Don't wanna be here? Send us removal request.

Text

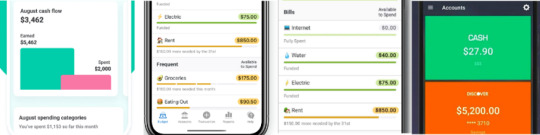

The Complete Guide to Finance Apps That Can Help You Manage Your Money

A finance app is a great way to manage your money and keep track of your expenses.

Since most people do not have the time or energy to learn everything about personal finance and may need some help.

With the help of a finance app, you can set up a budget and save money for the future. You can use them for investments, keeping track of your spending habits, setting up budgets and so on.

Managing money is easy when finance apps can help you with many different tasks.

Why Use a Finance App?

There are a few benefits of using a finance app.

First, apps can help you to budget your money more effectively.

This is because apps allow you to see your transactions in real-time, so you can make better decisions about where to allocate your funds.

Next, it can help you keep track of your expenses.

This is important because if you know where your money is going, you can make more informed decisions about how to spend it.

Additionally, a finance app can make it easier to budget for big expenses, such as a vacation or a new car.

Finally, finance apps can also be used to analyze your spending habits and give you insights into what is working for you and what isn’t.

They also have features like budgeting, which is essential for managing money.

Perhaps most importantly, finance apps provide an efficient and convenient way to track your finances.

They can help you stay on top of your budget, monitor your investments, and keep track of your bills.

What Types of Tools are Available for Managing Money?

1. Money management apps

Money management apps can help you stay organized and in control of your finances.

One of the most obvious benefits is that it can help you keep track of your finances.

By having all of your financial information in one place, you can more easily see where you are spending your money and where you might be able to make some cuts.

Additionally, a money app can make it easier to invest your money in a variety of different investment options, including stocks, bonds, and real estate.

Types of money management apps:

Personal finance apps: budgeting, tracking expenses

Investing apps: robo-advisors, stock trading, retirement planning, crowdfunding, Portfolio Management, Stock Analysis

Savings apps: automatic savings, goal setting

2. Money App

Money apps provide a convenient way to pay bills or transfer money between accounts.

One benefit is that they are faster and easier to use than traditional methods like cash or checks.

Another benefit is that they allow for easy and immediate transfer of money, often without having to enter any bank account information.

In addition, many payment apps offer features like tracking expenses or splitting bills with others, making them an all-in-one solution for managing your finances.

Types of money apps:

Payment apps: money transfer, splitting bills with friends, pay friends

Earn money apps: task, paid survey, rewards, shopping

2 Types of Personal Finance Apps

1. Budgeting Apps

Some popular budgeting apps are Mint, Acorns, and YNAB.

Budgeting apps can help you stay on top of your spending and save money. They typically allow you to create budgets for different categories of expenses, and track your progress over time.

With the help of a budgeting app, you can easily keep track of your spending and save more money. These apps are available for all types of budgets, from free to paid.

2. Tracking Expenses

If you’re just looking to get a handle on your spending, a tracking spending apps is the way to go.

Some popular tracking spending apps are Tiller, Truebill, and Money Manager.

Tracking your expenses is a great way to see where your money is going each month.

This can help you to figure out where you can save money and where you might need to spend more.

8 Types of Investing Apps

1. Tracking Investments

Portfolio management apps offer a number of benefits for investors. They allow you to track your portfolios and individual stocks in real-time, making it easy to see how your investments are performing.

Some popular portfolio management apps are Personal Capital, SigFig Wealth Management, and Sharesight

In addition, portfolio management apps can help you to develop a long-term investment plan, learn about new investment opportunities, and research specific stocks or mutual funds.

By using a portfolio management app, you as a investors can improve your understanding of the financial markets and make more informed investment decisions.

2. Robo-advisors

There are a few primary benefits of Robo-advisors apps.

They include: lower fees, automatic portfolio rebalancing, and tax optimization.

Robo-advisors typically have much lower fees than traditional financial advisors. This is because they use technology to automate the investment process, which eliminates the need for many of the human costs associated with traditional advising.

Some popular Robo-advisors apps are SoFi Automated Investing ,Ellevest, Betterment, and Wealthfront.

And finally, they provide access to sophisticated investment strategies that may be unavailable to individual investors.

3. Stock Analysis

Popular Stock Analysis apps are TradingView, Seeking Alpha, and Webull.

First, these apps allow you to track your portfolios and view your current holdings.

This information can be helpful in making informed investment decisions.

Additionally, many of these apps offer real-time quotes and news updates, so you can stay up-to-date on the latest market trends.

Some apps even provide in-depth analysis of individual stocks, making it easier to identify new potential investments.

4. Retirement Planning

One of the biggest benefits is that you can easily track your progress towards your retirement goals.

Some popular apps are Silvur, My Retirement, and personal capital

The app will help you stay on track by providing regular updates on how close you are to meeting your goals.

Additionally, the app can help you find new ways to save for retirement. The app will provide suggestions on how to reduce your expenses and invest your money in a way that will help you reach your retirement goals.

5. Peer-To-Peer Lending

There are many benefits to using a Peer-To-Peer Lending app.

Peer-to-peer lending is a type of loan where investors provide financing to borrowers through an online platform.

Example: Prosper, Myconstant, and Funding Societies.

This type of lending has become popular in recent years because it allows borrowers to get lower interest rates and it gives investors the opportunity to earn higher returns on their investment.

The benefit of P2P lending is that it offers borrowers a way to get a loan without going through a bank.

6. Trading Apps

The benefits of trading apps include the ability to trade on the go, access to real-time market data, and the ability to customize your trading experience.

Trading apps allow you to trade stocks, options, and futures contracts from your mobile device, giving you the flexibility to trade wherever you are.

Trading apps provide access to real-time market data, which can help you make informed trading decisions.

Some popular trading apps are TD Ameritrade, Robinhood, E-Trade, and Interactive Brokers.

7. Savings Apps

Perhaps the most obvious benefit is that savings apps make it easy to keep track of your finances and stay on budget.

