#Bearish engulfing pattern

Explore tagged Tumblr posts

Text

How To Commerce The Inverse Head-and-shoulders Sample

With the investor loosing interest in investing in shares, the volume drops and the inventory worth starts to decline. The heart trough is the deepest and the opposite two are of roughly the same depth. An inverted Head and shoulders pattern occurs when the price of a security drops marking the bearish pattern and reaches the bottom level. Then the bullish development kicks back in and pushes the worth upwards.

In this case, the inventory's price reaches three consecutive lows, separated by momentary rallies.

This breakdown ought to be convincing, occurring on robust volume and coinciding with momentum indicators pointing towards sturdy bearish momentum.

If the value advance preceding the top and shoulders top is not long, the following worth fall after its completion may be small as nicely.

All expressions of opinion are subject to vary without discover in response to shifting market circumstances.

Some progress on the US debt ceiling talks is lifting the general market mood. The Relative Strength Index indicator turned bearish, warranting that additional downside is expected, whereas the 3-day Rate of Change , continues to slide beneath its neutral level. Futures and futures choices buying and selling includes substantial risk and isn't appropriate for all investors. Please read theRisk Disclosure Statementprior to buying and selling futures merchandise.

Figuring Out The Pinnacle And Shoulders Trading Pattern

The neckline can additionally be an essential part of the pinnacle and shoulders sample as it is the stage of resistance that merchants use in order to set up the world vary to put orders. So, to find the neckline, first, find the left shoulder, head, and proper shoulder. Then connect the low factors after the left shoulder with the low after the head, which creates the neckline.

youtube

youtube

It can be difficult for newbies to determine the altering developments.

Is Your Risk/reward Enough?

Chart patterns Understand the method to learn the charts like a professional trader. Live streams Tune into day by day live streams with expert merchants and transform your buying and selling abilities. A catalyst is something that can move traders or buyers to buy or promote a stock. That’s as a outcome of you must use this sample to discover out a significant change in development. Ascending triangle pattern need a lot of traders to see the sample, so they act accordingly and the price sample plays out.

#Chart patterns#Price action trading#Trading basics#Technical analysis#Candlestick patterns#Support and resistance#Trend lines#Breakout trading#Reversal patterns#Continuation patterns#Fibonacci retracements#Moving averages#Trading strategies#Bullish engulfing pattern#Bearish engulfing pattern#Head and shoulders pattern#Double top pattern#Triple bottom pattern#Cup and handle pattern#Ascending triangle pattern#Descending triangle pattern#Wedge pattern#Harami pattern#Doji candlestick#Morning star pattern#Evening star pattern#Trading psychology#Risk management#Entry and exit points#Backtesting strategies

0 notes

Text

How to Trade with Engulfing Candlestick Patterns

Engulfing Candlestick Patterns are a type of chart pattern used in technical analysis to predict market trends. They occur when a larger candlestick completely covers or “engulfs” the previous smaller one, signalling a potential reversal in price direction. There are two types of engulfing candlestick patterns, i.e., bullish engulfing pattern and bearish engulfing pattern. These patterns are a useful tool in determining entry and exit points for trade or understanding the market behaviour to make informed portfolio decisions.

Types of Engulfing Candlestick Patterns

How to Trade Using Engulfing Candlestick Patterns

Pros and Cons of Bullish Engulfing Candlestick Pattern

Pros and Cons of Bearish Engulfing Candlestick Pattern

#engulfing candlestick#types of engulfing candlestick pattern#bullish engulfing candlestick#bearish engulfing candlestick pattern

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the March FOMC meeting and options expiration in the books, that equity markets shifted to stability after 3 weeks of downward price action. Elsewhere looked for Gold ($GLD) to continue its ascent into space while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to have found support in its drift lower while US Treasuries ($TLT) looked weaker in their consolidation. The Shanghai Composite ($ASHR) looked to digest the recent move higher while Emerging Markets ($EEM) consolidated in a narrow range.

The Volatility Index ($VXX) looked to remain slightly elevated putting some pressure on equity markets. Their charts remained at risk of more downside, especially on the longer timeframe. On the shorter timeframe both the $QQQ and $SPY looked to be stabilizing as they held the bounce during the week. The $IWM was a bit weaker.

The week played out with Gold retesting 3000 before a run up to new all-time highs while Crude Oil found some strength and moved higher in the consolidation range. The US Dollar held in a narrow range while Treasuries fell back to a 5 week low before catching a bid Friday. The Shanghai Composite found support and moved sideways while Emerging Markets dropped out of the short consolidation.

The Volatility Index started by moving lower but reversed Wednesday to end the week slightly higher. This saw the bounce rally in equities grind to a halt early in the week and they dropped back through Friday. This resulted in the SPY and the QQQ and the IWM printing new 2 week lows. What does this mean for the coming week? Let’s look at some charts.

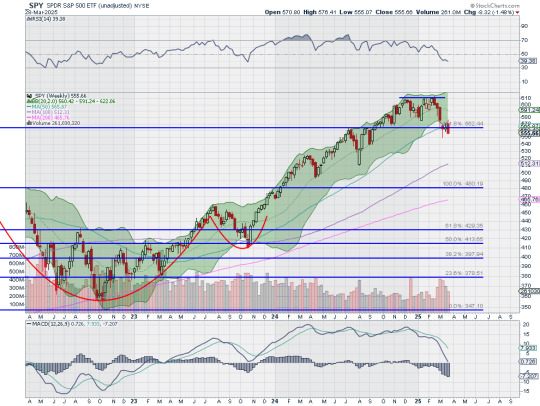

The SPY came into the week pausing in a bounce off the 61.8% retracement of the leg higher since August 2023 and reclaiming the 161.8% extension of the retracement of the 2022 drop. It gapped up Monday to touch the 200 day SMA and over the 20 day SMA but then printed and Evening Star reversal pattern and started lower Wednesday. It gathered steam in the move lower Friday to end the week at a 2 week low. It looks as if the bounce might confirm as a bear flag and confirmation would give a target to 513. It has a RSI dropping back from a stall at the midline in bearish territory with the MACD curling to cross down and negative.

The weekly chart shows a bearish engulfing candle, also suggesting more downside, holding under the 50 week SMA. The RSI has gone level at the bottom of the bullish zone with a peak into the bearish zone with the MACD dropping but positive. There is resistance above at 556.50 followed by 565.50 and 569 then 571 and 574.50 before 581 and 585. Support lower is at 549.50 then 545.75 and 542.50 before 540 and 537. Pullback in Uptrend.

