#Annuity Services

Explore tagged Tumblr posts

Text

Bright Fiduciary Financial Advisor

At Bright Wealth Management, we believe that a bright future starts with a solid foundation.

That’s why we take the time to connect with our clients and craft personalized financial plans that will help you build the future you envision.

Website: https://brightwm.com

Google Map: https://www.google.com/maps?cid=13486753487099948787

Add: 6991 E Camelback Rd #D300, Scottsdale, AZ 85251

Tel(833) 777-4296

1 note

·

View note

Text

Lack of financial literacy is OVER‼️

Email linked on the page feel free to REACH OUT📲

IG - jg_strategic_financial

#life insurance#indexed universal life#financial services#financial#debt solutions#annuity#annuities#401k#financialliteracy

4 notes

·

View notes

Link

Contact our experts for guidance and personalized solutions when seeking Insurance consultation services in Buford GA. Our Denny Insurance USA team assists with business, dental, and family health plans and navigating federal health insurance guidelines. As trusted health insurance agents, we offer access to the best insurance companies in Buford, GA, ensuring you receive comprehensive coverage tailored to your needs. Whether you require dental and vision coverage or financial insurance protection, Denny Insurance USA is here to help. Contact us today for reliable insurance consultation services near you, and let us provide you with peace of mind knowing your insurance needs are in capable hands.

#Insurance protection#Insurance annuities#Individual medical coverage#Insurance consultation service

0 notes

Text

Fusco Insurance, Retirement $ Wealth Planning Services, Inc.

August 2024 Newsletter Fusco Insurance, Retirement & Wealth Planning Services Inc.August 2024 Newsletter A Message from Fusco Insurance Dear Valued Clients and Friends, As we move through August, we want to remind you that planning for the future is more than just a necessity—it’s an opportunity to secure peace of mind for you and your loved ones. This month, we’re focusing on essential…

#annuities#Asset Protection#Client Success Stories#Elder Care Planning#estate planning#financial-planning#Fusco Insurance#Insurance Services#LegalShield#Long Term Care#Medicare Planning#retirement planning#Retirement Security#wealth management#Wealth Preservation

0 notes

Text

Secure Your Future with Expert Retirement Planning Services in Dearborn, MI

Looking for retirement planning services in Dearborn, MI? Hayside Financial offers personalized retirement strategies to help you achieve your financial goals. Our expert advisors will guide you through comprehensive planning to secure your future.

#financial-services-company-detroit-mi#retirement-planning-advisor-ann-arbor-mi#best-annuity-plan-dearborn-mi

0 notes

Link

Pillar Life Insurance has launched a new website that highlights their innovative annuity and life insurance services and more. The new website features an improved user experience as well as updates to the company’s service offering descriptions.

0 notes

Text

How much does it cost to file a design patent in China?

Compared with utility model patents, there is not much difference in official fees for design patents in China.

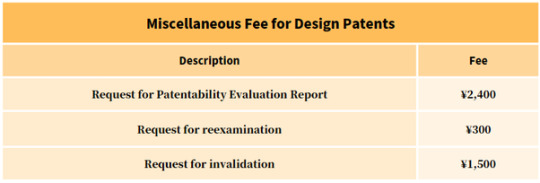

Filing Fees for Design Patents

Miscellaneous Fees for Design Patents

Annuities for Design Patents

0 notes

Text

"[The isle of Voorne] constituted an important part of Margaret of York’s dower lands because of its financial revenues, its economic possibilities and its endless stock of salted herring. For the administration of the isle, the duchess used a number of experienced officers from her own and that of Maximilian’s household, as well as from regional and local institutions. Margaret maintained a close relationship with her administrators of Voorne; offices, emoluments and gifts were given in exchange for loyalty and service. In this way she managed to establish durable links between her court, her dower land, and the administrative apparatus in The Hague.

Margaret’s relationship with the town of Brielle was expressed through an exchange of financial and material gifts and favours. The town administration offered her and her retinue prestigious consumable goods and money. Not all gifts were donated spontaneously, but were more often than not the result of a process of negotiation: new privileges in exchange for money. At the same time the dowager could appeal to the town for financial loans which were financed by selling annuities. Brielle benefited from Margaret’s protection because it was not obliged to provide new subsidies. And yet, Margaret was not able to stop the decline of the port of Brielle that was losing ships and trade to Rotterdam and Schiedam.

