#Best broker for long term investing

Explore tagged Tumblr posts

Photo

Best online trading platform:- Are you planning to trade commodities, CFDs and indices? If so, utilize our platform. We make use of technology and industry standard practices to deliver the best results. Feel free to contact us if you want to learn more about our platform. https://www.elpmarkets.com/

0 notes

Text

Understanding the Power of Compounding with the Best Mutual Fund Services in Kolkata

People often hear about the power of compounding, but many don't fully understand its impact on wealth creation. This is where the best mutual fund services in Kolkata come to the rescue. With the right guidance, investors can leverage compounding to grow their investments significantly over time.

How Does Compounding Work?

The basic idea behind compounding is reinvestment. When you invest in a mutual fund, the returns you earn are reinvested to generate more returns in the future. This creates a cycle of growth, where your initial investment continues to multiply over time. Let’s look at a simple example:

● Suppose you invest ₹10,000 in a mutual fund that gives a return of 10% per year. ● In the first year, you earn ₹1,000 in returns, bringing your total to ₹11,000. ● In the second year, you earn 10% on ₹11,000, which is ₹1,100. ● Now, your total investment is ₹12,100, and the cycle continues.

Each year, the returns earned are added to the principal, allowing you to earn more in subsequent years. Over time, this can lead to significant wealth creation, especially if you stay invested for the long term. If you wish to know more, a long term mutual fund advisor in Kolkata, like INV Rajat can help.

Benefits of Compounding in Mutual Funds

1. Wealth Creation Over Time: Compounding is a long-term game. The more time you give your money to grow, the bigger the returns. This is why starting early is key to taking full advantage of compounding.

2. Reinvested Returns Grow Exponentially: Unlike simple interest, where you earn a fixed amount on your original investment, compounding allows your earnings to generate additional earnings. This exponential growth leads to higher returns over the years.

3. Achieve Financial Goals Faster: Whether you are saving for retirement, your child’s education, or a dream home, compounding helps you achieve these goals faster. The more time your money has to grow, the closer you get to your financial objectives.

4. Passive Growth: One of the best things about compounding is that it works in the background. Once you invest, the process continues without requiring any active involvement from you, allowing your wealth to grow passively.

Conclusion

Understanding the power of compounding is crucial for anyone looking to build wealth over time. Investors can unlock the full potential of this powerful financial tool. By starting early, reinvesting returns, and staying committed to long-term goals, compounding can transform even small investments into substantial wealth.

#best mutual fund services in Kolkata#best broker for mutual funds in Kolkata#long term mutual fund advisor in Kolkata#mutual fund sip advisor in Kolkata#sip investment plans in kolkata

0 notes

Text

What Sets Apart the Best Mutual Fund Company in Mumbai?

To experience innovative investment strategies and a client-centric approach, reach out to Chamunda Invest. It is recognized as the best mutual fund company in Mumbai. They prioritize transparency and performance to deliver superior investment outcomes for their investors. For more information, visit https://www.chamundainvest.com/best-mutual-fund-advisor-in-mumbai.php

#best mutual fund company in mumbai#best fund management companies in mumbai#best sip plan to invest in mumbai#long term mutual fund advisor in mumbai#best systematic investment plan in mumbai#best mutual fund sip plan in mumbai#best mutual fund services in mumbai#best broker for mutual funds in mumbai#search mutual funds advisors in mumbai#best mutual fund advisor in mumbai#best mutual funds for sip in mumbai#mutual fund best sip plan in mumbai#mutual fund sip advisor in mumbai#mutual fund investment planner in mumbai#best mutual fund for sip in mumbai#best mutual fund investments in mumbai#best mutual fund to invest in mumbai#mutual funds SIP plans in mumbai

0 notes

Text

Are you looking for the best stock broker in India to invest your money? With so many options available, finding the right one can be overwhelming. But don’t worry! We’ve done the research for you and compiled a list of the top 5 stock brokers in India that are perfect for long-term investment. From low brokerage fees to user-friendly apps, these brokers offer everything you need to make smart investments. So sit back, relax and read on to find out which stock broker is right for you!

Top 5 stock brokers in India

1. Angel Broking — With over two decades of experience, Angel Broking is one of the oldest stock brokers in India. They offer a user-friendly app and website for easy trading, as well as zero brokerage charges on delivery trades. Additionally, they have a wide range of investment options including stocks, mutual funds, IPOs and more.

2. Zerodha — This discount broker offers low brokerage fees with no hidden charges, making it a popular choice among investors. Their platform is simple to use and allows for investing in multiple asset classes including equities, commodities and currencies.

3. HDFC Securities — One of the leading full-service brokers in India, HDFC Securities offers a diverse range of investment products such as equity trading across NSE/BSE exchanges and other segments like derivatives & currency futures.

4. ICICI Direct — Another top full-service broker with extensive research tools that provide valuable insights into market trends and help users make informed decisions about their investments.

5. Upstox — A relatively new entrant to the market but has quickly gained popularity due to its competitive pricing (zero brokerage fees on delivery trades) and feature-rich mobile application that provides real-time data on stock prices and market trends.

These are just some of the best stock brokers available in India for long-term investment strategies based on various factors such as pricing structure, customer service quality etc., so be sure to do your own research before choosing which one works best for you!

Angel Broking Login — Find Login Method of App & Back Office

These are just some of the best stock brokers available in India for long-term investment strategies based on various factors such as pricing structure, customer service quality etc., so be sure to do your own research before choosing which one works best for you!

