#(mostly just planning and putting together the crowdfunding which was still a lot of work but like compare it to the past few months)

Explore tagged Tumblr posts

Text

vent incoming:

got my grades back for my courses last semester and most of it was to be expected, mostly A's, maybe an A-, etc. but i honestly can't get over the fact that my independent study (the buddy cole documentary) was for some reason given a B. like sure getting a B isn't bad per se, I usually get at least one B every semester and i honestly don't really care about what my exact gpa is as long as i can graduate, but come on. this school put me through months of psychological torment over this project and didn't even have the nerve to give me a B+??? i'm still coping with the self-doubt they forced on me and this bullshit is not helping!!

#honestly it's kind of hilarious ngl. especially bc i also got my documentary work counted as an independent study the previous semester#and the previous semester even tho i barely worked on the doc itself#(mostly just planning and putting together the crowdfunding which was still a lot of work but like compare it to the past few months)#they were willing to give me an A (my school doesn't do A+ so this is the highest mark possible)#vs this semester. like i'll admit my final assignment was late and could have been more polished#but i was literally on tour in documentary-mode 24/7 for several weeks. i filmed an entire comedy special! i put together a live interview!#not to mention having to fucking negotiate with my own college censoring the footage they'd promised me of an event i put together#and play nice with a professor who literally outed me on twitter in an attempt to cancel one of my best friends#at this point the ''B'' feels more like a petty grudge than anything else#like ok we can't get away with *actually* fucking over jessamine's grades bc clearly ze did do the work. but let's just give zir a B#like i will admit the audio quality in my final isn't great. and i could have used more polished footage in some sections#but counterpoint: 100+ students were arrested at a protest while i was editing and i was having a mental breakdown#the fact that i finished *anything* is goddamn impressive especially after they essentially conditioned me to hate myself any time i was#working on a project i loved!!!#due to the aforementioned student arrests my college did put out an option where we could change any letter grade this semester to pass/fai#so anything passing wouldn't impact our gpa if we didn't want it to. so i could just change the B to a ''pass''#but really what's the point. ''B'' is still a good grade and my GPA is fine (3.65 on a 4.0 grading scale. 2.0 is required to graduate)#it just sucks that after what i went through last semester i feel like nobody takes it seriously#i was reminiscing earlier about how it's honestly kind of funny how after that professor outed me on twitter#i was at the hotel with scott like an hour later sobbing and having an existential crisis about my relationship to gender#and scott was so supportive but also awkwardly being like#''i know i should offer the crying child a tissue but where the fuck are the tissues in this room what do i do''#and he just handed me a full-on towel instead like oh my god he was trying his best but also so clearly out of his depth#but of course i then had to remember how when i told that story to a different professor to be like ''this is how much scott cares about me#this guy called me fucking UNPROFESSIONAL for crying in front of the subject of my documentary?????????#like yeah maybe so but how DARE you call me unprofessional when a different professor tweeted my full name and gender without my consent#in an attempt to fucking cancel one of my friends for ''misgendering'' me for using pronouns i'm fine with him using!!!#i don't think i'm ever going to be able to forgive my college and i don't know how i'll be able to get through one more semester#that experience genuinely changed things about my psychology that i'm not proud of and i need to work through#so if i have to miss a goddamn kids in the hall event because i have class this november i am going to set something on fire

9 notes

·

View notes

Text

Crowdfunding II

Still on the topic of crowdfunding.

My team decided to launch a crowdfunding campaign on Indiegogo to gather extra funding for our short film, “Days of Night”, the story of a creative teenage girl who leads an extraordinary life in a town without sunlight, but who’s slowly realising she doesn’t belong there anymore.

It’s a very special project for a number of reasons. First of all, this is an idea carefully developed over many months in the context of the Masters programme I’m attending. I was very lucky to be put on the same team as Juulia, the director, and Clarice, the producer. We spent the first semester of the programme barely talking, walking with different crowds, and then suddenly we were having endless meeting to craft this very unusual story together, finding lots of things in common and tackling on themes we all felt particularly close to.

Our main goal was to tell a story about the importance of letting go and moving on, even if what comes next scares us. Clarice is also Brazilian, and together we have been watching from a distance as our country and our people live the darkest period in recent history, under an extreme-right political regime that has been wrecking our economy and destroying years of very slow social and cultural revolution. And here we are, living in Edinburgh in a similar turbulent time, with Brexit just around the corner, xenophobia threatening to take over the UK, and Scotland once again claiming for independence. If there was ever a good time to talk about change, this is it.

By taking this extreme point of view, the two last remaining inhabitants of a town in the dark, a teenage girl who doesn’t know what it’s like to live in the normal world and a middle-aged man who never found his place out there, we invite both open-minded and more traditional people to empathise with how the other side feels and thinks. Change is necessary, but also very difficult. We should encourage it for sure, but at the same time be mindful of certain concepts such as rootedness and fear of the unknown. Attachment is a powerful sentiment, and most things in life cannot be faced with a dualistic approach.

The plan is to use the short as proof of concept to develop a feature film that revolves around the same universe, characters and plot (hello, transmedia!). So getting it right before putting it in the festival circuit is crucial. That’s why we felt the £5000 budget allotted by the programme needed and extra boost. Unfortunately, a few things got in the way, including the fact that neither of us really had the time or the skills to develop a professional crowdfunding campaign, which made it a little difficult to launch it prior to the shoot.

We still tried to get some material to do it anyway, but ultimately decided against it. It wasn’t fair to such a beautiful project to do things in a hurry and not be able to convey how powerful and meaningful it was. I stick to what I said about emotional investment, and my producer and director both share that feeling. The idea is to wait until we’re done with the shoot to really focus on a post-production campaign, equally important to the results we want to achieve.

What’s really cool about doing it after the shoot is that we have actual footage to include in the campaign material, showing proof of everybody’s commitment and talent, as well as offering mind-blowing images to our audience, which will mostly be made of people outside of the industry who would have had more difficulty to understand certain aspects of filmmaking which might have otherwise prevented them from contributing. We also have our amazing cast that so greatly resembles our main characters in history and personality, and it shows in their performance.

Unfortunately, Facebook is not what it was 5 years ago when I campaigned for votes to my TV project, but Instagram has grew immensely, and every single adult person is on Whatsapp these days, so even the oldest folks can be impacted by our marketing. Also, we have had time to create and feed our Instagram page for over a month now, which helps with our professional reputation and works as a business card when people are looking for more information before putting money on the project.

I feel a bit anxious, but mostly excited. This is a story that deserves to be told, hopefully in more than one platform and definitely in all five continents. It’s a sensitive and universal topic, and the genre, fantastical coming-of-age, sets the perfect tone and mood.

We’ll just have to be creative and tenacious like our main character!

1 note

·

View note

Video

vimeo

GARAGE PUNK DOC IN THE WORKS!

Wherein Italian trash rock lifers dust off their old VHS concert tapes and pick up a new camera to document the 1990s garage rock scene.

About the last week of November, a trailer of sorts (above) was making the trash rock rounds. It’s cool clips and odd editing of some of the best garage bands of the 1990s piqued lots of interest and fevered sharings, garnering excited queries of “What?” “When?” “Who?” Gaaaaaggghh!!”

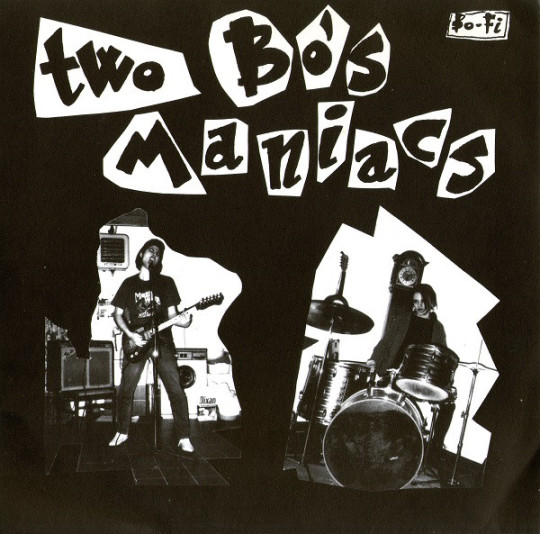

Well it turns out I had a clue, as this in-the-works documentary of the end-of-the-century garage rock scene (ala the one covered in my book) is being scrummed up by Italian uber-fans, Massimo Scocca and Gisella Albertini. They not only started booking great bands from all over the wold in their town of Torino and beyond northern Italy back in the early ‘90s, but they had their own great trash trio, Two Bo’s Maniacs. And yes, @newbombturks have been pals with them since they first booked us in 1993, and are one of many interview subjects planned for the film.