However, we should be cautious when explaining the relationship between Margaret and Voorne merely in economic terms. Margaret showed sincere compassion for the poor and the needy in her town of Brielle. Although the financial implications resulting from this concern were small in comparison with gifts for her trustees or her expenditure for stained glass windows on the island, her financial controllers were very strict with her spontaneous acts of charity. There was a continuous tension between the application of financial rules and her princely urge for largesse.

The representation of Margaret in the glass windows was partly inspired by local efforts to remind the duchess of her duties. On the other hand, the iconography of the two windows in Brielle and Dirksland show that Margaret was genuinely interested in being commemorated and in being represented with her late husband. Thus Margaret contributed in a material way to the celebration of the liturgy and the maintenance of the building. At the same time she publicly showed her devotion and appealed to the citizens of Voorne to be loyal towards her."

-Mario Damen, "Charity against the odds. Margaret of York and the isle of Voorne (1477-1503)" Women at the Burgundian Court: Presence and Influence (Turnhout 2010)

#it's available online if anyone wants to read it!#margaret of york duchess of burgundy#burgundian history#15th century#historicwomendaily#my post

11 notes

·

View notes

Text

Approximately 400,000 pensioners in Bulgaria will receive a Christmas supplement of 100 leva (50 euros), according to the National Social Security Institute's data as of September. The payments are expected to begin on December 9 and will be completed by December 20. A government decree is anticipated to be adopted shortly to ensure the bonuses are paid out before the holidays.

The Christmas bonus will be granted to the most financially vulnerable pensioners, with the target group including individuals receiving basic pensions up to the poverty line of 526 leva. Finance Minister Lyudmila Petkova confirmed the details of the initiative on Wednesday.

Bulgaria to Raise Maximum Social Security Income to 4,130 Leva in 2025

The National Social Security Institute’s latest figures show that 7,600 pensioners receive pensions of up to 267 leva, 118,000 receive up to 435 leva, and 155,000 receive up to 494 leva. Additionally, there are likely at least 100,000 more pensioners whose income is near or below the poverty line, though precise figures are not available.

Eligible pensioners include those receiving inheritance pensions, social pensions for old age or disability, and those with minimal disability pensions. However, individuals with additional income from annuities, rents, or salaries—such as working pensioners—are excluded from receiving the bonus. Pensioners with the minimum pensions for full service and age, who already receive more than the poverty line after the July indexation, are also not eligible.

3 notes

·

View notes

Note

Hi, i want to know how does elizabeth of york live after her death? After the queen's death, no one provided them with an annuity.

Hi! I'm assuming your question is about what happened to Elizabeth of York's household after her death.

Following her death, Henry [VII] settled several of Elizabeth’s outstanding obligations. In April 1503, the king paid wages to several of the queen’s attendants: £68 to her ladies and gentlewomen, £47 12s 4d to the servants of her staple, and £3 6s 8d to her dry nurse (perhaps the woman who attended her during her last illness). He also paid some of her debts: £100 to Steven Jenyns for pledged jewels, £30 to James Jentille, and £120 to William Halybrand for pledging out certain plate (Arlene Okerlund).

That seems to be the standard for Henry, he also kept paying for Arthur's debts/expenses well over a year after his son's death. As to what happened to Elizabeth's household servants afterwards is that they simply weren't dismissed from court. Some of them entered into the service of the king, others into the service of Prince Henry (such as Elizabeth's illegitimate brother, Arthur Plantagenet), others entered into the service of Princess Margaret and went with her to Scotland and others remained in the service of Princess Mary (such as Joan Vaux, Lady Guildford, who remained with Mary until her marriage to the king of France, for example).

The only servants that come to my mind that were not easily employed elsewhere were her minstrels, but they kept receiving a reward from the king each year at New Year's.