To login to your Angel Broking account, you can follow these steps:

Go to the Angel Broking website: www.angelbroking.com

Click on the “LOGIN” button on the top right corner of the homepage.

Enter your “User ID” and “Password” in the fields provided.

You can select the “Remember Me” option to save your login details for future use.

After entering your login details, click on the “LOGIN” button.

If you have entered the correct login details, you will be directed to your account dashboard.

Alternatively, you can also use the Angel Broking mobile app to login to your account. You can download the app from the App Store or Google Play Store, depending on your mobile device’s operating system. Once you have downloaded and installed the app, you can use your login credentials to access your account.

Read more — https://comparebrokeronline.com

Source — https://sites.google.com/view/stocks-long-term-investment/

#best stock broker in india#angel broking login#angel broking share price#angel one share price#top 5 stock brokers in india#best stock broker app in india#best stock broker in india for long term investment#top 50 stock broking companies in india#best stock broker in india? - quora#oldest stock broker in india#account opening charges#best stock broker#no brokerage

0 notes

Text

the beginner's guide to making money by investing in stocks (hot girl version)

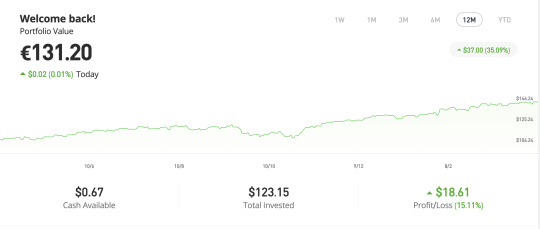

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. for some stocks, the company may also pay dividends. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

47 notes

·

View notes

Text

Advanced Tips and Tricks for Global Market Trading

Trading in the global market can be both exciting and profitable if you employ the right strategies. Whether you're dealing with Forex, commodities, or other investments, these advanced tips will set you up for success.

Master Technical Analysis: Technical analysis is crucial for predicting market movements. Learn to read charts and use indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help you identify trends and make informed trading decisions.

Choose the Best Trading Platform: Selecting the right trading platform is essential. Look for platforms that offer real-time data, analytical tools, and a user-friendly interface. Good platforms also provide educational resources and excellent customer support.

Diversify Your Investments: Diversification reduces risk. Spread your investments across different asset classes like Forex, commodities, and stocks. This approach ensures that your portfolio is protected from market volatility.

Stay Updated with Market News: Keeping up with global news, economic events, and market trends is vital. Regularly read financial news and reports. Use economic calendars to track important events that might impact your trades.

Implement Risk Management Strategies: Effective risk management is key to long-term success. Use stop-loss orders to limit potential losses and ensure no single trade can hurt your portfolio too much. This way, you can trade with confidence.

Follow Expert Insights: Industry experts and analysts provide valuable insights. Platforms like TradingView and social media channels can offer advanced strategies and techniques. Learning from these experts can enhance your trading approach.

Use Automated Trading Systems: Automated trading systems can execute trades based on pre-set criteria, helping you take advantage of market opportunities without constant monitoring. Understand the algorithms and monitor their performance regularly.

Focus on Continuous Learning: The trading world is always changing. Participate in webinars, attend workshops, and take online courses to stay updated with the latest strategies and trends. Continuous learning helps you stay ahead.

Monitor Your Performance: Regularly review your trades and performance. Keep a trading journal to track your decisions, outcomes, and lessons learned. This practice helps you improve your strategies and avoid repeating mistakes.

Partner with Reliable Brokers: Choosing a reliable broker is crucial. Look for brokers with competitive spreads, low fees, and robust security measures. A good broker provides the tools and support you need for successful trading.

Trust APM for more expert insights and trading solutions.

5 notes

·

View notes

Text

When the agreement between Saudi Arabia and Iran to resume diplomatic relations was announced on March 10, many U.S. officials and commentators welcomed it. Even though the Chinese-sponsored deal was an apparent blow to the United States’ status in the Middle East, experts speculated that normalization between the Saudis in Riyadh and the Iranians in Tehran would lead to regional de-escalation.

The well-respected Economist Intelligence Unit best summed up this view, declaring, “Greater dialogue and co-operation between Saudi Arabia and Iran rather than antagonism and active support for rival factions would remove an important destabilising dynamic from the region’s conflict zones”—though the unnamed authors acknowledged that violence remained possible. Others suggested that the agreement could provide a range of benefits beyond the conflict zones, including an end to Iran’s meddling in Bahrain, renewed Saudi investment in Iran, and even improved chances for nuclear nonproliferation.

Greater dialogue and cooperation between the Saudis and Iranians is positive, of course. Yet despite the planned exchange of ambassadors and an invitation from Saudi King Salman to Iranian President Ebrahim Raisi to visit Saudi Arabia, de-escalation has not happened. A tour around the region, from Syria to Israel’s borders to the Strait of Hormuz, indicates the opposite. It is early, of course. The Beijing-brokered agreement is only three months old. But so far, it looks like the Iranians are leveraging normalization to press their regional advantage rather than diminish tensions.

The greatest promise of the Iran-Saudi Arabia normalization is peace in Yemen. The Saudis want to end their military intervention there and have sought help from Tehran, which has become a patron of Riyadh’s antagonists, the Houthis. But so far, normalization has not had a dramatic impact on the situation on the ground.

