#2017 tax cuts for the wealthy

Explore tagged Tumblr posts

Text

Ok, so. The Trump budget. It has already passed the House and now just needs 51 senators to pass it and send it to Trump for signature.

There are 53 Republican senators, 45 Democratic ones, and 2 Independents that vote with the Democrats. VP Vance is a tiebreaker vote.

So to block the bill, at least four Republican senators need to find their spines and the Democrats and Independents all need to keep their spines. This will not happen without direct action from voters.

They are only going to resist this bill if they hear from voters in their states. They do not care if some person from California calls them.

It's really fucking bad for everyone except the ultra-wealthy, surprise surprise.

I'm going to go through some of the features of this budget in reblogs, but trust and believe that it's horrible for the vast, vast majority of Americans, including you.

Highlights include:

Extends the Trump tax cuts passed in 2017. This continues $3.7 billion in tax cuts for the wealthy. If this budget does not pass, these tax cuts will expire and go back up without any action.

$150 billion in additional military spending

Work requirements for Medicaid. "childless adults without disabilities would be required to work 80 hours per month to qualify for benefits.". They expect millions of people to fail to meet work requirements and lose Medicaid.

Planned Parenthood and trans care. "Bans Medicaid from providing funding to Planned Parenthood as long as the organization continued to provide abortions, and would bar Medicaid from covering gender affirming health care to any beneficiaries. "

Reduces SNAP food stamp access that 40 million people use. "mandates work requirements for able-bodied SNAP enrollees who don't have dependents.".

Clean energy "dramatically scaling back many of the tax credits for clean energy."

Border walls and ICE. "$46.5 billion toward completing Trump's border wall. It also allots $5 billion for Customs and Border Protection facilities and more than $6 billion to hire and retain more agents and officers"

Student loans. "cut $330 billion from the student loan system by scrapping several existing repayment options, including the Biden-era SAVE program that based payments on income and household size.". Does anyone want to have student loan payments that you cannot afford?

Guts Obamacare. "Saves $100 billion, but will result in millions of Americans becoming uninsured if they fail to adhere to new paperwork requirements or can no longer afford insurance premiums."

Weakens federal courts that keep using orders that his actions are illegal and unconstitutional. It prohibits courts from enforcing contempt citations for violations of injunctions or temporary restraining orders unless the plaintiff pays a bond. Bonds can be EXTRAORDINARILY EXPENSIVE and are not currently required in these cases. The provision "would make most existing injunctions—in antitrust cases, police reform cases, school desegregation cases, and others—unenforceable," says the god of constitutional law, Dean Erwin Chemerinsky.

So, you folks in red states and you folks in wobbly blue states (PA, NC, etc), you need to call your senators and save us all.

Call every day. Call after hours so you can leave a voicemail and not talk to anyone.

For real y'all, millions of people are going to starve, go broke, and be without medical care if this bill passes. Which is a feature, not a bug, of the Trump administration.

And it will balloon the national debt to pay for these tax cuts for the wealthy.

#elections have consequences so here we fucking are#fuck trump and fuck everyone who voted for him#5calls.org#call your senators#direct action item

11K notes

·

View notes

Text

Biden’s 2025 would raise the child tax credits back to the levels they were at during the pandemic, an objectively good thing for literally everyone. Those benefits were slashed by Trump in 2017, and others trailed off after the pandemic “ended”. Biden is going to pay for it by undoing Trump’s tax cuts on wealthy corporations, aka by taxing them more.

You can bet your pants Trump won’t enact this budget if he wins the election.

3K notes

·

View notes

Text

Why they're smearing Lina Khan

My god, they sure hate Lina Khan. This once-in-a-generation, groundbreaking, brilliant legal scholar and fighter for the public interest, the slayer of Reaganomics, has attracted more vitriol, mockery, and dismissal than any of her predecessors in living memory.

She sure must be doing something right, huh?

A quick refresher. In 2017, Khan — then a law student — published Amazon’s Antitrust Paradox in the Yale Law Journal. It was a brilliant, blistering analysis showing how the Reagan-era theory of antitrust (which celebrates monopolies as “efficient”) had failed on its own terms, using Amazon as Exhibit A of the ways in which post-Reagan antitrust had left Americans vulnerable to corporate abuse:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

The paper sent seismic shocks through both legal and economic circles, and goosed the neo-Brandeisian movement (sneeringly dismissed as “hipster antitrust”). This movement is a rebuke to Reaganomics, with its celebration of monopolies, trickle-down, offshoring, corporate dark money, revolving-door regulatory capture, and companies that are simultaneously too big to fail and too big to jail.

This movement has many proponents, of course — not just Khan — but Khan’s careful scholarship, combined with her encyclopedic knowledge of the long-dormant statutory powers that federal agencies had to make change, and a strategy for reviving those powers to protect Americans from corporate predators made her a powerful, inspirational figure.

When Joe Biden won the 2020 presidential election, he surprised everyone by appointing Khan to the FTC. It wasn’t just that she had such a radical vision — it was also that she lacked the usual corporate law experience that such an appointee would normally require (experience that would ensure that the FTC was helmed by people whose default view of the world is that it should be structured and regulated by powerful, wealthy people in corporate boardrooms).

Even more surprising was that Khan was made chair of the FTC, something that was only possible because a few Republican Senators broke with their party to support her candidacy:

https://www.senate.gov/legislative/LIS/roll_call_votes/vote1171/vote_117_1_00233.htm

These Republicans saw in Khan an ally in their fight against “woke” Big Tech. For these senators, the problem wasn’t that tech had got too big and powerful — it was that there were a few limited instances in which tech leaders failed to wield that power in the ways they preferred.

The Republican project is a matter of getting turkeys to vote for Christmas by doing a lot of culture war bullshit, cruelly abusing disfavored sexual and racial minorities. This wins support from low-information voters who’ll vote against their class interests and support more monopolies, more tax cuts for the rich, and more cuts to the services they rely on.

But while tech leaders are 100% committed to the project of permanent oligarchic takeover of every sphere of American life, they are less full-throated in their support for hateful, cruel discrimination against disfavored minorities (in this regard, tech leaders resemble the corporate wing of the Democrats, which is where we get the “Silicon Valley is a Democratic Party stronghold” narrative).

This failure to unquestioningly and unstintingly back culture war bullshit put tech leaders in the GOP’s crosshairs. Some GOP politicians actually believe in the culture war bullshit, and are grossly offended that tech is “woke.” Others are smart enough not to get high on their own supply, but worry that any tech obstruction in the bullshit culture wars will make it harder to get sufficient turkey votes for a big fat Christmas surprise.

Biden’s ceding of antitrust policy to the left wing of the party, combined with disaffected GOP senators viewing Khan as their enemy’s enemy, led to Khan’s historic appointment as FTC Chair. In that position, she was joined by a slate of Biden trustbusters, including Jonathan Kanter at the DoJ Antitrust Division, Tim Wu at the White House, and other important, skilled and principled fighters like Alvaro Bedoya (FTC), Rebecca Slaughter (FTC), Rohit Chopra (CFPB), and many others.

Crucially, these new appointees weren’t just principled, they were good at their jobs. In 2021, Tim Wu wrote an executive order for Biden that laid out 72 concrete ways in which the administration could act — with no further Congressional authorization — to blunt corporate power and insulate the American people from oligarchs’ abusive and extractive practices:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

Since then, the antitrust arm of the Biden administration have been fuckin’ ninjas, Getting Shit Done in ways large and small, working — for the first time since Reagan — to protect Americans from predatory businesses:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

This is in marked contrast to the corporate Dems’ champions in the administration. People like Pete Buttigieg are heralded as competent technocrats, “realists” who are too principled to peddle hopium to the base, writing checks they can’t cash. All this is cover for a King Log performance, in which Buttigieg’s far-reaching regulatory authority sits unused on a shelf while a million Americans are stranded over Christmas and whole towns are endangered by greedy, reckless rail barons straight out of the Gilded Age:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The contrast between the Biden trustbusters and their counterparts from the corporate wing is stark. While the corporate wing insists that every pitch is outside of the zone, Khan and her allies are swinging for the stands. They’re trying to make life better for you and me, by declaring commercial surveillance to be an unfair business practice and thus illegal:

https://pluralistic.net/2022/08/12/regulatory-uncapture/#conscious-uncoupling

And by declaring noncompete “agreements” that shackle good workers to shitty jobs to be illegal:

https://pluralistic.net/2022/02/02/its-the-economy-stupid/#neofeudal

And naturally, this has really pissed off all the right people: America’s billionaires and their cheerleaders in the press, government, and the hive of scum and villainy that is the Big Law/thinktank industrial-complex.

