#Best IT Services for Small Businesses

Explore tagged Tumblr posts

Text

Best Freelance Marketing & Design Services

Looking for affordable digital marketing services for small businesses? BigVisual Design is a top-rated digital marketing agency in South Delhi offering ROI-focused PPC, SEO, and graphic design services. Whether you need freelance digital marketing services, freelance graphic designers near you, or want to work with the best digital marketing freelancers, we’ve got you covered.

As one of the top 10 digital marketing companies in Delhi, we specialize in custom solutions for startups, local businesses, and brands that need results without blowing the budget. From Google Ads to visual branding, our team combines creativity and strategy to help your business grow online.

We are proud to be among the best digital marketing agencies in India, providing services that include:

Best digital marketing services for small business

Freelance graphic designer websites

Digital marketing freelancer website support

Graphic design services for startups

Full-suite PPC, SEO, and design from the best graphic design companies

Need help nearby? We're your trusted partner for digital marketing services near me with deep expertise in South Delhi and pan-India.

FOR MORE INFORMATION

FACEBOOK

INSTAGRAM

GMB

#best marketing agency in delhi#best graphic design companies#marketing#graphic design#digital marketing services for small business#affordable digital marketing services#digital marketing agency in south delhi#branding#digital art#poster

2 notes

·

View notes

Text

ES Group Marketing – Full‑Service Digital & Web Solutions

Since 2003, ES Group Marketing has delivered full-service digital marketing and web development solutions from Fort Dodge, IA. Specializing in SEO, PPC, geofencing, social media, display ads, and responsive web design, we help small and medium-sized businesses drive conversions, improve ROI, and grow online. Transparent, strategic, and results‑focused.

#seo agency near me#digital marketing agency near me#best digital marketing agencies#ppc advertising companies#email marketing advertising agencies#content marketing agencies#ecommerce seo services#marketing company for small business#digital marketing agency in usa#seo link building services#custom website design company#website development company in usa#advertising agency in usa#youtube marketing services#web design and development company in usa#digital marketing des moines#best digital marketing company in usa

2 notes

·

View notes

Text

GST Registration Consultants Madhapur

Get expert GST Registration services in Madhapur with Tirumalesh & Co | Chartered Accountants. Fast, hassle-free registration and compliance support. " Call: +91 84998 05550.

Visit link: https://www.catirumalesh.in/

Location: https://bit.ly/42ljdS4

#Small business accountants near me Hyderabad#best car for audit services near me#LLP Registration Madhapur#PVT LTD Registration Madhapur#Compliance Services Madhapur#Accounting and bookkeeping services Hyderabad#Payroll Services Madhapur

2 notes

·

View notes

Text

Best Voip Service

Are you looking for the best VOIP service? Then why not visit Sinch? Sinch offers the best VOIP, which helps customers interact over the phone. VOIP can be used by many devices, including Dell computers, laptops, smartphones, and many more, since VOIP api can be the best tool for your business development. You can connect with us today to learn more about VOIP.

#voip providers#voip service#voice api#voice api integration#best voip for small business#voip services#voice call

4 notes

·

View notes

Text

شركة GooglePD - احترافية التصميم والإبداع الرقمي

مرحباً بكم في GooglePD، شركتكم الرائدة في تقديم الحلول الرقمية الحديثة والخدمات الإبداعية. نحن هنا لنرتقي بأعمالكم ونحول أفكاركم إلى واقع ملموس بأعلى معايير الاحترافية.

خدماتنا:

التسويق الرقمي نضع خطط تسويقية مبتكرة ومدروسة بدقة لتعزيز وجودكم الرقمي وزيادة مبيعاتكم.

إدارة صفحات السوشيال ميديا فريقنا المتخصص يقدم إدارة احترافية لحساباتكم على مختلف المنصات، مع محتوى يجذب الانتباه ويزيد من التفاعل.

إنشاء المواقع الإلكترونية تصميم مواقع مميزة وسهلة الاستخدام تناسب هوية علامتكم التجارية وتلبي احتياجات جمهوركم.

تصميم الصور صور إبداعية تعكس هوية شركتكم وتجذب الأنظار، مع مراعاة التفاصيل الدقيقة والجودة العالية.

إنتاج الفيديوهات نصنع فيديوهات إبداعية تُبرز منتجاتكم وخدماتكم بأفضل طريقة ممكنة، مع مراعاة الجانب الإبداعي والتقني.

تصميم الشعارات نبتكر شعارات تعبر عن رؤيتكم وقيمكم، وتترك انطباعاً لا يُنسى لدى عملائكم.

لماذا تختار GooglePD؟

إبداع بلا حدود: نقدم أفكاراً فريدة ومبتكرة تعزز من تميز علامتكم التجارية.

احترافية مضمونة: فريقنا من الخبراء يضمن تقديم خدمات على أعلى مستوى من الجودة.

دعم مستمر: نحن هنا لنكون شركاء نجاحكم في كل خطوة من رحلتكم الرقمية.

انطلق بأعمالك إلى آفاق جديدة مع GooglePD. لأننا نصمم المستقبل بأيدي محترفة!

#Best digital marketing company.#Professional social media management services.#How to increase engagement on social media.#Effective digital marketing strategies.#أفضل شركة تسويق رقمي.#إدارة صفحات السوشيال ميديا باحترافية.#كيفية زيادة التفاعل على مواقع التواصل.#خطة تسويق رقمي فعالة.#Professional website design services.#Build a website that suits my business.#Creative logo design services.#Best company for corporate logo design.#شركة تصميم مواقع احترافية.#تصميم موقع يناسب نشاطي التجاري.#تصميم شعارات مبتكرة.#أفضل شركة تصميم شعارات للشركات.#Professional image design for websites and social media.#High-quality video production services.#Creative video ideas for businesses.#Attractive ad design services.#Trusted digital services company.#High-quality design at an affordable price.#Creative and professional marketing solutions.#Complete marketing services for small businesses.#A company that provides design and technical support services.#Where to find a company to manage my marketing campaigns.#A company to help develop my brand identity.#تصميم صور احترافية للمواقع والسوشيال ميديا.#إنتاج فيديوهات تسويقية مميزة.#أفكار فيديو إبداعية للشركات.

2 notes

·

View notes

Text

Best Web Design and Hosting for Small Business

User experience (UX) is a top priority for a successful small company website. This features responsive layouts that guarantee smooth surfing across devices, clear information hierarchy, and easy navigation. Websites should captivate users with eye-catching graphics, excellent photos, and interactive features that are consistent with the brand's identity. For small businesses looking to establish a strong online presence, investing in quality web design and reliable hosting is paramount.

Creating a powerful brand identity is essential. In order to create a unified image that makes an impression on visitors, this entails using logos, colors, and font consistently throughout the website. Retaining user interest also requires interesting material that speaks to the demands of the target audience, including educational blog entries and captivating product descriptions.

How to Make a Website for a Small Business

Select a User-Friendly Website Builder: Website construction is made easier by the intuitive interfaces of platforms like as Squarespace, Shopify, and Wix. Because these builders frequently have drag-and-drop capabilities, consumers can alter their websites without knowing any code23.

Choose a Domain Name and Register It

A memorable domain name is crucial for internet branding and represents your company's identity. Make sure it is pertinent to your services and simple to spell.

Select a Trustworthy Web Hosting Provider

The performance of the website depends on the hosting provider selection. Important things to think about are:

Uptime Promise: To reduce downtime, look for hosts that have 99.9% uptime.

Loading Speed: To improve user experience, try to keep page load times under three seconds.

Features of Security: To safeguard your site2, be sure the server offers SSL certificates, frequent backups, and virus detection.

