#what is forex reserves india

Explore tagged Tumblr posts

Text

youtube

India's foreign exchange reserves have plummeted to an 8-month low, sparking concerns about the country's economic stability. In this video, we'll dive into the reasons behind this decline and what it means for the Indian economy. From the impact on the rupee's value to the effects on foreign investments, we'll break down the implications of this significant development. Stay ahead of the curve and understand the intricacies of India's forex reserves with our in-depth analysis.

☑️ To Open A Demat Account Click : https://bit.ly/3gajLlF

☑️ Or Whatsapp Us on : 9329099009

Download Indira Securities App📱 https://www.indiratrade.com/mobile-trading

About Us---

The Indira Group founded in the year 1987 and since then it has set a benchmark for the quality services and a very special personal touch. It has reached out deep into the souls of investment class [right from corporate, to HNI’s, to conscious small investor’s].

To know more about Indira Securities visit us at: - https://www.indiratrade.com/

Follow Us On Social Media:

Like us on Facebook: - https://www.facebook.com/indirasecurities/

Follow us on Twitter:- https://twitter.com/indiratrade

Follow us on LinkedIn:- https://www.linkedin.com/company/indira-securities-p-ltd-/

Follow us on Instagram:- https://www.instagram.com/indira_securities/

#india's forex reserves#forex reserves of india#indias forex reserves latest#foreign exchange reserves#what is forex reserves india#forex reserves in hindi#india forex reserves news#india's forex reserve#india forex reserves#india's foreign exchange reserves#india's forex reserves cross $600 billion#indian foreign exchange reserves#india's foreign exchange reserve falling#gold reserves in india#india forex reserves 700 billion#india forex reserves drop#Youtube

0 notes

Text

My mum remembers Coca-Cola coming to the country for the first time.

The first time that bottled coke, in the sleek glass bottles with the elaborately painted logo, was sold out of crates and chillers by a vendor who would cycle from house to house, stacked crates in tow.

They'd seen them before, of course. Granddad was very well-travelled, his work took him across the country and occasionally overseas. It made him a knowledgeable, well-read and respected man. He'd been abroad: Malaysia, Germany, Indonesia, other places I wasn't told about. He'd seen Coca-Colas. He was an adventurer of sorts, which I suppose shouldn't seem too out of the ordinary for someone who had chosen a career of tinkering with chemicals professionally. Wherever he travelled, mum recounted, he'd bring back a little souvenir. Music from abroad, posters, books, branded sweets that weren't sold in protectionist India.

It wasn't an unreasonable decision. After 200 years of being leached dry and Indian industry being virtually nonexistent, it wasn't hard to see why post-colonial India had closed off its domestic industries to outsiders. The government took control of most local trade and incentivised the Indian economy to grow without competition from wealthier players (at that point, there were companies that were wealthier than the entire nation of India).

This did however mean that no international products were sold in India. Imports were limited to the most basic parts and things that could not be procured locally, often raw materials. Coca-Cola was limited to glimpses in foreign films, and of course, to those who travelled. (Nothing was banned, of course. It was about the economy, not access to international goods.)

This changed in 1991. Finance Minister Manmohan Singh's decision to deliberately devalue the rupee, open up the tightly-controlled Indian market for trade and usher in the age of globalisation introduced the world to India again, this time in its local paan shop (or cornershop, aware of the fact that like 3 people that follow me at best will know what that means). Mum remembers buying Coca Cola for the first time, in rupees, locally in 1991 as a girl. It sounds like a very small and trivial thing, but it was part of a decision that changed the Indian economy's fortunes forever.

From a country that had maybe two weeks' worth of forex reserves in tow, India evolved to become one of the fastest-growing GDPs in the world. It was once again Dr. Manmohan Singh's policies, this time as Prime Minister in 2008, that meant India escaped the worst of the global financial crisis. The economy didn't crash, didn't go into recession, fewer jobs were lost, and largely, India emerged unscathed compared to larger economies out west.

But I think about some of these little things, and how he changed the country forever, as the nation observes his passing today.

#politics#economy#history#world history#culture#coca cola#writing#manmohan singh#global news#global politics#news#world news#desi#India

5 notes

·

View notes

Text

Most Trusted Platform for Money Exchange in Delhi

When it comes to exchanging currency in Delhi, several factors contribute to determining the most trusted platform. These include transparency in rates, security of transactions, convenience of service, and customer support. Based on these criteria, Guruji Forex emerges as the leading choice for money exchange in Delhi.

Why Guruji Forex is the Most Trusted Platform

Transparent Rates: Guruji Forex offers live and transparent exchange rates without hidden fees or mark-ups. This means customers can see exactly what they are getting when they exchange their money, eliminating the uncertainty often associated with currency exchange.

Security and Reliability: The platform has exclusive tie-ups with banks and RBI-authorized money changers, ensuring that all transactions are secure and that customers receive genuine currency notes. This significantly reduces the risk of counterfeit notes.

Convenience of Service: One of the standout features of Guruji Forex is its online booking system, which allows users to order foreign currency from the comfort of their homes. With same-day doorstep delivery available for orders placed, it provides a level of convenience that traditional exchange counters cannot match.

24/7 Customer Support: Guruji Forex offers round-the-clock customer support to assist users with any queries or concerns they may have during the exchange process. This level of service enhances trust and reliability.

Comprehensive Forex Services: Beyond just currency notes, Guruji Forex also provides various forex products such as forex cards and travel insurance options, making it a one-stop shop for all foreign exchange needs.

User-Friendly Interface: The website (gurujiforex.com) are designed for ease of use, allowing even those unfamiliar with online transactions to navigate the process smoothly.

In Delhi, there are several trusted platforms for currency exchange. Here are some of the most reliable options:

1. Guruji Forex (www.gurujiforex.com)

Why Trusted? A recognized brand with secure and transparent processes.

Services Offered: Forex cards, cash currency exchange, and international money transfers.

How to Access? Online (www.gurujiforex.com) or via their physical offices in Delhi.