Take the WSJ: since Khan took office, they have published 67 vicious editorials attacking her and her policies. Khan is living rent-free in Rupert Murdoch’s head. Not only that, he’s given her the presidential suite! You love to see it.

These attacks are worth reading, if only to see how flimsy and frivolous they are. One major subgenre is that Khan shouldn’t be bringing any action against Amazon, because her groundbreaking scholarship about the company means she has a conflict of interest. Holy moly is this a stupid thing to say. The idea that the chair of an expert agency should recuse herself because she is an expert is what the physicists call not even wrong.

But these attacks are even more laughable due to who they’re coming from: people who have the most outrageous conflicts of interest imaginable, and who were conspicuously silent for years as the FTC’s revolving door admitted the a bestiary of swamp-creatures so conflicted it’s a wonder they managed to dress themselves in the morning.

Writing in The American Prospect, David Dayen runs the numbers:

Since the late 1990s, 31 out of 41 top FTC officials worked directly for a company that has business before the agency, with 26 of them related to the technology industry.

https://prospect.org/economy/2023-06-23-attacks-lina-khans-ethics-reveal-projection/

Take Christine Wilson, a GOP-appointed FTC Commissioner who quit the agency in a huff because Khan wanted to do things for the American people, and not their self-appointed oligarchic princelings. Wilson wrote an angry break-up letter to Khan that the WSJ published, presaging their concierge service for Samuel Alito:

https://www.wsj.com/articles/why-im-resigning-from-the-ftc-commissioner-ftc-lina-khan-regulation-rule-violation-antitrust-339f115d

For Wilson to question Khan’s ethics took galactic-scale chutzpah. Wilson, after all, is a commissioner who took cash money from Bristol-Myers Squibb, then voted to approve their merger with Celgene:

https://www.documentcloud.org/documents/4365601-Wilson-Christine-Smith-final278.html

Or take Wilson’s GOP FTC predecessor Josh Wright, whose incestuous relationship with the companies he oversaw at the Commission are so intimate he’s practically got a Habsburg jaw. Wright went from Google to the US government and back again four times. He also lobbied the FTC on behalf of Qualcomm (a major donor to Wright’s employer, George Mason’s Antonin Scalia Law School) after working “personally and substantially” while serving at the FTC.

George Mason’s Scalia center practically owns the revolving door, counting fourteen FTC officials among its affliates:

https://campaignforaccountability.org/ttp-investigation-big-techs-backdoor-to-the-ftc/

Since the 1990s, 31 out of 41 top FTC officials — both GOP appointed and appointees backed by corporate Dems — “worked directly for a company that has business before the agency”:

https://www.citizen.org/article/ftc-big-tech-revolving-door-problem-report/

The majority of FTC and DoJ antitrust lawyers who served between 2014–21 left government service and went straight to work for a Big Law firm, serving the companies they’d regulated just a few months before:

https://therevolvingdoorproject.org/wp-content/uploads/2022/06/The-Revolving-Door-In-Federal-Antitrust-Enforcement.pdf

Take Deborah Feinstein, formerly the head of the FTC’s Bureau of Competition, now a partner at Arnold & Porter, where she’s represented General Electric, NBCUniversal, Unilever, and Pepsi and a whole medicine chest’s worth of pharma giants before her former subordinates at the FTC. Michael Moiseyev who was assistant manager of FTC Competition is now in charge of mergers at Weil Gotshal & Manges, working for Microsoft, Meta, and Eli Lilly.

There’s a whole bunch more, but Dayen reserves special notice for Andrew Smith, Trump’s FTC Consumer Protection boss. Before he was put on the public payroll, Smith represented 120 clients that had business before the Commission, including “nearly every major bank in America, drug industry lobbyist PhRMA, Uber, Equifax, Amazon, Facebook, Verizon, and a variety of payday lenders”:

https://www.citizen.org/sites/default/files/andrew_smith_foia_appeal_response_11_30.pdf

Before Khan, in other words, the FTC was a “conflict-of-interest assembly line, moving through corporate lawyers and industry hangers-on without resistance for decades.”

Khan is the first FTC head with no conflicts. This leaves her opponents in the sweaty, desperate position of inventing conflicts out of thin air.

For these corporate lickspittles, Khan’s “conflict” is that she has a point of view. Specifically, she thinks that the FTC should do its job.

This makes grifters like Jim Jordan furious. Yesterday, Jordan grilled Khan in a hearing where he accused her of violating an ethics official’s advice that she should recuse herself from Big Tech cases. This is a talking point that was created and promoted by Bloomberg:

https://www.bloomberg.com/news/articles/2023-06-16/ftc-rejected-ethics-advice-for-khan-recusal-on-meta-case

That ethics official, Lorielle Pankey, did not, in fact, make this recommendation. It’s simply untrue (she did say that Khan presiding over cases that she has made public statements about could be used as ammo against her, but did not say that it violated any ethical standard).

But there’s more to this story. Pankey herself has a gigantic conflict of interest in this case, including a stock portfolio with $15,001 and $50,000 in Meta stock (Meta is another company that has whined in print and in its briefs that it is a poor defenseless lamb being picked on by big, mean ole Lina Khan):

https://www.wsj.com/articles/ethics-official-owned-meta-stock-while-recommending-ftc-chair-recuse-herself-from-meta-case-8582a83b

Jordan called his hearing on the back of this fake scandal, and then proceeded to show his whole damned ass, even as his GOP colleagues got into a substantive and even informative dialog with Khan:

https://prospect.org/power/2023-07-14-jim-jordan-misfires-attacks-lina-khan/

Mostly what came out of that hearing was news about how Khan is doing her job, working on behalf of the American people. For example, she confirmed that she’s investigating OpenAI for nonconsensually harvesting a mountain of Americans’ personal information:

https://www.ft.com/content/8ce04d67-069b-4c9d-91bf-11649f5adc74

Other Republicans, including confirmed swamp creatures like Matt Gaetz, ended up agreeing with Khan that Amazon Ring is a privacy dumpster-fire. Nobodies like Rep TomM assie gave Khan an opening to discuss how her agency is protecting mom-and-pop grocers from giant, price-gouging, greedflation-drunk national chains. Jeff Van Drew gave her a chance to talk about the FTC’s war on robocalls. Lance Gooden let her talk about her fight against horse doping.

But Khan’s opponents did manage to repeat a lot of the smears against her, and not just the bogus conflict-of-interest story. They also accused her of being 0–4 in her actions to block mergers, ignoring the huge number of mergers that have been called off or not initiated because M&A professionals now understand they can no longer expect these mergers to be waved through. Indeed, just last night I spoke with a friend who owns a medium-sized tech company that Meta tried to buy out, only to withdraw from the deal because their lawyers told them it would get challenged at the FTC, with an uncertain outcome.

These talking points got picked up by people commenting on Judge Jacqueline Scott Corley’s ruling against the FTC in the Microsoft-Activision merger. The FTC was seeking an injunction against the merger, and Corley turned them down flat. The ruling was objectively very bad. Start with the fact that Corley’s son is a Microsoft employee who stands reap massive gains in his stock options if the merger goes through.

But beyond this (real, non-imaginary, not manufactured conflict of interest), Corley’s judgment and her remarks in court were inexcusably bad, as Matt Stoller writes:

https://www.thebignewsletter.com/p/judge-rules-for-microsoft-mergers

In her ruling, Corley explained that she didn’t think Microsoft would abuse the market dominance they’d gain by merging their giant videogame platform and studio with one of its largest competitors. Why not? Because Microsoft’s execs pinky-swore that they wouldn’t abuse that power.

Corely’s deference to Microsoft’s corporate priorities goes deeper than trusting its execs, though. In denying the FTC’s motion, she stated that it would be unfair to put the merger on hold in order to have a full investigation into its competition implications because Microsoft and Activision had set a deadline of July 18 to conclude things, and Microsoft would have to pay a penalty if that deadline passed.

