#Aircraft Flight Control System Market

Explore tagged Tumblr posts

Text

Aircraft Flight Control System Market to Grow with a CAGR of 5.94% Globally

Increasing Air Travel Demand, Advancements in Aerospace Technology, and Regulatory Requirements and Safety Standards are factors driving the Global Aircraft Flight Control System market in the forecast period 2024-2028.

According to TechSci Research report, “Global Aircraft Flight Control System Market - Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028”, the Global Aircraft Flight Control System Market stood at USD 25 billion in 2022 and is anticipated to grow with a CAGR of 5.94% in the forecast period, 2024-2028. The flight control system of the airplane helps the pilot to fly the aircraft precisely. The system consists of the cockpit, the hydraulic mechanical connections and controls, and the flight control surfaces. The majority of military and commercial aircraft are currently equipped with hydro-mechanical control systems; newer aircraft, on the other hand, are equipped with fly-by-wire or electronic flight control systems.

Due to an increase in passenger traffic, rising levels of personal disposable income in developing nations have generated a demand for air travel. Airlines are expanding their fleets because of the growing demand for air travel. Thus, it is anticipated that rising aircraft orders will boost market expansion. Moreover, throughout the course of the forecast period, it is anticipated that the growing need for drones in military activities will propel market expansion.

Browse over market data Figures spread through XX Pages and an in-depth TOC on "Global Aircraft Flight Control System Market” https://www.techsciresearch.com/report/aircraft-flight-control-system-market/22487.html

The Global Aircraft Flight Control System (FCS) market has undergone transformative changes, propelled by technological advancements, increased air travel demand, and the ever-growing complexity of modern aircraft. As a critical component of aviation, the FCS plays a pivotal role in ensuring the safety, stability, and maneuverability of aircraft. This comprehensive system encompasses a range of components, including control surfaces, sensors, computers, and actuators, working in harmony to manage the aircraft's attitude, altitude, and direction. The evolution of the Aircraft FCS market reflects a dynamic landscape with continuous innovations, market consolidation, and a growing emphasis on automation and fly-by-wire technologies.

One of the key drivers behind the growth of the global Aircraft FCS market is the surge in air travel demand, driven by factors such as economic growth, increasing disposable income, and globalization. As airlines seek to expand their fleets and replace aging aircraft, there is a corresponding need for advanced flight control systems that can meet the operational demands of modern aviation. Additionally, the rise of low-cost carriers and the emergence of new players in the aviation industry have further fueled the demand for efficient and cost-effective FCS solutions.

The integration of advanced technologies, particularly fly-by-wire systems, has been a defining trend in the Aircraft FCS market. Fly-by-wire technology replaces traditional mechanical linkages with electronic systems, allowing for more precise and adaptable control of the aircraft. This innovation enhances safety, reduces weight, and opens up possibilities for automated flight control features. Major aircraft manufacturers, such as Airbus and Boeing, have embraced fly-by-wire technology in their latest aircraft models, driving the adoption of advanced FCS solutions across the industry. Military applications also significantly contribute to the growth of the Aircraft FCS market. Military aircraft demand robust and versatile flight control systems to meet the demands of complex missions, including combat, reconnaissance, and strategic transport. The integration of advanced avionics, sensor fusion, and artificial intelligence in military FCS further underscores the technological advancements in this sector. Countries around the world are investing in modernizing their military fleets, driving the development and adoption of sophisticated FCS solutions.

The competitive landscape of the global Aircraft FCS market is marked by the presence of established players, including Honeywell International Inc., Safran SA, and Moog Inc., among others. These companies continually invest in research and development to stay at the forefront of innovation. Collaborations with aircraft manufacturers, government agencies, and research institutions are common strategies to drive technological advancements and expand market reach. Additionally, mergers and acquisitions are prevalent in the industry, leading to the consolidation of key players and the creation of synergies to offer comprehensive FCS solutions.

Challenges facing the Aircraft FCS market include the increasing complexity of aircraft systems and the need for continuous upgrades to meet evolving safety and regulatory standards. The certification process for new FCS technologies is rigorous, requiring adherence to stringent safety and reliability criteria. This poses challenges for both manufacturers and operators, as they navigate the complex landscape of regulatory compliance. Moreover, the integration of artificial intelligence and autonomous systems in flight control introduces ethical and safety considerations that demand careful evaluation and consensus within the industry.

As the Aircraft FCS market continues to evolve, sustainability and environmental considerations are becoming increasingly important. Aircraft manufacturers and operators are under pressure to reduce fuel consumption and emissions, driving the development of more fuel-efficient and environmentally friendly FCS solutions. The integration of lightweight materials, aerodynamic improvements, and energy-efficient actuators are some of the strategies employed to enhance the ecological footprint of aircraft and their flight control systems.

Looking ahead, the future of the global Aircraft FCS market holds exciting prospects with the emergence of next-generation technologies. The advent of electric and hybrid propulsion systems, coupled with advancements in materials and manufacturing techniques, is expected to influence the design and functionality of FCS components. The integration of artificial intelligence and machine learning in FCS will further enhance system performance, predictive maintenance capabilities, and adaptive control responses.

Major companies operating in Global Aircraft Flight Control System Market are:

Honeywell International Inc.

Moog

Collins Aerospace

Parker Hannifin

Safran

BAE Systems

Leonardo SpA

Thales Group

Lockheed Martin Corporation

The Boeing Company.

Download Free Sample Report https://www.techsciresearch.com/sample-report.aspx?cid=22487

Customers can also request for 10% free customization on this report.

“The Global Aircraft Flight Control System (FCS) market is experiencing dynamic growth, driven by rising air travel demand, technological advancements, and a shift toward fly-by-wire technology. Key players, including Honeywell and Safran, lead innovation in this competitive landscape, investing in research and development to meet the evolving needs of modern aviation. Fly-by-wire systems, offering precise control and automation, are increasingly prevalent, especially in the latest aircraft models from major manufacturers.

Military applications also contribute significantly to market expansion, emphasizing the need for robust and advanced FCS solutions. Challenges such as regulatory compliance and environmental sustainability are shaping the industry's future, driving continuous evolution and collaboration within the Aircraft FCS market.” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“Aircraft Flight Control System Market –Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Primary Control Surfaces System and Secondary Control Surfaces System), By Component Type (Control Surfaces, Actuators, Flight Control Surface Mechanism, Sensors, Cockpit Control, Others), By Platform (Commercial Aircraft, Military Aircraft, Business Jets, General Aviation Aircraft), By Region,Competition, 2018-2028”, has evaluated the future growth potential of Global Aircraft Flight Control System Market and provides statistics & information on market size, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in Global Aircraft Flight Control System Market.

Contact

TechSci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

Tel: +13322586602

Email: [email protected]

Website: www.techsciresearch.com

#Aircraft Flight Control System Market#Aircraft Flight Control System Market Size#Aircraft Flight Control System Market Share#Aircraft Flight Control System Market Trends#Aircraft Flight Control System Market Growth

0 notes

Text

Hi, I'm Osaka

I'm a hobbyist designer, and I research esoteric concepts on the periphery of mecha to find new views nobody else is writing about. I also am obsesed with trying to push the genre forwards.

I also took up programming to build a game faster than ACFA, more airborne than Ace Combat, and more "art of the blade" than Zone of the Enders 2 by studying mecha games through the lens of published declassified military grade airwar and psywar human factors engineering and psychology concepts.

