#Auto Insurance in Texas

Explore tagged Tumblr posts

Text

Finding Affordable Auto Insurance in Texas, the Lone Star State

Finding Affordable Auto Insurance in the Lone Star State, Texas” Intro Searching for cheap auto insurance in Texas can be a daunting task. While it may seem challenging, there are several reputable insurance companies offering competitive rates for Texans. In this comprehensive guide, we will explore the cheapest car insurance providers in the state, broken down by coverage levels and various…

View On WordPress

#Auto Insurance in Texas#CAR INSURANCE#car insurance texas#Fred Loya Insurance#Geico#State Farm#Texas Farm Bureau#USAA

0 notes

Text

Full Coverage Online Auto Home Insurance in Texas, USA

Autozo Insurance is one of the best online auto home insurance service provider companies in the Texas, USA area. We have graduated to become a world-class automobile insurance agency. If excited about choosing automobile insurance, feel free to contact our team of experts at: +1 409-200-8888.

2 notes

·

View notes

Text

If you are looking for more help on your personal insurance policies of any kind, then visit the website for Judge Vic Cunningham Insurance Agency in Dallas. You will get access to an independent insurance agency which will help you get great prices for customized policies tailored to your specific needs.

#Automobile insurance#auto insurance#Dallas#independent insurance agency#auto insurance policies#texas

2 notes

·

View notes

Text

Christian Insurance Agency LLC offers tailored auto insurance in Pinehurst, ensuring drivers have peace of mind with policies that fit their unique needs. Whether it’s basic liability or full coverage, our team provides comprehensive options, including collision, comprehensive, and uninsured motorist coverage.

Christian Insurance Agency LLC 710 Melton St. Magnolia, TX 77354 (281) 789–4070

My Official Website: https://www.christianagency.net/ Google Plus Listing: https://www.google.com/maps?cid=2367622625284151193

Our Other Links:

Homeowners Insurance Pinehurst TX: https://www.christianagency.net/texas-home-insurance.html

Service We Offer:

Auto Insurance Home Insurance Commercial Insurance Boat/Watercraft Insurance Classic Car Insurance Condo Insurance Flood Insurance Motorcycle Insurance Motor Home Insurance Renters Insurance RV Insurance Umbrella Insurance

Follow Us On:

Linkedin: https://www.linkedin.com/in/bill-christian-108b9a46 Twitter: https://twitter.com/LlcChristi86990 Pinterest: https://www.pinterest.com/ChristianInsuranceAgencyLLC/ Instagram: https://www.instagram.com/christianinsuranceagencyllc/

#Auto Insurance Pinehurst#Car Insurance Magnolia TX#Homeowners Insurance Pinehurst Tx#Home Insurance Magnolia Texas#Magnolia Insurance Company

0 notes

Text

How Long Does a DUI Affect Your Insurance in Houston, Texas?

Getting a DUI in Houston can have a significant impact on your insurance rates. This article from The Butler Law Firm explains the duration and effects on your premiums and coverage. If you're facing a DUI, it’s crucial to know how to manage these financial consequences. Learn more about protecting yourself and minimizing costs.

Read the full article here: https://medium.com/@thehoustondwilawyer/how-long-does-a-dui-affect-your-insurance-in-houston-texas-7f4e67f7ad83 #HoustonDUI #InsuranceRates #DWILawyer #TexasLaw

#houston dwi lawyer#butler law firm#dwi lawyer#houston dwi#legal advice#dui#dwi houston#legal help#dui houston#dwi#insurance rates#auto insurance#car insurance#insurance#texas dwi lawyer#texas#texas news#houston dwi attorneys#houston#houston dui#dwi attorney houston

0 notes

Photo

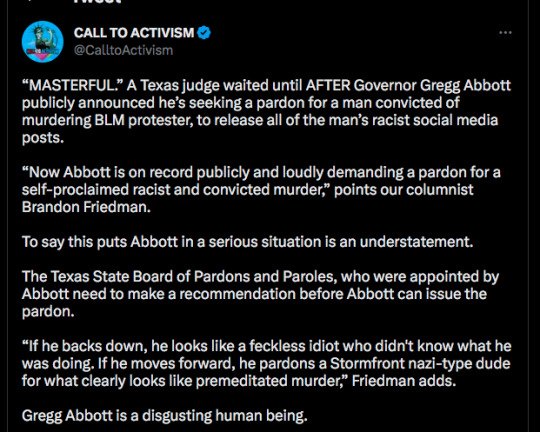

Wrong. If he backs down he looks like someone who alters their decision based on facts they may not have previously been aware of (although the idea of a pardon was an awful idea regardless). If he moves forward, he looks like every other Republican who is then applauded by their base, rewarded by their donors, and praised on Fox Newstainment. Another loss for democracy, another donation to Abbott by AT&T, USAA, and other corporate donors

