#your average Appalachian road sign

Text

#your average Appalachian road sign#appalachia#Virginia#appalachian trail#appalachian mountains#mountains#forest#southern gothic#appalachian gothic#gothic#rural#rural gothic#rural south#southern americana#Americana#outdoors#nature#adventure#southern aesthetic

112 notes

·

View notes

Text

The Story of Oil in Western Pennsylvania: What, How, and Why?

by Hannah Smith

I am a fries-on-salad, haluski dinner, dairy farm heritage kind of Western Pennsylvanian. I grew up near Venango and Crawford County and had a rural childhood. I went to a small school with about 300 kids in K-6th grade. Around 4th grade, I remember taking a field trip to Titusville, Pennsylvania. I remember seeing the familiar road signs and buildings as our bus gassed along the back roads. I had family in the Titusville and Oil City area, so it was a familiar route to take with my parents. I remember thinking, even at that young age, that the area looked worn and just, well, tired. But I was too young to grasp how this tired little town’s geology had changed the global economy and course of human history. When I was older, I pursued a degree in geology and began to understand more about my local community.

Our field trip took us to Titusville, Pennsylvania to visit Drake’s Well, the first commercial oil well in the United States. The site is named after the well’s driller, Edwin L. Drake who in 1859 struck oil outside of Titusville for the Seneca Oil Company. The company took the name from the Seneca Nation, one of the original Five Nations of the Haudenosaunee or Iroquois Confederacy, who had long made use of the resource Drake sought by skimming naturally-occurring slicks of petroleum, or unrefined oil, from the surface of local waters. These Indigenous people, who were removed from their native lands in the 1700s, 1800s, and 1900s, did not benefit from the Seneca Oil Company.

In the early 1800s oil was an unwanted by-product from salt wells (wells used to mine salt), and before that, a traditional medicine. In small doses, oil was used to treat respiratory diseases, epilepsy, scabies, and other ailments¹. Even today, chemicals made from the refining of petroleum are responsible for many of our modern medicines. Ointments, antihistamines, antibacterials, cough syrups, and even aspirin are created from chemical reactions created from petrochemicals².

However, the purpose of Drake’s Well was to produce oil for refining into kerosene for lamps, and thereby provide an alternative to the whale oil then used to illuminate homes and workplaces. Salt wells used water to dissolve salt source rock, and then carry the resulting brine through piping to the surface where it would be evaporated to leave salt as a solid residue. Although this method works for producing salt, it was far less efficient for producing oil. Productive oil drilling required new techniques, and one of Drake’s most important innovations was the “drive pipe,” sections of cast iron pipe driven into the shaft to protect the drill bit from water and cave-ins. Through experimentation and innovation, on August 27, 1859, Drake struck oil when his drill reached a depth of 69.5 feet.

While Drake’s Well was not the most productive, or largest oil well, the Titusville site is globally significant because it kick-started the petroleum drilling revolution that eventually changed global economies and environments. While Edwin Drake lived a hard life even after his discovery, he is still considered the father of the modern petroleum practices and industry³.

When my field trip class arrived at the Drake’s Well Museum I remember seeing an odd looking wooden building with an awkward chimney-like structure on one side. We were led through single-file so everyone could get a look at the steel machinery used in the drill, and the pipes that dispersed oil into wooden barrels clustered in the building. In my 10-year-old brain there is no way I could properly fathom that this discovery was related to many of the comforts and conveniences I took for granted in my life, such as cars, heating, electricity, plastics, medicines, and even the asphalt roads that we drove on. Why was Titusville special? More specifically, why did western Pennsylvania have oil in the ground?

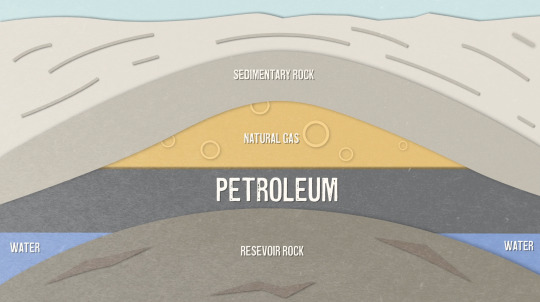

From about 490 to 360 million years ago, during the span of geological time known as the Ordovician Period and Devonian Period, most of what is now Pennsylvania was an ocean basin teeming with life. Pre-Appalachian Mountains systems eroded over time and deposited sediment of sand, silt, and mud that mixed on the seafloor with the dead plant material. Currents at the ocean bottom were minimal, leaving the accumulating sediments and organic material relatively undisturbed and oxygen-free. Without oxygen, bacteria that normally break down organic material could not act. A thick, black, anoxic ooze formed, preserving the organic material. Over millions of years, forces caused by plate tectonics generated enough heat and pressure to compact the sediments into rock and “cook” the organic material into petroleum.

If you’re from western Pennsylvania, you’ve probably heard of the Marcellus and Utica shales. The natural gas extracted from these rock units formed in a similar way to petroleum but was subjected to a much longer period of heat and pressure.

With Edwin Drake’s success, and layers of oil-bearing rock relatively close to the surface, Titusville boomed. The year Drake drilled his first oil well, Titusville only had 250 residents. However, by 1865 the population increased to 10,000. Nearby Pithole City, now a ghost town, had 50 hotels during the oil peak of the area around 1866. This boom was short lived as other drilling companies began operations in the area and excess production lowered oil prices. Companies picked up to look elsewhere almost as quickly as they appeared⁵. While Titusville boomed and busted, the oil industry itself was growing. Drake drilled for a product to compete with whale oil, but the oil industry underwent phenomenal growth because the demand for its product grew as a lubricant for engines and many other types of machines, a resource for heating on a distributed scale, and as a refined fuel for developing motorized vehicles. Two World Wars during the first half of the 20th Century and the population explosion of the 1950s further increased demand for petroleum. During the Century’s latter half advancements in oil drilling technology made ocean drilling platforms a reality, and with them an increase in oil production as well as an increase in negative impacts due to devastating oil spills.

As of 2016, the world consumed over 97 million barrels daily⁶. So what does combusting 97 million barrels of oil a day, a resource from below the surface, mean for the Earth’s atmosphere? The burning of fossil fuels produces greenhouse gases such as carbon dioxide, methane, nitrous oxide, and fluorinated gases. Greenhouse gases absorb heat from the sun that the earth’s surface reflects back out into the atmosphere, similar to how a blanket traps in body heat. Burning fossil fuels causes climate change by increasing the total amount of greenhouse gases in the atmosphere, thickening the “blanket” around the earth, and increasing the global average temperature. According to the International Energy Agency (IEA), in 2019 greenhouse gas CO₂ emissions totaled 33 gigatons, or 1 billion metric tons, or about the weight of 1.5 billion school buses⁸. Climate change is responsible for increased frequency and severity of weather disasters, wildfires, and flooding, to name a few negative impacts. The abundant CO₂ in our atmosphere equilibrates with and diffuses into our oceans, causing the water to become more acidic and eroding the calcium carbonate structures of coral and other marine organisms. Climate change does not just affect wildlife, it also affects the lives of Pennsylvanians. In Pennsylvania climate change is likely to lead to increasing home insurance rates, higher taxes to replace infrastructure, longer allergy seasons, increasing heat stroke rates in citizens, rising food costs due to crops damaged by erratic weather and higher temperatures, and decreasing water quality and availability due to large storms causing water contamination⁷.

Early organisms were buried by sediment 488 to 360 million years ago and altered into petroleum by heat and pressure. For thousands of years, Earth’s petroleum reserves were largely untouched. Innovator Edwin Drake changed petroleum’s role by successfully drilling the first commercial oil well in North America that August day in 1859. Petroleum became a global commodity, eventually fueling a fast paced modern life. Now in the 21st century, the burning of fossil fuels, such as petroleum, is causing worldwide rapid climate change.

When I was on that field trip to Drake’s Well in 4th grade, we did not discuss the global or local implications of petroleum. This resource is responsible for many of the day to day conveniences that have come to define contemporary life, but it also feeds environmental change that is forcing a “new normal,” and will cause an existential threat to humanity. I could not have fathomed that this global resource had its start in my own family’s backyard. I think that Drake’s Well is a good reminder that Earth-changing innovations can happen anywhere. I don’t think Drake could have predicted the scale to which his discovery would change society and the environment over the next 160 years, in the same way that most people do not realize how their small individual actions are affecting the larger social-ecological systems, and sustainability of all life on Earth. Although individual actions can negatively affect Earth, they can also be positive. Who knows, the next innovation to combat anthropogenic climate change may be happening in your backyard. Wind and solar farms have been developing and growing throughout Pennsylvania since 2007, providing an alternative option for electric energy use.

