#you can’t be considerate in this economy you have to be consumed by rage

Explore tagged Tumblr posts

Text

maybe you guys should block the jen rambles tag for the next few days bc it’s just gonna be me and my rage lol

#just me and my unresolved anger ✨#can’t believe i’ve had this shit bottled up for months now#never expect me to be the bigger person in any circumstance. i’m 5’1#i’m an angry lil person who holds grudges forever lmao#i’m really not above NOT taking the high road lol#you can’t be considerate in this economy you have to be consumed by rage#in my tswift reputation era#jezuz#jen rambles

3 notes

·

View notes

Photo

Previous: The Discord Timeline

The Industrial Devolution Timeline:

The road to economic domination was creeping and insidious.

First, Nightmare Moon returned. Celestia and Cadance were able to subdue her, locking her in a (very comfortable) prison while Celestia sought a way to free her sister of the evil influence warping her mind. With the monarch so distracted and Princess Cadance struggling to take up the slack, a few opportunistic entrepreneurs began getting their roots into the market.

Then the Crystal War began, dividing Celestia’s and Cadance’s attention even further. The Changelings attacked, sowing destruction and distrust until Cadance defeated their queen. Tirek cut a swath through the countryside before being stopped, increasing the economic struggles. It was as if a domino of assaults on the Equestrian daily life had started, with none able to stop the ever-larger dominoes from toppling.

Celestia was terribly injured during the final fight that destroyed King Sombra. Luna finally overcame her rage and the parasitic magic fueling it, but went into seclusion out of shame and a desire to tend to her wounded sister. Cadance’s focus was split between post-war rebuilding in Equestria, assisting the confused, freed, and much-distrusted crystal ponies with stabilizing their crippled city, and tending to her own first child. With their leaders so distracted and the country still reeling from so many attacks, ponies desperately reached out for any kind of financial and necessities stability.

Perfectly fertile soil for the country’s most hostile economic takeover in its history.

Flim and Flam’s tactics were simple yet effective: move in wherever large numbers of companies had collapsed and fill the void with simple, cheap necessities that anypony could afford. As their finances grew, they began to expand, beating out surrounding competition with their rock-bottom prices until they could either buy out or crush their competitors. They continued this strategy further and further out, their influence spreading like hives across Equestria until hardly any retailers of food, drinks, household goods, small machine parts, and pretty much every other goods reseller below industrial level still operated. (Although who knew what the future might hold for FlimFlam Industries?) Once competition decreased to almost nill, they raised their prices to just barely affordable, swelling their already full pockets.

By the end of the Crystal War, they had such a grip, so much financial and political power, that even if the princesses should realize the toxic hold this company has on the market, it will be a long road back to rebalancing the economy. The country has, regrettably, come to rely on Flim Flam Industries, and their stranglehold would not be easily broken.

Sales always dreamed of being a traveling salespony. He’d even gotten a taste of it before the war. But now... well, there was no one to sell for. Companies kept dying out from under him. And if it weren’t bad enough that FFI already sold cheap, unexciting product options, the further lack of competition gave them even less incentive to TRY. They could cut costs on everything from packaging to flavor to color options; there was absolutely no consideration for variety or improvement or innovation. Soon everything in those blasted pop-up depots came in bland, uniformly labeled containers, with names like FLOUR and SOAP and TOWELS. There was no ART to it, and worst of all, no heart. And certainly no need for a door-to-door sales technique - not when F&F Depots were on every corner and people already had little choice but to get their goods from them.

So that’s how Sales ended up here, running one of those blasted depots. It is barely salesponyship, but it was still the closest thing he could find to his special talent. Meanwhile pollution and unchecked labor laws are creeping out from the cities, and farms are being consumed for their timber and factory locations. Quills & Sofas went under, leaving Sales’ father without a job and one more worry for Salespitch. Everypony prays that Celestia would heal, that Cadance would realize the depths of what was happening and make some move to stop it, that even the once-evil Princess Luna rumored to be tending her sister in the castle would take a stand. But for now, FFI is taking full advantage of the rulers’ distraction and obliviousness to tighten their hold on the country’s economy. Sales works and keeps his head down; it’s too great an issue for one pony to tackle, especially a pony whose only real talent is talking.

He tries to remind himself that things could be worse. Despite crummy wages and the soul-deadening monotony of just grabbing standard crap off a shelf when asked, Sales IS making a living. He makes an effort to keep his depot looking like the pony who works there actually cares (a façade FFI has long since abandoned.) Black took up work as a stocker in the store, so at least they get to hang out. Pollution isn’t as bad in Featherhorn (yet), although the deforestation and smog have been spreading nearer. But Sales just can’t get around the fact that there’s a briefcase-shaped hole in his soul where good, honest, smart salesponyship was meant to be. It’s hard not to be bitter and miserable when your purpose has been almost completely taken away from you. Still... if Sales can find a way to get a new company going without being ground under Flim and Flam’s hooves... maybe he can go back to doing what he loves, and the world will feel a little more right again. Fun Facts About The Flim Flam Timeline:

- I got my idea for a total economic takeover from a book 6 of the Pendragon series, “The Quillen Games” by D.J. MacHale. Its setting is a world where a single corporation has such control that they even own the people to an extent, but I didn’t want to go THAT dark (although this is still darker than my initial draft), so I stopped at just owning all of the selling outlets. Lack of competition in capitalism breeds complacency, leading to high prices with minimal improvement or variety. (That book may have also stuck in my mind because it was the first time an author so thoroughly pulled the rug out from under me that I was too depressed to finish the series. I can’t HANDLE that kind of catastrophic reversal, MacHale!!!)

- Sales’s dad, Sales Patter, lost his job as Head of Sales at Quills & Sofas after the company was eaten by FlimFlam Industries. He currently lives at home taking care of Pitch Perfect while Pitch Forward does her best to bring in funding through her competitive high-diving sponsorships. Sales and Black contribute money as well, although Black has a surprisingly well-stocked savings account that he refuses to explain to anyone.

- Flim and Flam offered Sales a job as their company spokespony, mainly because they loved the idea of having an ‘alicorn’ as their mascot. Obviously he turned them down, but he did still grudgingly accept a position at the Featherhorn depot since it’s the closest thing he can find to what he’s good at. (Flim and Flam do still like to give people a show, especially when it comes to the smoke and mirrors they must use to keep the wealthier populace and government from paying too much attention to some of the ways FFI cuts their spending - at the expense of their workers, mostly.)

- I’ve seen others do this timeline harsher; there’s a fimfiction that had an interesting take on Celestia being injured in her fight with Nightmare Moon and then IMPRISONED by Flim and Flam’s company so it could take over, which led to an ever-rising problem with pollution, underage workers, poor labor laws, and backhoof politics. Some of that does exist in this timeline, but I went with a severe injury and seclusion in the palace. The Princesses are still AROUND, but being carefully shielded from the truly dark nature of some of Flim and Flam’s machinations. It may just take someone getting their attention drawn to the right things to start the ball rolling...

- Sales and Patter do team up to create a small startup company, selling goods made by Featherhorn’s citizens to the local area. Black uses his connections as a Royal Service agent to sneak them into the palace, where they get an uber-rare meeting with Princess Celestia, who is blessedly awake enough to recognize the little AI and hear their plight. She convinces Luna, who has been taking care of her this whole time, that something needs to be done. Luna is grossly undereducated about modern economics and business practices, but she pulls Cadance in, and while Cadance works on investigating these horrible labor practices they’ve reported, Luna begins brushing up on her education and offers some protection to Sales’ little company. She does, in fact, find some obscure ancient laws that give them a leg up in the fight against FFI when they inevitably try to buy out, sue, and/or bankrupt Sales’ and Patter’s company into the ground. But they start making some headway.

- It’s a long road back to a balanced market, and much of the work will be done by the Princesses. But the inspiration ponies draw from the changes they see starts the dominoes again - this time, in the direction of positive change.

Next Week: The Wasteland Timeline (finale!)

#mlp ask blog#pony ask blog#my little pony#flim flam brothers#IANAA#salespitch#celestia#cadance#luna

35 notes

·

View notes

Photo

Author’s note: well, my week has sucked, how about yours?

