#when the loan drops i may invest

Text

kind of obsessed with these scarves from ozlana 💕💫🐇

#just LOOK at them#the colour schemes are so so pretty#i wish i knew about these sooner but i already bought a scarf for winter#they're 35 quid each but they're so so pretty#when the loan drops i may invest#ozlana#winter fashion#ozlana fw22

3 notes

·

View notes

Text

astrology notes: 5 🌷💐🌸

quick note: i'm absolutely not an astrologer. these are just a collection of some observations, thoughts, theories, and personal experiences. with that being said, i'm still learning along the way & i may come back to edit this post to make corrections. above all this is just for fun.

lastly, keep in mind that i’m not reading your birth chart and i know nothing about you. these are just some possibilities that may or may not apply to you. enjoy!

◦ libra in the 11th house: the popular friend, everyone always wants to hang out with you, getting invited places. playful flirting with your friends. friends could have a crush on you. hmm, perhaps friends with benefits? they make every one of their friends feel included. this placement screams social awareness. they know how to behave & present themselves in various social gatherings, from informal to upper class events. if you’re a guy, you might have a lot of female friends. with libra being about fairness/justice & easily seeing things from different perspectives, these qualities are also beneficial in the 11th house which relates to debates & politics as well.

◦ chiron in the 8th house: experiencing financial problems like not profiting from your investments, difficulty getting loans, employment instability affecting your income, or randomly losing money. if you have cancer here it could indicate having conflict with your mom regarding money.

◦ mars dominant: action movies being one of your favorite movie genres.

◦ sags may feel uncomfortable being home all day, may feel the need to go out at least once even if only for 2 seconds.

◦ harsh mars-mercury aspects: speaking loudly, a rough or rude way of speaking, people often telling you to lower your voice, not being aware when you're talking loudly, playing music loud, noisy eater. can make you impatient and want to get things done immediately, otherwise you can get annoyed quickly.

harsh mars-uranus aspects: slamming doors, dropping things instead of placing them down, dragging a chair instead of picking it up, hard for you to do things quietly. can get mad out of nowhere. extra controlling cause you’re always fighting to keep things under control.

^ both aspects above can make someone loud, noisy, aggressive, impatient, and impulsive.

◦ has anybody with stelliums in a sign noticed they know/attract a lot of people with that sun sign? maybe most of the people you know/attract have that sun sign or perhaps they have that sign’s ruling planet as their dominant planet. for example, if you have a pisces stellium you may know or attract a lot of people with their sun in pisces or people who are neptune dominant.

◦ you might notice that the sign which asteroid eros (433) is in is associated with the body part you find attractive. for example, if you have eros in aries you might be attracted to the eyes, taurus - the voice, libra - the butt.

◦ pluto-risng or saturn-rising aspects: you probably look mean/serious or have been told you look intimidating. that’s not a bad thing though & you may have that defined high fashion model face. something that makes others look at you a little longer.

◦ capricorns: don’t like admitting they’ve had their heart broken (especially capricorn moons). you know how there’s some people who will continuously forgive a person who has hurt/mistreated them (i’m not talking about real abuse) but they decide to stay with them or keep them in their lives? yeah they aren’t capricorns lol. it usually only takes one person to trigger that straight forward and low tolerance for games/disrespect type of attitude when it comes to their relationships. or they’ve always been like that. they may be more merciful to family.

◦ i would like to take this time to personally thank geminis & sags for being so damn funny. thank you guys so much. 😘

◦ last but not least, people with difficult placements such as pluto, chiron, or saturn in the 4th house: i don’t even need to say anything. *gives you one of the flowers from the picture above*

if you read this until the end i hope you enjoyed it & thank you so much for reading. ♥︎♥︎♥︎, those hearts are for you.

2K notes

·

View notes

Text

Oh while I'm on U.S. economics, I have another thing that bugs the hell out of me: the hiking of mortgage interest rates.

For those who don't know, mortgage interest rates dropped low during the pandemic. Which is not all sunshine since it resulted in many bidding wars and a ton of way-over-asking offers in competitive areas, but it put home-ownership way more within reach for a lot of people.

Then the fed started to pee their pants over inflation, and hiked their rates up, prompting mortgage companies to follow.

Here's a chart of mortgage interest rates over the last 4 years

It hit a trough at 2.65% on average in early January 2021, and then you see it hiked itself way back up, now chilling at 6.27%

For context on how different these are: let's use an example of a $400,000 home - someone pays 20% down ($80,000) in cash, and finances the remaining 80% ($320,000).

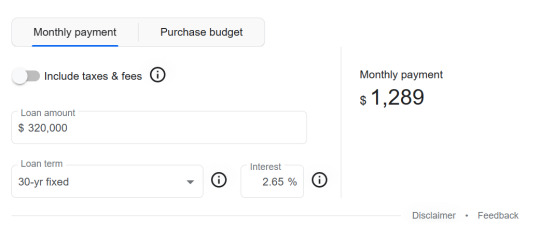

Monthly payments at 2.65%:

This results in paying back, in total, $464,040. You'll notice that's well over the initial $320,000, and that's because of the interest paid over those 30 years.

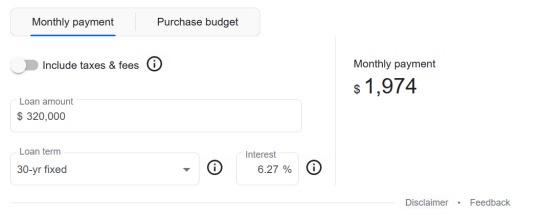

Now, monthly payments at 6.27%:

This results in paying back, in total, $710,640. That's more than twice the initial loan of $320,000.

And, of course, it means the same exact property which could be paid for with a monthly budget of ~$1,300 in early 2021 now requires a monthly budget of ~$2,000 in 2023.

Also, those pandemic lows were an anomaly... Historically, mortgage interest rates were on average HIGHER than 6.27% - but also, historically, wages were much better relative to the prices of homes and people could afford the high interest rates (with the exception of the people who got screwed over in the 2008 housing market meltdown... There's a really good Cold Fusion video on that.)

And because these low interest rates were an anomaly, they may never come back...

So with mortgage interest rates going up, home-buying becomes harder. When home-buying becomes harder, rents increase (because renters have no alternative).

So who DOESN'T get affected?

ENTITIES THAT CAN PAY IN ALL CASH.