I started having more appreciation for the Earth Sciences as I got older. This eventually led me to obtaining a bachelor’s degree in geology, interning with the National Park Service at the Hagerman Fossil Beds in Idaho, and working in mapping for a few years before returning to school for illustration and design in hopes to marry the sciences and arts together. While obtaining my geology degree I met my now husband who has a Master’s in Structural Geology, and worked in the natural gas field for five years before making the switch to environmental geology. Our family's income was supported by the fossil fuels industry for a time, and therefore we understand a decent amount of the ethics and controversy that is in the industry. However we are both very invested in the earth sciences and look forward to more sustainable tech preserving a better environment for the future.

Hannah Smith is an intern in the Section of Anthropocene Studies. Museum employees are encouraged to blog about their unique experiences and knowledge gained from working at the museum.

References:

1 Early Medicinal Uses of Petroleum 2015

https://daily.jstor.org/petroleum-used-medicine/

2 Modern Uses for Petroleum in Medicine 2019

https://context.capp.ca/articles/2019/feature_petroleum-in-real-life_pills

3 Drake’s Well History of Petroleum 2016

https://www.aoghs.org/petroleum-pioneers/american-oil-history/

4 Description of petroleum formation 2014

http://elibrary.dcnr.pa.gov/GetDocument?docId=1752503&DocName=ES8_Oil-Gas_Pa.pdf

5 The boom and bust cycle of the oil industry 2015

https://www.nytimes.com/2015/04/23/business/energy-environment/oil-makes-a-comeback-in-pennsylvania.html

6 World Oil Statistics 2016-Current

https://www.worldometers.info/oil/

7 List of the Effects of Climate Change on People and how to protect yourself 2019

https://blogs.ei.columbia.edu/2019/12/27/climate-change-impacts-everyone/

8 International Energy Agency 2019

https://www.iea.org/articles/global-co2-emissions-in-2019

9 Drake’s Well Museum

https://www.drakewell.org/

10 Seneca-Iroquois National Museum

https://www.senecamuseum.org/

11 Seneca Nation Oil Process in New York State

https://nyhistoric.com/2013/10/seneca-oil-spring/

#Carnegie Museum of Natural History#Drakes Well#Pennsylvania#Oil#Petroleum#Fossil Fuels#Anthropocene#Climate Change

57 notes

·

View notes

Text

Nothing For Us

@goblincxnt it’s here 👀

Warnings: Compulsive behaviors, mentions of death

Last exit in Pennsylvania

The words repeated in Roman’s mind. The sign was a warning telling him this is your last chance, turn back now.

He glanced at Peter, who was busy timing for their exit. He caught the wolf’s eye, who in turn flashed him a warm smile.

How did he end up here? Driving down the interstate with the boy who broke his heart. Left for hours in an aching silence, save for the stereo.

He couldn’t bear to say a word, not yet, not until they were somewhere where they could truly be alone. As Roman traced mindless circles on the upholstery, Peter took one last look at him before making their exit, offering one final chance to leave and go back home. Roman attempted to speak, the words catching in his throat and leaving him breathless for a moment.

It was too late.

Gentle drops of rain began to fall as they made their way down the highway, picking up soon after Peter took one last exit through small town, West Virginia.

“You hungry?” The wolf asked, breaking the lasting silence.

Roman nearly didn’t recognize that he was being spoken to, lost in thought about the day’s beginning.

“Hmm? Yeah, I could eat.” He answered, his voice hoarse from lack of use.

Peter pulled into the parking lot of a local burger joint, smiling softly at his traveling companion. He clicked off the radio, leaving them in silence once more.

Roman braced himself for the frigid rain as he stepped out of the car. The cold air burned his lungs as he took a breath, stretching his legs. As he looked at Peter, his mind drifted back to the night before.

“We should go,” The wolf’s voice echoed the heartache of many moons ago “There’s nothing for us here”

“Go where?”

The wolf cracked a smile, a mischievous glint in his eyes.

“Wherever the wind takes us.”

“You coming inside?”

Roman snapped back to reality, standing in the freezing rain next to a littered french fry carton.

“Yeah,” He nodded “Yeah…”

He followed Peter into the restaurant, a silver bell on the door jingling behind them. He glanced around at the sea of shabby tables before finding a spot that was vaguely clean.

The restaurant appeared to have been nice looking once, 30 years ago, though it was styled after a 1950’s diner. Done up in over-the-top cherry red, and black and white checkerboards.

Roman mindlessly ripped apart a discarded straw wrapper as he watched Peter give their order, his leg bouncing. He thought about asking to turn around or hitchhiking back home, but Peter returned to the table with their food and a smile. Damn that smile. Roman decided he’d stay, for now.

“You alright man?” Peter asked, settling in at the seat across from Roman “You’ve been quiet the whole ride up here.”

“Yeah, just thinkin’.”

The upir picked at his fries, silently refusing to look at Peter.

“You didn’t have to come if you didn’t want to, you know.” Peter said, watching Roman closely “You could’ve stayed.”

Roman shook his head

“Nah...It’s just that—” he chewed his lip for a moment “I’ve never really been this far from home before, y’know?”

Before Peter could answer, he was interrupted by a stout redheaded waitress, —whose name tag read Louise— arriving at their table, coffee pot in hand

“Can I top y’all off?” She asked, gum popping and fake southern accent layering heavy over her New England own. “Fresh cuppa coffee?” Her cherry red press-on nails tapped against the stale coffee pot.

“Uh, water. Thanks.” Roman replied, gesturing to his half-empty glass.

“Cherry Coke.” Peter smiled, taking the last sip before passing his glass over, along with his half empty coffee mug.

Roman looked around the restaurant, watching the other patrons and reading the road sign decor before his eyes finally landed on the wall beside him, which was covered in grayscale photos of people looking both miserable and triumphant.

“That’s our hall of fame” Louise beamed “If you order the Appalachian Avalanche apple pie and eat the whole thing in under fifteen minutes, your meal’s free! Y’all wanna try it?”

Roman eyed Peter, and then their waitress, shaking his head. He wasn’t in the mood for something sweet.

“Nah, not this time.”

As their waitress left his gaze returned to the wall, gravitating towards a specific picture. It was Norman, in his younger years, looking as though he was about to lose his lunch. Roman wasn’t surprised by this, surely he had a life before Roman was born. It was the hand on his shoulder that caught his eye, the smiling face next to his sickly looking uncle.

It was J.R., he looked to be around Roman’s age, and was smiling brighter than in any picture Roman had seen of him before.

“Y’know, my cousin actually finished one of these things before,” Peter said, interrupting Roman’s train of thought.

“I was about seven or eight, and my cousin Tommy—Scrawny little guy, no meat on him at all—had gone with us to this little hole in the wall down south. And there was this huge burger, bigger than your head-” Peter paused to pantomime just how large the burger had been, taking some creative liberties, of course “And Tommy- Tommy always thought he was hot shit, so he orders this thing and they set a timer on the table. Twenty minutes.”

Roman watched as his companion told his story with great passion, laughing and smiling as he spoke. He found himself lost in that smile, the rest of the world tuning out.

“So now he’s one bite away and looking a bit green in the gills, one bite. He’s only got forty-five seconds left. So we’re all banging on the table and screaming ‘Come one Tommy! You got this! One more bite!’ and the rest of the joint joins in and he got it down with two seconds to spare! Two!”

Roman sipped his coffee “He get his picture on the wall?”

“The whole family did!” Peter beamed “There’s a hall of fame for people who can keep it down for at least thirty minutes afterwards. Tommy didn’t make it to that one…”

Roman snorted, popping a french fry into his mouth.

“It’s still hanging there, I’ll have to show you when we make it down that way.”

The last fleeting thought Roman had about turning around vanished with that proposition.

“I asked Nic if I would ever have to do that and he told me only if I was the kind of man who needed an ego stroke. He said ‘The bigger the ego, the smaller the courage.’”

Nicolae’s words of wisdom hung in the air before Peter started laughing upon realizing what his grandfather had meant.

“I’ve known some guys with some pretty small courage then” Roman quipped.

