,” acknowledged Satoshi’s white paper was “pretty clever,” and warned his stance on cryptocurrencies often “gets the crypto people angry.” Musk added: “You must have a legal to illegal bridge. So, where I see crypto is effectively as a replacement for cash. I do not see crypto being the primary database [for transactions].” Musk has been known to write short tweets about crypto that were widely interpreted as jokes. Last year, he unexpectedly declared himself as the new CEO of Dogecoin — a gesture that helped the joke coin clock short-lived gains of 35%.

Winners and Losers

At the end of the week, Bitcoin is at $8,450.74, Ether at $163.88 and XRP at $0.22. The total market cap is at $233,388,704,913.

Among the biggest 1,000 cryptocurrencies, the top three altcoin gainers of the week are Polybius, Prometheus and Eureka Coin. The top three altcoin losers of the week are Q DAO Governance, OVCODE and CannabisCoin.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“I think there’s a lot of things that are illegal that shouldn’t be illegal. I think that sometimes governments just have too many laws about the missions that they should have, and shouldn’t have so many things that are illegal.”

Elon Musk, Tesla CEO

“So then there is the new technology, the digital, the blockchain. […] The Libra episode is just evoking a future digital currency.”

Paulo Guedes, Brazil’s economy minister

“When we started this journey almost six months ago, the whole idea was not around a certain way of doing things, but more around ‘let’s come together and try to figure out how we solve a problem that is unacceptable’ — 1.7 billion people who are currently unbanked, another billion underserved.”

David Marcus, Calibra CEO

“Given the critical roles central banks play in the global economy, any central bank digital currency implementation, including potentially with blockchain technology, will have a profound impact domestically and internationally.”

Sheila Warren, World Economic Forum head of blockchain

“In the next 12 months, you’ll see IPOs in the crypto/blockchain space. We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side… it’s a natural evolution for our company.”

Brad Garlinghouse, Ripple CEO

“My #Bitcoin mystery is solved. I mistook my pin for my password. When Blockchain updated their app I got logged out. I [tried] logging back in using my pin, which was the only ‘password’ I had ever known or used. I also never had a copy of my seed phrase. Honest but costly mistake!”

Peter Schiff, crypto skeptic and gold bug

“iCloud is now officially a surveillance tool. Apps that are relying on it to store your private messages (such as WhatsApp) are part of the problem.”

Pavel Durov, Telegram founder and CEO

FUD of the Week

Greece extradites alleged launderer of $4 billion in BTC, Alexander Vinnik, to France

A Russian national accused of heading a group that laundered $4 billion in Bitcoin has been extradited from Greece to France. Alexander Vinnik formerly operated the now-shuttered exchange BTC-e and is believed to have a direct relationship to the infamous hack of Mt. Gox. The case has risked triggering a diplomatic row, with Russia filing several requests to bring him under its jurisdiction. Lawyers writing on behalf of Vinnik’s young children had submitted a complaint to a Greek court at the start of the week in an attempt to prevent the extradition. Reports now suggest that Vinnik is being held at a hospital in Paris. His legal representative Zoe Konstantopoulou said: “In every way the government is trying to scare him, terrorize him, in a moment of great agony, while his health has worsened.”

India’s central bank says it hasn’t banned crypto

The Reserve Bank of India has said restrictions on regulated entities offering crypto assets do not equate to an overall ban. In a document submitted to the country’s supreme court back in September, which has now been made public, the institution said: “The RBI has not prohibited VCs (virtual currencies) in the country. The RBI has directed the entities regulated by it to not provide services to those persons or entities dealing in or settling VCs.” All of this comes as a landmark case against the RBI concludes its second week. Hearings are set to resume on Jan. 28.

Peter Schiff bungled wallet password, solving “Bitcoin mystery”

Long-running crypto skeptic and gold bug Peter Schiff is likely to be even more skeptical after losing access to his funds. At first, he believed his wallet was corrupted — but he later found out that he mistook his PIN for his password, and he was unable to log in after an app update because he had never taken a copy of his seed phrase. Many in the crypto community have criticized Schiff for making a rookie mistake, with Binance CEO Changpeng Zhao quipping: “I can’t believe I am about to say this, but maybe ‘stay in fiat?’” In recent days, CZ has said that keeping assets on an exchange is often safer than keeping the keys themselves — but those who have fallen victims to hacks on these platforms may not be so quick to agree.

