#11th ABN

Explore tagged Tumblr posts

Video

“I’ll take both, please.”

4 notes

·

View notes

Text

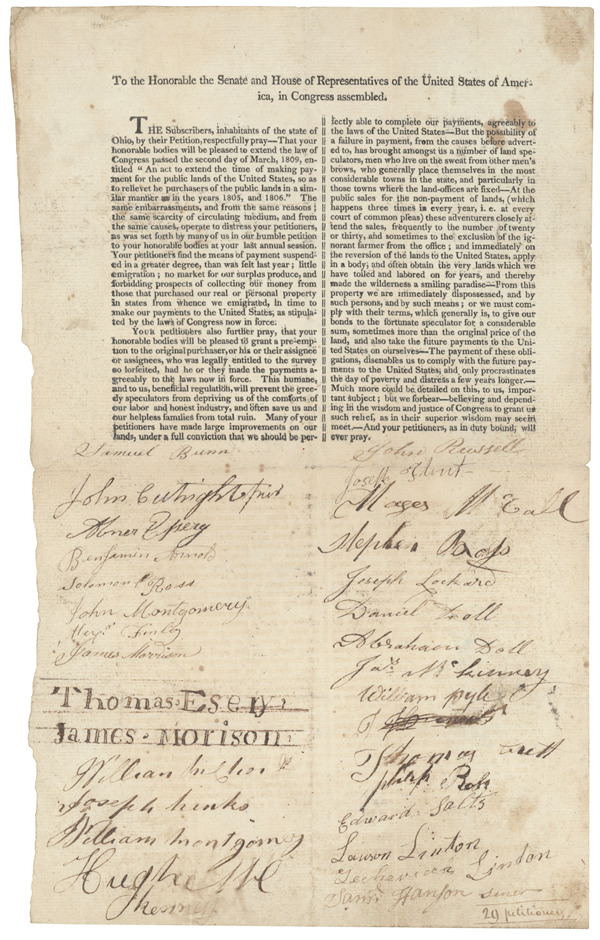

Petition of Ohioans to the Senate and House of Representatives Regarding Land Sale Policy

Record Group 233: Records of the U.S. House of RepresentativesSeries: Petitions and Memorials Referred to the Committee on Public LandsFile Unit: Petitions and Memorials, Resolutions of State Legislatures, and Related Documents Which Were Referred to the Committee on Public Lands during the 11th Congress

To the Honorable the Senate and House of Representatives of the United States of America, in Congress assembled.

[left column]

The Subscribers, inhabitants of the state of Ohio, by their Petition, respectfully pray-That your honorable bodies will be pleased to extend the law of Congress passed the second day of March, 1809, entitle "An act to extent the time of making payment for the public lands of the United States, as as to relievet he purchasers of the public lands in a similar manner as in the years 1805, and 1806." The same embarrassments, and from the same reasons ; the same scarcity of circulating medium, and from the same causes, operate to distress your petitioners, as was set forth by many of us in our humble petition to your honorable bodies at your last annual session. Your petitioners find the means of payment suspended in a greater degree, than was felt last year ; little emigration ; no market for our surplus produce, and forbidding prospects of collecting our money from those that purchased our real or personal property in states from whence we emigrated, in time to make our payments to the United States, as stipulated by the laws of Congress now in force.

Your petitioners also further pray, that your honorable bodies will be pleased to grant a pre-emption to the original purchases, or his or their assignee or assignees, who was legally entitled to the survey so forfeited, had he or they made the payments agreeably to the laws now in force. This humane, and to us, beneficial regulation, will prevent the greedy speculators from depriving us of the comforts of our labor and honest industry, and often save us and our helpless families from total ruin. Many of your petitioners have made large improvements on our lands, under a full conviction that we should be per-

