#20:

Explore tagged Tumblr posts

Photo

🧀🥪🌶️🥭 The Ravening War portraits 🧀🥪🌶️🥭

patreon * twitch * shop

[ID: a series of digitally illustrated portraits showing - top left to bottom right - Bishop Raphaniel Charlock (an old radish man with a big red head and large white eyebrows & a scraggly beard. he wears green and gold robes with symbols of the bulb and he smirks at the viewer) Karna Solara (a skinny young chili pepper woman with wavy green hair, freckled light green skin with red blooms on her cheeks. she wears a chili pepper hood lined with small pepper seeds and stares cagily ahead) Thane Delissandro Katzon (a muscular young beef man with bright pinkish skin with small skin variations to resemble pastrami and dark burgundy hair. he wears a bread headress with a swirl of rye covering his ears and he looks ahead, optimistic and determined) Queen Amangeaux Epicée du Peche (a bright mango woman with orange skin, big red hair adorned with a green laurel, and sparkling green/gold makeup. she wears large gold hoop earrings and a high leafy collar) and Colin Provolone (a scraggly cheese man with waxy yellow skin and dark slicked back hair and patchy dark facial hair. he wears a muted, ratty blue bandana around his neck and raises a scarred brow at the viewer with a smirk) End ID.)

#trw#the ravening war#dimension 20#acoc#trw fanart#ttrpg#dnd#bishop raphaniel charlock#karna solara#thane delissandro katzon#queen amangeaux epicee du peche#colin provolone

2K notes

·

View notes

Text

Retirement Savings in Your 20s: How to Start Early and Make the Most of Compounding

"Unlocking Financial Freedom: Starting Early with Retirement Savings in Your 20s and Harnessing the Power of Compounding"

Introduction Why Save for Retirement in Your 20s? Know Your Goals Compound Interest Is Your Friend Saving a Little Early vs. Saving a Lot Later What to Consider When Investing Individual Retirement Account (IRA) Roth IRA 401(k) Retirement Plan Invest in a Savings Account Should I Start Saving for My Retirement in My 20s? How Much Should I Save for My Retirement in My 20s? What Are the Saving Limits for Retirement Plans? The Bottom Line References

Introduction

Preparing for retirement is not something most people think about in their 20s. However, starting to save for retirement early can have a significant impact on your financial future. By taking advantage of the power of compound interest and making smart investment choices, you can set yourself up for a comfortable retirement. In this article, we will discuss why it's important to save for retirement in your 20s, how to choose the right retirement plan, and tips for maximizing your savings.

Why Save for Retirement in Your 20s?

Many people in their 20s may think that retirement is too far away to start saving. However, saving for retirement in your 20s has several advantages. Firstly, when you start early, you have more time for your investments to grow through the power of compound interest. This means that even small contributions can grow significantly over time. Additionally, starting early allows you to take advantage of tax benefits and employer matching contributions. Key Takeaways To sum up, here are the key takeaways for why you should save for retirement in your 20s: - Compound interest allows your investments to grow over time. - Starting early gives you more time to save and take advantage of employer matches. - Contributions to retirement plans may be tax-deductible.

Know Your Goals

Before you start saving for retirement, it's important to identify your goals. Think about the lifestyle you envision for your retirement years and how much income you will need to support that lifestyle. Consider factors such as healthcare expenses, travel plans, and any other financial goals you may have. By having a clear idea of your retirement goals, you can determine how much you need to save and create a plan to reach those goals.

Compound Interest Is Your Friend

One of the most powerful tools in retirement savings is compound interest. Compound interest is the interest earned on both the original amount of money invested and the accumulated interest. By reinvesting the interest earned, your savings can grow exponentially over time. This means that the earlier you start saving, the more time your investments have to compound and grow. Even small contributions made in your 20s can make a big difference in your retirement savings. Compound Interest Calculator

Compound Interest Calculator

Principal Amount ($): Annual Interest Rate (%): Number of Compounding Periods: Calculate Compound Interest Amount:

Saving a Little Early vs. Saving a Lot Later

Many people in their 20s may feel like they don't have enough money to save for retirement. However, even saving a small amount early on can have a significant impact on your financial future. Let's compare two scenarios: saving $100 per month starting in your 20s versus saving $500 per month starting in your 40s. Who Will Have More Money Saved Up in the End? Assuming a 7% annual return on investment, the person who started saving $100 per month in their 20s would have approximately $335,000 saved up by age 65. On the other hand, the person who started saving $500 per month in their 40s would only have approximately $214,000 saved up by age 65. This example illustrates the power of starting early and the impact it can have on your retirement savings.