Telegram CEO: Apple’s iCloud is “now officially a surveillance tool”

Pavel Durov, the founder and CEO of Telegram, has claimed that Apple’s cloud service iCloud is “now officially a surveillance tool.” His stinging rebuke followed reports that the tech giant dropped plans for end-to-end encryption on iCloud two years ago — apparently following complaints from the FBI. This ultimately means that backed-up texts from iMessage, WhatsApp and other encrypted services remain available to Apple employees and authorities. Telegram has been positioning itself as a global fighter for privacy — and in 2018, it refused to give Russian authorities the encryption keys to user accounts, prompting as-of-yet unfulfilled threats that the app would be blocked “in the near future.”

Best Cointelegraph Features

SEC goes head-to-head with Telegram, makes a guinea pig of TON

The Chamber of Digital Commerce submitted a legal document to the court overseeing the hearing between Telegram and the U.S. Securities and Exchange Commission. Shiraz Jagati looks at what it says.

Effect of CME futures options on BTC price depends on halving

CME Group has launched new Bitcoin options — further uplifting the institutional infrastructure supporting the asset class. Joseph Young writes that it’s a net positive for the crypto community, and the upcoming “halving” could make things more interesting.

Adam Back on Satoshi emails, privacy concerns and Bitcoin’s early days

Cassio Gusson has caught up with Adam Back to discuss the early years of Bitcoin, his emails with Satoshi Nakamoto and privacy — 11 years after BTC’s release.

0 notes

Link

Coming every Sunday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

World Economic Forum debuts framework for central bank digital currency

It was a c-c-c-cold week in Davos, but Cointelegraph’s reporters wrapped up warm to bring you all the news from the World Economic Forum. One particularly big announcement saw the WEF unveil a central bank digital currency policymaker toolkit. The framework, created in tandem with central banks, is designed to help policymakers understand whether deploying a CBDC would be advantageous. In other developments, a global consortium has been formed to focus on developing interoperable, transparent and inclusive policy approaches to regulating digital currencies. At the start of the week, the European Union and five major central banks — the United Kingdom, Japan, Canada, Sweden and Switzerland — announced they were planning to team up on their research for CBDCs.

WEF: Facebook’s Libra pushed world to reconsider USD as global reserve currency

Elsewhere in the snowy hills of Davos, global economists begrudgingly admitted that Libra had played an instrumental role in getting the world to evaluate CBDCs — and to challenge the U.S. dollar’s role as an anchor currency. On a panel exploring the issue, Brazil’s Economy Minister Paulo Guedes said new technologies like blockchain are paving the way for future currencies to be digital. Others, such as the International Monetary Fund’s chief economist, Gita Gopinath, cautioned that the dollar still remains attractive because it “provides the best stability and safety.” David Marcus, the head of Facebook’s Calibra wallet, was speaking at another WEF panel. He questioned whether “wholesale” CBDCs would solve any problems in the global economy, and argued that a retail-focused approach is the best way to tackle an “unacceptable” situation where 1.7 billion people are unbanked and another 1 billion underserved. Whether Libra will be that solution remains to be seen.

WEF: Ripple CEO hints at IPO, says more crypto firms will go public in 2020

And we’ve just got time for one final morsel of gossip from Davos. Ripple CEO Brad Garlinghouse has predicted that initial public offerings will become more prevalent in the cryptocurrency and blockchain space in 2020 — and he hinted his company would be among those seeking a public flotation. “We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side,” he said. Such a move could be instrumental in building confidence with mainstream investors and secure a pivot away from controversial initial coin offerings, which have seen young startups suffer often expensive run-ins with regulators such as the U.S. Securities and Exchange Commission.

Tether launches gold-backed stablecoin and begins trading on Bitfinex

Of course, plenty of news has been happening away from Davos. Tether has announced it is now supporting a gold-backed stablecoin, where one token represents ownership of a troy ounce of physical gold. The funds are said to be backed by physical gold held in a “Switzerland vault” — and the product is available as an ERC-20 token on the Ethereum blockchain, as well as a TRC-20 token on Tron. Plans for commodity-backed Tethers have been in place for some time, but the company has often been criticized for its opaque approach to reserve management. A high-profile class-action lawsuit recently accused the company of market manipulation in 2017. Tether reserves were also allegedly used to cover a liquidity shortfall.

