#Battery Manufacturing Equipment Industry

Explore tagged Tumblr posts

Text

Battery Manufacturing Equipment Market, Drivers, Future Outlook | BIS Research

Battery Manufacturing Equipment refers to the machinery, tools, and systems used in the production of batteries, typically for industrial, automotive, or consumer applications. This equipment encompasses the full range of processes involved in battery production, including material handling, electrode preparation, cell assembly, electrolyte filling, formation, aging, testing, and packaging.

According to BIS Research,the global battery manufacturing equipment market is projected to reach $88,093.50 million by 2031 from $9,439.22 million in 2021, growing at a CAGR of 27.12% during the forecast period 2022-2031.

Battery Manufacturing Equipment Overview

Battery manufacturing equipment plays a critical role in the production of various types of batteries, including lithium-ion, lead-acid, and solid-state batteries, among others. As demand for batteries rises due to the growth of electric vehicles (EVs), renewable energy storage, and portable electronics, the need for advanced, reliable, and efficient manufacturing equipment becomes increasingly important.

Key Stages of Battery Manufacturing

Material Handling and Preparation

Electrode Manufacturing

Cell Assembly

Electrolyte Filling and Sealing

Formation and Aging

Advancements in Battery Equipement

Automated Assembly Lines

AI and Machine Learning Integration

Environmentally Friendly Manufacturing

Download the Report Click Here !

Market Segmentation

1 By Application

2 Equipment By Process

3 By Battery Type

4 By Region

Demand – Drivers and Limitations

The following are the demand drivers for the global battery manufacturing equipment market:

• Rising Demand for Electric Vehicles (EVs) • Government Initiatives to Reduce Carbon Footprints and e-Waste

The market is expected to face some limitations too due to the following challenge:

• Rising Cost and Competitive Pressure for Battery Equipment Manufacturers • Logistics and Supply Chain Risks

Request a sample of this report on the Battery Manufacturing Equipment Market

Recent Developments in the Global Battery Manufacturing Equipment Market

• In May 2022, by aiding customers in the U.S. with battery manufacture, Xiamen Tmax Equipments maintained a favorable connection with them. It offered them the pouch cell pilot line, which comprises 52 machines ranging from mixing to testing. In accordance with the real requirements of the customer, Xiamen Tmax Equipments supplied complete solutions for the production of coin cells, cylinder cells, pouch cells, prismatic cells, and battery packs on a lab, pilot, and large-scale.

•In June 2022, Wuxi Lead Intelligent Equipment Co., Ltd. signed a contract with Volkswagen to deliver 20GWh lithium battery manufacturing equipment. The company would strengthen its presence in the European market and mark a new era of its global operation.

Battery Manufacturing Equipment Future Outlook

Several key trends and advancements are expected to shape the future of this industry

Increased Automation and Digitalization

Scalability and Flexibility

Sustainability and Energy Efficiency

Regionalization and Decentralization of Manufacturing

Access more detailed Insights on Advanced Materials,Chemicals and Fuels Research Reports

Conclusion

Battery manufacturing equipment is at the forefront of the global energy transformation, playing a crucial role in producing the batteries that power electric vehicles, renewable energy storage, and portable devices.

The evolution of battery technology, such as the shift towards solid-state batteries and the use of innovative materials, is reshaping the design and function of manufacturing equipment. Automation, digitalization, AI integration, and sustainable practices are expected to dominate the future of battery production, improving efficiency, reducing costs, and enhancing quality.

#Battery Manufacturing Equipment Market#Battery Manufacturing Equipment Report#Battery Manufacturing Equipment Industry

0 notes

Text

The global battery manufacturing equipment market is projected to reach $88,093.50 million by 2031 from $9,439.22 million in 2021, growing at a CAGR of 27.12% during the forecast period 2022-2031.

Request A Free Sample Click Here

China dominated the global battery manufacturing equipment market in 2021 due to the presence of a large electric vehicle industry, leading industry players across the supply chain, and a fast-developing economy.

#Battery Manufacturing Equipment Market#Battery Manufacturing Equipment Report#Battery Manufacturing Equipment Industry#Advanced materials chemicals#Bisresearch

0 notes

Text

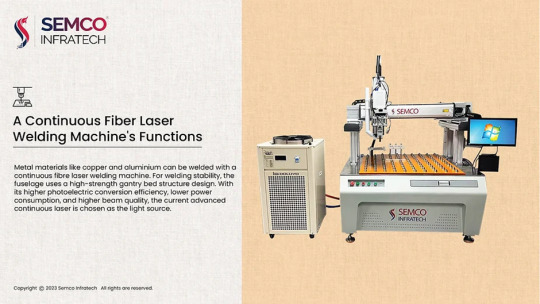

A Continuous Fiber Laser Welding Machine's Functions

Metal materials like copper and aluminum can be welded with a continuous fiber laser welding machine. For welding stability, the fuselage uses a high-strength gantry bed structure design. With its higher photoelectric conversion efficiency, lower power consumption, and higher beam quality, the current advanced continuous laser is chosen as the light source.

Benefits of the fiber laser apparatus include its small size, convenient use, and compact structure. Welding equipment can be efficiently integrated with other equipment in the system thanks to its versatile laser output mode. High speed and precision are ensured by the highly responsive servo motor output, which works with the high-precision and high-strength screw linear module as the operating transmission mechanism.