I want to make this game about mechposting and the trans experience, but I need your help: not money, but to speak with you about mecha.

The writing is simultaniously equal parts thesis to microfic a lot of the time, so your milage may vary.

Scroll through the mess below and find what suits you best.

Please.

Mecha Theory Writing

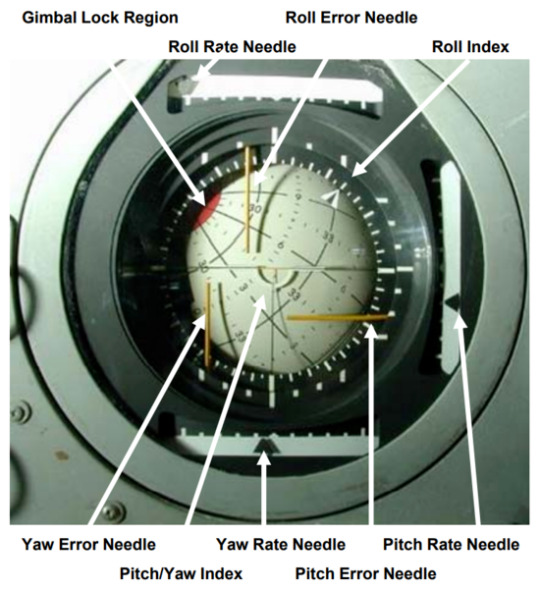

A comprehensive explanation of the evolutionary path from conventional ground and air vehicles, including a comprehensive outline of a functioning control-design based on the inceptor/software model seen in unmanned drones and 5th gen aircraft, complete with explanations.

The evolution of the walking thing called “mecha" (original)

Chapter 0: Establishing terminology & Concepts Part 1: Defining "the mechaness" of something: the 8 principles of mecha Part 2: Feisability: Mecha aren't realistic, but not for the reason you think

Chapter 1: How does "mecha" come into existence/why would you want one? Part 1: An evolution from ground vehicles of today Part 2: Skating, to walking, to running, to flight Part 3: “Why transform in the vacuum of space?”

Chapter 2: Cockpit & Software Design Control Theory Part 4: On Mecha Control Theory: Considerations Part 4a: On Mecha Control Theory II: OKAWARA Part 4b: On Mecha Control Theory III: TOMINO Part 4c: On Mecha Control Theory III: NAGANO

The World of Armored Core

An exploration of the world of Armored Core, using research into real phenomenon and engineering systems to infer how the world may itself function

Kojima particle physics (part 1): What are they? Kojima particle physics (part 2): The Human Consequences NEXT cockpit design (part 1): AMS and Lynx NEXT Cockpit Design (Part 2): G-force Tolerance Technocrat is SpaceX, and the legacy of Musk’s father (lmao) I am a 4th gen douchebag, and I love it (love-letter to ACFA) 4th gen shitpost: white gopnik

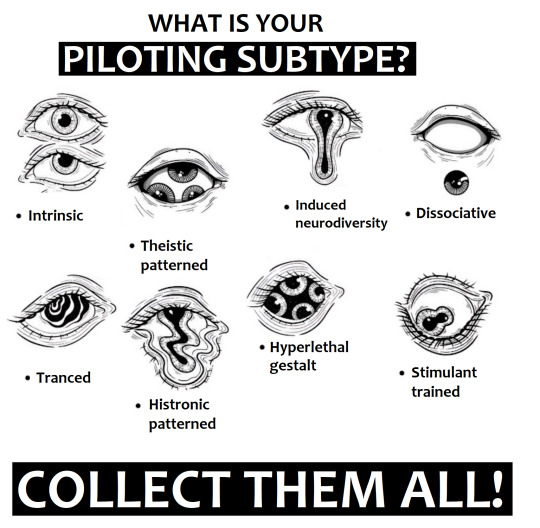

How To Domesticate Your Pilot

A husbandry guide for handlers, consisting of opinions and thoughts from various trainers and operators, as well as pilots. Includes practices, procedures, articles, stories and snippets.

I'm currently testing the waters with snippets and will likely be posting it out of order. I am extremely hungry for any and all possible feedback

If anybody knows the original source of the image of the eyes (which I first saw in a youtube ad) I'd love to know. I very much would like to commission them.

Inspired by mechposting

Chapter 3: Do not Abuse Your Wolves (Psychological patterning) Part 1: Action patterning (Initial Phases) Part 2: Action Patterning (Risks) Part 3: Once upon a mechanism

On mecha design: My personal thoughts on the assemblies of shape, form in the context of motion, action and function 1. Does anybody else have physical characteristics they find the most appealing? 2. Thoughts on self-altering dynamic form, and proportion designs 3. Shoji Kawamori and Armored Core: designers hallucinate, but do they hallucinate too? 4. Why is Gundam Gquuuuux called Gundam Gquuuuux?

Mechsploitation thoughts

#Mechposting

My personal thoughts on piloting culture, and mechanical design

1. The eroticism of the machine: Megastructures 2. Beyond pilebunker: The Grind-blade and the legacy of Overweapons 3. FLAT/Touchscreens are an act of hate: I will teach you love 4. You do not need to pick between a big hammer or daggers if you are a robot 5. O'Socks combat mix (tw: substance abuse) 6. Team dynamics, addiction, conflicts of interest and marketing 7. Commuication is hard, and mecha feet are cool 8. Morrigan Aensland is mecha and you cannot change my mind 9. re: Last Exile is not dieselpunk; its post-steampunk deleuzian dreams 10. Mecha PMC promotion is back, in pog form 11. Bodies, corporeal schema, and the body language of pilots 12. The blessing of the hounds; main system engaging combat mode 13. Exotic doctrine: Grappling & Booster-fu // torsion, aspect and control 14. Osaka, why do you always want to talk about ACFA? 15. You walk, so they can run

# Miscposting: Immacullate vibe-topia Pilot, for you: Love. Love. The sound of the ideal cockpit Left Hand/Right hand [gone]-- Mechposting vibes soundwall 🇸🇮🇨🇰🇧🇪🇦🇹🇸 🇹🇴 🇸🇪🇪🇰 🇦🇳🇩 🇩🇪🇸🇹🇷🇴🇾 🇹🇴: A #mechposting playlist [ongoing] Cicatrix: A writing playlist Sounds for violence: Mecha games vs FPS games

# Pilotcore: Dress & attire 1. Attire concept (includes #mechposting patch list) 2. Crew attire for things other than piloting a giant robot 3. Singleton over-jacket 4. Radios, straps and whips 5. Wearable keyboard for pilots 6. What color should a flight-suit be? (#AskOsaka from @siveine)

The Learning Tree

Reading this will help you grow as a person, or ask questions

"I experience depression as a failure of resource allocation systems" Adult social skills 101, because the world broke our ability to understand eachother Mental health: Things I wish I knew in my teens, my 20's or even my early 30's Sex-positivity, associations, critical thinking & deradicalization Crossing the hrt libido event horizon without libido heat-death by making biscuits Fool!: Your nostalgia isn't real: Your past has been stolen from you! Why Linux diehards are morons, and so is everybody else too On the ecology of slurs and the evolution of language Individualism can mean many things. The three fetishes of the human condition The real meaning of "you will not be an anime girl, you'll be your mom"

Nothing, but content for contented malcontents

Insightful, but stupid.