What to Consider When Investing

When it comes to investing your retirement savings, there are several factors to consider: Market Risk Investing in the stock market can offer higher returns, but it also comes with higher risk. It's important to assess your risk tolerance and choose investments accordingly. If you have a long retirement horizon, you may be able to afford more risk in your portfolio. However, if you have a shorter time frame until retirement, you may want to consider more conservative investments. Risk Tolerance Your risk tolerance refers to your ability to withstand fluctuations in the value of your investments. Some individuals are comfortable with more risk and are willing to accept the possibility of larger losses in exchange for potentially higher returns. Others prefer a more conservative approach and prioritize the preservation of their capital. It's essential to align your investments with your risk tolerance to ensure you're comfortable with the level of risk you're taking. Retirement Horizon Your retirement horizon is the number of years until you plan to retire. The longer your retirement horizon, the more time your investments have to grow. This means that you can afford to take more risk and potentially earn higher returns. As you approach retirement, it's generally recommended to shift to a more conservative investment strategy to protect your savings.

Individual Retirement Account (IRA)

An Individual Retirement Account (IRA) is a type of retirement account that individuals can open independently. There are two main types of IRAs: traditional IRAs and Roth IRAs. With a traditional IRA, your contributions may be tax-deductible, and your earnings grow tax-deferred until you withdraw them during retirement. On the other hand, with a Roth IRA, your contributions are made with after-tax dollars, but your earnings grow tax-free, and qualified withdrawals are also tax-free. IRAs offer a wide range of investment options, allowing you to tailor your portfolio to your risk tolerance and investment preferences.

Roth IRA

A Roth IRA is a retirement account that offers tax advantages for individuals saving for retirement. Unlike a traditional IRA, Roth IRA contributions are made with after-tax dollars, meaning you don't get a tax deduction for the contributions. However, the earnings in a Roth IRA grow tax-free, and qualified withdrawals in retirement are also tax-free. Roth IRAs are particularly advantageous for individuals in their 20s as they have many years for their investments to grow tax-free.

401(k) Retirement Plan

If your employer offers a 401(k) retirement plan, it's highly recommended to take advantage of it. A 401(k) plan allows you to contribute a portion of your pre-tax income towards retirement savings. Many employers also offer matching contributions up to a certain percentage of your salary. This employer match is essentially free money, and it significantly boosts your retirement savings. Additionally, contributions to a 401(k) are tax-deductible, and your earnings grow tax-deferred until you withdraw them in retirement.

Invest in a Savings Account

In addition to retirement accounts, it's also a good idea to have a savings account as part of your retirement strategy. A savings account offers a safe and accessible place to store your money. While the interest rates on savings accounts may not be as high as other investments, they provide stability and liquidity. Setting aside a portion of your income into a savings account can serve as an emergency fund and provide a financial cushion in case of unexpected expenses.

Should I Start Saving for My Retirement in My 20s?

Absolutely! Starting to save for retirement in your 20s is one of the best financial decisions you can make. The power of compound interest and the ability to take advantage of employer matches and tax benefits make early retirement savings incredibly valuable. Even if you can only afford to save a small amount, it's better to start early and gradually increase your contributions as your income grows. Retirement Savings Comparison

Retirement Savings Comparison

Age to Start Saving Total Amount Saved by Age 65 ($) 25 35 45

How Much Should I Save for My Retirement in My 20s?

The amount you should save for retirement in your 20s depends on your individual financial situation and retirement goals. As a general rule of thumb, financial advisors recommend saving 10-15% of your income for retirement. However, this may not be feasible for everyone, especially if you have other financial obligations such as student loans or credit card debt. The important thing is to start saving as early as possible and contribute consistently over time. Simple Retirement Calculator

Simple Retirement Calculator

Your Current Age: Desired Retirement Age: Monthly Savings Amount ($): Annual Bank Interest Rate (%): Accumulated Savings (including interest):

What Are the Saving Limits for Retirement Plans?

