#xposure-and-things

Explore tagged Tumblr posts

Text

70 notes

·

View notes

Note

Hey Hyleem!!! Your biggest fan here again <3 I gotta couple questions for you. 1. Have you like- Ever co-streamed with someone who you thought was fucking awesome, but they turned out to be an absolute shitlord? 2. I'm curious as to like- What your day to day life is like. Is it just all streaming? Or do you have other hobbies? 3. If Yarrow were to ever... Oh I don't know... Get hurt horribly or possibly die, how would you react?

0|||0 Yo, what's up? Nic= to h=ar from you! I was starting to think you forgot about m=. 0|||0

0|||0 L=t's s==... Back in my =arly nights of str=aming, my first collab was with a troll I won't m=ntion by nam= b=caus= I don't want to dir=ct any publicity toward h=r. Sh= had a h=ll of a following, and I was fucking pump=d that sh= said y=s wh=n I ask=d to do a str=am tog=th=r. 0|||0

0|||0 Things w=nt p=ar-shap=d fast. Turns out sh='s an =gotistical control fr=ak. B=for= th= str=am, sh= thr=at=n=d to dox m= and hav= my hiv= brok=n into if I upstag=d. I was just th=r= to los= and tol=rat= b=ing shit talk=d and insult=d all while talking h=r up. 0|||0

0|||0 I wouldn't put up with that shit now, but back th=n I was too intimidat=d and dying for =xposur=. N==dl=ss to say, w= n=v=r collab=d again. 0|||0

0|||0 My night to night lif= isn't anything sp=cial. I sp=nd most of my tim= str=aming, r=cording, or =diting, but I do hav= a lif= outsid= of my job. I lik= to tink=r with =l=ctronics and mak= littl= toys. I also sp=nd tim= with my lusus and Yarrow wh=n sh='s h=r=. 0|||0

0|||0 I go out on my nights off and hang out with my fri=nds. I'm nt th= most =xciting guy. 0|||0

0|||0 And that's a pr=tty fuck=d up qu=stion, don't you think? That's a sup=r p=rsonal and rud= thing to ask som=body. Obviously, I'd b= r=ally ups=t. Who wouldn't b=? I don't know what you =xp=ct=d m= to say. 0|||0

1 note

·

View note

Photo

Chiesel Bud

11 notes

·

View notes

Text

Three Greatest Direct Mail Advertising Ways For Real Estate Brokers

Covid friendly Virtual Realtor tour of latest listings open to one hundred thirty of Whistler's Realtors. Under the Create CMA Print Document found on step 5 of the CMA, you will see that you've got got the choice to customize a particular template to your model, after which addContent it as a template option. Xposure™ provides both Brokerages and REALTORS® the right instruments to supply a fluid, personalised shopper experience, in all categories, on all gadgets, and all within the Agent or Company Brand. Closing is essentially dealt with by your real estate lawyer, but we sometimes work with the lawyer to ensure a smooth closing and work by way of any problems, if any, that may come up. Therefore, whereas there is not a must maintain the home in “listing ready” situation, it's best to maintain it in the identical condition because it was in when the provide to purchase was accepted till completion. To make positive that the appliances and any gadgets included in the buy price have remained with the property and proceed to be in good working order.

The NP Comment publication from columnist Colby Cosh and NP Comment editors tackles the essential topics with boldness, verve and wit. Get NP Platformed delivered to your inbox weekdays by 4 p.m. It is a precedence for CBC to create a website that's accessible to all Canadians together with folks with visible, hearing, motor and cognitive challenges. There is a realtor named Cotty Lowry who began advertising his face on a billboard within the city he lives in. In the business of trust, a face is a powerful card to play. In those early days, the industry was rampant with scam artists.

As a result, you'll be able to increase your response rate and at all times stay on top of the prospect’s thoughts. The consumers on the fence are additionally another area of interest of real estate prospects that generally don’t get the eye they deserve. When an actual estate purchaser does not really feel it's urgent to make a buying decision, they linger around and look just sold real estate postcards for different options they can consider. Once you may have a template on file, we’ll simply be ready to produce postcards as you need them. Grow your small business and convert prospects to new clients with this acquisition postcard that includes autumn scenes. Send me exclusive presents, distinctive present ideas, and personalised tips for buying and selling on Etsy.

Real estate postcards that higher align with your goal group. Real estate postcards based on demographic information similar to age, income, household measurement, and so on. Postcards are maybe the most straightforward and simple to create junk mail for advertising a business. We supply high-quality full color digital and offset printing. In addition to print, we provide a big selection of product enhancements that will assist you stand out.

Realmedia reserves the proper to cancel, remove and/or update our value match guarantee at any time without discover. Real estate is a very aggressive market, therefore effective marketing collateral is essential to stand out from rivals just sold postcards. Invest in one thing that can depart an impression to your shoppers. Try as much as potential to be unique and unique in such a means your goal market can connect with you on a more personal degree.

Bag indicators are the best solution for promoting your business, on the market, for rent, or an occasion. We know selling your home is a journey, and the more knowledgeable you would possibly be about what to do and count on alongside the just sold real estate postcard way, the more profitable your home sale might be. Customer satisfaction surveys by his shoppers, and I advocate his providers highly. Working with Steven made our purchasing and promoting experiences as stress free as attainable.

7 notes

·

View notes

Text

@brandedsavior sennt: Coprolalia bc what is shame? Sinday:

Coprolalia: I’ll write my/your character talking dirty to the other

Exposure therapy, Hope called it. With how repressed they both were at the intimate parts of a relationship - No, that wasn’t right. Intimately they were fine. They were slow and sensual and open with one another.

“You are so damn wet right now.”

And then when it became clear from some blasted Oerbans that they were missing out on a whole other side of things - a raw, explicit, fun side, he and Light were stuck. Neither of them really knew how to tackle that kind of approach. And they were both too damn stubborn to just leave it there.

“But I’ll tell you something - you taste divine.”

So it became clear one of them was going to have to take charge. And because Hope was fairly sure an assertive Light would bring him to a sticky, messy end in no time, that left him taking the lead for a change. And he had to admit - there was definitely a rush of excitement at hovering above her, watching a steady blush pouring down her pale features, across her chest and leaving her breathing heavily.

All of it led to the here-and-now as he gazed at her, never breaking eye contact as he brought his wet fingers up and popped them into his mouth. An exaggerated moan hummed in his throat. Hope still wasn’t very flexible when it came to raw dirty talk. It would take more than he had to start using words like “cock” and “pussy,” or anything close to the language used in the few videos he had seen. (And he could imagine if he did start to talk like that, Light wouldn’t just shake and climax for finding it sexy.)

“I could just eat you up,” he said, his hand dropping down towards her foot. He was sure he felt her leg tremble a little as he wrapped his wet hand around ankle and guided her legs further apart. Slowly, seductively (as much as he could - Hope was certain he wasn’t seductive) he sank to the floor at the foot of the bed, gazing up at her. “Would you like me to?” he asked, wondering if his own heart was in any danger of stuttering.

“Want me to eat your hot, wet pussy...?”

Well. Maybe he did have it in him after all.

3 notes

·

View notes

Text

@rothmus there are some cool things how modern miltech canfind residue e xposures to chemical agents but the germans shuffled allkinds of tricks from irradiated nano finedust to 3000rem beta into heart and naziradar and what not it varies what trick itis then or allofit onpredamaged opcw are heros

@rothmus there are some cool things how modern miltech canfind residue e xposures to chemical agents but the germans shuffled allkinds of tricks from irradiated nano finedust to 3000rem beta into heart and naziradar and what not it varies what trick itis then or allofit onpredamaged opcw are heros

@rothmus there are some cool things how modern miltech canfind residue exposures to chemical agents but the germans shuffled allkinds of tricks from irradiated nano finedust to 3000rem beta into heart and naziradar and whatnot it varies what trick itis then or allofit onpredamaged opcw are heros //// itis nano finedusts why germans kill hideously with it it clogs veinwall bloodsupply of finest…