16 notes

·

View notes

Text

It is also possible that certain developments during the period in question provide hints of a decline in the king's physical condition. Henry had made a point of assuming the leadership of important military expeditions in the early years of his reign. At the beginning of 1408, however, contemporaries might have noted that he had not led his men in the field since an inglorious foray into Wales in the autumn of 1405. This inactivity could legitimately be explained by altered circumstances such as improved relations with the Scots and the employment of the king's fast-maturing sons Henry and John on active service on England's borders, or by the need for financial restraint. However, on at least four occasions between the illnesses of 1406 and 1408, the king formally announced his intention of marching at the head of his troops and then failed to do so. In the third session of the parliament of 1406, a French threat to Calais seemed to demand a forceful response. On 20 October, every sheriff in England was ordered to proclaim that various men who held royal fees or annuities should prepare for an expedition which was to leave for France on 9 November, under the command of Henry himself. By 13 November, however, these grandiose plans had been quietly dropped, and far more modest arrangements had been substituted. Just over three months later, there was a very similar sequence of events. On 5 February 1407, men holding certain Crown grants were commanded to join the king in London within fifteen days to sail to the aid of whichever of England's French possessions was in the greatest danger. After delays attributed to the failure of some men to obey the summons, 'whereat the king marvels', the date for the muster was altered to 10 April, but nothing more was heard of it. A matter of weeks afterwards, on 1 June, it was announced that Henry had taken 'a fixed resolve' to march in person against the Welsh rebels, and orders went out for an army to assemble at Hereford by 19 June. On 10 June, however, the sheriffs were ordered to announce that this force was not to go to meet Henry until further notice, 'as for particular causes the king does not purpose to be there so speedily.' It was becoming clear that Henry had no intention of going anywhere, speedily or otherwise, in the foreseeable future. And on 22 September 1407, another army was commanded to meet Henry at Evesham on 10 October to march with 'the king or his deputy' to the siege of Aberystwyth, and yet again it was soon obvious that Henry would not be personally involved.

Different circumstances surrounded all these projected campaigns, and reasons can be suggested for their cancellation or for Henry's non-participation. Plans may have been revised as a result of inter- action between the king and his 'new' council. The French alerts were possibly false alarms. The need for an expedition to complete the suppression of the Welsh revolt was real enough, but it was not essential that Henry should lead it. It could be claimed that a call to serve under Henry's personal command was an effective device to remind annuitants of their obligations to the Crown. Nevertheless, the king had led his men into Wales two years previously, and it would have seemed quite natural if he had done so again. Considered individually, none of these 'cancellations' can be regarded as implying anything about Henry's health; taken together, they represent four instances in less than a year when he declared that he would take action which was in character with his earlier practice, and yet never carried out his resolve. It seems at least possible that his forcefully phrased commands were designed to convince his subjects (and himself) that recent developments had not weakened his resolution or his physical faculties. If this was the case, his failure to convert word into deed may have been a sign of advancing illness as well as a growing source of frustration.

Peter McNiven, "The Problem of Henry IV's Health, 1405-1413", The English Historical Review, vol. 100, no. 397 (October 1985)

2 notes

·

View notes

Text

Navigate Your Retirement Journey with Confidence - Ann Arbor, MI's Premier Retirement Planning Advisor

Empower your retirement dreams with Hayside Financial Services, your trusted retirement planning advisor in Ann Arbor, MI. Our seasoned advisors specialize in crafting personalized retirement strategies tailored to your unique financial aspirations.

#financial-services-company-detroit-mi#retirement-planning-advisor-ann-arbor-mi#best-annuity-plan-dearborn-mi

0 notes

Text

The Will of James Laurens

Notes:

The handwriting here was incredibly difficult to decipher, so there are lots of gaps below - either words I could not make out at all, or some where I've included my best guess. If you have any corrections or suggestions to offer, please do let me know!

There are no line breaks in the original document, but to make for easier reading, I have added them in where they seemed most fitting.

Although all the other names are given in their English forms, for some reason the name Mary is given in the French form of Marie instead.

