Sell Your Home In Frisco TX http://sellahome.indallastexasarea.com 214-636-7138 Big News for Dallas TX Area Real Estate. Home Solutions Realty, 214-636-7138 has been awarded the Toyota Relocation Preferred Agent for Dallas Area. You Don't have to be...

Don't wanna be here? Send us removal request.

Text

New Post has been published on Homes Below Market | Homes For Sale Dallas TX Area

New Post has been published on https://foreclosures-dallas-texas.com/consumer-protection-notice/

Consumer Protection Notice

THE TEXAS REAL ESTATE COMMISSION (TREC) REGULATESREAL ESTATE BROKERS AND SALES AGENTS, REAL ESTATE INSPECTORS,EASEMENT AND RIGHT‐OF‐WAY AGENTS,AND TIMESHARE INTEREST PROVIDERSYOU CAN FIND MORE INFORMATION ANDCHECK THE STATUS OF A LICENSE HOLDER ATWWW.TREC.TEXAS.GOVYOU CAN SEND A COMPLAINT AGAINST A LICENSE HOLDER TO TRECA COMPLAINT FORM IS AVAILABLE ON THE TREC WEBSITETREC ADMINISTERS THE REAL ESTATE RECOVERY TRUST ACCOUNT WHICH MAY BEUSED TO SATISFY A CIVIL COURT JUDGMENT AGAINST A BROKER, SALES AGENT, OREASEMENT OR RIGHT‐OF‐WAY AGENT, IF CERTAIN REQUIREMENTS ARE MET.REAL ESTATE INSPECTORS ARE REQUIRED TO MAINTAIN ERRORS AND OMISSIONSINSURANCE TO COVER LOSSES ARISING FROM THE PERFORMANCE OF A REAL ESTATEINSPECTION IN A NEGLIGENT OR INCOMPETENT MANNER.PLEASE NOTE: INSPECTORS MAY LIMIT LIABILITY THROUGH PROVISIONS IN THE CONTRACTOR INSPECTION AGREEMENT BETWEEN THE INSPECTOR AND THEIR CLIENTS. PLEASE BESURE TO READ ANY CONTRACT OR AGREEMENT CAREFULLY. IF YOU DO NOT UNDERSTANDANY TERMS OR PROVISIONS, CONSULT AN ATTORNEY.

IF YOU HAVE QUESTIONS OR ISSUES ABOUT THE ACTIVITIES OFA LICENSE HOLDER, THE COMPLAINT PROCESS, OR THERECOVERY TRUST ACCOUNT, PLEASE VISIT THE WEBSITE OR CONTACT TREC AT

TEXAS REAL ESTATE COMMISSIONP.O. BOX 12188AUSTIN, TEXAS 78711-2188(512) 936-3000

0 notes

Text

New Post has been published on Homes Below Market | Homes For Sale Dallas TX Area

New Post has been published on https://foreclosures-dallas-texas.com/information-about-brokerage-services/

Information About Brokerage Services

0 notes

Text

New Post has been published on Denton County Foreclosures

New Post has been published on https://dentoncountytxforeclosures.com/the-benefits-of-buying-a-multi-generational-home-infographic-2/

The Benefits of Buying a Multi-Generational Home [INFOGRAPHIC]

Some Highlights

If you’re ready to buy a home but are having a hard time affording it on your own, or, if you have aging loved ones you need to care for, you might want to consider a multi-generational home.

Living with siblings, parents, and even grandparents can help you save money, give or receive childcare, and spend quality time together.

Talk to a local real estate agent to find a home in our area that’s perfect for you and your loved one’s needs.

0 notes

Text

New Post has been published on Denton County Foreclosures

New Post has been published on https://dentoncountytxforeclosures.com/dont-believe-everything-you-read-about-home-prices/

Don’t Believe Everything You Read About Home Prices

According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way?

It has a lot to do with all the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering. You may be hearing people in your own life saying they’re worried about home prices or see on social media that some influencers are saying prices are going to come tumbling down.

If you’re someone who still thinks prices are going to fall, ask yourself this: Which is a more reliable place to get your information – clickbait headlines and social media or a trusted expert on the housing market?

The answer is simple. Listen to the professionals who specialize in residential real estate.