There is a cease-fire, ships can offload aid and goods at ports that were previously blocked, and the airport in the Yemeni capital, Sana’a, is open. That is all good news, but these developments predate the Saudi-Iranian-Chinese agreement. There are peace talks, but an end to the conflict in Yemen remains elusive largely because the Houthis have been intransigent. Perhaps that will change, and perhaps it will be the result of the new dialogue between the Saudi and Iranian governments, but so far it is hard to argue that Yemen’s trajectory has improved markedly as a result of the agreement.

The situation elsewhere in the Middle East hardly seems better. Just three weeks after the Saudis and Iranians came to terms, Iranian proxies attacked U.S. forces in Syria, killing a U.S. contractor and injuring several U.S. soldiers. Iran’s agents routinely target the roughly 900 U.S. troops (and an undisclosed number of U.S. contractors) in Syria, but the resumption of ties between Saudi Arabia and Iran was supposed to have salutary effects on tensions across the Middle East.

One can debate why the United States is in Syria, but if Tehran were interested in regional de-escalation, its allies would likely hold their fire. Instead, Iran remains committed to pushing the United States out of the Middle East; and clearly, it wants to put Americans under fire to accomplish that goal.

Not long after U.S. soldiers fended off drone strikes in Syria, Esmail Qaani, the commander of Iran’s Islamic Revolutionary Guard Corps’ Quds Force, held a meeting with leaders of Hamas, Hezbollah, and Palestinian Islamic Jihad (PIJ) in Beirut. The result was coordinated rocket attacks on Israel from Lebanon, Syria, and the Gaza Strip. About a month later, in Syria’s capital, Damascus, Raisi met with Palestinian militant group leaders who reportedly expressed gratitude for Tehran’s support.

Iran’s goal seems to be an escalation of its shadow war with Israel. So far, the Israelis have had the clear advantage, routinely hitting Iranian and Iranian-aligned groups in Syria and Iraq. Until now, Iran has been unable to respond effectively on the battlefield; but Qaani evidently believes that if he can unite Iran’s proxies, he can reverse Iran’s fortunes. It may not work out that way for the Quds Force commander, however. The Israelis killed several PIJ commanders in fighting in early May as Hamas watched from the sidelines. There is no indication that this setback has caused Qaani to rethink his effort to escalate the conflict with Israel, though.

Then there are the waters of the Persian Gulf. In May, the Pentagon announced it was bolstering its “defensive posture” in the area. Why? Because the Iranians were, once again, threatening the sea lanes. After Qaani’s Beirut confab, the United States picked up information that Tehran was planning to attack commercial vessels in Middle Eastern waters.

In the span of just a week in late April and early May, Iranian forces seized two oil tankers; according to U.S. officials, Iran has harassed, attacked, or interfered with 15 internationally flagged commercial ships over the past two years. Tehran seems to be responding to U.S. sanctions enforcement, calculating that shipping—any shipping—in the Gulf is fair game. One of the tankers it took was steaming between Emirati ports in Dubai and Fujairah, even as the United Arab Emirates has normalized ties with Iran. That does not seem like de-escalation, does it?

The big story about the Iran-Saudi-China deal is not the development of a more stable, pacific Middle East in which regional actors take matters into their own hands to forge a better future. It is actually more straightforward than that: The Saudis lost, and normalization of diplomatic relations with Iran is just cover for that setback.

In a variety of ways, the Saudis seem ascendant: essentially buying the U.S. PGA Tour; pursuing policies independent of their patron, the United States; and investing everywhere from Beijing to the San Francisco Bay Area. But in the Middle East—specifically Yemen, Lebanon, Syria, and Iraq—the Saudis has been unable to dislodge the Iranians, who have either reinforced or extended their influence in all four countries in recent years. Perhaps the most dramatic manifestation of this was Saudi Arabia’s willingness to bring Syrian President Bashar al-Assad—who owes his continued rule in part to Iran—back into the Arab League’s good graces.

The Saudis may be masters of international golfing, but the Iranians have won where it counts. Now, having taken Riyadh off the table, Tehran is working to undermine what is left of the region’s anti-Iran regional coalition—a policy that includes going on the offensive against Israel and the United States.

For too long, bad assumptions have formed the basis of U.S. Middle East policy, including the notion that Iran’s leaders want to normalize ties with their neighbors. In reality, Iran does not want to share the region and is not a status quo power. The regime’s goal is to reorder the region in a way that favors Tehran, and with the Saudis now promising an ambassador and investment, the Iranians have determined they are now freer to advance their agenda. In other words, no de-escalation.

7 notes

·

View notes

Text

Squire’s Finance Limited

Squire's Finance Limited - your reliable partner in the financial markets

If you are looking for a reliable and professional partner for your investments, take a look at Squire's Finance Limited brokerage company. I would like to share my experiences of working with them and why I recommend them as your reliable partner in the financial markets.

The broker has extensive experience and expertise in the investment field. Their team consists of experienced professionals who have in-depth knowledge of the financial markets and masterful investment management. I have found their advice and guidance extremely valuable for my investment decisions.

One aspect that makes an outstanding company is their customer-centric approach. They really listen and understand the needs and goals of their clients, and then offer tailored solutions that best suit their needs. They work with clients on the basis of mutual trust and establishing long-term partnerships.

Of course, one of the most important traits of a broker is their transparency and honesty in all financial dealings. They provide clear and straightforward explanations of commissions.

