#whatsapp chatbot for healthcare

Explore tagged Tumblr posts

Text

https://www.kadhaipoma.ai/ai-healthcare-chatbot

0 notes

Text

#conversational whatsapp api#whatsapp chatbot for ecommerce#whatsapp api provider#whatsapp chatbot madurai#automobile chatbot#best whatsapp api provider#whatsapp api provider askeva#whatsapp green tick#whatsapp business API#Whatsapp API chatbot#whatsapp automation#white label whatsapp api#whatsapp chatbot#Whatsapp API provider#whatsapp chatbot for retail industry#whatsapp chatbot for healthcare#whatsapp chatbot for real estate#whatsapp chatbot for travel industry#whatsapp chatbot for education#whatsapp chatbot for HR#whatsapp chatbot for insurance#ai powered whatsapp chatbot

0 notes

Text

Get Chatbot service for business with APIWAA

In today’s fast-paced digital world, businesses are constantly looking for innovative ways to connect with their customers more effectively and efficiently. One of the most powerful tools available to achieve this is the APIWAA. By integrating APIWAA into your business operations, you can enhance communication, improve customer service, and drive engagement to new heights.

What is APIWAA?

APIWAA is a powerful communication tool that allows businesses to integrate WhatsApp messaging into their existing systems and workflows. Unlike the standard WhatsApp Business app, the API is designed for medium to large businesses, offering scalability and a range of advanced features that streamline customer interactions. It provides a programmable interface that enables businesses to send and receive messages, automate responses, and manage communication at scale.

1.Enhanced Customer Communication: With APIWAA, businesses can offer real-time customer support and engagement. The ability to send instant replies to customer queries, provide order updates, and share promotional content ensures a smooth and efficient communication process. This level of responsiveness helps build trust and loyalty among customers.

2.Automation and scalability: The APIWAA allows for the automation of routine tasks, such as sending appointment reminders, order confirmations, and personalized messages based on customer interactions. This not only saves time but also ensures consistent and accurate communication. The API’s scalability means it can handle a large volume of messages simultaneously, making it ideal for businesses of all sizes.

3.Rich Media support: Unlike traditional SMS, APIWAA supports rich media messages, including images, videos, documents, and interactive buttons. This capability allows businesses to create engaging and visually appealing messages that can capture the attention of their audience more effectively.

4.Secure and Reliable: Security is a top priority for APIWAA. The platform uses end-to-end encryption to protect messages and data, ensuring that customer information remains private and secure. This level of security helps businesses comply with data protection regulations and provides peace of mind to both the business and its customers.

Use Cases: Customer Support: Provide instant responses to customer inquiries, resolve issues quickly, and offer support 24/7.

Marketing Campaigns: Send targeted promotions, offers, and updates directly to customers’ WhatsApp accounts, ensuring high open and engagement rates.

Order Notifications: Keep customers informed with real-time updates on order status, shipping details, and delivery confirmations.

Appointment Reminders: Automate appointment reminders to reduce no-shows and improve customer experience.

Conclusion: The APIWAA is a game-changer for businesses looking to enhance their communication strategy. By integrating this powerful tool, businesses can improve customer engagement, streamline operations, and ultimately drive growth. Whether you’re a small startup or a large enterprise, the APIWAA offers the flexibility and functionality needed to stay ahead in today’s competitive market. Embrace the future of communication with APIWAA and unlock your business’s full potential.

#whatsapp api#api#whatsapp marketing#apiwaa#whatsapp chatbot#healthcare chatbots market#whatsapp automation

2 notes

·

View notes

Text

Improve the efficiency of your healthcare communication with the WhatsApp Business API. Perfect for clinics, hospitals, and healthcare providers who want to offer better patient support and streamline operations. Inquire today to transform your patient communication.

Learn more : https://www.go4whatsup.com/industries/healthcare/

Get in touch - Enquire Now - IND +91-9667584436 / UAE +971545085552 Email - [email protected]

#whatsapp business api#whatsapp api#whatsapp marketing#marketing automation tools#whatsapp marketing guide#whatsapp api provider#whatsapp chatbot#whatsapp chatbots#bulk whatsapp messaging#whatsapp crm#health#healthcare industry

0 notes

Text

#Top Technology Services Company in India#Generative AI Development Company#AI Calling Software#AI Software Development Company#Best Chatbot Service Company#AI Calling Software Development#AI Automation Software#Best AI Chat Bot Development Company#AI Software Dev Company#Top Web Development Company in India#Top Software Services Company in India#Best Product Design Company in World#Best Cloud and Devops Company#Best Analytic Solutions Company#Best Blockchain Development Company in India#Best Tech Blogs in 2024#Creating an AI-Based Product#Custom Software Development for Healthcare#NexaCalling Best AI Calling Bot#Best ERP Management System#WhatsApp Bulk Sender#Neighborhue Frontend Vercel

0 notes

Text

Navigating the Future of Pharma: How BizMagnets Outperforms Tata 1mg ?

Ready to boost your Business with BizMagnets ?

Contact us for a demo, and let’s start your journey towards enhanced customer engagement, streamlined processes, and increased revenue.

