#4th quarter tax advantages

Explore tagged Tumblr posts

Text

The Benefits of Buying a Home in the 4th Quarter

Spend Christmas in your new home!

1. Less Competition

One of the most significant benefits of buying a home in the 4th quarter is reduced competition. As the year winds down, many potential buyers take a break from house hunting due to holiday distractions or the desire to wait for the new year. This drop in demand often results in fewer bidding wars and more negotiating power for buyers, giving you a better chance of securing your dream home at a favorable price.

2. Motivated Sellers

Sellers who list their homes during the last few months of the year are often more motivated. They may be eager to close before the holidays or before the end of the tax year. This motivation can lead to more flexibility in negotiations, whether it's price, closing costs, or even including furniture and appliances in the sale. If you’re willing to look at homes that have been on the market longer, you might find sellers who are particularly eager to make a deal.

3. Year-End Tax Benefits

Purchasing a home before the end of the year can also yield significant tax benefits. Homebuyers can potentially deduct mortgage interest and property taxes from their taxable income, which can be especially beneficial if the purchase is completed by December 31st. This timing allows new homeowners to take advantage of these deductions in their tax filings for that year, providing potential savings.

4. Seasonal Pricing Trends

Historically, home prices can dip during the winter months. Many buyers believe that spring and summer are the best times to sell, leading to price adjustments as sellers try to attract buyers in the slower season. If you’re in the market during the 4th quarter, you may find more favorable pricing, particularly for homes that have been on the market for a while.

5. Time for Reflection and Planning

Buying a home is not just a financial decision; it’s also an emotional one. The 4th quarter often provides an opportunity for reflection as the year comes to a close. With the holiday spirit in the air, it’s a perfect time to envision your future in a new home, think about your family's needs, and plan for the upcoming year. This reflective mindset can help you make a more informed and thoughtful choice.

6. Favorable Interest Rates

The end of the year may also see more favorable interest rates as lenders look to meet year-end goals. By taking advantage of competitive rates, buyers can secure better financing options, resulting in lower monthly payments over the life of the loan.

Conclusion

In conclusion, while many people overlook the 4th quarter as a prime time for home buying, it presents unique advantages. From reduced competition and motivated sellers to potential tax benefits and favorable pricing, the last months of the year can be an excellent opportunity for homebuyers. If you're considering a home purchase, don’t underestimate the potential benefits of making your move before the year ends.

Contact me today to begin your homebuying journey.

Lanny Mixon - NMLS# 2450250

312 Hemphill St.

Hattiesburg, MS 39401

601-336-6862

#first time home buyer#home loans#home mortgage#usda loans#mortgage#fha loans#mortgage lending#va loans#home equity loan

0 notes

Text

December Magical Dates and Astrological Transits

The final month of this leap year has arrived! It's finally December!! A lot of energetic shifts are coming at the end of the cycle marking a new beginning along with positive aspects from Uranus rx and harder aspects from Neptune forcing us to review our habits, old stagnating beliefs, spiritual deceptions hindering our path in order to evolve and create new philosophies, insights, expanded perspectives and a spiritual path that is aligned with our evolution, freedom and authenticity. Both Saturn and Jupiter are shifting into Aquarius focusing our energies and responsibility towards the collective and how we individually play a role in our communities. There is another eclipse this month during the New Moon in Sagittarius causing endings in regards to old dogmatic ideas and philosophies and helping us regain truths that will aid us and the collective towards a new future.

Tip: If you have a moon journal or a folder on your desktop, the best way I like to keep track of each day and transits is by copy pasting this info and writing over ideas for each day and what I should do. Examples would be: Moon In Cancer - Deep clean your room. | Sun Trine Mars - charge items and exercise. | Moon enters Capricorn - make candles. It doesn't have to be anything lengthy but just planning ideas both mundane and magical to do when the transits are best!

Week 30 - 6

1st - ☾♊ Mercury enters Sagittarius

December will start off feeling like a fresh chapter after the full moon eclipse in Gemini passing yesterday. Take note where changes could have caused shifts in your life and how they could align you towards your highest potential. The energy could have drawn our focus on the finer details of what we require to achieve our goals and give us the motivation to tackle our tasks. Now today Mercury enters Sagittarius giving us a mental shift for two and a half weeks as our mindsets become more expansive, curious and optimistic giving us grander ideas and the courage to tackle whatever we need as long as we feel great about it. Make sure to write down your introspections and keep focused on your goals as Mercury in Sagittarius can make us a bit disorganized as we can potentially take on too much thus biting off more than we can chew. Today will be a great day to work with the full moon energy (especially charging crystals and items since the eclipse has passed), and focus on expanding our minds and channeling this power.

2nd - ☾♋ Moon enters Cancer

When the moon is in Cancer it’s a good time for magic around the home (aka Cottage Magic) such as cleaning and cleansing, kitchen magic and bath magic. It’s a great time for self-care rituals and water-based magic. The theme of burrowing and hibernation will feel amplified today as the moon is in it’s home sign.

The moon will be here for the next three days as no major aspects occur so it's a great time for rest and reflection on the previous energy shifts.

3rd - ☾♋ Moon in Cancer

4th - ☾♋ Moon in Cancer

5th - ☾♌ Venus in Scorpio trines Neptune in Pisces Disseminating Moon | Moon trine Sun

Today's energy will feel creative, dreamy and imaginative with Venus trining Neptune and the moon in creative Leo trining the Sun in positive Sagittarius. We will feel more in touch with art or beautiful experiences which inspires our sense of spirituality and creativity and will feel inclined to express this or create with the moon in Leo. It's a great time to do self love rituals, art based magic, create a beautiful ritual, celebrate life and channel in this lovely energy. Also the Disseminating moon is a time of gratitude and reaping rewards of hard work accumulated during this lunar cycle. Appreciate where you have found success and benefitted from the work you have put in and if you feel unsatisfied, this lunar energy in the cycle is the second chance to work again towards it. If you are happy, it's a lovely time to relax and celebrate life.

6th - ☾♌ Moon in Leo

When the moon is in Leo it’s a good time for creativity, fire and light based magic and acts of self love.

-----------------------

Week 7 - 13

7th - ☾♍ Last Quarter Moon in Virgo

As the moon enters Virgo today this lunar phase revolves around reflection of our journey so far since the Scorpio new moon in November and what we have learned verses what isn't working for us. It's a great day for reflection, meditation, journaling, taking stock and shadow work. With the moon in Virgo it's a great day for finding solutions or healing. Focus on how this lunar cycle was about shedding things your soul no longer needs or what was hidden by your shadow self (reflect on themes that the Scorpio New Moon brought up) and use this final quarter as a time to heal those qualities or find solutions.

8th - ☾♍ Moon in Virgo

When the moon is in Virgo it’s great to ground your tasks mentally in a to-do list, problem solve or focus on healing magic for yourself on a physical or spiritual level.

9th - ☾♎ Sun in Sagittarius Squares Neptune in Pisces Moon enters Libra

Be cautious today with your information and boundaries. When the sun squares Neptune we are subjected to deception, dishonesty intrusions and paranoia. Often I find with negative Neptunal aspects there is an increase of scammers or people that take advantage of this energy. Be careful! Put up wards today and be aware of your boundaries. Often this square can cause confusion as well and is not a great time to focus on hard work or do anything mentally taxing. This aspect can also make you more wary of health issues including mental health, however most of the issues you may uncover today revolving around health is just an illusion powered by paranoia and confusion so it's a good time to wait and see if your symptoms or worries persist until tomorrow. On a positive note this square is good for reflecting on your spirituality, seeing which truths hold up and how your path is serving you. If there is any corners where you have been dishonest with yourself or following/idolizing someone of your path who doesn't have your best interests at heart, it's time to take stock and make adjustments so that your path can be as genuine as possible.

10th - ☾♎ Venus in Scorpio sextiles Pluto in Capricorn Balsamic Moon | Moon sextile Sun Happy Hannukah!

The themes of shedding and cutting chords will be carried on today with the Balsamic moon which is a period of time that is ideal for cleansing the space, shedding what you no longer need, tying up loose ends and clearing this chapter before the next new moon. Whatever spiritual beliefs you've held that may not be truthful or aligned with your highest good, it's a good time to shed and shift your path today. In two days another transit will come which will make this theme more personal and focus our attention there.

