Updates on accounting technology, CRA changes, tax strategies, tax preparation and all kinds of related things

Don't wanna be here? Send us removal request.

Text

Best Receipt Scanners and Trackers of 2019

Keep a close eye on what you're spending and get reimbursed

When it comes to recordkeeping, tracking a pile of receipts can become daunting, especially if you travel often for business and need to organize them for expense tracking, or you run your own business and want to take every write-off your company deserves.

Using a receipt scanner and tracker can dramatically reduce the time and effort you put into tracking and organizing expenses and tame the tornado of papers and receipts floating around in your space.

The best receipt scanners read your receipts and automatically extract key information, such as the date, merchant, amount spent, and payment method. Being able to access your receipts from multiple locations and create expense reports on the go is also a plus. If you’re looking for a traditional scanner for keeping tabs on your receipts, check out some of the best receipt scanners and trackers to use today.

Best Overall: Expensify

After launching in 2008, Expensify has gathered more than five million users worldwide, making it one of the most widely known receipt tracking apps. Expensify can submit receipts to your manager, collect receipts from clients, and track your personal expenses.

After using your smartphone to take a picture of your receipt, the SmartScan feature automatically reads any important details. You can add a category to each receipt, then tag and group expenses for expense reporting.

In addition to tracking expenses, the app also includes mileage and time tracking. As a manager receiving expense reports from employees, you have the ability to approve or reject expense reports. Approved expense reports can be reimbursed via next-day direct deposit.

Potential downside: The receipt-scanning feature isn't always 100 percent accurate, so double-check the results against your original for accuracy.

Best for Tax Time: Shoeboxed

Use the Shoeboxed app to scan receipts and track mileage. The app extracts the most important information from the receipt: the merchant, the payment method, total amount, and the date of the purchase.

What makes Shoeboxed great for tax filing compared to the other receipt trackers is that you can indicate whether each expense is deductible. When it’s tax time, you can easily export deductible expenses and receipts for your tax preparer.

Shoeboxed also allows you to mark expenses as reimbursable for easy expense tracking for your employers. Automatically import receipts from Gmail. Create expense reports from within the app and send them directly from your phone without having to export to your computer or print them out.

For mileage reimbursements, you can track mileage easily with the GPS function on your smartphone. If you need to, you can export expenses to a variety of accounting software, including QuickBooks, Outright, Wave Accounting, and Excel.

Potential downside: If you scan items for reasons other than saving receipts, you are limited to saving as a PDF, with very few other options.

Best for Sharing and Collaborating: Neat

Neat is a complete filing system with a physical scanner, scanning app for your smartphone, and online account access. The app accesses your smartphone’s camera to scan receipts, then extracts the most important information, saving you the time and effort of entering these details separately.

If you need to give someone else access to your receipts—your manager or business partner, for example—you can share your receipts and expenses with necessary parties by providing view-only access to specific folders. The system even has the capability of storing comments on each expense item.

You can also upload PDFs, images, and electronic receipts from your computer and file these right along with the receipts you’ve scanned from your smartphone. Sync your data across devices so that you can access your files from anywhere. You can quickly and easily create expense reports from your smartphone or tablet using the data from your receipts with a summary of your spending and an itemized list of your expenses.

Potential downside: Neat isn't the most cost-effective option, although it does offer three payment plan levels.

Best Premium App: Smart Receipts Plus

Smart Receipts is great for businesses and traveling consultants who need to track expenses, but also flexible enough for personal expense tracking. When you’re traveling on business, it’s hard to find the time to keep track of all your receipts and time-consuming to organize receipts once you return from trips. Smart Receipts is designed with those problems in mind.

The app can be used to scan receipts and store them along with multiple types of account data like dates, comments, and payment data. Once you’ve stored your receipts, you can create customized PDF reports that contain a collage of receipt images along with your own categories for each receipt.

Smart Receipts also gives you the ability to export your expenses in a variety of formats: PDF, CSV, and ZIP. Businesses can even white label the app to use as their own expense tracking app. Individuals can download a free version of the app from the app store, then upgrade to the premium version within the app. The paid version is ad-free, offers automatic cloud backups, and allows you to customize the footer on expense reports.

