#worldfirst tracking

Explore tagged Tumblr posts

Text

The World Parcel is your trusted courier service offering a full spectrum of domestic and international logistics solutions. Specializing in document, medicine, electronics, and large parcel deliveries, they work with major logistics partners like DHL, FedEx, and UPS to guarantee safe, fast, and dependable deliveries worldwide, including to locations such as the USA, Canada, UK, Germany, Australia, and Thailand.

For local needs in Hyderabad and Secunderabad, The World Parcel offers same-day delivery services, covering document shipping, parcel transport, and excess baggage services. Whether it’s gifts, medical shipments, or business packages, they promise efficient, affordable service with expert handling. Additionally, their international services include reliable door-to-door shipping to countries like France, Spain, Italy, Mexico, and New Zealand. With a commitment to fast and professional service, The World Parcel is the ideal choice for both personal and business courier needs.

#worldwide tracking#worldwide express tracking#worldwide courier tracking#worldwide courier services#worldwide courier service#worldwide courier#worldfirst tracking#worldfirst courier tracking#world first tracking#world first courier tracking status#world first courier tracking

0 notes

Text

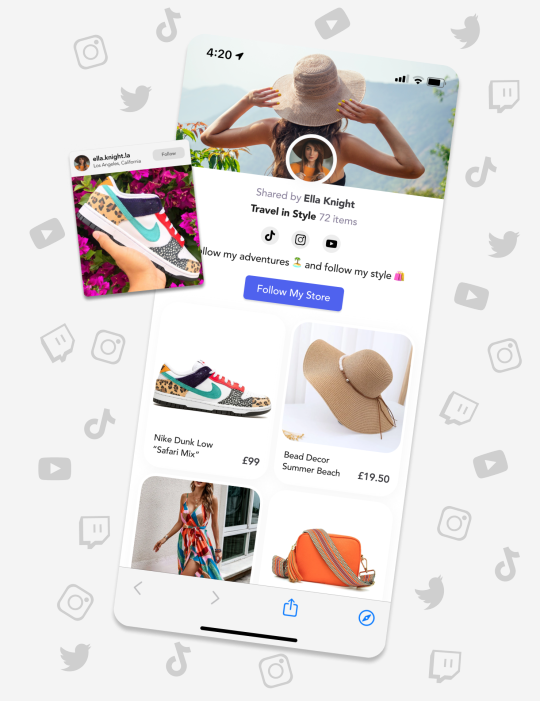

Stored Empowers Creators to Maximise Revenue with New Creator Tool

Stored, the innovative startup dedicated to helping creators turn their passion into profits, has announced the launch of its new creator tool. The new platform allows creators to store all of their affiliate links and commission-paying products, places and experiences behind just one link in bio, making it easier for their followers to purchase from their recommendations. The new creator tool is designed to increase conversion rates and revenue for creators and influencers, allowing them to turn their passion into profit. The Stored team developed the platform to help creators simplify their affiliate marketing efforts. Stored's creator tool streamlines the process by consolidating all affiliate links and product recommendations in one place, saving creators and influencers valuable time and effort and making it easier for followers to find and purchase products. Unlike other tools, Stored helps creators to earn from anywhere - all commission-paying links can be added to Stored and presented within a single, searchable storefront. "Our goal is to empower creators to focus on what they do best - creating amazing content - while we handle the technical aspects of affiliate marketing," said Danny Howe, co-founder of Stored. "With our new creator tool, creators and influencers can easily monetise their content and earn commissions and brand partnerships on their recommended products, places and experiences. We’re giving creators access to e-commerce tools typically reserved for retailers and the brands themselves to help them get the value they deserve." The Stored platform also provides real-time analytics to help creators track their performance and optimise towards revenue, while empowering them with the data and insights to command value from their brand partners. In addition, Stored’s consumer facing app will allow their followers to save a creator's product recommendations for later, notifying them when the creator adds new products and if the product price drops. Danny Howe and Lee Hart (Founders) "We understand the challenges that creators face when it comes to monetising their content. We’re building a platform with creators, for creators" said Lee Hart, co-founder of Stored. "Our platform is designed to simplify the process and enable creators to earn more from their passion. We are excited to launch this new tool and help creators take their affiliate marketing to the next level." Stored's creator tool is available now, and creators can download from app stores and get started straight away. With this innovative new platform, Stored is poised to revolutionise the way creators and influencers monetise their content and turn their passion into profits. About Stored: Stored is the first unrestricted e-commerce platform built specifically for creators from payments experts Danny Howe and Lee Hart in 2022. Investors include execs across the payments and fintech ecosystem from businesses including Marqeta, Mango Pay and numerous members of the WorldFirst founding team, including co-founder Nick Robinson. For consumers, Stored is a single shopping basket, designed to keep all items from any retailer in one place. Consumers can track price drops and deals and share baskets and wish lists with just one click. For creators, Stored provides a showcase of all commission-paying products, places and experiences, from any provider, behind just one link. www.joinstored.com Press Contact Frankie Communications stored@frankiecommunications.com Read the full article

0 notes

Photo

They said it couldn't be done. It can! 😳 Fulfilment is subjective, so it has seemed impossible to measure. Not anymore! 🧬 By defining and weighting what/who we value, and tracking our attention, we can cross-reference the two and measure how fulfilled we feel. ⚖️ The best part is that you can learn from it. I know exactly what to do more often to feel my very best! 😀 What do you need to pay attention to more? 👇 . . . . . #value #money #fulfilment #success #entrepreneur #businessman #goals #hustle #consistency #focus #mentorship #business #wealth #sentient #attentioneconomy #sentientfuture #attention #measure #nanage #worldfirst #happy #happiness #tracking #data #comparison #consult #consultant #new #brandnew #service (at Planet Earth) https://www.instagram.com/p/B1YHJ4xnPCf/?igshid=6jfn44lzkmf2

#value#money#fulfilment#success#entrepreneur#businessman#goals#hustle#consistency#focus#mentorship#business#wealth#sentient#attentioneconomy#sentientfuture#attention#measure#nanage#worldfirst#happy#happiness#tracking#data#comparison#consult#consultant#new#brandnew#service

0 notes

Text

Amazon, WesternUnion debut PayCode to sell goods in emerging markets and let shoppers pay in cash

While Amazon has been methodical (read: a little slow) in launching local versions of its site for various global markets, it has now embarked on a secondary track to snag more business outside the 14 countries where it has built out full operations.

