#"GST Council"

Explore tagged Tumblr posts

Text

GST Hike Proposed for Tobacco, Aerated Drinks to 35%: GoM Report

Latest News

News

Stock Market Update: Nifty 50 Movement, Trade Setup, and Top Stock Picks

News

Markets on Edge: Indian Indices Dip, Bitcoin Hits Record, and Global Trends Shape the Week Ahead

News

BlueStone Jewellery Plans ₹1,000 Crore IPO with Fresh Issue and OFS

Source: zeebiz.com

GoM Proposes New Tax Rate for “Sin Goods”

The Group of Ministers (GoM) on GST rate rationalization has recommended increasing the Goods and Services Tax (GST) on aerated beverages, cigarettes, and other tobacco products from the current 28% to 35%. This significant adjustment is aimed at bolstering revenue collection and aligning tax rates with broader fiscal objectives, according to a report by news agency PTI.

Chaired by Bihar Deputy Chief Minister Samrat Choudhary, the GoM convened on Monday to finalize the proposed rate changes. Apart from revising taxes on “sin goods,” the GoM also reviewed the GST structure for apparel and other categories. Under the proposed framework, items priced up to ₹1,500 would continue to attract a 5% tax, while goods priced between ₹1,500 and ₹10,000 would remain taxed at 18%. Products exceeding ₹10,000 would incur a 28% tax.

The Group of Ministers’s recommendations encompass 148 items, reflecting an ambitious effort to optimize GST collections. The report is slated for presentation to the GST Council on December 21, 2024. Comprising Union and state finance ministers, the council will determine the final course of action.

Current GST Framework and Proposed Adjustments

Under the existing GST system, goods are categorized into four primary slabs: 5%, 12%, 18%, and 28%. Essential items are exempt or taxed at the lowest slab, while luxury and demerit goods, such as cars, washing machines, tobacco, and aerated beverages, fall under higher tax brackets. These items also attract an additional cess, further increasing their tax burden.

If implemented, the proposed 35% rate would mark a departure from the current structure, potentially creating a fifth tax slab. This measure, the GoM suggests, would effectively target demerit goods while leaving the existing slabs untouched. “The introduction of the 35% rate aims to streamline tax collection on goods considered harmful, such as tobacco and aerated drinks,” an official was quoted as saying.

The GoM also discussed extending its mandate to allow for periodic reviews of GST rates. This would ensure a dynamic approach to tax adjustments based on economic trends and revenue needs.

Earlier Proposals and Broader Impact

The Group of Ministers’s latest recommendations follow a series of rate-related proposals from its October meeting. These included reducing GST on packaged drinking water (20 liters and above) from 18% to 5%, bicycles costing less than ₹10,000 from 12% to 5%, and exercise notebooks from 12% to 5%. Conversely, luxury items such as shoes priced above ₹15,000 per pair and wristwatches exceeding ₹25,000 were proposed to face higher taxes, moving from 18% to 28%.

As the council deliberates on these recommendations, the proposed changes underscore the government’s dual focus on maximizing revenue and discouraging the consumption of harmful goods. If approved, the new tax structure could reshape the GST landscape and influence market dynamics, particularly for luxury and demerit goods.

Catch the latest updates at Business Viewpoint Magazine

#god#grace#ministry#india#faith#christian#family#father#mindset#coach#success#leader#preacher#politics#celebrate#blessed

0 notes

Text

Understanding the Costs of Conveyancing Adelaide: What to Expect

When buying or selling property in Adelaide, one of the essential steps in the process is conveyancing. Conveyancing is the legal process of transferring property ownership, and while it’s a necessary service, many first-time buyers and sellers may be unsure about the costs involved. Understanding the costs of Conveyancing Adelaide will help you budget effectively and avoid any surprises along the way. Here's what you can expect to pay when hiring a conveyancer in Adelaide and how these costs are typically structured.

1. Professional Fees

The professional fees are the core component of Conveyancing Adelaide costs. These fees cover the conveyancer's time and expertise in handling the legal aspects of your property transaction. Conveyancers may charge either a fixed fee or an hourly rate, depending on the complexity of the transaction.

Fixed fees are often preferred by buyers and sellers as they provide transparency and predictability. On average, professional fees for conveyancing in Adelaide range between $800 and $2,500. Simpler transactions, such as the sale of a single-family home, typically fall at the lower end of this range, while more complex transactions, like buying off-the-plan or dealing with subdivided properties, can increase the fee.

2. Disbursements

Disbursements are out-of-pocket expenses that the conveyancer incurs on your behalf and then passes on to you. These are additional costs to the professional fee and typically cover services such as property searches, certificates, and title registration.

Some common disbursements associated with Conveyancing Adelaide include:

Title Search: This search confirms the legal ownership of the property and any encumbrances, such as mortgages or easements. The cost for a title search in Adelaide usually ranges from $20 to $30.

Council Rates Search: This search ensures all council rates are up-to-date and checks for any outstanding debts that need to be settled before settlement. Expect to pay around $30 to $100 for this search.

Land Tax Clearance Certificate: This ensures there are no outstanding land tax liabilities on the property. The cost is typically between $30 and $50.

Registration Fees: When transferring the property title, a registration fee is payable to the Land Titles Office. In South Australia, this fee can range from $170 to $600, depending on the value of the property.

Adjustments and Settlement Fees: Your conveyancer will calculate adjustments for rates, taxes, and water usage that need to be accounted for in the settlement process. These are usually minor costs but essential to ensuring a smooth transaction.

3. Stamp Duty

Stamp duty is a significant cost that applies to property purchases. It is a government tax based on the value of the property and is typically the largest single expense in any Conveyancing Adelaide transaction. In South Australia, stamp duty can range from several thousand dollars to tens of thousands, depending on the property's purchase price. For example, the stamp duty on a $500,000 property is approximately $21,330.

