#Attracting Investors

Explore tagged Tumblr posts

Text

Attracting investors for your startup can be challenging, but with the right strategies, it becomes achievable. By understanding your market, developing a realistic business model, building a skilled team, and crafting a compelling pitch, you can significantly increase your chances of securing funding. Focus on gaining market traction, setting a realistic valuation, and networking with key players in the startup ecosystem. Events like the 21By72 Global Startup Summit provide excellent opportunities for exposure, allowing you to practice your pitch and connect with potential investors.

#Attracting Investors#Attract Investors#Winning Investors#Attract investors for startup#How to approach investors#How to attract investors for startups#How to get startup funding#Startup Founders#Startup fundraising tips

0 notes

Text

Hospertz: Your One-Stop Partner for Building a Successful Healthcare Facility

Hospertz: Your One-Stop Partner for Building a Successful Healthcare Facility

Streamlining the Journey: Hospertz India Pvt. Ltd. (HIPL) caters to the healthcare industry as a turnkey solutions provider. They offer comprehensive support, guiding medical professionals through every step of establishing a new medical facility.

youtube

From the Ground Up: Their services encompass the entire process, from selecting a suitable location and obtaining necessary licenses to securing funding and attracting investors. They even assist with hiring qualified personnel and developing a strategic marketing plan.

Addressing Modern Challenges: HIPL acknowledges the growing complexities within the healthcare landscape. Their expertise helps navigate the increasing bureaucratic hurdles associated with setting up a new medical establishment.

Experience You Can Trust: With their extensive experience, HIPL has a proven track record of assisting doctors, dentists, and other specialists in building multi-specialty healthcare facilities across India. Their meticulous approachensures every detail is addressed, from acquiring high-tech equipment at competitive prices to recruiting qualified staff.

Focus on What Matters: By partnering with Hospertz, medical professionals can concentrate on their core competency: delivering exceptional patient care. HIPL takes care of the rest, handling day-to-day operations, licensing procedures, streamlining processes, and staff protocols. Their objective is to establish a smooth-running, patient-centric, and profitable healthcare facility.

Realizing Your Vision: HIPL acts as a trusted advisor, providing end-to-end project consultancy and management services. Their comprehensive solutions encompass the entire project lifecycle, from initial concept to final commissioning.

A Guiding Light: Driven by the vision of fostering quality-conscious and profitable healthcare institutions, HIPL leverages its three core strengths:

Physician-Inspired Knowledge: They understand the specific needs and challenges faced by medical professionals.

Unrivaled Technology: They provide access to state-of-the-art equipment and resources.

Impeccable Services: They offer a comprehensive suite of services to ensure a seamless operation.

A Collaborative Approach: HIPL prioritizes client satisfaction. They maintain continuous communication throughout the project, addressing any potential roadblocks and ensuring a collaborative effort towards achieving the desired outcome. Their ultimate goal is to transform your vision for a successful healthcare facility into a reality.

Building Trust: HIPL emphasizes transparency and honesty in all their dealings with clients and investors. They recognize that your vision is paramount, and they strive to make it the cornerstone of their every action.

#hospertz#turnkey solutions#comprehensive support#selecting a suitable location#obtaining necessary licenses#securing funding#attracting investors#hiring qualified personnel#strategic marketing plan#bureaucratic hurdles#multi-specialty healthcare facilities#high-tech equipment#recruiting qualified staff#delivering exceptional patient care#day-to-day operations#licensing procedures#streamlining processes#staff protocols#profitable healthcare facility#end-to-end project consultancy and management services#initial concept#final commissioning#fostering quality-conscious and profitable healthcare institutions#physician-inspired knowledge#unrivaled technology#impeccable services#client satisfaction#continuous communication#collaborative effort#transparency and honesty

1 note

·

View note

Text

Issuance of Shares and Debentures: Procedure and Definition

A share is a unit of ownership in a company. When a company issues shares, it divides its ownership into equal portions, and each portion is represented by a share. Shareholders who own these shares are considered partial owners of the company and are entitled to certain rights, such as voting on company matters, receiving dividends (if declared), and participating in the company’s profits…

View On WordPress

#attracting investors#debenture definition#debenture issuance procedure#financial instruments#issuance of debentures#issuance of shares#raising capital#share definition#share issuance procedure

1 note

·

View note

Text

I need someone to do like a deep dive investigation into what's going on with Tumblr live bc NONE of these people are actual regular tumblr users so like what's up

234 notes

·

View notes

Text

What Are The Major Factors Driving Retinal Biologics Market Growth?