Example: Mint, You Need a Budget, Qapital, and PocketGuard

Most apps allow you to create different savings goals and track your progress towards those goals. This can be helpful for people who are trying to save for a specific item or goal.

Additionally, many of these apps offer great features such as automatic deposits and reminders to help you stay on top of your savings.

6 Types of money apps

1. Money transfer

Money transfer apps offer a variety of benefits to users.

These apps allow users to easily and quickly send money to friends and family members.

Example: Wise, Western Union, Cash App, and MoneyGram

The apps also allow users to track their transactions, so they can keep track of how much money they are transferring and where it is going.

Additionally, many of these apps offer low or no fees for transactions, which can save users money.

2. Splitting bills with friends

One major benefit of bill-splitting apps is that it can help you save money.

Some popular apps are Zelle, Venmo, Splitwise, Split, and Splittr

When you use an app to split a bill, you can avoid paying any fees for using a credit card or for transferring money.

These apps also make it easy to collect money from a group.

This can be especially helpful when you are travelling or on vacation and need to collect money from a group of people.

Additionally, apps can help you track your spending and budget for future bills.

3. Pay friends app

One of the most obvious benefits is that it makes it easy to pay your friends back for things like dinner or drinks without having to exchange physical money or cards.

Example: Zelle, Venmo, chime, PayPal, Google Pay and Apple Pay Cash

This can be especially helpful when one is traveling or busy and doesn’t have time to stop and get cash.

Additionally, many of these apps offer features like notifications when payments are sent or received, so you can keep track of your transactions easily.

4. Short Tasks app

Apps to make money doing tasks: Swagbucks, Clickworker, Field Agent, Roamler, Streetbees, BeMyEye

Perhaps the most obvious benefit is that it allows users to complete tasks quickly and easily from their mobile devices.

This can be especially helpful for busy people who are always on the go.

Additionally, many of these apps offer users the opportunity to earn money by completing simple tasks, such as taking surveys or watching videos.

This can be a great way for people to make some extra money on the side.

5. Paid survey apps

This can be a great way to earn extra income, especially if you are already engaged in other money-making activities.

Popular paid surveys apps including InboxDollars, Swagbucks, Google Opinion Rewards, and Survey Junkie

Perhaps the most obvious benefit is that you can make money by completing surveys.

Additionally, many survey apps offer rewards for completing surveys, such as gift cards or coupons.

This can be a great way to save money on your favorite products or services.

6. Cash back apps

Cash back apps are beneficial to consumers because they offer discounts and rewards for shopping at certain stores.

Ibotta offers cash back on purchases from specific stores, and the app Swagbucks offers points for shopping at certain stores and online.

These apps also offer other benefits, such as coupons and exclusive deals.

This can be a great way to save money on groceries, gas, or other everyday expenses.

Key Takeaway

In conclusion, there are a number of great finance apps that can help you manage your money.

Each app has its own set of features and benefits, so be sure to choose one that fits your needs.

And don’t forget to keep track of your spending and budgeting goals so you can stay on track!

0 notes

Text

Everything You Can Do To Manage Finances Wisely

Managing your money is an important aspect of personal finance.

The best way to manage finances wisely is by creating a budget and sticking to it.

You should also be aware of your debt and credit score, so that you can make responsible decisions when borrowing money.

We’ll go over what a budget is, how to make one, and why it’s so important.

Finally, we’ll wrap up with some more general tips on managing your money well.

What are the Benefits of Managing Your Money?

Managing your money is a great way to make sure that you are financially secure.

There are many benefits of managing your money.

One of them is financial security.

You can feel confident about your future if you have an emergency fund and you know how much money you have to spend each month.

Another benefit is that it give you peace of mind.

This is because you know that if something unexpected happens, such as you lose your job, you will have enough money to cover your costs.

Additionally, if you are ever in a difficult financial situation, you will have the money to get yourself out of it.

How to Manage your Personal Finances Like a Pro?

Managing finances is the process of taking care of one’s money.

It is a part of process of budgeting, saving, and spending money. It also includes managing your income, debts and expenses.

The key is to not be scared of doing things differently or changing the way you think about spending money.

You can set up a budget, use an app for managing expenses, or find a way to save money.

It is when you are able to make the most out of what you have and not living paycheck to paycheck.

If we take into consideration certain things like our budget and our personal finance skills, it can be easier to manage our finances.

We should also consider the future and try to plan for it.

Budget Better With These 7 Tips and Tricks

1. Track your spending

There are a number of ways to track your spending, from simple pen-and-paper budgeting to sophisticated financial tracking software.

Whichever method you choose, the important thing is to be consistent and to review your spending regularly.

Keeping track of where your money goes can help you see where you might be able to cut back, and it can also give you a better understanding of your overall financial picture.

2. Make a Budget

Sit down with your spouse or partner and plan out your monthly expenses.

This will give you both a clear picture of what you’re spending on necessities like food, rent, utilities, etc., as well as fun things like going out or buying clothes.

You’ll also want to take into account any money that may come in from investments or other sources during the month (like an inheritance).

3. Cut down on waste

We all have some habits that we can cut down on to save some cash.

Giving up some of your vices like smoking or drinking too much alcohol, which can be expensive habits to maintain on top of everything else you’re paying for in life.

One way to do this is by switching from paper towels to a dishcloth — this will save you $500 per year!

Save money by cooking at home more often, and eating out less.

4. Get rid of high interest debt

Pay off debt as quickly as possible so that you don’t have to worry about it anymore.

And you can start saving money again for the future, or for emergencies that may come up in the future without having to worry about other financial obligations getting in the way of that goal.

5. Save on bills

You can reduce your energy consumption by turning off lights and electronics when you’re not using them, unplugging chargers when you’re not using them.

Another way to save money on your monthly bills is to comparison shop for services like internet, TV, and phone plans.

This can help you find the best deal and save money in the long run.

Finally, try to negotiate with your service providers. you can ask for a better rate or for remove features at no extra cost.