First-time homebuyers may be eligible for stamp duty concessions or exemptions, depending on the type of property and its location. Your conveyancer can help you determine if you qualify for any government assistance.

4. GST (Goods and Services Tax)

GST is usually included in the conveyancer's professional fee, so you should confirm whether the quoted price is inclusive of GST. This tax adds 10% to the total professional fees but does not typically apply to other disbursements or stamp duty.

5. Other Potential Costs

Depending on the nature of your property transaction, additional costs may arise. For instance, if there are disputes over property boundaries or encroachments, you may need to pay for a surveyor. Additionally, if legal disputes occur during the process, this could increase your overall conveyancing expenses.

Conclusion

Understanding the costs of Conveyancing Adelaide is essential for buyers and sellers to budget effectively and avoid unexpected financial strain. Professional fees, disbursements, stamp duty, and other potential costs all contribute to the overall expense of a property transaction. By being informed about these costs, you can plan for a smooth, successful transaction without financial surprises. A qualified conveyancer in Adelaide will guide you through each step, ensuring all legal requirements are met and that you get the best value for your money.

0 notes

Text

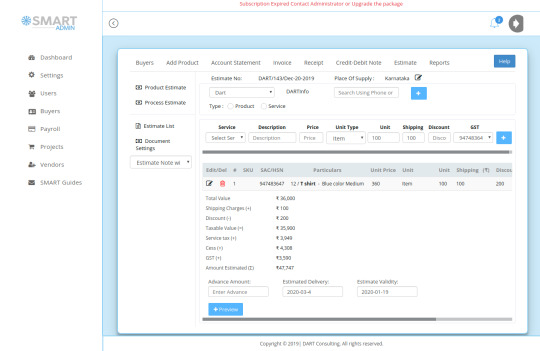

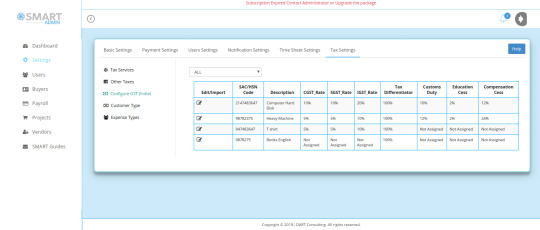

Best GST Invoice Software

The invoicing option of Smart Admin links estimate/quote, invoice, receipt, and Credit/Debit to ensure accurate flow of data points in the overall invoicing process. This will ensure zero error in all statutory filings connected with invoicing. The invoice management software captures data points associated with each of the documents and numbers it properly. The Import and Export transactions as well as SEZ transactions of both products and services are listed in the process.

Need for using GST Invoice Software

GST Invoice Software has been designed to meet the challenges as posed by GST implementation and its frequent updates. The implementation of GST has brought multitude of challenges to small and medium business owners. The larger businesses were fully equipped to meet challenges because of their affordability to invest in costly software whereas for small businesses, it turned out to be a nightmare. The organized sector with its regular stream of tax payment process was least affected by GST and the need for GST invoice generator. The small and medium segments were bogged down by the burden of generating GST Compliant Invoice and fear of reporting wrong data. In addition, there were compelled to route transactions through banking channels to meet the requirement of large suppliers. This posed additional challenges of keeping record of each and every transaction and its proper reporting.

Smart Admin stepped into this need and developed invoice management software to match up with the requirements of GST filing and minimize errors in transactions. The billing software has been designed taking into account of the level of expertise of common man. The Smart Admin Invoice Software can be operated by anyone who can handle Gmail and WhatsApp.

Further, Smart Admin has been configured to handle the future requirements of e-invoicing as if it is going to be implemented by GST Council for B2B transaction at any time in future. With such implementation, the e-invoice generated needs to be validated at Invoice Registration Portal (IRP). This will generate a unique Invoice Reference Number (IRN) and digitally sign the e-invoice and also generate a QR code. The QR Code will contain vital parameters of the e-invoice and return the same to the taxpayer who generated the document in first place. The IRP will also send the signed e-invoice to the recipient of the document on the email provided in the e-invoice. Smart Admin GST invoice software has the option to update the invoice with IRN as generated and send the same to buyers once the feature has been implemented at any time .

The options as given for GST Invoicing Software India are expected to speed up the filing process and minimize errors. With Smart Admin, users can go for multiple GST invoice formats, receipt and cr/dr vouchers according to requirements for generating Tax Invoices under GST.

The invoice management software is linked with all other transactions to avoid duplication of efforts and missing of entries. Once you subscribe for the mobile app, then invoice can be generated on the go. Invoice will be sent to the recipients over email or SMS instantly. If you are looking for best GST Invoice Software, then we can confirm that Smart Admin is one of the best invoicing software India, a solution for you.

0 notes

Text

Trusted Conveyancing Services in Melbourne: Experience Error-Free & Convenient Property Transfer Process

Recognised conveyancing services in Melbourne usually employ experienced and licensed conveyancers to handle all legal procedures to make sure their clients have results for an error-free, smooth, and convenient property transfer process. Some of them have a record of the highest degree of professionalism, customer service, and the fast-growing conveyancing firm in Melbourne.

Reason to Choose Professional Conveyancing Firms:

Some reliable and reputable conveyancing firms maintain a fixed price system for their services to deliver the best value of a cheap conveyancing service for a large number of clients with satisfaction.

Their clients complete their legal process of property buying, selling or transfer with the peace of mind that they have received affordable and genuine services from their conveyancer.

Their fixed price system assured clients, once the procedure is underway, the cost of conveyancing won't unexpectedly increase.