Customer service: For prompt problem solving, round-the-clock assistance can be essential.

Create the Visual Identity for Your Website

Make an eye-catching layout that complements the style of your brand. Make use of top-notch photos and keep design components consistent.

Plan the Navigation and Site Structure

Logically arrange your information to make it easier to navigate. A site with a clear structure makes it easier for people to find information fast.

Create Key Pages

Home, About Us, Services/Products, Blog, and Contact Us are all important pages. Every page should contribute to the general objectives of the website while fulfilling a distinct function.

Top Web Design Platforms for Small Businesses

WordPress:

Flexible and customizable with thousands of plugins and themes.

Ideal for businesses looking for scalability and SEO features.

Wix:

Drag-and-drop functionality for easy website creation.

Suitable for businesses without technical expertise.

Squarespace:

Modern templates and built-in e-commerce features.

Perfect for visually appealing designs.

Shopify:

Best for small businesses focused on e-commerce.

Features include inventory management, payment integration, and analytics.

Weebly:

Affordable and user-friendly.

Ideal for small businesses needing basic functionality.

#Best Web Design and Hosting for Small Business#website#website design#seo services#digital marketing#web design#web development#usa news#usa

3 notes

·

View notes

Text

Best Funding Options for Small Businesses: A Complete Guide to Secure the Capital You Need

Introduction

Securing capital is one of the biggest challenges for entrepreneurs and small business owners. Whether you're launching a startup, expanding operations, or covering cash flow gaps, finding the best funding options for small businesses is essential for growth and stability.

Why Small Business Funding Is Important

Running a successful business requires more than just a great idea. You need access to capital to: ✅ Hire staff and cover payroll ✅ Purchase equipment or inventory ✅ Market your business ✅ Expand to new locations ✅ Cover unexpected expenses

Choosing the right funding source helps you manage risk and fuel sustainable growth.

1. SBA Loans (Small Business Administration Loans)

Best for: Established businesses with solid financials looking for low-interest, long-term loans.

✅ Pros:

Low interest rates

Long repayment terms (up to 25 years)

Backed by the government

❌ Cons:

Strict qualification requirements

Longer approval process

💡 Popular SBA Loan Types:

SBA 7(a) Loan – general-purpose financing

SBA 504 Loan – for real estate or equipment

SBA Microloan – for smaller loan amounts (up to $50,000)

2. Business Lines of Credit

Best for: Managing cash flow, purchasing inventory, or handling emergencies.

✅ Pros:

Flexible access to funds

Pay interest only on what you use

Can reuse funds as you repay

❌ Cons:

May have variable interest rates

Requires decent credit and business history

💡 Think of it like a credit card—but with higher limits and better terms for businesses.

3. Term Loans

Best for: Large one-time expenses such as equipment purchases or expansion.

✅ Pros:

Fixed interest rates and monthly payments

Predictable and structured repayment

❌ Cons:

May require strong credit

Less flexible than a line of credit

💡 Offered by banks, credit unions, and online lenders with terms ranging from 1–10 years.

4. Equipment Financing

Best for: Purchasing vehicles, machinery, or business equipment.

✅ Pros:

Equipment serves as collateral

Easier to qualify than unsecured loans

❌ Cons:

May require a down payment

You only get funds for equipment purchases

💡 Great option for restaurants, construction companies, or manufacturers.

5. Invoice Financing (Accounts Receivable Financing)

Best for: Businesses with unpaid customer invoices.

✅ Pros:

Quick access to cash

Doesn’t require perfect credit

❌ Cons:

Fees can be high

Short-term solution only

💡 You receive up to 85% of the invoice value upfront, and the rest after payment minus fees.

6. Business Credit Cards

Best for: Everyday expenses and building business credit.

✅ Pros:

Easy to apply

Rewards, cashback, or travel points

Helps separate business and personal expenses

❌ Cons:

High interest rates if not paid in full

May require a personal guarantee

💡 Use wisely and pay in full each month to avoid costly interest charges.

7. Merchant Cash Advances

Best for: Quick funding based on daily sales (especially for retail and restaurants).

✅ Pros:

Fast approval (often within 24–48 hours)

No collateral needed

❌ Cons:

Very high fees

Daily or weekly repayment from future sales

💡 Best as a last resort due to high effective APRs.

8. Crowdfunding

Best for: Product-based businesses or startups with a compelling story.

✅ Pros:

Raise money without giving up equity or taking on debt

Builds a loyal customer base

❌ Cons:

Time-consuming

Not guaranteed to reach your goal

💡 Platforms like Kickstarter, Indiegogo, and GoFundMe are popular choices.

9. Peer-to-Peer (P2P) Lending

Best for: Entrepreneurs who don’t qualify for traditional bank loans.

✅ Pros:

Online platforms like LendingClub and Funding Circle

Easier approval than banks

❌ Cons:

Interest rates vary based on credit profile

Not available in all states

💡 Ideal for borrowers with good personal credit and a solid business plan.

10. Grants and Free Funding Options

Best for: Small businesses, women-owned, minority-owned, or nonprofit startups.

✅ Pros:

Free money—no repayment required

May offer mentorship and resources

❌ Cons:

Competitive application process

Strict eligibility and reporting requirements

💡 Check Grants.gov, SBA grants, local chambers, and private foundations.

How to Choose the Best Funding Option for Your Small Business

✅ Consider These Factors:

Loan amount needed

How quickly you need funds

Your credit score (personal & business)

Time in business

Monthly revenue

Willingness to provide collateral or personal guarantee

📌 Pro Tip: Always compare multiple lenders and funding options before committing. Look beyond interest rates—consider fees, repayment terms, and total cost.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts: The Right Funding Fuels Growth

With so many options available, the best funding option for your small business depends on your goals, timeline, and financial situation.

✅ Need working capital? Try a line of credit or business credit card. ✅ Purchasing equipment? Equipment financing is perfect. ✅ Launching a startup? Explore crowdfunding or microloans. ✅ Growing fast? Consider SBA loans or term loans.

🎯 Be proactive, understand your needs, and choose the funding solution that aligns with your business goals.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

💬 Need help choosing the right loan? Drop your questions in the comments!

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#best business loans 2025#business financing solutions#business loans#Prestige Business Financial Services#small business funding options#entrepreneur#personal loans

1 note

·

View note

Text

Can You Use a Personal Loan for Creating a YouTube Studio?

In today’s digital era, content creation has become one of the most lucrative career choices. With platforms like YouTube offering opportunities to earn revenue through ads, sponsorships, and memberships, many aspiring creators are looking to invest in a professional YouTube studio. However, setting up a high-quality studio requires a significant financial investment. This raises an important question: Can you use a personal loan to create a YouTube studio?

Understanding a Personal Loan

A personal loan is an unsecured loan that you can use for various purposes, including debt consolidation, medical expenses, home improvement, and even business-related investments. Unlike business loans, a personal loan does not require collateral, making it an attractive financing option for individuals who need quick funds.

Lenders approve personal loans based on your credit score, income, employment status, and repayment capacity. Since it is a multipurpose loan, you can use it to finance your YouTube studio without any restrictions from the lender.

Costs Involved in Creating a YouTube Studio

Before taking out a personal loan, it’s essential to understand the costs involved in setting up a YouTube studio. Here’s a breakdown of key expenses:

1. Camera and Equipment

A high-quality camera is the heart of any YouTube studio. Depending on the content type, you may need DSLR cameras, mirrorless cameras, or even 4K camcorders. Additionally, essential accessories like tripods, gimbals, and lenses can add to the costs.