6. Set up automatic payments

Automatic payments are a great way to ensure that your bills are paid on time without having to worry about forgetting or being late.

This is useful because it means you don’t have to worry about remembering to pay your bills every month — the bank will take care of it for you.

Automatic payments can help you avoid missed payments, late fees, and damage to your credit score.

7. Save for emergencies

Having a savings account is crucial for emergencies. It can help you stay afloat when you need it the most.

One reason to save for emergencies is that if something unexpected happens, like your car breaking down, you’ll have money to pay for it.

Another reason is that if you have money saved up, you won’t have to borrow money from friends or family members, which can cause tension in your relationships.

Additionally, if you don’t have to borrow money, you won’t have to pay interest on the loan.

How to create a budget?

A budget is a plan that shows how much money will be spent and earned during a specific time period.

The first step in creating a budget is to figure out your income and expenses.

First, list your sources of income and estimate how much money you will receive in the coming months.

Income can come from a variety of sources, such as:

Job

Government Benefits

Investments

Be realistic about your income and expenses.

Next, make a list of your regular expenses, such as

Rent

Groceries

Utilities

Car payments

Mortgage payments

Factor in one-time expenses, such as car repairs or holiday gifts.

Once you have an idea of how much money comes in and goes out each month, you can start to create a budget spreadsheet or by using a budgeting app.

Create a savings goal and plan how you will achieve it.

Types of financial goals:

Short-term goals: Saving for a car, a vacation

Long-term goals: Retirement, House down payment, paying for college

Emergency funds: cover at least three months’ worth of living expenses

Retirement planning: IRA, 401(k) , and Roth IRA account

Investing: Stocks, Bonds, Mutual funds, Exchange-traded funds and Real estate

One important thing to keep in mind when setting financial goals is to make sure they are realistic and achievable.

It’s important to avoid setting goals that are impossible to reach or that would require unrealistic amounts of money or time.

Finally, Review your budget regularly and make changes as necessary.

What is the Best Personal Finance App?

Personal finance apps are a great way to help you manage your money and stay on top of your finances.

There are many free and paid options available on the market today.

You can use these apps to :

1. Track your spending

One popular option is to use a budgeting app, which can help you keep track of your income and expenses.

Another option is to use a tracking app, which can help you monitor your spending patterns and identify areas where you might be able to save money.

Some apps even allow you to connect directly with your bank account or credit card so that you can get real-time updates on your spending.

2. Plan your future purchases

There are a number of apps that can be used to help plan future purchases.

One such app is called Goodbudget, which allows users to create budgets and track their spending over time. Another app, called Mint, helps users track your expenses and find deals on the items you want to buy.

Both of these apps can be useful in helping you to stay on track with their spending and make informed decisions about what items to purchase.

3. Get an overview of your finances

One such app is You Need A Budget (YNAB), which allows you to connect all of your financial accounts in one place so that you can see your total net worth, your monthly income and expenses, and more.

4. Helps you with your budgeting

One app that can help you budget your money is Personal Capital.

Personal Capital is a free app that allows you to connect all of your financial accounts in one place so you can see your complete financial picture. Personal Capital also offers budgeting tools and tips to help you stay on track.

Another app that can help you budget is PocketGuard.

PocketGuard is an app that helps you manage your finances by showing how much spendable money you have after setting aside enough for bills, goals and necessities.

5. Splitting the dinner bill with friends

When splitting the dinner bill with friends, there are a few different app options that can be used in order to make the process easier.

One option is the Splitwise app, which allows users to create a group and then share expenses evenly or proportionally based on what each person has contributed.

Another option is the Venmo app, which is used for sending and receiving money between friends. Venmo also has a split function, which allows users to easily divvy up a bill among friends.

6. Saving money on groceries

There are a few different apps that can help you save money on groceries.

The first is called Ibotta.

With this app, you can earn cash back on purchases from certain stores. You simply scan your receipt and the app will give you a list of eligible items.

The second app is called Grocery iQ.

This app allows you to create a grocery list and compare prices between different stores.

Key Takeaway

In conclusion, managing your finances wisely is important for your overall well-being.

You should make a budget and stick to it, make a plan for your money, save regularly, and invest for the future.

These are all important steps in becoming financially responsible and securing your financial future.

Just make sure you stay disciplined and don’t overspend, and you should be able to enjoy a comfortable financial future.

0 notes

Text

How to Invest Money to get Maximum Returns

Investing money is a great way to make your money grow.

You can invest in stocks, bonds, and other assets that are worth more than when you bought them.

It’s important to know which type of investment is best for you so you don’t lose any of your hard-earned cash.

This guide will help you make an informed decision about where to put your money and how to get the best return on your investment.

Types of Investment Accounts

Investment accounts can be broken down into three categories: brokerage accounts, retirement accounts and educational savings plans.

Brokerage account

A brokerage account is an ordinary checking or savings type of bank account that also allows you to buy stocks and other investments through a broker.

And is used for buying and selling stocks, bonds, and other investments.

Retirement account

A retirement account is used for investing money on a longer time horizon with the goal of making more money in the long term.

The types of investment accounts are IRA, 401(k) , Roth IRA and 529 plan.

IRA, 401(k) , and Roth IRA is a retirement account that provides tax-deferred growth until withdrawal at retirement age.

While 529 plan, is a state-sponsored educational savings plan for anyone who wants to save for a child’s education.

What Kind of Investments are Right For You?

Investing is the process of providing money and capital to an enterprise with the expectation of a future financial return.

Investments can be made in a variety of ways, including stocks, bonds, mutual funds and real estate.

The most common way of investing is by purchasing stocks in publicly traded companies.

And, also some investments that have tax advantages over other types of investments such as municipal bonds or tax-deferred annuities.

Stocks

Investing in stocks will give you a share of the company’s profits.

Stocks represent ownership in publicly traded companies and are more volatile than other types of investments.

When you invest in a stock, you are buying a piece of the company and become a shareholder.

As a shareholder, you have the right to vote on important issues affecting the company and you may receive dividends if the company pays them.