They are experts in local knowledge, rules, and regulations of the local council and can deliver expert advice and guidance as well as their administration work also adheres to local rules.

They provide the fastest turnaround service for Section 32 statements and contracts of sale within 24 hours after receiving all required information from their clients.

More on their fixed price feature, they quote their price that includes all expenses, legal certificates such as the Title Certificate, Land Registry Certificate, Building Compliance Certificate, Energy Performance Certificate, Environmental Certificate, Surveyor's Report, Certificate of Occupancy, and Financial Certificates for residential and commercial property as well as property enquiries or disbursements required to complete the transaction and GST.

In summary, as part of their services, trusted conveyancing firms work closely with their clients to gather the required information and documentation.

They have the expertise to liaise with various parties involved, including government authorities, solicitors, and other relevant stakeholders, to obtain the necessary certificates.

Additionally, they have an acute knowledge of the specific requirements and processes in different jurisdictions across Australia. They understand the importance of obtaining the correct certificates for different purposes, to ensure a smooth and legally compliant property transaction.

Therefore, when planning for property buying, selling or transfer, people should engage with a trusted conveyancing service and get benefit from their expertise and experience.

Source

0 notes

Text

Importance of Adopting GST Consultant for Your Company

Company regulations are difficult to implement. It entails carrying out a variety of critical tasks. Ignoring any of these operations can significantly affect your company, and you will be unable to afford them. Therefore, it is always advisable to pay attention to all the activities or responsibilities a business should undertake. However, filing a tax return is one of the most important things that every firm should do. A company is required to file many taxes. GST is one of them. Many business owners are confused of this tax, which is why they require a GST expert to help them navigate the procedure.

As GST consultants, they assist businesses to file their taxes and file the returns on time. The GST Council has frequently revisited the rules and added to the requirements over the last 4 years. For this reason, a GST consultant will ensure that you stay up to date on any new rules or guidelines that apply to the various areas of activitiesof your organization. Emblaze is one among the best GST Consultants in Kochi, Kerala, Chennai. We assist new and existing businesses in GST Registration, Returns and Other Compliances.

• With the help of the consultants, you can now file your GST returns within the stipulated time without errors. They will save you the full time involved before preparing and then filing your GST return. There are several payments to be made under this tax at different time intervals.

• There are several benefits to choosing a GST consultant. If a person does not have enough knowledge, he/she may not have enough information about the law and hence errors may occur in filing GST returns. In these situations, a consultant, who knows the law, will guide you in the right direction.

• The GST tax consultant will help you with the entire tax planning for your business that will make this process easier, quicker, and effective. He /she well aware of every detail, process, updates, laws, provisions, etc that needs to be taken care of in your daily operations.

• GST consultants are not only for identifying tax liabilities but also for reducing the tax burden. They will be well-prepared to track any problems in various sections and be ready to take appropriate remedies for that.

We will provide you with the easiest and quicker GST registration and compliance services for your business. For more assistance contact us at +91 999 549 2484 or give a quote at [email protected].

0 notes

Text

GST Council की बैठक में कारोबारियों को बड़ी राहत, इस दिन तक दूर हो जाएगी GSTN समस्या

New Post has been published on https://apzweb.com/gst-council-%e0%a4%95%e0%a5%80-%e0%a4%ac%e0%a5%88%e0%a4%a0%e0%a4%95-%e0%a4%ae%e0%a5%87%e0%a4%82-%e0%a4%95%e0%a4%be%e0%a4%b0%e0%a5%8b%e0%a4%ac%e0%a4%be%e0%a4%b0%e0%a4%bf%e0%a4%af%e0%a5%8b%e0%a4%82/

GST Council की बैठक में कारोबारियों को बड़ी राहत, इस दिन तक दूर हो जाएगी GSTN समस्या

केंद्रीय वित्त मंत्री निर्मला सीतारमण (ANI)

जीएसटी काउंसिल की बैठक में आज कई बड़े फैसले लिए गए. इसमें सबसे बड़ी राहत कारोबारियों को दी गई है. वहीं, जीएसटी की खामियों को लेकर कहा गया है कि वो तय समय में इसे खत्म करे.

नई दिल्ली. जीएसटी काउंसिल (GST Council) की 39वीं बैठक के बाद वित्त मंत्री (Finance Minister) ने बैठक में लिए गए फैसलों के बारे में जानकारी दी. काउंसिल की बैठक में मोबाइल फोन्स पर लगने वाले जीएसटी दर (GST Rate) को 12 फीसदी से बढ़ाकर 18 फीसदी कर दिया गया है. साथ ही एयरक्रॉफ्टस की सर्विस पर लगने वाले जीएसटी को 18 फीसदी से घटाकर 5 फीसदी कर दिया गया है. जीएसटी दरों में यह बदलाव 1 अप्रैल से लागू कर दिए जाएंगे.

1 जुलाई से जीएसटी पेमेंट (GST Payment) में देरी करने पर ब्याज के साथ नेट टैक्स लायबिलिटी भी देनी होगी. छोटे बिजनेस को इस बार राहत देते हुए GSTR-9C की डेडलाइन को आगे बढ़ा दिया गया है. 5 करोड़ रुपये से कम एन्युअल रिटर्न वाले कारोबारियों के लिए वित्त वर्ष 19 के लिए अंतिम डेडलाइन 30 जून 2020 होगी.