Right, no rest for the wicked then. So as I mentioned at the tail end of last month, I’m working on a new kind of Recommended Reading blog feature here on Can’t You Read.

The tl;dr is these posts are designed to combine a sharable info graphic (or meme, if you must) with some short burst analysis and an important link to a related and often overlooked story by someone else. Ideally, all of this fits into an 800 or 1,000 word package that actually gives you enough time in your undoubtedly busy day to read the article I’m linking to.

Got it? Good, let’s get cracking.

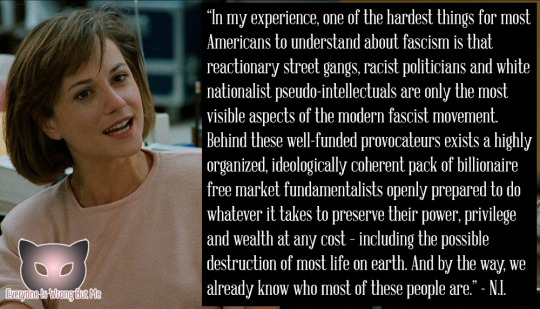

American Fascism and Networks of Power

Well my friends, the last nauseating funeral gasp of the Trump era is almost over. With the recent news that (soon-to-be) former swine emperor Trump’s own Department of Justice can find no evidence of widespread election fraud, we all appear to be getting collectively closer to the final resolution of the Klepto Kaiser’s “chicken coup” and perhaps, the waning of his political influence even on the reactionary right.

Good riddance to bad rubbish I suppose, but as I’ve repeatedly tried to explain to virtually anyone who would listen, the end of Trump is most certainly not the end of fascism in the larger Pig Empire, or even just American fascism. The reasons for this are of course myriad but a short list might look something like this:

the pre-existing and increasingly normalized strain of ideological white nationalism in our society and ingrained into non-elected portions of the state (think police, ICE, and Trump’s complete transformation of the American judiciary; similar processes are also occurring in places like India, and Brazil of course.)

A weakened incoming, center-right administration (and its “liberal” establishment lackeys) that not only lacks the courage to purge fascists from public service but also attempts to weaponize far right violence against the American left, and regards antifascist street action as being akin to terrorism or crime.

the indefinite survival of an objectively fascist opposition party that probably has a better than even chance of retaining control of the U.S. Senate.

the existence of multiple right wing, mainstream media outlets and personalities that propagate fascist ideology, which are in turn buttressed by a seemingly endless wave of Astroturfed online media and internet psyops funded and controlled by fascist, or at least hyper-capitalist to the point of being reactionary, billionaires and their lobby networks.

the continued existence of violent, reactionary street gangs, far right neo-fascist militias, fascist conspiracy cults, and of course, roughly seventy-four million people who just gleefully voted for an open fascist and in some cases, continue to agitate for what would effectively be a coup.

the need for elite capital to defend itself against social upheaval and acquire soon-to-be scare resources in the face of evidence that capitalism is simply not compatible with avoiding the impending climate apocalypse our current political and economic course is actively ensuring will come to pass.

Naturally, I could have also mentioned the ongoing political, social and economic fallout from the still-raging coronavirus crisis, but I saved that for last because I want to unpack the ways we know many of the above forces function together in action - and as luck would have it, the Covid-19 anti-lockdown protests provide an extremely clear and documented example of what might otherwise look a little bit like a conspiracy theory.

Now as you may well be aware, a concerted and sustained disinformation campaign conducted by not only President Trump, but the larger Republican Party and right wing media has successfully weaponized the response to the coronavirus as a culture war issue in America; and that conflict is rapidly spreading across the entire Pig Empire.

This in turn was combined with a purely Astroturf protest movement, and judicious application of billionaire reactionary funding to literal white nationalist and fascist militias, to churn out thousands of cultists, chuds and other members of the reactionary “Volk” who demanded the economy be “re-opened” no matter how many elderly, marginalized or otherwise compromised people it might kill. Which as we’ve learned the month’s since, is quite a lot.

While each of these groups would vehemently deny it, it’s quite obvious that the billionaires and their media, are working with reactionary politicians in the Republican Party to marshal an aggressive, potentially violent protest movement against their political enemies and policies that threaten their profits. The rich guys get to keep raking in the cash, the politicians (who work for the rich guys anyway) get power and support from the chuds, and the Volk get to disguise a backlash against equality, decolonization and social advances as a battle against tyranny. All of which is wrapped up in a neat little bow under the auspices of covert white supremacy, in a situation that looks a little bit like eugenics, and bears all the hallmarks of historically racist (and obviously, false) attitudes in America about the genetic and more importantly *hygienic* superiority of whites over non-whites.

Of course and as I mentioned above, all of this might sound like a conspiracy theory, but if you’ve been clicking on the links as we go along you know that it’s all true; unfortunately, a bipartisan billionaire-owned media interest in protecting the power and influence of elite capital in the Pig Empire, by and large prevents the mainstream media from presenting all of this information in its proper context. To counter that problem, let’s turn to investigative journalist Alex Kotch, an anti-corruption muckraker of considerable ability and someone who exists at least partially (but not entirely) outside the corporate media sphere.

On October 21st, 2020, Kotch and the Center for Media and Democracy published an extraordinary story that laid bare the inner workings of American fascism (and its capitalist roots) - we’re talking about exposing the direct financial connections between billionaire propaganda networks, fascist chud militias, right wing think tanks, GOP politicians and Astroturfed anti-lockdown protests; dark money meets dirty deeds done dirt cheap in a fake uprising that ends in obstructive lawsuits, partisan impeachment recommendations and a plot to kidnap and maybe even execute the governor of Michigan for... saving lives, apparently.

This is what the fascist alliance of elite capital (DeVos Family, Koch Network,) political power and street violence looks like in direct application; this is why I’m certain American fascism will outlast Trump’s fall - it’s all there in black and white.

Unfortunately, hardly anyone noticed it at the time because the election consumed all of the oxygen in the room; as anything involving Trump is want to do. Let’s not make that mistake again - to check out Kotch’s incredible story, click on the title header below:

GOP Politicians and Conservative Groups Set the Stage for Attempted Kidnapping of Michigan Governor by Alex Kotch

-nina illingworth

Independent writer, critic and analyst with a left focus. Please help me fight corporate censorship by sharing my articles with your friends online!

You can find my work at ninaillingworth.com, Can’t You Read, Media Madness and my Patreon Blog

Updates available on Twitter, Instagram, Mastodon and Facebook. Podcast at “No Fugazi” on Soundcloud.

Inquiries and requests to speak to the manager @ASNinaWrites

Chat with fellow readers online at Anarcho Nina Writes on Discord!

“It’s ok Willie; swing heil, swing heil…”

#Fascism#white supremacy#COVID protests#ALEC#Koch#Bob Mercer#DeVos Family#Trump#AstroTurf#anti-lockdown protests#chuds#dark money#recommended reading#Alex Kotch#nina illingworth#racism#power networks#conspiracy facts#Eco Fascism#Climate Catastrophe#CMD

2 notes

·

View notes

Text

This Week in Collapse

If like us, you keep track of the disparate stories that track the decline of a collapsing civilization, the big news this week was the Evergreen container ship Ever Given stuck in the Suez Canal. Like an oversized lozenge stuck in the world’s throat, the ship got stuck in a narrow part of the Suez where about 30% of the world’s ocean container volume transits.

Beached by a raging sand storm and then jammed in to one of the world’s most important shipping choke points, at 1,300 feet long the Ever Given is slightly larger than the Empire State Building. And every bit as seaworthy at the moment.

Speaking of the sandstorm, the conspiracy types have had a field day, speculating that since the influence on the global trade and economy is so huge, it must be a deliberate act, amirite? Cui bono? Some see cover for an attempt to control the narrative around the big world-wide economic collapse that is just around d the corner. Some comment ranges along the lines of “my gut tells me it's not just an accident,” a position marginally more responsible than speculating that Israeli commandos had beached the stricken ship to prevent the transit of 50,000 children for Hillary Clinton’s sex-trafficking operations. My gut tells me to listen to reports from people who work in shipping, such as tug captains, who say that tankers with 100k+ GRT (Gross register tonnage, the total internal volume of cargo vessels) shouldn't sail under high winds because they can't adjust course quickly enough.