In the field of new energy lithium battery PACK modules, this makes the laser welding machine an essential piece of equipment. With its outstanding beam quality, quick welding speed, and gorgeous, sturdy welding pool, the continuous fiber laser welding machine offers the ideal, stable, and effective welding solution for the lithium battery welding process.

Unlocking the Advantages: Your Guide to the Equipment's Benefits

Perfect welding: Easy adjustment, fine focusing, imported optical lenses, high-precision laser welding head.

High-quality fiber laser: Internationally recognized, with years of industrial application, a long lifespan, and no maintenance required.

Energy efficiency: Low power consumption, high electro-optic conversion efficiency, and excellent beam quality.

Adjustable power: A continuous 2000-watt (adjustable) pure fiber laser that can penetrate materials with depths ranging from 0.1-3 mm.

Precision control: A precise servo system ensures welding accuracy.

User-friendly interface: Easy-to-learn PC industrial computer with a welding CNC programming system.

Wide range capabilities: large surface stroke welding, a gantry frame motion structure, high machine tool precision, and a stable, long-lasting service life.

Enhanced functionality: Data-saving call functions, strong drawing and editing graphics capabilities, and compatibility with a range of input formats.

Exploring Equipment Indicators and Parameters: Key Features

This welding equipment offers a range of features that make it versatile and reliable for various applications:

Material Compatibility: Welds materials with thicknesses ranging from 0.5 mm to 2.0 mm, suitable for diverse projects.

Workspace Flexibility: Effective travel range spans 870 mm in the X-axis and 600 mm in object workpiece height.

Adjustable Welding Speed: Operates at speeds of up to 10 mm/s, ensuring welds meet specific requirements.

Power Options: Offers adjustable laser power levels, including 2 KW, 3 KW, and 6 KW.

Durability: Features an optical fiber working medium with a service life exceeding five years.

Material Versatility: Suitable for welding nickel strips, copper sheets, and aluminum rows.

Welding Modes: Offers both continuous and pulse modes for versatile welding processes.

Spot Welding Capabilities: Achieves contact surface melting depths ranging from 0.5 mm to 1 mm, ensuring strong welds with tensile strength exceeding material destructive strength.

Characteristics of the Equipment

This welding equipment offers advantageous features for a seamless and efficient welding experience:

Maintenance-Free Operation: Reduces downtime and maintenance costs.

Adjustable Parameters: Allows for easy modification of welding parameters, including motion speed.

Fault Alerts: Real-time fault alarm prompts for immediate issue resolution.

Flexible Operation: Offers automatic and manual operation modes, supporting arc and straight-line interpolation.

Laser Processing: Enables the creation of various plane graphics such as points, straight lines, circles, and squares.

Durable Components: Equipped with imported lenses in the welding field mirror to withstand high laser-generated temperatures.

User-Friendly System: Easy-to-learn operating system simplifies manual operation.

Smoke and Slag Control: Built-in air-blown wind knife ensures welding quality.

Cooling System: A water-cooled cycle in the welding head ensures stable welding effects.

Precision Mechanism: High-precision screw transmission and high-speed servo motors ensure accuracy and responsiveness.

Environmental Conditions

To ensure optimal performance and safety, adhere to these specifications for the operating environment:

Ambient Temperature: Operates effectively between 5°C and 35°C.

Humidity: Maintain relative humidity levels between 20% and 90% to prevent condensation and corrosion.

Air Source Pressure: Requires a compressed air source with a pressure range of 0.5 to 0.6 Mpa.

Power Supply Voltage: A stable voltage of 380V at 50Hz or 60Hz is required.

Total Power: Consumes ≤10KW of power to prevent electrical overloading.

Load-Bearing Capacity: The installation area must support up to 500 kg/m².

Grounding Type: Direct grounding ensures safety and minimizes electrical hazards.

Installation Environment: Requires a flat, vibration-free, and shock-free area for precise and stable operations.

Adhering to these specifications ensures reliable operation, extending the equipment’s service life while preventing potential issues related to environmental conditions.

Final Thoughts

The continuous fiber laser welding machine represents a revolutionary step forward in welding technology. Its ability to deliver precise, efficient, and versatile welding solutions makes it an essential tool across industries, including automotive, aerospace, and renewable energy. By understanding its functions, benefits, and operational requirements, manufacturers can fully leverage this equipment to enhance productivity, reduce costs, and achieve superior product quality.

Investing in a continuous fiber laser welding machine is not just about adopting advanced technology—it's about future-proofing your manufacturing processes for the demands of tomorrow.

#Fiber Laser Welding Machine#Fiber Laser Welding Technology#High-Precision Welding Machines#Laser Welding for Copper and Aluminum#Industrial Laser Welding Equipment#Applications of Fiber Laser Welding#High-Strength Welding Equipment#Lithium Battery PACK Welding Solutions#Laser Welding for Automotive Manufacturing#Spot Welding vs. Continuous Laser Welding

0 notes

Text

What Are the Benefits of Compressed Air Systems?

In industrial environments, pneumatic systems that use compressed air systems provide effective and versatile output. This introduction to pneumatics is perfect for those who want to know the benefits of compressed air systems which is a very important aspect of pneumatic engineering.

What is Pneumatic Engineering?

Pneumatic Engineering is a branch of engineering, that deals with high-pressure air to utilize it for industrial purposes.

