#best foreign currency trading platform

Explore tagged Tumblr posts

Text

Online Foreign Exchange Account - UltraTrendFX

Access the global Forex market with UltraTrendFX's online foreign exchange account. Trade currencies anytime, anywhere with competitive spreads and fast execution.

#Online Foreign Exchange Account#online currency trading platforms#best forex charts online#make money online by trading forex#forex easy online trading#best foreign currency trading platform#top online forex brokers

3 notes

·

View notes

Text

Litecoin trading platform

Actamarkets offers a cutting-edge Litecoin trading platform, designed for traders seeking fast execution, advanced tools, and seamless experience. Join Actamarkets to maximize your Litecoin trading potential.

Visit Us : - https://actamarkets.com/account-types/

#uk#Litecoin trading platform#international brokerage company#Commodity Trading Companies#Currency Exchange Foreign Forex Trading#Low Spreads Forex Trading#Best Forex Trading Platforms#Trade Currency Online With Forex#Foreign Exchange Investment Fx#forex trading investment company#Best Platform For Forex Trading#best commodities trading#MOBUIS TRADER 7 app#best ACTA MARKETS APPS#ACTA MARKETS MT7#best MetaTrader platform#best forex trading with CFDs#BUY or SELL forex CFDs#best cryptocurrency trading platform#litecoin trading platform#best Ethereum with CFDs

0 notes

Text

Start Corporate Forex Trading with Best Consultant in India For more details visit: https://www.myforexeye.com/corporate-forex

#Corporate Forex#Forex trading#Corporate Foreign Exchange#Corporate Forex Solutions#FX service#Corporate Account#Best Forex Consultant#Currency Exchange#Forex trading platform#online trading platform

0 notes

Text

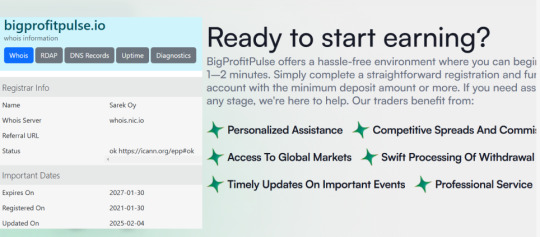

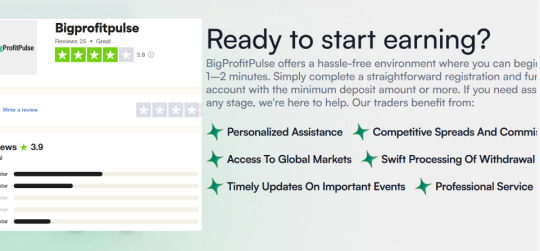

BigProfitPulse.io Reviews Explore the Best Trading Conditions

The online trading world is dynamic and ever-evolving making it crucial to choose a reliable and efficient platform that provides traders with the best opportunities. BigProfitPulse.io reviews showcase why this platform stands out as a leader in the financial industry offering a combination of innovative tools competitive trading conditions and high-speed execution. With a diverse range of financial instruments and a user-friendly interface traders can seamlessly engage in trading without unnecessary hurdles. The ability to access real-time market prices and leverage personalized support ensures that every trader from beginners to professionals can optimize their strategies and achieve financial success.

BigProfitPulse.io Reviews Why Traders Choose Us

Traders are always in search of a platform that not only meets their expectations but also exceeds them. BigProfitPulse.io reviews highlight how this platform consistently delivers top-tier trading services ensuring that every trader has access to the best possible conditions. A major reason why traders trust BigProfitPulse.io is the platform’s commitment to transparency and efficiency. With instant order execution and competitive spreads traders can capitalize on opportunities without worrying about delays or hidden fees. Additionally the platform’s training programs provide users with invaluable insights helping them refine their skills and develop well-informed trading strategies. Whether you are just getting started or already an experienced trader BigProfitPulse.io has the tools and resources to support your journey.

BigProfitPulse.io A Cutting-Edge Trading Platform

One of the most discussed features in BigProfitPulse.io reviews is its cutting-edge trading platform which is designed to cater to traders of all levels. The web-based terminal allows users to analyze financial markets track real-time price movements and execute trades effortlessly from their browsers. There is no need for additional software installations or complicated setup procedures making it easier than ever to engage in global trading. Whether you are trading stocks foreign currencies or precious metals BigProfitPulse.io provides an advanced yet accessible trading environment. The platform is equipped with the latest tools for technical analysis ensuring that traders can make data-driven decisions with confidence.

BigProfitPulse.io Reviews Comprehensive Client Support

A key highlight in BigProfitPulse.io reviews is the comprehensive customer support that ensures traders receive assistance whenever they need it. The platform prides itself on offering professional support services with a team of knowledgeable experts available to answer questions resolve technical issues and provide valuable insights. Whether traders require help navigating the trading terminal understanding market trends or optimizing their trading strategies BigProfitPulse.io’s support team is always ready to assist. This level of commitment to customer service sets the platform apart making it a preferred choice for traders looking for reliability and security.

BigProfitPulse.io Real-Time Liquidity and Instant Execution

Market conditions can change in an instant and traders need a platform that provides real-time liquidity and swift order execution. BigProfitPulse.io reviews emphasize how the platform ensures that trades are processed without delays allowing traders to take advantage of market fluctuations as they happen. The integration of interbank liquidity ensures that users get the best available prices maximizing their profitability. By eliminating execution lags and providing seamless order processing BigProfitPulse.io enhances the overall trading experience giving users a competitive edge in the financial markets.