[right column]

fectly able to complete our payments, agreeably to the laws of the United States-But the possibility of a failure in payment, from the causes before adverted to, has brought amongst us a number of land speculators, men who live on the sweat from other men's brows, who generally place themselves in the most considerable towns in the state, and particularly in those towns where the land-offices are fixed-At the public sales for the non-payment of lands, (which happens three times in every year, i.e. at every court of common pleas) these adventurers closely attend the sales, frequently to the number of twenty or thirty, and sometimes to the exclusion of the ignorant farmer from the office ; and immediately on the reversion of the lands to the United States, apply in a body, and often obtain the very lands which we have toiled and labored on for years, and thereby made the wilderness a smiling paradise-From this property we are immediately dispossessed, and by such persons, and by such means ; or we must comply with their terms, which generally is, to give our bonds to the fortunate speculator for a considerable sum, sometimes more than the original price of the land, and also take the future payments to the United States on ourselves-The payment of these obligations, disenables us to comply with the future payments to the United States, and only procrastinates the day of poverty and distress a few years longer.-Much more could be detailed on this, to us, important subject ; but we forbear-believing and depending in the wisdom and justice of Congress to grant us such relief, as in their superior wisdom may seem meet.-And your petitioners, as in duty bound, will ever pray.

[handwritten signatures, left column]

Samuel Bunn

John [Cunningham ? illegible]

Abner Epery

Benjamin Arnold

Solomon Ross

John Montgomery

Alex. Finley

James Morrison

Thomas Esery

James Morison

William [Aniston ? illegible]

Joseph Hanks

William Montgomery

Hugh [? illegible]

[handwritten signatures, right column]

John Russell

Joseph Flint

Moses McCall

[Hephra? illegible] Boyd

Joseph Lockard

Daniel Doll

Abraham Doll

[J ? illegible] Linnary

William Dyk

Thomas Cartt

Joseph Ross

Edward Salts

Lawson Linton

[Gecheviacca ? illegible] Lindon

Sam Hanford Senior

-----------

29 petitioners

-----------

51 notes

·

View notes

Text

Malgorzata Izabela Kwoka

Malgorzata Izabela Kwoka is a registered Australian Business Name with the Australian Business Number (ABN) of: 16780850799.Her business was first added to the ABN register on 11th July 2016 and has been trading for 3 years in the business trades under the name: The Diamond Girls.

1 note

·

View note

Text

Enterprise Social Networks

Kent Institute Australia Pty. Ltd. Assessment Brief ABN 49 003 577 302 CRICOS Code: 00161E RTO Code: 90458 Version 2: 11th October, 2019 Page 1 of 7 TEQSA Provider Number: PRV12051 ASSESSMENT BRIEF COURSE: Bachelor of IT / Bachelor of Accounting / Bachelor of Business Unit Code: ENSN201 Unit Title: Enterprise Social Networks Type of Assessment: Group Assignment Length/Duration: 2000 Words &…

View On WordPress

0 notes

Text

Enterprise Social Networks

Kent Institute Australia Pty. Ltd. Assessment Brief ABN 49 003 577 302 CRICOS Code: 00161E RTO Code: 90458 Version 2: 11th October, 2019 Page 1 of 7 TEQSA Provider Number: PRV12051 ASSESSMENT BRIEF COURSE: Bachelor of IT / Bachelor of Accounting / Bachelor of Business Unit Code: ENSN201 Unit Title: Enterprise Social Networks Type of Assessment: Group Assignment Length/Duration: 2000 Words &…

View On WordPress

0 notes

Text

Enterprise Social Networks

Kent Institute Australia Pty. Ltd. Assessment Brief ABN 49 003 577 302 CRICOS Code: 00161E RTO Code: 90458 Version 2: 11th October, 2019 Page 1 of 7 TEQSA Provider Number: PRV12051 ASSESSMENT BRIEF COURSE: Bachelor of IT / Bachelor of Accounting / Bachelor of Business Unit Code: ENSN201 Unit Title: Enterprise Social Networks Type of Assessment: Group Assignment Length/Duration: 2000 Words &…

