#Best Individual Health insurance in Louisiana

Explore tagged Tumblr posts

Text

Best Individual Health insurance in Louisiana

Health insurance is a crucial aspect of safeguarding one's well-being, providing financial protection against unforeseen medical expenses. In the state of Louisiana, individuals have a range of options when it comes to choosing the best individual health insurance plan. Understanding the unique healthcare landscape in Louisiana and the various plans available is essential for making an informed decision. In this article, we will explore the factors to consider when selecting individual health insurance, highlight some of the top providers in the state, and discuss key features that make them stand out.

Louisiana, like many other states, offers a diverse array of individual health insurance plans, each with its own set of features and coverage options. When looking for the best plan, it's important to consider factors such as coverage, affordability, network size, and additional perks.

Blue Cross and Blue Shield of Louisiana:

One of the most prominent health insurance providers in the state, Blue Cross and Blue Shield of Louisiana offers a comprehensive range of individual health plans. Their plans often include coverage for essential health benefits, preventive services, and access to a vast network of healthcare providers. It's crucial for individuals to assess their specific healthcare needs to determine the most suitable plan from Blue Cross and Blue Shield.

Vantage Health Plan:

Vantage Health Plan is another notable player in the Louisiana health insurance market. Known for its commitment to customer satisfaction, Vantage Health Plan provides a variety of individual plans with different coverage levels. Prospective policyholders should carefully review the details of each plan, considering factors like prescription drug coverage, copayments, and deductibles.

Louisiana Healthcare Connections:

For those seeking Medicaid managed care plans, Louisiana Healthcare Connections offers options tailored to individual needs. These plans often come with additional benefits beyond basic healthcare coverage, such as wellness programs and care coordination services. Individuals with Medicaid eligibility should explore the offerings of Louisiana Healthcare Connections.

Humana:

Humana is a national health insurance provider with a presence in Louisiana, offering a range of individual health plans. Their plans often come with tools and resources to help individuals manage their health effectively. Prospective policyholders may appreciate the emphasis on preventive care and the availability of digital health services.

UnitedHealthcare:

UnitedHealthcare is another major player that provides individual health insurance options in Louisiana. Their plans may include innovative features like virtual care, allowing policyholders to consult with healthcare professionals from the comfort of their homes. Evaluating the technology and digital services offered can be a key consideration for tech-savvy individuals.

In conclusion, choosing the best individual health insurance in Louisiana requires careful consideration of personal healthcare needs, budget constraints, and preferences. Blue Cross and Blue Shield of Louisiana, Vantage Health Plan, Louisiana Healthcare Connections, Humana, and UnitedHealthcare are just a few of the providers offering diverse options in the state. Prospective policyholders should thoroughly review plan details, compare coverage options, and take advantage of available resources, such as online tools and customer support, to make an informed decision. Ultimately, securing the right individual health insurance plan ensures peace of mind and financial protection in the face of medical uncertainties.

1 note

·

View note

Text

A few people responded to this post wanting to know more. I tried to make a follow-up post twice on mobile and Tumblr deleted my in-progress post both times, so I’m trying again on desktop.

I’m currently writing a paper on the history of de-institutionalization in the United States, so I’ve been learning a lot about mental hospitals in the US lately. That got me thinking about the references in Interview with the Vampire to Paul de Pointe du Lac’s institutionalization. Here’s what we know, via Louis:

I was curious to learn if there really was a mental hospital in Jackson, Louisiana in the early 1900s, so I did some digging and discovered that there was. Not only that, but it’s still operating today and is one of only two mental hospitals in the state of Louisiana. It has been renamed East Louisiana State Mental Hospital, but at the time that Paul would have been there, it was called East Louisiana State Hospital for the Insane.

Before I share any photos or talk further, I want to reiterate: this is a real hospital that has served and continues to serve people with severe mental illnesses. It also has a disturbing history of neglect and abuse that continues today. You’ll see in some of the photos that I share that even in modern times, much of the hospital looks outdated and run down. A news article from 2019 referred to the facility as “deteriorating.” I don’t want to talk about this facility in a fictional context without recognizing that real people have been impacted by it. If learning this information piques your interest in any way, I recommend taking time to look into the history of how people with mental illnesses have been treated and continue to be treated in the United States (or in your own country, if you aren’t from the US). Also, obligatory caveat that I am by no means a historian, but I’ve done my best to compile accurate information.

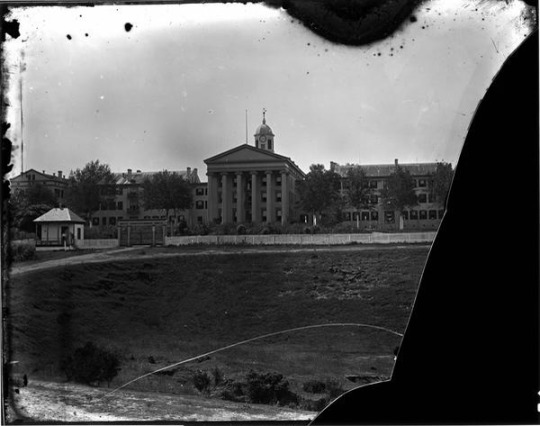

The Louisiana State Mental Hospital was established in the 1840s, when many similar institutions were being built in the US. It was requested that the building “not look like a prison,” so it was built in a Greek Revival style. Here’s an early picture of the hospital:

Here is a more current photo:

And here is a photo from around the time Paul would have been there (this photo is dated between 1900 and 1909, and we can assume from the timeline established by Louis that Paul was probably removed from the hospital around 1905 or 1906, following their father’s death five years prior to the beginning of the narrative in 1910):

Here are a couple more exterior shots from around the same time period, and an interior (?) shot from a women’s ward. I couldn’t find a photo of a men’s ward, unfortunately:

Here are some photos taken more recently. The first two appear to be older areas that don’t seem to be used much anymore, and the last appears to be from a more commonly used area (although you can see it’s still fairly dated):

I couldn’t find any photos of the hallways leading to individual rooms that didn’t feature people in them. Since I’m not clear on who those people were (whether or not they were consumers), I’m not comfortable posting them here. However you can find them if you go looking.

Finally, here is a fire insurance map of the facility, made in 1908, near the time Paul would have been there. As you can see, if you are able to zoom in, the hospital was segregated at the time, so you will find the ward where Paul would likely have stayed in the lower left-hand corner of the map.

I’m not sure who, if anyone, this information will be useful for, but I hope it provides some insight and historical context to the show (and to mental health treatment in the United States).

#interview with the vampire#iwtv#interview with the vampire meta#iwtv meta#ableism cw#abuse cw#neglect cw#racism cw

107 notes

·

View notes

Text

NaCl in Louisiana?? What does this even mean?

How are Southeast Louisiana homeowners, businesses, and communities affected by the Mississippi River Saltwater Intrusion?