This is surreal: a judge ruled that a corporation’s radical, massive merger shouldn’t be subject to full investigation because that corporation itself set an arbitrary deadline to conclude the deal before such an investigation could be concluded. That’s pretty convenient for future mega-mergers — just set a short deadline and Judge Corely will tell regulators that the merger can’t be investigated because the deadline is looming.

And this is all about the future. As Stoller writes, Microsoft isn’t exactly subtle about why it wants this merger. Its own execs said that the reason they were spending “dump trucks” of money buying games studios was to “spend Sony out of business.”

Now, maybe you hate Sony. Maybe you hate Activision. There’s plenty of good reason to hate both — they’re run by creeps who do shitty things to gamers and to their employees. But if you think that Microsoft will be better once it eliminates its competition, then you have the attention span of a goldfish on Adderall.

Microsoft made exactly the same promises it made on Activision when it bought out another games studio, Zenimax — and it broke every one of those promises.

Microsoft has a long, long, long history of being a brutal, abusive monopolist. It is a convicted monopolist. And its bad conduct didn’t end with the browser wars. You remember how the lockdown turned all our homes into rent-free branch offices for our employers? Microsoft seized on that moment to offer our bosses keystroke-and-click level surveillance of our use of our own computers in our own homes, via its Office365 bossware product:

https://pluralistic.net/2020/11/25/the-peoples-amazon/#clippys-revenge

If you think a company that gave your boss a tool to spy on their employees and rank them by “productivity” as a prelude to firing them or cutting their pay is going to treat gamers or game makers well once they have “spent the competition out of business,” you’re a credulous sucker and you are gonna be so disappointed.

The enshittification play is obvious: use investor cash to make things temporarily nice for customers and suppliers, lock both of them in — in this case, it’s with a subscription-based service similar to Netflix’s — and then claw all that value back until all that’s left is a big pile of shit.

The Microsoft case is about the future. Judge Corely doesn’t take the future seriously: as she said during the trial, “All of this is for a shooter videogame.” The reason Corely greenlit this merger isn’t because it won’t be harmful — it’s because she doesn’t think those harms matter.

But it does, and not just because games are an art form that generate billions of dollars, employ a vast workforce, and bring pleasure to millions. It also matters because this is yet another one of the Reaganomic precedents that tacitly endorses monopolies as efficient forces for good. As Stoller writes, Corley’s ruling means that “deal bankers are sharpening pencils and saying ‘Great, the government lost! We can get mergers through everywhere else.’ Basically, if you like your high medical prices, you should be cheering on Microsoft’s win today.”

Ronald Reagan’s antitrust has colonized our brains so thoroughly that commentators were surprised when, immediately after the ruling, the FTC filed an appeal. Don’t they know they’ve lost? the commentators said:

https://gizmodo.com/ftc-files-appeal-of-microsoft-activision-deal-ruling-1850640159

They echoed the smug words of insufferable Activision boss Mike Ybarra: “Your tax dollars at work.”

https://twitter.com/Qwik/status/1679277251337277440

But of course Khan is appealing. The only reason that’s surprising is that Khan is working for us, the American people, not the giant corporations the FTC is supposed to be defending us from. Sure, I get that this is a major change! But she needs our backing, not our cheap cynicism.

The business lobby and their pathetic Renfields have hoarded all the nice things and they don’t want us to have any. Khan and her trustbuster colleagues want the opposite. There is no measure so small that the corporate world won’t have a conniption over it. Take click to cancel, the FTC’s perfectly reasonable proposal that if you sign up for a recurring payment subscription with a single click, you should be able to cancel it with a single click.

The tooth-gnashing and garment-rending and scenery-chewing over this is wild. America’s biggest companies have wheeled out their biggest guns, claiming that if they make it too easy to unsubscribe, they will lose money. In other words, they are currently making money not because people want their products, but because it’s too hard to stop paying for them!

https://www.theregister.com/2023/07/12/ftc_cancel_subscriptions/

We shouldn’t have to tolerate this sleaze. And if we back Khan and her team, they’ll protect us from these scams. Don’t let them convince you to give up hope. This is the start of the fight, not the end. We’re trying to reverse 40 years’ worth of Reagonmics here. It won’t happen overnight. There will be setbacks. But keep your eyes on the prize — this is the most exciting moment for countering corporate power and giving it back to the people in my lifetime. We owe it to ourselves, our kids and our planet to fight one.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

[Image ID: A line drawing of pilgrims ducking a witch tied to a ducking stool. The pilgrims' clothes have been emblazoned with the logos for the WSJ, Microsoft, Activision and Blizzard. The witch's face has been replaced with that of FTC chair Lina M Khan.]

#pluralistic#amazon's antitrust paradox#lina khan#business lobby#lina m khan#ftc#federal trade commission#david dayen#microsoft#activision#blizzard#wsj#wall street journal#reaganomics#trustbusting#antitrust#mergers#merger to monopoly#gaming#xbox#matt stoller#the american prospect#jim jordan#click to cancel#robert bork#Judge Jacqueline Scott Corley#microsoft activision#fuckin' ninjas

6K notes

·

View notes

Text

I think that one of the things I find most frustrating about the tariffs conversation (and I find a lot of it frustrating) is... well, okay, it's two things, which are related:

ONE: MAGA are stealing leftist talking points

TWO: That's not how protectionist tariffs work. (This is probably the more important one.)

So.

ONE: The rhetoric of 'temporary hardship to reach eventual greater collective stability' is something that the left generally says with a little more sincerity, oftentimes with things like taxes for public infrastructure or welfare.

It also generally means that everyone experiences a touch of hardship, but the wealth is reinvested into the economy to boost the collective good; the sincerity is low with centrists, but higher with the far left.

The hardship is also more likely to not be moving money to the wealthy, something that is very much happening here. There are some massive shortfalls in tax income these past few years, some of which have been going on for decades, like the subsidization of the fossil fuel industry or unusually high investment in the military, but a big one recently has been the 2017 tax cuts that Trump introduced for the wealthy in his first term. They are, from articles I've seen, responsible for trillions in lost revenue per year sine their introduction, and while they expire in 2025, Trump and this Republican Congress have made it clear that they intend to extend those tax cuts as long as they can. The tariffs are to cover that gap in the budget, meaning that everyone is paying more in taxes, on goods that are disproportionately consumed by the lower and middle classes, in order to cover the tax breaks that billionaires got.

Very much stealing from the poor to give to the rich! That's what the tariffs are about!

e.g. yes you're paying a few extra dollars in taxes this year, but it's being invested in developing a free and reduced school lunch program; while you won't see any immediate benefits, and you'll be a little strapped for cash for month or two if you're living paycheck to paycheck, but you'll see a huge load off your mind come September. Could also be a few extra dollars for an infrastructure project, which takes ten years to build... but once it's built, your commute is cut in half because of the new bridge, or the electricity is subsidized by some new wind farms, or the landfill has been assessed and built over to be a safe, clean park. This second example about infrastructure is Biden's Inflation Reduction Act, which fed money into infrastructure work and other major projects across the country; in many cases, state Senators, congresspeople, and governors who had voted or campaigned against the IRA would then take credit for the benefits their constituents saw.

TWO: You can't use protectionist tariffs to revive local industry without investing in it. High tariffs can minimize damage to the economy if the industry hasn't already left.

If the factories are still around, and the employees are still there and knowledgeable, and the resources haven't been left to diminish on their own, then you protect them with tariffs in the immediate aftermath of a shift in the status quo. You prevent the 'theft of business' with the tariffs, and since it all just seems to be business as usual domestically, it's a blip in the radar for consumers. A bit more complicated if the domestic market has also been exporting the product, as markets abroad will shift to the cheaper product you are protecting against, but you now have a bit more time to innovate a reason to keep market share.

If the industry has been allowed to diminish, or never really existed in the first place (we can't grow coffee or bananas or avocado or mangos at an industry scale, we do not have the weather for it), then a sudden implementation of protectionist tariffs will pass costs along to the consumer until the industry is up and running again.

You know how you fix that? Subsidize the industry you're trying to revive.