“Oh, like you don’t have the biggest ego.” Peter teased

Roman rolled his eyes.

“Let’s just get going, alright?”

Roman began to pull out his credit card when Peter grabbed his wrist. He tensed up at the feeling of the wolf’s calloused hand on his own.

“You said your mom was gonna try and find you right? She can track that.” Peter said, referencing a conversation they had the night prior.

“Sheeit,” Said Roman “You’re right.”

Roman counted the cash in his wallet, only a couple thousand.

“How far will this get us?” He whispered, flashing his cash.

“Further if you quit waving it around.”

He tucked it back into his wallet, scanning the restaurant to see if anyone had noticed. The patrons seemed to be unbothered by his wealth, caught up in their own conversations.

“We’ll talk about it later.”

Peter pulled out a wad of crumpled cash, counting out enough for their bill and leaving it on the table next to their trash.

As they pulled out of the parking lot, Peter reached into the ashtray and pulled out a quarter, handing it to Roman.

“What’s this for?” The upir asked

“Flip it. Heads Carolina, tails California.”

Roman raised a brow, unaware of what his friend was referencing.

“Just flip it so I can pick which direction I’m going.”

Roman ran his thumb across the embossed face of the coin before flicking it into the air. Heads.

“Alright, we’re headed south.”

As miles of open road stretched out before them, the radio began to fade. Pop songs turned to garbled static as the town grew smaller and smaller in the rearview mirror.

Peter fiddled with the knob, switching to the cassette tape that was inside the stereo. A song from the eighties began to play.

The car was somewhat of a family heirloom, passed around to whichever family member needed it at the moment. Most recently it had been Destiny’s. Peter had made arrangements to borrow it in case Roman had wanted to come with him.

Although its pale brown color and faux-wood paneling were enough to nauseate the average man, Peter had fond memories of him and his mother traveling across the states in the beat up old station wagon.

Roman stared out the window, watching as trees turned to blurs of green as they drove.

“Horses.” Peter pointed to a nearby field of horses and goats.

“What about them?”

“I dunno man, that’s just what you say when you pass horses. They’re pretty or some shit.”

“Oh…” Roman looked back at the horses in question. Peter was right, they were pretty.

Roman’s eyes threatened to close as he stared at the open road. The sun was beginning to set, and the upir had been awake since the previous night. He had intended to sleep that morning but his nerves had gotten the better of him.

“If you’re tired you can sleep in the backseat,” Peter offered “Just let me find somewhere to pull over first.”

Roman nodded, trying to stay awake. He couldn’t remember the last time he had fallen asleep on a car ride.

“There should be a blanket back there somewhere,” Peter said, slowing to a stop on the side of the road.

The backseat was cluttered with soda cans and other gas station garbage. Roman swept it onto the floorboards, stretching out on the velour seat covers.

The seats had gone years without a deep clean and thus were slightly crunchy to the touch.

Roman traced his finger along a small hole in the fabric, left there by a cigarette butt many years ago. The feeling of melted plastic was oddly calming to him.

The blanket was thin and rough, and the edges were frayed from years of use. It was once a gift, made with love, but had long since lost its luster. Roman thought it impossible to find a comfortable position with the scratchy mess.

He was asleep before Peter even hit the highway.

When Roman awoke it was dark. The rhythm of the windshield wipers brought him back to reality.

“What time is it?”

“About three o’clock”

“Sheeit.”

Roman sat up slowly, shaking the remaining sleep from his head. He rested his head against the window and watched the rain fall.

“I just realized there’s a few things I need to get, you wanna come in with me?” Peter asked, gesturing to the sign for a nearby supermarket.

“Yeah, sure. I need to get a pack of smokes while we’re at it.”

“What state are we in?” Roman asked as they pulled into the parking lot.

“West Virginia still, we’ve still got a while ahead of us.”

Roman checked his hair in the rearview mirror before stepping out of the car. He covered his head with his blazer and waited for Peter to join him in the freezing rain.

Peter locked the car doors and tucked the key into his pocket.

“After this, I figured we should get a motel, the storm is only going to get worse and I don’t think we should drive in that.”

Roman nodded and walked with Peter into the smalltown supermarket.

The air conditioning hit Roman’s wet skin and sent a shiver down his spine. The air smelled like stale bread and lemon cleaner. Roman found himself wondering where the employees were.

Peter grabbed a shopping cart and placed his wet jacket inside. After a moment, Roman did the same.

“So, what do we need?”

“Food, stuff we can eat in the car.”

“Beer?” Roman asked

“Nah, not here. Too expensive and we’ll need to get some new IDs.” Peter’s fake ID only said he was 18, since his mother was usually the one buying alcohol for him.

“Right.”

Peter pushed the cart towards the snack aisles, one wheel spinning loosely on its own accord.

The sound of wet footsteps on the linoleum floor felt like little knives inside Roman’s brain. The squelching was enough to make his eye twitch.

“You okay man?” Peter asked, looking up from the potato chip shelf.

“Yeah, yeah. Tired.” the upir lied. Truthfully he felt as though he could feel every sound in the universe through his teeth, the fluorescent lights assaulting his eyes.

Peter studied two bags of chips carefully before shrugging and throwing both in the cart.

Roman stared at the checkered floor tiles, making a conscious effort to only step on the white ones. He didn’t know why, all he knew was that the idea of stepping on a green tile filled him with a deep sense of dread.

“Playing hopscotch?” Peter asked, moving on to the aisle that contained beef jerky.

Roman shook his head.

“No, I just have a bad feeling about the green ones I guess.” He said, feeling rather silly for admitting it. But despite his rationality, he knew deep inside that the danger was all too real.

“Ah, Okay.” Peter looked across the aisles “The deli doesn’t have any green ones, wanna get us some sandwiches while I ask someone to get one of those coolers down for us?” He gestured to a row of coolers that sat atop the freezer aisle.

Roman nodded and began walking carefully in the direction of the deli.

“What kind do you want?”

“Nothing fancy, anything with meat so none of that veggie crap.”

Roman held his breath as he skipped over the green tiles until he arrived at the deli, its flooring a solid mustard yellow, it appeared to be either faded or incredibly dirty, Roman wondered if that was intentional.

He smiled at the middle-aged woman behind the counter. She did not smile back. She had a vacant stare and her nametag was falling off.

Brenda, Roman read.

He waved awkwardly before putting his hands in his pockets and looking over the prepackaged sandwiches instead.

Each sandwich was wrapped in white paper with a date stamped across it. Roman grabbed two at random, checking to make sure neither was vegetarian, before heading off to find Peter.

Peter was talking to a store manager and trying to fit the cooler into their cart.

Roman started towards him but stopped in his tracks as the mustard yellow tile ended, a sea of checkers before him. He didn’t want to draw attention to himself but he also didn’t feel safe stepping on the green tiles.

He took slow careful strides towards Peter, trying his hardest to nonchalantly avoid those evil squares.

Peter saw him and ended the conversation with the clerk, meeting Roman halfway.

“Hey, sorry I didn’t come find you. You okay?” Peter placed his hand on Roman’s shoulder.

“Yeah, it’s fine,” Roman looked at his shoes and the white tiles underneath them “The whole thing is pretty stupid anyway.”

He offered Peter the sandwich in his hands, Peter took it and inspected it before placing it in the cart next to a 12 pack of orange soda.

“No, it’s not. Not if it makes you feel safer.”

Roman opened his mouth to argue but couldn’t find the words. He was so used to his mother telling him that his actions were nonsensical and embarrassing that he had never thought that they could be anything else.

“C’mon, let’s go check out. We need to make it to the motel before this storm gets any worse.”

Peter stood near the open trunk of his station wagon, pouring the remainder of a bag of ice into their new cooler. Roman was sitting on the bars of the cart return smoking a cigarette. The rain had let up for a moment, the pavement still freshly wet under Peter’s feet.

Roman flicked his cigarette butt into a nearby puddle and grabbed a soda from where Peter was stocking the cooler.

“Man, c’mon! It’s not even cold yet.”

Roman shrugged and cracked it open, taking a sip. He eyed the orange label, wishing he had grabbed a Cherry Coke instead. By the third sip, it began to grow on him.

Peter finished stocking the cooler, setting it in the corner and closing the trunk.

Roman slid into the passenger’s seat, waiting for Peter to start the car. As he shut the door the rain began to fall once more, starting softly but quickly picking up.