2. Lighting Setup

Proper lighting enhances video quality, making it more professional. Ring lights, softbox lights, and LED panels are necessary investments for a well-lit studio.

3. Microphones and Audio Equipment

Audio quality is just as crucial as video quality. A shotgun microphone, lavalier mic, or condenser mic, along with an audio interface and soundproofing materials, can improve the overall production quality.

4. Computer and Editing Software

Video editing is an integral part of content creation. A powerful computer with sufficient RAM, storage, and a high-quality graphics card is necessary for smooth video editing. Premium editing software such as Adobe Premiere Pro, Final Cut Pro, or DaVinci Resolve can enhance post-production quality.

5. Studio Setup and Backdrop

A well-designed backdrop adds to the aesthetics of a YouTube studio. Depending on the theme, you may need a green screen, customized backgrounds, or decorative items.

6. Internet and Streaming Equipment

A high-speed internet connection and streaming gear like capture cards and encoders are essential for live streaming and uploading high-resolution videos.

7. Marketing and Promotion

Investing in SEO, social media ads, and branding materials can help grow your YouTube channel quickly.

How a Personal Loan Can Help You Set Up a YouTube Studio

Using a personal loan for your YouTube studio can be beneficial in multiple ways. Here’s how:

1. Immediate Access to Funds

A personal loan allows you to access funds instantly, helping you purchase essential equipment without delay.

2. No Collateral Required

Unlike business loans, a personal loan does not require collateral, making it a risk-free borrowing option.

3. Flexible Usage

Since personal loans are multipurpose, you can use them for any studio-related expenses without lender restrictions.

4. Structured Repayment Plans

Most personal loans come with fixed monthly installments, making it easier to manage finances and plan repayment effectively.

5. Lower Interest Rates Compared to Credit Cards

Personal loans often have lower interest rates than credit cards, making them a more affordable financing option.

Things to Consider Before Taking a Personal Loan for Your YouTube Studio

While a personal loan can be an excellent financing option, there are certain factors you should consider:

1. Loan Amount and Interest Rate

Compare loan offers from different lenders to get the best interest rates and loan terms.

2. Repayment Terms

Choose a repayment plan that aligns with your earning potential from YouTube to avoid financial strain.

3. Credit Score Requirements

A good credit score can help you secure a loan at lower interest rates. Check your credit score before applying.

4. Alternative Financing Options

Consider alternatives like crowdfunding, grants, or business loans before opting for a personal loan.

Steps to Get a Personal Loan for Your YouTube Studio

If you’ve decided to take out a personal loan for your YouTube studio, follow these steps:

Step 1: Assess Your Financial Needs

Calculate the total amount required for your studio setup.

Step 2: Check Your Credit Score

A higher credit score increases your chances of loan approval at favorable interest rates.

Step 3: Compare Lenders

Research various lenders and compare interest rates, repayment terms, and processing fees.

Step 4: Apply for the Loan

Submit an online or offline application with the required documents, including proof of income and identification.

Step 5: Receive Funds and Start Your Studio Setup

Once approved, the loan amount will be disbursed to your account, allowing you to purchase the necessary equipment.

Conclusion

Yes, you can use a personal loan to create a YouTube studio. It provides an excellent financing option for aspiring content creators who need immediate funds to invest in high-quality production equipment. However, it’s crucial to evaluate your repayment ability and explore different loan options before making a decision. By using the loan wisely, you can build a professional YouTube studio and turn your content creation passion into a sustainable career.

If you’re considering applying for a personal loan for your YouTube studio, compare different loan providers and choose the one that best suits your financial needs. With proper planning and investment, your YouTube journey can be both financially rewarding and creatively fulfilling.

#nbfc personal loan#fincrif#bank#personal loan online#personal loans#loan apps#loan services#personal loan#personal laon#finance#Personal loan#YouTube studio#Personal loan for YouTube studio#Financing a YouTube studio#Loan for content creators#Personal loan for equipment#YouTube studio setup cost#Funding for YouTube channel#Personal loan for business#Best loan for YouTubers#How to finance a YouTube studio#YouTube studio investment#Personal loan for video production#Small business loan vs personal loan#Studio loan for content creation#Loan for vloggers#Best personal loan for YouTubers#Borrow money for YouTube channel#Loan for creative projects#Personal loan benefits for YouTubers

1 note

·

View note

Text

Skrrt Marketing | Leading Digital Marketing Agency in Delhi NCR

Looking for a top-tier digital marketing agency in Noida? Skrrt Marketing is your go-to partner for all things digital. We specialize in website development, PPC (Pay-Per-Click) advertising, SEO (Search Engine Optimization), content marketing, social media marketing, blogging, and email marketing. Our expert team is dedicated to helping businesses grow online by delivering tailor-made strategies that drive traffic, generate leads, and boost sales.

Why Choose Skrrt Marketing?

Expertise in Website Development: We build responsive, user-friendly websites optimized for performance and search engines.

Proven PPC Campaigns: Maximize your ROI with targeted, data-driven PPC strategies that reach your ideal audience.

SEO That Works: Our advanced SEO techniques improve your website's visibility on search engines, ensuring you rank higher for relevant keywords.

Content Marketing Mastery: We create compelling content that engages your audience and drives meaningful interactions.

Social Media Marketing: Grow your brand’s presence on social media platforms with customized strategies that resonate with your audience.

Professional Blogging Services: Enhance your website’s content with SEO-friendly blogs that inform, engage, and convert.

Effective Email Marketing: Reach your customers directly with personalized email campaigns that increase engagement and sales.

Get in Touch

Located in the heart of Noida, Skrrt Marketing is committed to delivering exceptional digital marketing solutions that meet your business goals. Contact us today to take your online presence to the next level!

www.skrrtmarketing.com

B-91 Sector 2 Noida U.P. 201301

+ 91 7905280368

#Best Digital marketing agency in Delhi NCR#Best digital marketing services#Top digital marketing company#Noida digital marketing experts#Affordable digital marketing solutions#website development company#website design company#web development services#web design company#SEO services Noida#Content marketing strategies#social media marketing#search engine marketing#SEO and PPC services for small businesses#Social media marketing for eCommerce

2 notes

·

View notes

Text

How To Start Your Accounting Firm with No Experience? + Free Checklist

Starting your own accounting firm can feel like a big challenge, especially if you don’t have previous experience. But with the right approach, tools, and industry knowledge, it’s entirely possible to build a successful and sustainable business. Whether you aim to provide outsourced bookkeeping and accounting services or manage accounting outsourcing services for small businesses, this guide will help you lay a strong foundation, even if you're starting from scratch.

If you’re considering the exciting opportunity of initiating an accounting firm, you likely have plenty of questions. How do you build a credible brand without a track record? What key steps should you follow to ensure a successful launch? More importantly, how do you compete in a market where established firms already offer accounting outsourcing services and outsourced bookkeeping solutions?

In this blog, we’ll cover the essential steps to help you get started, from understanding your motivations to structuring your firm and integrating the right technology. By the end, you’ll have a clearer path forward and a free checklist to guide you through those first important steps. With a focus on building your firm efficiently and effectively, even without prior experience, this guide will help you confidently enter the accounting industry.

Understanding Your Motivation and Purpose

Before examining the details of launching your accounting firm, it is essential to take a moment to reflect on your motivations. Understanding why you want to embark on this journey will significantly influence your path and help you make informed decisions.

Are you driven by a passion for helping small businesses streamline their finances and achieve their goals? Perhaps you’re inspired by the potential to provide top-tier financial services that empower growing companies to thrive in competitive markets. Identifying your core motivation will not only inform your service offerings but will also serve as a guiding principle in your firm's mission.

