#3. a new currency that will be SIGNIFICANTLY less than the american dollar

Explore tagged Tumblr posts

Text

I want the us to balkanize soooo bad I think economic disparity would humble texans correctly

#things texans would have to deal with#1. border control while entering the us#2. having to maintain a visa when working in the states#3. a new currency that will be SIGNIFICANTLY less than the american dollar#4. MASSIVE tariffs on what would now be considered international goods#these dumb fucks think it'd be a conservative safe haven when it'd be literal economic disparity#BALKANIZE! BALKANIZE! BALKANIZE!

9 notes

·

View notes

Text

7 Reasons Why Cryptocurrency Belongs In Your Retirement Portfolio

Across the world, governments are faced with the reality that most households aren’t saving enough for retirement.

Sadly, the era of company-sponsored pension plans is long gone and both Millennials and Boomers are bombarded with the high costs of basic priorities such as housing, education and healthcare that compete directly with investment plans and retirement savings.

According to a recent study carried out by Ramsey Solutions, about half of Americans are not saving for retirement, and the few who do save aren’t saving enough. Folks, that’s a crisis.

In another survey, only 3 in 5 households headed by someone between the ages of 45 and 54 had a retirement account with an average value of $83,000, and 13% of people in their 40s had absolutely no retirement savings.

Apparently, 56% of Gen X folks have no clue how much they will need for retirement. This is according to a new study conducted by Bankrate. In addition, nearly half of working households will experience lower living standards during retirement, as revealed by the Center for Retirement Research at Boston College.

Save for Your Retirement By Investing in Crypto

It’s never too late to start planning or saving for your retirement. Its a fact that most people dread putting their money in risky (read: liquid and volatile) areas such as cryptocurrencies.

We will tell you for free that any viable future financial plan should include Bitcoin and other cryptocurrencies which will provide a secure hedge against existing shaky financial systems.

Today, many people are searching for opportunities that deliver high ROI within a short time frame, possibly through options like private equity funds, venture capital, real-estate investment trusts and lately cryptocurrency.

And there are many people that continue with the struggle to max out their 401(k) contributions, stashing money in traditional IRA or mutual funds.

Of course that’s crucial, but since the majority of retirement plans adhere to the “contribute and coast” rhetoric, ensuring smooth operations and optimal earnings, they eventually demand rebalancing of your finances as the global financial landscape evolves.

Keep in mind that cryptocurrency is one of the biggest and most disruptive technologies in the financial arena in recent tim

Cryptocurrency is coming into the broader market as a new asset class. The puzzling price swings in Bitcoin are luring millennials into pouring their money into risky investments. Interestingly, even the IRS has approved cryptocurrency IRAs.

At this juncture, people are wondering which crypto asset class belongs to the retirement accounts, which crypto and retirement portfolios can feature in their investment strategy and if buying crypto is a great idea for long-term investing?

Why Cryptocurrency Has Become Such a Big Deal?

Well, it’s the next big thing. Ask Wall Street fund managers — they say it is the future!

Don’t be surprised when your friends and family start channeling their retirement dollars into cryptocurrency sooner rather than later. And don’t be startled when you see the cryptocurrency index or exchange-traded funds start to appear on the New York Stock Exchange.

While the crypto space is susceptible to volatility, there are numerous indications that point to Bitcoin and blockchain as being a strong bull ideal for building exchange-traded funds as well as other instruments that are great for retirement savings. You too should be bullish on blockchain, Bitcoin and other cryptos.

Rafael Carmona Toscano, a private investor and scholar of cryptocurrency who has been accumulating Bitcoin since 2013, notes that Bitcoin has a bright future. Rafael boasts hands-on experience with cryptos as he started out mining Bitcoin, and later purchased it.

“Bitcoin is a bank for the unbankable,” he says, while stating that many people in the world have no bank accounts and hence cryptocurrency would solve a huge problem for those folks.

Digital assets represent a new, fundamental asset class — one that is being considered carefully by investors. The main reason for this can be illustrated by Real Estate Investment Trusts, abbreviated as REITs.

The underlying concept of REIT was first introduced as an asset class designed for legal investment in 1960. The investment grew gradually in subsequent decades, but did not gain momentum until the 1990s. In short, the early investors profited incredibly.

Similarly, Bitcoin and other cryptocurrencies are probably the fastest growing asset class in the financial space. But do they qualify to be in your retirement account? Many experts believe so.

Here are 7 reasons why you should include a cryptocurrency IRA (individual retirement account) in your retirement portfolio.

#1: Diversification

The rule of thumb is never put all your eggs in one basket! Did you know that diversification is one of the strategies used to minimize exposure to a single asset class while still ensuring its growth? When it comes to retirement planning, one of the most effective ways to diversify is to put your savings in multiple mutual funds for different reasons such as income, growth, investing etc. Thereafter, you may need to re-balance your portfolio to ensure any rapidly growing segments of your portfolio do not skew your intended allocation.

In traditional financial markets, most of the available tax-deferred retirement accounts restrict diversification to only two classes — bonds and stocks. But, as much as diversification involves spreading the risk across different asset classes, this should extend beyond bonds and stocks to include real estate, cryptocurrency and precious metals, among others. Since cryptocurrency is a promising new asset class with exciting upside potential, it is worth considering as a retirement plan alternative for your diversified portfolios.

#2: Government Hedge

No government can directly control cryptocurrency. This is one of the reasons that has fueled its growth as an alternative currency. However, government regulations and policies do impact the bond market or Wall Street. In addition, central banks debase traditional currencies such as the U.S Dollar with evolving approaches to exchange and monetary policies. In contrast, digital assets like Bitcoin are immune to the effects of changing governmental directives. As such, we can consider cryptocurrency as an asset class capable of shifting in the opposite direction to dominant markets. This gives more credence to its diversification potential.

#3. Long-Term Growth Opportunities

Keep in mind that while cryptocurrency is proving to be an ideal long-term investment, it is also volatile. And just like any other volatile investment, what skyrockets today can plummet tomorrow and that can be bad for your health!

But do you know what other investments can be volatile? Stocks! That’s right. We all remember the Great Recession that happened from 2007–2009 where the U.S equities lost about 50% of their value in less than 18 months.

But we’re not talking about day-to-day transactions. Retirement planning is a long term horizon where individuals count on accruing tax deferred benefits for several decades in order to achieve a given milestone. It’s this long term view that got those who saved for retirement out of the muddy waters of the Great Recession.

Remember the lowest level for the Dow Jones Industrial Average during the crunch? It was at 6,547. Most notably, its highest level before the crash was at 14,164. A decade later, and the market has drastically risen over those points of the Great Recession.

Similarly, while the price of cryptocurrency and particularly Bitcoin is significantly low at the moment, it is obviously higher when compared to early 2017. I bet that anyone would be quite happy with the returns, with the coin price having increased beyond double from its value of about $2,000 in May 2017 to the current November 2018 prices of around $4,000.

#4. Cryptocurrency is Still Cheap

Is the current price tag of Bitcoin turning you away? Well, think again and remember even if Bitcoin’s not cheap, other cryptocurrencies are.

The most important question is not whether or not cryptocurrency is cheap, but will it have appreciated in value a decade later?

If you believe Bitcoin’s price will be in the range of $10,000, $100,000 or $1 million, then the coin is damn cheap today!

While you may not be that guy who spent $100 in 2010 and now has a net worth of $7.4 million, you can still take the advice provided by Wences Casare, PayPal board member that you “put 1 percent of your income into Bitcoin and forget about it for ten years.”

#5. Bitcoin Is Highly Resilient

Bitcoin is huge and the news of its death as highlighted in the 2013 smug LA Times article was premature, given that the coin is aging well.

While the Bitcoin market has faced some tumultuous times, like earlier in the decade when it lost about 70 per cent of its value overnight, the coin has recovered — along with other cryptocurrencies. Realistically, the thought of Bitcoin fading away is impossible as long as the concept of cryptocurrency still exists.