Efforts to refloat the Ever Given have so far fallen short; an array of heavy construction equipment and mammoth tugboats have been far less successful at dislodging the ship’s bow from the sand of the canal as at demonstrating the difficult-to-imagine size of the boat in photos.

Ships are already rerouting around Africa to avoid the delays, but every hour the Ever Given remains lodged in the canal puts stress on a global supply chain already taking water from the pandemic, which in turn puts upward price pressure on all manner of goods.

Perhaps you noticed a shortage of toilet paper, or baking flour, or antiseptic wipes to go with your empty supermarket shelves about a year ago at the beginning of the pandemic. A good summary explanation of the brittleness of our supply chain that is simple and straightforward, see Amanda Mull’s article, Why Everything Is Sold Out.

As is the case with America’s larger pandemic failures, the consumer system had begun to rot long before the coronavirus made its brittleness obvious. American corporations have spent decades squeezing every last dollar out of the market, largely at the expense of its flexibility and resilience. The worst of it started 30 years ago, [Steve Rowen, a managing partner at the retail-analytics firm Retail Systems Research] said, when Walmart crushed local competition across the country and popularized the “just in time” inventory model. Costs are kept low by keeping very little on hand, and shelves are restocked with freshly delivered products; there are no paper towels or sweatpants waiting to be called into duty. In a crisis, this means that store shelves empty quickly. People panic and start hoarding or hunting for things online, depleting those supplies as well. “Efficiency is great if there’s no interruption of any sort and if things go exactly as planned,” Rowen said. “Unfortunately, at least for the foreseeable future, there is really no ‘according to plan.’” It’s not just a pandemic that can cause this kind of logistical chaos. Hurricanes, wildfires, and major civil unrest can all tank the best-laid plans of executives trying to wring profit out of a business through “efficiency.” The United States is currently undergoing all four crises at once.

Not to mention a giant container ship Tokyo-drifting into a sandbar. We’ll see what happens, but although gambling is perhaps the only vice I’ve missed in this life, I’d be willing to bet there are higher prices in our future.

The Rest of the Week: Climate Change Doesn’t Care Whether You Believe in it or Not

Tiny Town, Big Decision: What Are We Willing to Pay to Fight the Rising Sea?

Avon, NC, a small town on North Carolina’s Outer Banks, is wrestling with the immediate effects of global warming and sea level rise: the encroaching seas. And residents there have opened up a large can of, “somebody ought to do something.” But in the spirit of NIMBYs everywhere, the only thing they can agree on is that someone else ought to pay for it.

Bobby Outten, a county manager in the Outer Banks, delivered two pieces of bad news at a recent public meeting. Avon, a town with a few hundred full-time residents, desperately needed at least $11 million to stop its main road from washing away. And to help pay for it, Dare County wanted to increase Avon’s property taxes, in some cases by almost 50 percent.

Homeowners mostly agreed on the urgency of the first part. They were considerably less keen on the second.

People gave Mr. Outten their own ideas about who should pay to protect their town: the federal government. The state government. The rest of the county. Tourists. People who rent to tourists. The view for many seemed to be, anyone but them.

The fact is that Avon is located on a narrow sandbar that is part an island chain, in a relentlessly rising Atlantic. As seas continue to rise and storms intensify, the question will echo along the American coastline from Norfolk to Miami. What price can be put on saving a town, a neighborhood, a home, and who pays? One suspects that an elimination of subsidized flood insurance will force the issue.

Kuwait Records Hottest March Temperature Ever Amid Dust Storms and Locusts

What, no frogs?

Nearly half the U.S. is in drought and conditions are expected to grow worse, NOAA says

Nearly half of the continental U.S. is in a moderate to exceptional drought, government forecasters said Thursday, and conditions are expected to grow more severe and persistent over the next three months.It’s the most significant spring drought to grip the country since 2013 and will impact roughly 74 million people, per NOAA.

The End of Industrial Society

Post-industrial society is neither the next vaunted stage of human progress, nor the prelude to a catastrophic reversion to pre-industrial ways of life. Our social technologies have not been upgraded in the wake of the Industrial Revolution’s conclusion; they have been exhausted before we even finished industrializing.

Two mass shootings within a week: America's gruesome "bingo card" total keeps growing

And a third in Virginia Beach Saturday AM. We are clearly getting back to what passes for “normal,” in which we become numb to mass slaughter.

So it’s been a week of supply chain disruption, droughts, sandstorms, rising seas, and mass shootings. Another week of downward spin as the American Empire unwinds.

0 notes

Text

Apple’s trillion dollar market cap was always a false idol

Let’s face it, we love large numbers. We are obsessed with them, whether it’s Forbes list of wealthiest individuals or tech unicorns, if it’s a big number we can’t get enough. Such is the case with the somehow magical trillion dollar mark that Apple briefly reached last summer. We splashed the headlines and glorified it as though it mattered…but it didn’t.

It was just a number.

Sure it showed the tremendous value of the Apple stock, but it was a moment in time fueled by an overheated stock market, full of sound and fury, but in the end adding up to nothing. Fast forward 4 months and the company has lost more than a third of its stock value. Last week, it lost $75 billion with a B in market cap in a single day. We got a hard lesson in stock market physics — what goes up eventually must come down.

Hard lessons

In that light, the trillion dollar mark was fun, but it didn’t mean much in the end. Ultimately, Apple stock still has value. It may be make a few less billion next quarter than it predicted, but it’s still got plenty of cash on the books, and chances are it will be just fine in the end.

Apple lowers guidance on Q1 results, cites China trade tensions

As long as the US-China trade war rages on and the US economy continues to cool, it’s probably not going to approach that trillion threshold again any time soon. Investor enthusiasm for tech stocks in general has waned considerably since those heady dog days of August.

Just as Bill Gates or Warren Buffet or Jeff Bezos may have a few billion more or less on the books on any given day, it just doesn’t matter all that much. It’s not as though they’re going broke. Just as Apple isn’t going to shut down because it might have a bad (less good) quarter than it was projected to have.

Nobody grows forever, not even Apple. It had to cool off at some point, and if this is cooling off, 87 billion instead of 91 billion, it’s a drop-off that investors should be able to understand and live with. If it became a troubling pattern and an ice age set in, that would be another matter, but Apple is still selling product hand over fist, tens of millions of iPhones is still a lot of iPhones. Wall Street should probably take a chill pill.

Tech stock doldrums

It’s worth noting that Apple has hardly been in alone taking a huge hit on its stock price, especially tech stocks, which have been taking a beating since November on Wall Street. Want to talk a trillion dollars, how about the biggest names in tech losing a trillion (that’s with a T, folks) in value in one stretch in November. When Apple halted trading last week to announce lower than expected revenue, the stock dove even further, as it confirmed the worst fears of investors.

Worse, Chinese consumers have driven iPhone sales just as the Chinese economy has hit a massive speed bump this year. In June, Reuters reported shockingly weak growth. In November, Bloomberg reported that the Chinese economy was slowing down long before the president started a trade war. .

Apple also appears to be having more trouble selling the XR worldwide than it had projected, and fluctuating currency rates are also wreaking havoc — not to mention the trade war — but analyst Horace Dediu from Asymco sees Apple generating strong revenue from non-iPhone hardware, as the chart he shared on Twitter recently shows:

How does Apple’s business look if you exclude the iPhone? pic.twitter.com/bk5xGCQ2oR

— Horace Dediu (@asymco) January 6, 2019

Whatever the future holds for Apple and other tech stocks, we clearly like to throw around large numbers. Yet companies don’t tend to live and die by their market cap. It’s not a metric that matters all that much to anyone, except those of us who like to marvel at the size of the biggest numbers, and then click our tongues when they inevitably fall to earth.