With just one trading day left in the 1st Quarter of 2025, equity markets showed renewed weakness after a positive start to the week. Elsewhere look for Gold to continue its record breaking drive higher while Crude Oil rises in consolidation. The US Dollar Index looks to continue to drift to the downside while US Treasuries pullback in their consolidation. The Shanghai Composite looks to consolidation in the short term uptrend while Emerging Markets continue a short term consolidation.

The Volatility Index looks to remain slightly elevated making the path easier for equity markets to the downside. Their charts look vulnerable on both timeframes. On the shorter timeframe the SPY if a bit stronger than the QQQ and IWM. On the longer timeframe all look set up for more downside. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview March 28, 2025

11 notes

·

View notes

Text

How Many Candlestick Patterns Are There

How Many Candlestick Patterns Are There? A Friendly Guide to Understanding the Basics

Understanding the world of trading can feel like learning a new language. And if you’ve ever seen a candlestick chart, you might’ve wondered, “What am I even looking at?” Don’t worry—you're not alone! Whether you're someone just getting into trading or simply curious about how it all works, this article will walk you through the mysterious world of candlestick patterns. We’ll break it down in a way that makes sense, no financial dictionary required.

Imagine candlestick patterns like traffic signals on the road of trading—they give hints about what might happen next. Some say, “Hey, the market might go up!” Others hint, “Watch out, things could go south.” So, how many candlestick patterns are there? Great question—let’s find out.

Learn how many candlestick patterns are there, different types of candlestick patterns, and what is candlestick patterns in simple language for beginners.

Introduction to Candlestick Patterns

Let’s start at the beginning. If you’ve ever seen a stock or cryptocurrency chart, you’ve probably noticed those little red and green rectangles—they're called candlesticks. They're not just colorful bars; they tell a story about price movement.

What is Candlestick Patterns?

Candlestick patterns are specific formations of these candles on a chart. Think of them as facial expressions of the market. Just like a smile can tell you someone’s happy, a certain pattern in candles can suggest whether the market is feeling bullish (going up) or bearish (going down).

Each candlestick gives four main pieces of information:

Open Price

Close Price

High Price

Low Price

Why Are Candlestick Patterns Important?

Imagine driving with your eyes closed. Sounds scary, right? That’s what trading without understanding patterns is like. Candlestick patterns act like headlights—they help traders see where the road might lead. While they don't guarantee success, they give valuable clues that many traders use to make decisions.

How Many Candlestick Patterns Are There?

Here’s the big question: how many candlestick patterns are there? Well, in total, there are more than 50 recognized patterns, but most traders focus on about 30 key ones. These patterns are grouped into:

Single Candlestick Patterns

Double Candlestick Patterns

Triple Candlestick Patterns

Each category offers insight into different possible future movements of the market.

Types of Candlestick Patterns

To make things easier, let’s break them down:

Single Candlestick Patterns

These involve just one candlestick. They're quick and simple.

Double Candlestick Patterns

These involve two candles and often signal a trend reversal.

Triple Candlestick Patterns

These use three candles to tell a more complete story about what the market might do next.

Let’s dig deeper into each one.

Single Candlestick Patterns

These are the building blocks of chart reading. They’re easy to spot and understand.

Doji

A Doji looks like a cross. It happens when the open and close prices are almost the same. It shows market indecision—like the market saying, “I’m not sure which way to go.”

Hammer

A Hammer looks like—you guessed it—a hammer! It has a small body with a long lower wick. It usually shows up at the bottom of a downtrend, signaling a potential reversal upward.

Inverted Hammer

Similar to the Hammer, but flipped upside down. It also signals a possible trend reversal, but needs confirmation from the next candles.

Double Candlestick Patterns

These patterns give a stronger message since they involve two candles working together.

Bullish Engulfing

This happens when a small red candle is followed by a big green candle that completely “engulfs” it. It signals a potential move upward.

Bearish Engulfing

The opposite of bullish. A small green candle is followed by a larger red one. This can signal a downward move ahead.

Tweezer Tops and Bottoms

These are two candles with matching highs (tops) or lows (bottoms). They can suggest that a trend is losing strength.

Triple Candlestick Patterns

When three candles join forces, the pattern becomes even stronger and more reliable.

Morning Star

This is a bullish reversal pattern made of three candles: a bearish candle, a small-bodied candle (which can be a Doji), and a bullish candle. It's like a sunrise—things are looking up!

Evening Star

The opposite of Morning Star. It begins with a bullish candle, followed by a small one, and ends with a bearish candle. It's a sign the sun is setting on an uptrend.

Three White Soldiers

This pattern consists of three strong green candles in a row. It’s a very bullish sign, showing continued buying pressure.

Three Black Crows

You guessed it—this one's bearish. It’s made of three long red candles in a row, suggesting strong selling pressure.

Common Mistakes When Reading Patterns

Let’s face it, we all mess up sometimes. Here are some pitfalls to avoid:

Relying on patterns alone: Always use other tools too.

Ignoring the bigger trend: A bullish pattern in a strong downtrend may not hold up.

Overtrading: Just because you see a pattern doesn’t mean you must act on it.

Tips for Learning Candlestick Patterns

Learning candlestick patterns is like learning to read emotions. Start small:

Practice with paper trading.

Use flashcards to memorize patterns.

Review historical charts to see how patterns played out.

Keep a trading journal to track your learning.

Conclusion

So, how many candlestick patterns are there? There are over 50—but don’t panic! You really only need to master about 30 core patterns to start making smarter decisions. Whether you’re an aspiring trader or just a curious learner, understanding these patterns is like having a window into the market’s soul.

Remember, candlestick patterns are tools—not magic tricks. Use them wisely, and always double-check with other indicators and research.

FAQs

How many candlestick patterns are there?

There are over 50 recognized candlestick patterns, but traders mostly use 30 key ones regularly.

What is candlestick patterns in simple terms?

They are visual representations of price movements in a chart. Each pattern gives clues about where the market might go next.

Are candlestick patterns accurate?

They can be helpful, but no pattern is 100% accurate. They're best used with other tools and indicators.

Can beginners learn candlestick patterns easily?

Absolutely! With practice, even beginners can understand and use them to make better trading choices.