3 notes

·

View notes

Text

4 Best Forex brokers 2022

Exness

Exness is rated #2 of the recommended FX brokers with an overall rating of 4.9/5. It reserves a minimum deposit of $10 and offers low trading fees across its total of 97 currency pairs and crypto. Exness can be traded on various trading desks including MT4, MT5, MT4 WebTerminal, mobile (iOS & Android, Exness Trader) and offers an affiliate program with commissions of up to $45 for every registration, depending on the country and the platform.

Exness Pros and Cons

Pros

-Regulated by both CySEC and FCA

-Client funds kept in segregated accounts

-Tight spreads

-130+ Currency Pairs with Multiple Trading Platforms

Cons

-No multi-currency accounts available

Avatrade

Ranked #1 for recommended FX brokers with an overall rating of 4.8/5. Avatrade offers a minimum deposit fee of $100 for a total of 55+ currency pairs and cryptocurrencies which is traded on various trading desks namely: MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central with low trading fees.

AvaTrade offers 4 affiliate programs:

CPA

You get a fixed payment for every client you refer to AvaTrade and this program' commission structure guarantees a consistent rate for every new investing trader.

RevShare

RevShare is a long-term affiliation where you can maintain receiving your revenue share as long as your referral keeps trading.

Dynamic CPA

This is recommended for people who bring big clients, and you get an incentive of their first-time deposit.

Master Affiliate

Get paid for your clients’ traffic and trading, as well as a fixed percentage of your sub-affiliates' performance.

Avatrade Pros and cons

Pros

-Easy and fast account activation

-Free deposit and withdrawal options

-Provides good educational tools

Cons

-outdated research tools

-There's an inactivity fee payable

-Does not adequately support mobile phones

HFM

Although it is ranked #6 FX broker with an overall rating of 4.8/5, it is a good platform with very good customer support. HFM has a minimum deposit of $5 and offers low trading fees. The platform has a total of 50+ currency pairs and cryptocurrencies but its trading desks are limited to MetaTrader4, MetaTrader5 and the HFM platform.

HF Markets Pros and Cons

Pros

- Low deposit requirement for new traders with Micro accounts

-Offers good customer support

-There's a variety of premium trader tools available

Cons

-Limited range of instruments

- Difficult account opening

-US clients not accepted

XM

Rated #68 for recommended FX Brokers with a minimum deposit of $5 and no trading fees. XM is a widely used and well-loved online brokerage which operates in 196 countries and offers trading on an enormous range of assets. You can trade more than 1,000 companies through stock contracts for difference (CFDs), commodities, forex, and cryptocurrencies.

Here is a preview of the accounts it offers and their Pros and Cons

Based on the above analysis, which broker is best suitable for you?

12 notes

·

View notes

Text

Forex Tips That Everyone Should Know About

Global Financial Solutions Asia Top service provider.Currency trading can imply a lot of different types of trades depending upon whom you ask or talk to about it. We all know that it's what and when you trade that determines your profit or loss. Take some time to train yourself and work on your trading using the tips below.

While trading forex, it is important that you stay humble and patient. If you begin to believe that you have a magical knack for picking out investments, you could end up losing a lot of money. Each investment that you make should be a well thought out investment, so that you can minimize loses.

The best way to earn profits in forex trading is to trade in the long-term. It's easy to get suckered in to short-term or day trading, but the biggest profits are seen over weeks and even months. Currency trends depend the trends of large economies, and large economies don't change quickly.

Find a broker you can trust. An unreliable broker can negate any and all gains you acquire through your trading. It is also important that your goals and level of expertise match that of your broker's offer. Look at what kind of clientele they service, and be sure their trading software is up to your needs.

A great Forex trading tip is to not worry too much about what other traders are doing. You might be comfortable with a three percent risk, taking in five percent profits every month, while another trader might be comfortable with four times the amount of risk and profit. It's best not to compete with other traders.

One important Forex fact to keep in mind is that every currency pair has its own unique behavior. While there are overall strategies every trader can apply to every market, the wise investor will be careful not to treat every pair as equal. Trade in a new pair should start out cautious until the trader is comfortable with the pair's particular idiosyncrasies.

When entering the foreign exchange market, it is best to start off with small sums. You should also have a low leverage and add to your account as it gains revenue. You can increase the size of your account if you wish, but do not continue to add money to an account that steadily loses revenue.

Do not take big risks. Try to limit your risks to two or three percent of your entire trading account. You may find that you will lose 10-15 trades consecutively and if you bank more money than a small percentage, you will find yourself out of the game before you even get started.

Keep a very detailed journal about what you have done on the market. It will help you learn your tendencies so you can better understand what your weaknesses are and how to avoid loss. You will benefit by maximizing your strengths in a more efficient manner which will in turn make you more money.

Make sure you have access to the internet at all times of the day and night so that you do not miss any opportunities. You can receive alerts on a laptop or a cell phone for instance: this way you will know when you have to buy or sell and react quickly.

Try your best to keep your emotions out of the FOREX trading market in order to make clear, level-headed decisions. Many trading mistakes have been made because traders take market swings personally. By keeping your feelings in check, you can develop self-discipline, which you will find is essential in making logical, well-reasoned trading moves.

Start your forex trading by learning the fundamentals. Many people jump right in, excited to make a quick buck. The forex market does not care if you have a college education, but you must educate yourself well about trading forex if you want to compete with top traders and increase your chances of success.

Everything you need to get started with forex is presented in NFA's Forex Online Learning Program. This program is free and allows you to learn at your own rhythm. You should go over the program once and go back to the material later if you need clarification on one point.