RBI-Authorized Money Changers

Why Trusted? They follow strict Reserve Bank of India (RBI) regulations. Examples include Guruji Forex.

How to Find? You can check the RBI website for a list of authorized money changers.

Tips for Safe Transactions:

Always verify the platform's RBI authorization if it’s not a well-known brand.

Compare rates online before making a decision.

Use Guruji Forex online platforms (Gurujiforex.com) for transparency in rates and fees.

In summary, considering all these aspects—transparency in rates, security measures, convenience through online services, comprehensive customer support, and additional forex products— Guruji Forex stands out as the most trusted platform for money exchange in Delhi.

#money exchange in Delhi#authorized money changers#best currency exchange in delhi#money exchange near me#forex exchange in delhi#currency exchange services#foreign currency exchange#forex dealers#currency exchange#currency exchange in delhi airport#money changer in delhi

0 notes

Text

Yuan Moves and Dollar Grooves: A Forex Trader’s Cheat Sheet The Yuan Whisper: What China’s Currency Devaluation Plans Mean for You In the high-stakes world of Forex trading, news is your North Star—but only if you know how to read it. While most traders are still scratching their heads over yesterday’s headlines, you’re here for the insider’s guide. Today, we’re diving deep into the implications of China’s rumored plans to weaken the Yuan in 2025 and unraveling the threads connecting the USD, JPY, and more. Let’s decode the market moves so you can act with precision—and maybe a little swagger. The Plot Thickens: Yuan Weakening in 2025 Imagine planning a party two years in advance. Now replace the balloons with billions of dollars, and you’re thinking like China’s policymakers. Reuters reports that China may allow the Yuan to weaken in 2025 as a countermeasure to lingering Trump-era tariffs. The news gave the USD a boost, with the Dollar Index (DXY) hitting a new weekly high at 106.68, flirting with last week’s peak at 106.73. What This Means for You: A weaker Yuan typically bolsters Chinese exports by making them cheaper. For traders, this could spell heightened USD strength—a ripple effect that might disrupt your usual EUR/USD or USD/JPY setups. Stay sharp: the early bird catches the pips. The EUR/USD Rollercoaster: A Quick Dip Below 1.05 In response to the USD’s rally, EUR/USD dipped briefly below 1.05, scraping a low of 1.0489. It stopped just short of the December low at 1.0460. This isn’t just a dip—it’s an invitation. With the European Central Bank (ECB) unlikely to pull out any surprises, the USD’s momentum could keep pressing the EUR down. Insider Tip: Look for opportunities to short EUR/USD if the pair revisits the 1.05 mark. A bounce-back strategy could also be in play if today’s CPI data surprises to the downside, cooling USD enthusiasm. JPY Strikes Back: The BoJ’s Balancing Act Over in Japan, the Yen made some noise during APAC hours after Japanese Producer Price Index (PPI) data came in hot. However, the buzz around a potential Bank of Japan (BoJ) rate hike was tempered by Bloomberg’s report—the BoJ isn’t rushing. USD/JPY reclaimed its position above the 200-day moving average at 152.00, peaking at 152.65. Key Takeaway: The BoJ’s reluctance to intervene could make the Yen vulnerable to further losses against the USD. Keep an eye on the 152.00 level; a sustained break below could signal a shift. GBP’s Snooze Button: A Quiet Day for the Pound The British Pound’s range-bound behavior reflects a lack of catalysts. GBP/USD hit 1.2781 overnight but settled back into its usual 1.2724-1.2778 groove. Friday’s UK GDP report isn’t expected to shake things up for the Bank of England (BoE), leaving traders to focus on external USD drivers. Trading Tip: When the Pound goes quiet, consider cross-pair opportunities like EUR/GBP, where volatility might provide better setups. CAD in the Spotlight: Bank of Canada Rate Decision The Canadian Dollar stood steady ahead of today’s Bank of Canada (BoC) rate decision. Markets expect a 50 basis point cut but remain wary of a smaller 25bps move. While not the headline-grabber of the day, CAD’s trajectory could influence USD/CAD dynamics significantly. Strategy Insight: If the BoC surprises with a more conservative cut, expect USD/CAD to pull back. Conversely, a 50bps cut could fuel further USD dominance. The Hidden Forces: China, India, and Beyond China’s Yuan saga isn’t the only game in town. The Reserve Bank of India (RBI) is reportedly selling USD to curb the Rupee’s slide, while the People’s Bank of China (PBoC) set the USD/CNY midpoint lower than expected. These moves reflect a broader trend: central banks in emerging markets are actively defending their currencies. Final Thoughts: When central banks play defense, opportunities arise for traders who know where to look. Watch for knock-on effects in cross-pairs like USD/INR and USD/CNH. Elite Tactics Recap: - China’s Yuan Strategy: Monitor USD strength and its ripple effects across major pairs. - EUR/USD Short Opportunity: Target the 1.05 level with tight stops. - JPY Watch: 152.00 is your line in the sand for USD/JPY. - BoC Decision: Stay nimble; smaller-than-expected cuts could swing USD/CAD sharply. - Emerging Markets: Keep tabs on central bank interventions in INR and CNH. Stay Ahead with StarseedFX Want real-time updates, advanced strategies, and exclusive Forex insights? Here’s how we can help: - Forex News Today: Get the latest market movers and shakers. - Free Forex Courses: Upgrade your skills with actionable education. - Community Membership: Join a network of pros for expert analysis and daily alerts. - Smart Trading Tool: Optimize your trades with precision tools. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

🚨𝐏𝐥𝐚𝐧𝐧𝐢𝐧𝐠 𝐚 𝐭𝐫𝐢𝐩 𝐭𝐨 𝐌𝐚𝐥𝐝𝐢𝐯𝐞𝐬?🚨 𝐓𝐫𝐚𝐯𝐞𝐥 𝐣𝐮𝐬𝐭 𝐠𝐨𝐭 𝟒𝟎𝟎% 𝐞𝐱𝐩𝐞𝐧𝐬𝐢𝐯𝐞!! 😱😱😱 🌴 What's Happening in the Maldives? 🌴

It seems the Muizzu government might have taken a misstep!