Residents of Southeast Louisiana will face hardship as a result of the saltwater contamination. The Mississippi River today provides sustainable drinking water for thousands of people, but future salt water contamination will render the water unfit to drink. Residents who are uninformed of the hazards of salt water may believe that boiling the water will remove the salt, but science suggests that this is not the best course of action. Business owners, particularly those in the fast food industry, will be affected. Water is utilized for cooking and cleaning, however due to the high salt concentration, companies may be forced to close temporarily. The high salt water percentage in the Mississippi River also poses a significant risk to homeowners. The saline water has the ability to corrode the pipelines in the water system. Salt water can hasten pipe corrosion in water distribution systems. Saltwater intrusion, according to health officials, could erode lead and galvanized steel pipes, potentially leaking heavy metals into drinking water, depending on how long the situation lasts. As a result of the repair damage, many homeowners' insurance premiums will rise.

Do you believe the saltwater intrusion is currently being handled appropriately?

Emergency management officials have been collaborating for weeks and moving with deliberate speed on various plans to dilute the salt in water systems, including the construction of costly pipelines, rushing in fresh water from further upriver, implementing saltwater extraction equipment, and augmenting the underwater dams. In response to salt water contamination, Jefferson Parish leaders plan to construct four temporary water lines on the West Bank and five on the East Bank.

Why do you think some people are hesitant to trust authorities about the saltwater intrusion issue?

Because of the absence of security, I believe people are afraid to trust officials with the salt water poisoning. Officials are merely warning people about the hazards of the salt water crisis while giving few resources or plans for managing it. In response to environmental concerns, individuals flood grocery stores in search of water, believing they will go without. Lack of security stems from the Flint, Michigan water catastrophe; some residents are still without safe drinking water. The lack of help provided to inhabitants of Flint, Michigan does not set a good example for other U.S citizens.

References

Brand, E. (2023, October 5). Metro area businesses prepare for saltwater intrusion challenges. WDSU. Retrieved October 30, 2023, from https://www.wdsu.com/article/metro-area-businesses-prepare-for-saltwater-intrusion-challenges/45311947

Hudson, B. (2023, February 15). 'Flint is not fixed': Activists demand change years after water crisis started. FOX 2 Detroit. Retrieved October 30, 2023, from https://www.fox2detroit.com/news/flint-is-not-fixed-activists-demand-change-years-after-water-crisis

2 notes

·

View notes

Text

Finding the Best Insurance Agents in Lafayette, LA

Lafayette, Louisiana, often referred to as the “Hub City,” is known for its vibrant culture and deep-rooted traditions. However, when it comes to securing your financial future, navigating the world of insurance can be daunting. Whether you’re looking for home, auto, health, or life insurance, having the right agent by your side can make all the difference. Insurance agents in Lafayette play a crucial role in helping individuals and businesses protect what matters most.

Understanding the Role of Insurance Agents

The best insurance agents in Lafayette, LA, are more than just intermediaries between you and an insurance policy. They act as trusted advisors, ensuring you have the right coverage tailored to your unique needs. These professionals possess in-depth knowledge of the insurance market and can guide you through the complexities of policies, premiums, and claims. With their expertise, you can make informed decisions and avoid common pitfalls in the insurance process.

Lafayette’s diverse population and industries mean that insurance needs vary widely. For instance, a small business owner might need a comprehensive commercial insurance policy, while a homeowner could be looking for flood insurance given the region’s susceptibility to hurricanes. The best insurance agents in Lafayette, LA, are adept at understanding these specific requirements and recommending the most suitable options.

Key Qualities of Top Insurance Agents

When searching for an insurance agent, it’s essential to look for certain qualities that set the best apart from the rest. Experience and expertise are non-negotiable. Agents with a proven track record in Lafayette are likely to have a better understanding of local challenges and opportunities.

Another critical quality is communication. The insurance process involves a lot of jargon and technical terms that can overwhelm clients. A good agent simplifies these concepts, ensuring you understand every aspect of your policy. Additionally, accessibility is vital; the best agents are readily available to address your concerns and provide timely assistance when needed.

Honesty and transparency are also crucial. Reliable agents will provide unbiased advice, even if it means recommending a lower-cost option that better suits your needs. They will ensure that you are fully aware of the terms and conditions of your policy, helping you avoid unpleasant surprises down the road.

Types of Insurance Coverage in Lafayette

Insurance agents in Lafayette offer a wide range of coverage options to cater to the diverse needs of the community. Homeowners insurance is a popular choice, especially in areas prone to natural disasters. Auto insurance is another essential, given the city’s bustling roads and traffic.

Health insurance remains a critical area of focus for many residents, particularly with changing healthcare regulations. Similarly, life insurance is an essential tool for securing your family’s financial future. Commercial insurance options are also abundant, helping business owners mitigate risks and protect their assets.

Regardless of the type of insurance you’re seeking, having a knowledgeable agent is invaluable. They can identify potential gaps in your coverage and provide tailored solutions to address them.

Why Local Expertise Matters

The importance of local expertise cannot be overstated when choosing an insurance agent. Lafayette’s unique geography and climate present specific challenges that require a deep understanding of the area. Agents familiar with the local landscape are better equipped to recommend appropriate policies, such as flood insurance for properties in low-lying areas.

Moreover, local agents often have established relationships with insurance providers, which can be advantageous when negotiating premiums or filing claims. Their connections and understanding of the community make them an indispensable resource for residents and businesses alike.

Building a Strong Relationship with Your Agent

Working with the best insurance agents in Lafayette, LA, is a collaborative process. To get the most out of this relationship, it’s essential to communicate openly and provide accurate information about your needs and circumstances. Regular check-ins with your agent can also ensure that your coverage remains up-to-date as your life or business evolves.

Trust is the foundation of any successful relationship, and it’s no different when it comes to insurance. Choosing an agent who prioritizes your best interests and offers honest advice will give you peace of mind, knowing that you’re well-protected against life’s uncertainties.

0 notes

Text

Health Insurance Plans for Individuals Louisiana

Health Insurance Plans for Individuals in Louisiana: A Comprehensive Guide

Introduction

Navigating the world of health insurance can be overwhelming, especially for individuals who are not covered by an employer-sponsored plan. In Louisiana, like in many other states, having health insurance is crucial for accessing affordable healthcare and safeguarding against unexpected medical expenses. Whether you are self-employed, between jobs, or simply exploring options outside of employer-sponsored coverage, understanding the available health insurance plans for individuals in Louisiana is essential. This guide will provide an overview of the types of health insurance plans available, key considerations when choosing a plan, and tips for finding the best coverage for your needs.

Understanding Health Insurance Options in Louisiana

In Louisiana, individuals can access health insurance through various sources, including the federal marketplace, private insurance companies, and government programs. Each of these options comes with its own set of benefits, costs, and coverage levels, making it important to evaluate them carefully.

1. Health Insurance Marketplace

The Health Insurance Marketplace, established under the Affordable Care Act (ACA), offers a range of health insurance plans to individuals and families. These plans are categorized into four metal tiers: Bronze, Silver, Gold, and Platinum, each representing a different level of coverage and cost-sharing. Here’s a brief overview:

Bronze Plans: These plans have the lowest monthly premiums but the highest out-of-pocket costs when you need care. They are best suited for individuals who are generally healthy and do not anticipate needing much medical care.

Silver Plans: Offering a balance between premium costs and out-of-pocket expenses, Silver plans are popular among those who qualify for cost-sharing reductions, which further lower deductibles and copayments for eligible enrollees.