Global Financial Solutions Asia Proficient tips provider.You should always look for the new thing on forex markets. Because it is entirely online, forex changes quickly, and new methods or technologies appear constantly. You should stay up to date, perhaps by signing up for a newsletter. Do not buy any new product before you are sure you actually need it.

Don't approach the forex market as if you were walking into a casino. Don't make trades just to see what happens or just to take a chance on a hunch. Long shots generally don't pay off, and trading without a measured plan of action is a recipe for losing money.

Do the type of forex trading that you currently understand. This seems like a simple principle, but many new traders get caught up in the excitement of the market and trade outside of their expertise level. Spend time learning how to trade correctly, practice in a demo account and build your confidence before putting money in the market.

Another good idea when using Forex is to invest according to your personality style. Some people are patient enough to sit for hours and wait for a price to fluctuate. Whereas others will be frustrated at mere minutes. Choose the one that fits your personality best.

You can make money with short term and long term forex trading. Short term trading is attractive because you get money right away. You should set some money aside and experiment in long term forex trading as well. You may be surprised at the results when you give it a try.

Global Financial Solutions Asia Top service provider.Currency trading involves various types of trading strategies, but no matter who you are, you can always refine your strategy. Study and improve upon your own techniques to learn to trade on par with trading experts. With any luck, this list of tips gave you advice on how to do that.

2 notes

·

View notes

Text

youtube

Business Name: Marcelle And Company Real Estate

Street Address: 2513 W Straford Dr.

City: Chandler

State: Arizona (AZ)

Zip Code: 85224

Country: United States

Business Phone: (480) 207-0648

Business Email: [email protected]

Website: https://marcelleandcompany.com/

Facebook: https://www.facebook.com/marcelleandcompany/

Twitter: https://twitter.com/MarcelleRealtor

Youtube: https://www.youtube.com/channel/UCiCeLIUICyKgh0RGxm1JOXg

Google Website: https://marcelle-and-company-real-estate-mesa-az.business.site/

Instagram: https://www.instagram.com/marcellerealtor

LinkedIn: https://www.linkedin.com/in/marcelleandcompany/

Pinterest: https://www.pinterest.com/marcelle8307/

Tumblr: https://marcelleandcompany.tumblr.com/

Yelp: https://www.yelp.com/biz/marcelle-and-company-real-estate-mesa-2

DNB: https://www.dnb.com/business-directory/company-profiles.marcelle_and_company_real_estate.4f0a348c14db1aa3401661f26ff79822.html

Business Description: Chandler's Best Realtor, Marcelle & Company Real Estate Agent can help you sell your home, buy a new one, investment properties, and vacation rentals.

Google My Business CID URL: https://www.google.com/maps?cid=5212259554729018336

Business Hours: Sunday Closed Monday 9:00 AM - 6:00 PM Tuesday 9:00 AM - 6:00 PM Wednesday 9:00 AM - 6:00 PM Thursday 9:00 AM - 6:00 PM Friday 9:00 AM - 6:00 PM Saturday 9:00 AM - 6:00 PM

Payment Methods: Cash, Cashiers Check, Financing

Services: Real Estate Agent, Residential Real Estate Agent, Homes For Sale, Real Estate & Brokers, Real Estate Agency

Keywords: real estate, selling, buying, investing, flipping, short term rentals, long term rentals, realtor, realtors

Business/Company Establishment Year: 2015

Number of Employees: 2

Location:

Service Areas:

2 notes

·

View notes

Text

Professional Mortgage Lenders in Texas

Securing a loan through a traditional bank or large financial institution can be a hassle. It often involves administrative red tape and rigorous scrutiny. Working with the best mortgage lenders in Texas is a common substitute preferred by many people.

Traditional loans are typically based on your credit score and better financial history. However, the best Texas mortgage lenders offer loans secured by collateral. They require you to have a property that was valued higher than the amount you need to borrow. However, a best mortgage loan can be more advantageous to both parties in many situations. The mortgage broker in Texas helps the borrower get the money they need faster and with less hassle. And the mortgage lenders can make money on interest without assuming much risk. Here are some benefits of working with the best mortgage lenders in Texas.

Flexibility

Banks are known for their stringent lending guidelines and restrictions. Securing a loan that meets your specific needs can be challenging when working with a bank. They usually offer lending products that follow strict criteria. On the other hand, the best Texas mortgage lenders in Texas can customize a loan that works with your budget and timeframe. Traditional banks or financial institutions might prefer longer-term loans to assume less risk. However, mortgage lenders are okay with shorter-term loans based on your needs. Whatever investment you require, the flexibility of working with mortgage lenders ensures you’re not getting a one-size-fits-all deal.

Speed

There is no surprise that the loan approval process for banks takes a lot of time. You could occasionally have to wait 60 days or longer to see your money. This might not be a quick and wise option if you wish to secure an investment or make a deal. Mortgage brokers in Texas work quickly and help you get the loan as quickly as possible. If you have previous investing experience and can highlight the successful deals you’ve purchased in the past, that will also add credibility in the eyes of mortgage lenders. They have an advantage over banks because they don't have to go through the time-consuming procedures that banks do when lending money.

Fewer Requirements

Mortgage lenders have a positive approach towards financing. They carefully review your condition to determine whether you are a good candidate for a loan, whereas banks are required to tick off a set of boxes to satisfy company standards. You have experience in your type of investment as long as the deal is reasonable. Discussing things with a mortgage broker in Texas resulted in a better solution. They can simplify the lending process. This contrasts sharply with banks. They meticulously review your entire financial history before approving a loan.