Each year, the IRS sets contribution limits for retirement plans such as IRAs and 401(k)s. As of 2021, the contribution limit for traditional and Roth IRAs is $6,000. If you are over the age of 50, you can make an additional catch-up contribution of $1,000, bringing your total contribution limit to $7,000. For 401(k) plans, the contribution limit for 2021 is $19,500, with an additional catch-up contribution of $6,500 for individuals over 50.

The Bottom Line

Starting your retirement savings in your 20s can set you on the path to a secure financial future. By taking advantage of the power of compound interest and making smart investment choices, you can grow your savings significantly over time. Consider opening an Individual Retirement Account (IRA), contributing to your employer's retirement plan, and building an emergency fund. Remember, the earlier you start saving, the more time your investments have to grow, and the more secure your retirement will be.

References

- The Power of Compounding Interest - https://www.investopedia.com/terms/c/compoundinterest.asp - Employer Matching Contributions - https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits Compound Interest as a Powerful Savings Tool - How Compound Interest Works - https://www.investopedia.com/articles/investing/072115/how-interest-rates-work.asp - The Cost of Waiting to Save - https://www.bankrate.com/retirement/the-cost-of-waiting-to-save-for-retirement/ Retirement Investment Strategies - 401(k) and IRA Contribution Limits - https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-401k-and-profit-sharing-plan-contribution-limits - Roth IRAs - https://www.fidelity.com/building-savings/learn-about-iras/what-is-a-roth-ira - Investing in Stocks - https://www.merrilledge.com/article/stocks-for-beginners-learn-the-basics-of-investing-in-stock Estimating Retirement Income Needs - Replacement Income Targets - https://www.fidelity.com/viewpoints/retirement/how-much-money-should-I-have-when-I-retire - Retirement Planning Tips - https://www.ameriprise.com/retirement/retirement-planning/

Investing small amounts can add up over time through compounding.

Read the full article

0 notes

Photo

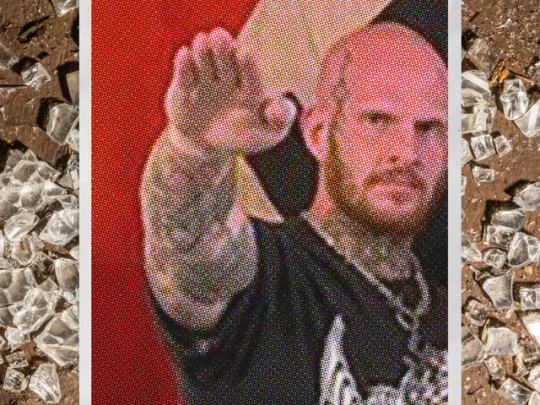

How Concerned Citizens Drove a Neo-Nazi Out of Rural Maine

Christopher Pohlhaus planned to build a fascist training compound in the woods of rural Maine. The local journalists, veterans, lumberjacks, and policymakers weren't having it.

Pohlhaus, 37, is a former U.S. marine, an itinerant tattoo artist, and a hardcore white-supremacist influencer. He is loud and hostile, and proud to be both. His voice is pitched surprisingly high, and he has a slight Southern drawl. He has a large body and small bald head; a blue-black tattoo crawls up the right side of his face, from his chin to his forehead. Over the years, Pohlhaus has collected thousands of social media followers, who know him by his nickname: Hammer.

Hammer had been living in Texas for a few years when, in March 2022, he bought the land in Maine. He told his followers that he was going to use it to build a haven, operational center, and training ground for white supremacists.

Check out our excerpt of The Atavist’s latest blockbuster story.

1K notes

·

View notes

Photo

PORTO ROCHA

885 notes

·

View notes

Photo

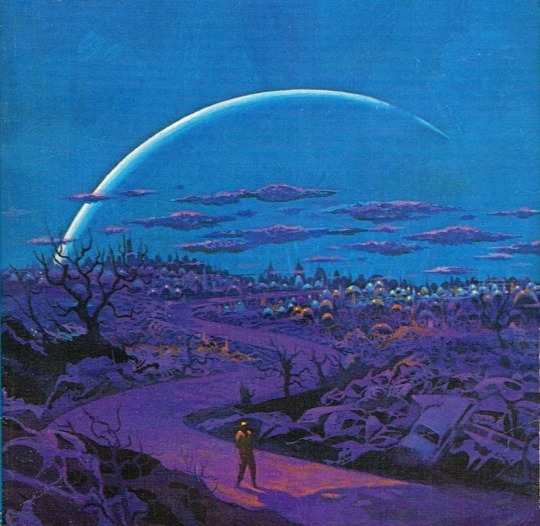

One of my favorites by Paul Lehr, used as a 1971 cover to "Earth Abides," by George R. Stewart. It's also in my upcoming art book!