BigProfitPulse.io Reviews Personalized Training for Traders

Education and continuous learning play a significant role in a trader’s success and BigProfitPulse.io reviews highlight how the platform offers personalized training programs to support users at every stage of their trading journey. Traders are matched with experienced tutors who provide insights into market movements risk management and profitable trading strategies. This hands-on approach helps traders develop confidence and refine their skills ensuring they can navigate financial markets with greater precision. The platform’s commitment to education makes it an ideal choice for both newcomers and seasoned professionals looking to expand their knowledge.

BigProfitPulse.io Reviews Secure and Fast Withdrawals

Security and convenience are top priorities for traders and BigProfitPulse.io reviews confirm that the platform provides a safe and efficient withdrawal process. Users can request fund withdrawals at any time knowing that transactions will be processed swiftly without unnecessary delays. The platform employs advanced security measures to protect user funds and personal data giving traders peace of mind while they focus on their trading activities. Whether traders are actively trading or cashing out their profits they can trust BigProfitPulse.io to handle their transactions smoothly and securely.

BigProfitPulse.io Getting Started is Easy

A major advantage noted in BigProfitPulse.io reviews is the simplicity of getting started on the platform. Registration is quick and straightforward allowing traders to create an account and begin trading within minutes. The low minimum deposit requirement makes it accessible to traders of all backgrounds whether they are testing the waters or fully committing to the trading lifestyle. The platform also provides personalized guidance during the onboarding process ensuring that new traders have all the necessary tools and knowledge to begin their journey with confidence.

BigProfitPulse.io The Advantages of Trading Here

Traders continue to choose BigProfitPulse.io for the numerous advantages it offers. BigProfitPulse.io reviews frequently mention the following key benefits

Competitive spreads and low trading commissions ensuring maximum profitability

Swift and hassle-free processing of withdrawal requests allowing traders to access their funds at any time

Timely updates on significant market events helping traders stay informed and make strategic decisions

Access to global financial markets enabling users to diversify their portfolios and explore multiple investment opportunities

Professional customer support dedicated to resolving issues and providing expert assistance

BigProfitPulse.io Reviews Your Path to Financial Success

Finding the right trading platform is essential for achieving success in the financial markets. BigProfitPulse.io reviews highlight how this platform combines advanced technology expert guidance and superior trading conditions to create an unparalleled trading experience. Whether you are an aspiring trader or a seasoned professional looking for a reliable partner BigProfitPulse.io provides all the tools and resources necessary for success. By choosing BigProfitPulse.io traders gain access to a secure transparent and innovative trading environment that empowers them to reach their financial goals.

6 notes

·

View notes

Text

Forex for Beginners: A Step-by-Step Guide to Start Trading in 2025

If you're curious about forex trading for beginners, you're not alone. Thousands of new traders are entering the market in 2025, eager to explore opportunities in the global currency exchange. Forex trading, or foreign exchange trading, involves the buying and selling of currencies on a global online market. It's one of the most accessible financial markets, making it incredibly popular among novice traders. With the potential for significant returns and the ability to trade from anywhere in the world, many are drawn to the allure of the foreign exchange. However, as enticing as it may sound, embarking on a forex trading journey requires careful planning and execution. This guide will help you take your first confident steps in the world of Forex.

What is Forex Trading and Why is it Popular Among Beginners?

Forex trading refers to the process of exchanging one currency for another in the hopes of making a profit. It is conducted over the counter (OTC) through a network of banks, brokers, and individuals—all of whom facilitate transactions in the currency market. One of the primary attractions for beginners is the high liquidity of forex, which allows traders to enter and exit positions quickly, often with small amounts of capital.

The 24-hour market availability from Monday to Friday is another advantage, enabling flexibility for part-time traders and those in various time zones. Beginners are also drawn to the relatively low barriers to entry—many brokers allow you to start with just $10–$50.

Additionally, educational resources are widely available, and many trading platforms offer a forex demo account for beginners, allowing them to practice trading without incurring real financial risk. As technology continues to evolve, trading tools and mobile platforms are becoming more intuitive, further enhancing the overall beginner experience.

How Forex Trading for Beginners Works in 2025

For new traders, the mechanics of Forex might seem complex, but at its core, it operates on straightforward principles. You trade in currency pairs—for example, EUR/USD (Euro/US Dollar). If you believe the Euro will rise against the Dollar, you buy the pair. If the price moves in your favor, you profit.

What drives these price changes? A combination of economic indicators (like inflation and employment data), central bank decisions, geopolitical events, and market sentiment. As a trader, you can use:

Technical analysis: Studying price charts, trends, and indicators.

Fundamental analysis: Evaluating economic news and events.

Both approaches are essential in building a complete trading strategy.

Key Forex Trading Terminology You Should Know

Understanding Forex jargon is vital for success. Here's a quick rundown:

Pip (Percentage in Point): The smallest price change in a currency pair, typically 0.0001 for most pairs.

Lot: A standardized trading volume. A standard lot equals 100,000 units of the base currency.

Spread: The difference between the buy (ask) and sell (bid) prices. Tighter spreads mean lower trading costs.

Leverage: A tool that allows you to trade larger positions using borrowed funds. For example, 1:100 leverage means you can control $10,000 with just $100.

Familiarizing yourself with these terms early on can help prevent misunderstandings and build confidence.

Step-by-Step Guide to Starting Forex Trading

Now that you understand the basics, here’s a structured breakdown of how to start forex trading:

Choosing the Best Forex Broker for Beginners

Your broker plays a critical role in your trading journey. When searching for the best forex brokers for beginners, prioritize the following:

Regulation: Choose brokers regulated by trustworthy bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

User Experience: An intuitive interface can ease your learning curve.

Educational Support: Tutorials, webinars, eBooks, and market analysis.

Low Spreads and Fees: Keep trading costs manageable.

Demo Account: A forex demo account for beginners is a must-have feature.

Compare reviews, test out demo platforms, and make sure the broker’s policies align with your goals.

