#Best Brokers for Forex

Explore tagged Tumblr posts

Text

Best Brokers for Forex, Stocks & Crypto Trading: Beirman Capital

0 notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

145 notes

·

View notes

Text

FxPro Review: Unveiling the World's Leading Online Forex Broker

In the dynamic realm of financial trading, the significance of efficient and reliable online forex brokers cannot be overstated. Among the myriad options available, FxPro stands out as a beacon of excellence, earning its reputation as the world’s number one online forex (FX) broker. This detailed FxPro review aims to explore the unique features, offerings, and overall experience that have established this broker as a preferred choice for traders globally.

youtube

Discovering FxPro: A Legacy of Trust and Innovation

Founded in 2006, FxPro has carved a niche for itself in the competitive forex market, showcasing a steadfast commitment to providing an exceptional trading experience. As a Top Forex Brokers review, FxPro has successfully built a reputation for transparency, reliability, and innovation, making it a trusted partner for thousands of traders around the world. With a user-centric approach, the broker continuously evolves to meet the needs of its clients, ensuring they have the tools and resources necessary to thrive in the fast-paced world of forex trading.

The FxPro Trading Platforms: A Gateway to Success

Central to FxPro's appeal is its diverse array of trading platforms, designed to cater to the varied preferences of both novice and experienced traders. Each platform boasts unique features that facilitate seamless trading, empowering users to make informed decisions in real-time.

MetaTrader 4 (MT4): The Industry Standard

The MetaTrader 4 (MT4) platform is a cornerstone of the forex trading experience, and FxPro offers an optimized version that enhances its functionality. Known for its user-friendly interface, MT4 provides traders with powerful charting capabilities, a plethora of technical indicators, and automated trading options through Expert Advisors (EAs). This platform is particularly favored by those who appreciate a straightforward yet effective trading environment.

MetaTrader 5 (MT5): The Next Generation

For traders seeking a more advanced experience, FxPro also provides access to the MetaTrader 5 (MT5) platform. MT5 is a comprehensive trading environment that includes advanced order management, a greater array of analytical tools, and an integrated economic calendar. Its multi-asset capabilities extend beyond forex, allowing traders to delve into commodities, stocks, and futures, making it an excellent choice for those looking to diversify their trading portfolio.

cTrader: Innovative and Intuitive

In addition to MT4 and MT5, FxPro offers the cTrader platform, which is designed for traders who prefer a more innovative and user-friendly experience. cTrader features a clean interface, advanced charting tools, and customizable workspaces, catering to both manual traders and algorithmic trading enthusiasts. The platform also includes a community-driven marketplace where traders can share and access trading tools, fostering collaboration and innovation.

Competitive Spreads and Pricing Structure

When it comes to trading costs, FxPro excels in providing competitive spreads and transparent pricing. The broker’s commitment to low trading costs is evident across its various account types, allowing traders to choose an option that best fits their trading style and budget.

FxPro offers several account types—each tailored to different trading needs—ensuring that clients can find a suitable option. For instance, the FxPro MT4 account is popular for its tight spreads and no commission trading, while the FxPro cTrader account provides a commission-based structure with slightly tighter spreads. This flexibility allows traders to optimize their trading strategies while minimizing costs.

Moreover, the broker’s commitment to transparency ensures that traders are always aware of the costs associated with their trades, allowing for effective financial planning and decision-making.

A Diverse Selection of Trading Instruments

One of the standout features of FxPro is its extensive range of trading instruments. While the broker is predominantly known for its forex offerings, it also provides access to a wide array of asset classes, including commodities, indices, and cryptocurrencies.

Forex Trading

FxPro covers a vast selection of currency pairs, encompassing major, minor, and exotic pairs. This diversity enables traders to capitalize on global economic trends and currency fluctuations, providing ample trading opportunities.

Commodity Trading

For those interested in commodities, FxPro offers trading in popular assets such as gold, silver, oil, and agricultural products. This allows traders to hedge against inflation or geopolitical risks while diversifying their investment portfolios.

Indices and Cryptocurrencies

In addition to traditional forex and commodities, FxPro provides access to global indices and a selection of cryptocurrencies. Traders can engage with major indices like the S&P 500 and FTSE 100, or explore the burgeoning cryptocurrency market, including popular coins such as Bitcoin and Ethereum. This extensive range of instruments empowers traders to explore various market dynamics and seize opportunities across different sectors.