“Shit,” Peter started the car, turning on the windshield wipers

“I saw a sign for a motel back that way” Roman gestured helpfully.

Peter nodded and put the car in gear.

Roman watched out the window as the city lights turned to watercolor blurs in front of his eyes. He’d never seen so much rain in one night.

Peter followed the main road until they arrived at a motel whose sign proudly boasted that they had color TV. He put the car in park, counting out enough money for two rooms. He instructed Roman to stay in the car and watch their stuff while he went to the front desk and got their keys.

Roman closed his eyes and listened to the sound of the rain against the windows. The steady rhythm of the windshield wipers and the low rumble of the engine was almost enough to put him to sleep again.

He had almost drifted off when Peter knocked on the window, gesturing for him to get out.

“They were down to one room,” He yelled over the heavy rain “You don’t mind sharing do you?”

Roman weighed his options: sleep in the same room as another man, or sleep in the parking lot of a seedy motel in the middle of a thunderstorm.

The upir answered with a shrug, grabbing his bag from the backseat and taking the key from Peter’s hand.

“Are you going to help carry stuff in?” the wolf asked.

Roman was already on his way to the motel room.

As Roman opened the door to room 227, he noticed a smell. A foul, sour smell. He turned away in disgust, gagging before he covered his nose with his shirt sleeve and trudged forward. He was almost afraid to touch anything in fear of locating the source of the stench.

As he set his bag down, he forced himself to take a breath, and in doing so he realized that he knew that smell.

It was the smell of death.

#bri babbles#nothing for us#hemlock grove#hemlock grove fanfiction#Romancek#roman godfrey#peter rumancek#this is my absolute favorite story to write and I'm so excited that it's finally here

22 notes

·

View notes

Text

Rules: Answer the questions (which you can change if you don’t feel like answering certain questions) then tag 20 followers you want to get to know better!

i was tagged by @sad-ghxsts !! thank u

1. Nickname?

god idk. all the nicknames i have are associated with my deadname so ill pass

2. Gender?

my gender is literally gay man

3. Star Sign?

pisces sun, moon, and ascendant

4. Height?

im 170cm / 5'5"

5. Favorite Feature?

my hair

6. Favorite Color?

uhhh its a tie between yellow, grass green, sky blue, and lilac

7. Favorite Animal?

dogs & horses

8. Average Hours Spent Sleeping?

average is around 6-8h but i could sleep anywhere between 4-12h

9. Dogs or Cats?

dogs even tho i love cats almost as much

10. Number of Blankets You Sleep With?

idk depends on the weather! but during winter i sleep with up to 5

11. What’s Your Dream Trip?

a road trip on a camper van across north america visiting the rocky mountains, the appalachians, the mojave desert, etc but no big cities tbh

12. How Many Followers Do You Have?

right now im at 572

13. How Many Pets Do You Have?

i have a dumbass dachshund and i love him

14. Best Places to Visit in Your Town or Country?

theres nothing really to see in my town except for this extremely small 15th century church, but tbh the best places to visit in italy are rome, venice, the tuscan hills, and the alps but. theres a lot to see honestly

15. Favorite Ice Cream Flavor?

chocolate b its a fuckin classic

16. How Often Do You Read?

uh idk depends if im reading something good then everyday. if not like once a month lmao

17. Favorite Study Locations?

id say my room but actually i can concentrate better when im around other people so yeah

18. Favorite Book?

i literally cannot remember books ive read more than 3 months ago but my recently finished favourite is jurassic park by michael chricton

im not gonna tag 20 people lmao i cant think of that many

tagging: @kotor , @comrade-bastard , @vienb , @jotaro-kuho , @tabt-solskin , @temptation-revelation , @selfsoulfriend and idk literally everyone who feels like doing this just say i tagged u

(btw you don't have to do this if u dont feel like it)

#long post#kinda#i totally forgot about this and it sat in my likes for about a week#anyway it was fun!!

9 notes

·

View notes

Text

Get to know Devlin Hodges, the Steelers’ new duck-calling QB

Photo by Justin K. Aller/Getty Images

While Mason Rudolph remains in the NFL’s concussion protocol, Hodges has the reins of Pittsburgh’s offense for now.

The Pittsburgh Steelers are now on their third-string quarterback. Backup Mason Rudolph was ruled out for Week 6 after taking a scary shot against the Baltimore Ravens the week before. Devlin Hodges will make his first career start when the Steelers take on the Los Angeles Chargers on Sunday Night Football.

Hodges was on Pittsburgh’s practice squad until Ben Roethlisberger suffered his season-ending elbow injury on Sept. 15. The Steelers signed Hodges as a rookie undrafted free agent in May, released him, and then re-signed him to the practice squad on Sept. 10. You may not have heard much about Hodges, but he’s got a pretty interesting backstory — and nickname.

While playing his college ball at FCS Samford, he broke one of Steve McNair’s records.

From 2015-18, he played his college ball at FCS Samford, where he finished as the FCS’ all-time leader in career passing yards with 14,584 yards, McNair’s previous record of 14,496 yards. During his senior season in 2018, he won the FCS Walter Payton Award and set a single-season school record for passing records, throwing for 4,283. He’s also the first Samford QB playing in the league since the 1940s!

Steelers new QB Devlin Hodges is all-time FCS passing yards leader, first QB from Samford to play in NFL since 1940s. Showed well enough in camp that some observers liked him better than Dobbs, who was then traded to JAX. Marched down field for go-ahead TD, best PIT drive of day

— Chris Wesseling (@ChrisWesseling) October 6, 2019

A former three-star recruit from Morris, Ala., Hodges committed to Samford despite having offers from Appalachian State, Georgia State, and Louisiana-Monroe. He averaged 254 yards on the ground per season at Samford, but he can stand strong on the pocket when he needs to:

TOUCHDOWN ‼️

Hodges puts it to Ware on the wheel route!#FunFastPhysical#AllForSAMford pic.twitter.com/TfEURLJqXV

— Samford Football (@SamfordFootball) November 3, 2018

He’s got a nice touch on the long ball, too:

Samford Prospect Thread:

Finishing up my QB list & the 1st play I see from Devlin Hodges vs FSU is this. Patient, goes thru progressions, steps up in the pocket & FIRES a shot 2 the other NFL prospect Kelvin McKnight @SamfordFootball #FunFastPhysical #AllForSAMford pic.twitter.com/ieZr0Pwx52

— Chris Nelson (@THEffVigilante) February 24, 2019

Despite his impressive arm and big numbers, Hodges draft stock wasn’t very high, but the Steelers saw something in him they liked. Head coach Mike Tomlin even reportedly pushed to keep him over Josh Dobbs during the preseason before Dobbs ended up being traded to Jacksonville. During the preseason, Hodges threw for 190 yards, two touchdowns, and an interception.

Devlin Hodges finds Tevin Jones for the score‼️ pic.twitter.com/sSNpHBK1fW

— Pittsburgh Steelers (@steelers) August 10, 2019

Off the field, the greatest fact about Hodges is that his nickname is literally “duck.” OH AND HE’S A DUCK-CALLING NATIONAL CHAMPION!

Hodges is an avid hunter, and the nickname became his when he he first got to Samford, per ESPN:

The nickname started during his redshirt freshman year at Samford, because he constantly talked about duck hunting and duck calling. Coach Chris Hatcher started calling him Duck, and it wasn’t long before his receivers picked up on it.

”When you say Devlin around our place, people don’t even know who you’re talking about,” Samford offensive coordinator Russ Callaway said.

When he got to Pittsburgh, coach Mike Tomlin added his own spin to the name, calling him “Duck Dynasty.”

View this post on Instagram

Great Thanksgiving week with some good friends and family! Always fun to get after em in the woods! #GetWhatYouCan

A post shared by Devlin Hodges (@devlinhodges) on Nov 25, 2018 at 4:05pm PST

In 2009, Hodges won Junior World Duck Calling Contest when he was just 13 years old.

“In middle school and the first couple of years of high school, I was heavily into duck calling and practiced constantly,” Hodges explained. “But when I went to college, I couldn’t spend as much time on my duck calling because I had to dedicate more time to football and schoolwork. However, I definitely want to get back into duck calling and competing in duck calling contests when my football days are over.”

youtube

Hodges embraces the nickname fully:

Quack pic.twitter.com/k1LKKvvjQS

— Devlin Hodges (@DevlinHodges10) October 12, 2019

Hodges is being thrown into the fire, but he’s handled himself well so far.