Finance Minister Nirmala Sitharaman: Late fees not to be levied for the delayed filing of the annual return & reconciliation statement for 2017-18 & 2018-19 for taxpayers with aggregate turnover less than Rs 2 Crores. https://t.co/IDuanp7ODC

— ANI (@ANI) March 14, 2020

यह भी पढ़ें: कैंसिल करनी पड़ रही है इमरजेंसी में शादी, घबराएं नहीं ऐसे मिलेगा पूरा पैसा वापस78 हजार करोड़ रुपये का कंपेनसेशन सेस काउंसिल ने वित्त वर्ष 2018 और 2019 के लिए एन्युअल जीएसटी रिटर्न भरने पर लेट फीस से राहत देने का ऐलान किया. ये इन ईकाईयों ��र ही लागू होगा, जिनका सालाना टर्नओवर 2 करोड़ रुपये से कम होगा. वित्त मंत्री ने कहा कि कंपेनसेशन सेस के तौर पर 78,000 करोड़ रुपये जुटाया गया है.

जीएसटी की खामियां दूर करने के लिए जुलाई तक का समय जुलाई 2020 तक इन्फोसिस बेहतर GSTN सिस्टम सुनिश्चित करेगी. इंफोसिस के चेयरमैन नंदन निलेकणी ने इस भी बैठक में हिस्सा लिया है. नंदन निलेकणी ने जीएसटीएन संबंधिक खामियों को दूर करने के लिए जनवरी 2021 तक का समय मांगा था. काउंसिल ने इन्फोसिस को कहा कि वो मैनपावर बढ़ाकर और अपनी हार्डवेयर क्षमता बढ़ाकर तय किए गए समय में अपने काम पूरे करे.

यह भी पढ़ें: Yes Bank ग्राहकों के लिए बड़ी खबर, इस दिन से निकाले सकेंगे ₹50 हजार से ज्यादा

इन बातों पर बैठक में हुई विशेष चर्चा शनिवार को हुए जीएसटी काउंसिल की इस बैठक में सबसे अधिक फोकस इन्वर्टेड ड्यूटी स्ट्रक्चर, बिजनेस करने में सरलता और टैक्स अनुपालन करने में बोझ को कम करने पर था. इन्वर्टेड ड्यूटी का मतलब फिनिश्ड प्रोडक्ट्स के मुकाबले कच्चे माल पर लगने वाले अधिक टैक्स से है. इससे कारोबारियों को अधिक इनपुट टैक्स क्रेडिट क्लेम करना पड़ता है.

यह भी पढ़ें: LIC की खास स्कीम, एक बार लगाएं पैसा और जिदंगीभर पर पाए 8000 रु/महीना पेंशन

News18 Hindi पर सबसे पहले Hindi News पढ़ने के लिए हमें यूट्यूब, फेसबुक और ट्विटर पर फॉलो करें. देखिए मनी से जुड़ी लेटेस्ट खबरें.

First published: March 14, 2020, 7:23 PM IST

function serchclick() var seacrhbox = document.getElementById("search-box"); if (seacrhbox.style.display === "block") seacrhbox.style.display = "none"; else seacrhbox.style.display = "block";

document.addEventListener("DOMContentLoaded", function() document.getElementById("search-click").addEventListener("click", serchclick); /* footer brand slider start */ new Glide(document.querySelector('.ftrchnl-in-wrap'), type: 'carousel', perView: 8, ).mount(); ); !function(f,b,e,v,n,t,s)if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments);if(!f._fbq)f._fbq=n; n.push=n;n.loaded=!0;n.version='2.0';n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0];s.parentNode.insertBefore(t,s)(window, document,'script','https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '482038382136514'); fbq('track', 'PageView'); Source link

#"GST Council"#"GST news"#"GST updates"#"gst"#"Nirmala Sitharaman"#"Phones"#business news in hindi#clothes#get news#GST on footwear#gst on phones#gst on textiles#new gst rules#new gst slabs#shoes#slippers#जीएसटी#जीएसटी मीटिंग में सस्ती हुई ये चीजें#जूता-चप्पल#सेल फोन#News

0 notes

Text

Mobile Phones To Cost More As GST Increased From 12% To 18%

Home » Website » Business

» Cellular Telephones To Value Extra As GST Elevated From 12% To 18%

Outlook Internet Bureau March 14, 2020 00:00 IST Cellular Telephones To Value Extra As GST Elevated From 12% To 18%

outlookindia.com

2020-03-14T18:47:09+0530

The Items and Companies Tax (GST) on cell phones and specified components has been elevated…

View On WordPress

#"Phones"#Cost#Goods and services tax#gst#GST Council#GST Council meeting#GST hike on mobile phone#GST on smartphone#increased#mobile#Mobile phone#Mobile phones#Nirmala Sitharaman#What is GST rate on mobile phone

0 notes

Text

Smartphones May Get Expensive from April 1 as Govt Hikes GST Rate to 18% from 12%

[ad_1]

At its 39th meeting held today (March 14), the GST Council headed by Finance Minister Nirmala Sitharaman, has hiked the Goods and Services Tax (GST) rates on mobile phones and allied parts from 12 percent to 18 percent.

The Council corrected the inverted duty structure that was being faced by the industry. It has also rationalised the GST rates on handmade and machine-made matchsticks…

View On WordPress

#"GST Council"#"gst"#"Nirmala Sitharaman"#"Smartphone"#finance minister nirmala sirtharaman#Goods and Service Tax#Gst on mobile phone#Mobile phone#Mobile phone prices#Mobile Phone prices to increase#Smartphone gst#Smartphone price

0 notes

Text

GST (Tax) E-invoice Mandatory From January 1 For Businesses With Over Rs 5 Crore Annual Turnover

GST (Tax) E-invoice Mandatory From January 1 For Businesses With Over Rs 5 Crore Annual Turnover

The e-invoice threshold has been lowered to Rs 5 crore annual turnover The Goods and Service Tax Council has made it mandatory for businesses with an annual turnover of over Rs 5 crore to move to e-invoicing from next year. Such businesses will have to generate electronic invoices for business-to-business (B2B) transactions starting January 1, 2023, reported the Economic Times quoting a…