Other energy we will feel today is the sextile between Venus and Pluto. This aspect will deepen our values, our bonds to our closest friends and our lovers helping us illuminate what is the most important things in our lives and helping us to shed whatever doesn't make the cut. With the moon in Libra our relationships with all kinds will be highlighted and if there are people in your life that don't respect you or have your best interests in mind, today may be the day where you need to let them go. Another influence this aspect can bring is obsessions on our crushes or things we value. In terms of crushes the energy today can help you uncover their secrets or how they feel about you. In terms of what you value, it's a great day to explore your creativity, artistic/aesthetic side or how you honor your values today.

Also Hannukah begins today! If you celebrate Hannukah then I hope you have a lovely 7 days!

11th - ☾♏ Sun in Sagittarius trines Mars in Aries Moon enters Scorpio

This is an excellent day to use for a boost of courage, taking risks and chances or applying a boost of energy towards whatever you desire. With the sun trining Mars (both fiery planets in fiery placements!) We will feel the power to charge onwards! However trines are very agreeable transits which can flutter by unnoticed so it's a good time to mark this date on a calendar as an opportunity to use the energy wisely. If you do not have an occasion to channel this energy, trines are excellent energy to charge your magical items with or channel within yourself. It's not necessarily the same as charging items under full moon light, however since the Sun is involved in the aspect you can leave some items out in the sun to soak in the energy. Additionally you can write the glyph of mars down or play it's frequency to bring in it's energy in your space and have your magical items be charged with it's fiery power!

12th - ☾♏ Moon in Scorpio

When the moon is in Scorpio it’s a good time for shadow work, trance magic, uncovering secrets, sex magic, blood magic and energy based magic.

13th - ☾♐ Mercury in Sagittarius squares Neptune in Pisces Moon enters Sagittarius

Another day for being wary with your boundaries! Mercury and Neptune squares brings about another day of confusion and a chance for predators to take advantage of our clouded minds and lowered guards. Take this day to also put up wards, be alert and not take on too many tasks or too much work. Today we can be especially deceived with the planet ruling our logical minds and processing being harshly aspected by the dreamy planet of illusions. There is potential for a lack of clarity, miscommunication and bad luck involving transport, plans, anything mercury rules. You should be especially wary of believing extreme spiritual views or conspiracy theories as people with agendas are sure to come out of the woodwork on this day. Especially with the moon in Sagittarius it's a good day to examine your own faith and any extreme views you may hold or beliefs that are deceiving you. Focus on the truth and creating a spiritual path that is authentic to you.

-----------------------

Week 14 - 20

14th - ☾♐ New Moon in Sagittarius, Solar eclipse Mercury in Sagittarius trines Mars in Aries Venus in Scorpio sextiles Jupiter in Capricorn

This new moon in Sagittarius will not only be a solar eclipse but... it's ANOTHER square with Neptune in Pisces. Our spirituality or faith is being highlighted in this chapter and we may find ourselves completely shifting our beliefs especially as the sun and mercury may have highlighted some deceptions we possibly haven't noticed that were apart of our belief systems before. Mercury trines Mars today giving our minds a fiery boost as we could be showered with endless new ideas and be ready to expand our horizons and develop a new path. Venus will sextile Jupiter helping us create a new reality aligning our values with our true authenticity which will help us shape our new path that aligns us to our higher good. You may witness others coming up with new approaches to their path or even hear of new religions (or conspiracy cults depending on how others have taken in all of the Neptune squares). It's a fantastic day for shedding and reflection of our path and how this new lunar cycle will be focused on our faith and what lies and deceptions need to be addressed. The energies are aligned to help you uncover this and find the truths within yourselves.

15th - ☾♑ Venus in Scorpio sextiles Saturn in Capricorn Venus enters Sagittarius Moon enters Capricorn

Today is a lovely day to work on existing relationships or start a commitment that you would want to last long term, whether it be a project, a job or relationship. With Venus sextiling Saturn everything that we value can be improved on by solving any recent difficulties or by dedicating our time towards it.

Venus will then enter Sagittarius bringing us in a four week long new transit cycle where our values can be expanded upon and explored, we could expand our friendship groups and find values and pleasure in traveling, exploration and philosophy. It's a great day for love magic and doing blessings for yourself or loved ones.

16th - ☾♑ Moon in Capricorn

When the moon is in Capricorn it's an excellent time to get work done, get organized, address our tasks and responsibilities, do ancestor magic as well as earth and mineral based magic.

17th - ☾♒ Saturn enters Aquarius Moon enters Aquarius

Today we face a massive energy shift as Saturn enters Aquarius (officially) for the next two and a half years. With Saturn in Aquarius we can focus on improving our community and our individual roles we play within it. It briefly entered Aquarius earlier in 2020 spring showing in positive areas how community can be cared for and the standards of living can increase where as in negative areas (most of the earth) how some government's lack of care for their community is the base reason why so many have suffered and died due to Covid or Covid related issues that damaged the economy, cut jobs and tore people's access to money, food and shelter. Saturn in Aquarius in previous years brought about revolution and evolution, sparking awareness and anger of the government's failed response to AIDS, the end of the apartheid in South Africa and Civil Rights with Rodney King. Early 2020 got a taste as many were enraged with government's failed response to Covid, Police Brutality and community care. The term Mutual Aid was used more often and that theme may carry out and be improved upon with Saturn's transit through Aquarius. For us 1992-1993 babies this is our first SATURN RETURN baby!! For the next two years we will be facing a coming-of-age transit as we enter celestial adult hood and review all of the work we have put into this life, the foundations we've built, and how we can improve or tear down what is no longer working for us. Most people our age have suffered a lot with failed systems that promised to help us and instead we lost like.. everything.. in this lifetime. So this return may be how we create new sound structures to help ourselves and each other and get rid of what no longer works. It can be a challenging transit, however it will bring about needed change for us to thrive in the future. (We also have our natal Uranus and Neptune in Capricorn on our sides to help us dream up new structures and revolutionize the ones that already exist.) Emotionally we will be aligned and invested with this shift as the moon enters Aquarius today so it will be conjunct with Saturn. It's a great day to meditate with Saturn's frequency, write down insights, and see how you can get to work on yourself. Especially if this is your Saturn's return, it's an excellent time to GET YOUR SHIT TOGETHER, cause honestly if you don't Saturn fucking will. So chat with Daddy Saturn, ask your guides for advice, channel the energy within and get organized!

18th - ☾♒ Waxing Crescent | Sun Sextile Moon

As the moon transits it's waxing crescent phase, it reaches it's sextile with the Sun today making it a great day to review the themes of the New Moon in Sagittarius and what we can do either as research, or experimentation to learn new materials and expand our horizons which can help us acheive our goals in the long run. This is a great time to try a new class, try something new or do some reading and research. Especially with the moon in Aquarius, the energy is all about new perspectives and new knowledge. In regards to the themes of Sagittarius new moon and our spiritual paths shifting, today is a great day to do some reading and research in regards to this or try new forms of magic, meditation, sound journeys or approaches to your spiritual path which can help broaden your horizon.

19th - ☾♓ Jupiter enters Aquarius Sun conjunct Mercury in Sagittarius Moon enters Pisces

Another major energy shift occurs today with Jupiter entering Aquarius. This energy is major and can help us create visions of a new future that is community focused (as opposed to needs of the wealthy few that run the government), expand on our technology, create new discoveries and expand on our collective freedoms. As the moon enters Pisces we will be dreaming of a new reality in this shift and this will be amplified with the Sun and Mercury conjunct in Sagittarius aligning our will and the themes of the day with our mind, new ideas and mental expansion.

With Jupiter transiting Aquarius we will see an expansion of our perspectives along with new perspectives which can incite reform or even experimentation to bring something new and revolutionary out of the ordinary all in a quest for a new, better life. This (especially with Saturn in Aquarius) can bring a surge for change which means more protests and rebellions however it will all be in faith for the future and in hope for a miraculous change. This transit will be a bit chaotic as Uranus (ruler of Aquarius and all about evolution, revolution and new perspectives) is currently in Taurus which will bring shocks and insecurity in our everyday lives by breaking the usual mold apart. The two planets are in conflicting fixed signs that will cause a square for most of Jupiter's early transit in Aquarius and since Jupiter takes a year to go through a sign, this will be felt for a good quarter of 2021 bringing challenges in regards to our freedom that we will feel inclined to fight for. However with hard work, realism, planning and perseverance, which Saturn will gladly lend a hand in, enduring alternatives can eventually be established.