3K notes

·

View notes

Text

Texas Insurance Services - Home Auto Boat RV Business Professional Liability Commercial Trucking Oil & Gas Workers Comp Insurance

Did you know Arizona Insurance Company provides personal and business insurance in Texas? We offer insurance services throughout Texas and 5 other states. We provide personal insurance, homeowners, auto, boat, RV, motorcycle and life insurance coverage. We also provide commercial business insurance, general business insurance, professional liability insurance, workers comp insurance and commercial trucking and transportation insurance including oil and gas trucking insurance. Give Arizona Insurance Company a call if you are looking for insurance in Texas, including Dallas, Fort Worth, Houston, San Antonio, Austin, Corpus Christi, Beaumont, El Paso, and Arlington, TX.

0 notes

Text

Navigating the Roads: Unveiling the Most Affordable Car Insurance in Texas

Introduction:

Finding the most budget-friendly car insurance in Texas is a common goal for many drivers seeking coverage without breaking the bank. With numerous options available, the quest for the cheapest car insurance often involves navigating through policies, coverage, and premiums. In this article, we'll explore strategies to uncover the most affordable auto insurance in Texas, with a focus on securing cost-effective coverage in Arlington.

1. The Landscape of Car Insurance in Texas:

Texas boasts a diverse insurance market with a multitude of providers offering various coverage options. The cost of car insurance can vary based on factors such as location, driving history, vehicle type, and coverage needs.

2. Factors Influencing Car Insurance Rates:

Several factors contribute to determining car insurance rates in Texas, including:

Driving Record: A clean driving record is often rewarded with lower premiums, while accidents and traffic violations may lead to higher costs.

Vehicle Type: The make and model of your vehicle impact insurance rates, with factors such as repair costs and safety features taken into consideration.

Coverage Needs: The extent of coverage you choose, including liability, comprehensive, and collision, influences your insurance premiums.

Location: Different areas within Texas may have varying insurance rates due to factors like population density, crime rates, and local traffic patterns.

3. Unveiling Affordable Options in Arlington, TX:

Arlington, as part of the Dallas-Fort Worth metroplex, offers a competitive insurance market. To uncover the most affordable car insurance in Arlington:

Comparison Shopping: Obtain quotes from multiple insurance providers. Online comparison tools make it easier to evaluate rates and coverage options side by side.

Discount Opportunities: Inquire about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for completing defensive driving courses.

Local Providers: Consider reaching out to local insurance agencies in Arlington, as they may offer personalized service and competitive rates tailored to the region.

4. Top Picks for Affordable Car Insurance in Texas:

While individual rates may vary, several insurance providers are often recognized for offering competitive rates in Texas:

GEICO: Known for its straightforward approach and a variety of discounts.

Progressive: Offers options for customization and competitive rates.

State Farm: A reliable choice with a vast network of agents and a range of coverage options.

USAA: If eligible, USAA often provides competitive rates for military members and their families.

5. Tips for Lowering Car Insurance Costs:

Maintain a Good Driving Record: Safe driving habits contribute to lower insurance premiums.

Bundle Policies: Consider bundling auto insurance with other policies, such as homeowners or renters insurance, for potential discounts.

Opt for Higher Deductibles: Choosing a higher deductible can lower your premium, but be sure it aligns with your financial comfort.

Conclusion:

While the quest for the cheapest car insurance in Texas involves considering various factors, including your location in Arlington, comparison shopping remains a crucial strategy. By exploring options, leveraging discounts, and understanding the factors that influence rates, drivers can secure affordable coverage that meets their needs. Whether you're a resident of Arlington or elsewhere in Texas, the key to finding the most budget-friendly car insurance lies in proactive research, informed decision-making, and a commitment to safe driving.