Amazon has partnered with WesternUnion to set up a service called PayCode, which lets people shop and pay for Amazon items using local currencies that would not have been accepted on the site before, starting with services in 10 countries: Chile, Columbia, Hong Kong, Indonesia, Kenya, Malaysia, Peru, Philippines, Taiwan and Thailand.

Specifically, shoppers in these markets will now be able to go into Western Union outposts and pay for their Amazon purchases in cash, which also means that payment cards or other virtual payment methods will also not be required to buy from Amazon �� one of the barriers to expanding the service up to now into more emerging economies, where card and bank account penetration is much lower than in developed markets like the US and Europe.

“Amazon is committed to enabling customers anywhere in the world to shop on Amazon.com, and a big part of that is to allow customers to pay for their cross-border online purchases in a way that is most convenient for them,” said Ben Volk, Director, Payment Acceptance and Experience at Amazon, in a statement. “Amazon PayCode leverages the reach of Western Union to make cross-border online shopping a reliable and convenient experience for customers who do not have access to international credit cards, or prefer to pay in cash.”

In terms of what they will be able to buy, people can shop across the breadth of the Amazon marketplace, but Amazon notes that they will only be able to use PayCode if it’s offered as an option at checkout (which will only happen in the markets where PayCode is supported); if the item that is chosen is “export eligible”, and if the item’s value “exceeds the maximum value allowed for use on this payment type” — although Amazon doesn’t appear to specify what that maximum value is. Once you complete the purchase online (or possibly more likely, on mobile), you get a “PayCode” QR code that you will have 48 hours to take to a Western Union to pay for the goods; otherwise your order gets cancelled.

The deal between Amazon and Western Union was initially announced last October, with very little detail and fanfare. The PayCode name then appeared to leak out a month later around what appeared to be a test in India (where it has not launched… yet). Today was the first time that the companies unveiled the first launch countries.

PayCode is a significant advance for Amazon as it seeks to step up to the next level of being a global e-commerce powerhouse to compete against the likes of Alibaba.

The latter company has made a lot of inroads to work in a wider array of markets beyond its home base of China, specifically tapping into a long tail of supply from its home market and demand for those goods abroad. Alibaba is also taking care of business when it comes to making transactions related to those trades more seamless. Just today, its financial services affiliate Ant Financial announced that it would acquire UK’s WorldFirst, which provides foreign money transfer for businesses and individuals, for a price that we heard from sources was in the region of $700 million.

Amazon currently operates 14 Amazon websites globally: in the US, UK, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Spain and Turkey. (It appears also to have a Prime-only site in Singapore.) Up to now, these would have been the only countries where Amazon would offer goods in local currencies.

Adding a new tranche of countries using PayCode will potentially massively expand how many people can shop on Amazon without Amazon going through the steps of setting up full-fledged operations in those countries to serve those consumers and sellers. (Or, this being Amazon, this would be a key way for the company to start testing the waters to figure out which market might do best with a full-fledged store.) Over time, you might imagine that Amazon might extend PayCode also to markets where it has sites, too, to give shoppers more flexibility in how they pay for goods for themselves or that they are buying for others.

It’s a big market opportunity. Amazon cites estimates from Forrester Research that say cross-border shopping will represent 20 percent of e-commerce by 2022, accounting for $630 billion.

For Western Union, this is a potentially big partnership, too.

Today, PayCode allows people to use Western Union to act as a physical pay station for their Amazon goods, giving Western Union a small cut on those transactions. But you might imagine how this could evolve over time, where remittances sent from family members abroad via Western Union — a very common use of remittance networks — might immediately get redeemed to cover purchases on Amazon.

Similarly, Western Union is working closer with MPesa, the African mobile wallet service that lets people essentially use their phone top-up account as a payment account, and you could imagine how this too could get incorporated into the PayCode experience to facilitate buying and paying on devices, without having to go into Western Union shops and use actual cash.

“We’re helping to unlock access to Amazon.com for customers who need and want items that can only be found online in many parts of the world,” said Khalid Fellahi, SVP and General Manager of Western Union Digital, in a statement. “This is a great example of two global brands innovating and collaborating to bring customers more convenience and choice. In a world where cross-border buyers and sellers are often located on different continents and in completely different financial ecosystems, our platform is ideally suited to solving the complexity of collecting local currency and converting it into whatever currency merchants need on the other end.”

0 notes

Text

Dubai Financial Hub Added 2,000 Jobs as Listed Firms Rise

(Bloomberg) — The Dubai International Financial Centre, the Middle East’s financial hub, added more than 2,000 new jobs last year.

The number of those employed in the DIFC climbed to 25,600 as the amount of registered companies rose 14% to 2,437, the business park said in a report Sunday. There are now 737 “active financial firms” registered, up 18% from 2018.

Registrations in 2019 include AntFinancial’s global payments pioneer WorldFirst, Malaysia’s Maybank Islamic Berhad, Cantor Fitzgerald and Mauritius Commercial Bank.

Business park says it’s on track to achieve 2024 goals.

The post Dubai Financial Hub Added 2,000 Jobs as Listed Firms Rise appeared first on Businessliveme.com.

from WordPress https://ift.tt/2TPWTg8 via IFTTT

0 notes

Text

Amazon, WesternUnion debut PayCode to sell goods in emerging markets and let shoppers pay in cash

While Amazon has been methodical (read: a little slow) in launching local versions of its site for various global markets, it has now embarked on a secondary track to snag more business outside the 14 countries where it has built out full operations.

Amazon has partnered with WesternUnion to set up a service called PayCode, which lets people shop and pay for Amazon items using local currencies that would not have been accepted on the site before, starting with services in 10 countries: Chile, Columbia, Hong Kong, Indonesia, Kenya, Malaysia, Peru, Philippines, Taiwan and Thailand.

Specifically, shoppers in these markets will now be able to go into Western Union outposts and pay for their Amazon purchases in cash, which also means that payment cards or other virtual payment methods will also not be required to buy from Amazon — one of the barriers to expanding the service up to now into more emerging economies, where card and bank account penetration is much lower than in developed markets like the US and Europe.