In 1910, there were 144,607 people employed in clothing factories in the US (1910 census, employment). This doesn't include people working in shoe factories (181,010), tanneries (33,553), dressmakers and seamstresses (449,342; presumably separated from the first statistic by not being in a factory), dyers (14,050), sewers and sewing machine operatives (291,209), shoemakers and cobblers not in factories (69,570), and the hundreds of thousands of people in the textiles alone (I'm not doing the math, but it's over a million). So we're looking at several million people in the garment industry in the US, in 1910.

In 2020, the combined category of Textile, Apparel, and Furnishing employment contained a total of 16,510 people.

You cannot bring an industry like that back to the US without heavily, heavily subsidizing it to

A. Keep the costs down to where the public can still buy clothing without making it so the people suddenly in this industry are paid pennies on the hour.

B. Train this new generation of people in an industry that barely exists anymore.

C. Build the infrastructure to support the industry, from cotton gins to sewing factories.

You can't bring back an industry that was in the millions in 1910 when there are less than 20,000 people doing it now, in a population that has more than tripled (92mill in 1910, 331mill in 2020).

I just. You have to feed those tariffs into rebuilding the industry. You can't feed them into tax breaks for the wealthy if your stated goal is to rebuild industry. I know that feeding money to his rich friends is the goal for Trump, but I'm so incredibly frustrated that people don't seem to get the basic functions of protectionist tariff application.

Almost forgot to advertize myself since this was just me venting about current events, inspired by a LegalEagle video, but:

Prompt me on ko-fi! I’m trying to move out of my parents’ house.

#economics#tariffs#united states#politics#history#protectionism (trade)#industry#phoenix talks#phoenix politics

205 notes

·

View notes

Text

The ‘One Big Beautiful Bill’ Act aka the One Big Bullshit Bill has passed in the Republican led House of Representatives and will now go to Trump’s desk to sign. Every Senate Republican and House Republican voted for this bill. This is Donald Trump’s economy

No Senate Democrats and No House Democrats voted for this bill. The Democratic Party was completely unified in protecting the social safety nets for low income and middle class Americans.

The One Big Beautiful Bill Act will:

Cut over $900 billion dollars from Medicaid pushing over 17 million Americans to lose health insurance coverage in the next 10 years.

Republicans have scheduled the Medicaid cuts to not take into affect until 2026 right around the midterm elections

Increase the national debt by $5 trillion dollars due to permanent tax cuts for the wealthy. The Donald Trump Wealthy Tax Cuts from 2017 will now be made permanent.

The Child Tax Credit will not be expanded and will remain at $1,000 per child. Biden had it at $2,300

Massive funding cuts for programs such as food stamps, school meals, and head start with $185 billion dollars cut from (SNAP)food stamps alone.

20% reductions in Affordable Care Act subsidies.

The Republican Party abandoned lower income Americans entirely. They attacked the middle class and now work for the wealthy exclusively.

#breaking news#us politics#politics#donald trump#news#potus#president trump#united states politics#tumblr#president of the united states#one big beautiful bill act#big bullshit bill#big beautiful bill#big ugly bill#house democrats#house republicans#house of representatives#republicans#senate republicans#us congress#congress#united states news#current events#usa news#us news

90 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

January 16, 2025

Heather Cox Richardson

Jan 17, 2025

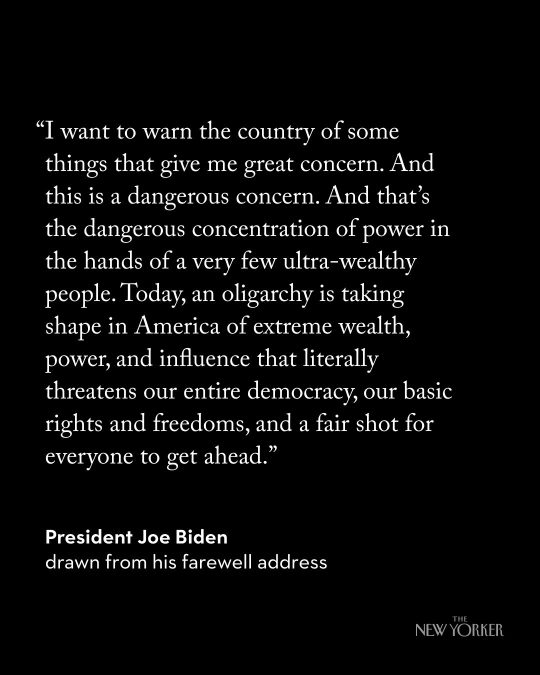

In his final address to the nation last night, President Joe Biden issued a warning that “an oligarchy is taking shape in America of extreme wealth, power, and influence that literally threatens our entire democracy, our basic rights and freedoms, and a fair shot for everyone to get ahead.”

It is not exactly news that there is dramatic economic inequality in the United States. Economists call the period from 1933 to 1981 the “Great Compression,” for it marked a time when business regulation, progressive taxation, strong unions, and a basic social safety net compressed both wealth and income levels in the United States. Every income group in the U.S. improved its economic standing.

That period ended in 1981, when the U.S. entered a period economists have dubbed the “Great Divergence.” Between 1981 and 2021, deregulation, tax cuts for the wealthy and corporations, the offshoring of manufacturing, and the weakening of unions moved $50 trillion from the bottom 90% of Americans to the top 1%.

Biden tried to address this growing inequality by bringing back manufacturing, fostering competition, increasing oversight of business, and shoring up the safety net by getting Congress to pass a law—the Inflation Reduction Act—that enabled Medicare to negotiate drug prices for seniors with the pharmaceutical industry, capping insulin at $35 for seniors, for example. His policies worked, primarily by creating full employment which enabled those at the bottom of the economy to move to higher-paying jobs. During Biden’s term, the gap between the 90th income percentile and the 10th income percentile fell by 25%.

But Donald Trump convinced voters hurt by the inflation that stalked the country after the coronavirus pandemic shutdown that he would bring prices down and protect ordinary Americans from the Democratic “elite” that he said didn’t care about them. Then, as soon as he was elected, he turned for advice and support to one of the richest men in the world, Elon Musk, who had invested more than $250 million in Trump’s campaign.

Musk’s investment has paid off: Faiz Siddiqui and Trisha Thadani of the Washington Post reported that he made more than $170 billion in the weeks between the election and December 15.

Musk promptly became the face of the incoming administration, appearing everywhere with Trump, who put him and pharmaceutical entrepreneur Vivek Ramaswamy in charge of the so-called Department of Government Efficiency, where Musk vowed to cut $2 trillion out of the U.S. budget even if it inflicted “hardship” on the American people.

News broke earlier this week that Musk, who holds government contracts worth billions of dollars, is expected to have an office in the Eisenhower Executive Office Building adjacent to the White House. And the world’s two other richest men will be with Musk on the dais at Trump’s inauguration. Musk, Amazon founder Jeff Bezos, and Meta chief executive officer Mark Zuckerberg, who together are worth almost a trillion dollars, will be joined by other tech moguls, including the CEO of OpenAI, Sam Altman; the CEO of the social media platform TikTok, Shou Zi Chew; and the CEO of Google, Sundar Pichai.

At his confirmation hearing before the Senate Committee on Finance today, Trump’s nominee for Treasury Secretary, billionaire Scott Bessent, said that extending the 2017 Trump tax cuts was "the single most important economic issue of the day." But he said he did not support raising the federal minimum wage, which has been $7.25 since 2009 although 30 states and dozens of cities have raised the minimum wage in their jurisdictions.

There have been signs lately that the American people are unhappy about the increasing inequality in the U.S. On December 4, 2024, a young man shot the chief executive officer of the health insurance company UnitedHealthcare, which has been sued for turning its claims department over to an artificial intelligence program with an error rate of 90% and which a Federal Trade Commission report earlier this week found overcharged cancer patients by more than 1,000% for life-saving drugs. Americans championed the alleged killer.

It is a truism in American history that those interested in garnering wealth and power use culture wars to obscure class struggles. But in key moments, Americans recognized that the rise of a small group of people—usually men—who were commandeering the United States government was a perversion of democracy.