Elon Musk reveals his true opinion on Bitcoin and crypto

Tesla’s CEO may be constantly cryptic on his attitudes toward crypto, but this week, we got a little insight into Elon Musk’s thinking. On a podcast, the billionaire said he’s “neither here nor there on Bitcoin,” acknowledged Satoshi’s white paper was “pretty clever,” and warned his stance on cryptocurrencies often “gets the crypto people angry.” Musk added: “You must have a legal to illegal bridge. So, where I see crypto is effectively as a replacement for cash. I do not see crypto being the primary database [for transactions].” Musk has been known to write short tweets about crypto that were widely interpreted as jokes. Last year, he unexpectedly declared himself as the new CEO of Dogecoin — a gesture that helped the joke coin clock short-lived gains of 35%.

Winners and Losers

At the end of the week, Bitcoin is at $8,450.74, Ether at $163.88 and XRP at $0.22. The total market cap is at $233,388,704,913.

Among the biggest 1,000 cryptocurrencies, the top three altcoin gainers of the week are Polybius, Prometheus and Eureka Coin. The top three altcoin losers of the week are Q DAO Governance, OVCODE and CannabisCoin.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“I think there’s a lot of things that are illegal that shouldn’t be illegal. I think that sometimes governments just have too many laws about the missions that they should have, and shouldn’t have so many things that are illegal.”

Elon Musk, Tesla CEO

“So then there is the new technology, the digital, the blockchain. […] The Libra episode is just evoking a future digital currency.”

Paulo Guedes, Brazil’s economy minister

“When we started this journey almost six months ago, the whole idea was not around a certain way of doing things, but more around ‘let’s come together and try to figure out how we solve a problem that is unacceptable’ — 1.7 billion people who are currently unbanked, another billion underserved.”

David Marcus, Calibra CEO

“Given the critical roles central banks play in the global economy, any central bank digital currency implementation, including potentially with blockchain technology, will have a profound impact domestically and internationally.”

Sheila Warren, World Economic Forum head of blockchain

“In the next 12 months, you’ll see IPOs in the crypto/blockchain space. We’re not going to be the first and we’re not going to be the last, but I expect us to be on the leading side… it’s a natural evolution for our company.”

Brad Garlinghouse, Ripple CEO

“My #Bitcoin mystery is solved. I mistook my pin for my password. When Blockchain updated their app I got logged out. I [tried] logging back in using my pin, which was the only ‘password’ I had ever known or used. I also never had a copy of my seed phrase. Honest but costly mistake!”

Peter Schiff, crypto skeptic and gold bug

“iCloud is now officially a surveillance tool. Apps that are relying on it to store your private messages (such as WhatsApp) are part of the problem.”

Pavel Durov, Telegram founder and CEO

FUD of the Week

Greece extradites alleged launderer of $4 billion in BTC, Alexander Vinnik, to France

A Russian national accused of heading a group that laundered $4 billion in Bitcoin has been extradited from Greece to France. Alexander Vinnik formerly operated the now-shuttered exchange BTC-e and is believed to have a direct relationship to the infamous hack of Mt. Gox. The case has risked triggering a diplomatic row, with Russia filing several requests to bring him under its jurisdiction. Lawyers writing on behalf of Vinnik’s young children had submitted a complaint to a Greek court at the start of the week in an attempt to prevent the extradition. Reports now suggest that Vinnik is being held at a hospital in Paris. His legal representative Zoe Konstantopoulou said: “In every way the government is trying to scare him, terrorize him, in a moment of great agony, while his health has worsened.”

India’s central bank says it hasn’t banned crypto

The Reserve Bank of India has said restrictions on regulated entities offering crypto assets do not equate to an overall ban. In a document submitted to the country’s supreme court back in September, which has now been made public, the institution said: “The RBI has not prohibited VCs (virtual currencies) in the country. The RBI has directed the entities regulated by it to not provide services to those persons or entities dealing in or settling VCs.” All of this comes as a landmark case against the RBI concludes its second week. Hearings are set to resume on Jan. 28.

