#Bitcoin Investment Website

Explore tagged Tumblr posts

Text

Pick this web UI design kit to streamline your crypto HYIP investment web development. Get access to pre-designed icons and layouts optimized for better user experience. 😃

Never miss the chance to create a user-friendly website for crypto HYIP investment. ✨

✅ Account registration

✅ Earning history

✅ Real-time transaction details

✅ Withdraw option

Visit Now- https://allclonescript.com/product-detail/crypto-hyip-ui-kit

#website template#web template#webui#uikit#hyip#investment#cryptocurrency#crypto#bitcoin#userfriendly#uidesign#uxdesign#ui ux design#uiux#landingpage

2 notes

·

View notes

Text

#domain#business#bitcoin#cryptocurrency#website#mining#NFTs#NFT#Bank#Investments#Cards#Shares#Bonds#Funds#following#Follow

0 notes

Text

LOST YOUR BITCOIN? HERE IS HOW YOU CAN RECOVER IT - ULTIMATE HACKER JERRY.

A bitcoin investor I met on Instagram first exposed me to it. I chose to invest through the site because I thought the idea was good. I started off investing and making money, and I kept doing that until the website disappeared. Prior to the incident, I was unable to withdraw any money, but fortunately, a buddy of mine recommended ultimate hacker Jerry. He came just on time and helped me get all the money back. He was a delight to work with and performed a great job. Although it's hard to imagine, it really happened. He worked hard, and we were able to get our money back.Jerry the Ultimate Hacker, I appreciate your great job.

Whatsap: +,1,5,2,0,2,8,2,7,1,5,1,

Web: (Ultimateshackjerry.c om),

Email: ([email protected] om)

Recommended by,

Ron Glassman, PhD, MPH · Author,

Workshop Leader & Stress Reduction Instructor since 1983

BITCOIN SCAM RECOVERY SOLUTIONS - ULTIMATE HACKER JERRY

At Ultimate Hacker Jerry, Have a team of legal cryptocurrency investigators. The team is excellent at conducting extensive investigations. They have advanced software that classifies links between cryptocurrency addresses and entities. It assists in finding similar criminals, fiat on and off-ramps, and mixers. They create and document everything on these servers; in the form of intelligence for law enforcement cases. It helps with Bitcoin Recovery. It also assists in cases of ransomware, money laundering, terrorism financing, narcotics trafficking.

UHJ's detailed reports proved to be beneficial for the investigation and always lent a hand with judicial proceedings.

Their experts will help with the witness in the court; when it��s time to prosecute and recover the assets. Ultimate Hacker Jerry acts as a network connecting an exceptionally trained team with the investors who’ve lost their bitcoins and other cryptos along the way.

E-Mail ([email protected]) Call or Whtsp +1(520)282-7151) Visit website: ultimateshackjerry.com

THE HUFFINGTON POST

#LOST YOUR BITCOIN? HERE IS HOW YOU CAN RECOVER IT - ULTIMATE HACKER JERRY.#A bitcoin investor I met on Instagram first exposed me to it. I chose to invest through the site because I thought the idea was good. I sta#and I kept doing that until the website disappeared. Prior to the incident#I was unable to withdraw any money#but fortunately#a buddy of mine recommended ultimate hacker Jerry. He came just on time and helped me get all the money back. He was a delight to work with#it really happened. He worked hard#and we were able to get our money back.Jerry the Ultimate Hacker#I appreciate your great job.#Whatsap: +#1#5#2#0#8#7#Web: (Ultimateshackjerry.c om)#Email: ([email protected] om)#Recommended by#Ron Glassman#PhD#MPH · Author#Workshop Leader & Stress Reduction Instructor since 1983

12 notes

·

View notes

Text

Why are all of my tumblr ads about using AI for advertising and investing in bitcoin. Do the advertisers not know this is the hating capitalism and AI and cryptocurrency website.