Forex Trading Strategies: A Quick Guide for Every Trader

The forex market offers a range of strategies suited for different trading styles and timeframes. Whether you're after quick gains or long-term growth, there's a method to match your goals.

Day Trading: Fast-Paced and Precise Day traders open and close positions within the same day, relying heavily on technical analysis, chart patterns, and rapid decision-making. This strategy suits those who thrive on quick market movements and real-time risk control.

Swing Trading: Ride the Market Waves Swing traders hold positions for days or weeks to capture price swings. It’s a balanced approach using trend analysis, key support/resistance levels, and indicators like moving averages to spot entry and exit points.

Long-Term Investing: The Patient Path Long-term forex investors look beyond daily moves, focusing on macroeconomic indicators, interest rates, and geopolitical trends. This approach emphasizes portfolio diversification and staying updated with global events.

Hybrid Strategies: Best of All Worlds Some traders combine elements of day, swing, and long-term trading to create a custom strategy based on their time, risk tolerance, and financial goals.

Risk Management: The Key to Longevity Regardless of your strategy, protecting capital is crucial. Use tools like stop-loss orders, proper position sizing, and diversification to manage risk and trade sustainably.

How to Open a Forex Trading Account

The process of opening a trading account is generally quick and can be done entirely online. Here’s what you’ll need:

Select a broker and visit their official website.

Complete the registration with your details.

Upload KYC documents, such as ID proof and address verification.

Fund your account using a credit card, e-wallet, or bank transfer.

Choose whether to start with a demo or live account.

Take your time exploring the dashboard and tools available before placing your first trade.

Setting Up Your Trading Platform: MetaTrader 4 vs. MetaTrader 5

When choosing a forex trading platform, most beginners go for either MT4 or MT5:

MetaTrader 4 (MT4): Best for beginners due to its simplicity, ease of use, and large community support.

MetaTrader 5 (MT5): Offers more advanced charting tools, a wider range of indicators, and access to more financial instruments.

Both platforms support automated trading via expert advisors (EAs), and most brokers offer both for free. MT4 is more than enough to get started, but if you're thinking long-term, MT5 might offer better scalability.

Top Forex Trading Strategies for Beginners

A well-defined strategy gives your trading structure and helps you avoid emotional decisions.

Risk Management Tips for New Traders

Risk management is the backbone of successful trading. Obey these rules:

Start Small: Limit your initial risk per trade to 1–2% of your capital.

Use Stop-Loss Orders: Always have an exit strategy to protect against big losses.

Keep a Trading Journal: Track wins, losses, and emotional triggers to continuously improve.

Avoid Overtrading: Quality over quantity—don’t chase the market.

These forex trading tips for beginners can keep you grounded and focused.

Simple Trading Strategies to Get You Started

Try these beginner-friendly strategies:

Trend Following: Trade in the direction of the prevailing trend. Use moving averages to identify entry/exit points.

Breakout Trading: Identify consolidation zones and trade when price breaks above resistance or below support.

Scalping: Execute multiple trades within short periods to capture small price movements. Ideal for fast learners.

Before going live, test these in a forex demo account for beginners to build confidence.

Common Mistakes Forex Beginners Should Avoid

Even experienced traders make mistakes—but being aware of them early can save you from costly errors.

Trading Without a Strategy

Trading on impulse or "gut feeling" is one of the fastest ways to lose money. Create a strategy and stick to it, even when emotions tempt you otherwise. A solid trading plan includes entry/exit criteria, risk limits, and specific goals.

Overleveraging Your Trades

Leverage can magnify both gains and losses. New traders often misuse it, assuming bigger trades mean bigger profits. Instead, use leverage conservatively and only after you’ve fully understood how it works.

Embarking on your forex trading journey in 2025 can be an exciting and potentially lucrative experience if approached with knowledge and caution. By familiarizing yourself with the terminology, finding the best forex brokers for beginners, effectively managing risks, and avoiding common mistakes, you will set a strong foundation for your trading endeavors.

The forex market is dynamic and ever-evolving as technology and strategies develop—stay updated and continuously educate yourself on forex trading tips for beginners to enhance your trading process.

Whether you're just curious or ready to dive in, remember: success in Forex doesn't come overnight, but with patience, practice, and discipline, it's within reach.

2 notes

·

View notes

Text

An Overview of Different Financial Instruments in Global Trading

Introduction Entering global trading can be both exciting and complex. To help you navigate, this guide explores various financial instruments, assisting you in finding the best trading platform and making informed investment decisions. 1. Stocks Buying stocks means owning a share of a company. Stock prices fluctuate with company performance and market trends. Stocks are ideal for long-term investments, especially for those aiming to become the best forex trader. 2. Bonds Bonds are loans given to companies or governments, repaid with interest. Bonds are generally safer than stocks but offer lower returns. 3. Forex (Foreign Exchange Market) The forex market deals with currency trading and is the largest financial market globally. It operates 24/7, providing high liquidity. Forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to excel as the best forex trader. 4. Commodities Commodities include raw materials like gold, oil, and agricultural products. Trading commodities can diversify your investment portfolio. Their prices are affected by supply and demand, political events, and natural factors. 5. Mutual Funds Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they are ideal for beginners, offering a hassle-free investment approach. 6. ETFs (Exchange-Traded Funds) ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities. 7. Options Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks. Conclusion Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

4 notes

·

View notes

Text

Shocking Facts About Trading You Didn't Expect

Have you ever believed that trading was only for experts or Wall Street whiz kids? To be honest, that couldn't be more untrue. Trading is a talent that anyone can master with the correct attitude; it's not just about statistics. Allow me to introduce you to some shocking facts that will actually change your perspective on the trading field.