Potential downside: This app has no cloud backup for its data, so you need to rely on the app for storage and email yourself reports as a safeguard.

Best for Small Businesses: Receipts by Wave

Receipts by Wave is a great receipt tracking app for small business owners and freelancers who need to keep up with receipts, invoices, and bills. The app does require you to also use Wave’s free accounting software, which provides additional functionality for expense tracking and report creation.

Use the app to take pictures of your receipts and it then utilizes optical character recognition technology to pull vital details from the receipt like the merchant, payment method, and total. The receipt details and image are imported to your Wave account. You can also upload receipts from other locations, including Google Drive, Dropbox, and Skydrive.

Receipts are stored in the cloud, allowing you access from your smartphone or computer you have an Internet connection.

0 notes

Text

Tax rates for 2019

Here are the tax rates for personal income taxes in Canada:

15% on the first $47,630 of taxable income, plus

20.5% on the next $47,629 of taxable income (on the portion of taxable income over 47,630 up to $95,259),plus

26% on the next $52,408 of taxable income (on the portion of taxable income over $95,259 up to $147,667),plus

29% on the next $62,704 of taxable income (on the portion of taxable income over 147,667 up to $210,371), plus

33% of taxable income over $210,371

Provincial and territorial tax rates for 2019

Tax for all provinces (except Quebec) and territories is calculated the same way as federal tax.

Form 428 is used to calculate this provincial or territorial tax. Provincial or territorial specific non-refundable tax credits are also calculated on Form 428.

Provincial and territorial tax rates (combined chart)Provinces and territories

Rates

Newfoundland and Labrador

8.7% on the first $37,591 of taxable income, +

14.5% on the next $37,590, +

15.8% on the next $59,043, +

17.3% on the next $53,689, +

18.3% on the amount over $187,913

Prince Edward Island

9.8% on the first $31,984 of taxable income, +

13.8% on the next $31,985, +

16.7% on the amount over $63,969

Nova Scotia

8.79% on the first $29,590 of taxable income, +

14.95% on the next $29,590, +

16.67% on the next $33,820, +

17.5% on the next $57,000, +

21% on the amount over $150,000

New Brunswick

9.68% on the first $42,592 of taxable income, +

14.82% on the next $42,592, +

16.52% on the next $53,307, +

17.84% on the next $19,287, +

20.3% on the amount over $157,778

Quebec

Go to

Income tax rates

(Revenu Québec Web site).

Ontario

5.05% on the first $43,906 of taxable income, + 9.15% on the next $43,907, + 11.16% on the next $62,187, + 12.16% on the next $70,000, + 13.16 % on the amount over $220,000

Manitoba

10.8% on the first $32,670 of taxable income, +

12.75% on the next $37,940, +

17.4% on the amount over $70,610

Saskatchewan

10.5% on the first $45,225 of taxable income, +

12.5% on the next $83,989, +

14.5% on the amount over $129,214

Alberta

10% on the first $131,220 of taxable income, +

12% on the next $26,244, +

13% on the next $52,488, +

14% on the next $104,976, +

15% on the amount over $314,928

British Columbia

5.06% on the first $40,707 of taxable income, + 7.7% on the next $40,709, + 10.5% on the next $12,060, + 12.29% on the next $20,030, + 14.7% on the next $40,394, + 16.8% on the amount over $153,900

Yukon

6.4% on the first $47,630 of taxable income, +

9% on the next $47,629, +

10.9% on the next $52,408, +

12.8% on the next $352,333, +

15% on the amount over $500,000

Northwest Territories

5.9% on the first $43,137 of taxable income, +

8.6% on the next $43,140, +

12.2% on the next $53,990, +

14.05% on the amount over $140,267

Nunavut

4% on the first $45,414 of taxable income, +

7% on the next $45,415, +

9% on the next $56,838, +

11.5% on the amount over $147,667

0 notes

Text

How to Write a Business Plan

What makes a good business plan?