“Amazon is committed to enabling customers anywhere in the world to shop on Amazon.com, and a big part of that is to allow customers to pay for their cross-border online purchases in a way that is most convenient for them,” said Ben Volk, Director, Payment Acceptance and Experience at Amazon, in a statement. “Amazon PayCode leverages the reach of Western Union to make cross-border online shopping a reliable and convenient experience for customers who do not have access to international credit cards, or prefer to pay in cash.”

In terms of what they will be able to buy, people can shop across the breadth of the Amazon marketplace, but Amazon notes that they will only be able to use PayCode if it’s offered as an option at checkout (which will only happen in the markets where PayCode is supported); if the item that is chosen is “export eligible”, and if the item’s value “exceeds the maximum value allowed for use on this payment type” — although Amazon doesn’t appear to specify what that maximum value is. Once you complete the purchase online (or possibly more likely, on mobile), you get a “PayCode” QR code that you will have 48 hours to take to a Western Union to pay for the goods; otherwise your order gets cancelled.

The deal between Amazon and Western Union was initially announced last October, with very little detail and fanfare. The PayCode name then appeared to leak out a month later around what appeared to be a test in India (where it has not launched… yet). Today was the first time that the companies unveiled the first launch countries.

PayCode is a significant advance for Amazon as it seeks to step up to the next level of being a global e-commerce powerhouse to compete against the likes of Alibaba.

The latter company has made a lot of inroads to work in a wider array of markets beyond its home base of China, specifically tapping into a long tail of supply from its home market and demand for those goods abroad. Alibaba is also taking care of business when it comes to making transactions related to those trades more seamless. Just today, its financial services affiliate Ant Financial announced that it would acquire UK’s WorldFirst, which provides foreign money transfer for businesses and individuals, for a price that we heard from sources was in the region of $700 million.

Amazon currently operates 14 Amazon websites globally: in the US, UK, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Spain and Turkey. (It appears also to have a Prime-only site in Singapore.) Up to now, these would have been the only countries where Amazon would offer goods in local currencies.

Adding a new tranche of countries using PayCode will potentially massively expand how many people can shop on Amazon without Amazon going through the steps of setting up full-fledged operations in those countries to serve those consumers and sellers. (Or, this being Amazon, this would be a key way for the company to start testing the waters to figure out which market might do best with a full-fledged store.) Over time, you might imagine that Amazon might extend PayCode also to markets where it has sites, too, to give shoppers more flexibility in how they pay for goods for themselves or that they are buying for others.

It’s a big market opportunity. Amazon cites estimates from Forrester Research that say cross-border shopping will represent 20 percent of e-commerce by 2022, accounting for $630 billion.

For Western Union, this is a potentially big partnership, too.

Today, PayCode allows people to use Western Union to act as a physical pay station for their Amazon goods, giving Western Union a small cut on those transactions. But you might imagine how this could evolve over time, where remittances sent from family members abroad via Western Union — a very common use of remittance networks — might immediately get redeemed to cover purchases on Amazon.

Similarly, Western Union is working closer with MPesa, the African mobile wallet service that lets people essentially use their phone top-up account as a payment account, and you could imagine how this too could get incorporated into the PayCode experience to facilitate buying and paying on devices, without having to go into Western Union shops and use actual cash.

“We’re helping to unlock access to Amazon.com for customers who need and want items that can only be found online in many parts of the world,” said Khalid Fellahi, SVP and General Manager of Western Union Digital, in a statement. “This is a great example of two global brands innovating and collaborating to bring customers more convenience and choice. In a world where cross-border buyers and sellers are often located on different continents and in completely different financial ecosystems, our platform is ideally suited to solving the complexity of collecting local currency and converting it into whatever currency merchants need on the other end.”

from iraidajzsmmwtv https://tcrn.ch/2GF2sci via IFTTT

0 notes

Link

While Amazon has been methodical (read: a little slow) in launching local versions of its site for various global markets, it has now embarked on a secondary track to snag more business outside the 14 countries where it has built out full operations.

Amazon has partnered with WesternUnion to set up a service called PayCode, which lets people shop and pay for Amazon items using local currencies that would not have been accepted on the site before, starting with services in 10 countries: Chile, Columbia, Hong Kong, Indonesia, Kenya, Malaysia, Peru, Philippines, Taiwan and Thailand.

Specifically, shoppers in these markets will now be able to go into Western Union outposts and pay for their Amazon purchases in cash, which also means that payment cards or other virtual payment methods will also not be required to buy from Amazon — one of the barriers to expanding the service up to now into more emerging economies, where card and bank account penetration is much lower than in developed markets like the US and Europe.

“Amazon is committed to enabling customers anywhere in the world to shop on Amazon.com, and a big part of that is to allow customers to pay for their cross-border online purchases in a way that is most convenient for them,” said Ben Volk, Director, Payment Acceptance and Experience at Amazon, in a statement. “Amazon PayCode leverages the reach of Western Union to make cross-border online shopping a reliable and convenient experience for customers who do not have access to international credit cards, or prefer to pay in cash.”

In terms of what they will be able to buy, people can shop across the breadth of the Amazon marketplace, but Amazon notes that they will only be able to use PayCode if it’s offered as an option at checkout (which will only happen in the markets where PayCode is supported); if the item that is chosen is “export eligible”, and if the item’s value “exceeds the maximum value allowed for use on this payment type” — although Amazon doesn’t appear to specify what that maximum value is. Once you complete the purchase online (or possibly more likely, on mobile), you get a “PayCode” QR code that you will have 48 hours to take to a Western Union to pay for the goods; otherwise your order gets cancelled.

The deal between Amazon and Western Union was initially announced last October, with very little detail and fanfare. The PayCode name then appeared to leak out a month later around what appeared to be a test in India (where it has not launched… yet). Today was the first time that the companies unveiled the first launch countries.

PayCode is a significant advance for Amazon as it seeks to step up to the next level of being a global e-commerce powerhouse to compete against the likes of Alibaba.

The latter company has made a lot of inroads to work in a wider array of markets beyond its home base of China, specifically tapping into a long tail of supply from its home market and demand for those goods abroad. Alibaba is also taking care of business when it comes to making transactions related to those trades more seamless. Just today, its financial services affiliate Ant Financial announced that it would acquire UK’s WorldFirst, which provides foreign money transfer for businesses and individuals, for a price that we heard from sources was in the region of $700 million.

Amazon currently operates 14 Amazon websites globally: in the US, UK, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Spain and Turkey. (It appears also to have a Prime-only site in Singapore.) Up to now, these would have been the only countries where Amazon would offer goods in local currencies.