#6. Crypto Is Going Mainstream

You can use cryptocurrency on the online ecommerce marketplace, Overstock. Restaurants in Kenya and Silicon Valley will accept and give you a discount for using it. You can also buy your Sacramento Kings tickets with it.

Some of the biggest companies on the planet like Microsoft, Dell, Tesla and Virgin Galactic are accepting Bitcoin. And why not? Its price is likely to be more tomorrow than it is today.

BitPay, a global payment company is already working with over 125,000 merchants across the globe that accept Bitcoin as a medium of exchange. The company goes a notch higher to allow Bitcoin users to hold a Bitcoin Visa credit card which enables users to transact anywhere this Visa is accepted.

In essence, the fiction that “you can’t use Bitcoin to buy anything” is a fallacy, not a fact. Of course, We don’t expect you to hit your grocery store with it now, but you might be interested in knowing that a guy purchased a house with Bitcoin and made a $1.3 million return on the deal.

#7. Supporting Technology

The world of technology is evolving so rapidly and its successful integration into crypto and retirement portfolios will depend on how fast its functionality will allow holders to quickly and smoothly trade coins and exchange cryptocurrency for fiat currency or non-tokenized assets in their portfolios, while ensuring complete automation, transparency and record-keeping. This will reduce the need for having “middlemen” that drive up charges and cost layers.

The maturation of technologies that support trading in crypto is poised to increase its value, while pushing it into becoming mainstream.

Ideally, the emergence of more retirement platforms that support the technological characteristics of cryptocurrency exchange and portfolio integration have the power to increase crypto gains for the early adopters.

One example of a supporting retirement platform is Dacxi, an innovative platform that empowers new customers looking to hold on to their assets for the long-term. The company’s Dacxi Bundle is a first-of-its kind, combining the major coins by market capitalisation with an emerging coin with rapid growth potential. Ultimately, this helps new customers to spread their risk across four crypto assets automatically and at zero transaction fees!

Tokens or bundles purchased by users are kept safely in 2FA, secure wallets. Users are able to rebalance amounts and adjust their portfolio as they choose.

Take The Plunge

So, why be a statistic among people whose biggest regret is not saving enough for retirement?

How much do you plan to spend when you finally take the plunge? The answer to this question is — as much you can afford. Only you know your own risk tolerance and capability to save or spend.

Dacxi is proud to support people on a path to prosperity with crypto. If you would like to find out more then please join us at dacxi.com. We’re here to help.

1 note

·

View note

Text

Over the winter of 2015– 2016 what threatened the world economy was, in the words of the Economist, nothing less than a “calamity.” 9 The emerging market boom, which for so long had energized the narrative of globalization, had ground to a shuddering halt. Russia, Central Asia, Brazil and South Africa were already in recession. An implosion of the Chinese economy, with a plunging yuan and investors scrambling for the exit, could easily have pushed the world economy into recession. The Economist painted a horror scenario in which the funds flowing out of China and a huge glut of overcapacity amplified a global cycle of deflation, the momentum of which would have been more unstoppable than in 2008. Industrial and commodity producers would be left insolvent. At the same time, if the yuan peg broke, it would not be the only currency to devalue. Dollar carry trades across the emerging markets would unravel,provoking a general financial crisis. Western banks would not be immune.

The scenario was terrifying. Even the possibility of its unfolding was enough to spread panic. Commodity markets were intensely nervous. After falling off a cliff in November 2014, oil had stabilized in the spring of 2015 at c. $ 60 per barrel. But China was now the world’s largest crude importer. The prospect of a China crisis coupled with the abundant supply of shale oil from the United States and the intransigent stand of the Saudi government sent markets over the edge once more. 10 Between the summer of 2015 and January 2016, prices halved from $ 60 to $ 29 per barrel. As the Saudis no doubt intended, this dealt a painful blow to the heavily leveraged US shale industry and sent ripples of anxiety through American financial markets. Even in the advanced economies propped up by quantitative easing, deflationary pressures were looming. In January 2016 the question at Davos was not how China would lead, but how it would cope. Could Beijing prevent a collapse? Would a Chinese implosion turn the jarring reversal of the fortunes in the emerging markets into a comprehensive rout? A year on, this is the global crisis that the Trump administration did not inherit. The question is, why not?

Any answer must start with the actions taken in Beijing. On the basis of its dramatic response to the crisis of 2008, the Chinese regime had a formidable reputation for effective economic policy. But in 2015 China’s initial response to the crisis was anything but reassuring. The fumbling efforts to stabilize the Shanghai stock market exposed the myth of Beijing’s omnicompetence. 11 QE with Chinese characteristics was not a success. The August 2015 liberalization of foreign exchange trading was mishandled. But Beijing held its nerve. Rather than allowing the yuan to continue its slide, the PBoC stabilized a new peg. Capital controls were stiffened, but otherwise the PBoC allowed the unwinding of exposed dollar positions. If this was an adjustment of balance sheets and not general panic, it was the right thing to do. From their peak of $ 4 trillion in the summer of 2014, China’s currency reserves fell by early 2017 to $ 3 trillion. Watching the monthly drain of tens of billions was nail biting, but eventually at the lower level reserves stabilized. To revive demand in early 2016, Beijing unleashed another credit boom and a fiscal stimulus, while at the same time it set about purging the most overexpanded heavy industrial sectors of overcapacity. Western media ordinarily known for their advocacy of market freedom could not hide their relief that Beijing’s grip had been restored. As the Economist remarked: “With capital now boxed in, much of it flowed into local property: house prices soared, first in the big cities and then beyond. Sales taxes on small cars were reduced by half. Between them, these controls and stimuli did the trick.” 12 In reaction commodity prices rebounded and manufacturing surged across Asia, pulling China’s giant manufacturing capacity back from the brink. The threat of global deflation receded. This is how the triumphalist narrative goes. China is not just another crisis-prone emerging market. Beijing is in control. A threat of crisis spawned in China that threatened to destabilize the world economy was contained by China. So far so good, one might say. But 2015 demonstrated not only that China was neither invulnerable nor omnicompetent. Even more significantly, it demonstrated that it was not autonomous. In 2008 the question had been whether China would dump its dollar holdings and destabilize the United States. Eight years later, thanks to China’s deeper financial integration, the question was reversed. As Beijing struggled to gain a grip on its stock market and the drain of foreign exchange, the question was not whether China would dump the dollar but whether the Fed would cooperate with China’s efforts to stabilize the yuan.

