#” “monetary policy

Explore tagged Tumblr posts

Text

Foreplay w/ Nanami leading up to hate sex is just asking him why we can't print more money

#nanami kento#Finance bro mode : activated#Man's dicking you down in a mating press so he can explain basic monetary policy to you face to face#romance isn’t dead#jjk nanami#jujutsu kaisen

29 notes

·

View notes

Text

Dollarization is so funny. “Yeah our currency is too fucked up to function, we’re just gonna use theirs now.”

#clearly the US dollar is too important to be managed by one country#American monetary policy should be placed in the hands of the UN

55 notes

·

View notes

Note

When minting new coins and decreeing that coins showing the former monarch or monarchs were no longer legal tender, was it common to have an amnesty period, where anyone who had coins with the former monarch could trade them in for coins of equal value showing the new monarch? Was this ever used as a pretext to devalue currency, as changing from old to new currency in our own world often is?

Yes!

As I suggested in the previous post, the practice of "renovatio monetae" involved a fair bit of public outreach - such that the royal decree announcing one generally came with a grace period of a couple months to allow for people to make the trek to the royal mint, usually coordinated with seasonal markets and fairs.

And yes, medieval governments used the opportunity to adjust monetary policy in a number of ways. In addition to making money through seignorage by carefully constructing the difference between old coins turned in vs. new coins handed out in order to ensure that the crown would profit from a "hidden" tax, the renovatio monetae could be used to either "cry down" (devalue) the new currency or "cry [it] up" (revalue) - depending on which monetary policy approach the government wanted to take.

25 notes

·

View notes

Text

Brazil Central Bank Steps in Currency Markets Again Amid Selloff

Brazil’s central bank stepped into currency markets again on Tuesday as the real continues to weaken even after policymakers pledged to lift interest rates to eight-year highs.

The spot auction was the latest in a series of interventions from the bank as it tries to tame a recent spike in volatility that has weakened the real to record lows.

The real jumped on the announcement, rising as much as 0.6% versus the dollar Tuesday morning in one of the best performances in emerging markets. Still, it remains among one of the world’s worst-performing major currencies, weakening about 20% this year.

Investors have grown increasingly skeptical of the government’s pledges to shore up public accounts and address the country’s debt trajectory. President Luiz Inacio Lula da Silva last month unveiled new income tax breaks alongside a plan to cut 70 billion reais ($11.5 billion) in spending, disappointing traders who saw it as the latest sign that the leftist leader remains more focused on boosting growth than bolstering Brazil’s fiscal outlook.

Continue reading.

#brazil#brazilian politics#politics#economy#central bank#monetary policy#image description in alt#mod nise da silveira

3 notes

·

View notes

Text

🎙 NEW PODCAST ~ This week we spoke to Tony Arterburn and dove deep into the monetary challenges facing America, dissecting how the ruling elite have weaponized the dollar as a tool of global control.

Apple Podcasts: https://podcasts.apple.com/us/podcast/guest-tony-arterburn-mastering-money-how-to-outsmart/id1439014279?i=1000677319630

Spotify: https://open.spotify.com/episode/29TlOQrbxJuuHtt08yAzHj

#TheFreeThoughtProjectPodcast

#the free thought project#tftp#podcast#tony arterburn#fiat#banking#crypto#dedollarization#america#economics#monetary policy#money#gold#silver

4 notes

·

View notes

Text

*closes my eyes and taps my shoes together*

The US Dollar is still the dominant reserve currency

The US Dollar is still the dominant reserve currency

The US Dollar is still the dominant reserve currency

#fed#the fed#federal reserve#monetary policy#economic news#us news#us dollar#multipolar movement#multipolar world#multipolarity#economics news#socialism#communism#marxism leninism#socialist politics#socialist worker#socialist news#socialist#communist#marxism#marxist leninist#progressive politics#politics#jerome powell#us dollar dominance#neoliberalism#neoliberal capitalism#dollar imperialism#us imperialism#imperialism

31 notes

·

View notes

Text

In The Super Mario Bros. Movie (2023), Mario passes by a group of Toads clearly laboring by hitting coin blocks with their heads to farm coins, raising all sorts of troubling questions about the Mushroom Kingdom’s monetary policy

8 notes

·

View notes

Text

Help my post-Canon TOH fic is turning into a discussion of financial and monetary policy.