🚨 Big Changes Ahead: 🔹 Departure Fees skyrocket starting December 1st:

💺 Economy: $50

🛋️ Business: $120

👑 First Class: $240

🛩️ Private Jets: $480

🔹 Green Tax doubles from January 1st:

🌱 Now $6/day (regular tourists)

🌿 $12/day (luxury accommodations)

Will these changes dampen the allure of this island paradise? 🌊✈️

🧐𝐖𝐡𝐲? - Due to the country’s forex crisis. - Maldives suffers from poor forex reserves as estimates suggest the country has less than $500 million in reserves! - The country narrowly avoided becoming the first to default on Islamic sovereign debt! - The country recently set new rules mandating all foreign currency revenues to be deposited in local banks! - Last month, India signed a massive $760 million currency swap agreement with the Maldives to help the latter’s struggling economy! 😲𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐢𝐧𝐠𝐥𝐲: - Tourism bodies in Maldives have spoken against the move. - Some believe that increasing taxes so sharply would force individuals to look for other beach locations and kill the domestic tourism industry! - On the other hand, others have asked for more time to accommodate these changes. ❓𝑾𝒊𝒍𝒍 𝒕𝒉𝒊𝒔 𝒎𝒐𝒗𝒆 𝒉𝒆𝒍𝒑 𝒕𝒉𝒆 𝑴𝒂𝒍𝒅𝒊𝒗𝒊𝒂𝒏 𝒆𝒄𝒐𝒏𝒐𝒎𝒚? 𝑶𝒓 𝒓𝒖𝒊𝒏 𝒕𝒉𝒆 𝒕𝒐𝒖𝒓𝒊𝒔𝒎 𝒊𝒏𝒅𝒖𝒔𝒕𝒓𝒚 𝒕𝒉𝒆𝒓𝒆?? Follow Jobaaj Stories (the media arm of Jobaaj.com Group for more)

Stay updated on stories that matter. Jobaaj Stories, the media arm of Jobaaj Group, is here to bring you insights, analysis, and news that educate and inspire. Follow us for the latest updates and deeper dives into the stories shaping our world!

0 notes

Text

What is Forex Reserves & How is India winning the game?

At the end of every week, you hear news that Indian forex reserves have increased by X billion dollars or have reduced by Y billion dollars. What is forex reserve, and what does it mean when it increases or decreases?

Forex Reserves are assets held by the Reserve Bank of India (RBI) in different forms. Some forms are foreign currencies, gold, and Special Drawing Rights (SDRs). These reserves by RBI act as a cushion for India against economic shocks and help us maintain stability in the face of currency fluctuations, trade deficits, or sudden capital outflows.

How does it help India?

Here are some ways:

Economic Stability: Forex reserves support the rupee as they help stabilize its value against other currencies. When the rupee depreciates, the RBI sells dollars from its reserves, supporting the rupee and keeping inflation in check. Recently, if you check the news, the same is happening. Indian forex reserve is falling as RBI is selling dollars.

Trade and Investment Confidence: High reserves enhance confidence among foreign investors, as they indicate that India can manage external obligations, attracting more Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI).

Emergency Fund for Economic Crises: During economic downturns or financial crises, reserves provide a buffer, allowing the Indian government to meet international obligations or import essential goods without borrowing.

Managing Inflation and Imports: Reserves allow the country to finance imports in challenging times, preventing supply shortages that could drive inflation.

For the stock market, High forex reserves make India more attractive to foreign investors, as they signal a stable economy and reduce the risk of currency volatility. In September, India reached a milestone of $700 billion in forex reserves. However, the reserves are falling. Also, FIIs are exiting the market, and the stock market is falling. Are you confused about which stocks to pick in such a volatile market? Take help from a SEBI Registered Investment Advisor or use Jarvis AI to make the most of the stock market in India.

#jarvis ai#stock market ai#share market advisor#AI Stock in India#Best long term stocks#forex reserves#equity advisory company

0 notes

Text

What You Should Know Before Doing Money Exchange in India

When it comes to exchanging currency for any personal or professional purpose, the process can be tricky if you have not banked on the right platform. Also, little knowledge about money exchange in India can give you great loss in return. Therefore, in this article, I will talk about the key things that you should know before considering money exchange in India. Especially if you are looking for currency exchange in Gurgaon or other cities in Delhi, this article will really help you.

So, without further ado, let’s talk about the things to consider before buying forex exchange or money exchange in India.

Arrange Forex Exchange Before Your Travel Date To avoid last minute hurry, get your money exchange ready a few days before your actual travel date. If you have decided to do this a week before the travel date and the currency rates are quite high at that time, you can wait for one or two days to see whether there is a falling in the rate. Currency rates are dynamic, so if you are lucky you may get the deal at the lowest possible rate before your travel date.

Avoid Airport Outlets To Exchange Money Airports have foreign exchange outlets to serve people like you. But exchanging currency from airport outlet is certainly a costly option. A particular amount of money will be charged as a commission. If you wait for the last minute to do the money exchange, finally you will be left with no choice except opting for airport outlets. The worst thing is you cannot bargain in such outlets.

Compare Currency Exchange Rates Before Making The Buying Decision Currency exchange rates may vary, depending on the vendors. You must compare the rates from various vendors and digital platforms before buying. Nowadays there are some organizations that offer the best deal in Money exchange in Noida and other places throughout Delhi. They compare the rates from numerous banks and help you get the best possible rate.

Opt For Only RBI Authorized Forex Dealer Never deal with unfamiliar forex dealers. Nowadays there are many forex dealers around India, each claiming to be the best. But not all among them are genuine. You should check first the vendor you are choosing has money exchange license by Reserve Bank of India. Make sure you get bills on all transactions from them.