Defining Your Long-Term Goals

Establishing clear, long-term goals is vital for the success of your accounting firm. Consider what you envision for your business in the next five to ten years. Do you aspire to expand your firm to include specialized services, such as outsourced bookkeeping and accounting or remote accounting services? Are you aiming to build a team of expert accountants who share your vision? By articulating your long-term goals, you create a roadmap that guides your decision-making processes and helps measure your progress.

Creating a Vision Statement

A well-crafted vision statement encapsulates your aspirations and purpose. It serves as a motivational tool for you and your team, providing clarity on what your firm stands for and the impact you want to make in the accounting industry. Your vision might focus on aspects like providing unparalleled customer service, fostering strong relationships with clients, or being a leader in innovative accounting practices. This statement will not only define your firm's identity but also attract clients who resonate with your values.

Identifying Your Target Market

Understanding your motivation also extends to defining your target market. Are you inclined to serve local small businesses, freelancers, or specific industries like real estate or technology? Each market has unique financial challenges and opportunities, so aligning your motivations with a specific target demographic will enable you to tailor your services effectively. Conducting market research to assess the needs and preferences of your potential clients can further refine your focus, ensuring that your firm addresses real-world challenges and delivers meaningful solutions.

Staying Committed to Your Purpose

As you embark on this journey, remember that challenges will arise. Staying committed to your core motivation and purpose will help you navigate obstacles and maintain your focus. It’s essential to remain adaptable and open to feedback as you grow, while always keeping your initial vision in mind. This dedication not only fuels your personal motivation but also inspires confidence in your clients, fostering long-term relationships built on trust and reliability.

Gaining Industry Knowledge

Even without prior experience, you can swiftly build the essential industry knowledge needed to launch a successful accounting firm. In today's fast-paced and ever-evolving financial landscape, staying informed about accounting trends, regulations, and best practices is crucial for delivering high-quality services to your clients.

Embrace Continuous Learning

The accounting profession is marked by constant changes in regulations, technologies, and client expectations. Embracing a mindset of continuous learning is fundamental to staying ahead. Consider enrolling in online courses that cover essential topics such as tax laws, auditing standards, and accounting software. Obtaining relevant certifications, such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant), can also enhance your credibility and open doors to new opportunities.

Stay Updated with Industry Trends

Being proactive in your learning journey includes staying updated on industry trends and regulatory changes. Subscribing to reputable accounting publications, such as the Journal of Accountancy or CPA Practice Advisor, will keep you informed about the latest news, case studies, and best practices. Many of these publications also offer newsletters, making it easy to receive timely updates directly in your inbox.

In addition, attending webinars and industry conferences can provide valuable insights and networking opportunities. These events often feature expert speakers who share their knowledge on emerging trends, challenges, and innovative solutions in the accounting field. Participating in professional organizations, such as the American Institute of CPAs (AICPA) or state CPA societies, can further enhance your network and provide access to resources that support your growth.

Leverage Technology and Resources

As you build your knowledge base, leverage technology to your advantage. There are numerous resources available online, including forums, podcasts, and blogs dedicated to accounting and finance. Engaging with these platforms can expose you to diverse perspectives and practical tips that can be applied in your firm. Consider joining accounting-focused online communities or social media groups where professionals share insights, answer questions, and support one another.

Develop a Knowledge Network

Building a network of knowledgeable contacts within the accounting industry can be incredibly beneficial. Connect with experienced accountants, mentors, or industry peers who can provide guidance and share their experiences. Networking not only allows you to gain insights but also opens doors for collaboration and potential referrals as you establish your firm.

Commit to Lifelong Learning

Finally, make a commitment to lifelong learning. The accounting profession demands adaptability, and being open to new knowledge will serve you well in your entrepreneurial journey. Regularly assess your skill set and identify areas for improvement or specialization. By prioritizing education and knowledge, you’ll not only enhance your expertise but also position your firm as a trusted resource for clients seeking comprehensive accounting solutions.

Identifying Your Target Market

Defining your niche is a pivotal strategic move that can significantly distinguish your accounting firm from the competition. As you consider the direction of your business, ask yourself: Will you focus on serving small businesses, freelancers, or larger corporations? By honing in on a specific target market, you can better understand their unique challenges and tailor your services to meet their needs effectively.

Understanding the Needs of Your Target Market

Every market segment has distinct characteristics and requirements. For instance, small businesses may prioritize affordable outsourced bookkeeping and accounting services that fit their budget, while larger corporations may seek comprehensive financial strategies and in-depth reporting. To accurately identify your target market, conduct thorough market research to uncover the specific needs and pain points of potential clients. Surveys, interviews, and industry reports can provide valuable insights that inform your service offerings and marketing strategies.

Key Services to Offer

Once you’ve established your target market, consider the key services that will resonate with them. Some essential services to contemplate include:

Outsourced Bookkeeping and Accounting Services: Many small businesses struggle to maintain accurate financial records. Offering tailored solutions can alleviate their burden and allow them to focus on core operations.

Tax Preparation: Tax regulations can be complex and time-consuming for business owners. Providing expert tax preparation services can help clients navigate their obligations while ensuring compliance and maximizing potential deductions.

Financial Planning: Helping businesses develop comprehensive financial strategies not only enhances their stability but also positions you as a trusted advisor. This service can include budgeting, forecasting, and investment advice tailored to the specific goals of your clients.

Specialized Industry Services: Consider focusing on niche markets, such as real estate, healthcare, or technology. Designed expertise in these areas can set you apart as a go-to resource for clients seeking specialized knowledge.

Building Your Reputation as an Expert

A clear niche simplifies your marketing efforts and allows you to concentrate your resources on attracting the right clients. It also enables you to build a solid reputation as an expert in your chosen area. By delivering high-quality services and demonstrating your industry knowledge, you’ll cultivate trust with your clients, making them more likely to refer you to others.

Engaging in thought leadership activities, such as writing articles, giving presentations, or hosting webinars, can further enhance your visibility within your target market. Sharing valuable insights and practical advice showcases your expertise and positions your firm as a reliable resource for prospective clients.

Shaping Your Marketing Strategy

Once you've defined your target market and service offerings, adapt your marketing strategy accordingly. Utilize SEO-friendly content on your website and blog to attract your ideal clients, focusing on keywords relevant to their needs, such as outsourced accounting services and tax consultancy for small businesses. Leverage social media platforms to connect with potential clients and engage in conversations about industry trends and challenges.

By thoughtfully identifying and understanding your target market, you can create a strong foundation for your accounting firm, ensuring your services align with client needs and establishing a reputation for excellence in your niche.

Creating a Solid Business Plan

Every successful business starts with a comprehensive plan. A well-structured business plan serves as your roadmap, guiding you through the various stages of establishing and growing your accounting firm. It outlines your mission, details the services you will offer, and presents your financial projections. A solid business plan is not just a document for your reference; it's a crucial tool for attracting investors and securing funding.

Define Your Mission and Vision

At the heart of your business plan should be your mission and vision statements. These articulate what your firm stands for and the impact you aim to make within the accounting industry. Your mission should clearly express your firm's purpose—whether it’s providing exceptional outsourced accounting services or supporting small businesses with tailored financial solutions. Your vision should outline your long-term aspirations, guiding your strategic decisions and inspiring your team.

Detail Your Service Offerings

Clearly defining your service offerings is essential for positioning your firm in the marketplace. Highlighting services such as remote bookkeeping solutions, tax preparation, and financial consulting can attract potential clients looking for modern, efficient options. Each service should be accompanied by a description of its benefits, demonstrating how you can meet the specific needs of your target market. For example, explain how your outsourced bookkeeping services can save clients time and reduce stress, allowing them to focus on their core business operations.