Transcript:

In the Name of God so be it on this sixth day of the month of September in the year one thousand seven hundred and eighty two in the afternoon at the City of Vigan diocess of Alais in Languedoc I the undersigned James Laurens a Native and Inhabitant of Charles Town Capital of the State of South Carolina in North America but having been for several years in Languedoc because of my health being at present in an infirm state but of sound understanding and having the use of my Memory I find it necessary to explain my last will and testament and make the [—]

and first I recommend my Soul to God in the name of Jesus Christ and as to my body that it be buried in the most private manner and the least expensive

and as to what relates to my estate I dispose as I think I ought institute in [manner] following first it is my will that my proportion which is two fifth part of the debt in Great Britain in the partnership of Hawkins Petrie and Company be paid therewith the just and lawful Interest unless that an argument can be made with the Auditors to receive the payment in South Carolina

I give to my most dear and beloved wife Marie Laurens an annuity of five hundred pounds sterling during her natural life to be paid regularly every six months in advance in the proportions of two hundred and fifty pounds sterling to commence from the day of my decease and it is my will that all my Real and personal Estate be liable for the payment of the said annuity unless that my Testamentary Executors and Executrices should choose to give her some other security for the payment of the said annuity to the satisfaction of my said wife and in case my said wife shall remain in Europe after my decease it is my will that the said annuity be paid to her at the place of her residence [clear] of all deductions and expenses whatsoever

I give unto my said wife all the money I have at present or that I may have in the hands of Mr William Manning of London and also the sum of five hundred pounds sterling invested for my account in the Consolidated Bank of London in the name of Mr John Savage if those two sums exceed the sum of twelve hundred pounds sterling Madam Laurens shall have a right to receive the whole and she shall render an account of the overplus to the Executors but if the said two sums shall not make twelve hundred pounds sterling then it is my will that my Executors and Executrices or some of them pay the sum that shall be wanting in sterling or in that which shall be equivalent to its full value in sterling

I also give unto my said beloved wife all the plate [—] [—] my wearing apparel table [service] and furniture of every denomination whatsoever whether in France London or America

I also give unto my said wife all and [—] my Male and Female Negroes excepting the female Satira whom I declare free from all servitude whatsoever and I [recommend] it to all my Executors and Executrices to assist the said Negro Woman if she be reduced to poverty or in any other distress

I give unto my dear friend Elizabeth Petrie widow and sister of my dear wife an annuity of fifty pounds sterling payable every six months in advance during her natural life unto my friend Edmond Petrie as a token of my regard an hundred pounds sterling and to each of his Brothers namely Alexander and George fifty pounds sterling and to his sister Marie Petrie fifty pounds sterling

I give unto my dear Brother Henry Laurens as a token of my unalterable friendship and esteem the sum of five hundred pounds sterling and twenty pounds sterling to purchase a Mourning Ring as a remembrance of his Brother

I give unto my dear Niece Martha Laurens as a token of my friendship for her and as an acknowledgement for the service she has rendered to me and my family and for her good and gentle conduct upon all occasions five hundred pounds sterling

I give unto my Nephew Francis Bremar of South Carolina the sum of three hundred and twenty pounds sterling to my Nephew John Bremar two hundred and fifty pounds sterling to my Niece Martha [L—] widow two hundred and fifty pounds sterling

I give unto my dear sister in law Ann Sanders as a token of my friendship and esteem fifty pounds sterling

I give as a mark of my friendship and respect for the memory of my deceased friend Jacob Motte to each of the Children of his last Marriage two hundred pounds sterling

I give unto my worthy friend Isaac Motte as a token of my friendship fifty pounds sterling to my worthy friend Louis Gervais as a token of my friendship fifty pounds sterling

I give three hundred pounds sterling to be distributed amongst my poor relations in such proportion as my Executors and Executrices shall think proper

I give five hundred pounds sterling to be distributed among the poor of South Caroline at the discretion of my Executors and Executrices I give unto the Protestant Church at Vigan fifty pounds sterling and in case that the Roman Catholic Church should pretend to and could possess [herself] of this Legacy It is my will that It shall become void and of none effect

And lastly I give unto my dear Nephew John Laurens to my dear Niece Martha Laurens to my dear Nephew Henry Laurens Junior and unto my dear Niece Marie Eleanor Laurens Minor and unto their Heirs for ever all my [Real] and personal Estate of what kind soever and at what place soever they be situated to be equally shared between them subject nevertheless to the payment of the annuity of five hundred pounds sterling to my wife and as my said Niece Marie Eleanor Laurens is under age her share shall remain in trust in the hands of my said Brother Henry Laurens her father and in case that my said Nephew and Niece Henry Laurens and Marie Eleanor Laurens shall happen to die in their minority it is my will that the share to them here above bequeathed shall go and be divided in equal shares between their Brothers and Sisters who shall survive each as [—] [them]