94 notes

·

View notes

Text

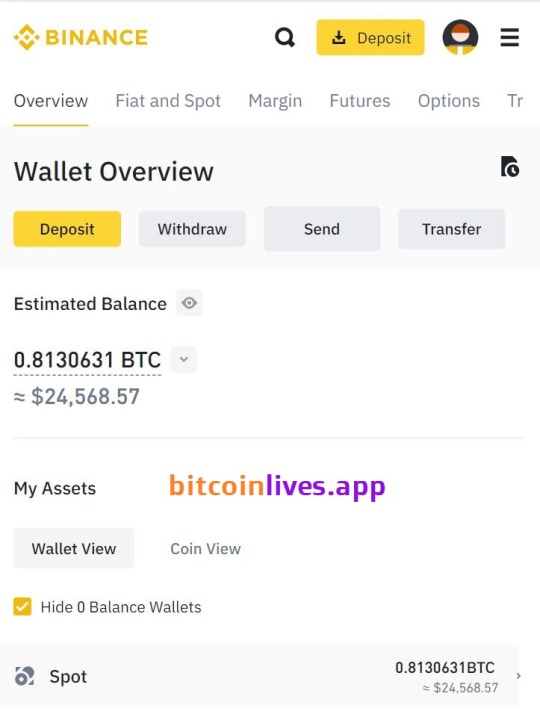

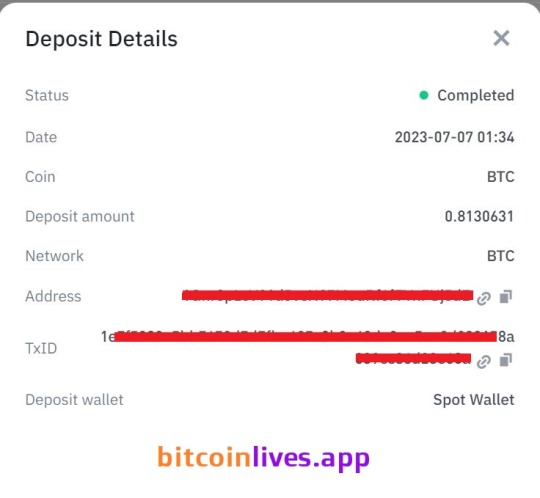

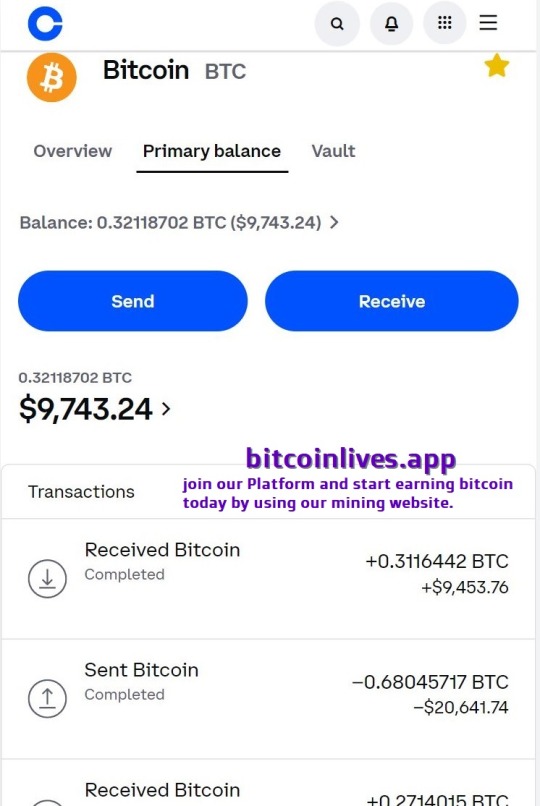

Bitcoin Mining platform

Bitcoin Live App is a crypto mining platform to help you start earning BTC! It contains the most necessary tools for working with digital assets: cloud bitcoin mining equipment with high hash power. It is a meta-universe of crypto investments available to everyone.

How does Bitcoin Mining App work?

Previously, to mine cryptocurrencies, you had to buy equipment and then recoup its cost. Bitcoin Live App allows you to start mining right now with a minimum cost threshold.

We have developed a quantum decryption algorithm to mine Bitcoin at unsurpassed speed. You only have to log in and activate our process with very simple steps, the magic happens in our the magic happens in our mining farms, so you just have to wait for your profits to be generated. No more hassle with buying and maintaining equipment or mining pools.It's easiest and most efficient way to make money from cryptocurrency mining without having to buy and maintain your equipment. Just choose and buy the best Crypto Mining Key for you and start earning today!

Join over 50.000 people with the world’s leading hashpower provider

During this time, We have won the trust of thousands of users. So, join our Platform and start earning bitcoin today by using our mining website. Start mining the quick way, Generate 1 BTC fast and easy with instant withdraw.

138 notes

·

View notes

Text

The Beginner's Guide to Bitcoin: Overcoming the Fear of the Unknown

We've all been there – staring at headlines about Bitcoin's latest price movement, wondering if we've missed the boat or if it's all just a complicated scam. The truth is, Bitcoin represents one of the most significant financial innovations of our time, yet many people still hesitate to take their first step into this new world. This guide will help you understand why Bitcoin matters and how you can start your journey with confidence.

Why Bitcoin Matters

In a world where governments can print unlimited money and banks can freeze your accounts, Bitcoin offers something revolutionary: true financial freedom. It's not just another investment vehicle – it's a technology that gives you complete control over your money. Unlike traditional currencies that lose value through inflation, Bitcoin has a fixed supply, making it a potential hedge against economic uncertainty.

But let's be honest: trying something new, especially when it involves your hard-earned money, can feel intimidating. That's completely normal, and it's exactly why we're here to guide you through this journey step by step.

What is Bitcoin, Really?

Think of Bitcoin as digital gold for the internet age. Just as gold has been valued for thousands of years because of its scarcity and durability, Bitcoin is valuable because it's limited (only 21 million will ever exist) and cannot be counterfeited or controlled by any government or institution.

Unlike traditional money that relies on banks and governments, Bitcoin operates on a decentralized network of computers worldwide. This means no single entity can shut it down, manipulate its supply, or prevent you from using it. It's truly global money that works the same way whether you're in New York, Lagos, or Tokyo.

Breaking Down the Barriers

Let's address some common fears that might be holding you back:

"Isn't Bitcoin just for criminals?" This misconception stems from Bitcoin's early days. In reality, all Bitcoin transactions are recorded on a public ledger, making it far more transparent than cash. Major financial institutions and public companies now hold Bitcoin as a legitimate asset.

"Isn't it too late to invest?" While early adopters saw incredible returns, Bitcoin's journey is far from over. As global adoption continues to grow, many experts believe we're still in the early stages of this technological revolution.

Modern tools have made Bitcoin more accessible than ever. User-friendly apps like Cash App, Coinbase, and Strike have transformed the once-complex process of buying Bitcoin into something as simple as ordering a ride-share.

Taking Your First Steps

Before investing any money, invest some time in education. Start with beginner-friendly resources like "The Bitcoin Standard" by Saifedean Ammous for a deep understanding of Bitcoin's role in economic history. Websites like Bitcoin.org offer clear, non-technical explanations of key concepts.

When you're ready to buy your first Bitcoin, here's a simple process:

Choose a reputable exchange (Coinbase, Kraken, or Gemini are good for beginners)

Create and verify your account (you'll need ID and basic personal information)

Connect your bank account

Start with a small amount – even $20 is fine

Remember: never leave significant amounts of Bitcoin on an exchange. Instead, transfer it to a personal wallet (like Blue Wallet for mobile or Ledger for hardware storage) where you control the private keys.