Sorry that I took so long to upgrade, Apple

0 notes

Text

New story in Business from Time: Bank of America CEO Brian Moynihan Is Still Optimistic About the Economy—and the Lure of Cash

(Miss this week’s The Leadership Brief? This interview above was delivered to the inbox of Leadership Brief subscribers on Sunday morning, Aug. 9; to receive weekly emails of conversations with the world’s top CEOs and business decisionmakers, click here.)

Banks offer a front-row seat to the state of the economy. After a brutal second quarter for the U.S, Bank of America CEO Brian Moynihan believes that the worst is behind the country. Still, his bank’s economists predict that the unemployment rate will be at 10% at the end of the year and that the economy won’t fully recover to 2019 levels until early 2023.

BofA, like other banks, has played a critical role in getting government stimulus funds into the hands of cash-starved businesses: It processed 334,000 Paycheck Protection Program (PPP) loans, delivering $25 billion in funding for small businesses. At the same time, the bank has worked with major corporations to bolster its balance sheets, raising $461 billion in capital for clients (earning record fees for its investment-banking unit in the process).

Moynihan, who in college was a co-captain of the Brown University rugby team, worked as a corporate lawyer before moving into banking and became CEO of BofA in 2010. He led a turnaround at the bank after a near crippling 2008 acquisition of troubled subprime lender Countrywide Financial, attracting Warren Buffett as a major investor along the way. Buffett’s conglomerate, Berkshire Hathaway, in recent days increased its holding in BofA, bringing its total ownership stake to approximately 12% of the company. Moynihan, 60, joined TIME for a conversation about the need for additional stimulus, why he’s optimistic about America and its economy, and why Winston Churchill is a good role model for these times.

Subscribe to The Leadership Brief by clicking here.

This interview with Bank of America CEO Brian Moynihan has been edited and condensed for clarity.

How would you characterize your economic outlook right now?

We’re optimistic as a company. We continue to see clients making progress; we continue to see the stress in the system come down because of the work the Fed did and the stimulus work that was done.

Even with a forecast of double-digit unemployment at year-end?

Now, you could say, “How is that optimistic?” The answer is, what’s optimistic about it is the worst is behind us. April was the worst month, May was a less worse month, June was better, and in fact July was even better than June. You’re going to have some ebbs and flows based on the virus track, but I think you have to be optimistic that you’re seeing the U.S. consumer continue to spend.

How important is it that the government passes another round of stimulus? [This interview was conducted Monday, Aug. 4, when there was still ongoing negotiations on the a new stimulus package.]

Let’s start with the beginning, that the Administration, Congress and the Fed did a very good job to step in at the end of March, to really put a lot of money into the economy, directly in the hands of the people who needed it most to maintain their ability to survive with an unemployment rate that went up to 15%. If you think about the analogy being a river that we’ve got to cross from pre-COVID to post-COVID, and need to get past COVID, and the river between is the COVID period, some industries are already past COVID because of the nature of what they do. The idea is to keep the money flowing to the people who are still in the process of crossing the river, as opposed to the people who have crossed.

What is your view of the newfound concern about deficit spending?

I think we’ve got to make sure the largest economy in the world recovers fast. If you talk to colleagues around the world, they are very concerned that the U.S. gets out of this because the U.S. economy is so big and creates such demand around the world for the rest of the economy. The idea of worrying about the ultimate deficit right now when you’ve got to get us to the other side of this thing is something that I think we can deal with later on.

So now is not the time to get religion on deficits?

It’s the time to make sure that you’re spending money to keep the economy recovering.

</span></span><span style="font-weight: 400; font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen-Sans, Ubuntu, Cantarell, 'Helvetica Neue', sans-serif; font-size: 16px;">It’s the time to make sure that you’re spending money to keep the economy recovering.</span><span style="font-weight: 400;"><span style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen-Sans, Ubuntu, Cantarell, 'Helvetica Neue', sans-serif;">

As CEO, you demand excellence from your employees. Why can’t we, as citizens, demand a higher level of excellence from our government?

That’s a political question in terms of getting this done that’s better served for the political advisers we have. Our job is to make sure we deal with whatever comes out of it well.

I hear you, but what should the business community be doing now in Washington to throw its considerable weight around to make sure there’s good outcomes for the country?

The No. 1 thing is businesses have to do what we can do inside our own companies to help blunt this for our teammates. And so, we’ve announced no layoffs; we’ve announced enhanced childcare. We’ve enhanced the pay at our branches; we’ve enhanced the overtime. The No. 1 thing is to take care of your people, and make sure they’re safe, and make sure that they can serve your clients well—then take care of your clients.

BofA is credited with doing a particularly good job of getting PPP funds quickly into circulation. Can you talk about that effort?

The team’s done a great job of getting people through this and helping provide $25 billion–plus of funds to our clients. At one point, we probably had 10,000 people working on this. We spent a lot of resources, a lot of time, a lot of effort. We had to take people off a lot of other places. Volunteers. People working every weekend. Easter holiday weekend. Saturday and Sunday. Overnight. It was all based on the basic principle that the American small-business community needed to get this program in their hands, and it was our job to push it through. We took it as an obligation to help deliver that for the government, and we did.

TIME for Learning partnered with Columbia Business School to offer a series of online, on-demand classes on topics like effective leadership, negotiation and customer-centric marketing. To sign up or learn more, click here.

You’ve also been active in helping corporate clients beef up their balance sheets.

What happened in mid-March to mid-April is that the companies came in and borrowed hundreds of billions of dollars from the banking system, including $70 billion in two weeks from us, with commercial loans.

What’s going on with M&A activity and the advisory business?

As you come into July, you’re starting to see more M&A activity because of the stability of the market. The third quarter, we expect to see more M&A activity. You’ll see more IPO activity—health care IPOs, plus some other tech IPOs

Subscribe to The Leadership Brief by clicking here.

How much interaction do you have with Warren Buffett, who just made another series of investment in BofA? Do you two have a regular call?

We talk periodically. But he wants us to run the company and do a good job with it.

Any particularly memorable insights that he’s shared with you?

He’s a great long-term thinker. The one thing that he both talks to, but also gives you confidence in, is just see where the long-term value of your company is and make sure you’re driving toward that, and not get caught up in the issues of the moment. It’s the work we did over the last decade that positions us well for the COVID-19 crisis; it’s not what we’re going to do today.

Are people still using cash?

We had as much cash go out of the ATMs in the month of July this year as we did last July, and that is $200 million–plus a day. But the digital part of this really grew through online digital purchases, online payments. And by the way, it’s a very good thing if Americans learn how to use less cash, and what you’re doing is, when you go to a coffee shop and you pay with your phone, you will see that grow at a good, fast rate.

Wait, cash is not dead? I thought people didn’t want to touch cash and that contactless payments were all the rage.

Yes, the cash piece is still big—it’s as big as the credit-card piece.

I know the answer to this is “They’re spending it,” but do you have any particular insight into what people doing with the cash? Maybe they are buying print newspapers and print magazines.

It’s still useful to pay for things. People still use cash to buy things every day. Not necessarily the $300 item, but the $10 item. That’s been changing slowly but surely, but cash is still out there, and so one great service that we provide is 18,000 ATMs and 4,000 branches that help people manage cash. Small businesses collect cash, they deposit it; and people use it. Long-term though, the trend of movement from dollar bills to digital dollar bills is relentless.

What type of behavior will you not tolerate on your management team?

People who are passive-aggressive. If you have a point, make it in front of everybody. Life’s busy; there’s not a lot of time. People who sit in a discussion and then come out and try to either talk to me afterward saying, “Well, this is what I thought.” That doesn’t do me any good because we need to process it together as a team.

I understand you’re an admirer of Winston Churchill.

It was unbelievable how he held the country together. You have to admire that kind of tenacity. One of my favorite things when we get into discussions about charities, museums and culture—and whether the story is 100% true, because a lot of Churchill stories can get embellished over the years—but there was a year when they were discussing the budget and Parliament cut the funding for the arts. And Churchill, in the middle of World War II, when they’re getting bombed and scraping by, said, “If we’re not funding the arts, what are we fighting for?”

What is the biggest, most complicated decision on your plate this week?

I’m not sure I can tell you that.

