Don't wanna be here? Send us removal request.

Photo

Interest in Cryptocurrency Jumped 15-Fold in Kazakhstan

Featured

Interest in cryptocurrency in Kazakhstan has surged fifteen-fold this year compared to 2017 according to a study by Yandex. The number of online searches began to rise significantly in June of last year for a number of cryptocurrency-related search terms.

Also read: Indians Look to Buy Bitcoin Overseas as Regulations Tighten

Crypto-Related Search Queries Increase

A multinational corporation specializing in Internet-related services and products, Yandex, recently conducted a study of search queries by Kazakhstanis on topics related to cryptocurrencies, blockchains, and crypto mining, Zakon reported.

Kazakhstanis are most actively searching combination words involving “cryptocurrency,” the study revealed. Users frequently search for courses in cryptocurrency, crypto exchanges, how to buy crypto, how to mine them, and other related search terms. The news outlet elaborated:

In early 2018, Kazakhstan residents made about 15 times more requests with this word [cryptocurrency] than in the same period of 2017.

For the search term “bitcoin” specifically, “users ask Yandex 7 times more than in early 2017,” the publication detailed.

Specific Searches

Among the topics with the most number of searches are bitcoin, blockchain, initial coin offerings (ICOs), and crypto mining, the study revealed.

However, Kazakhstanis also asked Yandex specific questions such as “can a schoolboy work for bitcoin?”, “what is a blockchain in simple words for dummies?”, “how much does mining pay really?”, and “where to get money for a mining farm?”

Searchers are also concerned about crypto mining malware, asking Yandex “how to find out if I have a mining virus,” as well as searching for software and solutions to protect themselves against this type of malware.

Last year, the number of crypto-related searches rose significantly in June and September, the news outlet noted, adding that:

10 times more often users from Kazakhstan began to ask Yandex about video cards for mining and how to mine.

The biggest jump in interest on this topic occurred between June and July of last year, Yandex further revealed, noting that “The query ‘to buy graphics cards’ saw the biggest increase last month”.

As for ICOs, search requests including this word by Kazakhstanis have grown “4 times more often than a year earlier,” the news outlet described, adding that the number of such requests has been growing since November of last year. Moreover, people are searching for “ICO projects,” “prospective ICO,” and “ICO support.”

Last month, four employees of the country’s Ministry of Finance were caught mining cryptos.

What do you think of the surge in interest in cryptocurrency by Kazakhstanis? Let us know in the comments section below.

Images courtesy of Shutterstock and Yandex.

Need to calculate your bitcoin holdings? Check our tools section.

Article Source

The post Interest in Cryptocurrency Jumped 15-Fold in Kazakhstan appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Trading Tip `The Wall´ – Bitcoin Dominance On The Rise

Op-Ed

In the cryptocurrency market today, there’s a wide variety of investors. But it wasn’t always like that. Between 2010-2016, the landscape was pretty uncomplicated. On a high level, there were only two distinct categories: 1, The ones who measured their wealth in fiat; 2, The ones who measured their wealth in bitcoin.

Also read: Meet the TA Gods

Bitcoin and Investor Types

When a Type 1 person meets a Type 2 person, this is typically how the conversation would go.

Type 1 person: Bitcoin is doing great, I’m so glad I bought some. One of my best investments.

Type 2 person: Yeah, it’s awesome.

Type 1 person: So at what price do you think you’re gonna sell at?

Type 2 person: Hm? I’ve already sold. I sold my fiat for bitcoin.

The fundamental bitcoin meme.

In the years 2010-2016, Type 1 investors typically got so destroyed in comparison to the performance of Type 2 that another label for these types quickly got adopted: “weak” vs “strong hands”. With the altcoin onslaught of 2017, I expect the distinction between weak and strong hands is about to retire in favor of a new categorization:

The ones who still hold only bitcoin

The ones who bought altcoins

In the future, assuming cryptocurrencies as a whole continue to flourish, we can imagine the cryptocurrency market going three different ways.

Scenario A: Bitcoin re-establishes itself as the king of crypto, succeeding in capturing the SoV (store-of-value) and the MoE (medium-of-exchange) market. All functionalities and attributes of its competitors are re-implemented through bitcoin features such as sidechain/drivechains and second-layer technologies. This view is known as bitcoin maximalism. Different altcoins come and go but fail to become relevant through lack of network effect, and those who staked too much on the success of the up-and-comers of today see their fortunes wither.

Scenario B: The dust never truly settles on the cryptocurrency battlefield. Different cryptocurrencies continue to emerge and fill different needs in harmony with each other. Protocols like Interledger tie the cryptocurrency landscape together via atomic swaps, allowing for a seamless experience of the multi-cryptocurrency world. While this scenario is interesting and plausible, it fragments both the liquidity and the security of cryptocurrencies as a whole. Depending on how marginalized bitcoin becomes in this scenario, the yearly performance of those who diversified with the right aptitude for spotting innovation will leave the bitcoin maximalists in the dust.

Scenario C: The bitcoin maximalist approach to protocol development and the politics surrounding it results in bitcoin eventually falling behind competing projects. Bitcoin maximalists become financially ruined. There may be some respite in this scenario where the maximalists survive to the altcoin domain through airdrops and forks, unless they liquidate all their crypto-dividends in favor for more bitcoin (which some do).

So, where are we heading currently?

Between 2009 and March 2017, bitcoin’s share of the cryptocurrency market never once dropped below 73% (known as “bitcoin dominance”). On this day one year ago (March 3, 2017) it was still 85%. Although dominance metrics are a controversial topic because market capitalization easily inflates, the figure still serves to indicate the valuations at which people are currently pricing things at.

In retrospect, it seems crazy how fast the market has changed. To think that just about 1.5 years ago, bitcoin at $10,000 was described as “magical and mythical“, and today, that same price borders on being considered cheap because we hit almost $20,000 in December. In a similar way, bitcoin dominance breaking above 40% is considered high now just because we were at 32% 2 months ago, even though it’s catastrophically low when we zoom out. We tend to mentally anchor ourselves in previous states, and we use those anchors as reference points when determining if something is high or low.

Source: Coinmarketcap.

One interesting way to look at the bitcoin dominance metric in a way that ignores the scaling debate is to look at it from a historical macro-perspective.

Bitcoin vs Index Portfolio of top 10 altcoins. Bitcoin 4.6x vs Index 1.2x

Source: Woobull.

The simple explanation here is that altcoins rally tremendously during bull trends, but dip even worse during bear trends. But in 2017, the altcoin bull trend was further amplified by 3 important factors:

Bitcoin hit its scalability ceiling, giving altcoins/forks their first shot at actual relevance

Altcoins are actually attempting to innovate now compared to before

The proliferation of ICOs is affording new altcoin marketing budgets and development teams that previously were unthinkable

So, we’re heading towards Scenario B/C?

Despite graphs and numbers, there is one much more important thing to keep in mind when it comes to cryptocurrency investing, and that is all current valuations are mostly a result of pure speculation. The market is currently just a reflection of everyone’s guesses in aggregate.

I often get questions along the lines of “Thinking about picking up some Litecoin, it seems like a pretty good buy at $200?”. The reason is most often because Litecoin has been $350 previously and is therefore now cheap in relative terms. In my opinion, the fact that Litecoin has been $350 doesn’t matter at all; the thing that should matter if you are considering an investment in Litecoin is whether you see Scenario A, B or C as the most likely future for the cryptocurrency space as a whole.

I’d like to suggest that the investment information you are looking for is not anywhere to be found in the charts. Rather, it’s in one’s ability to understand and visualize the future of this market.

What kind of investor are you? Let us know in the comment section below!