Introduction:

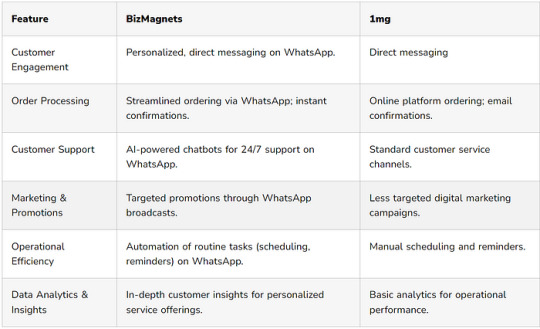

In a time when digital platforms are changing how people access healthcare, pharmacies need to use new and innovative solutions to stay ahead in the market. 1mg has been a leader in providing digital pharmacy services, but a new platform called BizMagnets WhatsApp Business Suite is offering an interesting alternative, especially when it comes to providing personalized and efficient customer service

The Advantage of the WhatsApp Business API

WhatsApp has a huge number of users all around the world, which makes it a great way for pharmacies to communicate with and engage their customers in a more personal way. The BizMagnets suite, which uses the WhatsApp Business API, allows pharmacies to not only reach their customers but also really connect with them. This can provide services that go beyond what other online pharmacy platforms like 1mg currently offer.

How WhatsApp Business API Can Transform Your Pharmacy Business ?

1. Personalized Customer Journeys : The BizMagnets platform uses AI to provide each customer with a customized experience, which can help build customer loyalty and encourage repeat business, unlike the more generic interactions on platforms like 1mg.

2. Efficient Operations : Automating tasks like appointment booking, test scheduling, and order confirmations through WhatsApp can save time and reduce errors, making pharmacy operations more efficient.

3. Data-Driven Decisions : The advanced analytics capabilities of the BizMagnets platform allow pharmacies to gain valuable insights into customer behavior, which they can then use to make more informed business decisions and tailor their services more precisely

Provoking Thoughts

How could personalized WhatsApp messages transform your pharmacy’s customer service experience?

Imagine the efficiency gains from automating routine operations through WhatsApp. How would that change the day-to-day of your pharmacy?

With the insights provided by BizMagnets, what new services or products could you offer to meet the unique needs of your customers?

For a more in-depth analysis on how the WhatsApp Business API can empower pharmacies to outshine competitors like Tata 1mg through specific features like WhatsApp broadcast, drip campaigns, and Click to WhatsApp ads, let’s expand on each of these components, highlighting their benefits and potential impact on business growth

WhatsApp Broadcast: The Power of Personalized Messaging at Scale

WhatsApp Broadcast allows businesses to send messages to multiple customers at once, provided the customers have saved the business’s phone number in their contacts and have agreed to receive messages. This feature is pivotal for pharmacies in announcing new health products, vaccine availability, or seasonal health tips directly through WhatsApp, ensuring high visibility and engagement. Unlike 1mg’s approach, which may rely more on app notifications or emails, WhatsApp broadcasts feel more personal and are likely to be read by customers

Drip Campaigns: Nurturing Customer Relationships Over Time

Drip campaigns are automated sets of messages that are sent out based on specific timelines or user actions. For pharmacies leveraging BizMagnets, this means being able to automatically send a welcome series to new subscribers, educational content on managing chronic conditions, or reminders for prescription refills. This strategic communication keeps the pharmacy top of mind for customers and can encourage repeat purchases. Drip campaigns through WhatsApp can be more effective than traditional methods used by companies like Tata 1mg, due to the personal and immediate nature of messagingw

Click to WhatsApp Ads: Driving Conversations and Conversions

Click to WhatsApp ads are a powerful tool that integrates with Facebook and Instagram advertising platforms. When users click on an ad, they are directly taken to a WhatsApp conversation with the business. For pharmacies, this means being able to advertise specific products or health services and instantly engage with interested customers, providing personalized advice or facilitating orders directly through WhatsApp. This immediate engagement model can significantly outperform the more static online purchasing experience offered by platforms like 1mg, leading to higher conversion rates and customer satisfaction

The Competitive Edge

Implementing these features through the WhatsApp Business API offers a dynamic and interactive customer experience that stands in contrast to the more traditional, website-centric approach of competitors like 1mg

Here’s how:

Enhanced Personalization: WhatsApp allows for direct, one-on-one communication, making each customer feel valued and understood.

Higher Engagement Rates: Messages on WhatsApp have a higher open and read rate compared to emails and app notifications.

Path to Purchase: By reducing the steps needed to inquire or purchase, customers are more likely to complete transactions.

Empowering Businesses to Thrive in the Digital Age with BizMagnets

In today’s fast-paced, technology-driven business world, adapting and innovating is crucial. By partnering with BizMagnets and leveraging the power of the WhatsApp Business API, companies can gain a significant competitive edge. The BizMagnets.ai platform offers an AI-driven WhatsApp Business Suite that empowers businesses to provide personalized, efficient, and seamless customer communication.

This innovative solution allows companies to meet their customers where they are and deliver a superior customer experience It can gather essential information from leads based on predefined criteria, ensuring that sales teams focus their efforts on high-potential prospects.

Visit: https://bizmagnets.ai/navigating-the-future-of-pharma-how-bizmagnets-outperforms-1mg-with-bizmagnets/

Email: [email protected]

Contact Number: 7845079333

#tata 1mg#medical chatbot#pharmacy#health#technology#whatsapp api#chatbot#whatsapp business#whatsapp api provider#whatsapp flows#business#chatgpt#healthcare chatbots market#whatsapp business api#saas#b2b saas#saas technology#saas software#artificial intelligence#tata#1mg

0 notes

Text

WhatsApp Chatbots for Appointment Booking: Revolutionizing Healthcare and Service-Based Industries

With the increasing demand for convenient and efficient communication, businesses are turning to WhatsApp chatbots to streamline their appointment booking processes. She is leveraging this technology to enhance customer experience and reduce wait times. They are implementing WhatsApp chatbots to automate tasks, such as scheduling and reminders, allowing staff to focus on more complex and high-value tasks. He believes that this technology has the potential to revolutionize the way businesses operate, particularly in healthcare and service-based industries.