From the last chapter of Tooze’s Crashed

11 notes

·

View notes

Text

Shelling out Can Be Lucrative With Real Estate in Slovenia

Very few ındividuals are aware that investments in Slovenia are much more cost-effective, compared to investing the same amount in the United States or the United Kingdom. Slovenia property investments have potential for higher returns on your hard-earned lifetime savings than other markets. With the guidance of any professional experienced in Slovenian markets, you would be able to experience the opportunities existing in Slovenia for maximizing your rewards. When you mention property investment in overseas markets, the original reception is usually skeptical. When you take this topic farther by saying that investments in Slovenia are more worthwhile compared to the property market in California, you are most likely in order to shock most of the people. For example , if you say that you had bought the housing property in Slovenia for $500, 000, the comments would most probably be, "Slovenia? Is it a place or a country? I have never heard of it", "Don't you believe buying a house in Slovenia is a risky affair? ", and "I am convinced that you are not acting in a intelligent manner. " Some of the comments could be even harsher. On the other hand, if you state that you have invested $1, 000, 000 in a waterfront property in a remote area in Los angeles, people would unanimously agree that you had made a great option. In reality, which of the above two investments is riskier? How to decide whether property investment in new international markets like Slovenia is riskier or safer as compared with an investment in native California? Slovenia Economy It will be true that many real estate investors in various countries had neither of the two heard of Slovenia or the opportunities that this little recognized neighbor of Italy offers in the property field. Slovenia joined the European Union in 2004 and recently adopted dollar as its currency. It would be interesting to know that Slovenia possesses the highest per capita GDP in the Central The world region, according to the CIA World Factbook. Further, the national infrastructure of this country is one of the best and the workforce is also rather well-educated. Like most global countries, properties appreciated significantly in between 2004 and 2007. However , the worldwide recession following the bursting of the real estate bubble in the middle of 2008 in the United States afflicted Slovenia also to a certain extent. Still, the country had managed to recover and is now on the growth path again. The actual GDP growth rate is around 5%, the highest for any new member state of the European Union. Slovenia Real Estate Market Data released by your Statistical Office of Republic of Slovenia (SORS) talk about that property values rose at an annual common of 1. 3% between 2004 and 2007 but been reduced after that. During the first quarter of 2009, the prices in houses on sale in second-hand market dropped by 7% from the same period in 2008, while the fall for real terms was at 8. 7%. The real residence prices in the capital city of Ljubljana collapsed through 8% in nominal terms and 9. 6% during real terms, while the decline was 6. 8% throughout nominal terms and 8. 5% in real words and phrases in the rest of the country during the first quarter of 09. This had brought down property prices, which is an excellent negative point but a positive factor. You could buy components at lower rates right now. Investment Opportunities in Slovenian Properties The biggest assets of Slovenia are its valleys blooming with vineyards, the breathtaking coastlines, the arctic peaks of Alps and the rolling hills, the numerous waterways, and beautiful waterfalls. These features had made Slovenia a major tourist attraction, with possibilities for rental real estate thriving financially. At the same time, the slump in property character and the possibility of significant appreciation in this decade make this place a prime location for real estate investment. After the setback regarding 2008, the Slovenian economy had been recovering at a faster rate compared with several other European and North American nations. A recent survey voted Slovenia among the top 10 countries offering best opportunities through real estate investment. According to the survey, the growth rate of place values in Slovenia are forecast to increase at the astonishing rate of 284% on an average, between 2010 and 2020. The annual rate of real estate rate growth is estimated at 30% at present. As such, expenditure of money in real estate of Slovenia is considered as a long-term, reliable and solid proposition. Do you know that you would be able to buy a very few hectares of prime land covered with vineyards as well as having a medium-sized 2-bedroom house for a low price of 70, 000 euros or about $100, 000? The helpful fact is that nearly 40% of Slovenia has area covered with vineyards and it is a major wine-producing nation. Sometimes the properties in major cities of Slovenia, which includes Ljubljana and Maribor cost only around 1, 500 to 3, 000 euros or $1, 800 to make sure you $3, 600 per square meter. Procedures of Investment decision in Slovenia Real Estate Apart from the several registered real estate providers in Slovenia, the local laws explicitly permit people out of your United States and European Union to buy properties in Slovenia with very little restriction. It would take about a month to complete all the thank you's required to buy a property. With certain stipulations, you could also utilize financing and mortgaging options but it is advisable for you to finance your purchases out of your own resources, if you want to capitalize on the returns on your investment. Conclusion It is obvious which a property investment in Slovenia is likely to be more profitable in the form of long-term venture when compared to the same amount being invested in the usa or other countries in the European Union, where the economic development rate is still sluggish. The present growth of Slovenia offers better returns in this decade than any real estate investment on these countries. As such, it could be safely concluded that your investment decision in Slovenian real estate would prove to be more profitable than a similar investment in several other countries right now and much much less riskier.

1 note

·

View note

Text

Last summer I spent two weeks of my summer travelling around Sri Lanka whilst collaborating with hotels and restaurants across the country. I used the public transport system and local drivers to visit six different locations in my thirteen full days there, seeing everything from the Indian Ocean from Mirissa’s beaches to elephants in Yala National Park. In this post I’ll outline costs of food, commuting and excursions in Sri Lanka as well as giving a rough itinerary outline. Of course, everybody visits this incredible country for different reasons. I’m aware that some people may want to safari or surf for the duration of their stay, but for me I wanted to cram as much as possible into my very short visit and at as low a cost as possible.

For those intending on visiting Sri Lanka, there is a limit on how many Sri Lankan rupees you can take out of the country so you will be unable to purchase currency before your trip. If you’re taking cash to convert on arrival, be sure to use a large currency such as Pounds (for my fellow Scots, make sure it’s English notes – trust me!) or Dollars. Sri Lanka requires an e-visa from most visitors. Our visas took around 3 working days to be confirmed and emailed to us, so make sure to apply in plenty of time and to use an official source (local governments should have links to where visas are safe to purchase from). I have a full post on applying for East and South Asian visas on my site, which you can read by clicking here.

Processed with VSCO with c1 preset

Processed with VSCO with c1 preset

Processed with VSCO with f2 preset

Itinerary

As I’ve already indicated we visited a total of six locations whilst in Sri Lanka, however there were countless other towns and sights I would love to have seen so I’ll be sure to include them in this post, too.

Colombo, 3 nights: We started in Colombo, spending three nights in the heart of the city. Colombo has a great culinary scene and its skyline is transforming almost daily. The city is experiencing incredible growth but managed to retain all the charm I expected to find in Sri Lanka. You can see more photos from our time in Colombo as well as hotel and restaurant reviews by clicking here.

Mirissa, 3 nights: From Colombo we took a beautiful coastal train to Galle followed by a bus to Mirissa (more on getting around Sri Lanka later in this post) where we spent a further three nights. You can read my full review of our hotel, Seaworld Resort, by clicking here. Mirissa is perfect for surfing, being close to the stick fishermen and is roughly forty-five minutes for the much pricier town of Galle.

Yala, 2 nights: We took a tuk tuk from our hotel in Mirissa and drove across the Southern belt of the country which took close to three and a half hours. Yala is an incredible National Park with an endless list of wildlife. You can see photos from our safari by clicking here, and if anyone would like a review for our hotel then just let me know in the comments.

Ella, 2 nights: We travelled by bus from Yala to Ella by public bus. Although they’re pretty crowded and poorly ventilated, this drive in particular was one of the most beautiful we took during our visit. We climbed into the mountains to reach the small town of Ella, where you can visit the famous nine-arch bridge, mountainside waterfalls and climb Little Adam’s Peak. For more photographs of Ella and a full review of a suitable-for-any-budget hotel, click here.

Kandy, 2 nights: We took the world-renowned train journey from Ella to Kandy which took a few hours. Kandy was incredibly hectic, but I have to say I preferred it to Colombo. We stayed with the same chain as in Colombo, Clock Inn, and you can read my review for the hotel/hostel by clicking here.

Pinnawala, 2 nights: I’m aware this location may be slightly controversial to some, and I will admit that after seeing wild elephants on safari I would rather have not stayed at the Pinnawala Elephant Orphanage, but hotels and transfers to the airport were already paid for. However, our hotel had an incredible view of the river and we were able to get up close and personal with the elephants during their times in the water. Note that you’re unable to get to your hotel without paying a fee outside the hours of 10am and 4pm, so be sure to arrive before or after then to avoid time wasting.

Because of both time and budget constraints we weren’t able to make it to Sigiriya, Udawalawe National Park or to the Cameron Highlands. When I visit Sri Lanka again I’ll make a point of visitng all three for very different reasons. Udawalawe because of its dense elephant population, the Cameron Highlands because of their incredible beauty and Sigiriya to learn more about its history.

Costs

During this trip I was fortunate enough to receive a lot of my meals and accommodation for free, but I’ve done some research on costs of both as well as that of public transport and excursions to give a fully comprehensive guide to Sri Lanka.

Our flights from Manchester to Colombo (with a stopover in Muscat) cost approximately £360 return with Oman Air. As far as long haul flights go, this is more than reasonable and the same path for the rest of 2018 will cost you roughly the same. I always use Skyscanner.net to source flights and compare prices. Nine times out of ten I’ll book the flights through the airline’s own website, but sometimes the discounted rates are available only through Skyscanner. If you’d like to learn more about using the website for flights and hotels, you can read my guide here.