1. Trading Isn't Dependent on Chance It's a Talent That Anyone Can Develop

The majority of people believe that traders who are successful are simply fortunate. In actuality, discipline and preparation are key.

A learning curve exists: Actually, not even the most successful traders were born with all the answers. They studied tactics and patterns for years.

Controlling Your Emotions: In actuality, maintaining composure and making thoughtful choices even when you lose, is the backbone of trading success.

Practice Pays Off: It's true that you can gain confidence without risking everything by practicing with demo accounts or tiny deposits.

2. The World of Trading Is Greater Than You May Imagine

Let me reassure you that trading is far more varied than you may have assumed.

Foreign exchange, or forex, is a worldwide phenomena with tremendous opportunities for trading currencies such as the US dollar or the euro.

Cryptocurrency Boom: Trading is now easier than ever because of platforms like Ethereum and Bitcoin, which are revolutionizing the market.

Commodities: Did you know that people exchange coffee, oil, and gold? These marketplaces are flourishing and can be excellent places to start.

3. The True Secret To Mastery Is Risk Management

The best traders try to safeguard their losses rather than win every time, which is something that most newcomers are surprised to learn.

Establish Limits at All Times: Stop loss orders act as a kind of safety net for your trades.

Little Steps, Big Results: Especially in inconsistent markets, diversifying your bets lowers risk.

Knowing when to Give Up: To be honest, giving up on a bad trade can prevent more serious problems later.

4. It's Not Just About Money, It's About a Mindset

Has trading ever seemed too daunting to you? How you think matters more than how much you own.

Patience Wins: Most gains take time to materialize. Waiting for the appropriate opportunities is extremely important.

Learning Never Stops: Even experienced traders are constantly improving and learning up new skills from changes in the market.

Resilience Is Essential: To be honest, what sets great traders apart from the rest is their capacity to recover from setbacks.

5. You Don’t Need a Fortune to Start

The idea that trading necessitates a large initial investment is out of date. Anyone can start small in the modern world.

Micro Trading Apps: Robinhood and other platforms enable trades with as little as a few dollars.

Learning with Low Risks: By starting small, you may gain an understanding of the market without worrying about suffering significant losses.

Leverage Wisely: If done well, even modest investments can increase in value.

A Genuine Truth About Trading:

Anyone who promises you that trading is a quick way to make a lot of money isn't telling the truth. It all comes down to developing a skill set that becomes better with time. The possibilities are unlimited if you're prepared to study, practice, and maintain your discipline.

What is stopping you, then?

Kindly send your ideas or questions in comments so that we may have an open discussion.

"We're Building This Together"

Success is more meaningful when we achieve it together, with each shared story and learned lesson. This is more than just trading knowledge it’s about building a supportive community where we can openly share advice, experiences, and encouragement.

Your story could truly encourage someone else who is struggling on their journey!

Remember, each of you brings unique value and respect to this community, and I’m really grateful to have you here. Let's keep learning, growing, and achieving success together.

Your shared experiences, with all their ups and downs, encourage us all.

Together We're not just a community; we're a family, always standing by each other, no matter what comes our way.

Good Lucks 😊

#stock market#trading tips#cryptocurrency#tradingmindset#forextrading#learntotrade#trading success#financialfreedom#tradingskills#entreprenuership#passive income#personal finance

2 notes

·

View notes

Text

Planning is underway for the G-7 summit that Italian Prime Minister Giorgia Meloni will host from June 13 to 15. As the 50th summit of the G-7, the club of the world’s leading democracies, there will be an impulse to celebrate.

Understandably so. The G-7—which includes Canada, France, Germany, Italy, Japan, the United Kingdom, the United States, and, since 1981, the EU—today represents 54 percent of world GDP and over 55 percent of global defense spending. For decades, G-7 members have gained additional weight on the world stage by coordinating their national economic power in pursuit of shared foreign-policy priorities, such as protecting democratic societies and open markets.

But the importance of the coming summit exceeds its status as a landmark anniversary. The G-7’s future—and the future of global democratic cohesion in general—is now at stake.

Recent disparaging remarks about NATO by presumptive Republican presidential nominee Donald Trump have led many to question the credibility of America’s commitment to its allies. Part of Trump’s frustration with NATO comes from other NATO members’ historically low defense spending compared to the United States. Why should Americans spend more on Europe’s defense than Europeans are willing to?

However, the G-7 might prove even more vulnerable to the vagaries of a second Trump term. For Trump, coordinating U.S. foreign policy with others is a pointless constraint on U.S. freedom of action—unless, that is, it provides a tangible net economic return to America.

Herein lies the problem. The United States currently runs a trade deficit in goods with all of its G-7 partners except the United Kingdom. In 2023, these deficits amounted to $337 billion, more than the U.S. deficit with China ($279 billion). Trade deficits in goods are a foreign-policy red flag to Trump. That is why he treated Angela Merkel’s Germany as a greater rival than Vladimir Putin’s Russia and torpedoed the 2018 summit communiqué after G-7 leaders tried to push back against U.S. protectionism.

G-7 leaders could cross their fingers and hope there is a second term for incumbent U.S. President Joe Biden. But this is currently, at best, a 50-50 proposition. Instead, they should use the next three months to put in place a policy agenda that could withstand the buffeting of a second Trump presidency while also serving as a platform for a second Biden term.

The G-7’s achievements in Biden’s first term have been impressive. Since Putin’s full-scale invasion of Ukraine in February 2022, the G-7 has implemented an unprecedented package of sanctions against Russia, ranging from freezing the roughly $300 billion of its central bank’s reserves held in their currencies to banning the provision of insurance to tankers carrying Russian oil if it’s sold above a cap of $60 per barrel. It can do this because over 93 percent of global reserves are held in G-7 currencies, and over 90 percent of the world’s oceangoing tonnage is covered by protection and indemnity insurance issued by companies based in the G-7.