Images via Shutterstock.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Article Source

The post Trading Tip `The Wall´ – Bitcoin Dominance On The Rise appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

GPU Producers Fear Drop in Demand from Crypto Miners

Hardware

Reports concerning major manufacturers of graphics processing hardware have indicated expectations of decreasing demand in the cryptocurrency mining sector. Nvidia is unlikely to unveil new video cards in the coming months, while AMD has shared concerns of dropping GPU sales in 2018, blaming the crypto market and regulatory risks.

Also read: Report: Crypto Miners Bought 3 Million GPUs Last Year

New GPU Launch Pushed Back

Several tech publications have suggested a launch of new product lines by Nvidia. The expectations were focused on the upcoming Game Developers Conference and GPU Technology Conference in March. The latest information, however, indicates the company may have changed its plans. New GPU announcements are now expected in July at the earliest.

Previously, it has been rumored that Nvidia may reveal a new card for crypto mining applications. The dedicated unit was reportedly codenamed “Turing” after the British computer scientist and cryptanalyst Alan Turing. Now, it turns out that Turing could be just another gaming video card, much like the other new line called Ampere.

The Turing graphics processing units (GPUs) were supposed to be designed specifically for calculating cryptocurrency transactions. GPUs are mainly utilized in rigs mining altcoins, like ethereum and monero. The Ampere processors should be integrated in the next-gen Geforce cards to replace the current Pascal lineup. Nvidia was expected to separate the GPU market in two segments – for miners and gamers, respectively.

Trends in Demand from Miners Change Plans

High demand for video cards used in mining applications last year has forced Nvidia to take measures to ensure gamers get hold of its GPUs. In January the company asked retailers to limit the number of cards purchased at a time. Miners usually buy the latest GPUs in bulk, and that has created shortages on many markets. Nvidia CEO Jen-Hsun Huang has stated that the company is working to resolve supply issues.

Nvidia partners have been expecting to receive the Turing specifications but they are not likely to get them until May, Tom’s Hardware Guide reports, quoting “multiple independent sources”. Mass production has been scheduled to begin in mid-June. The new cards may be announced in July, or even August. According to the online edition, Nvidia has no impetus to launch new products now, when AMD is not putting enough pressure and demand from miners may drop. On top of that, the current “Pascal” generation is selling well. The launch of the next-gen Ampere architecture may also be postponed in the consumer segment, where the professional Volta can be used instead.

AMD, Nvidia’s main competitor, has admitted that decreasing demand from miners can affect its business this year. Last month Advanced Micro Devices announced plans to increase production of graphics cards in response to strong market demand. This week, however, the company said that several factors, like increasing crypto market and regulatory risks, may change the GPU market by decreasing demand from cryptocurrency miners.

Gauging the crypto-related market and predicting its developments has proved difficult for major video card manufacturers. Nevertheless, newly released data suggests that sales in the mining segment have been profitable for both companies. More than 3 million graphics cards have been sold to cryptocurrency miners in 2017, according to a recent report.

Do you expect a decrease in demand for GPUs from crypto miners this year? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Bitcoin News is growing fast. To reach our global audience, send us a news tip or submit a press release. Let’s work together to help inform the citizens of Earth (and beyond) about this new, important and amazing information network that is Bitcoin.

Article Source

The post GPU Producers Fear Drop in Demand from Crypto Miners appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Two Indian Token Marketplaces Suspend Trading Due to Regulatory Pressure

News

Two Indian crypto token marketplaces have announced that they will halt trading from March 5. The platforms state that this is due to regulatory pressure which put their businesses “under a lot of stress.”

Also read: Indians Look to Buy Bitcoin Overseas as Regulations Tighten

Two Token Marketplaces Halt Trading

Two Indian crypto token marketplaces, Btcxindia and Ethexindia, have announced that they will “halt cryptocurrency trading from March 5,” the Economic Times reported.

Over 35,000 members have used the two platforms, the news outlet added. Btcxindia, which began as one of India’s oldest bitcoin exchanges, has been operating for four years. However, last year the platform dropped bitcoin trading to offer real-time ripple (XRP) trading for Indian rupees (INR). Btcxindia recently posted a notice on its website, stating:

Customers are advised to withdraw their funds (BTC, XRP and INR) on or before 04 March 2018, if not [their accounts] will attract annual wallet maintenance fees…XRP/INR trading will be halted effective from 05 March 2018.

Ethexindia is “India’s first ether exchange,” according to its website. The platform, which has been offering ether (ETH) trading for rupees for two years, has also halted both INR and ETH deposits. “Deposits received, if any, will be automatically reverted to the respective bank accounts,” the company emphasized, adding that, “ETH/INR trading has been halted from 01 March 2018. Customers are kindly advised to withdraw their INR and ETH.”

Both marketplaces are managed by S Capital Solutions Pvt Ltd. Other than these two platforms, S Capital also has a 12% equity stake in Crypt E Tech Solution, the company behind bitcoin payment service provider Blockonomics, according to its website.

Regulatory Pressure Mounting

The Indian government has been discussing the regulatory framework for cryptocurrencies and digital tokens. The roles of the regulators for cryptocurrencies have reportedly been decided and the law governing bitcoin is expected soon. Btcxindia recently informed its members:

As we heard in the budget speech, the Indian government is discouraging cryptocurrency trading. This has been clear also by government actions in the last year, and has put our business under a lot of stress and put us in a position where we don’t feel that we can continue our business in a professional manner any longer.

The company emphasized that “Until new rules are in place for tokens on public blockchains, we are halting our trading platform,” adding that the company will now focus solely on its blockchain consultancy work.

What do you think of these two platforms suspending trading because of regulatory pressure? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

Article Source

The post Two Indian Token Marketplaces Suspend Trading Due to Regulatory Pressure appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Coinbase User Files Class Action Against Company, Clai… | News

Coinbase, a major US-based cryptocurrency exchange and wallet platform, faces a class action lawsuit claiming that its employees and other insiders benefited from trading on non-public information that the exchange planned to introduce Bitcoin Cash (BCH) support last December, The Recorder Law reported on Friday, March 2.

The complaint was filed by Coinbase user and Arizona citizen Jeffrey Berk, represented by two law firms, in the US District Court for the Northern District of California on Thursday, March 1.

The introduction to the class action complaint brought against Coinbase explains that it is being made:

“on behalf of all Coinbase customers who placed purchase, sale or trade orders with Coinbase… during the period of December 19, 2017 through and including December 21, 2017… and who suffered monetary loss as a result of Defendants’ wrongdoing.”

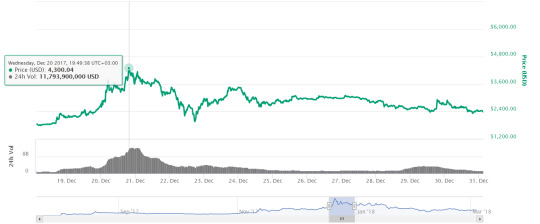

In the lawsuit, the plaintiff accuses Coinbase of “artificially inflated prices” by means of disclosing buy and sell orders moments after Coinbase launched BCH support on Dec. 19, 2017. The move may have caused the price of the cryptocurrency to soar by over 130 percent — from $1,865 on Dec. 18 it reached as high as $4,300 by Feb. 20, according to data from CoinMarketCap.

BCH was launched in August 2017 as a hard fork from Bitcoin. The day it launched on Coinbase, senior manager Brian Armstrong published a blog post stating that Coinbase employees were subject to the company’s trading policies, which applies to all trading activities on any platform and prohibits non-public information disclosure.