Gold Plans: With higher monthly premiums but lower out-of-pocket costs, Gold plans are ideal for individuals who expect to use medical services more frequently.

Platinum Plans: These plans have the highest premiums but offer the lowest out-of-pocket costs, making them suitable for those with significant healthcare needs.

2. Medicaid

Medicaid is a state and federally funded program that provides free or low-cost health coverage to eligible low-income individuals and families. In Louisiana, Medicaid expansion under the ACA has broadened eligibility, allowing more adults to qualify based on income alone. For those who meet the criteria, Medicaid offers comprehensive coverage, including doctor visits, hospital care, prescription drugs, and preventive services at little to no cost.

3. Private Insurance Companies

Individuals can also purchase health insurance directly from private insurance companies in Louisiana. These plans can offer more flexibility and a wider range of options, but they may come at a higher cost compared to marketplace plans, especially if you do not qualify for subsidies. Private insurance can be a good option for those seeking specific network providers or additional coverage options not available through the marketplace.

4. Short-Term Health Insurance

Short-term health insurance plans are designed to provide temporary coverage during transitional periods, such as between jobs or after aging out of a parent's plan. These plans typically offer limited benefits and do not cover pre-existing conditions, making them a less comprehensive option. However, they can be useful for individuals who need a stopgap measure while seeking more permanent coverage.

Key Considerations When Choosing a Health Insurance Plan

When selecting a health insurance plan, it’s important to consider several factors that can impact your overall healthcare experience and financial situation. Here are some key considerations:

1. Coverage Needs

Evaluate your healthcare needs, including any ongoing medical conditions, prescription medications, and anticipated healthcare services. Choose a plan that offers adequate coverage for these needs without excessive out-of-pocket costs.

2. Costs

Consider the total cost of the plan, including monthly premiums, deductibles, copayments, and coinsurance. While lower premiums may seem attractive, they often come with higher deductibles and out-of-pocket costs, which can add up if you need frequent medical care.

3. Provider Networks

Check whether your preferred doctors, hospitals, and specialists are in the plan’s network. Out-of-network care can be significantly more expensive and may not be covered at all under some plans.

4. Prescription Drug Coverage

If you take prescription medications regularly, review the plan’s formulary (list of covered drugs) to ensure your medications are covered and understand any associated costs.

5. Subsidies and Financial Assistance

If purchasing through the Health Insurance Marketplace, determine if you qualify for subsidies or cost-sharing reductions that can lower your monthly premiums and out-of-pocket costs based on your income.

6. Plan Type

Different plan types, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans, offer varying levels of flexibility in choosing healthcare providers. Consider how important provider flexibility is to you when selecting a plan.

How to Enroll in Health Insurance in Louisiana

Enrolling in a health insurance plan can be done during the open enrollment period or through a special enrollment period if you qualify due to a life event, such as losing other coverage, getting married, or having a baby. Here’s how you can enroll:

1. Health Insurance Marketplace

You can apply for and enroll in a plan through the federal Health Insurance Marketplace at HealthCare.gov. The marketplace provides tools to compare plans side by side and determine if you qualify for subsidies.

2. Medicaid

To apply for Medicaid in Louisiana, you can visit the Louisiana Medicaid website or contact your local Medicaid office. The application process will require proof of income and other eligibility information.

3. Private Insurance

If opting for private insurance, you can contact insurance companies directly or work with a licensed insurance agent or broker who can help you explore available plans and complete the enrollment process.

Conclusion

Choosing the right health insurance plan is a crucial decision that can significantly impact your health and financial well-being. In Louisiana, individuals have multiple options, including marketplace plans, Medicaid, private insurance, and short-term coverage. By carefully considering your healthcare needs, costs, provider preferences, and available financial assistance, you can find a plan that provides the coverage and peace of mind you need. Taking the time to research and compare plans will help ensure that you are well-equipped to manage your healthcare expenses and maintain access to the medical care you need. Whether you are seeking comprehensive coverage or a basic plan to meet your immediate needs, there is a health insurance option in Louisiana to suit your individual circumstances.

1 note

·

View note

Text

Medicare Advisors Group

Navigating Medicare: Why You Need a Medicare Advisors Group

Introduction: Medicare, the federal health insurance program for individuals aged 65 and older, can be complex to navigate. With its various parts, coverage options, and enrollment periods, understanding Medicare and making informed decisions about your coverage can be overwhelming. This is where a Medicare Advisors Group comes in. These specialized teams, like South Central Insurance Brokers serving Louisiana, offer invaluable assistance in deciphering the intricacies of Medicare and ensuring you make the best choices for your healthcare needs.

Body:

Expert Guidance: Medicare Advisors Groups consist of knowledgeable professionals who understand the nuances of Medicare inside and out. They stay updated on changes in legislation, coverage options, and plan details, ensuring that their clients receive the most accurate and up-to-date information.

Personalized Recommendations: Every individual's healthcare needs are unique. A Medicare Advisors Group takes the time to assess your specific circumstances, including your health status, budget, and prescription medication requirements. Based on this information, they can recommend Medicare plans that best suit your needs, whether it's Original Medicare, Medicare Advantage, or supplemental coverage.

Assistance with Enrollment: Navigating the Medicare enrollment process can be confusing, especially for those approaching eligibility for the first time. A Medicare Advisors Group simplifies this process by guiding you through each step, from understanding enrollment periods to helping you complete the necessary paperwork.

Comparing Plan Options: With so many Medicare plans available, choosing the right one can feel like searching for a needle in a haystack. A Medicare Advisors Group conducts thorough comparisons of plan options, including premiums, deductibles, copayments, and coverage limitations. This ensures that you have a clear understanding of the costs and benefits associated with each plan before making a decision.

Annual Review and Updates: Your healthcare needs may change over time, and so might your Medicare coverage requirements. A Medicare Advisors Group offers annual reviews of your plan to ensure that it continues to meet your needs. If necessary, they can help you make adjustments during the Medicare Annual Enrollment Period to ensure you have the most suitable coverage for the year ahead.

Claims Assistance and Problem Resolution: Dealing with Medicare claims and navigating the appeals process can be daunting tasks. A Medicare Advisors Group serves as your advocate, assisting with claims submissions and resolving any issues that may arise. This provides peace of mind knowing that you have someone in your corner, fighting for your best interests.

Education and Empowerment: Understanding your Medicare coverage empowers you to make informed decisions about your healthcare. A Medicare Advisors Group not only helps you navigate the complexities of Medicare but also educates you about your coverage options, rights, and responsibilities. This knowledge enables you to confidently manage your healthcare needs now and in the future.

Conclusion: In the maze of Medicare options, having a knowledgeable and experienced guide can make all the difference. A Medicare Advisors Group, such as South Central Insurance Brokers serving Louisiana, offers invaluable assistance in navigating the complexities of Medicare, providing personalized recommendations, enrollment assistance, plan comparisons, and ongoing support. By partnering with a Medicare Advisors Group, you can ensure that you have the coverage you need to maintain your health and well-being in the years ahead. Don't navigate Medicare alone—hire a trusted advisor to guide you every step of the way.