Robust Security and Regulatory Oversight

In an industry where security is paramount, FxPro stands out for its commitment to safeguarding client funds and personal information. The broker is regulated by multiple reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-tiered regulatory framework offers clients peace of mind, knowing that their investments are protected by stringent regulations.

FxPro also employs advanced security measures to ensure the safety of its clients’ funds. These measures include SSL encryption for data protection and two-factor authentication for account security. The broker’s proactive approach to security and regulatory compliance underscores its dedication to maintaining a trustworthy trading environment.

Enhanced Customer Support

Exceptional customer support is a hallmark of a reputable broker, and FxPro does not disappoint in this regard. The broker offers a robust support system designed to assist traders at any stage of their trading journey.

FxPro’s customer support team is available 24/7, providing multilingual assistance to cater to its diverse global clientele. Whether you require help with account management, technical inquiries, or trading strategies, the knowledgeable support staff is always ready to assist.

Additionally, FxPro offers a wealth of educational resources, including webinars, trading tutorials, and market analysis, empowering clients to enhance their trading skills and knowledge. This commitment to client education is a testament to FxPro’s dedication to fostering a supportive trading community.

Educational Resources and Trading Tools

FxPro goes beyond offering trading platforms and customer support by providing a comprehensive suite of educational resources and trading tools. The broker recognizes that informed traders are successful traders, and it strives to equip its clients with the knowledge they need to navigate the complexities of the forex market.

Webinars and Tutorials

FxPro hosts regular webinars led by industry experts, covering a variety of topics ranging from trading strategies to market analysis. These interactive sessions provide valuable insights and allow traders to ask questions in real time, fostering a collaborative learning environment. Additionally, the broker offers a library of tutorials and articles, catering to traders of all experience levels.

Market Analysis

To help traders make informed decisions, FxPro provides daily market analysis and insights. This analysis includes technical and fundamental reports, helping traders understand market trends and identify potential trading opportunities. By staying informed about market developments, traders can enhance their strategies and improve their overall performance.

Trading Tools

FxPro also offers a range of trading tools to enhance the trading experience. These tools include economic calendars, calculators, and trading signals, all designed to assist traders in making informed and timely decisions. Such resources are invaluable for both novice and experienced traders, facilitating a more strategic approach to trading.

Conclusion: The Ultimate Choice for Forex Traders

In this comprehensive FxPro review, we have explored the myriad features and advantages that make this broker a top choice for forex traders worldwide. From its cutting-edge trading platforms and competitive pricing structure to its diverse selection of trading instruments and robust security measures, FxPro has established itself as a leader in the online forex brokerage space.

Through its unwavering commitment to customer support and education, FxPro empowers traders to hone their skills and navigate the complexities of the financial markets with confidence. Whether you are a seasoned trader or just starting your journey in forex trading, FxPro offers the tools, resources, and support to help you succeed.

In conclusion, FxPro stands as a testament to what a premier forex broker should aspire to be. With its extensive offerings and client-focused approach, FxPro is not just a broker; it is a partner in your trading journey, ready to elevate your forex trading experience to new heights.

2 notes

·

View notes

Text

Discover the Best Forex Broker in UAE | Spectra Global Ltd

Looking for the best forex broker in UAE? Explore Spectra Global Ltd for expert forex trading services tailored to your needs. Discover advanced trading tools, reliable support, and competitive spreads. Visit now!

Visit Spectra Global Ltd for superior forex trading services in UAE.

2 notes

·

View notes

Text

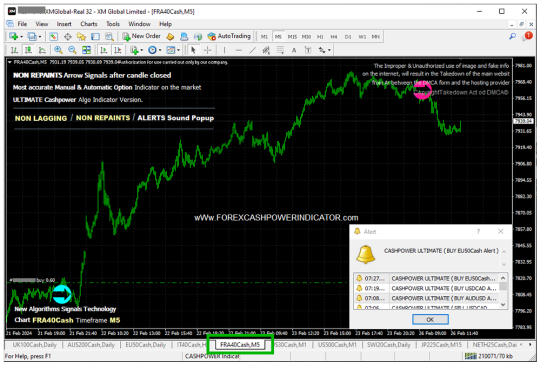

BIG Trade Profits #BUY Trade inside Indice #FRA40Cash M5. Oposite Signal time to close the trade. wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & NON REPAINT buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful AUTO-Trade EA Option

.