Bonds

Investing in bonds will give you interest on your investment.

Bonds are fixed income securities that pay interest until maturity or when they are redeemed by the issuer.

When you invest in a bond, you are lending your money to a company or the government.

In return, you get a set amount of money back every year until the bond matures. You also get your original investment back when the bond matures.

This is different from buying stocks, which means you become a part owner of the company.

Mutual funds

Mutual funds provide investors with a diversified portfolio of stocks and bonds in one investment product.

A mutual fund is managed by professional investment advisors who have years of experience in the markets.

This means you don’t have to spend time researching whether you’re picking the right investment.

When you invest in a mutual fund, you’re pooling your money with other people who also want to invest. This gives you access to a variety of investments that you might not be able to afford on your own.

However, they also carry a higher level of risk than other investments because they contain a variety of securities.

Real estate

There are three types of real estate:

Residential

Commercial

Industrial

Residential real estate is made up of homes and apartments, commercial real estate is made up of offices, stores, and other businesses, and industrial real estate is made up of factories and warehouses.

Real estate can be divided into two categories:

Land

Buildings

Land is the physical property itself, while buildings are the structures that sit on the land.

Commercial properties are usually larger than residential properties and are often located in busy areas with high traffic levels.

This makes them desirable to businesses that need a lot of space or want to be in a strategic location.

Investing in property will provide you with an asset that pays rent or generates income for you.

Exchange-traded funds (ETFs)

An exchange-traded fund, or ETF, is a type of investment fund that trades on a stock exchange.

ETFs are baskets of securities that track an underlying index, such as the S&P 500 or the Barclays U.S. Aggregate Bond Index.

ETFs can be bought and sold throughout the day like stocks, and they offer investors a way to gain exposure to a particular asset class or sector.

There are three types of ETFs:

Index ETFs

Actively Managed ETFs

and Leveraged ETFs

Index ETFs track an index, such as the S&P 500, and hold a basket of stocks that correspond to the index.

Actively managed ETFs are managed by a fund manager who makes buy and sell decisions in an attempt to outperform the market.

Leveraged ETFs use financial derivatives to amplify the returns of an underlying index.

One benefit of ETFs is that they offer tax efficiency. This means that the taxes you owe on your investment income are lower than they would be if you invested in a mutual fund.

How much money should I have before trying to invest?

You can start with as little as $100, and the more you invest, the more your money will grow.

This amount varies depending on what type of investment you are looking for and your risk tolerance.

Some people like to invest in penny stocks, which are typically low-priced shares that don’t trade on major exchanges such as the New York Stock Exchange (NYSE) or NASDAQ, but instead trade over-the-counter (OTC).

Penny stocks are more risky than other investments because they are less regulated and generally don’t offer the same

Determine your goals

The first thing that you need to do before you start investing is to set up a plan — a financial plan.

You should have a clear understanding of your goals and objectives so that you know what type of investment will suit your needs best.

You should also take into consideration your risk tolerance, time horizon and liquidity needs when setting up your plan.

1. Consider your goals:

What are your investment goals?

Do you want to build a retirement fund?

Buy a house in the next few years?

Save for your child’s college education?

2. Decide what you can afford to lose:

Once you know how much risk you’re willing to take, you need to figure out how much money you can afford to lose.

No one wants to lose money, but remember that losses are a part of investing.

3. Monitor your investment

The best way to monitor your investment is to keep track of how the company is performing financially, as well as its competitive landscape.

You can also look at analyst reports to get an idea of how the market views the company.

This can be done by looking at the asset’s price history or by calculating metrics such as the rate of return, dividend yield, and price-to-earnings ratio.

Additionally, you should pay attention to any news stories that could impact the stock price.

Diversification is the key to investing

It is important to have a mix of different stocks and shares, as well as other investments, in order to protect your portfolio from the risk of any one investment failing.

A diversified portfolio is a good way to minimize risk and maximize returns.

It’s important to have a proper balance in all asset classes so that if one goes down, others will go up.

The first step in this process is to choose a broad-based index fund, which invests in a variety of stocks and shares.

One option is the VDIGX, a mutual fund that invests in dividend-paying stocks.

It is designed to provide long-term growth of capital and income.

The fund has a low expense ratio, which means that more of your money stays invested in the market, and it is suitable for investors who are looking for a combination of growth and income.

The second step is to invest in a number of different funds.

For example, you could invest in an international index fund that invests overseas shares and an emerging markets index fund that invests in developing countries’ stocks and shares.

Lastly, If you have a low risk tolerance, then you should invest in things like bonds or cash as they are less volatile than stocks and shares.

Otherwise, stocks and shares might be right for you as they can make more money but are also more risky.

Key Takeaway

Hope this will help you stay disciplined as a noob for money with your finances and avoid unwanted debt, which is vital for anyone looking for financial stability.

Managing your money can be hard, but it’s important to do it well.

Take a look at our collection of articles for money, if you’d like to learn. Cheers:)

If you have any questions or suggestions about money noob guide, please feel free to leave your comment below.

0 notes

Text

A Beginner’s Guide to Saving Money

Saving money is not always easy. It takes a lot of discipline and self-control to resist the temptation to spend money.

The first thing to do is track all your expenses for a month or so.

This will help you figure out how much money you’re wasting each day on things that don’t really matter to your life, like takeout coffee or snacks from vending machines.

This article will explore some of the ways you can save more money by making small changes in your daily life and habits.

Why is Money Management Important?

One of the most important things you learn as you grow up is how to handle money.

Money Management is important because it helps us be in control of our money, and it helps us make the most of our money.

We can use our money to buy things we need and want, and we can also save our money so we have something to fall back on if we need it.

You can think of money like a pie.

If you only have a small piece of pie, you won’t be able to have as much as you want.

This means not spending all of your money on things you don’t need, and saving some of your money so you have it for later.

People who are good at money management skills are able to achieve financial goals such as buying a home or retiring comfortably.

Money management also requires discipline and patience, as it can often take time to see results.