Business plans come in many different formats and styles, but the best ones cover the same critical topics:

Purpose. Explain why your small business exists and why it’s important. What problem or need is your business trying to solve? How does it solve your customer’s pain points?

Product/Service. Describe the product or service that you’re offering, and what makes it unique from its competitors.

Customer. Identify your company’s ideal customer. Get into their head, have a clear understanding of their challenges, and explain why your product is perfect for them.

Marketing. How do you plan to promote your brand? Show what you’ve already done, what you plan to do given your existing resources, and what results you expect from your efforts.

Monetization. The key to a sustainable company is a profitable business model. Explain how your business will make money and what kind of ROI investors can expect.

Team. A business idea is only as good as the team that executes it. Identify your team members and why they are the perfect team to bring this idea to life. Also look ahead and mention the people you still need to expand your company.

It’s not enough to just dump all this information into a single document and send it off. Venture capitalists read dozens of these documents a month, and have little patience for badly written or poorly created documents. You want your business plan to be as attractive and readable as possible.

Here are some tips to make your business plan more presentable:

Don’t write a novel. Make your business plan as short as possible while still communicating all the essentials. The fewer pages you use, the better. According to Entrepreneur, a typical business plan can range from 15 to 20 pages, but there’s lots of room for variation.

Make it easy to read. Divide your document into distinct and logical sections, so that investors can quickly flip between key pieces of information.

Proofread. Double and triple check the writing for typos and grammatical mistakes. Awkwardly written documents are hard to read through and easy to dismiss as amateur.

Invest in design and printing. A proper layout and decent printing or bookbinding gives your business plan a professional feel.

Also remember that content is more important than design. Strategize and research your business plan thoroughly, and know your numbers inside out—from costs to sales projections. Once you’re confident in your plan’s viability, then you can worry about formatting and layout. If you can show investors you can perform to a professional standard even during the pitch phase, they’ll be more willing to join you in building a thriving business!

Once your business is off the ground, you will need to start developing an invoice and bookkeeping strategy. Intuit QuickBooks software is designed to streamline the bookkeeping process. Feel free to contact one of our experts to find out what our software can do for you.

0 notes

Text

What to do before December 31

It’s the end of the year, and amid all the celebrating and best-of lists, it’s time to get in a few smart financial moves before the new year begins. Consider the following suggestions to end your year in a financially strong position, setting yourself up for success in 2018.

One of the easiest things you can do is maximize your end-of-year retirement contributions. Even if you increase your RRSP contributions by just a percentage point or two, the extra contribution may add up in the long run. You may not even notice the difference in your income. Here is a relatively nice calculator to show how much your tax savings could be with an RRSP contribution. http://ativa.com/rrsp-tax-savings-calculator/

Donate to charity. Speaking of charity, any contributions you make to charity before year-end can be deductible against your income. You can make gifts with cash or property, including appreciated investments. If you want to see how it can benefit you, use this calculator: http://www.cra-arc.gc.ca/chrts-gvng/dnrs/svngs/clmng1b2-eng.html

Pay off debts: If you have credit card debt or student loans, funnel most of your bonus money towards paying off debts. If you are debt free, congratulations! That means you can consider opening a Tax Free Savings Account or CD and allow the money to grow.

Take some time to analyze your investments and revisit your allocations. Rebalance your investments, especially if you haven’t done so since last year. There are free, automated investment trackers that can be found online, or you can use a computer or hard copy spreadsheet.

Take advantage of programs that you participate in which have year-end due dates:

-If your company has a “use it or lose it” vacation plan, take any unused vacation days pronto or ask for an extension.

-Check if you have any frequent flier or rewards points expiring at the end of the year. If you do, redeem them. Check out www.points.com to consolidate points from different reward programs.

-If you have a Medical Reimbursement Plan or Flexible Spending Account, use any remaining funds if they expire at the end of the year. If you have no reason to visit your doctor, check your plan for an approved list of covered items that you may be able to purchase, such as glasses, a knee brace, or a humidifier.

-If you are retired and have a retirement plan that requires you to withdraw a certain amount each year, make sure you’ve done so.