“Given the price increase in the hours leading up the announcement, we will be conducting an investigation into this matter. If we find evidence of any employee or contractor violating our policies — directly or indirectly — I will not hesitate to terminate the employee immediately and take appropriate legal action,” Armstrong stated in his post.

On Feb. 23, Coinbase officially informed around 13,000 “high-transacting” customers that personal data from accounts would be turned over to the US Internal Revenue Service (IRS) following a legal order that is the result of an ongoing legal battle between the IRS and the crypto platform.

Article Source

The post Coinbase User Files Class Action Against Company, Clai… | News appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Markets Update: Crypto Markets Continue to Spike Higher

Market Updates

Cryptocurrency markets are on the rise again this weekend as the total market capitalization of all 1,500 digital assets touches $465Bn. Bitcoin core (BTC) volumes are still lower than a few weeks prior but bulls have managed to press past resistance reaching a high of $11,480 during last night’s trading sessions.

Also read: Crowdfire Founders Plan to Launch Indian Bitcoin Exchange

BTC/USD Markets Eye the $12K Zone

Digital asset markets are on the rise again this weekend as most cryptocurrencies are seeing gains between 0.60 to 15 percent. BTC/USD markets are up 4.6 percent as bulls have pushed the price up past the $11K region yesterday. Global trade volume is still a touch lower than the highs in December as the 24-hour volume is roughly around $6.9Bn. The Japanese yen is still dominating the world’s BTC volume as the yen currently commands 51 percent of the global volume. This is followed by the U.S. dollar (20%), tether (USDT 16%), the Korean won (5.3%), and the euro (3.4%). The top five exchanges swapping the most BTC today include Okex, Bitfinex, Binance, Upbit, and Bithumb.

Technical Indicators

Looking at charts over the past 48-hours shows bulls are taking the lead once again as buyers pushed the price of BTC past the $11K zone to a high of $11,480. Right now the two Simple Moving Averages (SMA) both short-term (100 SMA) and long-term (200 SMA) have a small gap between the two trendlines. The 100 SMA is slightly above the longer-term 200 SMA indicating the path to resistance will be on the upside. The MACd is heading northbound with more room for improvement. Moreover, the Relative Strength Index (RSI) and Stochastic oscillators show oversold conditions but also show bulls may continue to hold the reins in the short term over the course of the day.

Order books show there will be some resistance around $11,650 and another pitstop around $11,900. After breaking the $12K zone the opposition is less and there are smoother seas ahead until the $12,800-13,000 range. On the back side, foundational support is fairly strong up until the $10,500 territory. Again if the bears managed to push the price down below the Displaced Moving Average (DMA) at $10,200 then prices could drop to sub-$10K. However, it doesn’t look like bears have the advantage right now and bull market sentiment is in the air.

The Top Cryptocurrency Market Valuations

Most of the top cryptocurrencies are in the green right now seeing 5 percent gains or more. Ethereum (ETH) markets are up 0.82 percent as one ETH is averaging $863 per token. The third highest market capitalization held by ripple (XRP) is seeing gains around 0.49 percent as one XRP is $0.90. Bitcoin cash (BCH) markets are following a strong correlation with BTC markets once again as BCH is up 2 percent today. One bitcoin cash is averaging a USD price of around $1,280 at the time of publication. Lastly, the fifth highest market valuation held by litecoin (LTC) is up 3.5 percent. One LTC is hovering around $213 per coin at the moment. Bitcoin core (BTC) markets have a much stronger dominance today amongst all the other markets as BTC dominance is averaging 41 percent during today’s trading sessions.

The Verdict: Bullish Optimism

Overall cryptocurrency proponents are optimistic and believe prices are headed towards the upside. The trend has changed quite a bit since the beginning of the year when most cryptos suffered from 60 percent losses. Many still expect new all-time highs to happen for the top cryptocurrencies this year even after the drop in value. So far things are looking positive and new ATHs are definitely achievable. So far the community seems to think things are on the up as far as value over the long term and the next ATHs are nothing compared to the end game.

Where do you see the price of BTC and other digital assets heading from here? Do you think cryptocurrencies will see more gains? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Bitstamp, Bitcoin Wisdom, AP, and Coinmarketcap.

Want to create your own secure cold storage paper wallet? Check our tools section.

Article Source

The post Markets Update: Crypto Markets Continue to Spike Higher appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Belgian Tax Authority Going After Crypto Investors

Taxes

Cryptocurrency investments have attracted the attention of tax authorities in Belgium. Several investigations have been opened into cases of Belgian citizens who have traded on foreign exchanges. Anyone speculating on crypto markets is expected to pay 33% tax on their gains, despite the fact that bitcoin and the like are not regulated or legalized in the country.

Also read: Germany Treads Lightly on Bitcoin Taxation

Three Cases Under Investigation

The Special Tax Inspectorate (STI) is currently studying at least three different cases of Belgian investments in cryptocurrencies. A fourth file was closed and treated as a “non-case”. According to local media, the investigations have started after Belgian officials were tipped off by colleagues from abroad.

Belgian tax authorities are now more closely interested in Belgians investing in cryptocurrencies, De Standaard and Het Nieuwsblad wrote. Anyone speculating on the cryptocurrency market must pay a 33% tax on gains, and declare these in the “other income” section on their tax return, STI said at the end of last year.

The new rules, however, have proved difficult to implement, as the Brussels Times reports. The management of cryptocurrency assets takes place on foreign trading platforms and Belgian authorities find it hard “to penetrate” there, the magazine says.

Despite the obstacles, the Special Tax Inspectorate intends to strengthen its checks within the crypto sphere. “It is a world in which Belgian tax authorities still have much to achieve”, says Francis Adyns from FPS Finance.

STI has started the investigations after receiving information from a foreign tax authority about the crypto dealings of several Belgian citizens. The inspectorate intends to approach the trading platforms directly to obtain more data about their transactions.

In December, the Belgian tax agency decided to withhold 33% of profits and incomes from speculative trading of bitcoin and other cryptocurrencies. The tax is imposed on private individuals trading cryptos with the intention of making profit from price fluctuations. When the crypto trading is conducted by a business, taxes may reach 50%.

Taxation Without Legalization

Earlier last year media reports suggested that Belgium could tighten its cryptocurrency regulations. Belgian officials made it clear they were in favor of strengthening government control over cryptocurrencies. The Minister of Justice Koen Geens said that they should be subject to stricter rules because of their growing popularity with cybercriminals and scammers. He also insisted that crypto companies should be obliged to cooperate with authorities.

“Crime prevention and regulations should evolve with new technologies”, Geens tweeted in 2017, calling for the adoption of new legislation. He proposed regulating all digital currency transactions. The minister received support from the country’s tax authority, which admitted the number of ordinary Belgians interested in cryptocurrencies was growing, too.

Currently, cryptocurrencies are neither legal, nor illegal in Belgium. Brussels has not announced a comprehensive policy yet, despite comments and warnings from some officials. Like many other EU countries, Belgium is expecting a common European policy. In December, the governor of the Belgian National Bank Jan Smets said bitcoin was not a currency but also added that it was not a threat to the monetary stability. Smets stated that the risk of investing in bitcoin was relatively low.

Do you believe tax authorities in Belgium will go after cryptocurrency users and investors before the country has adopted a comprehensive regulatory framework? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Make sure you do not miss any important Bitcoin-related news! Follow our news feed any which way you prefer; via Twitter, Facebook, Telegram, RSS or email (scroll down to the bottom of this page to subscribe). We’ve got daily, weekly and quarterly summaries in newsletter form. Bitcoin never sleeps. Neither do we.

Article Source

The post Belgian Tax Authority Going After Crypto Investors appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Quarter Million Dollars Already Raised in Bitcoin Cash 48 Hour Challenge

Featured

Bitcoin Cash (BCH) is on a roll lately, scoring new mainstream adoption platforms in countries like the United States. But it’s still a relatively small player within the ecosystem, relative to Bitcoin Core (BTC) for example. For these reasons and more, BCH enthusiasts are participating in a 48 hour matching donation challenge, hoping to assist the nonprofit Fund in its mission to help bring the digital currency to one billion people in five years.

Also read: Bitpay Launches Bitcoin Cash Debit Card Top Ups

Donate to Bitcoin Cash Fund in Next 48 Hours, and it’ll be Matched

Late Friday night, BCH enthusiast @jarenfeser posted to the popular subreddit /r/btc, a popular and uncensored forum. The thread immediately turned into a challenge. “Over the next 48 hours I will match all donations made to The Bitcoin Cash Fund (up to 300 BCH),” he wrote.

The Bitcoin Cash Fund describes itself as “A community-driven, grassroots project to accelerate the adoption of Bitcoin Cash.” Bitcoin Cash, of course, forked from Bitcoin Core in August of last year in response to increasing transaction fees and mempool congestion causing long wait times plaguing bitcoin core. Since its inception, BCH has, in only a few months, stubbornly remained in the top four cryptocurrencies by market capitalization, including a brief stint as number 2, usurping ethereum.

These are heady times for BCH, as News.Bitcoin.com reported popular bitcoin payment provider Bitpay added BCH to its Visa debit card program for United States residents. And this was after a slew of other adoption news, such as bitcoin cash tip bots for Telegram and even new ATMs for the decentralized cryptocurrency.

Because BCH wasn’t created by a government nor corporation, an organic non-profit fund was set up to assist in its adoption growth. “Currently, we are looking to promote any non-profit project that will help promote the adoption of Bitcoin Cash. Examples of projects we’re funding now are Bitcoin Cash video tutorials,” the fund explains, “a BCH-specific JavaScript library, and an info pack to help businesses adopt BCH. We’ve previously funded the incredible TX Highway, as well as Bitcoin Cash meetups all over the world.” BCH supporters are encouraged to submit adoption ideas.

Redditor @jarenfeser also listed addresses he’ll monitor, promising, “I´ll check it every few hours and match any new deposits:”

https://explorer.bitcoin.com/bch/tx/1ecf924a7f4637faeed02135998f5bab25c9c4c93637b92b3b35cb9f63373bcf

https://explorer.bitcoin.com/bch/address/39M95ZPG2M5DJ9CizQmqSsnt2N3EJyzpSR

https://explorer.bitcoin.com/bch/tx/d567e3375d810c9602e9d489ae71769e0b419a70bf0b1b15d13dfaa55e2809f5

https://explorer.bitcoin.com/bch/tx/f1850f86e4a3f6d12a536c36e137e0fad2092559f867f218de79ef054dfa80f7

BCH supporters have already donated $250,000 to the fund as of a mere eight hours into the challenge, including support from Satoshi Dice. With only a little more than a day remaining, those wishing to maximize donations are asked to point their wallets to the QR code (see inset) or to click over to the fund itself.

Disclosure: Bitcoin.com CEO Roger Ver is an advisor to the Bitcoin Cash Fund.

What do you think of nonprofit crowdfunding for decentralized projects? Let us know in the comments section below.

Images courtesy of Pixabay, BCH Fund.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

Article Source

The post Quarter Million Dollars Already Raised in Bitcoin Cash 48 Hour Challenge appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

PR: ZeroEdge.Bet Casino Launched Its Pre-ICO and Offers 79% Discount for a Very Limited Time!

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

Today, February 28th, A unique blockchain based gambling platform ZeroEdge.Bet launched their Pre-ICO. The presale event will last until March 15th, 2018 or until the hard cap is reached which is set at only 1500 ETH. During the presale, investors will be able to purchase ZERO tokens with a 79% discount for a very limited time.

ZERO token owners will be able to use it on the ZeroEdge.Bet platform to play 0% house edge games such as Blackjack, Video Poker and many others. ZERO token will also be used to place bets on the platform’s decentralized sports betting exchange which is expected to be launched in Q4,2018. Project’s development roadmap also includes a poker room and an open-source platform for building and operating your own customized games for which ZERO tokens will be required.

One thing that really makes ZeroEdge.Bet stand out from other gambling related ICO’s is their team which has a strong background in the gambling/gaming industries. To supplement the team and make ZeroEdge.Bet a huge success, the advisory board consists of numerous well-known & accomplished professionals with an extensive knowledge and experience in their respective fields.

“We can see why other blockchain-based gambling project haven’t really penetrated the market, so we want to come in well-prepared to be among the first to do this. We believe the experienced team and accomplished advisors are the key here,” said Adrian Casey, CEO of ZeroEdge.Bet.

“Zero Edge offers a unique gambling model which potentially could revolutionise the $70 Billion gambling industry. Players won’t be losing money, but instead earning from the increasing Zerocoin value. Our ultimate goal is to become a leading gambling platform in the online gambling industry where thousands of different games are played each day using Zerocoin and where players have the best chance of winning,” – added Adrian.

TOKEN SALE DETAILS During the presale, contributions will only be accepted in ETH (ether). Minimum contributions for the campaign will be 0.1 ETH with no maximum purchase amount. A discount of 58% will be applied to reward early backers. Although, a very limited amount of tokens is issued for the pre-ico. A total of 777,000,000 ZERO tokens will offered for the public during pre-sale and main sale events which accounts for 60% of the total supply of tokens. The main ICO is scheduled to start on April 15th, 2018. Bonuses will start at 20% and stagger down to 15% and 10% for later contributions, incentivizing early ZERO supporters to invest earlier in the ICO. The main tokensale hardcap is set at 30,000 ETH.

To find out more about ZeroEdge.Bet project and their pre-ico, head to ZeroEdge.Bet official website and join their social media channels to get actively involved in making the gambling industry a better place for everyone.

https://tokensale.zeroedge.bet

Contact Email Address media@zeroedge.bet Supporting Link https://tokensale.zeroedge.bet

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Article Source

The post PR: ZeroEdge.Bet Casino Launched Its Pre-ICO and Offers 79% Discount for a Very Limited Time! appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Wendy McElroy: Silence and Soul in the Crypto Cold War – the Evolution of Privacy

Featured

The Satoshi Revolution: A Revolution of Rising Expectations. Section 2: The Moral Imperative of Privacy Chapter 6: Privacy is a Prerequisite of Human Rights

Silence and Soul in the Crypto Cold War: the Evolution of Privacy. Chapter 6, Section 3.

“It was terribly dangerous to let your thoughts wander when you were in any public place or within range of a telescreen. The smallest thing could give you away. A nervous tic, an unconscious look of anxiety, a habit of muttering to yourself–anything that carried with it the suggestion of abnormality, of having something to hide. In any case, to wear an improper expression on your face (to look incredulous when a victory was announced, for example) was itself a punishable offense. There was even a word for it in Newspeak: facecrime, it was called.”

–George Orwell, 1984

Cryptography and its offspring, cryptocurrency, are antidotes to Oceania–the dystopian society depicted in George Orwell’s novel 1984. The Orwellian culture is designed to eliminate privacy in order to make nonconformity and dissent impossible. In breaking the spirit of its citizens, Oceania denies them individuality and their humanity.

Cryptography returns the power of privacy to individuals. In privacy, they can reach their human potential.

Privacy is under attack for reasons similar to those in Oceania. Without privacy, political and social dissent becomes difficult to impossible to express—a situation that favors government. Total surveillance is the cornerstone of total social control. Totalitarian regimes rely upon secret police, surveillance, induced compliance, snitches, and massive data banks to assert their authority. The challenge is not only to make people obey but also to create an environment that discourages the emergence of dissent in the first place; less violent methods are preferred because they arouse less backlash. A side effect of such repression is the destruction of diverse thoughts and feelings, which strips people of their humanity.

Government needs to win the Cold War on privacy; its ability to command depends on it. Cryptocurrency is a special target because it threatens the central banking system and fiat currency, upon which elite power is propped. Government is beginning to realize that it could trip and fall over cryptography. Many believe it already has.

Crypto Cold War Tactics

A common battle tactic of government is to announce victory, whether or not the facts support it. Privacy is dead beyond resurrection, it claims. The contention is odd. If privacy is dead, then why do authorities pour ever more resources and legislation into making sure no one secretly commits illegal acts (with “illegal” meaning “peaceful acts of which the government disapproves”)? The constant enforcement and reinforcement means that the battle for privacy is still raging.

Another tactic of government is to shift blame for the wrongs it commits; it finds a scapegoat. In the crypto war, technology is blamed for the inevitable devastation of privacy. Even critics of surveillance tend to point an accusing finger at technology as the destroyer of privacy. In his article “Big Brother is Watching,” civil-rights activist Tom Head argued, “as technology improves, privacy as we know it will inevitably evaporate; the best we can hope for is the power to watch the watchers.”

Privacy as we knew it may well be over; potent technologies are being used both to spy on and to preserve data. But, just as the practice of free speech evolves in reaction to technology, the practice of privacy is transforming. And metamorphosis is not death. The shape of privacy’s future will depend on two factors: a change in social habits; and, the use of technology in self-defense against technology that is used as a weapon.

The evolution of social habits is underway, as pop culture reveals. Consider the 2016 Grammy-award winning song by Meghan Trainor, “NO.” Jeffrey Tucker, founder of the CryptoCurrency Conference, unpacked the significance of the song. He wrote, “The etiquette of information sharing in the age of social media has dramatically changed in the last decade. Maybe you have noticed. Most anyone under the age of 30 is wisely cautious about giving his or her full name to strangers. Why? With just a few data points – full name, place of business, hometown – anyone can discover more than ever, and gain access to messaging portals. This is why most social engagements today take place on a first-name-only basis. Here we have a great illustration of how our social mores adapt to technological changes.”

Head is also incorrect in stating that “…the best we can hope for is the power to watch the watchers.” Much more can be done. Individuals are not defined by their passive relationship or reaction to government. By nature, individuals are not watchers, but doers. As important as it is to watch government, it is more important to design tactics and technologies to make government’s power obsolete in people’s lives.

Moreover, technology is not to blame for social conditions. Technology is merely a tool. It is no more responsible for an erosion of privacy than guns are responsible for a declaration of war. Government is to blame for how it uses technology. (Businesses can be invasive, certainly, but they generally require some form of consent, and people can refuse to associate with them.) Shifting the blame to technology is a valuable ploy for government, however, because It distracts people from who or what is actually violating their rights. It imbues people with helplessness or a paralyzing ambiguity toward an inescapably invasive juggernaut that also brings great benefits. It pits technology against privacy, which makes people distrust the single best chance they have for protection against government overreach.

No. Technology is not to blame; as a tool, it is has become a key part of every solution. Privacy is not dead; it is evolving. And individuals should define their own futures, not merely “watch the watchers.”

The Promise of Cryptography

Cryptography is a method of distributing and storing information in a manner that is inaccessible to those who do not know how to decode it; often, the only ones who can do so are the sender and the receiver. As a privacy tool, cryptography dates back, at least, to the perfection of hieroglyphics by the ancient Egyptians. Its long history testifies the value cryptography offers human beings.

But the social impact of cryptography has changed dramatically. Elites used to be the primary beneficiaries. Modern cryptography is heavily weighted toward empowering individuals.

Blockchain transactions are transparent and easily traced, but the owners of individual wallets are difficult to track down unless addresses are linked to financial institutions, such as a centralized exchange or a bank.

Bitcoin is designed as a peer-to-peer, decentralized structure.

As long as private keys are privately-held, an individual’s cryptowealth is as secure as possible against government and other criminals.

Both profit and ideology drive the creation of a stunning number of privacy devices, including what bitcoin.com contributor Kai Sedgwick has called a “smörgåsbord of privacy-centric coins [that] can be a little overwhelming.”

With every day, cryptocurrency becomes more accessible to average people who know nothing of arcane matters, such as coding. Cryptography has universalized the power of privacy.

When cryptography was the tool of rulers and elites, it was embraced by them. Government funded military and law enforcement agencies that used it, purchasing the massive computers that ordinary people could not afford. The elite monopoly was cemented by the public’s deep ignorance of the intimidating technology.

Then, 1970 brought a game changer. Financial tech journalist Jamie Redman explained, “In 1970, James Ellis, a cryptographic expert…produced the theory of ‘non-secret encryption’ — which is now known as public-key encryption….This form of cryptography showed a new class of cryptographic algorithms, which required two separate keys to cipher and decipher.” Privacy was privatized. Breakthroughs, like Pretty Good Privacy (PGP), sped the process along. Developed by encryption expert Phil Zimmerman, PGP is a user-friendly form of data communication that vastly enhances the security of e-mail transmission. Cryptography no longer belonged to government; it belonged to the people.

Enter Satoshi Nakamoto.

Government’s business model, so to speak, was set on its head. For government, this is the Orwellian world: a society of people who do not need rulers and know it.

Side Benefit of Private Privacy: Human Beings Become More Human

“The thing that he was about to do was to open a diary. This was not illegal (nothing was illegal, since there were no longer any laws), but if detected it was reasonably certain that it would be punished by death.”

–George Orwell, 1984

The character arch of 1984‘s protagonist, Winston Smith, symbolizes the discovery of individualism. The diary symbolizes freedom of speech and conscience, which are essential to a sense of self. Winston considers the journey toward himself to be so important that he risks death to pursue it. He wants to think and reach conclusions for himself. As Orwell once said, “Freedom is the freedom to say that two plus two makes four. If that is granted, all else follows.” Big Brother destroys Winston for the attempt. He is tortured into nothingness, into a no one who cannot even escape oppression in dreams, which had been his only remaining outlet of pure self.

1984 is the most extreme expression of the total surveillance state. It is rarely necessary to go that far to stifle dissent. But every infringement of privacy comes at the expense of the human spirit. A word is not spoken, a thought is not formed, a feeling is not expressed…then, one day, the inner silence becomes an automatic habit of self-censorship. People no longer question. Perhaps, they no longer notice that they no longer question. They have developed the habit of ceasing to be an individual.

Which Vision of Privacy to Follow?

Two views of privacy vie with each other in the Cold War.

The government view: privacy has been killed by technology, so the War is effectively over. Government’s victory is for the best, because only criminals want privacy. What average people need is protection from those criminals. The intangible and already dead thing called privacy is a small price to pay for safety.

The cryptoanarchist view: “Computer technology is on the verge of providing the ability for individuals and groups to communicate and interact with each other in a totally anonymous manner. Two persons may exchange messages, conduct business, and negotiate electronic contracts without ever knowing the True Name, or legal identity, of the other. Interactions over networks will be untraceable…. Reputations will be of central importance, far more important in dealings than even the credit ratings of today. These developments will alter completely the nature of government regulation, the ability to tax and control economic interactions, the ability to keep information secret, and will even alter the nature of trust and reputation. “– Timothy May

[To be continued next week.]