Reflecting their common concerns over China’s rise and Beijing’s close alignment with Moscow, the G-7 has also engaged consistently over the past three years with close allies South Korea and Australia, in an effort to start “friendshoring” supply chains for the semiconductors and renewable energy inputs that will be central to their future economic growth.

All this important work could come to an end if a new Trump administration returned to punishing its closest allies for being free riders. But fixing G-7 members’ trade imbalances with the United States is impossible in the near term. That’s why the upcoming G-7 summit must prioritize preparing for the possible restoration of a hostile Trump presidency.

First, G-7 members need to send a clear signal to Moscow that their support for protecting the sovereignty of Ukraine has no time limit. The murderous conflict there is now shadowed by an intense contest to show which side can outlast the other politically and economically. With new U.S. support currently blocked in Congress, European countries plus the EU have already taken an important step to demonstrate their resolve, by committing a further 77 euros billion in future multiyear financial and military assistance to Kyiv, on top of the approximately 75 billion euros they have already allocated since the start of the war.

The summit should also decide how all G-7 members will start drawing on the profits earned from the frozen Russian reserves. The obstacle to date is that the bulk of these reserves are held by EU banks, and some governments and the European Central Bank are concerned that even the modest step of disbursing the earned interest (4.4 billion euros last year) lacks a firm legal foundation and could also undermine the euro’s credibility as a global reserve currency. Overcoming these reservations would underscore the G-7’s resolve; and a Trump presidency might think twice before reneging on an arrangement that would repay some of the U.S. costs of supporting Ukraine.

Second, G-7 members should invite South Korea and Australia formally into the group. If there is a second Biden term, their membership will strengthen the G-7’s collective resilience in high technology and renewable energy. If there is a second Trump presidency, these two democratic allies will be less isolated in the face of his mercantilist threats.

Third, G-7 members should allocate a first tranche of funding for the plan that the Biden administration, EU leaders, Saudi Arabia, the United Arab Emirates, and India announced last year to build a rail, energy, and data corridor from India through the Gulf and Israel to Europe. This belated but important project to compete with China’s Belt and Road Initiative will connect India’s and the Gulf states’ youthful, burgeoning economies with Europe’s wealthy but aging markets.

The war in Gaza has called the plan into question, but its benefits to Israel create an important additional incentive for a post-Netanyahu government to build a durable peace with the Palestinians. At the same time, it would support the Trump presidency’s main foreign-policy achievement: the 2020 Abraham Accords that normalized Israel’s relations with several Arab states.

The G-7 is an invaluable geo-economic coordinating body for what is shaping up to be a protracted new Cold War with China and Russia. Whether to cement the gains of the Biden presidency or lessen the global risks of a Trump presidency, the G-7’s 50th anniversary summit must live up to its billing.

2 notes

·

View notes

Text

Navigating the World of Forex and Stock Market Investments

The financial markets offer various opportunities for both seasoned and beginner investors. Whether you're exploring the foreign exchange market or looking to grow your wealth through share market trading, understanding the dynamics of each market is essential to building a successful investment strategy.

The Rise of Forex Trading in India

The foreign exchange trading platform has evolved significantly, allowing retail investors to participate in the global currency market. With increased access to data, advanced tools, and better regulations, the currency trading platform in India has become more robust and user-friendly.

Traders today focus on understanding the currency market movements driven by global economic indicators, geopolitical developments, and interest rate changes. Forex currency trading demands quick decision-making and a sound understanding of market dynamics—especially concepts like what is ask and bid price in forex, which directly impact trade execution and profitability.

Investing Through Trusted Stock Market Partners

On the equity side, share market trading continues to be a popular investment avenue in India. Backed by technology and expert support, investors can choose from a range of services including portfolio management, market research, and advisory insights.

A best share market broker in india not only offers access to the markets but also assists investors with personalized trading strategies. Services provided by stock broker in india networks have expanded to include stock market advisory and investment and advisory services—empowering clients to make informed decisions for the long run.

Building a Balanced Investment Approach

Combining the high liquidity of the foreign exchange market with the long-term growth potential of long term investment in share market can provide a well-rounded investment portfolio. While forex markets offer daily opportunities for quick gains, equity investments help in wealth accumulation over time through compounding and dividends.

Conclusion

Whether you’re drawn to the fast-paced nature of the foreign exchange trading platform or the stability offered by stock brokerage firms, success in the financial markets begins with choosing the right tools and partners. With platforms like Ajmera Exchange offering comprehensive solutions for both forex and equity investors, building a diverse and informed investment portfolio has never been easier.

0 notes

Text

How to Choose Online Accountants in UK for Global Business

In today's globalized economy, businesses are no longer confined to their home countries. With international trade and remote operations on the rise, managing finances across borders has become more complex than ever. This is where online accountants in UK play a crucial role, offering expert financial services that cater to global business needs.

Choosing the right accounting service can make a significant difference in maintaining compliance, ensuring tax efficiency, and streamlining financial operations. Here’s how you can select the best online accounting service for your international business.

Why Online Accountants in the UK Matter for Global Businesses

Whether you are an entrepreneur expanding overseas or a well-established company dealing with multiple currencies and regulations, hiring professional virtual accountants in the UK can help you manage your finances seamlessly. Online accountants provide:

Cloud-based financial management for real-time access to reports

Tax planning and compliance for both UK and international tax laws

Payroll management for employees in different countries

Bookkeeping and auditing services to maintain transparency

Key Factors to Consider When Choosing an Online Accountant

1. Industry Experience and Expertise

Look for online accountants in the UK who specialize in international business. Different industries have specific financial regulations, so hiring accountants with experience in your sector ensures compliance and efficiency.