In terms of hotels, prices fluctuate slightly from region to region. For more remote areas such as Pinnawala and Yala, hotels have the ability to jack up the prices because of their monopoly across the area. Even so, for two people rooms can range from £12 per night to upwards of £100. In the larger cities like Colombo and Kandy, I would budget around £30 per night for a three-star hotel and £75 for a five-star. This is really where I start to plan the lengths of my trips, as accommodation is always the biggest outlay apart from flights.

Food can be as expensive or inexpensive as you desire. Around half of the nights we bought ramen noodles and cooked them with the kettle at our hotel which cost just £2 to feed us both. Others we went to local restaurants, and others to larger restaurants like Kaema Sutra and Ministry of Crab. Like the hotels, you really can adapt your meal plan to suit your budget. Realistically, I would budget around £20 per day per person for food, however it’s more than doable on £5 each.

Processed with VSCO with f2 preset

Getting Around

For getting around the country, you can either use private transfers, hire a car yourself or use public transportation. With the exception of our final trip to the airport which cost us an insane £40, we used public transport and tuk tuks for the entirety of our trip.

Upon our arrival in Colombo we used the local 187 bus to take us to Colombo Fort, costing 60 rupees (120 LKR = 1 GBP) each. This is significantly cheaper than taking a taxi, and means you get a higher-up view of the city while you maneouvre the winding market streets of the outskirts of the city. From the fort we took a taxi to our hotel which cost us 400 rupees. At no point in Colombo did we ever pay more than this to get from A to B, and everytime we boarded a tuk tuk we asked either the driver turn on the meter or give us a price upfront.

For thirteen days and for two people we spent around £100 getting around Sri Lanka. We took two trains, one from Colombo to Galle and another from Ella to Kandy. The former can cost 50p for third class tickes, £1 for second and £5 for first. The latter is a little pricier, but worth it compared to the cost of private transfer, at £2 each for a second class ticket.

Twice we used tuk tuks for length journey, the first being from Mirissa to Yala which cost us 4000 rupees and the second from Kandy to Pinnawala which cost us much less at 2000 rupees. Both of these journeys are possible by bus, but we wanted to cut down our travel time and be able to stop on the drive wherever we wished. Private transfers begin at roughly £40, so if you’re on a budget I strongly recommend investigating the public transport system and its limits before heading to Sri Lanka. For every country – Asian, European and North American – I’ve visited I always use Seat61 to determine routes, prices and timetables. Click here to view his site.

Processed with VSCO with f2 preset

Processed with VSCO with c1 preset

If you’ve made it all the way to the end, thanks for taking the time to read this post! This is a brand new style of post for me, so I’d really like to hear your feedback on my social channels or in the comments. If you’d like to subscribe for more content like this, sign up at www.caitlinjeanrussell.com/subscribe

Two Weeks in Sri Lanka – Costs, Itinerary and Getting Around Last summer I spent two weeks of my summer travelling around Sri Lanka whilst collaborating with hotels and restaurants across the country.

#asia#backpacking#budget#Budget Travel#Hotels#money#Public Transport#saving#south asia#southeast asia#sri lanka#Transport#travel#travel guide

1 note

·

View note

Text

Companies turn to convertibles for much-needed cash

As a relatively small and often overlooked asset class, convertible securities rarely make headlines. However, the asset class has received a great deal of attention from financial publications in recent months. Convertibles have been making the news for two primary reasons – record-setting new issuance and strong absolute and relative performance.

COVID-19 spurred a wave of convertible issuance early this year

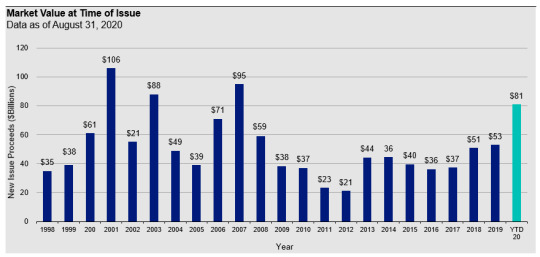

A convertible security is a corporate bond that has the ability to be converted into a fixed number of shares of the issuer’s common stock. New US convertible issuance has been strong this year, currently standing at about $81 billion according to Bank of America. That’s higher than all of 2019, which was in itself a very strong year with about $53 billion.1 This is highest level of issuance since before the financial crisis, when issuance totaled $95 million in 2007. 1 Additionally, with this surge in new issuance, the US convertibles market is now expanding versus shrinking, having recently crossed over the $300 billion threshold for total market value compared to around $200 billion just two years ago. 1

In the early days of the pandemic, new issuance was largely generated from “rescue names” – cash-strapped companies in sectors like retail, travel and restaurants that were looking for capital to help weather the downturn. That was different than the issuance that we saw over the past few years, which tended to be from companies (primarily within tech and health care) that were seeking growth capital. Some of the rescue names that have recently issued convertibles are household names like Carnival Cruise Lines, Southwest Airlines, Callaway Golf and American Eagle Outfitters.2 All saw huge revenue declines when COVID-19 hit, and the new issues were offered at very attractive terms, in my view.

Domestic convertibles: Historical new issuance Issuance year-to-date is at the highest level since before the financial crisis in 2008

Source: Bank of America Merrill Lynch. Historical data from 1998 through Aug. 31, 2020. Past performance does not guarantee future results.

The potential benefits of converts may keep them in the spotlight

Now, with a return to credit market stability and a strong equity rally since March, we have been seeing less rescue issuance. So what may be driving new convertible issues now?

Even amid the low interest rate environment, higher spreads can still make converts more compelling than other types of debt or equity issuance in terms of cost of capital, in our view.

Also, high stock prices are also an incentive for companies to issue converts. Companies are using converts for potential merger and acquisition funding, and are pushing out maturities by refinancing existing debt (including existing converts).

Companies have been seeking diversification of capital sources, with many issuers that previously relied on bank capital, investment grade, and high yield issuance now turning to converts.

Why have companies been looking at converts rather than the high yield market or equity? In my view, the asset class makes a lot of sense for high growth companies. For one thing, convertible coupons are generally lower than those attached to non-convertible debt. Also, the convert market allows unrated issuers to issue unsecured debt. Indeed, some companies don’t want to get rated given the time lag and the chance for an inaccurate rating. Converts can also be issued with a call spread,3 so initial premiums palatable to convert buyers can be moved higher, lessening the impact of earnings dilution to the issuer and making the financing more debt-like. And we have seen some companies look to converts earlier in their life cycles, since there is no collateral and usually no covenants. Upcoming accounting treatment changes may also benefit the asset class.4

Convert performance has been strong

Performance from the asset class has also captured investors’ attention this year, in our view. Convertibles have characteristics of both equities and fixed income, and this has helped the asset class weather the downturn and participate in the rally. The asset class, as represented by the ICE BofAML US Convertible Index, had a 24.88% return as of Aug. 31, according to Lipper, outperforming the S&P 500 Index return of 9.74% and several other equity and fixed income indexes. Performance is being driven partly by the unique make-up of the asset class, which is skewed to the technology, health care and consumer discretionary sectors. The asset class has also benefitted from a rebound in credit as the US Federal Reserve has provided support.

Looking ahead

Going forward, we expect the issuance calendar to remain healthy, but the pace will likely be a bit more modest than what we’ve seen this year so far given a probable pullback on the part of companies that were most impacted when the pandemic hit. Nevertheless, I believe technology, media and telecom are once again likely to be active sectors in terms of issuance as their share prices have moved higher during the year, significantly so in some cases. Health care may be a big source of issuance as well, including some COVID-19 beneficiaries in areas like drug development and telemedicine, for instance.

We expect the current environment to continue to be favorable for convertibles. For one thing, while convertible valuations have improved in recent weeks, they are still below where they were at the start of the year, according to data from Barclays as of Aug. 26, 2020. Additionally, if equities continue to climb, converts may be well-positioned given the asset class’s exposure to tech, health care and now consumer discretionary, sectors that have performed well thus far. If, however, equities pull back from their recent all-time highs, we expect converts may do what they are designed to do and post relative outperformance due to their fixed income attributes – high income stream relative to underlying stocks and bond floors.