Since the chances of 20th Century Fox coming along to bankroll a doc on the 1990s garage punk scene is probably out of the realm of possibility, here’s hoping Massimo and Gisella get all the help and funding they need to finish the project.

We Never Learn checked in with Gisella for some more details on the project.

So, what is the name of the documentary, and why is it named that?

We needed a working title that could pretty much summarize what it is about, and not just cool sounding: Live The Life You Sing About - Tales of Low Budget and Desperate Rock’n’Roll.

We started wondering how bands that sound so different from one another are often perceived as part of the same category or “genre.” When someone asks us to define it, we end up with a long series of terms: garage, punk, rock’n’roll; sometimes with an extra “sixties” or “lo-fi” or “low-budget” in all possible combinations because they’re not not necessarily all true at the same time. Maybe the one thing they have in common is attitude. Something like: play, sing, do what you think is right, no matter what other people think or say. This often comes along with struggle, frustration, and the feeling of being on a different planet, so we threw in an extra “desperate.” It also happens to be the title of an old song that a band brought back to the present, which is another common theme here. However, it might still change, if we come up with a better idea.

Who started the idea to do the documentary, and why?

We came across a box of Video 8 and cassette tapes, forgotten in a closet for years, and something clicked: “We should do something with this!”

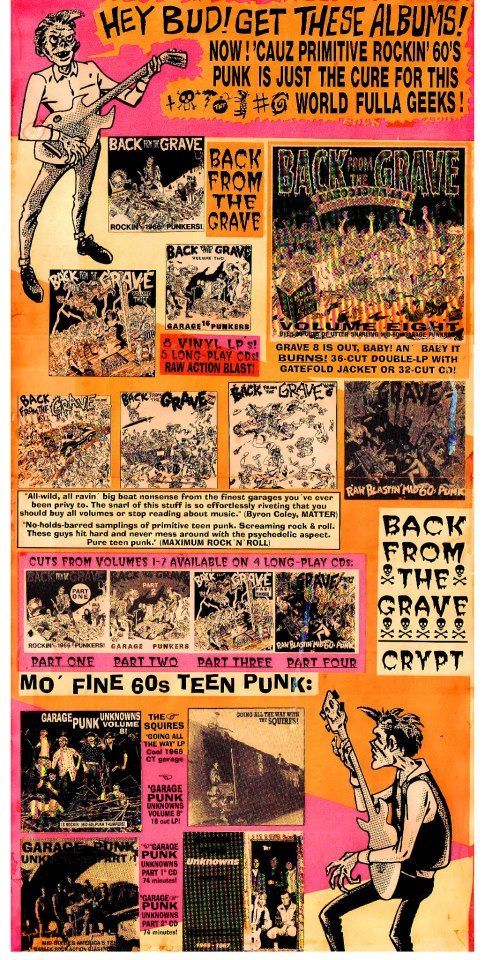

From time to time we happen to meet kids who were just babies or very young children in the 90’s, but are very much into this kind of music. Usually when they hear the names of the bands we saw play live, they look at us with amazement and envy. That reminds us of when we talked to people who had seen maybe like Bo Diddley and the Rolling Stones in the ‘60s in just one night. Ok, it means that we’re getting older, but at the same time, we feel lucky and grateful that someone worked hard to allow all that to happen. Now, it’s our chance to save someone “from the misery of being a Taylor Swift fan and do something good for the world” ( - Tim Warren). Ha ha ha!!!

Gisella (far right); Massimo (middle) - Photographer unknown

Is there a kind of timeframe to the bands in the movie?

I guess you know exactly what it means having to choose what to include and what to cut. So many stories that should be told, so little pages...or minutes. It’s just an impossible task. So, we somehow arbitrarily put some boundaries. We decided to focus on whatever happened between 1990 and 1999. Last decade of the millennium. Pretty epic, you know. The era of transition towards new technologies that deeply changed the way of doing many things, but at the same time, at least in this kind of music, strongly rooted in the previous decades of the century.

Oh sure, it’s not that a flying saucer with all these bands landed on Earth on January 1, 1990 and left on December, 1999. We will have flashbacks and references to the present as well. But since the documentary is mostly based on our own archive, it’s also necessarily influenced by the fact that we met some people and not others, and we saw, filmed, and photographed some bands more than others.

Tell me about what your backgrounds are -- in music or life in general.

Oh well, the main people [working on the doc] currently is the two of us -- with the precious help of a few people who could not devote themselves to the project until it’s completed, but worked with us and supported us in many ways.

When we came up with the idea, we had two main options: putting together a professional-looking proposal, sending it around and just wait, hoping some producer would notice its great potential and decide to invest thousands of dollars on it. Or, just jump in and start somehow and figure everything else out in the process. We chose the latter -- it’s more punk! There’s no fame and fortune guaranteed with this project. You do it just because you want to and no matter what.

I mean, we expected a bunch of dedicated fans and collectors would love to see a documentary like this. But being realistic, that’s a relatively small niche. We tried to figure what people know about this. in Italy, the closest they can usually get to this kind of music is what here is called the “Po-po-po-po-po-po-poo World Cup chant.” Real title: “Seven Nation Army” by the White Stripes. Not even something we plan to mention.

Next, a bunch of bands of the late 90’s-early 2000s, still quite a bit out of our range. Then numbers get lower and lower, down to the most obscure ones that only few geeks have ever heard of.

Anyway, if all goes well, we’ve finally found a stable technical crew. Also, we’re working on a few ways of funding the project, besides our own bank account, and including crowdfunding later. Plus a few other ideas, but nothing defined yet so I prefer not to say more, until we’re settled.