Go For Transferring Funds Instead Of Paying Cash There is a limitation in cash payments for buying forex exchange in India. Another buying option is paying through NEFT or RTGS directly to the dealer’s bank account. This option makes the entire transaction process traceable and transparent.

En cash Remaining Foreign Money If you have any leftover foreign currency in your forex card, encash it easily via a trusted platform. Also, you can keep the balance in the card if you are planning for your next international trip already. But one thing you should remember that your foreign currency worth up to USD 2000 can be kept in your card within six months maximum after you return form your last trip.

Following these tips will help you get the best deal in money exchange in India. Browse online and bank on a trusted dealer for availing money exchange service. When you sort out currency exchange matter properly you become hassle-free throughout your international trip.

#currency exchange in noida#currency exchange in gurgaon#money changer in noida#foreign exchange in gurgaon

0 notes

Text

Trusted Certificate Attestation Services in Bangalore | Attestation Services in Bangalore

Deeper economic engagement is strengthened with Attestation.

Banglore is a technically advanced city in India. The scientific research and training programs are boosting the realm of forex reserves. Capital investment is continuously thriving towards global migration. The educational efficacy in foreign countries is opening doors for opportunities in foreign territory. Certificate Attestation in Bangalore is necessary to pursue higher studies or permanent settlement in foreign countries. If you want to relocate abroad then it becomes your responsibility to have your certificates attested by the government agency.

What is Certificate Attestation in Bangalore?

Certificate Attestation in Bangalore is an essential part of verifying the individual's certificates. The attestation of the certificates is key to shift abroad legitimately. Certificate Attestation in Bangalore ensures that the certificates of the individual are genuine and original. The documents that need attestation from government authorities are commercial certificates, transfer certificates, diploma certificates, salary certificates, birth certificates, etc. The attestation of the certificates is affirmed by the legal norms and policies of the foreign countries. The sanctity of the certificates is confirmed with stamps, signatures, and seals of the government officer. When the certificates are attested foreign migration becomes viable and trustworthy.

What are the major requirements for the Certificate Attestation in Bangalore?

Original Certificates

Passport copies of the individual

What are the different types of Attestation?

Educational Certificates Attestation

Non-Educational Certificates Attestation

Commercial Certificates Attestation

What is the legal procedure for the Certificate Attestation in Bangalore?

For Educational Certificates Attestation:

Notary Attestation

HRD/SDM Attestation

MEA Attestation

Embassy Attestation

MOFA Attestation

For Non-Educational Certificates Attestation:

Notary Attestation

SDM/Home Department Attestation

MEA Attestation

Embassy Attestation

MOFA Attestation

For Commercial Certificates Attestation:

Chamber of Commerce Attestation

MEA Attestation

Embassy Attestation

MOFA Attestation

At Global Attestation, the immigrant can obtain the Certificate Attestation in Bangalore. For more details you can contact our team experts at Global Attestation Services

0 notes

Text

Domestic Markets Gain Slightly; Adani Stocks Surge, Forex Reserves Hit Record

What's Covered:

Domestic Markets: The Sensex and Nifty showed modest gains, with significant movements in sectoral indices and a record high in broader market indices.

Forex Reserves: India's forex reserves surged to an all-time high of $689.235 billion for the week ended September 6, 2024.

Stock Highlights: Adani Power and Adani Green Energy saw significant gains; Infosys and CDSL were also in the spotlight with major announcements.

In the afternoon trade on September 16, 2024, the Indian equity benchmarks exhibited limited gains. The Nifty 50 index was trading near the 25,400 level, recovering from an intraday low of 25,336.20. The barometer index, the S&P BSE Sensex, rose by 143.76 points or 0.17% to 83,034.59, while the Nifty 50 added 43.30 points or 0.17% to 25,399.80. Both indices had reached all-time highs earlier in the day, with the Sensex touching 83,184.34 and the Nifty hitting 25,445.70.

Among sectoral indices on the NSE, all except the Nifty FMCG index were trading in the green. The broader market saw positive movement, with the S&P BSE Mid-Cap index rising by 0.02% and the S&P BSE Small-Cap index increasing by 0.26%. These indices hit record highs of 49,506.01 and 57,502.74 respectively. The market breadth was positive, with 2,122 shares advancing and 1,882 shares declining.

Get More Info : Latest IPO Information

Website : https://financesaathi.com/

Contact Us : Economy and Finance News

#Indian Stock Market News Today#Finance Advisory services#Equity Investment Advisory#Indian Stock Market News

0 notes

Text

Business Travellers' Malaysia Visa Requirements: What You Need To Know

Knowing the visa requirements can help a business trip to Malaysia to be effective and seamless. Hub of economic activity in Southeast Asia, Malaysia has plenty of chances for business leaders. To seize these chances, however, business visitors have to properly negotiate the Malaysian visa application procedure. This blog will walk you through the necessary paperwork and procedures for a Malaysia Business Visa, therefore guaranteeing hassle-free and efficient travel.

Types of Malaysia Business Visas

Indian citizens seeking to work in Malaysia may obtain one of two types of visas.

E-Visa: The e-Visa is available in 166 countries, including India, and can be used for business, tourism, and urgent medical appointments.

Usually, it is valid for many entries spread over ninety days.

Regular Visa: Issued by the Malaysian Embassy or Consulate in your own country, this regular Visa is needed for longer stays or those ineligible for the e-Visa. Direct document submission to the embassy is part of the application procedure.

Malaysia Business Visa Eligibility Requirements

Those qualified for a Malaysia Business Visa have to satisfy the following requirements:

Real Purpose: You have to have a legitimate invitation from a real Malaysian firm from whom you are or will be doing business.

Financial Stability: You have to have enough money to cover your stay in Malaysia plus any dependents and yourself.

Ties to country: Evidence of links to your home country—such as property, family, or employment—that would guarantee your return after the business trip.

Good Character: One needs a spotless criminal record. Should you be asked, you might have to present a Police Clearance Certificate (PCC).

Good Health: As decided by Malaysian authorities, you have to satisfy the minimal health standards.