In the 1850s, the expansion of the past two decades into the new lands of the Southeast had permitted the rise of a group of spectacularly wealthy men. Abraham Lincoln helped to organize westerners against a government takeover by elite southern enslavers who argued that society advanced most efficiently when the capital produced by workers flowed to the top of society, where a few men would use it to develop the country for everyone. Lincoln warned that “crowned-kings, money-kings, and land-kings” would crush independent men, and he created a government that worked for ordinary men, a government “of the people, by the people, for the people.”

A generation later, when industrialization disrupted the country as westward expansion had before, the so-called robber barons bent the government to their own purposes. Men like steel baron Andrew Carnegie explained that “[t]he best interests of the race are promoted” by an industrial system, “which inevitably gives wealth to the few.” But President Grover Cleveland warned: “The gulf between employers and the employed is constantly widening, and classes are rapidly forming, one comprising the very rich and powerful, while in another are found the toiling poor…. Corporations, which should be the carefully restrained creatures of the law and the servants of the people, are fast becoming the people's masters.”

Republican president Theodore Roosevelt tried to soften the hard edges of industrialization by urging robber barons to moderate their behavior. When they ignored him, he turned finally to calling out the “malefactors of great wealth,” noting that “there is no individual and no corporation so powerful that he or it stands above the possibility of punishment under the law. Our aim is to try to do something effective; our purpose is to stamp out the evil; we shall seek to find the most effective device for this purpose; and we shall then use it, whether the device can be found in existing law or must be supplied by legislation. Moreover, when we thus take action against the wealth which works iniquity, we are acting in the interest of every man of property who acts decently and fairly by his fellows.”

Theodore Roosevelt helped to launch the Progressive Era.

But that moment passed, and in the 1930s, Franklin Delano Roosevelt, too, contended with wealthy men determined to retain control over the federal government. Running for reelection in 1936, he told a crowd at Madison Square Garden: “For nearly four years you have had an Administration which instead of twirling its thumbs has rolled up its sleeves…. We had to struggle with the old enemies of peace—business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering. They had begun to consider the Government of the United States as a mere appendage to their own affairs. We know now that Government by organized money is just as dangerous as Government by organized mob.”

“Never before in all our history have these forces been so united against one candidate as they stand today,” he said. “They are unanimous in their hate for me—and I welcome their hatred.”

Last night, after President Biden’s warning, Google searches for the meaning of the word “oligarchy” spiked.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#President Joe Biden#warning#political#oligarchy#Letters From An American#Heather Cox Richardson#income inequality#history#American History#FDR#Theodore Roosevelt#Robber Barrons

75 notes

·

View notes

Text

House Republicans are looking for a nearly $4.5 trillion dollar permanent hand out to the top 2% richest households in America including exempting the first $15 million dollars of a wealthy estate from any tax at all.

Adding trillions of dollars to the federal deficit each year

while gutting:

- Food assistance to needy families

- cutting the child tax credit

- cutting middle-class tax credits out after 2028 (right after the presidential election)

- gutting 700 billion from medicaid funding

- restricts a federal judge's ability to hold government officials in contempt for ignoring court orders

Republicans pass this "Big Bullshit Bill" they'll lose the House in 2026 in a wave that will make 2018 seem laughable by comparison.

Democrats lost 63 seats in 2010 because of a bill they passed that became so popular that with a decade to work on it and Republicans couldn't repeal, replace, or cut anything from it in 2017. A durability that Republicans have never been able to replicate in congress.

Trying to just replace said bill cost Republicans 41 seats in 2018, giving Democrats a 8.6% margin of victory. Republicans haven't had a red wave in the House since. Winning just 9 seats in 2022 and losing 2 of those gains in 2024.

Nevermind the outrage over cuts that'll fuel Senate seat wins in North Carolina, Michigan, and maybe even Maine, and Alaska, and with the right candidates: Alabama, Kentucky, Ohio, North Carolina, Montana, and Iowa.

Trump's "Big Beautiful Bill" will be tied around the neck of every Republican in office before throwing them into the sea of voter discontent.

28 notes

·

View notes

Text

Greg Sargent at TNR:

As the war between Donald Trump and Elon Musk worsens, what’s truly odd about this whole spectacle is that the actual substantive disagreement between them seems to be of little interest to media observers. And when you strip away the trolling and shitposting, here’s what becomes clear: This is really a battle over how comprehensively to screw over poor and working people, largely to the benefit of the wealthy. The superficial argument between them, of course, is over Musk’s opposition to the “big, beautiful bill” that the House passed and that Trump wants the Senate to adopt. That opposition is rooted in Musk’s claim that the bill is loaded with “pork” and will explode the deficit. Trump, meanwhile, is infuriated by Musk because he can’t brook criticism and wants the bill to pass to notch a victory. But the respective positions underlying those stances are mysteriously missing from the whole Trump-Musk discourse. Flush them into the open, and it helps illuminate the true spectrum of the MAGA movement’s ideological goals—and why its “pro-worker populist” pretensions are so thoroughly phony. The House GOP bill would entail a large upward transfer of resources. The bill, which would continue Trump’s 2017 tax law and add new tax giveaways for wealthy investors, heirs, and others, would deliver a big tax cut to those in the highest income brackets. According to the Center on Budget and Policy Priorities, the tax cuts enjoyed by those in the bottom 20 percent in 2027 would be one seven-hundredth the size of those reaped by the top 1 percent.

Worse, those relative table scraps for the bottom could be erased by other changes. The bill’s massive cuts to Medicaid and other health care changes would result in over 10 million people losing health insurance. Add in other cuts to the safety net, and you see why the bill ultimately would lower household resources for the bottom 10 percent while raising them for the top 10 percent—a sizable redistribution upward. As Paul Krugman notes, the bill’s “cruelty is exceptional even by right wing standards.” Musk is angry about the $2.4 trillion those changes would add to the debt. But, crucially, he’s said little—if anything—about the role that those tax cuts for the rich would have in that outcome. He is primarily obsessed with the bill’s “pork,” meaning that he wants the bill to cut more spending—much, much more. Where would that money come from? Musk’s cuts via his Department of Government Efficiency have already decimated foreign aid and other programs, producing more starvation, disease, and death among the global poor. Given that DOGE searched for “waste, fraud, and abuse” and found very little, if Musk wants massive additional cuts, by definition they would fall more heavily on important government programs, almost certainly ones that low-income Americans rely upon. Another way to say this is that their real difference is over how far to push the “waste, fraud, and abuse” scam. Trump, who’s mindful of the MAGA-GOP’s image as a “working-class party,” has insisted the GOP won’t cut Medicaid and will target only fraud. That’s a lie—even some MAGA Republicans warn that the bill’s deep Medicaid cuts will hammer Trump’s working-class base and, in so doing, expose how Trump is betraying MAGA’s “populist” aura. Indeed, Trump is actively deceiving his base by pretending those cuts only target fraud. Musk, similarly, would use the “waste, fraud, and abuse” canard to absolutely annihilate the state if he could.

The Trump-Musk feud is about who gets to harm America more, aka Satan A and Satan B.

See Also:

The Status Kuo (Jay Kuo): Are You Fucking Ketamine?!

28 notes

·

View notes

Text

I feel like I need to clarify how fucking... random the Big Ugly Bill is.

I do admit. I'm not reading 1000 pages. I did use AI to read it. I know, I know. You can hate me, but my attention span and reading comprehension are not great enough for that.

So here's 25 random ass points in the Big Ugly Bill.