⭐ TOP BROKER Recommended ⭐

Trade Conditions to use CASHPOWER INDICATOR & EA Money Machine.* Top Awards WorldWide trade execution * Regulamented Brokerage Forex * O.O Spreads with Fast Deposits * Fast WITHDRAWALS with Cryptos. open your MT4 Account Start your trade Journey with BEST Broker !!

👉 https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

. ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#cashpowerindicator#indicatorforex#forexindicators#forexsignals#forex#forextradesystem#forexindicator#forexprofits#forexvolumeindicators#forexchartindicators#forex brokers#best forex brokers#forex education

4 notes

·

View notes

Text

Best Regulated Forex Brokers for Secure Trading

Forex Regulation Inquiry for best regulated Forex brokers, ensuring a secure trading environment. These platforms adhere to stringent regulations, offering traders peace of mind and protection. Navigate the dynamic currency markets with confidence, knowing your investments are supported by reliable and trustworthy brokers committed to maintaining a secure trading experience.

#forex broker#stock broker#forex market news#online forex market#forex market#forexregulationinqury#stock market#forex trading#business#online forex trading#best regulated forex brokers

4 notes

·

View notes

Text

Online Foreign Exchange Account - UltraTrendFX

Access the global Forex market with UltraTrendFX's online foreign exchange account. Trade currencies anytime, anywhere with competitive spreads and fast execution.

#Online Foreign Exchange Account#online currency trading platforms#best forex charts online#make money online by trading forex#forex easy online trading#best foreign currency trading platform#top online forex brokers

3 notes

·

View notes

Text

Forex Market Analysis: How to Understand Market Volatility in Forex Trading.

Introduction.

In the financial market all over the world, the foreign exchange (forex) market is the biggest and is also a platform where assets can be easily turned into cash without a huge loss of value. It has many characteristics but the one that stands out the most is its volatility which is the fluctuation of exchange rates in the foreign exchange (forex) market. Understanding volatility is significant to traders because it highlights the profits to be made and also the potential risks and challenges involved while trading.

High volatility means prices fluctuate wildly and by huge amounts which is great because it creates more trading opportunities but also means high risks and challenges. Low volatility means prices change at a slow pace and are stable.

Volatility enables traders to understand the quantity at which a currency is likely to move which assists in setting profit levels that are realistic and also manage the levels of losses or challenges. Secondly, volatility enables traders to pick the right strategies while trading which helps them to get comfortable when trading conditions change.

What is Forex Volatility?

Forex market volatility is the degree of price variation in the foreign exchange (forex) market.

While it creates profit opportunities, it also expands risks and challenges. When it comes to trading decisions, volatility impacts the how, what and when traders can trade. High volatility means short – term solutions such as breakout trading to accommodate the rapid fluctuations. Low volatility means range – bound solutions to accommodate the slow fluctuations.

Secondly, when it comes to potential profits and losses, volatility influences the price range movement. Large price fluctuations create space for larger profits whose downside is huge risks and losses. Low price fluctuations create limited profits whose upside is limited risks and losses.

Thirdly, increased volatility also helps in reducing early exits through stop – losses strategies. It also helps traders to adjust their position sizes to small which helps them monitor their risk per trade.

Key Factors that Influence Forex Volatility.

3.1 Economic Indicators.

Economic indicators show the economy of a country. When it comes to forex, the traders keep tabs on them because they influence the currency prices fluctuations. These include;

Gross Domestic Product (GDP).

Gross Domestic Product (GDP) shows the general economic incline or decline of a country by estimating the total worth of goods and services in that country. High GDP expands the economy which allures foreign investment hence strong currency. Low GDP contracts the economy which causes weak currency.

Inflation.

Inflation influences the increase in price rate of goods and services. High inflation, if not accompanied by high interest rates can make a currency weak because it depreciates the purchasing power. The response of central banks can also strengthen or weaken a country’s currency. High rates allure investors while low rates pushes them away. Inflation and central bank policies go hand in hand as high volatility is influenced by unforeseen inflation numbers.

Unemployment rate.