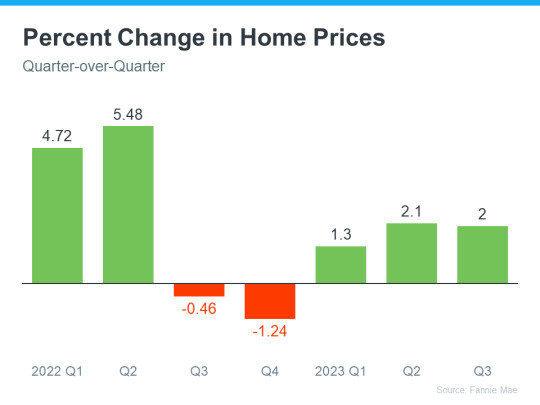

Here’s the latest data you can actually trust. Housing market experts acknowledge that nationally, prices did dip down slightly late last year, but that was short-lived. Data shows prices have already rebounded this year after that slight decline in 2022 (see graph below):

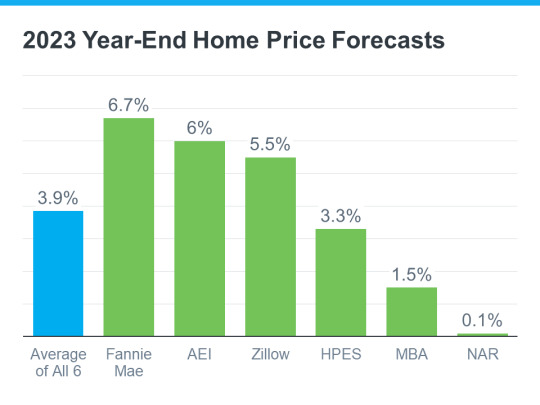

But it’s not just Fannie Mae that’s reporting this bounce back. Experts from across the industry are showing it in their data too. And that’s why so many forecasts now project home prices will net positive this year – not negative. The graph below helps prove this point with the latest forecasts from each organization:

What’s worth noting is that, just a few short weeks ago, the Fannie Mae forecast was for 3.9% appreciation in 2023. In the forecast that just came out, that projection was updated from 3.9% to 6.7% for the year. This increase goes to show just how confident experts are that home prices will net positive this year.

So, if you believe home prices are falling, it may be time to get your insights from the experts instead – and they’re saying prices aren’t falling, they’re climbing.

Bottom Line

There’s been a lot of misleading information about home prices over the past year. And that’s still having an impact on how people are feeling about the housing market today. But it’s best not to believe everything you hear or read.

If you want information you can trust, turn to the real estate experts. Their data shows home prices are on the way back up and will net positive for the year. If you have questions about what’s happening in your area, connect with a local real estate agent.

0 notes

Text

New Post has been published on Denton County Foreclosures

New Post has been published on https://dentoncountytxforeclosures.com/the-benefits-of-buying-a-multi-generational-home-infographic/

The Benefits of Buying a Multi-Generational Home [INFOGRAPHIC]

Some Highlights

If you’re ready to buy a home but are having a hard time affording it on your own, or, if you have aging loved ones you need to care for, you might want to consider a multi-generational home.

Living with siblings, parents, and even grandparents can help you save money, give or receive childcare, and spend quality time together.

Talk to a local real estate agent to find a home in our area that’s perfect for you and your loved one’s needs.

0 notes

Text

New Post has been published on Denton County Foreclosures

New Post has been published on https://dentoncountytxforeclosures.com/what-are-accessory-dwelling-units-and-how-can-they-benefit-you/

What Are Accessory Dwelling Units and How Can They Benefit You?

Maybe you’re in the market for a home and are having a hard time finding the right one that fits your budget. Or perhaps you’re already a homeowner in need of extra income or a place for loved ones. Whether as a potential homebuyer or a homeowner with changing needs, accessory dwelling units, or ADUs for short, may be able to help you reach your goals.

What Is an ADU?

As AARP says:

“An ADU is a small residence that shares a single-family lot with a larger, primary dwelling.”

“An ADU is an independent, self-contained living space with a kitchen or kitchenette, bathroom and sleeping area.”

“An ADU can be located within, attached to, or detached from the main residence. It can be created out of an existing structure (such as a garage) or built anew.”

If you’re thinking about whether an ADU makes sense for you as a buyer or a homeowner, here’s some useful information and benefits that ADUs can provide. Keep in mind, that regulations for ADUs vary based on where you live, so lean on a local real estate professional for more information.