The Bigger Picture

Bitcoin's impact extends far beyond investment returns. In countries like Venezuela, where hyperinflation has destroyed the local currency, Bitcoin provides a way for people to preserve their savings. In nations with limited banking access, it offers millions their first opportunity to participate in the global economy.

This isn't just about making money – it's about participating in a movement toward financial sovereignty and inclusion.

The Power of Dollar-Cost Averaging (DCA)

For newcomers, Bitcoin's price volatility can be nerve-wracking. This is where Dollar-Cost Averaging comes in – it's your secret weapon for building Bitcoin savings while managing risk.

DCA means investing a fixed amount regularly, regardless of price. Instead of trying to time the market, you might invest $50 every week. When prices are high, you buy less Bitcoin; when prices are low, you buy more. This strategy helps reduce the impact of volatility and removes the emotional stress of timing your purchases.

Here's how to start:

Choose your regular investment amount (start small – even $25/week adds up)

Select your frequency (weekly or monthly works well)

Set up automatic purchases on your chosen platform

Stay consistent and ignore short-term price movements

For example, if you had invested $50 weekly in Bitcoin over the past five years, you would have accumulated significant savings while avoiding the stress of market timing. This approach is particularly powerful as Bitcoin continues to gain mainstream adoption.

Take the Leap

Everyone in the Bitcoin space started exactly where you are now – curious but uncertain. The key is to start small, both with your education and your investments. Don't feel pressured to understand everything at once or invest more than you're comfortable with.

Remember, Bitcoin is a journey, not a destination. Take that first small step, whether it's buying $20 worth of Bitcoin or spending an hour learning about blockchain technology. Focus on learning and understanding rather than getting rich quick.

The future of money is changing, and you have the opportunity to be part of this transformation. Start your Bitcoin journey today, one small step at a time.

#Bitcoin#Cryptocurrency#Blockchain#FinancialFreedom#DecentralizedFinance#DigitalGold#InvestingTips#BeginnerGuide#CryptoEducation#DollarCostAveraging#BitcoinBasics#CryptoCommunity#CryptoRevolution#DigitalMoney#PersonalFinance#financial empowerment#digitalcurrency#unplugged financial#globaleconomy#financial experts#financial education#finance

2 notes

·

View notes

Text

What is USDT (Tether)? Is it a scam? (A must-read for beginners)

If you're new to cryptocurrency, you've likely heard of "USDT" or "Tether." In the news, phrases like "USDT scam" or "Tether money laundering" frequently appear, causing many newcomers to doubt the legitimacy of USDT. So, what exactly is USDT, and is it a scam? This article will explain what USDT is, its uses, and how to avoid potential scams involving it.

What is USDT (Tether)?

USDT, short for Tether, is a cryptocurrency issued by Tether Limited. Similar to other cryptocurrencies like Bitcoin or Ethereum, USDT is a virtual currency. What sets USDT apart is its 1:1 peg to the US dollar, making it a "stablecoin." In other words, 1 USDT typically equals 1 USD (with slight fluctuations). USDT is designed to function as a digital version of the dollar and is commonly used as a stable store of value in cryptocurrency trading.

Launched in 2014 under the name Realcoin, later rebranded as Tether, USDT's goal was to offer a digital asset backed by traditional currencies (primarily the US dollar), helping cryptocurrency users avoid the extreme volatility of other digital currencies. Tether operates by claiming that for every 1 USDT issued, the company holds an equivalent value in USD or other assets in reserve, thus maintaining its stable value.

Why is USDT often linked to scams?

USDT itself is not a scam; it is a legitimate cryptocurrency. The reason we often hear about "USDT scams" is that fraudsters prefer to use USDT's stability and widespread use in their schemes.

Because 1 USDT is roughly equal to 1 USD and is widely accepted across major crypto exchanges, scammers frequently use fake platforms or fraudulent investment opportunities to trick victims into buying or transferring USDT. Since USDT can be quickly converted into fiat currency or other cryptocurrencies, it's a preferred tool for scammers. However, this doesn't make USDT a scam in and of itself.

How do scammers use USDT to commit fraud?

Common methods include:

Fake exchanges: Scammers create fake cryptocurrency exchanges to steal users' personal information and funds. They may lure you into buying USDT, but you soon realize that the USDT is either fake or nonexistent.

Impersonating customer service or friends: Through social media or phishing, scammers impersonate customer service representatives or friends, tricking you into buying USDT and transferring it to them under the guise of investment or transaction needs. In reality, your funds vanish.

Phishing websites: Fraudsters create fake websites, appearing identical to official platforms, to trick users into entering their wallet private keys or passwords, enabling them to steal USDT.

How to avoid USDT-related scams?

Use trusted exchanges: Always purchase USDT through reputable cryptocurrency exchanges (such as Binance, OKX, Bitget, gate·io, bybit). These platforms are highly regulated and more secure.

Be wary of false investment opportunities: Any promise of "high returns with zero risk" should be viewed skeptically. The crypto market is highly volatile, and promises of quick profits often signal scams.

Avoid clicking on suspicious links: If you receive unfamiliar links, especially those encouraging you to buy USDT or make transactions, exercise caution to avoid phishing traps.

Does USDT always maintain a 1:1 peg to the USD?

While USDT is intended to maintain a 1:1 peg with the US dollar, slight fluctuations may occur during periods of market stress or loss of confidence in Tether's reserves. However, most of the time, USDT remains stable at around 1 USD.

For other currencies like TWD or HKD, the USDT exchange rate is influenced by market demand. In domestic markets, USDT prices may slightly differ from the direct USD exchange rate, depending on supply and demand dynamics.

Where can you buy USDT?

Through regulated cryptocurrency exchanges: The safest way to purchase USDT is through reputable global exchanges, which support various payment methods, including bank transfers and credit cards.