1 note

·

View note

Text

Cheap and Affordable Insurance Services in Dallas Texas, USA

Are you looking for reliable insurance in Dallas Texas, United States that will not put a strain on your finances? So your search is over because Autzo Insurance is known as the best Insurance Services company in Dallas Texas, USA considering all these problems. Our affordable insurance options are designed to protect your wealth, health, and future without breaking the bank. We are become a world-class automobile insurance agency. If you are interested in choosing automobile insurance and home insurance, feel free to contact us.

#affordable insurance dallas#full coverage insurance texas#online auto home insurance quotes#auto home insurance quotes#auto insurance quotes texas#business insurance san antonio#home insurance dallas tx

1 note

·

View note

Text

0 notes

Text

Christian Insurance Agency LLC, we pride ourselves on being a reliable Magnolia TX insurance agent that truly cares about the community. Our agency offers a wide range of insurance options to meet the diverse needs of individuals and businesses in the Magnolia area. Whether you need auto, home, life, or business insurance, we are committed to finding the best policies that offer both coverage and affordability.

Christian Insurance Agency LLC 710 Melton St. Magnolia, TX 77354 (281) 789–4070

My Official Website: https://www.christianagency.net/ Google Plus Listing: https://www.google.com/maps?cid=2367622625284151193

Our Other Links:

Auto Insurance Pinehurst: https://www.christianagency.net/texas-auto-insurance.html Homeowners Insurance Magnolia TX: https://www.christianagency.net/texas-home-insurance.html

Service We Offer:

Auto Insurance Home Insurance Commercial Insurance Boat/Watercraft Insurance Classic Car Insurance Condo Insurance Flood Insurance Motorcycle Insurance Motor Home Insurance Renters Insurance RV Insurance Umbrella Insurance

Follow Us On:

Linkedin: https://www.linkedin.com/in/bill-christian-108b9a46 Twitter: https://twitter.com/LlcChristi86990 Pinterest: https://www.pinterest.com/ChristianInsuranceAgencyLLC/ Instagram: https://www.instagram.com/christianinsuranceagencyllc/

#Magnolia Tx Insurance Agent#Auto Insurance Pinehurst#Homeowners Insurance Magnolia Tx#Home Insurance Magnolia Texas#Magnolia Insurance Company

0 notes

Text

Assigning The Terror characters cars cuz I’m bored

From a USA/Texas perspective.

Crozier: Pontiac Aztek

Walter white looking ahh… he transports the lieutenants around in it, the best carpool guy. Will stop by McDonalds but will never be late. Smells Neptune the dog and a few fries that got buried in the backseats but no one will help him clean it. Great oldies CD collection in the glove compartment!

John Franklin: Ford f-150, or whatever new ranching truck.

….Social security, baby! Uselessly big, he complains cuz he doesn’t know how the touchscreen dashboard works. He’ll let you ride it but you have to sit in the trunk. Costs like $50 to fill with gas. Plays Fox News on the radio and doesn’t believe in looking at the backup camera while in reverse. Everyone look out!, who knows if he even has auto insurance.

James Fitzjames: BMW Convertible / Mazda Miata

It’s hard to keep track of what car he’s driving cuz it seems like there’s a new one every few months. Whatever the car is, it’s sporty and cute. He’s been in a few crashes but always seems to end up fine. Smells like new car. Doesn’t let others have the aux, he only plays his one singular 10hour unorganized Spotify playlist. It’s always filled with mystery items.

He also owns and has crashed several Suzuki motorcycles.

Henry Goodsir: green KIA Soul.

It’s not fast but it’s SO cute and decently cheap. He’ll try to help you move but it’s no use. Acts confused when someone mentions hampsters. Scrambles to move all the papers and things out of the back seat whenever someone needs to get in.

Thomas Blanky: 1995 Ford F150

Fun uncle car. Really bad shape…I mean it's kinda scary to get in there. Jopson fell out of the trunk one time... It's always a fun time tho. Smells like cigarettes and cold mornings. 80's classics and Hank Williams on the radio. Neptune rides in the trunk. He works on classic cars and Harley Davidson motorcycles in his garage too but doesn't drive them.

George Hodgeson: 2004 Honda Element

(i say this because this is my car... rip). Great for moving, not as great for driving. There's always a bicycle in there. He gets lost but maybe the scenic route isn't so bad. Always drives with the windows down but has a strict "no smoking in the car" policy.