Market Analysis

A comprehensive market analysis is a critical component of your business plan. This section should include information on industry trends, target demographics, and competitive analysis. Understanding the landscape will help you identify opportunities for growth and areas where your firm can differentiate itself. Analyze competitors’ strengths and weaknesses to find gaps in the market that your firm can fill, such as offering niche services or exceptional customer support.

Financial Projections

Financial projections provide a clear picture of your firm’s anticipated performance over the next few years. Include detailed forecasts of your income, expenses, and cash flow. This section is essential for potential investors or lenders, as it demonstrates your understanding of the financial aspects of running a business. Be realistic with your projections, considering factors such as startup costs, pricing strategies, and expected growth. Break down your financial goals into actionable milestones to track your progress effectively.

Funding and Investment Strategy

If you plan to seek funding or investment, outline your strategy in this section. Detail how much capital you need, how you intend to use it, and what return investors can expect. Providing a clear funding strategy not only enhances your credibility but also reassures potential investors that you have a solid plan for growth. Highlight your unique value proposition, such as your expertise in outsourced bookkeeping and accounting, to make your firm appealing to investors.

Operational Plan

An operational plan outlines the day-to-day functions of your accounting firm. This section should detail your staffing needs, office setup (whether physical or virtual), and technology requirements. Discuss the systems and processes you will implement to ensure efficiency and effectiveness, such as project management tools, accounting software, and client relationship management systems. A well-thought-out operational plan helps demonstrate that you are prepared to handle the complexities of running an accounting firm.

Review and Revise

Creating a business plan is not a one-time task; it should be a living document that evolves as your firm grows. Regularly review and revise your plan to reflect changes in the market, shifts in your business strategy, or advancements in technology. Being adaptable and responsive to new information will help you stay ahead of the competition and ensure the long-term success of your firm.

By dedicating the time and effort to create a solid business plan, you lay the groundwork for a successful accounting firm. This document will not only guide your operations but also serve as a powerful tool for attracting clients and securing investments.

Choosing a Legal Structure

One of the fundamental decisions you’ll make when starting your accounting firm is choosing the right legal structure. This choice will have significant implications for your business operations, liability exposure, and tax obligations. The three most common legal structures for accounting firms are sole proprietorship, Limited Liability Company (LLC), and partnership. Understanding the pros and cons of each option will help you select the one that aligns best with your business goals and long-term vision.

Sole Proprietorship

Operating as a sole proprietorship is the simplest and most common structure for small business owners, particularly for those starting out in the accounting field. This structure allows you to have complete control over your firm and its operations.

Pros:

Simplicity: Setting up a sole proprietorship is straightforward and requires minimal paperwork.

Full Control: As the sole owner, you make all the decisions and retain all profits.

Tax Benefits: Income is reported on your personal tax return, potentially simplifying your tax obligations.

Cons:

Unlimited Liability: One of the most significant drawbacks is that you are personally liable for all debts and legal obligations of the business. This means your personal assets could be at risk in the event of a lawsuit or financial difficulties.

Limited Growth Potential: Raising capital can be challenging, as you may rely solely on personal funds or loans.

Limited Liability Company (LLC)

An LLC is a popular choice for many new accounting firms because it provides liability protection while allowing for flexibility in management and taxation.

Pros:

Liability Protection: An LLC shields your personal assets from business liabilities, meaning your personal finances are generally protected in case of lawsuits or debts incurred by the business.

Tax Flexibility: An LLC can choose to be taxed as a sole proprietorship, partnership, or corporation, providing options to optimize your tax situation.

Professional Credibility: Operating as an LLC can enhance your firm's credibility with clients, as it signals a commitment to professionalism.

Cons:

Formation Costs: Establishing an LLC typically involves filing fees and additional paperwork compared to a sole proprietorship.

Ongoing Requirements: Depending on your state, there may be ongoing compliance requirements, such as annual reports or fees.

Partnership

If you’re planning to start your accounting firm with one or more partners, forming a partnership can be an effective structure. Partnerships can be general or limited, depending on the roles and liabilities of each partner.

Pros:

Shared Resources and Expertise: Partnerships allow you to pool resources, skills, and knowledge, potentially leading to a stronger firm.

Simplified Taxation: Like sole proprietorships, partnerships typically do not pay income tax at the business level. Instead, profits and losses are passed over to the partners’ individual tax returns.

Cons:

Shared Liability: In a general partnership, all partners share liability for the business's debts and obligations, which can expose personal assets.

Potential for Disputes: Partnerships require a strong foundation of trust and clear communication to avoid conflicts that can arise from differing opinions or business decisions.

Making the Right Choice

When selecting the legal structure for your accounting firm, consider factors such as your business goals, financial situation, and the level of risk you’re willing to take. It’s essential to consult with legal and financial advisors to understand the implications of each structure fully. They can help you evaluate the benefits and drawbacks based on your specific circumstances and guide you in making an informed decision.

Ultimately, the right legal structure will not only protect your personal assets but also position your firm for growth and success. As you move forward, keep in mind that you can always adjust your legal structure as your business evolves, allowing you to remain flexible and responsive to changing circumstances.

Setting Up Your Office

As you establish your accounting firm, one of the crucial decisions you'll face is whether to operate from a physical office or embrace a virtual setup. The choice you make will significantly influence your firm’s operations, costs, and client interactions.

Physical Office vs. Virtual Office

Choosing a physical office offers a traditional approach, allowing you to create a dedicated space where you can meet clients, collaborate with team members, and maintain a professional presence. However, this option often comes with higher overhead costs, including rent, utilities, and maintenance.

On the other hand, a virtual office has become increasingly popular among accounting firms, thanks to advancements in technology. This model allows for reduced overhead expenses while providing greater flexibility for both employees and clients. Many firms find that a virtual setup not only enhances work-life balance for their teams but also enables them to attract talent from a wider geographical area.

Benefits of a Virtual Office

Cost Efficiency: Operating virtually can significantly reduce expenses related to office space, utilities, and commuting. These savings can be redirected towards technology investments and marketing efforts.

Flexibility: A virtual office allows you and your team to work from various locations, which can enhance productivity and job satisfaction. This flexibility can also make it easier to accommodate clients' schedules, as meetings can be conducted via video conferencing or phone calls.

Access to Technology: Virtual accounting firms often rely on cloud-based solutions, enabling seamless access to financial data and collaboration tools. This technological integration ensures that your team can work efficiently, regardless of location.

Setting Up Your Physical Office

If you choose to establish a physical office, consider the following essential components:

Location: Select a location that is convenient for your target clients and has access to essential amenities, such as parking and public transportation.

Office Equipment: Invest in high-quality office furniture, computers, printers, and other essential equipment to create a functional workspace. Ensure that you have reliable internet connectivity and cybersecurity measures in place to protect sensitive financial information.

Meeting Space: Designate a professional area for client meetings, equipped with the necessary technology for presentations and video conferencing.

Creating an Efficient Workflow

Regardless of the office setup you choose, it’s important to create an environment that fosters productivity and collaboration. Implement efficient workflows and utilize project management tools to streamline communication among team members. Cloud-based platforms allow for real-time collaboration, making it easier for your team to share documents and updates.

Essential Software and Tools

Equipping your office with the right software is essential for handling accounting tasks effectively. In addition to accounting software like QuickBooks or Xero, consider incorporating tools for:

Client Relationship Management (CRM): A CRM system can help you manage client interactions and track leads, ensuring no opportunities are overlooked.