1 note

·

View note

Text

Health Insurance in Louisiana for Individuals

Navigating Health Insurance in Louisiana: A Comprehensive Guide for Individuals

Health insurance is a vital aspect of personal finance and well-being, providing individuals with access to essential medical services while mitigating the financial risks associated with unexpected healthcare expenses. In Louisiana, understanding the intricacies of health insurance options is crucial for individuals seeking adequate coverage. From navigating the state's marketplace to comprehending various plan types and eligibility criteria, this article serves as a comprehensive guide to help Louisiana residents make informed decisions about their healthcare needs.

Understanding Louisiana's Health Insurance Landscape

Louisiana, like many states, offers health insurance coverage through various channels, including employer-sponsored plans, private insurers, and government programs. The state operates a health insurance marketplace, known as the Louisiana Health Insurance Exchange, where individuals and families can shop for and purchase insurance plans.

For those who do not have access to employer-sponsored coverage or government programs such as Medicaid or Medicare, the marketplace serves as a crucial platform for securing health insurance. It offers a range of plans with varying levels of coverage and costs, allowing consumers to compare options and choose the one that best fits their needs and budget.

Types of Health Insurance Plans

When exploring health insurance options in Louisiana, individuals will encounter several types of plans, each with its own set of features and cost structures. These include:

Health Maintenance Organization (HMO): HMO plans typically require members to select a primary care physician and obtain referrals for specialist care. While these plans often have lower premiums and out-of-pocket costs, they usually have a more limited network of healthcare providers.

Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers, allowing members to see specialists without referrals. However, premiums and out-of-pocket costs may be higher compared to HMOs.

Exclusive Provider Organization (EPO): EPO plans combine elements of both HMOs and PPOs, providing access to a network of preferred providers without requiring referrals. However, coverage is typically limited to in-network providers, and out-of-network care may not be covered except in emergencies.

High-Deductible Health Plan (HDHP): HDHPs have lower premiums but higher deductibles compared to traditional plans. They are often paired with Health Savings Accounts (HSAs), which allow individuals to save money tax-free for medical expenses.

Catastrophic Health Insurance: These plans are designed for young adults or individuals who cannot afford more comprehensive coverage. They offer minimal coverage for essential health benefits and are primarily intended to protect against major medical expenses.

Eligibility and Enrollment

To enroll in a health insurance plan through the Louisiana Health Insurance Exchange, individuals must meet certain eligibility criteria. This typically includes being a resident of Louisiana and not having access to affordable coverage through an employer or government program.

Open enrollment periods, during which individuals can sign up for or make changes to their health insurance plans, typically occur once a year. However, certain qualifying life events, such as marriage, birth or adoption of a child, or loss of other coverage, may trigger special enrollment periods, allowing individuals to enroll outside of the regular enrollment period.

For those who qualify for Medicaid, the state's Medicaid program provides free or low-cost health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Eligibility criteria for Medicaid in Louisiana are based on income and household size, with expanded coverage available under the Affordable Care Act.

Navigating Costs and Financial Assistance

Understanding the costs associated with health insurance is essential for individuals to make informed decisions about coverage. In addition to monthly premiums, individuals should consider out-of-pocket costs such as deductibles, copayments, and coinsurance when comparing plans.

Financial assistance may be available to help individuals afford health insurance coverage. Subsidies, in the form of premium tax credits and cost-sharing reductions, are available to eligible individuals and families with incomes between 100% and 400% of the federal poverty level. These subsidies can significantly lower monthly premiums and out-of-pocket costs for those who qualify.

Choosing the Right Plan

Selecting the right health insurance plan requires careful consideration of individual healthcare needs, budget constraints, and preferences. Factors to consider when comparing plans include:

Coverage options and network providers

Premiums, deductibles, and out-of-pocket costs

Prescription drug coverage

Additional benefits such as dental and vision care

Quality ratings and customer satisfaction reviews

Individuals should also review plan documents carefully, paying attention to coverage limitations, exclusions, and any restrictions on specific services or treatments. Navigating the complex world of health insurance in Louisiana can be challenging, but with the right information and resources, individuals can make informed decisions about their healthcare coverage. By understanding the state's marketplace, exploring different plan options, and considering eligibility criteria and financial assistance opportunities, Louisiana residents can find the right health insurance plan to meet their needs and protect their well-being. Making proactive choices about health insurance ensures access to essential medical services while safeguarding against the financial burdens of unexpected healthcare expenses.

1 note

·

View note

Text

Best Medicare Supplement Plans In Louisiana

Exploring the Best Medicare Supplement Plans in Louisiana: Why Supplemental Coverage is Vital

Introduction

As individuals approach retirement age, navigating healthcare options becomes increasingly important. For residents of Louisiana, understanding Medicare supplement plans is crucial for ensuring comprehensive healthcare coverage. Medicare alone may not cover all medical expenses, leading many individuals to seek additional coverage through supplemental plans. In this article, we will delve into the best Medicare supplement plans in Louisiana and why supplementing your Medicare coverage is essential for financial security and peace of mind.

Why You Need a Supplement

Medicare, while a vital resource for seniors, often leaves gaps in coverage that can result in high out-of-pocket costs. These coverage gaps include copayments, coinsurance, deductibles, and services not covered by Medicare at all. Supplemental insurance, also known as Medigap, helps fill these gaps, providing beneficiaries with more comprehensive coverage and financial protection.

One of the primary reasons individuals opt for supplemental coverage is to avoid unexpected medical expenses. Without a supplement, beneficiaries may face significant costs for services such as hospital stays, skilled nursing care, and certain preventative care measures. Supplemental plans help mitigate these expenses, allowing seniors to budget more effectively for their healthcare needs.

Moreover, Medicare supplement plans offer flexibility and choice in healthcare providers. While Medicare restricts beneficiaries to a network of providers, supplemental plans often allow individuals to see any healthcare provider who accepts Medicare assignment. This flexibility ensures that beneficiaries can access the care they need without worrying about network restrictions.

Understanding Medicare Supplement Plans in Louisiana

Louisiana residents have a variety of Medicare supplement plans to choose from, each offering different levels of coverage at varying costs. The most popular supplemental plans in the state are Plan F, Plan G, and Plan N.

Plan F: Historically the most comprehensive plan, Plan F covers all out-of-pocket costs associated with Medicare, including deductibles, copayments, and coinsurance. However, this plan is no longer available to new Medicare enrollees as of 2020. Those who were enrolled in Plan F prior to this date may keep their coverage.

Plan G: Plan G is similar to Plan F but does not cover the Medicare Part B deductible. However, it typically offers lower premiums than Plan F, making it a popular choice among beneficiaries looking to save on monthly costs while still enjoying comprehensive coverage.

Plan N: Plan N provides coverage for most Medicare out-of-pocket costs but may require beneficiaries to pay copayments for certain services, such as office visits and emergency room visits. While Plan N generally has lower premiums than Plans F and G, it offers slightly less coverage.

Choosing the right Medicare supplement plan depends on individual healthcare needs, budget, and personal preferences. Some beneficiaries may prioritize comprehensive coverage and are willing to pay higher premiums, while others may opt for lower premiums and are comfortable with some out-of-pocket costs.