They need no mortgage. They pay the sticker price on-spot with no interest applying to them. And I say ENTITIES because, sure, some people can buy their home in all-cash. But a huge number of the entities that can buy in all cash are BIG investment companies--the Blackrocks and the Mega-landlords who scoop up properties to sit on, rent out, and turn for a profit later like it's a piece of stock, and not a habitable property...

Anyway I don't have a conclusion for this. Fix wages, or bring interest rates back down, or kill Blackrock. Preferably all 3.

#Federal Reserve shivering quaking 'but if poor people have disposable income then companies will have no CHOICE but to price-gouge and#turn record profits and fuel inflation... theres no helping it... we have to make#everything harder for poor people...'#gonna start a bingo card if this breaches containment and sparks an argument on libertarian tumblr

279 notes

·

View notes

Note

Do you think Daniel is a millionaire in the show? And that Terry really is a billionaire? Idk how Johnny and Miguel survive in California, poor things.

I think that Daniel has, as I think they call it, "excellent collatoral", or "liquidity" or some shit, which means that he can borrow all the money for his expenses. I mean, to open a business, with their backgrounds, they will have saved for a deposit on a loan, no way they were given that money. May have been an investor if they were paying a cut of their future profits. So, do they have a million in the bank after everything they owe? I really doubt it. Could they get their hands on like 300 k if they needed it? Yes. Is that money theirs? No.

They have a shittown of money coming in on car sales, but they owe the bank a shitton too. They need to keep a lot of money flowing. The trick is to gradually owe the bank less and less, so that at the time you come to sell the business, most of that sum is yours. But you also don't give all your money to the bank. Most small business' owners pensions are what they get when they sell the business. Now, a single car wash in Alberquerque cost about 900 k. Daniels owns four or so franchises, which are definitely worth several millions when sold. But how much does he owe? If they want to give the business to Sam, they can't live off the money for the sale. Which means they must have invested in some form of pension. Which may actually pay out several hundreds of thousands a year should the time come. And of course by then they could make a good profit on their house which is also worth over a million.

But that all depends on the business generating that sweet sweet money for the bank business loans and the pension funds and the mortgage and the insurance... If that stops spinning money, and the price they can get when they sell it drops - they're in deep shit. And I mean deep shit. So if they lose their supplier, Doyona? Which means they have to pay a lot more per car to sell when switching to another? Yikes, that is really serious. So it doesn't really matter how much he has in the bank. The question is how much can he get upon sale and when not selling, how big is his pension payout, and how much will be left. Will they downsize the house upon retirement? How much will they get for that?

Will Daniel be a millionaire when the business keeps doing well and all that profit starts flowing in to their bank accounts, owing the bank less and less? Yes! But they might have to employ Sam for a decade or so, so that they can build up personal wealth to retire on. They have access to money now based on the performance of the business, but that money isn't theirs. If everything got really bad they could probably pay off the bank with the sales of the business, sell their house and still have a million left with that, so they'll be able to live without worry as perfectly normal middle class people. But the lifestyle they have now is dependent on a money generating business. They make a big payout, or they cash in on the money they make the last decade they own it before they pass it on? Yeah, they're millionaires.

But now, they're not. The value of the business tanks, a wealthy future goes with it.

Terry is bribing judges and buying up Cobra Kai franchises out of pocket. He doesn't give a shit if any of his franchises, or the whole business, tanks. He's investing in other people's businesses...

He's definitely someone who owns hundreds of millions. Is he a billionaire? A billion is 1000 million. I don't know. Probably. It's not something you can tell anymore by what car or wine or house they own. Nothing you consume is making a dent on even 500 million. It's staggeringly much. So maybe he isn't and can still easily fork out millions to invest in some kind of startup. But, the way he uses connections? And where he is? Keeps investing even now?

Very likely.

13 notes

·

View notes

Text

Jayden Camarena, in Northern California, is contemplating blowing off the 2024 presidential election. Evan McKenzie, in battleground Wisconsin, is looking for any other candidate than the current front-runners. In Philadelphia, Pru Carmichael isn’t even convinced this race matters.

These young voters live in different cities, work different jobs and have varying political beliefs. But among the things they have in common: They voted for Joe Biden in 2020 — and now say the president can’t count on their support in 2024.

“I genuinely could not live with myself if I voted for someone who’s made the decisions that Biden has,” said McKenzie, a 23-year-old working at Starbucks and as a union organizer in Madison, Wisconsin. “I didn’t even feel great about" voting for Biden in 2020, he said.

The feeling helps illustrate why Biden’s ratings and support among young voters have dipped noticeably in recent polling. In November, NBC News’ latest national poll showed Biden locked in close competition with former President Donald Trump at the moment for voters ages 18-34, a sharp drop from the margins Biden enjoyed over Trump in the 2020 election, according to exit polling.

“We’ve been seeing this in our data and focus groups actually since May,” said Ashley Aylward, a senior researcher at the Democratic polling firm HIT Strategies. “And to me, it’s because the 2024 campaign season for Democrats hasn’t started yet.”

Polling a year out from an election is a snapshot in time, and Biden and his party have time to bring young voters back into the fold. But Aylward and others said it will take work.

“This is the alarm bell that we needed to make sure that not only the Biden campaign, but every other Democratic operative out there and all the campaigns down the ballot — state and local — actually invest in young people, because we know how much they can change the outcome,” Aylward said.

NBC News spoke with voters who responded to the poll, as well as other voters 18-34 who supported Biden in 2020, but who now say he hasn’t earned their vote for next year, to get a clearer picture of why they are unhappy with Biden and what they want to see him do to earn their support back.

“It’s so complicated, because it almost feels like if I were to give my vote for Biden, I will be showing the Democratic Party that what they are putting out is enough, which is the bare minimum in my opinion,” said Camarena, a 24-year-old living outside the Bay Area.

Voters cited a number of policy areas that disappointed them, including insufficient moves to address climate change and Biden’s inability to fully cancel student loan debt or codify Roe v. Wade, as the president deals with a closely divided Congress. However, Biden’s response to the Israel-Hamas war may be having the greatest effect on his relationship with this voter bloc.

The NBC News national poll, conducted more than a month after the start of the Israel-Hamas war, shows 70% of voters under 35 disapproving of Biden’s handling of the war.

McKenzie cast his first presidential ballot three years ago for Biden, when the Democratic candidate carried Wisconsin narrowly, in part thanks to young voters like McKenzie. He said he urged his friends to vote for Biden then, telling them, “You’ve got to do this.”

He now says he won’t be having those conversations this election cycle. He’s angry at the president for his handling of the Israel-Hamas war, and the threat of losing the White House to the Republican Party has done little to win over his vote.

