#gst percentage

Text

The Icthus Directive

(part 1)

16:04:22 Galaxy Standard Time

Agent Kelton entered the numbers into the menu as precisely as his exosuit gloves would let him. 72% baroque orchestra. 28% smooth jazz.

He tapped a final button, flicked off the suit’s forearm screen, and grinned as the first notes sounded gently in his earpiece. Everyone had their own blends of automusic these days, but he was proud of this one. He’d spent weeks adjusting the percentages until the jazz notes wavered just between the melody and the continuo, supporting but not overwhelming the whole.

He started the rover again. Music should help the drive go faster. The planet Nereus was known for its constant pale-green twilight, bare, jutting landscape…and not much else. Working in census compliance didn’t really set you up for trips to the luxury biosphere planets.

Just one more isolated mining settlement to go.

18:20:37 GST

Kelton jerked the rover to the left as its fat rubber tires nearly collided with yet another spiky rock jutting from the canyon floor.

He could see the end of the canyon ahead, where one wall sank back into a dusty twilit plain. It couldn’t come soon enough. He’d been awake almost a full standard day, and he’d spent the last hour weaving through the canyon, straining to see ahead. The rover’s headlights were bright enough, but they turned the rocks nearest him into knife-sharp, mile-long shadows that obscured everything in their path.

He flexed one hand, sore from clenching the wheel. Right, right again, left—around a rock that towered taller than a D-class ship. He was nearly there.

And that’s when the tire popped.

Kelton knew by instinct what the sharp jerk was even as it flung him forward. He clung to the wheel as the rover careened to the right, wrenching it into a clear spot. He slammed on the brakes and slid to an unsteady halt. The rover rocked forward, then sideways, as any remaining air left the shredded tire in a rush.

Dust clouded and swirled in the headlights. Theorbo and bass guitar twanged together in his ear.

He took a long breath, switched off the automusic, and cursed. Very loudly.

Survival wasn’t the issue. The rover carried emergency oxygen and food, even a foldable shelter in case of something like this. This wasn’t the first time he’d broken down while on a job.

But the closest company craft was on the literal other side of the planet, over in Luton. Devor had taken it to do the big, spread-out mining centers there, leaving him with the rover for the little ones. He’d told her it wouldn’t be a problem.

Knowing her, she’d decide it was most efficient to finish up her compliance visits before coming to his rescue—and she’d expect him to get his last one finished anyway.

Flicking on his forearm screen, he typed a quick message and activated his location beacon.

I’ve broken down a few miles out from Settlement A412. Rover is currently inoperable and will need to be transported for maintenance. I’ll plan to meet you at A412 at your earliest convenience.

Scowling, he pressed “send.”

Then he swung down from the rover. Boots crunching in the dusty gravel, he walked around to the back and unhooked the survival essentials pack. With a grunt, he swung it unto his shoulders and fastened the straps.

He’d rather get to A412 tonight. The shelter wasn’t comfortable.

Cursing again, Kelton switched off the rover, sending his surroundings into stark blackness. Quickly, he turned on his exosuit’s own headlight. Then he marked his current coordinates, set up the routing system, and started walking.

He didn’t have Settlement A412’s exact coordinates—that was the other problem. Its census agreements hadn’t been updated in over ten years. An embarrassment to the Milky Way Authority, on all counts—one he would soon correct. But first, he had to get to the general area, keeping his eyes open for the domed shelters that would be burrowed into the rocks beside the yawning mining shafts. And he was tired.

He hadn’t walked for more than a few minutes when he saw a figure ahead—silhouetted in the pale light just beyond the canyon’s end. It seemed to be walking slowly in his direction. He tensed a little, gloved fingers twitching towards the stun rod clipped to his thigh, then dropping again. A lone traveler, on foot, was unusual. But Nereus wasn’t known for violence or gang activity.

The figure continued its slow progress toward him. As they drew even with another and his headlight flashed over it, he saw that it was an android.

An old DG-30 unit. Emphasis on old—a long crack ran down one of its legs, and the eye-sensors were separate, mounted on top of the head. Probably a pre-biometric scanning model. No visible weapons.

It had to be from Settlement A412. But why was it ranging miles away?

Kelton took a step closer. “Directive?” he asked it.

“Directive,” said a cool, carefully accented voice. “Feed the hungry. Give drink to the thirsty. Clothe the naked. Shelter the homeless. Visit the sick. Bury the dead.”

The directive was non-standard. Not mining protocol, that was for sure. The unit paused, as if waiting.

Then suddenly it bent at the waist, reached out a rust-spotted finger, and traced a shape into the fine gray dust. Two curving lines, like segments of a circle, meeting at one point and crossing at another.

He had hoped that the DG-30 would show him the way. But the scratched shape didn’t look like a map.

Kelton leaned forward and sent a visual search query for the symbol. But the results pane at the bottom of his vision came back empty.

The unit’s two greenish eye-sensors were tilted toward him. “I don’t understand,” he told it.

It paused again, as if recalibrating, then asked a new question.

“What is your need?” The metallic voice had a touch of sympathy.

“Nothing,” Kelton began; then, remembering its odd directive in a sudden flash of genius—“I mean, I’m homeless.”

“Homeless,” repeated the android. “No place of residence?”

“None,” he answered, hoping it somehow wouldn’t scan his identity chip.

It paused again. Then it nodded.

“Follow me,” it said, and it turned and began walking.

That worked?

Kelton followed. They crunched along in silence, out of the dark canyon, and struck out across the plain. For the first time in hours, he felt like laughing. The whole interaction had been so strange—just a few words, and now the unit was taking him where he needed to go. And the shape it had drawn? He’d have to ask about it at the mining settlement.

Odd that the visual search hadn’t found anything.

(part 2 coming soon)

@inklings-challenge

#yes I finally wrote this all tonight#part 2 coming tomorrow probably#so for now I’m not tagging it as incomplete#the Icthus directive#dimsilver writes#inklingschallenge#team Lewis#genre: space travel#theme: works of mercy#(all of them)#inklings challenge 2023

37 notes

·

View notes

Text

Understanding GST in Real Estate: Simplifying Taxes for Homebuyers

GST implementation in India on 1st July 2017 heralded a monumental change in the nation’s tax framework. Specifically in real estate, GST applies to the purchase of under-construction properties like flats, apartments, and bungalows. It replaced multiple indirect taxes like VAT, Central Excise, Octroi, and Entry Tax, which were complex and led to higher costs for homebuyers.

Before GST: Tax Challenges

Before GST, developers faced a maze of taxes that added to the cost of projects without the benefit of tax credits. This often led to higher prices for buyers, who struggled to understand the varied tax rates applied by different states.

Impact of GST: Transparency and Benefits

GST brought transparency to property transactions by streamlining taxes into a single system. It eliminated the cascading effect of taxes, benefiting both developers and buyers. For buyers, knowing the exact GST percentage applicable to their purchase simplified financial planning.