The Benefits of ADUs

Freddie Mac and the AARP identify some of the best features of ADUs for both buyers and homeowners:

Living Close by, But Still Separate: ADUs allow loved ones to live together while having separate spaces. That means you can enjoy each other’s company and help each other out with things like childcare, but also have privacy when needed. If this appeals to you, you may want to consider buying a home with an ADU or adding an ADU onto your house. According to Freddie Mac:

“Having an accessory dwelling unit on an existing property has become a popular way for homeowners to offer independent living space to family members.”

Aging in Place: Similarly, ADUs allow older people to be close to loved ones who can help them if they need it as they age. It gives them the best of both worlds – independence and support from loved ones. For example, if your parents are getting older and you want them nearby, you may want to buy a home with an ADU or build one onto your existing house.

Affordable To Build: Since ADUs are often on the smaller side, they’re typically less expensive to build than larger, standalone homes. Building one can also increase your property’s value.

Generating Additional Income: If you own a home with an ADU or if you build an ADU on your land, it can help generate rental income you could use toward your own mortgage payments. It’s worth noting that because an ADU exists on a single-family lot as a secondary dwelling, it typically cannot be sold separately from the primary residence. But that’s changing in some states. Work with a professional to understand your options.

These are a few of the reasons why many people who benefit from ADUs think they’re a good idea. As Scott Wild, SVP of Consulting at John Burns Research, says:

“It’s gone from a small niche in the market to really a much more impactful part of new housing.”

Bottom Line

ADUs have some great advantages for buyers and homeowners alike. If you’re interested, reach out to a real estate professional who can help you understand local codes and regulations for this type of housing and what’s available in your market.

0 notes

Text

New Post has been published on Denton County Foreclosures

New Post has been published on https://dentoncountytxforeclosures.com/foreclosures-and-bankruptcies-wont-crash-the-housing-market/

Foreclosures and Bankruptcies Won’t Crash the Housing Market

If you’ve been following the news recently, you might have seen articles about an increase in foreclosures and bankruptcies. That could be making you feel uneasy, especially if you’re thinking about buying or selling a house.

But the truth is, even though the numbers are going up, the data shows the housing market isn’t headed for a crisis.

Foreclosure Activity Rising, but Less Than Headlines Suggest

In recent years, the number of foreclosures has been very low. That’s because, in 2020 and 2021, the forbearance program and other relief options were put in place to help many homeowners stay in their homes during that tough time.

When the moratorium ended, there was an expected rise in foreclosures. But just because they’re up, that doesn’t mean the housing market is in trouble.

To help you see how much things have changed since the housing crash in 2008, check out the graph below using research from ATTOM, a property data provider. It looks at properties with a foreclosure filing going all the way back to 2005 to show that there have been fewer foreclosures since the crash.

As you can see, foreclosure filings are inching back up to pre-pandemic numbers, but they’re still way lower than when the housing market crashed in 2008. And today, the tremendous amount of equity American homeowners have in their homes can help people sell and avoid foreclosure.

The Increase in Bankruptcies Isn’t Dramatic Either

As you can see below, the financial trouble many industries and small businesses felt during the pandemic didn’t cause a dramatic increase in bankruptcies. Still, the number of bankruptcies has gone up slightly since last year, nearly returning to 2021 levels. But that isn’t cause for alarm.

The numbers for 2021 and 2022 were lower than more typical years. That’s in part because the government provided trillions of dollars in aid to individuals and businesses during the pandemic. So, let’s instead focus on the bar for this year and compare it to the bar on the far left (2019). It shows the number of bankruptcies today is still nowhere near where it was before the pandemic. Both of these two factors are reasons why the housing market isn’t in danger of crashing.

Bottom Line

Right now, it’s crucial to understand the data. Foreclosures and bankruptcies are rising, but these leading indicators aren’t signaling trouble that would cause another crash.

0 notes

Text

New Post has been published on Denton County Foreclosures

New Post has been published on https://dentoncountytxforeclosures.com/a-real-estate-agent-helps-take-the-fear-out-of-the-market/

A Real Estate Agent Helps Take the Fear Out of the Market

Do negative headlines and talk on social media have you feeling worried about the housing market? Maybe you’ve even seen or heard something lately that scares you and makes you wonder if you should still buy or sell a home right now.

Regrettably, when news in the media isn’t easy to understand, it can make people feel scared and unsure. Similarly, negative talk on social media spreads fast and creates fear. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

But it doesn’t have to be that way. Buying a home is a big decision, and it should be one you feel confident making. You should lean on a trusted real estate agent to help you separate fact from fiction and get the answers you need.

