#best regulated forex brokers

Explore tagged Tumblr posts

Text

Best Regulated Forex Brokers for Secure Trading

Forex Regulation Inquiry for best regulated Forex brokers, ensuring a secure trading environment. These platforms adhere to stringent regulations, offering traders peace of mind and protection. Navigate the dynamic currency markets with confidence, knowing your investments are supported by reliable and trustworthy brokers committed to maintaining a secure trading experience.

#forex broker#stock broker#forex market news#online forex market#forex market#forexregulationinqury#stock market#forex trading#business#online forex trading#best regulated forex brokers

4 notes

·

View notes

Text

Orient Finance: Your Reliable Partner for CFD Trading in the UAE

For new investors, CFD trading in UAE can be overwhelming. Orient Finance, a market leader, provides support and guidance for your investment journey.

0 notes

Text

Best 7 Reasons To Start Trading Forex Today

If you’re looking for a way to diversify your investment portfolio or simply want to try something new, Forex trading might just be the ticket. Here’s why starting your Forex trading journey today could be a great decision, especially with a broker like Xtrememarkets.

#best leverage brokers#xtreamforex partner#cfd trading platform#best ecn forex broker#top trading platform#best trading platform#best forex trading platform#across the spiderverse#top regulated forex brokers

0 notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

145 notes

·

View notes

Text

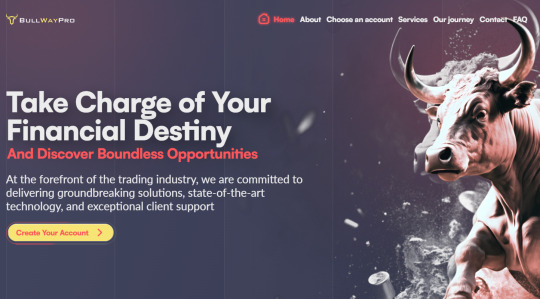

Bullwaypro.com review Registration

When choosing a forex broker, the biggest concern is always trust. Nobody wants to deposit funds into a platform only to discover withdrawal issues, shady practices, or poor regulation. That’s why we take a deep dive into every key aspect of a broker to see whether it’s legitimate or just another name in a long list of unreliable platforms.

Today, we’re looking at Bullwaypro.com review—a forex broker that has been gaining attention in the trading community. With a high Trustpilot rating, FCA regulation, and thousands of users, it certainly has some strong points. But does it truly hold up under scrutiny?

Let’s break it down step by step and find out.

Bullwaypro.com Registration Review: Quick and Easy Sign-Up Process

The registration process for Bullwaypro.com reviews is straightforward and efficient. Here’s how it works:

Locate the registration button in the upper right corner of the website.

Enter your personal data, ensuring accuracy for verification.

Wait for a manager to process the provided information.

Once verified, registration is successfully completed.

This structured approach suggests a secure onboarding process, where user information is checked before full access is granted. It’s a good sign—brokers who take verification seriously are often more reliable and compliant with financial regulations. Would you like details on the verification requirements or account setup next?

Bullwaypro.com – Establishment and Domain Registration Date

When assessing the legitimacy of a forex broker, one of the first things to check is whether the domain registration date aligns with the brand’s establishment date. If a broker claims to be operating for several years but its domain was only recently registered, that’s a red flag. So, how does Bullwaypro.com reviews measure up?

The company was established in 2022, and the domain bullwaypro.com review was registered on November 11, 2021. That means the domain was secured before the company officially started operating, which is a positive indicator. It suggests the brand was not hastily set up overnight but rather planned in advance.

Why is this important? Well, scam brokers often buy domains right before launching, making it easier to disappear without a trace. Bullwaypro, on the other hand, took steps ahead of time, likely to secure its brand identity and online presence early on. That’s a sign of long-term intentions, rather than a short-lived, fly-by-night operation.

This looks like a good argument in favor of legitimacy. What aspect should we analyze next?