Those who are successful at money management are typically good at planning ahead and are comfortable with taking risks when necessary.

How do I save money?

Saving money is an important part of your financial plan.

It can be difficult to know where to start, but the following are some ways you can save money:

1. Save automatically

Automatically put a certain amount of your paycheck into a savings account each month. This will help you build up funds for emergencies.

2. Set a spending limit

Set a monthly budget and stick to it. This will help you avoid impulse buys and overspending.

3. Plan ahead

If you know that your car needs new tires in the coming months, buy them now when they are on sale instead of waiting until they need replacing and prices go up.

Consider what purchases you will make in the future, and when it is best to buy them.

4. Replace expensive subscription service

Cutting down on unnecessary subscription service such as:

Streaming services: Netflix, Hulu, Amazon Prime Video

Music streaming: Spotify, Apple Music

Magazine subscriptions: Vanity Fair, Wired

Food delivery: Blue Apron, Hello Fresh

Services like Netflix, Hulu, and Spotify can be canceled. If you’re not using them at all, cancel them immediately.

This will help you save money and avoid unnecessary charges.

6 Secrets of Frugal People

Frugal lifestyle is not about being cheap or miserly. It’s about getting the most of what you have, for as long as you can.

These are six secrets to frugal living:

1. They take care of their belongings and buy quality items

Whether it is a car, a home, or a piece of jewelry, people want to make sure that their belongings are in good condition and are worth the money they paid for them.

Taking care of belongings can also help maintain their value so that they can be sold or traded for something else down the road.

2. They Buy in bulk to Save money and time by shopping smart

Instead of buying a bottle of water every day, buy a pack of water bottles and store them in the fridge for later use.

By buying items that are commonly used in bulk, they are taking advantage of discounts that are typically offered to those who purchase more than one item.

3. They buy what they need, not what they want

Shop Smart, Compare prices and only buy what you need.

Shopping using Coupon. original source from tlc uk

4. They are creative, use things in unusual ways or find cheaper substitutes

Selective about the brands they purchase from, often buying second-hand or on sale to save money.

5. They regularly clean their homes and cars to make them last longer

And use less energy and water when washing clothes or dishes by hand, which saves them time and money in the long run as well as energy, water, detergent, etc..

6. They use up what they have before buying more

This includes food in the fridge or pantry that is nearing its expiration date.

What is frugality?

Frugality is a lifestyle that values spending less and saving more. It is often used as a way of living that saves money, time, and resources.

It is the opposite of being wasteful with one’s time or belongings.

Frugal people are not necessarily cheap or miserly; they are just conscious of what they spend their money on and how much they spend it on.

How do I spend less?

You might have tried cutting back on your grocery budget and eating out less, but there are more ways you can save money.

One way to spend less is to use cash instead of credit cards or debit cards.

This will help keep track of your spending habits as well as make it more difficult to overspend.

This way you can avoid paying high interest rates and fees.

Another way to save money is by using coupons and discounts when shopping online or in-store.

There are many sites that offer coupons for stores and restaurants, all you need to do is search for the ones that work best for you!

Lastly, Take a look at your current spending habits and see if there are any areas where you can reduce your spending.

If some of the items on your list are necessities, then try to find cheaper alternatives that will still do the job.

How do I cut back my spending?

You might be wondering how you can cut back your spending. There are a few tips that can help you out.

1) Figure out what you spend your money on the most

Identify what you are spending money on. This will help you find areas where you are wasting money and where you can cut back.

If food is a big expense for you then try cooking your own meals instead of eating out all the time or buying expensive groceries.

2) Try to reduce or eliminate the things that you spend the most on

You can also try swapping out expensive habits like going to the bar with friends for cheaper activities like playing board games at home or going for walks outside.

Next, look for ways to save on everyday items like groceries or gas by shopping at cheaper stores or using coupons when possible.

3) Take a look at your budget and see if there is anything that can be cut down or eliminated

Keep track of your spending.

You can do this by keeping a budget, or simply noting down what you spend during the week.

This will help you figure out where you’re spending too much money and how much you’re spending in general.

4) Eat out less

Try to cook at home more often, or eat out at lunch time instead of dinner time.

5. Get discount while go grocery shopping

Try to find discount using app from your phone while grocery shopping to avoid impulse purchases that may not be necessary or healthy for you (e.g., junk food).

Key Takeaway

Hope this will help you stay disciplined as a noob for money with your finances and avoid unwanted debt, which is vital for anyone looking for financial stability.

Take a look at our collection of articles for money, if you’d like to learn. Cheers:)

If you have any questions or suggestions about money noob guide, please feel free to leave your comment below.

4 notes

·

View notes

Text

5 Ways to Earn Money and Become Rich

Making money is one of the most important things in life.

It provides us with the means to live a comfortable lifestyle, as well as provide for our loved ones.

The best way to make money is by finding a job that pays well and that you enjoy doing.

Some people work hard their entire lives and never achieve either goal.

However, there are also a number of methods that can help you achieve both simultaneously.

In this article, we will discuss the five best ways to earn money and become rich.

The 5 Best Ways to Earn Money and Become Rich

1. Invest in Yourself

Spending time on things that will help you grow and improve. People will be more likely to pay you for what you know than for the work you do.

“ Your Ability To Earn Money Is Depends On Your Knowledge And Expertise That Other People Want ”

This is because they know that you are good at it and that they can trust you to do a good job.

Set goals

Know what you want, this might mean taking classes to learn new things, buying books to read, or hiring a coach to help you achieve your goals.

Education

The more educated you are, the more opportunities will be available to you.

You may do this by attending college or university to gain new knowledge, or by taking classes to improve your skills.

Skills

Learn new things and new skills will make you more marketable and valuable to employers.

And constantly exploring new ideas and concepts, an individual can create a foundation of knowledge that will serve you well for years to come.

Additionally, taking care of your physically and emotionally health.

Take care of yourself

Eat well, sleep, and exercise.

Regular exercise, a balanced diet, and plenty of rest are all essential for maintaining optimal health and vitality.