It's a very easy way to move things using high-pressure dry air. This systems use compressed air to generate mechanical motion and power for any application.

Here are a few benefits of compressed air systems:

Energy Saving

One significant economic benefit is energy savings. For instance, power expenditures account for 80% of the entire cost of ownership of an air compressor. An energy-efficient model will therefore pay for itself rather soon. For example, dual set-point and automated stop are two of the many features found in modern compressors.

You may maximize energy consumption and cut costs during periods of low use by switching between two setpoints using smart unit controllers. The driving motor only comes on when required.

Improved Air Quality

Modern compressors don't emit any hazardous smoke or other waste gases that might cause accidents nearby or in the workplace. Clean air also lowers operating expenses.

Above all, the system is kept up and running smoothly thanks to the use of oil-free technology, which enables total risk-free production. No concern about product deterioration, contamination, or wasted hours.

Lower Noise Levels

Today's compressors are largely silent, making them environmentally benign devices. Improved interior parts and sound-absorbing features like canopies help to lower workplace noise levels.

Repair Leakages

The affordable repairability of compressed air systems is an additional benefit. Compressed air systems frequently have leaks, which waste energy and lower system efficiency. However, because compressed air is widely available and non-toxic, it may be used to easily identify and fix issues without endangering one's health. Businesses may avoid needless inefficiencies and save money by swiftly correcting leaks.

Important Aspects of Compressed Air Systems

Pneumatic solenoid valves, also referred to as electrically actuated valves, work by the use of electromagnetic force. A ferrous metal rod moves when an electrical current flow through the solenoid coil, creating a magnetic field. This is the fundamental mechanism that opens the valve and affects air pressure either directly or indirectly.

Quick Responsiveness

The quick and dependable regulation and control of pressurized air and gases is made possible by pneumatic solenoid valves. These valves may instantaneously switch from an open to a closed state or vice versa because they are activated by electromagnetic forces. The lightweight and compact designs of the valves are the reason for their quick response.

Compressed Air Systems provide efficient power using high-pressure air, a part of pneumatic engineering. If you are looking for the best air-compressed system for your project, then you are at the right place, because EDSIINC deals with all those compressed air systems, with very affordable range for you.

Feel free to contact us today.

#Wire Harness Manufacturers#Custom Cable Assemblies#Industrial Connectors#Custom Cable Manufacturers#Cable Assembly Manufacturers#Custom Wire Harness Manufacturers#Custom Battery Assemblies#Industrial Cable Assemblies#Molded Cable Assemblies#Custom Cable Assemblies Manufacturer#Wire & Cable In Michigan#Cable Harness Assembly#Industrial Wire & Cable Distributor#Custom Cable Assemblies In Michigan#Cable Harness Assemblies#Pneumatic Automation Equipment#Industrial Pneumatic Solutions

0 notes

Text

MELSS – MEL SYSTEMS AND SERVICES LTD, is an Engineering and Technology solutions company providing cutting-edge products and solutions to the Electronics, Automation and Aerospace and Defence Industries over the last 25 Years. MELSS Head Office and HO Annex. is located in Chennai and we have sales and support offices across all major metros in India.

#industrial automation and robotics#collaborative robots#solder paste#end of arm tooling#electric vehicle test solutions#battery test system#automated test equipment manufacturers#industrial iot solutions india

0 notes

Text

"It is 70 years since AT&T’s Bell Labs unveiled a new technology for turning sunlight into power. The phone company hoped it could replace the batteries that run equipment in out-of-the-way places. It also realised that powering devices with light alone showed how science could make the future seem wonderful; hence a press event at which sunshine kept a toy Ferris wheel spinning round and round.

Today solar power is long past the toy phase. Panels now occupy an area around half that of Wales, and this year they will provide the world with about 6% of its electricity—which is almost three times as much electrical energy as America consumed back in 1954. Yet this historic growth is only the second-most-remarkable thing about the rise of solar power. The most remarkable is that it is nowhere near over.

To call solar power’s rise exponential is not hyperbole, but a statement of fact. Installed solar capacity doubles roughly every three years, and so grows ten-fold each decade. Such sustained growth is seldom seen in anything that matters. That makes it hard for people to get their heads round what is going on. When it was a tenth of its current size ten years ago, solar power was still seen as marginal even by experts who knew how fast it had grown. The next ten-fold increase will be equivalent to multiplying the world’s entire fleet of nuclear reactors by eight in less than the time it typically takes to build just a single one of them.

Solar cells will in all likelihood be the single biggest source of electrical power on the planet by the mid 2030s. By the 2040s they may be the largest source not just of electricity but of all energy. On current trends, the all-in cost of the electricity they produce promises to be less than half as expensive as the cheapest available today. This will not stop climate change, but could slow it a lot faster. Much of the world—including Africa, where 600m people still cannot light their homes—will begin to feel energy-rich. That feeling will be a new and transformational one for humankind.

To grasp that this is not some environmentalist fever dream, consider solar economics. As the cumulative production of a manufactured good increases, costs go down. As costs go down, demand goes up. As demand goes up, production increases—and costs go down further. This cannot go on for ever; production, demand or both always become constrained. In earlier energy transitions—from wood to coal, coal to oil or oil to gas—the efficiency of extraction grew, but it was eventually offset by the cost of finding ever more fuel.