Adding a new tranche of countries using PayCode will potentially massively expand how many people can shop on Amazon without Amazon going through the steps of setting up full-fledged operations in those countries to serve those consumers and sellers. (Or, this being Amazon, this would be a key way for the company to start testing the waters to figure out which market might do best with a full-fledged store.) Over time, you might imagine that Amazon might extend PayCode also to markets where it has sites, too, to give shoppers more flexibility in how they pay for goods for themselves or that they are buying for others.

It’s a big market opportunity. Amazon cites estimates from Forrester Research that say cross-border shopping will represent 20 percent of e-commerce by 2022, accounting for $630 billion.

For Western Union, this is a potentially big partnership, too.

Today, PayCode allows people to use Western Union to act as a physical pay station for their Amazon goods, giving Western Union a small cut on those transactions. But you might imagine how this could evolve over time, where remittances sent from family members abroad via Western Union — a very common use of remittance networks — might immediately get redeemed to cover purchases on Amazon.

Similarly, Western Union is working closer with MPesa, the African mobile wallet service that lets people essentially use their phone top-up account as a payment account, and you could imagine how this too could get incorporated into the PayCode experience to facilitate buying and paying on devices, without having to go into Western Union shops and use actual cash.

“We’re helping to unlock access to Amazon.com for customers who need and want items that can only be found online in many parts of the world,” said Khalid Fellahi, SVP and General Manager of Western Union Digital, in a statement. “This is a great example of two global brands innovating and collaborating to bring customers more convenience and choice. In a world where cross-border buyers and sellers are often located on different continents and in completely different financial ecosystems, our platform is ideally suited to solving the complexity of collecting local currency and converting it into whatever currency merchants need on the other end.”

from Mobile – TechCrunch https://tcrn.ch/2GF2sci ORIGINAL CONTENT FROM: https://techcrunch.com/

0 notes

Text

Amazon, WesternUnion debut PayCode to sell goods in emerging markets and let shoppers pay in cash

While Amazon has been methodical (read: a little slow) in launching local versions of its site for various global markets, it has now embarked on a secondary track to snag more business outside the 14 countries where it has built out full operations.

Amazon has partnered with WesternUnion to set up a service called PayCode, which lets people shop and pay for Amazon items using local currencies that would not have been accepted on the site before, starting with services in 10 countries: Chile, Columbia, Hong Kong, Indonesia, Kenya, Malaysia, Peru, Philippines, Taiwan and Thailand.

Specifically, shoppers in these markets will now be able to go into Western Union outposts and pay for their Amazon purchases in cash, which also means that payment cards or other virtual payment methods will also not be required to buy from Amazon — one of the barriers to expanding the service up to now into more emerging economies, where card and bank account penetration is much lower than in developed markets like the US and Europe.

“Amazon is committed to enabling customers anywhere in the world to shop on Amazon.com, and a big part of that is to allow customers to pay for their cross-border online purchases in a way that is most convenient for them,” said Ben Volk, Director, Payment Acceptance and Experience at Amazon, in a statement. “Amazon PayCode leverages the reach of Western Union to make cross-border online shopping a reliable and convenient experience for customers who do not have access to international credit cards, or prefer to pay in cash.”

In terms of what they will be able to buy, people can shop across the breadth of the Amazon marketplace, but Amazon notes that they will only be able to use PayCode if it’s offered as an option at checkout (which will only happen in the markets where PayCode is supported); if the item that is chosen is “export eligible”, and if the item’s value “exceeds the maximum value allowed for use on this payment type” — although Amazon doesn’t appear to specify what that maximum value is. Once you complete the purchase online (or possibly more likely, on mobile), you get a “PayCode” QR code that you will have 48 hours to take to a Western Union to pay for the goods; otherwise your order gets cancelled.

The deal between Amazon and Western Union was initially announced last October, with very little detail and fanfare. The PayCode name then appeared to leak out a month later around what appeared to be a test in India (where it has not launched… yet). Today was the first time that the companies unveiled the first launch countries.

PayCode is a significant advance for Amazon as it seeks to step up to the next level of being a global e-commerce powerhouse to compete against the likes of Alibaba.

The latter company has made a lot of inroads to work in a wider array of markets beyond its home base of China, specifically tapping into a long tail of supply from its home market and demand for those goods abroad. Alibaba is also taking care of business when it comes to making transactions related to those trades more seamless. Just today, its financial services affiliate Ant Financial announced that it would acquire UK’s WorldFirst, which provides foreign money transfer for businesses and individuals, for a price that we heard from sources was in the region of $700 million.

Amazon currently operates 14 Amazon websites globally: in the US, UK, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Spain and Turkey. (It appears also to have a Prime-only site in Singapore.) Up to now, these would have been the only countries where Amazon would offer goods in local currencies.

Adding a new tranche of countries using PayCode will potentially massively expand how many people can shop on Amazon without Amazon going through the steps of setting up full-fledged operations in those countries to serve those consumers and sellers. (Or, this being Amazon, this would be a key way for the company to start testing the waters to figure out which market might do best with a full-fledged store.) Over time, you might imagine that Amazon might extend PayCode also to markets where it has sites, too, to give shoppers more flexibility in how they pay for goods for themselves or that they are buying for others.

It’s a big market opportunity. Amazon cites estimates from Forrester Research that say cross-border shopping will represent 20 percent of e-commerce by 2022, accounting for $630 billion.

For Western Union, this is a potentially big partnership, too.

Today, PayCode allows people to use Western Union to act as a physical pay station for their Amazon goods, giving Western Union a small cut on those transactions. But you might imagine how this could evolve over time, where remittances sent from family members abroad via Western Union — a very common use of remittance networks — might immediately get redeemed to cover purchases on Amazon.

Similarly, Western Union is working closer with MPesa, the African mobile wallet service that lets people essentially use their phone top-up account as a payment account, and you could imagine how this too could get incorporated into the PayCode experience to facilitate buying and paying on devices, without having to go into Western Union shops and use actual cash.