Project Management: Utilize project management tools like Trello or Asana to organize tasks, set deadlines, and monitor progress.

Communication: Implement secure communication tools such as Slack or Microsoft Teams to facilitate seamless collaboration among team members, regardless of their location.

Preparing for Future Growth

As your firm grows, be prepared to adapt your office setup to accommodate changing needs. Whether that means transitioning to a hybrid model or expanding your physical office space, staying flexible will ensure your firm remains agile in the face of growth.

In conclusion, the decision between a physical or virtual office should align with your firm’s vision, budget, and operational goals. By thoughtfully considering your options and equipping your office with the necessary tools, you set a strong foundation for your accounting firm’s success.

Integrating Technology

In today's fast-paced business environment, technology is at the heart of modern accounting practices. Integrating cutting-edge accounting software into your firm’s operations is essential for enhancing productivity, improving accuracy, and delivering exceptional service to your clients.

Choosing the Right Accounting Software

Selecting the right accounting software can significantly impact your firm’s efficiency and effectiveness. Look for solutions that streamline financial management processes and allow for real-time data access. Popular options like QuickBooks and Xero provide a range of features tailored to meet the needs of small to medium-sized businesses.

QuickBooks: This user-friendly platform offers robust functionalities for invoicing, expense tracking, payroll management, and financial reporting. Its extensive integrations with other applications make it a versatile choice for accounting firms.

Xero: Known for its intuitive interface, Xero provides comprehensive accounting tools, including bank reconciliation, expense claims, and reporting features. Its cloud-based nature allows for collaboration with clients and team members in real time, enhancing communication and efficiency.

Embracing Cloud-Based Solutions

Transitioning to cloud-based accounting solutions offers numerous advantages for your firm. Cloud technology ensures that your data is securely stored and accessible from anywhere, providing flexibility in how you operate. This is particularly beneficial for remote work environments, enabling you to manage client accounts, access financial reports, and collaborate with your team seamlessly.

Scalability: Cloud solutions can easily scale with your business as it grows, accommodating increased data storage needs and additional users without the hassle of upgrading hardware or software.

Enhanced Security: Reputable cloud providers invest heavily in security measures, protecting sensitive financial data from unauthorized access and potential breaches. Regular backups and disaster recovery options further safeguard your firm’s information.

Automating Routine Tasks

Integrating technology also allows you to automate routine accounting tasks, freeing up time for more strategic activities. For example, automated invoicing can ensure timely billing, while recurring payment features simplify the accounts receivable process. Consider implementing tools that automate payroll, tax calculations, and financial reporting, significantly reducing manual errors and saving valuable time.

Utilizing Client Portals

Establishing client portals is another effective way to integrate technology into your accounting practice. These secure online platforms enable clients to upload documents, access financial reports, and communicate with your team. Providing a seamless client experience enhances customer satisfaction and fosters trust, making your firm more appealing to prospective clients.

Staying Informed About Technological Advances

The accounting technology landscape is continually evolving, so staying informed about the latest advancements is crucial. Subscribe to industry publications, attend webinars, and participate in conferences to learn about emerging tools and software. Engaging with peers in professional networks can also provide insights into best practices and innovative solutions that enhance your firm’s operations.

Investing in Training and Support

As you integrate new technology, ensure that you invest in training for yourself and your team. Familiarity with the software and tools will maximize their potential and streamline your firm’s workflows. Consider utilizing online tutorials, vendor-provided training sessions, or industry-specific courses to boost your team’s proficiency.

By embracing technology and integrating it effectively into your accounting firm, you position yourself for long-term success. The right tools not only enhance productivity and accuracy but also allow your firm to remain agile and adaptable in a rapidly changing industry.

Marketing Your Firm

To attract clients to your accounting firm, a robust marketing strategy is essential. A well-executed marketing plan not only increases visibility but also establishes your reputation as a trusted provider of outsourced bookkeeping and accounting services. Here are key elements to consider when developing your marketing strategy:

Build a Professional Website

Your website completes as the digital storefront for your accounting firm. It should clearly highlight your services, expertise, and unique value proposition. Ensure your website is user-friendly and optimized for both desktop and mobile devices. Key elements to include are:

Service Descriptions: Clearly outline the accounting services you offer, such as tax preparation, financial planning, and remote bookkeeping solutions. Be specific about how your services can meet the needs of your target market.

Testimonials and Case Studies: Showcase positive feedback from satisfied clients to build trust with potential customers. Real-life examples of how you’ve helped clients achieve their financial goals can make a significant impact.

Blog Content: Regularly updating your website with informative blog posts not only positions you as an expert in the field but also improves your site’s search engine optimization (SEO). Use relevant keywords, such as outsourced accounting services and accounting firm checklist, to attract organic traffic.

Leverage Social Media Platforms

Social media is a effective tool for increasing visibility and engaging with potential clients. Choose platforms that align with your target market, such as LinkedIn, Facebook, or Instagram. Consider the following strategies:

Share Valuable Content: Post articles, tips, and industry news that provide value to your audience. Sharing insights related to accounting trends or tax updates can position you as a knowledgeable resource.

Engage with Your Audience: Reply to comments and messages quickly to foster engagement. Participate in significant discussions and groups to connect with potential clients and demonstrate your expertise.

Run Targeted Ads: Utilize social media advertising to reach a broader audience. Running targeted ads can help you attract specific demographics that align with your ideal client profile.

Utilize Email Marketing

Email marketing continues one of the most effective ways to foster leads and maintain relationships with clients. Create a mailing list and send regular newsletters that include:

Industry Updates: Share news about changes in tax laws, accounting practices, or industry trends to keep your audience informed.

Service Promotions: Highlight your services, special offers, or new service launches to encourage clients to reach out.

Client Success Stories: Showcase case studies that illustrate how your services have benefited clients, reinforcing your firm’s value.

Network Offline

While online marketing is crucial, offline strategies should not be overlooked. Building relationships within your community can significantly boost your firm’s reputation. Consider these approaches:

Attend Industry Events: Participate in accounting conferences, workshops, or local business expos to network with other professionals. These events provide opportunities to meet potential clients and establish valuable connections.

Join Professional Organizations: Becoming a member of accounting associations or local chambers of commerce can enhance your credibility and expand your network. Engage in community events to raise awareness of your firm.

Collaborate with Local Businesses: Partner with other businesses that complement your services, such as legal firms or financial advisors. Cross-promotions can introduce your firm to new audiences.

Monitor and Adjust Your Strategy

As you implement your marketing strategy, it’s essential to track your efforts and measure their effectiveness. Use tools like Google Analytics to assess website traffic and user behavior. Monitor your social media engagement and email open rates to understand what resonates with your audience. Based on the data, be prepared to adjust your strategy to optimize results continually.

In conclusion, a comprehensive marketing strategy that combines online and offline efforts is vital for attracting clients to your accounting firm. By establishing a professional online presence, engaging with your audience, and building relationships within your community, you can create a strong foundation for your firm's growth and success.

Building a Client Base

Networking is essential for establishing a robust client base, particularly during the initial stages of your accounting firm. Here are key strategies to consider:

Attend Industry Conferences: Participate in relevant events to connect with potential clients and industry peers. These gatherings provide opportunities to showcase your expertise and expand your professional network.

Join Professional Groups: Engage with local or national accounting associations to meet other professionals and gain insights into best practices. Membership often offers access to resources and networking events.

Ask for Referrals: Don’t hesitate to request referrals from satisfied clients or industry contacts. Word-of-mouth recommendations are powerful and can significantly enhance your credibility.

Establish Partnerships: Collaborate with other firms that offer complementary services, such as legal or tax advisory practices. These partnerships can start to common referrals and broaden your client base.