1K notes

·

View notes

Quote

もともとは10年ほど前にTumblrにすごくハマっていて。いろんな人をフォローしたらかっこいい写真や色が洪水のように出てきて、もう自分で絵を描かなくて良いじゃん、ってなったんです。それで何年も画像を集めていって、そこで集まった色のイメージやモチーフ、レンズの距離感など画面構成を抽象化して、いまの感覚にアウトプットしています。画像の持つ情報量というものが作品の影響になっていますね。

映画『きみの色』山田尚子監督×はくいきしろい対談。嫉妬し合うふたりが語る、色と光の表現|Tokyo Art Beat

150 notes

·

View notes

Photo

#thistension

XO, KITTY — 1.09 “SNAFU”

#xokittyedit#tatbilbedit#kdramaedit#netflixedit#wlwedit#xokittydaily#asiancentral#cinemapix#cinematv#filmtvcentral#pocfiction#smallscreensource#teendramaedit#wlwgif#kitty song covey#yuri han#xo kitty#anna cathcart#gia kim#~#inspiration: romantic.#dynamic: ff.

1K notes

·

View notes

Photo

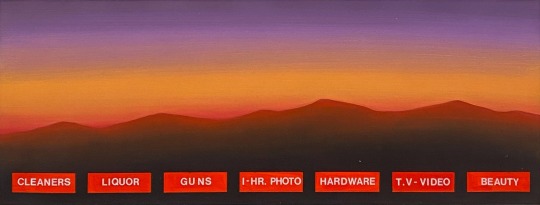

No one wants to be here and no one wants to leave, Dave Smith (because)

109 notes

·

View notes

Photo

Noodles with Lamb Sauce (Laghman, 新疆拌面) Xinjiang laghman features chewy noodles served with a bold and rich lamb and tomato sauce that is bursting with flavor.

Recipe: https://omnivorescookbook.com/recipes/uyghur-style-noodles-with-lamb-sauce

122 notes

·

View notes

Photo

CJ from Hello World (MSPFA) by phasedsun?

111 notes

·

View notes

Quote

よく「発明は1人でできる。製品化には10人かかる。量産化には100人かかる」とも言われますが、実際に、私はネオジム磁石を1人で発明しました。製品化、量産化については住友特殊金属の仲間たちと一緒に、短期間のうちに成功させました。82年に発明し、83年から生産が始まったのですから、非常に早いです。そしてネオジム磁石は、ハードディスクのVCM(ボイスコイルモーター)の部品などの電子機器を主な用途として大歓迎を受け、生産量も年々倍増して、2000年には世界で1万トンを超えました。

世界最強「ネオジム磁石はこうして見つけた」(佐川眞人 氏 / インターメタリックス株式会社 代表取締役社長) | Science Portal - 科学技術の最新情報サイト「サイエンスポータル」

81 notes

·

View notes

Photo

PORTO ROCHA

522 notes

·

View notes

Photo

HRH The Princess of Wales in Southport today, on her first engagement since completing chemotherapy. It’s so good to see her!❤️ --

#catherine elizabeth#princess catherine#princess of wales#princess catherine of wales#catherine the princess of wales#william arthur philip louis#prince william#prince of wales#prince william of wales#william the prince of wales#prince and princess of wales#william and catherine#kensington palace

113 notes

·

View notes

Photo

AGUST D : DAECHWITA (大吹打) & HAEGEUM (解禁) ⤷ movie posters | ig ; twt (click for hi-res)

#i'm back and ready to create again :'))#bts#bangtan#yoongi#agust d#suga#userbangtan#usersky#bangtanarmynet#hyunglinenetwork#dailybts#*latest#*posters#*gfx#btsgfx#idk if i wanna do an amygdala one#that one seems too personal to edit for me#so these will do for now

704 notes

·

View notes