Environment and Energy

1. Repeals grants and rebates from the government for clean energy projects

2. Reduces financial incentive and technical assistance to reduce methane production

3. Ends EPA initiative to label and certify greenhouse gas materials

4. Revokes money meant for modernizing and digitizing environment permitting process

5. Ends federal aid to states and tribes to improve emissions tracking and public access to environmental compliance data

Agriculture and Conservation

6. Reauthorizes major farm safety net programs

7. Rescinds unspent Inflation Reduction Act funds for the Environmental Quality Incentives Program (EQIP), Conservation Stewardship Program (CSP), and others

8. Provides $15 million/year to continue controlling the spread of destructive feral swine populations on agricultural lands

9. Continues payments to private landowners who open land for hunting, fishing, and conservation through 2031

10. Increases federal support for groundwater and drinking water safety projects via the USDA

Nutrition and Social Programs

11. Revises definitions of “qualified” non-citizens, likely restricting Supplemental Nutrition Assistance Program (SNAP) access

12. Reauthorizes through 2031 with ongoing food commodity purchases and distribution logistics support

Defense and National Security

13. Raises the multiplier for calculating military pensions, enhancing the defined-benefit portion for service members

14. Lets DoD keep using private contractors for base housing through September 2029

15. Adds appropriations for expanding the U.S. Navy fleet—part of a broader military-industrial buildup

Infrastructure and Industry

16. Eliminates tax incentives and grants for EV purchases and charging network development

17. Mandates quarterly oil and gas lease sales in areas like the Gulf of Mexico and Alaska, including ANWR

18. Adds metallurgical coal (used for steelmaking) to the list of industries eligible for domestic manufacturing tax credits

IRS and Taxes

19. Eliminates the free government-run tax filing system, reinstating reliance on private tax software providers

20. Doubles the estate tax threshold to $15 million per individual, shielding ultra-wealthy inheritances

21. Temporarily allows Americans to deduct interest on car loans for U.S.-made vehicles

22. Sets up “American Freedom Accounts” seeded with $1,000 at birth and available for tax-free growth

23. Codifies lower individual income tax brackets and corporate rates from the 2017 Tax Cuts and Jobs Act

Other

24. Bars local governments from regulating artificial intelligence for 10 years, centralizing control at the federal level

25. Creates a new EPA division for restoring abandoned hardrock mine sites in western regions

This could all be... a dozen bills... at least. The Big Ugly Bill should be renamed the special interest lobbying bill.

"BUT! NO TAXES ON TIPS! IT'S GOOD!"

But it revokes grants for clean energy and methane control, instead providing grants for coal production.

"BUT CHILD SAVINGS ACCOUNT"

But it creates stricter work requirements for SNAP eligibility.

"BUT CLEAN WATER"

But it eliminates the free government funded tax filing system.

We can do this all day. This is trash. The bill is trash. It's a "EVERYONE SHOVE WHATEVER SHIT YOU WANT INTO IT" bill.

And don't get me started on Obama's "EVERYONE SHOVE AS MUCH SHIT AS YOU CAN INTO IT." Bill. I'm tired of every time I criticize the current administration people want to say "BUT OBAMA". I wasn't okay with it when he did it. I'm not okay with it now. Besides, by your logic. Just because one person does something, that makes it okay for EVERYONE to do it.

How about "it wasn't okay for Obama to do it and it's not okay for Trump to do it"? Eh?

-fae

13 notes

·

View notes

Quote

Republicans identify the rapidly growing federal deficit as a crisis for which Democrats are to blame, but in fact, President Bill Clinton—with an assist from Republican president George H.W. Bush—eliminated the federal deficit in the 1990s. What threw the deficit into the red was the tax cuts and unfunded wars under George W. Bush, along with Trump’s 2017 Tax Cuts and Jobs Act, or TCJA, that disproportionately benefited the very wealthy and corporations. The U.S. Treasury estimates that extending the TCJA as is—Trump has mused on deeper cuts—would cost $4.2 trillion over the next ten years.

Heather Cox Richardson

21 notes

·

View notes

Video

youtube

Trump’s Tax Scam: Why Nothing Trickled Down

The Trump tax cuts were a YUGE scam.

But this November we have a chance to end this trickle-down hoax once and for all.

Donald Trump’s biggest legislative achievement (if you want to even call it that) was the 2017 Tax Cuts and Jobs Act.

The law permanently slashed corporate taxes and temporarily cut income tax rates mostly for rich individuals through the year 2025. The results were worse than I could have imagined.

Trump and his officials claimed the tax cuts would lead to corporations hiring more workers and would “very conservatively” lead to a $4,000 boost in household incomes.

What actually happened in the years since?

In AT&T’s case, the company saw its overall federal tax bill drop by 81%. It spent 31 times more on dividends and stock buybacks to enrich wealthy shareholders than it paid it in taxes. Meanwhile, it slashed over 40,000 jobs.

That was par for the course with Trump’s tax cuts.

Like AT&T, America’s biggest corporations didn’t use their tax savings to increase productivity or reward workers. Instead, they increased their stock buybacks and dividends.

Many of them, including AT&T, even ended up paying their executives more in some years than what they paid Uncle Sam.

Those executives (along with other high earners) then got to keep more of their earnings because Trump’s tax cuts for individuals were heavily skewed toward the rich. The lowest earners? They got squat.

And many middle-income families saw their taxes go up.

And those supposed $4,000 raises, did you get one?

The bottom line is that Trump’s tax law fueled a massive transfer of wealth into the hands of the rich and powerful. Corporate profits have skyrocketed. U.S. billionaire wealth has more than DOUBLED since 2018.

The tax cuts have also added $2 trillion to the national debt so far, but that hasn’t stopped Trump and the so-called “party of fiscal responsibility” from doubling down on renewing them.

If Trump is reelected and Republicans take control of Congress, they’re planning to renew the expiring tax cuts for individuals that primarily benefited the rich. This would cost $4.6 trillion over the next decade, more than double the cost of the original tax cuts.

Trump has also threatened to lower the corporate tax rate even further from 21% to 15% — which would cost another $1 trillion.

It’s trickle-down economics on steroids.

All of this would cause the federal deficit and debt to soar — which Republicans will then use as an excuse to cut spending on government programs the rest of us rely on.

But the Democrats have their own tax plan. We can make it a reality this November. What would it do? Just the opposite of Trump’s tax plan.

ONE: It would increase taxes on wealthy individuals with incomes in excess of $400,000 a year, while cutting taxes for lower-income Americans.

TWO: It would make billionaires pay at least 25 percent of their incomes in taxes, still leaving them with plenty left over.

THREE: It would raise the corporate income tax to 28 percent, which is about what it was in 1990.

LASTLY, it would quadruple the tax on stock buybacks to get corporations to invest more of their earnings in workers’ wages and productivity instead of windfalls for investors.

So the real choice is between the Republicans’ plan to make the rich much richer, and the Democrats’ plan to make the rich pay their fair share and provide what Americans need.

Which do you want?

351 notes

·

View notes

Text

March 10, 2025

HEATHER COX RICHARDSON

MAR 11

Last week’s dramatically dropping stock market prompted Fox News Channel personality Maria Bartiromo to ask Trump in an interview that aired yesterday if he was expecting a recession. Trump answered: “I hate to predict things like that. There is a period of transition because what we’re doing is very big.”

Yesterday evening, on Air Force One, a reporter asked President Donald Trump if he is worried about a recession. “Who knows?” the president answered. “All I know is this: We’re going to take in hundreds of billions of dollars in tariffs, and we’re going to become so rich, you’re not going to know where to spend all that money. I’m telling you, you just watch. We’re going to have jobs. We’re going to have open factories. It’s going to be great.”

Today the stock market plunged.

The Dow Jones Industrial Average of 30 prominent companies listed on U.S. stock exchanges fell by 890 points, more than 2%. The S&P 500, which tracks the stocks of 500 of the largest companies listed in the U.S., fell by 2.7%. The Nasdaq Composite, which tracks tech stocks, fell by 4%. Shares of Elon Musk’s Tesla closed down more than 15%, dropping more than 45% this year. Tonight, as the Asian markets opened on the other side of the world, the slide continued.

According to MarketWatch, this is the worst start to a presidential term since 2009, when the country was in the subprime mortgage crisis. Trump did not inherit an economy mired in crisis, of course; he inherited what was, at the time, the strongest economy in the world. That booming economy is no more: Goldman is now predicting higher inflation and slower growth than it had previously forecast, while its forecast for Europe is now stronger than it had been.

Trump has always been a dodgy salesman more than anything, telling supporters what they want to hear. He insisted that the strong economy under former president Joe Biden was, in fact, a disaster that only he could fix. In October, Trump told attendees at a rally: “We will begin a new era of soaring incomes. Skyrocketing wealth. Millions and millions of new jobs and a booming middle class. We are going to boom like we’ve never boomed before.”

That sales pitch got Trump away from the criminal cases against him and back into the White House. Now, though, he needs to make the sales pitch fit into a reality that it doesn’t match. Trump is “steering the country toward a downturn with his tariffs and cuts to spending and the federal workforce—for no logical reason,” Washington Post economic reporter Heather Long wrote on March 6. “Trump’s whipsaw actions have put businesses and consumers on edge,” she noted. If they stop spending at the same time that the government slashes jobs and spending, a downward spiral could lead to a recession. “Trump is inciting an economic storm,” Long wrote. “The big question is why he’s doing this.”