By actively networking and fostering relationships within the industry, you can effectively build a solid client base for your accounting firm.

Overcoming Challenges

Starting an accounting firm without prior experience presents a unique set of challenges. However, with the right mindset and strategies, you can effectively navigate these hurdles and build a successful practice. Here are some general challenges and tips for defeating them:

Managing Client Expectations

One of the most significant challenges you may face is managing client expectations. Clients often expect timely communication, transparency, and exceptional service. To address this, establish clear communication channels from the start and set realistic timelines for deliverables. Regularly update clients on their account status and be proactive in addressing any concerns they may have.

Keeping Up with Industry Changes

The accounting landscape is constantly evolving, with new regulations, technologies, and best practices emerging regularly. Staying informed is crucial for maintaining your firm's relevance. Commit to continuous learning through online courses, webinars, and industry publications. Joining professional organizations can also provide access to valuable resources and networking opportunities.

Building Confidence and Credibility

As a new firm owner, you may struggle with self-doubt or a lack of credibility. Overcoming this requires perseverance and a commitment to building your expertise. Leverage testimonials from satisfied clients, share success stories, and engage in thought leadership by writing articles or participating in webinars. Gradually, as you demonstrate your knowledge and skills, you will build trust with both clients and colleagues.

Developing a Strong Support System

Entrepreneurship can be isolating, so it’s essential to have a solid support system. Seek out mentors or join peer groups to share experiences and advice. Mentors can provide invaluable insights based on their own experiences, while peer groups can offer encouragement and accountability. Engaging with a community of like-minded professionals can help you navigate the challenges of starting and running your firm.

Staying Patient and Resilient

Success in the accounting industry doesn’t happen overnight. It requires patience, resilience, and a willingness to learn from setbacks. Accept challenges as opportunities for growth, and remember that determination is key. Reflect on your progress regularly, celebrate small wins, and remain focused on your long-term goals.

By being prepared for these challenges and implementing strategies to overcome them, you’ll be better equipped to navigate the complexities of starting your accounting firm. With resilience and a commitment to continuous learning, you can turn obstacles into stepping stones on your path to success.

Free Checklist: Steps to Start Your Accounting Firm

Starting your accounting firm can be a fulfilling journey when approached methodically. Use this checklist to ensure you cover all the essential steps:

Define Your Motivation and Goals

Reflect on why you want to start an accounting firm. Establish both short-term and long-term goals to guide your journey and keep you focused.

Gain Industry Knowledge Through Courses and Certifications

Enroll in relevant online courses and pursue certifications to enhance your expertise. This knowledge will build your confidence and credibility in the field.

Identify and Research Your Target Market

Determine the specific clientele you want to serve, such as small businesses, freelancers, or specific industries. Conduct market research to understand their unique needs and preferences.

Create a Comprehensive Business Plan

Develop a detailed business plan outlining your mission, services, market analysis, financial projections, and operational strategies. This file will serve as your roadmap for star.

Choose the Appropriate Legal Structure for Your Firm

Decide on the legal structure that best suits your business model, such as a sole proprietorship, LLC, or partnership. Consider liability protection, tax implications, and operational flexibility.

Set Up Your Office (Physical or Virtual)

Choose a suitable office setup based on your business model. Ensure you have the necessary equipment and technology in place to facilitate efficient operations.

Integrate Essential Technology and Software

Invest in accounting software and tools that enhance productivity and accuracy. Consider cloud-based solutions for better accessibility and collaboration.

Develop a Marketing Strategy

Create a marketing plan that includes online and offline strategies to attract clients. Focus on building a professional website, leveraging social media, and networking within your community.

Network and Build Your Client Base

Attend industry events, join professional groups, and seek referrals to establish connections. Building a solid network is vital for client acquisition and business growth.

Prepare for and Overcome Common Challenges

Anticipate potential challenges you may face and develop strategies to address them. Establish a support system of mentors and peers to help you navigate the ups and downs of entrepreneurship.

Conclusion

Starting an accounting firm with no prior experience may seem daunting, but it is entirely achievable with determination, the right resources, and strategic planning. As you embark on this exciting journey, remember that every successful firm begins with a solid foundation built on careful consideration and informed decisions.

By following this guide and utilizing our free checklist, you can systematically approach each critical step, from defining your motivation to building a robust client base. Each phase of this process is designed to equip you with the knowledge and tools necessary to navigate the challenges of the accounting industry effectively.

If you're ready to make your mark in the accounting sector, now is the time to act. Embrace the journey ahead, remain adaptable, and stay committed to your goals. Remember, many successful accounting professionals started just where you are now, facing uncertainty and challenges. Your passion, paired with the strategies outlined in this guide, will position you for success.

As you move forward, don’t hesitate to seek support from mentors and industry peers who can offer guidance and encouragement along the way. With the right mindset and preparation, you can establish a thriving accounting firm that meets the needs of your clients and stands out in a competitive market.

Take that first step today and unlock the potential that awaits you in the world of accounting!

Original Source: https://unisonglobus.com/how-to-start-an-accounting-firm-with-no-experience/

#Start an accounting firm#accounting firm with no experience#Beginner’s guide to accounting firms#accounting business startup#Unison Globus#Small business accounting#accounting firm technology#building a client base in accounting#Steps to Start Your Accounting Firm#unison globus#accounting#best accounting software for small business#outsourced accounting services

1 note

·

View note

Text

Get Complete SEO Services at Affordable Rates from Delhi’s Best Web Development Company

In today’s digital landscape, having a robust online presence is crucial for businesses of all sizes. Search Engine Optimization (SEO) plays a pivotal role in ensuring that your business ranks high on search engines, driving more traffic and potential customers to your website. If you’re looking for affordable SEO services without compromising on quality, you’re in the right place. Let’s explore how you can get SEO services at affordable rates from the best website development company.

Affordable SEO Services for Every Business

Finding affordable SEO services that deliver results can be challenging. Many businesses end up paying exorbitant fees for subpar services. However, Delhi’s best web development company offers top-notch SEO services that won't break the bank. Whether you're a small business or a large corporation, you can benefit from tailored SEO strategies designed to meet your specific needs.

Comprehensive and Complete SEO Services

When it comes to SEO, it's essential to look beyond just basic optimization. Complete SEO services encompass a wide range of strategies and techniques designed to improve your website's visibility and performance. From keyword research and on-page optimization to link building and content creation, the best website development company provides a holistic approach to SEO. This ensures that every aspect of your website is optimized for maximum search engine performance.

Why Choose the Top Web Development Company in Delhi?

Choosing the right partner for your SEO needs is crucial. The best web development company in Delhi stands out for several reasons:

Expertise: With a team of experienced SEO professionals, they understand the intricacies of search engine algorithms and how to leverage them to your advantage.

Customized Solutions: They offer tailored SEO strategies that align with your business goals and target audience.

Transparency They provide clear and concise reports, keeping you informed about your website's performance and the progress of your SEO campaigns.

Affordability: They offer competitive pricing without compromising on quality, making it possible for businesses of all sizes to access top-tier SEO services.

Boost Your Online Presence with Affordable SEO Services

Investing in affordable SEO services from the Delhi's web development company is a smart move for any business looking to enhance its online presence. By leveraging their comprehensive SEO services, you can expect improved search engine rankings, increased website traffic, and ultimately, higher conversion rates. Don’t let budget constraints hold you back from achieving your digital marketing goals.