As our essay this week explains, solar power faces no such constraint. The resources needed to produce solar cells and plant them on solar farms are silicon-rich sand, sunny places and human ingenuity, all three of which are abundant. Making cells also takes energy, but solar power is fast making that abundant, too. As for demand, it is both huge and elastic—if you make electricity cheaper, people will find uses for it. The result is that, in contrast to earlier energy sources, solar power has routinely become cheaper and will continue to do so.

Other constraints do exist. Given people’s proclivity for living outside daylight hours, solar power needs to be complemented with storage and supplemented by other technologies. Heavy industry and aviation and freight have been hard to electrify. Fortunately, these problems may be solved as batteries and fuels created by electrolysis gradually become cheaper...

The aim should be for the virtuous circle of solar-power production to turn as fast as possible. That is because it offers the prize of cheaper energy. The benefits start with a boost to productivity. Anything that people use energy for today will cost less—and that includes pretty much everything. Then come the things cheap energy will make possible. People who could never afford to will start lighting their houses or driving a car. Cheap energy can purify water, and even desalinate it. It can drive the hungry machinery of artificial intelligence. It can make billions of homes and offices more bearable in summers that will, for decades to come, be getting hotter.

But it is the things that nobody has yet thought of that will be most consequential. In its radical abundance, cheaper energy will free the imagination, setting tiny Ferris wheels of the mind spinning with excitement and new possibilities.

This week marks the summer solstice in the northern hemisphere. The Sun rising to its highest point in the sky will in decades to come shine down on a world where nobody need go without the blessings of electricity and where the access to energy invigorates all those it touches."

-via The Economist, June 20, 2024

#solar#solar power#solarpunk#hopepunk#humanity#electricity#clean energy#solar age#renewables#green energy#solar energy#renewable energy#solar panels#fossil fuels#good news#hope#climate change#climate hope

1K notes

·

View notes

Text

Caterham Showcases Project V at Tokyo Auto Salon

The Tokyo Auto Salon 2025 opened today at the Makuhari Messe in Chiba City, Japan. This premier event brings together leading brands in the automotive industry, serving as a global stage for the latest trends and innovations. This year, British legendary sports car manufacturer Caterham has joined forces with Taiwan's battery technology pioneer, XING Mobility, to demonstrate the all-electric lightweight concept sports car, Project V. Equipped with XING Mobility's cutting-edge IMMERSIO™ CTP (cell-to-pack) battery system, this collaboration marks a significant milestone in Caterham's electrification journey.

Since its debut at the UK's Goodwood Festival of Speed in 2023, Project V has garnered global attention from automotive enthusiasts with its innovative design and performance capabilities. Its presence at the 2025 Tokyo Auto Salon represents another crucial milestone in Caterham's electric transition journey. The partnership between Caterham and XING Mobility not only demonstrates their shared commitment to innovation and sustainability but also highlights the boundless potential of electric sports cars.

Caterham welcomes visitors to explore Project V up close at booth No. 703 in East Hall 7, where they can experience the pioneering design features powered by XING Mobility's advanced battery technologies. This groundbreaking electric sports car, equipped with XING Mobility's innovative IMMERSIO technology, demonstrates the future of high-performance electric vehicles.

22 notes

·

View notes

Text

North Sweden’s green industry boom

Northern Sweden’s plentiful supply of cheap hydro and wind renewable electricity, coupled with a supply of raw materials and affordable land prices are prompting a ‘green’ industry boom in Sweden’s far north.

Long home to polluting industries, the Norbotten and Västerbotten regions are at the centre of an eco-boom attracting industries including battery manufacturing, data centres and low carbon steel which Sweden’s government estimates to be worth around US$120bn.

Last month, Swedish steel producer SSAB announced it would be building a 2.5 million tonne capacity fossil-free steel mill in the city, supplied with fossil free sponge iron from the Hybrit plant in nearby Gällivare. In January, steel company H2 Green Steel announced it had secured US$4.4bn in debt financing to build the world’s first large scale green steel plant in Boden, to the northwest of Luleå. And also in January Swedish battery producer Northvolt announced it had raised US$5bn in debt financing to help it expand its gigafactory in Skellefteå in Västerbotten.

And the creation of thousands of new jobs in the region is in turn prompting a need for new homes, shops and roads, which is again increasing demand for low carbon construction equipment.

“We have been following the development in the northern market for many years and see that there is room for a niche player like us,” Eriksson adds. “With the market’s focus on sustainable development, we are well-positioned for expansion northwards. Our focus will be on making electric and hybrid-powered units available from the fleet as needed.”

Source

22 notes

·

View notes

Text

Name: Moth

Model: MTH-9L

Manufacturer: Ceres Metals Industries

Intro Year: 3145

Class: Light Battlemech

Cost: 4.677 mn c-bills

Weight: 30 T

Top Speed: 97.2 kph

Jump Capacity: 240 meters

Quirks: difficult to maintain, no/minimal arms, nimble jumper

In the wake of the 6th Andurian War, the Strategios of the Capellan Confederation Armed Forces determined that there was a need for a new, low cost light mech to serve as a forward observer and harassment unit in their augmented companies. While the venerable Raven remained in service, its relatively low speed and expensive suite of electronics lead to a number of costly losses during the conquest of Wallacia. To that end, specifications for a new scout were sent out for bids- the new mech had to be cheap, difficult for Free Worlds League precision energy weapons to engage with, and capable of engaging and providing support for indirect fire elements of the CCAF at a variety of ranges. Unusually, despite Hellespont Industrials, the Confederation's more seasoned light manufacturer, submitting a bid in the form of the Sunfire, Ceres Metals Industries won the contract. Their design, initially named Project GOSSAMER, was delayed several times due to production shortfalls and the discovery of a Federated Suns spy ring operating at Ceres' design bureau. Eventually the mech began full production in 3145 as the Moth.