I nominate for my Executors and Executrices of this my will my Brother Henry Laurens my Wife Marie Laurens my Nephew John Laurens my Niece Martha Laurens and my Nephew Henry Laurens

such is my last will and testamentary disposition which I will that it avail in the best manner it [can] by law which [—] of the difficulty I have to explain myself in french though I understand the Language I have transcribed it in English on an [separate] sheet of paper and Mr Louis Gendre Notary Public of Vigan aforesaid wrote and translated it into French upon this sheet of paper dictated by my dear Niece Martha Laurens and in my presence and that of my dear Wife my dear Nephew Henry Laurens and my dear Niece Marie Eleanor Laurens and the said translation made the said Mr Gendre read over the contents to me distinctly and intelligibly and which I clearly understood and comprehended and I declare that it comprises my will most expressively and it is my will that it be fulfilled after my decease the same as though it had been done at Charlestown the place of my residence even though it should not have all the required formalities In testimony thereof

I have signed my name under the two foregoing pages at the [House] where I reside at Vigan aforesaid on the day and year as above I annul all other wills which I have heretofore made Note the utilization of the words and [—] fifty pounds sterling I give as a mark of my friendship as approved James Laurens

--

(Thanks to @nordleuchten for filling in some of the gaps!)

#james laurens#henry laurens#john laurens#historical john laurens#martha laurens ramsay#harry laurens#mary eleanor laurens#laurens family

29 notes

·

View notes

Text

Navigating Your Federal Retirement Journey: Essential Training for FERS Employees

For federal employees enrolled in the Federal Employees Retirement System (FERS), planning for retirement is a complex and often daunting task. With a myriad of unique provisions, annuity options, and retirement strategies, it's crucial for FERS employees to receive the appropriate training to make informed decisions about their financial future. In this article, we will explore various training programs available to FERS employees to help them navigate the intricacies of the FERS retirement system.

FERS Annuity Training

Understanding the FERS annuity system is fundamental to planning a successful retirement. FERS annuity training provides federal employees with the knowledge they need to calculate their annuity benefits accurately. This training covers the different components of the FERS annuity, such as the Basic Benefit, Social Security, and the Thrift Savings Plan (TSP). By participating in this training, FERS employees can ensure they make well-informed choices when it comes to their retirement income.

FERS Special Provision Employee Training

FERS Special Provision Employees have unique retirement rules and benefits that differ from the standard FERS guidelines. Specialized training programs are available to help this subset of federal employees understand their specific retirement options. This training delves into the nuances of special provisions, such as law enforcement, military service, or specific agency requirements, ensuring that these employees are well-prepared for retirement under their unique circumstances.

FERS Retirement Training

General FERS retirement training provides comprehensive insights into the retirement process for all FERS employees. This program covers the eligibility criteria, annuity calculation methods, and other essential aspects of the FERS retirement system. FERS retirement training offers a solid foundation for planning retirement and making crucial decisions regarding annuity options.

FERS Law Enforcement Officer Retirement

Law enforcement officers under the FERS system have distinct retirement needs and regulations. Specialized training programs for law enforcement officers address these unique requirements, covering topics like the Law Enforcement Officer (LEO) retirement category, service credit, and eligibility criteria. This training helps law enforcement officers make informed choices about their retirement.

Federal Employee TSP Strategies Training Tampa

The Thrift Savings Plan (TSP) is a key component of the FERS retirement system, allowing federal employees to save for retirement. Training programs in locations like Tampa focus on TSP investment strategies, helping employees understand how to maximize their TSP accounts to secure a comfortable retirement. These programs cover investment options, contribution limits, and withdrawal strategies.

FERS Special Retirement Supplement Training Workshops Orlando

The FERS Special Retirement Supplement is designed to bridge the gap between federal retirement and Social Security benefits. Training workshops in locations like Orlando provide valuable insights into how this supplement works, when it applies, and how it impacts retirement income. Understanding the supplement is critical for FERS employees who retire before becoming eligible for Social Security.