“We’re helping to unlock access to Amazon.com for customers who need and want items that can only be found online in many parts of the world,” said Khalid Fellahi, SVP and General Manager of Western Union Digital, in a statement. “This is a great example of two global brands innovating and collaborating to bring customers more convenience and choice. In a world where cross-border buyers and sellers are often located on different continents and in completely different financial ecosystems, our platform is ideally suited to solving the complexity of collecting local currency and converting it into whatever currency merchants need on the other end.”

source https://techcrunch.com/2019/02/14/amazon-westernunion-debut-paycode-for-emerging-market-shoppers-to-pay-for-items-in-cash/

0 notes

Text

Amazon, WesternUnion debut PayCode to sell goods in emerging markets and let shoppers pay in cash

While Amazon has been methodical (read: a little slow) in launching local versions of its site for various global markets, it has now embarked on a secondary track to snag more business outside the 14 countries where it has built out full operations.

Amazon has partnered with WesternUnion to set up a service called PayCode, which lets people shop and pay for Amazon items using local currencies that would not have been accepted on the site before, starting with services in 10 countries: Chile, Columbia, Hong Kong, Indonesia, Kenya, Malaysia, Peru, Philippines, Taiwan and Thailand.

Specifically, shoppers in these markets will now be able to go into Western Union outposts and pay for their Amazon purchases in cash, which also means that payment cards or other virtual payment methods will also not be required to buy from Amazon — one of the barriers to expanding the service up to now into more emerging economies, where card and bank account penetration is much lower than in developed markets like the US and Europe.

“Amazon is committed to enabling customers anywhere in the world to shop on Amazon.com, and a big part of that is to allow customers to pay for their cross-border online purchases in a way that is most convenient for them,” said Ben Volk, Director, Payment Acceptance and Experience at Amazon, in a statement. “Amazon PayCode leverages the reach of Western Union to make cross-border online shopping a reliable and convenient experience for customers who do not have access to international credit cards, or prefer to pay in cash.”

In terms of what they will be able to buy, people can shop across the breadth of the Amazon marketplace, but Amazon notes that they will only be able to use PayCode if it’s offered as an option at checkout (which will only happen in the markets where PayCode is supported); if the item that is chosen is “export eligible”, and if the item’s value “exceeds the maximum value allowed for use on this payment type” — although Amazon doesn’t appear to specify what that maximum value is. Once you complete the purchase online (or possibly more likely, on mobile), you get a “PayCode” QR code that you will have 48 hours to take to a Western Union to pay for the goods; otherwise your order gets cancelled.

The deal between Amazon and Western Union was initially announced last October, with very little detail and fanfare. The PayCode name then appeared to leak out a month later around what appeared to be a test in India (where it has not launched… yet). Today was the first time that the companies unveiled the first launch countries.

PayCode is a significant advance for Amazon as it seeks to step up to the next level of being a global e-commerce powerhouse to compete against the likes of Alibaba.

The latter company has made a lot of inroads to work in a wider array of markets beyond its home base of China, specifically tapping into a long tail of supply from its home market and demand for those goods abroad. Alibaba is also taking care of business when it comes to making transactions related to those trades more seamless. Just today, its financial services affiliate Ant Financial announced that it would acquire UK’s WorldFirst, which provides foreign money transfer for businesses and individuals, for a price that we heard from sources was in the region of $700 million.

Amazon currently operates 14 Amazon websites globally: in the US, UK, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Spain and Turkey. (It appears also to have a Prime-only site in Singapore.) Up to now, these would have been the only countries where Amazon would offer goods in local currencies.

Adding a new tranche of countries using PayCode will potentially massively expand how many people can shop on Amazon without Amazon going through the steps of setting up full-fledged operations in those countries to serve those consumers and sellers. (Or, this being Amazon, this would be a key way for the company to start testing the waters to figure out which market might do best with a full-fledged store.) Over time, you might imagine that Amazon might extend PayCode also to markets where it has sites, too, to give shoppers more flexibility in how they pay for goods for themselves or that they are buying for others.

It’s a big market opportunity. Amazon cites estimates from Forrester Research that say cross-border shopping will represent 20 percent of e-commerce by 2022, accounting for $630 billion.

For Western Union, this is a potentially big partnership, too.

Today, PayCode allows people to use Western Union to act as a physical pay station for their Amazon goods, giving Western Union a small cut on those transactions. But you might imagine how this could evolve over time, where remittances sent from family members abroad via Western Union — a very common use of remittance networks — might immediately get redeemed to cover purchases on Amazon.

Similarly, Western Union is working closer with MPesa, the African mobile wallet service that lets people essentially use their phone top-up account as a payment account, and you could imagine how this too could get incorporated into the PayCode experience to facilitate buying and paying on devices, without having to go into Western Union shops and use actual cash.

“We’re helping to unlock access to Amazon.com for customers who need and want items that can only be found online in many parts of the world,” said Khalid Fellahi, SVP and General Manager of Western Union Digital, in a statement. “This is a great example of two global brands innovating and collaborating to bring customers more convenience and choice. In a world where cross-border buyers and sellers are often located on different continents and in completely different financial ecosystems, our platform is ideally suited to solving the complexity of collecting local currency and converting it into whatever currency merchants need on the other end.”

Via Ingrid Lunden https://techcrunch.com

0 notes

Photo

Day 191 - South Africa 🇿🇦 The Power Cut ——- I’ve now travelled 1200 miles in my little hire car along the garden route of South Africa. Today I abandoned it for a while and went on foot and by boat to do some exploring without the hum of the Polo’s tiny 1.1 litre engine buzzing in my ear. ——- Question: What do you do when the town you’re staying in looses all power for 2 days? No time for admin, no WiFi, and my phone on it’s last legs. ——- Answer: Get in a Kayak and paddle up stream for hours into nowhere. Jump out listen to the world in silence, explore the wilderness in a windy storm and paddle back fighting an even windier return. ——- Gently paddling through the reeds upstream i hit dirt track and then onto a waterfall high in the mountains. This was the best way to spend the day. ——- I am loving these days of rest; although my shoulders and arms are now feeling it from battling the head wind coming back. My legs are however fully fit ready for tomorrow’s 60th marathon. ——- Kayaking is so peaceful and gentle but I always forget about the sore hands and splashes of icey cold water which ultimately leave you soaking wet. Oh and my beloved bags which I’ve been carrying with me the entire journey came with me despite the potential dangers of carrying thousands of pounds of photography and video equipment with me now a tiny kayak with me at the helm. A stupid move in hindsight but they made it back in one piece. ——- I managed to do some scenery shots for the documentary today too. On top of all the logistics of this never ending challenge I’m very lucky to have a production company involved who are producing a documentary about this journey. A few members of the production crew join me from time to time in various countries. Generally though most of the content is shot by me, but I do manage to palm my cameras off to anyone that’s kindly willing to help. I do also have the drone which I can set up to follow me as I run; or like today, it gently followed me above the trees and mountains as I paddled in my little yellow boat below. #travelblogger #adventure #world #globe #runnersofinstagram #runner #expedition #worldfirst #restday #runner #running #kyaking #drone (at Wilderness East, Western Cape, South Africa)