Lastly, compare where you are now to where you planned to be when you mapped out your finances for the year back in January. Have you met or at least made tangible progress towards your goals? Were your goals too lofty, and should you consider adjusting and scaling back in the coming year? Making realistic plans is one of the best things you can do for yourself and your finances for the coming year.

0 notes

Text

How to Finance a Business Acquisition

An incorporated company is considered a separate entity, both legally and for tax purposes. Before you can start or buy a business, you should be able to estimate your personal borrowing capacity. Depending on your personal balance sheet, lenders could ask you to put up some of your assets as security (e.g. capital property, available cash flow, etc.). Your borrowing capacity can thus be used as a financial lever to acquire a business. If you do not have enough personal assets you will have to look for other sources of financing for your acquisition project.

There are several types of financing that can be used (or combined) to make your acquisition project a success:

Investing one’s own money may earn the confidence of a financial institution, increase the equity put into the transaction and share the risk. Purchasers often have to invest a substantial portion of their personal assets to prove their commitment.

Bank loans are often used to purchase shares held by the business owner. This type of financing is interesting because it is simple, the assets are used as security and interest rates are lower.

With vendor financing the payments can be spread over a certain number of years. This reduces the outlay at the time of the transaction and makes the transition easier.

The purchase of shares payable in instalments allows the vendor to keep some control until the full amount of the purchase has been paid off.

Growth and business transition capital can be used to complete the purchaser’s equity investment by combining aspects of debt financing and equity financing. If a profitable business maximizes the financing of its assets and the purchaser does not have enough personal funds, institutions that provide growth and business transition capital may agree to take on a higher risk to participate in the project.

Depending on the situation, it might be interesting to consider buying a business with one or more other business partners, which will reduce your initial investment and financial risk. However, it will also reduce your equity in the business.

Image thanks to FreeDigitalPhotos

0 notes

Text

When is it Not a Good Time to Invest in RRSP?

If your income is too low and you will not benefit from the tax deduction. Generally this is about $12,000 of income.

If you will be in a higher tax bracket in retirement than when you are working. It's rare, but it happens. For example, Martha owns her own business and spends next to nothing. She reports personal income of $33,000 per year. As a result of being a saver, she has accumulated $750,000 in RRSPs, $500,000 in investments and her business is worth at least $1,000,000. Her retirement income will be greater than $33,000, especially if she does not start spending some of her money. Martha should not buy RRSPs.

If you have too much money in RRSPs. Some people just have too much success in their RRSPs and should not buy more. For example, George worked in the tech industry at the right time. His RRSP grew to over $1.5-million, mostly because he had stocks like Nortel and Microsoft and sold most of them at the right time. He now has a tax liability because he will have to pay tax on all the money earned. There is no point putting more into RRSPs.

If you might be in a higher tax bracket in the near future, an RRSP contribution works as a tax deduction against your income. Any deduction saves you money in tax equal to whatever your marginal tax rate is. For example, Betty earns $43,000. She expects that her income i will rise to $48,000 next year because she is working in a new job. Say the tax bracket cutoff (where you move from one bracket to another) is $45,282. If Betty claimed a $1,000 contribution this year, the deduction will be worth 25 per cent. If she waited until next year to claim the contribution, she would save 31 per cent in taxes (because she is in a higher tax bracket).

0 notes

Text

Reduce your Taxes by Contributing to your RRSP

You have been working all year and you don”t think you have paid enough in taxes but you don’t want to pay any more? You would rather pay the amount you owe to yourself? Well how much do you need to pay in order to help yourself at the end of the year. There is a tool to help you here and it is a good idea to look at this as soon as you can and make some plans before February 28 !

The main advantage of a RRSP, other than reducing your tax payments, is easing your saving effort for retirement. It allows you to accumulate savings in a simpler way than if you would cash all your yearly income, pay the taxes on it and then invest the money. By being tax deductible, you invest your money first, and then pay tax on your yearly income less the contribution, which decreases tax payment and optimizes your savings for retirement.

