#1973-74 oil embargo

Explore tagged Tumblr posts

Text

I agree that he was a better president that people give him credit for, and I also remember the late 1970s.

However, it doesn't appear that there was "just bad luck" for Carter when it came to the Iranian hostage crisis. According to The New York Times, there is now some strong evidence from a reliable witness that the Reagan campaign worked hard to convince Iran to keep the hostages until after the 1980 election. In exchange for doing so, Reagan would offer Iran "a better deal," after he won. That dirty dealing by the GOP might have cost Carter a second term.

One problem you didn't mention above was inflation, which Carter inherited from Nixon and Ford, and which appears to have been set off in part by the 1973-74 oil embargo, imposed by OPEC against the U.S. for their support of Israel during the 1973 Arab-Israeli War. Although the embargo happened before Carter's presidency, its impact on inflation was most strongly felt during the Carter administration.

In addition, Carter had to deal with another oil crisis in 1979 as a result of cutbacks on oil production in the aftermath of the Iranian Revolution. This was followed by more cutbacks in 1980 because of the Iran-Iraq War. I remember the long lines waiting to get gas during that time. (But I still voted for Carter again in 1980, because I knew that Reagan would start to turn the clock back on the progress made in the 1960s and early 70s--and I was right.)

803 notes

·

View notes

Text

Pres Carter & the Road Not Taken

On June 20, 1979, the Carter administration installed 32 panels designed to harvest the sun's rays and use them to heat water.

Here is what Carter predicted at the dedication ceremony:

"In the year 2000 this solar water heater behind me, which is being dedicated today, will still be here supplying cheap, efficient energy…. A generation from now, this solar heater can either be a curiosity, a museum piece, an example of a road not taken or it can be just a small part of one of the greatest and most exciting adventures ever undertaken by the American people."

For some of the solar panels it is the former that has come to pass: one resides at the Smithsonian's National Museum of American History, one at the Carter Library and, as of this week, one will join the collection of the Solar Science and Technology Museum in Dezhou, China. Huang Ming, chairman of Himin Solar Energy Group Co., the largest manufacturer of such solar hot water heaters in the world, accepted the donation for permanent display there on August 5. After all, companies like his in China now produce some 80 percent of the solar water heaters used in the world today.

But they are based on the same technology developed here in the U.S. and once manufactured in Warrentown, Va., by InterTechnology/Solar Corp., the company behind the Carter panels. Roughly three meters long, one meter wide and just 10 centimeters deep, the blue-black panels absorb sunlight to heat water piped through their innards. The Carter administration set a goal of deriving 20 percent of U.S. energy needs from such renewable sources by the turn of the century. Today, the U.S. gets a mere 7 percent of its energy from renewables, the bulk of that from the massive hydroelectric dams constructed in the middle of the 20th century. Solar thermal and photovoltaic technology combined provide less than 0.1 percent.

[Note: this article was written in 2010; by the end of 2023 the figures were a respectable 21% renewables, 3.9% from solar and 10.1% from wind. ]

By 1986, the Reagan administration had gutted the research and development budgets for renewable energy at the then-fledgling U.S. Department of Energy (DoE) and eliminated tax breaks for the deployment of wind turbines and solar technologies—recommitting the nation to reliance on cheap but polluting fossil fuels, often from foreign suppliers. "The Department of Energy has a multibillion-dollar budget, in excess of $10 billion," Reagan said during an election debate with Carter, justifying his opposition to the latter's energy policies. "It hasn't produced a quart of oil or a lump of coal or anything else in the line of energy."

And in 1986 the Reagan administration quietly dismantled the White House solar panel installation while resurfacing the roof. "Hey! That system is working. Why don't you keep it?" recalls mechanical engineer Fred Morse, now of Abengoa Solar, who helped install the original solar panels as director of the solar energy program during the Carter years and then watched as they were dismantled during his tenure in the same job under Reagan. "Hey! This whole [renewable] R&D program is working, why don't you keep it?"

[...]

It was the oil shock that pretty much caused the government to take a very serious look at its domestic solar resource," recalls Abengoa's Morse, who has spent decades aiding and abetting the still fledgling solar thermal industry both in government and out. "The motivation was energy independence," a motive that remains recognizable in political rhetoric today because, as Carter himself put it, the sun cannot be embargoed, referring to the 1973–74 Arab oil embargo. "We have this big solar resource, we should use it," Morse explains.

Carter was the first president to take that idea seriously, warming the reviewing stand for his inauguration on January 20, 1977 with the sun's heat harvested by roughly 1,000 square meters of solar thermal panels, according to Morse. "President Carter saw [solar] as a really valid energy resource, and he understood it. I mean, it is a domestic resource and it is huge," Morse recalls, although he admits the inaugural solar system left some chilly. "It was the symbolism of the president wanting to bring solar energy immediately into his administration."

That symbolism became more concrete in the form of a vastly increased budget for energy technology research and development (pdf)—levels still unmatched by succeeding administrations—and tax credits for installing wind turbines or solar power that caused a first boom in renewable energy installation. In a sense alternative energy was finally getting the same government support used to develop and maintain other energy technologies, such as oil drilling or nuclear power. "It did not take long for the U.S. government to realize that energy was a great national interest and subsidize it," Morse notes.

But the real symbolism was the Carter family using hot water heated by the sun for some of their daily activities. "It was used for the cafeteria, in the laundry and other parts of the White House," Morse says.

That was symbolism that Morse suggests the Reagan administration did not support as wholeheartedly. "We had a new administration that really did not like renewables very much. I don't know if you remember those days when it was called alternative energy and there was something about 'alternative' that did not sit very well." So when the time came to resurface the roof, the panels were taken down. "It was working fine, but the decision was it was not cost-effective."

[...]

And those solar-thermal collectors also symbolize an alternative history. "We certainly didn't address the oil and energy issues going back to when Carter tried," Tardif says. "Maybe it would be different if Americans understood what actually happened. We were poised to achieve 20 percent renewables by 2000. What happened?"

What happened?

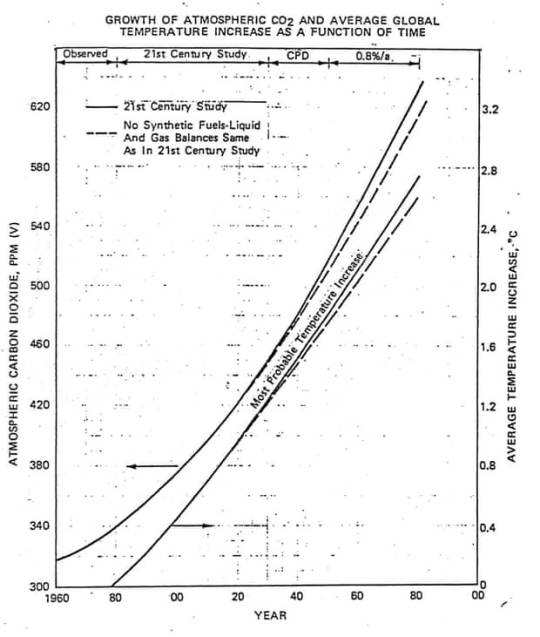

Big Oil's internal scientists concurred with public scientists, predicting global warming creates by fossil fuels, like this 1982 internal document at Exxon corp:

Source:

These projections turned out to be surprisingly accurate, 40 years later.