They are utilizing WhatsApp chatbots to provide patients with a seamless and user-friendly experience when booking appointments. She can simply send a message to the chatbot, specifying the desired date and time, and the chatbot will respond with available slots. He can then confirm the appointment, and the chatbot will send a notification to the healthcare provider. This process eliminates the need for phone calls and reduces the likelihood of miscommunication. They are also using chatbots to send reminders and notifications, reducing no-show rates and improving overall efficiency.

In service-based industries, such as salons and spas, WhatsApp chatbots are being used to manage bookings and appointments. She is using chatbots to offer customers a range of services, from scheduling appointments to making payments. He can simply interact with the chatbot, selecting the desired service and providing payment details. They are then sent a confirmation message, along with a receipt and any additional instructions. This streamlined process improves the overall customer experience, making it more convenient and efficient.

They are also benefiting from the use of WhatsApp API chatbots in terms of data analysis. She can access valuable insights into customer behavior and preferences, allowing her to make informed decisions about her business. He can analyze data on appointment bookings, cancellations, and no-shows, identifying areas for improvement. They can use this information to optimize their services, improving the overall quality and efficiency of their business. WhatsApp chatbots are providing businesses with a competitive edge, enabling them to stay ahead in today's fast-paced and technology-driven market.

To summarize, WhatsApp chatbots are revolutionizing the way businesses operate, particularly in healthcare and service-based industries. They are providing customers with a convenient and efficient way to book appointments, while also streamlining internal processes and improving data analysis. She believes that this technology has the potential to transform the way businesses interact with customers, improving overall efficiency and customer satisfaction. He is confident that WhatsApp chatbots will continue to play a vital role in shaping the future of appointment booking and customer service.

0 notes

Text

Chatbots 2.0: Enhancing Customer Experience with Conversational AI in 2025

Gone are the days when chatbots were mere question-answer machines with rigid scripts and robotic replies. Welcome to 2025, where Chatbots 2.0 are rewriting the rules of customer engagement, powered by advanced conversational AI. These next-gen bots are not just tools; they’re personalities, problem-solvers, and brand ambassadors that elevate customer experiences like never before.

What Makes Chatbots 2.0 So Special?

Let’s face it—the customer of 2025 is spoiled for choice and expects lightning-fast responses, personalized interactions, and 24/7 availability. Chatbots 2.0 are built to handle exactly that, and then some:

1.Hyper-Personalization With advanced AI, chatbots now understand customers better than their best friends. By analyzing purchase history, browsing patterns, and even sentiment, these bots offer personalized recommendations that make every interaction feel one-on-one.

2.Human-Like Conversations Forget mechanical responses. Chatbots 2.0 leverage natural language processing (NLP) to hold meaningful, human-like conversations. Think emojis, jokes, and empathetic tones—all fine-tuned to your brand’s voice.

3.Multi-Channel Integration Customers today switch between platforms like TikTok, WhatsApp, and Instagram in seconds. Chatbots 2.0 seamlessly follow them, offering consistent support and engagement across all channels.

4.Emotion Detection AI now detects moods through language and adjusts accordingly. For example, if a customer is frustrated, the bot responds with extra care, offering quick resolutions or escalating to a human agent.

5. Proactive Assistance Instead of waiting for users to ask questions, these chatbots anticipate needs. Missed your flight? A chatbot might proactively rebook it for you. Forgot to pay your bill? The bot’s got you covered with a gentle reminder and a one-click payment link.

Cool Ways Brands Are Using Chatbots 2.0

Virtual Shopping Assistants

Fashion brands are using chatbots as personal stylists. Customers can upload selfies, and the bot suggests outfits tailored to their body type, color preferences, and even the weather forecast for their location. It’s like having your own Anna Wintour on speed dial.

Healthcare Companions

In healthcare, chatbots are evolving into health monitors. They send medication reminders, provide mental health support, and even schedule doctor appointments. Patients feel cared for without stepping into a clinic.

Travel Planners

For travel enthusiasts, chatbots are the ultimate trip planners. From suggesting offbeat destinations to booking tickets and sharing local guides, they handle the nitty-gritty so you can focus on adventure.

Benefits for Businesses

Implementing Chatbots 2.0 is not just a win for customers but a game-changer for businesses:

Cost Efficiency: With bots handling repetitive queries, human agents can focus on complex tasks, saving resources.

Higher Engagement: Fun and interactive bots keep customers engaged longer, boosting brand loyalty.

Improved Conversion Rates: Personalized recommendations often lead to higher sales.

Real-Time Analytics: Businesses get valuable insights into customer behaviour, enabling data-driven decisions.

Challenges and the Road Ahead

While Chatbots 2.0 are impressive, they’re not without challenges:

Privacy Concerns: Customers are wary of data misuse. Brands need to prioritise transparency and robust security.

Complex Integration: Not all businesses have the infrastructure to support advanced bots.

Avoiding Over-Reliance: It’s crucial to strike a balance between automation and human touch.

Looking ahead, the future of chatbots lies in constant evolution. Think bots that understand cultural nuances, AI-driven humor, and even voice modulation to match user preferences.