�� This shows the amount of people in a country who are looking to work but are unable to get jobs. High unemployment rate influences weak currency because it reflects economic weakness while low unemployment rate influences strong currency because it reflects economic strength.

Case Example: UK Inflation surprise (October 2022).

3.2 Political Events and Global News.

Geopolitical events, elections and International tensions also have a part to play in controlling the forex market volatility in that they cause unpredictability in currency prices.

Geopolitical Events.

These include; wars, diplomatic conflicts or terrorist attacks. These often influence the traders to protect their money by transferring them to other currencies for protection hence weakening the currency of the country. Due to the unexpected nature of the events, the volatility rises as a result.

Elections.

Uncertain elections influence tension in the forex market hence increased volatility before and after voting while certain elections may not affect volatility.

International tensions.

These include; diplomatic breakdowns, trade disputes or sanctions. The tensions impact the decisions of investors due to uncertain economic outlook. This as a result weakens the currencies of the countries where trading is slow.

Case example: In the period of the Russia – Ukraine crisis, the Russian currency plummeted hence weakening the Euro. On the other hand, traders took safety by transferring funds to the US Dollar hence increased volatility.

3.3 Market Sentiment and Speculation.

Market sentiment represents the traders’ feelings towards a particular currency or market. This is caused by news, social media, and global events. Volatility is affected in that it may rise if positive news is expected before information release. If the news come as the opposite, the situation may reverse.

Speculation means decisions being made by traders due to anticipated price fluctuations. This raises the prices due to patterns of the algorithm or decrease the prices when the rumors are not fulfilled. Increased speculation can influence a hike in currency prices or a massive decline depending on the results of the speculation.

Example: If there is news that a Central Bank will participate in the market to help, the currency prices might plummet but if the news end up not being true, the currency prices might decrease.

4 How to Analyze Forex Volatility.

4.1 Technical Analysis Methods.

4.1.1 Bollinger Bands.

Bollinger bands are a technical analysis tool used to estimate volatility in the market and single out potential entry or exit conditions in a currency pair. They consist of 3 lines:

Upper band: Middle band with 2 standard deviations.

Middle band: Moving average.

Lower band: Middle band without 2 standard deviations.

Standard deviation is an estimate of the amount of prices that digress from the average (middle band). When volatility hikes, the upper and lower bands move away from each other (standard deviation widens). When volatility depreciates, the upper and lower bands move closer (standard deviation declines).

Breaking of the upper band by traders shows excessively bought states while breaking of the lower band shows excessively sold states. On the other hand, tightening of the bands signifies a breakout in any of the directions.

Example: EUR/USD Bollinger Band “Squeeze and Breakout”.

The two currencies have been trading in a tight range meaning slimming of the bands hence low volatility (Bollinger Bands Squeeze). Slimming of the bands shows potential breakout. This alerts the traders on a potential strong price move. Central Bank of Europe announces a rate hike to be expected. The two currencies rise upward suddenly going beyond the upper band. The bands widen wildly signaling a hike in volatility due to the news. Breakout traders have long states due to the currency increase beyond the upper band, while volatility based traders don’t enjoy full profits due to the potential increased risk.

4.1.2 Relative Strength Index (RSI)

Relative Strength Index (RSI) is a technical analysis tool used to estimate the tempo and price change movements. It is used to check for overbought or oversold market conditions.

Overbought (RSI > 70): shows that currency pair may have been overbought and could be because of a pullback hence traders will sell profits.

Oversold (RSI < 30): signifies that currency pair may have been oversold and could be because of a reversal upward hence traders will buy profits.

Using RSI, single out overbought or oversold conditions. Confirm with Bollinger Bands in that, there is a potential reversal when the price closes outside the upper band plus RSI > 70. Also, there is a possible bounce when the price closes outside the lower band plus RSI < 30

Example: EUR/USD have been in an increase. RSI elevates to 75 meaning the currencies are overbought. Similarly, the price closes above the upper band. This means that the price is overstretched in comparison to volatility (Bollinger Bands) hence traders may want to sell profits.

4.2 Fundamental Analysis Methods.

4.2.1 Economic Data Analysis.

Reports such as GDP, employment numbers and inflation data influence a country’s economic wellbeing and interest rate predictions. In volatility, interest rate increase means strong currency while interest rate decrease means weak currency.