View On WordPress

0 notes

Photo

I bought this because one, it's true, and two, it's funny af, and three, it shows local religious asses are full of it to make a big deal about me but that's a main thing and advertisements for strip clubs in the outskirts before you arrive in Utah for Southern Xposure etc and there's escort ads in the phone book and web. We need martial law. Supposedly there's two big organized crime groups in salt lake city but who's running the show? Either the military and government or the organized crime and last i checked i didn't go to a mafia school in the public education system. Lol though Mormonism has been compared to the mafia and i can vouch for it. Though it's more like a white mafia but not always bad, just kinda weird and depressed and depraved in subtle ways. Or overtly but they're also warriors and POWs at the same time. It's a mix and they did baptize both Ted Bundy and a rapie Black Panther that bragged and wrote a book that he enjoyed raping white women in warring against white people. Dude was nuts. Lol 🤣😆 you'd think the holy ghost would warn them like about the tans us Latinos and natives have. Lol #beaverutah #ilovebeaver #funnybeanies #humor #funnyboner #laughteristhebestmedicine #scienceoverreligioneverytime #americanphotographer #californiatransplant #californiaphotographer #mexicanphotographer #utahphotographer #utah #travelphotography #travelmatters #googlepixel4a5g #pixel4a5gphotography #pixel4a5g #teampixel #smartphonephotography #googlefi #googlefan (at Beaver, Utah) https://www.instagram.com/p/CIElT8vBF2u/?igshid=6ampemds0ovy

#beaverutah#ilovebeaver#funnybeanies#humor#funnyboner#laughteristhebestmedicine#scienceoverreligioneverytime#americanphotographer#californiatransplant#californiaphotographer#mexicanphotographer#utahphotographer#utah#travelphotography#travelmatters#googlepixel4a5g#pixel4a5gphotography#pixel4a5g#teampixel#smartphonephotography#googlefi#googlefan

0 notes

Text

59 notes

·

View notes

Photo

Chris Gillam, has a 16 year-old son and he describes the discussion a parent must have, when raising a black son, as “protocol.” According to Gillam, every time his son goes out of the house, he has certain “protocol” reminders. “Do you have your license?” “Do not reach for you license.” “Keep your hands on the steering wheel at ALL times.” “Do not give the officer any reason.” You continually train your son to act and talk a certain way, when interacting with law enforcement. And it’s your hope that when they do have a police encounter that their training will kick in, as second nature.

“I don’t know if that’s how white parents talk to their children about being pulled over. But, that is how you have to coach and train your children, as a black parent”, said Gillam. It’s ever-present in the black community and “if black parents are not having these conversations, shame on them.” He said, “you have to be as non-threatening as you possibly can, in that environment and as compliant, as possible.” When asked, if this was something you must be cognizant of on a daily basis, as a black man. Gillam responded, “if you wanna live.”

Gillam, grew up in Woodlawn, part of the Zone 15 community and has quite the resume. He is the Owner of The Grind Shop: Sports Performance Training; the Defensive Coordinator, College Recruiting Coordinator, and Director of Strength and Conditioning at Princeton High School; the Co-Founder of Redeemed Xposure; and Co-Owner of a flag football league. But, Gillam is much more than his accolades; he is a mentor, an educator, an advocate, a mediator, a motivator, a helper, and someone who leads by example.

He takes pride in being from “Zone 15” and the Woodlawn community. He has witnessed the economic decline of Lincoln Heights and Woodlawn, over the years; development and growth have been an issue for a long time in these areas. According to Gillam, this is not just isolated to Zone 15, many predominately black neighborhoods, have experienced shrinking economies and a reduction in affordable housing, due to systemic racism.”

The disparage between the predominately white community of Wyoming and Zone 15 is a prime example. Wyoming borders, Lockland and the two communities are separated by railroad tracks. Gillam, describes crossing the tracks from Wyoming to Lockland, as “heaven and hell.” “You have thriving businesses on the Wyoming side and on the Lockland side there are dilapidated buildings. The sad thing is, you see it so much, you become de-sensitized to it.” Gillam is hopeful that the Zone 15 community can regrow and prosper, as it once did.

Miami, FL, 2017, and Gillam is seated at the table with 50 other gym owners from around the world, in an open forum with CrossFit Champion and owner of NCFIT, Jason Khalipa. Gillam recalls, Khalipa asking the room full of gym owners, who has “CrossFit” in their gym name. Most everyone raised their hand, except for Gillam. Khalipa’s gyms were formerly called NorCal CrossFit and he illustrated the importance of not limiting your gym to the CrossFit brand. He encouraged the gym owners to remove CrossFit from their names, citing that any negativity geared toward the brand could have an adversarial affect to their personal gyms.

Fast forward to 2020, amidst the murder of George Floyd, the CEO of CrossFit, Greg Glassman, refuses to put out a statement on CrossFit’s behalf in support of the Black Lives Matter movement. Glassman, tweets a racially negative remark and the unraveling of the CrossFit brand begins. As a result, thousands of gyms de-affiliated with the CrossFit brand. Khalipa’s advice, reverberates in Gillam’s mind. Gillam arose out of this controversy as a sounding board, advocate, listener, and confidant to other local gym owners. Gillam says, “I was happy and honored to help others understand the gravity of the situation. I accepted and welcomed the call.”

Glassman’s comments reflect the whiteness of the CrossFit brand. Gillam’s gym, The Grind Shop, is quite diverse and that’s one thing he loves about it. That diversity contributed towards progressive conversations between Gillman and his members. He said that, after the killing of George Floyd, he had members come to him and ask for his help. People wanted to be educated and obtain an understanding on the current racial injustice climate. Gilllam says, “so many people are not racist, they just don’t understand. They are clueless to the conversations that I have to have with my black son. They are clueless to the number of people that have been victims to social injustices. They just don’t know.” Gillam believes, we have to be willing to aid in everyone’s growth and keep the conversations going about the plight of the black community.

The question was raised, if there was allowable ignorance in this current climate and Gillam gave the golden response. “Prior to George Floyd’s passing and the unrest that it has generated in our country, you are no longer allowed to be ignorant to racism and social injustice. People and sports leagues were given a pass. The NFL didn’t understand why Kap took a knee. They didn’t see the seriousness of this issue in our society. But now, they get it. Now it’s the responsibility of the human race to get involved, to know what is going on in the black community and aid in the progress, toward ending racism.

Follow The Grind Shop on Facebook, Instagram and Coach Gill on Twitter.

Photo credit: 1takebake

#wearetherightsideofhistory#cincinnati#lincolnheights#project15#blacklivesmatter#blackcommunities#blackcommunitiesmatter#blackbusiness#blackBUSINESSESmatter#blackaware#blackawareness#blackstories#blackphotographers#blackphotography#blackownedbusiness#realstories#realpeoplerealstories#voicesofthezone#ohio#awareness

0 notes

Text

Financial SEER: A Way To Quantify Risk Tolerance And Determine Appropriate Equity Exposure

This post is for someone who is wondering:

Whether they have the proper asset allocation

How to reduce investment stress while still benefitting from returns

How to quantify their risk tolerance

How to continue moving forward on their path to financial freedom despite all the uncertainty

One of my primary goals on Financial Samurai is to help readers build meaningful wealth in a risk-appropriate manner. Because I started my career soon after the 1997 Asian Financial Crisis, I've experienced a lot of carnage as many international college students in the US had to drop out due to a sudden and massive devaluation of their respective home country's currencies. I fully appreciate how hazardous the road to building great wealth can be.

Even the best-made plans can be laid to waste due to some unforeseen exogenous variable. We always hope for good surprises along the way. Unfortunately, life always has a way of kicking us in the face after knocking us in the teeth. Let's always be thankful for what we have and demonstrate kindness to those who are experiencing difficult times.

Most investors overestimate their risk tolerance, especially investors who've only been investing with significant capital since 2009. Once the losses start piling up, it's not only the melancholy of losing money that starts getting to you, it's the growing fear that your job might also be at risk.

You might also erroneously think that the richer you get, the higher your risk tolerance. After all, the more money you have, the bigger your buffer. This is a fallacy because the more money you have, the larger your potential loss. For most rational people, their lifestyles don't inflate commensurately with their wealth. This is why even rich people can't resist a free rubber chicken lunch.

Further, there will come a time when your investment returns have a larger impact on your net worth than your earnings. As a result, the richer you are, the more dismayed you will be to lose money. Your main hope for recovery is a rebound in investment performance because your work earnings won't contribute much at all.

How Most Of Us Rescue Our Investments

The reason we all continue to fight in this difficult world is because we have hope. But eventually, our hope fades because our brains and bodies slow down. When we're younger, we often think ourselves to be invincible. Then, eventually, we start experiencing the realities of aging.