GST Rates for Flat Purchase in India (2024)

Under-construction affordable housing: 1% GST

Under-construction non-affordable housing: 5% GST

Ready-to-move-in properties and land purchases: No GST

Benefits for Homebuyers

Transparent Pricing: Buyers now have clarity on taxes they pay, avoiding the confusion of multiple taxes.

Affordability: Reduced GST rates, especially 1% for affordable housing, make buying homes more accessible.

Financial Planning: Buyers must fund GST separately, as banks typically don’t finance this amount.

No GST on Land: Purchasing land for building homes is not subject to GST, making it an attractive option.

Galaxy Orizzonte: A Premier Residential Project

Galaxy Orizzonte, Baner, Pune, is an upcoming under-construction project offering 2, 3, and 4 BHK homes. Known for its strategic location and modern amenities, it exemplifies the benefits of GST on under-construction properties, ensuring transparency and clarity for potential homebuyers.

In conclusion, GST has simplified the tax structure for real estate transactions, benefiting both developers and buyers alike. Understanding these nuances helps homebuyers make informed decisions and plan their investments wisely.

0 notes

Text

Understanding Tax Laws in London, Ontario: A Guide by Local Tax Accountants

Navigating the intricate web of tax laws can be a daunting task, especially for residents and businesses in London, Ontario. Tax laws are continuously evolving, and keeping up with the changes requires both dedication and expertise. This guide, crafted by local tax accountants, aims to demystify the complexities of tax regulations in London, Ontario, providing valuable insights and practical advice to help you manage your tax obligations efficiently.

The Importance of Understanding Tax Laws

Understanding tax laws is crucial for both individuals and businesses. It ensures compliance, helps in optimizing tax liabilities, and avoids potential penalties or legal issues. In London, Ontario, tax laws encompass federal, provincial, and municipal regulations, each with its own set of rules and requirements.

Federal Tax Obligations

At the federal level, Canadians are required to pay income tax on their worldwide income. The Canada Revenue Agency (CRA) administers tax laws and collects income taxes. Key aspects include:

Income Tax: Individuals must report their income annually and pay taxes based on their income bracket. Deductions and credits, such as the Basic Personal Amount and charitable donations, can reduce taxable income.

Corporate Tax: Businesses must file annual corporate income tax returns. The general corporate tax rate is 15% at the federal level, with various credits and deductions available to reduce the tax burden.

GST/HST: Goods and Services Tax (GST) or Harmonized Sales Tax (HST) applies to most goods and services. In Ontario, the HST rate is 13%, combining the federal GST of 5% and the provincial rate of 8%.

Provincial Tax Obligations

Ontario's tax laws include additional obligations for individuals and businesses:

Personal Income Tax: Ontario levies its own income tax, calculated based on a percentage of federal taxable income. The rates are progressive, with higher income earners paying a higher percentage.

Ontario Trillium Benefit: This benefit combines the Ontario Sales Tax Credit, Ontario Energy and Property Tax Credit, and Northern Ontario Energy Credit, providing financial assistance to eligible individuals and families.

Corporate Income Tax: Ontario's general corporate tax rate is 11.5%. Small businesses may benefit from a lower rate of 3.2% on their first $500,000 of active business income.

Municipal Tax Obligations

In addition to federal and provincial taxes, London residents and businesses must also adhere to municipal tax regulations:

Property Tax: Property owners in London pay property taxes based on the assessed value of their property. The municipal government sets the tax rate, which funds local services such as schools, public transportation, and emergency services.

Business Tax: Businesses may be subject to additional municipal taxes, licenses, and permits, depending on the nature of their operations.

Common Tax Issues and How to Address Them

Tax accountants in London, Ontario, often encounter common tax issues faced by residents and businesses. Here are a few examples and how to address them:

Filing Errors

Filing errors, such as incorrect information or missing documents, can lead to delays and penalties. To avoid these issues, double-check your tax returns and ensure all necessary documents are included. Utilizing the services of a tax accountant in London, Ontario, can provide peace of mind, as they are well-versed in local tax regulations and can ensure accurate filing.

Missing Deadlines

Missing tax deadlines can result in penalties and interest charges. Keep track of important dates, such as the April 30th deadline for individual tax returns and the June 15th deadline for self-employed individuals. Setting reminders and working with a tax accountant can help you stay on top of these deadlines.

Understanding Deductions and Credits

Many taxpayers miss out on valuable deductions and credits simply because they are unaware of them. A tax accountant in London, Ontario, can help identify eligible deductions and credits, such as medical expenses, education costs, and business expenses, to minimize your tax liability.

The Role of a Tax Accountant

A tax accountant plays a vital role in ensuring compliance with tax laws and optimizing tax liabilities. Their services include:

Tax Planning: Developing strategies to minimize tax liabilities through careful planning and understanding of tax laws.

Tax Preparation and Filing: Accurately preparing and filing tax returns to meet deadlines and avoid penalties.

Audit Support: Assisting in the event of an audit by the CRA or other tax authorities, providing documentation and representation.

Conclusion

Understanding tax laws in London, Ontario, is essential for both individuals and businesses to ensure compliance and optimize tax liabilities. By staying informed about federal, provincial, and municipal tax obligations, and by seeking the expertise of a tax accountant in London, Ontario, you can navigate the complexities of the tax system with confidence. Local tax accountants are equipped with the knowledge and experience to provide tailored advice and support, making tax season less stressful and more manageable.

0 notes

Text

What are the different types of GST Registration?

Navigating the world of GST (Goods and Services Tax) can be overwhelming, especially when it comes to understanding the various types of GST registration available. Whether you’re starting a new business or managing an established one, choosing the right type of GST registration is crucial for compliance and growth. Here is a quick guide to different types of GST Registration.

Regular GST Registration: Ideal for most businesses, this type of registration is required if your turnover exceeds the prescribed threshold limit. It allows you to collect GST from customers and claim input tax credit, which helps in offsetting the tax you pay on inputs.

Composition Scheme: Perfect for small businesses with a turnover below a specified limit, this scheme simplifies tax compliance by allowing you to pay GST at a fixed percentage of turnover rather than the standard rate. Note that you can't claim input tax credit under this scheme.

Non-Resident Taxable Person Registration: If you're a business operating temporarily in India, this registration is essential. It enables you to conduct business and comply with GST regulations without the need for a permanent establishment.

Casual Taxable Person Registration: For businesses that occasionally supply goods or services in a state where they don’t have a fixed place of business, this registration is a must. It ensures that you meet GST requirements on a temporary basis.

Input Service Distributor (ISD): This type of registration is for businesses that receive input services and want to distribute the input tax credit across different branches or units.

E-Commerce Operator Registration: If you run an online marketplace or facilitate online transactions, this registration helps you manage GST compliance related to the supplies made through your platform.