20th - ☾♓ Mercury enters Capricorn

This is an excellent two and a half weeks to focus on getting things done, getting organized, focusing on tasks and prioritizing. Though Mercury in Capricorn may not be the most emotional placement, (there will be a time and place to process emotions so no worries), it's a wonderful transit and great timing with the Saturn and Jupiter shifts into Aquarius for us to review what we need to get done and how we can improve our lives and even the lives of others. If you are celebrating Yule or the Winter Solstice, it's a great time to get ready, make magic tools, plan rituals and get yourself prepared for early winter (and Capricorn season!) to come. -----------------------

Week 21 - 27

21st - ☾♈ YULE - Winter Solstice Sun enters Capricorn First Quarter Moon in Aries Jupiter conjunct Saturn in Aquarius

We've entered Capricorn season!! This will feel like a new start with the moon in Aries and will add a fiery element of new beginnings to the sabbat of rebirth and renewal. Additionally there will be a lot of intense saturn energies added today, not only as it's the beginning of Capricorn season but Jupiter and Saturn will be conjunct today in Aquarius expanding our mindset towards our liberation, our support of our communities and our mobilization. Especially coinciding on the Winter Solstice, a time for renewal and new cycles, this theme will highlight our solar cycle to come and be the tone set for 2021. This conjunction is also powerful and refered to as The Great Conjunction. It's a time of opportunity, growth and good fortune. We will feel we have reached the end of a phase of life and we will be advancing to the next higher level. This transit brings feelings of completion or alternatively it will highlight barriers to our progress which we need to overcome. If you are deeply disatisfied with your life or feel stifled by these barriers, you may feel that the restrictions are too much to cope with that this transit will cause you endless frustration that change becomes inevitable. Regardless this transit helps us seek greater freedom and prosperity. We may find the answers we need to push forward or to seek out our liberation. This Great Conjunction also brings fated events, lucky breaks and profound growth.

Regardless if you celebrate this sabbat, you can observe Winter Solstice from a secular celebration and plan a ritual revolving around rebirth and renewal with this energy. Especially as the moon is in it's First Quarter phase it's all about planning and strategizing. (Also here is a link comparing the lunar phases to the solar celebrations as Winter Solstice corresponds to the New Moon in the way that it is about renewal and new cycles, yet on a grander scale.) You can take the day to do some divination on the months ahead, channel the Saturn/Jupiter/Aquarius energies and how you would like to incite positive change for yourself in 2021, and focus on how you can renew yourself and focus on your growth.

22nd - ☾♈ Moon in Aries

When the moon is in Aries it's an excellent time to take on challenges, channel courage, do fire based magic or start something new.

23rd - ☾♈ Mars in Aries squares Pluto in Capricorn

With all of this revolution and evolution of course confrontation and power struggles will follow suit. This transit will unfortunately amplify that as we may feel the intense desire to fight for our rights and empower ourselves and may feel restrictions from the powers that be. It's a great time to reflect and strategize on how we can meet our goals instead of going face to face with where we feel restricted. People with more power will unfortunately have the upper hand during this transit so it's a good time to plan our success instead.

24th - ☾♉ Waxing Gibbous | Sun Trine Moon Moon enters Taurus

This lucky trine transit will be a great day to take action towards the goals we've set during the New Moon eclipse in Sagittarius. To recap the theme was about our spiritual path, our genuine beliefs, our truths or even deceptions we tell ourselves and how we can shed away past belief systems and dogma to reconstruct a better system of thinking, spirituality and philosophy that will align ourselves to our highest good. As the moon made it's waxing crescent in Aquarius (along when Saturn entered it), we experimented and expanded on different ways we could approach this. As the moon entered it's First Quarter phase in Aries (during the Grand Conjunction and Winter Solstice sparking renewal), we reviewed how this new energy can help us strategize on our freedom, expanded perspectives, new philosophies and paths and new visions for the future. Now as the Sun trines the moon it's a time for harmony and balance and a lucky day to focus and work towards our set intentions for the cycle. With Uranus rx in Taurus it's a great time to reflect on where we could feel restricted or stagnant and where we can change unhelpful beliefs or habits. With this aspect it's a good time to put work towards shifting our paths and our beliefs to ensure that our spiritual paths are aligned with our liberation and that we are not stagnating and able to evolve.

25th - ☾♉ Mercury in Capricorn trines Uranus rx in Taurus Merry Christmas!

The themes of yesterday continue on, now with Mercury in Capricorn trining Uranus rx in Taurus. With Mercury in Capricorn we can review our old habits and outdated beliefs with a more analytical and logical approach that won't be clouded by our emotional judgement. With this positive trine, we can find that we are able to shift our mindset, observe where we need to expand our perspectives and even bring new perspectives to other people. We will feel a shift and inner transformation happen on a mental level today.

If you celebrate Christmas then Merry Christmas! With the moon in Taurus it will feel like a relaxed and slow day with many sensual pleasures to enjoy such as scented candles, delicious food and presents. Take plenty of naps and eat plenty of cake.

26th - ☾♊ Moon enters Gemini

When the moon enters Gemini it's a great time for reading, learning, discussing topics which interest you, expanding your grimoire, meditating with sound baths or binural beats, doing air, writing or music based magic and socializing.

Happy Kwanzaa! Kwanzaa begins today. If you celebrate it I hope you have an incredible time!

27th - ☾♊ Sun in Capricorn trines Uranus rx in Taurus

Today's theme will be focused on self change and shifting our habits and perspectives as the Sun will trine Uranus rx. Already we have been dealing with this energy on different levels, on an emotional level with the moon and and Uranus rx conjunct on the 24th, a mental level with Mercury and Uranus rx trine on the 25th and now on a level that will impact our will and ego with the Sun making this trine. This is positive energy which can help us shift our reality to bring the changes that will help us feel more liberated, free to express ourselves and evolve. This energy will help us once again to break old habits and make shifts on an internal level that will benefit our external lives. It's a great time for transformation and renewal as the planets are helping us evolve from the inside out.

-----------------------

Week 28 - End

28th - ☾♊ Moon in Gemini

Yesterday's energy will carry on to today. It's a good time to explore any insights you have gathered, do some learning, write down experiences, ideas or insights in your grimoire and do some meditation.

29th - ☾♋ Full Moon in Cancer

We are nearly towards the end of 2020 and it's ending on a full moon in it's native sign of Cancer. Our emotions will be so tactile they will take a life of their own. This full moon marks the feeling of Winter coming as we will feel the optimum need to be home, hibernate and be one with our emotions and feelings.

Reflecting back again to the New Moon eclipse themes in Sagittarius, this opposition gives us insight towards our emotions and how they can cloud our judgement and the truths in our spiritual/philosophical path (and highlight our defensiveness towards change) OR it can show how our emotions are a simpler messanger of truths we hold and potentially suppress in our shadows and how when we listen to ourselves and don't shut off our genuine feelings it can bring us in alignment with our needs. (It really depends on you individually where you sit in this equation). It's a great time for reflection, home-based magic (aka cottage witchcraft which includes kitchen magic, bedroom/dream magic, bath magic, green/garden magic, cleansing and cleaning etc.) shadow work, charging items and releasing spells (especially since our emotions will be so potent today).

30th - ☾♋ Venus in Sagittarius squares Neptune in Pisces

In the final segment of Neptune giving us a terribly hard time, we are now faced with Venus in an unpleasant aspect with the planet that loves to emphasize deception and illusions. Especially since Venus rules our finances, once again put up your wards and defenses and make sure to be careful with your money and valuables. On a personal note with Venus and Neptune in a square, this energy makes us focus on the alignment of our values and spirituality and where we could be deceiving ourselves. Relationships definitely could be involved and we may be faced with our moral compass and how our compassion or moral structure with helping/dealing with others could allow some unsavory characters to walk all over us. With the themes of spirituality being so strong in this cycle this could definitely point to a spiritual leader that could be taking advantage or someone demanding too much access to your resources or energy. Energy vampires will be revealed today and we should be sure to look at others with descernment for being too optimistic or positive can attract predators our way. Today is a good time to review how our spiritual beliefs align with our values, if our relationships are harmonious with our healthy boundaries and if we find a "no" answer to any of these, how we can shift our patterns, habits and behaviors to no longer harbor these beliefs or host these people in our lives.

31st - ☾♋ New Years Eve

With the moon still in Cancer and people stifled from traveling, I could see this New Years being indoors with a glass of wine and being lowkey. Many will be happy this wild ass year is over, however it will be clear that negative events just don't pop up in one cursed year but are incidences of past issues the privileged have ignored until they snowball into tragic events that will roll on into something larger and more abominable until we address it head on. However energetically it's a good time to celebrate with good food and maybe at home over zoom.