1995 7″

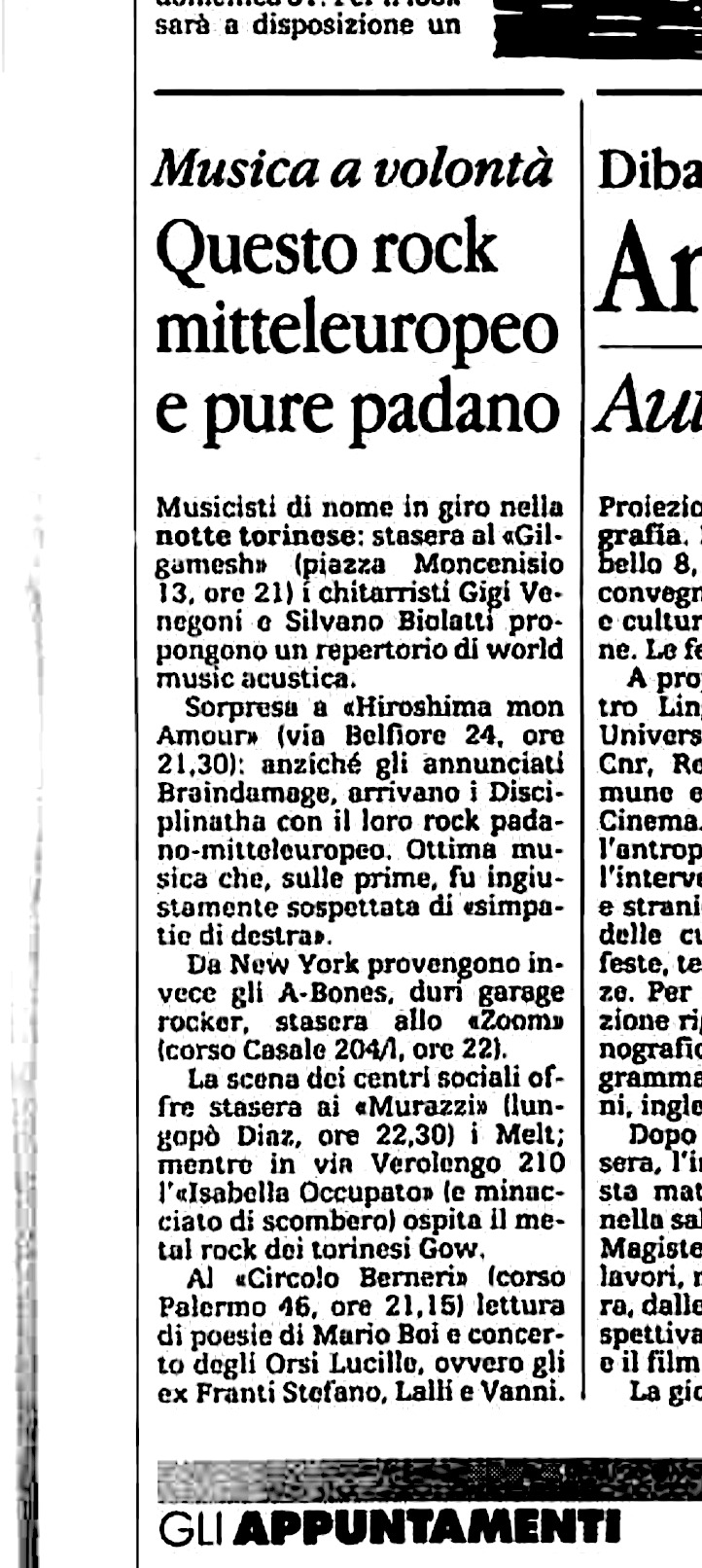

Torino newspaper clipping, 10/93. - “Shitty local bands get the main title, while they (A-Bones) only appear to deserve a "tough (?) garage rockers from NY.” - Gisella

How far along are you in finishing it, and when do you think it will be done?

We already did a lot of work on the archive and the structure that will help speed up the editing process. However, we still have quite a few interviews to make, presumably in the summer, and post-production that will involve quite a lot of work on sound especially. Sorry guys, sit down and relax, at least until late 2018. But we’ll keep everybody updated on our page.

Who have you talked to so far, and who do you hope to talk to when you come to the States?

We did long interviews with Tim Warren and Ben Wallers at their homes. Then we have eleven more, collected at gigs of the bands that happened to be touring Europe: opportunities that we couldn’t waste. Many interviews were between sound check and dinner, or even after the gig, and we might decide -- with the interviewees -- to use only part of them, or not at all, then do more while we’re in the U.S.A. Oh, I almost forgot to mention 30 audio-only interviews we had made for our zine in the ‘90’s that will be partially edited in as well. Who do we hope to talk to in the States? Hey, we’re Italian and superstitious, we don’t reveal names in advance!

Torino newspaper clipping, 1994.

Tell us about when you first started seeing these kind of garage punk bands. And what was an early show you saw that really made you get into this music?

Gisella: Sixties music has been my favorite since I was 4 or 5, when I found my mom’s Beatles records -- two 45’s -- in a cupboard. From there, you know, Kinks, Them, Animals, Pretty Things, and then Pebbles, Back From the Grave, and the bands more or less inspired by that. So when my friends and I heard that the guy from the Prisoners would play in town with his new band the Prime Movers, we all went, of course. There, we discovered the opening band would be the Wylde Mammoths. Great night, and a first glimpse of things to come. But it was really the Gories and Thee Headcoats records I came across at a local record store that blew my mind and had me say “Oh THIS is what I really want to hear!.” Everything else followed.

Massimo: Well I’m older than Gisella you know, and I saw some awesome bands during the ‘80s like Suicide, Gun Club, etc. I used to collect a lot of garage compilations, early blues records, r&b, soul, and all the good stuff. But the event that attracted me strongly into this music happened in 1990. I was in NYC, checking the Village Voice and saw that the Gories and the Raunch Hands would play that night. So I went there, and man, that gig was unbelievable! Totally different from anything you could hear at that time, and so shocking that it definitely changed my life forever.

I guess there will be a lot of old film footage in the movie. Can you tell us about one or two old videos you have that you are particularly excited about putting in the movie?

The first one we ever shot. it’s 1995, Micha [Warren, Crypt Records] tells us the Oblivians will be touring Europe. The 10” on Sympathy was awesome and the Country Teasers will be playing too, so we decide to follow them around for a week. Right before leaving, I remember a friend of mine had a Video 8 camera from the late 80s, ask him if we can borrow it, and he says yes. Great, off we go in our ‘70s orange, rusty Ford Transit that we can also sleep in. We get to Stuttgart, Germany. The venue is a sort of long narrow basement, really packed, hot wild atmosphere. Camera battery is fully charged, everything ready, we’re thrilled at the idea of filming such an event. Except... five minutes later, the camera’s dead! The battery was fucked up. What do we do? We can’t miss something like this. Between the sets, we ask if I can keep the camera plugged to the only socket around, at the back of the stage, and they say ok. So for the whole gig I’m there in a corner, trying not to pull my 3′ cord too much, horrified at the thought of blacking out amps and P.A., making the band and the crowd mad at me forever. Luckily, I didn’t. And we came home with some real crazy footage!

Was there any band so far that said NO to an interview for the film?

Considering that in most cases we basically popped up at sound-check asking for an interview for a basically nonexistent documentary, we’re really grateful that they all said yes in that moment, despite the often dire circumstances. It gave us the confidence to persist.

As for the future, we haven’t contacted 100% of those we’d like to interview yet. Until now there was only one who said, “Maybe, it depends.” But I already sort of expected this could happen, and in fact I contacted him way before all the others, in order to have time to figure out my countermoves. Not all hope is lost, ha!

Tell us anything else you want about the movie.

We want our documentary to reflect what we think was the feel of that era -- no bullshit, fun, crazy, and not too high tech!

Follow the film’s progress here!!

#livethelifedocumentary#cryptrecords#gories#theeheadcoats#twobosmaniacs#backfromthegrave#garagepunk#trashrock#garagerock#weneverlearn#we never learn

10 notes

·

View notes

Text

An alternative future

A project to self-build 33 sustainable homes in Ladywell is the antithesis of the large, impersonal developments that are commonplace in the capital, finds our write

WORDS BY ROSIE PARKYN

A housing crisis that sees pristine new apartments left empty for months on end while homelessness soars is such a trope of London life that we forget alternatives may exist. And yet across the city a quiet housing revolution is taking root, a gentle but determined riposte to waves of large-scale, imposed and impersonal developments that fuel a buy-to-let boom but leave home ownership and the ability to build long-term social ties out of reach for many Londoners.

Community-led housebuilding may well be the disruption so urgently needed, and yet it reflects old ideas that should not be radical or controversial. Put simply, it involves groups of people getting together to build their own homes.

At Church Grove in Ladywell, a team of local residents are waiting to start constructing the mixed-tenure affordable housing scheme in which they will eventually live. They were previously unknown to one another, and most come with limited experience of building. It might sound like the premise of a Channel 4 reality TV show, but this is the next stage of a real project that is years in the making.

Those poised to take up tools were selected by a lottery entered by 150 individuals and families, and will work to a plan they have co-designed and helped raise money to realise. A professional contractor will do the heavy lifting on the £8.6 million project, creating a waterproof shell into which the homes will be slotted.

Future residents will be trained to deliver packages of carpentry, plumbing and electrics across each other’s homes. This so-called “sweat equity” keeps costs down, but also develops skills and engenders a community spirit.

The resulting scheme will provide 33 sustainable homes, of which five will be for social rent to families on the council’s housing list. The rest will be a mix of share equity, shared ownership and affordable rent. Crucially, their market value will not rise exponentially in line with land prices in years to come: the site is held in a community land trust and has been leased by Lewisham Council for 250 years at a peppercorn rent.

The project is led by RUSS, a 900-strong volunteer-led community land trust founded by Kareem Dayes, who grew up on Walters Way – a self-build scheme created in SE23 in the 1980s. Despite its success, it didn’t spark a groundswell of similar initiatives, remaining a rare exemplar of community-led housebuilding for a couple of decades.

Perhaps in light of this, RUSS makes explicit its aim to both deliver this scheme and to grow and scale the community-led self-build model and the sustainable way of life that goes with it, including increased food security, reduced dependence on fossil fuels and protection of biodiversity.

These are increasingly mainstream concerns, and one of RUSS’s most appealing aspects is that it got on and built a prototype to address them. But it has taken graft and nerve to reach this point.

Trustee Ted Stevens identifies the moment they secured the land as key. While they were obliged to compete in a convoluted procurement process, the council saw the value of their proposal and chose them even though they didn’t come with cash incentives.