2. Understanding of International Tax Regulations

One of the biggest challenges for global businesses is navigating tax laws across multiple jurisdictions. Your chosen accounting firm should have expertise in:

UK tax laws

Double taxation treaties

VAT regulations for cross-border trade

Compliance with international financial reporting standards (IFRS)

3. Cloud-Based Accounting Solutions

Modern accounting relies heavily on cloud-based platforms such as Xero, QuickBooks, and Sage. These tools allow businesses to:

Access financial data from anywhere

Automate invoicing and expense tracking

Generate real-time financial reports

Ensure secure and efficient data storage

4. Cost and Service Packages

Hiring an online accounting firm should be cost-effective. Compare pricing models and services offered, such as:

Fixed monthly fees vs. hourly rates

Bundled services (bookkeeping, tax filing, payroll, and advisory)

Scalability for growing businesses

5. Compliance and Security Standards

Your financial data is sensitive. Ensure that your accountant follows GDPR regulations and uses encrypted platforms to protect business information. Additionally, check if they are accredited by professional bodies like:

Association of Chartered Certified Accountants (ACCA)

Institute of Chartered Accountants in England and Wales (ICAEW)

6. Communication and Support

International businesses operate in different time zones, so responsive customer support is vital. Opt for an accountant who provides:

24/7 customer service or dedicated account managers

Multi-channel communication (email, phone, video calls)

Proactive financial advice rather than just compliance services

Top Benefits of Hiring an Online Accountant in the UK

1. Saves Time and Increases Efficiency

By outsourcing your accounting tasks, you can focus on core business operations rather than dealing with tax filings and payroll management.

2. Cost-Effective Financial Management

Hiring a full-time, in-house accountant can be expensive. Online accountants offer flexible pricing structures, making financial management more affordable.

3. Ensures Legal and Tax Compliance

International businesses must comply with UK and foreign tax laws. A professional accountant will keep you compliant, helping avoid penalties.

4. Access to Real-Time Financial Data

With cloud accounting, you can monitor cash flow, generate reports, and make data-driven decisions from anywhere in the world.

5. Business Growth and Expansion Support

Many online accountants offer strategic financial planning, helping businesses expand into new markets with informed financial decisions.

Final Thoughts

Selecting the right online accountants in the UK is crucial for international businesses looking to maintain financial accuracy, compliance, and efficiency. By considering factors such as industry expertise, tax knowledge, cloud-based solutions, and cost-effectiveness, you can find an accountant who aligns with your business goals.

Whether you’re a startup, an e-commerce business, or a multinational company, the right accounting service will ensure smooth financial operations, allowing you to focus on growing your global presence.

If you're looking for professional accounting services for international businesses, start your search today and choose a provider that fits your needs!

0 notes

Text

Get the Most Trusted Forex Broker in the World!

UltraTrendFX is the most trusted forex broker in the world, known for its commitment to transparency, security, and client satisfaction. With a user-friendly platform, competitive spreads, and advanced trading tools.

To know more - https://ultratrendfx.com/

#forex easy online trading#best forex charts online#make money online by trading forex#online currency trading platforms#online foreign exchange account#best foreign currency trading platform#top online forex brokers

0 notes

Text

Online currency trading platforms

Actamarkets: Your gateway to online currency trading platforms. We offer cutting-edge tools for forex success. Our user-friendly interface makes navigating online currency trading platforms a breeze. Join thousands of traders who trust Actamarkets for their forex needs.

Visit Us : - https://actamarkets.com/trading-flatforms/

#uk#Online currency trading platforms#foreign exchange trading platforms#online forex trading platforms#forex trading download app#platforms for trading forex#popular forex trading platforms#online currency trading platforms#Actamarkets trading#actamarkets online trading#actamarkets online trading platform#actamarkets trading company#international brokerage company#Commodity Trading Companies#Currency Exchange Foreign Forex Trading#Low Spreads Forex Trading#Best Forex Trading Platforms#Trade Currency Online With Forex#Foreign Exchange Investment Fx#forex trading investment company#Best Platform For Forex Trading#best commodities trading#MOBUIS TRADER 7 app#best ACTA MARKETS APPS#ACTA MARKETS MT7#best MetaTrader platform#best forex trading with CFDs#BUY or SELL forex CFDs#best cryptocurrency trading platform#litecoin trading platform

0 notes

Text

Best Forex Trading Courses in Mumbai for Beginners

Forex trading, or foreign exchange trading, is an essential skill for those who want to understand global financial markets and investment opportunities. Best Forex trading courses in Mumbai help aspiring traders gain structured learning and expertise in forex trading. In Mumbai, many aspiring traders seek structured learning to grasp the fundamentals of forex trading. If you are a beginner, selecting the right educational course is crucial for building a strong foundation in trading strategies, market analysis, and risk management.

Understanding Forex Trading

Forex trading involves the exchange of one currency for another to generate profit based on fluctuating exchange rates. It is one of the most liquid financial markets, operating 24 hours a day across different time zones. Due to its complexity, beginners must acquire structured knowledge before entering live trading.

Key Elements of a Forex Trading Course

A well-structured forex trading course should provide step-by-step learning to ensure comprehensive understanding. Here are some essential components of an educational forex trading course:

Introduction to Forex Markets – Learn about currency pairs, trading platforms, and market participants.

Technical and Fundamental Analysis – Gain insights into reading price charts, indicators, market trends, and economic factors influencing forex markets.

Trading Strategies – Develop various trading techniques, including scalping, day trading, and swing trading.

Risk and Money Management – Understand how to manage capital, minimize losses, and implement risk management strategies.

Live Trading and Practice Sessions – Apply theoretical knowledge in simulated or real-market conditions under expert guidance.