#december#astrology#transits#grand conjunction#witchcraft#magic#sagittarius season#eclipse season#new moon#eclipse#sagittarius new moon#saturn in aquarius

91 notes

·

View notes

Text

Annals of Taihe (484)

[From WS007]

[Taihe 8, 12 February 484 – 31 January 485]

8th Year, Spring, 1st Month [12 February – 12 March], decreed that the Duke of Longxi, Yuan Chen, and the Master of Writing, Lu Rui, be Great Envoys of the Eastern and Western Circuits, to praise the good and punish the bad.

2nd Month [13 March – 10 April], the state of Ruanruan dispatched envoys to court to present.

Summer, 4th Month, jiayin [22 May], favoured Fang Mountain.

On wuwu [26 May], the Chariot Drove to return to the Palace.

On gengshen [28 May], travelled to favour the Xuanhong Pool. Thereupon favoured Guo Mountain.

On dingmao [4 June], returned to the Palace.

5th Month, jimao [16 June], decreed relief and bestowals to the defence troops in the seven provinces South of the He.

On jiashen [21 June], decreed the Outer Staff Cavalier in Regular Attendance, Li Biao, and the Outer Staff Gentleman Lan Ying as envoys to Xiao Ze.

6th Month, dingmao [3 August], a decree said:

To set up the officials' ranked beneficence is the highest of actions. The Rites of Zhou has a standard for receiving beneficence, the Two Han published the grading for accepting salary. Reaching Wei and Jin, neither did not tell about examining the former statutes, and so arranged threads [after] the Way of government. Since the Central Plains fell into chaos, these regulations by the middle were cut off. The former court followed and obeyed, and did not move on to modify and change.

We have forever reflected on the Four Regions and inquired into the distresses of the people, rising early in the dark dawn, growing depressed with the toil. For that reason [We] have taken as norm and set forth the old standards, and began ranking salary and beneficence. [We have] abolished the various merchants, so as to distinguish people's affairs.

For each household, add a muster of 3 bolts, and 2 hu and 9 dou of grain, to use as the beneficence of officials and ministers. Equally make ready a muster to be a tax of 2 bolts, to be combined with merchant employment. Even if there are troubles to be had for one season, in the end it will achieve the benefits of forever placidity. After beneficent acts, those who bribes fill a single bolt will die. To alter the laws and change the measures ought to be once more beginning. There should be a great amnesty Under Heaven, and give them only the new.

On wuchen [4 August], Wuzhou River overflowed and flooded, ruining people's dwellings and residences.

Autumn, 7th Month, yiwei [31 August], travelled to favour Fang Mountain's Stone Grotto Monastery.

8th Month, jiachen [9 September], a decree said:

An Emperor's profession is extremely heavy. Except for wide inquires, he has nothing by which to bring about government. A King's occupation is extremely difficult. Except for broad selection, he has nothing by which to foster merit. Previous kings knew it was like this, and for that reason they humbled themselves so as to seek beyond, and clarified leniency so as to ponder their faults. Hence admonishing drums were set up in the generation of Yao, defamation trees were erected in the courtyard of Shun. They employed whose ability to hear and see freely in four directions, the numerous kinds all together sprang forth.

We have inherited a vast foundation of accumulated sagacity, and belongs to a splendid cycle of a thousand years, always setting out distant manners, and looking up to and acting on previous models. At the beginning of the Chengming era [476 AD], distributed and sent down inside and outside, to heed the people in each case their fullest advise, so as to mend their deficits. Though the central aim was circulated, indeed the statements were few.

For that reason the alterations to the laws of the time in large extent complied with the ancient standards. The distributed regulations on salary and beneficence change further the law books. Magnanimity and severity is not yet fair, people sometimes have different opinions. Those who think and speak do not carry out declaring their feelings, those who seek out remonstrations are without causes to comprehend themselves. For that reason it causes the Sovereign's clarity not to pervade, and the subordinates' feelings to be obstructed and blocked off.

Now in regulating the hundred nobility, dignitaries, and scholars, and the artisans, merchants, and functionaries among the people, each send up what is expedient and proper. Profit to the people and advantage for administration, or damaging to reform and injurious for government, straight-away speak the utmost admonitions, there must not be secrets, to do the utmost to cause and explain without bothering the Hua, managing the followers simply and honestly. We want to personally look over it, so as to understand the core of the generation's affairs, to make those who speak of them have no crime, and those who listen to them satisfied to consider them warnings.

9th Month, jiawu [29 October], Xiao Ze dispatched envoys to court with tribute.

On wuxu [2 November], a decree said:

Salary regulations have been established, [and We] ought at time classify actions. Should use the 10th Month as the head, and each quarter as one request it.

Hence the inner and outer of the hundred officials accepted beneficence each proportionally.

Winter, 10th Month [4 November – 3 December], the state of Gaoli dispatched envoys to court with tribute.

Xiao Ze's Defence Master of Shuangcheng, Wang Jizong, belonged inside.

11th Month, yiwei [29 November], decreed the Outer Staff Unassigned Regular Attendant, Li Biao, and the Outer Staff Gentleman Lan Ying as envoys to Xiao Ze.

12th Month [2 January – 31 January], decreed that since that in 15 of the provinces and garrisons there were floods and droughts, and people was starving, he dispatched envoys to examine and seek out, and ask about the ills and hardships, and to open the granaries to relieve and aid.

2 notes

·

View notes

Text

SHOULD WE WAIT?!? Tips for sellers and buyers in the 4th quarter

With interest rates now over 4% buyers purchasing power has decreased. For sellers this can be a good thing in that it has given buyers a sense of loss due to waiting in securing a home loan. There is now real concern and understanding from the buyer pool that waiting will only hurt them rather than help them. I believe some buyers got to a point of disbelief with current pricing trends escalating quickly and determined to wait it out, expecting a market correction. Sadly, the market doesn't appear to have a correction for another year or probably two. Rents have gone up tremendously to where in most cases it is cheaper to purchase a home than to rent one. As I mentioned in prior publications, prices have normalized from the frantic appreciation of the 1st and early 2nd quarters, with more listings on the market having helped to create a stability of supply and demand.Some are waiting for the spring time with the thinking that it is a better time to sell. This is not necessarily the case. Here are a FOUR REASONS why selling NOW is better than waiting until spring. SELLERS:

1. LESS COMPETITION - There will be less competition (others similar homes to your competing for your same buyer) by selling now versus selling in the spring when everyone else is looking to list their home. Law of supply and demand - less homes offered means more motivated and serious buyers.

2. YOUR HOME SHOWS BETTER - Homes show better in the 4th quarter. Homes are decorated for the holidays. Add in a crackling fire as the days get cooler, along with some apple cider or pumpkin pie smells - you have a very inviting and warm home that appeals to all the buyers senses.

3. LOWER INTEREST RATES - Interest rates are on the rise. Waiting six months could be very detrimental to you as buying power decreases with every tick up of interest rates. When buyers cannot afford as much due to higher interest rates, you have less buyers available to your home. Combine that with Spring listing rush and now you have much supply and less demand. Not a good combo.

4. SERIOUS BUYERS - Buyers who are out looking after work in the dark (time change is coming), in the cold, in the rain, etc. are serious about buying a home. You do not have "Lookie Loo's" like you find in the spring selling season. Yes, there are less buyers in the marketplace, but in reality it is not a number as low as one might think when you factor in people in spring who are looking around and masquerading as buyers but have no real intention of buying.

It is a great time to sell, but be realistic regarding your pricing. Get greedy and your home will sit on the market, with eventual price reductions required to sell. You will sell for less money and take longer to sell. BUYERS: It is a very good time to buy because interest rates are still low and we are seeing more inventory for you to choose from. By purchasing in the up coming winter months, you generally can obtain a home for percentage points less than purchasing in the busy spring season. Work with an experienced Realtor that can access homes for sale and properly compare them against other similar offerings. A slow fourth quarter for real estate could be just the right speed to get you into your new home. Consider taking advantage of an environment that combines

FOUR BIG ADVANTAGES:

1. LOW INTEREST RATES - Historically speaking, current interest rates are a steal! Yes, even those in the 4% range. We have gotten spoiled with the artifically low rates since the crash in the late 2000's. Keep in mind that not too long ago, an interest rate in the 6%'s was crazy low!

2. LESS BUYER COMPETITION - As the 4th quarter is underway, there are less buyers as a whole in the market place which is good for you. When you have less competition you can be more aggressive with a seller and determine their true motivation level of selling versus another buyer in the mix which emboldens the seller to negotiate less. 3. TAX BENEFITS - With the current proposals for tax reform before legislatures it would make sense for you to lock in your tax benefits this year so you can take advantage of them when you file your tax returns come April. By waiting until next year, you will not realize the tax benefits until filing the following year (2019).SMXLL 4. LOW DOWN PAYMENT OPTIONS - Lenders have really loosened their purse strings since the crash and long winded recovery since. Regulations have lightened up and there is more of a freedom to lend once again. This is great for you as a buyer. Less cash on hand needed to get into a home means you can realize home ownership and actually save money (lower interest rates by buying now rather than waiting to save an acceptable down payment when interest rates are rising and decreasing your purchasing power).