View On WordPress

0 notes

Text

Performance of Indian rupee better than its peers, Sitharaman tells Rajya Sabha; Lok Sabha passes bill on wildlife protection

Aug 02, 2022 23:54 IST New Delhi , August 2 (Always First): Finance Minister Nirmala Sitharaman on Tuesday rubbished allegations of opposition in Rajya Sabha on the government's handling of the economy during a debate on price rise with the Lok Sabha passing Wildlife (Protection) Amendment Bill. In her reply to the debate, Sitharaman responded to the points raised by the opposition and said there is no collapse in the value of the Indian rupee and its performance against the US dollar is better than other major global currencies. "The performance of the Indian rupee is much better than its own peers, which withstood the impact of the US Fed's decision much better than any other peer currencies. Let us please understand the context and speak about the Indian rupee. There is no collapse," she said. "As I said, the RBI (Reserve Bank of India) is continuously monitoring it; monitoring and intervening only if there is volatility. The RBI's interventions are not so much to fix the value of the Indian Rupee because it is free to find its own course," she added. Trinamool Congres staged a walkout during the reply by the minister. Sitharaman said India's macroeconomic fundamentals are strong. "There was a time when we were quoted repeatedly - Bangladesh is doing well, you are not...The per capita GDP at PPP in 2013 for Bangladesh was USD 3,143 but it was USD 5,057 in the same period. In 2021, Bangladesh's per capita GDP at PPP is USD 6,613 whereas ours is USD 7,334," she said. Referring to opposition criticism of the hike in GST on some items of daily use, she said GST Council has members from every state. "They are not alone when they're inside the GST Council, they sit with their officers as well. So, it's not as if it's possible for anyone to say something about some other state outside and get away with it," she said. She said states had earlier imposed VAT on many items of daily needs. Responding to points made by opposition, Sitharman said she was also "a grehani " She said the government has taken measures to control inflation and no one was in denial of price rise. The minister had replied to the debate on the price rise in Lok Sabha on Monday. Lok Sabha on Tuesday passed a bill that seeks to amend Wild Life (Protection) Act, 1972 to insert a new chapter for proper implementation of Convention on International trade in Endangered Species of Wild Fauna and Flora. In his reply to the debate on the Wild Life (Protection) Amendment Bill, 2021, Environment Minister Bhupender Yadav said that development and protection of the environment were not opposed to each other. He said appropriate development work can be carried out by keeping in mind environmental concerns. He said environment conservation is the constitutional duty of the government. He also said that the government is committed to the conservation of wildlife. The minister said that in the last eight years protected areas in the country have increased from 693 to 987, which includes fifty-two tiger reserves. He said government works on the principle of Vasudhaiva Kutumbakam. Referring to the points raised by some members from West Bengal, Yadav said protecting Sundarbans is the government's constitutional responsibility. The Wildlife (Protection) Act, 1972 (the Act) provides for the protection of wild animals, birds and plants and for matters connected therewith or ancillary or incidental with a view to ensuring the ecological and environmental security of the country. India is a party to the Convention on International trade in Endangered Species of Wild Fauna and Flora (the Convention) which requires that appropriate measures are taken to enforce the provisions of the Convention. The Wild Life (Protection) Amendment Bill 2021 proposes to amend the Wild Life (Protection) Act, 1972. It proposes to amend the preamble to the Act so as to include the aspects of "conservation" and "management" of wildlife which are covered by the Act and rationalise and amend the Schedules to the Act for the purposes of clarity. It also proposes to insert a new chapter for proper implementation of the provisions of the Convention in India, insert provisions to enable control of invasive alien species and insert a provision to allow the State Boards for Wild Life to constitute Standing Committees. The bill proposes to make amendments for better management of protected areas. It seeks to insert an explanation so as to provide that certain permitted activities such as, grazing or movement of livestock, bona fide use of drinking and household water by local communities shall be considered as non-prohibitive under section 29 of the Act. It also seeks to insert provisions for better care of seized live animals and disposal of seized wildlife parts and products, to allow for transfer or transport of live elephants by a person having ownership certificates in accordance with conditions prescribed by the Central Government. (Always First) Read the full article

0 notes

Text

GST on online gaming to be finalized by August

Business Today quoted sources as saying that “GoM had no final conclusion due to certain members’ absence and information from the meeting.” By the end of the month, the GoM will probably convene once again. The group will turn in the report before the 48th GST Council meeting, or by the second week of August.

0 notes

Text

Everything there is to know about e-invoicing in Zoho Books.

Starting in the new fiscal year, companies and businesses with sales of ₹2 billion (₹20 crores) or more will be required to invoice all B2B transactions, according to the latest notice from the GST Council of India.

The easiest way to comply with this new regulation is to adopt an intelligent accounting platform that makes it easy to generate e-invoices. Useful features include seamless IRP integration, QR code capture, and invoice scheduling to help manage all e-billing operations.

Zoho Books is an example of a powerful, customizable, scalable, all-in-one solution that keeps you in compliance always. Trigya Innovations is an Advanced Partner who is an expert in Zoho Implementation services and providing Zoho Books Training.

How simple is it to create an e-invoice with Zoho Books?

One of our main goals is to make the transition to e-invoice by Zoho Books as smooth and easy as possible. This means a one-time integrated setup where you can start generating invoices in just one minute.

In Zoho Books, you can create invoices in the e-Invoicing format by choosing all the mandatory fields required in the e-invoice schema.

Zoho is recognized as a GSP (GST Suvidha Provider), so Zoho Books uploads invoices directly to the IRP with the click of a button. With features such as sending invoices in bulk to IRP, setting recurring invoices, and automatically converting accepted quotes into invoices, you can stay compliant and ahead of the competition.