Likely To Be Approved

If you’ve ever taken out a loan with a bank, you know that their approval process is too long. Even with excellent credit and a spotless financial history, you should be waiting for their answer. Sometimes the response may not be favorable because of a little, unforeseen element. If you wish to bypass the hassle of dealing with a major financial institution then consider using a mortgage broker in Texas. They can help you get the funds as quickly and easily as possible.

Aliton Finance Texas focuses on helping people through one of the most important investment decisions of their lifetime. They provide fast, honest, and professional mortgage consultation services for deserving clients. Call them today at +1 (972) 998 8522 to know more about their service.

0 notes

Text

Which is the best mutual fund company in Mumbai?

As a seasoned finance content writer with over 20 years of experience, I understand the importance of finding the right mutual fund company in Mumbai to help you achieve your financial goals. Whether you're saving for retirement, planning for your child's education, or looking to grow your wealth, the choice of a mutual fund company can make all the difference.

In the bustling city of Mumbai, home to a thriving financial ecosystem, navigating the world of mutual funds can be a daunting task. With numerous options available, it's crucial to identify the best mutual fund company that aligns with your investment objectives and risk appetite.

Identifying the Top Mutual Fund Companies in Mumbai

When it comes to the best mutual fund companies in Mumbai, a few names stand out. Our company is a leading financial services provider in the city, has consistently delivered exceptional performance and customer service. We have a team of experienced professionals offering a diverse range of investment products and services, we have earned a reputation as one of the top fund management companies in Mumbai.

Another prominent player in the Mumbai mutual fund market is Shree Investments. Known for its innovative investment strategies and a commitment to client satisfaction, Shree Investments has garnered a loyal following among investors in the city.

Factors to Consider When Choosing a Mutual Fund Company

When selecting a mutual fund company in Mumbai, there are several key factors to consider:

Investment Expertise: Look for a company with a proven track record of successful investments and a team of knowledgeable professionals who can guide you through the complexities of the market.

Fund Performance: Examine the historical performance of the mutual fund company's offerings, ensuring that they have consistently delivered competitive returns.

Diversification: You need to analyze the offerings of the company, ensuring that it offers a diverse range of funds to help you cater to your specific needs.

Fees and Expenses: Understand the fees and expenses associated with the mutual fund company's offerings, as these can significantly impact your overall returns.

Customer Service: Evaluate the company's responsiveness and the quality of its customer support, as this can be crucial in navigating the investment journey.

Why Choose Us Invest as Your Mutual Fund Partner in Mumbai?

Our company stands out as one of the best fund management companies in Mumbai for several reasons. With a team of seasoned investment professionals and a commitment to delivering exceptional results, we have consistently outperformed its peers in the Mumbai market.

Moreover, we offer a diverse range of mutual fund options, catering to the unique needs of investors in Mumbai. From conservative income-generating funds to growth-oriented equity funds, we have a solution for every investment goal.

Ultimately, when it comes to finding the best mutual fund company in Mumbai, we emerge as a clear frontrunner, offering a combination of expertise, performance, and personalized service that is unparalleled in the industry.

#best mutual fund company in mumbai#best fund management companies in mumbai#best sip plan to invest in mumbai#long term mutual funds services in mumbai#systematic investment plan in mumbai#best mutual fund sip plan in mumbai#mutual funds services in mumbai#best broker for mutual funds in mumbai#search mutual funds advisors in mumbai#best mutual fund advisor in mumbai#best mutual funds for sip in mumbai#mutual fund best sip plan in mumbai

0 notes

Text

How to Choose the Best Property Management Service in Hawaii

Owning property in Hawaii, whether it’s a vacation rental or a long-term investment, can be an incredibly rewarding experience. However, managing that property, especially from a distance, can be time-consuming and challenging. This is where hiring a professional property management Hawaii service can be a game-changer. A reliable property management company can handle everything from tenant screening to maintenance, marketing, and legal compliance, ensuring your investment is well taken care of.

Choosing the right property management service, however, requires careful consideration. With so many options available, it’s essential to know what to look for and how to evaluate potential partners. In this article, we’ll guide you through the key factors to consider when selecting the best property management service in Hawaii.

1. Understand Your Needs

Before you begin your search, it’s important to clearly define what you need from a property management company. Different services cater to different property types and ownership goals. Are you looking for someone to manage a vacation rental property on Maui, or do you need help with a long-term rental on Oahu? Do you want a hands-off approach where the property manager handles everything, or are there specific tasks you prefer to manage yourself?

Understanding your specific needs will help narrow your search to property management companies that specialize in your type of property and service level. Vacation rental management, for example, requires expertise in guest relations, marketing, and maintaining high turnover rates, while long-term rental management focuses more on tenant retention, legal compliance, and maintenance.

2. Research Local Experience

Hawaii’s real estate market is unique in many ways, from its geographic location to its local laws and culture. A property management service with local expertise will have a better understanding of these nuances, which can be invaluable in ensuring your property is well-managed.

When evaluating property management companies, look for those with extensive experience in Hawaii. They should be familiar with local regulations, zoning laws, and the specific requirements for operating short-term vacation rentals versus long-term leases. Additionally, their knowledge of the local market can help optimize rental rates and marketing strategies, ensuring your property remains competitive and profitable.

3. Verify Licensing and Certifications

In Hawaii, property management companies must be licensed real estate brokers. This ensures that the company follows state regulations and maintains a level of professionalism. When researching potential companies, ask for proof of their real estate license and verify it with the Hawaii Department of Commerce and Consumer Affairs.