An outwardly radical design, Ceres managed to reduce the cost of their bid significantly through the use of a number of off the shelf parts and existing research prototypes. The mech's engine was a GM 180 extralight fusion power plant, originally designed for a prototype Vindicator before the VND-4L project opted for a larger 225 power plant instead, allowing the 30 ton mech to achieve ground speeds of up to 97 kph. While this speed was deemed unacceptable for the task at hand, the mech's principle designer, Dr. Oxana Ufimtsev, opted to equip the mech with a battery of Anderson jump jets and used a novel delta design for the main hull of the mech, with very low profile arms and wide, integrated control surfaces to give the mech an unusually high glide coefficient. Together, these systems allow the Moth to leap distances similar to those achievable by the Spider, despite the mech's far less powerful engine. The cost of this innovative design is a frame with extremely cumbersome access points and systems not immediately intuitive to most mechtechs, leading to increased maintenance costs and repair times. When deployed in augmented formations alongside aerospace assets, technicians are commonly cross trained on both the unit's fighters and Moths, as the two repair schedules have been found to be similar.

The production model MTH-9L Moth uses a Moscovia light PPC as its main armament, supported by a pair of Ceres Arms model JX small pulse lasers mounted in the two weapons nacels that comprise the design's arms. Additionally, the mech carries a Diverse Optics ER small laser in the left arm and an Apple Churchill TAG system in the left, imported from Hellespont's Sian facility. Clad in 6 tons of Ceres mk III Stealth Armor, the Moth is easily capable of withstanding light fire from enemy mechs while confounding longer range sensor returns. Unfortunately, to make room for the light PPC, Ceres opted to reduce the size and ammenities of the mech's cockpit, resulting in complaints from pilots assigned to the machine for long scouting patrols.

In combat, Moths are most typically used as long range harassment units, using their stealth armor and long jump range to maintain evade enemy fire as they opportunistically engage with their TAG and light PPC. As the fight progresses, some pilots may choose to engage in more active combat, allowing the indirect elements they're supporting to remove the majority of a target'a armor before attempting to destroy vulnerable exposed components with their small lasers

The first recorded combat involving a Moth occurred on Brisbane between elements of the First Victoria Rangers and a raiding force of the Concordat Commandos. Captain Curtis Bao deployed a lance of Moths to waylay the advance of a Taurian armored colum and allow for his own heavy units and combat vehicles to position themselves in foothills east of the TDF landing site. The light mechs caught the tank company and their mech escorts by surprise, outflanking the vehicles and engaging into their weaker side armor at long range with their PPCs while painting targets for Bao's LRM carriers and Thunderbolts. Eventually, the Commandos' mechs rallied and began to engage the stealthy light lance, forcing them to withdraw, however the action blunted the Taurian advance and allowed time for the Victoria Rangers to mount a successful defense of Brisbane's capital, Badwater. The surviving Moths then saw use as city fighters, their jumping capabilities allowing them to manuever easily though the urban fabric of Badwater while their X-pulse lasers let them to brutally engage Taurian infantry.

As a new design, very few variants or operators outside the Confederation have yet to be spotted. Beyond the CCAF, a few Capellan aligned mercenary commands have been allowed to officially purchase small numbers of the design, while the allied Magistracy of Canopus has managed to acquire a number of lances of the mech through unknown sources.

While their infiltration was discovered and rooted out before the full design was finalized, MIIO operatives did manage to steal plans for the early prototypes of the Moth, which the New Avalon Institute of Science used as a test bed for re-engineered laser designs and new SRM munitions. A small production run of the design, similar but without the Capellan stealth armor, was produced by Corean Enterprises at their Augusta plant, but the AFFS appears to have abandoned adding the mech to its TO&E.

Finally, several examples of the Moth were captured by forces loyal to Alaric Ward's Star League during fighting on New Earth. The Jade Falcon remnant present immediately saw use in the design as a heavier alternative to their light Ion Sparrows. A Clantech refit of the mech has been spotted using an ER large laser in place of the PPC and a quartet of small pulse lasers in the weapons nacels.

9 notes

·

View notes

Text

Greetings yet again folks! Before today's news i should ask this: what would you think when wearable tech is mentioned? AR/VR glasses? A smart watch? a pair of fancy glasses? nfc based products or was it something else for you?

what if i tell you there is a battery that is so stretchable and bendable that can be tailored between linings of your clothes now what would you think?

Meet the age of stretchable batteries people!

in that case i should mention when people of today was so busy with nonsense politics and rightist or leftist ideas there were quite a race between the biggest tech schools and companies for manufacturing this tech such as apple, samsung, stanford, Yokohama National University, zotach (japan based wearable tech company), sydney's UNCW, Australian research comity and more.. you get the idea..

so what is this tech in its core?

basically building more softer and more long term reliable materials to replace our common daily use batteries

in term of materials it nearly uses our common li-on batteries but these are mainly works like electrodes and often use polymers, hydrogels, and other flexible materials for electrodes and electrolytes. we can see in recent inovations include the use of stretchable conductors like gold nanowires or carbon nanotubes.