Documents Needed for the Malaysia Business Visa

Applying for a Malaysia Business Visa requires the following paperwork:

Passport: Your passport must be valid for a minimum of six months after your entry to Malaysia.. It should have two blank pages minimum for stamping.

Pictures: New passport-sized pictures are needed. The pictures have to satisfy certain standards like a white backdrop, a neutral facial expression, and no spectacles.

Flight Itinerary: Proof of your travel plan and return to your home nation depends on a confirmed round-trip flying ticket.

Covering Letter: Printed on official letterhead, a covering letter from your firm or employer should address the reason for your visit, length of stay, and kind of business connection.

Invitation Letter: Official invitation letter from the Malaysian firm you are planning to visit. Along with any sponsorship information, this letter should provide the contact information and reason for the visit.

Bank Statement: A recent bank statement stamped and signed by the bank on every page indicates that you have enough money to meet your hotel costs.

Proof of lodging: Like a hotel reservation or a letter verifying your intended lodging during your trip,

Business Itinerary: Including meetings, conferences, and other pertinent events, this comprehensive calendar of your corporate activities in Malaysia.

Government ID: Proof of your nationality and identity issued by your government.

Forex Receipt: A documentation proving your access to enough foreign exchange to meet your costs or indicating your currency exchange activity.

Application Form: The application form for a Visa must be signed by the applicant after precise information completion. Every piece of information must be accurate as any errors could cause delays or visa refusal.

Malaysian Business Visa Application Process

Verify Your Eligibility: Verify you satisfy all the requirements for the Malaysia Business Visa before applying. To be sure, visit the official Malaysian government website or speak with a qualified visa agency.

Paperwork: Prepare the required paperwork by compiling all the previously mentioned ones. Make sure every paper satisfies the given requirements, including passport validity and picture standards.

Submit the Application: Apply online or at the closest Malaysian Embassy or Consulate based on the kind of visa you want—e-visa or Regular Visa. While for the Regular Visa, you may need to provide actual copies, for the e-visa you will need to upload digital versions of your documentation.

Pay the Visa Charge: Your nationality and the kind of visa will affect the visa charge. Usually, one makes payments online using a credit or debit card or an online payment wallet. Make sure your payment information is handy.

Receive Your Visa: Should you apply for an Electronic Travel Authorisation (ETA), you will get one after application submission. Regular Visa applicants will find your visa stamped in your passport. While processing periods vary, an e-visa usually takes up to 72 hours and a regular Visa takes longer.

Travel to Malaysia: You are ready to go having your visa with you.

Important Points to Remember

Validity: Usually valid for thirty days per visit, the Malaysia Business Visa allows for many visits within ninety days.

Entry Points: Valid for admission via five seaports and 25 approved airports, the e-Visa includes Langkawi International Airport and Kuala Lumpur International Airport.

Visa On Arrival: Under particular circumstances, like travel via Singapore, Thailand, Indonesia, or Brunei with a valid visa from one of these countries, Indian nationals may also receive a Visa on Arrival in Malaysia.

Expert Guidance: Seeking expert visa assistance is advised for a seamless application procedure, particularly if your application requires complicated documents or if you are not sure about certain requirements.

Finally,

Although applying for a Malaysia Business Visa seems like a difficult chore, it may be a simple procedure with the correct information and preparation. Making the most of your company prospects in Malaysia will allow you to concentrate on what counts—that is, making sure all of your documentation is in order and satisfies eligibility standards. Whether you're looking at new alliances, closing transactions, or showing up for meetings, a good visa application is your first step towards a trip that will be fulfilling.

Contact a professional visa agency like VisaCollect for more specific information and help with your visa application. Our trained consultants can walk you through each stage of the procedure.

FAQs

1. What is the Malaysia Business Visa processing time?

Usually processing in up to 72 hours, the e-Visa are handled by the Malaysian Embassy or Consulate; the Regular Visa may take more time depending on their processing schedule.

2. Can I get a Malaysia Business Visa in case my passport expires?

No; your passport has to be valid for at least six months starting on your arrival into Malaysia. Renewal of your passport before application is advised if it is about to expire.

3. With a Business Visa, may I remain in Malaysia longer?

Usually, the Malaysia Business Visa has no extendability. If you have to remain longer, you could have to apply for another kind of visa or depart and re-enter Malaysia depending on your visa enables multiple entries.

4. Does getting a Malaysia Business Visa call for any particular health considerations?

Indeed, you have to satisfy the minimal health standards established by Malaysian authorities. Based on your health state and duration of stay, a medical evaluation might be needed.

5. Can I go for vacation with a Malaysia Business Visa?

Although a Malaysia Business Visa is mostly meant for business purposes, it could let you travel some during your stay. Still, your main reason for travel should coincide with the kind of visa you have been issued.

0 notes

Text

Maximize Your Budget with Multicurrency Forex Cards

Muthoot FinCorp ONE is your gateway to seamless and efficient international transactions. In a world that’s increasingly interconnected, managing your finances across borders should be easy, secure, and cost-effective. And that's where multicurrency Forex cards come into play.

Your Multicurrency Advantage

Let's talk about the offering at your disposal - multicurrency Forex cards. At Muthoot FinCorp ONE, we cater to your international financial needs, allowing you to buy, sell, reload Forex cards, and send money abroad without the complexities of trading. Imagine the convenience of carrying multi-currency cards or cash, all under one secure and reliable platform.

Reliability and Security at Your Fingertips

With Muthoot FinCorp ONE, you can expect 100% secure transactions and competitive exchange rates. Whether you're planning a vacation, conducting business overseas, paying for education, or seeking medical treatment abroad, our services ensure hassle-free processes and 24-hour transfers guaranteed. Plus, our multicurrency cards are widely accepted, empowering you to withdraw cash from ATMs across the globe.

Convenience Redefined

The flexibility to get cash, a multi-currency card, or transfer money anytime, anywhere - that's what we offer. Purchasing Forex or conducting outward remittances doesn't require you to visit a Muthoot FinCorp branch. You have the convenience of applying for a multi-currency Forex card online and having it delivered to your doorstep. Moreover, reloading your existing card or sending money abroad can be seamlessly done both online and offline.