Choosing the right type of GST registration ensures smoother operations and better compliance with tax regulations. For expert guidance and hassle-free registration, visit Online Legal India to learn more about how we can assist you!

0 notes

Text

Weekly Market Outlook

It turned out to be a fabulous week of trade for Indian equity benchmarks with frontline gauges garnering weekly gains of over two percentage points and settling above their record 79,000 (Sensex) and 24,000 (Nifty) levels.

During the week, traders were seen taking bullish bets in fundamentally strong stocks in hopes of continuity in reforms and focus on the 100-day agenda of the NDA government. Sentiments are also buoyed by the expected revival in the technology space and consolidation in the cement industry.

Markets started the week slightly in the green as traders found some support after the GST Council at its 53rd meeting introduced sweeping reforms with an aim to simplify tax compliance and ease the burden on taxpayers.

Some support also came after S&P Global Market Intelligence said that the new government will likely focus on job creation and addressing farmers’ concerns in its first 100 days.

Markets extended their northward journey and looked resilient during most part of the week taking support from RBI’s statement that India recorded a current account surplus of $5.7 billion or 0.6 per cent of GDP in the March quarter. In the year-ago period, the current account deficit stood at $1.3 billion or 0.2 per cent of GDP.

Sentiments also remained upbeat with CRISIL Ratings’ report stating that capital goods makers are likely to see revenue rise 9-11% in fiscal 2025, led by continued significant outlays towards railways (including metros), defence, conventional and renewable sectors.

This compares with an expected around 13% growth in fiscal 2024. Optimism continued on Dalal Street taking support from RBI’s data showing that India’s financial position with the rest of the world improved over the year. The country increased its overseas assets more than it increased its foreign liabilities, largely due to a rise in reserve assets.

Key gauges continued to hit record levels one after other as traders took support with the National Council of Applied Economic Research (NCAER) stating that India’s economy is set to achieve significant growth, with projections nearing 7.5% for the current fiscal year (FY25).

Some solace also came with CRISIL’s report stating that India’s current account surplus in the fourth quarter of the 2023-24 fiscal was aided by the narrowing of the merchandise trade deficit, an increase in remittances and a surplus in services trade. The country’s current account recorded a surplus of $5.7 billion, which is 0.6 per cent of the GDP, in the fourth quarter of the last financial year.

However, domestic markets ended the week off record highs as traders booked minor gains on the final day of the week as participants turned wary of the high valuations. Traders also took note of a report that Securities & Exchange Board of India (SEBI) at its board meeting approved new criteria for a single stock F&O entry and exit, voluntary delisting norms and flexibility on the same, norms on finfluencers, measures to ease of doing business for REITs and InvITs and many other decisions.

Despite profit booking in the last session, Sensex and Nifty managed to settle above their psychological levels of 79,000 and 24,000, respectively.

BSE movement for the week

The Bombay Stock Exchange (BSE) Sensex jumped 1822.83 points or 2.36% to 79,032.73 during the week ended June 28, 2024.

The BSE Midcap index gained 191.28 points or 0.42% to 46,158.35 and the Small-cap index surged 193.88 points or 0.37% to 52,130.41.

On the sectoral front, S&P BSE TECK was up by 404.35 points or 2.41% to 17,164.41, S&P BSE Information Technology was up by 778.65 points or 2.15% to 36,951.36, S&P BSE Oil & Gas was up by 610.10 points or 2.11% to 29,473.40, S&P BSE Power was up by 138.80 points or 1.78% to 7,954.50 and S&P BSE BANKEX was up by 944.30 points or 1.61% to 59,640.90 were the top gainers.

S&P BSE Realty was down by 208.67 points or 2.36% to 8,634.76 and S&P BSE Metal was down by 685.83 points or 2.03% to 33,050.57 were the few losers on the BSE.

NSE movement for the week

The Nifty surged 509.50 points or 2.17% to 24,010.60.

On the National Stock Exchange (NSE), Nifty IT was up by 957.20 points or 2.72% to 36,157.50, Bank Nifty was up by 680.80 points or 1.32% to 52,342.25, Nifty Next 50 gained 411.65 points or 0.58% to 71,523.45 and Nifty Mid Cap 100 gained 307.75 points or 0.56% to 55,736.90.

FII transactions during the week

Foreign Institutional Investors (FIIs) were net buyers in the equity segment in the week, with gross purchases of Rs 132,345.34 crore and gross sales of Rs 117,951.08 crore, leading to a net inflow of Rs 14,394.26 crore.

They also stood as net buyers in the debt segment with gross purchases of Rs 12,056.35 crore against gross sales of Rs 7,676.37 crore, resulting in a net inflow of Rs 4,379.98 crore.

In the hybrid segment, FIIs stood as net sellers, with gross purchases of Rs 170.79 crore and gross sales of Rs 246.02 crore, leading to a net outflow of Rs 75.23 crore.

Outlook for the coming week

The passing week turned enthusiastic one for Indian equity markets, by hitting fresh record high levels garnering gains of over two percent this week.

The coming week marks the start of a new month and auto stocks will be buzzing on reporting monthly sales figures. Market participants will be watching out for the HSBC Manufacturing PMI Final scheduled to be released on July 01.

The HSBC India Manufacturing PMI increased to 58.5 in June 2024 from May’s three-month low of 57.5, preliminary estimates showed.

HSBC Composite PMI Final, HSBC Services PMI Final scheduled to be released on July 03. Foreign Exchange Reserves data going to be out on July 05.

The first session of 18th Lok Sabha and 264th Session of Rajya Sabha will be concluding on July 3. The first session of 18th Lok Sabha commenced on June 24. While 264th Session of Rajya Sabha had started on June 27.

On the global front, investors would be eyeing few economic data from world’s largest economy, starting with Fed Williams Speech on June 30, followed by S&P Global Manufacturing PMI Final, ISM Manufacturing PMI, ISM Manufacturing Employment, ISM Manufacturing New Orders, ISM Manufacturing Prices on July 01.

Redbook, Fed Chair Powell Speech, JOLTs Job Openings on July 02, Balance of Trade, Initial Jobless Claims, S&P Global Composite PMI Final, S&P Global Services PMI Final, ISM Services PMI, FOMC Minutes on July 03, Non – Farm Payrolls, Unemployment Rate, Government Payrolls, Manufacturing Payrolls, Baker Hughes Oil Rig Count on July 05.

0 notes

Text

From GST & Tax to PLI & Spectrum, Space Industry Association Releases Eight-Point Wish List for Private Companies Ahead of Budget

ISpA advocates for reasonable Spectrum Usage Charges as a percentage of Adjusted Gross Revenue to avoid excessive fees for satellite operators. (Getty)

To stimulate growth, ISpA recommends introducing tax holidays and exemptions for companies in the space sector, particularly those investing in space industrial parks

The Indian Space Association (ISpA), representing private space companies, has…

0 notes

Text

Understanding the Brokerage Calculator: A Guide to Calculating Trading Costs

In the world of stock market investing, understanding the costs associated with trading is crucial for making informed decisions and managing your investments effectively. One essential tool that aids investors in this regard is the brokerage calculator. This article explores what a brokerage calculator is, how it works, its benefits, and how you can use it to calculate trading costs.