What other e-invoicing features does Zoho Books offer?

Zoho Books can streamline the entire financial management process beyond accounting. Here are some of Zoho Books' best features when it comes to processing electronic invoices:

Seamless integration with advanced benefits

Setting up e-invoicing in Zoho Books is a one-time process that allows you to complete your billing upon completion. This secure integration protects all your data and provides features such as bulk IRN generation, automatic e-invoicing with recurring invoice settings, and more.

Eliminate Compliance Concerns

With Zoho Books, you don't have to worry about tax compliance. Zoho Books strictly adheres to government-mandated invoice requirements for all invoices and prints the appropriate QR code and IRN on PDF invoices for every transaction made.

Managing multiple branches and GSTIN's

Zoho Books is easy to understand when managing multiple branches. You can define a set of transactions for each branch / GSTIN and track the transactions that occur in all branches. And you'll get all the insightful reports on store performance and more in one solution.

Smart Invoice Verification

ZohoBooks performs smart verification checks on all e-invoices to prevent erroneous data entry. This saves time and provides an error-free billing experience by allowing you to generate IRNs with the correct data, without violations or missing required fields.

Useful status updates

Zoho Books has a status list that is updated at every stage of the e-invoicing process. It indicates if the invoice has already been sent and notifies the team if the e-invoicing fails or is cancelled. Keeping your invoices up-to-date means you can respond quickly to changes and improve the customer or supplier experience.

Want to see how Zoho Books works?

The introduction of e-invoicing obligations in India brings many benefits not only to businesses but also to the tax authorities of the Government of India. Benefits such as interoperability between companies, accuracy of manual data entry, and significant simplification of the tax filing process are welcome.

Also Read: Zoho Books Manual: How does Zoho Books Work ?

Zoho Books has always been at the forefront of helping companies digitally transform their financial operations while maintaining compliance. Similarly, Zoho Books' billing features are designed to keep your business compliant with affordable and advanced features.

Feel free to write to us at [email protected] if you have any concerns or questions about e-invoicing with Zoho Books. We’re happy to help!

#zoho consulting partners#zoho crm resources#Zoho Partners#Zoho CRM Consultant#Zoho CRM Consulting#Zoho Consulting Partner#Zoho Implementation Services#Zoho Implementation partner

0 notes

Text

Minor dwelling floor plans in nz

These lovely dwellings are an excellent alternative to container homes and mobile homes. Suitable for bachs, sleepouts, and granny flats.

These little houses, with their eye-catching exteriors, have a potential. Our homes were architecturally constructed to accommodate a wide range of budgets and specifications. Plans can be tailored to meet your specific requirements. Build package pricing is for a complete home build that includes standard materials and labor from beginning to end. You will need to have a minor dwelling floor plans nz first before starting the build.

While most expenditures are covered by our packages, sitework, excavation, engineering, and services to your site are not included, while we are pleased to assist in these areas. Our house estimates are based on a flat section build; however, depending on the land you choose for your new home, additional expenditures may arise. Before we can commit to a price for any pre-building work required and your final build expenses, the team will need to visit your site and prepare an official quote. GST is included in all prices.

Look at the plan requirements

It must have a kitchen and be designed to be used as a residence to qualify as a modest dwelling. It can not be a minor dwelling if an activity does not match the qualifications for a dwelling. As a result, a sleep-out without a kitchen or food preparation area would be considered an auxiliary building rather than a secondary house. The term "minor dwelling" implies that this structure is second in importance to the primary residence on the property. This also means that minor residences can not be built on land without a primary residence.

Quality drawing

Your building permit application drawings should be clear, accurate, and full, with sufficient detail. Before you begin, check with your local government to be sure you understand their rules.

It contains drawings-related material, including samples and explanations of 13 distinct types of drawings. The descriptions are representative of the information that should be displayed, although they are not mandatory.

Your application may need to include the following: site plan location plan, foundation plan, floor plan, roof framing plan, exterior elevation, sections, construction details, door and window schedule, plumbing layout or schematic plan, electrical plan, and wet area details, depending on the project.

Producer statements

As long as the council views producer statements as truthful and credible, they can help support building consent applications (and code compliance certification).

When deciding whether to accept a producer statement, a council will typically examine the author's qualifications to confirm that he or she has the necessary experience and knowledge in their field of specialty, as well as conduct their own inspections of the construction work.

Producer statements are commonly used for specialized labor, such as engineering, or when a proprietary product is installed by designated contractors. A producer statement can assist the council in determining whether the building work complies with the Building Code. Some aspects of this work will be outside the council's in-house expertise, and a producer statement can assist the council in determining whether the building work complies with the Building Code. When deciding how much weight to give producer statements, councils will use their discretion.

0 notes

Text

Mobile phones to cost more as GST hiked to 18% from 12% earlier

[ad_1]

Mobile phones will now attract an 18% goods and services tax (GST) rate, up from existing 12%, after the GST Council corrected the inverted duty structure that was being faced by the industry. The Council, however, deferred rationalizing the tax structure of other products such as fertilizers, man made yarn, fibre and footwear among others, to the next meeting.

Some states including West…

View On WordPress

#"coronavirus"#"GST Council"#"gst on mobile phones"#"Mobile phone parts"#"mobile phones GST"#"Nirmala Sitharaman"

0 notes

Text

Week 6 PREAMBLE

PREAMBLE[1]

Proposals inform people about an exhibition you would like to develop. Putting a proposal together helps you flesh out your own ideas, and will help others clearly see what you intend to produce. This document also requires that you contextualise your thinking by drawing on content and ideas introduced in the 237.331 course, alongside material you locate on the concepts and concerns that are the focus of your topic.