#Matthew Stewart#Matthew Stewart Realtor#Matthew Stewart Real Estate Team#Matthew Stewart Rocklin Real Estate#Matthew Stewart Rocklin Realtor#Roseville homes for sale#Granite Bay homes for sale#Rocklin homes for sale#Lincoln homes for sale#sell my home#sell my home in 4th quarter#buy a home#buy a home in 4th quarter#interest rates#4th quarter home buying tips#4th quarter tax advantages#for sale by owner#fsbo#tax advantages#real estate tax advantages#home staging#home staging during holidays#how to sell my home#best rocklin real estate agent#best granite bay real estate agent#best roseville real estate agent

0 notes

Text

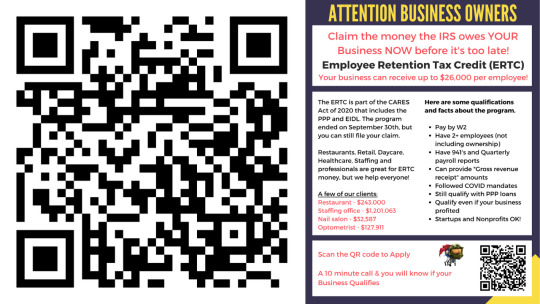

ERC Tax Credit Physicians New

Local Physician Practices Could Benefit From A Retention Tax Credit September 2021 Compendium

At the time it was started in the CARES Act, business that had actually received PPP funding were not permitted to take part in the credit. When the Consolidated Appropriations Act of was handed down Dec. 27, 2020, however, this limitation was gotten rid of. This activity allows over one million even more companies to qualify for the program. The internal revenue service deems that the federal, state, or local COVID-19 government order had a more-than-nominal effect on your business if it minimized your capacity to supply items or solutions in the normal program of your business by not much less than 10 percent. Numerous health care practices were affected beginning in the 2nd quarter 2020.

vimeo

youtube

A medical gadget business that mounted and also serviced robotic surgical treatment tools and also whose service technicians were restricted from going into a hospital due to COVID orders.

Copyright (c) 2022 Arizona Medical Professional, An Electronic Magazine Of The Maricopa Area Clinical Society All Legal Rights Booked

You intend to maximize your PPP forgiveness while likewise leaving area to declare the ERC. CRI can help you apply payroll expenses in a manner that will certainly enhance your use of both programs. It tells us that suggestions can be counted as incomes and also consisted of in the quantity made use of to calculate the ERC. Section 45B idea credit may be asserted on the employer's share of FICA tax obligations on excess suggestions received by its employees. Companies can declare both the ERC and also the Section 45B idea credit for the exact same incomes.

If you paid certified incomes to an employee in Q of $14,000, the tax credit is topped at $7,000. The substantial decline in gross invoices test can generally be simple. Nonetheless, the suspension of the operations test is based on truths and also scenarios, unique per taxpayer. While we have helped lots of customers in enjoying the tremendous benefits of the ERC, lots of others were deemed ineligible.

When Will The Irs Take Into Consideration Operations To Be Totally Or Partly Put On Hold?

The HHS Carrier Relief Funds is a federal program, applied by the Division of Health And Wellness and also Person Solutions, to reimburse dental practices for healthcare-related expenses to either stop, get ready for, or respond to COVID-19. The funds can likewise be made use of to reimburse the practice for any kind of lost earnings that were attributable to COVID-19. This program is very similar to the Employee Retention Credit and employee retention credit refund delays PPP finances where the income in the practice is compared by quarter for 2019 and also 2020 to determine if there was any kind of reduction in any of those quarters. That said, it is very important to begin with a solid interpretation of eligible incomes. It can be different for business considered to be big companies under the credit.

For 2020, the credit is 50% of up to $10,000 in certified incomes paid per employee in 2020.

I personally think a number of these reimbursement declares will not endure analysis by the Irs.

This means that medical/dental practices and also various other healthcare entities may be able to take advantage of these refundable credit scores if their businesses were impacted by COVID-19 restrictions.

Due to the fact that this kind of activity occurred in lots of various other states as well, it's important that doctor that may have had even a partial effect due to the COVID-19 pandemic evaluation their ERC qualification.

Companies who requested and also got an advanced payment of the ERTC for incomes paid in the 4th quarter of 2021 will certainly be needed to repay the advancements by the due date for the appropriate work income tax return that includes the 4th quarter of 2021.

The Coronavirus Aid, Relief, and also Economic Safety and security Act, authorized right into regulation on March 27, 2020, offers numerous rewards for medical facilities and also health care companies.

This blog site is meant to resolve a few of the most-frequently heard mistaken beliefs concerning the ERC. Ultimately, you'll need to submit particular amended tax forms; you need to talk to a specialist for this step. There are very complex estimations needed to apply, so make sure to fill it out entirely and also precisely. While the regulations for larger companies are similar to those for smaller companies, they do have a few exceptions. As we went over in previous problems of this Newsletter, health is vital to a thriving dental practice, and also the loss of a health day have to be avoided.

Exactly how can you see if you are eligible for the ERC?

After doing some first study concerning the employee retention tax credit you need to take some time to examine your records and also see if you qualify for the ERC. You can likewise follow this list of actions:

https://erctaxcreditphysiciansnews.blogspot.com/2022/11/erc-tax-credit-physicians-news.html What is the Employee Retention Tax Credit? Employee Retention Credit Doctors Doctors ERTC Tax Credit Physicians ERTC Tax Credit Medical Offices ERTC Tax Credit https://twitter.com/CryptoCrispsBee/status/1591169676150984704/ https://erctaxcreditdoctors.blogspot.com/ https://erctaxcreditdoctors.blogspot.com/2022/11/erc-tax-credit-doctors.html https://amadowelch.tumblr.com/post/701200695553097728/erc-tax-credit-dentists https://goalsettingtechnique58.blogspot.com/ https://goalsettingtechnique58.blogspot.com/2022/11/goal-setting-technique.html

0 notes

Text

A little white mountain

The Cosetans were the first people to settle in Montblanc, specifically in the Pla de Santa Bàrbara, a hill within the current town that gave it its present name, around the 4th to 2nd centuries BC. The Romans subjugated them when they constituted the province of Tarraconensis, but after the fall of their empire, not much more is known until the 10th century.

The invasion of the Iberian Peninsula by the Arabs from 711 onwards led to the formation of a depopulated territory on the border between the Saracen south and the Christian north, where the present-day capital of Conca de Barberà is located.

By the end of the 10th century, a caliphate had been established in Córdoba and raids in the Christian north became commonplace. The main Saracen warlord of the time, Almanzor, crossed the region in 978, when he led one towards Barcelona, then the capital of the Marca Hispanica, a territory that served as a buffer between the Muslim Peninsula and the Kingdom of the Franks, under the rule of a count-marquis.

However, the initiative of the local county dynasties, effectively detached from the royal authority of the Franks, caused the frontier to shift southwards. In 1076, the Count of Barcelona Ramon Berenguer II ordered the creation of a village (Duesaigües - two waters -, due to its location at the confluence of the Anguera and Francolí rivers), which in 1155, taking advantage of a tax exemption initiative by Ramon Berenguer IV, changed its name to Vilasalva.

In 1163, with the first King Alfons reigning in Catalonia and Aragon, there was a need for a stronghold halfway between Lleida and Tarragona. And as Vilasalva suffered continuous floods - such as the recent catastrophic flood in 2019 - the king had the town moved to a nearby hill and gave it to Pere Berenguer, lord of Vilafranca, to whom he granted a town charter.

This was the founding charter of Montblanc. In 1170 it already had a castle, the Romanesque church of Santa Maria and a commercial district called Mercadal. In the 13th century it continued to grow thanks to royal concessions and became the site of markets and livestock fairs, as well as a royal notary's office and an Estudi Major More churches and convents were built and a Jewish quarter was established.

In 1387, King John I the Hunter established the duchy of Montblanc, which he granted to his brother, the future Martin I the Humane, the last king of Aragon of the House of Barcelona dynasty.