Conclusion

In conclusion, getting complete SEO services at affordable rates is no longer a dream. With Delhi's best web development company, you can access top-quality SEO services that drive results. Their expertise, customized solutions, and transparent approach make them the ideal partner for your SEO needs. Elevate your online presence and watch your business grow with the help of budget friendly SEO services.

#affordable seo services#complete seo services#realestate seo services#best web development company in delhi#seo#best seo company in delhi#affordable seo company#seo strategies for small business#seo for small business#best digital marketing company#cheapest seo services#web development company in delhi

3 notes

·

View notes

Text

Best Digital Marketing & Graphic Design Services in South Delhi – Affordable & Professional

Looking for affordable digital marketing services for your small business? We offer the best digital marketing services in India, tailored specifically for startups and SMEs. As a leading digital marketing agency in South Delhi, we bring a perfect blend of strategy and creativity. Our services are also ideal for those searching for freelance digital marketing services, best digital marketing freelancers, or a trusted digital marketing freelancer website.

Our team includes freelance graphic designers near you, offering high-quality graphic design services at competitive rates. Whether you need a freelance graphic designer, professional visuals from the best graphic design companies, or want to explore top freelance graphic designer websites, we’ve got you covered.

We are recognized as one of the top 10 digital marketing companies in Delhi, known for performance, affordability, and personalized attention. Choose us as your best digital marketing agency in Delhi and unlock your brand’s full potential with expert strategies that work.

FOR MORE INFORMATION

FACEBOOK

INSTAGRAM

GMB

#best marketing agency in delhi#affordable digital marketing services#graphic design#branding#marketing#digital art#digital marketing services for small business#digital marketing agency in south delhi#best graphic design companies#poster

2 notes

·

View notes

Text

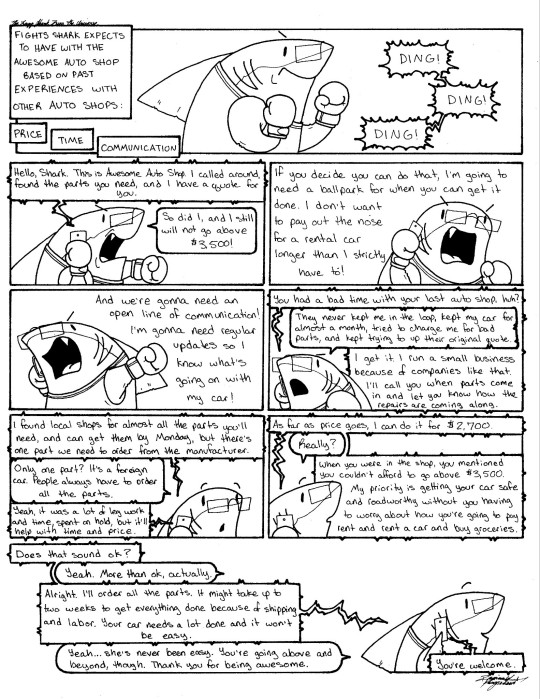

This is one of the many reasons to support small businesses.

#art#artwork#artists on tumblr#drawing#doodle#illustration#comics#comic#funny#cartoon#funnycomic#originalcomic#shark comic#animal#animal art#shark#lazyshark#the lazy shark runs the universe#car trouble#small business#best customer service ever

3 notes

·

View notes

Text

How effective digital marketing services can help small businesses?

You cannot deny the importance of an effective digital marketing strategy in a digitally driven world like today. Moreover, in today's cutthroat industry, digital marketing services can be vital in supporting small businesses' expansion and success. These services provide a range of tools and tactics that can improve a company's online visibility, draw in more clients, and boost revenue. This is an in-depth look at the advantages that small businesses can get from best digital marketing services for small business.

Expansion of the customer base

Every company works towards expanding their customers in order to making higher profits. That said, digital marketing services from digital marketing company in India are primarily helpful for small businesses in expanding their customer base. Moreover, conventional marketing techniques, such as print advertisements or fliers, can be costly and have a narrow audience. On the other hand, digital marketing enables companies to use the internet to connect with potential clients anywhere in the world. Small businesses can greatly increase their audience and customer base by taking advantage of the large number of people who use social media, search engines, and other online platforms on a daily basis.

What are the key cogs of an effective Digital marketing strategy?

It all depends and varies from one industry to another. Moreover, a company can have a different approach towards it digital marketing efforts in comparison to other companies. Also, search engine optimization is one of the best digital marketing techniques offered from affordable digital marketing agency in India. On the other side, optimizing a website for search engines to rank higher on search engine results pages is known as SEO.

SEO ( Search engine optimization)

Your website should be at the top of search results when customers look for goods or services associated with your company. Also, improved rankings make your website more visible and more likely to draw in visitors. Using proper keywords, producing excellent content, and creating back links are all part of SEO via digital marketing company in India. Similarly, small businesses can raise their online visibility, draw in organic traffic, and eventually boost sales by putting SEO strategies into practice.

Social media marketing

The role of social media marketing in today’s world is quite imperative. That said, millions of people use social media sites like Facebook, Instagram, Twitter, and LinkedIn every day to interact with content. Small businesses can engage with customers directly, establish brand awareness, and connect with their audience by making a strong online presence on these platforms. Social media marketing entails communicating with followers, sharing interesting content, and updating frequently. On social media, paid advertising can also be very successful. At the same time, Businesses can reach particular demographics, interests, and locations with the help of tailored advertising options offered by social media platforms like Facebook and Instagram. By focusing marketing efforts on the most relevant audience, this targeted approach maximizes return on investment.

Email marketing

Although many experts quote email marketing as an old horse, it still comes as highly capable of driving your digital marketing efforts. Businesses can send out newsletters, promotions, and updates straight to the inboxes of their customers and potential customers by gathering their email addresses. Also, email marketing fosters relationships with consumers by giving them access to exclusive deals and useful information. It is an affordable method of keeping clients informed and interested in your business. Email marketing via an affordable digital marketing agency in India can be made even more effective by using personalization and segmentation to target particular customer groups with messages that are tailored to their interests and behaviors.

Content marketing and PPC

Content marketing has its role to play in driving your digital marketing efforts even in a small business. Moreover, posts on blogs, articles, videos, infographics, and more can fall under this category. Also, Businesses can become industry experts and gain the audience's trust by offering pertinent and helpful information. Additionally, SEO is enhanced by high-quality content, which increases the website's organic traffic. Small businesses can use content marketing to inform, assist, and resolve customers' issues, which will eventually boost client loyalty and revenue.

For small businesses, pay-per-click (PPC) advertising is a very successful digital marketing tactic offered y digital marketing services for ecommerce. Moreover, PPC advertisements can be found on social media and search engine results pages; companies only have to pay when a user clicks on their ad. This model guarantees that marketing expenditures are closely linked to results and allows accurate budget control. One of the most well-known PPC networks is Google Ads, which enables companies to place bids on keywords associated with their goods or services. When used effectively, pay-per-click (PPC) advertising can quickly bring targeted traffic to a website and produce leads or sales.

Final words

There is no denying that trusted digital marketing agency can certain take your market value to next level. Moreover, small businesses can gain a lot from using best digital marketing services for small businesses. Also, small businesses can reach a wider audience, interact with customers, and increase sales by utilizing SEO, social media marketing, email marketing, content marketing, PPC advertising, analytics, local SEO, influencer marketing, and brand identity development. Having a strong online presence is crucial in the digital age, and digital marketing offers the tools and techniques to do so. Investing in digital marketing services has the potential to greatly accelerate the growth and success of small businesses.

#best digital marketing services for small business#affordable digital marketing agency in India#digital marketing company in India#digital marketing services for ecommerce#best digital marketing services for small businesses

2 notes

·

View notes

Text