What is a Brokerage Calculator?

A brokerage calculator is an online tool provided by stockbrokers or financial websites that helps investors calculate the total costs associated with their trades. These costs typically include brokerage charges, taxes, transaction fees, and other charges that may apply depending on the type and volume of trades conducted.

How Does a Brokerage Calculator Work?

Input Parameters: To use a brokerage calculator, you need to input certain parameters such as:

Buy price: The price at which you plan to buy a particular stock or security.

Sell price: The expected selling price of the stock.

Quantity: The number of shares or units you intend to buy or sell.

Brokerage rate: The percentage or flat fee charged by the broker per transaction.

Other charges: These may include Securities Transaction Tax (STT), Goods and Services Tax (GST), stamp duty, exchange transaction charges, etc.

Calculation Process: Once you enter these parameters into the brokerage calculator, the tool automatically computes:

Total brokerage charges: Based on the brokerage rate specified.

Taxes and fees: Including STT, GST, stamp duty, and other applicable charges.

Net profit or loss: After deducting all costs from the selling price.

Benefits of Using a Brokerage Calculator:

Transparency: It provides clarity on the total costs involved in a trade, ensuring there are no surprises.

Cost Comparison: Allows you to compare costs across different brokers and trading strategies.

Decision Making: Helps in making informed decisions about trade sizes and frequency based on calculated costs.

Profitability Analysis: Enables you to evaluate potential profits or losses before executing a trade.

How to Use a Brokerage Calculator

Choose a Broker: Select a brokerage firm that offers a brokerage calculator on its website or through its trading platform.

Enter Trade Details: Input the relevant details such as buy price, sell price, quantity, and brokerage rate.

Review Results: Examine the breakdown of costs provided by the calculator, including brokerage charges, taxes, and net profit or loss.

Make Informed Decisions: Use the calculated information to optimize your trading strategy and maximize your investment returns.

Conclusion

In conclusion, a brokerage calculator is an invaluable tool for investors seeking to manage their trading costs effectively. By providing transparency and clarity on expenses, it empowers investors to make informed decisions and optimize their investment strategies. Whether you are a novice or experienced trader, utilizing a brokerage calculator can significantly enhance your trading experience and financial outcomes in the stock market.

0 notes

Text

How Do Fantasy Apps Make Money?

Ever wondered how fantasy apps turn a profit? It's not just about you and your friends competing for bragging rights. These apps have a business model in place to keep things running.

Here's a breakdown of how fantasy apps make money:

Government Taxes: Uncle Sam takes a cut! Fantasy apps collect GST (Goods and Services Tax) on the total amount players put in. Winners also owe taxes (TDS) on their winnings.

Fantasy App Owner's Share: The app owner doesn't work for free! They take a percentage of the total collection as their profit.

So, where does your entry fee go?

A chunk goes to the government in taxes.

The app owner keeps a portion as their profit.

The remaining amount is distributed as prize money for the winners. (But remember, winners still owe taxes on their winnings!)

The government's a big winner! They earn significant revenue from fantasy apps through GST and TDS. This money helps fund various initiatives and development projects.

Thinking about joining a fantasy league? Now you know how the app makes money. It's a win-win situation: you have fun competing, the app stays afloat, and the government gets a cut to support important projects.

Want to learn more? Check out now.

0 notes

Text

How to Calculate Your Import Duty When Buying from China

Introduction

Are you considering importing goods from China to India? If so, understanding import duties from China is paramount to ensure a smooth and cost-effective importing process. import duty from Chinaplays a crucial role in determining the total cost of your imported goods, and failing to grasp its intricacies can lead to unexpected expenses and delays.

Picture this: You find the perfect product from a Chinese supplier, place your order, but upon arrival, you're hit with hefty import duties that were not accounted for. Sounds daunting, doesn't it? That's why delving into the world of import duty from China is essential for any importer looking to navigate the international trade landscape successfully.

Several factors come into play when calculating import duties from China, including the Harmonized System (HS) Code classification of your product, the customs value of the goods, and the applicable duty rates. Each of these elements influences the final import duty amount, making it crucial to understand how they interact and impact your bottom line.

In this guide, we'll delve deeper into the importance of comprehending import duties from China and explore the key factors that affect import duty calculations. By the end, you'll be equipped with the knowledge and insight needed to navigate the import process confidently and efficiently. Let's dive in!

What Are Import Duties and Taxes?

Import duties, also known as customs duties, are taxes imposed by the government on goods imported into a country from abroad. These duties are typically based on the value of the imported goods or their weight, and they serve as a source of revenue for the government. In addition to import duties, other applicable taxes may include:Customs Clearance Fees: Fees charged for processing and clearing imported goods through customs.Goods and Services Tax (GST): A tax levied on the supply of goods and services, including imported goods, within the country.OyeExpressValue Added Tax (VAT): Similar to GST, VAT is a consumption tax imposed on the value added to goods at each stage of production and distribution.

How Import Duties Contribute to the Total Cost

Understanding how import duties from China contribute to the total cost of imported goods is essential for importers:Increased Cost: Import duties add to the overall cost of imported goods, impacting profit margins and pricing strategies.Cost Transparency: Knowing the import duty from Chinaallows importers to accurately calculate the total cost of importing goods and factor it into their budgeting and pricing decisions.Customs Compliance: Properly accounting for import duties ensures compliance with customs regulations, reducing the risk of penalties or delays in the import process..

By grasping the implications of import duties and taxes when importing from China, businesses can make informed decisions to optimize their import processes and minimize costs effectively.

Factors Influencing Import Duty Calculations

Import duties from China are influenced by various key factors that play a significant role in determining the final duty amount. Understanding these factors is essential for importers to accurately predict and manage their import costs effectively.Product Value: The value of the imported product is one of the primary factors influencing import duty calculations. Higher-value products typically incur higher import duties, as duties are often calculated as a percentage of the product's declared value..Shipping Costs: Shipping costs, including freight charges, insurance, and handling fees, also impact import duty calculations. These costs are usually included in the customs value of the goods and contribute to the overall import duty amount.Product Classification: The classification of the product according to the Harmonized System (HS) Code plays a crucial role in determining the applicable duty rates. Each product is assigned a specific HS code based on its characteristics and materials, and import duties vary depending on the assigned code. .

By considering these key factors influencing import duty calculations, importers can better anticipate and manage their import costs, ensuring a smoother and more cost-effective importing process from China. Understanding the nuances of import duty from Chinaempowers businesses to navigate the import landscape more effectively, maximizing cost efficiency and compliance.