The collapse of the anime ecology's biodiversity Cycles of Nostalgia: Nobody is going to be nostalgic for Corporate Memphis Europe doesn't teach the Odyssey: Americentricism's fetishism is already its downfall Feeling used: The eternal disappointment of the Sawano Drop Lame? Bitch please: Clubbing deserves to go extinct every pmdd transmasc is that badass hot painting of satan crying The reviewer made a major error The Maid's Paradox Bread real

The horrors

Robo ComBAT: Cactus Jaque (original)

The Fear

Concerning plunges into the ne plus ultra culture of tomorrow

Humbert complex: When people prefer what they imagine to what's really there White Diamond, fascism, projection, ego, how Steven Universe botched its end. Sandwich names: the internet sucks now and smartphones are to blame! Gatekeeping is weird and knowledge-checks are arbitrary nonsense "The internet feels gross now", a trajectory of human events Providing feedback is also a skill and not everybody has it. AI isn't evil but it does embolden the worst people economics is just twitter brain for worth Do you?

My actual projects:

Art (I'm kind of private about my output and don't post often, sorry)

Pixelart: A very silly computer design that makes me smile idk

Games:

Project Force: 6dof aerodynamic high speed robot action [ongoing] Inspired by Armored Core For Answer, Freespace 2, Zone of the Enders 2 & Ace Combat 3, this game aims to merge their elements into a high speed mech sim.

e: yeesh this pinned post is getting kinda huge, I should break it into sub-pages or something so nobody can ever see any of it lol

78 notes

·

View notes

Text

Apropos nothing... Everyone always talking about quantum computing and quantum information as the big second-generation* quantum-tech applications. (Someday I will get into what I think about quantum computing.) But there's a whole world of quantum sensing out there that's way more successful, starting with atomic clocks, which are already an established second-gen quantum technology.

Here's a recent result in quantum sensing:

* First-generation quantum tech is things that rely on the quantum nature of materials. The whole semi-conductor industry, and lasers, are the primary examples. Second-generation quantum tech is technology that relies on quantum control: the active building and control of quantum systems. By far the earliest example, and the most commercially advanced, is quantum clocks. But there are other types of quantum sensors on the market (mainly quantum magnetometers).

#quantum sensing#quantum technology#there are a couple secondary articles on this that are way flashier than this one that are much easier to stumble across#but they all link back to this and I assume this is the most accurate

9 notes

·

View notes

Text

Turkish defense company tests high-tech EFSA radar that improves the country's combat aircraft

MURAD AESA radar of the Turkish ASELSAN completes inaugural flight with F-16 OZGUR warplane

Fernando Valduga By Fernando Valduga 03/28/2024 - 09:00 in Military

Turkey recently tested the nationally developed AESA radar, ASELSAN's MURAD, which recently conducted its first flight with an F-16 ÖZGÜR warplane.

“ASELSAN's AESA National Aircraft Nose Radar made its first flight with the F-16 ÖZGÜR platform. It will provide great capacity gains to our aircraft with simultaneous air-to-air and air-to-ground missions, detection/tracking of multiple targets, missile orientation beyond visual range, high-resolution ground images and electronic warfare functions,” the company confirmed in a social media post.

— ASELSAN (@aselsan) March 26, 2024

This demonstration provided data for additional testing and development of the radar system.

Future plans for MURAD include continuous testing and integration on various platforms, such as Bayraktar AKINCI TIHA, as well as other aerial platforms such as KIZILELMA, KAAN, HÜRJET, ANKA III, AKINCI and F-16.

According to the President of the Presidential Defense Industry, Prof. Haluk GÖRGÜN, the integration of the AESA radar will align the F-16 ÖZGÜR with the standards of generation 4.5 aircraft. In addition, radar integration could improve the capabilities of other platforms such as KAAN and combat UAVs, providing them with additional functionality and low visibility features.

Aselsan CEO Ahmet Akyol highlighted the versatility of AESA technology, emphasizing its application in various domains, including air, land and sea.

He noted that the internal development of Aselsan's EASA radar systems allows Turkey to maintain full control over technology and data, ensuring the highest level of security and capabilities.

The size of the global market for the combat aircraft equipped with AESA radar is estimated at $5 billion annually, with ongoing export negotiations positioning Aselsan radars as key actors in the global aerospace market.

The ÖZGÜR Project aims to modernize F-16 Block 30 warplanes with domestic avionics and software, including the AESA National Radar. This initiative is expected to align the capabilities of the F-16 ÖZGÜR aircraft with those of the F-16 Block 70 fighters, ensuring uniformity and effectiveness throughout the fleet.

The main functions and capabilities of the EFSA National Radar include long-range search, multiple target tracking, detection and tracking of terrestrial targets, weather detection, automatic target detection and electronic attack.

Tags: ASELSANMilitary AviationF-16 Fighting FalconAESA radarsTAF - Turkish Air Force / Turkish Air Force

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

MILITARY

Australian subsidiary of Boeing will establish production site of MQ-28 'Ghost Bat' drones in Queensland

28/03/2024 - 07:57

HISTORY

30 years after its inaugural flight, the Eurofighter is more important than ever

27/03/2024 - 21:54

MILITARY

Japan eases military restrictions to allow export of future fighters

27/03/2024 - 19:36

BRAZILIAN AIR FORCE

VIDEO: Meet Captain Jeciane, the first woman to fly the KC-390 Millennium aircraft

27/03/2024 - 19:17

MILITARY

NATO allies strengthen cooperation in military aviation training in Europe

27/03/2024 - 16:00

HELICOPTERS

Delivery of the first U.S. Army's first CH-47F Block II production helicopter is near

27/03/2024 - 15:00

2 notes

·

View notes

Text

Events 11.17 (after 1950)