Since then, RUSS has been on a perpetual fundraising drive, progressing through the costs of planning permission and survey work on a combination of grants, loans and crowdfunding initiatives. Once the scheme is complete and rents begin to flow, RUSS hopes to build a war chest to fund future projects. But it’s a hair-raising balancing act at each stage.

Ted says that homes are designed with the occupier in mind. “It is the opposite of everything else. With nearly every form of new housing, they’re built and then they find people to go into them. Community-led housing does it the other way round: let’s bring the people together so they can have the homes they need.”

Budget considerations predominate, but the group also discuss how much space they need to grow food or dedicate to play, and how far they want to take on aspects of managing the scheme, such as repairs.

At this point, the site is mostly bare. Yet tucked away to the right is a beautiful, newly completed timber building constructed by volunteers using materials left over from commercial developments.

This community hub is a home for RUSS and a training space that passes on members’ skills to other would-be self-builders, but it will also serve as a vital reminder of what lies in reach as the group traverse the inevitable highs and lows of the build itself.

I’m shown around the hub by RUSS member Gordon O’Connor-Read, who worked on it every weekend for months. With a background in construction, he may be better acquainted with the tasks and territory that lie ahead, but is no less enthusiastic for that familiarity.

The team will spend an average of 20 hours a week on the residential build in addition to their day jobs, but there is more in it for Gordon than a home. “This is not just about Church Grove,” he says. “This is about promoting community-led housing.”

The group have gotten to know each other through fundraising for and building the hub, but admit that “building can be incredibly tense and there are a lot of pressures. Relationships will be tested.”

It feels as if RUSS will be ready for that though. This is a rather special brand of idealism – grown up and practical. All building projects carry significant financial and safety risks without the additional complexity of volunteer involvement. Yet despite the deep responsibility and detailed work involved in managing these risks, the project still manages to convey hope, imagination and possibility.

It helps that local government is getting the message. Lewisham Council recently granted the London Community Land Trust a site in Brasted Close in Sydenham without the complex procurement process that RUSS underwent.

And across London, 30 such projects have emerged, including Older Women’s Co-Housing, a group of women looking for friendly, helpful neighbours in old age. Others come together because they need affordable housing and want to generate the lowest possible carbon footprint.

It’s hard to predict exactly how the scheme will fare in the long term. A lot could go wrong during the build, and recent history recounts numerous housing schemes that went awry despite noble intentions. But few were designed and managed with this level of participation, and future residents have serious skin in the game.

People who build their own homes live in them for an average of 25 years, which has important benefits for the wider community. More than this, though, RUSS’s efforts to spread the word and reduce the learning curve for others are already paying off. Ted would like to see 20,000 homes a year built like this by 2040, and who could argue?

0 notes

Text

Peer-to-Peer Lending 101

Peer-to-peer lending has come on strong since the financial meltdown – and not by coincidence. That was about the time that banks decided they weren’t lending to anybody. The decision opened up an opportunity for the free market to provide another way for people to borrow money. And that's when the peer-to-peer phenomenon started getting popular.

There are a lot of reasons why P2P lending has grown so quickly. But is it a good loan source for you? Learn more here on getting a loan as part of your decision making process.

The complete guide on peer-to-peer lending:

What is peer-to-peer lending?

Lending sites in the U.S.

Why invest through a P2P lending platform?

Why borrow through a P2P lending platform?

How it works

Types of peer-to-peer loans

Available lending software

What is peer-to-peer lending?

Peer-to-peer lending can loosely be thought of as non-bank banking. That is, it's a process of lending and borrowing that takes place without the use of traditional banks. And for that reason, it looks a whole lot different than conventional banking.

Peer-to-peer lending is mostly an online activity. Borrowers come to the various peer-to-peer lending websites looking for loans – and better terms than what they can get through their local bank – while investors come looking to lend money at much higher rates of return than what they can get at a bank.

On the surface, it may seem as if the higher rates paid to peer-to-peer lending investors would result in higher loan rates for borrowers, but that's not generally the case.

Peer-to-peer lending brings borrowers and investors together on the same websites. Commonly known as “P2P”, it's an arrangement that “cuts out the middleman”, more commonly known as the banker.

Here's the thing, it costs money to operate a bank. You need a physical bank branch that has to be purchased and maintained. You also have to staff the operation with employees, and that requires paying multiple salaries, as well as related employee benefits. Then there's the acquisition and maintenance of costly equipment, such as in-house computer systems and software, as well as sophisticated security equipment.

Now multiply the costs of that single bank branch by multiple branches, and you start to get an idea why you might pay 15% for a loan at the same bank where you will earn less than a 1% return on funds held on deposit there. It’s not exactly an equitable – or democratic – financial arrangement.

P2P lending doesn't have all that bank branch real estate, hundreds or thousands of employees, or expensive equipment. And for that reason, you might see an arrangement that looks more like 10% loan rates, and 8% returns on your investment money.

Lending sites in the U.S.

Though the entire concept of peer to peer lending started in the Third World decades ago, there are now dozens of P2P platforms operating in the US. Most people have heard of Prosper and Lending club, but there are several other lenders in the U.S. Market.

Some of the more common peer to peer lending sites include:

Lending Club

Started in 2007, Lending Club has since grown to become the largest peer-to-peer lending platform on the web. By the end of 2015, the site funded nearly $16 billion worth of loans, including more than $2.5 billion in the last quarter of the year. Obviously Lending Club is doing a bunch of things right.

youtube

As a peer-to-peer lending platform, Lending Club is a site that brings investors and borrowers together to put together loans that will benefit both parties. The entire application process takes place on the website, and can be completed in a matter of minutes. And after you apply for a loan, the site enables you to link up to Credit Karma where you can begin monitoring your credit.

That last point can be important. Since so many of the loans arranged on Lending Club involve debt consolidation, borrowers often see an increase in their credit scores shortly after initiating the loan. The reason for this increase is the fact that the borrowers credit card debt utilization ratio declines after several credit cards have been consolidated into a single loan on the platform.

As a general rule, Lending Club makes personal loans of up to $35,000. Loans are fixed rate and unsecured. Terms range from 24 months to 60 months, after which your debt is fully paid. Interest rates range from 5.24% APR to a high of 31.70% APR, which is determined by your credit grade.

Credit grades are determined by your credit score and credit profile, as well as by your income, and both the amount and term of the loan.

The platform also charges an origination fee of between 1% and 5% of the loan amount that you are borrowing. These origination fees are not unusual in the personal loans space, and can still result in APRs that are much lower than those charged by credit cards. However, there are no application fees, and no prepayment penalties.

Though Lending Club is best known for personal loans, they also make business loans and medical loans (under their “Patients Solutions” plan) that can be used for medical procedures that are not covered by health insurance, such as fertility treatments and hair transplants.

To get more information about this industry leading company see more in our in depth Lending Club review.

Prosper

Founded in 2005, Prosper is the first among the popular peer 2 peer lending sites. The site has more than 2 million members and has funded more than $5 billion in loans to date. The platform works in a fashion similar to Lending Club, but not identical.

Like Lending Club, Prosper brings individual investors and borrowers together on the same website. Some of those investors are large concerns, such as Sequoia Capital, BlackRock, Institutional Venture Partners, and Credit Suisse NEXT Fund. This institutional participation is important in itself; as peer-to-peer lending is rapidly growing, large, institutional investors are becoming more actively involved on the funding side.

Prosper makes personal loans for amounts of between $2,000 and $35,000. Proceeds of the loan can be used for just about any purpose, including debt consolidation, home improvement, business purposes, auto loans, and short-term and bridge loans. You can also borrow money to adopt a child, purchase an engagement ring, or take out “green loans”, which enable you to finance systems that are based on renewable energy.

Loan terms range from 36 months to 60 months, with interest rates between 5.99% APR and 36.00% APR. Your loan rate is calculated on the basis of your Prosper Rating, which is similar to Lending Club's credit grade, and is based on your credit score and credit profile, loan term and loan amount.

Loans are fixed rate installment loans, which means that the debt will be fully paid by the end of the loan term. There are no prepayment penalties, and no hidden fees, though Prosper does charge origination fees similar to Lending Club.