Finding the Right HS Code

Identifying the correct Harmonized System (HS) code for your product is essential for accurate import duty calculations. Here's how you can ensure you're assigning the right code:Research and Consultation: Start by conducting thorough research on the nature and characteristics of your product. Consult resources such as the World Customs Organization website or seek guidance from customs authorities to identify potential HS codes that match your product.Detailed Product Description: Provide a detailed description of your product, including its materials, composition, and intended use. This information will help narrow down the possible HS code options and ensure accurate classification.Compare and Confirm: Compare the characteristics of your product with the descriptions provided in the HS code classifications. Select the code that best matches your product and verify its accuracy with customs authorities or professional advisors.

Importance of Accurate HS Codes

Accurate Duty Calculation: The assigned HS code directly determines the applicable import duty rates, ensuring precise calculation of import duty from China.Customs Compliance: Using the correct HS code ensures compliance with customs regulations, reducing the risk of penalties or delays in the import processTrade Data Analysis: Accurate HS code classification facilitates trade data analysis, enabling businesses to make informed decisions and identify market trends.

By following these steps and understanding the importance of accurate HS codes, importers can streamline their import processes and minimize costs effectively.

Step-by-Step Guide to Calculating Import Duty

Calculating import duty from Chinamay seem daunting, but with this simple step-by-step guide, you can navigate the process with confidence:Determine Customs Value: Start by determining the customs value of your imported goods. This includes the cost of the product, shipping fees, insurance, and any additional charges incurred before the goods arrive in India.

Example: If you're importing electronic goods worth $10,000 from China and incur $2,000 in shipping and insurance costs, the total customs value would be $12,000.Identify the Applicable Duty Rate: Next, identify the applicable duty rate for your product. This rate varies depending on factors such as the type of product and its country of origin.

Example: Suppose the applicable duty rate for electronic goods from China is 10%.Calculate Import Duty: Multiply the customs value of your goods by the applicable duty rate to calculate the import duty amount.

Example:For electronic goods valued at $12,000 with a 10% duty rate, the import duty from Chinawould be $1,200.

Tips for Accurate Calculations

Double-check HS code classification to ensure accuracy in duty rates.Keep detailed records of all costs related to the import process.Consult with customs authorities or professional advisors for guidance on complex cases.

By following these steps, you can accurately calculate import duty from Chinaand ensure a smooth import process.

Using Online Calculators and Tools

Online tools and calculators offer a convenient way to estimate import duty from China. Here's what you need to know:

Benefits of Using Online Tools

Ease of Use: Online calculators are user-friendly and accessible, allowing importers to quickly estimate import duty amounts without extensive manual calculationsTime Savings: These tools save time by automating the duty calculation process, enabling importers to focus on other aspects of their business.Cost Efficiency: Many online calculators are free to use, offering cost-effective solutions for importers seeking to estimate import duty expenses accurately.

Limitations of Online Tools

Accuracy: While online tools provide estimates, they may not always account for all variables that can affect import duty calculations, leading to potential inaccuracies.Complex Cases: For complex import scenarios or unique products, online calculators may not offer sufficient customization options to accurately determine duty amounts.Reliance on Data: The accuracy of calculations depends on the completeness and accuracy of the data entered into the online tool, which may vary.

By leveraging online calculators and tools judiciously, importers can gain valuable insights into the potential expenses of import duty from Chinawhile being mindful of their limitations.

Case Study: Import Duty Calculation Example

Let's consider a real-life scenario of importing electronic gadgets from China to India and calculate the import duty:

Scenario:

A company in India plans to import 100 smartphones from a manufacturer in China. The total cost of the shipment, including the product cost, shipping, insurance, and handling fees, amounts to $10,000.

Calculation Process:

Determining Customs Value:

Product Cost: $8,000

Shipping, Insurance, and Handling Fees: $2,000

Total Customs Value: $10,000

Identifying the HS Code:

The smartphones are classified under HS Code 8517.12.00 - telephones for cellular networks or for other wireless networks.

Researching Duty Rates:

The duty rate for smartphones under HS Code 8517.12.00 is 20%. Calculating Import Duty:

Import Duty = Total Customs Value * Duty Rate

Import Duty = $10,000 * 20% = $2,000

Conclusion:

In this scenario, the import duty from Chinafor importing 100 smartphones to India amounts to $2,000. By accurately calculating import duties, the company can effectively budget and plan for the total import cost, ensuring a smooth and cost-effective import process.

Conclusion

Accurately calculating import duties from China is crucial for businesses importing goods into India. It ensures transparency in cost estimation, compliance with customs regulations, and effective budgeting. By utilizing the provided information and following the outlined steps, importers can make informed decisions, minimize errors, and streamline their import processes. Remember, understanding import duty calculations empowers businesses to navigate the complexities of international trade with confidence and efficiency, ultimately contributing to successful import ventures.

FAQ’s:

Q1: How do I determine the customs value of my imported goods?A: The customs value includes the product cost, shipping, insurance, and handling fees incurred before arrival in India. It's essential to maintain detailed records of these expenses for accurate calculation.Q2: What is an HS code, and why is it important?A:An HS code is a standardized classification system used to categorize products for customs purposes. It's crucial, as it determines the applicable duty rates based on the nature and characteristics of the imported goods.Q3:How can I find the correct HS code for my product?A:You can find the HS code by consulting resources such as the Indian Customs Tariff, the World Customs Organization website, or seeking guidance from customs authorities. It's essential to provide a detailed description of your product for accurate classification.Q4:Are there any online tools available to help with import duty calculations?A: Yes, several online calculators and tools are available to estimate import duties based on the customs value and HS code of your product. While these tools provide estimates, it's essential to verify the accuracy of the calculations and consider any additional factors that may affect duty rates.Q5:How can I minimize errors in import duty calculations?A:Minimizing errors involves ensuring accurate data entry, double-checking HS code classification, and staying updated on changes in duty rates and regulations. Consulting with customs authorities or professional advisors can also help ensure accurate calculations and compliance with customs requirements

Read More: Click Here

0 notes

Text

Unlock the Secrets of Smart Property Tax Management for Real Estate Investors

India's real estate sector is expanding, with many opportunities for future expansion. According to Mordor Intelligence, the market is currently worth USD 265.18 billion and is expected to increase at a CAGR of 25.6% by 2028, reaching USD 828.75 billion in total. Despite the present rise following the pandemic, real estate has always been a secure shelter for investors seeking long-term profits. Similarly, for developers, it is a profitable path because it allows several options to not only demonstrate modern architecture but also generate a significant ROI.

However, profits earned are subject to relevant property taxes, which an individual or a limited liability business must pay to the government. Avoiding this payment results in a fine and, in some situations, harsh legal action. Regardless of the conditions, there are always methods to save money on taxes if you have the correct strategies. This article examines some of the clever tax tactics that could help investors and developers save money in taxes.