John Irving: Toyota Camry

Real partykiller of a car. You'd think it was his grandma's or something. One time he flipped his lid cuz the others hotboxed it in the parking lot while he grabbed something in the Quiktrip. Gas efficient and cheap, and not too bad to drive. Probably the best car out of the bunch its just so fugly and boring, but he likes it that way. Wooden/twine cross hanging from the rearview mirror and K-Love on the radio.

Cornelius Hickey: Whatever this thing is

#probably gonna keep editing on this but my iPad suuuuuuucks to type on#the terror#amc the terror#henry goodsir#thomas blanky#james fitzjames#francis crozier#john franklin#cars lmao#cars!#john irving#george hodgeson#cornelius hickey

49 notes

·

View notes

Text

If you’re one of the millions of Americans worried about your pocketbooks and the general cost of living, you might have picked up on some good news recently: Inflation has really been cooling off this summer, as long-sticky (and long-lamented) food and energy prices continue to moderate. Some economic indicators remain stubborn, however—and they aren’t likely to abate anytime in the near future, no matter how long the Federal Reserve keeps interest rates high, what tweaks President Joe Biden makes to his trade policy, whether corporations decide themselves to slash prices on certain products, or whether Covid-battered supply chains finally get some long-needed fixes.

Other, grimmer recent headlines help to explain why. Hard rains from a tropical disruption in the Gulf have been battering Florida’s southern regions for days, leading to a rare flash-flood emergency. Another batch of storms is swirling near Texas at the moment and could form into a tropical depression, according to forecasts from the National Hurricane Center. Even if both states end up missing bigger storms now, it’s likely only a matter of time before they’re threatened again: The National Oceanic and Atmospheric Administration predicts that the United States will see its worst hurricane season in decades this summer.

Meanwhile, the heat waves that have enveloped Phoenix are intensifying to the point that some analysts are deeming its latest conditions “a Hurricane Katrina of heat.” Spanning outward, the Midwest and Northeast are projected to get their own extreme heat warnings as early as next week, with energy demand set to skyrocket as people turn on their air conditioners. The country has already seen 11 “billion-dollar disasters” this year, including the tornadoes that slammed Iowa just weeks ago. Meanwhile, the already strapped Federal Emergency Management Agency faces a budgetary crisis, and sales of catastrophe bonds are at an all-time high.

Now, let’s look back at the inflation readings. One of the categories remaining stubbornly high while other indicators shrink? Shelter and housing, natch, as rents and insurance stay hot—and still-elevated interest rates make construction and mortgage costs even more prohibitive. On the energy front, motor fuel may be cheapening, but fuel and electricity for home use are still pricey. Auto insurance remains a driving outlier, as I noted back in April, not least because of insurers hiking premiums for cars in especially disaster-vulnerable regions—like the South, the Southwest, and the coasts.

Look at what else is happening in those very regions when it comes to home insurance: Providers are either retreating from or dramatically heightening their prices in states like California, Texas, Florida, and New Jersey, thanks to their unique susceptibility to climate change. These states have seen supercharged extreme weather events like floods, rain bombs, heat waves, and droughts. National lawmakers fear that the insurance crises there may ultimately wreak havoc on the broader real estate sector—but that’s not the only worst-case scenario they have to worry about.

Agricultural yields for important commodities produced in those states (fruits, nuts, corn, sugar, veggies, wheat) are withering, thanks to punishing heat and soil-nutrition depletion. The supply chains through which these products usually travel are thrown off course at varying points, by storms that disrupt land and sea transportation. Preparation for these varying externalities requires supply-chain middlemen and product sellers to anticipate consequential cost increases down the line—and implement them sooner than later, in order to cover their margins.

You may have noticed some clear standouts among the contributors to May’s inflation: juices and frozen drinks (19.5 percent), along with sugar and related substitutes (6.4 percent). It’s probably not a coincidence that Florida, a significant producer of both oranges and sugar, has seen extensive damage to those exports thanks to extreme weather patterns caused by climate change as well as invasive crop diseases. Economists expect that orange juice prices will stay elevated during this hot, rainy summer.

(Incidentally, climate effects may also be influencing the current trajectory and spread of bird flu across American livestock—and you already know what that means for meat and milk prices.)