It is due to our fading abilities that we must bring down our risk exposure as we age. It is only the rare bird that goes all-in after making enough money to last a lifetime to try and make so much more. Sometimes they turn into billionaires like Elon Musk. But most of the time they end up going broke and filled with regret.

The only way most of us can rescue our investments after a market swoon is through contributions from earned income i.e. our salaries. We tell ourselves that when the markets are down, that's alright because we'll simply invest more at lower prices.

However, lower prices don't necessarily mean better value if estimates are cut, but all other things being equal, we like to trick ourselves into believing we're getting a better deal all the same.

To understand reward, we must first understand risk. Since 1929, the median bear market price decline is 33.51%, while the average bear market price decline is 35.43% since 1929.

Therefore, it's reasonable to assume that the next bear market could also bring equity valuations down by 35% over an 8 – 10 month period.

Let me share a quantifiable way to measure how much equity exposure you should have based on your risk tolerance.

I'm calling it the Financial Samurai Equity Exposure Rule or Financial SEER. It's an appropriate acronym because seer means a person who is supposed to be able, through supernatural insight, to see what the future holds.

How To Quantify Your Risk Tolerance

Most people just regularly invest in stocks over time through dollar cost averaging. They have little concept of whether the amount of stocks they have as part of their portfolio or their net worth is risk appropriate.

Hence, to quantify your risk tolerance based on your existing portfolio, use the following formula:

(Public Equity Exposure X 35%) / Monthly Gross Income.

For example, let's say you have $500,000 in equities and make $10,000 a month. To quantify your risk tolerance, the formula is: $500,000 X 35% = $175,000 / $10,000 = 17.5.

This formula tells you that you will need to work an 17.5 ADDITIONAL months of your life to earn a GROSS income equal to how much you lost in a -35% bear market. After taxes, you're really only making around $8,000 a month, so you will actually have to work closer to 22 more months and contribute 100% of your after-tax income to be whole.

But it gets worse. Given you need to pay for basic living expenses, you need to work even longer than 22 months. Good thing stocks tend to rebound after an average bear market duration of 10 months, if you can hold on.

Given everybody has a different tax rate, I've simplified the formula using a gross monthly income figure instead of a net monthly income figure. Feel free to adjust the Risk Tolerance Multiple based on your personal income tax situation.

Quantifying risk tolerance by calculating working months is the best way to go because time is money. The more you value your time, the more you hate your job, and the less you desire to work, the lower your risk tolerance.

The classic scenario is a 68-year-old retiree with a $1,000,000 portfolio living off $20,000 a year in Social Security and $20,000 in dividend income from his portfolio.

If his portfolio loses 30% of its value because it is way overweight equities, it is almost impossible to recover the lost $300,000 on his $20,000 a year fixed income. His dividend income may likely be cut as well as companies hold onto their cash for survival. The only thing this retiree can do is pray the market eventually goes up while cutting spending.

How To Determine Appropriate Equity Exposure

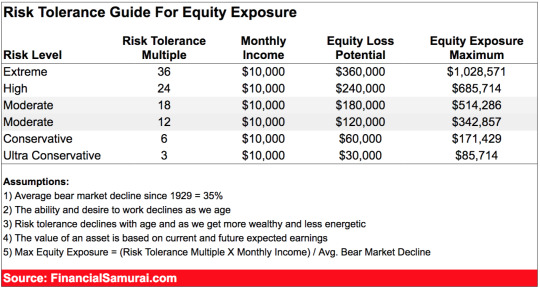

After you have quantified your risk tolerance by assigning a Risk Tolerance Multiple = the number of months you need to work to make up for your potential bear market loss, take a look at this guide below.

My guide will not only give you an idea of what your Risk Tolerance Multiple is, but it will also give you an idea of what your maximum equity exposure should be based on your risk tolerance. Solutions!

My advice to all investors is to not risk more than 18 months worth of gross salary on your equity investments using an assumed 35% average bear market decline in your public investment portfolio.

In other words, if you make $10,000 a month, the most you should risk is a $180,000 loss on a $514,285 pure equity portfolio.

The Max Equity Exposure formula = (Your Monthly Salary X 18) / 35%.

You can certainly have a larger overall public investment portfolio than $514,285 in this example, but I wouldn't risk much more than $514,285 in equities only if you have only a $10,000 a month gross salary.

You can have $514,285 max in equities plus $250,000 in AAA-rated municipal bonds if you wish, for a reasonable 67%/33% equities fixed income split. Your total portfolio size would therefore be $764,285.

Adjust The Assumptions As You See Fit

If you think the next bear market will only decline by 25%, feel free to use 25% in the Max Equity Exposure formula. In the above example, the result would be ($10,000 X 18) / 25% = $720,000 of maximum equity exposure for someone making $120,000 a year.

If you just got promoted and plan to see 20% YoY earnings growth for the next five years, you could use your current monthly salary and a higher Risk Tolerance Multiple to determine your equity exposure. For example, let's say you currently make $10,000 a month, but expect to make $20,000 a month in five years, You also think stocks will go down by 25% at most. The calculation would therefore be: ($10,000 X 36) / 25% = $1,440,000 as your target or maximum equity exposure.

If you decide to live like a hermit in a low cost town in the middle of nowhere, you could increase your Risk Tolerance Multiple to 36. But you've got to question your money priorities for trying to make a bigger return only to never spend your rewards.

Remember, whatever your Risk Tolerance Multiple is, you will have to increase it by 1.2 – 3X to truly calculate how many more years you will need to work to recover from your bear market losses due to taxes and general living expenses.

It is a judgment call regarding how much equity risk you should take. If you've quadrupled your net worth after a 9-year bull market, it's probably wise to lower your risk exposure multiple. Conversely, after a 30%+ correction in equities, it's probably wise to increase your risk exposure multiple.

The closer you get to retirement, the lower your multiple should be as well. Nobody wants to get close to the financially free finish line only to break a leg and get carted off in an ambulance.

Be A Rational Investor With Financial SEER

The valuation of everything is dependent on current and future earnings. It takes time and energy to create those earnings from your job or your business. If you are seriously burning out, please dial down risk and give yourself some time to heal.

For the average person in a normal economic cycle, a gross Risk Tolerance Multiple of 18 is my recommendation. Most people have the fortitude to waste up to around 2-3 years of their lives to gain back what they've lost from a bear market. But after three years of digging out of a hole, things start to feel hopeless as the average person starts giving up.

Remember, things could always be worse! Not only could your stock investments lose more than 35%, you could lose all your home equity due to leverage, your business, your job, and your spouse as well. Please invest rationally and responsibly.

I hope the Financial Samurai Equity Exposure Rule (SEER) helps you take the subjective term of risk tolerance and shapes it into something quantifiable. You now have a concrete way of determining your equity exposure and risk tolerance.

Financial SEER formulas:

Risk Tolerance = (Public Equity Exposure X Expected Percentage Decline) / Monthly Gross Income

Maximum Equity Exposure = (Your Monthly Salary X Risk Tolerance Multiple) / Expected Percentage Decline

Recommendation: Manage your finances in one place with Personal Capital, the best free financial tool on the web. It's important to stay on top of your net worth, understand your risk exposure, and make sure your retirement plans are on track. Get your finances right the first time. There's no rewind button in life.

https://www.financialsamurai.com/wp-content/uploads/2019/01/Financial-SEER.m4a

The post Financial SEER: A Way To Quantify Risk Tolerance And Determine Appropriate Equity Exposure appeared first on Financial Samurai.