Learn more about Invesco Convertible Securities Fund

1 Source: Bank of America, data as of Aug. 30, 2020

2 As of Aug. 31, 2020, the following were holdings in Invesco Convertible Securities fund: Southwest Airlines: 1.44% and Callaway Golf:�� 0.41%. Carnival Cruise Lines and American Eagle Outfitters were not held in the fund as of that date.

3 For an upfront cost, issuers may choose to overlay a “call spread” to effectively increase the conversion premium from the issuer’s perspective. This entails buying call options with a strike equal to the conversion price and selling further out-of-the-money call options.

4 The Financial Accounting Standards Board (FASB) issued an accounting standards update in August that changes the tax treatment of convertibles to simplify reporting for issuers. We expect the effect to likely reduce reported interest expenses, which would be a positive for issuers. The rule also changes the way converts are treated for calculating earnings per share (eliminating the treasury stock method), which may increase share dilution. The rules will go into effect for the fiscal years after Dec. 15, 2021, with early adoption permitted for the fiscal years after Dec. 15, 2020. For more details, please read the full FASB update on their website.

Important information

Blog header image: Jayden Staines / Unsplash

The ICE BofAML US Convertible Index tracks the performance of US-dollar-denominated convertible securities that are not currently in bankruptcy and have total market values of more than $50 million at issuance.

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

An investment cannot be made directly in an index.

Convertible securities may be affected by market interest rates, the risk of issuer default, the value of the underlying stock or the issuer’s right to buy back the convertible securities.

An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Derivatives may be more volatile and less liquid than traditional investments and are subject to market, interest rate, credit, leverage, counterparty and management risks. An investment in a derivative could lose more than the cash amount invested.

The risks of investing in securities of foreign issuers, including emerging markets, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Junk bonds involve a greater risk of default or price changes due to changes in the issuer’s credit quality. The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa.

Preferred securities may include provisions that permit the issuer to defer or omit distributions for a certain period of time, and reporting the distribution for tax purposes may be required, even though the income may not have been received. Further, preferred securities may lose substantial value due to the omission or deferment of dividend payments.

A decision as to whether, when and how to use options involves the exercise of skill and judgment and even a well conceived option transaction may be unsuccessful because of market behavior or unexpected events. The prices of options can be highly volatile and the use of options can lower total returns.

The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risks associated with an investment in the Fund.

The opinions referenced above are those of the author as of Sept. 22, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Before investing, investors should carefully read the prospectus and/or summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the fund(s), investors should ask their financial professionals for a prospectus/summary prospectus or visit invesco.com.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/companies-turn-to-convertibles-for-much-needed-cash/?utm_source=rss&utm_medium=rss&utm_campaign=companies-turn-to-convertibles-for-much-needed-cash

0 notes

Text

2:00PM Water Cooler 7/30/2019

Digital Elixir 2:00PM Water Cooler 7/30/2019

By Lambert Strether of Corrente

Trade

“How Trump Is Sabotaging Trade’s Ultimate Tribunal” [Bloomberg]. “As the U.S. wages its global trade war, companies and governments alike are taking notice of a little-known unit of the World Trade Organization that, if President Donald Trump’s administration has its way, will soon cease to function. The WTO’s appellate body, the preeminent forum for settling worldwide trade disputes, may no longer have the capacity to issue new rulings by year-end, which critics warn will undermine the WTO’s ability to resolve conflicts among its 164 members and will usher in an era where economic might trumps international law…. Lighthizer told U.S. lawmakers this year that his ultimate goal is to reform the WTO and sees the appellate body impasse as a form of leverage in pushing his agenda forward.” • And, as usual, this Administration is intensifying what the previous admininistration began.

“A Democrat Floats Options to Trump’s Trade Tactics” [Bloomberg]. “[T]he plan Elizabeth Warren released Monday is interesting, even if it reads less like a bold vision document than a treatise on process…. Warren does not say how she herself would tackle China, or what she would do with Trump’s tariffs. But she lays out elements of an attack. ‘We’ve let China get away with the suppression of pay and labor rights, poor environmental protections, and years of currency manipulation.’

Politics

“But what is government itself, but the greatest of all reflections on human nature?” –James Madison, Federalist 51

“They had one weapon left and both knew it: treachery.” –Frank Herbert, Dune

“2020 Democratic Presidential Nomination” [RealClearPolitics] (average of five polls). As of July 25: Biden up at 29.3% (28.6), Sanders flat at 15.0% (15.0%), Warren down at 14.5% (15.0%), Buttigieg flat at 5.0% (5.0%), Harris down 11.8% (12.2%), others Brownian motion. Harris reminds me of Clinton, in that her numbers are like a hot air balloon, which sinks unless air is pumped into it.

* * *

2020

Harris (D)(1): “Oddly Specific Kamala Harris Policy Generator” [@ne0liberal]. My result: “Yesterday, I announced that, as president, I’ll establish a school lunch program for games journalists who open a mini golf that operates for 15 days in Greenwich Village.” • It’s about ethics in miniature golf.

Sanders (D)(1): “”You can’t call this plan Medicare for All”: The Bernie Sanders camp pans Kamala Harris’s health care plan” [Vox]. “The differences between Harris’s plan and Sanders’s plan come down to two main factors. First, it’s phased-in over 10 years, versus Sanders’s four. And Harris’s would allow private insurers to compete within the government-run program, similar to the way that Medicare Advantage currently works for older adults’ plans. Sanders’s plan effectively eliminates private insurance.” • Why ten years? Why not fifteen? Meanwhile, Neera Tanden is just as nimble as Kamala Harris:

Reminder that the publication of @NeeraTanden‘s own think tank cited Medicare Advantage plans as proof that more Medicare privatization would be bad https://t.co/m4ZMK4a0u5 pic.twitter.com/mzaUo8N8rW

— David Sirota (@davidsirota) July 30, 2019

Sanders (D)(2): Theory of change:

The billionaire class will be behind Trump with endless amounts of money. We need an energized population of young people, working-class people and people of color—and the largest voter turnout by far in history—to beat him. And our campaign is going to do that.

— Bernie Sanders (@BernieSanders) July 30, 2019

Note this is not Warren’s theory of change, though she might be able to simulate it with #Resistance-style events dominated by professionals.

Sanders (D)(3): “Bernie Sanders: As a child, rent control kept a roof over my head” [CNN]. “I was born and raised in a three-and-a-half room apartment in Brooklyn. My father was a paint salesman who worked hard his entire life, but never made much money. This was not a life of desperate poverty — but coming from a lower middle-class family, I will never forget how money, or really lack of money, was always a point of stress in our home… [O]ur family was always able to afford a roof over our heads, because we were living in a rent-controlled building. That most minimal form of economic security was crucial for our family. Today, that same ability to obtain affordable housing is now denied to millions of Americans.”

* * *

“Democratic debate in Detroit: 7 things to watch for on Night 1” [Los Angeles Times]. “Although Sanders and Warren have a similarly adversarial approach to Wall Street — and both believe in eliminating private health insurance in favor of the type of government-run programs implemented in other Western democracies — they have very different political philosophies. Warren has called herself a “capitalist to my bones” who usually believes that markets just need to be better regulated; Sanders sees democratic socialism as the solution to fighting authoritarianism and plutocracy. A debate would normally be the kind of place where you’d see political candidates try to sharpen those sorts of differences, like how California Sen. Kamala Harris took on Biden over his position decades ago on busing for school desegregation in the last debate. But with so many candidates on the stage, Warren and Sanders could just as easily avoid each other if they don’t see an upside in picking a fight.” • Remember their constituencies are less than overlapping, and their theories of change are different.

“If Democrats Want to Win in 2020, They Have to Give Detroit a Reason to Vote” [The Nation]. “The Democratic presidential contenders who will debate this week in this city have come to a state where their party’s “blue wall” cracked in 2016… But what’s the best way to reach out to Detroiters? The Democrats can start by getting serious about urban policy. Both major parties once focused on the concerns of American cities, but in recent decades they have chased after suburban and exurban voters with such abandon that they have often neglected the beating hearts of our metropolitan areas.” • They have no place to go….