“I want to show the Democratic Party as a young person that you still need to earn our vote and if you don’t, the consequences will be your career,” McKenzie said. “A Republican getting elected isn’t the end. It is the beginning of a much larger fight.”

Big promises unfulfilled

In 2020, Biden carried young voters by more than 20 points against Trump, but some of that support appears to have been tepid — and tied to enormous campaign promises from Biden that he has not been able to deliver as president of a closely divided nation.

“I mean, he made a lot of really big promises in his campaign and virtually none of them were followed through on,” said Austin Kapp, a 25-year-old living in Castle Rock, Colorado. “I mean, he could have codified Roe v. Wade, he could have stood up for the rights of people all over the country, he could have done a lot of things, but he didn’t.”

________________

While Biden and Democrats pushed to codify the protections of Roe at the federal level, congressional realities made legislative efforts impossible. A vote to codify Roe in May 2022 failed in the Senate, with Biden lashing out at Republicans afterward and urging voters to “elect more pro-choice senators this November, and return a pro-choice majority to the House.” Democrats kept the Senate but lost the House in November 2022.

Biden also backed a rules change to the Senate filibuster, which would have allowed legislation to pass by simple majority instead of a higher, 60-vote threshold, but the change was blocked in a bipartisan vote.

Biden wasn’t Kapp’s first choice as a candidate in the last election, and this year he plans to vote third party if the contest is a Biden-Trump rematch. He graduated from school just last spring carrying both private and federal student loans.

When asked how he felt about his loan repayments beginning soon, Kapp groaned: “Oh, yeah, that was another thing.”

“It’s kind of sad to see that the quote unquote lesser of two evils that we were all promised, is this,” Kapp said of Biden.

Camarena agrees. Though she is vehemently against Trump, she says she only supported Biden in 2020 reluctantly.

“It was more of a well, [Biden]’s better than Trump, you know?” she said.

Camarena’s feelings toward Biden now are worse. She works for CalFire and is passionate about addressing climate change. She says she was “turned off” when the Biden administration approved the controversial Willow oil drilling project in Alaska.

“It made me really angry,” she said. “He painted himself as, you know, trying to advance or improve climate change.”

When she talks to other voters her age about Biden, she says, the sentiment is similar and discouraging. “It feels like the best option that we have isn’t good enough,” Camarena said with a sigh, adding, “It can feel really powerless.”

Worried voters cite higher prices

Sentiments like these among a constituency Democrats rely on to win elections mean campaigning in 2024 will be critical, maybe even more so than in previous elections, said Daniel Cox, director of the Survey Center on American Life at the American Enterprise Institute.

“I think on some level, you can say that the Biden-Harris team have not been as aggressively pitching their accomplishments to voters and maybe that they don’t feel like they’re in campaign mode yet,” he said. “You certainly see this with the economy, which the sort of macroeconomic indicators have been positive for quite a while and keep surprising analysts that things seem to be doing much better than folks thought they would.”

While the economy is performing stronger than when Biden first took office, Olivia Thompson, a 26-year-old mother in Elko, Nevada, says she doesn’t feel those improvements.

“Not even a little bit, and I’m living it firsthand,” Thompson said.

Her family of five lives paycheck to paycheck. She says Biden earned her vote last election based on promises for a more prosperous future.

“I was more excited about the fact that he was saying that he was gonna fix the economy and get everything back on track and then everything just skyrocketed,” she complained. “All of like our grocery bills and gas — it just never went back down.”

Thompson plans to vote for a third-party candidate in November.

Some of the economic anxiety voters have may be because they’re not hitting the same economic milestones that their parents did, said Aylward, the Democratic opinion researcher.

“I think it would do Biden wonders if he came out with a really, really clear plan for that to help these young people’s anxiety,” she said. Millennials and Generation Z voters "are seeing just how far out of reach buying a home is or saving money and, of course, student loans are really the first barrier and piece to that.”

Several voters said they supported Biden on the expectation he would tackle the student debt crisis. The administration successfully erased $127 billion in student debt — more than any president in history, but after the Supreme Court ruled against his original plans to cancel up to $400 billion in student debt, that failure became the lasting headline.

“Whether you like it or not, Biden has done a number of things, but young people are just far less likely to give him credit, good or bad, on anything that he’s done,” Cox said.

McKenzie, who graduated in the spring, said he remains unimpressed by the accomplishments of the administration.

“I’m glad it’s the most ever" canceled student debt, he said. "It’s still not even close to what was promised,” he added. “And I think that that’s sort of what I’m going into this campaign feeling, like broken promises all around.”

Combating that sentiment will be crucial to winning back support.

Cox said he thinks the Biden campaign "is in deep trouble at this stage.” He said, “There’s still plenty of time, but the trajectory is not good for him.”

Camarena is one voter leaving the door open for her mind to be changed.

“I think that there is a chance” of Biden winning back her support, she said, adding that she expects the president to call for a cease-fire in the Israel-Hamas war.

“If he would do that, that would make me reconsider. Though, she said, she would "still be a bit skeptical.”

Another voter said it’s already too late.

Carmichael, of Philadelphia, hoped the Biden administration would remind her of the Obama days. She says she is disappointed by both Biden and Trump and wants to spend her time focusing on local community care and voting in local elections.

“I don’t think the presidency has too much of an effect on what happens in my day-to-day life,” she said.

Carmichael won’t be supporting Biden in November. If the choices next fall are Biden and Trump, she says, she will likely leave those boxes empty.

“I gave him one shot and it was not worth it,” she said.

#nunyas news#A lot of the complaints#in this article#are things the man has no control over#but I'm glad to see#voters saying this kind of thing#even if I don't think most have the spine#to not still vote for the same guy

12 notes

·

View notes

Note

As someone who has recently sold her first book with 0 advance (extremely common around here and my publisher is a small indie one) reading your post about the Cait Corrain situation and having to imagine someone getting a 75k advance (!!!!!!!! I don’t even make that per year at my full time job!!!!!) for a first novel and not thinking they have hit the author jackpot is astounding to me. How is that kind of money not reassuring (apparently the usual advance for first novel with the biggest publisher around here is 1000€!)? Is the author supposed to reimburse the advance if the sales don’t match it in the USA? I know everything is bigger in the States but damn, we really live in different worlds.

Hi! Congrats on your upcoming release!