OTC (Over-the-Counter) dealers: In certain regions like Hong Kong, you can buy USDT at physical stores. However, exercise caution as not all stores are regulated, and scams do exist.

Avoid private transactions: Refrain from purchasing USDT through unofficial channels or individual sellers, especially those involving cash deals, as these carry high risks of fraud or theft.

Common Questions (FAQ)

How is USDT different from other cryptocurrencies? USDT is a stablecoin, meaning its value is relatively stable (around 1 USD), while other cryptocurrencies like Bitcoin or Ethereum are highly volatile. USDT is typically used as a store of value in crypto trading, while Bitcoin, for example, is more suitable for investment.

Is USDT safe? USDT itself is safe, but due to its popularity, scammers often use it in fraudulent schemes. Always use trusted platforms to purchase USDT and remain vigilant.

Why does USDT sometimes "de-peg"? USDT can experience minor fluctuations when market confidence in Tether's reserves wanes or in times of market stress. However, these instances are usually temporary.

Is USDT a good investment for beginners? USDT is not typically seen as an investment but rather as a stable store of value. It's more like a "digital dollar" in the crypto market, ideal for transferring value rather than speculating.

Conclusion

USDT is not a scam; it's a widely used stablecoin, designed to maintain a 1:1 value with the US dollar. However, due to its popularity, it is often used by scammers as a tool for fraud. To avoid being scammed, always purchase USDT through official channels and be cautious of investment offers. Remember, all investments carry risks, and caution is key to protecting your assets.

Through this article, I hope you now have a clearer understanding of USDT and how to avoid scams involving it. If you have further questions, feel free to reach out.

3 notes

·

View notes

Text

New Earn Money website 2025

Best investment platform, long-term video viewing profit, stable profit

🤝 Official registration link: https://ai-bg.top/#/register? i=369059

APP registration invitation code: 369059

❤️Telegram official customer service: https://t.me/a358syuign

🤝 Minimum investment 12USDT, minimum single deposit 12USDT = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

Start investing GB001 Member LEVEL!! GB membership is valid for 90 days!!

GB001: Investment [12-99] USDT daily yield of 18% [2.16-17.82] USDT

GB002: Investment [100-499] USDT daily return 20% [20-99.8] USDT

GB003: Investment [500-1999] USDT daily return of 21% [105-419.79] USDT

GB004: Investment [2000-4999] USDT daily yield 22% [440-1099.78] USDT

GB005: Investment [5000-9999] USDT daily return of 23% [1150-2299.77] USDT

GB006: Investment [10,000-29999] USDT daily return of 25% [2500-7499.75] USDT

GB007: Invest [3000-59999] USDT daily return 26% [7800-15599.74] USDT

GB008: Investment [60,000-99999] USDT daily return 27% [16200-26999.736] USDT

GB009: Investment [≧100000] USDT daily return 28% [≧28000] USDT

In order to facilitate the withdrawal of users in different countries, the platform uses TRC20-USDT and BEP20-USDT as withdrawal currencies! = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = = =

#usdtMine #usdt #trc20 #trx #quantification #Contract #quantitative #Ethereum #Bitcoin #USDTinvestment #USDTcontract

2 notes

·

View notes

Video

youtube

DOTUSDT 19 Consecutive Successes! Title: "PrimeXAlgo NVDA: 231 Consecutive Winning Trades! 🔥 | AI Trading Signals for Stock Markets"Description: 🚀 Breaking News: PrimeXAlgo OIL Achieves 27 Consecutive Trading Successes!Revolutionizing Oil Trading with Advanced AI Technology: ✅ 27 Consecutive Successful Trades ✅ Real-Time Live Chart Analysis ✅ No Repainting Signals ✅ AI-Powered Decision Making 🔍 Unique Features: Analysis of 2,500+ Market IndicatorsCross-Market Compatibility (Oil, Gold, Bitcoin, Nasdaq)Real-Time Signal Generation100% Legal & Ethical Trading TechnologyWorks in All Time ZonesAdvanced AI Implementation 💹 Markets Coverage: Oil TradingCommoditiesCryptocurrencyForexStocksIndices 🌐 Join Our Trading Community: Website: https://primexalgo.com Telegram: https://t.me/primexalgo Discord: https://discord.com/channels/1288670367401119888/1288670564126294078 Instagram: https://instagram.com/primexalgo X/Twitter: https://x.com/PrimeXAlgo Facebook: https://www.facebook.com/profile.php?id=61566510386136 ⏰ Video Timeline: 0:00 - Introduction 1:30 - Oil Trading Success Story 3:00 - Technology Overview 4:30 - Live Trading Demo 6:00 - Implementation Guide 8:00 - Results & TestimonialsStart maximizing your oil trading potential with PrimeXAlgo today! #OilTrading #AITrading #TradingSignals #CommodityTrading #PrimeXAlgo #FinancialMarkets #TradingSuccess #OilMarket #AITechnology #TradingStrategy #Investment #Finance #Trading Tags: primexalgo oil, oil trading signals, ai trading oil, commodity trading, trading algorithm, oil market analysis, oil trading strategy, automated trading, oil price prediction, trading indicators, real-time trading, technical analysis, oil market signals, crude oil trading, energy trading, market analysis, trading technology, ai trading system, oil futures, market prediction

2 notes

·

View notes

Text

Get a frontend-ready 👍 solution to build a website for investment and forex trading services.

Build your investment and forex trading platform based on the BitProfit Website Template and unlock 🔓 exciting features.

✅ User-friendly design

✅ Blog page

✅ CTA buttons

✅ Header and Footer

Visit Now-https://theme.bitrixinfotech.com/product-detail/bit-profit-html5-template

#web template#website template#cryptocurrency#crypto#web design#website#token#crypto token#bitcoin#investment#tranding#tailwind

3 notes

·

View notes

Text

For Sale Domain (bitcoingrandee.com) + Existing cloud mining website with user base.