Forgive me for ending on a philosophical note, but it’s about your name, Bank of America. What does America mean right now? I was in a Home Depot over the weekend and witnessed a rage-filled mask confrontation, an ugly, ugly exchange. What does America stand for right now?

America still represents the best place for opportunity to be recognized. Capitalism provides great opportunity. We have to keep focused on capitalism as the solution to the deep problems, but we have to be mindful that we have to manage capitalism to fully align it with what society wants from capitalism. You’ve got to produce profits and purpose. We believe that fully in running our company, and I believe that’s what America stands for: the ability to solve the world’s great problems. It’s an unfinished dream and continues to provide great opportunity. We’ve got to fine-tune it; we’ve got to fix it where it didn’t work right.

I believe that’s what America stands for: the ability to solve the world’s great problems.</span><span style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen-Sans, Ubuntu, Cantarell, 'Helvetica Neue', sans-serif;">

MOYNIHAN’S FAVORITES

BUSINESS BOOK: Jim Collins’ books. He’s always thought-provoking.

AUTHOR: The three that I read the most are James Patterson, David Baldacci and John Grisham. It’s not a world I’ve ever played in—spy novels—but they’re fun to read.

APP: ESPN

EXERCISE: I work out in the mornings in sort of a CrossFit nature.

ONE LAST SURPRISE QUESTION: IF YOU WERE STARTING OVER AGAIN, WHAT WOULD YOU DO INSTEAD?

If I had a talent, I’d have loved to have been an architect.

Subscribe to The Leadership Brief by clicking here.

from Blogger https://ift.tt/3gHE3C3 via IFTTT

0 notes

Link

(Miss this week’s The Leadership Brief? This interview above was delivered to the inbox of Leadership Brief subscribers on Sunday morning, Aug. 9; to receive weekly emails of conversations with the world’s top CEOs and business decisionmakers, click here.)

Banks offer a front-row seat to the state of the economy. After a brutal second quarter for the U.S, Bank of America CEO Brian Moynihan believes that the worst is behind the country. Still, his bank’s economists predict that the unemployment rate will be at 10% at the end of the year and that the economy won’t fully recover to 2019 levels until early 2023.

BofA, like other banks, has played a critical role in getting government stimulus funds into the hands of cash-starved businesses: It processed 334,000 Paycheck Protection Program (PPP) loans, delivering $25 billion in funding for small businesses. At the same time, the bank has worked with major corporations to bolster its balance sheets, raising $461 billion in capital for clients (earning record fees for its investment-banking unit in the process).

Moynihan, who in college was a co-captain of the Brown University rugby team, worked as a corporate lawyer before moving into banking and became CEO of BofA in 2010. He led a turnaround at the bank after a near crippling 2008 acquisition of troubled subprime lender Countrywide Financial, attracting Warren Buffett as a major investor along the way. Buffett’s conglomerate, Berkshire Hathaway, in recent days increased its holding in BofA, bringing its total ownership stake to approximately 12% of the company. Moynihan, 60, joined TIME for a conversation about the need for additional stimulus, why he’s optimistic about America and its economy, and why Winston Churchill is a good role model for these times.

Subscribe to The Leadership Brief by clicking here.

This interview with Bank of America CEO Brian Moynihan has been edited and condensed for clarity.

How would you characterize your economic outlook right now?

We’re optimistic as a company. We continue to see clients making progress; we continue to see the stress in the system come down because of the work the Fed did and the stimulus work that was done.

Even with a forecast of double-digit unemployment at year-end?

Now, you could say, “How is that optimistic?” The answer is, what’s optimistic about it is the worst is behind us. April was the worst month, May was a less worse month, June was better, and in fact July was even better than June. You’re going to have some ebbs and flows based on the virus track, but I think you have to be optimistic that you’re seeing the U.S. consumer continue to spend.

How important is it that the government passes another round of stimulus? [This interview was conducted Monday, Aug. 4, when there was still ongoing negotiations on the a new stimulus package.]

Let’s start with the beginning, that the Administration, Congress and the Fed did a very good job to step in at the end of March, to really put a lot of money into the economy, directly in the hands of the people who needed it most to maintain their ability to survive with an unemployment rate that went up to 15%. If you think about the analogy being a river that we’ve got to cross from pre-COVID to post-COVID, and need to get past COVID, and the river between is the COVID period, some industries are already past COVID because of the nature of what they do. The idea is to keep the money flowing to the people who are still in the process of crossing the river, as opposed to the people who have crossed.

What is your view of the newfound concern about deficit spending?

I think we’ve got to make sure the largest economy in the world recovers fast. If you talk to colleagues around the world, they are very concerned that the U.S. gets out of this because the U.S. economy is so big and creates such demand around the world for the rest of the economy. The idea of worrying about the ultimate deficit right now when you’ve got to get us to the other side of this thing is something that I think we can deal with later on.

So now is not the time to get religion on deficits?

It’s the time to make sure that you’re spending money to keep the economy recovering.

</span></span><span style="font-weight: 400; font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen-Sans, Ubuntu, Cantarell, 'Helvetica Neue', sans-serif; font-size: 16px;">It’s the time to make sure that you’re spending money to keep the economy recovering.</span><span style="font-weight: 400;"><span style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen-Sans, Ubuntu, Cantarell, 'Helvetica Neue', sans-serif;">

As CEO, you demand excellence from your employees. Why can’t we, as citizens, demand a higher level of excellence from our government?

That’s a political question in terms of getting this done that’s better served for the political advisers we have. Our job is to make sure we deal with whatever comes out of it well.

I hear you, but what should the business community be doing now in Washington to throw its considerable weight around to make sure there’s good outcomes for the country?

The No. 1 thing is businesses have to do what we can do inside our own companies to help blunt this for our teammates. And so, we’ve announced no layoffs; we’ve announced enhanced childcare. We’ve enhanced the pay at our branches; we’ve enhanced the overtime. The No. 1 thing is to take care of your people, and make sure they’re safe, and make sure that they can serve your clients well—then take care of your clients.

BofA is credited with doing a particularly good job of getting PPP funds quickly into circulation. Can you talk about that effort?

The team’s done a great job of getting people through this and helping provide $25 billion–plus of funds to our clients. At one point, we probably had 10,000 people working on this. We spent a lot of resources, a lot of time, a lot of effort. We had to take people off a lot of other places. Volunteers. People working every weekend. Easter holiday weekend. Saturday and Sunday. Overnight. It was all based on the basic principle that the American small-business community needed to get this program in their hands, and it was our job to push it through. We took it as an obligation to help deliver that for the government, and we did.

TIME for Learning partnered with Columbia Business School to offer a series of online, on-demand classes on topics like effective leadership, negotiation and customer-centric marketing. To sign up or learn more, click here.

You’ve also been active in helping corporate clients beef up their balance sheets.

What happened in mid-March to mid-April is that the companies came in and borrowed hundreds of billions of dollars from the banking system, including $70 billion in two weeks from us, with commercial loans.

What’s going on with M&A activity and the advisory business?

As you come into July, you’re starting to see more M&A activity because of the stability of the market. The third quarter, we expect to see more M&A activity. You’ll see more IPO activity—health care IPOs, plus some other tech IPOs

Subscribe to The Leadership Brief by clicking here.

How much interaction do you have with Warren Buffett, who just made another series of investment in BofA? Do you two have a regular call?

We talk periodically. But he wants us to run the company and do a good job with it.

Any particularly memorable insights that he’s shared with you?

He’s a great long-term thinker. The one thing that he both talks to, but also gives you confidence in, is just see where the long-term value of your company is and make sure you’re driving toward that, and not get caught up in the issues of the moment. It’s the work we did over the last decade that positions us well for the COVID-19 crisis; it’s not what we’re going to do today.

Are people still using cash?

We had as much cash go out of the ATMs in the month of July this year as we did last July, and that is $200 million–plus a day. But the digital part of this really grew through online digital purchases, online payments. And by the way, it’s a very good thing if Americans learn how to use less cash, and what you’re doing is, when you go to a coffee shop and you pay with your phone, you will see that grow at a good, fast rate.