Example: If the US GDP grows beyond expectation, traders may expect increased interest rates hence buying the USD.

4.2.2 Political Events and Geopolitical Risks.

Things like political instability or geopolitical events can lead to sharp movements in currency prices. This is because these events cause uncertainty hence increased volatility. Things like corruption and coups lead to withdrawal of investors which in turn depreciates the country’s currency.

Example: The UK political chaos (2022) caused a decrease in the British pound in comparison to the US Dollar. The Prime Minister, Liz Truss resigning meant political instability hence the results.

4.3 Using Volatility Indicators to Predict Market Moves.

4.3.1 Implied Volatility.

Implied volatility is an essential method which provides a look into the quantity of movement that is anticipated by traders in a currency pair. It helps in providing information in expected risks or volatile market conditions. High Implied Volatility means more expensive options due to large price swings anticipation while Low Implied Volatility means cheaper options due to less movement expectations.

Example: the EUR/USD showed volatility may escalate to 9% from 6% just before an interest rate decision. This shows that an increase in the currency pair was expected despite the uncertainty of the direction they would go.

4.3.2 Volatility Index (VIX)

It is a market index that estimates the volatility expectations in the market over the next 30 days solely in the US. It shows uncertainty and risk sentiment hence referred to as the ‘fear index’. A higher VIX means more volatility and risk is anticipated. This means geopolitical events are likely to occur. Traders keep tabs on VIX to have knowledge on global risk sentiment and to monitor risk – on (appetite for risk) and risk – off (flight to safety).

Example: During the pandemic (COVID – 19), the VIX surged to above 80. As a result, currencies like USD increased while currencies that were at risk like AUD shrunk.

5 How to Manage Risks in Volatile Forex Market.

5.1 Use of stop – loss and take – profit orders.

Stop – loss orders help manage risks by shutting down a trade when the market doesn’t favor a trader by a certain amount. They come in handy when volatility increases meaning uncertain price swings. They help avoid unanticipated losses.

5.2 Leverage Management.

In a calm market, a 1% move can bring a calm gain or loss but with leverage it could turn to 100% gain or loss. In volatile market, prices can plummet between 2% - 5% or more in minutes. With leverage, a trader’s trade can hit margin call or be automatically liquidated. Smart traders use tight risk management, and stop losses to protect themselves during high volatility.

6. Conclusion

In conclusion, by marrying fundamental analysis (events, news, and data) with technical analysis (Bollinger band, implied volatility, RSI) traders can:

Single out opportunities and risk.

Make strategic and informed trading decisions.

Expect market moves.

Call to Action (CTA).

Ready to take your forex trading to the next level? Start using volatility indicators to trade with more precision, confidence and control.

#forex trading trial#how forex trading works#best forex broker in india#virtual forex trading#forex trading app#forex trading platforms

0 notes

Text

FP Markets Review ☑️ Top Forex Brokers Review (2025)

Welcome to our in-depth FP Markets Review, where we explore everything you need to know about this well-established forex and CFD broker. Whether you're a seasoned trader or just starting your trading journey, this review will provide valuable insights into FP Markets' services, features, and its position in the competitive forex market of 2025. As part of our analysis, we’ll also touch on the broader forex market landscape and how FP Markets compares to its competitors. This review is brought to you by Top Forex Brokers Review, your trusted source for unbiased and detailed broker evaluations.

FP Markets Overview

Company Background

FP Markets, founded in 2005, is an Australian-based broker with a strong reputation for reliability and transparency. Over the years, it has grown into a global brand, offering a wide range of trading instruments and services. Headquartered in Sydney, FP Markets has achieved several milestones, including expanding its regulatory footprint and introducing advanced trading platforms to cater to a diverse clientele.

Regulation and Security

FP Markets is regulated by multiple top-tier authorities, including:

Australian Securities and Investments Commission (ASIC)

Cyprus Securities and Exchange Commission (CySEC)

Capital Markets Authority of Kenya (CMA)

Financial Sector Conduct Authority in South Africa (FSCA).

This robust regulatory framework ensures that FP Markets adheres to strict financial standards, providing a secure trading environment. Additionally, the broker segregates client funds from its operational capital, further enhancing safety and trustworthiness.