1950 – Lhamo Dondrub is officially named the 14th Dalai Lama. 1950 – United Nations Security Council Resolution 89 relating to the Palestine Question is adopted. 1953 – The remaining human inhabitants of the Blasket Islands, Kerry, Ireland, are evacuated to the mainland. 1957 – Vickers Viscount G-AOHP of British European Airways crashes at Ballerup after the failure of three engines on approach to Copenhagen Airport. The cause is a malfunction of the anti-icing system on the aircraft. There are no fatalities. 1962 – President John F. Kennedy dedicates Washington Dulles International Airport, serving the Washington, D.C., region. 1967 – Vietnam War: Acting on optimistic reports that he had been given on November 13, U.S. President Lyndon B. Johnson tells the nation that, while much remained to be done, "We are inflicting greater losses than we're taking…We are making progress." 1968 – British European Airways introduces the BAC One-Eleven into commercial service. 1968 – Viewers of the Raiders–Jets football game in the eastern United States are denied the opportunity to watch its exciting finish when NBC broadcasts Heidi instead, prompting changes to sports broadcasting in the U.S. 1969 – Cold War: Negotiators from the Soviet Union and the United States meet in Helsinki, Finland to begin SALT I negotiations aimed at limiting the number of strategic weapons on both sides. 1970 – Vietnam War: Lieutenant William Calley goes on trial for the My Lai Massacre. 1970 – Luna programme: The Soviet Union lands Lunokhod 1 on Mare Imbrium (Sea of Rains) on the Moon. This is the first roving remote-controlled robot to land on another world and is released by the orbiting Luna 17 spacecraft. 1973 – Watergate scandal: In Orlando, Florida, U.S. President Richard Nixon tells 400 Associated Press managing editors "I am not a crook." 1973 – The Athens Polytechnic uprising against the military regime ends in a bloodshed in the Greek capital. 1983 – The Zapatista Army of National Liberation is founded in Mexico. 1986 – The flight crew of Japan Airlines Flight 1628 are involved in a UFO sighting incident while flying over Alaska. 1989 – Cold War: Velvet Revolution begins: In Czechoslovakia, a student demonstration in Prague is quelled by riot police. This sparks an uprising aimed at overthrowing the communist government (it succeeds on December 29). 1990 – Fugendake, part of the Mount Unzen volcanic complex, Nagasaki Prefecture, Japan, becomes active again and erupts. 1993 – United States House of Representatives passes a resolution to establish the North American Free Trade Agreement. 1993 – In Nigeria, General Sani Abacha ousts the government of Ernest Shonekan in a military coup. 1997 – In Luxor, Egypt, 62 people are killed by six Islamic militants outside the Temple of Hatshepsut, known as Luxor massacre. 2000 – A catastrophic landslide in Log pod Mangartom, Slovenia, kills seven, and causes millions of SIT of damage. It is one of the worst catastrophes in Slovenia in the past 100 years. 2000 – Alberto Fujimori is removed from office as president of Peru. 2003 – Actor Arnold Schwarzenegger’s tenure as the governor of California began. 2012 – At least 50 schoolchildren are killed in an accident at a railway crossing near Manfalut, Egypt. 2013 – Fifty people are killed when Tatarstan Airlines Flight 363 crashes at Kazan Airport, Russia. 2013 – A rare late-season tornado outbreak strikes the Midwest. Illinois and Indiana are most affected with tornado reports as far north as lower Michigan. In all around six dozen tornadoes touch down in approximately an 11-hour time period, including seven EF3 and two EF4 tornadoes. 2019 – The first known case of COVID-19 is traced to a 55-year-old man who had visited a market in Wuhan, Hubei Province, China.

2 notes

·

View notes

Text

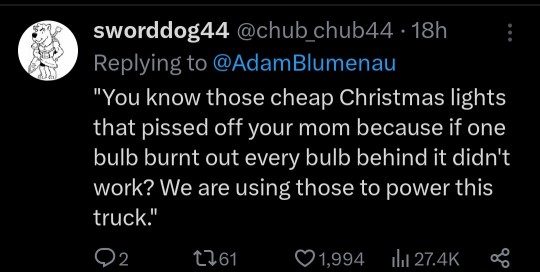

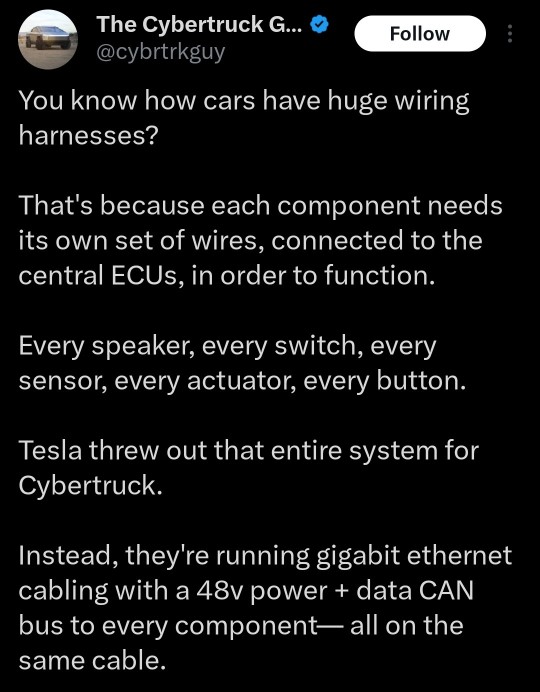

I was referencing the things put forth by OP, in order:

Huge wiring harnesses simplified: Cybertruck Guy and Radmad are both wrong, for different reasons.

Current industry standards don't have separate wires for each individual switch or control, either. They group several switches, lights, etc. that are nearby together, run them into a microcontroller, and put that controller on a vehicle bus. Currently that's usually a CAN (redundant, fault-tolerant) or LIN (neither, but much simpler) bus. This drastically simplifies wiring harnesses.

The main thing Tesla has done is change the DC voltage for that bus from 12 V to 48 V nominal. Since power is voltage times current, and wire thickness is dependent on current, this cuts about half the copper mass out of the power lines in the harness. The other (data) lines were already using smaller wires. The industry has been flirting with a 48V bus for around two decades by now; Tesla just went and did it and dealt with the engineering problems when they popped up. And this is a rare case where "they're a bunch of Silicon Valley nerds" may have helped: datacenters have been using 48V DC for in-rack power delivery for decades, so they had more familiarity with it than Detroit.

They've also adopted single-pair Ethernet (1000base-T1) for the high-speed entertainment data links. This technology has been in the industry since late 2016. It's usually integrated directly onto the custom ICs in ECUs. I remember another thread like this with a tweet where someone was complaining about the fragility of RJ-45 plugs and how that's disqualifying for a vehicle, and he's right, but single-pair Ethernet does not use those jacks; it's integrated into wiring harnesses with everything else.

Astronauts laded on the moon with altitude markers hand etched on the window: That was a backup system dramatized by the Apollo 13 movie. They had an inertial navigation system, like aircraft do, as their primary navigation.

Oh, and it's attitude, not altitude. Very different concepts that folks should not mix up.

Can't get a rocket off the pad without blowing up: Neither could NASA their first few years. Meanwhile SpaceX had 98 successful orbital flights last year, and they can reuse their boosters (the record is 18 times). But that's way off topic.

Tesla Model Y broke: It's not news when non-Teslas lose power steering, apparently. And I've had cars that took many more than three appointments to fix. We can throw around anecdata all day.

Series wiring like Christmas lights: Come on, you've got no basis for that.

It's like the Titan sub: Sigh. Really?

Okay, now to the RDN link:

the vehicle’s angular design and stainless steel body could pose danger to other road users

Absolutely true. Also true of almost every luxury pickup truck on the market. One example:

I'm all for figuring out some kind of regulatory regime to rein this in. Or maybe a modification of liability rules and increased insurance coverage minimums.

“The big problem there is if they really make the skin of the vehicle very stiff by using thick stainless steel, then when people hit their heads on it, it’s going to cause more damage to them,”

True, but it's not that thick or stiff; the speaker was speculating. Other have pointed out that "we shot it with a Tommy gun" is a lousy test because the bullets are rather low velocity. If you watch the side impact crash test, you can see the side panels visibly flexing.

And right after that, an IIHS rep said, “IIHS hasn’t evaluated the Cybertruck. The discussions we’ve seen so far appear to be based on speculation. I would add that our experience with Tesla is that they aim for the highest safety ratings in IIHS tests. We have no reason to expect anything different with the Cybertruck.”

The biggest problem with Teslas, from insurance companies' perspectives, has been that airbag-deployed collisions tend to result in totaling the vehicle more often than in other cars. Occupant safety, on the other hand, seems to be better than average. We've seen people walk away from their Model 3s after they got T-boned by speeding pickups (60-ish MPH in a 30 zone). We know this from accident reconstruction and camera data.