This helps your body to stay strong and healthy so that you can stay healthy and do all the things you want to do!

Find a community

Get out there, Surround yourself with positive people, meeting new people and networking can help you find new opportunities.

2. Get a High Paying Job

High paying jobs are out there. You just need to know where to look.

One strategy for getting a high paying job is to use complex academic jargon in your resume and cover letter.

This will show that you are capable of handling difficult intellectual challenges.

In addition, be sure to highlight your accomplishments and skills in your resume.

Job Market

The job market is always changing, so it’s important to stay up to date with changes in technology.

Skills needed for the modern workplace:

Critical thinking: analyzing data, problem solving

Communication: written, oral, and interpersonal

Technology: proficient in current software and tools

Teamwork: collaboration and cooperation

Flexibility: able to adapt to changes quickly

For example, if you have received any awards or scholarships, or if you have experience working in a high-pressure environment, be sure to mention these.

By doing so, you can demonstrate that you are the perfect candidate for the job.

Job Sectors

High paying jobs are not limited to a certain field or profession. There are many lucrative opportunities for those who are willing to put in the work.

1. Medical Profession

Doctors and surgeons have some of the highest paying jobs in the country. They often enjoy a six-figure salary as well as other benefits.

2. Legal Profession

Attorneys, judges, and paralegals also enjoy high salaries. Many of these positions come with excellent benefits packages as well.

3. Financial Sector

The financial sector is another high paying industry. Workers in this field can make a very good living, especially if they have specialized skills.

4. Technology Sector

With the growth of technology, the technology sector is a great place to look for high paying jobs.

The highest paying technology jobs are in the software development sector.These jobs pay an average of $100,000 per year.

Other high paying technology jobs include computer systems analyst and database administrator.

3. Start your own business

You can make something like cookies or clothes or toys and sell them to people. You can also do things like mow lawns or pet-sit to make money.

The best thing about starting your own business is that you get to be in control and you get to make your own decisions.

There are many factors to consider when starting a business, such as the type of business, the target market, and the necessary resources.

Types of businesses:

One important thing to keep in mind when starting a business is the importance of developing a strong business plan.

This document will outline your business goals and strategies, and can be used as a tool to help you track your progress over time.

1. Franchise

Example: 7-Eleven, Sonic Drive-In, Taco Bell, Club Pilates, Kona Ice

One of the biggest benefits is that you are buying into an already successful business model.

The ability to use a well-known brand name and logo, receive training and support from the franchisor, and benefit from the franchisor’s advertising and marketing efforts.

This can save you time and money as you don’t have to spend as much time researching how to start a business.

2. Online business

Example: eCommerce, Affiliate marketing, Dropshipping, Digital products

Online businesses typically have lower costs than traditional businesses. It give you greater flexibility than a traditional brick and mortar business.

An online business can reach a global audience quickly and easily with the use of technology to sell any product.

3. Home-based business

Example: Freelance services, Virtual assistant, Personal chef, Consultant, Crafters, Web designers, Direct sales, Multi-level marketing.

Perhaps the most obvious benefit is that you can save on overhead costs by working from home. This includes not having to pay for office space or commuting costs.

A home-based business also allows you to set your own hours, which can be a great advantage for parents with young children.

4. Service business

Example: pet care, moving companies, IT services, accounting, restaurants, hair salons, and car repairs.

First, the quality of the service is often more important than the quality of the product. Customers are often more willing to overlook small flaws in a product if the service is excellent.

Second, Service businesses typically have to be more creative and innovative in order to attract and keep customers, since they don’t have the same physical product to offer as other types of businesses.

5. Retail business

Retail businesses typically sell a variety of products, including clothes, cosmetics, food, and electronics.

In order to be successful, retailers must have a good understanding of their customers’ needs and desires and offer a selection of products that appeal to them.

you must also be able to efficiently and effectively manage the inventory and merchandise in your stores.

4. Invest money and make it grow

If you have money, you can put it in a bank and then it will start to grow.

That’s because the bank will give you back more money than you put in, with interest.

You can also invest money in things like stocks or businesses, which will also make your money grow.

Types of investment options:

Savings account: earning interest, building credit, and protecting your money.

Certificate of deposit: Earn higher yields than a regular savings account.

Bond: Get Regular interest payments when loan money to a company or government

Stock: Receiving a portion of the company’s profits.

Mutual fund: a way to invest in many companies at once

Real estate: typically appreciates in value, and can be rented.

Exchange traded funds (ETFs): Benefit from low-cost, passive investing

When an individual invests money into a financial security, like a bond or a stock, they hope to see that investment grow over time.

The hope is that the financial security will appreciate in value, providing the investor with a higher return on their investment than they would have earned if they had left the money in a savings account.

While there is no guarantee of success, investing money can be a way to achieve long-term financial stability and growth.

5. Side Hustles

It could be something you enjoy doing, like baking cookies or playing music, or something you’re good at, like fixing cars or painting houses.

Side hustles can be a great way to make some extra cash, and they can also help you learn new skills and meet new people.

They can be a lot of fun, but it’s important to make sure that you’re not overworking yourself.

Types of side hustles:

1. Virtual Assistant

Types of work: Bookkeeping, Customer service, Data entry, Travel arrangements

As a virtual assistant, you have the opportunity to do a variety of different types of work. This keeps things interesting and prevents burnout.

And the time flexibility, you can work from anywhere at any time you want.

2. Tutoring

Help students improved grades and test scores on academic skills such as reading, writing, and math.

Not only, you can get paid to teach subjects that you are already familiar with. you can work on hours that fit your schedule.

3. Freelancing

Types of freelancing: writing, graphic design, programming, web development

Freelancing allows you to work on a variety of projects. If you’re looking for a more flexible, creative, and independent career, freelancing may be the right choice for you.

4. Driving for a rideshare service

Example: Uber, Lyft, Sidecar, Getaround and RideAustin

Driving for a rideshare service can also help you meet new people and explore new areas.