View On WordPress

0 notes

Text

Enterprise Social Networks

Kent Institute Australia Pty. Ltd. Assessment Brief ABN 49 003 577 302 CRICOS Code: 00161E RTO Code: 90458 Version 2: 11th October, 2019 Page 1 of 7 TEQSA Provider Number: PRV12051 ASSESSMENT BRIEF COURSE: Bachelor of IT / Bachelor of Accounting / Bachelor of Business Unit Code: ENSN201 Unit Title: Enterprise Social Networks Type of Assessment: Group Assignment Length/Duration: 2000 Words &…

View On WordPress

0 notes

Text

Study in NETHERLANDS

Netherlands, also informally known as Holland, is located in Western Europe, is known for flat landscape, tulip fields, windmills and cycling routes. Its Capital is Amsterdam.

The Dutch society is egalitarian and Modern. The Netherlands is one of the most secular nations of the world. Cycling is a ubiquitous mode of transport in this country

The World economic forum has ranked the Netherlands as the third most educated country in the world

The country is a founding member of European Union, Eurozone, G10, NATO, OECD and WTO. It is a0 part of Schengen area and also trilateral Benelux Union.

Th Hague, hosts several intergovernmental organization and international courts, is also dubbed as ‘the world’s legal capital’

NETHERLANDS ECONOMY-

Netherlands has a developed economy, it has the 17th largest economy in the world,11th in GDP, per capita

Since 16th century, the leading sectors of the Dutch economy are- shipping, fishing, agriculture, trade and banking. And it has been playing a special role in the European economy

It ranks highest in international indexes of press freedom,economic freedom,Human development and quality of life, and happiness index

It ranked 8th on Human Development Index in the 2021 World Happiness Index. Its the 5th most Competitive economy in the world

INDUSTRIES-

Chemical, Mettallurgy,Machinery,Electrical goods,Trade,Servies and Tourism

Major Dutch international companies are- Randstad, Unilever, Heineken, KLM ,Financial services(ING,ABN,AMRO,Rabobank), Chemicals(DSM,AKZO), Petroleum refining(Royal Dutch Shell)

Electronic(Philips,ASML) ,Satellite navigation (Tom Tom)

In early 1950’s Netherlands discovered huge natural gas resources.

The Groningen gas field ,is one of the largest natural gas fields in the world

EDUCATION-

All Dutch schools and Universities are public funded and managed.

Dutch universities tuition fees range between 10,000 euros to 15000 euros for international students

To study in Netherlands, will be an experience of a lifetime, it being one of the most educated society of the world.

Thirdwave Overseas Education since we set off two decades ago, has left an indelible imprint in all the European Nations, enabling the students to choose from a wide range of options. If you want to be part of this experience, we #Thirdwave Overseas Education, the Best Overseas Education Consultants in Kochi, Bangalore and Coimbatore offer you the best! Make the wise choice by choosing us for your higher education abroad.

#study abroad#study in Netherlands#study abroad consultants in Bangalore#overseas education consultants in Coimbatore#Netherlands education consultants in kochi

0 notes

Text

Computer Science homework help

Computer Science homework help

Kent Institute Australia Pty. Ltd. Assessment Brief ABN 49 003 577 302 CRICOS Code: 00161E RTO Code: 90458 Version 2: 11th October, 2019 Page 1 of 5 TEQSA Provider Number: PRV12051

ASSESSMENT BRIEF COURSE: Bachelor of Information Technology Unit Code: DCAN 202 Unit Title: Data Communication and Networking Type of Assessment: Assessment 3 – Group Report Length/Duration: N/A Unit Learning Outcomes a…