The 16th and 17th centuries saw a decline in the town, and it suffered various attacks during the Reapers' War (1640-1652), which damaged the emblematic wall that surrounds the entire town. The subsequent wars of the Spanish Succession and the Napoleonic War, at the beginning of the 18th and 19th centuries, respectively, meant the loss of the privileges gained throughout the Middle Ages.

1 note

·

View note

Link

Jupiter home sales soar 42% during the 4th quarter. That's nothing when you look at the million dollar plus market where sales were up 70%.

The tax situation for the wealthy in America has been very advantageous since the tax cuts of 2017. That's about to change. How that affects Jupiter home sales and prices is unknown. But there are signs to watch.

To learn more, please enjoy this weeks Paradise Sharks market update....

0 notes

Text

February is a stock love fest for investors

Valentine’s Day is over, however financiers’ love affair with stocks may continue all month long and then some if history is any guide.

Over the previous decade, the 3 significant averages have actually produced their finest month-to-month gains of the entire year in February, according to Dow Jones Market Data Group.

For the S&P 500 and Dow Jones Industrial Average, that’s 2.3 percent each; for the Nasdaq, it’s 3 percent.

COULD THE CORONAVIRUS BE A BLACK SWAN?

With approximately 2 weeks left in the month, Wall Street is commemorating more than usual: Gains already are virtually double those averages, despite the volatility in recent days connected to increasing cases of the coronavirus.

What’s the driver?

Investors are looking beyond the global health crisis and focusing on the U.S.

GET FOX ORGANISATION ON THE GO BY CLICK ON THIS LINK

Incomes development for the S&P 500 is tracking at 0.9 percent for the 4th quarter, powered by heavy hitters such as JPMorgan Chase, Apple and Amazon. If that lasts, it will mark the first year-over-year development since the 4th quarter of 2018, as kept in mind by John Butters, senior revenues expert with FactSet.

TRUMP TALKS MAGA … STOCKS, THAT IS

A group of four companies with President Trump’s favorite acronym “MAGA” are leading the stock market’s charge. Microsoft, Apple, Google and Amazon are accountable for about 17 percent of the S&P 500 and almost 70 percent of the index’s gain in 2020.

Ticker Security Last Change Modification % MSFT MICROSOFT CORP. 18535 1.64 0.89% AAPL APPLE INC. 32495 0.08 0.02% GOOGL ALPHABET INC. 1,51873 5.34 0.35% AMZN AMAZON.COM INC. 2,13487 -1500 -0.70%

JANUARY JOBS REPORT SMASHES QUOTES

Likewise, U.S. economic data is solid. On Friday, consumer belief for February rose to 100.9, which is close to levels in March 2018, the “growth peak” recorded by the University of Michigan. Retail sales for January increased 0.3 percent., and while the gain was modest, economic experts recommend that’s an indication consumers are still investing.

Plus, January’s jobs report smashed records, with 225,000 positions developed.

This month, success by Sen. Bernie Sanders– a self-described democratic socialist looking for the Democratic election for president– in Iowa and New Hampshire primaries improved speculation that the party would be not able to wrest the White Home away from President Trump.

” The marketplace is believing he’s a fairly simple target for Trump,” Nuveen Chief Financial Investment Strategist Brian Nick observed during an appearance on FOX Business’ Varney & Co.

TRUMP’S TAX CUTS 2.0 COULD INCLUDE RETIREMENT ADVANTAGE

And on Friday the White Home ramped up speak about another round of tax cuts that might include combining savings and retirement accounts that offer tax breaks.

CLICK ON THIS LINK TO FIND OUT MORE ON FOX COMPANY

%.

from Job Search Tips https://jobsearchtips.net/february-is-a-stock-love-fest-for-investors/

0 notes

Text

Motivation a type in final week of CFL Fantasy

{{ currentSportDisplayName }}

nhl

nfl

mlb

cfl

mls

nba

Scoreboard

{{ currentSportDisplayName }}

nhl

nfl

mlb

cfl

mls

nba

NHL

Toffoli leads Kings' early barrage in win over Leafs

Scheifele's hat trick leads Jets over Stars

Cullen sparks Wild in win over Price, Canadiens

Giordano, Smith help Flames beat Pens in OT

Stone, Anderson lead Sens past Wings

Hextall: Flyers won't acquire D amid injuries

Channelling Astros, Vegas gives Leafs best odds to be 2019 champs

The Quiz: What's the worst pick 6 this season?

Housley: 'We almost shot ourselves in the foot'

Community of Flin Flon shaped Bobby Clarke's life and career

Insider Trading: Shipachyov has returned to Russia

Avs' Varlamov makes 57 saves in win

Miller scores in OT, Rangers beat Lightning

Neuvirth stands tall as Flyers blank Blues

Kuraly's goal lifts Bruins past Golden Knights

Anderson scores a pair; Blue Jackets top Panthers

Eller scores twice, adds assist as Caps beat Isles

Ovechkin starting social movement for Putin

Kapanen gets big chance against Kings

Leafs Ice Chips: Kapanen's big chance to play with mentor Komarov

CFL

Finale for Stamps, Bombers a battle of backup QBs

Tiger-Cats ready to give their all against Als

LeFevour confident with West semifinal home field on the line

Stamps still focused on beating Bombers to get set for playoff run

Motivation a key in final week of CFL Fantasy

Reilly, Ray among team finalists for outstanding player award

Woods has long history with Lions star Rainey

Ruffles Crunch Time: From one great country and league to another

Nichols ruled out, LeFevour to start Friday vs. Stamps

Davis disappointed, feels he should be starting this week for Bombers

3 Downs: How concerning are injuries to Nichols, Harris for Bombers?

Huddle Up: Should Riders keep playing both Bridge and Glenn?

Hervey hoping for CFL return

Eskimos' Thompson out for the season

Shiltz to become 12th post-Calvillo starter for Alouettes

Coombs will start at running back in Argos' regular season finale

Banks, Masoli, Reilly named CFL top performers

CFL Fantasy: Rainey takes advantage of his opportunity

NFL

Forte rushes for two TDs, Jets run over Bills

Report: Texans' Watson tears ACL

Colts shut down Luck for season

Jones' numbers are down, but he's not sweating it

Schultz’s Week 9 picks: Take the Lions at Lambeau

49ers' Garcon on IR with neck injury

Browns WR Gordon could return this month

Game of Throws: Bills, Eagles are trade deadline winners

Statistically Speaking: Changes coming at running back

Cowboys look to Morris, others with Elliott suspended

Report: Osweiler to start at QB for Broncos

Irvin shakes his head at the latest screw up by the Browns

Ranking the best NFL trade deadline deals

Hoyer signs three-year deal with Pats

Flacco expected to start Sunday vs Titans

Vikings GM: Bridgewater's status still being determined

Lynch back with Raiders after suspension

After motion denied, PA seeks to block ruling so Elliott can play

Beyond the Scoreboard: How everybody can win from NFL protests

NBA

Lillard nails game winner as Blazers top Lakers

Warriors crush injury-riddled Spurs

Five thoughts on Murray, Okafor and more

Cavs forward Thompson out 3-4 weeks

NBA to hold lottery in Chicago next spring

Celtics' Hayward back in gym, but no timeline for return

Murray leads Nuggets' rout of Raptors

Cavs drop 4th straight as Pacers roll

Irving, Celtics beat Kings for sixth straight

Butler's late points lift T-Wolves over Pelicans

Simmons, Embiid dominate in 76ers' win over Hawks

Harden's 31 points lead Rockets past Knicks

Fournier, Gordon help Magic top Grizzlies

Warren's career night leads Suns past Wizards

Heat top Bulls to end three-game slide

Walker, Monk lead Hornets past Bucks

Rautins on efficiency of Raptors' second unit, Cavs early struggles

Spurs bring back Parker after rehab stint

Okafor asks Sixers for buyout

George, Thunder cruise to win over Bucks

MLB

A Blue Jays free agency primer

Darvish, Otani and Arrieta top MLB free-agent class

Future Watch: Arizona Fall League edition

Angels, Upton agree on five-year, $106M deal

Dodgers face decisions, luxury tax bill in off-season

Nats' Martinez: 'We're here to win the World Series'

A's exercise Lowrie's $6 million option

White Sox' Soto declines option, becomes free agent

Twins' Sano to undergo surgery for leg injury

Nats hire ex-Mets, ex-Yankees hitting coach Long

Mariners decline options on Iwakuma and Gallardo

Astros beat Dodgers for first World Series title

Roberts on Darvish: I can't explain the results

Puig's home burglarized during Game 7

Dodgers' title drought extended to 30 years

With five homers, Springer named MVP

Verlander on WS win: 'Everything I could ever imagine'

Phillips: Entire city of Houston was in this together

Perez discusses Astros' long road to first World Series title

Red Sox hire La Russa as special assistant

Soccer

Dempsey nets two as Sounders eliminate Whitecaps from playoffs

TFC complains to MLS over fan abuse in NYC

Milan held to tie; Atalanta, Kyiv advance in Europa

United's Young recalled to England

Evra charged with violent conduct for kicking fan

Tottenham stuns Real Madrid to reach knockout phase

Sinclair leads young Canada squad against U.S.