This is a project for a hypothetical exhibition. You take on the role of curator. The aim is not about developing an exhibition of your own creative practice, but it is intended to extend your inquiry, knowledge and understanding of fields of interest in your degree.

This assignment is also designed to help you to develop skills for writing proposal(s) and application(s) in the industry sector, the art world, and the community.

§ Expected hours of project: Weeks 6 – 11 = 45 hours independent + 15 hours class contact

Contents

A. Exhibition overview

B. Curatorial processes

C. Ethics and/or kaupapa

D. Potential audiences and outreach

E. Budget (estimate, indicative)

F. Visual support

G. Bibliography

Name

Student ID

Exhibition Title

Location(s)

Date of event(s)

Section A: Exhibition Overview

A1. Exhibition Overview

A succinct statement of the exhibition idea/concept, its theme, the subject areas it covers, and why it is worthy of taking forward. [150-175 words]

A2. Objectives `

What are the key objectives of the exhibition? [50-100 words]

A3. Venue / site / location

The venue or site of your exhibition is a critical ingredient to its success. Explain why have you chosen the particular or specific venue or site? [75-150 words]

Section B: Curatorial Processes

B1. Curatorial Position In this section you will explain what types of decisions are guiding your curation processes. This includes explaining the relationships you seek to build in your selection of items within the exhibition. Use the following sub-titles to assist your explanations. [250-300 words in total]

What: Briefly introduce/overview the items of your exhibition in general terms. (The details of your exhibition items are placed in Part F Visual Support).

How: Explain why you have selected the particular items, then explain how the selection helps you to build an overall narrative / curatorial statement.

Narratives and Storytelling: What is the main narrative and its conceptual threads or issues? What relationships does your curating seek to achieve with and between exhibition items?

What: Explain what is represented in your exhibition/display? What is significant about these representations?

Who: Representation: Who is represented and why are they important?

Affect, atmosphere, emotional connections: What do you envisage are the intended qualities of the exhibition on the viewer/visitor/user? And how do intend to achieve this in the exhibition (eg spatially, lighting, sound, etc)? These details can be elaborated on in Section F (below).

B2. Context & other literature

This section contextualises your ideas in relation to the wider field of exhibition and curatorial practices by drawing on a relevant body of existing literature and knowledge. Here, you are asked to demonstrate wider knowledge that informs your curatorial project including the types of exhibitions or displays that exist and are similar to your own ideas, the work of curators or curatorial strategies that inform and help you shape your own project?

Use course resources as well as draw on wider research material. Write this as an integrated and synthesized discussion. [650-800 words]

Section C: Ethics and/or the Kaupapa guiding your project.

C. Demonstrate awareness for ethical concerns

Read through the various documents on Codes of Ethics and Kaupapa Māori Principles. See the folder called Kaupapa Māori –Principles – Ethics. This is on the Stream site for PDFs & URLs. Also, work through the modified Ethics Screening Questionnaire. If your answer to any question(s) is YES, write the question out below and write an understanding of the nature of potential risks involved that you can identify. [no word limit]

Section D: Potential audiences and outreach

D1. Audience/Market Analysis

Target audience

Outline who the exhibition seeks to attract. For example, the exhibition may target specific individuals, particular community groups, families, students, specialists in the field, etc. What projected weekly audience attendance figures do you anticipate? Identify and discuss audience demographic, be as specific as you can. [50-150 words]

D2. Exhibition Outreach Programmes

Discuss exhibition outreach and additional or supplementary programmes that may stem from this project. List any accompanying public programmes that will run in conjunction with the exhibition, such as: floor-talks, workshops, education programmes, family activities, tours, etc. [75-150 words]

D3. Documentation and publication record

How will you document the exhibition as a lasting record? Is this important? If not, why not? Do you intend to publish a catalogue, or documentary, or any other output? Who would be commissioned to write for this? [50 -125 words]

D3. Exhibition Outreach [75-150 words]

Indicate collaborations with other museums, individuals, commercial industries, organisations, or iwi: This could include loan of objects from other museums, individuals or organisations, any consultation undertaken in developing the concept, public programmes, exhibition development. Explain how the support might be acknowledged.

Other venues: Discuss/note the potential for other sites and venues your exhibition project might also travel to, be displayed and seen in.

Marketing and communications: Describe how you will promote the exhibition for example, online, story in local newspaper, radio, museum newsletter, posters, flyers.

Evaluation methods: Explain how you could assess visitor feedback on the exhibition: for example visitor numbers, anecdotal comments, visitor surveys, etc.

Section E: Budget

E1. List all exhibition requirements, prepare a budget of approximate costs.

Itemise expenditure under the fields provided, and add/delete rows as appropriate. Justify exhibition expenditure in broad terms below. Note that these are indicative fields only. Staff may advise on how this form can be adjusted depending on your projects. While there is not an explicit budget provided for you to work within, the objective is to demonstrate some degree of awareness of actual costings. [This section is not counted as part of your overall word count]

Item

Quantity

Cost $

Materials

Fabrication costs

Contractors, assistant(s), casual employment[2]

Participating artist's/designer’s fees

Loans fees

Freight Costs

Copyright/permissions for images etc.

Research and writer and editor costs (labels etc.)

Consumables 1. (electricity, rates, venue hire, transportation, etc.)

Consumables 2. (list any additional items that will attract a cost, e.g. costume hire, photocopying)

Catering

Miscellaneous

Total estimate costs excluding GST:

Income/revenue (what might your exhibition and related programme earn)

E2. Potential funding avenues

Please list at least 4 x potential sources you might apply to in order to fund this project.