One answer might be that Trump’s top priority is the extension of the 2017 tax cuts for the wealthy and corporations, at the same time that he has also promised to cut the deficit. Those two things are utterly at odds: the nonpartisan Congressional Budget Office estimates that extending the tax cuts will cost the country more than $4 trillion over the next ten years.

Tariffs appear to have been Trump’s workaround for that incompatibility. He claimed that tariffs would shift the burden of funding the U.S. government to foreign countries. When economists reiterated that tariffs are paid by U.S. consumers and would drive up prices and slow growth, he insisted they were wrong. Increasingly, tariffs seem to have become for him not just the solution to his economic dilemma, but also a symbol of American strength.

“[T]ariffs are not just about protecting American jobs,” Trump told Congress last week. “They are about protecting the soul of our country. Tariffs are about making America rich again and making America great again, and it is happening and it will happen rather quickly. There will be a little disturbance, but we are OK with that.”

After watching Trump talk to Fox News Channel host Bret Baier in mid-February, Will Saletan of The Bulwark noted that Trump seemed truly to believe that tariffs would bring in “tremendous amounts of money.” For that, as well as his apparent conviction that Palestinians should evacuate Gaza so the U.S. could “take over” and develop the real estate there, and that Canada should become the 51st U.S. state, and so on, Saletan concluded “Donald Trump is Delusional.”

Another reason for Trump’s dogged determination to impose tariffs despite the pain they are inflicting on Americans might lie in James Fallows’s observation in Breaking the News after the president’s speech to Congress that Trump’s mental acuity is slipping. Fallows noted that Trump’s vocabulary has shrunk markedly since his first term and he appears to be falling back on “more primitive and predictable” phrases. Tonight the president appeared to be moving back in time, as well, advertising the availability of the first season of “the Emmy nominated ORIGINAL APPRENTICE STARRING PRESIDENT DONALD TRUMP.”

The White House said today in a statement: “Since President Trump was elected, industry leaders have responded to President Trump’s America First economic agenda of tariffs, deregulation, and the unleashing of American energy with trillions in investment commitments that will create thousands of new jobs. President Trump delivered historic job, wage, and investment growth in his first term, and is set to do so again in his second term.”

As the administration’s economic policies are rocking the economy, the administration’s arrest and detention of Mahmoud Khalil, a 30-year-old Syrian-born Palestinian activist who figured prominently in the Gaza Solidarity Encampment at Columbia University last April, seems designed to rock society. According to Democracy Now, Khalil is an Algerian citizen, but he holds a U.S. green card and is married to a U.S. citizen who is 8 months pregnant.

Shortly after he took office, Trump issued an executive order saying he would revoke the student visas of anyone he claimed sympathized with Hamas. On Saturday, agents from U.S. Immigration and Customs Enforcement (ICE) arrested Khalil. Khalil’s lawyer said that ICE agents claimed they were acting on the orders of the State Department to revoke Khalil’s student visa, apparently unaware that Khalil, who graduated from Columbia’s School of International and Public Affairs in December 2024, is a lawful permanent resident of the United States. When his wife showed officers documents proving that status, the lawyer said, an officer said they were revoking his green card instead. He is apparently being held in Louisiana.

The revocation of a green card is very rare. The Associated Press noted that the Department of Homeland Security can begin the process of deportation for lawful permanent residents who are connected to alleged criminal activity. But Khalil hasn’t been charged with a crime. Nik Popli of Time magazine notes that a green card holder can be deported for supporting terrorist groups, but in that case the government must have material evidence. A Homeland Security spokesperson did not offer any such evidence, saying simply that Khalil’s arrest was “in support of President Trump’s executive orders prohibiting anti-Semitism” and that Khalil “led activities aligned to Hamas, a designated terrorist organization.”

That is, the Trump administration has arrested and detained a legal resident for expressing an opinion that Trump officials don’t like, likely using Khalil to launch this extraordinary attack on the First Amendment because they don’t expect Americans to care deeply about his fate. Once the principle is established that the government can arrest and jail protesters, though, officials will use it to silence opposition broadly. “This is the first arrest of many to come,” Trump posted just after noon. “We know there are more students at Columbia who have engaged in pro-terrorist, anti-Semitic, anti-American activity, and the Trump Administration will not tolerate it.”

Representative Greg Casar (D-TX) posted: “This is illegal, and it endangers the rights of all Americans. In this country, people must be free to express their views—left or right, popular or unpopular—without being detained or punished by the government.” On this basic principle, Americans across the political spectrum appear to agree. Right-wing pundit Ann Coulter was one of those who stepped back from the idea of arrests and deportations of those expressing opinions. “There’s almost no one I don’t want to deport,” she posted, “but, unless they’ve committed a crime, isn’t this a violation of the first amendment?”

Today, U.S. District Judge Jesse M. Furman ordered that Khalil “shall not be removed from the United States unless and until the Court orders otherwise,” and ordered a hearing on Wednesday.

—

17 notes

·

View notes

Text

M.Wuerker

* * * *

LETTERS FROM AN AMERICAN

June 30, 2025

Heather Cox Richardson

Jul 01, 2025

"This is the most deeply immoral piece of legislation I have ever voted on in my entire time in Congress,” said Senator Chris Murphy (D-CT).

“[W]e're debating a bill that’s going to cut healthcare for 16 million people. It's going to give a tax break to…massively wealthy people who don't need any more money. There are going to be kids who go hungry because of this bill. This is the biggest reduction in…nutrition benefits for kids in the history of the country.” Murphy continued: “We're obviously gonna continue to offer these amendments to try to make it better. So far not a single one of our amendments…has passed, but we'll be here all day, probably all night, giving Republicans the chance over and over and over again to slim down the tax cuts for the corporations or to make life a little bit…less miserable for hungry kids or maybe don't throw as many people off of healthcare. Maybe don't close so many rural hospitals. It's gonna be a long day and a long night.”

“This bill is a farce,” said Senator Angus King (I-ME). “Imagine a bunch of guys sitting around a table, saying, ‘I've got a great idea. Let's give $32,000 worth of tax breaks to a millionaire and we’ll pay for it by taking health insurance away from lower-income and middle-income people. And to top it off, how about we cut food stamps, we cut SNAP, we cut food aid to people?’... I've been in this business of public policy now for 20 years, eight years as governor, 12 years in the United States Senate. I have never seen a bill this bad. I have never seen a bill that is this irresponsible, regressive, and downright cruel.”

“When I worked here in the 70's,” King said, “I had insurance as a…junior staff member in this body 50 years ago. Because I had that insurance that covered a free checkup, I went in and had my first physical in eight years…and the doctors found a little mole on my back. And they took it out. And I didn't think much of it. And I went in a week later and the doctor said, ‘You better sit down, Angus. That was malignant melanoma. You're going to have to have serious surgery.’… And I had the surgery and here I am. If I hadn’t had insurance, I wouldn’t be here. And it’s always haunted me that some young man in America that same year had malignant melanoma, he didn’t have insurance, he didn’t get that checkup, and he died. That’s wrong. It’s immoral.”

Senator King continued: “I don’t understand the obsession and I never have…with taking health insurance away from people. I don’t get it. Trying to take away the Affordable Care Act in 2017 or 2018 and now this. What’s driving this? What’s the cruelty to do this, to take health insurance away from people knowing that it’s going to cost them…up to and including…their lives.”

In fact, the drive to slash health insurance is part of the Republicans’ determination to destroy the modern government.

Grover Norquist, a lawyer for the U.S. Chamber of Commerce and one of the key architects of the Republican argument that the solution to societal ills is tax cuts, in 2010 described to Rebecca Elliott of the Harvard Crimson how he sees the role of government. “Government should enforce [the] rule of law,” he said. “It should enforce contracts, it should protect people bodily from being attacked by criminals. And when the government does those things, it is facilitating liberty. When it goes beyond those things, it becomes destructive to both human happiness and human liberty.”