Just to clarify, indie publishers without advances do exist in the USA, as does, of course, total self-publishing, where the author puts in all the cost and earns all the money. Part of why Cait got a $75K advance is because she was published through, I believe, Del Rey, which is under Penguin Random House, a "Big 5" publisher. The Big 5 dominate the trad industry. I've seen some pretty solid authors published under Del Rey. I think screenshots indicated that she was comparing her advance to that of Danielle Jensen and Molly Chang. I'm not super familiar with Molly Chang, but Danielle is a fairly established fantasy author...? Who's presumably done well; otherwise, she wouldn't keep getting book deals.

But yeah, Cait's advance is pretty solid by USA numbers (if not pretty high). I think some numbers I read years ago indicates that the typical debut romance author may be lucky if their advance is around $5K-$10K. Cait's book was being packaged to be a more noteworthy debut. I personally think that a lot of authors have outdated or optimistic ideas about advances. Like, back in the day Stephenie Meyer got $750K for her debut. Advances used to be MUCH bigger. But a lot has changed since then. Publishers overpaid back in the day, and now they're arguably underpaying while also putting very, very little into marketing budgets.

So... what if she hadn't earned out her advance? A lot of the info I've found about this over the years is kind of older, but general wisdom is that, unless she's got some reeeeeally shady deal with a reeeeeallly shady publisher going on, she's not paying back the advance. It's basically an investment and a bet on the book. Lots of investors lose money on the businesses they invest in; but unless something is a loan, you're not paying them back. It's a loss. And it is hard for a book to earn out its advance; some numbers citing for authors that earn out are around 25%-30%. There is the cost that goes into making the book, the discount the booksellers get, etc. The sticker price on a physical book is way higher than the "take home pay". Furthermore, depending on the book, the publisher may have different expectations for how long it will take authors to earn out. AND publishers can potentially write at least some of that loss off on their taxes.

You're not expected to pay the advance back; if but if you don't earn out, it's very possible (likely in some cases, depending on your genre and publisher expectations) that a debut will be dropped by their publisher, series orders are cancelled, etc.

Plus... worth noting that advances are usually paid out in installments. Dirty little secret, there. Additionally, authors are essentially working similarly to freelancers, and are taxed in the same sense. I can attest, as a former freelancer lol... Those taxes hit HARD. So how much is the author actually getting paid, especially when you factor in cost of living, the fact that the author usually isn't actually able to devote their full time to writing, etc? Meh. But of course, a $75K advance is more than a lot of authors are getting.

And then you bring in the celebrity memoir, which, if it's for like... the BIG stars... I think Prince Harry had a $1 million advance, lol. Publishers bet big in very rare, usually celeb-based situations.

But yeah, a lot of authors don't really know this part of the game, it's super murky, not all agents are good at their jobs, etc. Plus, through semi-complicated math that I don’t fully understand, books are (allegedly) profitable for the publisher before the advance earns out. The writer just doesn’t necessarily benefit much from that.

7 notes

·

View notes

Text

Call Me Sunshine, Send Me To Space

Everyone has really loved this one on tumblr and on AO3. The tumblr app is a fucking nightmare (affectionate) and resets itself as if it has short term memory loss and people have mentioned that halfway through reading something, they lose it, and have to try to find it again. I know it’s happened to me plenty, so I wanted to also post the AO3 chapter by chapter links here so you don’t have to worry about losing it!

Chapter 1: nothing in life is permanent, but tattoos and you and me

Chapter 2: crashing to earth, your hands hold me down

Chapter 3: can't be alone for long, you're the company i need

Chapter 4: touch me just enough, send me closer to the sun

Chapter 5: something’s different here and now, come and part the clouds

Chapter 6: this flying feeling, it's natural babe

Chapter 7: he drops, we fall

Chapter 8: keep your fingers there, inside, where they belong

Chapter 9: i love you, do you know how much

Chapter 10: sweetheart, sweet thing, my love

Chapter 11: you deserve to feel beautiful, say it with me

Chapter 12: a lifetime of breakfasts with you

Chapter 13: testing the binds of these hands you've tied up, cutting the rope that holds us

Chapter 14: my love is not a loan, you can feel it in your bones

Chapter 15: easy to love, even when it's hard

Chapter 16: no cloud can cover my shine

Epilogue

Bonus Buckingham Chapter

I plan on keeping my tag list open on here until I reach the second to last chapter (which won’t be for a while so don’t hesitate to ask to be tagged!), but as a backup I do recommend subscribing on AO3 if you’re invested. Sometimes I post from my phone (shocking and risky I know) and the tags don’t always work because as I said above the app is a fucking nightmare, and also I am forgetful.

Everyone has been so fucking nice it blows my mind. I have no clue what I’m doing, just here to have a good time, but you guys have been so supportive and I cannot tell you how much it makes my day to see your likes, reblogs (with the most insane tags please continue to do that omg), and replies. And not just with this, but with ANYTHING I post. I haven’t had something that’s for me in a really REALLY long time, and this has been something that gives me a lot of happiness. I’ve never been a confident bitch, and I’m still not, but I’m working on it and letting myself enjoy being a part of the fandom more actively than just reading whatever everyone else posts.

This also feels like a good post to say that if you feel I miss any tags on AO3 as this goes on, please let me know! I never want anyone to get surprised by something. I update the tags as necessary for every chapter, but I’m human and may miss something or may consider something a tag that’s already there that may be a new one to others. This goes for ANY of the stuff I post on there, but especially the chaptered fics like this one.

SENDING ALL MY LOVE ALONG THE WIRE BABES ❤️❤️❤️

-Mickala

#steddie#steve harrington#eddie munson#stranger things#tattoo artist eddie munson#guidance counselor steve harrington#grumpy sunshine trope#soft dom eddie munson#sub steve harrington#call me sunshine send me to space#myfic#ao3fic#chapter links

47 notes

·

View notes

Text

ELI5: The Silicon Valley Bank Collapse

TL:DR SVB made a somewhat risky investment which went poorly in changing market conditions, and didn’t have the money to pay back their depositors. The FDIC has decided to fund the remaining bank accounts, but shareholders will realize a total loss on their stock.

If you haven’t been following the news, the second biggest bank collapse in American history just happened. But you probably have no idea what that means, so I’m going to explain it all in simple terms, with no frills, no biases, and no opinions.

Please let me know if I get anything wrong here. While I do work in finance, I’ve heard conflicting sources on some of the events.