BUT what these mambo, jambo, wombo, combo means for public eye?

much longer active use time, higher adaptability, flexible form factor yet lower energy and power density.

for now this tech has been used in certain medical implant cases, wearable techs, tv's, and watches for now but there is some attempts to imply this in to textile industry recently..

and japan is seems like ahead of the race for now with Zotac’s VR GO 4.0 backpack

this is a backpack pc and its power source is tailored between in entire foam/ fiber pad. this "pc" is specifically made for VR/AR and streaming which includes

11th Gen Intel Core Mobile i7-11800H processor, an NVIDIA RTX A4500 graphics card with 20GB of GDDR6 memory and 7,168 CUDA cores, 16GB (32GB maximum) of DDR4 RAM, an M.2 slot for storage, a 2.5′ SATA 3 hard drive/SSD bay for storage, three USB 3.1 Type-A ports, a single USB 3.1 type-C port, DisplayPort, and a 12V DC outlet, all powered by dual 86.4 watt-hour hot-swappable batteries.

like i said this tech is still under developement stage and people still trying to make this tech better than other compettitives...

time will show us what will it gonna be turn out at the end..

lastly.. see you guys tomorrow...

sources:

https://onlinelibrary.wiley.com/doi/10.1002/adma.202204457

#tech#tech news#daily news#cyberpunk#future tech#scifi tech#research#rnd#r&d#battery#stretchable battery#apple#stanford#samsung#labs

11 notes

·

View notes

Text

Strange Chinese trade-war recommendations at US Congress

COMPREHENSIVE LIST OF THE COMMISSION’S 2024 RECOMMENDATIONS Part II: Technology and Consumer Product Opportunities and Risks Chapter 3: U.S.-China Competition in Emerging Technologies The Commission recommends:

Congress establish and fund a Manhattan Project-like program dedicated to racing to and acquiring an Artificial General Intelligence (AGI) capability. AGI is generally defined as systems that are as good as or better than human capabilities across all cognitive domains and would surpass the sharpest human minds at every task. Among the specific actions the Commission recommends for Congress:

Provide broad multiyear contracting authority to the executive branch and associated funding for leading artificial intelligence, cloud, and data center companies and others to advance the stated policy at a pace and scale consistent with the goal of U.S. AGI leadership; and

Direct the U.S. secretary of defense to provide a Defense Priorities and Allocations System “DX Rating” to items in the artificial intelligence ecosystem to ensure this project receives national priority.

Congress consider legislation to:

Require prior approval and ongoing oversight of Chinese involvement in biotechnology companies engaged in operations in the United States, including research or other related transactions. Such approval and oversight operations shall be conducted by the U.S. Department of Health and Human Services in consultation with other appropriate governmental entities. In identifying the involvement of Chinese entities or interests in the U.S. biotechnology sector, Congress should include firms and persons: ○ Engaged in genomic research; ○ Evaluating and/or reporting on genetic data, including for medical or therapeutic purposes or ancestral documentation; ○ Participating in pharmaceutical development; ○ Involved with U.S. colleges and universities; and ○ Involved with federal, state, or local governments or agen cies and departments.

Support significant Federal Government investments in biotechnology in the United States and with U.S. entities at every level of the technology development cycle and supply chain, from basic research through product development and market deployment, including investments in intermediate services capacity and equipment manufacturing capacity.

To protect U.S. economic and national security interests, Congress consider legislation to restrict or ban the importation of certain technologies and services controlled by Chinese entities, including:

Autonomous humanoid robots with advanced capabilities of (i) dexterity, (ii) locomotion, and (iii) intelligence; and

Energy infrastructure products that involve remote servicing, maintenance, or monitoring capabilities, such as load balancing and other batteries supporting the electrical grid, batteries used as backup systems for industrial facilities and/ or critical infrastructure, and transformers and associated equipment.

Congress encourage the Administration’s ongoing rulemaking efforts regarding “connected vehicles” to cover industrial machinery, Internet of Things devices, appliances, and other connected devices produced by Chinese entities or including Chinese technologies that can be accessed, serviced, maintained, or updated remotely or through physical updates.

Congress enact legislation prohibiting granting seats on boards of directors and information rights to China-based investors in strategic technology sectors. Allowing foreign investors to hold seats and observer seats on the boards of U.S. technology start-ups provides them with sensitive strategic information, which could be leveraged to gain competitive advantages. Prohibiting this practice would protect intellectual property and ensure that U.S. technological advances are not compromised. It would also reduce the risk of corporate espionage, safeguarding America’s leadership in emerging technologies.

Congress establish that:

The U.S. government will unilaterally or with key interna- tional partners seek to vertically integrate in the develop- ment and commercialization of quantum technology.

Federal Government investments in quantum technology support every level of the technology development cycle and supply chain from basic research through product development and market deployment, including investments in intermediate services capacity.

The Office of Science and Technology Policy, in consultation with appropriate agencies and experts, develop a Quantum Technology Supply Chain Roadmap to ensure that the United States coordinates outbound investment, U.S. critical supply chain assessments, the activities of the Committee on Foreign Investment in the United States (CFIUS), and federally supported research activities to ensure that the United States, along with key allies and partners, will lead in this critical technology and not advance Chinese capabilities and development....