It goes beyond groceries, though. It applies to every basic building block of modern life: labor, immigration, travel, and materials for homebuilding, transportation, power generation, and necessary appliances. Climate effects have been disrupting and raising the prices of timber, copper, and rubber; even chocolate prices were skyrocketing not long ago, thanks to climate change impacts on African cocoa bean crops. The outdoor workers supplying such necessities are experiencing adverse health impacts from the brutal weather, and the recent record-breaking influxes of migrants from vulnerable countries—which, overall, have been good for the U.S. economy—are in part a response to climate damages in their home nations.

The climate price hikes show up in other ways as well. There’s a lot of housing near the coasts, in the Gulf regions and Northeast specifically; Americans love their beaches and their big houses. Turns out, even with generous (very generous) monetary backstops from the federal government, it’s expensive to build such elaborate manors and keep having to rebuild them when increasingly intense and frequent storms hit—which is why private insurers don’t want to keep having to deal with that anymore, and the costs are handed off to taxpayers.

When all the economic indicators that take highest priority in Americans’ heads are in such volatile motion thanks to climate change, it may be time to reconsider how traditional economics work and how we perceive their effects. It’s no longer a time when extreme weather was rarer and more predictable; its force and reasoning aren’t beyond our capacity to aptly monitor, but they’re certainly more difficult to track. You can’t stretch out the easiest economic model to fix that. And you can’t keep ignoring the clear links between our current weather hellscape, climate change, and our everyday goods.

Thankfully, some actors are finally, belatedly taking a new approach. The reinsurance company Swiss Re has acknowledged that its industry fails to aptly factor disaster and climate risks into its calculations, and is working to overhaul its equations. Advances in artificial intelligence, energy-intensive though they may be, are helping to improve extreme-weather predictions and risk forecasts. At the state level, insurers are pushing back against local policies that bafflingly forbid them from pricing climate risks into their models, and Florida has new legislation requiring more transparency in the housing market around regional flooding histories. New York legislators are attempting to ban insurers from backstopping the very fossil-fuel industry that’s contributed to so much of their ongoing crisis.

After all, we’re no longer in a world where climate change affects the economy, or where voters prioritizing economic or inflationary concerns are responding to something distinct from climate change—we’re in a world where climate change is the economy.

13 notes

·

View notes

Text

Auto Insurance - Auto Insurance and Car and Truck Insurance in Arizona, California, Colorado, Nevada, New Mexico, and Texas

Auto Insurance policies are not created equal. Arizona Insurance will help you determine the right amount of insurance for your vehicle. We provide Auto, car and truck insurance in Arizona, California, Colorado, Nevada, New Mexico, and Texas. At Arizona Insurance, we sell more than insurance, we sell peace of mind. Arizona Insurance - We've Got You Covered Since 2007!

#Auto#Insurance#car#truck#vehicle#fleet#agent#broker#Arizona#Glendale#Phoenix#California#Colorado#Nevada#NewMexico#Texas

1 note

·

View note

Text

Oh, this was on Jeopardy. “What corporations enable the GOP in Texas to undermine democracy and human rights.”

#at&t#exxon mobil corp#whole foods#dell computer#usaa auto insurance#american airlines#7 eleven#Texas

55 notes

·

View notes

Text

Maybe now that the people with the money to buy babies are being scammed even IVF proponents will admit that there needs to be regulations in the Buy a Baby Business

Dominique Side, the owner of Surrogacy Escrow Account Management, poses in 2023 at Vegan Fashion Week in Los Angeles.

(Gilbert Flores / WWD via Getty Images)

By Matt Hamilton Staff Writer June 30, 2024

They scrimped, and they saved. Some asked family and friends to pitch in. Others took out loans for tens of thousands of dollars.

Their goal was twofold: To raise the small fortune necessary to pay for a surrogate mother. And to realize a dream previously impossible — having a child of their own.

Hundreds of people across California, the U.S. and around the globe put their money, sometimes $50,000 or more, into the hands of a Texas-based escrow company so the funds could be held in trust and doled out to a surrogate for healthcare costs, insurance and compensation.

But this month, expectant parents and their surrogates learned the money they had set aside at Houston-based Surrogacy Escrow Account Management, or SEAM, is inaccessible and likely gone.