Peter Schiff bungled wallet password, solving “Bitcoin mystery”

Long-running crypto skeptic and gold bug Peter Schiff is likely to be even more skeptical after losing access to his funds. At first, he believed his wallet was corrupted — but he later found out that he mistook his PIN for his password, and he was unable to log in after an app update because he had never taken a copy of his seed phrase. Many in the crypto community have criticized Schiff for making a rookie mistake, with Binance CEO Changpeng Zhao quipping: “I can’t believe I am about to say this, but maybe ‘stay in fiat?’” In recent days, CZ has said that keeping assets on an exchange is often safer than keeping the keys themselves — but those who have fallen victims to hacks on these platforms may not be so quick to agree.

Telegram CEO: Apple’s iCloud is “now officially a surveillance tool”

Pavel Durov, the founder and CEO of Telegram, has claimed that Apple’s cloud service iCloud is “now officially a surveillance tool.” His stinging rebuke followed reports that the tech giant dropped plans for end-to-end encryption on iCloud two years ago — apparently following complaints from the FBI. This ultimately means that backed-up texts from iMessage, WhatsApp and other encrypted services remain available to Apple employees and authorities. Telegram has been positioning itself as a global fighter for privacy — and in 2018, it refused to give Russian authorities the encryption keys to user accounts, prompting as-of-yet unfulfilled threats that the app would be blocked “in the near future.”

Best Cointelegraph Features

SEC goes head-to-head with Telegram, makes a guinea pig of TON

The Chamber of Digital Commerce submitted a legal document to the court overseeing the hearing between Telegram and the U.S. Securities and Exchange Commission. Shiraz Jagati looks at what it says.

Effect of CME futures options on BTC price depends on halving

CME Group has launched new Bitcoin options — further uplifting the institutional infrastructure supporting the asset class. Joseph Young writes that it’s a net positive for the crypto community, and the upcoming “halving” could make things more interesting.

Adam Back on Satoshi emails, privacy concerns and Bitcoin’s early days

Cassio Gusson has caught up with Adam Back to discuss the early years of Bitcoin, his emails with Satoshi Nakamoto and privacy — 11 years after BTC’s release.

0 notes

Photo

Samourai Wallet Introduces Bitcoin via SMS Text Message for Censorship Resistance

Wallets

Bitcoin privacy wallet pioneers Samourai Wallet have announced a new proprietary app called Pony Direct, a transaction payment method (or to act as a relay) to send bitcoin via short message service (SMS), popularly used for texting. It’s a creative way to improve upon censorship resistance. Also read: Ditch University and High Transaction Fees!

Samourai Wallet’s Pony Direct App

T Dev D of Samourai Wallet explained to News.Bitcoin.com: “Pony Direct can be used to forward bitcoin transactions via SMS even when internet connections are blocked or shut down. Simply using the app to send a transaction via SMS to any cooperating and internet-connected Android device will effectively route around any internet censorship being practiced where the sender is located.”

“Pony Direct was developed in-house as a proof-of-concept app with the intention of open sourcing it to be an open invitation for developer participation in the Mule Tools project as a whole,” T Dev D noted. In keeping with their open source ethos, Pony Direct is available on Github.

Internet censorship is a favorite of governments as a way to shut down dissidents, and there’s every reason to believe it would be a first response should cryptocurrencies like bitcoin become a real threat. In 2016, countries like India, Saudi Arabia, Morocco, Iraq, Brazil, Republic of the Congo, Pakistan, Bangladesh, Syria, Turkey, and Algeria, to name just a few, worked hard to shut down social media access especially. SMS might be a way around such scenarios.

News.Bitcoin.com asked how SMS within the Samourai Wallet operates. T Dev D clarified: “The issue is that as SMS can only contain up to 160 characters, a way must be found to send as many SMS as possible to communicate the bitcoin transaction to the party capable of broadcasting it on the network. The first SMS in the sequence contains info on the total number of SMS in the series, the hash ID that must be matched at the end, a batch ID, a sequencing number, and a portion of the actual transaction hex. The following SMS contain a sequencing number, the batch ID, and more transaction hex data. Once the receiving device has accepted the expected number of SMS for a same batch from the same incoming number, the transaction data is extracted from each message and the entire transaction is re-assembled and pushed out to the bitcoin network.”

Pavol Rusnak

Pony Direct is “part of ongoing R&D into alternative broadcasting methods to enhance censorship resistance,” Samourai tweeted. Censorship resistance is a serious goal for the uber-privacy wallet project; its team bills themselves as “privacy activists who have dedicated our lives to creating the software that Silicon Valley will never build, the regulators will never allow, and the VC’s will never invest in. We build the software that Bitcoin deserves.” When asked about the wallet project’s overall status (it remains in alpha), T Dev D answered, “Samourai is moving ahead with its roadmap and experiencing rapid growth during this period of mass media attention on the crypto-currency space.” Though the wallet is Android-based at the moment, “We plan to have an iOS version of our wallet ready for later this year,” News.Bitcoin.com was told.

SMS transacting as an experiment was published summer of last year by Pavol Rusnak who wanted to use a legacy method to send bitcoin. Smspushtx was his project. He did have to register with an inbound SMS service provider and chose Nexmo because they didn’t charge.

He set up a virtual number which allowed him a webhook, and pointed it at his Flask server, which in turn consumes and forwards messages. The only trouble was limiting messages to 160 characters. The message is then linked together in a chain or series; he used an Insight service API to push the transaction and used both hexadecimal format and base64 format. Readers are encouraged to see the experiment for themselves.

Now there’s a bitcoin wallet that can do all that as well.

What do you look for in a wallet app? Let us know in the comments section below.

Images courtesy of Pixabay, Samourai Wallet.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

Article Source

The post Samourai Wallet Introduces Bitcoin via SMS Text Message for Censorship Resistance appeared first on Bitcoin E-Gold Rush.

0 notes

Text

Best Crypto News Podcast in India 2023 | Cryptocurrency Podcast

Discover the ultimate source of crypto knowledge with the CoinCRED Podcast. Get the best insights, news, and beginner-friendly content in the top-rated crypto podcasts of 2023. Perfect for beginners seeking a Bitcoin 101 education and anyone looking to dive deep into the world of cryptocurrencies.

#best crypto podcast 2023#best crypto podcast#best crypto podcasts#top crypto podcasts#best crypto news podcast#crypto podcast#crypto podcasts 2023#bitcoin 101 Podcast#best crypto podcasts for Beginners#the best podcast to learn about crypto

0 notes

Text

Best Crypto News Podcast in India 2023 | Cryptocurrency Podcast

Introducing CoinCRED Podcast, your ultimate source for the best crypto podcasts in 2023. Whether you're a seasoned crypto enthusiast or just starting your journey in the world of digital currencies, CoinCRED Podcast has got you covered. With our handpicked selection of the top crypto podcasts, we bring you the most insightful discussions, expert interviews, and up-to-date news to keep you informed and engaged. From the best crypto news podcast that delivers the latest market updates to the Bitcoin 101 Podcast, where you can learn the fundamentals of this revolutionary technology, our curated collection offers a diverse range of content for every level of expertise. If you're a beginner looking to dive into the crypto world, our list of the best crypto podcasts for beginners will provide you with the essential knowledge to get started. Join CoinCRED Podcast today and discover the best podcast to learn about crypto in an engaging and accessible format. Stay ahead of the game with the most informative and entertaining crypto podcasts of 2023, brought to you by CoinCRED Podcast.

#best crypto podcast 2023#best crypto podcast#best crypto podcasts#top crypto podcasts#best crypto news podcast#crypto podcast#crypto podcasts 2023#bitcoin 101 Podcast#best crypto podcasts for Beginners#the best podcast to learn about crypto

0 notes

Text

Best Podcast to Learn About Crypto Currency in India

CoinCRED is a popular podcast that offers an engaging and informative deep dive into the world of cryptocurrencies. Hosted by seasoned industry experts, the show provides listeners with valuable insights into the latest trends, news, and developments in the crypto world. Whether you're a seasoned investor or just starting out, CoinCRED covers all the essential topics, from Blockchain Technology to Bitcoin and beyond. With its easy-to-follow format and expert analysis, CoinCRED is the perfect podcast to stay up-to-date and learn more about the exciting world of cryptocurrencies.

0 notes