#globe#running#adventure#kyaking#drone#worldfirst#restday#travelblogger#expedition#runnersofinstagram#world#runner

0 notes

Photo

How You’d Likely Transfer Your Money In The Future

With the world becoming more and more globalised, there is an ever-increasing need for individuals and businesses to be transferring money overseas. But the traditional methods of using a bank for overseas money transfers continue to drain our pockets with the hefty bank fees.

But the industry saw some changes in recent years. A number of new providers have come online to fill the gap for cheaper overseas fund transfers. Some of these, including brands like TransferWise, WorldFirst Money Transfer and CurrenciesDirect are making waves in the industry and helping individuals like you and I save tens to hundreds of dollars each year off money transfer fees.

With the rise of Fintech, we can expect the industry to evolve even faster, reach more people and make overseas money transfer a cheaper endeavour. Let’s take a look at some rising trends and how money transfer might change in the near future.

Use of Mobile Money Transfer

One of the biggest issues with money transfer is that you would usually need your recipient to at least have a bank account where you can send the money to. But what about the “unbanked”? According to KPMG, only 27% of Southeast Asia’s population has a bank account. And some of the biggest remittance markets are right here in Asia.

Although with the current online money transfer providers, senders and recipients can sometimes skip the bank by having an online account. But what about sending money using mobile? It’s already happening. This makes it easy and convenient to transfer money in countries lacking in money transfer infrastructure so that individuals do not need to travel long distances to remittance agents. Recipients can use the money in their mobile account to directly pay at local shops and businesses, reducing the need to carry any physical cash.

Other services that we are likely to see include transferring money via social media and chat apps, which also means you bypass central authorities like banks, thus reducing any transaction costs.

Bitcoin/Cryptocurrency Fund Transfer

In recent years, we might have heard a lot of the following buzzwords – “Bitcoin” and “cryptocurrency”. In short, these work like virtual money where you can transfer and make purchases with anonymity. Because they do not belong to a single country, it is a “universal” currency that does not come with any exchange rate.

BitCoin Transfer

Because of these features, they seem to fulfil an attractive criteria for overseas money transfer. You can currently buy bitcoin on several marketplaces called “bitcoin exchanges” and send bitcoins to each other digitally. While many saw huge potential for their use in the money transfer industry, some also called out its volatility and that it adds an additional layer of “exchange” when you convert currency A to bitcoin before converting it to currency B.

Faster & cheaper Bank Transfer

Bypassing the banks definitely makes money transfers cheaper. Very often, individuals find that banks levy multiple layers of fees on money transfers, including cable fees, exchange rate margins, and agent bank fees.

Best Money Transfer Brands

Currently, providers like Currencies Direct Money Transfer allows you to view live exchange rate and buy currencies before you transfer them at a later date. This single feature already allows you to achieve savings that you will not get from a bank. Others allow you to track your money easily and even offer same-day transfers.

With the increasing need for overseas money transfer, the industry is set to grow and consumers can definitely look forward to faster, cheaper and better services!

0 notes

Text

Headline News from PaymentsNews.com - September 12, 2017 http://ift.tt/2xvODZP

Headline News is brought to you by Glenbrook Partners. Glenbrook provides payments consulting and education services to payments professionals worldwide!

ON THE WEB

How Apple's New Face ID Works - Gizmodo - "The technology builds on Touch ID and is called Face ID, of course. It uses a new selfie camera setup in the iPhone 10 called the “TrueDepth camera system.” TrueDepth uses a set of sensors, cameras, and a dot projector to create an incredibly detailed 3D map of your face."

Venmo is offering users an (ugly) physical debit card - TechCrunch - "After Square unveiled a free debit card that would be tied to their Square Cash App, it was only a matter of time until we saw Venmo do something similar. Now TechCrunch has learned that Venmo is inviting some users to a beta program where they’ll be sent a card for free that is attached to their Venmo account. Users can pay with this card in stores and online just like a normal debit card — and the money spent will be debited from their Venmo balance."

Belgian banks bid to banish passwords with itsme app - Finextra - "Belgium's major banks and mobile network operators have joined forces to create an app that lets people replace their various online usernames and passwords with a single code or fingerprint."

No ATM needed: Standard Chartered partners start-up soCash on 400 cash withdrawal points - Straits Times - "Standard Chartered Bank has partnered financial technology start-up soCash, which will allow its customers to withdraw cash at over 400 points through the bank's mobile app, SC Mobile. The cash points include merchants such as Buzz, U Star, UMart, as well as convenience stores and minimarts islandwide. Instead of having to look for an ATM, Standard Chartered Bank customers now have the option of getting cash through soCash, which has been integrated into the SC Mobile app."

The Evolution of Trust in the Era of Platforms and Blockchain - Wall Street Journal CIO Journal - "The IBM study analyzed the responses of the early adopters to figure out what’s driving them to embrace blockchain at this early stage. It found that early adopters viewed blockchain as a kind of trust accelerator."

UNDERSTANDING CRYPTO REGULATIONS - Multicoin Capital blog - "In light of the recent actions by the US Securities and Exchange Commission and People’s Bank of China, we’re receiving a lot of questions about regulation. In this post, we’ll provide some frameworks to understand how governments can enforce regulations on public blockchains."

Monopoly without a monopolist : An economic analysis of the bitcoin payment system - Bank of Finland - "Owned by nobody and controlled by an almost immutable protocol the Bitcoin payment system is a platform with two main constituencies: users and profit-seeking miners who maintain the system’s infrastructure."

The Equifax Breach: What You Should Know - Krebs on Security - "But if ever there was a reminder that you — the consumer — are ultimately responsible for protecting your financial future, this is it. Here’s what you need to know and what you should do in response to this unprecedented breach."