The Retinal Biologics Market is experiencing a surge in demand, fueled by advancements in eye disease treatments and a growing emphasis on vision health. According to a recent analysis by Future Market Insights (FMI), a leading market research firm, the market is currently valued at an impressive US$22.25 billion in 2022. Looking ahead, the market is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 11.1% over the next six years. This translates to a staggering market valuation of US$41.92 billion by 2028, highlighting the significant potential of retinal biologics in revolutionizing eye care.The remarkable expansion of the Global Retinal Biologics sector is fueled by advancements in technology, innovative research, and a growing demand for cutting-edge treatments. As the industry continues to evolve, it presents unprecedented opportunities for stakeholders, investors, and healthcare professionals alike.Key Retinal Biologics Market Insights:

Rising Prevalence of Diabetes-related Eye Disorders and Age-related Macular Degeneration (AMD) The prevalence of diabetes-related eye disorders and age-related macular degeneration is on the rise, underscoring the growing need for innovative solutions within the Retinal Biologics Industry.Substantial Investment in R&D for Biologics in Retinal Disorders The industry is witnessing a significant influx of research and development resources, aimed at advancing biologics for both infectious and non-infectious retinal disorders. This investment underscores the commitment to addressing unmet medical needs.

Emergence of Specific Biologic Molecules as Therapeutic Targets Specific biologic molecules are gaining prominence as highly promising therapeutic targets, offering new hope for patients with retinal conditions.Gene Therapy as a Solution for Monogenic Retinal Illnesses With a growing number of monogenic retinal illnesses, gene therapy is emerging as a pivotal component of the Retinal Biologics Market, presenting innovative solutions for these challenging conditions.

Request a Sample Copy of This Report Now.https://www.futuremarketinsights.com/reports/sample/rep-gb-8663

#The Retinal Biologics Market is experiencing a surge in demand#fueled by advancements in eye disease treatments and a growing emphasis on vision health. According to a recent analysis by Future Market I#a leading market research firm#the market is currently valued at an impressive US$22.25 billion in 2022. Looking ahead#the market is projected to witness a remarkable Compound Annual Growth Rate (CAGR) of 11.1% over the next six years. This translates to a s#highlighting the significant potential of retinal biologics in revolutionizing eye care.The remarkable expansion of the Global Retinal Biol#innovative research#and a growing demand for cutting-edge treatments. As the industry continues to evolve#it presents unprecedented opportunities for stakeholders#investors#and healthcare professionals alike.Key Retinal Biologics Market Insights:Rising Prevalence of Diabetes-related Eye Disorders and Age-relate#underscoring the growing need for innovative solutions within the Retinal Biologics Industry.Substantial Investment in R&D for Biologics in#aimed at advancing biologics for both infectious and non-infectious retinal disorders. This investment underscores the commitment to addres#offering new hope for patients with retinal conditions.Gene Therapy as a Solution for Monogenic Retinal Illnesses With a growing number of#gene therapy is emerging as a pivotal component of the Retinal Biologics Market#presenting innovative solutions for these challenging conditions.Request a Sample Copy of This Report Now.https://www.futuremarketinsights.#institutional sales in the Retinal Biologics Industry#where Retinal Biologics are supplied in speciality clinics and hospitals#will generate higher revenues. In 2018#hospital sales accounted for more than 35% of market revenue.According to the report#retail sales of Retinal Biologics will generate comparable revenues to hospital sales and will expand at an 11.9% annual rate in 2019. Reta#with retail pharmacies generating more money than their counterparts in the future years.Penetration in North America Higher#APEJ’s Attractiveness to IncreaseNorth America continues to be the market leader in Retinal Biologics revenue. According to FMI estimates#North America accounted for more than 46% of global Retinal Biologics Industry revenues in 2018. Revenues in North America are predicted to#continuous growth in the healthcare infrastructure#and a favourable reimbursement scenario.Europe accounted for about one-fourth of the Retinal Biologics market#with Western European countries such as Germany#the United Kingdom#France#Italy

2 notes

·

View notes

Text

¶

#a us american couple bought a piece from the gallery today#comes to about six months of my salary#and they casually charge it to a debit card#but whatever. i've worked in this industry long enough where this is normal#(and i do get a tiny commission on the sale so perhaps it's a bit less than six months all things considered)#anyway as I'm preparing their shipping and customs paperwork#they're telling me about other galleries they've visited#and that they bought 2x sculptures from a very well-known south african sculptor (won't disclose lest I doxx them accidently)#and they're not bragging or anything they're just making conversation#but I know that these works go for like 2 to 5 years of my salary. before taxes. each. and they bought two !#so oké they really are rich#and here's the thing that tipped me over the edge#the last straw#they're buying a camp in one of our major game reserves and the art is décor#tourism is a huge sector of south africa's economy#game/nature reserves and parks are some of our major attractions#and if we let private americans own these places#then where do the profits generated by these reserves and parks go ??#does it stay in south africa ? does it contribute to the south african economy ?#or does it flow out and enrich the american owners and investors ??#capitalists always say foreign investment is good but this doesn't feel like it can be ??? how ???#like I'm not being racist or xenophobic or nationalistic here#but like when Africa exports raw minerals like gold platinum cobalt copper etc through foreign mine owners#and we get sold back phones and cars etc at much higher cost#we understand how this is unhelpful for the economies and development in Africa#right#so why is it different when they buy our tourist attractions ?#yes it created jobs etc etc#but the profits don't stay in the country#or actually maybe investment is good