Bullwaypro.com – Strong Regulatory Oversight

When it comes to forex trading, regulation is one of the most critical aspects that separate trusted brokers from potential scams. A regulated broker is subject to strict financial laws, regular audits, and capital requirements. So, what kind of regulatory status does Bullwaypro.com reviews have?

This broker operates under the oversight of the FCA (Financial Conduct Authority)—one of the most respected and stringent financial regulators in the world. The FCA license is not something a broker can obtain easily; it involves rigorous checks, capital requirements, and compliance with strict operational standards. Only brokers who meet transparency, security, and client protection policies receive this approval.

Why does this matter? Because FCA-regulated brokers are legally required to:

Segregate client funds from company accounts, ensuring traders' money is protected even if the broker faces financial trouble.

Follow fair trading practices, meaning no price manipulation or conflicts of interest.

Be covered by a compensation scheme, which provides an extra layer of security to traders.

We think this is a strong argument in favor of Bullwaypro’s legitimacy. Many brokers operate without regulation or under weak offshore jurisdictions—but here, we see one of the best financial regulators backing this platform.

This definitely adds trust to Bullwaypro.com reviews. What should we analyze next?

Bullwaypro.com – Client Reviews and Reputation

One of the best ways to gauge a broker’s reliability is to look at what actual traders are saying. Scammers tend to have poor ratings, few reviews, and plenty of complaints. But what about Bullwaypro.com reviews?

On Trustpilot, this broker holds an impressive score of 4.4 out of 5, based on 2,995 reviews. That’s a strong indicator of trustworthiness, especially in the forex industry, where traders are quick to leave negative feedback if something goes wrong.

Here’s why this is significant:

A score above 4.0 is already considered very high for brokers, as the industry tends to be highly competitive and filled with mixed experiences.

The sheer number of reviews (2,995) suggests a well-established platform. It’s easy for a scam broker to fake a handful of positive comments, but accumulating thousands of reviews takes consistent service over time.

Out of those, 2,869 reviews (the majority) are rated 4 or 5 stars, meaning most traders are satisfied with their experience.

This definitely looks like a solid argument for legitimacy. A broker with nearly 3,000 reviews and a high rating is unlikely to be a short-term scam. Instead, it suggests that Bullwaypro delivers on its promises and maintains a good relationship with its clients.

Final Verdict: Is Bullwaypro.com review a Legitimate Broker?

After a thorough review, Bullwaypro.comreviews checks all the right boxes when it comes to trust and reliability. The broker is not just another name in the forex industry—it has strong regulatory oversight, positive user feedback, and a well-structured platform. Here’s why we think traders can confidently consider this broker:

✅ Regulation by FCA – One of the most trusted financial regulators, ensuring transparency, security, and fair trading conditions. ✅ Established Track Record – The domain was registered before the company officially launched, showing proper planning and long-term intent. ✅ Excellent User Reviews – With a 4.4 Trustpilot rating and nearly 3,000 reviews, traders are overwhelmingly satisfied with the platform. ✅ Secure Deposits & Fast Withdrawals – No hidden fees, instant processing for most transactions, and reliable payment methods. ✅ User-Friendly Trading Conditions – Multiple account types, fair leverage, and a widely used trading platform. ✅ Accessible Customer Support – Various contact options make it easy for traders to get assistance when needed.

With all these factors in mind, Bullwaypro.com review stands out as a legitimate and well-regulated broker. The combination of FCA oversight, positive reviews, and a transparent operational model makes it a solid choice for both beginner and experienced traders.

Of course, every trader should do their own research and choose a broker that fits their needs, but based on the evidence, Bullwaypro.com reviews appears to be a trustworthy option in the forex market.