The Bottom Line

Chatbots 2.0 are not just customer service tools; they’re experience creators. By combining personalization, empathy, and intelligence, these conversational AI marvels are setting a new benchmark for customer engagement. Whether you’re a small startup or a global brand, embracing Chatbots 2.0 in 2025 isn’t just an option—it’s the key to staying ahead in a hyper-competitive world.

So, what are you waiting for? It’s time to let the bots do the talking—and leave your customers delighted!

Visit More Information : https://vihaandigitals.com/

#best digital marketing agency in jubileehills#digital marketing agency in hyderabad telangana#digital marketing agency in jubileehills hyderabad#digital marketing agencies in hyderabad for real estate#best digital marketing agency in jubileehills hyderabad

0 notes

Text

A WhatsApp chatbot benefits businesses across industries, including e-commerce, healthcare, travel, education, and customer service. E-commerce can automate order updates, healthcare can send appointment reminders, and travel agencies can manage bookings. Bytepaper's advanced WhatsApp chatbot enhances communication, streamlines operations, and boosts engagement, making it a valuable tool for any business seeking efficient customer interaction.

0 notes

Text

Master Customer Support with Zoho SalesIQ Chatbots

In today’s fast-paced digital world, customer support has evolved into a critical touchpoint for brand loyalty and customer satisfaction.

Leveraging AI-powered tools like Zoho SalesIQ can redefine how businesses interact with their customers, ensuring seamless, efficient, and personalized support experiences.

This article explores how Zoho SalesIQ transforms customer service and why it’s a game-changer for businesses.

What is Zoho SalesIQ?

Zoho SalesIQ is an all-in-one customer engagement platform designed to enhance customer support, drive sales, and improve user satisfaction.

With its cutting-edge AI chatbot technology, businesses can provide real-time, personalized assistance while reducing operational costs.

Benefits of Using Zoho SalesIQ for Customer Support

1. 24/7 Availability for Uninterrupted Support

AI chatbots in Zoho SalesIQ work tirelessly, ensuring your business is accessible round the clock.

Customers can get answers to queries at any time, improving user satisfaction and loyalty.

2. Instant Responses and Reduced Wait Times

Handle multiple customer inquiries simultaneously, eliminating frustrating delays.

AI chatbots provide immediate resolutions, keeping customers happy and engaged.

3. Personalized Customer Experiences

With data-driven insights, Zoho SalesIQ chatbots can understand customer preferences and past interactions.

Deliver tailored solutions and recommendations that align with customer needs.

4. Omnichannel Integration for Seamless Interactions

Zoho SalesIQ integrates with platforms like WhatsApp, Facebook Messenger, and Slack.

Maintain a consistent brand voice across multiple channels to enhance customer trust.

5. Cost-Effective Solution for Growing Businesses

Automate repetitive queries, reducing the workload on human agents.

Minimize operational costs while scaling support efforts efficiently.

How Zoho SalesIQ Empowers Businesses

Quick Tip:

Levrage the expertise of Zoho Experts and Zoho Consultants like Evoluz Global Solutions to empower your business with tailored Zoho solutions.

Boosting Engagement Through Proactive Support

Zoho SalesIQ chatbots initiate conversations based on user behavior, ensuring timely assistance.

By guiding customers through their journey, businesses can reduce drop-offs and improve conversions.

Streamlining Support Workflows

AI chatbots can categorize and escalate complex queries to human agents.

Zoho SalesIQ ensures a smooth transition without disrupting the customer experience.

Driving Customer Insights

Advanced analytics tools provide actionable insights into customer behavior.

Identify pain points and optimize your support strategies to meet evolving expectations.

Why Choose Zoho SalesIQ for AI-Powered Customer Service?

1. Easy Customization

Create chatbots tailored to your business needs with simple drag-and-drop interfaces.

No coding skills required, making it accessible for businesses of all sizes.

2. Enhanced Security and Privacy

Zoho SalesIQ adheres to global data protection standards, ensuring customer data security.

Build trust with customers by safeguarding their information.

3. Scalable Solutions for Growing Enterprises

Whether you’re a startup or an established enterprise, Zoho SalesIQ grows with your business.

Handle increasing customer demands effortlessly.

Leverage the expertise of Zoho Experts and Zoho Consultants such as Evoluz Global Solutions to effectively implement Zoho SalesIQ for boosting customer engagement and support.

Real-Life Use Cases of Zoho SalesIQ

E-commerce

Provide instant product recommendations, assist with order tracking, and resolve common inquiries to boost customer satisfaction and sales.

Healthcare

Enable patients to book appointments, receive reminders, and access essential medical information in real-time.

Education

Facilitate student enrollment, answer FAQs, and provide course recommendations with Zoho SalesIQ’s chatbot solutions.

Optimize Your Customer Support with Zoho SalesIQ

Incorporating AI chatbots like Zoho SalesIQ into your customer support strategy is no longer optional — it’s essential.

From enhancing response times to delivering personalized experiences, Zoho SalesIQ is the ultimate tool for businesses aiming to revolutionize customer engagement.

Don’t wait to elevate your support game. Explore Zoho SalesIQ with Evoluz Global Solutions today and transform the way you connect with your customers.