Wait, cash is not dead? I thought people didn’t want to touch cash and that contactless payments were all the rage.

Yes, the cash piece is still big—it’s as big as the credit-card piece.

I know the answer to this is “They’re spending it,” but do you have any particular insight into what people doing with the cash? Maybe they are buying print newspapers and print magazines.

It’s still useful to pay for things. People still use cash to buy things every day. Not necessarily the $300 item, but the $10 item. That’s been changing slowly but surely, but cash is still out there, and so one great service that we provide is 18,000 ATMs and 4,000 branches that help people manage cash. Small businesses collect cash, they deposit it; and people use it. Long-term though, the trend of movement from dollar bills to digital dollar bills is relentless.

What type of behavior will you not tolerate on your management team?

People who are passive-aggressive. If you have a point, make it in front of everybody. Life’s busy; there’s not a lot of time. People who sit in a discussion and then come out and try to either talk to me afterward saying, “Well, this is what I thought.” That doesn’t do me any good because we need to process it together as a team.

I understand you’re an admirer of Winston Churchill.

It was unbelievable how he held the country together. You have to admire that kind of tenacity. One of my favorite things when we get into discussions about charities, museums and culture—and whether the story is 100% true, because a lot of Churchill stories can get embellished over the years—but there was a year when they were discussing the budget and Parliament cut the funding for the arts. And Churchill, in the middle of World War II, when they’re getting bombed and scraping by, said, “If we’re not funding the arts, what are we fighting for?”

What is the biggest, most complicated decision on your plate this week?

I’m not sure I can tell you that.

Forgive me for ending on a philosophical note, but it’s about your name, Bank of America. What does America mean right now? I was in a Home Depot over the weekend and witnessed a rage-filled mask confrontation, an ugly, ugly exchange. What does America stand for right now?

America still represents the best place for opportunity to be recognized. Capitalism provides great opportunity. We have to keep focused on capitalism as the solution to the deep problems, but we have to be mindful that we have to manage capitalism to fully align it with what society wants from capitalism. You’ve got to produce profits and purpose. We believe that fully in running our company, and I believe that’s what America stands for: the ability to solve the world’s great problems. It’s an unfinished dream and continues to provide great opportunity. We’ve got to fine-tune it; we’ve got to fix it where it didn’t work right.

I believe that’s what America stands for: the ability to solve the world’s great problems.</span><span style="font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, Oxygen-Sans, Ubuntu, Cantarell, 'Helvetica Neue', sans-serif;">

MOYNIHAN’S FAVORITES

BUSINESS BOOK: Jim Collins’ books. He’s always thought-provoking.

AUTHOR: The three that I read the most are James Patterson, David Baldacci and John Grisham. It’s not a world I’ve ever played in—spy novels—but they’re fun to read.

APP: ESPN

EXERCISE: I work out in the mornings in sort of a CrossFit nature.

ONE LAST SURPRISE QUESTION: IF YOU WERE STARTING OVER AGAIN, WHAT WOULD YOU DO INSTEAD?

If I had a talent, I’d have loved to have been an architect.

Subscribe to The Leadership Brief by clicking here.

0 notes

Text

30 Million Unemployed; Tesla Cries Freedom; Microsoft Goes Hard

30 Million Unemployed; Tesla Cries Freedom; Microsoft Goes Hard:

On the Turning Away…

…from the pale and downtrodden … and the words that they say which we don’t understand.

Wall Street almost — almost — became aware of the U.S. economy this morning.

Continuing the epic U.S. employment saga, the Labor Department put another brick in the unemployment wall this morning. Some 3.8 million Americans filed for first-time unemployment benefits last week.

The six-week total now stands at 30.3 million unemployed. CNBC called it “the worst employment crisis in U.S. history.”

The market opened down nearly 2% on the news, and, for a brief moment, you could see the sweat on Wall Street’s brow. A hint that somewhere in that sea of frothing bullishness, someone almost had an epiphany. A realization that economic demand might suffer considerably due to 30 million unemployed American consumers.

And then, while contemplating how waning demand might impact a U.S. economic recovery and corporate bottom lines, that someone stumbled over a pile of Fed money (It’s a gas!) and completely forgot the whole deal…

The Takeaway:

Hey you!

Are you still learning to fly in this crazy market? Or are you sitting back comfortably numb and enjoying the quarantine?

Yes, the economic data makes you want to run like hell, but you don’t have to say “goodbye blue sky” to investing in this market. Just breathe, be patient and take your time. Otherwise, your portfolio will play that great gig in the sky.

When it comes to investing, it’s hard to remove yourself from the “us and them” mentality, especially during these trying times. But giving in to emotions will eventually bankrupt you one of these days.

Yes, by all economic accounts, the market is more irrational than Roger Waters on a nicotine and whiskey bender. But you can be right and still lose money.

Now, Great Stuff has been pretty down on the market’s prospects since this whole pandemic thing started. We recommended putting most of your investment capital in gold, bonds and cash … you know, the standard safe havens. (By the way, which one’s Pink?)

But there’s one sector in which we have high hopes: tech.

No, we don’t have brain damage. We’re just reading the writing on the wall. Today, Great Stuff takes a look at three Big Tech companies post earnings, and we weigh their potential in the current market.

It’s our way of helping you shine on, you crazy diamond!

So, what’s … uh, the deal? Where can I grab that cash with both hands and make a stash?

Why, be careful with that ax, Eugene! If you’re wanting more, then it’s time to turn your tech investing into interstellar overdrive. See, nobody stays as fearless in the tech game as Paul Mampilly. And Paul just found one tech stock that’s set to transform the way we use and create energy.

Paul even said: “This technology can single-handedly power a major American city … virtually free of charge.” So, let there be more light! And as the market’s seesaw continues, and the Fed’s jugband blues carries on, find out more about the one tech stock that Paul recommends you buy now.

Click here to learn more!

Good: Freedooooom!

Did you miss crazy Elon Musk? I did.

The Tesla Inc. (Nasdaq: TSLA) CEO proffered up his best Rage Against the Machine impression yesterday, crying out “Freedom!” and calling the COVID-19 response in the U.S. “fascist.”

The outburst came during Tesla’s earnings call with investors … earnings, yeah right!

Speaking of earnings, Tesla posted a surprise profit. Doesn’t that make it three in a row?

Why yes … yes, it does. And that’s a good thing for Tesla investors in the wake of Musk coming a bit unhinged. The company posted a first-quarter profit of $1.24 per share, shocking analysts who expected a loss. Revenue also topped expectations, coming in at $6.2 billion.

While Tesla remained cautious in its outlook due to the pandemic, investors seized on the unexpected profit and better margins — a notable feat given Tesla’s lower production volume.

Our take at Great Stuff is that Tesla is a solid long-term investment. However, given our reservations about the overall market and the U.S. economy, now may not be the best time to chase TSLA shares. If you’re looking to invest, be patient. Wait for a pullback, and time your entry accordingly.

Better: Sign, Sign, Everywhere a Sign

Do this. Don’t do that. Can’t you read the signs?

Facebook Inc. (Nasdaq: FB) is in rally mode today. The company has seen the sign, and it’s opened up investors’ eyes. (A Tesla cover into and Ace of Base reference? Are you trying to give us whiplash?)

What sign? Why the most important sign of all for Facebook: stability in ad trends.

Forget that Facebook blew past Wall Street’s first-quarter earnings expectations, or that revenue of $17.74 billion rose 17% to beat the consensus target of $17.53 billion. It’s all about guidance in this market.

“After the initial steep decrease in advertising revenue in March, we have seen signs of stability reflected in the first three weeks of April,” Facebook said in its conference call with investors.

That’s all the sign that FB bulls needed to send the stock skipping more than 5% higher.

So, what’s our take on Facebook? Well, setting aside our distaste for the company’s mishandling of user data and its unwillingness to fully address misleading posts … FB is the best social media stock on the market.

It’s a dual-edged sword. FB is a solid investment choice if you can set aside your emotions on the company.