4 notes

·

View notes

Text

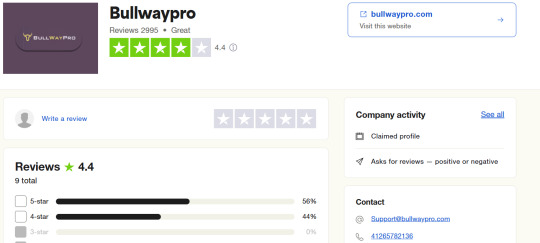

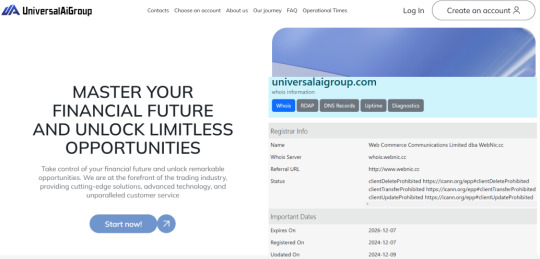

Universalaigroup.com review Trading Platform

When choosing a forex broker, traders look for security, reliability, and user experience. Nobody wants to risk their money with an unregulated or questionable platform. That’s why today, we’re taking a deep dive into universalaigroup.com reviews, analyzing its regulation, reputation, trading conditions, and user feedback.

A good broker isn’t just about flashy promises—it needs a strong foundation, proper licensing, positive trader reviews, and a seamless trading experience. So, does universalaigroup.com review check all the right boxes? Let’s find out. We’re going to break it down, step by step.

Universalaigroup.com Trading Platform: Versatility and Convenience

The trading platform offered by universalaigroup.com reviews includes a variety of options to suit different trading needs:

WebTrader Platform – A browser-based platform that allows users to trade without downloading software. This is a flexible option, ideal for those who prefer quick access from different devices.

Tablet Trader – Designed for tablets, this platform ensures smooth trading on larger touchscreens, making it convenient for traders who want mobility without compromising usability.

Mobile Trader – A smartphone-optimized platform, allowing users to trade on the go. This is particularly useful for those who want to monitor the market and execute trades anytime, anywhere.

Having multiple platform options like these indicates that universalaigroup.com review is catering to both professional and casual traders. A strong web-based and mobile infrastructure is a good sign of legitimacy because unreliable brokers often neglect user-friendly trading solutions. Would a broker that isn’t serious about its clients invest in such a well-rounded platform? We think not!

Universalaigroup.com: A Strong Foundation from the Start

One of the key indicators of a legitimate broker is the consistency between its establishment date and the date of domain registration. For universalaigroup.com reviews, the domain was purchased on December 7, 2020, while the company itself was officially established in 2022.

This alignment is crucial. Why? Because when a broker secures its domain well before launching, it shows a well-thought-out business plan rather than a hastily created operation. Scammers often set up domains at the last minute, trying to make a quick profit before disappearing. But here, we see a timeline that makes sense—the company took the time to prepare, build its infrastructure, and enter the market strategically.

Universalaigroup.com: Strong Regulatory Backing

One of the most important aspects when evaluating a broker’s legitimacy is its regulation. universalaigroup.com reviews operates under the FCA (Financial Conduct Authority), a top-tier regulatory body known for its strict standards and investor protection measures.

The FCA license isn’t easy to obtain. It requires brokers to meet rigorous financial requirements, ensure fair trading conditions, and implement strict anti-money laundering measures. Only companies with a transparent business model and financial stability get this approval. And what does this tell us? A broker under FCA regulation isn’t just legal—it’s one of the most secure options in the industry.

Brokers without strong oversight often operate in the shadows, avoiding strict compliance rules. But universalaigroup.com review has passed the high standards of one of the toughest regulators. If there was ever a sign of trustworthiness in the forex world, this is it.

Universalaigroup.com: What Do Traders Say?

A broker’s reputation is best reflected in its user reviews. universalaigroup.com review has a Trustpilot rating of 3.9, with 6 reviews so far.

Now, let’s break it down. While a rating of 4.0 or higher is considered excellent in the trading industry, a 3.9 is still close and shows a generally positive sentiment. But what really matters is the number of reviews. Since there are only 6 reviews, the score isn’t fully representative yet. Why? Because early reviews can fluctuate significantly with just a few ratings.