Once again, the entire process takes place online where you can complete an application in minutes, and get your Prosper Rating. From that point, your interest rate will be determined , and your loan profile will be made available to prospective investors who will decide to fund the loan. Since funding is done in small increments from multiple investors, the loan will not fully fund until there is sufficient interest from enough investors. But that process could happen is little as a one or two days.

Learn more about the oldest of the P2P companies in the united States in our full Prosper review.

PeerStreet

PeerStreet is taking what Lending Club and Prosper did for personal loans and applying it to real estate. Founded in 2013, Peerstreet has expanded rapidly and their private marketplace is very easy to use.

Unlike other companies that are funneling their investors into REITs, PeerStreet allows investors to invest directly in real estate loans. The loans are not your typical 30 year mortgages but short term loans (6-24 months). The loans are for special situations like rehabilitation of a property that a landlord wishes to rent out.

The annual returns for the average investor work out to be between 6-12% and you can get started investing with as little as $1,000.

PeerStreet also does all their own underwriting on the properties and evaluate all their loan originators.

The one downside to PeerStreet is that you must be an accredited investor to participate in their marketplace. This pretty much eliminates most small investors from having a shot at this unique P2P lender.

Fundrise

Another crowdfunding source that only deals in real estate is Fundrise. If you’re looking for a way to invest in properties without having to do the day-to-day duties of a landlord, investing with Fundrise can be an excellent way to get your foot in the door.

One of the advantages of investing with Fundrise is you can start with as little as $1,000. Fundrise uses all of the smaller contributions to invest in larger loans. Fundrise is basically a REIT, which is a company who owns income-producing real estate. According to Fundrise’s website performance page, they had a return of 8.76% back in 2016.

When you’re looking at fees, Fundrise has a 1.0% annual fee. This includes all of the advisor fees and asset management. While 1.0% might sound like a lot compared to some other investment routes, Fundrise has lower fees than other REITs.

There are several benefits of choosing Fundrise. If their returns stay on course, you might make more than you would with a traditional REIT or with other P2P sites. On the other hand, these investments are going to be a little riskier than other options.

Getting started and investing with Fundrise is easy. You can create an account and start investing in no time. Even if you don’t have any experience with investing in real estate, Fundrise makes it incredibly easy. In fact, they now have Fundrise 2.0, which will handle all of the investing for you. Fundrise 2.0 will select the eFunds and eREITS and diversify your investments based on your goals.

To learn more, check out my complete Fundrise review.

Funding Circle

Funding Circle is a peer-to-peer lending site for people who are looking for a business loan. This is important, because the small business market is completely underserved by the banking industry. Not only do banks typically have extensive requirements before they will make a loan to a small business, but they also have a preference for lending to larger businesses that are better established. The small, one man or woman shop is often left out in the cold when it comes to getting business financing.

The platform has made more than $2 billion in loans to more than 12,000 small businesses around the world.

With Funding Circle, you can borrow as little as $25,000, to as much as $500,000 on a business loan at rates that start as low as 5.49% (the range is between 5.49% and 20.99%). Loan terms are fixed rate, and range from one year to five years. And of course, Funding Circle also has an origination fee, that is typically 4.99% of the loan amount you are borrowing.

You can borrow money for a variety of business purposes, including refinancing existing debt, buying inventory or equipment, moving or expanding your operating space, or even to hiring more employees.

One of the best features of Funding Circle is that you only need to be in business for as little as six months to three years.The application process takes as little as 10 minutes, and you can receive funding within 10 days. The entire process takes place online, and you will be assigned your own account manager to help guide you through the process. Learn more about their small business loans and investing in our Funding Circle reviews.

Upstart

A recent newcomer to the list of peer to peer sites, Upstart began operations in 2014, but has already funded more than $300 million in loans. Among the major peer-to-peer lenders, Upstart has the most in common with SoFi. Like SoFi, Upstart takes a closer look at non-traditional underwriting criteria, preferring to look at a borrower's potential, which includes consideration of the school you attended, the area of study, your academic performance, and your work history.

They do take more traditional lending criteria like credit and income into consideration. The primary focus is on looking to identify what they refer to as “future prime” borrowers. Those are borrowers who are early in life, but are showing signs of having strong future potential. For this reason, the platform carefully evaluates factors that contribute to future financial stability, and makes loans accordingly.

For example, Upstart reports that the average borrower on the platform has a FICO score of 691, an average income of $106,182, is 91% likely to be a college graduate, and 76% likely to be refinancing credit cards. The last point is important – borrowers who refinance credit cards are typically improving their financial standing almost immediately as a result of lowering their interest rates, reducing their monthly payment, and converting revolving debt into an installment loan.

Loan amounts range from $3,000-$35,000, with terms of from three years to five years, and have no prepayment penalty. The site claims that their rates are 30% lower than those of other lenders on average. Upstart reports that rates average 15% on a three-year loan, though they can range from 4.00% to 26.06% for three year loans, and between 6.00% and 27.32% for five year loans. Like the other peer-to-peer lenders, Upstart also charges an origination fee, which can range between 1% and 6% of the loan. See the full details in our Upstart Loans Review.

PeerForm

PeerForm is a peer-to-peer lending platform that was founded in 2010, and makes loans to both individuals and small businesses. The site is somewhat more tolerant on credit scores in that they will lend to borrowers with scores as low as 600 (most others require a score in the mid-600s or better).

Much like the other peer-to-peer platforms, you start by completing a simple online application, that takes no more than a few minutes. You select the type of loan that you want, as well as the amount, and then your request is put into a loan listing on the site. That is where investors decide to fund your loan (the process can take anywhere from one day up to two weeks). Once they do, the information you provided in your application is verified, and the funding process begins.

Interest rates range from a low of 6.44% to a high of 29.99%, and require an origination fee of between 1% and 5% of the loan amount. However, there are no application fees and no prepayment penalties. The loans are unsecured, and require no collateral.

You can borrow money for a wide range of purposes, including debt consolidation, a wedding loan, home improvement, medical expenses, moving and relocation, car financing and more. Loan amounts range between $1,000 and $25,000, and all loans are for a term of three years. Get all the details on this great company in our Peerform reviews for investors and borrowers.

Sofi

SoFi, which is short for Social Finance, has become one of the leading sources for student loan refinances available anywhere. This site is virtually synonymous with student loans, though they also provide mortgages and personal loans.

The platform was founded by people who are close to the college scene, and well acquainted with the nuances of student loan refinances. That is an area of finance that is not adequately served by the banking industry. There are just a few major lenders who will provide student loan refinances, and SoFi is one of them.

SoFi is a peer-to-peer lending platform where student loan refinances are granted largely on the basis of non-traditional criteria, such as type of occupation, the college or university you graduated from, your GPA, and your major – as well as your income and credit profile. But this means that loan approval is not strictly based on income or credit. The education related criteria weigh heavily in the decision.

This is important because while student loans are granted on a virtually automatic basis, student loan refinances require that you qualify based on your ability to repay. SoFi considers your educational background as part of the evidence that you can repay.

Also, as a peer-to-peer lender, SoFi is available seven days a week, and you can complete the entire application process online. The site claims that the typical member can save an average of $14,000 as a result of refinancing a student loan with them.

SoFi currently has rates on student loan refinances that range from 3.50% APR to 7.49% APR on fixed rate loans, and between 2.13% APR and 5.68% APR on variable rate loans. You can also refinance the entire amount of student loan debt that you currently have, as the platform does not indicate any maximum loan amount.

You can refinance both private student loans and federal student loans, though the site recommends that you be careful in refinancing federal loans. This is because federal loans come with certain protections that are not available with private source loans, nor with SoFi refinances. You have to appreciate that kind of openness and honesty in a lender of any stripe!

These are just a handful of the growing number of peer-to-peer companies in the United States.

Why would anyone invest through a P2P platform?

Higher returns on investment are a powerful motivator. This is especially true since interest rates on completely safe, short-term instruments like money market funds and certificates of deposit are commonly paying less than 1% per year. And even if you want to invest in longer-term securities to get higher returns, they're not there either. For example, the 10 Year US Treasury note currently pays only 1.82% per year. That's an incredibly low return considering that you will have to tie your money up for a full decade just to get it.

By contrast, an investor can easily get a return in the neighborhood of 10% per year on a portfolio of five-year loan notes, with blended credit profiles, by investing his or her money through a peer-to-peer platform.