0 notes

Text

.@law @law @laws @harvard_law @lawyercom @ap @reuters @bbc_whys @snowd en @haaretzcom they are g e r m a ns they aeh germancure aeh nervous guts from crapping ocne a day or twice aday after subdue to t r y i n g t o fourtimes a day woopsie if mysteriously the organs die and they gladly kill support for it to resubdue as poi songas every chow irradiate and xraybeam and terror cockroachdrug spoil fi lters it is g e r m a n y its devious bbbbbbbbbbbbbbastardmonsters squared cubed with victimb lame and no why was something you got it d e e d typed //// th e germans usually poisongased arbitraritly that shifted to pathogengasi ng inthe chamber does noone wonder evenabout the co2 specialmix killtri cks inteh values in air vent throughput thatthey isntalled the gas valves intothe freshair channel above window plants because itis fres h throughput a n d a bubble of ionised air this year with minimal e xposure outside to people but rigorous washing after grocerystore and out side including pullover change phone cleaning they got pathogen loads and co2 values and nox values and interoxide exchange murdertricks and ars enide values and such of which use the chance notarstamp it pu blish it it is not just deedtyped itis f a c t u a l i t y deedtyped and as typical intel murder tricks hedged stigmas typical damages on counterfactual basis instead see if temperature (!)because its airflus h through can be nutted on what them gas allalong whcih allknow allalo ng asits daycharged allalong phone replace 1948 during mail is //// #teeth #example checkalso iftgermans were again onthe teeth the lowlef t outest one doesnt addup again its likely facebone teethbonemess ona fo rmerfix they always dothese things andimstuck withthe day damamge the 12tooth isthesame itwas fixed then faceboneteethbonemess february or ap ril redmamged it then it infected on rootcanal toothbase the facebone teethbonemesses were from experiment surgeries 2004 with cheap klammern s on but isntead fixed once remessed re remessed and re re remessed itis healthinsurance charged sothe teethdamamges the a b s c e n c e of oth er problems on teethflesh for tenyears the ring around which teeth were d amaged by their very own assessment their own assessment each front top teeth namely a big ring aroudn it a f t e r this they suddenly dr illed the outerlow ones too whihc were n o t highlighted as damamged in their very own assessment allofthe mess is a big big big fuckup of day damages based on r e a l d e a l harm forinstance verfassungsschutz installs a tooth inthe basis of leftlow in rubbertitts which occasionally injured the toothflesh then overtaped it the teeth scans are an (!)all einstellungsmerkmal they identify people by teeth scans and implant scans a nd such notjust chips the mmwaves are looooong time around inthe real deal the radio spectroscopy knew allalong their own mix as what i broug ht the cops a n d threw intothe mailbox to opcw and embassies //// c hildfoolmess 311 slapemdown squeeze em destroy gasvalves itisnot bigd eal germans shuffle stigmas because itis intel itis whichtrickworksrightn ow decoys that their government+criminal timecontrolsystem is daytimecha rged quells fortune access selfhelp shuffles murder tricks and pedo orgie s tomake guilty if pathologisationsticks its batshitnuts or cook forehead momfool if pervert itspedoorgies if hooker oftheland its hookersmear an dabuse if hatenut hitler terror threat its that if teenieweeenie turnba ckclock trick its taht because itis intel daytimecharged germangovt+ti mecontrolsystem itis which trick works thistime find foot aim catapulte r usually suffocatekilltrickssssuffocate cockroach ondamamgedheart 230 sq ueeze cautionwithsupport chekcifits gaser above only pieceof crap its like cockroaches damage moelst rape and see ifthey can reinterpet sth that youre guilty for t h e i r crimes this is mildsafe while youfight not to die on a hearttrick oftheirs repeated cockroaches ihate em //// bra inwave scissor nanooilantenna ornot readsout every thought realtime. @doc @doctors @redcross @who @harvard why can fools get away with trick fram ing priming fear fears uncontrolledfears p a n i c while the type is bomb out suffocator gaser jailassmolester in a n g e r victimisation how is it not o b v i o u s the criminal german govt with its timecontrol accomplices shuffled harms shuffl ed proxies quelled selfhelp got daytimecharged forthe monstrosities they commit realtime and there on shuffled a n y e v e r ysingle dirty trick th ey had to quell it as immunisation which isnt even new the first thi ng snowden expected was docification the gundeal bureacrat got intothei r realdeal- got docified - rehabilitated in daytime govt tv a miracle o n fresh leadership freshbroom miracle maybe vonderleyen but its not ne w? ******* how do the germans get away with misusing docifica tion for control and quell of their sins their german monstrosities th ey a r e daytime charged they quelledit and corner it to nutting while e fforting h e a r t k i l l and xraybeam and arbitrariy hideousmix trick n ot one unspoiled meal ******* catapult terror is just as spam as int el roofhole gasing deed typed andthefix: to either batshit nutsnesss: pedo orgies pedo sexual assault with minors dozens a day sometimes after daytimecharging it uptothis januar eu humanrights 3781/20 since 2800/10 6ar50/19local in d-74821 //// good doctors dont try to h avebeenright nomatter what the facts are and sure not if setup by a crimi nal system and damnsure not when everything thats happening is f a r f ar f a r m o r e relev ant than any cherrypicked template shitball throw bum lidokain atit or find the cockroach that intel roofhole gases and murder beam radartricks into heart and shutsdown digestive system+stomach and catapults intero xide exchange cellsuffocators into heart wait its deedtyped? and th e typing of it is the nutting? just thatthe heart dies from 69HDL 91LDL an d 91mgdl longtermsugar? I am Christian KISS BabyAWACS – Raw Independe nt Sophistication #THINKTANK + #INTEL #HELLHOLE #BLOG https://www.BabyAWACS .com/ [email protected] PHONE / FAX +493212 611 34 64 Helpful? Pay. S upport. Donnate. paypal.me/ChristianKiss ///// example: fortune: canth ey buy a magflight? @ap @reuters @bbc_whys @snowden @haaretzcom exam ple #gundeal discredited madeit into daysheeple govt tv. nothing is new about the trick /// framing here: wasit a mistake?nota mistake? : thege rmans?misuse?their doc system? as? control entity. its obvious and norway didnt lookatit before. /// as charged "immunisation is averted+nut tr icks asif no compensation is necessary ofwhatthey overtape allalong" @ap @r euters @bbc_whys @snowden @haaretzcom thebasisis intelhell +covered aswha t. whiletheir basis nutit doesnot undo compensate neutered mengeletricks //// repalced phone 1951 +ealrmypahtic then ehadimapct +ealrmypahtica ime 1954 /// dddddddddddddddrrowsyign headimapct bycockroach 1950 t hen ear whzatisit they donthave to justify each catapult and chamber g asing isitntit its howtoterrorise a pet in a cage w a y toooften then sneakintoit and pornit and thats the germanfix because they are germa n they deserve the inventions too itis hightreason togermany ifthey dont //// whatis the pro-word for idddiots that damageyou suffocate you to fi nd what a damaged transvestitefool you are soit saves em money #sudokus .@ law @law @laws @harvard_law @ap @reuters @bbc_whys @snowden @haaretzcom lawyers hedge abit that every crime the germans did,occured while they t ried to hedge every wet fart on hemmorides as severe mental illness allalo ng these tricks decoy who is charged daytime for what whilethey do what allalong while what is charged daytime decoyed with what allal ong //// is?nutting? intel hell a crime? and if staying damages h appen? staying damages they overtape and know? staying damamges they ov ertape and know c h a r g e d d a y t i m e? adds damages d u r i n g n utting rapes and adds pedo sexual assaults during nutting for charging it daytime andifits based on averted formality immunisation caused as botch? but immunised the rapers? from angle to angle it gets german german german and really german itsjust the part of it what youwanna pokein? poisons ? brought to clowncops inte firstplace whilethey shu ffle more harms? yomama from a criminally insane family while they dothe same with her? oh whoopsie it died barely averting the worst regularly? prostitute of the land and the worstpaid ever we set it up and breach ba rricades and set himup to after prep and reinstall barricades because wer e german nice? what aspects of this mess doyouwan to pokein? he s howers and feeds the cat but its not... .. .. aeh .. . .. aaadunno cant we .. ssssssex! pedo! sex! because he is aeh a t r a n s v e s t i t e and I am Christia n KISS BabyAWACS – Raw Independent Sophistication #THINKTANK + #INTEL #HEL LHOLE #BLOG https://www.BabyAWACS.com/ [email protected] PHONE / FAX +493212 611 34 64 Helpful? Pay. Support. Donnate. paypal.me/ChristianKiss