Here’s the key takeaway: a developing broker with a near-4-star rating is a good sign. As more traders use the platform, we’ll get an even clearer picture. For now, this suggests that traders have had a mostly positive experience, which is a solid indicator of trustworthiness.

Is universalaigroup.com review a Legit Broker?

After thoroughly analyzing universalaigroup.com reviews, the evidence strongly points to its legitimacy. Let’s quickly recap why:

✅ Domain History Aligns with Legitimacy – The domain was purchased two years before the company’s official launch, signaling a well-planned business rather than a rushed scam. ✅ Regulated by FCA – One of the most respected financial regulators, ensuring transparency, security, and fair trading conditions. ✅ Decent Trustpilot Rating – With a 3.9-star score, the early feedback from users suggests a mostly positive trading experience. As more traders leave reviews, this will give us an even clearer picture. ✅ Multiple Trading Platforms – From WebTrader to Mobile and Tablet trading, the broker offers flexibility for different types of traders. ✅ Fast Deposits and Withdrawals – Transactions are instant or take just a few hours, with zero commission fees, which is a major plus. ✅ User-Friendly Support and App – The app is available on App Store with a solid 4.8-star rating, proving its reliability for mobile trading.

Would an unreliable broker go through the trouble of obtaining an FCA license, investing in user-friendly technology, and ensuring seamless payment options? We highly doubt it. universalaigroup.com review presents itself as a serious and trustworthy platform for traders looking for a regulated and flexible forex experience.

4 notes

·

View notes

Text

RiseProfitFX.net Register review

When choosing a forex broker, legitimacy is the number one priority. No one wants to deposit funds with a company that might disappear overnight. That’s why today, we’re taking a deep dive into RiseProfitFX.net review, analyzing everything from its regulation and reviews to its platform and services.

A quick glance shows some strong indicators of reliability—FCA regulation, a solid Trustpilot score, and a structured registration timeline. But does that mean it’s a broker you can trust? Let’s break it all down, fact by fact.

Easy and Fast Registration on RiseProfitFX.net

The registration process for riseprofitfx.net review is straightforward and user-friendly. Here’s what you need to do:

On the main page, locate the "sign up" button.

Click it to begin the registration process.

Follow the on-screen instructions to enter the required details.

This simple and direct approach suggests that the broker aims to make onboarding as seamless as possible. The presence of a clear sign-up button on the homepage also indicates a user-centric design, which is a good sign for accessibility.

RiseProfitFX.net: Verified Timeline of Establishment

One of the key indicators of a broker’s legitimacy is whether its domain registration date aligns with its establishment date. If a company claims to have been in business for years but its website was only recently registered, that’s a red flag.

For RiseProfitFX.net review, we see a solid match:

Established: 2022

Domain Registered: August 28, 2021

RiseProfitFX.net: Strong Regulation Under FCA

One of the strongest signs of a legitimate broker is regulation by a recognized financial authority. And guess what? RiseProfitFX.net reviews is regulated by the FCA (Financial Conduct Authority), which is one of the most respected regulatory bodies in the financial world.

Why does this matter?

The FCA enforces strict financial standards, meaning the broker must operate transparently.

Brokers under FCA regulation must keep client funds in segregated accounts, reducing the risk of fraud.

It’s nearly impossible for a shady broker to obtain an FCA high-authority license, so this is a solid mark of legitimacy.

This level of oversight is not something just any broker can achieve. The fact that RiseProfitFX.net reviews meets these standards shows that it’s playing by the rules—and that’s exactly what you want in a broker.

RiseProfitFX.net reviews: Solid Trustpilot Ratings Back Its Legitimacy

When evaluating a broker, real user feedback is one of the best ways to measure its credibility. If a broker consistently receives high ratings, it’s usually a good sign.