ON THE WIRES

Rabobank introduces IBAN-Name Check - "The IBAN-Name Check allows customers to check the name of the beneficiary before the transfer is executed,’ says Alexander Zwart, Manager Online Access at Rabobank. ‘The check works with all Dutch IBANs. If the entered name differs from the registered account holder, the user can cancel the transfer."

Starling Bank’s Marketplace goes live with Flux as first integrated partner - "The Starling Marketplace is a brand new concept in banking whereby products from other fintech providers – and in the future lifestyle products – can sit within an easily browsed ecosystem all from within the app. These partners integrate with Starling Bank using their Open Banking and PSD2 compliant APIs."

STACK PARTNERS WITH MASTERCARD TO OFFER PREPAID CARDS WITHIN FINANCIAL SERVICES PLATFORM - "Stack provides users with an all-encompassing banking platform, offering financial services like mobile tap-to-pay, tracking spending, automated savings, and a rewards program for reaching financial goals. Stack has 20,000 Android users registered for the beta, which will onboard users this month."

Bank of Ireland Partners with WorldFirst to Launch Fast and Secure International Payments Service with No Transaction Fees in US - "Bank of Ireland Global Markets has today announced that it is expanding its U.S. customer offering by launching Bank of Ireland Global Payments – a foreign exchange and payments service in partnership with WorldFirst. This unique alliance between a FinTech company and a traditional bank will allow businesses in the U.S. to make fast and safe international payments with no transfer fees."

TNS Report Uncovers Significant Global Variances in ATM Usage - "The report, called Global Variances in ATM Usage, shares the results of a survey* which TNS commissioned early this year. It investigates, among other things, how frequently people used ATMs, whether they have used ATMs at mobile and temporary sites, whether they have used ATMs in other countries, and their willingness to pay ATM fees. It also explores the reasons why some chose not to use ATMs."

At Finovate: ATM Innovation for Emergency Assistance and Merchant Rebates - "With Mastercard Cash Pick-Up®, a bank can help an individual or company send money to anyone with a valid mobile phone number. A text message is sent to a recipient’s mobile telephone providing him or her with an order number, four-digit PIN and directions to the nearest branded ATM."

KBC launch new app to revolutionise account openings - "KBC Bank Ireland, Ireland’s digital-first bank, has launched a ground-breaking new mobile app for new customers. KBC’s app is the first of its kind, and works by allowing customers to open, activate and use their bank account at any time, within just five minutes."

GLENBROOK PAYMENTS EDUCATION EVENTS

Understanding the accelerating pace of change in the payments industry has never been more important. Get the knowledge you need fast at one of our two day Payments Boot Camps. Our one day Insight Workshops follow each Boot Camp and are deep dives into key topics. Take a discount for attending all three days. Here's our fall schedule:

Payments Boot Camp, October 3-4, 2017, San Jose, CA, Logistics

Payments Boot Camp, October 17-18, 2017, NYC, NY, Logistics

Payments Boot Camp, December 5-6, 2017, Palo Alto, CA, Logistics

Global Payments, October 5, 2017, San Jose, CA, Logistics

Digital Payments, October 19, 2017, NYC, NY, Logistics

Innovation in Payments, December 7, 2017, Palo Alto, CA, Logistics

For more, click here. We hope to see you soon!

Bring your colleagues along! Group discounts are available. For more information or to learn about our private workshops conducted at your location, contact Glenbrook's Russ Jones.

UPDATES FROM GLENBROOK

Join our mailing list for updates about Glenbrook events. Follow us on Twitter: @paymentsnews and @paymentsviews

Click here to share PaymentsNews with a friend

Note: Headline News is compiled by Glenbrook Partners. Throughout the day, as we spot interesting developments, this post is updated. Do you have news to share? Tell us here: gotnews@paymentsnews.com!

from Payments News - from Glenbrook Partners http://ift.tt/2xvODZP via IFTTT

0 notes

Photo

A WORLD FIRST! What if YOU paid attention to your attention? 😳 For the last 365 days (8,760 hours), I tracked my attention down to the second... evolving beyond tracking my time/activity/behaviours which I'd done for 7 months prior to that. 🌎🔄☀️ Why? . The Attention Economy is a VERY real threat to our fulfilment in life. Your attention will be grabbed and kept, on foci that you don't value, causing UNPRECEDENTED Global Suffering in the form of Regret. 🌎😭 Will YOU be a VICTIM or a HERO? 😢/💪 Be a HERO! ❤️ 1} Define what you value 2) Master your self-awareness 3) Schedule your time 4) Execute 5) Monitor your attention and correct as necessary 🔄 Eradicate Regret, Feel Fulfilled, Live Intentionally 👍 What if YOU paid attention to what has your attention? Could you be a HERO for yourself? For others? 👇 . . . . . #sentient #process #network #theory #sentientfuture #intentionalliving #life #time #attention #attentioneconomy #schedule #priorities #worldfirst #worldrecord #worldrecords #consultant #consulting #success #graphicdesign #graphic #art #engineering #money #fulfilment #happiness #happy #grateful #gratitude #selfrespect #selflove (at Planet Earth) https://www.instagram.com/p/B1M6XvOnWJ7/?igshid=18r242z02x075

#sentient#process#network#theory#sentientfuture#intentionalliving#life#time#attention#attentioneconomy#schedule#priorities#worldfirst#worldrecord#worldrecords#consultant#consulting#success#graphicdesign#graphic#art#engineering#money#fulfilment#happiness#happy#grateful#gratitude#selfrespect#selflove

0 notes

Text

Flexy Review And Honest Review

Flexy Review - Employee Your personal Personal Internet Developer With Advanced Abilities - And also They Won't Also Expense You A Regular monthly Wage ...

Save Time & & Initiative By Conveniently Constructing Sensational Pages In Simply Minutes - Completely With Your Voice With The Globe's First Synthetically Intelligent Web page Builder.

Your Personal Page Structure Guide: Be directed with the page structure procedure by your own unnaturally intelligent digital aide. Never have to raise a finger: #Create magnificent sites, quicker, much easier as well as utilizing only your voice! Fast, Easy, Effective Cloning: Clone a site in one single click. Absolutely no Understanding Contour: Easy to make use of - Instinctive to learn. Time Conserving and also Effective: Export your whole site into a solitary line of code. Never EVER Waste Traffic: Test conversions BEFORE you go cope with a 91% - 95% precision rating - without squandering a solitary site visitor. #WorldFirst Rise Your Engagement And also Conversions: Your very own 3D character will greet your site visitors AND ALSO read out your duplicate. #WorldFirst

VITAL FEATURES:

Be guided with the page structure procedure by your very own artificially smart digital assistant.