There's a linked video in the article comparing the Tesla Cybertruck collision to a Dodge Ram 1500. There are several others like it on YouTube (I saw one that had six trucks in it, all synced up). They all have the same flaw: they're comparing different crash types. The Cybertruck is doing a full frontal crash, where you drive the vehicle into a solid, immovable wall, while the others are moderate overlap crashes, where the hood goes over the obstacle and only the left 1/3 of the vehicle is obstructed, so the engine can deflect to the sides instead of going into the firewall and then the passenger compartment. The Cybertruck, of course, does not have a large engine in that space; it's mostly cargo storage. And we can clearly see it crumpling and the front wheel moving outward instead of back into the passenger compartment, like practically all cars do now.

(Some folks like to point out how the rear wheel breaks away, too: this is expected because it's a steering wheel, since the Cybertruck has four-wheel steering, and uses the same suspension technology as the front, instead of connecting the rear wheels more directly to the rear axle like most vehicles. Not completely directly, though, like the Chevy Corvair's swing axles. In any case, kinetic energy breaking the rear wheels off like that is energy that isn't compromising the cabin.)

The article addresses the "lack" of crumple zones:

Samer Hamdar, a George Washington University auto safety professor, told Reuters that while a lack of crumple zones concerned him, there could be other factors that accounted for it. “There might be a possibility of shock-absorbent mechanism that will limit the fact that you have a limited crumple zone,” Hamdar said.

I'm not going to speculate about crumple zones beyond the above ("the cargo area collapses, taking some energy with it; we have to see if that's enough to call a crumple zone, but it's not nothing") until someone tears one down and documents it. But crumple zones aren't the only means of keeping kinetic energy out of the passengers.

The rest of the article goes back to concerns about pedestrian safety, which seem to be the main substantive concern, and is noted at the end of this video:

youtube

And again, pedestrian safety is an industry-wide problem. We need another Ralph Nader, but demonizing Tesla alone (god it's so easy, Elon is such an asshole) only gives cover to the rest of the industry. And none of the tweets in OP's post spoke of this.

41K notes

·

View notes

Text

Clear Skies Ahead: Aerospace Filters Market to Expand to $6.4B by 2033 🌍☁️

Aerospace Filters Market is projected to grow from $3.5 billion in 2023 to $6.4 billion by 2033, with a CAGR of 5.5%. As aviation technology advances, the demand for high-performance filtration systems continues to rise, ensuring aircraft efficiency, safety, and durability.

To Request Sample Report: https://www.globalinsightservices.com/request-sample/?id=GIS25924 &utm_source=SnehaPatil&utm_medium=Article

🔍 Why Aerospace Filters Matter? Aerospace filters play a crucial role in maintaining optimal performance across commercial, military, and private aircraft. These components help: ✅ Enhance Fuel Efficiency — Preventing contaminants from affecting fuel systems, ensuring smooth engine operation. ✅ Improve Air Quality — Cabin air filters eliminate pollutants, allergens, and bacteria, providing a safe & comfortable environment for passengers. ✅ Extend Component Life — Hydraulic and oil filters prevent wear & tear in aircraft engines and mechanical systems. ✅ Ensure Flight Safety — Avionics filters protect electronic systems from electromagnetic interference (EMI), preventing malfunctions.

🔧 Key Aerospace Filter Types 🔹 Fuel Filters — Ensure clean fuel flow, preventing engine failure & inefficiency. 🔹 Oil Filters — Remove contaminants from lubrication systems, enhancing engine longevity. 🔹 Hydraulic Filters — Maintain fluid purity in landing gear, brakes, and control systems. 🔹 Cabin Air Filters — Improve passenger experience by ensuring clean, breathable air. 🔹 Avionics Filters — Shield electronic systems from electromagnetic interference.

🌍 Market Insights & Regional Growth 📌 North America — Leading due to strong aerospace manufacturing & stringent safety regulations. 📌 Europe — Driven by green aviation initiatives & advanced aircraft production. 📌 Asia-Pacific — Rapid growth fueled by increasing air travel & military investments.

🏆 Key Industry Players Companies like Donaldson Company, Pall Corporation, Safran, and Parker Hannifin are driving innovations in high-efficiency aerospace filtration technologies.

🔮 Future Outlook With the aviation industry focusing on sustainability, performance optimization, and enhanced passenger safety, aerospace filters will play an even bigger role in the future of air travel.

#AerospaceFilters #AviationTechnology #AircraftSafety #FlightEfficiency #AirlineInnovation #HydraulicFilters #FuelEfficiency #CabinAirQuality #DefenseTechnology #MilitaryAircraft #CommercialAviation #Avionics #OilFilters #CleanAirTravel #GreenAviation #AirTravelSafety #FiltrationTechnology #NextGenAircraft #AerospaceIndustry #AviationMaintenance #AircraftComponents #TechInAviation #AerospaceEngineering #SustainableAviation #AviationSolutions

Research Scope:

· Estimates and forecast the overall market size for the total market, across type, application, and region

· Detailed information and key takeaways on qualitative and quantitative trends, dynamics, business framework, competitive landscape, and company profiling

· Identify factors influencing market growth and challenges, opportunities, drivers, and restraints

· Identify factors that could limit company participation in identified international markets to help properly calibrate market share expectations and growth rates

· Trace and evaluate key development strategies like acquisitions, product launches, mergers, collaborations, business expansions, agreements, partnerships, and R&D activities

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

MULTI-FUNCTION DISPLAY MARKET : INNOVATION DRIVING NEXT GENERATION OF DISPLAYS

The Multi-Function Display (MFD) market is rapidly evolving, driven by advancements in display technology and increasing demand across various industries, including aerospace, defense, automotive, and consumer electronics. Multi-function displays consolidate multiple data sources into a single interactive screen, improving efficiency, situational awareness, and user experience. From cockpit displays in aircraft to modern vehicle dashboards and industrial control panels, MFDs are transforming the way information is presented and interacted with.

Market Growth and Trends

The global Multi-Function Display market is projected to experience steady growth, with a compound annual growth rate (CAGR) of around 7% from 2024 to 2030. Key trends contributing to this expansion include:

Increased Adoption in Aerospace and Defense: MFDs are extensively used in military and commercial aircraft to provide pilots with real-time flight data, navigation assistance, and system monitoring. The demand for advanced avionics systems is driving market growth.

Automotive Industry Integration: Modern vehicles are increasingly incorporating MFDs in dashboards, infotainment systems, and heads-up displays (HUDs) to enhance user interaction and safety. The rise of electric and autonomous vehicles is further fueling this trend.

Advancements in Display Technologies: OLED, AMOLED, and touchscreen innovations are making MFDs more versatile, responsive, and energy-efficient, leading to higher adoption rates across industries.

Growing Demand in Consumer Electronics and Industrial Applications: Beyond aerospace and automotive, MFDs are being used in gaming consoles, medical devices, and industrial control systems, expanding their market potential.

Market Challenges

Despite the positive outlook, the Multi-Function Display market faces some challenges:

High Development and Manufacturing Costs: Advanced display technologies require significant investment in research, development, and production, making MFDs costly for some industries.