Best: Good Ol’ Softy

Microsoft Corp. (Nasdaq: MSFT) is probably one of our favorite tech stocks here at Great Stuff. While we haven’t made it an official pick for the Great Stuff free portfolio, you should probably pick up a few shares if you can.

Why? Because of statements like this: “COVID-19 had minimal net impact on the total company revenue.”

Fact: MSFT was the only Dow stock to gain in the first quarter.

While practically every other company in the U.S. issues warnings and pulls forecasts, Microsoft is plowing ahead. The company just reported fiscal third-quarter results, beating even pre-virus estimates.

Driving that performance was an impressive 59% spike in Azure sales. Azure is Microsoft’s “Intelligent Cloud” business, and it’s eating Amazon Web Services’ lunch with JEDI-like prowess.

Finally, Microsoft actually provided fourth-quarter guidance — one of the very few companies to do so this earnings season. The company expects revenue of $35.85 billion to $36.8 billion, largely in-line with Wall Street’s targets.

The thing is, Microsoft has been an essential company for decades. It’s weathered dot-com busts, financial crises and government antitrust lawsuits. In fact, when I hear that “buy and hold” is dead, I always point to Microsoft.

You spoke to me, and now it’s time to breathe in the air.

Mr. Great Stuff, how long are you keeping this Pink Floyd thing going?

One of these days … one of these days I’ll stop speaking in song lyrics. But until then, you can count on Great Stuff to get countless eclectic earworms stuck in your head.

Meanwhile, if you’ve been hanging on in quiet desperation for this week’s Reader Feedback, wait no longer! It’s that time again, so let’s see what Great Stuff readers are thinking about this week.

Bye-Cycles

I feel like the stock market has three things going against that people don’t talk about but I’m not sure if they even really matter.

“Sell in may and go away”

We are at a serious technical resistance for SPY.

We are at the end of the month and we tend to see people selling more at the end of the month as opposed to the beginning … right?

I have also read that we Tuesdays tend to be more bearish than other days of the week.

I am thinking that since we didn’t see much of a sell-off on Tuesday, no one is talking about ‘sell in May,’ and we aren’t really seeing a sell-off due to resistance or it being the end of the month … the fed is going to win and we are going to plow through resistance and the recovery will continue. Does what I’m thinking make any sense?

— Preston B.

My, my … someone’s been reading his Chad Shoop! (For anyone guessing: Chad focuses on investing around many of these market cycles — as well as some hidden market cycles too. Details here!)

Thank you for your thorough email, Preston. I wanted to touch on just a few of your questions today, but honestly, you already answered it yourself in the first line. Here’s the lowdown:

Yes, we often see a seasonal dip in May. Yes, the end of the month often brings a flurry of Big Money rebalancing and profit taking. Resistance … why, up until today’s market dive, it seemed like the S&P 500 Index had the rearview mirror torn off like it was in a Jo Dee Messina song.

All of these are true to their own extents. Yes. But somewhere along the line, Mr. Market declared that fundamentals and technical logic are dead, instead deciding to leap headfirst into the chasm of “fear of missing out” uncertainties.

Preston, your observations are most astute. In normal market climates, those trends are what we’d talk about this week instead. But today, as things are right this instant, I mostly agree with your statement at the top: “I’m not sure if they even really matter.”

Just Like Starting Over

Yo, Joe,

Well, I tried. That’s about all the slang I know. I am the newest of the newbies, have never placed an order. … How can I go find a broker when I have to stay inside? How can I get my monies out of banks into brokers’ hands? Is that all done electronically? Help!

— Janis W.

Yo, J.W.! What’s good, homie? You keeping things 100 during quarantine?

Let’s help you get that bread — err, a brokerage account to start with. Your hunch is right: Almost all brokerage action is done electronically these days, as is moving money into your account once it’s set up.

I know that many people are put off investing entirely because it’s mostly online. But once you get started with a broker you like and trust, I’m sure you’ll appreciate the convenience — and the possible addiction of checking on your stocks every second of the trading day (which, frankly, is a stage most new investors get through sooner or later).

Before we go any further, let me just say that Banyan Hill doesn’t have any personal or business relationship with any of these services. They’re just the top choices I see among many of our readers.

Check out some of these links below and see what broker is right for you. You’ll want a trading platform that’s easy to use and gives you the information you want without having to sift through a bajillion different web pages:

I also want to add that, just like starting any kind of account where money is concerned, there will be fine print. (There’s always fine print, right? It’s like the ever-returning pocket lint of the legal world.)

I wish you the best of luck, Janis!

I Am You, and What I See Is Me

Are you still ok with your advice to buy Starbucks put options?

— Philip H.

Philip, I … I don’t think that was my recommendation. By any chance, are you thinking of this Winning Investor Daily article by John Ross back on April 10? Hey now, us Joes and Johns aren’t interchangeable, you see…

So, while I can’t give you personalized investment advice here (legal beagles and whatnot), what I can say is that, when it comes to options … you definitely want to keep any losses short and take gains when you’ve got ‘em.

Options Land is a fast-moving (yet insanely profitable) place … and you might want to ask John Ross directly for your next move, Philip. For everyone else out there looking for a spot to jump into the options game (and trust me, there’s no better time to do so), you can get started with expert John Ross right here.

That’s a wrap for today, but if you still crave more Great Stuff, check us out on social media: Facebook and Twitter.

Until next time, be Great!

Regards,

Joseph Hargett

Editor, Great Stuff

0 notes

Link

On the Turning Away…

…from the pale and downtrodden … and the words that they say which we don’t understand.

Wall Street almost — almost — became aware of the U.S. economy this morning.

Continuing the epic U.S. employment saga, the Labor Department put another brick in the unemployment wall this morning. Some 3.8 million Americans filed for first-time unemployment benefits last week.

The six-week total now stands at 30.3 million unemployed. CNBC called it “the worst employment crisis in U.S. history.”

The market opened down nearly 2% on the news, and, for a brief moment, you could see the sweat on Wall Street’s brow. A hint that somewhere in that sea of frothing bullishness, someone almost had an epiphany. A realization that economic demand might suffer considerably due to 30 million unemployed American consumers.

And then, while contemplating how waning demand might impact a U.S. economic recovery and corporate bottom lines, that someone stumbled over a pile of Fed money (It’s a gas!) and completely forgot the whole deal…

The Takeaway:

Hey you!

Are you still learning to fly in this crazy market? Or are you sitting back comfortably numb and enjoying the quarantine?

Yes, the economic data makes you want to run like hell, but you don’t have to say “goodbye blue sky” to investing in this market. Just breathe, be patient and take your time. Otherwise, your portfolio will play that great gig in the sky.

When it comes to investing, it’s hard to remove yourself from the “us and them” mentality, especially during these trying times. But giving in to emotions will eventually bankrupt you one of these days.

Yes, by all economic accounts, the market is more irrational than Roger Waters on a nicotine and whiskey bender. But you can be right and still lose money.

Now, Great Stuff has been pretty down on the market’s prospects since this whole pandemic thing started. We recommended putting most of your investment capital in gold, bonds and cash … you know, the standard safe havens. (By the way, which one’s Pink?)

But there’s one sector in which we have high hopes: tech.

No, we don’t have brain damage. We’re just reading the writing on the wall. Today, Great Stuff takes a look at three Big Tech companies post earnings, and we weigh their potential in the current market.

It’s our way of helping you shine on, you crazy diamond!

So, what’s … uh, the deal? Where can I grab that cash with both hands and make a stash?

Why, be careful with that ax, Eugene! If you’re wanting more, then it’s time to turn your tech investing into interstellar overdrive. See, nobody stays as fearless in the tech game as Paul Mampilly. And Paul just found one tech stock that’s set to transform the way we use and create energy.

Paul even said: “This technology can single-handedly power a major American city … virtually free of charge.” So, let there be more light! And as the market’s seesaw continues, and the Fed’s jugband blues carries on, find out more about the one tech stock that Paul recommends you buy now.

Click here to learn more!

Good: Freedooooom!

Did you miss crazy Elon Musk? I did.

The Tesla Inc. (Nasdaq: TSLA) CEO proffered up his best Rage Against the Machine impression yesterday, crying out “Freedom!” and calling the COVID-19 response in the U.S. “fascist.”