Dortmund faces Champions League exit after draw with APOEL

Besitkas closer to knockout stage after draw with Monaco

Moor, Vazquez questionable for TFC vs. Red Bulls

Crew take advantage of short-handed NYCFC in first leg

United beats Benfica after more agony for keeper Svilar

PSG win big, advance in Champions League

Must See: Neymar belts a screamer vs. Anderlecht

Atletico held by 10-man Qarabag in Champions League

Giovinco's free kick lifts TFC over Red Bulls

Atletico Madrid returns to former stadium

FIFA exec says 24-team Club World Cup discussed

After ten matches, Madrid facing big deficit

EPL: Leicester City 2, Everton 0

NCAA

Duke is No. 1 in AP preseason poll for second straight year

Barrett to make NCAA decision on Nov. 10

Georgia ranked at top of first CFP rankings

Predictions for a huge CFB weekend

Oklahoma's win over Ohio State important to CFP committee

Must See: College football coach scares players

Kelly focused on Notre Dame maintaining success

The road to the CFP has been wild

Florida, HC McElwain mutually part ways

AP Top 25: Georgia rises to No. 2, Ohio State up to No. 3

No. 6 Ohio State rallies to beat No. 2 Penn State

No. 25 Iowa State upsets No. 4 TCU in low-scoring game

No. 7 Clemson rebound for victory over Georgia Tech

No. 3 Georgia thumps rival Florida

No. 8 Miami stays unbeaten, tops North Carolina

No. 5 Wisconsin holds off Illinois, stays unbeaten

Northwestern stuns No. 16 Michigan St. in OT

No. 9 Notre Dame wears down No. 14 NC State

Peters helps Michigan pull away and top Rutgers

Rudolph shines in rain, No. 11 Oklahoma St. beats No. 22 WVU

UFC

St-Pierre, Bisping trade barbs ahead of UFC 217

TSN Original: 'The Mind of GSP'

Things get heated at UFC 217 news conference

Does Namajunas have a chance against Jedrzejczyk?

Garbrandt trying to create tense environment ahead of Dillashaw fight

McGregor: I'd beat Mayweather in a rematch

Is Bisping really 'terrified' of St-Pierre's wrestling?

Duffy on training with St-Pierre during his fight camp

Thompson ready to adapt to any style Masvidal brings

Gall explains why he brings so much confidence to mixed martial arts

Brown on fighting for New York in the wake of a tragic incident

Vick frustrated UFC has been unable to secure him a Top 15 opponent

This Fight is Important: Garbrandt vs. Dillashaw

This Fight is Important: Jedrzejczyk vs. Namajunas

GSP can cement his place in UFC history with win in his return

UFC Notebook: Covington cements himself as a contender

St-Pierre holds open practice in Montreal

Lawler: MacDonald using steroid accusations as a coping mechanism

UFC Notebook: Till delivers upset over Cerrone

Tennis

Del Potro beats Haase in third round of Paris Masters

Nadal wins in Paris, will end year as No. 1

Vandeweghe, Barty, Sevastova advance to semifinals

Rybarikova upsets Mladenovic at WTA Elite Trophy

Shapovalov bounced in straight-sets at Paris Masters

Thiem grinds past Gojowczyk at Paris Masters

Vandeweghe opens WTA Elite Trophy with win

Federer wins hometown Swiss Indoors

Wozniacki claims trophy at WTA Finals

Wozniacki advances in WTA Finals

Federer moves on at Swiss Indoors

Shapovalov falls in second round to Mannarino

Garcia advances at WTA Finals

Federer, Del Potro, Cilic advance to Basel quarters

Venus Williams reaches semifinals at WTA Finals

Del Potro beats Sousa in quest for third Basel title

Wawrinka needs coach after Norman leaves

Federer beats Tiafoe in at hometown Basel event

Sock rallies to beat Pospisil at Swiss Indoors

Williams needs more than 3 hours to beat Ostapenko

Golf

Whee shoots 65 to take Las Vegas lead

Report: Olympic to get PGA, Ryder Cup

Hot putter leads to fast start for Taylor

Tiger's back, but there's a lot to be addressed

Rose keeps alive streak of winning every year since 2010

Silverman's top 10 an important finish

Woods to play in Hero World Challenge

Armour shoots 68, earns 1st career win at Sanderson Farms

Rose wins title at HSBC Champions

PGA: Sanderson Farms Championship - Rd. 4

Kerr wins in Malaysia with birdie on last hole

Johnson leads at HSBC Champions

Armour takes five-shot lead at Sanderson Farms

Woods pleads guilty to reckless driving

Johnson grabs lead with new putter at HSBC Champions

Armour takes one-shot lead at Sanderson Farms

Toms makes ace, shares lead at Sherwood

Feng shoots 65 to lead Sime Darby

Johnson would welcome a PGA shot clock

Landry, Spaun among leaders at Sanderson Farms

Hockey Canada

Spooner calls Olympic funding 'amazing'

Canada continues search for hockey talent ahead of Olympics

Canada unveils 2018 hockey jerseys

TeamSnap partners with Hockey Canada

Spooner scores twice as Canada beats U.S.

Scrivens, Lee on Canada's pre-Olympic roster

Labonte sees great development in Canadian goalies

Canada's women's team falls to U.S. in pre-Olympic matchup

Bonhomme: Coyne, Decker and Knight overpower Team Canada

Davidson discusses challenges of assembling Olympic roster

66 players chosen to represent Canada at 2017 World Under-17 Hockey Challenge

Renney discusses Canada's Olympic expectations

Olympic gold medalist Watchorn announces retirement

IIHF release Olympic hockey schedule

Canadian women's forward Campbell retires from international play

Olympian Labonte retires from women's hockey

Hockey Canada contacts Doan and Iginla for Olympics

Regina hockey legend Tuer dies at 87

McBain leads Canada over Czechs to win Ivan Hlinka

Canada beats Sweden to advance to Ivan Hlinka final

Curling

Simmons finds right fit alongside three young guns ahead of Pre-Trials

Gushue, Jones capture Masters title in Lloydminster

Big names highlight field at men's Road to the Roar Pre-Trials

Anybody's game at women's Road to the Roar

WCT Recap: Edin defends at Champery, Roth surprises at Canad Inns

WCT Recap: Carruthers defends title at Canad Inns

Canada takes silver at mixed curling worlds

Brier to be held in Brandon in 2019

Mourning the passing of Ray Turnbull

WCT/CCT Recap: Gushue, Homan just keep on winning

WCT/CCT Recap: World champions Gushue, Homan victorious

Canada to face Brazil for men's worlds curling berth

WCT Recap: Gunnlaugson, Tippin, Englot pick up wins

WCT Recap: Jacobs, Sinclair take home Shorty Jenkins

What you need to know for the women's curling season

What you need to know for the men's curling season

Curling worlds to stay in Canada until 2020

Gushue downs Walstad to claim Tour Challenge

Team Gushue captures Everest Curling Challenge

2 notes

·

View notes

Photo

Last weekend Frogtown Hobbies hosted a modern format Star City Games Invitational Qualifier and pulled in an exciting field of 62 players from all over Ohio and Michigan. Later this month (Saturday, August 24th to be specific) we are holding our first ever Mythic Championship Qualifier and the format will again be modern, so we thought a brief analysis of the decks played last Saturday would be informative for anyone coming out in a few weeks. Two notes before I begin; first, space will be limited for the MCQ and we are capping attendance at 132 so if you are planning on playing, sign up sooner rather than later. Second, while 62 players is a good turnout for an IQ, all analysis in this article still comes with a small sample size warning. This last point is accentuated by the disparity in player skill at local tournaments. That being said, on with the analysis.