Reprints of this article should credit bitcoin.com and include a link back to the original links to all previous chapters

Wendy McElroy has agreed to ”live-publish” her new book The Satoshi Revolution exclusively with Bitcoin.com. Every Saturday you’ll find another installment in a series of posts planned to conclude after about 18 months. Altogether they’ll make up her new book ”The Satoshi Revolution”. Read it here first.

Article Source

The post Wendy McElroy: Silence and Soul in the Crypto Cold War – the Evolution of Privacy appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Liechtenstein Bank Offers Account Holders Direct Crypto Investments

News

This week the private bank headquartered in the Principality of Liechtenstein, Bank Frick, announced its customers will now have the ability to directly invest in cryptocurrencies. According to the financial institution, the company will offer account holders the means to purchase fives different cryptocurrencies that will be held in cold storage using the bank’s platform.

Also Read: Australian High School to Host Information Night on Cryptocurrencies

Bank Frick Offers Direct Crypto Purchases Held in Cold Storage for Euros, Dollars, and Swiss Francs

Bank Frick is a banking firm based in Liechtenstein that offers private financial services for a wide array of international clientele. On February 28 the bank announced it was enabling direct cryptocurrency investment for customers and the digital assets will be kept in cold storage under the bank’s supervision. Bank Frick is initially offering five cryptocurrencies including bitcoin core, bitcoin cash, litecoin, ripple, and ethereum.

“Starting today, professional market participants and financial intermediaries are able to invest in the five leading cryptocurrencies,” explains the Liechtenstein bank.

The cryptocurrencies can be bought using euros, US dollars and Swiss francs. Trading takes place once a day.

Bank Frick will offer BTC, LTC, ETH, BCH, and XRP.

‘Crypto-Banking and Traditional Banking’

Bank Frick hopes it can offer institutional traders and market makers stronger protection from theft alongside traditional regulations that are applied to other asset classes. For instance, the bank says all the funds will be “physically separated from the Internet” by utilizing cold storage devices. Moreover, the company will make sure its cryptocurrency trading activities and account holders follow Liechtenstein and European (EU/EEA) laws. Bank Frick explains that all interested parties will have to initiate the verification process.

“Clients can only invest in cryptocurrencies once they have been fully identified and verified,” the bank details. “The verification and identification process also involves checking the origin of the money used to invest in them.”

The bank’s Chief Client Officer Hubert Büchel adds:

Our services are in demand from companies across the whole of Europe. This is because they know that we can offer them reliable support in implementing their business models with cryptocurrencies and blockchains in line with the existing regulatory framework — We aim to place crypto-banking on at least the same level of quality as traditional banking.

The Liechtenstein Bank’s Future-Oriented Digital Strategy

Bank Frick details the business move is in line with its “future-oriented digital strategy.” Back in September of 2017, the company became the first financial institution to offer regional CHF basket trackers based on BTC and ETH. These investments have increased in value exponentially following the rise of cryptocurrency spot markets last year as the trackers surpassed 360 percent on January 10th.

What do you think about Bank Frick offering direct investments into cryptocurrencies like ethereum and bitcoin cash? Let us know your thoughts on this subject in the comments below.

Images via Bank Frick websites, and Pixabay.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

Article Source

The post Liechtenstein Bank Offers Account Holders Direct Crypto Investments appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

PR: The Most Significant Event of March 2018! Don’t Miss out on Datarius Cryptobank ITO!

This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release.

Less than a week is left until one of the major events of Spring 2018. On March 5 at 12:12 UTC Datarius, the first social p2p cryptobank, launches its Main ITO Round. The project has already experienced more than a year of preparatory work, attention from key personalities and companies, crypto-community support, highly successful pre-ITO round, gap analysis, a fivefold increase in the number of community members since the beginning of the year, and high ratings of the rating agencies.

What is Datarius?

Datarius is the first social p2p cryptobank. The main idea of the project is to provide the consumer with the widest range of financial instruments. The widest possible. To bring the maximum number of financial consumers together. To give freedom of choice and action. To provide a high level of automation. To create a truly social fintech product. We will prove by ourselves that the decentralization and lack of borders are benefits, and a financial company can and should be a partner and a friend. No one fintech project has thus far paid so much attention to socialization and direct interaction between the participants. The project team decided to completely eliminate the strict regulation, preserving only the technical support of the platform and providing a wide range of the related services on an equal basis with other project partners. Users will have the right to choose the most appropriate cost and terms of borrowing funds. They will always be able to call on analysts, risk managers, databases, credit and user ratings, the entire history of transactions and expert opinion – not one and not just of the project’s staff.

Why participate in ITO?

DTRC token is a unique key and the only tool to access all the benefits of the Cryptobank: loans with the most favorable terms, joint investments, personal piggy cryptobank, trust limits, trust management and much more. The ITO round, which runs from March 5th to April 5th, is the last chance to become the key holder and get significant bonuses. The emission of tokens will end together with the round. The number of people, willing to gain access to the most complete set of financial instruments, will continuously grow and the number of tokens will remain the same forever. This is the last unique opportunity to become an active user of the bank of the future and start earning money with the project’s team.

What to do? It is rather simple to become a part of the future. You have only to: – Visit the Datarius official website and register as a future member at ito.datarius.io – Subscribe to any project’s official social media to stay abreast of the latest news, updates and to follow the Datarius development. – Participate in the Referral Program of the project and share your vision and information with friends to get an additional 5% bonus. – Come on March 5 at 12:12 UTC to participate directly in ITO and get a 30% bonus.

And speaking of bonuses, note that following the ITO restructuring, the project’s bonus grid is as follows now: 30% – 0-6 hours; 25% – 6-12 hours; 20% – 12-24 hours; 15% – 24-48 hours; 10% – 48h (hours) -15d (days) Since the 15th day and until the round completion no bonuses will be available.

Outlook.

In January, the team decided to bring the product to market as soon as possible. The launch will be effected through the integration of the DTRC token into a classic core, which has been under the development of the large studio аrtARTERY with an extensive experience in developing classical banking applications since mid-2017. Though the main round hasn’t finished yet, the company has already submitted an application for a license, which completely covers the legal framework for implementing and launching a commercial version of an ecosystem with its basic functionality. The strategic objective of the team is to celebrate 1,000,000 users as early as 2019.

Are you sick of lobbism, opacity, greed, classical financial systems banality? Do you aspire to freedom of choice and financial services? Do you believe in the future of decentralization and blockchain technology? Do you want to earn with your bank? We too! Datarius is your social p2p cryptobank. March 5, 12:12 UTC at datarius.io.

«We believe in what we are doing and we are confident that the format of the fintech we propose is the format of the future #Cryptorize!» (с) Datarius Team

Contact Email Address community@datarius.io Supporting Link datarius.io

This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Article Source

The post PR: The Most Significant Event of March 2018! Don’t Miss out on Datarius Cryptobank ITO! appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Talking About Decentralization Is Easy – Achieving It Is Hard

News

Browsing the latest cryptocurrency projects, it would be easy to conclude that decentralization is a panacea; a cure for humanity’s financial woes. It must be, surely, given that it’s a key tenet of every other new cryptocurrency and ICO. Without the gospel of decentralization, there would be no point in launching a blockchain version of Uber/Facebook/Airbnb or whatever web 2.0 platform is due for tokenization this week. Censorship-resistance is now reason enough to place a product on the blockchain it seems – even if that product has never been censored in the history of mankind.