Yes, there's more risk involved in investing/lending through a P2P platform – after all, there's no FDIC insurance on your money. But the rate is much higher than what it is on conventional fixed income instruments, as well as the fact that a P2P investor can create his own portfolio to match his own risk tolerance.

For this reason, peer-to-peer lending platforms tend to have plenty of investor money to lend out. And if you’re a borrower, that’s a win for you.

Why would a borrower use P2P?

If investing through peer-to-peer sites makes good sense for investors, there are probably even more reasons why a borrower would want to get a loan from one.

Here are just a few of them:

Interest rates – Depending on the type of loan taken, rates are often lower on P2P sites than what you can get through a bank. This is especially true when you compare P2P rates with those that you will pay for credit cards and business loans. It gets back to P2P platforms having a lower cost of doing business than the banks. They’re not lower in all cases, but they’re always worth a try on just about any loan type you want to take.

Credit profile – P2P platforms are not subprime lenders, but they will often make loans that banks won't. You'll be charged higher interest if you have credit blemishes, but that may be preferable to not being able to get a loan at all.

Loan purpose – P2P platforms are a lot less restrictive when it comes to the purpose of your loan. One example is business loans. A P2P lender might make you a personal loan for business purposes, while a bank may not want to make a business loan at all, under any guise.

Ease of application – The entire loan process is handled online, so you never have to leave your house. Even third-party verification and document signing can usually be done online. All you need to do is scan them, then either email them, or download them to a portal on the P2P site.

Speed – You can often handle the entire loan process, from application to receipt of funds, in little as two or three days. By contrast, certain bank loans can take weeks or even months to drag out.

No face-to-face meetings – Some people feel uncomfortable when applying for a loan requires a face-to-face meeting, particularly at a bank. Such meetings can often have the feel of a physical exam, and include requests by bank personnel for information and documents that make you feel uncomfortable. There are no face-to-face meetings when you apply for a loan through a peer-to-peer website.

Your loan application is processed anonymously – Investors will see your loan request, but you won't be personally identified in the process. There’s little danger that a neighbor who works at at bank will have access to your loan information, since a P2P is not a bank..

When you consider all of those advantages, it’s easy enough to see why people are increasingly choosing peer-to-peer sources over the local bank.

How it works

Each peer-to-peer lender works a little bit differently from the others, but there are some common steps to the loan application process.

It generally goes something like this:

You complete a brief questionnaire, the platform does a “soft credit pull”, and you're assigned a loan grade (we'll get deeper into these with individual P2P reviews).

Your loan inquiry will be made available to investors, who will review the loan request and determine if they want to invest at the assigned loan rate (which based on the loan grade).

When enough investor interest is shown in your loan, your loan will then be eligible to be funded.

You will then be required to furnish certain documentation, such as proof of income and employment, and a list of existing debts that you intend to repay with the new loan (refinances and debt consolidation loans are very common with P2P platforms).

The loan is then underwritten to make sure that the documentation supports your claims in the initial questionnaire; the package will either be approved for funding, or there will be a request for additional documentation.

Once fully approved, the loan documents will be prepared, and sent to you for signature.

Funds are typically wired to your bank account within 24 to 48 hours of the receipt of your signed documents by the peer-to-peer platform

Though the process may seem as if it takes several weeks, it will actually proceed very quickly if you are prepared to immediately furnish any and all required documentation. Since you can usually scan and email information, the entire application process can be compacted down to just a few days.

Loan amounts granted are typically anywhere between $2,000 and $35,000, though many platforms will lend higher amounts for various purposes – all the way up to well over $100,000 depending on the loan purpose. You will usually be required to have a credit score in the mid-600s or higher in order to qualify, though loans for those with impaired credit are becoming more common. And loans typically run between three years and five years, but once again there is significant flexibility for different loan types and from different lending platforms.

P2P platforms usually don't charge application fees, or any of the various fees that are generally charged by banks in connection with loans. But one fee with peer-to-peer loans that you will need to be aware of is that they generally charge origination fees. They can represent anywhere from 1% to 5% of the loan amount provided, and are usually deducted from the loan proceeds. So if you are approved for a $10,000 loan with a 2% origination fee, $200 will be deducted from the amount of the loan proceeds that you will receive.

The actual amount of the origination fee is closely tied to your loan grade, which is largely (but not entirely) determined by your credit profile. Other factors include the term of the loan, the purpose, the loan amount and your income or employment.

Types of peer-to-peer loans

As the number of peer-to-peer lenders has expanded, so have the types of loans that are available through them.

Common loan types available include:

Not all peer-to-peer lenders do all of these loans, in fact a single platform typically specializes in just one or two loan types. But never assume that a certain kind of loan is not available through a peer-to-peer platform somewhere; new sites are coming up all the time, and some are moving into previously unexplored territory.

Investing Software Services

As interest in investing through peer-to-peer sites becomes more popular, there is growing demand for software services that can help investors select specific loans – or notes – that they want to invest in. These software services help with the construction, management, custody, and reporting requirements for a portfolio of peer-to-peer loans.

An example of such a provider is NSR Invest, who entered the P2P investing software services market last year.

NSR Invest is a managed account investment platform that provides P2P investment tools to financial advisors. They launched a new generation of software that is enabling financial advisors to establish and manage separate investment accounts specifically through Lending Club. And though the specific software is new, NSR Invest has actually been working with Lending Club since 2011, and also has ongoing relationships with Prosper Marketplace and Funding Circle.

NSR Invest is hardly alone, even though the industry is new. Some of the more prominent peer-to-peer investing software services include:

Lending Robot

BlueVestment

Peer Trader

PeerCube

Each of these firms are actively working to improve the investment experience on P2P platforms. And as they do, the lending process itself will become increasingly streamlined and more efficient.

Despite the fact that peer-to-peer lending has been happening in the US for only a few years, the practice is growing rapidly. As general participation increases, along with the various loan types the industry will serve, peer-to-peer lenders will provide serious competition for banks when it comes to lending.

But the future is already here, since hundreds of thousands of people have already taken loans through the many peer-to-peer lending platforms that are up and running. Have you tried to use one yet, either as an investor or a borrower?

The post Peer-to-Peer Lending 101 appeared first on Good Financial Cents.

from All About Insurance https://www.goodfinancialcents.com/peer-to-peer-lending/

0 notes

Text

4 things I would’ve done differently in my successful crowdfunding campaign

Early in 2016 I released my first new album in five years.

It felt great to shake off the rust. And some good stuff came of it (besides the simple satisfaction of putting new music into the world): a nice review in No Depression, a video premiere on KCRW, a super-fun string of seven shows in Portland, Oregon with the band who helped me create the album, that sort of thing.

But everything about this release, especially the PledgeMusic and PR campaigns surrounding the album, reminded me that anything done well — and done mostly DIY — is bound to eat up twice as much time as you initially anticipated.

Last year, in the midst of my crowdfunding campaign, I wrote “A Musician’s Guide to PledgeMusic: building and running a campaign for my upcoming album.” For anyone who hasn’t run a crowdfunding campaign before, that article is a pretty thorough summary of the process, or at least my process with PledgeMusic.

But in hindsight, there’s a handful of things I would’ve done differently to make better use of my time during my PledgeMusic campaign. I’m not saying it’ll necessarily apply to you or your campaign, but maybe my perspective will be useful.

I also realize that some of these “lessons” have already been taught in a number of crowdfunding tutorials. Why didn’t I take them to heart before I started my campaign? I guess I was running the kind of campaign that came most naturally. Live and learn!

So here it is…

1. I wouldn’t spend as much time creating the campaign video

In the end I’d say that about 95% of the contributors to my PledgeMusic campaign were already fans, friends, or family. As long as my campaign video didn’t look like a catastrophe, many of them were probably going to contribute anyways.

I say this because, well, I spent a long time making my campaign video. My editing skills are limited, and I didn’t have the budget to hire someone to make the video for me. Thus, to get the thing to look decent and to capture the spirit of the project, it probably took me three times longer than it should have: collecting footage and gathering up photos from the session, shooting new stuff, getting two of the musicians on the album to do interviews, creating graphics, writing my “script,” figuring out how to use Final Cut Pro X, and then cutting it all together.

I’m proud of the video I made for the campaign, don’t get me wrong — but I seriously think I could’ve reached my goal almost as quickly if I’d just talked into my iPhone camera for 45 seconds and told people why I was excited about the new album.