Export your whole site into a solitary line of code.

Test web traffic with a 91% - 95% accuracy ranking - without squandering a solitary site visitor. #WorldFirst

Clone a site in one click.

Never need to raise a finger: #Create stunning sites, quicker, much easier and also utilizing just your voice!

Enhance your involvement as well as conversions by having your very own online aide welcome your visitors AND ALSO review out your copy!

Easy to make use of - instinctive to find out

Be Super-Creative: Flexy will make changes in an instant, indicating you could transform your mind with just a word - meaning you obtain excellent outcomes every single time.

Take the decision making anxiety away: Flexy's Selection - Smart Video clip Picker.

Boost engagement as well as make your site visitors feel right at home with that personal touch: Smart elements immediately transform your web page photos, video clips and also even more depending upon your site visitors places!

Never 'obtain it wrong' again - never ever before 'waste website traffic: Predict your conversions with 91 - 95% precision.

Adaptable: 3 methods to create: From the ground up, using among our spectacular consisted of templates or by duplicating an additional site in simply one click.

Go Global: Instantly as well as instantly translate your site into over 100 various languages depending on where your site visitor is from.

This set of amazing innovative features make the difference between Flexy being a great A.I gimmick -

As well as an essential, delightful to make use of item of software application that will certainly become part of your everyday -

And also make your everyday simpler.

Flexy Review is not simply different - it's best page-building flexibility.

The very first sales page maker to provide develop you spectacular pages without ANY handbook modifying.

Quickly produce web pages - without ANY handbook editing and enhancing.

Flexy - your unnaturally smart Digital Aide guides you with a seamlessly, simple web page creation experience

Allow's Have A More In-depth Take a look at Flexy's Next-Generation, Yet Easy To Use Attributes:

Feature # 1: Overall Versatility With Just how You Develop Your Pages

Develop from square one: Start With a Space Page

Want overall flexibility? Have a vision of specifically just what it is you desire from your web page? After that this alternative is for you.

Start from scratch and develop your ideal page with Flexy entirely with your vision.

Clone Currently Existing Pages

Just include the LINK of the page you intend to clone ...

And also ta dah - in secs your page is duplicated with Flexy! Prepared to edit with just your voice -

And also include any one of Flexy's extremely innovative features to your freshly duplicated website.

Attribute # 2: 2 Choices For Quick and also Easy Editing

Totally free Type Setting

Permits you to drag your element to any type of placement as well as modify the means you like.

Block Mode

Allows you to build web pages utilizing rows as well as columns to permit material to be responsive on all tools. Function # 3: Flexy Will Inform You Your Conversion Future

Simply Visualize If You Might Tell Exactly what Your Conversions Were Mosting likely to Be ... Without Having To Waste Real Website traffic On It ...

With a Stunning 91% + Precision!

Flexy is your conversion crystal ball.

Flex permits you to see right into the future without needing to lose any of your genuine web traffic -

Our ConverMetric AI will certainly send out from 50 to 500 online site visitors (you selected the amount!) to your page -

Who will smartly involve and scroll similar to real customers.

Our ConverMetric has actually been trained to tape-record data and flow of the page and also automatically compares it to web pages that continually convert highly.

It gives you an involvement rating, a bounce price, conversion price, user retention price and more ...

With 91% - 95% precision!

As well as suggests particularly just how you can enhance your conversions Attribute # 4: Make Your Site visitors Promptly Feel At Home With Automatic Smart Personalization.

Since the success of products like SmartVideo - we all recognize the interaction rising power of web page personalization.

Involving with your possibility on an individual degree could enhance your click with prices by up to 985% (Forrester).

So simply you wait to see how many percent points your conversions go up by when you visitors see their home city stated right there for them.

( And also remember, this is all done instantly for you - you do not even need to lift a finger!).

Your visitors could see a video clip or image particular to their region - And also this is all done automatically for you.

You do not also need to lift a finger.

Feature # 5: Be Imaginative In No Time In any way And also Get Perfect Results.

Flexy Review can also take some of those difficult fiddly decision making procedures off your hands ...

Since it's so quick and also very easy to get Flexy to try a new colour or put a brand-new photo ...

You can attempt as numerous alternatives as you like in less than half the moment it would certainly take you manually ...

As well as you could be certain you're getting the most effective feasible feel and look for your web page. Be completely imaginative - in a split second - and with just a couple of words! Attribute # 6: Always Get That Perfect Picture Specifically Where You Need It With Flexy's Smart Picture Picker.

Currently, (unless you actually intend to), there is not any have to um and also ah over that killer image to put on your web page.

Just chose a category or search phrase and state "Flexy, your choice" ...

And also Flexy will immediately choose for you the excellent picture that will fit great on 'that area' on your web page -.

Flexy keeps track of the dimensions, colours and even more of you web page in order to help you make best choices without the stress ...

And help you set off the ideal feeling to shut your clients every single time.

Function # 7: Flexy's Exclusive Storytelling 3D Characters Boost Your Engagement.

People like paying attention. Numerous individuals lean in the direction of auditory info rather than reviewing it.

( Think about the rise of audio publications!).

With Flexy - not only are you standing up impressive 3D avatars that will certainly invite and also greet your site visitors to your web page ...

They LIKEWISE precisely read out your web pages for you.

Utilizing Flexy's duplicate analysis 3D characters can enhance your engagement by as much as?%. Feature # 8: Instant language Translation To Over 100 Different Languages With Over 99% Accuracy.

Flexy Review is not only the most artificially smart page home builder ever created.

She's multi-lingual - An immediate language translator.

Actually, Flexy's AI has actually exceeded the typical human translation accuracy.( She's a clever woman!).

Once you've produced your web page -.

Your page gets quickly converted right into the languages of every one of the countries you have actually picked.

As well as it's 99% precise.

The language translation is automatic and also immediate.

Powered by the most recent neural network translator powered by Google - (So it's not like other engines that translate each word - as well as therefore obtain it incorrect).

This engine really reviews out the sentence prior to translating and also comes out with a 99% best translation.

https://www.mylinkspage.com/flexy-ai-review/

0 notes