But Exxon and other fossil fuel companies used hundreds of billions of dollars in taxpayer subsidies to fund a multi-pronged, decades-long disinformation campaign, ranging from funding pro-fossil-fuels politicians to creating fake thinktanks of energy experts to advise news media to subsidizing university programs and professors in exchange for favorable research, as extensively documented by this spring 2024 US Congressional investigation which the press ignored:

This is not simply a history lesson. Trump put sone of his most diligent efforts in his first term into dismantling as much of his predecessor's' signature accomplishments as possible.

Biden's biggest accomplishment is the Infrastructure Act which included aggressive tax breaks, incentives and subsidies for renewables, jobs in the renewables industry, and R&D. Biden got us over the 20% renewables goal Jimmy Carter set.

We cannot afford to let Donald Trump imitate Reagan and put the renewables industry back another 40 years, no matter how many billions of dollars Big Oil gave his campaign.

2 notes

·

View notes

Text

Week 4: Blazing Saddles- Yanissa Agbigay

The movie I chose for this week is called Blazing Saddles. This 1974 film is a western comedy directed by Mel Brooks. This movie captures Bart (played by Cleavon Little) a railroad worker who becomes the first black sheriff of Rock Ridge. Though most people of Rock Ridge is racially biased, they are much more open and warm to Bart, with the hope that he and his friend will be the defenders against thugs. The purpose for sending the thugs is with the purpose of lowering the towns population. Not to mention, Blazing Saddles got nominated for Academy award best actress in supporting role, along with four other nominations with different titles.

youtube

Within the year 1974, Blazing Saddles was released and had two releases that were done domestically and worldwide. The domestic release made around $119,616,663 while the worldwide release was roughly the same. The movie had a budget of $2.6 million and earned $26.7 million in its initial release in the United States and Canada.Also within the same year, Inflation reached high levels in the mid to late 1970s. Though milk prices went up, they did not keep up with the rate of inflation (that would’ve meant that milk cost a whopping $1.85 per gallon in 1975).The federal government began requiring nutrition labels on all foods, including milk.

In 1974, unemployment peaked at 7.2% in December, and inflation remained steady at 11.04%. Median household income was $11,100, and Americans paid an average of $4,441 for a new car.The 1973-75 recession in the United States resulted from rocketing gas prices, OPEC’s oil embargo against the U.S., heavy government spending on the Vietnam War, and a Wall Street stock crash in 1973-74. The recession also came about from efforts by the Federal Reserve to tame inflation through restrictive monetary policy, which had the expected effect of dampening economic growth.

From my perspective, I think that this movie is a success and have many viewers that keep coming back to watch. Whether if it’ll be viewers from the time it was released or from today, it will still be one of Mel Brooks’ best comedy films. From what I have read, all the reviews on Blazing Saddles are mostly positive and include the words “funniest, top-tier, and incredibly good.” The ones that are negative reviews are because others found the movie to be unhumorous and a big waste of time.

youtube

This was my first time watching Blazing Saddles and I would have to agree with the reviews that said it had to be one of the funniest films to have been released. I also enjoyed the context of the movie and all the characters’ individual identities.

Overall, Blazing Saddles is a film that I will keep coming back to watch.

1 note

·

View note

Text

1973 Oil Crisis

10/17/23: It was 50 years ago today, October 17th, 1973, OAPEC (not OPEC, I learned) or the Organization of Arab Petroleum Exporting Countries placed an embargo on oil to certain countries who supported Israel in the ongoing Yom Kippur war, including the United States. This 'oil shock' event added more fuel to the fire (or... less) of the 1973-74 economic recession. Yep, when American-made retrospectives say the seventies sucked they focus on events like this.

0 notes

Text

LIKE. OKAY. SO:

>politics were absolutely incoherent inconsistent and corrupt as hell. during the 1970s there were four general elections, four prime ministers, and five state emergencies. internationally you had a background of multiple wars: the vietnam war didn't end until april 1975, and a few years earlier british soldiers had been involved in the nigerian cvil war in 1967-1970. tensions in ireland and northern ireland were off the charts. in 1972, british soldiers shot into a group of Irish civilian in derry, murdering 13 protesters (and fun fact, to this day, if you post the names of these soldiers publicly online the british government WILL block you from british servers, because ~anonymity~ i guess. fucking assholes.) this was bloody sunday. the troubles continued all through the decade and into the next, only "ending" in 1998. throughout the decade, people would have been reading newspapers and listening to radio reports on violent skirmishes between the british army and the ira, as well as bombings (including the birmingham pub bombings in 1974), assassinations, kidnappings, and riots, in ireland, northern ireland, and england.

>economic stability was out the window (as is typical with capitalism). there were two different oil crises. arabian oil producers imposed an embargo after the us supported israel in the yom kippur war and that resulted in the price of oil skyrocketing. heath's conservative government was already struggling with food prices that were massively high due to global shortages; the inflation rate hit more than 24% that year. massive manufacturing hubs in yorkshire and other northern counties were collapsing completely. In certain parts of the country (leeds, for example) unemployment rates were up to 21% because of industry collapses. Strikes were omnipresent, starting with dockworkers in 1970 and spreading across almost every industry in the uk. at one point strikes were so intense that the government had to restrict the average work week to only three days in 1973-74 because so many coal miners and railway workers were striking for better pay and a cost of living increase that you literally could not have the lights on. garbage piles got so high in london during a sanitation strike in 1970 that they were two storeys tall. there are photos of this if you just google it. firemen went on strike in 1977. in 1978-79, bus drivers, authority workers, health care workers, and other industries also went on strike because of the horrific levels of inflation. everyone was on strike, and everyone was at risk of losing their jobs, all the time, for a decade. houses literally fell down around people's ears.

>women were becoming more and more present in the workplace, but there was a massive societal backlash with the conservative majority that resulted in shocking levels of misogyny and misogynistic violence. three different serial killers that I know of were operating during this time (the yorkshire ripper as well as fred and rose West) and memories of myra hindley and ian brady (the moors murderers) were fresh in the minds of many people. jimmy savile was the most popular man in the country and behind closed doors he was sexually abusing children and vulnerable adults for DECADES (this was pointed out by former sex pistols member john lydon, during an interview; the BBC edited it out and only published the complete interview in 2013).

>the levels of racism were appalling. afrocaribbean and asian folks were often being encouraged by the uk govt to move there but they faced shocking amounts of racism and discrimination in housing, society, and other social fields. police brutality against community of colors was rampant. the grumwick strike was in 1976. the black people's alliance was also founded in the 1970s. antifascists movements were off the charts in response to the british national front being formed in 1967 (careful when you google this one).