.@law @law @laws @harvard_law @lawyercom @ap @reuters @bbc_whys @snowd en @haaretzcom they are g e r m a ns they aeh germancure aeh nervous guts from crapping ocne a day or twice aday after subdue to t r y i n g t o fourtimes a day woopsie if mysteriously the organs die and they gladly kill support for it to resubdue as poi songas every chow irradiate and xraybeam and terror cockroachdrug spoil fi lters it is g e r m a n y its devious bbbbbbbbbbbbbbastardmonsters squared cubed with victimb lame and no why was something you got it d e e d typed //// th e germans usually poisongased arbitraritly that shifted to pathogengasi ng inthe chamber does noone wonder evenabout the co2 specialmix killtri cks inteh values in air vent throughput thatthey isntalled the gas valves intothe freshair channel above window plants because itis fres h throughput a n d a bubble of ionised air this year with minimal e xposure outside to people but rigorous washing after grocerystore and out side including pullover change phone cleaning they got pathogen loads and co2 values and nox values and interoxide exchange murdertricks and ars enide values and such of which use the chance notarstamp it pu blish it it is not just deedtyped itis f a c t u a l i t y deedtyped and as typical intel murder tricks hedged stigmas typical damages on counterfactual basis instead see if temperature (!)because its airflus h through can be nutted on what them gas allalong whcih allknow allalo ng asits daycharged allalong phone replace 1948 during mail is //// #teeth #example checkalso iftgermans were again onthe teeth the lowlef t outest one doesnt addup again its likely facebone teethbonemess ona fo rmerfix they always dothese things andimstuck withthe day damamge the 12tooth isthesame itwas fixed then faceboneteethbonemess february or ap ril redmamged it then it infected on rootcanal toothbase the facebone teethbonemesses were from experiment surgeries 2004 with cheap klammern s on but isntead fixed once remessed re remessed and re re remessed itis healthinsurance charged sothe teethdamamges the a b s c e n c e of oth er problems on teethflesh for tenyears the ring around which teeth were d amaged by their very own assessment their own assessment each front top teeth namely a big ring aroudn it a f t e r this they suddenly dr illed the outerlow ones too whihc were n o t highlighted as damamged in their very own assessment allofthe mess is a big big big fuckup of day damages based on r e a l d e a l harm forinstance verfassungsschutz installs a tooth inthe basis of leftlow in rubbertitts which occasionally injured the toothflesh then overtaped it the teeth scans are an (!)all einstellungsmerkmal they identify people by teeth scans and implant scans a nd such notjust chips the mmwaves are looooong time around inthe real deal the radio spectroscopy knew allalong their own mix as what i broug ht the cops a n d threw intothe mailbox to opcw and embassies //// c hildfoolmess 311 slapemdown squeeze em destroy gasvalves itisnot bigd eal germans shuffle stigmas because itis intel itis whichtrickworksrightn ow decoys that their government+criminal timecontrolsystem is daytimecha rged quells fortune access selfhelp shuffles murder tricks and pedo orgie s tomake guilty if pathologisationsticks its batshitnuts or cook forehead momfool if pervert itspedoorgies if hooker oftheland its hookersmear an dabuse if hatenut hitler terror threat its that if teenieweeenie turnba ckclock trick its taht because itis intel daytimecharged germangovt+ti mecontrolsystem itis which trick works thistime find foot aim catapulte r usually suffocatekilltrickssssuffocate cockroach ondamamgedheart 230 sq ueeze cautionwithsupport chekcifits gaser above only pieceof crap its like cockroaches damage moelst rape and see ifthey can reinterpet sth that youre guilty for t h e i r crimes this is mildsafe while youfight not to die on a hearttrick oftheirs repeated cockroaches ihate em //// bra inwave scissor nanooilantenna ornot readsout every thought realtime. @doc @doctors @redcross @who @harvard why can fools get away with trick fram ing priming fear fears uncontrolledfears p a n i c while the type is bomb out suffocator gaser jailassmolester in a n g e r victimisation how is it not o b v i o u s the criminal german govt with its timecontrol accomplices shuffled harms shuffl ed proxies quelled selfhelp got daytimecharged forthe monstrosities they commit realtime and there on shuffled a n y e v e r ysingle dirty trick th ey had to quell it as immunisation which isnt even new the first thi ng snowden expected was docification the gundeal bureacrat got intothei r realdeal- got docified – rehabilitated in daytime govt tv a miracle o n fresh leadership freshbroom miracle maybe vonderleyen but its not ne w? ******* how do the germans get away with misusing docifica tion for control and quell of their sins their german monstrosities th ey a r e daytime charged they quelledit and corner it to nutting while e fforting h e a r t k i l l and xraybeam and arbitrariy hideousmix trick n ot one unspoiled meal ******* catapult terror is just as spam as int el roofhole gasing deed typed andthefix: to either batshit nutsnesss: pedo orgies pedo sexual assault with minors dozens a day sometimes after daytimecharging it uptothis januar eu humanrights 3781/20 since 2800/10 6ar50/19local in d-74821 //// good doctors dont try to h avebeenright nomatter what the facts are and sure not if setup by a crimi nal system and damnsure not when everything thats happening is f a r f ar f a r m o r e relev ant than any cherrypicked template shitball throw bum lidokain atit or find the cockroach that intel roofhole gases and murder beam radartricks into heart and shutsdown digestive system+stomach and catapults intero xide exchange cellsuffocators into heart wait its deedtyped? and th e typing of it is the nutting? just thatthe heart dies from 69HDL 91LDL an d 91mgdl longtermsugar? I am Christian KISS BabyAWACS – Raw Independe nt Sophistication #THINKTANK + #INTEL #HELLHOLE #BLOG https://www.BabyAWACS .com/ [email protected] PHONE / FAX +493212 611 34 64 Helpful? Pay. S upport. Donnate. paypal.me/ChristianKiss ///// example: fortune: canth ey buy a magflight? @ap @reuters @bbc_whys @snowden @haaretzcom exam ple #gundeal discredited madeit into daysheeple govt tv. nothing is new about the trick /// framing here: wasit a mistake?nota mistake? : thege rmans?misuse?their doc system? as? control entity. its obvious and norway didnt lookatit before. /// as charged “immunisation is averted+nut tr icks asif no compensation is necessary ofwhatthey overtape allalong” @ap @r euters @bbc_whys @snowden @haaretzcom thebasisis intelhell +covered aswha t. whiletheir basis nutit doesnot undo compensate neutered mengeletricks //// repalced phone 1951 +ealrmypahtic then ehadimapct +ealrmypahtica ime 1954 /// dddddddddddddddrrowsyign headimapct bycockroach 1950 t hen ear whzatisit they donthave to justify each catapult and chamber g asing isitntit its howtoterrorise a pet in a cage w a y toooften then sneakintoit and pornit and thats the germanfix because they are germa n they deserve the inventions too itis hightreason togermany ifthey dont //// whatis the pro-word for idddiots that damageyou suffocate you to fi nd what a damaged transvestitefool you are soit saves em money #sudokus .@ law @law @laws @harvard_law @ap @reuters @bbc_whys @snowden @haaretzcom lawyers hedge abit that every crime the germans did,occured while they t ried to hedge every wet fart on hemmorides as severe mental illness allalo ng these tricks decoy who is charged daytime for what whilethey do what allalong while what is charged daytime decoyed with what allal ong //// is?nutting? intel hell a crime? and if staying damages h appen? staying damages they overtape and know? staying damamges they ov ertape and know c h a r g e d d a y t i m e? adds damages d u r i n g n utting rapes and adds pedo sexual assaults during nutting for charging it daytime andifits based on averted formality immunisation caused as botch? but immunised the rapers? from angle to angle it gets german german german and really german itsjust the part of it what youwanna pokein? poisons ? brought to clowncops inte firstplace whilethey shu ffle more harms? yomama from a criminally insane family while they dothe same with her? oh whoopsie it died barely averting the worst regularly? prostitute of the land and the worstpaid ever we set it up and breach ba rricades and set himup to after prep and reinstall barricades because wer e german nice? what aspects of this mess doyouwan to pokein? he s howers and feeds the cat but its not… .. .. aeh .. . .. aaadunno cant we .. ssssssex! pedo! sex! because he is aeh a t r a n s v e s t i t e and I am Christia n KISS BabyAWACS – Raw Independent Sophistication #THINKTANK + #INTEL #HEL LHOLE #BLOG https://www.BabyAWACS.com/ [email protected] PHONE / FAX +493212 611 34 64 Helpful? Pay. Support. Donnate. paypal.me/ChristianKiss

.@law @law @laws @harvard_law @lawyercom @ap @reuters @bbc_whys @snowden @haaretzcom

they are g e r m a ns

they aeh germancure aeh nervous guts from crapping ocne a day or twice aday after subdue

to t r y i n g

t o

fourtimes a day

woopsie if mysteriously theorgans die

and they gladly kill support for it to resubdue

as poisongas every chow irradiate and xraybeam and terror cockroachdrug spoil…

View On WordPress

0 notes

Text

Financial SEER: A Way To Quantify Risk Tolerance And Determine Appropriate Equity Exposure

This post is for someone who is wondering:

Whether they have the proper asset allocation

Whether they should sell equities and buy bonds

How to reduce investment stress while still benefitting from returns

How to quantify their risk tolerance

How to continue moving forward on their path to financial freedom despite all the uncertainty

One of my primary goals on Financial Samurai is to help readers build meaningful wealth in a risk-appropriate manner. Because I started my career soon after the 1997 Asian Financial Crisis, I've experienced a lot of carnage as many international college students in the US had to drop out due to a sudden and massive devaluation of their respective home country's currencies. I fully appreciate how hazardous the road to building great wealth can be.