That agent will use their knowledge of what’s really happening with home prices, housing supply, expert forecasts, and more to give you the best possible advice. The National Association of Realtors (NAR) explains:

“. . . agents combat uncertainty and fear with a combination of historical perspective, training and facts.”

The right agent will help you figure out what’s going on at the national level and in your local area.

They’ll debunk headlines using data you can trust. Plus, they have in-depth knowledge of the industry and can provide context, so you know how current trends compare to the normal ebbs and flows in the housing market, historical data, and more.

Then, to make sure you have the full picture, an agent can tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you can use all that information to make the best possible decision.

After all, making a move is a potentially life-changing milestone. It should be something you feel ready for and excited about. And that’s where a trusted expert comes in.

Bottom Line

If you need reliable information about the housing market and expert advice about your own move, get in touch with a real estate agent in your area.

0 notes

Text

New Post has been published on Buy A Home

New Post has been published on https://buyahome.indallastexasarea.com/the-benefits-of-buying-a-multi-generational-home-infographic/

The Benefits of Buying a Multi-Generational Home [INFOGRAPHIC]

Some Highlights

If you’re ready to buy a home but are having a hard time affording it on your own, or, if you have aging loved ones you need to care for, you might want to consider a multi-generational home.

Living with siblings, parents, and even grandparents can help you save money, give or receive childcare, and spend quality time together.

Talk to a local real estate agent to find a home in our area that’s perfect for you and your loved one’s needs.

Tweet

renderPlusone("gbutton_111");

0 notes

Text

New Post has been published on Buy A Home

New Post has been published on https://buyahome.indallastexasarea.com/dont-believe-everything-you-read-about-home-prices/

Don’t Believe Everything You Read About Home Prices

According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way?

It has a lot to do with all the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering. You may be hearing people in your own life saying they’re worried about home prices or see on social media that some influencers are saying prices are going to come tumbling down.

If you’re someone who still thinks prices are going to fall, ask yourself this: Which is a more reliable place to get your information – clickbait headlines and social media or a trusted expert on the housing market?

The answer is simple. Listen to the professionals who specialize in residential real estate.

Here’s the latest data you can actually trust. Housing market experts acknowledge that nationally, prices did dip down slightly late last year, but that was short-lived. Data shows prices have already rebounded this year after that slight decline in 2022 (see graph below):

But it’s not just Fannie Mae that’s reporting this bounce back. Experts from across the industry are showing it in their data too. And that’s why so many forecasts now project home prices will net positive this year – not negative. The graph below helps prove this point with the latest forecasts from each organization:

What’s worth noting is that, just a few short weeks ago, the Fannie Mae forecast was for 3.9% appreciation in 2023. In the forecast that just came out, that projection was updated from 3.9% to 6.7% for the year. This increase goes to show just how confident experts are that home prices will net positive this year.

So, if you believe home prices are falling, it may be time to get your insights from the experts instead – and they’re saying prices aren’t falling, they’re climbing.

Bottom Line

There’s been a lot of misleading information about home prices over the past year. And that’s still having an impact on how people are feeling about the housing market today. But it’s best not to believe everything you hear or read.

If you want information you can trust, turn to the real estate experts. Their data shows home prices are on the way back up and will net positive for the year. If you have questions about what’s happening in your area, connect with a local real estate agent.

Tweet

renderPlusone("gbutton_87");

0 notes

Text

New Post has been published on Buy A Home

New Post has been published on https://buyahome.indallastexasarea.com/what-are-accessory-dwelling-units-and-how-can-they-benefit-you/

What Are Accessory Dwelling Units and How Can They Benefit You?

Maybe you’re in the market for a home and are having a hard time finding the right one that fits your budget. Or perhaps you’re already a homeowner in need of extra income or a place for loved ones. Whether as a potential homebuyer or a homeowner with changing needs, accessory dwelling units, or ADUs for short, may be able to help you reach your goals.

What Is an ADU?

As AARP says:

“An ADU is a small residence that shares a single-family lot with a larger, primary dwelling.”

“An ADU is an independent, self-contained living space with a kitchen or kitchenette, bathroom and sleeping area.”

“An ADU can be located within, attached to, or detached from the main residence. It can be created out of an existing structure (such as a garage) or built anew.”

If you’re thinking about whether an ADU makes sense for you as a buyer or a homeowner, here’s some useful information and benefits that ADUs can provide. Keep in mind, that regulations for ADUs vary based on where you live, so lean on a local real estate professional for more information.