* * *

“Bernie Sanders and Pete Buttigieg Hold Contrasting Hollywood Fundraisers” [Variety]. “Bernie Sanders held a ‘grassroots fundraiser’ in Hollywood on Thursday night, delivering his message of political transformation to an adoring crowd at the Montalban Theatre. At the same time, Pete Buttigieg was holding a sold-out fundraiser at the home of NBCUniversal international chairman Kevin MacLellan and Brian Curran, featuring co-hosts Ellen DeGeneres, Portia de Rossi, Chelsea Handler and Sean Hayes…. ‘Some politicians go to wealthy people’s homes and they sit around in a fancy living room, and people contribute thousands and thousands of dollars and they walk out with a few hundred thousand bucks or whatever,’ Sanders said. ‘We don’t do that. … To me, an $18 check or a $27 check from a working person is worth more than all the money in the world from millionaires.’” Cf., ironically enough, Luke 21:1-4.

RussiaGate

“Ex-Host Krystal Ball: MSNBC’s Russia ‘Conspiracies’ Have Done ‘Immeasurable Harm’ to the Left” [Daily Beast]. “Elsewhere in the six-minute monologue, [former longtime MSNBC anchor Krystal] Ball accused MSNBC of cynically following the Russia story in pursuit of ratings, making journalistic compromises along the way. She directly criticized hosts like Rachel Maddow (“You’ve got some explaining to do,” Ball said to her) and on-air analysts like Mimi Rocah (a Daily Beast contributor) for leading viewers to believe that there was a strong possibility that Trump and his family would be indicted. Ball also suggested that the ‘fevered speculation’ of guests like New York columnist Jonathan Chait and former British MP Louise Mensch would have been more at home on conspiracy network Infowars. ‘Russia conspiracy was great for ratings among the key demographic of empty nesters on the coasts with too much time on their hands,’ said Ball, who now hosts an inside-baseball streaming political talk show for The Hill.” • Oddly, this story got no traction at all.

Impeachment

“Impeachment, always a longshot, fades in wake of Mueller hearing” [Los Angeles Times]. “the window of opportunity has rapidly begun shrinking. About 90 House Democrats have joined the call to open a formal impeachment inquiry. That’s less than 40% of the caucus — far short of what would be needed to overcome the opposition of Speaker Nancy Pelosi (D-San Francisco), who views the move as politically unwise and likely to backfire. To significantly change the current path, backers of impeachment needed a dramatic boost out of this week’s hearing with former special counsel Robert S. Mueller III. His testimony fell far short of that mark.” • Yes, the 90 includes a few new faces, but I’d bet they’re revolving heroes. So, after three years of daily hysteria from liberal Democrats, this is where we are.

Health Care

“More than two-thirds of Obamacare cosponsors are now backing Medicare for All proposal” [Fast Company]. “Twelve of the current 17 House members who cosponsored the landmark 2009 measure known as Obamacare have signed on as cosponsors of legislation that would create a universal healthcare system, according to a MapLight analysis. The five incumbent House Democrats who cosponsored Obamacare but who have declined to endorse a “Medicare-for-All” proposal have received an average of $209,000 in campaign contributions since 2011 from the 10 largest U.S. healthcare companies, their employees, and five major trade associations. The dozen cosponsors have received an average of $65,000 from the industry…. The disparity highlights the importance of moderate and conservative Democrats to the healthcare industry, which has united against proposals to ensure that the United States guarantees health coverage for all citizens.” • Ka-ching. This may also explain Harris et al. moving up their assault.

“Obama Alums Tell Health Insurance Lobby ‘Medicare For All’ Won’t Happen” [Tarbell]. “Axelrod said that Medicare for All has “become a phrase as much as anything else.” He suggested that some Democratic presidential candidates may not want to go as far as Sen. Bernie Sanders, a Vermont independent credited with sparking support for Medicare For All during his 2016 presidential campaign, and might support more limited reforms like a public option or allowing some people under the age of 65 to buy into Medicare…. The AHIP conference featured a slew of other former Obama officials, including Andy Slavitt, who led the Centers for Medicare & Medicaid Services; former Surgeon General Vivek Murthy; Sam Kass, the former White House chef and nutrition adviser; and Kavita Patel, who served as a policy aide in the Obama White House. Patel, currently a Brookings Institution nonresident fellow and vice president at the Johns Hopkins Health System, harshly criticized Medicare for All. ‘People who are very serious about health policy on either side of the fence know this is not reality,’ she said. She suggested that Democratic presidential candidates’ support for Medicare for All is ‘all just campaign talk.’” • Why, it’s almost as if preventing #MedicareForAll was the liberal Democrats #1 policy priority!

“One Nation Launches Campaign To Stop Medicare For None” [One Nation]. • A Republican front group, whose ads have been spotted by alert reader JM in California.

Realignment and Legitimacy

“Activists Urging Lacey to ‘Do Her Job’ in Second Ed Buck Death” [Los Angeles Sentinel]. “Local activists are urging District Attorney Jackie Lacey to ‘do her job’ and find that the evidence presented to Los Angeles Sheriff’s is probable cause to immediately charge and prosecute Ed Buck in spite of his ‘Whiteness, wealth, and her political ambitions,’ in the death of Timothy Dean, the second man to die at Buck’s residence. ‘We’ve done all that we could do to aid the sheriff’s investigators with their investigation,’ said community activist and advocate, Jasmyne Cannick. ‘Once again, we gathered evidence and brought the sheriff’s other young men who could speak directly to their experiences with Ed Buck. I hope that this time around, the political will and prosecutorial creativity that we’ve seen used so often against Black people is used to bring charges against Ed Buck for the deaths of Gemmel Moore and Timothy Dean. Two men have died on the same mattress, in the same living room, of the same drug, at the same man’s house within months of each other …’”

“House Democratic Campaign Chair Vows To ‘Do Better’ After Senior Staffers Quit” [HuffPo]. “The chair of the Democratic Congressional Campaign Committee admitted to making mistakes and vowed to “do better” after several senior staffers resigned on Monday. The staff exodus came on the heels of a report that the committee, whose primary mission is to help Democrats maintain and expand their House majority, was ‘in chaos’ over concerns about hiring and a lack of diversity…. ‘I have never been more committed to expanding and protecting this majority, while creating a workplace that we can all be proud of,’ Bustos said in the statement. ‘I will work tirelessly to ensure that our staff is truly inclusive.’” • Bring back DWS?

“Can a New Think Tank Put a Stop to Endless War?” [The Nation]. “[A] newly formed think tank in Washington, the Quincy Institute for Responsible Statecraft… states that its mission is to ‘move US foreign policy away from endless war and toward vigorous diplomacy in the pursuit of international peace.’ The group is still raising money, but with a projected second-year budget of $5 million to 6 million, enough to support 20 to 30 staffers, it aims to match the scale of more established think tanks and to disrupt the foreign policy consensus in Washington…. [T]he Quincy Institute includes the unlikely duo of Charles Koch and George Soros among its founding donors—each has committed half a million dollars—and is intended to serve as a counterweight to the Blob, as the bipartisan national security establishment dedicated to endless war has come to be known… When it comes to foreign policy, [co-founder Eli] Clifton says, there’s little difference between CAP and Republican-aligned think tanks like the American Enterprise Institute, the Foundation for Defense of Democracies, and the Hudson Institute. One way Quincy will distinguish itself from its better-established rivals will be to refuse money from foreign governments.”

Stats Watch

Personal Income and Outlays, June 2019: “The month-to-month breakdown of consumer spending shows slowing in what will offer support for those on the FOMC who want to cut interest rates this week” [Econoday]. “Core inflation which is under target and which suggests that an increase in demand would be sustainable.”