Smart tax-saving Ideas

If you are a real estate investor, you may have to pay a variety of taxes, including municipal corporation tax, goods and services tax (GST), stamp duty, registration fees, and others. With so many taxes, it's difficult for an individual to design a perfect approach for any one tax. However, with the combination of many smart techniques, a collective favorable outcome can be achieved.

Save on depreciation

While real estate can appreciate dramatically in value, it is also prone to depreciation. As a result, both investors and developers employ this method to reduce their property taxes. Depreciation can be used to demonstrate the loss of value of a property, which can dramatically lower taxable income for both investors and developers. The actual use of depreciation deductions allows individuals to avoid tax while still retaining a significant percentage of their earnings. According to the Income Tax Act, the annual depreciation rate for residential properties is 5%, while for non-residential developments it is 10%.

Benefits of Joint Ownership

Another profitable option for both investors and real estate developers is to jointly own a property. Section 80C of the Income Tax Act gives relief of up to Rs. 1.5 lakh for properties owned jointly by co-owners and financed with a home loan. Furthermore, if the co-owners generate a rental income from the property, they can divide the rental or capital gains in a way that reduces their overall tax liability. This method may be more effective if the other owner is in a low tax bracket.

Investment in agricultural land

Agricultural land in India is not only a profitable investment opportunity, but it may also be an excellent tax-saving technique for investors. According to Section 54 of the Income Tax Act, agricultural land is not considered a capital asset, hence no capital gains tax is levied on its sale. This is why this form of land is profitable in terms of both income and tax savings. Aside from these benefits, the owners can use the land for other benefits such as organic farming or fractional holdings, which can provide a passive source of income.

Strategic investments

Investors and developers must time their investments to avoid excessive taxes. To avoid a late penalty, short-term buyers and sellers must consider the tax deadline. Furthermore, the timing of purchasing building materials or making repairs early in the year is critical for developers because these actions qualify for immediate tax deductions. One effective method is to invest in 54EC bonds, which allow investors to deduct up to Rs 50 lakh on capital gains from the sale of a flat. However, one must only buy the 54EC bonds, which are issued by the Rural Electrification Corporation (REC) and the National Highways Authority of India (NHAI).

All things considered

For a long time, real estate has provided investors with security through quick value appreciation, rental opportunities, and long-term reliability. However, with large capital gains come a slew of taxes that can be overwhelming for home sellers. To dramatically minimize these taxes, one can use a variety of tactics, including depreciation deductions, investing in agricultural land, jointly owning a property, and strategically timing their investment.

The real estate market is expected to rise in the near future. Those who are ready to invest in properties must understand not only their taxes but also how to maximize their revenue. If there are any complications with tax planning, it is recommended that they contact a professional or use an automated tax solution to streamline their tax filing procedure.

#Secrets of Smart Property Tax Management#Property Tax Management#Property Tax#Real Estate#property taxes#Bricksnwall

0 notes

Text

7 Types of Taxes in Australia

Introduction:

All countries have a tax system in place, to pay for public, common societal, or agreed national needs and for the functions of government. Understanding the different types of taxes is crucial for both individuals and businesses operating in any country. In this article, we’ll explore 7 key types of taxes in Australia, shedding light on their purpose and impact.

Types of Taxes:

1. Personal Income Taxes:

Personal income tax is one of the primary sources of revenue for the Australian government. It is levied on the income earned by individuals and is progressive, meaning higher earners pay a larger percentage of their income. Anyone with over 180000 AUD income is required to pay 45% of their income.

2. Capital Gains Tax:

When individuals or businesses sell assets such as real estate or investments, they may be subject to capital gains tax. This tax is calculated on the profit made from the sale of these assets.

3. Corporate Taxes:

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The rate may vary, and it plays a significant role in funding government activities.

4. Goods and Services Tax (GST):

The Goods and Services Tax is a consumption tax levied on most goods and services sold in Australia. It is currently set at 10%, and businesses are required to register for GST if their annual turnover exceeds a certain threshold.

5. Property Taxes:

Property taxes in Australia can take various forms, including land tax and municipal rates. Land tax is imposed on the unimproved value of land, while municipal rates fund local government services.

6. Departure Tax:

A departure tax is a fee charged by a country when a person is leaving the country. When individuals leave Australia permanently or for an extended period, they may be subject to a departure tax. This tax aims to capture a portion of the wealth accumulated during the individual’s time in the country.

7. Fringe Benefits Tax (FBT):

FBT is levied on non-cash benefits provided to employees in addition to their salary or wages. The tax is levied on the employer, not the employee, and will be levied irrespective of whether the benefit is provided directly to the employee or an associate of the employee.

Conclusion:

Understanding the various types of taxes in Australia is essential for individuals and businesses alike. As the taxation landscape evolves, staying informed about these taxes is crucial for compliance and effective financial planning. Whether you’re an employee, business owner, or investor, navigating the Australian tax system is a key aspect of financial management.

Expertax Consulting provides professional Business Taxation services in Preston, Victoria.

0 notes

Text

WHAT ARE THE DIFFERENT TYPES OF INVOICES? IMPORTANCE OF INVOICING IN AN ENTERPRISE

Generally, the invoicing process is an important activity in an enterprise. It needs to be more structured, reliable, and effective since it is the mode of asking customers to make payments and bring cash to the company. Any business selling goods or services needs to be paid for. Invoice is an instrument asking for such payment. Any business enterprise needs to maintain records to keep track of transactions occurring as part of its business activities. Invoice is a document that preserves this important transaction record related to payment.

When it comes to invoices, every industry sector has its own specific requirements. The invoice for a construction industry would not necessarily have been the same as the invoice for any retail transaction. That is because invoices differ on whether they are for services provided on a time-based, weekly or regular basis or whether goods are bought or sold. On the basis of these various criteria for specific sectors, as well as for various goods and services, invoices can be classified as below’ However, in the end the invoice structure needs to comply with the regulatory requirements of each State/Country.

Types of Invoices

Standard Invoice

It is straightforward and is used to bill your services whenever a service is provided. This will include a description of service, cost, tax, payment methods accepted, and the due date. The standard invoice is used by a number of industries, such as retail, agriculture, wholesale and one can add other elements like shipping, discount, etc.

Export / Import Invoice

These invoices are one of the most important documents for international trade and ocean freight transport. It is a legal document issued by the seller (exporter) to the purchaser (importer) in an international transaction and serves as a contract and proof of sale between the purchaser and the seller. Simply it is used for customs declaration when the product is crossing international borders.

Progress Invoice

Progress invoicing also referred to as progress billing is the process of invoicing the client incrementally for the percentage of work that has been completed by the total amount of work due. It is commonly used in works that stretch over a long period. It is mostly used in the construction industry that not only takes a lot of time for each project but is also very expensive

Timesheet

This is a combination of timesheet and invoice which is generally used during a project. It is mostly used in process-oriented units. Not only does it record the number of hours worked on the project, but it also attaches the invoice for the amount payable by the client for the amount of work done. This is a special type that is preferred by professionals whose services are accessed on the basis of the time period for which the service is provided.