For Sale Domain (bitcoingrandee.com) + Existing cloud mining website with user base.

Продается Домен (bitcoingrandee.com) + Действующий сайт облачного майнинга с базой пользователей

https://www.reg.ru/domain/shop/lot/bitcoingrandee.com

#домен#бизнес#финансы#инвестиции#биткоин#криптовалюта#вебсайт#майнинг#domain#business#finance#investment#bitcoin#cryptocurrency#website#mining

1 note

·

View note

Text

The Memecoin Jungle: How to Escape the Scams and Keep Your Profits

Imagine this: you go into the world of memecoins, having the FOMO as you buy into the next big “gem.” Hours later, you watch the value plummet, and just like that, your money vanishes into thin air.

Website Link https://coinvirally.com/

Bubblemaps: This one gives you a peek into the wallets of the top holders. If the top 10 wallets control more than 10% of the supply, that’s a big warning sign.

A coin with a concentrated supply is often at risk of being manipulated or pulled out from under you. Always look at the distribution before you jump in.

These tools will get you halfway there, but don’t expect them to do all the work. The next part is up to you.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Step 2: Slow Down and Observe When you find a potential memecoin, don’t dive in immediately. Impulse decisions are your worst enemy.

Too often, I’ve rushed into a coin that looked perfect on the surface, only to see it crash moments later. Take your time.

Observe the coin’s movement, see if it starts to show any signs of inconsistency, and don’t get swept up in the excitement of a big jump.

Sometimes, patience is the only thing standing between you and a massive loss.

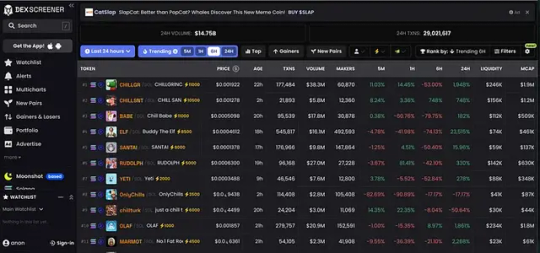

Step 3: Keep an Eye on the Buzz Here’s a little secret most traders don’t know: Dexscreener is an underutilized gem.

It allows you to track which influencers are talking about the memecoin and how active the buzz around it is.

The influence of major personalities can make or break a memecoin.

If Elon Musk tweets about it, the value can skyrocket. But don’t take that as a guarantee. Even major influencers get behind coins that flop.

Website Link https://coinvirally.com/

Sound all too familiar? You’re not alone.

Memecoins have earned a notorious reputation. They promise huge, life-changing profits, only to leave most traders holding empty bags.

It’s a game of high stakes, and too many have fallen victim to its traps. But what if I told you that 95% of rug pulls can be avoided if you know what to look for?

Website Link https://coinvirally.com/

Over the past several months, I’ve been learning the hard way about how to survive this dangerous but profitable world.

Now, I’m sharing my insights so you don’t have to make the same mistakes I did. Here’s the roadmap for avoiding scams and taking control of your memecoin strategy.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

The Allure of Memecoins: The Rush and the Risk Let’s face it — memecoins are seductive. They promise insane returns, and everyone loves a good underdog story.

A coin that costs less than a dollar explodes into the next big thing, and suddenly, your small investment turns into a windfall.

Website Link https://coinvirally.com/

But that’s the thing about memecoins — they’re unpredictable, and the vast majority don’t last.

The truth is, 98% of these coins will fail to even deliver moderate returns.

They surge briefly and then crash, leaving everyone who hopped on board too late with nothing to show for it.

Most people think they’ve found the next Bitcoin, but in reality, they’re holding onto a mirage.

Website Link https://coinvirally.com/

It’s easy to get excited when you see the big numbers flashing on your screen, but the reality of memecoins is much darker. A lot of the time, it’s just a fast-track to losing everything.

While you’re here, consider joining our Telegram Channel where you can find FREE reliable crypto intel!!

Step 1: Equip Yourself with the Right Tools So how do you avoid falling into the trap? First, you need the right tools in your arsenal. T

hese tools won’t guarantee that every coin you buy will succeed, but they’ll significantly increase your chances of dodging the bad ones.

Rugcheck: This tool is a must-have. It allows you to quickly analyze a memecoin and check for red flags. Roughly 50% of rug pulls can be filtered out just by using this tool, giving you a solid starting point before you even think about investing.

Website Link https://coinvirally.com/

#blockchain#branding#business#marketing agency#marketing automation#marketing#bnb#telegram#crypto#coin

2 notes

·

View notes

Text

Top Common Bitcoin Scams That Investors Should Avoid

Bitcoin has become a global investment sensation, captivating everyone from professional traders to beginners hoping to strike it rich. Its rising popularity, however, has also attracted scammers eager to exploit inexperienced investors. Knowing how to spot these scams is crucial to safeguarding your hard-earned funds in the world of cryptocurrency. Today, I’ll walk you through the most common Bitcoin scams and provide practical tips on how to avoid them. My goal is to arm you with the knowledge to keep your investments safe, no matter your experience level.

1. Phishing Scams

What Are Phishing Scams?

Phishing scams are one of the most prevalent online threats and are especially common in cryptocurrency. In these scams, hackers attempt to steal your sensitive information by imitating reputable companies, such as exchanges or wallets. They often send fake emails or create identical websites to trick you into entering personal details like your login credentials or wallet keys.

How It Works

Phishing attacks can be sophisticated. You might receive an email that looks exactly like one from your cryptocurrency exchange, with logos and designs matching the real site. The email may warn you about “suspicious activity” on your account, urging you to click a link to “secure” it. This link, however, leads you to a fake login page where any details you enter go straight to the scammer.