#business#zoho consulting services#zoho experts#marketing#business growth#zoho one#zoho consultant#zoho salesIQ#Zoho SalesIQ#customersupport#customer service#customerengagement#customerexperience#customersatisfaction#customer relationship management

0 notes

Text

WhatsApp Business API: A Game-Changer for Healthcare Operations

#WhatsAppBusinessAPIforHealthcare

In the realm of modern healthcare operations, communication efficiency can significantly impact patient care, operational effectiveness, and overall satisfaction. The integration of technology has revolutionized many aspects of healthcare, and one such innovation making waves is the WhatsApp Business API. This tool, originally known for personal messaging, has evolved into a robust platform for businesses, offering a secure and convenient way to connect with customers and clients. In healthcare, where timely communication is crucial, leveraging WhatsApp Business API can streamline processes, enhance patient engagement, and improve operational workflows.

Understanding WhatsApp Business API

WhatsApp Business API is a specialized tool designed to facilitate communication between businesses and their customers at scale. It offers features beyond the standard WhatsApp application, catering specifically to the needs of enterprises. Key functionalities include automated messaging, message templates for consistency, and integration capabilities with existing CRM (Customer Relationship Management) systems. For healthcare providers, this means having a reliable platform to send appointment reminders, share test results securely, and even provide basic telehealth services.

WhatsApp API for healthcare simplifies patient communication and care coordination. Send reports, broadcast messages, schedule appointments, and send reminders all through one platform. Enhance your patient engagement and operational efficiency today.

Benefits for Healthcare Providers

1. Enhanced Patient Communication

WhatsApp Business API allows healthcare providers to communicate with patients in real-time, enhancing the overall patient experience. Whether it’s sending notifications about upcoming appointments, sharing educational health content, or conducting post-appointment follow-ups, the platform enables direct and personalized interaction. This not only improves patient engagement but also reduces no-show rates and increases adherence to treatment plans.

2. Streamlined Operational Efficiency

By integrating WhatsApp Business API with internal systems such as scheduling software and electronic health records (EHR), healthcare providers can automate routine tasks. Administrative processes like appointment scheduling, prescription refill reminders, and billing inquiries can be handled efficiently through automated messages and chatbots. This frees up staff time, allowing them to focus more on delivering quality patient care.

3. Secure and Compliant Communication

Security and privacy are paramount in healthcare communications. WhatsApp Business API provides end-to-end encryption, ensuring that sensitive information such as medical records and test results remains protected. Moreover, the platform adheres to regulatory requirements such as HIPAA (Health Insurance Portability and Accountability Act) compliance, making it suitable for handling healthcare data securely.

4. Improved Accessibility to Care

In regions where access to healthcare services is limited, WhatsApp Business API offers a convenient channel for patients to reach healthcare providers. Telehealth consultations, remote monitoring, and patient education can be facilitated through the platform, extending the reach of healthcare services beyond physical locations. This accessibility is particularly beneficial for elderly patients, those with mobility issues, or individuals in rural areas.

Implementing WhatsApp Business API in Healthcare

Step-by-Step Integration Guide

Provider Registration: Healthcare providers register for the WhatsApp Business API via a verified WhatsApp Business Account.

API Integration: IT teams integrate the API into existing CRM or patient management systems to enable seamless communication channels.

Customization: Customize message templates for appointment scheduling, lab report delivery, and patient education to align with regulatory guidelines.

Training and Support: Train staff on using WhatsApp Business API effectively and provide ongoing technical support for smooth operations.

Conclusion

The WhatsApp Business API represents a significant advancement in how healthcare providers can communicate and engage with patients. By leveraging its capabilities, healthcare operations can achieve greater efficiency, improved patient outcomes, and enhanced overall satisfaction. From streamlining administrative tasks to facilitating remote consultations, the platform offers versatile solutions that align with modern healthcare needs. As the healthcare industry continues to evolve, integrating technologies like WhatsApp Business API will undoubtedly play a pivotal role in shaping the future of patient care delivery.

FAQs (Frequently Asked Questions)

Q1: Is WhatsApp Business API compliant with healthcare regulations?

A: Yes, WhatsApp Business API ensures end-to-end encryption and compliance with HIPAA and GDPR regulations.

Q2: How can patients opt-in for communication via WhatsApp?

A: Patients can opt-in by providing their consent through a secure verification process initiated by healthcare providers.

Q3: Can WhatsApp Business API handle multimedia files like X-rays or CT scans?

A: Yes, healthcare providers can securely share multimedia files within WhatsApp using the API.

#whatsapp business api#whatsapp api#whatsapp marketing#marketing automation tools#whatsapp api provider#whatsapp chatbot#healthcare#WhatsApp API for healthcare#healthcare industry#healthcare products

0 notes

Text

As a top technology service provider, Tech Avtar specializes in AI Product Development, ensuring excellence and affordability. Our agile methodologies guarantee quick turnaround times without compromising quality. Visit our website for more details or contact us at +91-92341-29799.

#Top Technology Services Company in India#Generative AI Development Company#AI Calling Software#AI Software Development Company#Best Chatbot Service Company#AI Calling Software Development#AI Automation Software#Best AI Chat Bot Development Company#AI Software Dev Company#Top Web Development Company in India#Top Software Services Company in India#Best Product Design Company in World#Best Cloud and Devops Company#Best Analytic Solutions Company#Best Blockchain Development Company in India#Best Tech Blogs in 2024#Creating an AI-Based Product#Custom Software Development for Healthcare#Best ERP Management System#WhatsApp Bulk Sender#Neighborhue Frontend Vercel

0 notes

Text

WATI Alternatives to Watch in 2025: The Rise of BizMagnets

In today’s digital-first world, communication platforms like WhatsApp Business API are crucial for businesses to connect with their customers efficiently. WATI has been a popular choice, but as business needs evolve, companies are exploring robust and scalable WATI alternatives. Among these, BizMagnets has emerged as the most compelling choice for businesses seeking a comprehensive solution.