Additionally, look for property management companies that are members of professional organizations such as the National Association of Residential Property Managers (NARPM) or the Institute of Real Estate Management (IREM). Membership in these organizations indicates a commitment to industry best practices and ongoing education.

4. Evaluate Their Services

Not all property management companies offer the same range of services, so it’s important to ask what specific tasks they handle. A comprehensive property management service in Hawaii should include the following:

Marketing: They should effectively market your property across multiple platforms to attract the right tenants or guests. For vacation rentals, this includes listing on popular booking sites like Airbnb and VRBO.

Tenant Screening: For long-term rentals, thorough tenant screening is essential to ensure responsible tenants who will care for your property and pay rent on time.

Rent Collection: A good property management company should handle all aspects of rent collection and ensure that funds are transferred to you efficiently.

Maintenance and Repairs: They should coordinate all necessary repairs and maintenance, either in-house or through a network of trusted local vendors.

Financial Reporting: Regular financial reports are crucial for keeping track of income and expenses related to your property.

Legal Compliance: The company should ensure that your property complies with all local and state regulations, including taxes, permits, and lease agreements.

Make sure the company offers the specific services you need and that they can customize their services to meet your property’s unique requirements.

5. Read Reviews and Ask for References

One of the best ways to gauge the effectiveness of a property management company is to read online reviews and ask for references. Platforms like Google, Yelp, and property management-specific sites can provide insights into the company’s reputation, customer service, and overall performance.

In addition, ask the company for references from other property owners they work with in Hawaii. Contact these references to ask about their experience with the company, including communication, responsiveness, and the overall condition of their property under the company’s management.

6. Evaluate Their Communication Style

Effective communication is key to a successful relationship with your property management company. You want a company that is responsive, transparent, and proactive in keeping you informed about your property’s status. During your initial meetings, pay attention to how the company communicates with you. Are they quick to respond to your inquiries? Do they provide clear and detailed answers to your questions?

Make sure they have a system in place for regular updates on your property, such as monthly reports, and that they can be easily reached in case of emergencies.

7. Compare Fees and Contracts

Property management fees can vary widely, so it’s important to understand the fee structure of any company you’re considering. Most companies charge a percentage of the monthly rental income, which can range from 8% to 12% for long-term rentals and 20% to 30% for vacation rentals. Be sure to ask about any additional fees, such as maintenance markups, leasing fees, or advertising costs.

Also, carefully review the contract terms before signing. Look for clauses related to contract length, termination policies, and fee structures. Make sure you’re comfortable with the terms and that they align with your expectations.

Conclusion

Choosing the best property management Hawaii service is a critical decision that can significantly impact the success of your rental property. By carefully evaluating your needs, researching local companies, and asking the right questions, you can find a property management company that will provide excellent service and help maximize your property’s value. For more information about property management services in Hawaii, visit Happy Vacations Hawaii, where you can find expert solutions to meet your property management needs.

0 notes

Text

Stock analysis websites

TradingView - With this charting and stock analysis platform, users can access opportunities across both domestic and international stock markets. A large user base of more than 60 million traders and investors reveals the strength of TradingView website. A wide variety of advanced tools are available such as supercharts, Pine Script, forex screener, crypto coins screener, stock screener, stock heatmap, economic calendar and earnings calendar. Users also benefit from the strong social network setup available with TradingView. It allows users to connect with other investors and share their ideas and opinions.

GoCharting - This is a good option for folks looking for advanced technical analysis of various stocks. Users can access more than 300 technical analysis studies and over 150 premium indicators. The package includes market profile, orderflow charts and volume profile tools. GoCharting is also known for its advanced options trading platform. You can create your own strategies or choose from readymade options available on GoCharting. The platform also provides users the flexibility to choose their favorite broker. Users can access a wide range of profiling tools and analytical tools to improve their trading skills.

StockEdge - Users can get a comprehensive 360° view of the stock markets by accessing indices, trending stocks, sectors, new and upcoming deals and the latest news and updates. Moreover, StockEdge offers a wide variety of analytical tools and resources such as chart patterns, trading strategies, investment ideas, market breadth, sector analytics and company filings. A wide variety of stock screening options are also available such as price scans, technical scans, fundamental scans, candlestick scans, etc. These help users to choose the most appropriate stocks that suit their investment goals.

Invest Yadnya - This platform focuses on improving financial literacy in India. To achieve that goal, Invest Yadnya offers a wide variety of financial advisory and financial planning services to investors. One of the key products is Stock-O-Meter Plus that provides detailed analysis of various companies. The long-term prospects of stocks are also analyzed in detail and made available to users. Stock analysis is done using various parameters such as financial results, industry growth prospects, market valuation, enterprise details and governance structure.

MarketSmith India - Users can improve their stock analysis skills with advanced tools such as chart pattern recognition and peer comparisons to shortlist the best stocks. MarketSmith India is backed by more than 10 years of fundamental data and analysis. The platform provides unbiased ratings and rankings of stocks. Users can analyze the best performing industry segments and benefit from a wide variety of stock screens. Users also have the option to create their own personalized screens. Advanced research tools are available such as stock ideas, in-depth stock evaluation, model portfolio and market outlook.

source : newspatrolling.com

Stock analysis websites

0 notes

Text

How First Choice Business Brokers - Omaha Helps Buyers Avoid Common Pitfalls

Purchasing a business is a significant step, requiring careful planning, due diligence, and strategic guidance to make the right investment. In Omaha, a thriving market offers many businesses for sale, attracting both first-time buyers and experienced investors. However, navigating this process alone can be challenging, with potential pitfalls that could turn a promising venture into an unexpected burden. That’s where First Choice Business Brokers - Omaha comes in, providing expert guidance to help buyers avoid common pitfalls and make informed, successful purchases.