The Field

Modern is, of course, a hugely diverse format with anywhere from 10 to 40 decks being competitive, depending on how strictly you define competitive. Using MTGTop8.com we see that 9 different modern archetypes have managed to top-8 at least 10 times in the last 2 weeks alone, 21 have at least 4 top-8s, 32 have at least 2 top-8s and a full 50 have managed to make at least 1 top-8. By this metric Dredge (which includes Hogvine decks on MTGTop8) leads the way with 53 top-8s (15%) followed by Phoenix variants (mostly UR or mono-R) with 37, UW Control (28), Eldrazi Tron (25), Urza’s Foundry (23), Classic Tron (23), Burn (22) and Jund (21). Mythic Championship IV in Barcelona had 11 different decks played by at least 10 players and 20 played by at least 3 led by Hogvine (98 players), UR Phoenix (48 players), Eldrazi Tron (42 players), Humans (38 players), UW Control (38 players) and Jund (36 players).

The Frogtown IQ was no less diverse, with 24 different archetypes being played by its 62 players and 13 being played by at least 2 players. Like the Mythic Championship the week before Hogvine was the most played deck with 8 intrepid pilots braving the seas of graveyard hate for the possibility of its explosive starts. All of the Hogvine decks played were pretty uniform in the maindeck with the only decision point seeming to be what removal suite to use in the last 3-5 slots between Lightning Axe (most popular), Assassin’s Trophy, Abrupt Decay and Fatal Push (least popular). Despite its heavy representation, Hogvine players were shut out of the top-8 with it’s best performance being put up by Michael Barabe in 9th place at 4-2.

The second most popular deck was Jund, right behind Hogvine with 7 players. Befitting of a midrange deck built around answering threats the Jund decklists were very diverse.Wrenn and Six was universally adopted with everyone running between 2 and 4. All 7 players also ran some number of Inquisition of Kozilek, Thoughtseize, Tarmogoyf, Lightning Bolt and Liliana of the Veil, and 6 of 7 players also ran some number of Bloodbraid Elf and Assassin’s Trophy. Raja Sulaiman managed the archetype’s only top-8 with one of the most unique lists, splashing white for 3 maindeck Path to Exile (with the 4th in the sideboard) to compliment a full boat of Assassin’s Trophies and fully tax his opponents’ basic land counts. The fourth color probably precluded Raja from playing a ghost quarter or two but modern’s basic land light decks are definitely ill-equipped to handle that many of that effect.

A trio of very disparate deck choices were brought by 5 players each in Monogreen Tron, Burn and Urza’s Foundry (sometimes called Grixis Urza or Whirza). Tron lists are obviously pretty stock at this point with the variety basically boiling down to whether to run the Karn-Lattice package or not. Notably, our five players all chose not to, led by Nick Moore who managed to top-8 despite leaving his trusty Celestial Colonnades at home. The burn decks were similarly uniform with all five players running nearly identical 75s. All five were RW (with one lightly touching green for some sideboard cards) and all 5 ran Skewer the Critics, Boros Charm and Lightning Helix on top of the usual suspects. One burn player made top-8 with the archetype, Peter Duhamel II. Urza’s Foundry was the final deck to be brought by 5 players and, despite the deck being fairly new to Modern, there was not a lot of variation in the lists. Teferi, Time Raveler was in the maindeck of 3 of the lists (and the SB of another), 4 of the players ran Goblin Engineer, 1 player ran a Time Sieve and another ran the Karn package but for the most part the decks were pretty uniform. Yours truly was the only player to top-8 with the archetype, running it back for my second straight top-8 with it.

The rest of the decks to be played by at least 2 players were Humans (4 players, 1 top-8), Mono-R Phoenix (4 players, 1 top-8), UW Control (3 players), UR Phoenix (2 players, 1 top-8), Affinity (2 players), Goblins (2 players), TitanShift (2 players) and Eldrazi Tron (2 players). For those of you counting at home thats 7 of the 8 Top-8 slots. With the last slot being taken by the eventual winner Jarad Carroll on RW Reckoner (!!) thats a full 8 distinct archetypes (depending on how you feel about UR vs mono-R Phoenix). Our 13 decks with multiple pilots were the same as the 13 decks with more than 10 players at the Mythic Championship with 2 exceptions (Goblins and Affinity at Frog Town vs 2 different Dredge variants in Barcelona).

Results

I mentioned the top-8 decks above but let’s look a little more in depth at how decks did during the IQ. Tracking all 13 2+ pilot decks, along with the “other” category, we saw three distinct tiers emerge from the tournament. Tier 1 (Humans, UR Phoenix, Affinity, Mono-R Phoenix and Tron) all saw their players post mean and median point totals of 9 or more and match win percentages greater than 54%. Humans had an especially good day in terms of number of standings points with its players managing 3, 12, 12 and 15 points led by Max Hersch’s top-8 appearance. UR Phoenix had only 2 players but one made top-8 (Joe Romeo) with a 4-0-2 record that buoys the match-win percentage for the archetype. Affinity also had two players (who finished on 12 and 6 points). Mono-Red Phoenix was all over the map with point totals for its four players of 3,6,12 and 15 (A top-8 for Aaron Miotke).

The second tier of decks (Burn, Whirza, Hogvine, Jund, Goblins and UW Control) all had mean and median point totals between 6 and 9 and match win percentages between 42% and 54%. It should be noted that the more players a deck has the harder it is to move into the top tier just based on there being a limited number of places available at the top of the standings. Accordingly we see most of our top played archetypes here in the middle tier.

The lowest tier of decks includes the 11 decks in the “other” category as well as Titan Shift and Eldrazi Tron. Besides Jarad Carroll’s Reckoner deck no singleton deck finished higher than 9 points. Titan Shift and Eldrazi Tron had especially bad days at the office with final point totals of 0, 9, 3 and 3 combined.

Conclusion

Overall, it looks like the best plan for the IQ was to be aggressive with a little bit of disruption as this adequately describes Humans, both Phoenix decks, Affinity, Burn and Hogvine. The little bit of flux caused by recent strong Modern sets like Modern Horizons and War of the Spark makes it hard to play control (where a settled field helps make sure you play the right answers). Of course, the deck that won took advantage of all of those aggressive decks (beating BR Elementals, Devoted Vizier, Affinity, Humans, Burn and Mono-R Phoenix while losing only to Whirza) by playing maindeck Auriok Champions, Worships, Blessed Alliance, Pyroclasm and Blasphemous Act to the top of the heap so there’s that.

Boros Reckoner Swans

Jarad Carroll

1st Place at Star City Games Invitational Qualifier on 8/3/2019

Creatures (19)

4 Auriok Champion

4 Boros Reckoner

2 Spiteful Sliver

2 Swans of Bryn Argoll

2 Volcano Hellion

4 Wall of Omens

1 Hazoret the Fervent

Planeswalkers (2)

2 Chandra, Torch of Defiance

Lands (21)

2 Mountain

6 Plains

1 Bloodstained Mire

1 Clifftop Retreat

4 Inspiring Vantage

2 Marsh Flats

2 Sacred Foundry

3 Wooded Foothills

Spells (18)

2 Rest in Peace

2 Worship

1 Blessed Alliance

3 Lightning Bolt

3 Path to Exile

1 Blasphemous Act

4 Faithless Looting

2 Pyroclasm

Sideboard

1 Pithing Needle

3 Blood Moon

2 Leyline of Sanctity

1 Rest in Peace

2 Stony Silence

1 Boil

1 Wear

2 Anger of the Gods

My recommendation is the same as it always is in modern: either play something proactive with just enough disruption or win the matchup lottery and coast through without playing decks that beat you. Good luck to all of those coming to Frogtown’s Mythic Championship Qualifier, I’ll be there battling it out for fame and glory, stop and say hello.

-Stephen K Timmons

0 notes

Text

Pennsylvania Fireworks Laws: What Exactly Are They?

By Olivia Pereira, Villanova University Class of 2020

July 9, 2019

During the summer months, a lot of people enjoy setting off fireworks in celebration. If you live in Pennsylvania or go to a summer party in Pennsylvania, you should be aware of the state firework laws. In October 2017, House Bill 542 was passed that made it legal for Pennsylvania residents to purchase “consumer” fireworks. The state tax rate on each fireworks item is 12%. You must be 18 years of age or older to purchase consumer fireworks. Examples of the types of fireworks you can legally purchase in Pennsylvania include:

● Sparklers

● Roman Candles

● Bottle Rockets

● Fireworks that contain a maximum of 50 milligrams of explosive material

Display fireworks are still illegal to purchase in Pennsylvania and you must have a permit to purchase them. Explosives commonly referred to as “M-80,” “M-100,” “Blockbuster,” “Cherry Bomb,” “Quarter or Half Stick,” and “Ash Cans” are still considered federally illegal [5].

The Pennsylvania Department of Agriculture licenses stores that are allowed to sell consumer fireworks throughout the state.

Restrictions on setting off fireworks: