#who will do industrial policy to increase the number of sales jobs?

Explore tagged Tumblr posts

Text

I had figured that these young men were in town for a convention or meeting—as a rule, groups of people wearing matching t-shirts tend to spend only a long weekend in New Orleans—until I saw them the next Sunday. They wore their same shirts, made reference to a coach having assigned them each their own workout plan. I got the sense that their entrepreneurial spirit had led them to the sort of scam that leads you to wear a shirt with a huge dollar sign on it alongside a number of similar young men willing to wear that same shirt, the type of scam that encourages you to work out with and find community among your new colleagues, the type of scam that answers the two dominant questions posed by the young American man in 2024: what will make this mean something, and how can I get rich as quick as possible? [...] The internet feels more right wing now—it is more right wing—and it’s not crazy to think that this shift is what’s responsible for turning young men more conservative. But the turn is more toward, to borrow Max Read’s immortal phrasing, the Zynternet than it is Bronze Age Pervert, Curtis Yarvin, Nick Fuentes, Andrew Tate, or any among the miscellany of freaks that we have had to know about for what feels like forever now. What I’m trying to say is I don’t think that young men are irredeemable, or that they have been radicalized into an abyss of hatred and bigotry, although some have been and some are. I think young men have turned more conservative because “conservatism,” as it were, is the mode of politics that makes the most sense in Scam America, and these young men are the Scam Generation.

Sometimes think about how the masculine jobs are "strong man hitting things with hammer" and "sales", and people discussing the fall of manufacturing jobs and masculine industrial policy don't seem to talk about sales, tends to get skipped over in economics, sociology, and policy discussions in general.

18 notes

·

View notes

Text

Career Kickoff: Essential Job Roles for Young Graduates Ready to Excel

Graduating from college marks the start of an exciting new chapter in your life. But with so many career paths to choose from, how do you find the right role to kick off your professional journey? As a young graduate, you want a job that not only aligns with your skills but also offers room for growth. Here are some essential job roles that are perfect for graduates eager to excel in their careers.

Check This Page: Course Training and Assessment

1. Software Developer

For graduates with a degree in computer science or a related field, a career as a Software Developer is one of the most rewarding options. Developers are responsible for designing, coding, and testing software applications. With technology continuing to evolve rapidly, there is a constant need for talented developers in various industries.

Why It’s Great: The tech industry is booming, offering high-paying salaries, flexible work environments, and opportunities for career advancement. Developers can specialize in fields like artificial intelligence, mobile app development, or cybersecurity, all of which offer growing demand.

2. Marketing Specialist

A Marketing Specialist role is ideal for graduates who are creative and have a passion for brand building. In this position, you’ll help develop marketing campaigns, analyze market trends, and improve customer engagement. The digital landscape continues to change, making this an exciting time to get involved in marketing.

Checkout This Page: How to Prepare for a Job Interview

Why It’s Great: Marketing offers diverse career paths, from social media management to SEO and content marketing. It’s a field that allows you to combine creativity with data-driven strategies, and there’s always room for innovation.

3. Sales Representative

For graduates who enjoy working with people and have a natural ability to persuade, a Sales Representative role can be a fantastic starting point. Sales reps are responsible for identifying potential clients, building relationships, and driving revenue for businesses.

Why It’s Great: Sales positions often come with performance-based incentives, meaning you can increase your earnings based on results. As you gain experience, you can move up into account management or sales leadership positions.

4. Data Analyst

If you’re analytical and enjoy working with numbers, becoming a Data Analyst could be a great career choice. Data analysts help businesses make informed decisions by collecting and interpreting data. With more companies relying on data to shape strategies, this role is in high demand.

Why It’s Great: Data analysts enjoy strong job security and have numerous opportunities to advance into more specialized roles like data scientist or business intelligence analyst, especially as they gain experience and learn new tools.

Related Page: Career Path Planning

5. Human Resources Assistant

For graduates who have strong organizational skills and enjoy working with people, a role as an HR Assistant can be a great entry point. HR professionals help with recruitment, onboarding, employee relations, and maintaining a positive company culture.

Why It’s Great: HR offers plenty of career progression opportunities. As you gain experience, you can move into roles like HR coordinator, recruiter, or HR manager, helping shape company policies and employee engagement strategies.

Conclusion

Your first job after graduation is an important step in building your career. By choosing a role that aligns with your interests and strengths, you can set yourself up for success. Whether you’re interested in tech, marketing, sales, data, or HR, there are exciting opportunities for young graduates to grow, learn, and thrive.

Related Post: How to improve Career Development

#FreshGrad#CareerOpportunities#JobRoles#SoftwareDeveloper#MarketingCoordinator#SalesCareer#DataAnalyst#HRJobs#CareerGrowth

0 notes

Text

Master the Hidden Secrets Behind USD/CHF & Wage Growth Correlation Navigating the Wage Labyrinth: USD/CHF Secrets Revealed Ever wonder why your trade on the USD/CHF pair fell apart like an IKEA bookshelf assembled without instructions? Well, you might have ignored the quiet, unassuming influence of wage growth—a data point as overlooked as that weird cousin at family reunions. Today, we're digging into how wage growth can impact the value of the US dollar against the Swiss franc. This isn't your typical "stale data equals boring market movement" guide. Nope, it's a behind-the-scenes look at how you can leverage underground trends and ride a wave of wage insights all the way to Forex profit. Let's get into some ninja tactics and uncover the secrets behind wage growth and the USD/CHF currency pair. Why Wage Growth Matters for USD/CHF: A Story of Two Different Worlds If you think wage growth is just for economists who love data as much as we love coffee, think again. Wage growth directly influences inflation, which then drives central bank policies. It's like the domino effect—one wage bump and boom! Rates are affected, currencies fluctuate, and traders either celebrate or stare into the abyss of their P&L. For the USD/CHF pair, the relationship is pretty much a Swiss watch in terms of precision. Switzerland’s economy relies heavily on exports, which means that changes in purchasing power or interest rates in the U.S. have a ripple effect. For example, when wage growth is on the rise in the U.S., inflation tends to increase, pushing the Fed to hike interest rates. This leads to a stronger dollar, making it pricier against the safe-haven Swiss franc. But here's the real kicker: wage growth figures often arrive before major inflation data is published. So, while the masses are waiting for inflation stats, you, my sharp-witted reader, already have the lead by focusing on wage growth numbers. It's like knowing the punchline of a joke before your competition gets the setup—and trust me, the joke's on them. Wage Whispering for Better Timing Forget indicators that everyone and their aunt uses—MACD, RSI, the works. Let’s talk about wage growth data. More specifically, how you can whisper into the ears of wage reports to give yourself an edge. The U.S. Average Hourly Earnings report can be your best buddy. Released monthly alongside non-farm payroll (NFP) data, it's usually overshadowed by the hype of jobs added. But pay attention to wages. Rising wages? You can bet the Fed will see inflation risks, and USD will flex its muscles. Here’s a tip: Start watching how the market reacts around these releases. If wages grow faster than expected, USD usually rallies against CHF. And if wages miss, expect the franc to shine, with traders running to the safety of Switzerland. It's like the difference between watching your portfolio grow like a houseplant versus watching a soufflé collapse in a cooking disaster show. Contrarian Secret: Traders typically look at wage growth at face value, but you can dig deeper. Look for trends within sectors—when wage growth in industries like technology or construction outpaces expectations, it hints at economic health beyond mere headline data. Play this angle with your USD/CHF trades and watch how precision outplays volume. Swiss Stability vs. US Uncertainty: What to Do When the Market Overreacts Switzerland loves stability. They love chocolate, cows, and a steady franc. When the U.S. economy is booming with robust wage growth, the Fed's interest rates rise, and the USD gets stronger, potentially causing an exaggerated dip in CHF. Here's where you come in—the trader ninja who knows how to take advantage of an overreaction. The Trap Most Traders Fall For: Many traders panic and go all-in on USD/CHF the moment wage data drops. It’s like grabbing every cake at a bakery sale—sure, it feels good, but do you really need all of that? Instead, use patience as your weapon. Wait for the market to settle from its initial knee-jerk reaction, and then assess whether the wage data truly supports a trend reversal. A lot of rookie traders get caught in the frenzy, but you can use this as your moment to step back, watch, and enter once the air clears. Wage-Based Swing Trading I know, swing trading can seem as intimidating as trying to explain quantum mechanics to a toddler, but hear me out. Wage growth is the perfect trigger for a swing trade strategy in USD/CHF. Here's how you can do it: - Watch for the Wage Data Release: The first Friday of every month, those wage numbers will drop alongside NFP. - Wait for the Overreaction: USD/CHF usually sees a volatile spike or dip right after. - Take the Contrarian Approach: Instead of chasing the spike, look for a reversal opportunity once the dust settles. Markets tend to overshoot, and with a pair like USD/CHF, a reversion to the mean is quite common. Swiss National Bank's Invisible Hand One aspect that’s not talked about enough is the influence of the Swiss National Bank (SNB) when it comes to wage data's impact on CHF. Wage growth news in the U.S. that strengthens USD can lead to interventions by the SNB to weaken the franc, as they aim to keep their exports competitive. It’s like a never-ending tug of war, and if you’re able to spot when SNB might step in, you could surf that wave—even before it forms. Look out for subtle signs—if USD surges on wage growth news and CHF falls dramatically, the SNB often steps in when the franc gets "too strong." They won't announce it on Twitter, but you can see it in price action. Recognize the patterns of intervention, and you'll know when to catch or avoid falling knives. The Great Wage-CHF Pivotal Moment In April 2023, when U.S. wage growth spiked unexpectedly, the USD rallied hard against CHF. Everyone and their dog jumped on the USD/CHF long trades, thinking they were about to print money. But the SNB stepped in subtly—by Friday evening, the Swiss franc reversed and ended the week stronger than expected. Traders who understood the nuances between wage growth and SNB intervention knew better than to stick around for the aftermath. Lesson Learned: Be the trader who doesn't just look at wage growth in isolation—understand how different players (like SNB) react to this data. Stay Ahead with Wage Growth and USD/CHF It's easy to fall into the trap of focusing on just "the big numbers" that everyone else follows—inflation, GDP, interest rates. But the real game-changer? Wage growth. Treat it like the front line in the battle of economic indicators, with central bank actions as the cavalry coming in after. And if you want to stay ahead, you need the right tools, data, and community. At StarseedFX, we offer in-depth Forex courses, live alerts, and exclusive tools designed to help you navigate these subtle yet powerful trends like a pro. Take Action Today Ready to step up your trading game with these elite strategies? Check out our Free Forex Courses and Community Membership at StarseedFX, where we offer expert analysis, insider tips, and disruptive innovations to keep you ahead of the curve. Remember, trading is a journey. Wage growth might just be your secret weapon, one that can turn a losing trade into a winning streak—as long as you know how to read the signals and avoid the overhyped, overly simplified noise. Until next time, keep trading smart and never be afraid to dig deeper. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

QWERTY

If I have seen further, it is by standing on the shoulders of giants. Isaac Newton, 1675

A new Industrial Revolution signposted a divergence from sooty factory floors to the sterilized ateliers of semiconductors in the wake of the space program. The Rube Goldberg machines of bulky proportions from yesteryear diminished into relics in the face of digital infrastructure when such analogue computing fell into disrepute. As prices for microchips descended down the cost curve the technology’s omnipresence signalled the economy’s new currency would be data over tangible goods. Indeed Apollo’s industrial policy altered the value proposition of microchips triggering great disruption in traditional manufacturing which was later besieged by a flight of capital. An existential crisis would see the Midwest bear scars of decline as steel mills shuttered when computers supplanted manpower. Although a raft of fissures did predate the demise of steelworkers prior to the digital bonanza in virtue of global competition much of this quiet revolution made blue-collar workers redundant. Intangible assets like software and intellectual property were the new darlings of the knowledge economy as the steel heartland of America’s industrial belt haemorrhaged jobs. It was a fait accompli that bits and bytes would replace steel and coal upon Apollo’s adoption of microelectronics in its bid to land on the Moon.

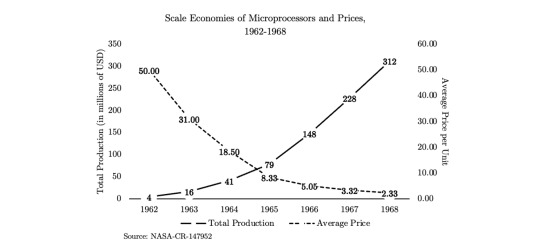

Not only was the semiconductor industry’s growth intimately linked to the space program but so too was the computer empire that followed suit. By 1968 the average price of the most basic microchip nosedived to $2.33 whose cost efficiencies bootstrapped downstream firms like Apple and Microsoft. Government procurement subsidized the technology to the point where its affordability vaulted a proliferation in the commercial sector. In an atavism to when Washington dumped its surplus planes from WWI at bargain prices onto a market of hobbyists the computer industry’s chronology bears an uncanny resemblance. Early adopters of cheap microchips partook of a subculture where enthusiasts in garages soldered kits of disparate parts. When these electronic evangelists congregated in the Homebrew Computer Club whose alumni included Steve Wozniak and Steve Jobs a whole marketplace of schematics and software came to fruition. This iconoclasm of open-source sharing in short order disrupted IBM’s corporate monopoly. The user-friendly Apple II and Tandy’s TRS-80 then democratized the industry for the layperson with grassroots computing. In a mere two years the sales of the former crested from $7.8m in 1978 to $117m in 1980 (Hynes 2021). Manifestly Apollo’s technology trickled down into personal computers.

Whilst Apple graduated into a household name Microsoft was not too far behind. A software boom occurred in lockstep with the groundswell of computers just as hardware prices plummeted. In a clone of Apple’s duo the fountainheads Bill Gates and Paul Allen collaborated to author the MS-Dos operating system that was standardized across the industry. What differentiated Microsoft was the longer time horizon of its business model. Licensing software to multiple buyers rather than one lucrative payout from a single source ended the operating system war even before it began. Whereas exclusivity begot great value it was ubiquity that monopolized marketshare. As more manufactures signed on to host MS-Dos the greater was the number of software developers who gravitated towards tailoring their programs to this specific platform. A self-perpetuating cycle emerged. Third-party developers elected to target the market’s largest segment populated by MS-Dos computers whereby its growing utility saw Microsoft boast increasing returns to scale as more consumers fancied the product. Much like moths to a flame the herd behaviour of users generated rapid adoption when popularity equated with the endorsement of the software. In retrospect the philosophy of ubiquity over exclusivity proved correct.

As markets reacted to Apollo’s demand for integrated circuits with lower prices per unit over time the seeds of industrial policy germinated into another organic outgrowth. Not only were computers mass produced but the network they plied to interface with each other derived from this wellspring as well. The creation of the Internet vindicates just how much space exploration was not at all a sunk cost but rather the paragon of shrewd investment. The cascading effect was aplenty. As more institutions and households adopted computers in a positive feedback loop the greater was the need for a decentralized method of communication between these monuments to reason. Crowdsourcing information would be a fillip to research whereby the Internet’s prototype first liaised the Universities of California, Stanford, Santa Barbara and Utah with each other. Under the government’s Defence Advanced Research Projects Agency and its eponymous network the ARPANET computers were interlinked in the first of its kind by 1969 at the cost of $1m in R&D (Lukasik 2010). As chip designs and manufacturing techniques catered to NASA the knock-on effects gave prominence to cyberspace. The Internet’s genealogy thus can be traced to the law of unintended consequences wherein Apollo was the chief protagonist.

The very essence of industrial policy is to plant seeds. Create a market where none existed and once it has matured no longer is it needed for government to cosplay a gatekeeper. Being this silent benefactor was how the Internet evolved into the lingua franca of the knowledge economy. The seed money from NASA’s procurement that subsidized the semiconductor industry was what staged the advent of the Digital Age. It is not reductionist to posit how the moonshot ushered in a whole new paradigm from manufacturing to curating information whose progenitor was the Saturn V rocket. The true genius of public funds into this program was not to so much a footprint on the lunar surface as much as it was the boom in technology. Once microelectronics diffused into a constellation of industries they quickly became household mainstays in a virtuous cycle where early adopters mainstreamed their use. Were it not for Apollo it is reasonable to assume the trajectory of microprocessors would have been abjectly impaired. The technology might have been buried in the graveyard next to inventor Nikola Tesla’s Wardenclyffe Tower whose wireless power found no demand nor immediate application for its use. Once the viability of microprocessors was proven courtesy of public dollars the buccaneers like Intel summarily refined these tiny slivers of silicon for profit.

0 notes

Text

San Antonio, Tx Real Estate & Homes For Sale Re

It is your accountability to independently verify the data on the site. Rest assured that your children are receiving a quality training with excellent faculty districts. CENTURY 21®, the CENTURY 21 Logo and C21® are service marks owned by Century 21 Real Estate LLC. Century 21 Real Estate LLC fully helps the rules of the Fair Housing Act and the Equal Opportunity Act. Listing information new home builders san antonio is deemed dependable however not guaranteed correct. Get Knock Certified for free and you may provide your purchasers these game-changing options at present. Our rent prices are sometimes less than the value of a mortgage, and most upkeep is free.

These legislative pointers enable residents to rollback or restrict any will increase within the tax price. As a taxpayer, you would possibly be strongly inspired to attend a number of of these hearings. MHVillage limits access to private information about you to staff who MHVillage believes need to come back into contact with that data to supply products or services to you or to be able to do their jobs. Brackingridge Park and Natural Bridge Caverns are two spots worthy of your time. San Antonio eating places convey the flavors together with Tex-Mex, nice dining, seafood and quite lots of ethnic fare. While San Antonio is a sizeable metropolis it comes with a pleasant demeanor, appeal and facilities homes for sale san antonio making it a well-liked place to quiet down. Give this Texas treasure some severe consideration for its nice new home developments. You can also create and save a custom home search by clicking the "Save this Search" button and register for a free account.

Discover your place on a devoted staff that feels like family, seek to grow with new alternatives, and make a difference within the lives of others. We provide easy accessibility to opportunities you wouldn’t have in any other case. We also work behind the scenes to eliminate home builders in san antonio issues, ship a marketable title and provide a fast, seamless course of to shut. I acknowledge that I even have learn and comply with the Terms of Use and Privacy Policy. We have the industry’s largest, most diverse assortment of unique business actual estate listings.

The result is thriving communities which are certain to face the take a look at of time. Welcome to the San Antonio, a house with an open central gathering house and break up dwelling quarters. The front entrance leads directly into the household room, which is overlooked by the kitchen’s open counter and consuming bar. The kitchen additionally contains homes for sale san antonio tx a walk-in pantry, and has a utility closet with house for a washer and dryer near the rear exit. A master bedroom with a big walk-in closet and a big selection of customization choices occupies one facet of the house. Two bedrooms and a full toilet full the structure on the alternative side.

Our model homes favor modern themes and embody unbelievable base-price features like a coated out of doors dwelling area and energy-efficient parts. Use our mortgage calculatorto see how much it might be to finance a house in San Antonio. Jade Oliverio, an actual property agent with Howard Hanna Rand Realty, noticed major increases in costs and multiple provides on nearly each home new homes san antonio through the pandemic, however that’s beginning to slow down. Renderings, photos, square footages, ground plans, features, and colors are approximate for illustration purposes only. Nothing on our website must be construed as authorized, accounting or tax recommendation. Incentives and vendor contributions might require using certain independent lenders or title corporations.

0 notes

Text

Monopoly so fragile

A big boat stuck in the Suez Canal, catastrophically disrupting global logistics - it wasn't just predictable, it was inevitable. For decades, the shipping industry has consolidated into just a few companies, and ships got bigger - too big to sail.

As Matthew Stoller points out, in 2000 the ten biggest shippers controlled 12% of the market, today, it's more that 82%, and even that number is misleadingly rosy because of alliances among the megashippers that effectively turn them into one company.

https://mattstoller.substack.com/p/what-we-can-learn-from-a-big-boat

The Suez crisis illustrates one of the less-appreciated harms of monopoly: all of us are dunderheads at least some of the time. When a single person wields a lot of unchecked power, their follies, errors and blind-spots take on global consequence.

The "efficiencies" of the new class of megaships - the Ever Given weighs 220 kilotons and is as long as the Empire State Building - were always offset by risks, such as the risk of getting stuck in a canal or harbor.

Despite this, a handful of executives were able to green-light their deployment. Either these execs didn't believe the experts, or they didn't care (maybe they thought they'd retire before the crisis) or they thought they could externalize the costs onto the rest of us.

Running a complex system is a game of risk mitigation: not just making a system that works as well as possible, but also making one that fails as well as possible. Build the Titanic if you must, but for the love of God, make sure it has enough life-boats.

Monopolies are brittle. The ideology that underpins them is fundamentally eugenic: that there exists among us superbeings, genetic sports who were born with the extraordinary insights and genius that entitle them to rule over the rest of us.

If we let nature run its course, these benevolent dictators will usher in an era of global prosperity.

This is catastrophically, idiotically, manifestly wrong. First, even people who are very smart about some things are very stupid about other things.

Charles Koch took over his father's hydrocarbon empire and correctly concluded that the industry was being held back by a focus on short-term profits. He made a series of long-term bets on new production technologies and grew the business a thousandfold.

Being patient and farsighted made Koch one of the richest people in world history - and one of the most influential. He pioneered a kind of slow, patient policy entrepreneurship, investing in a network of think-tanks that mainstreamed his extremist ideology over decades.

And yet, this man who became a billionaire and changed the character of global politics with his foresight has managed to convince himself that there is no climate emergency. That patience, foresight, and cool weighing of probabilities have gone out the window completely.

Smart people are often fools (so are regular people). History is full of them. Take William Shockley, the Nobel-winning inventor of silicon transistors who failed in industry because he became obsessed with eugenics and devoted his life to a racist sterilization campaign.

Moreover, fools sometimes succeed. Take Mark Zuckerberg, who justified his self-serving "real names" policy (which makes it easier to target ads by banning pseudonyms) by claiming that any attempt to present yourself in different ways to different people is "two-faced."

That is a genuinely idiotic thing to believe: presenting yourself differently to your lover, your parents, your toddler, your boss and your friends isn't "two-faced," it's human. To do otherwise would be monstrous.

But even when monopolists aren't idiots, they are still dangerous. The problem with Zuck isn't merely that he's uniquely unsuited to being the unaccountable czar of 2.6 billion peoples' social lives - it's that no one should have that job.

Monopolists all have their own cherished idiocies (as do the rest of us), but they share a common pathology: the ideology, popularized by Thomas Friedman and others, that "efficiency" is the highest virtue.

The whole basis for 40 years of tolerating (even encouraging) monopolies is the efficiencies of scale that come from consolidating power into a few hands, and the shared interests that arise from a brittle interdependence.

Who would go to war with the trading partner that controls the world's supply of some essential item?

This was always, predictably, a system that would work well but fail badly. Clustering the world's semiconductor production in Taiwan made chips cheap and plentiful, sure.

But then the 1999 Taiwan quake shut down all the world's computer sales. There are plenty of examples like this that Stoller lists: a single vaccine factory in England shuts down in 2004 and the US loses half of its flu vaccines.

Despite the increasing tempo of supply-chain crises that ripple out across the world, we have allowed monopolists to "take the fat out of the system at every joint," setting up a thousand crises among us and yet to come.

Bedding makers can't make mattress for want of foam. RV manufacturers can't get enough "air conditioners, fridges, furniture" to meet orders. Often, the pivotal items are obscure and utterly critical, like the $1 "flat steel form ties," without which home construction halts.

"For the want of a nail, the shoe was lost." We've understood that tightly coupled systems have cascading failures since the 13th century. "Resiliency" is inefficient - but only if you ignore what happens when brittle systems fail.

Every monopolist *necessarily* shares an ideology that elevates brittleness to a virtue. They must, because monopolies are brittle. One foolish mistake, one ship wedged in a canal, one delusive denial of climate change, and we all suffer.

Every monopolist believes in their own infallibility. They must, because to have someone as fallible as me or you in charge of the world's social media or shipping or flat steel ties is otherwise a recipe for disaster.

Of all the dangerous things monopolists are wrong about, this belief in their own inability to be wrong is the most dangerous.

Image: Copernicus Sentinel (modified) https://commons.wikimedia.org/wiki/File:Container_Ship_%27Ever_Given%27_stuck_in_the_Suez_Canal,_Egypt_-_March_24th,_2021_cropped.jpg

CC BY: https://creativecommons.org/licenses/by/2.0/deed.en

99 notes

·

View notes

Link

LETTERS FROM AN AMERICAN

July 23, 2021

Heather Cox Richardson

On July 20, 1969, American astronauts Neil Armstrong and Edwin “Buzz” Aldrin became the first humans ever to land, and then to walk, on the moon.

They were part of the Apollo program, designed to put an American man on the moon. Their spacecraft launched on July 16 and landed back on Earth in the Pacific Ocean July 24, giving them eight days in space, three of them orbiting the moon 30 times. Armstrong and Aldrin spent almost 22 hours on the moon’s surface, where they collected soil and rock samples and set up scientific equipment, while the pilot of the command module, Michael Collins, kept the module on course above them.

The American space program that created the Apollo 11 spaceflight grew out of the Cold War. The year after the Soviet Union launched an artificial satellite in 1957, Congress created the National Aeronautics and Space Administration (NASA) to demonstrate American superiority by sending a man into space. In 1961, President John F. Kennedy moved the goalposts, challenging the country to put a man on the moon and bring him safely back to earth again. He told Congress: “No single space project in this period will be more impressive to mankind, or more important for the long-range exploration of space; and none will be so difficult or expensive to accomplish.”

A year later, in a famous speech at Rice University in Texas, Kennedy tied space exploration to America’s traditional willingness to attempt great things. “Those who came before us made certain that this country rode the first waves of the industrial revolutions, the first waves of modern invention, and the first wave of nuclear power, and this generation does not intend to founder in the backwash of the coming age of space. We mean to be a part of it—we mean to lead it,” he said.

[T]here is new knowledge to be gained, and new rights to be won, and they must be won and used for the progress of all people…. We choose to go to the moon in this decade and do the other things, not because they are easy, but because they are hard, because that goal will serve to organize and measure the best of our energies and skills….”

But the benefits to the country would not only be psychological, he said. “The growth of our science and education will be enriched by new knowledge of our universe and environment, by new techniques of learning and mapping and observation, by new tools and computers for industry, medicine, the home as well as the school.” The effort would create “a great number of new companies, and tens of thousands of new jobs…new demands in investment and skilled personnel,” as the government invested billions in it.

“To be sure, all this costs us all a good deal of money…. I realize that this is in some measure an act of faith and vision, for we do not now know what benefits await us.”

Seven years later, people across the country gathered around television sets to watch Armstrong step onto the moon and to hear his famous words: “That's one small step for [a] man, one giant leap for mankind.”

President Richard Nixon called the astronauts from the White House: “I just can't tell you how proud we all are of what you have done,” he said. “For every American, this has to be the proudest day of our lives…. Because of what you have done, the heavens have become a part of man's world…. For one priceless moment in the whole history of man, all the people on this Earth are truly one…in their pride in what you have done, and…in our prayers that you will return safely to Earth.”

And yet, by the time Armstrong and Aldrin were stepping onto the moon in a grand symbol of the success of the nation’s moon shot, Americans back on earth were turning against each other. Movement conservatives who hated post–World War II business regulation, taxation, and civil rights demanded smaller government and championed the idea of individualism, while those opposed to the war in Vietnam increasingly distrusted the government.

After May 4, 1970, when the shooting of college students at Kent State University in Ohio badly weakened Nixon’s support, he began to rally supporters to his side with what his vice president, Spiro Agnew, called “positive polarization.” They characterized those who opposed the administration as anti-American layabouts who simply wanted a handout from the government. The idea that Americans could come together to construct a daring new future ran aground on the idea that anti-war protesters, people of color, and women were draining hardworking taxpayers of their hard-earned money.

Ten years later, former actor and governor of California Ronald Reagan won the White House by promising to defend white taxpayers from people like the “welfare queen,” who, he said, “has 80 names, 30 addresses, 12 Social Security cards and is collecting veteran’s benefits on four non-existing deceased husbands.” Reagan promised to champion individual Americans, getting government, and the taxes it swallowed, off people’s backs.

“In this present crisis, government is not the solution to our problem; government is the problem,” Reagan said in his Inaugural Address. Americans increasingly turned away from the post–World War II teamwork and solidarity that had made the Apollo program a success, and instead focused on liberating individual men to climb upward on their own terms, unhampered by regulation or taxes.

This week, on July 20, 2021, 52 years to the day after Armstrong and Aldrin stepped onto the moon, former Amazon CEO Jeff Bezos and four passengers spent 11 minutes in the air, three of them more than 62 miles above the earth, where many scientists say space starts. For those three minutes, they were weightless. And then the pilotless spaceship returned to Earth.

Traveling with Bezos were his brother, Mark; 82-year-old Wally Funk, a woman who trained to be an astronaut in the 1960s but was never permitted to go to space; and 18-year-old Oliver Daemen from the Netherlands, whose father paid something under $28 million for the seat.

Bezos’s goal, he says, is not simply to launch space tourism, but also to spread humans to other planets in order to grow beyond the resource limits on earth. The solar system can easily support a trillion humans,” Bezos has said. “We would have a thousand Einsteins and a thousand Mozarts and unlimited—for all practical purposes—resources and solar power and so on. That's the world that I want my great-grandchildren's great-grandchildren to live in.”

Ariane Cornell, astronaut-sales director of Bezos’s space company Blue Origin, live-streamed the event, telling the audience that the launch “represents a number of firsts.” It was “[t]he first time a privately funded spaceflight vehicle has launched private citizens to space from a private launch site and private range down here in Texas. It’s also a giant first step towards our vision to have millions of people living and working in space.”

In 2021, Bezos paid $973 million in taxes on $4.22 billion in income while his wealth increased by $99 billion, making his true tax rate 0.98%. After his trip into the sky, he told reporters: “I want to thank every Amazon employee and every Amazon customer because you guys paid for all of this…. Seriously, for every Amazon customer out there and every Amazon employee, thank you from the bottom of my heart very much. It’s very appreciated.”

—-

Notes:

https://www.businessinsider.com/jeff-bezos-space-flight-passenger-revealed-wally-funk-2021-7

https://www.businessinsider.com/blue-origin-auction-spacecraft-jeff-bezos-winner-seat-astronaut-2021-6

https://www.businessinsider.com/jeff-bezos-launches-to-space-blue-origin-first-human-spaceflight-2021-7

https://www.washingtonpost.com/business/2021/06/08/wealthy-irs-taxes/

https://www.businessinsider.com/jeff-bezos-thanks-amazon-customers-for-paying-trip-to-space-2021-7

Share

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

[From comments: “When you’ve been able to amass your money by not paying your fair share of taxes, your “privately funded” venture is a diversion of rightfully public funds. This new space race is publicly funded, but absent public controls and alignment. Socialize the expenses, privatize the profits.”

“After May 4, 1970, when the shooting of college students at Kent State University in Ohio badly weakened Nixon’s support, he began to rally supporters to his side with what his vice president, Spiro Agnew, called “positive polarization."Combined with the unsubtle racism of Nixon's Southern Strategy, thus began the decades long Republican policy of dividing Americans against each other that has led us to what we have today; two Americas that reside in different universes, and our national wealth controlled by a handful of unelected, supremely, in some cases psychotically, self-centered white men.Jeff Bezos could not have existed in Kennedy's America. We must make that so again.”

#political#polarity#division#greed#Heather Cox Richardson#history#space race#common good#Letters From An American#wealth inequality#fair share

7 notes

·

View notes

Text

The economy – what is it good for?

Politics is neither unaware, nor corrupt, nor conflict averse, when it fosters economic growth at people’s and nature’s expense. States rely upon capitalist production as a historically unparalleled source of power. No mode of production has ever granted so much wealth to a rule, allowing this rule to fulfill its aims. From the job centre to universities and the car registration offices: the state uses tax returns to keep society going – and thereby also to keep money making going. For this to work well and efficiently, states make sure that companies have access to enough reliable and cheap energy sources, whilst also ensuring that companies may use the whole world as a marketplace. Think about Germany with its rather successful car industry, selling its cars worldwide.

Other states have the same interest for their own economy. In the competition between states, every single one tries to subordinate others: when negotiating trade agreements, each one tries to gain as many advantages for their own economy as possible. Thereby, each state makes itself a means for its capitalist economy. It does so because with a strong economy, the political power of the state increases as well. The economic success of its companies is the state's decisive power tool in the competition between states for supremacy and subordination, i.e. in order for the state to assert itself against others. (This is why economic powerful states are usually the ones who rule the world). And vice-versa: a states' success in this competition is the basis for its national companies to strive globally.

Environmental protection – what’s the value of waste?

It is commonly noted that this economic system drastically damages the environment. Increasing numbers of dying people or areas of land that can no longer be used are expressed as a financial burden to the national economy. While companies use people as well as the environment as free resources, the state takes measures to ensure that these assets remain available for its and the economy’s use – that is why the state makes social and environmental policies in the first place.

But the state encounters a problem here: these policies are costly, they constitute “a burden on the economy” and they obstruct some profitable business opportunities – e.g. the ban on (unconventional) fracking in Germany. Hence, the question is on the table, whether the state can allow itself to implement policies that may restrict the economy Sometimes, as a result, the government does nothing regarding the protection of the environment. Instead, damages are either denied or played down in public. When the state does take environmental measures, it does so in a particular way: companies are given as much time as possible in order to adapt to the new requirements at the lowest cost possible. With time, some thresholds or limits might be defined and pollution might be given a price – through emission trading or a CO2 tax.

Climate policy – how much does the world cost?

When the governments of the world meet to do something about climate change, they are usually in disagreement. Firstly, states have fundamentally different positions with regards to how urgently action is required. This is because they differ in the levels of global warming which they find acceptable. For many small island states, a global temperature increase of 1.5 degrees celsius is too much. For countries like Russia, a 2 degree temperature increase may come with some hoped-for advantages. Countries are affected very differently by the consequences of climate change.2

Secondly, states follow different strategies for climate protection, which often contradict or hinder each other. This is because states may be very eager to follow some measures to protect the climate, whilst being reluctant to pursue other proposals. This mainly depends on how their national economy may benefit. For most industrialised states, depending on other countries for oil and gas has long been an annoying side effect of their energy policy. For these states, energy from sources other than oil and gas is very interesting – and that is for reasons completely unrelated to climate policy. Some governments strive to support and develop renewable energy sources in order to establish an independent energy provision for their national economies. The more independent from foreign energy providers a state becomes, the better it can bargain with supplier countries for lower oil and gas prices.

Once a new industry emerges from these deliberations, the economic consideration immediately kicks in, seeking to make it a winner in the export market. For instance, the German government until 2012 tried to do its part to support its nationally successful solar engineering to expand. However, Chinese solar technology proved to be more competitive. Thus, German solar energy manufacturing was no longer subsidised by the state. States gaining most of their income from gas and oil and transit countries for raw material are obviously in strong opposition to the new energy policies of the industrialised part of the world. Other states see an opportunity to at least gain a bit of rent from capitalist powers and their entrepreneurs by providing large areas of land for biomass and solar fields.

If a national economy has key industries – such as the car industry in Germany – then any measures, economic or otherwise, that might endanger said industry will be opposed. That’s why, for example, different German governments from left to right have repeatedly rejected any of France’s suggestions for further climate protection measures. The reaction was much different when the German car industry’s pole position was contested: for example when China took advantage of climate issues, adaptingits national electric car standards in order to help finally set up a car company with global outreach. One of the biggest German car companies, Volkswagen, did not want to lag behind – sales opportunities in China and beyond being too promising. The German government was also on board, for instance by accelerating the expansion of charging stations for electric cars.

Conclusion – Heading into climate crisis with climate policy?

This is how climate policy works and continues to work. Measures that are disadvantageous for a state’s national economy are simply avoided. Measures that contribute to its national economy, for example by opening up sales opportunities for its own “green” global market winners, are promoted. As always, technological progress is considered a means for further capitalist growth. Firstly, it is a means for the global dissemination of domestic products. Secondly, the hope is to come up with more innovations in the future: If some future invention “made in Germany” could attenuate or even prevent climate change or its consequences, any other difficult decision – like how strictly emissions should be limited – would be superfluous.

The German chancellor, Angela Merkel, addresses all this, when she praises the climate protests for their honorable intentions, whilst also pointing out that “many things” need to be accounted for. “We must reconcile jobs and economic power with the goals of climate protection.” One should not expect much else if the Green party were to take over: In his role as minister of the environment, Jürgen Trittin (Green party) was a revelation. Instead of the envisioned short-term phasing-out of nuclear energy, a decades-long guarantee for safe profits prior to the phasing-out was given to the operators. This, as well as rejecting French proposals for further climate goals, shows that the Green Party also keeps the interests of the national economy very much in mind.

So there is climate policy – and this is how it works in national capitalist economies. It is unlikely to avoid any tipping points. Thus, an environmental movement that turns to politics is mistaken and ineffective. Maybe climate policy will succeed in reducing damaging emissions. This is not very likely, though. And even if it does, it will come with all the side effects of modern politics described above. Thus, it is now the time to oppose the purposes and objectives of this political and economic system. Urging those with more political and economic power to “please try harder” is completely out of place.

- “Climate Policy – even worse than its reputation”, Gruppen gegen Kapital und Nation

7 notes

·

View notes

Text

Back Office Solutions - Business Process Outsourcing (BPO)

The back office solution is that the portion of a corporation made from administration and support personnel who aren't client-facing. Back-office functions include settlements, clearances, record maintenance, regulatory compliance, accounting, and IT services. for instance, a financial services firm is segmented into three parts: the front office (e.g., sales, marketing, and customer support), the center office (risk management), and therefore the back office (administrative and support services).

What is Back Office Solutions

The term Back office Solutions refers to any and everyone role within a corporation that enhances the customer experience without directly concerning it.

For example, photo editing, ecommerce support, data entry, online research, and other back office administration duties are all important tasks that modern businesses got to complete. Without them, customer bases wouldn't be ready to interact with their favorite organizations in the same ways they typically do.

But at an equivalent time, these tasks are behind-the-scenes tasks and should not actually be seen or felt by consumers. this is often what's meant by "back office."

The problem with back office support functions is that the significant amount of resources companies must spend on them. Fortunately, there is a solution. It's called Business Process Outsourcing and it's what we'll discuss within the next section.

What is Business Process Outsourcing?

Business process outsourcing (BPO) is that the practice of contracting a selected work process or processes to an external service provider. The services can include payroll, accounting, telemarketing, data recording, social media marketing, customer support, and more. BPO usually fills supplementary - as against core - business functions, with services that would be either technical or nontechnical.

From fledgling startups to massive Fortune 500 companies, businesses of all sizes outsource processes, and therefore the demand continues to grow, as new and innovative services are introduced and businesses seek advantages to urge before the competition. BPO is often an alternative to labor migration, allowing the labor pool to stay in their home country while contributing their skills abroad.

BPO is usually divided into two main sorts of services: back office and front office. Back office Solutions include internal business processes, like billing or purchasing. Front-office services pertain to the contracting company’s customers, like marketing and tech support. BPOs can combine these services in order that they work together, not independently.

The BPO industry is split into three categories, supported the situation of the seller.

A business is able to do total process optimization by combining the three categories:

1. Offshore vendors are located outside of the company’s own country. for instance, a U.S. company may use an offshore BPO vendor within the Philippines.

2. Nearshore vendors are located in countries that neighbor the contracting company’s country. for instance, within us, a BPO in Mexico is taken into account by a nearshore vendor.

3. Onshore vendors operate within an equivalent country because the contractor, although they'll be located in a different city or state. for instance, a corporation in Seattle, Washington, could use an onshore outsourcing vendor located in Seattle, Washington, or in Huntsville, Alabama.

Business Process Outsourcing Important?

The reason for companies to outsource their business processes is pretty simple. Business Process Outsourcing enables business owners to scale back the burden of labor and consider other core aspects of their operation. Outsourcing to a third-party company, which is already well-established and has the relevant experience in providing services, maybe a far more convenient option. Outsourcing your business processes comes with a series of benefits. a number of those include:

Cost Reduction: Outsourcing helps organizations cut costs and economize, and is one of the foremost important reasons for people opting to outsource their business process. BPO has given rise to a talented pool of employees available at low wages leads to huge cost reductions, which successively leads to better revenues for the corporate

Availability of Experienced Professionals: Recruiting new employees and training them involves tons of hassle and maybe a huge cost to the corporate. When the tasks are outsourced to an already established company with all the resources, the troubles of hiring and training is conveniently avoided

Ability to specialize in Core Business: Since a substantial chunk of the business is outsourced to a service provider, the highest management of the corporate can focus their attention on core operational areas. This also results in better employee productivity and helps them make better and more informed business decisions

Excellent Source of Customer Feedback: Most BPO employees are in direct contact with the purchasers, as a result of which they're ready to receive first-hand feedback about products and services. This valuable feedback, in turn, helps the corporate to enhance the services provided

Access to the newest Updated Technologies: Buying a licensed version of the newest software and other technologies is extremely expensive. This proposition is additionally risky, especially for little to medium-sized businesses who cannot afford to dedicate a gentle budget to purchasing the newest technologies. Therefore, it becomes difficult for a corporation to remain updated with the newest developments. Outsourcing to companies that have already got access to the technology and have the relevant expertise, therefore, proves to be more advantageous for global organizations

Excellent Employment Opportunity: The BPO industry is one of the very best job providers in most countries. In fact, it's ranked second in terms of the number of jobs created in a number of Asian countries. The remuneration provided to the workers is additionally one among the simplest within the industry, which is one of the main reasons for kids to figure in BPO. The BPO industry has provided employment to tons of talented youngsters and has single-handedly changed the GDP of varied small countries

Outsourcing Companies Support?

BPO providers now support a variety of services and help fill any gaps within companies. a number of the participating industries include healthcare, pharmaceuticals, energy, business services, E-commerce and Retails, telecom, Insurance, Healthcare, Real State Firms, automotive, utility companies, banking, supply chain, capacity solutions, and asset management. In fact, the expansion in BPOs has resulted in the emergence of subspecialties, including the following:

Information technology-enabled services (ITES) BPO: this type of BPO leverages information technology (IT) over the web or data network to deliver services. Some samples of ITES BPO jobs are service desk analysts, production support analysts, and IT analysts.

Knowledge process outsourcing (KPO): KPO has changed BPO a touch. Some KPO vendors support functions that are considered core in business, although they'll not be core functions within the particular business that hires them. KPO firms offer quite a process expertise; they'll also provide business and domain-based expertise. Some samples of KPO services include research, analysis, or Microsoft Word and Excel work. KPOs could also be capable of creating low-level business decisions if they are doing not conflict with higher-level business policies, but those decisions could also be undone easily. KPO vendors are usually linked to the business’s value chain, and that they hire people that are competent during a specific field.

Legal process outsourcing (LPO): LPO may be a subset of KPO and encompasses an enormous range of higher-level legal work, not merely lower-level legal transcription. LPO firms can draft patent applications and legal agreements, also as perform legal research. Some LPO firms even advise clients. In-house legal departments usually retain LPOs. Experienced paralegals using industry-standard databases do the work.

Research process outsourcing (RPO): A subset of KPO, RPO focuses on research and analysis functions. RPO companies perform research and analysis work that supports business, investment, biotech, and marketing firms.

Travel: This pertains to all or any operations a business must support its travel logistics, from reservations to hotel and vehicle bookings. Travel BPO saves money for the corporate because it cuts costs while increasing customer satisfaction. Airline and travel companies also engage in BPO for either front- or back-office process streamlining. for instance, an airline could outsource its ticketing process.

Each BPO company will concentrate on specific services. they'll be grouped as follows:

Customer interaction services: The BPO company would cover a business’s voicemail services, appointment schedules, email services, marketing program, telemarketing, surveys, payment processing, order processing, quality assurance, customer support, warranty administration, and other customer feedback.

Back-office transactions: This includes check, credit, and open-end credit processing; collection; receivables; direct and indirect procurement; transportation administration; logistics and dispatch; and warehouse management.

IT and software operations: These technical support functions include application development and testing, implementation services, and IT helpdesk. for instance, manual data entry are often replaced with automated data capture, increasing data intake and reducing cycle time.

Finance and accounting services: These functions include billing services, accounts payable, receivables, general accounting, auditing, and regulatory compliance.

Human resource outsourcing: BPOs can help address workforce challenges. they will also cover payroll services, healthcare administration, hiring and recruitment, workforce training, insurance processing, and retirement benefits.

Knowledge services:

These higher-level processes may include data analytics, data processing , data and knowledge management, and internet and web research, also as developing an information governance program and providing the voice of customer feedback.

#backoffice#outsource#BackOfficeSolutions#outsourcing#businessowner#businessprocess#humanresources#newzealand#BusinessProcessOutsourcing#freelnacing#businessprocessservices#HumanResourcesOutsource

2 notes

·

View notes

Text

Theories on Entrepreneurship

An Austrian-American economist and social theorist Joseph Schumpeter was born in Triesch, Moravia (that is now known the Czech Republic), and studied at Vienna University. In 1907, he began practicing law. After winning the recognition as an economic theorist, he taught economics for various periods at the universities of Vienna, Gernowitz (that is now Chernivtsi, Ukraine), Graz, and Bonn after 1909. After visiting the United States as an exchange professor at Columbia University in 1913 and at Harvard University in 1927 to 1931, he received a permanent faculty appointment at Harvard in 1932. Schumpeter achieved recognition for his theories about the vital importance of the entrepreneur in business, highlighting the entrepreneur's role in stimulating investment and innovation, thereby causing "creative destruction." When innovation makes old ideas and technologies obsolete, this is where Creative Destruction occurs. His known books are The Theory of Economic Development (in 1911), Business Cycles (in 1939), Capitalism, Socialism, and Democracy (in 1942), and The History of Economic Analysis (in 1954).

vimeo

https://vimeo.com/75421736

To begin with, it has mentioned that Schumpeter started with a reasonably representation of the Dynamic Model. It is an abstract simplified model of an economy as being in a circular flow. And if an economy is in an equilibrium in a circular flow, all of these flows are in a steady state. For him, the fundamental phenomenon that underlies economic growth is the disruption of the circular flow, and that occurs through innovation. He describes this phenomenon as a source of new combinations of existing resources. He explained the categories: the production of new goods and services; the creation of new methods of production; new production techniques; discovery/exploitations of new markets; finding new sources of raw materials; and the new industrial methods of organizations. This interruption that Schumpeter described results in an economic growth. Hence, this is done through the activities of the entrepreneurs. He defined the that entrepreneurs plays a crucial role in this process. They are the “disruptive innovator”. It was said that he also agreed to the argument of Karl Marx, a German economist, about the importance of the dynamics of innovation; the importance of the history and the culture in influencing diversity; how development happens; and the economic consequences of change.

youtube

https://youtu.be/ZT2kICLatT8

Innovation results in economic change. We all know in this new era, a lot of innovation and changes has already been done but in this theory, the less successful you are in innovation you may go out of business because its somehow the driving force. In this era of changes, in economic development, it’s a perfectly competitive economy just pure competitions, as what he defines innovation. First is New production method is to make new products and to introduce new products and gain much sales. Second is New market is to look for other alternative to get out of the cycle of competitions. Third is the New supplier it has the new approach for sourcing and people supplying raw materials and negotiating discounts. Lastly, the New industry structure it wants a new product and structure that can be different from others and it will cause abnormal profits than the usually normal. In conclusion, this video completely shows what Joseph Schumpeter means about innovation this video support every factor and development an entrepreneur must know it deals this clearly state the main idea and goal of the theory and how it can affect the social skill and mindset of an entrepreneur.

For more information, you can just visit: https://www.economicsdiscussion.net/economic-development/schumpeters-theory-economic-development/schumpeters-theory-of-economic-development-economics/30174

John Maynard Keynes is a famous and one of the most renowned British economist because of his published works but he his best known for his Keynesian theories. The main objective of his theories is to aid for government increased expenses and lower demand of taxes and ascend the global economy out from the great depression. As Keynes famous line “ in the long run we are all dead” and it was misinterpreted as a YOLO quotes about seizing the moment but he was referring to the inflation and the quantity theory of money, in a different view of classical economics to Keynesian economics, Keynesian believe that consumers demand is the primary driving force in an economy in his academic perspective demand creates supply and that supply creates demand. Though there is a debate of wether it worth spending to stimulate the economy and how much do they spend but the main goal here about Keynesian policies like every policies have a trade of that being said that the Keynesian policies of increase in government during financial crisis remarkably reduce the depth and length of the Great Depression.

youtube

https://youtu.be/hPkh8kOldU4

The great depression change everything all of a sudden its 25% unemployment that one in four losing a job.

What really drives a capitalist economy?

People have money and that people is spending that money in the economy people spend money in services and grow that’s what allow business to grow to the economy.

John Maynard Keynes proposed during the great depression that the government should spend more money in peoples hands, driving up demand. His ideas is now often called demand-side economics and through government action, recessions can be minimized while maintaining steady economic growth. In this video the clear overview and explanation about John Maynard Keynes and his Keynesian theory is shown and well discuss it explains more about how the great recession started and how it ended, the unemployment of the people and the fact of a low economy is being said in the video and it supported the Keynesian theory.

Alfred Marshall a well known and one of the most influential English economist after publishing the principles of economics in 1890. His books contains a scientific explanation of notion such as supply, demand and marginal utility. The principles of economics has four factors of production (land, labor, capital, and organization). Land deals with natural resources, everything has its natural resources but some mad an enhancement and developed it to something better and greater . Labor deals with mental and physical skills it takes physical efforts and services to labor something. Capital deals with the machineries and tools to produce good quality product and lastly is the organization it coordinates all the elements.

youtube

https://youtu.be/oTd0nQeW05U

As we all know The Principles of Economics is equal to fundamentals of truth in which economics is established. It can be categorized under, how people makes opinion as for the fact that some people trades something to get another and its all on what you give to get it. Second is on how people interact, trading can make a better off and lastly, how the economy as a whole, a nation that can produce goods and services demand its wealth and that’s where it meets the peoples marginal utility its all in the consumers satisfaction and most best outcome of it is the inflation and unemployment is in the short run. Therefore this video supports the theory of Alfred Marshall for it discuss on point matter about the improvement of the economy and the clear and precise over view of the principles of economics.

Frank Hyneman Knight (born November 7, 1885, White Oak township, McLean county, Illinois, U.S., died on April 15, 1972, Chicago, Illinois), was an American economist who spent most of his work times at the University of Chicago, an became one of the founders of the Chicago School. Knight made his reputation with the book which was based on his Ph.D. dissertation, Risk, Uncertainty and Profit In it, Knight set out to elaborate why competitions would not necessarily eliminate profits. The book was published in 1921, is one of his most important contributions to economics. In that book, he makes an important difference between uninsurable and insurable risks. According to Knight, profit that is earned by the entrepreneur who makes decisions in an uncertain environment, is the entrepreneur’s reward for bearing uninsurable risk.

youtube

https://youtu.be/3-Rk9OpYyKY

To start the following theories, one should know how to distinguish risk from uncertainty. On this video, the speaker explained how Frank H. Knight establishes the way how risk differentiates from uncertainty. “Risk as the ‘known unknows’, things that exist and can be measured. Uncertainties, however, are the ‘unknown unknowns’, things that do not exist yet and can not be measured.”

Risk Bearing Theory

It suggested that it depends on the risk-taking behavior of the entrepreneur that he/she gather his/her profit. How the entrepreneur efficiently manage the risks is the main determiner of the amount of profit he/she gains, not on the amount of risk borne by him/her.

More information on: https://www.economicsdiscussion.net/theories-of-profit/top-7-theories-of-profit-with-criticisms/21072

https://youtu.be/vAzj_CBgSPk

Uncertainty Theory

The speaker stated that according to Frank Knight, uncertainty is the paid reward to the entrepreneur, not for bearing the risk but for undertaking the uncertainty. He argues that risks are purely physical in nature and therefore, they can be seen in advance and can be protected against. Such risks are taken cover by the insurance. But there are uncertainties in every business that can not be covered by measured insurance. The speaker aforesaid a list 4 examples of risks enlisted by Knight. Starting off with the risk due to the Competitors. Any business worth has the risk expected to the increase in number of competitors. The changes in vital firms, marketing, strategies, improvement in the quality and management, decrease in the cost of production, and many more. Then the risk caused by the Trade Cycle. Most of the business firms suffer the loss due to the decrease in the demand for good and services during the recession and depression. Followed by the risk rooted by the changes in policy of the government. Any firm may suffer loss because of the government may change its policy related to investment, export, taxes, and many more. And lastly, The risk due to the Technological changes. Technology advances with flight of time. If any firm failed to adjust to the change of this aspect, they may suffer deficiency. Thus, the term risk is applied to those dangers which can be seen in advance and which can be insured against. But the term uncertainty is applied to those dangers which is can not be foreseen and can not guarantee accomplishment. It is for the those uncertainties that the entrepreneur is rewarded with profit. Concluding on Profit is the reward for uncertainty bearing.

Israel Meir Kirzner (born on February 13, 1930) is a British-born American economist. Kirzner was born in London and by way of South Africa, he reached United States. After studying at the University of Cape Town, South Africa in 1947 to 1948 and with the University of London External Programme in 1950 to 1951, he received his B.A. summa cum laude from Brooklyn College in 1954, and an MBA in 1955 and a Ph.D. on 1957 from New York University, where he studied under Ludwig von Mises. Kirzner's research on entrepreneurship economics is widely recognized. His book, the Competition and Entrepreneurship reviews as a western cultural theory for its model of development that preoccupied it, which neglects the significant role of entrepreneurship in economic diversity. Kirzner's work integrating entrepreneurial action into neoclassical economics has been more widely accepted than any other Austrian idea of the early twenty-first century.

https://youtu.be/Bu-i1q8LVvA

The speaker said what Kirzner stated in his theory that what causes knowledge to grow and spread is our alertness to opportunities that permit us to “grasp pure profit”. He is referring to the ability to see ways of doing things that others have overlooked. Entrepreneurship, for him, is about seeing possibilities not given by data. Rather than optimizing based on a given framework, it is the act of seeing new means-end relationships. An ability to notice the world that you thought it was, turns out to be the opposite. In the market, these moments of entrepreneurship amounted the discovery of knowledge that otherwise not exist. Entrepreneurship is a moment of discovery. It is important to comprehend and understand for Kirzner that discovery is not the same as search, it is not looking for something that we know is out there, but the moment of genuine surprise realizing that we did not know what it was we didn’t know. Get it? “Discovery is a moment of realization of knowing what is not known. These are the moment of entrepreneurship. If this is successful, it also brings the expectations of market actors into greater coordination by using resources in ways to better satisfy wants.” He also emphasized that entrepreneurship and competition are the two sides of coin. As long as people are free to envision alternative uses of resources and act on that vision, markets are competitive. What they mean by competition, he argued, is not the perfectly competitive market of mainstream economics, where people react passively to given prices and cost curves or where there is a large number of small firms. But instead, competition refers to the process by which people constantly engage their entrepreneurial alertness to see the world in new and better ways. Viewing competition as discovery procedure is more helpful for understanding the world.

2 notes

·

View notes

Text

Don’t Act Prematurely

Don’t Act Prematurely

The market pundits continue to communicate that we are nearing the end game of this economic cycle. They are warning that the Fed could take the punchbowl away earlier than assumed, attempting to slow the economy, curb inflationary pressures, and therefore cause a market top.

The truth is that we are just in the very early innings domestically and several quarters away from overseas economies kicking in too, making this a synchronous global expansion, something that we have not seen in years. The Fed and all monetary bodies are probably a year away from beginning to shift policy, which would begin by tapering the amount of bond purchases eventually to zero before even considering raising rates. This is a long way ahead out so don’t act prematurely. The markets will continue to be supported by trillions of excess liquidity already in the system, trillions in additional stimulus to come, and much higher levels of earnings, cash flow, and ROIC over the next few years than currently forecasted. Yesterday’s employment data put to rest, at least for now, that the Fed will act anytime soon even though the employment problem right now is the lack of labor supply rather than demand for hiring. That, too, will change as supplemental benefits expire later in the summer.

The key to the sustainability of the economic expansion is getting our arms around the coronavirus so that we can reopen and return to our lives as we knew them before the pandemic hit a year ago. More than 1.23 billion doses have been administered across 174 countries, and we are vaccinating at a rate close to 19.4 million per day. We have distributed over 252 million doses in the United States, now averaging 2.09 million per day. We continue to believe that we will have herd immunity in the U.S sometime this summer and globally by the end of the year. We also expect that we will have vaccines that can be administered orally before year-end, which could play a significant role next year if we all need booster shots, as many experts now think.

Nevertheless, Pfizer and Moderna expect to have close to 5 billion doses of traditional vaccines readily available next year to protect the world from further outbreaks. All good news which supports our view that the coronavirus will soon be in the rear-view mirror and viewed much like the flu by year-end. It will not interrupt our daily existence going forward, supporting a sustained economic expansion.

The Wall Street pundits are all placing bets as to when the Fed will shift policy as they would consider that a precursor to a market correction. Removing extra accommodation is good news as it means that the economy is on firm footing and growing. We have listened to comments from Powell and all Fed governors that the Fed is far from achieving its inflation and employment goals. The Fed expects the economy to expand rapidly and inflation to exceed its 2% target as we come out of the pandemic and are fulfilling pent-up demand. But as Fed Governor John Williams said last week ‘that doesn’t mean that the Fed needs to shift gears” as they want to see the data points and conditions, after the fact, before considering a change on policy. The Fed expects growth over 7% this year with inflation over 2%, so significant numbers will not be a surprise. We believe that the Fed will wait to see 2022 numbers before acting, recognizing that 2021 is a sharp recovery from a deep recession caused by the pandemic. By the way, Janet Yellen, Secretary of the Treasury, corrected her comments last week as she sees no need for the Fed to raise rates because she does not see persistently higher inflation moving forward. We agree as we see significant productivity gains, like reported last week, offsetting higher wages, keeping a lid on unit labor costs, as well as global competition and disruptors pressuring prices. On the other hand, we continue to see higher industrial commodity and agricultural prices over the next few years as demand outstrips supply.

The debate on Biden’s two additional stimulus plans: American Jobs ($2.2 trillion) and American Families Plan ($1.8 trillion) center on what is considered infrastructure and how it will be paid for. We continue to believe that we will have a traditional infrastructure bill passed this year above $1.5 trillion paid by hiking the corporate tax rate to around 25% (even Biden is going there now), user fees, higher tax rates on the very wealthy, closing tax loopholes, project financing, and better collections. The bottom line is that whatever stimulus plans are passed, they will boost growth in future years. Whatever tax changes happen, they will not be as onerous as initially thought, nor will they alter the shape of the economic recovery.

Recent economic data continues to be off the charts despite Friday’s surprise employment report. We consider that report an outlier as jobs in April increased by only 266,000. Current unemployment benefits limit labor supply while the demand to hire has never been more robust. We see robust increases in employment ahead as those extra benefits expire in a few months. Recent strong data points include: April ISM Manufacturing Index at 60.7; new orders at 64.3; employment index hit 55.2; backlogs rose to 68.2; ISM Output Index was 63.5 up from 59.7 in March; the Services Index was 62.7; new orders was 63.7; prices paid increased to 76.8; new orders for manufactured goods increased 1.1% while shipments rose 2.1% such that the inventory to sales ratio fell further to 1.38, and the trade gap widened to $74.4 billion as the value of imports rose to a new high reflecting strong domestic demand. We found it particularly important that productivity increased 5.4% in the first quarter as we believe that productivity will meaningfully accelerate holding down unit labor costs over the next few years benefitting from massive increases in technology spending plus managements’ have learned during the pandemic how to be more efficient and productive with less.