The Basics of How Banks Work

Left to their own devices, people ordinarily wouldn’t just give their wealth to someone else for safekeeping. But these days there are many incentives for the average person to lend their money to a bank. Yes, there’s the matter of security (robbers can steal physical tender, such as physical bills and valuables), but there is also interest. By lending your money to a bank (like a loan!), the bank then uses your balance to invest in the stock market or major projects such as other peoples’ mortgages, with the promise that all of the money you’ve placed with them will be returned to you when you ask... with a little bit extra as interest. That’s your incentive for placing your money with them.

The point is, you placed your money with a bank, and in exchange for you lending them your money, they’ve promised to give it back to you when you ask, with a little bit extra. That’s important to understanding the next topic.

Investments, Reserves, and Insolvency

Okay, but how do banks generate the “little bit extra” that they promised to give you in exchange for borrowing your money? Through investments!

Investments can be a lot of things. Mortgages are investments- a bank can lend someone a big chunk of money, and in exchange the bank receives cash monthly that ends up being worth more than they loaned out. They can be investments into the stock market- buying stocks at low price, watching the price rise, and selling them high is a way to net profit. There are other types of investments too, like bonds (mini loans), CDs (low risk, long-term investments that guarantee profits that bank customers can take out), and options (very complicated). What they have in common is that you lend your money, and hopefully get more back (though there’s some risk of loss).

As an example, let’s pretend you’ve put $20,000 in a bank account. The bank could then take $10,000 and put it into a risk-free investment that returns at 2%. One year later, the return is $10,200, at least $10,000 of which must return to you. The bank may take $100 of that as their own profit and return the remaining $10,100 to your account- the remaining $100 is your interest. (This is a theoretical example. My own bank account hasn’t generated nearly that much in interest.)

But let’s say the investment isn’t risk-free. They’ve taken $10,000 of your money, invested in that 2% return project, and it flopped. Ouch. Now they’re out $10,000- of your money! That doesn’t seem fair!

That’s why banks have reserves. It’s a buffer/stockpile of cash or liquid assets (things that can be converted to cash really quickly) that covers a depositor’s finances should the bank’s own investments go south, OR if people need to pull out their money. Banks usually have a dedicated team of analysts that calculate the amount of reserves a bank can safely set aside to cover these sorts of events. This covers souring investments as well as times when a big customer is planning to pull out a ton of savings. That $10,000 is a drop in the bucket for them, but something like $1 million is more concerning.

So, even if the investment goes south, at least you’ve still got that guaranteed $20,000 on demand in case of, say, a medical emergency.

... At least, that’s how it should work.

If a bank doesn’t have enough reserves/quick money to fulfill its obligations of money on demand to everyone who lent it to them, it becomes insolvent- basically bankrupt unless they do a lot of stuff to get money fast really quickly. This can involve pulling money out of investments (which costs money to do, and is not something any investor would want to do unless they need a lot of money really really fast). This is the worst case scenario for any financial institution and one they want to prevent at all costs.

Understandably, the insolvency of the bank you’re keeping your money at is a terrifying situation for people who really need that money. And it was a common situation up until the 1930′s.

Bank Runs

You probably know someone who lived through the Great Depression who has a large stockpile of cash and refuses to use credit cards or banks. Some people probably even call them stupid for doing so. I’m not going to call your money hoarding grandparents stupid, since they’re operating off a very real fear- the fear that a bank won’t have the legal tender to give them their money when they ask. That situation was VERY COMMON before the FDIC was created in 1933 to insure the deposits of its member banks.

What would happen is that you’d hear that some news about how a certain bank was having financial trouble, and might close very, very soon. You freak out and realize that if they close, you’ve given your money to them, and now you’re not going to get it back! You go to a branch of the bank to withdraw all of your money, only to find that everyone else had the same thoughts as you, and the branch is already out of physical tender. As more and more people realize they’re about to lose all of their savings, the bank is drained at an exponentially increasing rate- and soon, the bank has become insolvent.

Banks have defenses for this- suspending withdrawals, limiting withdrawals, and asking their central bank for more liquid funds. But in the case of a bank run, or a bank panic, which is a bunch of banks experiencing bank runs at once, those defenses might fail entirely.

The FDIC, an American Government Corporation, was created as an insurance company for banks. Basically, banks pay dues to the FDIC, and in the case of the bank’s insolvency, the FDIC guarantees deposits up to about $250,000. It was created partially as a way to avoid future bank runs and protect consumers in the case of a bank collapse.

Interest Rates and Inflation

You’ve probably heard about the Federal Reserve hiking interest rates or keeping them low throughout the recent pandemic, but what does that actually mean, and why is it relevant here?

The Federal Reserve sets target interest rates- basically, setting the price at which major banks can borrow from the government. This ends up forming the basis for other types of loans you can get from banks- mortgages, car loans, etc.. Periodically these are revised with regards to economic conditions.

Basically, raising interest rates is used to encourage people to STOP borrowing money and START lending money- the return for lending is higher, and the price of borrowing is higher. Lowering interest rates is used to encourage people to START borrowing money and STOP lending money- the return for lending is lower, and the price of borrowing is lower.

(This is why you always want a loan with a low interest rate, btw!)

(And keep in mind that these are with regards to major economic decisions, and not necessarily the types of loans an ordinary person would get.)

Now, why is inflation relevant? Yes, it’s really high right now, and that means that the prices of everything are increasing a lot! The Federal Reserve’s answer to that is to increase interest rates- by making it more costly to borrow money, they’re hoping to stop an unsustainable level of price increases in everything else.

I think I get it. Now what’s going on?

Silicon Valley Bank was a fast-growing bank that, in recent years, held a lot of funds for entrepreneurs and tech startups- about 50% of all venture capital money in the US! What this means is a. a lot of large accounts in b. mainly one sector of the economy (technology).

That being said, the bank would most certainly not outpace inflation if they didn’t invest it. However, at the time, they couldn’t find any places they could loan money to.

Furthermore, the tech/crypto/startup sector of the economy has been going through hard times for a while. Many needed to slowly pull out funds from the bank, further straining the amount of liquid cash on hand.

In 2021, SVB instead decided to invest in mortgage-backed securities with the deposits placed with them. Mortgages are basically very long loans, but they can also be very risky. Mortgage-backed securities are based on mortgages. (The risk surrounding mortgage-backed securities is one reason for the housing crisis of 2008.) It should also be noted that they’re very susceptible to changes in interest rates- if interest rates increase, mortgage-backed securities lose their value.

In 2022, we got severe inflation.

And then, the Federal Reserve’s answer to severe inflation: raising interest rates.

And the mortgage-backed securities that SVB took out became unprofitable!

Now remember how I said that banks need to be able to not only provide customers their deposits on demand, but also give it back with interest? Because the investment in mortgage-backed securities failed, SVB didn’t have money for interest OR deposits, and not enough in reserves to fill the gap. They would be insolvent, if they didn’t come up with a lot of money really, really fast.

Word spread fast- depositors had already realized that the bank had become insolvent, and they demanded their deposits back. In other words, SVB went through a bank run, losing their money over the course of three days.

The FDIC then stepped in. Now this is a bit of an unusual case, because the FDIC only insures accounts up to $250,000. Most venture capital startups have accounts that are many times that. However, the FDIC has decided (with their own member deposits, not taxpayer money) that all of the venture capital money will be paid. All of the bankers will get their deposits back.

SVB is still closing, however, and shareholders and stockholders will not be compensated for the stock loss.

So while shareholders lose out, every creditor/depositor who invested will be getting their money back. As for Silicon Valley Bank, it’s being administered by the FDIC up until it’s time for it to close down.

#silicon valley bank#eli5#economics#finance#the more you know!#life as an aj#okay what other tags should i put in here#please reblog if you found this informative i worked VERY hard on it!#this is 1.8k words

10 notes

·

View notes

Note

so Tesla's stock has been going down and down and down some more and we may see under 100 dollars a share by New Years

I just have to wonder a few things, 1) Tesla is a publicly traded company and Musk owns not a very big share of it (13.4% after his sell offs) when (if ever) will other stockholders coup him out of of the CEO chair? I mean from my outsider view it seems very clear to me any ways that the only hope to save the ship is to throw out the captain (idk if it can be saved given how tied to his image it is, but..)

2) with so much of the twitter debt backed by Tesla stock, and that stock having dropped dramatically and trending down with it's CEO clearly having no answers, blaming everything other than himself, and spends all his time making it worse by damaging his own image and brand, so like what happens to the debt backed up on that stock?

I mean, if the board continues to just go along or not question Musk, the shareholders can either pressure the board or replace the board and replace the CEO (the CEO is hired by and answers to the board of directors, who are chosen by and answerable to the shareholders). And with prominent Tesla shareholders like Leo KoGuan starting to get more vocal about their displeasure and with Musk selling more of his shares, it could get to that point real fast. Cue the retired janitors of idaho.

The $6billion or so Tesla-secured margin loan (meaning that he pledged $6billion of Tesla securities - either equity such as stock, or debt like a bond or CD - that he already owned as part of his investments or issued by the company) that was part of the Twitter financing (account for something like 13% of the overall amount) only really becomes an issue if the lender or whomever is holding that $6billion either gets worried that the value will drop or is dropping and that there's not enough to match or maintain that amount and therefore either Musk or Tesla or whomever has to put more money in to prevent a loss or the lender sells/liquidates those securities/that loan. The lender can do a margin/maintenance call at any time without warning and can sell those securities at any time without warning. And there's the potential for tax liabilities on Musk or Tesla's part as well as further financial instability for Twitter.

However that would really only be an issue if the value of those securities falls below $6billion and/or if Musk/Tesla can't inject enough cash or equity to maintain that $6billion, and since Tesla is still in the hundreds of billions value-wise, barring some serious and drastic change, it probably won't be an issue.

What *would* be an issue is Musk and/or Tesla having to continue to maintain that margin loan, which would suck more money/finances away from them. And wherever that margin loan is located, Musk/Tesla are stuck with that broker or investment firm unless and until they pay off that loan.

The real issue is the $13billion in loans/debt that Musk took out to buy Twitter - that's what doubled the debt obligations of the company to $1billion a year and $3billion of which is unsecured (meaning there's nothing backing it or committed to it in value). At one point earlier this month the banks holding that $13billion were thinking of replacing that unsecured portion with more Tesla-secured margin loans (which would lower the debt payments Twitter has to make, and also puts more equity and value into the loans and financing). Adding more Tesla-backed securities as loan collateral increases the risks I mentioned earlier, and the value of the Twitter loans are both volatile but decreasing, which means that there's both potentially pressure on the banks to sell those loans in a market with lowered investor interest in buying them (because similar kinds of loans for similar companies resulted in serious losses for investors and banks earlier this year) or face more losses with holding onto those loans and that debt.

6 notes

·

View notes

Text

#Sense Of Cents#Personal Finance#Investing#Side Hustle#Budgeting#Finance#Savings#Retirement#Retirement Planning

0 notes

Text

How to Reduce the Interest Rate on Home Loans and Maximizing Your Line of Credit

How to Reduce the Interest Rate on Home Loans

Securing a lower interest rate on your home loan can significantly reduce the overall cost of your mortgage and save you thousands of dollars over the life of the loan. Here are some strategies to help you achieve a more favorable rat

Improve Your Credit Score:

Lenders use your credit score to assess your risk as a borrower. A higher credit score typically qualifies you for lower interest rates. To improve your credit score, pay off existing debts, keep credit card balances low, and avoid opening new credit accounts close to your mortgage application.

Shop Around for Lenders:

Different lenders offer different rates and terms. Obtain quotes from multiple lenders and compare their offers. Use online comparison tools to streamline this process. Be sure to consider both interest rates and closing costs when evaluating offers.

Consider a Shorter Loan Term:

Loans with shorter terms, such as 15-year mortgages, often come with lower interest rates compared to 30-year loans. While your monthly payments will be higher, you'll pay less in interest over the life of the loan.

Make a Larger Down Payment:

A larger down payment reduces the loan amount and can result in a lower interest rate. Lenders view borrowers who put down more money upfront as less risky, which can lead to better rates.

Buy Mortgage Points:

Mortgage points, or discount points, are upfront payments that reduce your interest rate. One point typically costs 1% of the loan amount and can lower your rate by 0.25%. This can be a good option if you plan to stay in your home for a long time.

Refinance Your Mortgage:

If interest rates have dropped since you initially took out your mortgage, refinancing can allow you to secure a lower rate. Be sure to factor in the closing costs of refinancing to determine if it’s a financially sound decision.

Negotiate with Your Lender:

Don't be afraid to negotiate with your lender. If you have a strong credit profile and a good payment history, ask your lender if they can offer you a better rate. Sometimes, just asking can result in more favorable terms.

How Much Line of Credit Can I Get

The amount of line of credit you can get depends on several factors, including the type of line of credit, your creditworthiness, and the value of any collateral you may use.

Home Equity Line of Credit (HELOC):

A HELOC is a popular option for homeowners looking to tap into their home equity. The amount you can borrow is typically based on a percentage of your home's appraised value minus the balance of your mortgage. For example, if your home is valued at $400,000 and you owe $200,000 on your mortgage, you might be able to get a HELOC for up to 80% of your equity, or $160,000.

Personal Line of Credit:

This type of credit is based on your credit score, income, and debt-to-income ratio. Lenders will evaluate your ability to repay the line of credit. Higher credit scores and income levels generally result in higher credit limits. Personal lines of credit typically range from $1,000 to $100,000.

Business Line of Credit:

For business owners, the amount of credit you can access depends on your business's financial health, including revenue, profitability, and credit history. Lenders will also consider the business's collateral. Business lines of credit can range from $10,000 to several million dollars, depending on the size and financial standing of the business.

Secured Line of Credit:

If you use collateral, such as a savings account or investment portfolio, you might qualify for a larger line of credit. The credit limit will usually be a percentage of the value of the collateral, often up to 90%.

1 note

·

View note

Text

i spent the last few days with my aunt. I came to a decision to spend time with her because I wanted to. I can give a thousand reasons that stems from logic and rational thinking. But I think I've come far enough to admit that I do want to spend time with her willingly.

It is always a mixed bag, spending time with her. I think there are many ways we're similar and I think in another world, we may have been very good acquaintances.

But the problem is that she's related to me. She's my closest relative in terms of proximity. She's the closest family member related to my parents. She's a stranger who I share genetics with and I'm not sure what that makes us.

I'd often wish that I had a sense of closeness to her when I was younger. She always seemed to love other two cousins a lot more. I was just an extra one who happened to be around.

I can't blame her though, everyone on my dad's side of the family were so invested in my cousins. Even my dad. He never really seemed to be invested in my future like he was in theirs.

And I thought by this point, I accepted our relationship for what it is — her attempts to be concerned over me and my well being would be met with my ( mostly) polite response that encompass the message of " I didn't ask your advice or opinion". Toss in some of her prejudices and bigotry that I also decline to engage in.

But I find resentment through these interactions. I hate how convenient I am for my family. How my cousins had everyone dropping money for them, for their education, for their passions. But I could barely get funding for a bachelor's degree, and I'm paying back my dad for whatever money he's given me to pay off the last 6k of my loans. My future and my dreams were treated like a loan, something that expected payment in return. But somehow their dreams were worth the investment.

And it doesn't mean I want the money now. Or that I don't want to pay my dad back. But I can't help but feel resentful of the relationship that I couldn't have with my own dad and the fact that my aunt or no one else will acknowledge the disconnect I have with him.

1 note

·

View note

Text

Chapter 42 of Good Investment is now up on my Patreon!

Good Investment is available at the $5/month tier. People who pledge $5 a month have access to not only Good Investment but The Sponsors series (ongoing), Pretty Things (complete), May the Blood Run Pure (complete), and Kept Man (complete), along with the $1/month tier books, the Reflections trilogy (ongoing) and The Halfwife (ongoing).

Adri Schvaneveldt has always felt split between two worlds. In one world, they are the adopted child of a large and conservative Mormon family. In another, she is the CEO of a burgeoning fashion empire that pushes boundaries. But in order to be the latter, Adri first has to find the funding. After gaining a hefty following as a social media influencer/model, Adri has the potential customers– if they can get a reliable production model pounded out. And that means a bit of groveling at the feet of investors, most of who have never even heard the term “non-binary”.

But Adri lucks out with Gideon Snow, whose youth and open mind bring much needed funds to make Adri’s dream of diverse, accessible fashion a reality. Of course, lifting a newborn company to its feet is no small task, and late nights drive Adri to occasional stays at Gideon’s nearby house, where their relationship begins stretching beyond business. Adri knows they can’t put an entire business venture at risk for the turbulent whims of their heart. But reason doesn’t always win out.

Excerpt:

Anthony snorted. “Fine, you know what? I’ll tell you the truth. The person who posted that picture reached out to me and asked me some questions before they posted it. I thought it was weird or whatever, but I also thought it was very funny.”

“What’s funny about this to you?”

“That you’re gay now or whatever, but, like, gay light? Christ, between you and Tiffany, there’s gotta be something in the water.”

Gideon wished he wasn’t high when having this conversation. It made sorting his thoughts and responses difficult. Was it even worth arguing with Anthony? He was going to believe what he wanted to believe. Who cares if he thought Gideon was gay? And yet, Gideon’s brain wasn’t at full capacity. “I’m not gay.”

“Kissing a man dressed like a woman is still gay.”

“You’re a fucking piece of shit.”

Anthony laughed. “What’s it like sucking dick?”

“What’s it like being a fucking…” Gideon brain shorted out, his tongue stuck to the roof of his mouth. While he stumbled to conjure words, Anthony laughed again.

“You coulda had your choice of hot 20-somethings, dude. Hell, maybe even 18 or 19-year-olds. You could have been drowningin pussy if you weren’t such a fucking cuck. Instead you’re sucking crossdresser dick. It’s sad. I don’t think you deserve death threats or any of that, but you can’t do degenerate shit without getting any pushback.”

“What’s wrong with you?” Gideon said, at a loss for what else to say.

“I’m alpha now. I’m on top of my shit.”

Gideon’s rage suddenly dropped off a cliff, and what followed was laughter—starting with a snort before descending into uncontrollable giggling.

“What the fuck?” Anthony said amidst Gideon’s onslaught.

“Alpha,” Gideon snickered, then started laughing again, this time louder. Oh yeah, he was still definitely high. He struggled to keep his grip on his phone as he wheezed for breath. He tried to say something but got caught by hysteria again.

“Fuck you,” Anthony snarled. “Fuck you and your soy boy bullshit.”

“Are you 13?” Gideon giggled. “Jesus fucking Christ.”

“At least I’m not gay.”

“Grow up.”

“Whatever, I actually don’t care about any of this, especially since you never helped me out with that loan I asked for. I don’t owe you shit. If my fans are being dickheads, that’s on them.”

1 note

·

View note

Text

factors that could affect financing your start-up

Beyond the humble $50 investment that kickstarted our endeavour, I recognize the critical importance of securing additional funding to scale our operations and realize our vision of transforming the landscape of Naija shopping drop shipping in Nigeria. In this blog post, I will delve into the financial sources we are considering for the future of Naija Shopper's drop shipping business. a good business strategy. When you diversify your financing sources, you also have a better chance of getting the appropriate financing that meets your specific needs. Keep in mind that bankers don’t see themselves as your sole source of funds. And showing that you've sought or used various financing alternatives demonstrates to lenders that you're a proactive entrepreneur.

1. Personal Investment: As an entrepreneur deeply committed to the success of my venture, I recognize the value of personal investment. Beyond the initial $50, I am willing to invest additional resources—whether in the form of cash or collateral—demonstrating my long-term commitment to the project. Personal investment not only showcases my dedication but also instills confidence in potential investors and lenders, highlighting my unwavering belief in the business's potential for success.

2. Your Professional Profile: Leveraging my professional background and expertise is crucial in establishing credibility with lenders. As a proactive entrepreneur, I understand the importance of showcasing my industry knowledge, relevant work experience, and thorough research to mitigate risks and drive sustainable growth. By articulating a compelling case for the venture and demonstrating diligence in planning and execution, I strengthen my position in securing financing for future business endeavours.

3. Your Guarantee: While banks may typically require a personal guarantee for startup businesses, I view this as an opportunity to showcase my commitment and confidence in the venture. Assuming personal responsibility for the loan underscores my dedication to the business's success and reinforces my accountability to stakeholders. By providing a guarantee, I demonstrate my willingness to take calculated risks and stand behind the venture's growth trajectory.

In navigating the complexities of startup financing, I am guided by a strategic approach that prioritizes diversification of funding sources and meticulous planning. By combining personal investment with a strong professional profile and a willingness to provide guarantees, I position myself for success in securing the financing needed to fuel future business ventures.

In conclusion, as I continue to chart the course for Naija Shopper's drop shipping growth and expansion, I am committed to leveraging these financial sources to unlock new opportunities and drive innovation in the e-commerce landscape. By embracing a proactive mindset and strategic financial planning, I am confident in our ability to realize our vision and make a meaningful impact on the drop shipping experience in Nigeria. while each entrepreneur's journey is unique, a strategic approach to financing that combines personal investment, a strong professional profile, and a willingness to provide guarantees lays the foundation for sustainable growth and success.

Source:

Business Development Bank of Canada (BDC). (n.d.). Start-up financing: 4 factors affecting start-up financing. Retrieved from https://www.bdc.ca/en/articles-tools/start-buy-business/start-business/4-factors-affecting-start-up-financing?type=C&order=4

#StartupFunding#Entrepreneurship#BusinessFinancing#NaijaShopper#DropShipping#FinancialStrategy#PersonalInvestment#ProfessionalProfile#Guarantee#Ecommerce#NigeriaEconomy

1 note

·

View note

Text

DT December 2023 Update

There will be interest cut only when there is a recession coming.

3 main symptoms of recession: i. 10Y3M inverted yield curve https://fred.stlouisfed.org/series/T10Y3M/ ; ii. 3% rise in inflation over 2 years time; iii. quick rise in interest rate, 2.5% over 2 years; iv. when SAHM jobless indicator goes above 0.5 https://fred.stlouisfed.org/series/SAHMREALTIME

potentially bond price will go down mid Jan 2024. Potentially will be another interest hike in April next year

bull market when RRI goes above 40 and willshare increase 20%, or check DT facebook page photo

the market may have santa rally from 22nd Dec till 2nd Jan, then adjust down again and ranging, until next directional change in April to really go down.

Yen is bottoming and will strengthen as the inflation is increasing, bank of Japan is going to increase interest rate soon, then Yen will strengthen, then Yen loan taker will liquidate their foreign currency investment and convert back to Yen, global pull back on investment will happen, Grey Rhino.

7 months to 22 days before BTC halfing then will range, then will go up. if break 38k with good volume then will go higher, maybe reach 70k

8. when FED says last hike or start considering interest drop, that's when they are going to cut rate

1 note

·

View note

Note

Hey!

Please share me your opinion. Thanks in advance.

I was wondering if you could help me out a bit. The protagonist in my story doesn't come from a very wealthy background but she gets accepted into her dream University. She can't get a scholarship or a student loan (she is already under debt) and later on in the story her mother is diagnosed with dementia.

I am confused as to what the first chapter should be about: should it start from when her life was back on track and move forward to her mother's illness, or should it start from when her mother is in the hospital and move through flashbacks of when she got accepted into her dream University?

I would love to hear your opinion on this matter. Please share your thoughts.

Thanks in advance.

Hi Anon :) That sounds like a nice pickle for your protagonist.

It does have perks to start in medias res; it helps immediately engage the reader in the stakes. However, a lot of writers tend to get it wrong and put it stakes as bait, only to do nothing with them once they've built up the plot. I'm thinking of Struck by Lightning, which starts with the protagonist's funeral but it turns out nothing in the story has anything to do with his death, they literally just Dropped A Bridge On Him at the end for the sake of a catchy opener. That's why, personally, I don't like books that start with the ending ("wow it's so subversive it's so unique no one else does it" yeah boo it's because people generally know it's poor storytelling).

That said, if this moment in the hospital isn't the end of your book, and there are more developments afterward, it helps solve that problem, because you're invested in how they got in that pickle, but also how they'll get out of it, if they do.

It's a very important part of it, I think; you've got to be invested in how they got there. We make fun of "yup, that's me- you may be wondering how I got myself in that situation" openers, with reason, but they have the right idea, if a somewhat cliché phrasing. You have to be wondering how they got themselves in that situation.

Example: there's a really good (and really dark and triggery, like, a thousand warnings on that) miniseries that came out this year called Quicksand, which starts with a girl being arrested for shooting up her school, except she doesn't remember any of it and there are no living witnesses. It really does a great job keeping you on the edge of your seat through flashbacks trying to figure out how, why and even if she did it, while in the present she's going through the investigation and trial.

So that's my (amateur, personal-reading-taste-based) advice: if you're starting in the middle of things, make sure there are things to surprise us in how we got there, and that we still have things to be surprised by/invested it after this first chapter reveal.

Otherwise, if your story doesn't really have suspenseful elements (which is totally okay, it's just a different genre), you may want to stick to a more classic linear storyline - it's a staple for a reason.

#i'm sure there are writers that can pull off the ''starting with the end'' thing but I really wouldn't advise it for a first book#literally Struck by Lightning was a more than okay book and flick from what I remember it's really just that death ending that ruined it al#it's so pointless#and it makes the whole thing so depressing#like the end is pretty depressing in general it's not a happy ending#but it would have been so much better to end with the seaside scene#it's really like ''well he failed his quest but he learned a lot on the way about himself and the world so perhaps one day he can-#*boom piano falling on his head*#anyway hope this helps anon

0 notes