So, is the video important? Yes. But it doesn’t need to be a blockbuster with a hundred cuts, a bunch of B roll, and multiple talking heads. If you can deliver the message convincingly with minimal distractions, go that route. Find a good room with good lighting, set up your camera, press record, talk to your fans, and save up your energy and time so you can avoid this next mistake…

2. I would make private Facebook messages my #1 priority from the start

If I remember correctly, I think it was about 15-20 days into my campaign when I realized that the most effective thing driving pledges was private messages to my friends on Facebook. NOT followers of my band page. Friends of my personal profile.

I’d spent the first couple weeks of the campaign worrying about big picture stuff: the launch, my website, the email newsletters, tweets and Instagram photos and Facebook posts, etc.

THEN I started to write to people individually. And they responded. I’d say at least 25% of the people I wrote to personally ended up contributing. (And an added bonus is you get to strike up conversations with people you haven’t talked to in a while.)

So what’s the problem? Well, it takes FOREVER. I have more than a thousand “friends” on Facebook and I didn’t want to spam them all with a copy-and-pasted message. So I tried to customize it, at least a little bit, to acknowledge the fact that I’m asking a real live human being for their support; and that meant that I could really only write to about 20 people a night, after you factor in my job, family, (infrequent) hygiene, and anything else I needed to do for the PledgeMusic campaign that day.

So here I am discovering this approach that REALLY worked for boosting contributions at the same time as I’m nearing my goal. By the time I reached my goal, I’d probably only written to a few hundred of my friends on Facebook at most. That’s less than a quarter of my FB friends.

It sounds crass to lump my social media friends into one big statistic, but basically, at the end of my campaign, 75% of the community that was 25+% responsive remained untapped. Unasked. In short: had I started writing people personally a whole lot sooner, I could’ve raised a whole lot more money.

Which leads me to another issue…

3. I should have set a higher initial goal OR had a clearer plan for continuing “the ask” with stretch goals

I’ll be honest. Despite all the advice of every “crowdfunding expert” out there, I didn’t feel comfortable reaching out to people individually to ask for additional support once I’d already achieved my goal. It felt… icky.

I know, I know. Shame! Shame!

I set a modest goal. Just enough to master and manufacture the album, plus pay a publicist for about 3 months of PR help.

I met that goal in less than 30 days, with 30 days remaining in my 60-day campaign.

After those 30 days, I still had 800+ FB friends that I’d yet to write, despite the fact that this method had proven to be the most effective way of driving pre-sales.

So I guess there’s two conclusions:

I should’ve started with a higher goal, and had more ambitious plans: music video budget, tour support, a radio or streaming promotion campaign! (There’s no shortage of things to spend money on when releasing new music).

Or, I should’ve built clear stretch-goals into the campaign from the start, and made a point of mentioning them all along the way. One stretch goal could’ve been, “Hey, if we can raise an extra $2000, we can press vinyl!” If I’d made a clearer point of mentioning stretch goals along the way, I’d probably have been able to overcome that self-conscious voice inside me that said, “You’ve reached your goal; don’t be greedy.”

4. I wouldn’t have offered as many exclusives

It was fun to come up with a ton of different offerings to meet every kind of “price point.” But honestly, most people contributed $100 or less. Some people contributed $500 or more. But I think I can count on two hands the number of people who contributed an amount between $100-500.

However, even if only two people end up ordering the thing you’re offering for $150, you still have to MAKE it and ship it to them! That potentially means design costs, manufacturing costs, postage, and — last but not least — time.

For sanity, budget, and time reasons, I think my next campaign will offer fewer exclusives, the bulk of which would be priced lower than $100. Keep in mind that fans who want to contribute more can always bundle multiple exclusives together.

Well, there they are: the four things I wish I’d done differently. Hopefully this perspective helps as you’re dreaming up your next crowdfunding campaign.

If you’d change anything about how you ran YOUR previous crowdfunding campaigns, let me know in the comments. I think it could be a helpful conversation.

Go HERE to for more information about building a PledgeMusic campaign from the start.

The post 4 things I would’ve done differently in my successful crowdfunding campaign appeared first on DIY Musician Blog.

0 notes

Text

Peer-to-Peer Lending 101

Peer-to-peer lending has come on strong since the financial meltdown – and not by coincidence. That was about the time that banks decided they weren’t lending to anybody. The decision opened up an opportunity for the free market to provide another way for people to borrow money. And that's when the peer-to-peer phenomenon started getting popular.

There are a lot of reasons why P2P lending has grown so quickly. But is it a good loan source for you? Learn more here on getting a loan as part of your decision making process.

The complete guide on peer-to-peer lending:

What is peer-to-peer lending?

Lending sites in the U.S.

Why invest through a P2P lending platform?

Why borrow through a P2P lending platform?

How it works

Types of peer-to-peer loans

Available lending software

What is peer-to-peer lending?

Peer-to-peer lending can loosely be thought of as non-bank banking. That is, it's a process of lending and borrowing that takes place without the use of traditional banks. And for that reason, it looks a whole lot different than conventional banking.

Peer-to-peer lending is mostly an online activity. Borrowers come to the various peer-to-peer lending websites looking for loans – and better terms than what they can get through their local bank – while investors come looking to lend money at much higher rates of return than what they can get at a bank.

On the surface, it may seem as if the higher rates paid to peer-to-peer lending investors would result in higher loan rates for borrowers, but that's not generally the case.

Peer-to-peer lending brings borrowers and investors together on the same websites. Commonly known as “P2P”, it's an arrangement that “cuts out the middleman”, more commonly known as the banker.

Here's the thing, it costs money to operate a bank. You need a physical bank branch that has to be purchased and maintained. You also have to staff the operation with employees, and that requires paying multiple salaries, as well as related employee benefits. Then there's the acquisition and maintenance of costly equipment, such as in-house computer systems and software, as well as sophisticated security equipment.

Now multiply the costs of that single bank branch by multiple branches, and you start to get an idea why you might pay 15% for a loan at the same bank where you will earn less than a 1% return on funds held on deposit there. It’s not exactly an equitable – or democratic – financial arrangement.

P2P lending doesn't have all that bank branch real estate, hundreds or thousands of employees, or expensive equipment. And for that reason, you might see an arrangement that looks more like 10% loan rates, and 8% returns on your investment money.

Lending sites in the U.S.

Though the entire concept of peer to peer lending started in the Third World decades ago, there are now dozens of P2P platforms operating in the US. Most people have heard of Prosper and Lending club, but there are several other lenders in the U.S. Market.

Some of the more common peer to peer lending sites include:

Lending Club

Started in 2007, Lending Club has since grown to become the largest peer-to-peer lending platform on the web. By the end of 2015, the site funded nearly $16 billion worth of loans, including more than $2.5 billion in the last quarter of the year. Obviously Lending Club is doing a bunch of things right.

youtube

As a peer-to-peer lending platform, Lending Club is a site that brings investors and borrowers together to put together loans that will benefit both parties. The entire application process takes place on the website, and can be completed in a matter of minutes. And after you apply for a loan, the site enables you to link up to Credit Karma where you can begin monitoring your credit.

That last point can be important. Since so many of the loans arranged on Lending Club involve debt consolidation, borrowers often see an increase in their credit scores shortly after initiating the loan. The reason for this increase is the fact that the borrowers credit card debt utilization ratio declines after several credit cards have been consolidated into a single loan on the platform.

As a general rule, Lending Club makes personal loans of up to $35,000. Loans are fixed rate and unsecured. Terms range from 24 months to 60 months, after which your debt is fully paid. Interest rates range from 5.24% APR to a high of 31.70% APR, which is determined by your credit grade.

Credit grades are determined by your credit score and credit profile, as well as by your income, and both the amount and term of the loan.

The platform also charges an origination fee of between 1% and 5% of the loan amount that you are borrowing. These origination fees are not unusual in the personal loans space, and can still result in APRs that are much lower than those charged by credit cards. However, there are no application fees, and no prepayment penalties.

Though Lending Club is best known for personal loans, they also make business loans and medical loans (under their “Patients Solutions” plan) that can be used for medical procedures that are not covered by health insurance, such as fertility treatments and hair transplants.

To get more information about this industry leading company see more in our in depth Lending Club review.