Services and Features

Trading Platforms

FP Markets offers a variety of trading platforms to suit different trading styles and preferences:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These industry-standard platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces. They are available on desktop, web, and mobile devices.

cTrader: This platform is ideal for traders who value the depth of market visibility and advanced order capabilities. It also supports algorithmic trading through cAlgo.

IRESS Platform: Designed for trading equities, indices, and futures CFDs, IRESS offers a high level of customization and transparency in market pricing.

TradingView Integration: FP Markets integrates with TradingView, a popular platform for technical analysis and social networking among traders.

Account Types

FP Markets provides several account types to cater to different trading needs:

Standard Account: Aimed at beginners, this account requires a minimum deposit of AUD 100 and offers spreads starting at 1.0 pips with no commissions.

Raw Account: Designed for experienced traders, it also requires an AUD 100 minimum deposit but offers spreads from 0.0 pips with a commission of $3.50 per lot per trade.

IRESS Accounts: These include Standard, Platinum, and Premier accounts, each with varying minimum deposits and brokerage fees. They are tailored for active traders and offer Direct Market Access (DMA).

Islamic Accounts: Swap-free accounts adhering to Sharia law are available for both MetaTrader and IRESS platforms.

Range of Tradable Instruments

FP Markets boasts an impressive range of over 10,000 tradable instruments, including:

Forex: Over 70 currency pairs, covering both major and exotic pairs.

Shares: Access to more than 13,000 global shares.

Indices, Commodities, and Cryptocurrencies: A wide selection of indices, commodities like gold and oil, and cryptocurrency CFDs 9.

Leverage and Spreads

FP Markets offers competitive leverage options, with forex leverage up to 500:1. The Raw ECN account provides spreads starting from 0.0 pips, making it an attractive choice for cost-conscious traders

Additional Services

FP Markets goes beyond trading by offering:

Educational Resources: Webinars, trading guides, and video tutorials to help traders improve their skills.

Market Analysis: Daily market updates and insights to keep traders informed.

Customer Support: 24/7 multilingual support via live chat, email, and phone.

User Reviews and Feedback Customer Satisfaction

FP Markets generally receives positive feedback from users, particularly for its:

Competitive Pricing: Low spreads and transparent fee structures are frequently praised.

Platform Variety: The availability of multiple platforms like MetaTrader, cTrader, and IRESS is well-received.

Customer Support: The broker's 24/7 multilingual support is highly rated.

Common Criticisms

Some users have noted areas for improvement, such as:

Limited features in the proprietary mobile app compared to industry leaders.

Higher spreads on the Standard account, which may not be ideal for traders seeking commission-free options.

Forex Market Landscape in 2025

Geopolitical and Economic Factors

The forex market in 2025 is shaped by several key trends:

Geopolitical Tensions: Ongoing conflicts and rising tensions between major powers like the US and China are driving market volatility.

US Political Climate: The return of Donald Trump to the White House is expected to influence the US dollar through policies like tariffs and increased spending.

Central Bank Policies: Interest rate adjustments by central banks like the Federal Reserve and the European Central Bank are pivotal in shaping currency values.

Technological and Regulatory Developments

AI in Forex Trading: The integration of AI tools is democratizing market analysis, enabling traders to make more informed decisions.

Regulatory Changes: Enhanced oversight in forex trading is improving transparency but may increase operational costs.

Implications for FP Markets

FP Markets is well-positioned to thrive in this dynamic landscape by leveraging its advanced trading platforms and robust regulatory compliance. Its focus on emerging markets and technological innovation further strengthens its competitive edge

Competitive Analysis

Top Competitors

FP Markets faces competition from brokers like IC Markets, Pepperstone, and XM. While these brokers also offer competitive pricing and advanced platforms, FP Markets stands out for its extensive range of tradable instruments and strong regulatory framework

Strengths and Weaknesses

Strengths: Regulatory compliance, competitive pricing, and platform variety.

Weaknesses: Limited mobile app features and higher spreads on Standard accounts

Conclusion

FP Markets is a reliable and well-regulated broker that offers a comprehensive range of services and features. Its competitive pricing, extensive platform offerings, and robust regulatory framework make it a strong choice for traders in 2025. While there are areas for improvement, such as mobile app features and Standard account spreads, the overall user feedback is positive. For traders seeking a secure and versatile trading environment, FP Markets is undoubtedly worth considering.