What's the difference between bullish and bearish patterns?

Bullish patterns suggest prices may rise, while bearish patterns indicate a possible decline in prices.

#how many candlestick patterns are there#what is candlestick patterns#how to read candlestick pattern#types of candlestick patterns

0 notes

Text

Gold Price Forecast: Navigating Market Trends and Potential Reversals

The gold market is currently experiencing fluctuations following a recent record high of $2,956. Analysts are closely monitoring key support and resistance levels, as predictions suggest a potential bearish retracement could be on the horizon. Investors are advised to stay alert to market signals that may indicate the next direction for gold prices. Key Takeaways - Gold reached a record high of $2,956 but has since pulled back. - Current support is seen at $2,833, with resistance around $2,930. - A drop below $2,894 may signal a bearish reversal. - Key targets for further declines are set around $2,820 to $2,813. Recent Market Trends Gold prices have shown significant volatility in recent weeks. After hitting a record high, the market has seen a pullback, with prices dropping below previous weekly lows. This behavior is typical in the early stages of a bearish retracement, where key support levels are tested. - Record High: $2,956 - Recent Low: $2,833 - Current Resistance: $2,930 The recent rally to $2,930 is viewed as a counter-trend movement, likely testing previous support levels as resistance. Analysts suggest that unless gold can sustain an advance above the record high, the market may continue to face downward pressure. Potential Bearish Reversal Signals Market indicators suggest that a bearish reversal could be imminent. The completion of a 78.6% retracement has raised concerns about the sustainability of the recent gains. A bearish engulfing pattern was noted at the end of last week, indicating a potential shift in market sentiment. - Key Support Levels: - $2,894: Critical level to watch; a drop below this may confirm bearish sentiment. - $2,820: Initial target for further declines, supported by Fibonacci retracement levels. Technical Analysis Insights Technical analysis reveals that the 20-Day moving average, which previously acted as support, has now become a resistance level. The market's behavior around this moving average will be crucial in determining the next steps for gold prices. - Resistance Levels: - 20-Day Moving Average - Rising Trendline If gold prices can break above these resistance levels, it may signal a continuation of the bullish trend. Conversely, failure to maintain support at $2,833 could lead to further declines, with targets set around $2,813 to $2,810. Conclusion As the gold market navigates these fluctuations, investors should remain vigilant. The potential for a bearish retracement looms, and understanding key support and resistance levels will be essential for making informed trading decisions. Keeping an eye on market indicators and economic events will provide further clarity on the direction of gold prices in the coming weeks. Sources - Gold Price Forecast: Rebounds but Bearish Retracement May Resume Below $2,894, FXEmpire. - Gold Price Forecast: Holds Near Highs but Faces Potential Bearish Reversal, FXEmpire. - Gold Price Forecast: Stalled at Resistance – Bearish Continuation Ahead?, FXEmpire. Read the full article

0 notes

Text

Certificate in Technical Analysis - Master Market Trends with Empirical Academy

Whether you are a beginner or an experienced trader, mastering technical analysis can significantly improve your ability to navigate the financial markets. In this blog, we will explore the fundamentals of technical analysis and the advantages of taking an advanced certification course.

Key Concepts of Technical Analysis

Price Trends: The market moves in trends — upward (bullish), downward (bearish), or sideways (consolidation). Identifying these trends helps traders make informed decisions.

Support and Resistance Levels: These are key price levels where buying or selling pressure increases, influencing market direction.

Chart Patterns: Traders analyze patterns such as head and shoulders, double tops, and triangles to anticipate price movements.

Technical Indicators: Tools like moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands help traders identify potential entry and exit points.

Candlestick Patterns: Patterns like doji, hammer, and engulfing provide insights into market sentiment and possible reversals.

Why Enroll in a Technical Analysis Certification Course?

A structured certification course provides in-depth knowledge and hands-on experience with technical analysis tools. Here are a few reasons why enrolling in a Technical Analysis Certification Course can benefit you:

Comprehensive Learning: Covers everything from the basics to advanced concepts.

Practical Application: Real-world case studies and live market analysis.

Trading Strategies: Learn tested and effective trading strategies.

Risk Management: Understand how to manage risks and minimize losses.

Industry Recognition: A certification enhances your credibility as a trader or investor.

Advanced Technical Analysis: Taking Your Trading to the Next Level

For seasoned traders looking to refine their skills, an Advanced Technical Analysis Course offers deeper insights. Here’s what you can expect:

Advanced Charting Techniques: Mastering Fibonacci retracement, Elliott Wave theory, and Gann analysis.

Algorithmic Trading: Learning how to automate trading strategies using algorithms.

Market Psychology: Understanding the psychology behind price movements.

Intermarket Analysis: Studying the relationship between stocks, commodities, and forex markets.

Volume Analysis: Learning how to use volume data for better decision-making.

Conclusion

Technical analysis is a valuable skill that can help traders make more informed and strategic decisions in the stock market. Whether a beginner or an advanced trader, taking a Technical Analysis Certification Course can give you the tools and knowledge needed to succeed. If you’re serious about improving your trading skills, explore Empirical Academy’s courses and take the first step towards becoming a professional trader.

Start your journey today and unlock the power of technical analysis!

0 notes

Text

Shifting Averages

Price crossovers can be combined to trade within the larger trend. The longer moving common sets the tone for the bigger trend and the shorter shifting common is used to generate the indicators. One would search for bullish value crosses only when prices are already above the longer shifting common. For Breakout trading , if value is above the 200-day transferring common, chartists would only give attention to alerts when worth strikes above the 50-day shifting average. The calculation is extra advanced, as it applies more weighting to the latest prices. A shifting average is commonly used with time collection data to clean out short-term fluctuations and highlight longer-term developments or cycles. The threshold between short-term and long-term depends on the applying, and the parameters of the moving common will be set accordingly. It can be utilized in economics to look at gross domestic product, employment or other macroeconomic time series. Mathematically, a shifting common is a type of convolution and so it may be seen for example of a low-pass filter used in signal processing. When used with non-time sequence knowledge, a shifting common filters greater frequency elements with none particular connection to time, although usually some sort of ordering is implied.

A bullish cross occurs when the 5-day EMA moves above the 35-day EMA on above-average quantity.

One attribute of the SMA is that if the data has a periodic fluctuation, then applying an SMA of that interval will get rid of that variation .