6 notes

·

View notes

Text

Battery Manufacturing Equipment Market, Drivers, Future Outlook | BIS Research

Battery Manufacturing Equipment refers to the machinery, tools, and systems used in the production of batteries, typically for industrial, automotive, or consumer applications. This equipment encompasses the full range of processes involved in battery production, including material handling, electrode preparation, cell assembly, electrolyte filling, formation, aging, testing, and packaging.

According to BIS Research,the global battery manufacturing equipment market is projected to reach $88,093.50 million by 2031 from $9,439.22 million in 2021, growing at a CAGR of 27.12% during the forecast period 2022-2031.

Battery Manufacturing Equipment Overview

Battery manufacturing equipment plays a critical role in the production of various types of batteries, including lithium-ion, lead-acid, and solid-state batteries, among others. As demand for batteries rises due to the growth of electric vehicles (EVs), renewable energy storage, and portable electronics, the need for advanced, reliable, and efficient manufacturing equipment becomes increasingly important.

Key Stages of Battery Manufacturing

Material Handling and Preparation

Electrode Manufacturing

Cell Assembly

Electrolyte Filling and Sealing

Formation and Aging

Advancements in Battery Equipement

Automated Assembly Lines

AI and Machine Learning Integration

Environmentally Friendly Manufacturing

Download the Report Click Here !

Market Segmentation

1 By Application

2 Equipment By Process

3 By Battery Type

4 By Region

Demand – Drivers and Limitations

The following are the demand drivers for the global battery manufacturing equipment market:

• Rising Demand for Electric Vehicles (EVs) • Government Initiatives to Reduce Carbon Footprints and e-Waste

The market is expected to face some limitations too due to the following challenge:

• Rising Cost and Competitive Pressure for Battery Equipment Manufacturers • Logistics and Supply Chain Risks

Request a sample of this report on the Battery Manufacturing Equipment Market

Recent Developments in the Global Battery Manufacturing Equipment Market

• In May 2022, by aiding customers in the U.S. with battery manufacture, Xiamen Tmax Equipments maintained a favorable connection with them. It offered them the pouch cell pilot line, which comprises 52 machines ranging from mixing to testing. In accordance with the real requirements of the customer, Xiamen Tmax Equipments supplied complete solutions for the production of coin cells, cylinder cells, pouch cells, prismatic cells, and battery packs on a lab, pilot, and large-scale.

•In June 2022, Wuxi Lead Intelligent Equipment Co., Ltd. signed a contract with Volkswagen to deliver 20GWh lithium battery manufacturing equipment. The company would strengthen its presence in the European market and mark a new era of its global operation.

Battery Manufacturing Equipment Future Outlook

Several key trends and advancements are expected to shape the future of this industry

Increased Automation and Digitalization

Scalability and Flexibility

Sustainability and Energy Efficiency

Regionalization and Decentralization of Manufacturing

Access more detailed Insights on Advanced Materials,Chemicals and Fuels Research Reports

Conclusion

Battery manufacturing equipment is at the forefront of the global energy transformation, playing a crucial role in producing the batteries that power electric vehicles, renewable energy storage, and portable devices.

The evolution of battery technology, such as the shift towards solid-state batteries and the use of innovative materials, is reshaping the design and function of manufacturing equipment. Automation, digitalization, AI integration, and sustainable practices are expected to dominate the future of battery production, improving efficiency, reducing costs, and enhancing quality.

#Battery Manufacturing Equipment Market#Battery Manufacturing Equipment Report#Battery Manufacturing Equipment Industry

0 notes

Text

Excerpt from this New York Times story:

When President Biden signed the 2022 Inflation Reduction Act, it was expected to set off a boom in renewable energy, with hefty tax breaks that would make solar and wind power cheaper than fossil fuels.

So far, however, that dream has only come partly true. Solar panel installations are indeed soaring to record highs in the United States, as are batteries that can store energy for later. But wind power has struggled, both on land and in the ocean.

The country is now adding less wind capacity each year than before the law was passed.

Some factors behind the wind industry’s recent slowdown may be temporary, such as snarled supply chains. But wind power is also more vulnerable than solar power to many of the biggest logistical hurdles that hinder energy projects today: a lack of transmission lines, a lengthy permitting process and a growing backlash against new projects in many communities.

If wind power continues to stagnate, that could make the fight against global warming much harder, experts say. Many plans for quickly shifting the country away from fossil fuels envision a large expansion of both solar and wind, because the two sources generate electricity at different hours and can complement each other. A boom in solar power alone, which runs only in daytime, isn’t enough.

Some of the early predictions that the Inflation Reduction Act would help slash U.S. greenhouse gas emissions roughly 40 percent below 2005 levels by 2030 depended on a rapid acceleration of both solar and wind power this decade.

Wind and solar power are often lumped together, but they have important differences that partly explain why one is slowing and the other is thriving right now.

For one, wind power is much more sensitive to location. Wind turbines in a gusty area can generate eight times as much electricity as turbines in an area with just half the breeze. For solar power, the difference between sunny spots and less sunny spots is considerably smaller. That means developers can’t just build wind farms anywhere.

In the United States, the best places for wind tend to be in the blustery Midwest and Great Plains. But many areas are now crowded with turbines and existing electric grids are clogged, making it difficult to add more projects. Energy companies want to expand the grid’s capacity to transport even more wind power to population centers, but getting permits for transmission lines and building them has become a brutal slog that can take more than a decade.