I once nearly fell for a phishing scam when I received a message claiming my account was compromised. The link looked legitimate at first glance, but I noticed the URL was off by a single letter. That’s all it takes for a scam to look genuine.

How to Avoid Phishing Scams

Always verify URLs before entering personal information. Look for HTTPS and double-check the spelling of the site.

Use two-factor authentication (2FA) for added security.

Be cautious of urgent-sounding messages and double-check with the official app or support page.

2. Ponzi and Pyramid Schemes

What Are Ponzi and Pyramid Schemes?

These scams promise incredibly high returns for relatively little investment, usually relying on the money of new investors to pay “profits” to earlier ones. Pyramid schemes involve recruiting others to participate, while Ponzi schemes simply pay returns from new deposits.

How It Works

Ponzi and pyramid schemes often involve people you trust, like friends or family, who may not even know they’re part of a scam. Many scams will boast “guaranteed returns” on Bitcoin investments, a red flag because crypto’s inherent volatility makes such guarantees impossible.

How to Avoid Ponzi and Pyramid Schemes

Be skeptical of “guaranteed” or “too-good-to-be-true” returns.

Look up reviews or do a quick Google search on the platform offering the investment.

Verify licensing and transparency by checking if the investment is registered with financial authorities.

3. Fake Bitcoin Exchanges and Wallets

What Are Fake Exchanges and Wallets?

Some scammers go as far as creating entire fake exchanges or wallets that look and feel just like reputable platforms. Their purpose is simple: to steal your Bitcoin when you deposit it.

How It Works

These fake exchanges and wallets can look identical to well-known platforms. You deposit your Bitcoin, only to find later that you have no way to withdraw it. I’ve known people who unknowingly transferred funds into fake wallets, thinking they were saving in a secure location.

How to Avoid Fake Exchanges and Wallets

Stick to well-known, reputable exchanges and wallets with a solid track record.

Double-check the site’s URL and make sure it’s HTTPS-secured.

Read reviews on multiple sites before signing up.

4. Pump-and-Dump Schemes

What Are Pump-and-Dump Schemes?

Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency by spreading misleading information to attract buyers. When the price spikes, the orchestrators sell their assets, causing the price to plummet and leaving other investors with losses.

Be wary of hype on social media or chat groups, especially with lesser-known coins.

Stick to established cryptocurrencies and popular trading pairs like BTCUSDT to avoid erratic price spikes with unknown assets.

Research thoroughly before buying in—check the project’s fundamentals and team legitimacy.

How It Works

Scammers often start in online forums or social media, hyping up a particular cryptocurrency, usually a small-cap coin. Once enough people buy in and the price goes up, they quickly sell off their holdings, leaving unsuspecting investors at a loss. I’ve seen this happen countless times in crypto communities.

How to Avoid Pump-and-Dump Schemes

Be wary of hype on social media or chat groups.

Stick to established cryptocurrencies and avoid coins that see massive, sudden price increases without any clear reason.

Research thoroughly before buying in—check the project’s fundamentals and team legitimacy.

5. Impersonation and Social Media Scams

What Are Impersonation Scams?

These scams often involve fraudsters posing as well-known figures or reputable companies, offering “giveaways” if you send them a small amount of Bitcoin.

How It Works

These scammers create fake accounts on Twitter, Instagram, or even YouTube, mimicking real influencers or cryptocurrency figures. They’ll post messages saying something like, “Send 0.1 BTC, and you’ll receive 0.5 BTC back!” Unfortunately, anyone who sends funds to these addresses never sees their money again.

How to Avoid Impersonation and Social Media Scams

Verify the account handle and look for the blue verification badge.

Avoid any offers that require you to send crypto to receive a larger amount in return.

Report fake accounts if you come across them.

6. Fake ICOs and DeFi Projects

What Are Fake ICOs and DeFi Projects?

Some scammers take advantage of Initial Coin Offerings (ICOs) or decentralized finance (DeFi) projects by creating fake or poorly designed projects to steal investor funds.

How It Works

Fake ICOs usually promise revolutionary technology or groundbreaking solutions but don’t deliver. These projects may lack transparency, have anonymous teams, or offer extremely vague information about how their technology works. I’ve seen well-designed websites with polished whitepapers that later turned out to be scams.

How to Avoid Fake ICOs and DeFi Projects

Research the team members and verify their identities on professional sites like LinkedIn.

Look for partnerships with known companies and check their legitimacy.

Be cautious of anonymous teams or vague project descriptions.

7. Malware and Ransomware Attacks

What Are Malware and Ransomware Scams?

Malware and ransomware attacks occur when hackers install malicious software on your computer or mobile device to steal cryptocurrency from your wallet or demand a ransom.

How It Works

Malware can be disguised as a link, download, or software update. Once installed, it can track your keystrokes or even access your wallet. In ransomware attacks, hackers lock your data and demand a ransom in Bitcoin for its release.

How to Avoid Malware and Ransomware Scams

Install a trusted anti-virus program and regularly update it.

Enable multi-factor authentication on your accounts for an added layer of security.

Avoid downloading files from unknown sources or clicking on suspicious links.

Conclusion

Bitcoin scams can be frightening, especially if you’re new to cryptocurrency. But by following a few key precautions and staying aware of the tactics scammers use, you can significantly reduce your risk. Remember to always double-check websites, be skeptical of unrealistic promises, and research any project or investment opportunity thoroughly.

Crypto investing can be incredibly rewarding, but it requires a cautious approach. Staying informed and vigilant is your best defense against falling victim to Bitcoin scams.

2 notes

·

View notes

Text

How to Ride the Uptrend and Maximize Profits

Capitalizing on a market uptrend can significantly increase your investment returns. Read on for practical tips to navigate market movements and optimize your profits. Start improving your investment strategy today!