Factors to Consider When Choosing a Supplemental Plan

When evaluating Medicare supplement plans in Louisiana, several factors should be considered:

Cost: Compare monthly premiums, deductibles, and out-of-pocket costs to determine which plan offers the most value for your budget.

Coverage: Review the coverage provided by each plan to ensure it meets your healthcare needs. Consider factors such as doctor visits, hospital stays, and prescription drugs.

Provider Network: Determine if the plan restricts you to a network of providers or if you have the flexibility to see any doctor who accepts Medicare assignment.

Stability of the Insurance Company: Research the financial stability and reputation of the insurance company offering the supplemental plan to ensure reliability and quality customer service.

Conclusion

In conclusion, Medicare supplement plans play a vital role in ensuring comprehensive healthcare coverage for seniors in Louisiana. With Medicare alone leaving gaps in coverage, supplemental insurance provides financial protection and peace of mind against unexpected medical expenses. By understanding the various supplemental plans available and evaluating factors such as cost, coverage, and provider networks, beneficiaries can make informed decisions to secure the best possible healthcare coverage in their retirement years. Whether opting for Plan F, Plan G, Plan N, or another supplemental plan, investing in supplemental coverage is a wise decision for safeguarding one's health and financial well-being.

1 note

·

View note

Text

The importance of Medicare Plans in Baton Rouge

In the heart of Louisiana lies the vibrant city of Baton Rouge. Apart from the lively local culture, Baton Rouge holds a diverse demographic where the elderly population is just as vital. In this respect, understanding Medicare plans can make an enormous difference for seniors who need to secure their healthcare choices. Here, we delve into why medicare plans baton rouge matter for Baton Rouge residents and how they can promote healthy living in their golden years.What are Medicare Plans?Medicare is a federal health insurance program primarily meant for individuals aged 65 and over. It comprises various parts: Part A includes hospital insurance, Part B pertains to medical insurance, and Part D covers prescription drugs. Additionally, there are Supplemental plans (often called Medigap), providing additional coverage gaps not covered by traditional Medicare.For many seniors in Baton Rouge, these Medicare plans offer a robust support system that caters to their unique health needs. They offer financial security and assurance that medical care is always accessible- crucial factors for residents looking forward to peaceful retirement years.Knowing Your OptionsOne size doesn't fit all when it comes to healthcare provisions - different people have different needs. Selecting which plan suits your requirements best becomes critical here. In Baton Rouge, Medicare participants have multiple plans available – Traditional Medicare (Parts A & B) or a more comprehensive option such as a Medicare Advantage Plan (Part C). Residents might also consider adding on a Supplemental plan or Prescription Drug plan (Part D).It's essential to evaluate your options carefully before making decisions on your coverage choice. Visiting experienced advisors in the local Baton Rouge area may prove beneficial since they understand state-specific nuances that could influence decision-making.Why Research MattersResearch flicks on the light bulb when exploring complex subjects like health insurance avenues—being armed with knowledge aids seniors in avoiding gaps in their insurance coverage.In Baton Rouge, it's vital to be educated about Medicare plans. Knowing when to enroll, understanding enrollment periods and penalties, helping in-advance financial planning are a few areas where your research can leap off the page.Securing Future HealthSecuring one's health for the future is a significant aspect of retirement planning. For Baton Rouge residents, choosing the right Medicare plan lays out the foundation for continued well-being. With access to comprehensive medical care including specialist visits, hospital stays, long-term care planning options and preventive services among others - seniors in Baton Rouge can lay claim to more secure and healthier years ahead.

Magnolia65

8550 United Plaza Blvd #702, Baton Rouge, Louisiana 70809

(888) 874-6550

#baton rouge medicare#medicare advantage baton rouge#medicare part d baton rouge#medicare part a baton rouge#baton rouge medical insurance

1 note

·

View note

Text

How to Choose the Right Orthopedic Specialist Louisiana?

Selecting the right orthopedic specialist in Louisiana is a pivotal decision that can significantly impact your musculoskeletal health and overall quality of life. Whether you're seeking treatment for chronic joint pain, recovering from an injury, or considering orthopedic surgery, finding a skilled and compassionate specialist is essential. Louisiana is home to numerous healthcare providers specializing in orthopedics, making the decision-making process seem daunting. However, by considering factors such as expertise, experience, patient reviews, and location, you can make an informed choice that aligns with your unique needs and preferences. In this guide, we will navigate the key considerations and provide valuable insights to help you choose the right orthopedic specialist in the Pelican State. If you're experiencing joint pain, it's important to consult an orthopedic specialist Louisiana for a proper diagnosis.

Understanding Your Orthopedic Needs

When it comes to addressing orthopedic concerns, the journey often begins with understanding your specific needs. Whether you're dealing with joint pain, fractures, or musculoskeletal issues, it's crucial to identify the source of your discomfort. Start by evaluating your symptoms, their duration, and any activities that exacerbate your condition. This self-assessment will serve as a foundation for your conversation with a specialist, helping you articulate your concerns and goals effectively. By gaining clarity on your orthopedic needs from the outset, you empower yourself to take the right steps toward recovery and improved quality of life.

Evaluating the Specialist's Qualifications

Selecting the right orthopedic specialist is a critical decision in your healthcare journey. To make an informed choice, it's essential to evaluate the specialist's credentials and expertise. Look for board-certified orthopedic surgeons with extensive experience in treating your specific condition. Investigate their educational background, training, and any subspecialties that align with your needs, such as sports medicine or joint replacement. By delving into the specialist's qualifications, you can trust that you're in capable hands, receiving care from a skilled professional who can provide the best possible solutions for your orthopedic concerns.

Patient Reviews and Recommendations

Patient reviews and recommendations are valuable sources of insight when choosing an orthopedic specialist. They offer firsthand accounts of the patient experience, shedding light on the quality of care, communication, and outcomes. Reading reviews and seeking recommendations from friends, family, or your primary care physician can help you gauge a specialist's reputation and patient satisfaction. While individual experiences may vary, patterns in reviews can provide a valuable glimpse into the overall performance and patient-centered approach of a healthcare provider. This information can play a pivotal role in your decision-making process, guiding you toward a specialist who aligns with your expectations and needs.

Practical Considerations for Your Convenience

The location and accessibility of your orthopedic specialist's practice are practical considerations that can significantly impact your healthcare experience. Opting for a clinic or hospital that is conveniently located can save you time and reduce the stress of commuting, especially if you require frequent visits. Additionally, consider factors such as parking availability, public transportation options, and the ease of reaching the facility. These practical considerations ensure that you can access the care you need with minimal logistical challenges, allowing you to focus on your orthopedic treatment and recovery.

Insurance and Financial Considerations

Navigating the financial aspects of orthopedic care is a crucial step in your healthcare journey. Before committing to a specialist, it's essential to understand your insurance coverage, including copayments, deductibles, and out-of-pocket expenses. Verify that the specialist accepts your insurance plan to avoid unexpected costs. Additionally, discuss the estimated costs of procedures, surgeries, or treatments with the specialist's office to plan your finances accordingly. By proactively addressing insurance and financial considerations, you can ensure that you receive the necessary care without compromising your financial stability.