Even the best-made plans can be laid to waste due to some unforeseen exogenous variable. We always hope for good surprises along the way. Unfortunately, life always has a way of kicking us in the face after knocking us in the teeth. Let's always be thankful for what we have and demonstrate kindness to those who are experiencing difficult times.

Most investors overestimate their risk tolerance, especially investors who've only been investing with significant capital since 2009. Once the losses start piling up, it's not only the melancholy of losing money that starts getting to you, it's the growing fear that your job might also be at risk.

You might also erroneously think that the richer you get, the higher your risk tolerance. After all, the more money you have, the bigger your buffer. This is a fallacy because the more money you have, the larger your potential loss. For most rational people, their lifestyles don't inflate commensurately with their wealth. This is why even rich people can't resist a free rubber chicken lunch.

Further, there will come a time when your investment returns have a larger impact on your net worth than your earnings. As a result, the richer you are, the more dismayed you will be to lose money. Your main hope for recovery is a rebound in investment performance because your work earnings won't contribute much at all.

How Most Of Us Rescue Our Investments

The reason we all continue to fight in this difficult world is because we have hope. But eventually, our hope fades because our brains and bodies slow down. When we're younger, we often think ourselves to be invincible. Then, eventually, we start experiencing the realities of aging.

It is due to our fading abilities that we must bring down our risk exposure as we age. It is only the rare bird that goes all-in after making enough money to last a lifetime to try and make so much more. Sometimes they turn into billionaires like Elon Musk. But most of the time they end up going broke and filled with regret.

The only way most of us can rescue our investments after a market swoon is through contributions from earned income i.e. our salaries. We tell ourselves that when the markets are down, that's alright because we'll simply invest more at lower prices.

However, lower prices don't necessarily mean better value if estimates are cut, but all other things being equal, we like to trick ourselves into believing we're getting a better deal all the same.

To understand reward, we must first understand risk. Since 1929, the median bear market price decline is 33.51%, while the average bear market price decline is 35.43% since 1929.

Therefore, it's reasonable to assume that the next bear market could also bring equity valuations down by 35% over an 8 – 10 month period.

Let me share a quantifiable way to measure how much equity exposure you should have based on your risk tolerance.

I'm calling it the Financial Samurai Equity Exposure Rule or Financial SEER. It's an appropriate acronym because seer means a person who is supposed to be able, through supernatural insight, to see what the future holds.

How To Quantify Your Risk Tolerance

Most people just regularly invest in stocks over time through dollar cost averaging. They have little concept of whether the amount of stocks they have as part of their portfolio or their net worth is risk appropriate.

Hence, to quantify your risk tolerance based on your existing portfolio, use the following formula:

(Public Equity Exposure X 35%) / Monthly Gross Income.

For example, let's say you have $500,000 in equities and make $10,000 a month. To quantify your risk tolerance, the formula is: $500,000 X 35% = $175,000 / $10,000 = 17.5.

This formula tells you that you will need to work an 17.5 ADDITIONAL months of your life to earn a GROSS income equal to how much you lost in a -35% bear market. After taxes, you're really only making around $8,000 a month, so you will actually have to work closer to 22 more months and contribute 100% of your after-tax income to be whole.

But it gets worse. Given you need to pay for basic living expenses, you need to work even longer than 22 months. Good thing stocks tend to rebound after an average bear market duration of 10 months, if you can hold on.

Given everybody has a different tax rate, I've simplified the formula using a gross monthly income figure instead of a net monthly income figure. Feel free to adjust the Risk Tolerance Multiple based on your personal income tax situation.

Quantifying risk tolerance by calculating working months is the best way to go because time is money. The more you value your time, the more you hate your job, and the less you desire to work, the lower your risk tolerance.

The classic scenario is a 68-year-old retiree with a $1,000,000 portfolio living off $20,000 a year in Social Security and $20,000 in dividend income from his portfolio.

If his portfolio loses 30% of its value because it is way overweight equities, it is almost impossible to recover the lost $300,000 on his $20,000 a year fixed income. His dividend income may likely be cut as well as companies hold onto their cash for survival. The only thing this retiree can do is pray the market eventually goes up while cutting spending.

How To Determine Appropriate Equity Exposure

After you have quantified your risk tolerance by assigning a Risk Tolerance Multiple = the number of months you need to work to make up for your potential bear market loss, take a look at this guide below.

My guide will not only give you an idea of what your Risk Tolerance Multiple is, but it will also give you an idea of what your maximum equity exposure should be based on your risk tolerance. Solutions!

My advice to all investors is to not risk more than 18 months worth of gross salary on your equity investments using an assumed 35% average bear market decline in your public investment portfolio.

In other words, if you make $10,000 a month, the most you should risk is a $180,000 loss on a $514,285 pure equity portfolio.

The Max Equity Exposure formula = (Your Monthly Salary X 18) / 35%.

You can certainly have a larger overall public investment portfolio than $514,285 in this example, but I wouldn't risk much more than $514,285 in equities only if you have only a $10,000 a month gross salary.

You can have $514,285 max in equities plus $250,000 in AAA-rated municipal bonds if you wish, for a reasonable 67%/33% equities fixed income split. Your total portfolio size would therefore be $764,285.

Adjust The Assumptions As You See Fit

If you think the next bear market will only decline by 25%, feel free to use 25% in the Max Equity Exposure formula. In the above example, the result would be ($10,000 X 18) / 25% = $720,000 of maximum equity exposure for someone making $120,000 a year.

If you just got promoted and plan to see 20% YoY earnings growth for the next five years, you could use your current monthly salary and a higher Risk Tolerance Multiple to determine your equity exposure. For example, let's say you currently make $10,000 a month, but expect to make $20,000 a month in five years, You also think stocks will go down by 25% at most. The calculation would therefore be: ($10,000 X 36) / 25% = $1,440,000 as your target or maximum equity exposure.

If you decide to live like a hermit in a low cost town in the middle of nowhere, you could increase your Risk Tolerance Multiple to 36. But you've got to question your money priorities for trying to make a bigger return only to never spend your rewards.

Remember, whatever your Risk Tolerance Multiple is, you will have to increase it by 1.2 – 3X to truly calculate how many more years you will need to work to recover from your bear market losses due to taxes and general living expenses.

It is a judgment call regarding how much equity risk you should take. If you've quadrupled your net worth after a 9-year bull market, it's probably wise to lower your risk exposure multiple. Conversely, after a 30%+ correction in equities, it's probably wise to increase your risk exposure multiple.

The closer you get to retirement, the lower your multiple should be as well. Nobody wants to get close to the financially free finish line only to break a leg and get carted off in an ambulance.

Be A Rational Investor With Financial SEER

The valuation of everything is dependent on current and future earnings. It takes time and energy to create those earnings from your job or your business. If you are seriously burning out, please dial down risk and give yourself some time to heal.

For the average person in a normal economic cycle, a gross Risk Tolerance Multiple of 18 is my recommendation. Most people have the fortitude to waste up to around 2-3 years of their lives to gain back what they've lost from a bear market. But after three years of digging out of a hole, things start to feel hopeless as the average person starts giving up.

Remember, things could always be worse! Not only could your stock investments lose more than 35%, you could lose all your home equity due to leverage, your business, your job, and your spouse as well. Please invest rationally and responsibly.

I hope the Financial Samurai Equity Exposure Rule (SEER) helps you take the subjective term of risk tolerance and shapes it into something quantifiable. You now have a concrete way of determining your equity exposure and risk tolerance.

Financial SEER formulas:

Risk Tolerance = (Public Equity Exposure X Expected Percentage Decline) / Monthly Gross Income

Maximum Equity Exposure = (Your Monthly Salary X Risk Tolerance Multiple) / Expected Percentage Decline

Related Posts:

Recommended Net Worth Allocation By Age Or Work Experience

The Proper Asset Allocation Of Stocks And Bonds By Age

Readers, how do you quantify risk tolerance? How many months are you willing to work to make up for potential losses in your portfolio? Is your equity exposure appropriate for your risk tolerance? What is your Risk Tolerance Multiple?