For RiseProfitFX.net review, the numbers speak for themselves:

Trustpilot Score: 4.1

Total Reviews: 12

Positive Reviews (4-5 Stars): 11

A 4.1 rating in the forex industry is impressive, especially given that satisfied clients rarely leave reviews, while unhappy users are more likely to vent. The fact that 11 out of 12 reviews are positive tells us that traders are experiencing good service, reliable execution, and smooth transactions.

Is RiseProfitFX.net review a Legitimate Broker?

After analyzing all the key factors—regulation, reviews, platform features, and operational transparency—the evidence strongly supports the legitimacy of RiseProfitFX.net reviews.

Regulated by the FCA, one of the most respected financial authorities. This alone sets it apart from many unregulated brokers.

Trustpilot rating of 4.1, with the vast majority of reviews being positive—a strong sign of satisfied users.

Domain registered before establishment, showing that the company planned its launch properly instead of rushing to set up a shady operation.

A structured trading environment with competitive leverage, multiple payment methods, and a user-friendly platform.

All these factors suggest that RiseProfitFX.net reviews is a trustworthy broker that operates transparently and meets industry standards. If you’re looking for a broker that provides security, compliance, and positive trader feedback, this one checks all the right boxes.

5 notes

·

View notes

Text

MaxDeAlways.com review Withdrawals

Fast & Fee-Free Withdrawals at MaxDeAlways.com

When it comes to withdrawing funds from MaxDeAlways.com review, traders can breathe easy. The platform offers SWIFT as the withdrawal method, which is widely recognized for secure and efficient international transactions. That alone tells us something—this broker is catering to serious traders who need reliable banking options.

Now, let's talk speed. The withdrawal time is instant, typically ranging from just a few minutes to a maximum of 2 hours. That’s incredibly fast for this industry, where some brokers take days to process transactions. A speedy withdrawal system signals that the company is financially stable and isn’t holding onto client funds unnecessarily.

And the best part? Zero commission on withdrawals. Many platforms charge hidden fees, but here, what you earn is what you get. This suggests a trader-friendly approach—something that trustworthy brokers tend to prioritize.

MaxDeAlways.com review is Regulated by a Top-Tier Authority

One of the most critical aspects of a broker’s legitimacy is its regulation. And here, MaxDeAlways.com review doesn’t disappoint—it operates under the supervision of the Financial Conduct Authority (FCA). This isn’t just any regulator; the FCA is known worldwide for its strict rules, rigorous oversight, and high standards. Brokers under FCA regulation must maintain transparent operations, segregate client funds, and ensure financial stability.

Now, let’s add another layer of trust. The broker holds a "High Authority" license, which further confirms its credibility. This level of regulation is not handed out to just anyone—it’s reserved for companies that meet strict financial and operational criteria. If a broker has an FCA license, it means they’ve been vetted thoroughly, and that’s a solid sign of reliability.

So, what does this mean for traders? Safety, transparency, and legal protection. When you trade with MaxDeAlways.com reviews, you’re dealing with a company that’s held to the highest standards in the financial industry.

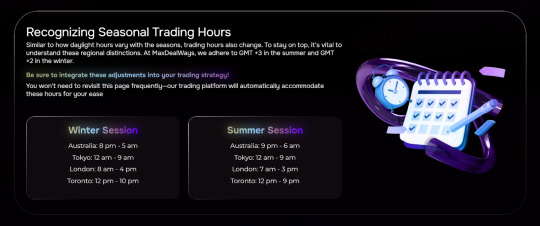

Trading Hours at MaxDeAlways.com – Global Market Access Around the Clock

One of the best things about trading is that the markets never really sleep, and MaxDeAlways.com review ensures traders can access opportunities at any time. The platform follows a structured global trading schedule, covering all major financial centers.

Here's how it breaks down:

Winter Session:

Australia: 8 PM - 5 AM

Tokyo: 10 PM - 7 AM

London: 3 AM - 12 PM

New York: 8 AM - 5 PM

This setup means traders can engage in forex, stocks, and other financial instruments across different time zones, maximizing their chances of catching market movements.