2 notes

·

View notes

Text

#understanding business taxes tips for small business owners.#how to attract investors to your startup#how to create a content marketing strategy that works#how to expand your business into new markets#business blogs

0 notes

Text

Colonel Rajyavardhan Rathore said: The Rising Rajasthan Global Investment Summit, to be held in Jaipur from 09 to 11 December 2024, is set to be a gamechanger for entrepreneurs and investors alike. This summit presents a golden opportunity to attract major investments to the state while fostering innovation and economic growth. With global investors eyeing Rajasthan, this conference is an unparalleled platform for entrepreneurs to pitch their ideas, network with industry leaders, and secure funding. Don’t miss out on this rare opportunity to make your mark at this prestigious event. Be part of the change and unlock Rajasthan’s future potential by attending the Rising Rajasthan Summit.

#Colonel Rajyavardhan Rathore said#Rising Rajasthan Global Investment Summit#Rajasthan 2024 conference#Jaipur summit December#global investors Rajasthan#Rajasthan entrepreneurs#investment opportunities Jaipur#Rising Rajasthan Summit 2024#global investment event India#Jaipur business summit#entrepreneurship conference Rajasthan#Rajasthan investment opportunities#Jaipur investors conference#investment summit Jaipur 2024#Rajasthan business growth#Rajyavardhan Rathore Rajasthan#global business summit 2024#networking opportunities Jaipur#entrepreneurs Rajasthan event#global business leaders Rajasthan#Jaipur summit December 2024#Rajasthan entrepreneurs summit#attracting investors Rajasthan#Jaipur business investment#business opportunities Rajasthan#future of Rajasthan economy#Jaipur innovation summit#global economy Jaipur 2024#entrepreneurs networking Rajasthan#Rising Rajasthan Jaipur December

0 notes

Text

we've finished reading an academic text on neoliberalism. i need the FMI to explode

#in neoliberalist thought the flexibilization of labour for the sake of attracting investors is a good thing#in 'caring about the well being of people' thought this is a bad thing because it makes the jobs more precarious and the wages worse

1 note

·

View note

Text

Why Surat Is Becoming a Startup Hotspot for Global Investors Surat is rapidly emerging as a startup hotspot, attracting global investors with its strategic location, government support, thriving entrepreneurial spirit, and cost-effective infrastructure. With robust connectivity, a skilled talent pool, and events like the Global Startup Summit, Surat offers a unique ecosystem that fosters innovation and growth for startups aiming for international success.

#Attracting global investors#Benefits of investing in Surat#Global investment opportunities in Surat#Global investor trends#Global investors in India#Investment opportunities in Surat#Surat startup ecosystem

0 notes

Text

While I'm writing things that I've been intending to write for a while... one of the things that I think that a lot of people who haven't been involved in like... banking or corporate shenaniganry miss about why our economy is its current flavor of total fuckery is the concept of "fiduciary duty to shareholders."

"Why does every corporation pursue endless growth?" Fiduciary duty to shareholders.

"Why do corporations treat workers the way they do?" Fiduciary duty to shareholders.

"Why do corporations make such bass-ackwards decisions about what's 'good for' the company?" Fiduciary duty to shareholders.

The legal purpose of a corporation with shareholders -- its only true purpose -- is the generation of revenue/returns for shareholders. Period. That's it. Anything else it does is secondary to that. Sustainability of business, treatment of workers, sustainability and quality of product, those things are functionally and legally second to generating revenue for shareholders. Again, period, end of story. There is no other function of a corporation, and all of its extensive legal privileges exist to allow it to do that.

"But Spider," you might say, "that sounds like corporations only exist in current business in order to extract as much money and value as possible from the people actually doing the work and transfer it up to the people who aren't actually doing the work!"

Yes. You are correct. Thank you for coming with me to that realization. You are incredibly smart and also attractive.

You might also say, "but Spider, is this a legal obligation? Could those running a company be held legally responsible for failing their obligations if they prioritize sustainability or quality of product or care of workers above returns for shareholders?"

Yes! They absolutely can! Isn't that terrifying? Also you look great today, you're terribly clever for thinking about these things. The board and officers of a corporation can be held legally responsible to varying degrees for failing to maximize shareholder value.

And that, my friends, is why corporations do things that don't seem to make any fucking sense, and why 'continuous growth' is valued above literally anything else: because it fucking has to be.

If you're thinking that this doesn't sound like a sustainable economic model, you're not alone. People who are much smarter than both of us, and probably nearly as attractive, have written a proposal for how to change corporate law in order to create a more sensible and sustainable economy. This is one of several proposals, and while I don't agree with all of this stuff, I think that reading it will really help people as a springboard to understanding exactly why our economy is as fucked up as it is, and why just saying 'well then don't pursue eternal growth' isn't going to work -- because right now it legally can't. We'd need to change -- and we can change -- the laws around corporate governance.

This concept of 'shareholder primacy' and the fiduciary duty to shareholders is one I had to learn when I was getting my securities licenses, and every time I see people confusedly asking why corporations try to grow grow grow in a way that only makes sense if you're a tumor, I sigh and think, 'yeah, fiduciary duty to shareholders.'

(And this is why Emet and I have refused to seek investors for NK -- we might become beholden to make decisions which maximize investor return, and that would get in the way of being able to fully support our people and our values and say the things we started this company to say.)

Anyway, you should read up on these concepts if you're not familiar. It's pretty eye-opening.

18K notes

·

View notes

Text

Funding IoT Startups: Strategies for Attracting Investors

Securing the Future: Winning Strategies for Funding IoT Startups and Attracting Investors

Accessing funding in the competitive environment of the Internet of Things (IoT) is an important step for startups looking to scale their innovative solutions strategies -Requires special strategies to attract investors and provides funding for start-ups, providing insight into what drives successful investments in this dynamic and rapidly growing sector.

Clear Value Proposition:

Communicating a clear and compelling value proposition is the foundation of any successful financial plan. IoT startups need to communicate how their solution meets a specific market need, solves a pain, or improves performance in a way that sets them apart from competitors.

Determine market potential:

Investors are looking for start-ups with significant market potential. Conduct comprehensive market research to determine target market size, growth forecast, and scalability of IoT solutions. Demonstrating a deeper understanding of market dynamics and potential return on investment is key to capturing investor interest.

Technological innovations demonstrated:

Highlighting unique and innovative IoT technologies is essential. Whether it's cutting-edge hardware devices, cutting-edge software solutions, or a combination of both, it will attract investors looking for cutting-edge opportunities that emphasize technological innovation and its competitive advantages.

Proof of Concept and Traction:

Investors are more likely to support startups with a proven track record. Confirm the feasibility of the IoT solution by providing evidence of successful proof of concept, research work, or early customer traction validates the viability of the IoT solution. Real-world results and positive feedback from initial deployments build confidence among potential investors.

Scalability and long-term vision:

Investors are interested in start-ups that can provide flexible growth and long-term sustainability. Clearly explain how IoT solutions can scale to reach a wider audience and how the startup plans to evolve in response to market trends. A well-defined long-term vision instills confidence in investors in a startup’s prospects.

Strong Business Model:

A strong and well-defined business model is essential to attract investors. Clearly define revenue, pricing strategies, and profitability strategy. Investors want to see a clear path to funding and a sustainable business model that aligns with the objectives of the IoT startup.

Team Proficiency:

Investors generally bet on the team as much as the technology. Demonstrate the expertise of the founding team, with emphasis on relevant experience in IoT, technology development, and operations management. A strong and qualified team gives confidence that a startup can successfully deliver on its vision.

Managing Safety and Compliance:

Given the nature of the IoT, addressing security concerns is paramount. Clearly state how the startup addresses cybersecurity challenges and complies with industry regulations. Assuring investors of robust security measures and compliance promises increases trust in IoT solutions.

Conclusion:

Funding IoT startups requires a strategic approach that combines a strong value proposition, market potential, technological innovation, and a solid business model. By demonstrating proof of concept, emphasizing scalability, and assembling an experienced team, IoT startups can attract investors looking for opportunities in this exciting and changing industry.

0 notes

Text

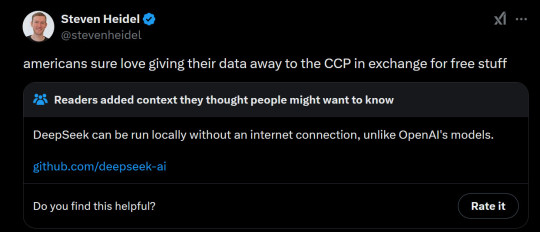

I am very wary of people going "China does it better than America" because most of it is just reactionary rejection of your overlord in favor of his rival, but this story is 1. absolutely legit and 2. way too funny.

US wants to build an AI advantage over China, uses their part in the chip supply chain to cut off China from the high-end chip market.

China's chip manufacturing is famously a decade behind, so they can't advance, right?

They did see it as a problem, but what they then did is get a bunch of Computer Scientists and Junior Programmers fresh out of college and funded their research in DeepSeek. Instead of trying to improve output by buying thousands of Nvidia graphics cards, they tried to build a different kind of model, that allowed them to do what OpenAI does at a tenth of the cost.

Them being young and at a Hedgefund AI research branch and not at established Chinese techgiants seems to be important because chinese corporate culture is apparently full of internal sabotage, so newbies fresh from college being told they have to solve the hardest problems in computing was way more efficient than what usually is done. The result:

American AIs are shook. Nvidia, the only company who actually is making profit cause they are supplying hardware, took a hit. This is just the market being stupid, Nvidia also sells to China. And the worst part for OpenAI. DeepSeek is Open Source.

Anybody can implement deepseek's model, provided they have the hardware. They are totally independent from DeepSeek, as you can run it from your own network. I think you will soon have many more AI companies sprouting out of the ground using this as its base.

What does this mean? AI still costs too much energy to be worth using. The head of the project says so much himself: "there is no commercial use, this is research."

What this does mean is that OpenAI's position is severely challenged: there will soon be a lot more competitors using the DeepSeek model, more people can improve the code, OpenAI will have to ask for much lower prices if it eventually does want to make a profit because a 10 times more efficient opensource rival of equal capability is there.

And with OpenAI or anybody else having lost the ability to get the monopoly on the "market" (if you didn't know, no AI company has ever made a single cent in profit, they all are begging for investment), they probably won't be so attractive for investors anymore. There is a cheaper and equally good alternative now.

AI is still bad for the environment. Dumb companies will still want to push AI on everything. Lazy hacks trying to push AI art and writing to replace real artists will still be around and AI slop will not go away. But one of the main drivers of the AI boom is going to be severely compromised because there is a competitor who isn't in it for immediate commercialization. Instead you will have a more decentralized open source AI field.

Or in short:

1K notes

·

View notes

Text

Sophie grifting: hot duchess. seductive investor. mysterious businesswoman.

Eliot grifting: ridiculously competent chef. hot athlete (any sport). heartthrob country musician.

Hardison grifting: overly-confident criminal. assertive FBI agent. heartthrob classical musician.

Nathan Ford grifting: goddamn piece of shit oily slimy scumbag ambulance-chaser untrustworthy con artist with a stupid fucking voice and a silly hat

the show is not doing Nate any favors in the likeability or attractiveness departments here

(Bonus mention: Parker grifting: autism creature)

5K notes

·

View notes

Text

The Blueprint for Success: How a Well-Crafted Business Plan Can Attract Investors and Secure Funding

Imagine embarking on a journey to build your dream business without a roadmap. You may have a brilliant idea, unyielding determination, and unwavering passion, but without a well-crafted business plan, you're sailing into uncharted waters. A business plan serves as your guiding compass, outlining your goals, strategies, and financial projections. However, its significance goes beyond internal clarity; a meticulously prepared business plan holds the key to attracting investors and securing the funding you need to bring your vision to life.

Let’s delve into the essential elements of a business plan that capture the attention of investors, ignite their interest, and convince them to align their financial resources with your entrepreneurial journey. From presenting a compelling executive summary to demonstrating a thorough market analysis and showcasing realistic financial projections, we will explore how these elements work together to instill confidence and inspire potential investors.

Section 1:

The Power of a Persuasive Executive Summary

The journey towards securing funding starts with a captivating executive summary. Often considered the gateway to your business plan, the executive summary is a concise yet compelling snapshot of your venture. It should convey your business's unique value proposition, market potential, competitive advantage, and growth prospects. By distilling the essence of your business plan into a concise format, the executive summary entices investors to delve deeper into the details and learn more about your venture.

Section 2:

Demonstrating a Thorough Market Analysis

Investors want to see that you have a deep understanding of your target market and its dynamics. A comprehensive market analysis showcases your research prowess and highlights the market opportunity for your business. By providing data-driven insights into the size of the market, industry trends, customer demographics, and competitor analysis, you demonstrate that you have a clear vision of how your business fits into the larger ecosystem. This not only instills confidence in investors but also allows them to assess the potential return on investment.

Section 3:

Developing a Solid Business Model and Strategy

Investors seek assurance that your business model is viable and has the potential for sustainable growth. This section of your business plan should outline your revenue streams, pricing strategy, distribution channels, and customer acquisition plans. By showcasing a well-thought-out strategy, you demonstrate that you have carefully considered the operational aspects of your business and have a clear roadmap for success. Investors want to see that you have identified potential risks and have mitigation strategies in place.

Section 4:

Presenting Realistic Financial Projections

Numbers speak louder than words when it comes to attracting investors. Your financial projections should demonstrate a thorough understanding of your business's financial viability and its potential for profitability. By including projected revenue, expenses, and cash flow statements, investors can assess the financial feasibility of your venture. It is essential to present realistic assumptions and validate them with market research and industry benchmarks. Investors need to see a clear path to return on their investment, making financial projections a crucial aspect of your business plan.

Section 5:

Highlighting Your Team and Expertise

Investors not only invest in ideas but also in the people behind them. Highlight the qualifications, expertise, and track record of your team members to instill confidence in potential investors. A strong team with relevant experience and a diverse skill set can mitigate risk and demonstrate your ability to execute the business plan successfully. Investors want to see that you have assembled a capable team that can navigate challenges and drive the business towards growth.

Section 6:

Addressing Risk and Mitigation Strategies

Investors understand that every business venture comes with inherent risks. Addressing these risks and presenting viable mitigation strategies in your business plan is crucial. Identify potential risks specific to your industry, market, or business model, and outline strategies to mitigate them. This demonstrates that you have a proactive approach to risk management and are prepared to navigate challenges effectively. By showcasing your awareness of potential obstacles and presenting well-thought-out contingency plans, you build investor confidence in your ability to handle adversity and protect their investment.

Section 7:

Outlining the Use of Funds

Investors want to know exactly how their investment will be utilized and the impact it will have on your business's growth. In this section, provide a detailed breakdown of how you plan to allocate the funds you seek to secure. Whether it's for product development, marketing campaigns, operational expenses, or expansion plans, be transparent about your financial priorities. By aligning the use of funds with your business objectives and growth strategies, you demonstrate that you have a strategic plan for maximizing the investment and achieving significant milestones.

Crafting a well-prepared business plan is not just an administrative exercise; it is a strategic tool that can attract investors and secure the funding you need to turn your entrepreneurial dreams into reality. From the persuasive executive summary to the thorough market analysis, robust business model, realistic financial projections, strong team presentation, addressing risk factors, outlining mitigation strategies, and providing a clear roadmap for utilizing funds, you instill confidence in potential investors. Remember to continually refine and update your business plan as your business evolves and market conditions change. With a compelling business plan in hand, you have the foundation to attract investors who share your vision and contribute to the success of your venture. Each element of your business plan plays a vital role in instilling confidence and generating investor interest.

However, creating a comprehensive and compelling business plan can be a complex task. That's where the expertise of Business Plan Writers comes into play. Their knowledge and experience can help you navigate the intricate process of developing a business plan that captures the attention of investors and increases your chances of securing funding. Remember, a well-crafted business plan is not a static document but an evolving blueprint that adapts to market changes and reflects your business's growth. Continuously refine and update your business plan as you gather new insights and milestones. With the guidance of Business Plan Experts, you can ensure that your business plan stands out, making a compelling case for potential investors. So, don't hesitate to take the first step towards turning your entrepreneurial dreams into a thriving reality.

0 notes

Text

Google’s enshittification memos

[Note, 9 October 2023: Google disputes the veracity of this claim, but has declined to provide the exhibits and testimony to support its claims. Read more about this here.]

When I think about how the old, good internet turned into the enshitternet, I imagine a series of small compromises, each seemingly reasonable at the time, each contributing to a cultural norm of making good things worse, and worse, and worse.

Think about Unity President Marc Whitten's nonpology for his company's disastrous rug-pull, in which they declared that everyone who had paid good money to use their tool to make a game would have to keep paying, every time someone downloaded that game:

The most fundamental thing that we’re trying to do is we’re building a sustainable business for Unity. And for us, that means that we do need to have a model that includes some sort of balancing change, including shared success.

https://www.wired.com/story/unity-walks-back-policies-lost-trust/

"Shared success" is code for, "If you use our tool to make money, we should make money too." This is bullshit. It's like saying, "We just want to find a way to share the success of the painters who use our brushes, so every time you sell a painting, we want to tax that sale." Or "Every time you sell a house, the company that made the hammer gets to wet its beak."

And note that they're not talking about shared risk here – no one at Unity is saying, "If you try to make a game with our tools and you lose a million bucks, we're on the hook for ten percent of your losses." This isn't partnership, it's extortion.

How did a company like Unity – which became a market leader by making a tool that understood the needs of game developers and filled them – turn into a protection racket? One bad decision at a time. One rationalization and then another. Slowly, and then all at once.

When I think about this enshittification curve, I often think of Google, a company that had its users' backs for years, which created a genuinely innovative search engine that worked so well it seemed like *magic, a company whose employees often had their pick of jobs, but chose the "don't be evil" gig because that mattered to them.

People make fun of that "don't be evil" motto, but if your key employees took the gig because they didn't want to be evil, and then you ask them to be evil, they might just quit. Hell, they might make a stink on the way out the door, too:

https://theintercept.com/2018/09/13/google-china-search-engine-employee-resigns/

Google is a company whose founders started out by publishing a scientific paper describing their search methodology, in which they said, "Oh, and by the way, ads will inevitably turn your search engine into a pile of shit, so we're gonna stay the fuck away from them":

http://infolab.stanford.edu/pub/papers/google.pdf

Those same founders retained a controlling interest in the company after it went IPO, explaining to investors that they were going to run the business without having their elbows jostled by shortsighted Wall Street assholes, so they could keep it from turning into a pile of shit:

https://abc.xyz/investor/founders-letters/ipo-letter/

And yet, it's turned into a pile of shit. Google search is so bad you might as well ask Jeeves. The company's big plan to fix it? Replace links to webpages with florid paragraphs of chatbot nonsense filled with a supremely confident lies:

https://pluralistic.net/2023/05/14/googles-ai-hype-circle/

How did the company get this bad? In part, this is the "curse of bigness." The company can't grow by attracting new users. When you have 90%+ of the market, there are no new customers to sign up. Hypothetically, they could grow by going into new lines of business, but Google is incapable of making a successful product in-house and also kills most of the products it buys from other, more innovative companies:

https://killedbygoogle.com/

Theoretically, the company could pursue new lines of business in-house, and indeed, the current leaders of companies like Amazon, Microsoft and Apple are all execs who figured out how to get the whole company to do something new, and were elevated to the CEO's office, making each one a billionaire and sealing their place in history.

It is for this very reason that any exec at a large firm who tries to make a business-wide improvement gets immediately and repeatedly knifed by all their colleagues, who correctly reason that if someone else becomes CEO, then they won't become CEO. Machiavelli was an optimist:

https://pluralistic.net/2023/07/28/microincentives-and-enshittification/

With no growth from new customers, and no growth from new businesses, "growth" has to come from squeezing workers (say, laying off 12,000 engineers after a stock buyback that would have paid their salaries for the next 27 years), or business customers (say, by colluding with Facebook to rig the ad market with the Jedi Blue conspiracy), or end-users.

Now, in theory, we might never know exactly what led to the enshittification of Google. In theory, all of compromises, debates and plots could be lost to history. But tech is not an oral culture, it's a written one, and techies write everything down and nothing is ever truly deleted.

Time and again, Big Tech tells on itself. Think of FTX's main conspirators all hanging out in a group chat called "Wirefraud." Amazon naming its program targeting weak, small publishers the "Gazelle Project" ("approach these small publishers the way a cheetah would pursue a sickly gazelle”). Amazon documenting the fact that users were unknowingly signing up for Prime and getting pissed; then figuring out how to reduce accidental signups, then deciding not to do it because it liked the money too much. Think of Zuck emailing his CFO in the middle of the night to defend his outsized offer to buy Instagram on the basis that users like Insta better and Facebook couldn't compete with them on quality.

It's like every Big Tech schemer has a folder on their desktop called "Mens Rea" filled with files like "Copy_of_Premeditated_Murder.docx":

https://doctorow.medium.com/big-tech-cant-stop-telling-on-itself-f7f0eb6d215a?sk=351f8a54ab8e02d7340620e5eec5024d

Right now, Google's on trial for its sins against antitrust law. It's a hard case to make. To secure a win, the prosecutors at the DoJ Antitrust Division are going to have to prove what was going on in Google execs' minds when the took the actions that led to the company's dominance. They're going to have to show that the company deliberately undertook to harm its users and customers.

Of course, it helps that Google put it all in writing.

Last week, there was a huge kerfuffile over the DoJ's practice of posting its exhibits from the trial to a website each night. This is a totally normal thing to do – a practice that dates back to the Microsoft antitrust trial. But Google pitched a tantrum over this and said that the docs the DoJ were posting would be turned into "clickbait." Which is another way of saying, "the public would find these documents very interesting, and they would be damning to us and our case":

https://www.bigtechontrial.com/p/secrecy-is-systemic

After initially deferring to Google, Judge Amit Mehta finally gave the Justice Department the greenlight to post the document. It's up. It's wild:

https://www.justice.gov/d9/2023-09/416692.pdf

The document is described as "notes for a course on communication" that Google VP for Finance Michael Roszak prepared. Roszak says he can't remember whether he ever gave the presentation, but insists that the remit for the course required him to tell students "things I didn't believe," and that's why the document is "full of hyperbole and exaggeration."

OK.

But here's what the document says: "search advertising is one of the world's greatest business models ever created…illicit businesses (cigarettes or drugs) could rival these economics…[W]e can mostly ignore the demand side…(users and queries) and only focus on the supply side of advertisers, ad formats and sales."

It goes on to say that this might be changing, and proposes a way to balance the interests of the search and ads teams, which are at odds, with search worrying that ads are pushing them to produce "unnatural search experiences to chase revenue."

"Unnatural search experiences to chase revenue" is a thinly veiled euphemism for the prophetic warnings in that 1998 Pagerank paper: "The goals of the advertising business model do not always correspond to providing quality search to users." Or, more plainly, "ads will turn our search engine into a pile of shit."

And, as Roszak writes, Google is "able to ignore one of the fundamental laws of economics…supply and demand." That is, the company has become so dominant and cemented its position so thoroughly as the default search engine across every platforms and system that even if it makes its search terrible to goose revenues, users won't leave. As Lily Tomlin put it on SNL: "We don't have to care, we're the phone company."

In the enshittification cycle, companies first lure in users with surpluses – like providing the best search results rather than the most profitable ones – with an eye to locking them in. In Google's case, that lock-in has multiple facets, but the big one is spending billions of dollars – enough to buy a whole Twitter, every single year – to be the default search everywhere.

Google doesn't buy its way to dominance because it has the very best search results and it wants to shield you from inferior competitors. The economically rational case for buying default position is that preventing competition is more profitable than succeeding by outperforming competitors. The best reason to buy the default everywhere is that it lets you lower quality without losing business. You can "ignore the demand side, and only focus on advertisers."

For a lot of people, the analysis stops here. "If you're not paying for the product, you're the product." Google locks in users and sells them to advertisers, who are their co-conspirators in a scheme to screw the rest of us.

But that's not right. For one thing, paying for a product doesn't mean you won't be the product. Apple charges a thousand bucks for an iPhone and then nonconsensually spies on every iOS user in order to target ads to them (and lies about it):

https://pluralistic.net/2022/11/14/luxury-surveillance/#liar-liar

John Deere charges six figures for its tractors, then runs a grift that blocks farmers from fixing their own machines, and then uses their control over repair to silence farmers who complain about it:

https://pluralistic.net/2022/05/31/dealers-choice/#be-a-shame-if-something-were-to-happen-to-it

Fair treatment from a corporation isn't a loyalty program that you earn by through sufficient spending. Companies that can sell you out, will sell you out, and then cry victim, insisting that they were only doing their fiduciary duty for their sacred shareholders. Companies are disciplined by fear of competition, regulation or – in the case of tech platforms – customers seizing the means of computation and installing ad-blockers, alternative clients, multiprotocol readers, etc:

https://doctorow.medium.com/an-audacious-plan-to-halt-the-internets-enshittification-and-throw-it-into-reverse-3cc01e7e4604?sk=85b3f5f7d051804521c3411711f0b554

Which is where the next stage of enshittification comes in: when the platform withdraws the surplus it had allocated to lure in – and then lock in – business customers (like advertisers) and reallocate it to the platform's shareholders.

For Google, there are several rackets that let it screw over advertisers as well as searchers (the advertisers are paying for the product, and they're also the product). Some of those rackets are well-known, like Jedi Blue, the market-rigging conspiracy that Google and Facebook colluded on:

https://en.wikipedia.org/wiki/Jedi_Blue

But thanks to the antitrust trial, we're learning about more of these. Megan Gray – ex-FTC, ex-DuckDuckGo – was in the courtroom last week when evidence was presented on Google execs' panic over a decline in "ad generating searches" and the sleazy gimmick they came up with to address it: manipulating the "semantic matching" on user queries:

https://www.wired.com/story/google-antitrust-lawsuit-search-results/

When you send a query to Google, it expands that query with terms that are similar – for example, if you search on "Weds" it might also search for "Wednesday." In the slides shown in the Google trial, we learned about another kind of semantic matching that Google performed, this one intended to turn your search results into "a twisted shopping mall you can’t escape."

Here's how that worked: when you ran a query like "children's clothing," Google secretly appended the brand name of a kids' clothing manufacturer to the query. This, in turn, triggered a ton of ads – because rival brands will have bought ads against their competitors' name (like Pepsi buying ads that are shown over queries for Coke).

Here we see surpluses being taken away from both end-users and business customers – that is, searchers and advertisers. For searchers, it doesn't matter how much you refine your query, you're still going to get crummy search results because there's an unkillable, hidden search term stuck to your query, like a piece of shit that Google keeps sticking to the sole of your shoe.

But for advertisers, this is also a scam. They're paying to be matched to users who search on a brand name, and you didn't search on that brand name. It's especially bad for the company whose name has been appended to your search, because Google has a protection racket where the company that matches your search has to pay extra in order to show up overtop of rivals who are worse matches. Both the matching company and those rivals have given Google a credit-card that Google gets to bill every time a user searches on the company's name, and Google is just running fraudulent charges through those cards.

And, of course, Google put this in writing. I mean, of course they did. As we learned from the documentary The Incredibles, supervillains can't stop themselves from monologuing, and in big, sprawling monopolists, these monologues have to transmitted electronically – and often indelibly – to far-flung co-cabalists.

As Gray points out, this is an incredibly blunt enshittification technique: "it hadn’t even occurred to me that Google just flat out deletes queries and replaces them with ones that monetize better." We don't know how long Google did this for or how frequently this bait-and-switch was deployed.

But if this is a blunt way of Google smashing its fist down on the scales that balance search quality against ad revenues, there's plenty of subtler ways the company could sneak a thumb on there. A Google exec at the trial rhapsodized about his company's "contract with the user" to deliver an "honest results policy," but given how bad Google search is these days, we're left to either believe he's lying or that Google sucks at search.

The paper trail offers a tantalizing look at how a company went from doing something that was so good it felt like a magic trick to being "able to ignore one of the fundamental laws of economics…supply and demand," able to "ignore the demand side…(users and queries) and only focus on the supply side of advertisers."

What's more, this is a system where everyone loses (except for Google): this isn't a grift run by Google and advertisers on users – it's a grift Google runs on everyone.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/03/not-feeling-lucky/#fundamental-laws-of-economics

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#enshittification#semantic matching#google#antitrust#trustbusting#transparency#fatfingers#serp#the algorithm#telling on yourself

6K notes

·

View notes