Flash is an advanced trading algorithm that combines three powerful indicators to...

In basic, a transfer towards the higher band suggests the asset is turning into overbought, while a transfer near the lower band suggests the asset is becoming oversold.

With IG, you'll be able to entry transferring averages on our charts, as properly as different technical tools like Bollinger bands and RSI.

A shifting common simplifies worth data by smoothing it out and creating one flowing line. Exponential transferring averages react quicker to cost changes than simple transferring averages. In some cases, this can be good, and in others, it could trigger false alerts. Moving averages with a shorter look-back period will also respond quicker to cost modifications than a mean with a longer look-back period . The 50-day simple moving average, which is certainly one of three main transferring averages, is broadly utilized by traders and analysts to determine support and resistance levels for a range of securities.

Palantir Technologies Inc (pltr) Just Flashed Golden Cross Sign: Do You Buy?

To create a moving common, each day we’ll drop the last day in the time-frame and add today’s. When a brief interval SMA crosses above a long interval SMA, you might need to go lengthy. You may wish to go brief when the short-term SMA crosses again beneath the long-term SMA. When costs cross above the SMA, you may want to go long or cowl short; once they cross below the SMA, you might want to go brief or exit lengthy.

youtube

If the traces are running in parallel, this means a robust development. If the ribbon is expanding , this means the development is coming to an finish. If the ribbon is contracting , this will indicate the beginning of a model new trend. Another choice which boils down to the trader’s preference is which kind of Moving Average to make use of. While all of the various varieties of Moving Averages are rather comparable, they do have some variations that the dealer should pay consideration to. For example, the EMA has a lot much less lag than the SMA and subsequently turns faster than the SMA.

What Does A Shifting Common Chart Inform You?

Average Vs Weighted AverageIn Excel, the words common and weighted average are totally different. A weighted average, on the opposite hand, is a mean calculated in the same means but with a weight multiplied with each knowledge set. Since it isn't a one-size-fits-all phenomenon, completely different gamers out there use totally different versions of it for various purposes. Some use transferring common trading strategy, some simply want to perceive the trend of the market, and a few analysts use to hold out a detailed evaluation.

By default, 20 periods are used to calculate the Simple Moving Average. However, since P&F transferring averages are double smoothed, a shorter moving common may be most popular when inserting this overlay on a P&F chart. If you're taking the two Moving Averages setup that was discussed within the earlier section and add in the third element of worth, there is one other kind of setup known as a Price Crossover. With a Price Crossover you start with two Moving Averages of various term lengths .

youtube

This indicator not solely tracks the EMA and ATR but also plots these levels as help and resistance traces,... The only distinction here is that it makes use of solely closing numbers, whether inventory prices or balances of accounts and so on. So, the first step is to collect the information of the closing numbers after which divide that number by the period in question, which could probably be from day 1 to day 30, etc.

#Chart patterns#Price action trading#Trading basics#Technical analysis#Candlestick patterns#Support and resistance#Trend lines#Breakout trading#Reversal patterns#Continuation patterns#Fibonacci retracements#Moving averages#Trading strategies#Bullish engulfing pattern#Bearish engulfing pattern#Head and shoulders pattern#Double top pattern#Triple bottom pattern#Cup and handle pattern#Ascending triangle pattern#Descending triangle pattern#Wedge pattern#Harami pattern#Doji candlestick#Morning star pattern#Evening star pattern#Trading psychology#Risk management#Entry and exit points#Backtesting strategies

1 note

·

View note

Text

Best Crypto Charts for Traders in 2025 📊📈

Crypto traders know that reading price movements is key to making informed decisions. Whether you're a beginner or a seasoned trader, using the best crypto charts in 2025 can help you analyze trends, predict market shifts, and optimize your strategy.

🔍 What Are Crypto Charts?

Crypto charts are visual tools that display cryptocurrency price movements over time. They help traders identify trends, spot potential entry/exit points, and refine their trading strategies.

Among the different chart types, candlestick charts are the most popular due to their detailed price representation. Let’s explore some of the best charting platforms available for 2025.

📊 Best Crypto Charting Tools for 2025

🔥 TradingView – The Market Leader

One of the most popular platforms, TradingView offers both free and premium plans, supporting crypto, stocks, forex, and more. It provides customizable charts with 12+ formats and an active trading community to share strategies.

⚡ Bitbo – Bitcoin Specialists

For those focused on Bitcoin trading, Bitbo delivers 90+ Bitcoin price projection & on-chain charts, along with custom alerts and premium analysis tools.

📉 Coinigy – Advanced Crypto Trading

Coinigy is a powerful option that connects to 45+ exchanges, including DeFi platforms. It features AES 256-bit encryption for security and is ideal for portfolio tracking & trade execution.

📈 GoCharting – Multi-Asset Support

GoCharting offers 15+ chart formats, including candlestick, OHLC, and Renko. It’s great for traders involved in US & Indian markets, with extra features like paper trading & an educational academy.

🔄 CryptoView – Integrated Trading & Analytics

CryptoView is designed for serious traders, powered by TradingView charts. It supports multi-screen setups, portfolio sharing, and enterprise-grade security with API encryption.

📖 How to Read Crypto Candlestick Charts

Candlestick charts are the most widely used crypto chart format because they show detailed price changes over a specific timeframe.

Each candlestick consists of:

Open price – the starting value of a crypto asset

High price – the peak value within the timeframe

Low price – the lowest value in that period

Close price – the final value before a new candlestick begins

📊 Understanding Candlestick Colors

🟢 Green Candle = Price closed higher than it opened (Bullish)

🔴 Red Candle = Price closed lower than it opened (Bearish)

📏 Analyzing Wick & Body Lengths

Long bodies → Strong trend (bullish or bearish)

Short bodies → Possible market indecision

Long wicks → Price volatility

Short wicks → Price stability

📌 Recognizing Crypto Chart Patterns

Bullish Patterns (Uptrend Signals)

Bullish Engulfing → Large green candle overtakes a smaller red candle

Rising Three → Three small red candles followed by a large green candle

Bullish Harami → Small green candle inside a larger red candle

Bearish Patterns (Downtrend Signals)

Bearish Engulfing → Large red candle overtakes a smaller green candle

Shooting Star → Long upper wick, small lower body (indicating reversal)

Bearish Harami → Small red candle inside a larger green candle

🛠 Alternative Crypto Analysis Methods

Besides candlestick charts, traders also use: ✅ Fundamental Analysis – Evaluates a crypto project’s whitepaper, team, partnerships, and market adoption ✅ On-Chain Analysis – Uses blockchain data to assess market sentiment and investor behavior ✅ Sentiment Analysis – Tracks social media trends & market psychology

🚀 Final Thoughts

Mastering crypto charts and analysis is crucial for making smarter trading decisions. Whether you use TradingView, Bitbo, Coinigy, GoCharting, or CryptoView, selecting the right charting tool can help you track trends and develop winning strategies.