>wales won recognition of the welsh language in 1973 with the construction of the council for the welsh language (previously the british govt had tried to destroy the welsh language in its entirety, because wales and cornwall and scotland were some of england's first colonial entities). The gay liberation front was founded in 1970 and published its first manifesto for LGBTQ+ rights, and in 1972 the first ever british gay pride rally was held. punk rock got its start in camden, london, in 1974, and you can clearly see why when you realize that its messages of community solidarity, fuck the man, and acab were strongly inherent right from the start.

there is SO much to dig into with this decade and everything new thing i uncover is like OH!!! ANOTHER HORRIBLE LITTLE THING UNDER A ROCK THAT HAS A HORRIBLE PARALLEL TO TODAY!!! WHAT FUN FOR ME

hands down my weirdest special interest to date is "cultural and political upheavals of the uk in the 1970s" and tbh i'm not mad about it

46 notes

·

View notes

Link

"This is the new American energy era," U.S. Energy Secretary Rick Perry told an industry conference in Houston earlier this month.

Oil traders and shale executives believe U.S. crude exports are set reach 5 million barrels a day by late 2020, up another 70 percent from current levels. If the U.S. hits that target, America will be exporting, on a gross basis, more crude than every country in OPEC except Saudi Arabia. (On a net basis, the U.S. remains, just, a net importer, but that’s likely to change in the next few months.)

“The second wave of the U.S. shale revolution is coming,” said Fatih Birol, the head of the International Energy Agency. “This will shake up international oil and gas trade flows, with profound implications for geopolitics.”

The political impact is already being felt. The Trump administration has been able to impose aggressive sanctions on oil exports from Iran and Venezuela knowing the flow of crude from Texas will keep on rising. The economic impact on the U.S. is also evident: in dollar terms, the country’s petroleum trade deficit fell to its lowest in 20 years in 2018.

The U.S. is already a big exporter of refined products such as gasoline and diesel. When combined with rising crude exports, the IEA forecasts American petroleum exports will reach roughly 9 million barrels a day within five years, up from just 1 million in 2012. In the process, the U.S. will become the world’s second-largest exporter of crude and refined products by 2024, overtaking Russia and nearly topping Saudi Arabia.

Until now, the surge in U.S. oil production from the Permian and other shale basins like the Bakken in North Dakota was absorbed at home, feeding refineries in the U.S. Gulf of Mexico coast. Now, U.S. refiners are finding it increasingly hard to process more of the kind of light crude pumped in the Permian as their plants were built to process denser heavy crude -- the type pumped in Venezuela and the Middle East.

"The United States is probably darn close to being able to process as much light crude as it can," Thomas J. Nimbley, the head of U.S. oil refiner PBF Energy Inc., told investors.

As a result, shale executives are traveling the world to seek new customers. Gary Heminger, the head of Marathon Petroleum Corp., for example, was recently in Singapore and South Korea looking for buyers for shale crude.

"All the incremental Permian production needs to be exported," said Raoul LeBlanc at consultant IHS Markit Ltd. and a former head of strategy at Anadarko Petroleum Corp. "The Permian needs to find refineries willing to take U.S. light sweet crude as a base-load, most likely in Asia."

Despite a tight oil market due to American sanctions on Venezuela and Iran mixed with OPEC production cuts, finding new buyers isn’t as easy as it sounds. The crude from the Permian is light, yielding lots of naphtha -- used in the petrochemical industry -- and gasoline, but comparatively little diesel. And most refineries want to produce diesel.

Until now, U.S. shale producers and oil traders had been selling most of their crude on spot transactions -- one at a time. As a result, American oil exports saw wildly different destinations from month to month, from Spain to Thailand to Brazil.

A few stable markets are starting to emerge. Oil refineries in Canada, Italy, the U.K., and South Korea are becoming regular buyers. And little by little, oil traders are securing long-term deals with overseas refineries, known as term contracts.

Yet, the rapid rise in oil exports is challenging. Not even Saudi Arabia in the 1960s and 1970s saw exports grow so quickly.

"The U.S. export market needs to transition from infancy to adulthood far more rapidly than any major exporter ever has," said Roger Diwan, another oil analyst at IHS Markit.

Key for U.S. oil exports is China, mired in a trade war with Washington. Until this year, Chinese refiners were buying large chunks of American shale exports. But the flows all but dried up in August. If U.S. oil exports are going to increase at the pace that executives and traders anticipate, the shale industry needs the White House to strike a trade deal with the Chinese.

"If the China demand pull fails to materialize, for political reasons, quality mismatch or otherwise, U.S. exports will likely have to muscle their way into the global refining system, likely via price discounts," Diwan said. [my mf note: china is likely going to experience pricing issues due to a recession soon, so american predictions for shale oil will almost certainly collapse]

U.S. shale crude is already selling at a big discount to Brent, the international oil benchmark. West Texas Intermediate sells nearly $10 under Brent. And some of the lighter grades from the Permian, including a new stream called West Texas Light, are seeing even wider discounts.

Finding buyers for the light Permian crude isn’t the only obstacle. Pipelines and ports have become the biggest bottleneck in U.S. oil exports, with traders engineering logistically complex chains combining railways, trucks, pipelines, barges, and ship-to-ship transfers to get crude out of the country. Several ventures are aiming to build new facilities to allow exports via supertankers, which need deepwater ports.

The export surge started in late 2015 when Washington lifted a 40-year ban on most oil sales overseas, imposed in the aftermath the 1973-74 oil embargo by the Arab members of the Organization of Petroleum Exporting Countries.

Although the Permian isn’t growing as fast as last year, oil traders and executives still anticipate that America will add another million barrels a day this year to its production, with the bulk coming in the second half. The current slowdown, which some executives jokingly call a "fracking holiday," is the direct result of shareholder demands for higher returns and less growth, and lower oil prices in late 2018 and early 2019. But the Permian is likely to re-accelerate in the second half of this year when new pipelines open.

If the forecast proves correct, U.S. crude production will surpass 13 million barrels a day by December, up from 11.8 million barrels a day at the end of last year and well above the previous all-time high set in 1970.

"It’s going to be less than if people were able to spend unconstrained, but there’s going to be growth, lots of it," said Osmar Abib, chairman of global energy at Credit Suisse Group AG.

48 notes

·

View notes

Text

1973-74 ad for the Audi Fox. A foxy solution to the gas problem. The oil crisis began in October 1973 when the members of the organization of Arab petroleum exporting countries proclaimed an oil embargo.

4 notes

·

View notes

Text

Keeping the Oil in the Soil

Digital Elixir Keeping the Oil in the Soil

By James Boyce, Professor of Economics, University of Massachusetts Amherst. Originally published at the Institute for New Economic Thinking website

Efforts to reduce demand for fossil fuels by promoting energy efficiency and clean energy can do a lot. But to meet the Paris Agreement target of holding the rise in average surface temperatures to 1.5-2 °C, we need to curtail the supply of fossil fuels, too. This means capping the total quantity of fossil carbon that we allow into the economy each year, and tightening the cap over time on an emission-reduction trajectory anchored to the Paris target.

Curbing the supply of fossil fuels means raising their price – effectively putting a price on carbon emissions. This is a feature of the policy, not a bug: higher fossil fuel prices spur greater energy efficiency in the short run and more investment in clean energy in the longer run.