In this blog, we’ll delve into the reasons why businesses are shifting toward WATI alternatives in 2025 and why BizMagnets leads the pack.

Why Businesses Seek WATI Alternatives

WATI has been a dependable solution for leveraging the WhatsApp Business API, but its limitations are driving businesses to consider other options. Here’s why:

Limited Features

WATI provides basic features but lacks the advanced tools required for modern businesses, such as AI-driven workflows and deep analytics.

Scalability Concerns

Many businesses find WATI's platform unable to scale seamlessly as their operations grow.

Pricing Mismatches

The pricing structure of WATI doesn’t always align with the budgets or usage needs of small and medium-sized businesses.

Customization Constraints

Certain industries, like education and healthcare, require tailored workflows that some platforms, including WATI, struggle to deliver.

This demand for enhanced capabilities has paved the way for WATI alternatives like BizMagnets.

Why BizMagnets is the Leading WATI Alternative

BizMagnets is redefining how businesses use the WhatsApp Business API. By offering advanced features, seamless scalability, and personalized solutions, BizMagnets has positioned itself as the top WATI alternative for businesses of all sizes.

Key Features of BizMagnets

AI-Powered Automation

Automate repetitive tasks, including FAQs, customer onboarding, and real-time query handling.

Interactive WhatsApp Flows

Create guided flows that simplify customer journeys, from product inquiries to purchase completion.

Multi-Agent Collaboration

Facilitate teamwork with tools like chat assignment, internal notes, and centralized dashboards.

Advanced Analytics

Gain actionable insights into customer behavior, operational performance, and marketing campaigns.

Tailored Solutions for Industries

BizMagnets offers industry-specific features, making it an excellent WATI alternative for sectors like e-commerce, education, and healthcare.

Benefits of Choosing BizMagnets as a WATI Alternative

Enhanced Customer Engagement

BizMagnets’ personalized messaging ensures customers feel valued, boosting satisfaction and loyalty.

Seamless Scalability

Whether handling 100 or 10,000 messages daily, BizMagnets scales effortlessly with your needs.

Cost-Effectiveness

BizMagnets provides a feature-rich platform at competitive pricing, making it the perfect WATI alternative for budget-conscious businesses.

Future-Proof Technology

With regular updates and innovations, BizMagnets ensures your business stays ahead in the digital communication game.

How BizMagnets Meets Diverse Business Needs

Marketing

Create and manage WhatsApp marketing campaigns.

Use advanced analytics to refine strategies and improve ROI.

Sales

Automate lead nurturing processes with interactive WhatsApp Flows.

Reduce response times to boost conversions.

Customer Support

Handle queries 24/7 with AI-driven chatbots.

Manage multiple customer interactions with multi-agent tools.

Education

Streamline student enrollment and inquiries with automated workflows.

Provide instant updates to students and parents via WhatsApp.

Healthcare

Automate appointment scheduling and patient reminders.

Provide real-time assistance with customized chatbots.

Why BizMagnets is the Best WATI Alternative for 2025

BizMagnets not only bridges the gaps left by WATI but also introduces innovative solutions that redefine WhatsApp Business API capabilities.

Customization Beyond Expectations

Businesses can tailor every aspect of their workflows to align with their goals.

Scalability Across Industries

Whether for small businesses or large enterprises, BizMagnets scales without limits.

User-Friendly Interface

Its intuitive platform ensures easy onboarding and effortless management.

Robust Support

BizMagnets provides round-the-clock support to address any technical issues or queries.

Real-Life Success Stories with BizMagnets

Retail Industry

An e-commerce brand increased its sales by 35% using BizMagnets’ personalized marketing flows.

Education Sector

A university handled 50% more admission inquiries in less time with BizMagnets’ automation.

Healthcare Services

A clinic improved appointment scheduling efficiency by 40% through WhatsApp automation.

Getting Started with BizMagnets

Switching to BizMagnets as your preferred WATI alternative is simple:

Sign Up

Visit the BizMagnets website to explore available plans.

Integrate

Seamlessly integrate BizMagnets into your existing systems.

Customize

Design workflows and chatbots tailored to your business needs.

Analyze

Leverage advanced analytics to refine and optimize performance.

Conclusion

As businesses continue to demand more from their WhatsApp Business API solutions, finding the right WATI alternative is critical. BizMagnets stands out by offering advanced features, unmatched scalability, and affordable pricing.

For businesses looking to elevate their communication strategies, BizMagnets is not just a WATI alternative—it's the future of WhatsApp Business API solutions.

Make the switch today and experience the BizMagnets difference!

0 notes

Text

Ready to Enhance Your WhatsApp Automation with MessageNest?

In today's fast-paced business environment, seamless communication is the cornerstone of success. With billions of users globally, WhatsApp has become an essential platform for businesses to engage with customers. However, managing extensive customer interactions manually can be challenging and time-consuming. This is where MessageNest, your ultimate WhatsApp automation solution, steps in.

Let’s explore how MessageNest can transform your communication processes and elevate your business to the next level.

Revolutionizing Communication with WhatsApp Automation

WhatsApp automation is no longer a luxury—it's a necessity for businesses looking to stay ahead. Whether you’re managing customer queries, sending promotional messages, or following up on leads, automating these processes saves time and ensures consistency.