Now, why is this important? Because liquidity and volatility vary throughout the day, and having access to multiple sessions lets traders choose the best times for their strategy. Night owls might prefer the Tokyo session, while early risers can take advantage of London’s high activity.

Trustpilot Reviews – A Solid Reputation for MaxDeAlways.com reviews

When it comes to choosing a broker, real user feedback speaks louder than any marketing claim. MaxDeAlways.com review holds a 4.0 rating on Trustpilot, which is a very respectable score in the trading industry. But let’s break this down a bit further.

The broker has 7 total reviews, and here’s something interesting—all 7 of them are rated 4 or 5 stars. That means 100% of the feedback is positive. In a field where traders are often quick to leave complaints, this is an impressive indicator of reliability.

Why MaxDeAlways.com review is a Broker You Can Trust

After exploring all the essential aspects of MaxDeAlways.com review, it’s clear this broker is committed to providing a secure and efficient trading experience. The FCA regulation and "High Authority" license ensure that your funds and trades are protected by one of the most reputable authorities in the financial world. Combine that with instant, fee-free withdrawals and a trading schedule that spans key global markets, and it's easy to see why MaxDeAlways.com review stands out.

Furthermore, the perfect score on Trustpilot and the positive feedback from users provide solid evidence that this platform delivers on its promises. It’s not just a broker; it’s a trusted partner for traders looking for reliability, speed, and transparency. Whether you're a novice or an experienced trader, MaxDeAlways.com reviews offers a seamless experience that inspires confidence.

So, if you’re looking for a broker that ticks all the right boxes, MaxDeAlways.com review is worth considering.

5 notes

·

View notes

Text

Who is a Regulated Forex Broker?

A best regulated forex brokers is a financial intermediary authorized and supervised by governmental bodies. Committed to ensuring fair trading practices, they adhere to strict industry standards, safeguarding clients' funds and providing transparent services. Regulatory oversight enhances trust, mitigates risks, and fosters a secure environment for individuals engaging in foreign exchange trading.

#stock broker#forex broker#forex market#forex market news#forexregulationinqury#online forex market#business#forex trading#online forex trading#stock market#best regulated forex brokers

0 notes

Text

The Ultimate Forex Brokers Comparison for South African Traders

Introduction:

The forex market in South Africa is one of the fastest-growing financial sectors, and selecting the right broker can make all the difference. In this Forex Brokers Comparison in South Africa, we will explore the best options available for traders in 2025. Whether you're just getting started or are looking for a more advanced trading experience, this guide will help you navigate your choices and make an informed decision.

Why Forex Trading in South Africa is Thriving:

Forex trading in South Africa has seen a steady rise in popularity over the past few years. This growth can be attributed to the country's stable financial regulations, mainly governed by the Financial Sector Conduct Authority (FSCA). With a secure regulatory framework, traders are assured of a safe trading environment. In addition, many brokers now offer dedicated services tailored for South African traders, including local deposit methods and customer support in native languages.

Key Features to Look for in a Forex Broker in South Africa:

When choosing a forex broker, several key factors should guide your decision:

Security and Regulation: Ensure your broker is regulated by the FSCA for a secure trading environment.

Trading Platforms: Popular platforms such as MT4 and MT5 offer robust features, but many brokers now offer proprietary platforms as well.

Low Spreads and Fees: Low trading costs are crucial to maximizing profits.

Customer Support: 24/7 support in the South African time zone can enhance your trading experience.

Account Types: Brokers offering diverse account types with local payment options can cater to a wide range of traders.

Top Forex Brokers for South African Traders in 2025:

Eightcap: Known for its low spreads, quick deposits, and intuitive platform, Eightcap is perfect for both beginners and seasoned traders.

IC Markets: With low spreads and fast execution, IC Markets is ideal for scalpers and day traders.