Utility Invoice

Utility invoice differs from other invoices as it mentions a due date, the amount of penalty payable after the due date, and the billing period. Generally, these are the invoices received by a company for natural gas, electricity, water and sewer charges that the company used during the previous month or another period of time.

Recurring Invoice

Recurring invoices can be used to bill customers for on-going services. This usually applies to the rental industry. This type of invoicing tool works well for subscription-based businesses and utility segments as well.

Pro-Forma Invoice

This is basically referred to as estimation or a quote. A Pro-forma invoice is a commitment to provide something. The terms in this may change as the project proceeds. It can be termed as Estimate or Quote and ultimately it moves to standard invoice later. Registration and Free trial are available for SmartAdmin’s invoicing software.

SMART ADMIN is a cloud-based software for generating GST Compliant Invoice, Payroll management, Timesheet, and Project Tracking – visit SMART ADMIN for FREE Trial and Registration.

0 notes

Text

What are the additional documents required for an MSDS certificate?

Below is the list of documents necessary for obtaining an MSDS certificate:

Company Information:

Company Letterhead

Email ID, Contact Number, and Website

Copy of GST Registration

Product Information:

Product Name

Percentage-wise composition of ingredients

Certificate of Analysis/Test Report

Product Image

0 notes

Text

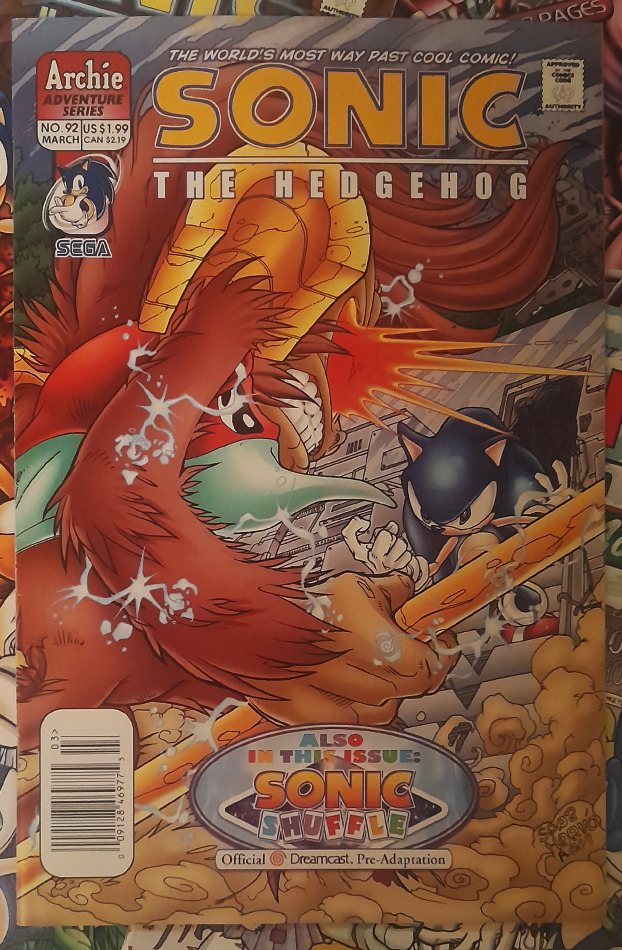

Sonic the Oz-Hog Act 3/12: Maximum Khanage!

Sonic the Hedgehog issue 92

AU Publication Date: 9th March 2001

Price: $4.98

No self-deprecating musings or long-winded prologues this month. There's quite a bit to cover, so let's just dive into round three of this rodent-related rabbling retrospect.

Much can change in the space of three years. Australia had come far since the release of January 1998's Sonic Firsts, and unfortunately not all of it positive. After half a decade of insistently proclaiming the policy was dead, then-Fearless Leader John Howard pulled a spectacular electoral backflip and, by the skin of its teeth, legislated the GST. From 1st July 2000, goods and services across the land were hit with a 10% price hike. The policy was marketed to voters as a means of easing tax collection by procuring money during production, as opposed to a US-style system of adding percentages at checkout. It didn't quite work out smoothly as they hoped, and the policy remains as decisive today as it was over 20 years ago.

Barely any products were spared from the increase, including publications produced locally and imported. MAD Magazine took the government to task with their infamous "GST Free" issue 377, jumping from $3.95 (cheap!) to $4.35 (not so cheap!). Comic books equally suffered; X-Men might've stopped Onslaught, but they couldn't stop the rise from $4.25 to $4.68, and for anyone not quick enough to buy issue 84 immediately, Sonic the Hedgehog spun up $4.50 to hover around the $5 mark before eventually settling at $4.95. A far cry from the glory days of 1993's piggy bank busting $2.25.

From a cynical standpoint, the GST's timely implementation felt like an attempt to monopolize on the impending tourist trade. Within two months, Australia would take global limelight with the Sydney Olympic Games, or as the late Juan Antonio Samaranch infamously declared "Syddernee!". Thousands travelled from overseas to watch the two week event, while millions tuned into Channel Seven to cheer on our teams bringing home 58 medals, an unprecedented tally which remains unbeaten to this day. Unfortunately the government's price hike failed to aid the flailing SEGA World Sydney, which closed its doors one final time a month after the closing ceremony.

Beyond a hectic few days in South Australia, the 2000-01 summer bushfire season was...n't that bad. A very surprising and much-needed reprieve before the catastrophic events come year's end. Eminem and Dido's collaboration Stan was just about to knock LeAnn Rimes off musical pole position. Steven Soderbergh's Traffic usurped Meg Ryan and Russell Crowe's thrilling Proof of Life as the countries number one film, but only one week before losing to the month-long reign of Miss Congeniality. DVD's and Wi-Fi were still foreign objects, thus Hollow Man was Video Ezy's top VHS release.

When it came to media domination however, a new king stood proud. Having won hearts and wallets throughout 1999, former children's champion Pikachu and pals were overthrown by the arrival of Goku and his crew. Initially launched on 31st January 2000, it wouldn't be until a heavy promotional push come July that Aussies fell head over heels into the world of Dragon Ball Z.

By 9th March 2001, the series was unstoppable; toys, magazines, bedspreads, videotapes, cards, Crazy Bones and virtually everything in between. Dragon Ball Z came, saw and conquered, and on that particular day, Aussies tuned into Cheez TV at 8am to lap up the premiere of Last Ditch Effort. Having suffered a humiliating defeat at the hands of Androids 17 and 18, the Z Warriors are left arguing among themselves as Piccolo sets out to make a life-changing decision. Meanwhile there's little Chi-Chi and Yamcha can do to assist the ailing Goku, having been struck down by the insidious Heart Virus. A situation only compounded with the ruthless Androids slowly closing in on their hideout.

It's a level of public praise Archie Comics could only envy.