What’s your go-to crypto charting tool? Let’s discuss! ⬇️💬

0 notes

Text

Master Technical Analysis: Your Guide to the Indian Stock Market

Navigating the Indian stock market can feel overwhelming. With thousands of stocks and constant fluctuations, how do you make informed decisions? Technical analysis offers a way to understand market movements through charts and indicators. This guide will help you get a grip on the essentials of technical analysis, making it easier to trade wisely.

The Allure and Challenges of the Indian Stock Market

The Indian stock market has its own excitement. Investors are drawn to the potential for great returns. However, with opportunity comes risk. The market is volatile, and prices can change quickly. Understanding the tools available can help traders to manage that risk effectively.

Why Technical Analysis is Crucial for Indian Traders

Technical analysis simplifies the process of Stock Marketing Trading. It focuses on price movements and volume rather than company fundamentals. By studying price charts and patterns, traders can make predictions about future market behavior. This method helps reduce emotional decision-making and allows for a more disciplined approach.

Setting the Stage: What This Guide Covers

This guide covers key aspects of technical analysis, including:

Chart Patterns

Technical Indicators

Candlestick Patterns

Risk Management

Advanced Techniques

Each section aims to provide clear insights and actionable strategies for traders in the Indian market.

Chart Patterns: Deciphering Market Signals

Identifying Trend Reversals: Head and Shoulders, Double Tops/Bottoms

Chart patterns are graphical representations of price movements. Recognizing these patterns can signal potential trend reversals:

Head and Shoulders: Indicates a reversal from bullish to bearish.

Double Tops: Signals a peak before a downward trend.

Double Bottoms: Suggests a potential upward movement.

Spotting Continuation Patterns: Flags, Pennants, Wedges

Continuation patterns suggest that a trend will continue. Key patterns to watch include:

Flags: Short-term consolidation before a continuation.

Pennants: Small symmetrical triangles after a sharp price movement.

Wedges: Indicates a potential reversal in a strong trend.

Practical Application: Real-world examples of pattern recognition in Indian stocks

For example, if an Indian stock like Reliance Industries shows a head and shoulders pattern, it might indicate a shift from a bullish trend to a bearish one, guiding traders to adjust their positions accordingly.

Technical Indicators: Unveiling Market Momentum

Moving Averages: Simple, Exponential, Weighted – Explained

Moving averages smooth out price data to identify trends over a specific period. Key types:

Simple Moving Average (SMA): Averages prices over a set time.

Exponential Moving Average (EMA): Gives more weight to recent prices.

Weighted Moving Average (WMA): Assigns different weights to prices based on their age.

Relative Strength Index (RSI): Gauging Market Strength and Weakness

The RSI is a momentum oscillator that ranges from 0 to 100. It helps traders spot overbought or oversold conditions:

Above 70: Indicates overbought conditions.

Below 30: Suggests oversold conditions.

MACD: Identifying Momentum Shifts and Potential Trading Signals

The Moving Average Convergence Divergence (MACD) can identify shifts in momentum. When the MACD line crosses above the signal line, it may indicate a buy signal, and vice versa.

Candlestick Patterns: Unlocking Price Action Insights

Understanding Candlestick Formation and Interpretation

Candlestick charts provide visual insights into price movements. Each candle shows the open, close, high, and low prices for a specific time period.

Powerful Candlestick Patterns: Doji, Hammer, Engulfing Patterns

Some key candlestick patterns include:

Doji: Indicates indecision in the market.

Hammer: Suggests potential bullish reversal.

Engulfing Patterns: Signals strong shifts in market sentiment.

Combining Candlestick Patterns with Indicators for Enhanced Accuracy

By pairing candlestick patterns with indicators like RSI or MACD, traders can enhance their analysis and improve trade accuracy.

Risk Management and Position Sizing in the Indian Context

Defining Your Risk Tolerance and Setting Stop-Loss Orders

Understanding personal risk tolerance is crucial. Setting stop-loss orders helps limit potential losses. For example, if a trader is willing to risk 2% of their portfolio on a trade, they should set a stop-loss accordingly.

Position Sizing Strategies for Indian Stock Market Trading

Calculating position sizes based on risk tolerance aids better capital management. A common method is the fixed percentage approach, allowing traders to determine how much to invest in each trade.

Adapting Risk Management to the Unique Characteristics of Indian Markets

Consider the high volatility in Indian stocks. Adjust risk management practices to protect capital during price swings.

Advanced Technical Analysis Techniques

Fibonacci Retracements and Extensions: Identifying Support and Resistance Levels

Fibonacci levels are used to identify potential retracement levels. Traders often look for support or resistance at these levels during price corrections.

Elliott Wave Theory: Understanding Market Cycles and Trends

Elliott Wave Theory suggests markets move in predictable cycles. Identifying these waves helps traders anticipate future price movements.

Combining Multiple Techniques for Comprehensive Market Analysis

Using multiple technical analysis tools together provides a fuller picture. For instance, analyzing chart patterns alongside indicators can enhance trading decisions.

Conclusion: Mastering Technical Analysis for Sustainable Success

Key Takeaways: Actionable Steps for Indian Stock Market Traders

Focus on mastering chart patterns and technical indicators.

Incorporate risk management strategies tailored to the Indian market.

Continuously learn and adapt to market changes.

Continuous Learning and Adaptation in the Dynamic Indian Market

The Indian stock market is ever-changing. Stay updated with market trends and refine your strategies regularly.

Resources for Further Learning and Development

Books, online courses, and webinars can enhance your understanding. Explore resources like financial news platforms, stock market blogs, and trading forums to continue your education in technical analysis.

By mastering technical analysis, you position yourself for success in the dynamic Indian stock market. Embrace the tools and strategies outlined in this guide to make informed trading decisions. Start analyzing today!