However, for cash collection or foreign currency exchange, visiting your nearest Muthoot FinCorp Forex branch might be necessary.

Understanding RBI Guidelines

You might wonder about the limitations and permissible purposes for international money transfers. The Reserve Bank of India operates under the Liberalized Remittance Scheme (LRS), allowing an annual transfer limit of USD 2,50,000 per financial year. Various purposes, such as private visits, business travels, education expenses, medical treatments abroad, and more, are endorsed by RBI for non-trade accounts.

Your Financial Freedom with Muthoot FinCorp ONE

At Muthoot FinCorp ONE, our goal is to facilitate your financial freedom. Whether it's securing Forex with competitive rates, obtaining cash from branches, or having a multicurrency card delivered to your doorstep, we ensure a hassle-free experience. Reloading your card for multiple currencies is a breeze, making international money transfers a seamless affair, available anytime and anywhere.

When it comes to maximizing your budget and ensuring convenience in international transactions, Muthoot FinCorp ONE stands as your trusted partner. Say goodbye to the complexities and uncertainties and embrace a world where managing your finances globally is simple, secure, and accessible.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Muthoot FinCorp ONE website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

Riding the Forex Wave: Hidden Insights to Trade Smarter The Dollar Index Takes a Chill Before the US CPI Splash The DXY (Dollar Index) spent the session doing its best impression of a Zen monk: calm and still. Traders held their collective breath, waiting for the US CPI report to drop like a rock into the market pond. By late APAC trade, the index decided to stretch a little, inching toward its highs. Think of it as the prelude to a movie where you just know the fireworks are coming. Pro Tip: Keep your eyes on that CPI release. It's like the cliffhanger of a Forex thriller—you don’t want to miss what’s next. EUR/USD: The Calm Before the ECB Storm If EUR/USD were a movie, today would’ve been the extended montage of characters staring at each other meaningfully. The pair tiptoed between 1.0521 and 1.0539 with barely a ripple. Why so quiet? Traders are saving their energy for Thursday’s ECB meeting. Underground Insight: ECB meetings often come with surprises. Have your contrarian strategies ready—sometimes the market’s “obvious” move isn’t so obvious. GBP/USD: All Quiet on the Sterling Front Sterling’s action today was akin to the British weather: uneventful but still worth preparing for. GBP/USD stayed within a tight APAC range of 1.2769-81, with the UK news cycle as dry as a desert. Hidden Tactic: Use days like this to fine-tune your trading plan. Small ranges can offer opportunities to test scalping techniques without the chaos of high volatility. USD/JPY: PPI Surprise Hits Hard USD/JPY had a brief identity crisis after higher-than-expected Japanese PPI data. The pair slipped below 152.00 and even flirted with 151.50 before finding some footing. It’s like the market collectively said, “Wait, what just happened?” Game-Changer: Keep an eye on Japanese economic data. It’s often underrated but can pack a punch, especially when paired with BOJ policy shifts. Antipodeans: A Flatline with a Twist AUD and NZD traded like a heart monitor in a rom-com—flat with a few minor blips. Catalysts were nowhere to be found, but traders are prepping for upcoming risk events. Advanced Move: Flat markets are your sandbox for experimenting with range-trading strategies. Perfect those, and you’ll have an edge when volatility returns. Yuan’s Modest Gains Amid Chinese Optimism The yuan had a modest morning, buoyed by continued optimism around China. Gains were capped as traders awaited insights from the Central Economic Work Conference. Meanwhile, the PBoC set the USD/CNY midpoint at 7.1843, slightly stronger than expected. Elite Tactic: Watch how markets react to PBoC’s midpoint settings. It’s a subtle but telling indicator of their monetary policy leanings. INR Intervention? RBI Gets Tactical The Reserve Bank of India likely stepped in to sell USD and curb the rupee’s fall. Reuters reported trader chatter about this sneaky intervention. Contrarian Tip: Emerging market currencies like INR can offer incredible opportunities when central banks intervene. It’s like a cheat sheet—you get clues about their strategy. Closing Thoughts: Mastering the Market’s Quiet Days Not every trading day is a blockbuster, but even the calm ones hold nuggets of gold. Use these moments to sharpen your strategies, spot subtle trends, and prepare for the next big move. And remember—success in Forex isn’t just about catching the big waves; it’s about mastering the quiet currents too. Read the full article

0 notes

Text

Make Your Money Work for You: The Best Forex Trading App in India!

Unlock financial freedom with the top Forex trading app in India! Let your money soar to new heights effortlessly.

Introduction

In a world where your investments flourish,the prospect of making your money work for you has never been more enticing. Picture this: and your dreams become reality, is increasingly turning to Forex trading as a means to unlock the potential for substantial returns. In this article, we will discuss an exciting journey to explore the best Forex trading apps in India, empowering you to seize the reins of your financial future.

Understanding Forex Trading

What is Forex Trading?

Forex trading, short for foreign exchange trading, involves the buying and selling of currencies in the global financial market. The goal is to profit from the fluctuating exchange rates.

Why Choose Forex Trading?

Forex trading offers unparalleled flexibility, accessibility, and the potential for substantial profits. Unlike traditional investments, you can trade 24/7, making it an excellent choice for those who want their money to work around the clock.

The Best Forex Trading Apps in India

1. MetaTrader 4 (MT4)

MetaTrader 4 is a globally acclaimed Forex trading app known for its user-friendly interface and advanced analytical tools. It's an excellent choice for both beginners and experienced traders.

2. MetaTrader 5 (MT5)

Building on the success of MT4, MetaTrader 5 brings more features and enhanced trading capabilities, making it a preferred choice for traders looking for advanced charting and technical analysis tools.

3. IQ Option

IQ Option is a versatile trading app, offering Forex, CFDs, and options trading. It's popular for its intuitive platform and a wide range of tradable assets.