#the owl house#owl house#toh#toh finale#darius deamonne#toh darius#eda clawthorne#lilith clawthorne#steve toh#money laundering#money#finance#financial#monetary policy

18 notes

·

View notes

Text

3 notes

·

View notes

Text

Kiddushin 12a

#daf yomi#talmud#kiddushin#judaism#jumblr#harry potter#hagrid#gringotts#exchange rate#the wizarding world has no monetary policy

3 notes

·

View notes

Text

im literally obsessed w money its so funny. not with earning it or having it just with like the history and development of it. a couple terms ago i had the opportunity to research any topic in all of classical antiquity for a seminar presentation and i looked at harbour taxes.

#this shit bores a lot of my colleagues TO TEARS.#and im here like woooooaaaagh the monetary policy........

3 notes

·

View notes

Note

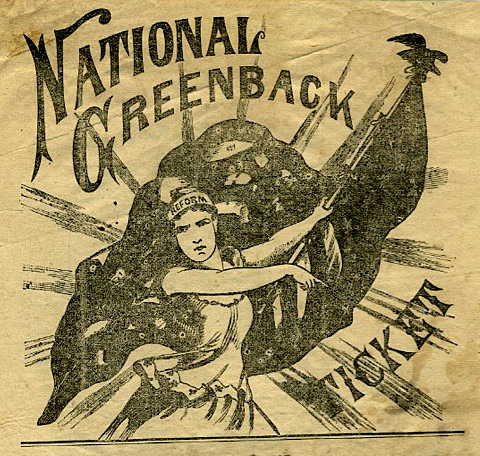

Does fiat, sovereign money (greenback), and metal backed currency have any differing effects on MMT? and do you have your own opinion on which the US should have stuck with?

Yes. You can't really do MMT, or indeed a lot of modern economic policymaking, with a gold standard. (That's one of the major purposes of having a metallic standard.)

As to your second question, the U.S would have been in a much better place in the 19th century (especially for workers and farmers, i.e the vast majority of the American people) had it stayed on the fiat currency model after the Civil War and never looked back, rather than returning to the gold standard.

The Greenback Party was right.

13 notes

·

View notes

Text

Brazil's key interest rate now at 13.25% as Central Bank signals more tightening

COPOM upheld guidance for another 100-basis-point hike in March but offered no signals on its course of action beyond May

Now under the leadership of Gabriel Galípolo, the Central Bank’s Monetary Policy Committee (COPOM) followed its previous guidance and raised the benchmark interest rate, the Selic, by 100 basis points, from 12.25% to 13.25%. The committee also maintained its guidance for another 100-bp hike in March but provided no indications regarding its plans beyond May.

The increase of 100 bp was widely expected, with unanimous agreement among the 120 financial institutions and consultancies surveyed by Valor. At 13.25%, the Selic returns to the same level it reached in August 2023, when the COPOM began a cycle of rate cuts.

Earlier in the day, the Federal Reserve kept its fed funds rate unchanged at 4.25%-4.50% after three consecutive cuts. As a result, the interest rate differential between Brazil and the U.S. widened further.

The COPOM’s decision was unanimous, with the new directors Nilton David (monetary policy), Gilneu Vivan (regulation), and Izabela Correa (relations, citizenship, and conduct supervision) voting alongside the other members.

Continue reading.

#brazil#brazilian politics#politics#economy#monetary policy#central bank#image description in alt#mod nise da silveira

2 notes

·

View notes

Text

Bank of Canada's Bold 50 Basis Point Cut: A Lifeline or a Leap into Economic Uncertainty?

In a move that has sent shockwaves through Canada’s economic landscape, the Bank of Canada (BoC) has announced a significant interest rate cut, lowering the key policy rate by 50 basis points to 3.25%. This decision marks a pivotal moment in Canadian monetary policy, raising questions about economic stability, inflation control, and the future of borrowing and saving in the country. This…

#50 basis points cut#bank of Canada#bank of canada interest rate#BoC#canada economic landscape#canadian monetary policy#economic mayhem#economic uncertainty#rate cut 2025#Tiff Macklem

0 notes

Text

youtube

0 notes

Note

Is there really any difference between the government spending money into circulation rather than lending to private banks?

How would the former allow the government to capture seigniorage rents?

Well, MMT would argue they are essentially the same thing, except that in the latter the government is outsourcing the spending decision-making to the finance sector. They do differ in that lending provides additional liquidity to banks and other financial institutions, and gives the government some income from interest.

As to how "the former allow the government to capture seigniorage rents," essentially the government makes money from the difference between the cost of producing the money and the value of the money. Moreover, when the government spends money into circulation as opposed to lending it into circulation, it also gets the stuff it's spending the money on (and usually at a discount), whether that's goods or services (or labor in general).

17 notes

·

View notes