0 notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the unofficial start of summer ahead and just 4 trading days left in May, equity markets were mixed with tech strong, large caps flat and small caps lower. Elsewhere looked for Gold ($GLD) to continue to consolidate in the uptrend while Crude Oil ($USO) resumed a short term downtrend. The US Dollar Index ($DXY) might resume the short term move lower while US Treasuries ($TLT) remained in a downtrend. The Shanghai Composite ($ASHR) looked to pause in the short term move higher while Emerging Markets ($EEM) might be confirming a failed break out higher.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ looked strong, especially on the longer timeframe. On the shorter timeframe the QQQ was also strong with the SPY in consolidation. The $IWM continued to be the outlier, consolidating at a higher range.

The week played out with Gold finding support and holding in a narrow range while Crude Oil consolidated rose early in the week before giving back the gain later. The US Dollar held over support while Treasuries moved higher in the downtrend. The Shanghai Composite held at support while Emerging Markets rocketed to the downside.

Volatility rose up off the recent lows but but only to 14. This put pressure on equities and the large caps and tech names responded with a 4 day move lower. The small caps found support mid week and bounced in consolidation. This resulted in the SPY, IWM and QQQ ending back below their 20 day SMA’s. What does this mean for the coming week? Let’s look at some charts.

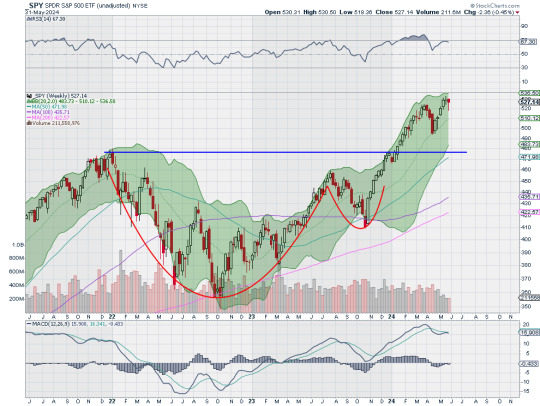

SPY Daily, $SPY

The SPY came into the week consolidating at the all-time high but after a bearish engulfing candle failed to confirm Friday. It held Tuesday and then started to move lower on Wednesday. Thursday it crossed below the 20 day SMA for the first time since May 2nd and dropped again Friday before a strong move higher the last 30 minutes of the day. The RSI is dropping at the midline but in the bullish zone with the MACD crossed down and positive. So far this could just be a momentum reset, with no threat to the uptrend yet.

The weekly chart shows a more damaging pattern as the doji last week is confirmed as a reversal with a move lower this week. This happened as the RSI stalled at a lower high showing a divergence. The price is far from the 20 week SMA and the last pullback found support there. The MACD is crossed down and moving lower but positive. There is support at 520.50 and 517.50 then 513.50 and 510 before 503.50 and 501.50. Resistance higher is at 524.50 and 530. Digestion in Uptrend.

SPY Weekly, $SPY

With the month of May in the books, equity markets showed some signs of weakness following divergences last week. Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil consolidates in a narrow range after a pullback. The US Dollar Index continues to drift to in broad consolidation while US Treasuries continue their downtrend. The short term move higher in the Shanghai Composite looks to be at risk of reversing while Emerging Markets enter a short term downtrend.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong on the longer timeframe, but with a possible momentum reset continuing in the short run. On the shorter timeframe both the QQQ and SPY have reset to their 20 day SMA’s where they often find support. How they react next week could tell if this week was meaningful or not. The IWM continues to be the laggard, stalled near the top of a 2 year range. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview May 31, 2024

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is on at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

9 notes

·

View notes

Text

Olymp Trade Strategy For Beginners 2025: Price Action

Introduction to Price Action Trading

Price action trading is a powerful strategy that focuses on analyzing historical price movements without relying on indicators. Instead, traders observe price patterns, candlestick formations, and key support and resistance levels to make informed trading decisions. This guide will help beginners apply price action strategies on Olymp Trade in 2025 effectively.

Key Concepts of Price Action Trading

Support and Resistance Levels

Support: A price level where demand is strong enough to prevent further decline.

Resistance: A price level where selling pressure is strong enough to prevent further rise.

Identify these levels using historical price movements and previous highs/lows.

Candlestick Patterns

Doji: Indicates market indecision.

Pin Bar (Hammer & Shooting Star): Suggests potential reversal.

Engulfing Pattern: Strong signal of trend continuation or reversal.

Trend Analysis

Uptrend: Higher highs and higher lows.

Downtrend: Lower highs and lower lows.

Sideways Trend: Price moves within a horizontal range.

Step-by-Step Price Action Trading Strategy on Olymp Trade

Step 1: Identify Market Structure

Look for trends using higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).

Draw support and resistance levels using historical price points.

Step 2: Wait for a Price Action Signal

Observe candlestick patterns near support or resistance levels.

Example: A bullish pin bar at support suggests a buy opportunity.

Example: A bearish engulfing at resistance suggests a sell opportunity.

Step 3: Confirm with Volume

Although price action trading doesn’t rely on indicators, checking volume can confirm breakout strength.

High volume during a breakout indicates strong momentum.

Step 4: Execute the Trade

Buy Trade: Enter when price bounces off support with a bullish candlestick confirmation.

Sell Trade: Enter when price rejects resistance with a bearish candlestick confirmation.

Use a stop-loss below support (for buy) or above resistance (for sell).

Step 5: Set Take-Profit and Stop-Loss

Take-Profit: Place it near the next key resistance or support level.

Stop-Loss: Keep it slightly beyond recent highs/lows to protect against market reversals.

Risk-to-reward ratio: Aim for 1:2 or higher for better profitability.

Step 6: Manage Your Trade

Use trailing stop-loss to lock in profits if the trade moves in your favor.

Avoid overtrading — stick to quality setups based on price action.

Best Timeframes for Beginners

5-Minute Chart: Suitable for quick trades (scalping) but requires fast decision-making.

15-Minute Chart: Good for short-term traders seeking stable setups.

1-Hour Chart: Ideal for beginners to catch strong trends with minimal noise.

Common Mistakes to Avoid

Trading Without a Clear Plan

Always define entry, stop-loss, and take-profit before trading.

Overtrading

Stick to 2–3 quality setups per session instead of jumping into random trades.

Ignoring Market Conditions

Avoid trading during high-impact news events as they cause unpredictable price swings.