In his first regular season game action against the Ravens, Hodges completed seven passes for 68 yards. He led the Steelers to a scoring field goal drive in his first series of the game to take a 23-20 lead in the third quarter, but couldn’t get the win as an overtime completion to JuJu Smith-Schuster was fumbled by the receiver, setting up a game-winning field goal for the Ravens.

“I thought he represented himself well,” Tomlin said of Hodges after the game. “I thought he gave us a chance. You have to tip your hat to him. You are talking about a guy that didn’t make our opening 53 and all those things, we know his story. You also have to acknowledge that he has done some good things at every step along the way through the team development process when given the opportunity and that is why he is in the position he is in.

“That is probably why he made the positive showing in spots that he did.”

Hodges might only be the Steelers’ starting quarterback for a week or two, but Pittsburgh’s offense is in competent hands until then. Rudolph was a limited participant in practice until the Steelers ruled him out on Thursday afternoon. Hodges has a tough task ahead of him in playing on the road against LA, but if he does more of what he did last week, Pittsburgh should be just fine.

0 notes

Text

Delmas Parker: A great teacher and a great man

Delmas Parker

By JERRY LANKFORD

Record Editor

There’s only one thing I can say about my experiences at Millers Creek Elementary and West Wilkes High School – I carry with me few fond memories in regards to the educational parts of those years.

I did, however, make some good friends — some that I still have and speak or visit with fairly regularly, particularly Jimmie Moretz, Mark Brooks and Ricky Killen.

But, I’ve never been to a class reunion. And, unless something drastically changes my thinking, after low so much time and so much water under the bridge, it’s very doubtful that I ever will.

With that said, there were good things that happened over the course of my school years — those came in the forms of a couple of teachers who really went out of their way to show me patience, kindness and encouragement.

One was the late Lizzie Deal. She was our neighbor on Kite Road in Millers Creek and was married to my first cousin, Bobby Deal. I spent countless hours at their home next door, playing with their sons, Richey and David, who were close to my age. I was never in Lizzie’s class, but she was very nurturing toward me, particularly when she discovered my love for history.

The focus of this column however, is my sixth-grade teacher, Delmas Parker.

At the time I went to school there, Millers Creek Elementary was in the building that now houses Millers Creek Baptist Church on Boone Trail. Mr. Parker’s classroom was located at the top of the stairs on the gymnasium side of the school.

The best I can recall, I had his class during the afternoon. He taught language arts and social studies, which were my favorites.

Mr. Parker came to like me despite my horrible and disruptive ways. And, in return, I developed a great respect for this kind and gentle spirited man.

Several weeks ago, I spoke with Mr. Parker, who is now 81, via phone from his home in Clemmons. I told him I wanted to interview him for a column. He seemed surprised. But after a bit of coaxing, he related to me a brief history of his life.

Mr. Parker was born in Gaston County on April 23, 1938, to parents Delmas and Helen Parker. He is married to Sue Lewis Parker from Ashe County, whom he met while teaching at West Jefferson School. They have a son, Kevin, and daughter-in-law, April, and three grandchildren, Danielle, Luke, and Sara.

But, let’s backtrack a bit.

When asked about his career as an educator, Mr. Parker said, “It was a slow process in the beginning.”

He explained that his parents had not had many educational opportunities. His father had a seventh-grade education, while his mother only went as far as the fourth grade.”

Mr. Parker looked back on his childhood and recalled the time he was diagnosed with “a bad case of rheumatic fever” at age 11.

“I spent a year in bed, looking out the window,” he said. “My mother and my aunt would go to the library and bring me book after book. I read all kinds of books. But, (Charles Dicken’s) ‘David Copperfield’ opened a whole new world for me. I knew more about David Copperfield than I did about myself. That book helped me get started.”

The first college he attended was Charlotte College.

“At first I planned to take engineering courses then, I became interested in the idea of teaching,” he said. “From there, I went to Appalachian State Teachers College.”

He worked various jobs to pay for his education.

“I started teaching at West Jefferson when I was 26 or 27,” Mr. Parker said. “I hadn’t finished college. In the summer I would go back to school and finally received my bachelor’s degree when I was about 28. Before that, I had an old grammar school certificate to teach first through eighth grades.”

When he got his BS, he went on to acquire his master’s degree, “the same way, working on it in the summer,” he said.

In 1966, his focus shifted.

“I was teaching in West Jefferson and we were watching Walter Cronkite one night on TV. His segment was about integrating schools in South Carolina. The report stated the white teachers left after this happened.”

Mr. Parker applied for a position in Lamar, S.C. where he taught African-American students.

“The only problems I had were dealing with antiquated buildings and books,” he said.

When he came back from South Carolina, his father-in-law, B.F. Lewis, who had been a teacher in Ashe County, knew Mr. Cowles, the principal at Millers Creek Elementary.

“Sue and I were living in a trailer park near Boone,” Mr. Parker said. “Mr. Cowles came and talked to me about coming to Millers Creek. I went there, and signed a one-year contract, teaching eighth-grade language arts and social studies (that was in 1969). I got along really well with Mr. Cowles.”

Wayne Barker later became principal and Mr. Parker went on to teach sixth-grade and seventh-grade classes.

“When I was there, there were only two sixth-grade teachers,” he said.

Mr. Parker had found a home at Millers Creek Elementary School. He wound up teaching there for 28 years.

“I saw a lot of people come and go at Millers Creek,” he said. “I worked with a lot of good teachers and I worked for some great principals.”

I openly admit that during my elementary school years I was mean as a striped snake. And, I felt the sting of countless paddlings — yes, they really used to do that — but I never cried.

Some of those teachers Mr. Parker referred to above — it was made very apparent — didn’t think much of me and my, let’s just say, rowdy ways. I’ll not name names because they are still alive, but I distinctly recall a couple of stinging comments made by two of my mentor/educators.

One came in either the winter of 1976 or spring of 1977, when my father, Sammie Lankford, was dying from cancer. I was entering this teacher’s classroom, laughing with a friend. That teacher said to me, “What have you got to laugh about? Your father is dying.”

Another came the next year when a teacher announced in front of the entire class that he was “certain that Jerry Lankford would spend his entire adult life in prison.”

Well, so far, so good.

I told Mr. Parker about those comments. “That’s not how you talk to a student,” he said. “You try to encourage them.”

His classroom was like a soothing, kind, and compassionate oasis for me.

Mr. Parker retired in1998, but came back to fill in for sick teachers and substitute when needed.

Mr. Parker knew nearly my entire family.

“I remember your mother, Willa Mae, very well,” he said to me. “She was a very sweet lady. And, she was very concerned about your education. I’d see her coming up the stairs and I knew she was here to talk about Jerry.”

He also taught my sister, Ellen.

About Ellen, Mr. Parker said, “She was very intelligent. She was perfect in her work and very conscientious. She always used precise language. She was a great student in all her subjects and an avid reader. When she finished her work, she’d have a book open and reading.”

My sister said Mr. Parker was one of her all-time favorite teachers and recalled him loaning her a copy of Anna Karenina by Leo Tolstoy – some heavy duty reading for your average sixth-grader, but not for Ellen.

After he had come out of retirement, he also taught my two oldest daughters, Jennifer and Anna.

“Jennifer was in the seventh grade when I taught her,” Mr. Parker recalled. “She was shy, but sweet. She was easy to talk to.”

Jennifer remembers Mr. Parker well and fondly.

Anna was either in the sixth or seventh grade when he was her teacher. “Anna never talked much,” he said. “She was sweet, but you never knew what she was thinking.”

Finally, I just had to ask, “How would you describe me as a student?”

Mr. Parker paused a moment, then said, “You were all boy.”

A very polite euphemism, I must say.

Back in my elementary school days it was semi-customary to buy your teachers Christmas presents. The year I was in Mr. Parker’s class, I remember picking out his present at the old Roses store where Melody Square is now. It was a porcelain figurine of a Revolutionary War soldier.

“I still have it on my mantle,” Mr. Parker said. “It’s always been very special to me.”

When asked if he had any idea how many students he taught during his 28-year stint at Millers Creek, Mr. Parker estimated the number at more than 2,000.

Over the years, Delmas Parker has also been very active in the Democrat Party, having even ran for 10th District Congress in 2000 against Republican Cass Ballenger.