ChFEBC Retirement Training Texas

Chartered Federal Employee Benefits Consultants (ChFEBC) offer specialized retirement training in Texas. These consultants are well-versed in the intricacies of the FERS system and provide personalized guidance to federal employees. ChFEBC retirement training in Texas caters to the specific needs of each employee, offering tailored solutions and strategies to ensure a successful retirement.

FERS Survivor Benefit Training Orlando

FERS Survivor Benefit Training in Orlando addresses the important topic of survivor benefits. It is essential for FERS employees to understand the survivor annuity options available to their spouses and beneficiaries in the event of their passing. This training covers the eligibility criteria, annuity amounts, and the impact on survivor finances.

Conclusion

Navigating the Federal Employees Retirement System (FERS) can be a complex and challenging journey. To ensure a smooth transition into retirement and make informed decisions, FERS employees should take advantage of the various training programs available. Whether it's annuity training, special provision employee training, or Thrift Savings Plan strategies, these programs offer the knowledge and expertise needed to secure a comfortable retirement. By investing in proper FERS training, federal employees can make well-informed choices and embark on their retirement journey with confidence.

#fers special provision employee training#fers special retirement supplement workshops#thrift savings plan - tsp training orlando#Federal Group Life Insurance FEGLI Workshops Phoenix#FERS Law Enforcement Officer Retirement Training Workshops Kansas City#FERS Firefighter Retirement Training

2 notes

·

View notes

Text

A topic less discussed here concerns those behind the scenes where the royal children are concerned. Arthur Tudor was not an exception: his early years were spent under the care of respectful women of different degrees under the scale of aristocracy before he was handled to a full male court.

Yet, one question remains: who were these people King Henry and Queen Elizabeth trusted not only to care for their son and precious heir but also to educate the next king of England?

Here’s what we do about them.

“By the time he was christened, the first phase of Arthur’s care was established. The nursery was to have a lady governor, supported by four female servants known as chamberers or rockers.

A chamberlain would be appointed to oversee all the other officials and to swear and hold them to their oaths of loyalty and service. The more menial and physical tasks were undertaken by yeomen and grooms.

The relatively small number of offices meant that many of the male servants would have undertaken multiple roles. They would have been found in he chamber and in the hall, especially at meal times. Other men were appointed to specific posts. A sewer organised meals, precedence and seating and oversaw the serving and tasting of food. A panter was put in charge of bread and food supplies. Of greatest importance was the safeguarding of Arthur's wet nurse.

What she ate and drank was key to the health and growth of the baby prince. Her diet and portions were carefully monitored. She would even be watched by a physician as she ate, to ensure that no sudden changes came over her or the boy in her care.

The manager of the Yorkist nursery was Elizabeth Darcy. She had overseen the early upbringing of Queen Elizabeth and all of her royal siblings at Eltham. Darcy was reappointed in 1486 to head a team of nurses and daily attendants that went on to look after the first years of life of all of Henry VII and Elizabeths children.

Darcy brought in her own specialist team - a group of women very familiar to Queen Elizabeth. Arthur's cradle rockers were Agnes Burler, Evelyn Hobbes and Alice Bywymble. The prince’s wet nurse was Elizabeth Gibbs.

(…) The prince's wet nurse, Katherine Gibbs, was paid off in April 1490 with a generous annuity of £20 to come directly from the first monies received at the start of the exchequer year - a notable recognition of how Arthur had been safeguarded in his first thirty months of life.

By the time the arrangement of this payment had made its way through the convoluted exchequer system it is likely that Arthur's household had taken on a different appearance. This was the period of transition from nursery to education and service.

In March 1488, Thomas Poyntz, esquire for the king's body, was rewarded with 40 marks per year partly for services to the prince. Poyntz later received a gift of French books of hours from Arthur, suggesting that the relationships forged in that early stage of his life were lasting and would have continued had Arthur become king. These services were likely to have been related to the tightening of security around Arthur in response to the Household Act passed by Parliament before 18 December the previous year. Poyntz's specific role is not recorded but he is the first of the king's more senior officers to be personally attached to the prince.