Consultations and Second Opinions

Seeking consultations and second opinions is a proactive approach to making informed decisions about your orthopedic care. Schedule consultations with multiple specialists to discuss your condition, treatment options, and expected outcomes. This allows you to compare their recommendations and approaches, ensuring that you choose the treatment plan that aligns best with your goals and preferences. Second opinions provide a broader perspective on your orthopedic needs and empower you to make confident decisions about your health. Remember that your healthcare journey is a collaborative effort, and taking the time to explore your options can lead to a more tailored and effective treatment plan.

The Key to a Successful Patient-Specialist Relationship

Building trust and effective communication with your orthopedic specialist is paramount to a successful patient-specialist relationship. It's essential to feel comfortable discussing your concerns, asking questions, and actively participating in your treatment plan. Trusting your specialist's expertise and judgment is equally crucial, as it fosters confidence in the care you receive. Open and transparent communication ensures that you and your specialist are on the same page regarding your goals and expectations. A strong patient-specialist relationship is built on mutual respect, trust, and collaboration, ultimately leading to the best possible outcomes for your orthopedic needs.

Conclusion

Selecting the right orthopedic specialist in Louisiana is a decision that should not be taken lightly. By assessing your individual needs, researching potential specialists, and consulting with trusted healthcare professionals, you can make an informed choice that ensures you receive the best possible care for your musculoskeletal issues. Remember that communication and trust are fundamental in the patient-specialist relationship, so don't hesitate to ask questions and express your concerns. With the right orthopedic specialist by your side, you can embark on a journey towards improved mobility, reduced pain, and a better quality of life. Your musculoskeletal health is worth the effort, and the right specialist can make all the difference.

0 notes

Text

Gaining a Better Understanding of Orthopedic Care in Louisiana

Orthopedic care in Louisiana is important for maintaining physical health and well-being. Louisiana is a state of America that is based in the south-central region of the country and has a rich and diverse population. Orthopedic specialist louisiana care focuses on preventing, diagnosing, and treating problems that have to do with muscles, bones, and joints. This type of medical care is essential for keeping people of all ages healthy and active. In order to provide the best possible treatment, it is important to have a better understanding of orthopedic care in Louisiana. These areas of expertise are critical for properly diagnosing, treating, and caring for patients with orthopedic conditions. It is also important for healthcare providers to have a thorough understanding of orthopedic care in Louisiana as well as the laws and regulations that govern that type of care. By doing so, healthcare professionals can ensure they are providing the best possible care to their patients.

Overview of Orthopedic Services in Louisiana

Louisiana has an abundance of excellent providers of orthopedic care including top surgeons, caregivers, and physical therapists. These providers specialize in diagnosing, treating, and preventing musculoskeletal conditions such as fractures, sprains, sports injuries, and chronic conditions like arthritis and osteoporosis. Many Louisiana orthopedic centers are staffed by experienced and highly trained specialists in the field and offer a range of services, from routine exams and x-rays to advanced surgeries. By working together, orthopedists can develop comprehensive, individualized treatments plans to optimize patient outcomes. It is also important to note that many of these specialized orthopedic services are covered by traditional health insurance plans.

Understanding the Different Types of Orthopedic Care Available

Orthopedic care can vary in scope, from simple adjustments and physical therapy to more invasive surgical procedures. Primary orthopedic services cover a range of issues from common musculoskeletal injuries to chronic conditions such as arthritis. Primary orthopedists are typically generalists in the field. They provide basic diagnosis and treatment services as well as helping to plan comprehensive long-term care plans for patients. On the other hand, orthopedic subspecialists are experts in a specific area of the musculoskeletal system. Subspecialists specialize in spinal health, sports medicine, joint replacement, and other niche orthopedic areas. Having a specialization in any given area often allows for more precise diagnosis and improved outcomes.

Comparing Orthopedic Care Options in Louisiana

When looking for orthopedic care in Louisiana, it is important to compare the different options available in the state to determine which would best suit one’s needs. Among the most important criteria to consider are provider expertise, location, cost, and out-of-pocket expenses. It is also important to read reviews and find out more about a provider’s training and experience. Additionally, one should take into account hospital rankings and patient satisfaction ratings so that the best decision can be made in the end.

Identifying the Best Orthopedic Care Providers in the State

When selecting an orthopedic care provider in Louisiana, it is important to seek out the best providers available. This means researching the credentials and experience of a provider. It is also important to look into the provider’s history of successful procedures and patient interactions. Furthermore, a physical examination by a qualified orthopedist is always a good idea to ensure that any underlying issues are addressed. Reading reviews about orthopedists in the state is also beneficial in helping to narrow down the best practitioners.

Investigating Credentials and Experience of Orthopedic Specialists

Orthopedists have undergone rigorous training in terms of the diagnosis and treatment of musculoskeletal issues. This is why it is important to investigate the credentials and experience of an orthopedic specialist to ensure that the best treatment is administered. Verifying the qualifications of an orthopedist is essential, as is researching their experience in the field. Reviewing both customer reviews and medical literature pertaining to the specialist is one way of doing this. Also, one should always arrange an initial consultation with any potential provider in order to get a better understanding of their background.

Keeping Up With the Latest Advances in Orthopedic Performance Technologies

One of the most exciting aspects of orthopedic care is the push towards better performance via advanced technologies. Orthopedists are continuously versed with the latest devices and techniques to ensure that patients receive the highest level of care possible. A specialist should always stay up to date on the latest innovations in their field in order to provide the most effective treatment. Additionally, recent developments in technology have pushed the boundaries of performance, driving a new era of orthopedic care. By exploring the pioneering strategies and treatments available, orthopedists can provide the highest level of care possible.

Learning About Cost and Insurance Options for Orthopedic Care in Louisiana

To get the most out of any orthopedic care in Louisiana, patients need to be aware of the cost and insurance options available to them. Costs associated with orthopedic care can vary greatly depending on the type of treatment needed as well as the provider or facility used. It is important to compare costs between different providers in order to find the best financial arrangements. It is also important to understand all available insurance options. Patients should take the time to research their insurance plan’s coverage to ensure that they are getting the best possible coverage for their individual circumstances.

Conclusion

In conclusion, Louisiana has a great many orthopedic care centers that provide comprehensive, compassionate, and effective treatment to those suffering from musculoskeletal and joint conditions. The orthopedic care specialists in Louisiana offer a wide range of services for both diagnosis and treatment, including a range of physical therapy techniques, support for surgical procedures, and pain management for patients. All these services work together to ensure that patients receive the most appropriate and beneficial care for their particular condition. By gaining a better understanding of orthopedic care in Louisiana, patients can make informed decisions about the care they receive and benefit from the most comprehensive treatment available.

0 notes

Text

Day 7, 8, 9, and 10 / Elaboration

Hey y’all! I said yesterday I would elaborate a little more on what my doctor’s visit yesterday told me, and here I am to do just that! I meant to yesterday, honestly, but by the time I got home my medicine had worn off and that wasn’t looking very likely 😅😅 But regardless!!! Here is what my results look like and honestly? These things probably have been affecting my sleeping disorder to a degree I’d previously disregarded without detailed info I’ve gotten from these tests.