Here are a couple of sites where you can estimate how much you should invest in an RRSP to save on the taxes that you pay:

http://ativa.com/rrsp-tax-savings-calculator/

http://www.ey.com/ca/en/services/tax/tax-calculators-2016-rrsp-savings

0 notes

Text

Consider this.

SOURCE: BDC Monthly Economic Letter

Over the next few years, there will be a significant increase in the number of small businesses for sale.

Why?

Because so many entrepreneurs are heading for retirement. Small business owners are generally older than the workforce. Indeed, nearly 60% of Canada’s small business owners are 50 years old or older. This demographic reality means that four in 10 small business owners are planning to exit their businesses in the next five years, according to a new BDC study.

What does the retirement of so many entrepreneurs mean for the economy?

There are over one million small and medium-sized businesses in Canada, accounting for approximately 40% of gross domestic product. With 40% of entrepreneurs planning to exit their businesses over the coming few years, roughly $300 billion worth of business value will change hands via transfers of family businesses to the next generation, sales or liquidation.

Over the next many years, we should anticipate an increase in entrepreneurship dynamism. Since 2001, business creation has been relatively stable, with the creation of an additional 11,000 active firms each year. However as entrepreneurs retire and sell their businesses, more new firms will be created, stimulating the economy.

An opportunity to scale up!

With an increase in businesses for sale over the next few years, valuations are likely to be driven down. This presents an opportunity for entrepreneurs to scale up their businesses by making acquisitions. That’s good news for the Canadian economy which is marked by a large number of very small businesses. Companies that can scale up through acquisitions will typically be better positioned in their market, enjoy greater economies of scale and be more competitive both at home and abroad.

A possible drag on investment

On the other hand, entrepreneurs planning to exit their business may be less likely to pursue growth or take risks. This may put an additional damper on already lacklustre business investment levels in Canada. Once newly amalgamated businesses are able to capture new markets, investments should increase.

Knowledge will not necessarily be lost

Often, when the older generation leaves the workforce, there is fear that knowledge will be lost. However, about a quarter of entrepreneurs planning to exit their business will transition their firm to the next generation. Another 50% of entrepreneurs will sell their firms, but many of these sales will be to the management team.

In both cases, knowledge about the business will be preserved. Even in cases where owners sell to outsider buyers, former owners often stay involved, ensuring some level of knowledge transfer.

Where are the opportunities?

Buyers and sellers both have an interest in what kinds of companies have the best prospects and therefore will attract top prices.

According to BDC’s research, the most sought-after firms are those which have a good track record of at least three years of healthy cash flow and low operating costs. In recent years, firms with the fastest growing revenues have been in construction, manufacturing, professional and technical services, and transportation and warehousing.

Furthermore, export-oriented companies outshine their domestically-focused counterparts in terms of revenue and profit growth, with nearly twice as many exporters reporting 25% or more annual growth in profits than non-exporters, based on BDC's study Exporting: A key driver of SME growth and profits.

Owners of exporting firms tend to be older and have more experience (10+ years) and thus may be looking to exit in the coming few years.

To ensure full value at the time of sale, owners need to maximize their firm’s cash flow as this variable is critical in estimating enterprise value. If you are planning to sell your business in the near future, check out The Coming Wave of Business Transitions in Canada: Are Entrepreneurs Ready to Exit Their Company? for tips on how to maximize your firm’s value.

0 notes

Text

Choosing the Best Bookkeeper

You may be asking yourself, why do I need a bookkeeper when I already have an accountant?

To some, the roles seem synonymous. Even the dictionary contributes to the confusion, listing both as a person who records the accounts or transactions of a business. Though bookkeepers and accountants deal with the same financial information, they manage different aspects of it. One handles the day-to-day while the other focuses on the big picture.

Every entrepreneur should understand what they need and what to look for as they search for the best bookkeeper for their business. As their accountant, here’s how to help y you choose the right one:

A Great Bookkeeper has Skills

They should have some level of training or accreditation. Several national associations offer bookkeeping certification, including the National Association of Certified Public Bookkeepers, the American Institute of Professional Bookkeepers and the National Bookkeepers Association. Additionally, bookkeepers can receive training and certification through the QuickBooks ProAdvisor® Program.