How to Predict the Uptrend?

Predicting exactly when the market will experience an uptrend is challenging. Even if experts anticipate an uptrend soon, the exact timing—whether in 2024, 2025, or beyond—remains uncertain.

The real challenge lies in avoiding premature profit-taking that could cause you to miss out on gains, while also not holding investments too long and risking losses when the market turns.

So, how can we navigate these challenges and maximize our gains during an uptrend? Here are some strategies to consider:

Focus on Your Goals

Monitoring market movements is not sufficient on its own. It’s crucial to establish clear financial goals. Attempting to buy at the absolute lowest and sell at the highest points is an impractical approach since it’s impossible to precisely predict the end of an uptrend.

Instead, set clear, achievable targets that align with your financial objectives. This approach will guide you in making well-informed decisions rather than chasing market trends.

Use the Four-Year Cycle

The four-year cycle remains a dependable framework for anticipating market movements, even though minor deviations can occur. This cycle can help guide your profit-taking strategy, allowing you to gauge the mid-phase of an uptrend.

Utilizing a dollar-cost averaging (DCA) approach, particularly from late 2024 to Q3 2025, can be beneficial. DCA involves consistently investing a fixed amount, which mitigates the risk of buying at peak prices manipulated by market whales. For those preferring a safer strategy, DCA can be an effective way to spread investment risk over time.

Stick to Your Strategy

Maintaining a well-defined and disciplined strategy is crucial. This disciplined approach helps you stay focused and avoid making emotional decisions driven by market volatility.

Adhering to your plan, even amidst market fluctuations, is key to successful profit-taking. Regularly reviewing and adjusting your strategy based on your goals and market conditions can also enhance your decision-making process.

Diversify Your Investments

Diversification is a time-tested strategy to manage risk and enhance profit potential. While applying DCA to established assets like Bitcoin, consider diversifying your portfolio by holding presale tokens such as $BUSAI or participating in airdrops.

Presale tokens are often available at lower prices, offering potential high returns with reduced initial investment. Diversification spreads your risk across various assets, reducing the impact of any single asset’s performance on your overall portfolio.

BUSAI PRESALE CASE STUDY

In today’s crowded presale landscape, distinguishing between genuine opportunities and scams is crucial. For example, the meme AI project BUSAI is gaining significant attention, but don’t let the hype cloud your judgment.

Before diving in, it's vital to thoroughly examine the whitepaper, tokenomics, and the project's backers. If your research checks out, it could be worth considering.

BUSAI stands out with its impressive ecosystem and strategic tokenomics. Its innovative features, such as the interact-and-earn and staking rewards, set it apart from typical meme tokens.

Its tokenomics emphasizing substantial presale, marketing, and liquidity allocations, the project shows strong growth potential. Additionally, BUSAI’s focus on community engagement and cutting-edge technology makes it a distinctive and promising investment in the evolving crypto arena.

By following these guidelines, you can navigate the uptrend effectively and avoid common pitfalls. Stay focused, be disciplined, and make informed decisions to achieve your financial goals.

BUSAI Official Channel: Website | Twitter | Telegram

3 notes

·

View notes

Text

The Power of Doing Your Own Research (DYOR) in the World of Bitcoin and Cryptocurrencies

In today's digital age, information is more accessible than ever before. With a few clicks, you can find countless articles, videos, and social media posts about almost any topic. This is especially true for Bitcoin and the broader cryptocurrency market. While this abundance of information can be empowering, it also comes with the risk of misinformation and hype-driven narratives. This is why it’s crucial to emphasize the importance of doing your own research (DYOR) before making any financial decisions.

The Cryptocurrency Information Overload

The cryptocurrency space is notoriously fast-paced and filled with complex jargon. From blockchain technology to decentralized finance (DeFi), understanding the basics can be overwhelming. Moreover, the crypto market is often subject to wild speculation and hype, leading to sensational headlines and exaggerated claims. While some sources provide valuable insights, others might be misleading or outright false. In this environment, DYOR becomes not just a recommendation but a necessity.

Why DYOR Matters

Understanding the Fundamentals: When you conduct your own research, you gain a deeper understanding of the fundamentals of Bitcoin and other cryptocurrencies. This includes learning about the technology, the problem it aims to solve, its potential applications, and the risks involved. A solid grasp of these basics will help you make informed decisions and avoid falling for scams or overhyped projects.

Avoiding Hype and FOMO: The fear of missing out (FOMO) is a powerful force in the crypto market. It can drive individuals to make impulsive decisions based on hype rather than sound analysis. By doing your own research, you can evaluate the true potential of a project or investment, rather than relying on the opinions of others. This disciplined approach helps you avoid the pitfalls of hype-driven investments.

Building Confidence: Investing in Bitcoin and cryptocurrencies can be a volatile journey. Conducting your own research instills confidence in your decisions. When you understand why you are investing in a particular asset, you are more likely to stay committed to your investment strategy, even during market downturns.

Identifying Opportunities: The crypto market is filled with opportunities, but not all of them are immediately obvious. Through thorough research, you can identify promising projects and investment opportunities that others might overlook. This proactive approach can lead to more profitable outcomes.

How to Do Your Own Research

Diverse Sources: Don’t rely on a single source of information. Read articles, watch videos, listen to podcasts, and follow reputable figures in the crypto space. Cross-referencing information from multiple sources helps ensure accuracy and provides a well-rounded perspective.

Official Documentation: Always review official documents such as whitepapers, technical papers, and project websites. These sources offer detailed insights into a project's vision, technology, and roadmap.

Community Engagement: Engage with the community through forums, social media, and discussion groups. Platforms like Reddit, Twitter, and Telegram host vibrant discussions where you can ask questions and get diverse viewpoints. Be cautious, however, as not all advice you encounter will be accurate or trustworthy.