MessageNest takes WhatsApp automation to a new level by offering a range of advanced features, including automated broadcasts, chatbot flows, template messaging, and detailed analytics. These tools empower businesses to handle thousands of customer interactions simultaneously while maintaining a personal touch.

Features That Set MessageNest Apart

MessageNest isn't just another chatbot software; it’s a complete communication hub designed to meet the diverse needs of modern businesses. Here’s a closer look at its standout features:

Team Inbox for Streamlined Collaboration Managing customer inquiries efficiently requires teamwork. MessageNest’s Team Inbox consolidates all customer chats into one unified interface, enabling your team to collaborate seamlessly and respond faster.

Broadcast and Bulk Messaging Reaching a broad audience has never been easier. With the Broadcast feature, you can send personalized messages to thousands of contacts at once, whether for promotions, announcements, or reminders.

Chatbot Flow Builder Create sophisticated, automated chatbot flows to handle routine queries like FAQs, booking confirmations, or order tracking. This feature allows businesses to remain available 24/7 while reducing operational load.

Template Messaging Speed up communication with pre-approved WhatsApp templates. Whether it’s a payment reminder or a welcome message, MessageNest ensures you maintain professionalism in every interaction.

Analytics Dashboard Make data-driven decisions with comprehensive analytics. Track message performance, user engagement, and campaign success metrics to refine your strategies and improve ROI.

Contact Management Keep your customer database organized and up to date. MessageNest’s contact management system makes it easy to segment your audience for targeted campaigns.

Empowering Businesses Across Industries

MessageNest is designed to cater to businesses of all sizes and industries. Here are just a few ways different sectors can benefit:

E-commerce: Automate order confirmations, shipping updates, and feedback requests.

Healthcare: Streamline appointment reminders and patient follow-ups.

Education: Send bulk notifications to parents, students, or staff about events, deadlines, and updates.

Hospitality: Handle booking inquiries and confirmations without delays.

No matter your industry, MessageNest adapts to your specific needs, making it an indispensable tool for customer engagement.

Why Choose MessageNest for WhatsApp Automation?

With so many automation tools available, you might wonder what makes MessageNest unique. Here are some compelling reasons to choose it:

Ease of Use: The intuitive interface ensures that anyone on your team can start using it without extensive training.

Scalability: Whether you’re a startup or an enterprise, MessageNest grows with your business.

Data Security: Your customers' privacy is paramount, and MessageNest adheres to the highest data protection standards.

Customizability: Tailor every feature to align with your brand and workflow.

By offering flexibility and reliability, MessageNest helps businesses build stronger relationships with their customers.

The Benefits of WhatsApp Automation

Investing in WhatsApp automation with MessageNest offers tangible benefits, including:

Time Efficiency: Automating repetitive tasks frees up your team to focus on more strategic initiatives.

Cost Reduction: Save on labor costs by letting automation handle routine interactions.

Enhanced Customer Experience: Prompt, accurate responses lead to happier customers and higher retention rates.

Improved Campaign Effectiveness: Targeted, personalized messages yield better engagement and conversion rates.

These benefits directly contribute to the growth and success of your business, making WhatsApp automation a worthwhile investment.

Future-Proof Your Business with MessageNest

As technology evolves, customer expectations continue to rise. Staying ahead in this competitive landscape requires tools that not only meet current demands but also prepare you for future challenges. With its innovative features and commitment to excellence, MessageNest ensures your business is always a step ahead.

By adopting MessageNest, you're not just investing in a WhatsApp automation tool—you're investing in the future of your business.

0 notes

Text

WhatsApp AI: Revolutionizing Communication and Beyond

In today’s fast-paced world, communication plays a pivotal role in personal and professional spheres. Enter WhatsApp AI, a game-changer that is reshaping how individuals, businesses, and organizations interact. Leveraging artificial intelligence to enhance WhatsApp’s capabilities is transforming it from a simple messaging app to a robust tool for automation, customer engagement, and personalized experiences. Let’s dive into the world of WhatsApp AI and explore how it is influencing various aspects of our lives.

What is WhatsApp AI?

At its core, WhatsApp AI refers to integrating artificial intelligence technologies into WhatsApp to enhance its functionalities. This includes chatbots, machine learning algorithms, and natural language processing (NLP) models that make interactions smarter, faster, and more intuitive. AI can automate tasks, provide instant responses, and even offer data-driven insights, making WhatsApp a go-to platform for more than just chatting.

The Role of AI in WhatsApp

The application of AI in WhatsApp extends across various domains, such as:

1. Chat Automation with WhatsApp Chatbots

WhatsApp chatbots powered by AI are revolutionizing customer service. These bots can handle multiple inquiries simultaneously, provide 24/7 support, and deliver accurate information instantly. Whether it’s answering FAQs, processing orders, or troubleshooting, businesses can rely on AI-driven chatbots to improve efficiency and customer satisfaction.

2. Personalized Communication

WhatsApp AI enables personalized messaging by analyzing user behavior and preferences. This is particularly useful for businesses running marketing campaigns. Instead of sending generic messages, companies can tailor their communication to individual needs, boosting engagement and conversion rates.

3. Language Translation

Breaking language barriers is another significant advantage of WhatsApp AI. AI-powered translation tools integrated into WhatsApp can instantly translate messages into various languages, fostering seamless communication between users across the globe.