Recommended Forex Trading Academy in Mumbai

For individuals seeking structured forex education, enrolling in a professional institute enhances learning efficiency. Below is a highly recommended forex trading academy in Mumbai:

Dollar Dex Academy

Dollar Dex Academy is a well-recognized forex education provider in Mumbai, offering beginner-friendly courses. The curriculum covers essential aspects of forex trading, including market structure, risk management, and trading psychology. Students benefit from live trading sessions, expert mentorship, and real-time market insights. The academy focuses on hands-on learning, ensuring that learners gain practical experience before venturing into live trading.

Practical Tips for Beginners in Forex Trading

Apart from taking an educational course, beginners should follow certain best practices to enhance their trading skills:

Start with a Demo Account – Before trading with real money, practice on a demo account to gain confidence.

Stay Updated with Financial News – Global events impact currency values; staying informed helps in making strategic trading decisions.

Use Stop-Loss and Take-Profit Orders – These features help in minimizing risks and securing profits.

Develop a Trading Plan – Setting clear goals and strategies prevents impulsive decisions.

Maintain Discipline and Patience – Forex trading requires analytical thinking and consistent learning.

Conclusion

Learning forex trading is a step-by-step process that requires proper education, practice, and discipline. Dollar Dex Academy offers a comprehensive learning experience for beginners in Mumbai, equipping them with the necessary skills to navigate the forex market confidently. By gaining theoretical knowledge and applying it in practical scenarios, aspiring traders can develop successful trading strategies and achieve long-term financial growth.

#forex education#forex market#forextrading#learntotrade#forex expert advisor#onlineclasses#forex#forex trading#online forex trading

0 notes

Text

** Browsing the World of FOREX: A Beginner's Overview to Currency Trading **

The international exchange market, generally referred to as FOREX, is the biggest and most liquid monetary market on the planet, boasting an everyday trading volume surpassing $6 trillion. Unlike traditional securities market, which run throughout particular hours, the FOREX market is open 24 hours a day, 5 days a week, allowing investors from all edges of the globe to deal currencies at any offered time. This continuous availability creates a vibrant environment full of opportunities for investors to profit from fluctuations in money worths. Nonetheless, it additionally presents obstacles, consisting of the need for a strong understanding of market trends, financial indicators, and geopolitical occasions that can influence money prices.For beginners, diving right into the world of FOREX can seem daunting, but with the best knowledge and sources, any person can start their trading trip. Education and learning is key; aspiring investors need to familiarize themselves with essential concepts such as currency sets, pips, take advantage of, and margin. Furthermore, utilizing trial accounts supplied by numerous trading platforms allows newcomers to exercise their techniques in a safe atmosphere. As you begin on your foreign exchange trip, staying educated with market evaluation, leveraging trading devices, and developing a disciplined trading strategy can substantially boost your opportunities of success. Welcome the learning curve, and you'll find that the world of currency trading can be both fulfilling and amazing.

Read more here https://f004.backblazeb2.com/file/atzxdj/Bitcoin-slots/Casino-Guide/Casino-Guide-Online.html

0 notes

Text

Online Forex Broker: Choosing the Right Platform for Your Trading Journey

Forex trading has emerged as one of the most widely used financial markets globally, with millions of traders seeking to earn profits from the fluctuations in currencies. The forex market is open 24 hours a day, five days a week, and offers tremendous opportunities for new as well as experienced traders. But the success of forex trading depends on selecting the right online forex broker. A good broker can give the traders the tools, facilities, and assistance that they need to make the right choice and yield the highest possible returns. In this blog, we will discuss the online forex broker's role, key characteristics, and how you should select the ideal platform for your needs.

What is an Online Forex Broker?

An online foreign exchange broker is a go-between for traders and the foreign exchange market. It is an online platform where the traders can buy and sell foreign currency pairs. Brokers serve as intermediaries by providing the traders with market information, trading tools, charting programs, and other useful resources. Brokers also provide leverage, with which the traders can manage more positions using less capital.

Internet-based forex brokers operate by linking retail traders to financial institutions and banks, which provide liquidity. This facilitates real-time quotes and near-instant trading. The broker generates profits through spreads (the difference between the ask price and bid price) or by receiving a commission on each trade.

It's essential to choose the correct forex broker since it can reflect directly on your trading success. A reliable broker offers a safe trading environment, quick order execution, and investment protection. Conversely, an unfaithful broker will put you at risk of price manipulation, delayed execution, or even fund mismanagement.

Most Important Advantages of Selecting a Reputable Forex Broker:

Access to Market Data: A quality broker offers real-time price quotes, market news, and analysis.

Low Spreads and Commissions: Competitive spreads and commissions lower trading costs and increase profitability.

Fast Order Execution: Fast execution reduces slippage and guarantees trades are executed at the desired price.

Secure Trading Environment: A regulated broker guarantees that your money is safe and held in segregated accounts.

Advanced Trading Tools: Access to technical indicators, charting software, and automated trading options.

Customer Support: Good customer support assists with solving problems and offering advice when necessary.

How to Select the Best Online Forex Broker

Getting the proper broker involves considering a number of factors in order to match it with your trading objectives and approach. Below are the main factors to consider:

1. Regulation and Security

One of the key considerations when choosing a forex broker is regulation. Legitimate brokers are regulated by financial regulators like:

The U.S. Commodity Futures Trading Commission (CFTC)

The Financial Conduct Authority (FCA) in the UK

The Australian Securities and Investments Commission (ASIC)

The Cyprus Securities and Exchange Commission (CySEC)

Regulation guarantees that the broker has stringent financial requirements, protects client funds, and operates in an open manner. Steer clear of unregulated brokers because they do not offer sufficient protection against fraud or mismanagement of funds.