The post Financial SEER: A Way To Quantify Risk Tolerance And Determine Appropriate Equity Exposure appeared first on Financial Samurai.

0 notes

Text

Financial SEER: A Way To Quantify Risk Tolerance And Determine Appropriate Equity Exposure

This post is for someone who is wondering:

Whether they have the proper asset allocation

Whether they should sell equities and buy bonds

How to reduce investment stress while still benefitting from returns

How to quantify their risk tolerance

How to continue moving forward on their path to financial freedom despite all the uncertainty

One of my primary goals on Financial Samurai is to help readers build meaningful wealth in a risk-appropriate manner. Because I started my career soon after the 1997 Asian Financial Crisis, I've experienced a lot of carnage as many international college students in the US had to drop out due to a sudden and massive devaluation of their respective home country's currencies. I fully appreciate how hazardous the road to building great wealth can be.

Even the best-made plans can be laid to waste due to some unforeseen exogenous variable. We always hope for good surprises along the way. Unfortunately, life always has a way of kicking us in the face after knocking us in the teeth. Let's always be thankful for what we have and demonstrate kindness to those who are experiencing difficult times.

Most investors overestimate their risk tolerance, especially investors who've only been investing with significant capital since 2009. Once the losses start piling up, it's not only the melancholy of losing money that starts getting to you, it's the growing fear that your job might also be at risk.

You might also erroneously think that the richer you get, the higher your risk tolerance. After all, the more money you have, the bigger your buffer. This is a fallacy because the more money you have, the larger your potential loss. For most rational people, their lifestyles don't inflate commensurately with their wealth. This is why even rich people can't resist a free rubber chicken lunch.

Further, there will come a time when your investment returns have a larger impact on your net worth than your earnings. As a result, the richer you are, the more dismayed you will be to lose money. Your main hope for recovery is a rebound in investment performance because your work earnings won't contribute much at all.

How Most Of Us Rescue Our Investments

The reason we all continue to fight in this difficult world is because we have hope. But eventually, our hope fades because our brains and bodies slow down. When we're younger, we often think ourselves to be invincible. Then, eventually, we start experiencing the realities of aging.

It is due to our fading abilities that we must bring down our risk exposure as we age. It is only the rare bird that goes all-in after making enough money to last a lifetime to try and make so much more. Sometimes they turn into billionaires like Elon Musk. But most of the time they end up going broke and filled with regret.

The only way most of us can rescue our investments after a market swoon is through contributions from earned income i.e. our salaries. We tell ourselves that when the markets are down, that's alright because we'll simply invest more at lower prices.

However, lower prices don't necessarily mean better value if estimates are cut, but all other things being equal, we like to trick ourselves into believing we're getting a better deal all the same.

To understand reward, we must first understand risk. Since 1929, the median bear market price decline is 33.51%, while the average bear market price decline is 35.43% since 1929.

Therefore, it's reasonable to assume that the next bear market could also bring equity valuations down by 35% over an 8 – 10 month period.

Let me share a quantifiable way to measure how much equity exposure you should have based on your risk tolerance.

I'm calling it the Financial Samurai Equity Exposure Rule or Financial SEER. It's an appropriate acronym because seer means a person who is supposed to be able, through supernatural insight, to see what the future holds.

How To Quantify Your Risk Tolerance

Most people just regularly invest in stocks over time through dollar cost averaging. They have little concept of whether the amount of stocks they have as part of their portfolio or their net worth is risk appropriate.

Hence, to quantify your risk tolerance based on your existing portfolio, use the following formula:

(Public Equity Exposure X 35%) / Monthly Gross Income.

For example, let's say you have $500,000 in equities and make $10,000 a month. To quantify your risk tolerance, the formula is: $500,000 X 35% = $175,000 / $10,000 = 17.5.

This formula tells you that you will need to work an 17.5 ADDITIONAL months of your life to earn a GROSS income equal to how much you lost in a -35% bear market. After taxes, you're really only making around $8,000 a month, so you will actually have to work closer to 22 more months and contribute 100% of your after-tax income to be whole.

But it gets worse. Given you need to pay for basic living expenses, you need to work even longer than 22 months. Good thing stocks tend to rebound after an average bear market duration of 10 months, if you can hold on.

Given everybody has a different tax rate, I've simplified the formula using a gross monthly income figure instead of a net monthly income figure. Feel free to adjust the Risk Tolerance Multiple based on your personal income tax situation.

Quantifying risk tolerance by calculating working months is the best way to go because time is money. The more you value your time, the more you hate your job, and the less you desire to work, the lower your risk tolerance.

The classic scenario is a 68-year-old retiree with a $1,000,000 portfolio living off $20,000 a year in Social Security and $20,000 in dividend income from his portfolio.

If his portfolio loses 30% of its value because it is way overweight equities, it is almost impossible to recover the lost $300,000 on his $20,000 a year fixed income. His dividend income may likely be cut as well as companies hold onto their cash for survival. The only thing this retiree can do is pray the market eventually goes up while cutting spending.

How To Determine Appropriate Equity Exposure

After you have quantified your risk tolerance by assigning a Risk Tolerance Multiple = the number of months you need to work to make up for your potential bear market loss, take a look at this guide below.

My guide will not only give you an idea of what your Risk Tolerance Multiple is, but it will also give you an idea of what your maximum equity exposure should be based on your risk tolerance. Solutions!

My advice to all investors is to not risk more than 18 months worth of gross salary on your equity investments using an assumed 35% average bear market decline in your public investment portfolio.

In other words, if you make $10,000 a month, the most you should risk is a $180,000 loss on a $514,285 pure equity portfolio.

The Max Equity Exposure formula = (Your Monthly Salary X 18) / 35%.

You can certainly have a larger overall public investment portfolio than $514,285 in this example, but I wouldn't risk much more than $514,285 in equities only if you have only a $10,000 a month gross salary.

You can have $514,285 max in equities plus $250,000 in AAA-rated municipal bonds if you wish, for a reasonable 67%/33% equities fixed income split. Your total portfolio size would therefore be $764,285.

Adjust The Assumptions As You See Fit

If you think the next bear market will only decline by 25%, feel free to use 25% in the Max Equity Exposure formula. In the above example, the result would be ($10,000 X 18) / 25% = $720,000 of maximum equity exposure for someone making $120,000 a year.

If you just got promoted and plan to see 20% YoY earnings growth for the next five years, you could use your current monthly salary and a higher Risk Tolerance Multiple to determine your equity exposure. For example, let's say you currently make $10,000 a month, but expect to make $20,000 a month in five years, You also think stocks will go down by 25% at most. The calculation would therefore be: ($10,000 X 36) / 25% = $1,440,000 as your target or maximum equity exposure.

If you decide to live like a hermit in a low cost town in the middle of nowhere, you could increase your Risk Tolerance Multiple to 36. But you've got to question your money priorities for trying to make a bigger return only to never spend your rewards.

Remember, whatever your Risk Tolerance Multiple is, you will have to increase it by 1.2 – 3X to truly calculate how many more years you will need to work to recover from your bear market losses due to taxes and general living expenses.

It is a judgment call regarding how much equity risk you should take. If you've quadrupled your net worth after a 9-year bull market, it's probably wise to lower your risk exposure multiple. Conversely, after a 30%+ correction in equities, it's probably wise to increase your risk exposure multiple.

The closer you get to retirement, the lower your multiple should be as well. Nobody wants to get close to the financially free finish line only to break a leg and get carted off in an ambulance.

Be A Rational Investor With Financial SEER

The valuation of everything is dependent on current and future earnings. It takes time and energy to create those earnings from your job or your business. If you are seriously burning out, please dial down risk and give yourself some time to heal.

For the average person in a normal economic cycle, a gross Risk Tolerance Multiple of 18 is my recommendation. Most people have the fortitude to waste up to around 2-3 years of their lives to gain back what they've lost from a bear market. But after three years of digging out of a hole, things start to feel hopeless as the average person starts giving up.

Remember, things could always be worse! Not only could your stock investments lose more than 35%, you could lose all your home equity due to leverage, your business, your job, and your spouse as well. Please invest rationally and responsibly.

I hope the Financial Samurai Equity Exposure Rule (SEER) helps you take the subjective term of risk tolerance and shapes it into something quantifiable. You now have a concrete way of determining your equity exposure and risk tolerance.