Consumer Confidence, July 2019: “Boosted by an evermore favorable view of the jobs market, consumer confidence jumped sharply” [Econoday]. “Jobs-hard-to-get is down sharply… One interesting point in the report is a drop in inflation expectations… [T]he overall strength of the consumer, whether in confidence or spending which are both tied to the health of the jobs market, does not speak to the need for lower rates.”

S&P Corelogic Case-Shiller Home Price Index, May 2019: “Home prices continue to slow to underscore what is becoming another difficult year for the housing sector” [Econoday]. “Despite low mortgage rates and consumer strength, housing data whether for prices or sales or construction have been flattening out in recent reports in what will support arguments to cut interest rates at this week’s FOMC meeting.”

Pending Home Sales Index, June 2019: “A fast break just when housing needed one appears in a …. surge in pending sales of existing homes” [Econoday].

Housing:

The age of the housing stock gives a fascinating insight into the development of settlement across the US. The predominance of pre-1939 settlement in North/Eastern corridor is striking.https://t.co/mlWUKDlylu pic.twitter.com/aJr89vVuNK

— Adam Tooze (@adam_tooze) July 30, 2019

In ME-02, blue (“1939 and earlier”) is, like, new!

Real Estate: “Supply-chain automation is gaining ground in logistics as companies look to get the most out of real estate close to consumers. Startup Attabotics will use $25 million raised in a new funding round to expand its platform in the growing e-commerce market. … [T]he company’s focus is on bringing efficiency to the tight spaces companies are turning to for fulfillment operations The Canadian company makes automated vertical systems for storing, retrieving and sorting goods that it says use less space than traditional warehouses.” [Wall Street Journal].

Manufacturing: “Air Canada Removes 737 Max Flights Until 2020” [Industry Week]. “Air Canada has removed the Boeing 737 Max from its schedule until January pending regulatory approvals, joining Southwest Airlines Co. in scrapping plans for flights of the jetliner into 2020…. The Montreal-based airline said that third-quarter projected capacity is expected to fall about 2% compared with the same period in 2018, contrasting the originally planned increase of about 3%.”

Manufacturing: “Boeing needs to come up with a Plan B for grounded Max jets” [Financial Times]. “As a researcher of confidence-driven decision making, 2020 looks woefully optimistic to me, as does the company’s special charge. In fact, based on what I see, it is not too early for Boeing to start considering a Plan B for the existing Max series fleet. First, the extreme overconfidence that existed at Boeing prior to the two crashes suggests that there may be more problems still to surface. Second, the aerospace industry is uniquely vulnerable when it comes to confidence. Confidence requires perceptions of certainty and control, but aeroplane passengers are inherently powerless: they can’t and don’t fly the plane. Finally, everything that has unfolded to date has occurred with consumer confidence near all-time highs. The crowd is inherently optimistic today and demand for air travel is soaring. Should the broader mood decline ahead, not only will passenger and regulatory scrutiny naturally intensify, but interest in travel itself will drop. In an economic recession, airlines will have little use for the now-grounded planes.” And the Plan B? “Given the industry’s prior experience with the DC-10, which struggled to regain passenger confidence after a series of early safety issues, one option could be a conversion of the existing fleet to air freight. Establishing trust with a small group of professional freight pilots is likely to be far easier.” • Yikes.

Manufacturing: “Boeing drops out of competition to replace Minuteman III” [Wyoming Tribune Eagle]. “Boeing confirmed this week that it had withdrawn from bidding on the contract for the U.S. Air Force’s Ground-Based Strategic Deterrent program. The contract is to replace the Air Force’s Cold War-era Minuteman III intercontinental ballistic missiles. Experts have estimated the project could be worth about $85 billion…. Boeing’s departure from the project creates a situation where only one company [Northrop Grumman ] will be bidding on a massive military contract to supply the nation with the ground-based portion of its nuclear triad system.” • So no bailout for Boeing that way.

The Bezzle: “Millions use Earnin to get cash before payday. Critics say the app is taking advantage of them.” [NBC]. “But critics say that the company is effectively acting as a payday lender — providing small short-term loans at the equivalent of a high interest rate — while avoiding conventional lending regulations designed to protect consumers from getting in over their heads. Earnin argues that it isn’t a lender at all because the company relies on tips rather than required fees and does not send debt collectors after customers who fail to repay the money.” • Hmm.

Tne Bezzle: “FBI found bucket of human heads, body parts sewn together at donation facility: report” [The Hill]. “The center’s owner, Stephen Gore, was sentenced to a year of deferred prison time and four years of probation after pleading guilty in October to illegal control of an enterprise.” • Ick. I’m sure the same thing will never happen at cryogenic facilities….

The Biosphere

Metaphor:

Massive Rock slide triggered in Monsoon. An excellent example of rock joints failure. Be careful while travelling to #Himalayas. @RockHeadScience @BGSLandslides @NatGeo pic.twitter.com/XD9zczxEEq

— Aamir Asghar (@jojaaamir) July 29, 2019

“Modest (insipid) Green New Deal proposals miss the point – Part 2” [Bill Mitchell]. “At the basis of the [standard neoclassical microeconomics] ‘solution’ is the belief that there is a trade-off between, say, environmental damage and economic growth (production). And the market failure skews that trade-off towards growth at the expense of environmental health. So all that is needed is some intervention (a tax) that will skew the trade-off back to something more preferable. The problem is that the whole idea that there is a trade-off between protecting our environment and economic production is flawed at the most elemental level. There is no calculus (which underpins this sort of microeconomic reasoning) that can tell us when a biological system will die. The idea that we can have a ‘safe’ level of pollution, regulated via a price system, is groundless and should not form part of a progressive response. Carbon trading schemes (CTS) are neoliberal constructs which start with the presumption that a free market is the best way to organise allocation.” • Worth repeating: Mark Blyth says that “Markets cannot internalize their externalities on a planetary scale. They just can’t. It’s impossible.” I’m wondering if carbon tax failure is a lemma from that (heretical) proposition. Also, somebody tell Elizabeth Warren.

“Stopping Climate Change Will Never Be ‘Good Business’” [Jacobin] (review of Bill McKibben’s new book, Falter). “McKibben mistakenly believes that the problems of climate destruction stem from bad ideas and policies, rather than systemic issues. The 1970s turn toward neoliberalism in fact originated with a general crisis in capitalist profitability, not with Ayn Rand’s ideas…. If you believe [with McKibben] that all working-class led revolutions end in disaster, and that it is therefore necessary to prioritize collaborating with the existing rulers of society (the capitalists and their governmental representatives), then a radical alternative to the status quo is not possible.”

“How much does your flight actually hurt the planet?” [Quartz]. “Flygskam (translated as ‘flight shame’) is a burgeoning Sweden-led movement which calls on people to consider limiting their flight use…. Michael Mann of Penn State University, and some other climate scientists, have argued against making individual sacrifices in the name of climate change, even big ones, because they feel the only true impact can be made at the level of government…. It’s true: despite incontrovertible evidence of the toll our collective lives are taking on the planet, any action an individual takes carries with it the knowledge that, however huge the personal sacrifice, the result will be nothing more than a dot in the vast global matrix. One person’s actions can’t make a difference; only collective action can…. Perhaps ‘flight shame’ is a misnomer: It denotes a sensation of embarrassment, and implies something hidden, rather than a strong ethical choice.” •

Water

“Overpopulation, Not Climate Change, Caused California’s Water Crisis” [The American Conservative]. “The issue is population. California has grown from 10 million to at least 40 million since 1950, making it necessary to move water over long distances to where people live and work. Close to two thirds of the state’s population is bunched in a few water-dependent coastal counties. Only about 15 percent of California’s water consumption is residential. Most of that is used outdoors to make the desert bloom and hillside pools sparkle and shimmer David Hockney-like, and millions expect that water at will.” But: ” Farm water comprises an estimated 70 percent of annual state water use. Private water ownership and 1,300 competing irrigation districts complicate matters…. Agriculture’s $40 billion contribution to the California economy is only about 3 percent of the state’s GDP. Rural California is still a potent voting bloc in the state legislature and the U.S. Congress, but less so every decade.” • The headline seems oversimplified, even agenda-driven.