FP Markets: Offering excellent customer support and a user-friendly platform, FP Markets provides an outstanding trading experience.

Octa: Specializing in accounts suitable for South African traders, Octa stands out for its commitment to local customers.

BlackBull: If you're after low-cost trading with access to a wide range of assets, BlackBull is a top contender.

XM: XM’s global reach and local support make it a solid choice for traders looking for both global opportunities and local assistance.

FXPro: Known for its top-tier services and robust tools, FXPro is ideal for traders seeking a complete package.

FBS: FBS’s user-friendly interface and attractive promotions make it an appealing option for beginners.

Comparing Forex Brokers in South Africa: Which One is Right for You?

Choosing the right broker depends on your trading needs. For beginner traders, brokers with easy-to-use platforms and strong customer support, like FBS and Eightcap, might be the best fit. Experienced traders, however, may benefit from IC Markets or FP Markets, which offer advanced tools and low-cost trading. If you're focused on low spreads, BlackBull and Octa are excellent options.

The Future of Forex Trading in South Africa:

As we look toward 2025, the future of forex trading in South Africa appears promising. Technological advancements, such as AI-based trading tools and faster transaction systems, are set to make trading more efficient. Moreover, evolving regulations may offer even greater protection for traders. Staying informed about the latest trends and innovations will help traders maintain a competitive edge.

Conclusion:

In conclusion, choosing the right forex broker is critical for successful trading in South Africa. With the Forex Brokers Comparison in South Africa above, you are equipped with the knowledge to make an informed decision. Visit Top Forex Brokers Review for more in-depth insights and to explore detailed broker reviews

2 notes

·

View notes

Text

Global Premier Forex Trading Companies

Global Premier Best Forex Trading Company refers to the elite group of forex brokers that stand out in the global market for their exceptional services, advanced trading platforms, and strong regulatory compliance. These companies are recognized for offering competitive spreads, a wide range of currency pairs, and robust customer support.

#best ecn forex broker#top trading platform#cfd trading platform#xtreamforex partner#best trading platform#best leverage brokers#across the spiderverse#best forex trading platform#top regulated forex brokers

0 notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

The Benefits of Trading with a Regulated Broker in the Indian Forex Market

India is a popular market for forex traders looking for global opportunities. However, investors must trade with regulated forex brokers in India to ensure investment protection.

Here are some key benefits of Forex trading with a regulated broker in India:

Investor Protection: Indian brokers are licensed and monitored by the Securities and Exchange Board of India (SEBI). In this way, investors are protected from fraud and financial malpractice by following strict guidelines and regulations.

Safety and Security: Brokers who are regulated provide high levels of safety and security to their clients. For account security, data protection, and financial transactions, they must follow strict protocols.

Transparency: Brokers are required to provide accurate and transparent information about their services, fees, and risks. As a result, traders are able to make informed decisions and manage their investments effectively.

Professionalism and Expertise: Regulated brokers in India must have qualified and experienced staff to provide high-quality services. By getting expert advice and guidance, traders can make better trading decisions.

Access to Trading Tools and Resources: Regulated brokers provide traders with a wide range of trading tools and resources, including trading platforms, market analysis tools, and educational materials. Traders can use these tools to stay informed and make better trading decisions.

With Forex4you India, you can enjoy a safe and secure trading environment that is reputable and trustworthy. Additionally, it provides access to valuable trading resources and competitive pricing. This makes it an attractive option for Indian traders making it easy for traders of all levels to get started.

0 notes

Text

Best Online Forex Broker

Online Forex trading broker currently operating from around the globe, each and every broker has their own regulations and quality of services they provide to their customer/users. Forex Trading market has a Transaction of around 6 Trillion dollars each and every day, it’s a very huge market for traders, business peoples, and common people.