“I didn’t do so well,” he said with a laugh.

When asked to sum up his educational career, Mr. Parker said, “I am proud to have been a teacher. I’m proud to be a teacher today.”

He continued, “A teacher is almost immortal. A good teacher does not die. He continues to live through his students. He should see the potential and good in each student and try to bring that out in each of them. I really believe that. That’s my philosophy. Each classroom is a little community, and each student is a part of that community. Some are rich, some are poor, you have all that. You try to bring that community together as something good. It’s not just what you learn in books. It’s developing a sense that you can do great things in life. Character is so important. That comes from the way you treat a student. They are all one of God’s children, no matter where they come from.”

Delmas Parker…a great teacher, a great man, and truly, also a Child of God.

Note: Mr. Parker added, “If any of my former students would like to contact me, I’d love to hear from them.”

He can be reached at [email protected]

Jerry Lankford has been editor of The Record since February 1999. He has worked as a professional journalist for more than 30 years. He can be reached at 336-667-0134 or at [email protected]

0 notes

Text

These toilets use worms to compost your poop, and they are our future

New Post has been published on https://nexcraft.co/these-toilets-use-worms-to-compost-your-poop-and-they-are-our-future/

These toilets use worms to compost your poop, and they are our future

A vermicomposting toilet in Valhalla Provincial Park, British Columbia (BC Parks/)

When I visited Squamish, British Columbia for a rock climbing trip, I did not know I was also visiting the origin of a backcountry toilet revolution. One day during the trip, my gut rumbled just as we reached the granite cliff we’d spend the rest of the day scaling. I thought back to the little building we’d passed hiking in, which looked like a typical wood-sided pit toilet, except for the smaller structure attached behind it.

I hiked back to it and opened the door to reveal what a sign inside informed me was a “Urine Diverting, Vermicomposting Toilet.” Inside the toilet, a conveyor belt tilted up toward the back of the building. Pee runs down the conveyor belt and into the soil, where it’s a nutrient source for plants and microbes, I read. Meanwhile, poo is transported to a chamber behind the toilet, where earthworms and other soil organisms eat and decompose it. After doing my business, I pumped a pedal next to the toilet five times, which spun the conveyor belt toward the poo chamber. I returned to the cliff and excitedly told my friends about the coolest toilet I had ever seen.

Increasingly, land managers are looking to new ways to solve the problem of human waste in the backcountry, where the convenience of modern plumbing is unavailable. There are more people enjoying public lands than ever before, and that means there’s more poop than ever before. Across the past decade, there’s been a 15 percent increase in visits to Bureau of Land Management lands and an 18 percent increase in national parks. National park visits have topped 300 million for four years in a row. While the simple cathole method—digging a hole and burying your waste in it—may have once sufficed in many areas, the sheer volume of feces today presents a hazard to health, waterway pollution, and aesthetics; no one wants to see partially buried turds and TP when they’re in the backcountry (or anywhere, really). “What tends to happen is that over time, as visitation generally tends to increase, that dispersal strategy [of digging catholes] no longer works,” says Ben Lawhorn, education director for Leave No Trace Center for Outdoor Ethics, an organization focused on educating the public about responsible outdoor practices.

Historically, the next step up from the cathole was a pit toilet; literally, a deep pit in the ground with a privy over it. When one pit fills up, it’s covered with soil, and the privy is moved to a new pit. But it’s unknown how long it takes the contents of these pits to break down, making the live bacteria, viruses, and protozoa in the poo a continued public health threat. In fact, the U.S. EPA, under the Safe Drinking Water Act, considers pit toilets to be “large capacity cesspools.” The agency banned the construction of new pit toilets in 2000 and is giving the Forest Service until 2024 to shut down its existing facilities.

But if you can’t flush the waste away or simply dig a pit, what other options are there for remote areas? Many national parks and other public lands use vault toilets, which are kind of like pit toilets except they keep waste sealed in an impermeable chamber, so it doesn’t leach into surrounding soil and groundwater. A porta pottie is technically a vault toilet. Most restrooms you’d visit at a park parking area are vault toilets. Although a well-maintained one isn’t supposed to smell, my experience tells me they almost always do.

A composting toilet along the Appalachian Trail (John Hedrick/)

But in remote areas without direct road access, maintaining vault toilets is a burden to park agencies. Facilities staff need to pump out the waste, then haul it all out to be treated and disposed of. As a recent REI Co-Op Journal article points out, officials spend about $20,000 yearly using helicopters to fly out human waste in 55-gallon oil drums off Mt. Rainier. At Rocky Mountain National Park, llamas carry bins of waste down the Longs Peak trail. And along the Appalachian Trail, volunteer crews drive out to remote vault toilets in a truck equipped with septic pumper nicknamed the “Big Gulp” and bring the sewage back to an RV septic treatment center.

The difficulty and hazard of hauling raw sewage has led managers to consider other options. As early as 1980, remote national parks have used composting toilets. A 1995 Forest Service publication describes a basic design: a privy atop a “digester tank.” Toilet users add a scoop of carbon-rich material, usually wood shavings or sawdust, after going. The woody material is supposed to control moisture and balance the carbon-to-nitrogen ratio of the waste, making it an ideal food for microbes.

In some areas, these simple composting toilets have been successful. There are many along the Appalachian Trail, according to John Hedrick, vice president of operations of the Potomac Appalachian Trail Club, which maintains 240 miles of the AT between Pennsylvania and Virginia. Trail workers construct two bins, building a toilet over one. When one fills up with waste and wood shavings, which takes about two years, that bin is sealed up and the toilet structure is moved to the adjacent bin. After at least two more years, that sealed bin is considered composted and the contents resemble soil. Volunteers sort errant trash out of the compost and then bury the decomposed waste in the woods. The process eliminates the need to pump out vault toilets and the public seems to like them better, too. “[Visitors] prefer the composting toilets,” says Hedrick. “They don’t smell as bad.”

While Hedrick says that the composting toilets have worked out fine across the seven years they’ve had them, other locations haven’t had as much success. Back in British Columbia, officials struggled with a number of “composting” toilets not actually composting—the waste and sawdust mixture failed to heat up with microbial activity, which is necessary to create compost. So they started to test a new design by Geoff Hill, director at Toilet Tech Solutions.

Some of Toilet Tech Solutions’ vermicomposting potties at Zion National Park (Geoff Hill/Toilet Tech Solutions/)

The problem, according to Hill, was mixing urine and solid waste. When the two are combined in the chamber, a lot of ammonia forms—that’s the compound responsible for the sharp scent of a vault toilet. This ammonia is kills off would-be decomposer microbes. In his dissertation research, Hill found that all of the so-called composting toilets he studied in western Canada and the Pacific Northwest failed to produce compost. “None of the composting toilets I visited made compost,” says Hill. “Ammonia is toxic and you can use it as a commercial cleaner. So now you’ve started sterilizing this waste, making it toxic to all forms of life. The whole concept of a composting toilet is a total joke.”

Inspired by urine-separating, vermicomposting (worm composting) toilets he saw in European backcountry areas like the Alps, Hill created a new design—the conveyor belt toilet I used in Squamish. Because urine is diverted to a septic field below the toilet, there’s no ammonia problem. Bugs can get to work decomposing the poo.

Hill’s first toilet was built about 10 years ago at the Smoke Bluffs, another park in Squamish, an “extremely popular” climbing area with 1,500 visitors on busy summer weekends, according to Brian Moorhead, the Vice Chair of the Squamish Access Society, an organization protecting climber access in the Squamish area.

Before the vermicomposting toilet, the Smoke Bluffs visitors used porta potties, which had to be pumped out every week, costing $90 per toilet per month to maintain, says Moorhead. While the new vermicomposting toilet cost $15,000 in Canadian dollars, it’s needed little in maintenance since. The toilets have to be “raked” occasionally: the poo and TP in the front of the decomposing chamber moved to the back, where the waste can decompose more fully while new material accumulates in the front. Despite how many visitors the park sees, Moorhead says they didn’t do their first raking until three or four years in. “That [toilet] was done as a test case and proved very, very successful,” he says. “We see it as the way forward.”

That toilet’s success had led to the construction of more around British Columbia, says Moorhead. Justin Sabourin, facilities engineer with the B.C. Ministry of Environment, says there are now about 20 of these urine-diverting toilets in B.C. parks—and there are plans for more. Perhaps unintentionally, Moorhead helped start what became a trend in backcountry toilet technology. “It’s a standing joke: Brian is an expert in shithouses,” he says. “Not quite the legacy I had in mind.”