4. Smart Notifications and Reminders

AI can also help users stay organized by offering smart notifications and reminders based on their habits and schedules. For instance, it can remind users of upcoming meetings, tasks, or appointments in a personalized and timely manner.

5. E-commerce Integration

AI has transformed WhatsApp into a mini e-commerce hub. With AI-driven solutions, businesses can showcase products, guide users through purchase decisions, and complete transactions—all within the app.

Benefits of WhatsApp AI

Efficiency: Automating repetitive tasks allows businesses to save time and allocate resources more effectively.

Scalability: Businesses can handle a large volume of interactions without compromising on quality.

Cost-Effectiveness: AI reduces the need for extensive human intervention, cutting operational costs.

Improved User Experience: Real-time responses and personalized communication enhance user satisfaction.

Data Insights: AI tools analyze interactions to provide valuable insights for businesses to make data-driven decisions.

Real-World Applications

1. Customer Support

From handling complaints to tracking orders, WhatsApp AI is becoming a trusted assistant for customers and companies alike.

2. Healthcare

Hospitals and clinics use WhatsApp AI to schedule appointments, share reports, and send reminders to patients, ensuring a seamless healthcare experience.

3. Education

Educational institutions are leveraging AI-powered WhatsApp tools for administrative tasks, such as fee reminders, class schedules, and assignment submissions.

4. Travel and Hospitality

Travel agencies use WhatsApp AI to send ticket details, itinerary updates, and hotel booking confirmations, making the travel experience hassle-free.

5. Retail

Retailers are integrating AI into WhatsApp to showcase products, manage inventory, and guide customers through their shopping journey.

The Future of WhatsApp AI

As artificial intelligence continues to evolve, the scope of WhatsApp AI is bound to expand. Future innovations may include even more advanced conversational AI, predictive analytics for proactive customer engagement, and seamless integration with other apps and services. The possibilities are limitless, and the potential for growth is immense.

1 note

·

View note

Text

The Hidden Power of WhatsApp Chatbots: Are You Ready?

Businesses use WhatsApp chatbots to improve customer experience by offering a personal touch to customer interactions, increase engagement, and generate leads. All within the world’s most popular messaging app, which has around 500 million users in India.

This popularity of WhatsApp makes it easy for businesses to connect with their customers. The app's end-to-end encryption also adds an extra layer of security, which makes businesses more comfortable using the WhatsApp chatbot for business.

WhatsApp Bot for Business: A Closer Look

WhatsApp chatbot for business comes with the following features and benefits:

1) WhatsApp Bot API

The WhatsApp Bot API connects directly with the WhatsApp platform. It allows your business to automate communications, link with your CRM systems, and manage customer interactions all in one place.

2) Automation and Customization

You can configure bots to respond to specific queries, send order updates, manage appointment bookings and a lot more. At the same time, it ensures the bot behaves according to your brand's tone and style.

3) Multi-Language Support

In case you’re serving a global audience, the multi-language support in WhatsApp chatbots comes extremely handy. Bots can be programmed to interact in various languages, ensuring all customers are heard, understood, and responded to in their languages.

WhatsApp Chatbot brings you hordes of advantages.

4) Customer Engagement 24/7 with Reduced Operational Costs

Bots handles all your customer queries without holidays and 24/7. It ensures your customers always get quick responses, whether for product inquiries, order status, or support questions. You can reduce the need for additional staff and enjoy cost savings.

5) Lead Generation

Your bot chats with potential customers automatically. It asks a few questions to see if they’re genuinely interested and then shares offers based on what they’re looking for. This way, your business can bring in more sales with less work.

6) Better User Experience

These bots don’t just send out standard replies; they use customer data to send messages that feel more personal and human. This makes the interaction feel like it’s tailored to each person’s needs.

Let’s see how the WhatsApp bot for business is proving a pathbreaker for companies.

Case Study

How Wabo.ai’s WhatsApp Bot Helped a Healthcare Company Cut Response Times by 30% and Improve Patient Experience

The Company

The client is a well-known healthcare provider that offers a wide range of services, from medical consultations to wellness programs. With a growing number of patients, they were struggling to keep up with all the inquiries coming in through multiple platforms like WhatsApp, email, and their website.

The Problem

With so many messages coming in, it was hard to respond quickly to every patient. This caused delays in appointment bookings, follow-up questions, and other important queries. Plus, their system didn’t work well with the different communication channels, which made it tough to keep track of important patient information.

Patients weren’t happy with the slow response times, and it was becoming a bigger problem as more people reached out for help.

The Solution

The client decided to use Wabo.ai’s WhatsApp bot to make things easier. By integrating WhatsApp with their customer management system (CRM), they were able to streamline communication and provide faster, better service.

Here’s how it worked:

Centralized Communication

All patient messages from WhatsApp, email, and the website were combined in one place. This made it much easier for the support team to manage.

Automated Replies with Personalized Messages

Routine questions about appointments, prescriptions, or insurance were handled automatically by the WhatsApp bot. This meant patients didn’t have to wait for a human to respond. The patients also received better and more personalized answers.

The Results

Faster Responses

Response times were 30% faster. The bot took care of many routine tasks, so staff could focus on more complex issues.

More Satisfied Patients

With quicker, personalized replies, patient satisfaction increased.

Better Efficiency

The support team could handle more patients without needing to hire more people. This saved money and made the business more efficient.

Final Thoughts

WhatsApp chatbots are no longer just a trend. They are fast becoming a game-changer for companies that want to improve customer engagement, reduce operational costs, and increase sales.

0 notes