View On WordPress

0 notes

Text

Presentatie - Saskia Noor van Imhoff

- Bachelor Fine Art Gerrit Rietveld Academie - De Ateliers (onafhankelijke kunstopleiding) - Künsterlerhaus Bethanien, Berlin - Verschillende prijzen gewonnen zoals ABN Amro Art Prize Exposities: the Arnulf Rainer Museum, Baden (AT); the 11th Gwangju Biennial (KR); Centre Pompidou, Paris (FR); Frans Hals Museum / DeHallen, Haarlem (NL); Stedelijk Museum, Amsterdam (NL); De Appel, Amsterdam (NL) and the Moscow Biennial (RU). Van Imhoff’s works are included in the collections of the Stedelijk Museum, Amsterdam (NL); Museum Voorlinden, Wassenaar (NL); Verbeke Foundation, Kemzeke (BE); De Nederlandsche Bank, Amsterdam (NL); AKZO Nobel Art Foundation, Amsterdam (NL) and ABN Amro Art Collection, Amsterdam (NL)

“Een lust voor het oog en betekenis ontdekken is aan de kijker zelf. Noor van Imhoff valt de bezoeker niet lastig met maatschappelijke theorieën.” – De Volkskrant

- Legt op onverwachte en associatieve wijze elementen uit architectuur, interieurs, kunstwerken en de natuur in een nieuw verband bij elkaar - De sculpturen vormen een soort tijdcapsule, waarin heden en verleden zijn stilgezet - Vragen over de groei, vergankelijkheid en de waarde van kunst - De locatie-specifieke installaties - Objecten alsof ze vanuit een kunst depot gehaald zijn, kunstwerken van andere kunstenaars, gebruiksvoorwerpen - Hoe classificeren en interpreteren we de wereld om ons heen? - Welke status en waarde kennen wij toe aan de objecten en systemen waarmee we ons omringen?

Door beelden te reproduceren en te manipuleren, bestaande situaties opnieuw te ordenen én slim in te grijpen in de architectuur stuurt zij de blik van de toeschouwer en nodigt deze uit om op een nieuwe en associatieve manier te kijken.

1 note

·

View note

Text

GST – IN SIMPLE TERMS

GST – In Simple Terms

Goods and services tax (GST) is a broad-based tax of 10% on most goods, services and other items sold or consumed in Australia.

Generally, businesses and other organizations registered for GST will:

• include GST in the price they charge for their goods and services • claim credits for the GST included in the price of goods and services they buy for their business.

Do you need to be registered for GST?

If you run a business or other enterprise and have a GST turnover of $75,000 or more ($150,000 or more for non-profit organizations) or you provide taxi travel – you need to register for GST.

GST registration is voluntary if your annual turnover is less than $75,000 in case of a business or less than $150,000 in case of non-profit organization. You can register ABN (Australian Business Number) and GST via the Australian Business Register (ABR) website – www.abr.gov.au or please contact us to assist you in registering your ABN.

How GST works?

Current GST rate is 10%. This means that if you sell an item for $110.00 inclusive of GST, it includes $10 GST that needs to be remitted to Australia Taxation Office (ATO).

Similarly, when you buy items that will be used in your business you will pay GST in those items. GST that you pay in items purchased for business use can be claimed as a credit on your GST return. On every GST return, it could be monthly, quarterly or yearly – depending on your registration you will declare GST collected (from Gross Sales) and GST paid (from Gross Purchases). The difference is the amount payable (If GST collected is more than GST paid) or refundable (If GST paid is more than GST collected). GST returns are lodged by completing a business activity statement commonly referred to as BAS Statements.

Issuing Tax Invoices

When you make a taxable sale of more than $82.50 (including GST), your GST registered customers need a tax invoice from you to be able to claim a credit for the GST in the purchase price. If a customer asks you for a tax invoice, you must provide one within 28 days of their request.

A valid tax invoice must include at least seven pieces of information – • that the document is intended to be a tax invoice • the seller’s identity • the seller’s Australian business number (ABN) • the date the invoice was issued • a brief description of the items sold, including the quantity (if applicable) and the price • the GST amount (if any) payable – this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, as a statement such as ‘Total price includes GST’ • the extent to which each sale on the invoice is a taxable sale (that is, the extent to which each sale includes GST). This applies if invoice is for more than 1 item. Each item needs to be mentioned separately on the invoice and invoice should also specify if the item is taxable supply or GST free.