2 notes

·

View notes

Text

Forex Trading Platforms in India to Meet Your Trading Goals

Choosing the Best Forex Trading Platform in India is one of the most important steps for anyone entering the world of currency trading. As forex gains popularity among Indian traders, the demand for platforms that offer security, speed, ease of use, and insightful tools continues to grow. The right platform not only supports your trading strategy but also helps manage risks and improves efficiency. With so many options available, selecting one that aligns with your trading goals can set the foundation for long-term success. Read more : https://technegraph.com/best-forex-trading-platform-in-india/

0 notes

Text

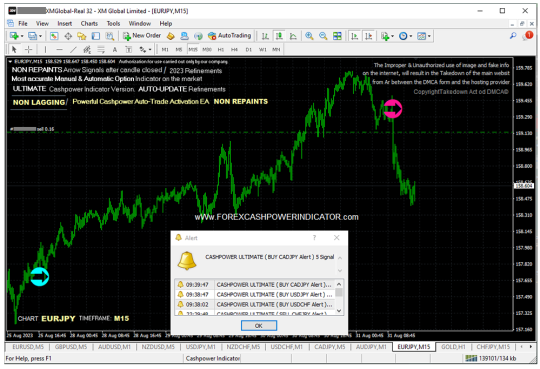

Forex #Metatrader4 EURJPY M15 Sell trade 0.16 lots. More Info about Non Repaint Trade system in Website.

. 🔥 wWw.ForexCashpowerIndicator.com . Cashpower Indicator is Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING ✅ Less Signs Greater Profits 🔔 Sound And Popup Notification ✅ Minimizes unprofitable/false signals 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#cashpowerindicator#forexindicator#forexindicators#forexsignals#forex#indicatorforex#forextradesystem#forexprofits#forexvolumeindicators#forexchartindicators#forex forum#forex baby pips#forexstation#how trade forex#what is forex#best forex brokers#xm forex broker

5 notes

·

View notes

Text

Zero Spread Brokers: Are They Really Cost-Free?

All traders feel that a spread cost is a major cost that they have to pay when they are trading. That is why a zero spread forex broker is a dream come true for traders. It is a great way to save money that you seem to spend each time you make a trade. However, there are platforms that tend to charge you some hidden costs. You need to be aware of them as they can impact your profits. This blog will run you through some hidden costs that you should know to help make better trading decisions.

For More Information Visit Our Website: https://www.slideshare.net/slideshow/zero-spread-brokers-are-they-really-cost-free/277040424

#zero spread forex broker#zero brokerage brokers in india#zero commission forex broker#best forex broker zero spread#zero spread account forex broker#top zero spread forex broker

0 notes

Text

Online Forex Broker: Choosing the Right Platform for Your Trading Journey

Forex trading has emerged as one of the most widely used financial markets globally, with millions of traders seeking to earn profits from the fluctuations in currencies. The forex market is open 24 hours a day, five days a week, and offers tremendous opportunities for new as well as experienced traders. But the success of forex trading depends on selecting the right online forex broker. A good broker can give the traders the tools, facilities, and assistance that they need to make the right choice and yield the highest possible returns. In this blog, we will discuss the online forex broker's role, key characteristics, and how you should select the ideal platform for your needs.

What is an Online Forex Broker?

An online foreign exchange broker is a go-between for traders and the foreign exchange market. It is an online platform where the traders can buy and sell foreign currency pairs. Brokers serve as intermediaries by providing the traders with market information, trading tools, charting programs, and other useful resources. Brokers also provide leverage, with which the traders can manage more positions using less capital.

Internet-based forex brokers operate by linking retail traders to financial institutions and banks, which provide liquidity. This facilitates real-time quotes and near-instant trading. The broker generates profits through spreads (the difference between the ask price and bid price) or by receiving a commission on each trade.

It's essential to choose the correct forex broker since it can reflect directly on your trading success. A reliable broker offers a safe trading environment, quick order execution, and investment protection. Conversely, an unfaithful broker will put you at risk of price manipulation, delayed execution, or even fund mismanagement.

Most Important Advantages of Selecting a Reputable Forex Broker:

Access to Market Data: A quality broker offers real-time price quotes, market news, and analysis.

Low Spreads and Commissions: Competitive spreads and commissions lower trading costs and increase profitability.