The Benefits of ADUs

Freddie Mac and the AARP identify some of the best features of ADUs for both buyers and homeowners:

Living Close by, But Still Separate: ADUs allow loved ones to live together while having separate spaces. That means you can enjoy each other’s company and help each other out with things like childcare, but also have privacy when needed. If this appeals to you, you may want to consider buying a home with an ADU or adding an ADU onto your house. According to Freddie Mac:

“Having an accessory dwelling unit on an existing property has become a popular way for homeowners to offer independent living space to family members.”

Aging in Place: Similarly, ADUs allow older people to be close to loved ones who can help them if they need it as they age. It gives them the best of both worlds – independence and support from loved ones. For example, if your parents are getting older and you want them nearby, you may want to buy a home with an ADU or build one onto your existing house.

Affordable To Build: Since ADUs are often on the smaller side, they’re typically less expensive to build than larger, standalone homes. Building one can also increase your property’s value.

Generating Additional Income: If you own a home with an ADU or if you build an ADU on your land, it can help generate rental income you could use toward your own mortgage payments. It’s worth noting that because an ADU exists on a single-family lot as a secondary dwelling, it typically cannot be sold separately from the primary residence. But that’s changing in some states. Work with a professional to understand your options.

These are a few of the reasons why many people who benefit from ADUs think they’re a good idea. As Scott Wild, SVP of Consulting at John Burns Research, says:

“It’s gone from a small niche in the market to really a much more impactful part of new housing.”

Bottom Line

ADUs have some great advantages for buyers and homeowners alike. If you’re interested, reach out to a real estate professional who can help you understand local codes and regulations for this type of housing and what’s available in your market.

Tweet

renderPlusone("gbutton_63");

0 notes

Text

New Post has been published on Buy A Home

New Post has been published on https://buyahome.indallastexasarea.com/foreclosures-and-bankruptcies-wont-crash-the-housing-market/

Foreclosures and Bankruptcies Won’t Crash the Housing Market

If you’ve been following the news recently, you might have seen articles about an increase in foreclosures and bankruptcies. That could be making you feel uneasy, especially if you’re thinking about buying or selling a house.

But the truth is, even though the numbers are going up, the data shows the housing market isn’t headed for a crisis.

Foreclosure Activity Rising, but Less Than Headlines Suggest

In recent years, the number of foreclosures has been very low. That’s because, in 2020 and 2021, the forbearance program and other relief options were put in place to help many homeowners stay in their homes during that tough time.

When the moratorium ended, there was an expected rise in foreclosures. But just because they’re up, that doesn’t mean the housing market is in trouble.

To help you see how much things have changed since the housing crash in 2008, check out the graph below using research from ATTOM, a property data provider. It looks at properties with a foreclosure filing going all the way back to 2005 to show that there have been fewer foreclosures since the crash.

As you can see, foreclosure filings are inching back up to pre-pandemic numbers, but they’re still way lower than when the housing market crashed in 2008. And today, the tremendous amount of equity American homeowners have in their homes can help people sell and avoid foreclosure.

The Increase in Bankruptcies Isn’t Dramatic Either

As you can see below, the financial trouble many industries and small businesses felt during the pandemic didn’t cause a dramatic increase in bankruptcies. Still, the number of bankruptcies has gone up slightly since last year, nearly returning to 2021 levels. But that isn’t cause for alarm.

The numbers for 2021 and 2022 were lower than more typical years. That’s in part because the government provided trillions of dollars in aid to individuals and businesses during the pandemic. So, let’s instead focus on the bar for this year and compare it to the bar on the far left (2019). It shows the number of bankruptcies today is still nowhere near where it was before the pandemic. Both of these two factors are reasons why the housing market isn’t in danger of crashing.

Bottom Line

Right now, it’s crucial to understand the data. Foreclosures and bankruptcies are rising, but these leading indicators aren’t signaling trouble that would cause another crash.

Tweet

renderPlusone("gbutton_39");

0 notes

Text

New Post has been published on Buy A Home

New Post has been published on https://buyahome.indallastexasarea.com/a-real-estate-agent-helps-take-the-fear-out-of-the-market/

A Real Estate Agent Helps Take the Fear Out of the Market

Do negative headlines and talk on social media have you feeling worried about the housing market? Maybe you’ve even seen or heard something lately that scares you and makes you wonder if you should still buy or sell a home right now.