Another vermicomposting toilet in Valhalla Provincial Park, British Columbia (BC Parks/)

Officials at Smith Rock State Park in Oregon are also pleased with Hill’s design. Park ranger Josie Barnum says that the park’s two composting toilets weren’t cutting it—the waste simply was not decomposing: “Three to four times a year, staff would have to hand shovel partially decomposed waste and take to the landfill.” So in 2012, they retrofitted one of the compost toilets with Hill’s design—the first in the states. The new toilet requires some maintenance, including a twice-yearly raking and cleaning of the conveyor belt every couple weeks, but not as much as the remaining composting toilet. “It’s definitely a great product,” says Barnum. “I don’t have anything bad to say about it.”

The bugs behind the toilet can eat so much crap that even high-use vermicomposting toilets like the one at Smith Rock, which averages 100 uses a day during spring and fall, don’t need to be emptied of the decomposed waste for up to 20 years. But the finished product is not really “compost,” says Hill, because it can still harbor pathogens (though their numbers are reduced from the raw sewage). He even verified this with an experiment in his garage in which he fed hookworm-infested poop to worms and looked to see if their digestion killed the parasite. It didn’t. “Vermicomposted human waste is not fully safe or sanitized material,” he says, so it does still need to be disposed of off-site. Still, the huge reduction in the volume of waste saves time and effort for land managers.

So although some areas are content with their basic composting toilets, for other, heavily-used parks, Hill’s design is showing a lot of promise. Even in rocky, high-altitude zones where decomposition isn’t feasible, like Colorado’s Longs Peak, the urine-diverting mechanism cuts down on the overall amount of waste. A version of Hill’s technology installed there sends the poo to a bag, which is later packed out by those same llamas. “Now they’re packing out about one-fifth of the waste off the mountain,” says Hill.

In the future, we’ll probably see more interest in other new dry toilet technologies as the number of people visiting parks grows. “At least in my experience, the land management community is evolving at a rapid pace in their management [of human waste],” says Lawhorn. “We’re seeing a rapid adoption of different techniques to address the problem.”

Hill has now sold about 200 toilets and says that number is growing. “I can’t quite keep up with enquiry,” he says. “I think over the next couple years, it will go from a new technology to something that’s well-establishing and going on all over the country.”

Written By Ula Chrobak

0 notes

Text

Lifestyles of the Rich and Foolish

It's the first of April. You know what that means. Spring is here! Your friends and family are pulling April Fools' Day pranks. And my tree allergies are kicking my butt. Every year, tree pollen makes my life miserable. This year is no different.

Facebook kindly reminded me this morning that three years ago, Kim and I were in Asheville, North Carolina. After wintering in Savannah, Georgia, we'd resumed our tour of the U.S. by RV.

While in Asheville, we toured the Biltmore Estate, the largest home in the U.S. This 250-room chateau contains 179,000 square feet of floor space — including 35 bedrooms, 43 bathrooms, and 65 fireplaces — and originally sat on 195 square miles of land. (Today, the estate “only” contains 8000 acres.)

“This feels like Downton Abbey but in North Carolina,” I said as we walked the endless halls. Just as Downton Abbey documented the excesses of British upper class, so too the Biltmore sometimes feels like an example of how rich Americans indulged in decadence.

George Washington Vanderbilt II, the man who built Biltmore, was a member of one of the country's wealthiest families. His grandfather, Cornelius Vanderbilt, was born poor in 1794, but by the time he died in 1877 he had become one of the richest men in the world. During his lifetime, he built a fortune first from steamships and then as a prominent railroad tycoon.

By family standards, grandson George didn't have a lot of money. He inherited about $7 million, and drew income from a $5 million trust fund. He decided to use the bulk of his fortune to build a huge house high in the Appalachians. Work on the Biltmore Estate began in 1889, when George was 26 years old. Six years and $5 million later, he moved into his palace. (That $5 million would be roughly $90 million in today's dollars.)

Strolling the grounds of the Biltmore Estate got me thinking about the stories we hear of wealthy people who squander their riches. How and why do they do this? Are there lessons from their stories that you and I can put to use?

We hear all the time about the “lifestyles of the rich and famous”. Today, on April 1st, let's look at some lifestyles of the rich and foolish.

Lifestyles of the Rich and Foolish

There are so many stories of athletes and entertainers who have blown big fortunes that it's tough to know where to start. Who should we pick on first? Since I've never been a fan of Nicolas Cage — and since he seems to be especially bad with money — let's use him an example.

Over a period of fifteen years, Cage earned more than $150 million. He blew through that money buying things like:

Fifteen homes, including an $8 million English castle that he never stayed in once.

A private island.

Four luxury yachts.

A fleet of exotic cars, including a Lamborghini that used to belong to the Shah of Iran.

A dinosaur skull he won after a bidding contest with Leonardo DiCaprio.

A private jet.

It's not fair to characterize Cage as “broke” — he's still a bankable movie star — but his net worth is reportedly only about $25 million. (That's like someone with an average income having a net worth of roughly $25,000.) He could be worth ten times as much but his foolish financial habits have caused him woe.

Cage got in trouble with the IRS for failing to pay millions of dollars in taxes. He's been sued by multiple companies for failing to repay loans. His business manager says that he's tried to warn Cage that his lifestyle exceeds his means, but the actor won't listen.

Cage is but one of many celebrities who have done dumb things with money. Other prominent examples include:

MC Hammer sold the rights to his songs to raise money after being bankrupted by his lavish lifestyle. Hammer earned more than $33 million in the early nineties, but spent the money on a $12 million mansion (with gold-plated gates), a fleet of seventeen vehicles, two helicopters, and extravagant parties. [source, source]

Actress Kim Basinger paid $20 million to buy the town of Braselton, Georgia in 1989. When Basinger filed for bankruptcy just four years later, she was forced to sell the town. [source]

On the night of 01 February 1976, Elvis Presley decided he wanted a Fool's Gold Loaf, a special sandwich made of hollowed bread, a jar of peanut butter, a jar of jelly, and a pound of bacon. He and his entourage flew from Memphis to Denver. The group ate their sandwiches and then flew home. Price: $50,000 – $60,000. [source]

Even authors get in on the act. Writer Mark Twain made tons of money through his work, but he lost much of it to bad investments, mostly in new inventions: a bed clamp for infants, a new type of steam engine, and a machine designed to engrave printing plates. Twain was a sucker for get rich quick schemes. [source, source]

When it comes to frittering way fortunes, it's hard to compete with sports superstars. In a 2009 Sports Illustrated article about how and why athletes go broke, Pablo S. Torre wrote that after two years of retirement, “78% of former NFL players have gone bankrupt or are under financial stress.” Within five years of retirement, roughly 60% of former NBA players are in similar positions.

Some examples:

Boxer Mike Tyson earned over $300 million in his professional career. He lost it all, spending the money on cars, jewels, pet tigers, and more. He eventually filed for bankruptcy. [source]

When Yoenis Cespedes signed a new $75 million contract with the New York Mets, he drove a new vehicle each day during the first week of training camp, including a Lamborghini Aventador ($397,000) and an Alfa Romeo 8C Competizione ($299,000). [source]

Basketballer Vin Baker earned $100 million during his career. He's now worth $500,000. He manages a Starbucks store in a small town in Rhode Island. (To be fair, Baker sees to be turning his life around, which is awesome.) [source]

Hall-of-fame pitcher Curt Schilling earned $112 million during 20 years in the big leagues. It wasn't enough to keep up with his spending. Plus he lost $50 million through the collapse of a company he owned. In 2013, he held a “fire sale” to avoid bankruptcy.

It can be tough to sympathize with these folks. Used wisely, their immense fortunes could sustain them and their families for a long time. Instead, they squander their money on fleeting pleasures and the trappings of wealth.

Still, I believe it's best to keep the schadenfreude in check. “There but for the grace of God” and all that, right? I've seen plenty of examples of average folks who have wasted smaller windfalls. In fact, this sort of thing seem to be the rule rather than the exception.

But why does this happen? The answer might be Sudden-Wealth Syndrome.

Lottery winners have the same kinds of problems. A 2001 article in The American Economic Review found that after receiving half their jackpots, the typical lotto winner had only put about 16% of that money into savings. It's estimated that over a quarter of lottery winners go bankrupt.