“We want answers,” said Chris Kettmann of Fair Oaks, Calif., a suburb of Sacramento. “Is there recourse to get the money back? If not, what can we do?”

Chris Kettmann and his wife with their ultrasound in an undated photo. (Chris Kettmann)

Kettmann, 33, said he and his wife had about $45,000 in their escrow account, money owed to their surrogate mother, who is pregnant with their baby boy and due in October. “We don’t know enough to say what happened,” he said. “We just know there’s something crazy going on.”

Police in Houston have opened a wide-reaching investigation. Christina Garza, a spokeswoman for the FBI’s Houston field office, confirmed last week that the agency also is investigating SEAM. The FBI has developed a public portal for SEAM clients to report their account information and how much money they believe they are owed. Garza, however, cautioned that the inquiry was in its early stages and said, “We’re trying to compile as much information as possible.”

A married same-sex couple in Washington, D.C., says they are out $55,000. A Los Feliz couple said they demanded their $40,111 be returned and believe it is gone. Arielle Mitton, an L.A. native who recently moved to Bellingham, Wash., can recite the amount that she and her husband are missing down to the cent: $37,721.44.

“I assumed naively that an escrow account was a safe thing,” said Mitton, whose surrogate mother in Indiana is pregnant with their daughter and is due to deliver on Christmas Eve.

Mitton has joined hundreds of affected parents and surrogates in a private Facebook group that has become a forum for venting, grieving, exchanging information and trying to answer the overriding questions: What happened here? And where did all their money go?

Scrutiny has centered on the sole owner of SEAM, Dominique Side, who has told customers that she had once been a surrogate. The 44-year-old billed herself as an entrepreneur of multimillion dollar businesses in the Houston area, including a vegan grocery store, a nonprofit school, a vegan music studio, and the surrogacy escrow outfit. She walked the red carpet in L.A. for vegan fashion events and ran a concierge service for those seeking a more eco-friendly lifestyle.

“One common thread runs through all my businesses: each is based firmly on a foundation of compassion — for others, for myself and for the planet,” she told a Houston publication in 2022.

Side did not respond to calls or written questions. Emails to Side triggered an auto-response that doubled as a press statement. Citing the “active investigation by federal authorities,” Side wrote in the email, “Under the advice of counsel, I am not permitted to respond to any inquiries regarding the investigation.”

On Thursday, Side and SEAM were hit by a lawsuit from a merchant cash-advance lender, the third such lawsuit this year. Merchant cash advance lenders provide small businesses with quick infusions of money at high fees akin to interest rates of 50% to 100%.

A judge in Texas also froze all of the company’s accounts along with Side’s other businesses after a SEAM client, Marieke Slik, sued over her “vanished” $28,000.

Calling herself a “victim of a scam,” Slik alleged that Side and her company had lured her and others “into a fiduciary relationship in order to steal their escrow funds,” according to her lawsuit, which was filed in Texas. “The Defendants have left hundreds of surrogates throughout the country — who are pregnant with a child that does not belong to them — with no way to pay for necessary prenatal care.”

Sides’ actions, according to the lawsuit, “are nothing short of evil.”

Struggling parents

Many surrogacies often involve LGBTQ+ couples who want children, or older couples for whom childbearing is no longer a viable possibility.

For others, the road to surrogacy is one of heartbreak and tragedy.

The married woman in Los Feliz said she had had multiple miscarriages. She was recently pregnant but gave birth in the second trimester. The newborn died at Cedars-Sinai in his parents’ arms.

The couple turned to surrogacy after exhausting all other options. They selected a surrogate mother, completed the necessary contract — which often requires using an escrow firm — and put more than $40,000 into the account, a portion of the overall cost. But their embryo had yet to be transferred into the surrogate mother.

“Nothing is clear,” she said, explaining that she and her husband demanded their funds weeks ago. “Obviously that fell on deaf ears — we didn’t get our money back,” she said, speaking on the condition of anonymity because their extended family remains unaware of their attempt at using a surrogate.

“I’d love to carry this child,” she said, and “not spend any money on a surrogate. There’s a level of that, where you feel so terribly sad. You feel sad about the money, but you feel sad about the situation.”

‘Something really bad has happened’

For intended parents and surrogates, trouble emerged around late May, when surrogates did not receive their usual payments.

Arielle Mitton gives surrogate mother Tena Doan’s belly a kiss. Doan is carrying Mitton’s baby. (Arielle Mitton)

In early June, Tena Doan — a 42-year-old surrogate mother in Indiana — said she noticed her bank account balance was lower than expected and realized her monthly payment and allowance had not come through. Her surrogacy agency told her that banking issues at SEAM had delayed the arrival of the money.

“I said, ‘No problem, they’ll get it fixed,’” Doan recalled, figuring that banking issues happen. When she logged into SEAM’s portal, she saw that the money listed as due her was still there.

Then came a June 12 email from Side claiming that fraudulent charges had prompted Capitol One to freeze SEAM’s account.

“Some payments were able to go through before the accounts were frozen,” Side wrote in the email. She stated that new bank accounts were established and promised service would be restored.

Two days later, however, Side sent another email indicating that “all operations have been placed on hold” due to legal action.

Doan said that the email stopped her in her tracks.

“That’s when we were like, ‘Oh s��, this is not good. Something really bad has happened,’” Doan recalled. “From there, it’s been a whirlwind.”

Mitton — the mother of the child that Doan is carrying — was at home more than 2,000 miles west.

“The first few days, I barely slept, I was nauseous from all the emotional aspects and had vertigo,” Mitton remembered.

She contacted the FBI, Houston police, the Texas attorney general. Mitton even emailed the CEO of Capital One, questioning how the money could apparently vanish.

Tena Doan, left, and Arielle Mitton. (Arielle Mitton)

Both Doan and Mitton joined the Facebook group and realized they were part of a club they never wanted membership in: those affected by SEAM’s financial collapse.

An informal poll among members suggested that about $10 million was unaccounted for. Parents and surrogates from across the country and around the world have traded information in the Facebook group about current police investigations and become sleuths themselves.

They’ve pored over Side’s various businesses — the Vgn Bae Music Studio, and Nikki Green, a luxury vegan fashion line. They’ve also mined her social media accounts.

A recent post on Side’s Instagram page VgnBaeDom, which has since been deleted, recounted her birthday week in June: Side said she flew to L.A., enjoyed a vegan dinner at the upscale Culver City vegan restaurant Shojin, dined at Crossroads Kitchen and Craig’s — both frequent celebrity hotspots — enjoyed a “full day of spa and cabana” at the Four Seasons, before doing fittings at Celine, the luxury French fashion house.

“The week this was going down was also her birthday week,” said Mitton, who recalled thinking, “She’s probably spending our escrow money there.”

Signs of financial difficulty SEAM was first registered in Texas in 2014. Testimonials from 2017 onward show glowing reviews, and one parent told The Times he had used SEAM for their first child without issue.

Lawsuits from cash advance lenders filed against SEAM and Side in New York this year indicate mounting financial trouble in recent months.

So-called merchant cash-advance lenders send sums of money to distressed businesses, often with a rapid turnaround, and, in exchange, a business lets the lender withdraw a portion of future receipts directly from the business’ bank account to pay off the debt. Cash-advance lenders often insist they aren’t lenders and that cash advances against future revenue aren’t technically loans — but New York’s former attorney general had lambasted the industry for predatory debt-collection practices.

In January, Side received an unspecified sum from Pearl Delta Funding and agreed to pay back $69,500. But she defaulted the next month, prompting the lender to sue her in New York in March. (Pearl Delta’s attorney did not respond to an email seeking comment.)

On May 6, Side secured $650,000 from Dynasty Capital and agreed to pay $975,000, or 150% of the amount borrowed, according to court records.

Under the agreement, the lender was allowed to debit $12,500 per day from SEAM’s account until the full amount was paid back. On May 31, Dynasty Capital said in court papers, SEAM “breached the agreement” and either failed to put revenue into the business account or diverted it elsewhere, leaving Dynasty unable to recoup its money.

Dynasty Capital sued Side, SEAM and her various businesses on June 18. Dynasty’s lawyer declined to comment.

On May 29, Side obtained $100,000 from Arsenal Funding and agreed to allow Arsenal to deduct 1.25% of SEAM’s daily revenue from its business bank account until $149,000 was paid off.

Arsenal sued Side and SEAM last week after Side stopped making payments on June 21 and defaulted, according to the lawsuit filed in New York, which demands about $190,000 to cover the outstanding debt and fees.