The outburst came during Tesla’s earnings call with investors … earnings, yeah right!

Speaking of earnings, Tesla posted a surprise profit. Doesn’t that make it three in a row?

Why yes … yes, it does. And that’s a good thing for Tesla investors in the wake of Musk coming a bit unhinged. The company posted a first-quarter profit of $1.24 per share, shocking analysts who expected a loss. Revenue also topped expectations, coming in at $6.2 billion.

While Tesla remained cautious in its outlook due to the pandemic, investors seized on the unexpected profit and better margins — a notable feat given Tesla’s lower production volume.

Our take at Great Stuff is that Tesla is a solid long-term investment. However, given our reservations about the overall market and the U.S. economy, now may not be the best time to chase TSLA shares. If you’re looking to invest, be patient. Wait for a pullback, and time your entry accordingly.

Better: Sign, Sign, Everywhere a Sign

Do this. Don’t do that. Can’t you read the signs?

Facebook Inc. (Nasdaq: FB) is in rally mode today. The company has seen the sign, and it’s opened up investors’ eyes. (A Tesla cover into and Ace of Base reference? Are you trying to give us whiplash?)

What sign? Why the most important sign of all for Facebook: stability in ad trends.

Forget that Facebook blew past Wall Street’s first-quarter earnings expectations, or that revenue of $17.74 billion rose 17% to beat the consensus target of $17.53 billion. It’s all about guidance in this market.

“After the initial steep decrease in advertising revenue in March, we have seen signs of stability reflected in the first three weeks of April,” Facebook said in its conference call with investors.

That’s all the sign that FB bulls needed to send the stock skipping more than 5% higher.

So, what’s our take on Facebook? Well, setting aside our distaste for the company’s mishandling of user data and its unwillingness to fully address misleading posts … FB is the best social media stock on the market.

It’s a dual-edged sword. FB is a solid investment choice if you can set aside your emotions on the company.

Best: Good Ol’ Softy

Microsoft Corp. (Nasdaq: MSFT) is probably one of our favorite tech stocks here at Great Stuff. While we haven’t made it an official pick for the Great Stuff free portfolio, you should probably pick up a few shares if you can.

Why? Because of statements like this: “COVID-19 had minimal net impact on the total company revenue.”

Fact: MSFT was the only Dow stock to gain in the first quarter.

While practically every other company in the U.S. issues warnings and pulls forecasts, Microsoft is plowing ahead. The company just reported fiscal third-quarter results, beating even pre-virus estimates.

Driving that performance was an impressive 59% spike in Azure sales. Azure is Microsoft’s “Intelligent Cloud” business, and it’s eating Amazon Web Services’ lunch with JEDI-like prowess.

Finally, Microsoft actually provided fourth-quarter guidance — one of the very few companies to do so this earnings season. The company expects revenue of $35.85 billion to $36.8 billion, largely in-line with Wall Street’s targets.

The thing is, Microsoft has been an essential company for decades. It’s weathered dot-com busts, financial crises and government antitrust lawsuits. In fact, when I hear that “buy and hold” is dead, I always point to Microsoft.

You spoke to me, and now it’s time to breathe in the air.

Mr. Great Stuff, how long are you keeping this Pink Floyd thing going?

One of these days … one of these days I’ll stop speaking in song lyrics. But until then, you can count on Great Stuff to get countless eclectic earworms stuck in your head.

Meanwhile, if you’ve been hanging on in quiet desperation for this week’s Reader Feedback, wait no longer! It’s that time again, so let’s see what Great Stuff readers are thinking about this week.

Bye-Cycles

I feel like the stock market has three things going against that people don’t talk about but I’m not sure if they even really matter.

“Sell in may and go away”

We are at a serious technical resistance for SPY.

We are at the end of the month and we tend to see people selling more at the end of the month as opposed to the beginning … right?

I have also read that we Tuesdays tend to be more bearish than other days of the week.

I am thinking that since we didn’t see much of a sell-off on Tuesday, no one is talking about ‘sell in May,’ and we aren’t really seeing a sell-off due to resistance or it being the end of the month … the fed is going to win and we are going to plow through resistance and the recovery will continue. Does what I’m thinking make any sense?

— Preston B.

My, my … someone’s been reading his Chad Shoop! (For anyone guessing: Chad focuses on investing around many of these market cycles — as well as some hidden market cycles too. Details here!)

Thank you for your thorough email, Preston. I wanted to touch on just a few of your questions today, but honestly, you already answered it yourself in the first line. Here’s the lowdown:

Yes, we often see a seasonal dip in May. Yes, the end of the month often brings a flurry of Big Money rebalancing and profit taking. Resistance … why, up until today’s market dive, it seemed like the S&P 500 Index had the rearview mirror torn off like it was in a Jo Dee Messina song.

All of these are true to their own extents. Yes. But somewhere along the line, Mr. Market declared that fundamentals and technical logic are dead, instead deciding to leap headfirst into the chasm of “fear of missing out” uncertainties.

Preston, your observations are most astute. In normal market climates, those trends are what we’d talk about this week instead. But today, as things are right this instant, I mostly agree with your statement at the top: “I’m not sure if they even really matter.”

Just Like Starting Over

Yo, Joe,

Well, I tried. That’s about all the slang I know. I am the newest of the newbies, have never placed an order. … How can I go find a broker when I have to stay inside? How can I get my monies out of banks into brokers’ hands? Is that all done electronically? Help!

— Janis W.

Yo, J.W.! What’s good, homie? You keeping things 100 during quarantine?

Let’s help you get that bread — err, a brokerage account to start with. Your hunch is right: Almost all brokerage action is done electronically these days, as is moving money into your account once it’s set up.

I know that many people are put off investing entirely because it’s mostly online. But once you get started with a broker you like and trust, I’m sure you’ll appreciate the convenience — and the possible addiction of checking on your stocks every second of the trading day (which, frankly, is a stage most new investors get through sooner or later).

Before we go any further, let me just say that Banyan Hill doesn’t have any personal or business relationship with any of these services. They’re just the top choices I see among many of our readers.

Check out some of these links below and see what broker is right for you. You’ll want a trading platform that’s easy to use and gives you the information you want without having to sift through a bajillion different web pages:

I also want to add that, just like starting any kind of account where money is concerned, there will be fine print. (There’s always fine print, right? It’s like the ever-returning pocket lint of the legal world.)

I wish you the best of luck, Janis!

I Am You, and What I See Is Me

Are you still ok with your advice to buy Starbucks put options?

— Philip H.

Philip, I … I don’t think that was my recommendation. By any chance, are you thinking of this Winning Investor Daily article by John Ross back on April 10? Hey now, us Joes and Johns aren’t interchangeable, you see…

So, while I can’t give you personalized investment advice here (legal beagles and whatnot), what I can say is that, when it comes to options … you definitely want to keep any losses short and take gains when you’ve got ‘em.

Options Land is a fast-moving (yet insanely profitable) place … and you might want to ask John Ross directly for your next move, Philip. For everyone else out there looking for a spot to jump into the options game (and trust me, there’s no better time to do so), you can get started with expert John Ross right here.

That’s a wrap for today, but if you still crave more Great Stuff, check us out on social media: Facebook and Twitter.

Until next time, be Great!

Regards,

Joseph Hargett

Editor, Great Stuff

0 notes

Text

Apple’s trillion dollar market cap was always a false idol

Let’s face it, we love large numbers. We are obsessed with them, whether it’s Forbes list of wealthiest individuals or tech unicorns, if it’s a big number we can’t get enough. Such is the case with the somehow magical trillion dollar mark that Apple briefly reached last summer. We splashed the headlines and glorified it as though it mattered…but it didn’t.

It was just a number.

Sure it showed the tremendous value of the Apple stock, but it was a moment in time fueled by an overheated stock market, full of sound and fury, but in the end adding up to nothing. Fast forward 4 months and the company has lost more than a third of its stock value. Last week, it lost $75 billion with a B in market cap in a single day. We got a hard lesson in stock market physics — what goes up eventually must come down.

Hard lessons