Take Bud Post: He won $16.2 million in 1988. Within weeks of receiving his first annual payment of nearly half a million dollars, he'd spent $300,000. During the next few years, Post bought boats, mansions, and airplanes, but trouble followed him everywhere. “I was much happier when I was broke,” he's reported to have said. When he died in 2006, Post was living on a $450 monthly disability check.

Sudden-Wealth Syndrome

In 2012, ESPN released a documentary called Broke that explores the relationship between pro athletes and money. How does sudden wealth affect young men? What happens when highly-competitive athletes with high incomes hang out together? Lots of stupid stuff, as it turns out.

Here's a nine-minute montage from Broke in which wealth manager Ed Butowsky talks about why athletes get into trouble with money:

youtube

Broke is an interesting film. The players speak candidly about the mistakes they've made: buying 25 pairs of shoes at one time, buying fur coats they never wore, buying cars they never drove. They're not proud of their pasts — some are ashamed — but they're willing to talk about the problem in the hopes they can help others avoid doing the same dumb things in the future.

Curious how much your favorite actor or athlete earns? Check out Celebrity Net Worth, a website devoted to tracking the financial health of people in the public eye.

Broke does a good job of explaining why our sports heroes can't seem to make smart money moves. The problem is Sudden-Wealth Syndrome. Essentially, young folks who earn big bucks don't get a chance to “practice” with money before they're buried with wealth.

The typical person earns a little when they're young, but watches their salary grow slowly with time. Their income peaks during their forties and fifties. As a result, they get time to make mistakes with small amounts of money first which means (in theory) that they're less likely to blow big bucks down the road.

On the other hand, athletes (and entertainers) have a completely different earning pattern. They leave school to instant riches. For a few years, they earn great gobs of money. But usually their income declines sharply with time — until it stops altogether.

Here's a (pathetic) chart I created to help visualize this phenomenon:

Athletes and entertainers need to figure out how to make five years of income last for fifty years. This never occurs to most of them. “[A pro athlete] can't live like a king forever,” says Bart Scott in ESPN's Broke. “But you can live like a prince forever.”

Sudden-Wealth Syndrome doesn't just affect athletes and actors. Lottery winners experience it too. So do average folks who inherit a chunk of change or business owners who sell their companies.

The fundamental problem is that nobody ever teaches us how to handle a windfall. Windfalls are rare, and in most cases they can't be planned for. (Some folks might be able to plan for an inheritance or the sale of a business, but these situations are relatively uncommon.) As a result, when the average person happens into a chunk of change, they spend it.

Here's what you should do instead.

How NOT to Waste a Windfall

When you receive a windfall, whether it's a tax refund, an inheritance, a gift, or from any other source, it's like you've been given a second chance. Although you may have made money mistakes in the past, you now have a chance to fix those mistakes (or some of them, anyhow) and start down the path of smart money management.

It can be tempting to spend your windfall on toys, trips, and other things that you “deserve,” but doing so will leave you in the same place you were before you received the windfall. And if that place was chained to debt, you'll be just as unhappy as you've always been.

If you receive a chunk of cash, I recommend that you:

Keep five percent to treat yourself and your family. Let's be realistic. If you receive $1,000 or $10,000 or $100,000 unexpectedly, you're going to want to spend some of it. No problem. But don't spend all of it. I used to recommend spending one percent of a windfall on yourself, but from talking to people, that's not enough. Now I suggest spending five percent on fun. That means $50 of a $1,000 windfall, $500 of a $10,000 windfall, or $5,000 of a $100,000 windfall.

Pay any taxes due. Depending on the source of your money, you might owe taxes on it at the end of the year. If you forget this fact and spend the money, you can end up in a bind when the taxes come due. Consult a tax professional. If needed, set aside enough to pay your taxes before you do anything else.

Pay off debt. Doing so will generally provide the greatest possible return on your investment (a 20 percent return if your credit cards charge you 20 percent). It'll also free up cash flow; if you pay off a card with a $50 minimum monthly payment, that's $50 extra you'll have available each month. Most of all, repaying debt will relieve the psychological weight you've been carrying for so long.

Fix the things that are broken. After you've eliminated any existing debt, use your windfall to repair whatever is broken in your life. Start with your own health. If you've been putting off a trip to the dentist or a medical procedure, take care of it. Do the same for your family. Next, fix your car or the roof or the sidewalk. Use this opportunity to patch up the things you've been putting off.

Deposit the rest of the money in a safe account. It can be tempting to spend the rest of your windfall on a new motorcycle or new furniture or new house. Don't. After attending to your immediate needs, deposit the remaining money in a new savings account separate from the rest of your bank accounts — and then leave this money alone.

To successfully manage a windfall, you must allow the initial euphoria to pass, getting over the urge to spend the money today. Live as you were before. Meanwhile, calculate how far your windfall could go. Most people have unrealistic expectations about how much $10,000 or $100,000 can buy.

In 2009, I received an enormous windfall. The old J.D. would have gone crazy with the money. The new, improved model of me was prepared, and made measured moves designed to favor long-term happiness over short-term happiness.

Today, the bulk of my windfall remains in the same place it's been for the past five years: an investment account. That cash eases my mind. It helps me sleep easy at night. And that's more rewarding than spending it on new toys could ever be.

Setting a Good Example

Not everyone who gets rich quickly does dumb things with money. Especially as the plight of pro athletes becomes better known, there are prominent examples of young superstars making savvy money moves. They're learning from the lessons of those who came before.

Take Toronto Raptors superstar Kawhi Leonard, for instance. This 27-year-old NBA MVP earns $23 million per year — but still clips coupons for his favorite restaurant. He drives a 1997 Chevy Tahoe. Sure, he bought himself a Porsche, but he's not interested in flash and bling. “I'm not gonna buy some fancy watch just to show people something fancy on my wrist,” he says. [source]

Jamal Mashburn has made wise use of his wealth. So has LeBron James, who takes his investment advice from Warren Buffett:

youtube

Here are other superstars who act as money bosses:

During his 12-year career in the NBA, Junior Bridgeman never earned more than $350,000. Unlike most players, however, he planned ahead. He recognized his basketball income would eventually vanish. He bought a Wendy's fast-food franchise and learned the business inside-out. He became a hands-on owner. He expanded from one store to three to six — and then to a small empire. Today, twenty-five years after retirement, Bridgeman owns more than 160 Wendy's restaurants and 120 Chili's franchises. His company employs 11,000 people and generates over half a billion in revenue every year. His personal net worth tops $400 million. [source]

Patriots tight end Rob Gronkowski — who just retired last week — is a shining example of how to handle sudden wealth correctly. The 29-year-old earned over $53 million for playing on the field — and hasn't spent any of it. Here are his own words: “To this day, I still haven't touched one dime of my signing bonus or NFL contract money. I live off my marketing money and haven't blown it on any big-money expensive cars, expensive jewelry or tattoos and still wear my favorite pair of jeans from high school.” [source]

Oakland Raiders running back Marshawn Lynch has a similar story. During his twelve-year NFL career, Lynch has collected nearly 57 million from his contract. Reportedly, he hasn't spent a penny of that money. Instead, he's been cautious to live only off his endorsement earnings. Whether this is true or not, Lynch is known to be a good example to his teammates, helping them with their 401(k)s and other financial issues. [source]

Sometimes superstars who have been poor with money have a flash of insight and they're able to turn things around. Former NFL player Phillip Buchanon is a perfect example. After watching ESPN's Broke, he realized he was headed for trouble. He mended his ways and started managing his money wisely. Now he's written a book with advice for other folks who are fortunate enough to encounter a windfall. [source]

When people make a lot of money, they're able to spend a lot of money. Sometimes the super-rich can afford to build a place like the Biltmore Estate. The problem isn't a single extravagant purchase, but a lavish lifestyle in which they spend more than they earn. Real wealth isn't about earning money — it's about keeping money.

The post Lifestyles of the Rich and Foolish appeared first on Get Rich Slowly.

from Finance https://www.getrichslowly.org/lifestyles-of-the-rich-and-foolish/

via http://www.rssmix.com/

0 notes

Text

Lifestyles of the Rich and Foolish

It’s the first of April. You know what that means. Spring is here! Your friends and family are pulling April Fools’ Day pranks. And my tree allergies are kicking my butt. Every year, tree pollen makes my life miserable. This year is no different.