Yet some climate activists who embrace the slogan “keep the oil in the soil” have been deeply skeptical about carbon pricing.

One sensible basis for this skepticism is the reality that where carbon pricing has been implemented to date, the price typically has been too low to make much of a difference. But this points to the need for more robust prices, not a price of zero. It’s not a reason to oppose carbon pricing across the board, any more than having tasted weak coffee is a reason never to drink coffee again.

Sometimes the skepticism is also a result of muddled thinking. Rather than charging a price, the argument goes, wouldn’t it be fairer and more effective simply to keep the oil in the soil and the coal in the hole, to “just say no” to fossil fuels? Why should anyone be able to pay to pollute?

In thinking through this objection, it is useful to consider what would happen if one were to succeed in keeping fossil fuels in the ground in a place big enough to make a difference. Imagine, for example, that the people of Nigeria somehow manage to shut down that country’s oil production, compelling their government and its multinational partners to keep its oil in the soil. Imagine, for good measure, that the people of Angola do the same. These two nations are the top oil producers in sub-Saharan Africa, together accounting for about 4% of world supply. What would happen to oil prices if they stopped production? The answer, of course, is that they would go up.

We saw something like this happen in October 1973, when the newly formed Organization of Arab Petroleum Exporting Countries announced an embargo on oil exports to nations that supported Israel in the Arab-Israeli war. By January 1974, the world oil price quadrupled to almost $12/barrel, an episode remembered as the world’s first oil shock. Five years later a second shock was precipitated by the Iranian revolution and the Iran-Iraq war, and the world oil price rose to about $40/barrel.

On both occasions, the increase in prices far exceeded the decrease in oil supplies. World crude oil production was basically flat in 1973-74, and declined by only 4% in 1979-80. Yet prices soared. This was passed along to consumers in higher prices for transportation fuels and everything else that uses oil in its production and distribution.

The lesson was clear: when fossil fuel supplies are cut, their prices go up. A lot.

If some major producing countries managed to keep their oil in the soil, pushing up prices to consumers around the world, where would the extra money go?

The answer, of course, is that the money would flow to producers who do not keep their oil in the soil. The biggest beneficiaries would be oil companies in Saudi Arabia, Russia, and the United States, the world’s top three producer countries. As the price of oil goes up, their profit margins would rise accordingly.

The net result would be a transfer of money – lots of it – from consumers to some of the richest and most powerful corporations in the world, including some of the most stubborn opponents of effective climate policies. Oops.

The just-say-no strategy would reduce emissions, at least until other producers step up output in response to the higher prices. But in terms of who pockets the money, few would call this outcome fair.

The price effect occurs regardless of the cause for the reduction in supplies or its motivation. If oil producers cut supply to punish adversaries or fatten their profit margins, the end result is higher prices for consumers. If some oil-producers were to “just say no” to further extraction, the outcome would be the same. If carbon pricing is implemented by means of a cap or a tax, again we get the same result.

The crucial difference is where the money goes. In the case of the just-say-no strategy, as in the case of a producer cartel, the extra money paid by consumers goes to fossil fuel producers in proportion to the amount they continue to produce. In the case of carbon pricing, there are more attractive options. One policy, recently adopted in Canada and increasingly discussed in the United States, is to return the money directly to the public as carbon dividends: equal annual or quarterly payments to every person.

The case for carbon dividends rests on three pillars.

The first is political. Carbon dividends would protect the purchasing power of the majority of households in the face of rising fuel prices, bolstering public support for effective climate policy. The importance of this feature is underscored by the “yellow vest” movement that broke out in France in November when the government announced increased fuel taxes. The rationale for the tax hikes – about 12 US cents on a gallon of gasoline and 35 US cents on a gallon of diesel – was to combat climate change by promoting fuel efficiency. The government “talks about the end of the world,” the protesters declared, “while we are talking about the end of the month.”

The second pillar is economic. Dividends turn what would otherwise be a regressive tax, hitting the poor harder than the rich as a percentage of their incomes, into a progressive one. Everyone receives the same dividend regardless of their personal carbon footprint. But in absolute dollar terms (rather than as a percentage of income) the rich have outsized carbon footprints as a result of lifestyles that include bigger houses and more jet travel. With dividends most low-income households come out ahead, the middle class breaks even, and the rich pay more into the carbon revenue pot than they get back. The net result is a modest dent in income inequality, the other crisis of our time.

The final pillar of the case for carbon dividends is ethical. Dividends give concrete expression to the principle that the gifts of nature – in this case, the limited capacity of the biosphere to absorb carbon emissions safely – belong in equal and common measure to all.

All in all, not a bad way to keep the oil in the soil.

Keeping the Oil in the Soil

from WordPress https://ift.tt/2JNwc7X via IFTTT

2 notes

·

View notes

Link

0 notes

Text

Arab oil embargo | History, Cause, Impact, & Definition | Britannica

0 notes

Text

Time for a New Energy Policy

OWOE Staff: It’s a new year, we have a new president and administration, and we have new hope that the plan to vaccinate Americans is going to finally end the pandemic. What we don’t have is new thinking on what this country should be doing for a long term, rational and strategic energy policy. OWOE believes it is the right time to propose a comprehensive energy policy that balances America’s needs with the planet’s needs and is based on sound economics, realistic technology and good common sense. The OWOE energy policy combines several key elements, including: firm commitment to dramatically reduce dependence on fossil fuels in a planned and rational manner, sustainable investment in renewable technologies, and establishment of a North American Energy Alliance (NAEA) between the US and Canada to aggressively develop and globally sell our existing energy resources.

This country desperately needs a cohesive and strategic energy policy that is more than a reaction to current events or political lobbyists. The country has been talking about one since the first Arab oil embargo of 1973-74, but never had the political will to create one. Recent history shows how poorly we have addressed this issue.

The Trump administration tried to push through new pipeline approvals, open up the Arctic National Wildlife Reserve (ANWR) and offshore drilling, exit the Paris climate accord and gut clean air rules. All very fossil fuel supportive. But what happened? The environmentalists began screaming, states put up roadblocks to the federal plans, covid caused demand to plummet, and economics got in the way. The results? No new drilling, no bids on ANWR leases, oil production falling (Fig. 1), oil and gas companies slashing budgets and personnel.

Fig. 1 – US Oil Production Drop (EIA)

The new Biden administration has already started to follow in the footsteps of the Obama administration, so we’re back in the Paris accord, the Keystone XL pipeline permit has been revoked, the federal auto fleet will be replaced by EVs, and money will be thrown at renewable energy technology. All very climate friendly and renewables focused. But how soon before conservatives and oil lobbyists start to scream or the States of Alaska or Texas sue the federal government? And what about the fundamental fact that oil and gas is still necessary for America’s economy and will remain so for quite a while.

With respect to new, green energy, there has been noticeable progress in many states with large commercial onshore solar and wind farms being installed. Texas, known for its oil industry, is the largest producer and consumer of renewable energy in the union. Wyoming, the leading coal producing state in the union, has the potential to become a leading wind energy producing state. Unfortunately, in many areas of the country new renewable energy projects face opposition from utilities and local concerns, lack of infrastructure, inconsistent regulations, and both cost and technology challenges. More needs to be done with a strategic vision. OWOE proposes a comprehensive energy policy that derives from a fundamental premise that safe, secure energy resources are vital for a modern society. Ancillary to this is that for the long term benefit to America and the planet the future of energy is renewable. We must remove our dependence on fossil fuels, reduce carbon emissions and bring global warming under control. The question is how we get from here to there, recognizing that this cannot happen overnight. OWOE has argued since inception that there must be a sustainable and planned transition to renewables.

In order to achieve the Paris Agreement goal of controlling global warming, experts believe the world must achieve carbon neutrality by 2050. While the populist rallying cry is to stop pumping oil immediately, the reality is that this is impossible unless you immediately shut down economies (food production, pharmaceuticals, smart phones, etc.). A more realistic view is a gradual decline that gives time for the fundamental changes required. Pre-pandemic worldwide oil consumption was about 100 million barrels per day. If we define carbon neutrality at 20 million barrels per day oil consumption (see Fig. 2), doing the math and assuming a straight-line decline, that implies a total consumption over the next 30 years of about 650 billion barrels of oil. Yes, billion.

Fig. 2 – Oil Demand Forecast (BP)

Where will that oil come from? Here are the 10 countries with the largest proven oil reserves:

Venezuela – 304 billion barrels

Saudi Arabia – 298 billion barrels

Canada – 170 billion barrels

Iran – 156 billion barrels

Iraq – 145 billion barrels

Russia – 107 billion barrels

Kuwait – 102 billion barrels

United Arab Emirates – 98 billion barrels

US – 69 billion barrels

Libya – 48 billion barrels

The total for these 10 countries is approximately 1500 billion barrels, or 1200 billion barrels excluding Venezuela, which is so messed up that they can’t be counted on to make a meaningful contribution, despite purportedly having the largest reserves in the world. This means that the world will need to produce about 50% of current reserves.

Of note is that the only Western democracies on this list are the US and Canada, which in total account for 240 billion barrels and could supply a significant fraction of the world’s needs, if we have the will to do it. Alternatively, we could supply zero and leave it up to countries such as Saudi Arabia, Iran and Russia to fill the gap, making billions and billions of dollars for their corporations and rulers. That’s what many of the most ardent environmentalists in Canada and the US seem to be advocating: Make the US and Canada stop oil production because it generates greenhouse gasses. But wait a minute…those other countries are already investing in additional oil production and would dearly love for the US and Canada to quit producing oil altogether. Those other countries aren’t democracies, don’t care about the wellbeing of their people and don’t have any qualms about spewing carbon dioxide or methane into the air or polluting everything in their way. Why would we ever think it is worse for the US or Canada with our strong environmental laws to produce the oil that the world needs instead of Russia or Saudi Arabia or Iran? Why would we ever think it is better for consumers to buy oil and send money to countries that murder journalists, ignore human rights, subjugate women, pollute their land and water, or openly supports terrorism against us?

So here’s OWOE’s proposal for a real energy policy:

1) Create the NAEA with the goal to produce as much energy as possible in the US and Canada, as quickly and with as low an environmental impact as possible, to ensure all domestic needs are met and to sell the remainder to the world markets by: a) removing all barriers both within and between both countries to transporting crude, natural gas, and high-voltage power, i.e., restart the XL Pipeline, build LNG facilities, build transmission lines, and repeal the Jones act that puts the US at a shipping disadvantage; b) re-invigorating domestic energy production by removing obstacles that are based on political activism rather than science and economics, i.e., fracking bans, offshore drilling bans; c) developing consistent and streamlined environmental regulations; and d) competing on the world market as a unified entity.

It should be noted that the US and Canada are already very mature, highly integrated energy partners with annual bilateral energy trade of $119 billion in 2019 (See Fig. 3 for details of existing energy trade, including infrastructure that is already in place), and extending to a more formal NAEA would not be difficult. There are already proponents for an NAEA on both sides of the border. In 2017 the Canadian Electricity Association published a research report advocating more interconnection between the two nations. The report concluded that much integration would achieve a higher level of reliable service, enhanced system stability and greater overall operating efficiencies. Such benefits could be achieved across all NAEA energy systems and would benefit both nations collectively more than each working independently.

Fig. 3 – US-Canada bilateral energy trade (CSIS)

2) Invest in renewable energy technology development and implementation. This should include research and development, support for prototypes, investment tax credits, production tax credits, and rebates to consumers who drive the move to renewables by purchasing electrical vehicles, solar panels, energy efficient homes, etc.

3) Streamline and make consistent all regulations across the states and provinces to encourage investments in commercial and private energy facilities, including wind and solar, oil drilling and production, LNG export, pipelines, high voltage transmission lines, etc.

4) Develop mechanisms to put the economic impact from the use of fossil fuels on climate change, public health issues, and world security onto the end users of such fuels. This cost impact should be on the consumer rather than the producer and very visible for the simple reason that consumers react much more quickly to a cost that hits them directly in the wallet vs one that is combined in, and obscured by, all the other product cost elements. Plus, it makes no logical sense to burden a company and its shareholders for supplying a product that the consumer wants.

The world is moving toward a renewable energy future, and OWOE believes that with a coordinated and concerted effort, the two largest democratic oil-rich countries on earth can both accelerate that move and profit greatly from it. It’s us or them. Onward NAEA!

(Note: this blog was originally published on 2/1/2021. It was updated on 2/2/2021 to add Figure 2.)

Time for a New Energy Policy was originally published on OurWorldofEnergy

0 notes

Photo

Trump Orders Department of Energy to Replenish U.S. Strategic Petroleum Reserve in Coronavirus Era

President Donald Trump announced during his press conference on Friday on the coronavirus outbreak that the United States will be replenishing its Strategic Petroleum Reserve (SPR) to ensure the nation’s energy security.

“Based on the price of oil, I’ve also instructed the Secretary of Energy to purchase at a very good price large quantities of crude oil for storage in the U.S. strategic reserve,” Trump said at the press conference in the White House Rose Garden.

“We’re going to fill it right up to the top, saving the American taxpayer billions and billions of dollars, helping our oil industry [and furthering] that wonderful goal — which we’ve achieved, which nobody thought was possible — of energy independence,” Trump said.

Trump’s announcement follows market turmoil in the international market when Russia and Saudi Arabia’s negotiations recently broke down and the Saudis announced they were increasing production.

The industry reacted positively to the president’s announcement, CNBC reported.

“It is a fantastic idea,” John Kilduff, founding partner of Again Capital said in the CNBC report. “The SPR is one of the few levers that the U.S. can pull in times of oil market tumult.”

“It has served the country well when supplies get tight or otherwise become unavailable during times of natural disasters or geopolitical turmoil,” Kilduff said. “Releases of supplies have served to short-circuit price rallies in the past, and this filling may well serve to ebb the current sell-off.”

“Russia, the world’s second-largest producer, does not appear willing to return to its agreement with the Organization of the Petroleum Exporting Countries (OPEC), which has kept oil in a range around $30 a barrel for much of the last week,” CNBC reported.

Saudia Arabia is the de facto leader of OPEC.

CNBC reported on Trump’s decision as it relates to the coronavirus:

The move to purchase more oil for the U.S. reserve also came as part of the administration’s response of supporting the American economy that’s trying to determine to what extend the novel coronavirus will impact growth. Trump declared a national state of emergency in his Friday speech from the Rose Garden.

The Department of Energy describes the importance of the SPR:

Established in the aftermath of the 1973-74 oil embargo, the SPR was established to counter a disruption in commercial oil supplies which could threaten the U.S. economy. It is also the critical component for the United States to meet its International Energy Agency obligation to maintain emergency oil stocks.

At the press conference, Trump declared a national state of emergency to free up money to help states deal with the fallout from the coronavirus outbreak.

Follow Penny Starr on Twitter.

2020 ElectionHealthPoliticscoronavirusDepartment of EnergyDonald TrumpNational State of EmergencyOilOPECRussiaSaudia ArabiaStrategic Petroleum Reserve

0 notes

Photo

Straight out of the old school of "bigger is better," this 1974 Mercury Marquis #Brougham is from the very apogee of the land yacht era, although it wasn’t a happy year for big cars. In an effort to further differentiate them from Fords, the big Mercs of 1969 were redesigned into a cleaner, more Lincoln-like machine which was enlarged and given more elaborate trim for 1971 and again for 1973 when the big cars sprouted gigantic 5-mph impact bumpers. - They looked gigantic. The low, tight greenhouse made the hood and deck look like aircraft carrier landing sstrips and the fender skirts produced a long uninterrupted bodyside - 226.7 inches (5.76M) of steel slab. A true #LandYacht, powered by the 460 V8. It was no surprise then, that events in the fall of 1973, era defining, took a huge bite out of sales. The ’74s were little changed from 1973 in that they’d just been updated, but sales were down by more than 50% for the year. - The OPEC embargo had multiple origins - the Nixon economic shock; the decline of domestic oil production as demand increased (Eisenhower-imposed quotas kept prices low but led to production declines, Nixon ended them); the strengthening of OPEC in the the late 1960s; and the immediate cause - the political fallout of the Yom Kippur War which led to the embargo. The Nixon shock and limited supply were a one-two punch, with gas prices rising 20% year over year. - We’ve had two serious fuel shocks since 2007, but in 1973/74 this was unprecedented, and it coincided with serious economic turmoil (wage and price controls, stagflation, global recession). Supply was restored, but prices only softened a little. All of the Big 3 were caught out with huge cars that were now scarily thirsty. But there was still a market for such cars - the #Brougham was the best seller of the big Mercs in ’74 and in 1975 the low-level Monterey was dropped in favor of a top-line #GrandMarquis. - By 1977, big Mercury sales recovered almost entirely, but the days were numbered for the very largest cars. The replacements for these big cars, the Panthers, bowed in late 1978. The Grand Marquis survived three more fuel spikes, and was the last Mercury built in 2011. https://www.instagram.com/p/Bsqevqbl3h4/?utm_source=ig_tumblr_share&igshid=ndckishc8nu0

0 notes

Link

“Nothing is so permanent,” said Milton Friedman, “as a temporary government program.”

In 1975, shortly after the Arab oil embargo (1973–74), Congress passed and President Gerald Ford signed legislation creating the Corporate Average Fuel Economy program. CAFE mandated an average minimum miles-per-gallon standard for fleets of cars and light trucks produced for sale in the United States. The initial rationale was to force Americans to economize on gasoline. One would expect rising prices in the face of the smaller supply to induce drivers to economize, but Americans were paying artificially low prices thanks to former President Richard Nixon’s price controls. Instead of scrapping price controls and having drivers pay the actual market price for gasoline, the politicians piled on a new regulation. Later, when price controls ended, oil became more plentiful, and prices fell, the rationale switched to climate change. It’s called mission creep.

The first average level for passenger-car fleets, 18 mpg, took effect in 1978. A year later, light trucks had to average 15.8 mpg for four-wheel-drive and 17.2 for two-wheel-drive vehicles. The standards have risen since, reaching, under President Barack Obama, 30.7 for cars and 25.5 for trucks. Just before leaving office, the Obama administration set the combined standard for 2025 models at 54.5 mpg. Automakers had earlier signed on to the administration’s plans but have since expressed opposition.

President Trump has criticized CAFE, and in March the new head of the Environmental Protection Agency, Scott Pruitt, announced a review, with a decision anticipated a year from now.

For the sake of individual liberty and sound economic policy, let’s hope CAFE is toast.

What could be wrong with fuel-economy standards? As already noted, if drivers have to pay the true market price of gasoline, they will tend to use less when the price rises (other things being equal) and carmakers will cater to the demand for fuel efficiency. That’s the law of supply and demand, which needs no help from government. CAFE is the politicians’ way to make you use less even when you find the price attractive.

But it doesn’t work. Observe: if your new car uses less gas to travel one mile, you can now drive more miles for the same price — which is what people have done. It’s called the “rebound effect.” As a result, gasoline consumption did not decline. The Wall Street Journal observed in 2007, “Since the 1990s, oil imports have increased; Americans use more gasoline than ever.” (The subsequent decline in imports was not brought on by CAFE standards.) In 2013 Valerie J. Karplus, a research scientist in MIT’s Joint Program on the Science and Policy of Global Change, found that “the new standards also encourage more driving, not less.”

So it doesn’t save gasoline, and it doesn’t reduce CO2 emissions.

Another problem is that more fuel-efficient vehicles tend to be smaller and lighter, and by the laws of physics smaller, lighter vehicles are more dangerous to drivers and passengers than less-fuel-efficient larger, heavier cars. The Journal noted, “There is a tradeoff between safety and efficiency. The National Academy of Sciences concluded that CAFE standards contributed to as many as 3,200 additional fatalities each year, because downsized cars are less safe in accidents.” Other studies drew similar conclusions. (Later, fuel efficiency was achieved through technological improvements as well as downsizing.)

There’s an additional lesson here. The term efficiency has meaning only in relation to a person’s objectives. CAFE advocates want us to be single-mindedly focused on using the least amount of fuel, as if we were running out. (If the price system is allowed to work for oil and everything else, this need not be a concern.) But regular people have objectives other than fuel economy, such as safety and comfort, which larger cars afford. If we can buy an increment of those things at a reasonable cost in additional fuel, many of us will happily make that exchange. We always face trade-offs. Why should politicians have the power to decide for us?

Finally, note that CAFE imposes a greater burden on lower-income people than it does on higher-income people. Indeed, the mandate is equivalent to a hidden regressive tax, enabling the politicians to escape the wrath of the taxpayers. Salim Furth and David Kruetzer of the Heritage Foundation estimate that CAFE has added at least $3,800 to the price of cars, and maybe much more. That obviously harms the poor (not to mention those of moderate income) more than the rich. Because of the higher price, people have to borrow more to buy a new car, increasing their interest payments, and those priced out of the market must stick with their older cars and face increasing maintenance expenses.

On all counts the CAFE program is a bad deal for Americans.

10 notes

·

View notes

Text

Favorable Outlook For US Equities

All of the US equity indices made new all-time highs again last week. Treasuries were the biggest winner. A drawdown of at least 5-8% in SPX is odds-on before year year end, but there are a number of compelling studies suggesting that 2017 will probably continue to be a good year for US equities.

On Friday, SPX and DJIA made new all-time highs (ATH). During the week, COMPQ, NDX, RUT and NYSE also made new ATHs. All the indices moving to new highs together suggests that this is a broadly based rally. The trend remains up.

For the week, SPX and DJIA gained 1%. NDX notched a 0.4% gain and RUT closed lower. The biggest gain came from treasuries, with TLT gaining 1.4%. We continue to like the set up in treasuries, as explained in detail last week (here).

Little has changed from last week's summary. Instead of repeating those the same messages, we'll highlight four new studies that show a favorable longer term outlook for US equities.

First, SPX has now gone 76 days since the last 3% drawdown ended on November 4, right before the US election. That is the longest streak since July 2006 to February 2007, when the SPX went 150 days without a 3% drawdown. The chart below shows the duration and magnitude of the current rally relative to other long streaks in the past 14 years (yellow highlighting equals the current rally). Enlarge any chart by clicking on it.

The message from this chart is twofold.

First, the current uninterrupted rally is rare and extended from a historical perspective, but these periods can last much longer.

Second, when the current uptrend ends, it is not likely to lead directly into a more significant downturn. Momentum like this weakens before it reverses. In each of the cases highlighted above, after a 3-5% drawdown, SPX either continued higher or retested the prior high before falling lower. Mid-2011, 2012 and 2014 are recent examples of the latter case (shown below). That would be our expectation now as well.

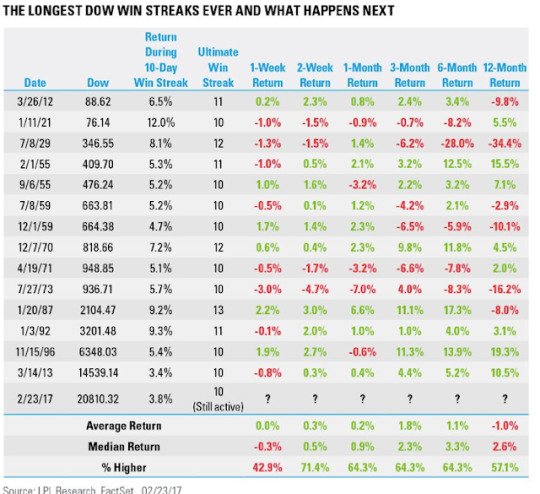

Second, the current rally is perhaps most pronounced in the Dow Industrials. DJIA has closed at new ATH the past 11 days in a row. The streak has only extended to 12-13 days twice since 1900. Of the 14 similar streaks, the DJIA closed higher after 1 or 3 months 11 times (79%). It also closed higher after 6 or 12 months 11 times. In other words, the upward momentum most often continued in the months following the end of the streak (from Ryan Detrick).

In the chart above, note that the only outright failure was 44 years ago, in 1973. This period coincides with the 1973-74 oil embargo. Within 4 months, the price of crude oil quadrupled, causing the US economy to plummet into the 1973-75 recession. A repeat of that scenario now is not likely.

One of the other long streaks ended in January 1987. In October of that year, the SPX crashed 30%. It was devastating, but note that between the end of the streak in January and the start of the crash in October, SPX rose a further 30%. In other words, the upward momentum lasted another 9 months.

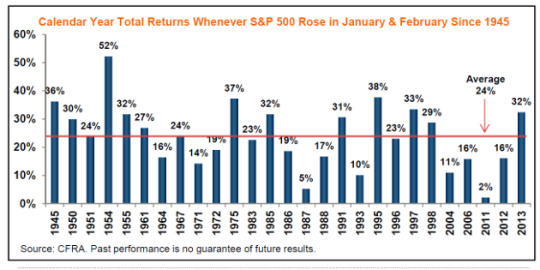

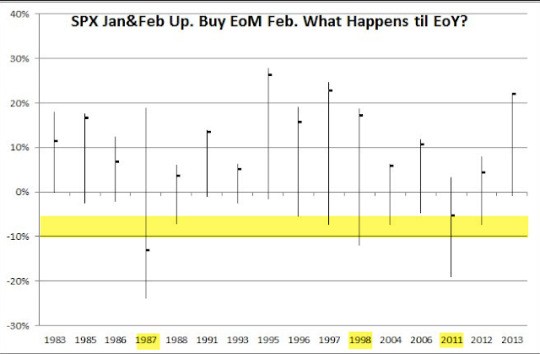

The third long term study relates to seasonality. Specifically, with two days left in February, the SPX has risen almost 6% YTD. In the 27 prior instances since 1945 that SPX has been up in both January and February, it has closed up for the full year all 27 times. The average full year gain was 24%; in only 2 cases was full year gain less 10% (from CFRA).

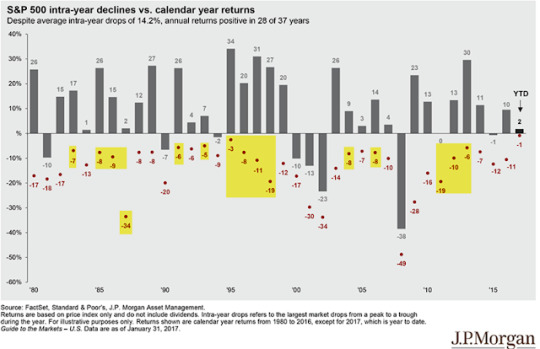

That doesn't mean that the index didn't experience turbulence in the next 10 months. In the 16 occurrences since 1980, SPX had a median intra-year drawdown of 8% (those 16 cases are highlighted in yellow). With the index up 6% YTD, a drawdown of median size could take the SPX into negative territory for the year (from JPM).

What happened if you bought the close on the last day of February and held until year-end? In most cases (14 of 16, or 88%), SPX closed higher, often by more than 10%. But in half the cases, there was an intra-year drawdown of at least 5% and more than 10% in three memorable years (1987, 1998 and 2011; from @Minion_of_Gozer).

Based on the strong start to the year, returns are likely to be positive through year end but a drawdown of at least 5-8% before then is also odds-on. Buy the dip.

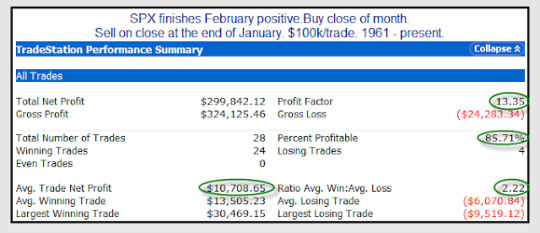

In a related study that examines positive closes in February, the next 11 months saw net gains 86% of the time (24 of 28 years since 1961). The profit factor (gains divided by losses) is 13, which is very attractive (from Rob Hanna).

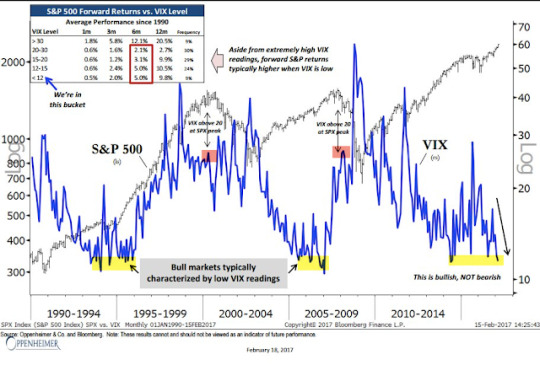

The fourth study with longer term implications relates to volatility. Much has been made of the persistently low level of the Vix. The three most recent bull markets have each been characterized by a persistently low Vix. Historical instances are severely limited, but a low Vix has been a positive sign for the SPX. The market did not peak in either 2000 or 2007 until Vix had climbed, over the course of years, to more than 25. Since 1990, when the Vix has been below 12, SPX has returned 5% and 10% over the next 6 and 12 months, respectively (from Ari Wald).

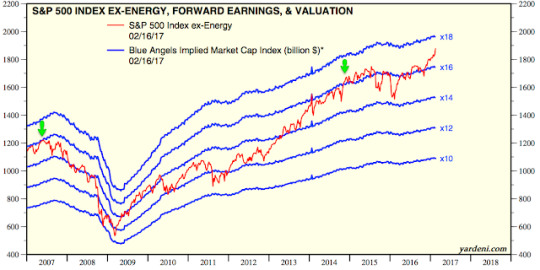

It's true that current market valuations are unattractive, a headwind we have raised when discussing earnings (read further here). But keep in mind that overvaluation has been a very bad mechanism for market timing. The correlation between valuations and forward one-year returns is nearly zero. Investors rightly indicated that the SPX was fully valued in late 2014; since then, it has gained another 25% (from Yardeni).

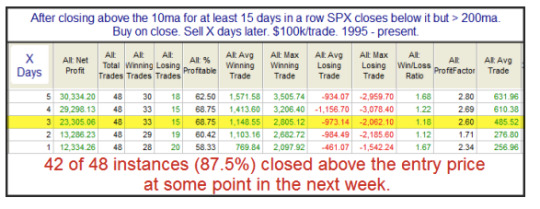

A final note on the current market: SPX has closed above its 5 and 10-dma for 15 days in a row. This is an exceptional period of strength. It can continue longer. Importantly, the first close below these averages is likely to be aggressively bought, something to watch for should the streak end this week (from Rob Hanna).

In summary, there are a number of compelling studies suggesting that 2017 will probably continue to be a good year for US equities. In addition to the four such studies reviewed in this post, add in rebounding equity fund flows and positively trending macro data. All of that said, a drawdown of at least 5-8% in SPX is odds-on before year year end. Our summary last week suggests that drawdown could happen sooner than many investors current believe is likely (read further here).

The calendar is heavy for the week ahead. Durable Goods on Monday; GDP on Tuesday; and Personal Consumption on Wednesday. NFP is the following Friday, March 10.

2 notes

·

View notes

Video

Do metaphorical perfect storms happen in politics and capital markets?

The answer is yes, provided the conditions of the perfect storm definition are satisfied. The multiple events that make up the true perfect storm must be independent and rare and come to converge in an almost impossible way.

Unfortunately, a political and market perfect storm is now on the way and may strike as early as Halloween 2019, marking a new “Halloween storm.” Get ready.

In my 40-plus years in banking and capital markets, I have lived through a number of financial fiascos that arguably qualify as perfect storms. Here’s a partial list:

1970: Penn Central bankruptcy, the largest in history at that time 1973–74: Arab oil embargo 1977–80: U.S. hyperinflation 1982–85: Latin American debt crisis 1987: One-day 22% stock market crash 1988–92: Savings and loan (S&L) crisis 1994: Mexican tequila crisis 1997: Asian financial crisis 1998: Russia/Long Term Capital Management (LTCM) crisis 2000:Dot-com crash 2007: Mortgage market collapse 2008: Lehman Bros./AIG financial panic.

I believe a perfect storm is coming. It’s hard to foresee the full magnitude of it, but it will likely be dramatic. It will have a major impact on markets. How it impacts you depends on how far in advance you see it coming.

What are the three specific elements of the new perfect storm I see coming for markets?

The first is an effort by the Democratic House of Representatives to impeach President Trump. The second is the socialist-progressive tilt in the 2020 presidential election field. The third is the fallout from the Mueller report and the Russia collusion hoax — what I and others called “Spygate.” ...

Any one of these storms would create enough uncertainty for investors to sell stocks, raise cash and move to the sidelines. The combination of all three will make them run for the hills. That’s my warning to investors.

The next six months will present unprecedented challenges for investors ...

***** Hopefully, by now you realize the importance of being prepared for financial disaster. Be sure to check out my videos on economic collapse preparation, and don’t forget to like and share this video.

PAUL CRAIG ROBERTS : US ECONOMY ABOUT THE COLLAPSE: https://youtu.be/8_DnCpOb9a8

13 Scary Things that Happen When an Economy Collapses: https://youtu.be/b84Mg16a7r0

10 Things You Must Do Before The Dollar Collapses : https://www.youtube.com/watch?v=mEWmQW4Sp8E

The Systemic Lehman Crisis Has Begun - Witness The Many Warning Signals Imminent Crisis by Jim Willie: https://youtu.be/M4NEM9RHqow

***** READ FULL ARTICLE:

https://dailyreckoning.com/rickards-perfect-storm-is-coming/

https://dailyreckoning.com/the-perfect-storm-2/

** (DISCLAIMER: The financial and political opinions expressed in this video are not necessarily of "Financial Argument" or its staff. Opinions expressed in this video do not constitute personalized investment advice and should not be relied on for making investment decisions.) **

Donate to Financial Argument: https://www.patreon.com/financialargument

* * * * *

Report Date: June 2019

* * * * *

Follow us on Twitter https://twitter.com/financialargmnt

Like us on Facebook: https://www.facebook.com/financialargument/

Financial Argument: https://financialargument.net

* * * * *

Are You Prepared For The Coming Economic Collapse And The Next Great Depression ?

It is to say that economic developments, financial crisis, stock market collapse speculations, changes in gold prices could lose all of your investments or it can make you money.

Financial Argument shares many experts ' assessments and predictions about financial developments with you every day with current videos.

All you have to do is follow the “Financial Argument” channel and subscribe it.

In order to support us, please do not forget to like our videos and comment it with on your own views.Finally, you can visit our website address;

https://financialargument.net

and social media accounts for more financial news.

Stock footage provided by Videvo, downloaded from https://www.videvo.net

#paulcraigroberts #economiccollapse #useconomy

0 notes