The main benefit is that it is a flexible job that allows you to work on your own schedule. You can also make your own hours, which is great if you have other commitments.

6. Doing odd jobs on TaskRabbit

TaskRabbit is a website and mobile app that connects people who need to get things done with people who are looking for short-term work.

Tasks can range from home repairs to grocery shopping, and everything in between.

The service uses a complex algorithm to match the right tasker with the right job, based on location, skills, availability, and price.

8. Becoming a pet sitter or dog walker

Pet sitting and dog walking is a fun way to make money by taking care of animals.

Perhaps the most obvious benefit is that you get to spend time with animals, which can be incredibly rewarding.

You also get to help pet owners by providing a service that allows them to leave their pets in safe hands while they’re away.

9. Take Surveys (Earn cash for your opinion)

They’re a fast and easy way to make money.

And, you can get paid for your opinions.

By providing your feedback, you can help companies improve their products and services, which can lead to a better overall experience for consumers.

Key Takeaway

Hope this will help you stay disciplined as a noob for money with your finances and avoid unwanted debt, which is vital for anyone looking for financial stability.

Managing your money can be hard, but it’s important to do it well.

Take a look at our collection of articles for money, if you’d like to learn. Cheers:)

If you have any questions or suggestions about money noob guide, please feel free to leave your comment below.

0 notes

Text

Money: A Basic Guide To Understanding Our Relationship With It

Money is often used as a shortcut to happiness.

It is seen as a way for people to feel secure and to enjoy the things they want. But, what does it mean to have money?

It means different things to different people. It can be in the form of cash, credit cards, debit cards, checks, or anything else that can be used for payment.

What are the 3 Types of money?

1. Fiat Money

Fiat money is paper money and coins that a government says is worth a certain amount of money.

For example, the United States dollar is a fiat currency.

This means that the U.S. government says that one dollar is worth a certain amount of goods or services.

You can use fiat money to buy things in the U.S. or any other country that uses it.

The problem with fiat money is that it can be created in unlimited amounts, and this can lead to inflation.

2. Commodity Money

Commodity money is made out of a valuable material, like gold or silver.

This type of money has been used throughout history, and can be seen in examples such as gold coins.

A commodity can be anything that has value, such as gold, silver, copper, or other precious metals. The advantage to using commodity money is that it can be easily traded and has a known value.

For example, if I have a gold coin and I want to buy a toy, the shopkeeper might give me the toy because he knows that the coin is worth something.

3. Cryptocurrencies

Bitcoin, Litecoin, and Ethereum are examples of cryptocurrencies.

Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them attractive to people who want more control over their finances.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

The encryption system, which uses blockchain technology, makes it difficult for hackers to tamper with the cryptocurrency systems.

There are many different types of cryptocurrencies in the market, but Bitcoin currently seems to dominate the market in terms of volume and value.

It’s a bit more complicated than fiat currency but it provides a lot more freedom for both parties during transactions

3 Ways To Get Rich

1. Earn Money

To earn money is to receive something of value in return for one’s labor. In a capitalist economy, individuals typically earn money through employment, investment or self-employment.

Most often, this is done through some form of employment, where an individual exchanges their time and effort for a wage or salary.

However, there are many other ways to earn money as well, such as through investments, business ventures, or even gambling.

In order to make money, one must typically produce something of value that is in demand in the marketplace.

Earning money enables people to purchase the things they need or want in life.

Lastly, In order to increase one’s earning potential, it is important to be knowledgeable about the various ways to make money and to develop skills that are in demand in the marketplace.

2. Saving Money

Saving money refers to the act of setting aside a portion of one’s income with the intention of using it in the future.

The purpose of saving money is to have a cushion against unexpected expenses or to provide funds for a specific goal, such as retirement or a child’s college education.

To save money, one needs to develop good spending habits and find ways to reduce expenses.

This can be done in a variety of ways, such as putting money into a savings account , a certificate of deposit, or by investing in assets such as stocks or real estate.

When done consistently, saving money can provide individuals and families with a cushion against unexpected expenses or retirement.

It can also help them to achieve their financial goals more quickly.

By spending less than one earns, an individual can create a surplus of cash that can be saved and used for future expenses.

Additionally, savings can provide a cushion against unexpected financial setbacks.

There are a number of ways that you can use to save money, such as develop a budget, track one’s expenses, avoiding impulse purchases, and taking advantage of discounts.

3. Invest Money

When somebody invests money, they’re essentially lending it to a company or individual in the hopes that they will be able to make more money back than they originally invested.

For example, if someone puts $100 into a savings account, they may get back $105 after a year because the bank has earned interest on that money.

“ Investing Money Is Like Planting A Seed In The Ground ”

It takes time for the seed to grow, but if you water it and take care of it, it will sprout and grow into a big plant.

Over time, the seed will grow into a big plant, and it will produce fruit.

The same is true for your money.

If you invest it in a good company and let it grow, over time you will make more money than if you just left it in your bank account.

And if you’re lucky, you’ll get some fruit in the form of dividends or interest payments.

The most common way to invest money is through the purchase of stocks, which give the investor a share in the ownership of the company.

Other popular options include purchasing bonds, which are essentially loans that are repaid with interest, and investing in real estate.

While there are many risks associated with investing, there are also opportunities for high rewards.

Ways To Manage Finances wisely

Money is important in our lives.

We use it to buy the things we need, like food and clothes.

It’s important to learn how to manage our money so that we can have enough to buy the things we need, and also save some for rainy days.

One way to think about managing your finances is like managing a grocery store. You need to make sure that you have enough money to buy the food that you need, and that you are not spending too much money on things that you don’t need.

3 ways to manage your personal finance:

Tracking your daily expenses

Make a budget

Always spending less than you’re making

Simple rule of thumb, managing your finances is to make sure you’re always spending less than you’re making so you can save up for the things you want in the future.

You might want to make a budget so you that you can keep track of how much money you have and how much money you are spending.

You can also save money by putting it in a bank account or buying things on sale. And finally, you can make money by working hard and getting a job.