Financial SEER formulas:

Risk Tolerance = (Public Equity Exposure X Expected Percentage Decline) / Monthly Gross Income

Maximum Equity Exposure = (Your Monthly Salary X Risk Tolerance Multiple) / Expected Percentage Decline

Related Posts:

Recommended Net Worth Allocation By Age Or Work Experience

The Proper Asset Allocation Of Stocks And Bonds By Age

Readers, how do you quantify risk tolerance? How many months are you willing to work to make up for potential losses in your portfolio? Is your equity exposure appropriate for your risk tolerance? What is your Risk Tolerance Multiple?

The post Financial SEER: A Way To Quantify Risk Tolerance And Determine Appropriate Equity Exposure appeared first on Financial Samurai.

0 notes

Photo

[source]

are they being deliberately obtuse or are they that stupid? i can’t tell.

this picture is from AKM-GSi. Now i’m sure they’re not reading my blog where I JUST POINTED OUT photos from Xposure photo agency always include a disclaimer about UK clients pixelating children, even if it’s a pic of Karl Lagerfeld, but pics from AKM-GSi never do. AKM-GSi do not give a shit about blurring children’s faces.

Xposure does not seem to have any paparazzi pics of Freddie. They do include the disclaimer on pics of Louis.

The only pictures of Freddie that Xposure has uploaded in this system are ones posted by Freddie’s family on social media, such as this one. This does not have a disclaimer as it presumably doesn’t need one. I didn’t find other examples of personal social media pics that they’ve shared, but they do include a lot of images from TV shows, and all things where Xposure wouldn’t hold the copyright don’t have the children pixelation warning.

AKM-GSi absolutely dominates the pictures of Freddie on that site. However, IMP Features Entertainment has also posted some, despite apparently being mostly based in London. IMP Features does not include any type of disclaimer about blurring (on any of their photos), despite being UK-based. Also, if you look through the other photos they have uploaded to the site, you can see that they are without a shadow of a doubt the lurking/stalking type of paparazzi that Larries say barely exist. Which is not to say it’s impossible for any of the pics to be arranged, but certainly they aren’t all. Here they are posting a different baby’s face without blurring. I did not see any photos with blurred faces, although I only went through their search page so far.

You can also see that IMP Features, like AKM-GSi, clearly has neighborhoods and locations where they know they might run into celebs, and therefore the same celebs feature in their pictures over and over. AKM-GSi has actually a pretty broad range, from what I’m seeing - i guess being LA-based helps. But they seem to be the agency with the most familiarity with where Briana or Louis might take Freddie. It’s not proof that the photos are never arranged, but that doesn’t seem to be the case to me. There’s nothing odd about being captured repeatedly by the same agency.

None of the evidence indicates that parents have to give consent in order for their children’s faces to be posted without blurring to websites like this. None of it. None of the evidence or patterns or information supports what Larries say is happening.

21 notes

·

View notes

Text

Oklahoma offensive line vs

First he had the officers teach him the signals they use to keep pilots from crashing their F 18s on the flight deck. After choreographing a dance based on those signals, he taught the number to the initially skeptical and later jubilant sailors wholesale nfl jerseys from china. He didn have much time because we were scheduled to fly off the ship on a cargo plane via catapult that morning, but he rehearsed it and filmed it in about 30 minutes, start to finish..

Cheap Jerseys from china If fell running is nothing else, it traction. A good shoe will have a lot of it to keep you upright over wet grass and chossy terrain more than your typical trail shoe wholesale nfl jerseys. A proper fitting fell shoe can do as much for your running as a shoe does for. Cheap Jerseys from china

Cheap Jerseys china As the billionaire business mogul has broken the conventional rules of politics time and time again this year, his supporters have remained steadfast and loyal, showing remarkable resistance to the stream of criticism that skeptics have thrown Trump's way. And their numbers are growing; Trump was at 36% among Republican leaning voters in a CNN poll this month the broadest support yet for the GOP frontrunner. Now, nfl jerseys many are digging in their heels as the candidate fights off intense backlash from his latest and most controversial comments yet about banning all Muslims from entering the United States.. Cheap Jerseys china

Cheap Jerseys from china They stuck the knee out and tripped us just before their third goal. Then they high sticked Suts in the head. I don't understand why these things aren't being called around the league anymore. 2 stalks bring love and 3 stalks bring happiness www.cheapjerseyschinatrade.com. 6 stalks will bring you peace of mind and harmony and 8 stalks will bring wealth to the bearer. With so much to look forward to, simple instructions are followed for lucky bamboo plant care. Cheap Jerseys from china

Cheap Jerseys china "He was ready made to be a coach," Bill recalled. "I think he was quite strict with the players, but he was very fair with them. He didn't train them from the sidelines, he used to get stuck in and demonstrate what he wanted to do and play with them. Cheap Jerseys china

cheap nfl jerseys Even though he hasn't lived up to those expectations, he still has that in him. This will be his last shot to prove himself to NBA scouts. Plus, I had to put someone from Arizona on this list; freshman Allonzo Trier can flat out score, www.cheapjerseyschina8.com but you know I break out in hives when I put too many freshmen on this list.. cheap nfl jerseys

Cheap Jerseys free shipping Oklahoma offensive line vs. Notre Dame defensive line. The Irish front, anchored by NG Louis Nix, played a key role in holding the Sooners to 15 yards rushing last season, the seventh lowest total in Sooners' history. The news remains positive. New Jersey has gone from having 17 months of existing inventory at the beginning of this year to about nine months now. We have seen six straight months of increased sales. Cheap Jerseys free shipping

cheap nfl jerseys There it is. There it is. Reporter: This sighting caught on camera July 19th. www.cheapjerseysfromchinasale.com Alberto Contador (Spa Astana) 27secs, 7. Tyler Farrar (US Garmin Transitions) 28secs, 8. Levi Leipheimer (US RadioShack), 9. Paris Jackson's nipple piercings on full display in pink vest as she strolls around in the sunshineThe 18 year old and a friend were spotted shopping in Venice, California, on Tuesday01:38, 15 MAR 2017Updated05:58, 15 MAR 2017Paris nips out in Venice (Photo: AKM GSI XPOSURE) Get celebs updates directly to your inbox+ SubscribeThank you for subscribing!Could not subscribe, try again laterInvalid EmailParis Jackson didn't seem at all fazed by the fact she was giving passersby a very good look at her nipple piercings on Tuesday.Michael Jackson's daughter was spotted in Venice, California, and was dressed for the warm weather in a pale pink cropped vest.However, she was flashing more than her tummy as the piercings were plain to see underneath the thin fabric.The confident 18 year old looked happy and relaxed as she shopped with a pal.General electionWho should I vote for in the general election 2017? Take our quiz to see which party should get your backingThe 2017 general election's in full swing. So how will you decide who to vote for? Find out if Labour, Lib Dem, UKIP, Green or Conservative policies match your interestsSummer transfer windowTransfer news LIVE: Liverpool end interest in Virgil van Dijk, plus latest on Kylian Mbappe, Hector Bellerin and every dealThe summer sales are on the way as clubs look forward to a busy few months. Here are the latest results and analysis of what it all meansLondon Bridge terror attack"Insensitive" traffic wardens pounce on trapped cars just minutes after police lift behind London Bridge cordon. cheap nfl jerseys

cheap nfl jerseys We arrived in Charleston about 3:00 that Saturday afternoon and strolled around downtown Charleston. Like many of the small towns in the Delta, it had a rustic downtown, that really had that old, western, southern charm type feeling, or so. Hasna Muhammad (see picture to right with Second Year Fellow, Reggie Higgins,) and Myrna Colley Lee. cheap nfl jerseys

Cheap Jerseys from china Like everything you shouldn't really dwell on it, many years down the line now. You shouldn't dwell on it. But at that time, it was very crucial. Before his breakout role as Aaron Samuels in the hit movie Mean Girls, Jonathan Bennett launched his career on the small screen. After getting his start starring in the Emmy Award winning series All My Children, Jonathan appeared on Law Order: SVU, Smallville and Veronica Mars. In addition to his work on television, he has starred in many leading motion pictures, including Love Wrecked, The Dukes of Hazzard: The Beginning, Cheaper by the Dozen and National Lampoon's Van Wilder: Freshman Year Cheap Jerseys from china.

0 notes

Text

51 notes

·

View notes