4. eToro

eToro, a global social trading platform, has gained popularity in India. It allows users to copy the trades of experienced investors, making it an ideal choice for beginners.

5. Zerodha Kite

Zerodha Kite is a prominent choice for Indian traders. It offers a straightforward trading experience and is known for its low brokerage fees.

Benefits of Using Forex Trading Apps

Convenience

Forex trading apps provide the convenience of trading on the go. like Bajaj Finserv Brokerage Calculator, You can access your account from your smartphone or tablet, ensuring your money works for you wherever you are.

Education and Analysis

These apps offer educational resources and in-depth analysis to help you make informed trading decisions. Many provide access to news, market trends, and expert insights.

Risk Management

Forex trading apps allow you to set stop-loss orders and take-profit levels, helping you manage risk and protect your investments.

Tips for Successful Forex Trading

1. Education is Key

Invest time in learning about Forex trading before diving in. Understanding the market and strategies is crucial.

2. Practice with a Demo Account

Most Forex apps offer demo accounts to practice trading without risking real money. Utilize this feature to gain experience.

3. Start with a Small Investment

Begin with a modest investment to minimize risk. As you gain confidence, you can gradually increase your capital.

4. Stay Informed

Keep up with the latest financial news and global events that could impact currency markets.

Conclusion

In a dynamic financial landscape, making your money work for you through Forex trading is a viable option. With the right knowledge and the best Forex trading apps in India, you can navigate the complexities of the currency market and potentially reap substantial rewards.

Are you ready to take the plunge and explore the world of Forex trading in India? The best Forex trading app awaits you. Start your journey towards financial empowerment today!

Frequently Asked Questions

Q1. Is Forex trading in India legal?

A1: Yes, Forex trading is legal in India. However, it is subject to specific regulations and guidelines set by the Reserve Bank of India.

Q2. Can I start Forex trading with a small investment?

A2: Yes, many Forex trading apps in India allow you to start with a small investment, making it accessible to a wide range of investors.

Q3. Are there any risks associated with Forex trading?

A3: Yes, like any form of trading, Forex trading carries risks. It's essential to be aware of these risks and implement risk management strategies.

Q4. What is the minimum age for Forex trading in India?

A4: To engage in Forex trading, you must be at least 18 years old and have a valid KYC (Know Your Customer) document.

Q5. Can I use multiple Forex trading apps simultaneously?

A5: Yes, you can use multiple Forex trading apps to diversify your trading strategy and access various features and assets.

1 note

·

View note

Text

Top Tips for Locating Reliable Forex Exchange Services Near Me

When traveling abroad or handling international transactions, finding a reliable forex exchange service is essential. Getting the best exchange rates and trusted services can make a big difference in how much money you end up with. Whether you’re looking for a "forex exchange near me," need "currency exchange in Kolkata," or want specific recommendations for "money exchange in Kolkata New Market," this guide will provide top tips to help you find the best and most reliable forex services near you.

1. Research Exchange Rates Online

One of the first steps in locating a trustworthy forex exchange service is researching exchange rates online. Websites and currency converter tools give you a clear idea of the current rates, helping you gauge what you should expect from local forex services. Knowing these rates helps you spot good deals, and it becomes easier to identify when a provider is offering favorable rates or overcharging. Many forex exchange services also list their rates on their websites, giving you the option to compare and choose the best.

2. Check for Authorized and Certified Providers

Finding an authorized forex service is crucial to ensuring safety and transparency in your transactions. In India, the Reserve Bank of India (RBI) licenses and regulates foreign exchange dealers, making it safer to transact with them. When searching for a "forex exchange near me," look for certification or an RBI authorization displayed at the business location or on the website. This verification confirms that the provider adheres to regulatory standards, giving you peace of mind that your transactions are handled legally and securely.

3. Look for Transparent and Competitive Rates

A reliable forex exchange service should offer competitive rates and be transparent about any additional fees. Some providers may advertise low exchange rates but add hidden charges later. Before finalizing a transaction, ask for a breakdown of the costs and check if there are any hidden fees. Forex exchange kiosks in prominent areas like "money exchange in Kolkata New Market" often display their rates publicly, so take the time to compare options to get the best deal.

4. Ask for Recommendations and Read Reviews

When looking for "currency exchange in Kolkata" or any other city, personal recommendations and online reviews can be incredibly useful. Ask friends or family members who have recently exchanged currency in your area about their experiences with local forex services. Additionally, read online reviews to gauge customer satisfaction and service reliability. Check platforms like Google Reviews, where customers share genuine feedback about their experiences, helping you make an informed decision.

5. Check for Convenient Locations and Operating Hours

Convenience plays a significant role when choosing a forex exchange service. If you’re based in Kolkata, finding a service with a convenient location, such as "money exchange in Kolkata New Market," can save you time. Services in commercial hubs or near airports usually offer extended hours to accommodate travelers’ needs. Checking the provider’s operating hours and proximity to your location can help you plan your visit and avoid last-minute hassles.

6. Consider Online Forex Services

Many online forex exchange services offer a convenient and often more affordable way to exchange currency. These platforms provide competitive rates, and some even offer home delivery of cash or traveler’s cards. If you're looking for a "forex exchange near me" but would prefer not to go to a physical location, exploring online services might be a great option. However, ensure that the online provider is certified and secure before sharing any personal or financial information.

7. Look for Additional Services Like Travel Cards

Many reliable forex exchange providers offer more than just cash exchange. Some services provide traveler’s cards, which are prepaid cards loaded with foreign currency. These cards can be more convenient than carrying cash and are generally accepted at most international locations. Some providers in popular areas for currency exchange, like Kolkata’s New Market, offer bundled services, including insurance and card activation, making travel smoother and more secure.

8. Negotiate for Better Rates

In some cases, forex providers are open to negotiation, especially if you’re exchanging a large sum. It never hurts to ask for a better rate, and if you have checked online rates beforehand, you’ll be in a good position to negotiate. When you inquire about currency exchange at local providers, especially in competitive areas like Kolkata New Market, politely ask if there’s any flexibility in the rates. Some services may offer a discount or waive transaction fees for larger exchanges.