Health Care

Original Medicare took only a year to implement, back in the era of steam:

Harry Truman’s application card for Medicare, co-signed by Lyndon Johnson on same day he signed Medicare bill at Truman Library, today 1965: pic.twitter.com/Gecp2uzYWc

— Michael Beschloss (@BeschlossDC) July 30, 2019

I wonder who we should give the first #MedicareForAll card to. Jonathan Gruber? Nancy Pelosi?

Yikes:

NEWS: 75% of rural hospitals have now closed in states that chose not to expand Medicaid.https://t.co/1Urak8yQOg

— Andy Slavitt (@ASlavitt) July 29, 2019

“‘Leaving billions of dollars on the table‘” [Gatehouse News] (source of map above). “‘The irony to me,’ said John Henderson, who heads The Texas Organization of Rural & Community Hospitals and supports Medicaid expansion, ‘is that we’re paying federal income taxes to expand coverage in other states. We’re exporting our coverage and leaving billions of dollars on the table.’… High rates of poverty in rural areas, combined with the loss of jobs, aging populations, lack of health insurance and competition from other struggling institutions will make it difficult for some rural hospitals to survive regardless of what government policies are implemented. For some, there’s no point in trying. They say the widespread closures are the result of the free market economy doing its job and a continued shakeout would be helpful. But no rural community wants that shakeout to happen in its backyard.” • Good reporting! I wonder who those “for some” are. I bet a lot of them don’t live in rural areas.

Games

“A teen who frustrated his mom gaming 8 hours a day became a millionaire in the Fortnite World Cup” [Business Insider]. “More than 40 million players participated in the qualifying events for the final, which took place at Arthur Ashe Stadium in New York City on Saturday and Sunday. Fifty duos and 100 solo players made it through the final and were competing to take home a cut of the $30 million prize pool, the largest prize pool in the history of e-sports.” • Filling a stadium. This old codger thinks that’s quite remarkable, a new thing on the face of the earth.

MMT

“The Invention of Money” [The New Yorker]. • Fun factoids, but a serious attempt would include Michael Hudson, and MMT on the origin of money as well.

Class Warfare

“When I joined my father on the building site, I saw a different side to him” [Guardian (DG)]. “It was on those building sites that, for the first time in my life, I saw a different side to my father. At home, my mother was not only the main breadwinner but also did practically all the cooking, cleaning and organisation. She was the engine of the family: paying the mortgage, asking me about my homework, remembering my friends’ names, picking up discarded socks and cooking dinner every night from scratch. My father was, at times, little more than a lodger. But at work, he suddenly turned into something like a figure of authority: intelligent, in charge, hard-working, exacting. He knew about things I had never even heard of, such as building regulations, damp-proof courses, rendering, load-bearing walls and lintels. He was patient, informed. He may have lost his pencil, hammer, spirit level and saw every 30 seconds, but he knew what he was doing. As I watched him briefing a bricklayer or discussing some finer detail of a knocked-through dining room with a plasterer, I saw someone who rarely came home. Since then, I have often suggested to friends struggling with parental relationships that might feel disappointing and strained to try meeting that parent at work, to visit them in situ, have lunch on their territory, watch them in action, and try to find this other side to someone with whom you are so familiar… Being a young woman on a building site, I also learned that the class system is alive and well in modern Britain. People I knew from school would fail to recognise me as they walked past the building site… There is nothing innately superior about life with a boardroom or swivel chair. The income discrepancy between so-called white-collar and blue-collar work is unfounded. …. work is work is work is work.” • A really splendid article.

News of the Wired

“The Pirate Who Penned the First English-Language Guacamole Recipe” [Atlas Obscura]. “British-born William Dampier began a life of piracy in 1679 in Mexico’s Bay of Campeche. … He gave us the words ‘tortilla,’ ‘soy sauce,’ and ‘breadfruit,’ while unknowingly recording the first ever recipe for guacamole. And who better to expose the Western world to the far corners of our planet’s culinary bounty than someone who by necessity made them his hiding places?” • So globalization has a culinary upside; always has!

* * *

Readers, feel free to contact me at lambert [UNDERSCORE] strether [DOT] corrente [AT] yahoo [DOT] com, with (a) links, and even better (b) sources I should curate regularly, (c) how to send me a check if you are allergic to PayPal, and (d) to find out how to send me images of plants. Vegetables are fine! Fungi are deemed to be honorary plants! If you want your handle to appear as a credit, please place it at the start of your mail in parentheses: (thus). Otherwise, I will anonymize by using your initials. See the previous Water Cooler (with plant) here. Today’s plant (meeps):

Meeps writes: “The columbines are pink and yellow this year.” Columbines are so stylish and old-fashioned.

* * *

Readers: Water Cooler is a standalone entity not covered by the annual NC fundraiser. So do feel free to make a contribution today or any day. Here is why: Regular positive feedback both makes me feel good and lets me know I’m on the right track with coverage. When I get no donations for five or ten days I get worried. More tangibly, a constant trickle of small donations helps me with expenses, and I factor in that trickle when setting fundraising goals. So if you see something you especially appreciate, do feel free to click this donate button:

Here is the screen that will appear, which I have helpfully annotated.

If you hate PayPal, you can email me at lambert [UNDERSCORE] strether [DOT] corrente [AT] yahoo [DOT] com, and I will give you directions on how to send a check. Thank you!

2:00PM Water Cooler 7/30/2019

from WordPress https://ift.tt/2ZobDo6 via IFTTT

0 notes

Text

6. Finger on the pulse

More often than not price is a powerful indicator of the economic conditions in different countries around the world. As people and firms make decisions, they drive the price of their currency up and down, buying & selling, trading and exchanging. The governments have to keep on top of it.

Big Brother

If the US dollar for example, rises too much in comparison to other currencies, American industries suffer as international demand for US goods falls, and so do exports.

Should the dollar fall too low, and you have devaluation which can lead to inflation should exports rise too high spiking up GDP. Industries without exporting capacity are then hurt by the rise in general prices, while exporters enjoy lucrative profits, which can eventually collapse the price.

Caution: Swim at your own risk

While we as Forex Traders live off of volatility, a currency that is way too volatile can be a risky investment. Firms are less likely to carry a currency if they believe that the currency might be worth something drastically different very soon.

They can purchase currency options, but even then excess volatility is not something people look for when they travel/trade/save.

Now what happens when the price rises too much and the Federal Reserve bank of a country has to react to it? Seeing that price is too high, technical traders (traders based off of charts & price action), wait for Red (major) news releases and attempt to predict the actions of the Fed.

It’s the Feds, run!

Should the fed be more drastic in their decisions than expected, price can take quite a tumble. If the Forex traders in question, predict correctly, they are in for a significant gain.

The problem with this strategy is that it is a guess at best, seeing as predicting news can be incredibly difficult; most Fed meetings carry the highest security of information in the world. Reacting is understanding, predicting is betting against the house.

Masters of the Universe

Calling a trade and executing successfully is one of the most exhilarating feelings in the world. It is complete dominance over a currency and when correct, will boost you up.

The problem with losing is that if the price falls too fast or jumps over your stop loss (the point in which you have your limit set for the most you are willing to lose; price your broker automatically takes you out of a trade), there is nothing stopping the market from emptying out your pockets during the shake down.

If price falls far enough, you get kicked out of the trade once you’ve lost your entire trading account. It happens more often than you think.

Who’s behind the curtain

Governments of course do not want people to be able to guess what they’re up to. If enough people can speculate successfully what the Fed will do, it can cause a significant effect on the dollar as not only people but major banks move millions and millions of dollars, trying to capture the volatility.

Currency is a powerful tool in economic policy. By reading the pulse of the US economy, the Federal Reserve can predict market movements and act accordingly, either injecting money into the economy or taking it out.

OMP- Obsessive Monetary Policy

These actions are known as open market operations as they buy or sell bonds to try to control the flow of cash. Since most financial instruments are related, changes in interest rates are particularly powerful movers of the markets.