Henry VII’s concern for his son’s health is apparent in another grant, made with the king’s ‘cordial affection’ a few months after Poyntz received his reward. Arthur’s doctor was Stephen Bereworth and the medical attention he had already given to Arthur was enough to earn him £40 each year for the rest of his life. By May 1488, when this grant was made, Arthur would have been a toddler, fully weaned and becoming exposed to the childhood ailments, bumps and bruises that as youngsters experience.

(…) In December I488 Robert Knollys, one of the king's henchmen, was instructed to join Arthur's household with a payment of 100s. He could not be admitted to the name roll of servants because the king had placed his sign manual at the head and foot of the roll and left no space for additions. The check-roll might have been small enough to fit on a single sheet at this stage of Arthur's life (it has not survived), but it would soon expand in parallel to the prince's role.

Once Arthur was considered to have grown and matured sufficiently to cope with the endurance test of the ceremonies of his knighthood and creation as Prince of Wales at the end of November 1489, his household also developed a more formal structure in preparation for this changing role. The age of six or seven seems to have been one at which many royal children moved out of the nursery and into a junior version of the royal household." In Prince Arthur's case, this seems to have happened when he was abour three years old.

(…) John Whytyng was described as Arthur's sewer in grants of annuities in November 1489 and January 1490. The naming of Whytyng in a specific appointment indicates that an element of structure and more formal ritual was entering his household.

An important first stage in his development was how the prince began to learn his social role. Mastering the first formal steps of the art of household ritual, etiquette and the hierarchy of social status would lead to a smoother transition into the refined world of court politics and diplomacy.

In January 1490 there is first mention of Richard Howell as marshal of the prince's household. Howell's role was to ensure Arthur's security and to monitor the discipline of the other men and women who served him at Farnham. The greater prominence given to household policing might also indicate that the king's heir was developing a less closeted role within his small community. Once his wet nurse and rockers were no longer required physically, the services provided for Arthur had to begin to mirror that of any other senior noble. Within a few weeks of Howell's appointment, King Henry's servant Thomas Fisher was awarded an annuity of 40 marks on 20 April 1490 as yeoman of the cellar to the prince. His appearance points to a greater sophistication in the way that the prince's meals were prepared and served.

He was soon followed by John Almor, appointed to Arthur's household on 29 October 1490. Almor was a veteran of the king's hall, one of the main military resources of the royal household. He became Arthur's first sergeant-at-arms; a post that would have incorporated the role of a personal bodyguard with broader responsibility for the security of the household such as the vetting of visitors and servants, guarding doors and access, and setting the watch.”

Cunningham, S. “Prince Arthur: The Tudor King Who Never Was.”

8 notes

·

View notes

Text

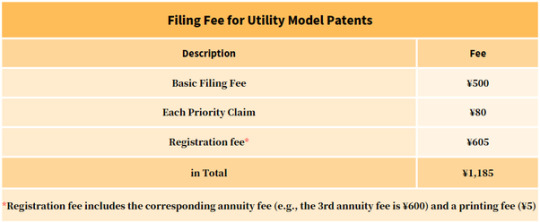

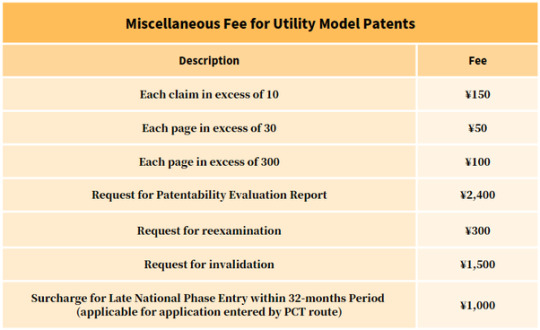

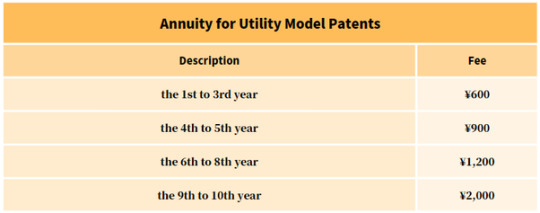

How much does it cost to file a utility model patent in China?

Compared with invention patents, it is much cheaper to file a utility model in China.

Filing Fees for Utility Model Patents

Miscellaneous Fees for Utility Model Patents

Annuities for Utility Model Patents

0 notes