Section F: Visual Support - the nature and scope of your exhibition

[This section is not counted as part of your overall word count]

F1. Floor plans and visual support

Work to a range of between 5-10 exhibition items. Any less defeats the need to demonstrate skills with the scope of the assignment, any more creates too large and demanding project for you to complete necessary details.

Include floor plans to show the layout of exhibition/display items, and/or include maps to indicate exterior site location(s). Create a system that can reference each exhibition item on the floor plan or map. This will allow for cross-referencing between the proposed layout/floor plan/map, with each ‘thing’ marked in its place and the content provided in the following section, below.

F2. List of exhibition items/artefacts/works

Provide a visual list of items each item with a caption. Aim to keep list to 1-2 pages.

Also produce a MLA Works Cited list of all of the items. This includes providing details of each item and also identify if the artefacts/items are on loan from public or private collections, or the provenance of exhibition items. This list will cross-reference to your exhibition layout or map.

Section G: Bibliography

Draw from course set texts and other credible sources you have located to support your A2. Project Proposal. Use MLA bibliographic style for in-text citations (quotes and paraphrasing). Visual representations require MLA style captions.

[This section is not counted as part of your overall word count]

G1. Annotated Bibliography

In support of your investigation, ideas and research include an annotated bibliography of at least 3 texts [75-200 words each text].

G2. Extended Bibliography

Includes resource material cited in the body of proposal, and all other sources that have informed this project assignment.

[1] Acknowledgment: This document has been developed by 237.331 staff guided by project proposal briefs held in the public domain (Te Papa National Services Te Paerangi, and Creative New Zealand Arts Council of New Zealand Toi Aotearoa).

[2] If you require casual assistant(s) for your project use a living wage hourly rate ($21.15/hour in 2019). If you require casual employment for specialised task (e.g. models) use a rate of $27.00/hour.

0 notes

Text

GST Collection Affected due to Coronavirus Pandemic:

The Union Finance Secretary on Thursday said GST collection has been brutally compressed this year, primarily on account of the coronavirus pandemic. As per GST Compensation Law, states need to be given reimbursement, he told the 41st GST Council meeting.

Shortage in compilation gap of goods & services tax (GST) stands which has occurred this year at (estimated to be Rs 2.35 lakh crore), is due to coronavirus pandemic as well, the government said on Thursday. The cess accrued for GST compensation was Rs 95,444 crore & total amount of reimbursement released for 2019-20 is Rs 1.65 lakh crore to states for fiscal 2020, including Rs 13,806 crore for March, Finance Minister Nirmala Sitharaman stated after the 41st GST Council meeting. Adding Up, Sitharaman said that the covid-19 was "an act of God" & an astonishing factor that influenced GST collection.

Speaking with the media after the 41st GST Council meeting, Finance Minister Nirmala Sitharaman on Thursday, 27 August, stated that two possibilities of reimbursing states were considered at the 5-hour-long meeting.

"Option 1 initiated to the GST Council was to offer a special window to states, in discussion with RBI, to make accessible Rs 97,000 crores at a satisfactory interest rate... & Option 2 given to GST Council was that the absolute GST reimbursement gap of Rs 2,35,000 crore of this year can be met by states, in consultation with RBI. These options will be forwarded to states for a viewpoint in 7 days & will be relevant for this financial year only," Finance Secretary Ajay Bhushan Pandey was mentioned as saying at the conference.

The 41st meeting of the Goods & Services Tax (GST) Council led by Union Finance Minister Nirmala Sitharaman & including delegates of all states, held discussions through video conferencing on ways to set up for the shortage in states' revenues, resources said.

A reduction of 0.5% in the deriving limit of states under the Fiscal Responsibility & Budget Management (FRBM) Act will also be given as part of the second leg under the first option, Sitharaman said.

States have requested us to give them 7 working days to consider concerning the options. These options would be accessible only for the duration of the current year, the condition would be reassessed next year. We may have an additional GST meet shortly,” FM Sitharaman added.

“Once the agreement is approved by the GST Council, we can progress fast & clear out these dues, & also take care of the balance of the financial year,” reported ANI, quoting Sitharaman.

"As acknowledged by finance minister in GST Council meeting apprehended in March, allowable views of the substance were tracked from the attorney general of India who said that GST reimbursement has to be remunerated for the evolution period from July 2017 to June 2022," Ajay Bhushan Pandey said, addition to that the AG has discoursed that deficit in GST gatherings cannot be met from Combined Fund of India.

GST Collection Severely Compressed Due to COVID-19’

The finance secretary began the meeting by stating that GST collection has been brutally crushed this year due to the COVID-19 epidemic.

He pointed out that the amount due to states for April-July 2020, the total GST reimbursement to be compensated to states is Rs 1.5 lakh crore, attributing the amount to low GST collections this is because there was barely any GST Collection in April & May," said the secretary.

The GST deficit in FY21 is estimated to be Rs 2.35 lakh crore, of which only Rs 97,000 crore is approximate to be due for execution of GST & the rest due to the epidemic, Pandey indicated out at the conference.

Although Congress & the states governed by non-NDA parties forced for the Centre meeting its legislative responsibility of concealing the shortfall, the Union government cited a legal opinion to say it had no such responsibility if there was a shortage in tax collections.

The options being considered at the GST Council meeting consist of market deriving, increasing cess rate or expanding the number of items for levy of reimbursement cess.

In the previous meeting held on June 12, the GST Council agreed to waive off fees for late filing returns between July 2017 to January this year to write off the effect of COVID-19 disaster on micro, small & medium enterprises (MSMEs).

#gstcouncil#covid19#gst#nirmalasitharaman#government#meeting#epidemic#compensation#deficit#rbi#shortfall#cessrate#collection

0 notes