“Getting wind projects built is getting a lot harder,” said Sandhya Ganapathy, chief executive of EDP Renewables North America, a leading wind and solar developer. “The low-hanging fruit, the easier access places are gone.”

The wind industry has also been hampered by soaring equipment costs after the pandemic wrecked supply chains and inflation spiked. While those factors initially hurt solar, too, the solar industry has adjusted much faster, with China nearly doubling its manufacturing capacity for panels over the last two years. Wind supply chains, which are dominated by a few manufacturers in China, Europe and the United States, have yet to fully recover.

The cost increases have been devastating for offshore wind projects in the Northeast, where developers have canceled more than half the projects they planned to build this decade.

Wind isn’t languishing only in the United States. While a record 117 gigawatts of new wind capacity came online last year globally, virtually all of that growth was in China. In the rest of the world, developers weren’t installing wind turbines any faster than they were in 2020.

6 notes

·

View notes

Text

Is India's Electric Vehicle Manufacturing Ecosystem Ready to Scale up Mass Adoption?

India is on the brink of a major shift in its automotive industry. Driven by the global and domestic push towards electric vehicles (EVs), the country’s EV manufacturing ecosystem is showing promise and ambitious growth projections. It shows a clear commitment to sustainable mobility. However, the road to mass adoption is fraught with challenges that need to be addressed if India is to fully capitalize on this opportunity.

Promising Growth Projections

The potential for growth in India’s EV market is enormous. By 2030, EVs could account for over 40 percent of the automotive market, generating a staggering USD 100 billion in revenue. The penetration rates are particularly impressive for two and three-wheelers, where EVs are expected to make up 80 percent of the market. Even for four-wheelers, the projection is significant, with a 50 percent market share anticipated by 2030. These numbers underscore the growing acceptance of EVs in India and the opportunity for the country to become a global leader in sustainable transportation.

Challenges Hindering Scalability

Despite the promising outlook, several hurdles stand in the way of scaling up EV manufacturing to meet mass adoption. These challenges must be addressed if India’s EV ecosystem is to realize its full potential.

High Ownership Costs: One of the most significant barriers to mass adoption is the high cost of owning an EV in India. This is primarily due to the limited charging infrastructure, which makes it difficult for consumers to rely on EVs for their daily commute. Additionally, there are deficits in battery cell production (20-25 percent) and semiconductor chips (40-50 percent), both of which are critical components for EV manufacturing. These shortages drive up the costs, making EVs less accessible to the average consumer.

Import Dependency: India’s reliance on imports for key EV components is another major challenge. Currently, 60-70 percent of battery cells, e-motor magnets, and electronics are sourced from China. Several lithium-ion battery manufacturing equipment suppliers in India are dependent on the import of cells and assembly equipment. This dependency not only creates supply chain vulnerabilities but also raises concerns about the sustainability of scaling up EV manufacturing. To reduce this reliance, India needs to invest in building local capacities for producing these critical components.

Scalability Issues in Local Manufacturing: While there are efforts to boost local manufacturing, many small enterprises in India are struggling to keep up with the growing demand for EV components. These scalability issues are exacerbated by a fragmented supply chain, where small and medium enterprises (SMEs) face coordination challenges that can lead to delays in production and distribution. This fragmentation hinders the efficiency of the entire EV ecosystem.

Lack of Standardization: Another significant challenge is the lack of standardization in EV manufacturing, particularly in battery specifications. This lack of uniformity complicates component sourcing and integration, making it difficult for manufacturers to scale up production quickly and efficiently. Standardization is crucial for streamlining the manufacturing process and ensuring that components are interchangeable and easily available.

Conclusion

India’s EV manufacturing ecosystem is at a critical juncture. While the growth potential is immense, several challenges must be addressed to scale up production and achieve mass adoption. By focusing on local manufacturing, expanding infrastructure, standardizing components, and supporting SMEs, India can overcome these hurdles and position itself as a global leader in electric mobility. The journey ahead is challenging, but with the right strategies and collaborations, India’s EV revolution is not just possible—it’s inevitable.

#India electric vehicle industry#EV manufacturing in India#Electric vehicle adoption in India#India's EV market growth#Sustainable transportation in India#EV infrastructure in India#Electric vehicle policy India#Mass adoption of EVs in India#Challenges in EV manufacturing#Future of electric vehicles in India#lithium-ion battery manufacturing equipment suppliers in India

0 notes

Text

https://www.edsiinc.com/

We provide pneumatic parts and assemblies, bulk cable and cable assemblies, and control panels, to the machinery OEM, robotic, automation, and integration industries.

#Pneumatic Automation Equipment#Industrial Pneumatic Solutions#Wire Harness Manufacturers#Custom Cable Assemblies#Industrial Connectors#Custom Cable Manufacturers#Cable Assembly Manufacturers#Custom Wire Harness Manufacturers#Custom Battery Assemblies#Industrial Cable Assemblies#Molded Cable Assemblies#Custom Cable Assemblies Manufacturer#Wire & Cable In Michigan

1 note

·

View note

Text

MELSS is an organisation with decades of experience in providing customers with state-of-the-art technology solutions in different domains and verticals.

#industrial automation and robotics#solder paste#collaborative robots#electric vehicle test solutions#automated test equipment manufacturers#industrial iot solutions india#uv curing#batching plant#battery test system#end of arm tooling

0 notes