To secure the loan from Arsenal, Side had to disclose her largest revenue sources. She listed three companies, all in Southern California: US Harvest Babies Surrogacy in the City of Industry; Mle & Mlang International Surrogacy in L.A.; and a Shady Grove Fertility office in Solana Beach.

But there is reason to doubt the accuracy of what Side told the lender. In a statement, Shady Grove said it had no financial relationship with Side or SEAM and did not refer patients to the company, explaining that “some patients may have independently engaged with SEAM.”

Further, the name that Side had listed as her contact has never been an employee of Shady Grove, according to a person familiar with the company’s operations. And the address she listed for Shady Grove is a small branch in the San Diego area that’s been open for only a few months; Shady Grove is headquartered in Maryland and has 49 locations nationwide.

Neither Harvest Babies or Mlan responded to requests for comment.

Side told Arsenal that she was the 100% owner of SEAM and projected an average monthly revenue of $2.78 million, according to a copy of the financial agreement that Arsenal included with its lawsuit.

Lori Hood, a Houston-based attorney who is representing Slik — the client who sued Side this month in Texas — said she was confounded by SEAM’s financial practices. She said the lawsuit from Dynasty Capital indicated that escrow money was used to secure the $650,000 cash payment.

“How do you put up escrow funds as collateral?” said Hood. “That’s my first indication that something’s desperately wrong. You don’t recognize escrow funds as revenue.”

Second, Hood said, SEAM’s tax records that she’s reviewed also showed revenue of “millions of dollars.”

“Did her company make millions of dollars, or is she putting into the tax returns that the escrow money was her revenue?” Hood asked.

To press their client’s lawsuit against SEAM, Hood and her law partner, Marianne Robak, petitioned a judge to freeze all of SEAM’s accounts at Capital One along with other accounts owned or controlled by Side.

“The evidence shows that SEAM’s escrow account with Capital One ... has no funds available,” notes the request for a restraining order to freeze all accounts. “SEAM is insolvent.”

In the filing, Hood also accused SEAM of diverting money into accounts in the name of Life Escrow LLC, a company registered last year to Side’s business partner, Anthony Hall, who is also a defendant in the suit filed by Slik.

Side’s “actions appear to be to avoid having to face the clients she defrauded. It appears she had absconded,” states the restraining order, which a Harris County, Texas, judge signed off on June 21.

Reached by phone on Thursday, Hall said he “had no connection with SEAM,” adding, “I wish I had answers.” Hall said he was a business partner of Side in the vegan music studio, Vgn Bae Studios, adding, “Everything was great until it wasn’t.”

Hall said he did not know if Side had an attorney and said that he was speaking only for himself.

“She’s not gonna respond,” he said of Side. “I’m defending myself. I don’t know what they have going on.”

Pregnancies don’t wait

For Hood and hundreds of surrogate mothers and parents, questions mount.

“I won’t cast blame on any of the parents. They did everything they were supposed to do,” Hood said.

Time is short, however, for ongoing pregnancies and those couples who hope to have a surrogate receive an embryo soon.

Kettmann, from the Sacramento area, said their surrogate mother is 22 weeks pregnant. Of the $57,000 they put into SEAM, he said, $45,000 is missing. The rest had already been distributed to the surrogate.

“It’s a scramble,” he said. He and his wife had some money saved for additional expenses, which they’ve used to cover the June payment that never arrived from SEAM. He’s now fundraising from family and friends.

“We told her we’ll do everything we can to keep her up to date on payments,” he said, “but [we’re] asking her to be patient.”

Mitton and her surrogate mother, Doan, have started collecting donations through GoFundMe and plan to extend the payment terms two years, rather than having all the money sent to Doan shortly after delivery.

“I’m growing a healthy baby girl for them,” Doan said, “and that’s all that matters.”

#Dominique Side#Surrogacy Escrow Account Management#Buying babies is a big business#Fertility industry#Surrogacy exploits women#The Fertility industry can put people desperate for a baby in debt#How will surrogates be paid?#Vegan music studio?#Being in a same sex relationship is not infertility#Waiting too long is not infertility#Capital One#VgnBaeDom#merchant cash-advance lenders#They could have just put that money into starting an adoption process

3 notes

·

View notes