Regrettably, when news in the media isn’t easy to understand, it can make people feel scared and unsure. Similarly, negative talk on social media spreads fast and creates fear. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

But it doesn’t have to be that way. Buying a home is a big decision, and it should be one you feel confident making. You should lean on a trusted real estate agent to help you separate fact from fiction and get the answers you need.

That agent will use their knowledge of what’s really happening with home prices, housing supply, expert forecasts, and more to give you the best possible advice. The National Association of Realtors (NAR) explains:

“. . . agents combat uncertainty and fear with a combination of historical perspective, training and facts.”

The right agent will help you figure out what’s going on at the national level and in your local area.

They’ll debunk headlines using data you can trust. Plus, they have in-depth knowledge of the industry and can provide context, so you know how current trends compare to the normal ebbs and flows in the housing market, historical data, and more.

Then, to make sure you have the full picture, an agent can tell you if your local area is following the national trend or if they’re seeing something different in your market. Together, you can use all that information to make the best possible decision.

After all, making a move is a potentially life-changing milestone. It should be something you feel ready for and excited about. And that’s where a trusted expert comes in.

Bottom Line

If you need reliable information about the housing market and expert advice about your own move, get in touch with a real estate agent in your area.

Tweet

renderPlusone("gbutton_15");

0 notes

Text

New Post has been published on Homes Below Market | Homes For Sale Dallas TX Area

New Post has been published on https://foreclosures-dallas-texas.com/dont-believe-everything-you-read-about-home-prices/

Don’t Believe Everything You Read About Home Prices

According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way?

It has a lot to do with all the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering. You may be hearing people in your own life saying they’re worried about home prices or see on social media that some influencers are saying prices are going to come tumbling down.

If you’re someone who still thinks prices are going to fall, ask yourself this: Which is a more reliable place to get your information – clickbait headlines and social media or a trusted expert on the housing market?

The answer is simple. Listen to the professionals who specialize in residential real estate.

Here’s the latest data you can actually trust. Housing market experts acknowledge that nationally, prices did dip down slightly late last year, but that was short-lived. Data shows prices have already rebounded this year after that slight decline in 2022 (see graph below):

But it’s not just Fannie Mae that’s reporting this bounce back. Experts from across the industry are showing it in their data too. And that’s why so many forecasts now project home prices will net positive this year – not negative. The graph below helps prove this point with the latest forecasts from each organization:

What’s worth noting is that, just a few short weeks ago, the Fannie Mae forecast was for 3.9% appreciation in 2023. In the forecast that just came out, that projection was updated from 3.9% to 6.7% for the year. This increase goes to show just how confident experts are that home prices will net positive this year.

So, if you believe home prices are falling, it may be time to get your insights from the experts instead – and they’re saying prices aren’t falling, they’re climbing.

Bottom Line

There’s been a lot of misleading information about home prices over the past year. And that’s still having an impact on how people are feeling about the housing market today. But it’s best not to believe everything you hear or read.

If you want information you can trust, turn to the real estate experts. Their data shows home prices are on the way back up and will net positive for the year. If you have questions about what’s happening in your area, connect with a local real estate agent.

0 notes

Video

youtube

Dallas County TX Market Update April 2022 The Roots Of My Family Tree Have Been Burrowed Deep Into The Farm Country for More Than 100 Years. https://www.youtube.com/watch?v=YHGr4A4BDtI Please contact me, Debbie Warford, Real Estate Consultant North Dallas & Surrounding Areas For any of your Real Estate needs 214-636-7138 https://ift.tt/YlE2NB9 by Home Solutions Realty Dallas TX Area

0 notes

Video

youtube

But You need to Buy before you sell...Now You Can! 214-636-7138 The Roots Of My Family Tree Have Been Burrowed Deep Into The Farm Country for More Than 100 Years. https://www.youtube.com/watch?v=YHGr4A4BDtI Please contact me, Debbie Warford, Real Estate Consultant North Dallas & Surrounding Areas For any of your Real Estate needs 214-636-7138 https://ift.tt/YlE2NB9 by Home Solutions Realty Dallas TX Area

0 notes

Video

youtube

Collin County Texas Marketing Update April 2022 The Roots Of My Family Tree Have Been Burrowed Deep Into The Farm Country for More Than 100 Years. https://www.youtube.com/watch?v=YHGr4A4BDtI Please contact me, Debbie Warford, Real Estate Consultant North Dallas & Surrounding Areas For any of your Real Estate needs 214-636-7138 https://ift.tt/YlE2NB9 by Home Solutions Realty Dallas TX Area

0 notes