Critical Thinking: Approach every piece of information with a critical mindset. Question the credibility of the source, the validity of the claims, and the underlying motivations. This analytical approach helps you separate valuable insights from noise.

Stay Updated: The crypto space evolves rapidly. Continuously updating your knowledge helps you stay informed about new developments, regulatory changes, and market trends.

Conclusion

In the dynamic world of Bitcoin and cryptocurrencies, doing your own research is not just a best practice—it’s an essential skill. By taking the time to educate yourself, you empower yourself to make informed, confident, and rational investment decisions. Remember, the journey to financial freedom through Bitcoin starts with knowledge and understanding. So, embrace the DYOR mindset and take control of your financial future.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#Blockchain#DYOR#FinancialFreedom#CryptoEducation#CryptoResearch#BitcoinCommunity#DigitalGold#CryptoInvesting#HODL#CryptoMarket#CryptoAwareness#BitcoinNews#CryptoTips#BitcoinKnowledge#BitcoinRevolution#CryptoJourney#CryptoLife#financial experts#globaleconomy#unplugged financial#financial empowerment#financial education#digitalcurrency#finance

5 notes

·

View notes

Text

What is Bitcoin? A Beginner's Guide to Bitcoin

When it comes to cryptocurrency, Bitcoin (BTC) is what most people think of first. However, many beginners don’t fully understand how Bitcoin works or how to invest in it. So, what exactly is Bitcoin? What is its history? And how should you invest in Bitcoin? This article will address these questions to help you better understand how to participate in Bitcoin investing. What is Bitcoin? Bitcoin (BTC) is a form of virtual currency, also known as cryptocurrency. It was introduced in 2008 by a mysterious person or group under the name "Satoshi Nakamoto." While we still don’t know Satoshi Nakamoto's true identity, Bitcoin has become a popular global investment asset. Bitcoin relies on blockchain technology, a distributed ledger that is immutable and ensures transparency and security in transactions. Why is Bitcoin so important? The primary reason Bitcoin has gained attention so quickly is its decentralized nature. Unlike traditional currencies, Bitcoin isn’t controlled by any government or financial institution. This means that in any country, the government cannot directly interfere with Bitcoin transactions. Additionally, Bitcoin’s anonymity makes it a valuable tool for those seeking to protect their privacy. Key Advantages of Bitcoin • Decentralization: Bitcoin isn’t controlled by any central authority or government, offering users greater financial freedom. • Anonymity: Although Bitcoin transaction records are public on the blockchain, transaction addresses aren’t directly linked to the owner's identity, protecting privacy. • Global Reach: Bitcoin can be circulated globally without the need for exchange rates or transaction restrictions. • Security: Bitcoin uses advanced encryption techniques to ensure the security of transactions and prevent asset theft. Risks of Investing in Bitcoin While Bitcoin has many advantages, there are also some risks that cannot be ignored. Due to its price volatility, investors may experience significant gains or losses in a short period. Additionally, since Bitcoin is decentralized and not government-regulated, if it’s hacked or you lose your private key, the funds cannot be recovered. Common questions: • Why is Bitcoin worth investing in despite its price fluctuations? • If I lose my Bitcoin wallet, can I recover it? • What are the risks associated with Bitcoin's anonymity? Bitcoin’s Use Cases Beyond being an investment tool, Bitcoin has many real-world applications. On platforms like Paxful and Noones, users can exchange Bitcoin for various gift cards (such as Amazon, iTunes, Steam, etc.) and points, making it a flexible asset tool. Bitcoin can also be used for cross-border payments, particularly in restricted countries or regions where it bypasses traditional financial systems, enabling quick and convenient transactions. Other use cases include: • Online shopping: An increasing number of merchants accept Bitcoin as a payment method, allowing users to make purchases using cryptocurrency. • Travel and accommodation: Some websites like Travala allow users to book flights, hotels, and travel packages using Bitcoin. • Charity donations: Some charitable organizations have started accepting Bitcoin donations, leveraging its decentralization and low transaction fees. • Peer-to-peer payments: Bitcoin facilitates fast peer-to-peer fund transfers, making it especially useful for international remittances.

Three Basic Ways to Invest in Bitcoin

Buy and store on an exchange This is the simplest investment method. You can buy Bitcoin through exchanges like Binance, OKX, or Bitget and store it in your exchange account. While this method is easy to operate, the security of the exchange is a risk factor. If an exchange is hacked or goes bankrupt, your assets could be lost.

Use a cold wallet to store Bitcoin Cold wallets are a more secure storage method. Users can transfer Bitcoin to an offline wallet they control, avoiding the risks of exchange hacks or collapses. However, if the private key is lost, the assets cannot be recovered, so users must take full responsibility for their wallets.

Contract trading Contract trading allows users to speculate on Bitcoin price movements without owning the actual asset. By leveraging positions, contract trading can amplify profits and losses. This approach carries high risk and is more suited to experienced investors. Advanced Strategies: Bitcoin Derivatives and Mining As the Bitcoin market matures, financial products like options, dual-currency savings, and liquidity mining are becoming increasingly popular. Additionally, traditional mining—contributing computing power to secure the network in exchange for Bitcoin rewards—remains an important source of income for some investors. Though mining has a high entry threshold, it is still a valuable way for participants to earn Bitcoin. Conclusion There are many ways to invest in Bitcoin. For beginners, the simplest approach is to buy and hold Bitcoin on an exchange. As you gain more market knowledge, you can explore cold wallet storage or contract trading. More advanced strategies, like Bitcoin derivatives and mining, require higher technical expertise and capital. Common questions: • What can Bitcoin be used to buy? • What are the advantages of using Bitcoin for payments? • Which Bitcoin trading platform is the most secure?

3 notes

·

View notes