Cybersecurity and Data Privacy Concerns: As MFDs become more connected, especially in aviation and automotive applications, ensuring security against cyber threats is a critical challenge.

Durability and Environmental Limitations: MFDs used in military, aerospace, and industrial applications must withstand extreme conditions such as high temperatures, humidity, and vibrations, posing challenges in design and durability.

Future Outlook

The future of the Multi-Function Display market looks promising, with technological advancements playing a crucial role in shaping its growth. Key developments include:

Enhanced AI and Machine Learning Integration: AI-driven MFDs will offer predictive analytics, voice recognition, and adaptive display functionalities, improving user interaction.

Expansion of Augmented Reality (AR) and Virtual Reality (VR): AR-based MFDs will become more common in aviation, automotive, and medical sectors, enhancing visualization and decision-making.

Development of Flexible and Transparent Displays: Innovations in flexible and transparent screens will open new possibilities for next-generation multi-function displays in various applications.

Conclusion

The Multi-Function Display market is on a steady growth trajectory, fueled by technological innovations and increasing demand across multiple sectors. While challenges such as high costs and cybersecurity risks persist, ongoing advancements in display technology, AI integration, and AR/VR applications will continue to drive market expansion. Industries that rely on real-time data visualization and enhanced user interaction will increasingly adopt MFDs, making them a key component of modern digital ecosystems.

Read More Insights @ https://www.snsinsider.com/reports/multi-function-display-market-5002

Contact Us:

Akash Anand – Head of Business Development & Strategy

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

0 notes

Text

Aircraft Aileron Market Size, Share and Analysis by 2025-2033

The Reports and Insights, a leading market research company, has recently releases report titled “Aircraft Aileron Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033.” The study provides a detailed analysis of the industry, including the global Aircraft Aileron Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Aircraft Aileron Market?

The global aircraft aileron market was valued at US$ 464.6 Million in 2024 and is expected to register a CAGR of 13.6% over the forecast period and reach US$ 1,470.1 Mn in 2033.

What are Aircraft Aileron?

An aircraft aileron is a hinged flight control surface located on the trailing edge of each wing, typically near the wingtips, used to control the aircraft's roll motion. By moving in opposite directions—one aileron rising while the other lowers—they create differential lift, causing the aircraft to tilt and turn. Ailerons are essential for maintaining lateral stability and executing precise maneuvers during flight. They are controlled by the pilot through the control yoke or stick, often working in conjunction with other control surfaces like the rudder and elevator to ensure smooth and coordinated flight operations.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/2564

What are the growth prospects and trends in the Aircraft Aileron industry?

The aircraft aileron market growth is driven by various factors and trends. The aircraft aileron market is driven by increasing demand for advanced flight control systems in commercial, military, and general aviation sectors. Growing air traffic, fleet expansion, and technological advancements in composite materials for lightweight and durable ailerons are key market drivers. The rise of unmanned aerial vehicles (UAVs) and next-generation aircraft with enhanced maneuverability further contribute to market growth. North America and Europe dominate due to strong aerospace industries, while Asia-Pacific is witnessing rapid growth with rising aircraft production. However, challenges such as high manufacturing costs and stringent regulatory requirements impact market expansion. Hence, all these factors contribute to aircraft aileron market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Type

Conventional Aileron

Frise Aileron

Differential Aileron

Spoiler Aileron

Coupled Ailerons

Others

By Material

Aluminum Alloy

Composite Materials

Steel

Titanium

By Aircraft Type

Commercial

Military

Private

Cargo

By Mechanism

Mechanism Control

Hydraulic Control

Fly-By- Wire Control

North America

United States

Canada

Europe

Germany

United Kingdom

France

Italy

Spain

Russia

Poland

Benelux

Nordic

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

Saudi Arabia

South Africa

United Arab Emirates

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Boeing

Lockheed Martin

Raytheon Technologies

General Dynamics

Bombardier Aerospace

L3Harris Technologies, Inc.

Embraer

Saab Group

Mitsubishi Aircraft Corporation

Antonov

Korea Aerospace Industries

Asian Composites Manufacturing (ACM)

View Full Report: https://www.reportsandinsights.com/report/Aircraft Aileron-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

0 notes

Text

Aircraft Wire and Cable Market: Trends, Drivers, and Future Growth

The aviation industry is undergoing a transformative shift driven by the twin forces of digitalization and electrification. These trends are not only enhancing operational efficiency but are also redefining the design and functionality of modern aircraft. Central to this transformation is the Aircraft Wire and Cable Market, which is witnessing substantial growth due to the increasing demand for advanced wiring solutions in aviation systems.

Aircraft wire and cable systems are critical components that facilitate data transmission, power distribution, and communication within an aircraft. From flight control systems to in-flight entertainment, these components are essential for seamless operation in both commercial and military aviation. The rapid adoption of digitalized and electrified systems is driving the demand for high-performance wire and cable solutions, making this market a cornerstone of aviation innovation.

The Impact of Digitalization on the Aircraft Wire and Cable Market

Digitalization has emerged as a key driver of growth in the Aircraft Wire and Cable Market. With advancements in avionics, navigation, and communication systems, modern aircraft rely on sophisticated wiring architectures to handle the increasing complexity of onboard systems.

The integration of digital technologies, such as advanced sensors, data processing units, and real-time communication systems, requires wires and cables capable of transmitting large volumes of data with minimal latency. High-speed data cables, optical fibers, and shielded wires are in high demand to support the seamless operation of these systems.

Digitalization is also driving the need for modular wiring designs that can be easily upgraded or reconfigured to accommodate technological advancements. This trend is particularly evident in commercial aviation, where airlines are constantly seeking to enhance passenger experiences through cutting-edge in-flight entertainment and connectivity systems.

Moreover, digitalization is revolutionizing aircraft maintenance and monitoring processes. With the adoption of predictive maintenance systems and digital twins, aircraft are equipped with advanced wiring systems that enable real-time data collection and analysis. This shift not only reduces downtime but also enhances the safety and reliability of aircraft operations.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=105042386

The Role of Electrification in Shaping the Aircraft Wire and Cable Market

Electrification is another major trend reshaping the aviation industry. As the focus on sustainable aviation intensifies, the adoption of electric and hybrid-electric aircraft is gaining traction. Electrification requires robust wire and cable systems capable of managing high-voltage power distribution while maintaining safety and efficiency.

Electric propulsion systems, which are at the core of electrified aircraft, rely heavily on advanced wiring solutions to transmit power from batteries to motors. These systems demand lightweight yet durable wires and cables that can withstand high electrical loads without compromising performance.

In addition to propulsion, electrification is influencing other aircraft systems, such as environmental control, de-icing, and braking. Electrically driven subsystems are replacing traditional hydraulic and pneumatic systems, leading to an increased demand for specialized wires and cables.

The transition toward more-electric aircraft (MEA) and all-electric aircraft (AEA) is driving innovation in wire and cable materials and designs. Lightweight materials, such as aluminum alloys and advanced composites, are being used to reduce the overall weight of wiring systems, thereby improving fuel efficiency and reducing emissions.

Challenges in the Aircraft Wire and Cable Market

While digitalization and electrification present significant growth opportunities, the Aircraft Wire and Cable Market also faces challenges. One of the primary challenges is the complexity of integrating advanced wiring systems into existing aircraft designs. Retrofitting older aircraft with modern wiring systems requires careful planning and significant investment.