Conclusion

Price action trading is a reliable strategy for beginners on Olymp Trade in 2025. By mastering support and resistance, candlestick patterns, and trend analysis, traders can make consistent profits without relying on indicators. Focus on discipline, risk management, and continuous learning to improve your success rate in trading.

0 notes

Link

#CandlestickFormations#candlestickpatterns#chartpatterns#ForexTrading#marketpsychology#MarketSentiment#MomentumTrading#priceaction#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendReversals

0 notes

Text

Candlestick Patterns and Their Role in Trading

In the world of trading, understanding and predicting market movements is crucial for success. Among the various tools available to traders, candlestick patterns stand out as one of the most powerful and widely used methods for technical analysis. Candlestick patterns not only help traders anticipate market trends but also offer valuable insights into the psychology of market participants. This article delves into what candlestick patterns are, their significance in trading, and how traders can use them to make more informed decisions.

What Are Candlestick Patterns?

Candlestick patterns are a type of chart pattern that originated in Japan in the 18th century. They were first used by Japanese rice traders to track and predict price movements. Over time, these patterns gained popularity in the Western world and have become an essential tool for modern traders.

Each candlestick on a chart represents the price movement for a specific time frame, such as one minute, one hour, or one day. A single candlestick is composed of four key pieces of information:

Open Price – The price at which the trading period started.

Close Price – The price at which the trading period ended.

High Price – The highest price reached during the trading period.

Low Price – The lowest price reached during the trading period.

The body of the candlestick (the rectangular part) shows the range between the open and close prices, while the thin lines above and below (called wicks or shadows) represent the high and low prices.

Bullish vs. Bearish Candlesticks

Bullish Candlestick: Indicates that the closing price is higher than the opening price. It’s often colored green or white and signifies upward price movement.

Bearish Candlestick: Indicates that the closing price is lower than the opening price. It’s often colored red or black and signifies downward price movement.

Understanding how to read individual candlesticks is the foundation for recognizing more complex candlestick patterns.

Why Are Candlestick Patterns Important?

Candlestick patterns provide valuable insights into market sentiment and potential future price movements. Unlike other technical indicators that rely on calculations and formulas, candlestick patterns offer a visual representation of the battle between buyers and sellers.

These patterns can:

Identify market reversals: Some patterns signal that a trend may be about to reverse direction.

Confirm existing trends: Others confirm the continuation of an ongoing trend.

Provide entry and exit points: Candlestick patterns help traders time their trades effectively.

Enhance decision-making: By understanding market psychology, traders can make more informed decisions.

Popular Candlestick Patterns Every Trader Should Know

There are numerous candlestick patterns, but some are more reliable and commonly used than others. These patterns can be broadly classified into two categories: reversal patterns and continuation patterns.

Reversal Patterns

Reversal patterns indicate a potential change in the current trend direction.

Hammer

Description: A single candlestick with a small body and a long lower wick.

Significance: Appears at the bottom of a downtrend, signaling a potential reversal to the upside.

Example: A hammer indicates that sellers pushed the price lower during the session, but buyers regained control before the close.

Shooting Star

Description: A single candlestick with a small body and a long upper wick.

Significance: Appears at the top of an uptrend, indicating a potential reversal to the downside.

Engulfing Pattern

Bullish Engulfing: A larger green candlestick completely engulfs the previous red candlestick, signaling a potential upward reversal.

Bearish Engulfing: A larger red candlestick engulfs the previous green candlestick, signaling a potential downward reversal.

Morning Star and Evening Star

Morning Star: A three-candlestick pattern that signals a bullish reversal. It consists of a bearish candle, a small indecisive candle, and a bullish candle.

Evening Star: The bearish counterpart of the Morning Star, signaling a potential downward reversal.

Continuation Patterns

Continuation patterns indicate that the current trend is likely to continue.

Doji

Description: A candlestick with an almost equal open and close price, resulting in a very small body.

Significance: Reflects market indecision. Depending on its position in the trend, it can either signal a continuation or a potential reversal.

Three White Soldiers

Description: Three consecutive bullish candlesticks with higher closes each time.

Significance: A strong bullish continuation pattern.

Three Black Crows

Description: Three consecutive bearish candlesticks with lower closes each time.

Significance: A strong bearish continuation pattern.

Rising and Falling Three Methods

Rising Three Methods: A bullish continuation pattern consisting of several small bearish candles followed by a large bullish candle.

Falling Three Methods: The bearish counterpart of the Rising Three Methods.

How to Use Candlestick Patterns in Trading

Recognizing candlestick patterns is only the first step. To use them effectively, traders must combine them with other technical indicators and strategies. Here are some practical tips for incorporating candlestick patterns into your trading plan:

Combine with Support and Resistance Levels Candlestick patterns are more reliable when they appear near significant support or resistance levels. For instance, a bullish engulfing pattern at a strong support level is a more reliable buy signal.

Use Multiple Time Frames Analyzing candlestick patterns across multiple time frames can provide a clearer picture of market trends. A pattern that appears on a daily chart is generally more significant than one on a five-minute chart.

Confirm with Technical Indicators Indicators such as the Relative Strength Index (RSI), Moving Averages, and Bollinger Bands can help confirm the signals provided by candlestick patterns.

Practice Risk Management No pattern guarantees success. Always use stop-loss orders and maintain a disciplined approach to risk management.

Monitor Market Context Always consider the broader market context. A candlestick pattern that appears during a news event or high-volatility period may behave differently than one in a stable market.

Common Mistakes to Avoid

While candlestick patterns can be powerful, they are not foolproof. Here are some common mistakes traders should avoid:

Over-reliance on a single pattern: Always seek confirmation from other indicators or patterns.

Ignoring the trend: Patterns are more reliable when traded in the direction of the prevailing trend.

Forgetting risk management: Even the most reliable patterns can fail, so proper risk management is essential.

Failing to practice: New traders should practice identifying and interpreting candlestick patterns using demo accounts before trading with real money.

Conclusion

Candlestick patterns are a valuable tool for traders seeking to anticipate market movements and improve their decision-making. At Shenzhou Capital, we believe that understanding the various patterns and how to use them effectively can give traders a significant edge in the markets. However, it’s essential to remember that no pattern is foolproof, and combining candlestick analysis with other technical tools and strategies is key to long-term success.

Whether you’re a beginner or an experienced trader, mastering candlestick patterns can enhance your trading journey and help you navigate the complexities of financial markets with greater confidence.