Prosper

Founded in 2005, Prosper is the first among the popular peer 2 peer lending sites. The site has more than 2 million members and has funded more than $5 billion in loans to date. The platform works in a fashion similar to Lending Club, but not identical.

Like Lending Club, Prosper brings individual investors and borrowers together on the same website. Some of those investors are large concerns, such as Sequoia Capital, BlackRock, Institutional Venture Partners, and Credit Suisse NEXT Fund. This institutional participation is important in itself; as peer-to-peer lending is rapidly growing, large, institutional investors are becoming more actively involved on the funding side.

Prosper makes personal loans for amounts of between $2,000 and $35,000. Proceeds of the loan can be used for just about any purpose, including debt consolidation, home improvement, business purposes, auto loans, and short-term and bridge loans. You can also borrow money to adopt a child, purchase an engagement ring, or take out “green loans”, which enable you to finance systems that are based on renewable energy.

Loan terms range from 36 months to 60 months, with interest rates between 5.99% APR and 36.00% APR. Your loan rate is calculated on the basis of your Prosper Rating, which is similar to Lending Club's credit grade, and is based on your credit score and credit profile, loan term and loan amount.

Loans are fixed rate installment loans, which means that the debt will be fully paid by the end of the loan term. There are no prepayment penalties, and no hidden fees, though Prosper does charge origination fees similar to Lending Club.

Once again, the entire process takes place online where you can complete an application in minutes, and get your Prosper Rating. From that point, your interest rate will be determined , and your loan profile will be made available to prospective investors who will decide to fund the loan. Since funding is done in small increments from multiple investors, the loan will not fully fund until there is sufficient interest from enough investors. But that process could happen is little as a one or two days.

Learn more about the oldest of the P2P companies in the united States in our full Prosper review.

PeerStreet

PeerStreet is taking what Lending Club and Prosper did for personal loans and applying it to real estate. Founded in 2013, Peerstreet has expanded rapidly and their private marketplace is very easy to use.

Unlike other companies that are funneling their investors into REITs, PeerStreet allows investors to invest directly in real estate loans. The loans are not your typical 30 year mortgages but short term loans (6-24 months). The loans are for special situations like rehabilitation of a property that a landlord wishes to rent out.

The annual returns for the average investor work out to be between 6-12% and you can get started investing with as little as $1,000.

PeerStreet also does all their own underwriting on the properties and evaluate all their loan originators.

The one downside to PeerStreet is that you must be an accredited investor to participate in their marketplace. This pretty much eliminates most small investors from having a shot at this unique P2P lender.

Fundrise

Another crowdfunding source that only deals in real estate is Fundrise. If you’re looking for a way to invest in properties without having to do the day-to-day duties of a landlord, investing with Fundrise can be an excellent way to get your foot in the door.

One of the advantages of investing with Fundrise is you can start with as little as $1,000. Fundrise uses all of the smaller contributions to invest in larger loans. Fundrise is basically a REIT, which is a company who owns income-producing real estate. According to Fundrise’s website performance page, they had a return of 8.76% back in 2016.

When you’re looking at fees, Fundrise has a 1.0% annual fee. This includes all of the advisor fees and asset management. While 1.0% might sound like a lot compared to some other investment routes, Fundrise has lower fees than other REITs.

There are several benefits of choosing Fundrise. If their returns stay on course, you might make more than you would with a traditional REIT or with other P2P sites. On the other hand, these investments are going to be a little riskier than other options.

Getting started and investing with Fundrise is easy. You can create an account and start investing in no time. Even if you don’t have any experience with investing in real estate, Fundrise makes it incredibly easy. In fact, they now have Fundrise 2.0, which will handle all of the investing for you. Fundrise 2.0 will select the eFunds and eREITS and diversify your investments based on your goals.

To learn more, check out my complete Fundrise review.

Funding Circle

Funding Circle is a peer-to-peer lending site for people who are looking for a business loan. This is important, because the small business market is completely underserved by the banking industry. Not only do banks typically have extensive requirements before they will make a loan to a small business, but they also have a preference for lending to larger businesses that are better established. The small, one man or woman shop is often left out in the cold when it comes to getting business financing.

The platform has made more than $2 billion in loans to more than 12,000 small businesses around the world.

With Funding Circle, you can borrow as little as $25,000, to as much as $500,000 on a business loan at rates that start as low as 5.49% (the range is between 5.49% and 20.99%). Loan terms are fixed rate, and range from one year to five years. And of course, Funding Circle also has an origination fee, that is typically 4.99% of the loan amount you are borrowing.

You can borrow money for a variety of business purposes, including refinancing existing debt, buying inventory or equipment, moving or expanding your operating space, or even to hiring more employees.

One of the best features of Funding Circle is that you only need to be in business for as little as six months to three years.The application process takes as little as 10 minutes, and you can receive funding within 10 days. The entire process takes place online, and you will be assigned your own account manager to help guide you through the process. Learn more about their small business loans and investing in our Funding Circle reviews.

Upstart

A recent newcomer to the list of peer to peer sites, Upstart began operations in 2014, but has already funded more than $300 million in loans. Among the major peer-to-peer lenders, Upstart has the most in common with SoFi. Like SoFi, Upstart takes a closer look at non-traditional underwriting criteria, preferring to look at a borrower's potential, which includes consideration of the school you attended, the area of study, your academic performance, and your work history.

They do take more traditional lending criteria like credit and income into consideration. The primary focus is on looking to identify what they refer to as “future prime” borrowers. Those are borrowers who are early in life, but are showing signs of having strong future potential. For this reason, the platform carefully evaluates factors that contribute to future financial stability, and makes loans accordingly.

For example, Upstart reports that the average borrower on the platform has a FICO score of 691, an average income of $106,182, is 91% likely to be a college graduate, and 76% likely to be refinancing credit cards. The last point is important – borrowers who refinance credit cards are typically improving their financial standing almost immediately as a result of lowering their interest rates, reducing their monthly payment, and converting revolving debt into an installment loan.

Loan amounts range from $3,000-$35,000, with terms of from three years to five years, and have no prepayment penalty. The site claims that their rates are 30% lower than those of other lenders on average. Upstart reports that rates average 15% on a three-year loan, though they can range from 4.00% to 26.06% for three year loans, and between 6.00% and 27.32% for five year loans. Like the other peer-to-peer lenders, Upstart also charges an origination fee, which can range between 1% and 6% of the loan. See the full details in our Upstart Loans Review.

PeerForm

PeerForm is a peer-to-peer lending platform that was founded in 2010, and makes loans to both individuals and small businesses. The site is somewhat more tolerant on credit scores in that they will lend to borrowers with scores as low as 600 (most others require a score in the mid-600s or better).

Much like the other peer-to-peer platforms, you start by completing a simple online application, that takes no more than a few minutes. You select the type of loan that you want, as well as the amount, and then your request is put into a loan listing on the site. That is where investors decide to fund your loan (the process can take anywhere from one day up to two weeks). Once they do, the information you provided in your application is verified, and the funding process begins.

Interest rates range from a low of 6.44% to a high of 29.99%, and require an origination fee of between 1% and 5% of the loan amount. However, there are no application fees and no prepayment penalties. The loans are unsecured, and require no collateral.

You can borrow money for a wide range of purposes, including debt consolidation, a wedding loan, home improvement, medical expenses, moving and relocation, car financing and more. Loan amounts range between $1,000 and $25,000, and all loans are for a term of three years. Get all the details on this great company in our Peerform reviews for investors and borrowers.

Sofi

SoFi, which is short for Social Finance, has become one of the leading sources for student loan refinances available anywhere. This site is virtually synonymous with student loans, though they also provide mortgages and personal loans.

The platform was founded by people who are close to the college scene, and well acquainted with the nuances of student loan refinances. That is an area of finance that is not adequately served by the banking industry. There are just a few major lenders who will provide student loan refinances, and SoFi is one of them.

SoFi is a peer-to-peer lending platform where student loan refinances are granted largely on the basis of non-traditional criteria, such as type of occupation, the college or university you graduated from, your GPA, and your major – as well as your income and credit profile. But this means that loan approval is not strictly based on income or credit. The education related criteria weigh heavily in the decision.

This is important because while student loans are granted on a virtually automatic basis, student loan refinances require that you qualify based on your ability to repay. SoFi considers your educational background as part of the evidence that you can repay.