The comic industry had been reeling for years. Sales were down all over the board, distributors barely getting books to shelves, and smaller retail chains dropping titles left and right. Archie had a solid track record, but columnists predicted the company would be lucky to reach 2006, sooner depending on how the Dan DeCarlo litigations went. Money was tight, and had it not been for the injection of revenue and public interest from the live-action Sabrina the Teenage Witch, even their top-selling speeder came perilously close to cancellation.

In an attempt to keep Sonic alive, editor Justin Gabrie was given the unenviable order of trimming the fat, which in true comic book fashion meant abruptly dropping all their freelancers. For several months no new stories were purchased, instead running whatever material was left on file. Unfortunately most of said freelancers had moved on by the time Archie's embargo was lifted, resulting in a 'skeleton crew' of two writers, two artists and two inkers. It didn't last, as by 2001, one artist had departed for the House of Mouse and the other publicly fired.

Issue 92's double billing of The Wrath of Khan and Sonic Shuffle: Premonition perfectly encapsulated the turbulent turmoil behind closed doors. With nobody available to draw the main story, Marvel stalwart Michael Higgins was rushed in. What should've been a happy reunion with former co-conspirator Karl Bollers was anything but, as he was given only the script and several back issues for reference. The finished product proved hardly his finest work, being unfamiliar with the franchise he resorted to tracing panels from said back issues just to meet the incredibly tight deadline. All while SEGA demanded at the last minute 8 pages be dedicated to promoting their latest game.

For all Archie's efforts getting the book out on time and into fan hands, said audience were furious once it arrived. Already incited after an impromptu interview with artist James Fry revealed newcomer Mina Mongoose was set up as Sonic's new love interest, they let it be known under no uncertain terms that 2001's first offering was a sign of the apocalypse. "Cancelled!" they hollered, with "If it makes it into next year, I'll be very impressed" and "They bury themselves in plot holes, and the artists try WAY too hard to make it look more of an anime instead of a comic book" between bitter breaths. Karl Bollers and James Fry were routinely harassed on Usenet and AIM for doing their jobs, and after spending years as everyone's favourite punching bag, Nate Morgan was temporarily sidelined to make space for Mina.

The sheer vitriol aimed towards the teen mongoose was staggering. Pointless for a comic book character, but staggering. Her design was ridiculed, her name (rumoured to be a Sailor Venus homage at the time) gutted, her super speed lauded, and her connection to Sonic (feeble as it was) lambasted. Fans labelled her as "pure fan character crap there to drive the nail into SatAM's coffin". Witnessing hate spiels on message boards became par the course, while enterprising fans littered Sonic HQ and teamARTAIL with art of Mina scribbled or outright slaughtered.

It's ironic. 2001 kicked off with fans jumping online to complain about the comic's writing, Geoffrey St. John being an underhanded jerk, and Mina Mongoose' existence heavily resented. And while the entire creative team changed between them, 2011 kicked off with... fans jumping online to complain about the comic's writing, Geoffrey St. John being an underhanded jerk, and Mina Mongoose' existence heavily resented. The more things change.

A pity life turned out the way they did. Somewhere is an alternate universe where Archie Sonic was never rebooted, a universe where I can only begin to imagine what Mina did to cheese off readers in early 2021.

Next Time: The mayhem continues in April with the revisitation of a spinoff comic equally popular as it was polarising. Until then, have a reconstruction of March 2001's personal survival kit. Life was fairly turbulent back then, but certainly could've been far worse compared to travesties going on in the world then and as now. Never forget to be grateful for what we already have and give even a minute of our times for those without. Even just lending an ear to someone worse off can make all the difference.

< Previous \ Index / Next >

#Sonic the Hedgehog#Archie Sonic#Sonic the Hedgehog Comics#Archie Comics#Comic Books#Karl Bollers#Michael Higgins#Justin Gabrie#Frank Strom#Monkey Khan#Dragon Ball Z#Mina Mongoose#Australia#2001#Musings

0 notes

Text

7 Types of Taxes in the Australian Tax System

Introduction:

All countries have a tax system in place, to pay for public, common societal, or agreed national needs and for the functions of government. Understanding the different types of taxes is crucial for both individuals and businesses operating in any country. In this article, we’ll explore 7 key types of taxes in Australia, shedding light on their purpose and impact.

Types of Taxes:

1. Personal Income Taxes:

Personal income tax is one of the primary sources of revenue for the Australian government. It is levied on the income earned by individuals and is progressive, meaning higher earners pay a larger percentage of their income. Anyone with over 180000 AUD income is required to pay 45% of their income.

2. Capital Gains Tax:

When individuals or businesses sell assets such as real estate or investments, they may be subject to capital gains tax. This tax is calculated on the profit made from the sale of these assets.

3. Corporate Taxes:

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The rate may vary, and it plays a significant role in funding government activities.

4. Goods and Services Tax (GST):

The Goods and Services Tax is a consumption tax levied on most goods and services sold in Australia. It is currently set at 10%, and businesses are required to register for GST if their annual turnover exceeds a certain threshold.

5. Property Taxes:

Property taxes in Australia can take various forms, including land tax and municipal rates. Land tax is imposed on the unimproved value of land, while municipal rates fund local government services.

6. Departure Tax:

A departure tax is a fee charged by a country when a person is leaving the country. When individuals leave Australia permanently or for an extended period, they may be subject to a departure tax. This tax aims to capture a portion of the wealth accumulated during the individual’s time in the country.

7. Fringe Benefits Tax (FBT):

FBT is levied on non-cash benefits provided to employees in addition to their salary or wages. The tax is levied on the employer, not the employee, and will be levied irrespective of whether the benefit is provided directly to the employee or an associate of the employee.

Conclusion:

Understanding the various types of taxes in Australia is essential for individuals and businesses alike. As the taxation landscape evolves, staying informed about these taxes is crucial for compliance and effective financial planning. Whether you’re an employee, business owner, or investor, navigating the Australian tax system is a key aspect of financial management.

Expertax Consulting is the best tax agent and accountant in Preston, Victoria. We offer the best individual taxation and business taxation services in Preston, Victoria. Contact us Now for the best taxation services.

0 notes

Text

What are the three types of GST Registration in India?

In India, there are primarily three types of GST registration:

Normal GST Registration: This type of registration is for regular taxpayers whose turnover exceeds the threshold limit specified by the GST law. They are required to collect GST on their sales and can claim input tax credit for GST paid on their purchases.

Composition Scheme Registration: Small businesses with a turnover below a certain threshold can opt for the composition scheme. Under this scheme, taxpayers pay tax at a fixed percentage of their turnover without collecting GST from customers. They cannot claim input tax credit.

GST Registration for Non-Resident Taxable Persons: Non-resident individuals or businesses supplying taxable goods or services in India need to register for GST. They are not required to have a physical presence in India to register under this category.

These are the main categories of GST registration in India, each catering to different types of taxpayers based on their turnover, business model, and residency status.

0 notes