Full write up under the cut!

—I got two major tests done, blood work and a genetics test. Back in my hometown the nurses couldn’t even figure out how to open the damn swab, but technology here managed to map out my entire DNA sequence which is utterly NUTS to me.

—My body is deficient in almost every important vitamin known to mankind, which makes sense because my diet is not… the best 😅 So, I started on several (SEVERAL) supplements to start out.

—I say start out because it’s very likely that I’ll be taking vitamin C and some liver enzyme through an IV once a month. A younger me might’ve thought something like this was scary, but at this point I’m so desperate to be healthy that getting nutrients drip fed into my system for them to work quicker sounds just fine to me.

—Other than that it’s normal lifestyle stuff. Eat more fruits and vegetables (I’ve been eating olives by the can for like days and I intend to buy fresh fruit packets for breakfast whenever I can afford them) as well as staying more active— which I DEFINITELY have been since I moved closer to New Orleans, in Louisiana proper where my dad lives.

But enough of the boring medicinal stuff. I’m sure you guys are much more interested in the whys— is there a reason my hypersomnia is so bad? Is there a deeper explanation than “lack of vitamins bad and you should feel bad”?

Well, yeah. YES. The genetics test revealed a metric fuckton to say the least 😂😂😂 but the most important was what kinds of diseases I’m predisposed to or how my body can process certain types of hormones/enzymes/proteins. Things like why caffeine won’t work for me (my body processes it very fast but not very thoroughly) or my metabolism being the strongest recorded genotype (which is why it’s been so hard to gain weight). Below, I’ll go into detail about stuff my new general doctor’s in-office geneticist (I still can’t believe that’s a thing I’m typing) has revealed about my disorder.

Naturally, this is specific to me because of my parents and our family lines. Maybe if you see info pertinent to yourself, looking into genetic mapping may be a good idea for you?

We are pretty confident that I have Idiopathic Hypersomnia. The reason for this is that a tiny link has been found between individuals who contracted mononucleosis in their childhood and adolescence and individuals who fell within the sleep cycles indicating IH. Now, IH will be genetic sometimes, but considering I’ve tracked my disorder to starting around 14, the same year I contracted Mono, the coincidence definitely doesn’t seem like… well, a coincidence. My blood test shows that I do in fact have the antibodies in my system, and they’re doing something… odd.

The geneticist found some “active” antibodies. Well, not some, really 😅 Basically, she’s surmised that these antibodies have a hair-trigger response and can react to any given environmental factor (stress, hunger, etc.) to the point where they activate as if they think they’re **fighting off a virus that’s been out of my system for ten years.** Of course this takes up an inordinate amount of energy, which is her hypothesis as to why my hypersomnia is so random and varies in intensity. The goal for this summer is flushing these antibodies out of my system.

My previous neurologist tried out a couple stimulants and then shit insurance prevented me from trying any others. So I’m stuck on something traditionally prescribed for adhd. A narcotic. *However* since my body is severely dysfunctional in general, the way I describe it is I basically have to induce a high to stay awake and function normally. We want to eventually get me off of these kinds of drugs, of course, since prolonged exposure weakens their effects and they’re highly addictive.

Another in credibly interesting thing we found is that I'm lacking in three major hormones. However, it's not because I don't produce them. I've never identified with symptoms of depression (anxiety, certainly, but not depression) yet for most of my life my childhood general practitioner insisted I had it. Well, the geneticist found that while I'm lacking in serotonin, dopamine, and melatonin, which yes are the two major mood enhancers and then the hormone that induces sleep, it's not because I can't produce them. It's because my neural transmitters are so damaged from a less-than-good diet and years of exhaustion that they simply can't process them. Just as the antibodies can have a hair-trigger response to environmental factors, so too can these processors. Simple things like a good meal, my high from my stimulants, or even micro dopamine shots from getting things done can activate the transmitters. Another thing on the docket for the summer is fixing these permanently with treatments of vitamins and supplements.

My stimulants have caused appetite issues, unfortunately, and that plus Covid at the beginning of this year caused me to get down to my lowest recorded weight ever, 94 pounds, which I haven't weighed since before I hit my final growth spurt way back in middle school. My dad does physical labor (he's a contractor who frames houses in the humid heat of the Deep South lol) so he's used to feeling tired. When he caught Covid, he said that he'd never felt as tired, drained, or out of it in his entire life. He never gets sick and hardly goes to the doctor and NEVER takes off work because of health, but in his last few weeks before full recovery he had to take off early multiple times. He was floored when he described the brain fog and exhaustion and I told him that I had no idea I even had Covid, because I just thought it was my disorder acting up. It was only when my grandmother started feeling tired that we got tested and we tested positive.

All that said, we think that there's hope for a future for me. She said that while there's no cure for IH, the cause that I have may can be mitigated by changes in exercise, diet, routine, and medication,to the point where I may mitigate symptoms of my disorder entirely. I'm still setting up appointments with a new neurologist here in the city, though, because technology is of course more advanced here.

And again, taking all of this into consideration, while it was looking likelier by the day, we've both agreed that I'll be here in the city 'til New Years. Which means no school this semester, but if I can go back in spring at more than 20% functionality and maybe succeed, I'm perfectly fine having to remain on break.

However, another good update: I weigh 103 pounds! I'm steadily gaining weight-- which means the other medication, the one for my appetite, is working as it should and as long as I stay on-track I should reach my goal of 120 by the end of the year as well.

So, yeah! That's what it's looking like. I have another appointment to go more in depth with the results tomorrow, but for now I'm planning out my week since I decided to let myself rest all last week. I'd love to finish helping out for our current podfic, ACTUALLY start the damn 100 Theme Challenge (LOL), finish betaing something that's been on hold for months, properly reconnect with our discord, catch up on all the media I fell behind on, clean my damn room, and establish a budget for this week on what I can buy. A more specific plan for today will follow, but til then, I hope this gives everyone some insight on what I'm looking at and how I'm gonna try to fix it.

Xoxo

Dani

7 notes

·

View notes

Text

Are Sober Living Homes profitable in Bossier City LA?

Have you ever heard of a Sober Living Home in Bossier City LA? "The Sober Living Home for men is a residential treatment facility for men struggling with drug and alcohol addiction. The Sober Living Home offers a secure recovery environment designed around a 12-step recovery program in the Shreveport-Bossier Louisiana region. We believe that every man will receive a safe, affordable and structured residential living setting where they can be free from all emotion and mind controlling substances and discover a new way of life through self-esteem and confidence building activities." - Steve Davidow

Sober Living Homes is strategically located near the southern part of Bossier City, Louisiana. It has five residential neighborhoods with a mixture of styles of living. "We want to provide an environment that will give our residents the tools they need to become independent and self-reliant. Our Sober Living Homes is an excellent choice for those who are recovering from substance abuse addiction," says Dr. Mark Fields, Board President of the Sober Living Home. "Our Sober Living Homes is a non-profit organization that serves our guests and clients with a warm, compassionate and understanding atmosphere. Our mission is to empower our residents through educational programs, spiritual support, therapeutic service and comprehensive alcohol and drug rehabilitation and addiction treatment."