Fast Order Execution: Fast execution reduces slippage and guarantees trades are executed at the desired price.

Secure Trading Environment: A regulated broker guarantees that your money is safe and held in segregated accounts.

Advanced Trading Tools: Access to technical indicators, charting software, and automated trading options.

Customer Support: Good customer support assists with solving problems and offering advice when necessary.

How to Select the Best Online Forex Broker

Getting the proper broker involves considering a number of factors in order to match it with your trading objectives and approach. Below are the main factors to consider:

1. Regulation and Security

One of the key considerations when choosing a forex broker is regulation. Legitimate brokers are regulated by financial regulators like:

The U.S. Commodity Futures Trading Commission (CFTC)

The Financial Conduct Authority (FCA) in the UK

The Australian Securities and Investments Commission (ASIC)

The Cyprus Securities and Exchange Commission (CySEC)

Regulation guarantees that the broker has stringent financial requirements, protects client funds, and operates in an open manner. Steer clear of unregulated brokers because they do not offer sufficient protection against fraud or mismanagement of funds.

2. Trading Platform and Technology

The trading platform is the doorway to the forex market. A good and easy-to-use platform increases the overall trading experience. Some of the best known platforms are:

MetaTrader 4 (MT4): Renowned for its sophisticated charting features and automated trading.

MetaTrader 5 (MT5): Provides more timeframes and order types.

cTrader: Offers a new interface and improved order execution speed.

Make sure the platform has mobile compatibility, customizable charts, and quick execution to suit your trading style.

3. Spreads, Commissions, and Fees

The trading cost is a significant consideration when choosing a broker. Most brokers make money from spreads and commissions.

Spreads: Low spreads minimize trading expenses and enhance profitability.

Commissions: Certain brokers have a fixed commission per trade, while others have commission-free trading with increased spreads.

Additional Fees: Look for withdrawal fees, inactivity fees, and overnight fees.

Select a broker with a clear fee structure to prevent surprise charges.

4. Leverage and Margin Requirements

Leverage enables you to trade greater positions with less deposit. While leverage magnifies profits, it also magnifies the risk of losses.

High Leverage: For experienced traders who can deal with the risks.

Low Leverage: Ideal for beginners in order to avoid exposure to volatility in the markets.

Make sure that the broker offers flexible leverage choices and understandable margin requirements.

5. Account Types and Minimum Deposits

Various brokers have different account types to suit diverse trading styles:

Micro Accounts: Ideal for newbies with small capital.

Standard Accounts: Ideal for frequent traders with modest capital.

Professional Accounts: Have lower spreads and larger leverage for professional traders.

Take note of the minimum deposit amounts and account specifications prior to registration.

6. Customer Support and Educational Resources

Good customer support is vital for troubleshooting technical problems and trading-related questions. Seek out brokers with:

24/5 or 24/7 customer support through live chat, email, and phone.

Multilingual customer support for overseas traders.

Learning resources in the form of webinars, tutorials, and market commentaries.

Good learning resources can assist you in enhancing your trading acumen and keeping up with current market trends.

Best Online Forex Brokers in 2025

Here are some of the best trustworthy online forex brokers to look at:

1. IG Group

Regulated by FCA, ASIC, and other prominent authorities.

MT4 and in-house platforms.

Competitive spreads and low commission fees.

2. eToro

Best used for social trading.

Commission-free trade with tight spreads.

User-friendly platform perfect for beginners.

3. XM

CySEC and ASIC are regulated.

High leverage available.

Minimum slippage with fast execution.

Conclusion:-

Selecting a good online forex broker is a key step to success in the forex market. A well-regulated broker with a stable platform, competitive spread, and solid customer support can make your trading experience better and improve your possibilities of profitability. Take time to compare various onnline forex brokers, trial their platforms, and compare their fees before you make a choice. With the right broker, you can trade the forex market comfortably and make progress toward your trading ambitions.

0 notes

Text

Best Forex Broker in India – Trade with Confidence

Discover the top forex brokers in India with our expert reviews. Trade securely with regulated platforms and find the best forex trading app in India.

#forex broker in India#RBI approved forex broker in India#the best forex broker in india#top forex broker india#Best Forex Brokers in India#Top Forex Brokers in India#forex trading app in India

0 notes