2. Trading Platform and Technology

The trading platform is the doorway to the forex market. A good and easy-to-use platform increases the overall trading experience. Some of the best known platforms are:

MetaTrader 4 (MT4): Renowned for its sophisticated charting features and automated trading.

MetaTrader 5 (MT5): Provides more timeframes and order types.

cTrader: Offers a new interface and improved order execution speed.

Make sure the platform has mobile compatibility, customizable charts, and quick execution to suit your trading style.

3. Spreads, Commissions, and Fees

The trading cost is a significant consideration when choosing a broker. Most brokers make money from spreads and commissions.

Spreads: Low spreads minimize trading expenses and enhance profitability.

Commissions: Certain brokers have a fixed commission per trade, while others have commission-free trading with increased spreads.

Additional Fees: Look for withdrawal fees, inactivity fees, and overnight fees.

Select a broker with a clear fee structure to prevent surprise charges.

4. Leverage and Margin Requirements

Leverage enables you to trade greater positions with less deposit. While leverage magnifies profits, it also magnifies the risk of losses.

High Leverage: For experienced traders who can deal with the risks.

Low Leverage: Ideal for beginners in order to avoid exposure to volatility in the markets.

Make sure that the broker offers flexible leverage choices and understandable margin requirements.

5. Account Types and Minimum Deposits

Various brokers have different account types to suit diverse trading styles:

Micro Accounts: Ideal for newbies with small capital.

Standard Accounts: Ideal for frequent traders with modest capital.

Professional Accounts: Have lower spreads and larger leverage for professional traders.

Take note of the minimum deposit amounts and account specifications prior to registration.

6. Customer Support and Educational Resources

Good customer support is vital for troubleshooting technical problems and trading-related questions. Seek out brokers with:

24/5 or 24/7 customer support through live chat, email, and phone.

Multilingual customer support for overseas traders.

Learning resources in the form of webinars, tutorials, and market commentaries.

Good learning resources can assist you in enhancing your trading acumen and keeping up with current market trends.

Best Online Forex Brokers in 2025

Here are some of the best trustworthy online forex brokers to look at:

1. IG Group

Regulated by FCA, ASIC, and other prominent authorities.

MT4 and in-house platforms.

Competitive spreads and low commission fees.

2. eToro

Best used for social trading.

Commission-free trade with tight spreads.

User-friendly platform perfect for beginners.

3. XM

CySEC and ASIC are regulated.

High leverage available.

Minimum slippage with fast execution.

Conclusion:-

Selecting a good online forex broker is a key step to success in the forex market. A well-regulated broker with a stable platform, competitive spread, and solid customer support can make your trading experience better and improve your possibilities of profitability. Take time to compare various onnline forex brokers, trial their platforms, and compare their fees before you make a choice. With the right broker, you can trade the forex market comfortably and make progress toward your trading ambitions.

0 notes

Text

Dollar to PKR: Latest Exchange Rate and Market Trends

The https://cookingblogbyazraa.blogspot.com/?m=1 to PKR (USD to PKR) exchange rate is a crucial economic indicator for Pakistan. It affects trade, investments, inflation, and remittances. Whether you are a business owner, investor, or traveler, keeping an eye on the exchange rate can help you make informed financial decisions.

Current USD to PKR Exchange Rate

The exchange rate between the US Dollar (USD) and Pakistani Rupee (PKR) fluctuates daily due to market conditions, including supply and demand, global economic trends, and Pakistan's financial policies. To check the latest Dollar to PKR rate, visit reliable financial platforms, banks, or forex exchange services.

Factors Affecting the USD to PKR Exchange Rate

Several factors influence the Dollar to PKR exchange rate, including:

1. Economic Stability of Pakistan

Pakistan's economy plays a significant role in determining the rupee’s value. Inflation, GDP growth, foreign reserves, and trade deficits impact PKR's strength. If Pakistan's economy faces uncertainty, the USD to PKR rate tends to rise.

2. Inflation Rate

Higher inflation leads to a weaker Pakistani Rupee. When inflation rises, the purchasing power of PKR decreases, making it less valuable against the USD.

3. Interest Rates

Higher interest rates attract foreign investment, increasing the demand for PKR and stabilizing its value. Conversely, lower interest rates can weaken the currency.

4. Trade Deficit

Pakistan imports more than it exports, leading to a trade deficit. This increases demand for the US dollar, raising the Dollar to PKR exchange rate.

5. Political Stability

Political uncertainty affects investor confidence. If Pakistan experiences political instability, investors tend to withdraw their investments, weakening the PKR.

6. Foreign Reserves & IMF Loans

Pakistan's foreign exchange reserves impact the rupee's value. A higher reserve strengthens PKR, while low reserves result in depreciation. IMF loans and external borrowings also influence exchange rates.

Impact of USD to PKR Exchange Rate on Pakistan

1. Inflation & Cost of Living

A weaker PKR means expensive imports, leading to higher inflation and increased prices of goods and services. Essential items like fuel, medicine, and electronics become costly.

2. Foreign Investments & Trade

A fluctuating Dollar to PKR exchange rate affects foreign investments. A stable PKR attracts investors, while a depreciating rupee discourages them.

3. Overseas Pakistanis & Remittances

Millions of Pakistanis send remittances from countries like the USA, UK, and UAE. A higher USD to PKR rate benefits them as they get more rupees for their dollars.

How to Get the Best Exchange Rate?

Compare rates from banks, forex exchange companies, and online platforms.

Use real-time forex rate apps for instant updates.

Exchange currency when PKR strengthens to maximize value.

Final Thoughts

The Dollar to PKR rate is essential for Pakistan's economy. Staying updated with market trends, economic news, and financial policies can help individuals and businesses make informed financial decisions.

0 notes