#forex broker#forex#online Forex trading#forex trading#forex trading platform#forex traders#online trading#xtreamforex

3 notes

·

View notes

Text

Best Online Forex Broker

There are many Online Forex trading broker currently operating from around the globe, each and every broker has their own regulations and quality of services they provide to their customer/users. Forex Trading market has a Transaction of around 6 Trillion dollars each and every day, it’s a very huge market for traders, business peoples, and common people.

4 notes

·

View notes

Text

How the fuck will that get you cancelled?

That is the most uncancellable, milquetoast shit I have ever seen.

If you start saving at 30 years old and you expect to retire at 65 and use $100k/year until 85 you have to invest $3000/month

Thats fucking nuts. I am putting that much away. Its insane

Here are some that will get you cancelled:

If you have good enough credit to get a $42,000 credit card and preferably like $100k credit card you could (if you made it your full time job) make $30 mil/year

Rental properties are priced based on revenue, not property value. This can be exploited both ways

A car payment should not be more than 8% of your income

A house should cost twice your salary but with a 30 year mortgage 4x your salary is affordable

Its almost impossible to sell a house thats 5x the average income in a town. So in a town with “average” income $60k per person a $300k house will need to be on the market for 6 months or more. Most nice/suburban towns have average incomes above $100k.

Banks have just cut mortgages and business loans to 90% of what it was in 2008. So were pretty fucked

You first house (with the first time home buyers program) can have a down payment of 3-5%. Its okay to not do 20%

If you’re poor places with low cost of living are more important than taxes. Virginia have high taxes but at $15/hr it doesn’t matter. you can get cheap rent and food and fuel there.

Buying a home is a scam by the banks

Refinancing your home is a scam

Refinancing your debt WITH ANOTHER BANK is not always a scam. They get your business instead of the other guys.

If you refinance with the same bank they have no incentive to help you and, in fact, have an incentive to fuck you

You will die poor

Warren Buffet invests in shit businesses and props them up by lobbying for government regulation that makes him more profitable like the Keystone pipeline. You cannot invest like Warren Buffet no matter what some book says and if you could, you shouldn’t

You can’t beat an index fund. Other people can. I do. You can’t

FOREX is actually straight up gambling. The “brokers” control the prices. Arguably its more fun than gambling but just be aware

You don’t “need” that new thing

Lifestyle creep will ruin your finances

Unless you are actively trying Costco and Sam’s Club will not save you money. Its pretty easy to do it right though

Some things are actually more expensive at Walmart than at the fancy grocery stores

You should be going to 2 or 3 different stores to get your stuff for less

Don’t buy super cheap stuff. Its a waste of money

Sometimes it is cheaper to eat out because you will have a lot of food waste and meal prep sucks. The only thing I like to prep is soup.

Most jobs have an economic impact 3 to 4x the actual pay. Get over it. The company doesn’t make that much.

Banks won’t lend to independent contractors

Net worth is not comparable to actual cash in hand

$25k is a reasonable amount to keep in the bank as. A rainy day fund. With minimum account amounts on high interest savings accounts $30k is actually reasonable. Yeah I know the average american has less than $1k

If you live in a place that has slightly above average rent and food costs the living wage is like $18.75 or more

When bond interest rates reverse that means rich people and banks are buying 30 year bonds and not 5 year bonds. This is not financial advice but thats when I am eyeballing those 5 year bonds. Banks are forced to buy bonds when the Federal Reserve “prints” money. They choose 30 year bonds even though they are a terrible investment.

If you are going to buy bonds consult an advisor. There are ways to time the market and times when inflation adjusted bonds aren’t the best so yes you do actually need to talk to someone knowledgable

The best investors are paid commission. They make money when you make money so their interests are aligned with yours

Vending machines, laundromats, and other side hustles are a scam. They are a waste of your precious time. Just work overtime at your job or grow cash crops like Oyster mushrooms

You don’t have enough money to get into real estate or most of those side hustles anyway. Minimum is like $150k cash

Oh and if you do manage to build wealth your children or grandchildren will waste it and be wage slaves again

31K notes

·

View notes