#CandlestickPatterns#TradingStrategies#TechnicalAnalysis#ForexTrading#StockMarket#CryptoTrading#MarketTrends#BullishPatterns#BearishPatterns#TradingTips

1 note

·

View note

Text

Whether you are a beginner or an experienced trader, mastering technical analysis can significantly improve your ability to navigate the financial markets. In this blog, we will explore the fundamentals of technical analysis and the advantages of taking an advanced certification course.

Key Concepts of Technical Analysis

Price Trends: The market moves in trends — upward (bullish), downward (bearish), or sideways (consolidation). Identifying these trends helps traders make informed decisions.

Support and Resistance Levels: These are key price levels where buying or selling pressure increases, influencing market direction.

Chart Patterns: Traders analyze patterns such as head and shoulders, double tops, and triangles to anticipate price movements.

Technical Indicators: Tools like moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands help traders identify potential entry and exit points.

Candlestick Patterns: Patterns like doji, hammer, and engulfing provide insights into market sentiment and possible reversals.

Why Enroll in a Technical Analysis Certification Course?

A structured certification course provides in-depth knowledge and hands-on experience with technical analysis tools. Here are a few reasons why enrolling in a Technical Analysis Certification Course can benefit you:

Comprehensive Learning: Covers everything from the basics to advanced concepts.

Practical Application: Real-world case studies and live market analysis.

Trading Strategies: Learn tested and effective trading strategies.

Risk Management: Understand how to manage risks and minimize losses.

Industry Recognition: A certification enhances your credibility as a trader or investor.

Advanced Technical Analysis: Taking Your Trading to the Next Level

For seasoned traders looking to refine their skills, an Advanced Technical Analysis Course offers deeper insights. Here’s what you can expect:

Advanced Charting Techniques: Mastering Fibonacci retracement, Elliott Wave theory, and Gann analysis.

Algorithmic Trading: Learning how to automate trading strategies using algorithms.

Market Psychology: Understanding the psychology behind price movements.

Intermarket Analysis: Studying the relationship between stocks, commodities, and forex markets.

Volume Analysis: Learning how to use volume data for better decision-making.

Conclusion

Technical analysis is a valuable skill that can help traders make more informed and strategic decisions in the stock market. Whether a beginner or an advanced trader, taking a Technical Analysis Certification Course can give you the tools and knowledge needed to succeed. If you’re serious about improving your trading skills, explore Empirical Academy’s courses and take the first step towards becoming a professional trader.

Start your journey today and unlock the power of technical analysis!

0 notes

Text

Bitcoin Nears $94K: Analysts Predict Potential Fall to $70K Amid Weak Support

Key Points

Bitcoin’s struggle under $100K triggers a pullback, raising concerns about its ability to hold key support levels.

Experts warn of a potential drop to $70K, but remain optimistic about a long-term rally by 2025.

Bitcoin, currently struggling under the $100K mark, has triggered a significant pullback, causing concerns about its ability to maintain key support levels. The dominance of bearish signals and a surge in liquidation events have led to the price facing critical zones.

Short-term risks suggest a potential drop as low as $70,000. However, some experts maintain a positive outlook for a long-term rally by 2025.

Potential Breakdown to $90K

The failure to reach the $100,000 mark resulted in a 3.71% pullback, creating a bearish engulfing candle and completing a leading share pattern. This undermines the week’s price recovery, with the BTC price continuing in a bearish trend. With an intraday pullback of 1.11%, the BTC market price has decreased to $94,624.

This creates a second consecutive bearish candle and is testing the nearest crucial support level of $94,403. It’s also approaching the 50-day EMA line, priced at $93,170. Amid the increasing bearish influence, the daily RSI line is down under the halfway level and warns of a downtrend continuation.

Expert Predictions and Market Analysis

Despite multiple bouncebacks, the 50-day EMA line remains the final support before the retest of the $90,000 support level. The crypto market in the last 24 hours has lost $251 million in liquidations, with $200 million liquidated from the long-side investors. This indicates a market-wide selling spree, threatening a bearish start to 2025.

A recent tweet by independent analyst Ali Martinez, along with other market analysts, supports the bearish narrative. In a recent video, Tone Vays, a former Wall Street quant trader, warns of cataclysmic conditions if Bitcoin starts to trade below the $95K level. If this happens, it increases the possibility of Bitcoin extending the correction phase to the $73K level.

Technical analyst Peter Brandt has said that Bitcoin is making a broadening triangle pattern in the daily chart, with the support level for this standing at the $90K support level. If the BTC price breaks under this, a possibility of retesting the $70K levels is possible.

Despite these predictions, Thomas Lee holds a positive view on Bitcoin reaching $250K in 2025. However, Chartered Market Technician Mark Newton estimates Bitcoin to take a downswing to $60K before the parabolic rise. Benjamin Coven believes the BTC price is likely to flash crash to $60K near Donald Trump’s inauguration day.

On-Chain Data and Key Levels

The Bitcoin price, based on the on-chain data, suggests $70,000 as a potential drawdown target if BTC starts trading below $93,806. Ali Martinez highlighted a key support zone between $93,806 and $97,041. If this critical demand area doesn’t hold up, the nearest significant support is present near the $70,085 level.

Savvy investors have sent 33,000 BTC to exchanges over the past week, valued at $3.23 billion. Meanwhile, on December 23 alone, $7.17 billion in BTC profits were realized.

Bitcoin faces critical support at $94,403 and the 50-day EMA at $93,170, with a break below potentially leading to a retest of $90K or even $70K. Despite short-term bearish risks, long-term optimism persists with projections of a rise to $250K by 2025. Traders should watch key levels closely to navigate the current uncertainty.

0 notes

Text

Mastering Candlestick Patterns: A Beginner’s Guide for Forex Traders

Candlestick patterns are powerful tools for Forex trading, providing crucial insights into price action and market sentiment. This beginner-friendly guide explains how to identify and use basic patterns like bullish and bearish engulfing, doji, hammer, and shooting star to predict market movements. Combining candlestick analysis with technical indicators, understanding market context, and practicing risk management can enhance your trading strategies. Whether you’re new to Forex trading or looking to refine your approach, mastering candlestick patterns is essential. Partnering with the Best Forex Broker ensures access to the right tools, educational resources, and a reliable trading platform for long-term success.

0 notes