A Great Bookkeeper is Experienced

Whether an independent contractor or operating through a firm, a great bookkeeper has experience – preferably in your industry and with the same accounting software you use.

In terms of technology, you want someone who is familiar with (if not already an expert in) the accounting software you use.

A Great Bookkeeper Wants to Build Their Business

A great bookkeeper understands your business, spots red flags, and recognizes opportunities for improvement and growth. A great bookkeeper will ask questions to allocate things correctly; he or she will want to solve problems and implement processes that offer you and your business the most value.

A great bookkeeper understands that by building your client's business, they are bettering theirs.

A Great Bookkeeper is Someone You Can Trust

More than qualifications and good references, the best bookkeeper is someone you can trust. They should be honest and transparent. They should be easy to reach via phone or email. Whether employed full time, their personality should mesh well with your company culture to ensure the best fit for both of you.

Good luck!

0 notes

Text

Haven’t Filed Past Tax Returns?

In many instances, the failure to file tax returns starts quite innocently as a consequence of life changing events such as divorce, family sickness, the death of loved ones or, the loss of employment. Because of the calamities faced by the taxpayer, the filing of a tax return is relegated to the lowest priority.

However, when the next year arrives, the taxpayer feels that the filing of a return for that particular year will give rise to CRA’s discovery of the failure to file from the previous year. This leads to a never-ending cycle of failing to file.

There are many taxpayers who have unwittingly found themselves in this situation which has arisen rather innocently.

In addition, of course, there are numerous taxpayers who have decided that they simply are not required to pay tax or, feel justified in failing to report some portions of their income.

Thankfully, CRA offers a program known as the Voluntary Disclosure Program (“VDP”) which allows non-compliant taxpayers to correct their sins of the past and “come clean” with CRA.

The result of participating in the VDP is that CRA will not prosecute you, nor will it levy civil penalties against you in connection with your previous failures. To “clean up” your past, apply now:

http://bit.ly/2vV6Vjx

0 notes

Text

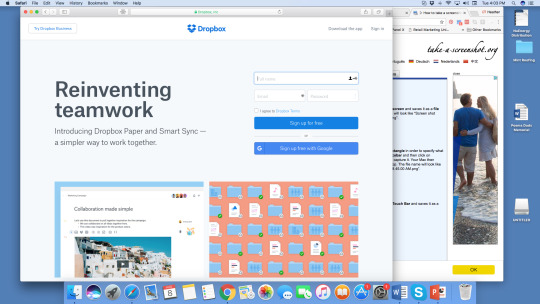

Do You Know How to Use Dropbox?

Dropbox is a convenient storage cabinet for your files that is secure and safe. But the best thing about it is your files live in the cloud. You can store photos, files, and data in Dropbox anytime....and access it anywhere. If you use different computers, a tablet, or a phone....you can access those files anywhere, anytime!

Type into your browser: Dropbox.com

You should see a screen like the one below.

Sign up with your email and name; check the box that you agree to the Dropbox terms , then click on SIGN UP FOR FREE.

When you have signed up, go back and download the app onto your computer (upper right hand corner).

More to come later. If you have questions, just ask us for help !

0 notes

Video

tumblr

We are now live! M & L Cloud Accounting and Consulting Inc. is here to serve you.

0 notes

Text

WELCOME to mlcloudaccounting.ca

Hello everyone and thank you for reading our blog on this new website. Elisabeth and Heather have amalgamated to form M & L Cloud Accounting Inc.

Some you of you already know Elisabeth and Heather who worked with Allan Scope at Execuplan (before he passed).

Heather built up her own accounting business, and Elisabeth focused on restructuring the accounting function at BVo2 and completed that project. Forming M&L was a natural evolution and the timing was perfect. Both Heather and Elisabeth believe that clients deserve individual attention to detail and are focused on client satisfaction.

If you are overpaying taxes, Heather and Elisabeth will help streamline and optimize your financials so that you keep as much of your hard earned money as possible !

0 notes