How Finance App Can Help To Better Manage Your Finance?

A finance app can help to better manage your finance by allowing you to track your spending and saving patterns.

The app can also help you to set financial goals and stay on track to meeting them.

For example, if you want to save up for a new car, the app can help you to break down your goal into smaller, more manageable steps, and track your progress along the way.

It can help them track their spending, budget their money, and invest their savings.

By having all of your financial information accessible in one place, you can make more informed decisions about your money and stay on track with your financial goals.

1. Personal finance apps

Help you track your spending and saving. Some personal finance apps connect to your bank account so you can see how much money you have available to spend.

One popular personal finance app is called Mint. It connects to your bank account and shows you how much money you have, how much you have spent, and what bills you need to pay.

2. Budget apps

Helps you keep track of your money. It can be helpful to create a budget and then use the app to keep track of how well you are following your budget.

Some popular budget apps include Mint, You Need a Budget, and Wally.

An analogy for this might be like a coach helping you stay on track with your diet and exercise goals.

3. Money transfer apps

The app lets you type in the amount of money you want to send, and the person you’re sending it to.

Then it sends the money electronically, and the other person can pick it up using a special code or password.

Some examples of popular money transfer apps are PayPal, Venmo, and Square Cash.

4. Money Earning apps

Apps that help you earn money are ones where you can do things like take surveys, watch videos, or do tasks and get paid for them.

For example, there is an app called “Swagbucks” where you can watch videos and then get paid to do so. There are also “cash back” apps that will give you money back for shopping at certain stores, like Walmart or Target.

What is Money?

Money is a system of trade or exchange that uses standardized units of measure.

The term money is used in different meanings and contexts, often for the same thing. Recall how your mom told you to put away your toys when you were younger — did she mean the toy’s worth? Nope, she meant that it was time to stop playing and put them away.

The word “money” has different meanings for different people.

This is because the meaning of money can be interpreted in many ways. For some, money is power, while for others, money represents security and prestige.

Money can be a means of transaction for buying goods and services while some believe that it’s more than just a means of exchange.

Some people want to earn more and save up all their lives while others want to spend as much as possible and not worry about the future. It’s clear that there are many definitions on what money really is and it’s difficult to put an exact definition on it.

How To Manage Money Problems ?

If you have money problems, you can try to solve them by managing your money better.

You can do this by creating a budget and sticking to it, by saving your money, and by not spending more than you have.

If you follow these Finance 101 tips, you can hopefully get your money problems under control.

Try to fix them by:

1. Making more money

You can also try and find ways to make some extra money on the side, like by doing odd jobs or selling things that you don’t need anymore.

2. Spending less money

You can cut your bills. This means that you can find ways to spend less money each month on things like rent, food, and transportation.

One way to do this is by looking for cheaper alternatives, like eating at home instead of going out to eat, or taking the bus instead of driving.

You can also try negotiating lower rates with your service providers, like your cable company or cellphone provider.

3. Getting help from someone else

If you’re having financial trouble and don’t have enough money to get by, you can ask your parents or other friends for a loan. This will help you survive through your tough time and pay the money back later.

You can also try to borrow money from other people or from a bank.

4. Sell your old staff

Finally, you can sell some of your belongings to raise money.

If you are in a tough spot money-wise, you can sell your old stuff to help make ends meet. You can also sell clothes, furniture, or anything else you don’t need anymore to make some extra money.

Just be sure to research what things are worth before you put them up for sale!

How to Get More Money with Different Ideas & Plans

One way to make more money is to adopt a different mindset; it is important to be open-minded and think creatively.

If you are looking for ways to get more money, you might want to consider the following:

1. Consider your skills and talents.

Do you have any skills that can be put into work? For example, if you are good at baking, then this might be a skill that can earn money for you.

2. Consider your life goals.

Perhaps earning more cash now will help you reach your goals in the future.

Your life goals might be to be a doctor, a teacher, or an artist. You might want to travel to different places or learn new things.

And, you might want to help other people or make the world a better place.

These are all good things to work towards!

How Manage Money Better ?

One of the most important habits is you should develop is tracking spending.

It is not enough to know how much you’re making, but you also need to know where it’s going.

Managing your money well means that you need to make sure that you have enough money to cover your expenses, like food, clothes, and rent or a mortgage.

If you want to manage your money better, you need to learn about budgeting and saving.

1. Budgeting

Budgeting is when you figure out how much money you have and how much you need, and then plan how to spend your money wisely.

2. Savings

Savings is when you put some of your money aside so you have it for later, when you might need it.

There are many Android apps that can help you with your budget.

These apps have the ability to create budgets for you, track your spending habits and can even be synced with your bank account so that you know exactly where your money is going.

Key Takeaway

Hope this will help you stay disciplined as a noob for money with your finances and avoid unwanted debt, which is vital for anyone looking for financial stability.

Managing your money can be hard, but it’s important to do it well.

Take a look at our collection of articles for money, if you’d like to learn. Cheers:)

If you have any questions or suggestions about money noob guide, please feel free to leave your comment below.

0 notes

Text

About US

Money Noob is a resource that provides beginner-level information on personal finance topics for people just starting out.

We helps you get organized with your personal finances by creating personalized checklists for every stage of life, from graduating college to retirement.

Money lessons for Newbies :

1. Confidently take control of your money

2. Learn how to invest, budget, and maximize the value of your 401k

3. Get your finances right for retirement

4. Become financially literate

5. Make and track a budget

Money Noob teaches the basics of everything from budgeting to investing, so you can feel competent with your finances.

Identify basics concepts in money management and everyday financial decisions, such as

Budgets

Saving

Investments

Retirement planning

Debt reduction

Insurance policies

Credit cards

to help empower you to make better financial decisions.

Financial literacy is important, but it takes time, effort, and sometimes trial and error to learn the tricks of the investment trade. That doesn’t mean you’re a loser for not getting started sooner, but it does mean you have to start somewhere.

That’s where Money Noob comes in.

The goal of this blog is to help you set a plan for your life and invest for your future.

0 notes