Norquist vehemently opposed taxation, saying that “it’s not any of the government’s business who earns what, as long as they earn it legitimately,” and proposed cutting government spending down to 8% of gross domestic product, or GDP, the value of the final goods and services produced in the United States.

The last time the level of government spending was at that 8% of GDP was 1933, before the New Deal. In that year, after years of extraordinary corporate profits, the banking system had collapsed, the unemployment rate was nearly 25%, prices and productivity were plummeting, wages were cratering, factories had shut down, farmers were losing their land to foreclosure. Children worked in the fields and factories, elderly and disabled people ate from garbage cans, unregulated banks gambled away people’s money, and business owners treated their workers as they wished. Within a year the Great Plains would be blowing away as extensive deep plowing had damaged the land, making it vulnerable to drought. Republican leaders insisted the primary solution to the crisis was individual enterprise and private charity.

When he accepted the Democratic nomination for president in July 1932, New York governor Franklin Delano Roosevelt vowed to steer between the radical extremes of fascism and communism to deliver a “New Deal” to the American people.

The so-called alphabet soup of the New Deal gave us the regulation of banks and businesses, protections for workers, an end to child labor in factories, repair of the damage to the Great Plains, new municipal buildings and roads and airports, rural electrification, investment in artists and writers, and Social Security for workers who were injured or unemployed. Government outlays as a percentage of GDP began to rise. World War II shot them off the charts, to more than 40% of GDP, as the United States helped the world fight fascism.

That number dropped again after the war, and in 1975, federal expenditures settled in at about 20% of GDP. Except for short-term spikes after financial crises (spending shot up to 24% after the 2008 crash, for example, and to 31% during the 2020 pandemic), the spending-to-GDP ratio has remained at about that set point.

The national debt is growing because tax revenues have plummeted. Tax cuts under the George W. Bush and Trump administrations are responsible for 57% of the increase in the ratio of the debt to the economy, 90% if you exclude the emergency expenditures of the pandemic, and have left the United States with a tax burden nowhere close to the average of the 38 other nations in the Organization of Economic Cooperation and Development (OECD), all of which are market-oriented democracies. And those cuts have gone primarily to the wealthy and corporations.

Republicans who backed those tax cuts now want more. They are trying to force through a measure that will dramatically cut the nation’s social safety net while at the same time increasing the national debt by $3.3 trillion over the next ten years.

“There are two ways of viewing the government's duty in matters affecting economic and social life,” FDR said in his speech accepting the 1932 Democratic nomination for president. “The first sees to it that a favored few are helped and hopes that some of their prosperity will leak through, sift through, to labor, to the farmer, to the small business man.” The other “is based upon the simple moral principle: the welfare and the soundness of a Nation depend first upon what the great mass of the people wish and need; and second, whether or not they are getting it.”

The Republicans’ budget reconciliation bill takes wealth from the American people to give it to the very wealthy and corporations, and Democrats are calling their colleagues out.

“This place feels to me, today, like a crime scene,” Senator Sheldon Whitehouse (D-RI) said on the floor of the Senate. “Get some of that yellow tape and put it around this chamber. This piece of legislation is corrupt. This piece of legislation is crooked. This piece of legislation is a rotten racket. This bill cooked up in back rooms, dropped at midnight, cloaked in fake numbers with huge handouts to big Republican donors. It loots our country for some of the least deserving people you could imagine. When I first got here, this chamber filled me with awe and wonderment. Today, I feel disgust.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Matt Wuerker#Letters From An American#Heather Cox Richardson#The Big Bad Bill#Senator Sheldon Whitehouse#Chris Murphy#FDR#American History#The New Deal#The Great Depression#history#income inequality#the very wealthy and corporations

20 notes

·

View notes

Text

Republicans in Congress this week staggered a step forward to passing a brutal budget that would strip healthcare from those most in need, in exchange for (another) massive tax cut for the wealthy. But it could be a Pyrrhic victory for MAGA.

One bright spot is that Democrats in the House — who have struggled to figure out how to respond to a second Trump term — remained totally united in voting against the budget framework. As Trump’s approval sinks, the opposition appears to be organized and more willing to fight.

Republicans are nervous, and Democrats may have a real chance to derail their grim priorities — especially if they can connect the unpopular Republican billionaire budget to Elon Musk, the unpopular billionaire illegally and unconstitutionally rampaging through the federal government at Trump’s behest.

2017 all over again

The budget process is complicated in large part because of the filibuster in the Senate. Republicans have a 53-47 majority in the chamber, but that is not enough to reach the 60 vote threshold needed to pass legislation through normal procedures. So the GOP is planning to pass a budget through reconciliation — an expedited process that allows certain vital bills to pass without a filibuster.

Before they can vote on reconciliation, the Senate and House first need to pass budget resolutions that set out priorities and determine which committees will be responsible for expenditures, and cuts. The Senate passed a two-track budget resolution earlier this month that separates extending Trump’s tax cuts from most other spending measures. This week, the House passed its own budget resolution with only one vote to spare. Unlike the Senate bill, the House plan would roll tax cuts and all other spending into “one big beautiful bill,” as Trump calls it.

Senate and House Republicans need to agree on the same budget resolution before they can move forward on reconciliation. But the House bill sets out some terrifying priorities. In order to pass $4.5 trillion in tax cuts, the resolution orders $2 trillion in spending cuts.

The resolution instructs the House Energy and Commerce Committee to slash $880 billion from the budget. Most of that money is going to come from Medicaid which, along with the Children’s Health Insurance Program (CHIP), covers healthcare for low-income people, people with disabilities, pregnant people, and seniors — a total of one in four Americans.

If the House budget is enacted, some 15.9 million people could lose healthcare coverage. Each congressional district would lose around $2 billion in federal funds for Medicaid coverage. It’s 2017 all over again — and it’s worth remembering how poorly that effort to take away healthcare from tens of millions of people in the first year of Trump’s first term worked out for Republicans the next year, when they were waxed in the midterms and lost control of the House.

Democrats in array

In January, Minority Leader Hakeem Jeffries emphasized his willingness to seek bipartisan compromise and work with Republicans. That stance infuriated the Democratic base, which deluged House members with calls demanding stronger opposition to the new Trump administration.

Those calls, and the extreme cruelty of the Republican House budget, have stiffened Democratic spines. Before the budget resolution battle on the floor, Jeffries declared Tuesday that “they will not get a single Democratic vote.”

Jeffries was true to his word. Every Democrat voted against the bill.

Only one Republican, the deficit-obsessed Thomas Massie, voted against the resolution on the grounds that it would massively increase debt (which it would). That gave Johnson an extremely narrow 217-215 win. But there are plenty of other fault lines in the GOP which could open up as the process grinds on.

Republican House members from purple districts like Nicole Malliotakis (New York) and Jeff Van Drew (New Jersey) have expressed concerns about Medicaid cuts. Johnson has papered over those concerns in part by mendaciously suggesting that the cuts he’s proposing won’t come from Medicaid, even though everyone knows they will.

It’s unclear whether Malliotakis, Van Drew, and other members in potentially vulnerable districts will vote for Medicaid cuts when they can no longer pretend that’s not what they’re doing. As political scientist Jonathan Bernstein notes, “The long-term history of the less extreme conservatives is that they regularly fold.”

On the other hand, Republicans are already facing substantial resistance and blowback from constituents angered by chaotic spending cuts and federal worker firings instituted by Trump and his sugar daddy Musk. Musk’s unilateral austerity measures included 1,000 layoffs at Veteran’s Affairs — layoffs so indiscriminate that the VA had to stumble over itself to rehire many of those fired as it realized it could not function adequately without them.

Ruthlessly stripping healthcare from veterans is popular with basically no one, and Musk’s other measures have inspired pushback as well. Belligerent constituents in Glenn Grothman’s solidly conservative Wisconsin district caught him flatfooted at his town hall, booing and jeering as he tried to tout Trump’s achievements and demanding he oppose Social Security and Medicaid cuts. Alaska’s Nick Begich hosted a virtual town hall which was flooded with constituent comments demanding he address federal job losses and illegal executive actions.

One rattled Republican, speaking anonymously, told Axios, “It would be more helpful if some of those DOGE folks showed more sensitivity to the people who are being terminated this way ... who didn't do anything wrong."

The honeymoon is already over

The anger at the town halls is showing up in polling.