"Sober Living Homes is a non-profit residential treatment and rehab facility for persons struggling with substance abuse, alcoholism and other related problems. The mission of Sober Living Homes is to provide an environment that will assist its guests and clients to cope effectively with addiction and recover from their addictions," says Ron Henderson, CEO of Sober Living Home. "We provide a warm, supportive and clean environment for our residents so that they can conquer their addictions and lead productive and successful lives. Ron Heinderson has dedicated his career to helping people recover from addiction and alcoholism, most notably with the formation of the Sober Living Home." Ron Henderson is certified as a certified alcohol therapist and is known for his expertise with the twelve step programs.

Sober Living Homes in Bossier City, Louisiana offers a complete range of care products for those suffering from various addictions including but not limited to alcohol, drugs, smoking, prescription pills, gambling, pornography, sex addiction and eating disorders. The clinical services provided by Sober Living Homes are provided by licensed mental health and social services professionals who offer qualified, specialty care. The goal of Sober Living Homes is to offer quality care to its guests and clients who have recently been discharged from a state or federal facility. The clinical services offered by Sober Living Homes include detoxification, aftercare, psychiatric follow-up, individualized family therapy, relapse prevention program management, periodic monitoring and peer support. The psychiatric follow-up includes periodic counseling with a psychiatrist and family therapy group. The programs and services are coordinated to meet the needs of the addict and his or her family.

Sober Living Homes is licensed to operate by the Louisiana Department of Insurance. The address of Sober Living Homes is 41006 Industrial Way, Suite 100 New Orleans, Ste. Geneve, LA - 8 Warehouse. Sober Living Homes is proud to be a partner of Google Scholars Program, a program that provides scholarship money to low income students who are majoring in areas related to the field of humanities and liberal arts. Sober Living Homes is proud to be a partner of the New Orleans Schools Corporation, which is administering the schools i.e. Acadiana Consolidated School District (ACSD) located in New Orleans.

Sober Living Homes provides its occupants with the best of services and amenities that is required to live in this era of tough living. Sober Living Homes is not a residential house but a community of residential houses for low income people. Residents are required to pay taxes and utilities and enjoy limited access to city resources. Sober Living Home is an associate state tax non-profit corporation.

1 note

·

View note

Text

What Treatment Does Health Insurance Cover For My Child With Autism?!?

Navigating health insurance can be complex when you’re the parent of a child on the autism spectrum. While the CDC estimates that 1 in 54 children have autism spectrum disorder (ASD), treatment coverage can vary greatly depending on your insurance plan and state of residence. There is no “cure” for autism, but early intervention treatment programs have been shown to be highly effective in alleviating symptoms and improving daily functioning for children with ASD. Fortunately, it’s likely that some forms of autism treatment willbe covered by your insurance.

In this guide, we’ll break down the details of what you can expect when seeking health insurance coverage for your child’s autism treatments and also will tell is autism treatment covered by insurance?

Contents [hide]

Autism Screening and Treatment Under the Affordable Care Act

Applied Behavior Analysis

Other Forms of Treatment

Autism Screening and Treatment Under Non-Marketplace Insurance Plans

Conclusion

Autism Screening and Treatment Under the Affordable Care Act

Under the Affordable Care Act (ACA), all Marketplace insurance plans must cover preventative services for children, which includes autism screening for children at 18 and 24 months. If you have a Marketplace plan, you will not be charged a copayment or coinsurance for the screening.

It’s also important to note that Marketplace plans are not allowed to discriminate against those with pre-existing conditions, which includes ASD. This means that if your child does receive a diagnosis for autism, your ACA provider would not be able to charge more for coverage or limit your services.

Applied Behavior Analysis

The most widely used therapeutic intervention for ASD is Applied Behavior Analysis (ABA). This treatment focuses on understanding and improving certain behaviors, such as communication or adaptive learning skills. On average, ABA therapy costs $17,000 annually, and can even reach as much as $100,000, so choosing an insurance plan that includes ABA coverage is crucial for many parents of children with ASD.

Get affordable health insurance

There are 33 states where ABA is currently included in the “Essential Health Benefits” package for ACA insurance plans. If you live in one of the following states and purchase a plan through the Marketplace, your child’s ABA therapy should receive coverage: Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Hawaii, Idaho, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Dakota, Ohio, Oregon, Tennessee, Texas, Vermont, Virginia, Washington, West Virginia, Wisconsin and Wyoming.

Marketplace plans are also required to offer child-only options. So, for example, if your employer-based health insurance doesn’t cover ABA, you could purchase a child-only plan through the Marketplace that offers the coverage your child with autism needs. If you have employer-based insurance, your child-only plan cannot be subsidized, but it still might help round out the gaps in your child’s autism treatment coverage.

Other Forms of Treatment

Unfortunately, ABA is not currently a covered essential benefit in Marketplace plans in Alabama, Florida, Georgia, Iowa, Kansas, Minnesota, Mississippi, North Carolina, Nebraska, Oklahoma, Pennsylvania, Rhode Island, South Carolina or South Dakota.

However, all new Marketplace health plans must cover essential benefits such as hospitalizations, preventive services, and prescription drugs. Forms of treatment like speech, physical, and occupational therapy, as well as psychiatric services, are likely to fall under these categories. They can help your child with autism, despite the fact that they’re not autism-specific services. Additionally, some physicians prescribe medications that can assist with certain symptoms of autism, like aggression and anxiety, and these would be covered under the essential health benefits. TrueCoverage can help you research your Marketplace health insurance options in your state, so you can have a better understanding of what specific types of treatment will be covered.

Purchasing a plan through the Marketplace will also mean that your provider cannot put a dollar limit on your lifetime insurance benefits or most annual benefits. Under the ACA, your child will also be able to stay on your plan until they turn 26 years old.

Autism Screening and Treatment Under Non-Marketplace Insurance Plans

Forty-six states and the District of Columbia have passed mandates that require certain private health insurance plans to cover ABA and other autism services, treatment, and diagnosis.

The laws for these states vary. For example, while ABA isn’t included under Alabama’s Marketplace plans, the state mandate requires all insurance plans delivered to employers with over 50 employees to offer applied behavioral therapy. The practitioner must be certified with the Behavior Analyst Certification Board in order for the treatment to be covered. North Carolina, on the other hand, mandates that health benefit plans cover autism services, but does not explicitly include behavioral therapy as a type of treatment that must be covered.

Other states might require coverage for autism services, but have different stipulations about practitioner certifications, the age of children that can be covered, and the types of plans included in the mandate (i.e. group plans vs. individual plans). Many states cap the annual benefits covered for autism services around $36,000. The American Speech-Language-Hearing Association has a helpful guide that breaks down the specifics of what is protected under each state’s mandate. Understanding the laws in your specific state and discussing your options with providers is crucial for determining which plan will be right for your child with autism.

Conclusion

Autism treatment is a complex topic that varies on a case-by-case basis, depending on your child’s unique situation. TrueCoverage is here to help you throughout the process, so that you can find the best health insurance plan at the lowest cost, all while giving your child the autism coverage they need. If you have any questions, please reach out. Our insurance experts are ready to help!

1 note

·

View note