Example – Invoice for a taxable supply

John (Carpenter) goes to local Bunnings store and buys a hammer for $110. The tax invoice will clearly specify the $10 GST included in the price i.e. 1/11th of the total invoice amount.

Example 2 – Invoice for mixed supplies

John buys following items from local Coles Supermarket – o Milk o Bread (without icing) o Chocolate o Ice cream

Milk and bread are considered to be GST free items and chocolate & ice cream are considered to be taxable supplies. Therefore, the tax invoice will have total amount of the invoice and the GST component will be less than 1/11th of the total invoice as there are some GST free items in the invoice.

GST and Deductions

If the item bought is for business purpose, you can only claim the net amount of the item i.e. Total amount less GST. In example 1 above, John bought a hammer for $110 including GST and uses this item for his business. Assuming he is registered for GST, he can claim a deduction of $100 i.e. $110 less $10 (GST) on his tax return and $10 GST will offset his GST liability.

If John wasn’t registered for GST and he bought hammer for business use, then his deduction will be $110.

We are open 7 days and after hours, strictly by appointment. For further assistance on Tax and GST related matters, contact Expert Tax on 0449 952 855.

0 notes

Text

Lithium Power International Ltd (ASX-LPI) 11th Lithium Supply and Markets Conference Presentation

Lithium Power International Ltd (ASX:LPI) 11th Lithium Supply and Markets Conference Presentation Yahoo Finance Sydney, Australia, June 12, 2019 - (ABN Newswire) - Lithium Power International Ltd (AS Buenos Aires news today

0 notes

Text

Thanks to our contributors our first b-double load of drinking water is on it’s way to Menindee

We heard about the drinking water crisis in the N.S.W. dry west in December and decided to do something about it.

The biggest thank you goes to our contributors without whose compassion kindness and generosity this project would still be a pipe dream.

And there would not be enough drinking water in Menindee, Wilcannia, Tilpa, Sunset Strip or White Cliffs

The list is in completely random order and each named contributor paid the delivered cost of one or more pallets:

Whaitiri and Taumata families

FIRE Fighting in Resistance Equally

Johnston family

Sydney Lightning Chess Group

Azzurro Workers Social Club

Malcolm MacDonald & Family

Sydney’s Homeless Community via Sydney’s 24/7 Street Kitchen Safe Space Community

Ghossayn family

Shoreline Workers Social Club

Catholic Workers & Friends

The Ngo family

The Night Shift

Rebels MC

The Morrison & Morton families

The Hill Billies

Rev Heads Cruising Club

The O’Byrne Family

Woolies Distribution Workers

Yes you can help:

Can you organise a group to raise funds for a pallet of water delivered to the Dry West ? Each fortnight with your help we will send another 32 pallet load - or more if needed.To do so we need your help. Each pallet costs $450 delivered.

Why not organise a fundraiser to buy one or more pallets? Suggest it to your social club, workmates, union, company or community group.

The next truck needs to be paid for by 11th March 2019.

Account details:

BSB: 112879, Account Number: 451979140

ABN: 97 489 201 101

0 notes

Text

February 11th, 2019

ABN & CJN. This will be the year of change.

0 notes

Photo

76th TANK BTL.(AIRBORNE), 11th ABN. DIV., CREST/DUI, CLUTCH BACK, N.S. MEYER BUY IT NOW – 76th TANK BTL.(AIRBORNE), 11th ABN. DIV., CREST/DUI, CLUTCH BACK, N.S. MEYER

0 notes

Text

Rotterdam. Karen Khachanov lost at the start

Rotterdam. Karen Khachanov lost at the start

The 11th racket of the world, Russian tennis player Karen Khachanov, in the first round of the ABN AMRO World Tennis Tournament lost to Dutchman Tallon Griekspoor, who holds 211st place in the world ranking, 6/3, 3/6, 2/6.

For 1 hour and 39 minutes of the match, Karen made five aces and one break, making a mistake six times when serving. While Tallon once filed through and implemented three break…

View On WordPress

0 notes