Another challenge is the need for wires and cables that meet stringent safety and performance standards. The aviation industry demands materials that are highly resistant to extreme temperatures, electromagnetic interference, and mechanical stress. Ensuring compliance with these standards while maintaining cost-effectiveness is a critical hurdle for manufacturers.

Furthermore, the growing complexity of aircraft wiring architectures has led to increased weight and space constraints. Addressing these issues requires innovative solutions, such as miniaturized wires, multiplexing technologies, and wireless systems, which can reduce the wiring footprint without compromising functionality.

Opportunities for Growth in the Aircraft Wire and Cable Market

Despite these challenges, the Aircraft Wire and Cable Market presents numerous opportunities for growth. The rising demand for lightweight materials and compact designs is driving innovation in wire and cable manufacturing. Advanced materials, such as high-strength alloys, carbon nanomaterials, and self-healing polymers, are being explored to enhance the durability and performance of wiring systems.

Government and industry initiatives to promote sustainable aviation are also creating opportunities for the market. The electrification of aircraft systems aligns with global efforts to reduce carbon emissions, making it a priority for governments and regulatory bodies. Incentives for the development of electric and hybrid-electric aircraft are encouraging investments in advanced wire and cable technologies.

Emerging markets in Asia-Pacific and the Middle East are witnessing rapid growth in aviation activity, driven by rising air travel demand and expanding airline fleets. These regions offer untapped potential for the Aircraft Wire and Cable Market, particularly in the commercial aviation segment.

Moreover, advancements in automation and digital manufacturing are streamlining the production of wires and cables, enabling manufacturers to meet the growing demand while maintaining quality and cost efficiency.

Competitive Landscape

The Aircraft Wire and Cable Market is highly competitive, with several key players driving innovation and market expansion. Companies are focusing on strategic partnerships, mergers, and acquisitions to strengthen their market presence and enhance their product portfolios.

Investments in research and development are at the forefront of market competition, with manufacturers exploring new materials, designs, and manufacturing techniques to cater to evolving customer requirements. Collaborations with aircraft manufacturers and system integrators are also enabling wire and cable companies to develop customized solutions that address specific needs.

Ask for Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=105042386

Future Outlook

The Aircraft Wire and Cable Market is poised for significant growth as digitalization and electrification continue to transform the aviation industry. Advanced wiring solutions will play a crucial role in enabling the integration of next-generation technologies, from autonomous flight systems to fully electric aircraft.

As the industry moves toward a more connected and sustainable future, the demand for lightweight, high-performance wires and cables will only intensify. By addressing challenges related to integration, compliance, and complexity, the market can unlock new opportunities and drive the next phase of aviation innovation.

The Aircraft Wire and Cable Market stands at the forefront of aviation's digital and electric transformation. With its critical role in enabling advanced systems and sustainable operations, the market is set to play a pivotal role in shaping the future of air travel.

As manufacturers continue to innovate and adapt to the demands of a rapidly evolving industry, the Aircraft Wire and Cable Market will remain a cornerstone of aviation's journey toward enhanced efficiency, connectivity, and sustainability.

#aircraft wire and cable market#aviation wiring systems#aircraft electrification#aircraft digitalization#wire and cable trends aviation

0 notes

Text

The Aircraft Flight Control System Market is projected to grow from USD 17550 million in 2024 to an estimated USD 33706.6 million by 2032, with a compound annual growth rate (CAGR) of 8.5% from 2024 to 2032.The aircraft flight control system (FCS) market has seen remarkable growth in recent years, driven by advancements in technology, the increasing demand for air travel, and the expanding role of unmanned aerial vehicles (UAVs). This article delves into the dynamics of the market, exploring key trends, drivers, challenges, and the future outlook.Flight control systems are essential for the safe and efficient operation of aircraft. They ensure stability, manage aerodynamic forces, and provide pilots with the ability to maneuver the aircraft. Modern FCS incorporates advanced technologies such as fly-by-wire systems, autopilots, and automated flight control, enhancing safety and performance. These systems are deployed across various types of aircraft, including commercial, military, and UAVs.

Browse the full report at https://www.credenceresearch.com/report/aircraft-flight-control-system-market

Key Market Trends

Technological Advancements

The adoption of fly-by-wire systems, which replace traditional mechanical controls with electronic systems, has revolutionized the market. These systems are lighter, more reliable, and provide enhanced control precision.

Integration of Artificial Intelligence (AI) and machine learning (ML) in autopilot and automated flight systems is another significant trend. AI-driven systems enable predictive maintenance and adaptive flight operations.

Growing Demand for UAVs

The proliferation of drones for military, commercial, and recreational purposes has significantly boosted the demand for advanced flight control systems. UAVs rely heavily on sophisticated FCS to ensure precision and stability in operations.

Focus on Sustainability

Airlines and manufacturers are increasingly prioritizing eco-friendly designs. Lightweight FCS components reduce overall aircraft weight, leading to improved fuel efficiency and reduced emissions.

Market Drivers

Increase in Air Travel

The rise in disposable incomes and globalization has led to an upsurge in air travel. Consequently, the demand for new aircraft with state-of-the-art flight control systems has grown.

Defense Modernization Programs

Governments worldwide are investing in advanced military aircraft and UAVs, further driving the market for sophisticated flight control technologies.

Focus on Safety

Enhanced safety regulations and the need to minimize human error in flight operations are pushing manufacturers to develop more reliable and automated flight control solutions.

Challenges in the Market

High Development Costs

Developing advanced FCS requires significant investment in research, development, and testing. These costs can pose a barrier, particularly for smaller manufacturers.

Regulatory Compliance

Adhering to stringent aviation safety standards and certification requirements can be a complex and time-consuming process for FCS manufacturers.

Cybersecurity Concerns

The increasing reliance on digital and automated systems makes FCS vulnerable to cyber threats. Ensuring robust cybersecurity measures is a critical challenge for the industry.

Future Outlook

The global aircraft flight control system market is poised for robust growth in the coming years. The increasing adoption of electric and hybrid-electric aircraft, coupled with advancements in automation and AI, will redefine the landscape of flight control systems. Additionally, the rising demand for UAVs across various industries, including logistics, agriculture, and surveillance, will continue to propel market expansion.

As manufacturers address challenges such as cost and cybersecurity, the focus will remain on innovation, safety, and sustainability. The integration of cutting-edge technologies and adherence to evolving regulatory standards will be pivotal in shaping the future of this dynamic market.

Key Player Analysis:

Airbus SAS (France)

BAE Systems (U.K.)

Collins Aerospace (U.S.)

Honeywell International Inc. (U.S.)

Leonardo SpA (Italy)

Lockheed Martin Corporation (U.S.)

Moog (U.S.)

Parker Hannifin (U.S.)

Safran (France)

Thales Group (France)

The Boeing Company (U.S.)