Understanding the Omaha Market

Omaha's diverse economy, marked by growth in technology, healthcare, manufacturing, and hospitality, makes it a fertile ground for entrepreneurs. The opportunities are plentiful, with an array of businesses for sale across various industries. This diversity also means that each business comes with unique advantages, risks, and market dynamics. First Choice Business Brokers - Omaha specializes in assessing these elements, ensuring buyers understand the industry landscape and competitive positioning of each potential acquisition.

The Benefits of Working with Business Brokers in Omaha

Business brokers, like the team at First Choice Business Brokers - Omaha, play an essential role in ensuring buyers make informed decisions. While it may be tempting to navigate the purchase process independently, having a broker can save both time and money while minimizing risk. Here are some key benefits of working with business brokers in Omaha:

Market Insight and Access to Listings First Choice Business Brokers - Omaha provides exclusive access to a broad network of businesses for sale in Omaha. They offer insight into both publicly listed and confidentially marketed businesses, giving buyers a comprehensive view of the available options. With their market expertise, buyers can focus on opportunities best aligned with their financial goals and experience.

Due Diligence and Financial Analysis One of the biggest challenges in buying a business is conducting due diligence and assessing financial health. Brokers at First Choice Business Brokers - Omaha are skilled in analyzing a company’s books, understanding cash flow, and identifying any red flags that could impact long-term profitability. This thorough analysis helps buyers avoid the pitfalls of overpaying or investing in businesses with hidden financial issues.

Navigating Legal and Financial Complexities Acquiring a business involves several legal and financial processes, from contract negotiations to financing and regulatory compliance. Experienced business brokers like those at First Choice Business Brokers - Omaha guide buyers through these complexities. By handling negotiations, legal documentation, and financial requirements, they help ensure a smooth transaction and prevent costly mistakes.

Objective Evaluation and Avoidance of Emotional Decisions It’s easy for buyers to become emotionally invested in a business, especially if it aligns with their passions or vision. However, emotions can cloud judgment. First Choice Business Brokers - Omaha offers objective evaluations, helping buyers weigh the pros and cons of each option and avoid decisions driven by excitement rather than practical considerations. They work to ensure that buyers make investments based on facts and business viability.

Valuation Expertise Correctly valuing a business is crucial to avoid overpayment. Business brokers in Omaha use industry-standard valuation methods to assess the fair market value of businesses for sale. First Choice Business Brokers - Omaha has a deep understanding of local market trends and industry benchmarks, ensuring buyers pay a fair price for their acquisitions. This service helps buyers maximize their return on investment and avoid unnecessary financial strain.

Avoiding Common Pitfalls in Business Purchases

Even with ample resources available, common pitfalls can complicate the process of buying a business. Here’s how First Choice Business Brokers - Omaha helps buyers steer clear of these issues:

Pitfall 1: Overlooking Hidden Liabilities Hidden liabilities like pending lawsuits, undisclosed debts, or customer complaints can threaten a business's success. First Choice Business Brokers - Omaha conducts thorough checks to uncover any potential liabilities, ensuring buyers are fully aware of the business’s standing.

Pitfall 2: Rushing the Due Diligence Process Buyers are sometimes eager to close a deal quickly, but rushing through due diligence can lead to costly oversights. With First Choice Business Brokers - Omaha, buyers benefit from a structured, comprehensive due diligence process that leaves no stone unturned. From analyzing supplier contracts to reviewing employment agreements, they ensure every detail is examined.

Pitfall 3: Misjudging Cash Flow Needs Cash flow is a critical component of business success. Inadequate working capital can disrupt operations, especially for new owners who may need time to adapt to the business. The experienced brokers at First Choice Business Brokers - Omaha assess cash flow requirements, helping buyers plan for smooth operations from day one.

Pitfall 4: Ignoring Cultural Fit and Transition Plans A business’s culture is often as important as its financials, affecting both employee morale and customer loyalty. First Choice Business Brokers - Omaha considers cultural factors and helps buyers develop effective transition plans to retain key employees and maintain client relationships. This insight enables a smoother handover and strengthens the new owner’s position from the start.

The First Choice Business Brokers - Omaha Advantage

Choosing First Choice Business Brokers - Omaha provides buyers with more than just brokerage services. Their team combines experience with a personalized approach, giving clients access to tailored advice and comprehensive support throughout the buying journey. The goal is not only to facilitate the sale but to build a long-term relationship based on trust and client satisfaction.

The Omaha market offers a wide range of opportunities, but purchasing a business is a significant commitment that demands due diligence, expertise, and careful planning. With First Choice Business Brokers - Omaha as a trusted partner, buyers can navigate the complexities of the acquisition process with confidence, ensuring a well-informed purchase that aligns with their business goals.

By avoiding common pitfalls and leveraging the knowledge and connections of experienced brokers, buyers stand a better chance of achieving success with their new ventures.

First Choice Business Brokers - Omaha 1901 Howard Street Suite 234 Omaha, Nebraska - 68102 (402) 230-7003 https://omaha.fcbb.com/ https://maps.app.goo.gl/BsKt27R4FqxxXdBz6

1 note

·

View note