Also read: Most Cryptocurrencies Are More Centralized Than You Think

Crypto Startups Are Craving the D

It’s hard to say when the decentralization meme kicked in. Like all trends, it occurred gradually; insidiously. It wasn’t in Satoshi’s white paper, that’s for sure. Words such as “decentralize” and “censorship” don’t get a mention. The first use of the term in regards to cryptocurrency appears to have occured on the Bitcointalk forum in February 2010. In response to a post from Satoshi announcing the first automatic adjustment of the proof-of-work difficulty, forum member Sabunir replied: “How do you adjust this difficulty, anyway? (Administrating a decentralized system?)”

Eight years later and decentralization is the prefix for all things crypto. It’s a word so powerful that simply uttering it is justification enough for seeking $20 million in a crowdsale. The magic word may not have appeared in Satoshi’s white paper, but it has become a defining trait of cryptocurrencies…or at least it has to the ones that do more than pay lip service to the concept. It’s no coincidence that one of the most heated recurring arguments in the cryptoverse concerns the extent to which major cryptocurrencies are centralized.

Centralization is a dirty word around these parts, synonymous as it is with bankers, governments, control, and censorship. What’s the point in creating an IoT cryptocurrency with its own Direct Acyclic Graph if it’s reliant on a central coordinator? Or a Chinese smart contract blockchain that can be shut down by a kill switch? That doesn’t sound very true to the spirit of cryptocurrency, with all its promises of sidestepping oppressive regimes and facilitating peer-to-peer transactions. Put it this way: if bitcoin came with an off button or was mined by a single entity, shutting down darknet markets would have been a lot quicker and easier.

The State of Decentralization Today

The crypto space has come a long way since the dark web days of 2013, and while the need for censorship-resistant currency and platforms is as important as ever, many ICOs seem to be missing the point. If a token is reliant on the project’s founders staying alive or continuing to pay for their web hosting, it’s not decentralized. A truly decentralized cryptocurrency is one that ideally has as many nodes and validators as possible and which will continue to be usable come what may; subpoenas; death; hacks; schisms.

Of the 200-odd ICOs scheduled to take place in the coming weeks, there are some interesting “decentralized” projects to look forward to. Shopin, for example, is “the world’s first decentralized shopper profile built on the blockchain”. There’s also a decentralized lending and borrowing network (Datarius), video platform (Viewly), business data network (Loyakk Vega), and Git hosting (Ellcrys). Not all crowdsales claim decentralization as their USP in fairness. Cryptoflix, for example, aims to become a movie streaming and funding platform on the blockchain. Crypto and chill, anyone?

Decentralization isn’t the be all and end all of crypto. Many tokenized projects make no mention of it in their official documentation. Any ICO that does trade on the D-word, however, deserves close scrutiny to see whether it has any intention of making good on its promise. Talking about decentralization is easy. Delivering it is hard work.

Do you think decentralization matters? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

Article Source

The post Talking About Decentralization Is Easy – Achieving It Is Hard appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

New ‘Hack-Proof’ Security-Centric Phone Features Built-In Bitcoin Wallet

Wallets

Mobile cybersecurity firm Sikur has unveiled “the first fully encrypted, hack-proof smartphone that can safely store cryptocurrencies.” The phone’s hardware and software were built from the ground up with a dedicated bitcoin wallet and a custom app store for high-security apps.

Also read: Indians Look to Buy Bitcoin Overseas as Regulations Tighten

‘First Fully Encrypted, Hack-Proof Smartphone’

Sikur unveiled a new, security-centric smartphone this week at Mobile World Congress in Barcelona, Spain. Designed from scratch with security as the primary goal, the company claims that this phone is “the first fully encrypted, hack-proof smartphone that can safely store cryptocurrencies,” Engadget reported.

The company has also created its own app store and an operating system called SikurOS, which is “a fork of Android,” the news outlet described. “Any third-party apps must be vetted and confirmed by the company before they’re available in an upcoming app store.” Claiming to have built “the safest platform on the market,” Sikur wrote on its website:

Keep your cryptocurrency in the digital marketplace’s safest wallet. The only wallet that protects via software and hardware.

Sikur was previously known for its high-security smartphone launched in 2015 called Granitephone.

Sikurphone’s Specs

The Sikurphone “has a 5.5-inch ‘full HD’ Gorilla Glass display, 4GB of RAM, 64GB of storage, a 13MP rear and 5MP front camera and sports a 2800 mAh battery,” Engadget described.

The phones can now be pre-ordered on the company’s website, which states that “The pre-sale price will only be available for the first 20,000 units. Available in August / 2018.” Furthermore, “Sikurphone comes with a two-year license. With the device, you will also receive the Sikurplatform for free to use on your desktop PC.” The cost of the phone is $799 plus shipping.

Security and Wallet

The built-in Sikurwallet is a configurable wallet app made for the SikurOS. Customers can safeguard their funds “with one or multiple signatures,” the company explained on its website. This wallet “includes native support for the Bitcoin Testnet, perfect for testing new bitcoin applications across multiple platforms,” Sikur elaborated, adding:

With multisignature (P2SH) and multiple wallet support, Sikurwallet makes it simple for developers to test and demo Bitcoin applications without fumbling between other mobile apps.

According to Sikur COO Alexandre Vasconcelos, the company hired security researchers Hackerone to try and break into the device in November and December of last year. “Sikurphone was subjected to rigorous hacking tests for two months,” he said, declaring that “Hackers failed to gain access to any information.”

What do you think of the Sikurphone? Let us know in the comments section below.

Images courtesy of Shutterstock and Sikur.

Need to calculate your bitcoin holdings? Check our tools section.

Article Source

The post New ‘Hack-Proof’ Security-Centric Phone Features Built-In Bitcoin Wallet appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

Bitcoin.com Wallet Celebrates 2 Million Wallets Created

This week our company is proud to say that two million Bitcoin.com Wallets have been created since its release just seven months ago. The multi-currency wallet allows users to store Bitcoin Cash (BCH) and Bitcoin Core (BTC) in a non-custodial fashion. Moreover, our developers have big plans for the Bitcoin.com Wallet as more features are coming to the platform in the future.

Also read: How To Regain Control From Nanny Zuck

Two Million Wallets Download Since August

The Bitcoin.com Wallet reached a milestone of over two million wallets created this week. Bitcoin interest and demand has spurred thousands of downloads each and every week since the wallet was introduced back in August of 2017. The multi-currency wallet that holds BCH and BTC is available for download on mobile or desktop from every major operating system, including Windows, Mac, Linux, Google Chrome, Android, and iOS. The wallet allows users to store their private keys themselves; which means the funds are not held by a third party and Bitcoin.com has no access to the coins.

Just recently the wallet has added a few additions to the client’s interface making the user experience more enjoyable. For instance, the Bitcoin.com Wallet is one of seven wallet providers that offers Bitpay’s Payment Protocol compatibility. This makes paying Bitpay invoices with the Bitcoin.com Wallet simple and easy. Moreover, the wallet now offers ShapeShift abilities by utilizing the company Shapeshift’s API. This means users can swap BTC for BCH or vice versa natively—within the wallet’s interface. The platform also allows for multi-signature wallets where keys can be split between more than one device/user for added security.

The Bitcoin.com Wallet enables the ability to swap BTC for BCH or vice versa via the Shapeshift API.

Demand for Bitcoin Cash Has Doubled Usage

Bitcoin.com’s owner and CEO Roger Ver is excited about the future of his company’s flagship product. Ver states during the announcement:

“Usage of our wallet has doubled in less than three months as demand for Bitcoin Cash continues to grow worldwide. With this, we are seeing an increase of industry support as well as merchant adoption on websites and retail venues. We are working hard to consistently roll out new features and improvements that add to the user experience of the Bitcoin.com Wallet.”