Segmentation:

By Component

Flight Control Computers

Cockpit Control

Sensors

Others

By Fit

Linefit

Retrofit

By Technology

Fly-By-Wire

Digital Fly-By-Wire

Hydro-Mechanical

Power Fly-By-Wire

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

By Aircraft Type

Fixed-wing

Rotary-wing

By Region

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/aircraft-flight-control-system-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

SpaceX's Starship Grounded After Test Flight Explosion

SpaceX's Starship Grounded After Test Flight Explosion The U.S. has grounded SpaceX's Starship rocket following a dramatic explosion during its latest test flight. The upper stage of the rocket disintegrated over the Caribbean after launching from Texas on Thursday, prompting airlines to alter flight paths to avoid falling debris. Fortunately, there were no reports of injuries. Investigation Underway The Federal Aviation Administration (FAA) is collaborating with SpaceX and other authorities to investigate the incident, particularly reports of damage to public property in the Turks and Caicos Islands. As part of the investigation, the FAA has mandated a "mishap" inquiry to assess the situation before determining whether Starship can return to flight. The agency activated a "debris response area" to manage air traffic, temporarily slowing or halting aircraft outside the affected zone. Some planes requested to divert due to low fuel levels while awaiting clearance. Details of the Launch Starship is the largest and most powerful rocket ever built, pivotal to Elon Musk's vision of colonizing Mars. The uncrewed launch was Starship's seventh test mission and the first featuring a taller, upgraded upper stage, which is two meters (6.56 ft) taller than earlier versions. The rocket lifted off at 17:38 EST (22:38 GMT) and successfully separated from its Super Heavy booster nearly four minutes into flight. However, shortly thereafter, SpaceX reported that mission control had lost contact with the upper stage. While the Super Heavy booster returned to the launchpad as planned, the upper stage experienced what SpaceX described as "rapid unscheduled disassembly." Musk later indicated that preliminary findings suggested the explosion was related to an "oxygen/fuel leak in the cavity above the ship engine firewall." Despite the setback, Musk noted that nothing so far indicates a delay for the next launch, which could occur as soon as next month. Future of Starship The Starship system, which stands at 123 meters (403 feet) tall, is designed to be fully reusable. NASA plans to utilize a modified version of the rocket for its Artemis missions aimed at returning humans to the Moon. In the long term, Musk envisions Starship facilitating long-duration trips to Mars, with each journey estimated to take about nine months. The test launch occurred shortly after the inaugural flight of the Blue Origin New Glenn rocket system, backed by Amazon's Jeff Bezos, marking significant progress in the competitive space vehicle market. As investigations continue, both SpaceX and Blue Origin are poised to play pivotal roles in shaping the future of space exploration and travel. Read the full article

0 notes

Text

0 notes

Text

F-20 Tigershark: an F-5 with steroids

Fernando Valduga By Fernando Valduga 12/03/2023 - 22:46 in History, Military

The F-20 Tigershark was a high-level, elegant and robust jet fighter, created to enhance the F-5 model. Northrop Corporation developed it in the 1980s, making it remarkable with advanced avionics, state-of-the-art weapon systems and a powerful engine, reminiscent of a steroid F-5 jet fighter.

It was really an aviation wonder that crossed the line and raised the standards. However, despite being positioned as an important player in the global jet market, military customers did not accept it and the program had to be filed.

The F-20 Tigershark was an updated version of Northrop Corporation's F-5 Freedom Fighter, designed to be a light and affordable jet fighter that could be exported internationally. Northrop had plans to sell to countries such as Taiwan, South Korea and others who were looking for a modern fighter that would fit their budget.

One of the outstanding features of the F-20's design was its fly-by-wire digital control system, allowing exceptional handling and maneuverability. It also included a more robust engine than its predecessor, providing greater speed and better climbing capabilities. In addition, the F-20 incorporated some stealth features to reduce its radar cross-section and used materials that absorbed the radar.

Any buyers?

The F-20 Tigershark completed an extensive flight test program during development. In August 82, the first prototype flew from Edwards Air Force Base in California, reaching 20,000 feet and Mach 1.4 on its 35-minute maiden voyage. In the following months, the prototype underwent handling, performance and system tests. In November, it reached Mach 2.05 during a maximum speed attempt, in addition to discreet demonstrations of avionics, weaponry and stealth in flight.

youtube

In addition to the tests in the US, the F-20 also had demonstrations in countries such as South Korea and Switzerland to boost sales. High-speed performance, high-G curves, low-level flights and handling impressed potential buyers during these demonstrations.

Overshadowed by the competition

The F-20 Tigershark project faced a variety of challenges that eventually led to its cancellation. The intense competition in the global jet fighter market was a key factor, as the F-20 encountered strong competition from other popular models such as the F-16 and Mirage 2000. Many potential buyers have opted for these established projects, considered safer and more reliable.

Political pressure also contributed to the fall of the F-20. The U.S. government was concerned that the F-20 could reduce the price of the more expensive F-16, produced by General Dynamics, an American company. In addition, there were concerns about the sale of advanced military technology to certain countries, such as Taiwan, one of the main potential buyers of the F-20. This damaged Northrop's marketing efforts and led to limited sales.

Economic factors also played a role at the end of the program. Northrop invested heavily in the development of the F-20, but without significant requests, it was unlikely that this investment would be recovered. In addition, the high cost of production made it difficult to compete with other established models that had already achieved economies of scale.

FX Program

Much of the development of the F-20 was carried out under a U.S. Department of Defense project called "FX". FX sought to develop fighters that would be able to combat with the latest Soviet aircraft, but excluding sensitive frontline technologies used by U.S. Air Force (USAF) aircraft.

FX was a product of the Carter government's military export policies, which aimed to provide foreign nations with high-quality equipment without the risk of U.S. frontline technology falling into the hands of the Soviets. Northrop had high hopes for the F-20 in the international market, but the policy changes after the election of Ronald Reagan meant that the F-20 had to compete for sales against the newer variants of the F-16 and not with the F-16/79 downgraded.

The F-20 Tigershark program was abandoned in 1986 after three prototypes were built (two of which fell after their pilots fainted due to excessive g-forces) and a partially completed quarter.

youtube

The cool promotional video of the F-20 above was made in the 1980s and presents an introduction of the super ace Chuck Yeager, the first pilot to break the sound barrier, who at the time was a spokesman for Northrop.

In his autobiography, which he wrote after the F-20 was canceled, Yeager praised Tigershark as being "magnificent".

Source: Jets 'N' Props

Tags: Military AviationHISTORYNorthrop F-20A TigersharkUSAF - United States Air Force / U.S. Air Force

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. Uses Canon equipment during his photographic work throughout the world of aviation.

Related news

MILITARY

Indian Air Force orders six additional 228 Dornier aircraft

13/03/2023 - 16:00

MILITARY

U.S. Air Force reformulates plans to modernize replenishers and cuts next purchase

13/03/2023 - 14:00

MILITARY

Finland says it is open to sending Hornets to Ukraine

13/03/2023 - 08:40

AERONAUTICAL ACCIDENTS

Indian Air Force lost 1,786 aircraft in accidents during 90 years

12/03/2023 - 19:13

MILITARY

F-104 Starfighter jet will fly in the Italian Air Force centenary air show

12/03/2023 - 16:00

WAR ZONES

Which fight is best for Ukraine while fighting Russia?

12/03/2023 - 13:39

homeMain PageEditorialsINFORMATIONeventsCooperateSpecialitiesadvertiseabout

Cavok Brazil - Web Creation Tchê Digital

Commercial

Executive

Helicopters

HISTORY

Military

Brazilian Air Force

Space

Specialities

Cavok Brazil - Web Creation Tchê Digital

14 notes

·

View notes