Our open source Bitcoin.com Wallet has many new features coming in the near future. In time, there will be the potential for debit-card top offs using the platform. Bitcoin.com developers are also researching BCH-based colored coin management. The Bitcoin Cash network may soon have the ability to create token based assets (colored coins), and Bitcoin.com wants to remain at the forefront of such technological advances.

Two million wallets created is a significant milestone for us, but it’s also just the start. Bitcoin.com hopes to provide wallets, tools, and educational resources to everyone all across the globe. The user-friendly Bitcoin.com Wallet is pushing that goal towards the next level as the cryptocurrency economy continues to grow exponentially.

Check out all the latest features and download the Bitcoin.com Wallet today!

Do you use our wallet? Let us know what you think about the Bitcoin.com Wallet in the comments below.

Images via Shutterstock and Bitcoin.com.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

Article Source

The post Bitcoin.com Wallet Celebrates 2 Million Wallets Created appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

16 Government-Approved Crypto Exchanges Forming Self-Regulatory Body in Japan

Regulation

16 cryptocurrency exchanges that have been approved by the Japanese government are teaming up to form a self-regulatory group, following the hack of one of the country’s most popular exchanges. Besides these exchanges, there are 16 “quasi-operators” for cryptocurrencies as well as about 100 firms seeking to enter the market in Japan.

Also read: Japan’s DMM Bitcoin Exchange Opens for Business With 7 Cryptocurrencies

Exchanges Forming Self-Regulatory Body

Japan currently has no self-regulatory body. However, following the major hack of one of the country’s most popular crypto exchanges, the need for self-regulation in the country has elevated. Coincheck was hacked for 58 billion yen (~USD$530 million) worth of the cryptocurrency NEM in January. Following the hack, the Japanese Financial Services Agency (FSA) started scrutinizing all exchanges operating in the country. The agency also urges industry players to adopt self-regulation standards.

16 crypto exchange operators are currently fully approved by the FSA. All crypto exchanges are required by the revised payment services act, which went into effect in April of last year, to register with the agency.

The exchanges announced on Thursday, as reported by Reuters:

Japan’s 16 government-registered cryptocurrency exchanges will set up a self-regulatory body to bolster trust in an industry rocked by a $530 million digital money heist in January.

While neither the name of the new organization nor the date of registration with the FSA has been announced, sources told the news outlet that “the body would be set up this spring.”

Japanese Exchanges Participating

The FSA started issuing licenses to crypto exchange operators in the second half of last year. Eleven were approved in September: Money Partners, Quoine, Bitflyer, Bit Bank, SBI Virtual Currencies, GMO Coin, Bittrade, Btcbox, Bitpoint, Fisco Virtual Currency, and Zaif. In early December, Tokyo Bitcoin Exchange, Bit Arg Exchange Tokyo, FTT Corporation, and Xtheta Corporation were additionally approved. Then within the same month, Bitocean became the 16th and the last operator to obtain a license from the FSA so far.

In addition to the 16 approved exchanges, the FSA has allowed “quasi” cryptocurrency operators to conduct business while their applications are pending. These operators have been in crypto exchange businesses prior to the introduction of the registration system.

The 16 quasi-operators are Minnano Bitcoin, Payward Japan, Lemuria Bitcoin Exchange (Bitcrements), Campfire Corporation, Tokyo Gateway, Lastroots Corporation, Debit, Eternal Link, FSHO Corporation, Kirin Corporation, Bit Station, Blue Dream Japan, Mr. Exchange, Bmex Corporation, Bitexpress Corporation and Coincheck.

In addition, there are over 100 companies reportedly seeking to obtain a license to operate crypto exchanges in the country.

According to Thursday’s announcement by the exchanges:

The body will later invite other cryptocurrency exchanges whose applications for registration with the government are pending, as well as those that plan to register in the future.

What do you think of Japanese crypto exchanges forming a self-regulatory organization? Let us know in the comments section below.

Images courtesy of Shutterstock and Nikkei.

Need to calculate your bitcoin holdings? Check our tools section.

Article Source

The post 16 Government-Approved Crypto Exchanges Forming Self-Regulatory Body in Japan appeared first on Bitcoin E-Gold Rush.

0 notes

Photo

EU Losing Patience – Urges Global Crypto Regulation

Featured

Commissioner for Financial Stability, Financial Services and Capital Markets Union, Valdis Dombrovskis of the European Union (EU), is urging a broader regulatory regime upon cryptocurrencies, and is threatening an EU move especially if there appears to be no global consensus on how to address the decentralized currency phenomenon.

Also read: Bitcoin Futures Regulator Allows Employees to Trade Crypto

EU Financial Commissioner Urges Global Crypto Regulation

Valdis Dombrovskis, Vice-President of the European Commission, warned, “[Bitcoin] is a global phenomenon and it’s important there is an international follow-up at the global level. We do not exclude the possibility to move ahead (by regulating cryptocurrencies) at the EU level if we see, for example, risks emerging but no clear international response emerging.”

Mr. Dombrovskis’ remarks were delivered this week in Brussels at a an EU Commission meeting termed Roundtable on cryptocurrencies. The agency “aims to ensure investor protection, market integrity and financial stability while taking full advantage of the new technological developments,” according to its website.

Valdis Dombrovskis

Participants in the “Cryptocurrencies – Opportunities and Risks, exchanged views on how the EU institutions, supervisors and Member States should respond to the challenges posed by fast technological developments, and seize the opportunities they offer. So-called cryptocurrencies (virtual currencies) and their underlying blockchain technology are affecting many sectors of the economy, including finance,” the site explained.

The Commission plans to use the discussion at Brussels to inform broader policy as they head into the G20 meetings later in Argentina. “The discussion was organised around three themes: cryptocurrencies and their implications for financial markets, investor protection and market integrity in relation to cryptocurrencies as an emerging asset class, and the potential and challenges posed by initial coin offerings,” they detailed.

Clear, Frequent, and Across All Jurisdictions

For his part, Mr. Dombrovskis urged the roundtable to follow up on an existing Franco-German letter concerned with crypto regulation. “Crypto-asset markets are global, with worldwide transactions between investors, consumers and intermediaries,” he said. “On its own, Europe represents only a small share of global cryptocurrency trading, so we need to work together with our partners in the G20 and international standard-setters.”

After applauding “blockchain technology,” the Vice President outlined issues he felt were previously unaddressed: Cryptocurrencies “which are not currencies in the traditional sense, and whose value is not guaranteed, have become subject of considerable speculation. This exposes consumers and investors to substantial risk including the risk to lose their investment. This is why our third conclusion is that warnings about these risks to consumers and investors are important: these must be clear, frequent, and across all jurisdictions.”

For good measure, he was careful not to miss initial coin offerings (ICOs), which he termed an “opportunity” but ultimately “there are also problems that expose investors to substantial risk, such as the lack of transparency regarding the identity of the issuers and underlying business plans.” Perhaps the most ominous of his remarks were saved for the very end, as he pounded home the point “crypto-assets present risks relating to money laundering and the financing of illicit activities. That is why the Commission proposed that virtual currency exchanges and wallet providers should be subject to the Anti-Money Laundering Directive. The co-legislators reached an agreement in December, and we invite Member States to prepare for a speedy transposition of this legislation. To sum up, the Commission will continue to monitor these markets together with other stakeholders, at EU and international level, including in the G20. We stand ready to take action based on an assessment of risks and opportunities,” he insisted.

What do you think of the EU’s proposals? Let us know in the comments section below.

Images courtesy of Pixabay, EU.

Not up to date on the news? Listen to This Week in Bitcoin, a podcast updated each Friday.

Article Source

The post EU Losing Patience – Urges Global Crypto Regulation appeared first on Bitcoin E-Gold Rush.

0 notes