9. Beware of Street Exchange Offers

Though you may encounter street vendors offering tempting exchange rates, it’s wise to avoid these offers. Unofficial street exchanges are often unregulated and pose a risk of counterfeit currency. Stick to authorized exchange counters or registered services with good reviews to ensure you’re getting legitimate currency and secure service.

10. Plan Ahead and Avoid Last-Minute Exchanges

Finally, planning ahead can help you secure the best rates and avoid the high fees that often accompany last-minute transactions. When you have time, research forex services and check rates to ensure you’re not settling for unfavorable terms. By giving yourself enough time, you can make a more informed decision and find a reliable service.

Conclusion

Finding a reliable forex exchange service doesn’t have to be challenging. By doing your research, checking credentials, and comparing rates, you can secure a trustworthy service that offers good value for your money. Whether you’re looking for a "forex exchange near me," a reliable "currency exchange in Kolkata," or a "money exchange in Kolkata New Market," following these tips can help you locate a reputable service that meets your needs. Safe travels and happy exchanging!

0 notes

Text

Currency exchange | Buy forex online | Money exchange

Best Currency Exchange services in India

Orient exchange comes with a global experience of 95 years in UAE, providing Foreign currency exchange services to the expat community. We at India gained from that global experience and taking our price advantage from Dubai and share it with our customers in India. We can assure you the best forex rates and services when you deal with us through online.

Reserve Bank of India has licensed handpicked entities with Authorized dealer category license to deal in foreign currency exchange. We being pioneers in Money exchange business in Dubai is one among the very few to have this license.

We have 25 branches across India in select 20 cities catering to Foreign exchange conversion, forex card & Outward remittance (Send money abroad). We also sell travel insurance policy, which will take care of medical emergencies through our branches.

Apart from physical branches, customers can buy forex online from comfort of their home by logging into our website and avail options of physical delivery of currency at one’s door step (Conditions apply)

Get the Best Exchange Rate

Its always better to deal with pioneers in the field with a goodwill close to 100 years for your foreign exchange requirements. Orient exchange with expertise in Money Exchange in Dubai and dedicated staff who is at your service always is the best choice for your travel related Foreign currency requirement. Being a global entity knowing the forex market well, we will be offering the best rates for all foreign currencies through our online platform. We also assure what you see online is what you will get when you walk-in to our physical branches

Documents Required for Buying Foreign Currency

Passport

PAN

Air Ticket

Visa ( if applicable)

0 notes

Text

Why RupeeChanger is the best money exchanger in INDIA

RupeeChanger is an Online Exchange Service provider in India. Among the various options available in India, RupeeChanger stands out as the best money exchanger. With its exceptional services and customer-centric approach, RupeeChanger offers numerous benefits to individuals and businesses alike. This article will explore the reasons why RupeeChanger is the preferred choice for currency exchange in India.

Convenient Exchange Services

RupeeChanger understands the importance of convenience for its customers. They have established a seamless process that ensures hassle-free currency exchange. Whether you need to exchange currency for travel purposes or for business transactions, RupeeChanger simplifies the process, saving you time and effort.

Competitive Exchange Rates

One of the key advantages of RupeeChanger is its commitment to providing competitive exchange rates. They understand the significance of getting the best value for your money, and therefore, offer rates that are favorable compared to other money exchangers in India. By choosing RupeeChanger, customers can maximize their currency conversion and enjoy significant savings.

Secure and Reliable Transactions

Security is a top priority for RupeeChanger. They have implemented robust security measures to ensure that every transaction is safe and reliable. By leveraging advanced encryption technology, RupeeChanger safeguards sensitive customer information and ensures that financial transactions are conducted securely.

Wide Range of Currencies

Check our currency reserve

RupeeChanger offers a comprehensive selection of currencies to cater to the diverse needs of its customers.

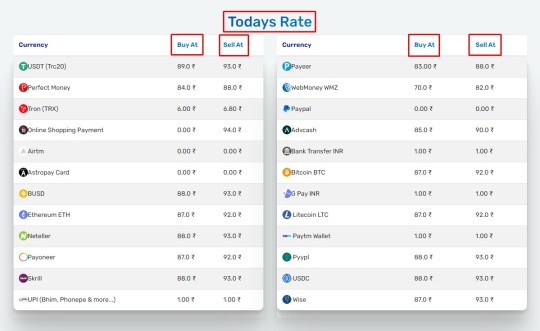

What RupeeChanger offers? Here is the List:

Usd to UPI/Bank

USD to INR

UPI to Perfectmoney

UPI to Webmoney

UPI to Payeer

UPI to AirTm

UPI to Skrill

UPI to Neteller

UPI TO USDT

INR TO USD

USD to INR

E-wallet like

Perfectmoney

Skrill

Advcash

Payeer

Netteler

USDT

Webmoney

Payoneer

Wise

Pyypl

Trading Forex

Auto surfs

High Yield Investment Plans

Online Product Purchase

We Help You to Convert Rupees to E-wallet and Buy/sell and Exchange using our App/ Website in India.

User-Friendly Online Platform

With a user-friendly online platform, RupeeChanger simplifies the currency exchange process further. Their intuitive interface allows customers to easily navigate through the website, select the desired currency, and complete transactions seamlessly. The online platform is accessible 24/7, providing convenience and flexibility to customers at their fingertips.

Efficient Customer Support

RupeeChanger takes pride in its exceptional customer support. Their team of knowledgeable professionals is readily available to assist customers with any queries or concerns they may have. Whether you need assistance with transaction-related matters or require guidance on currency exchange, RupeeChanger's customer support ensures a satisfactory experience.

Trusted and Established Reputation

Over the years, RupeeChanger has built a trusted and established reputation in the money exchange industry. Their commitment to transparency, reliability, and customer satisfaction has earned them the trust of countless individuals and businesses across India. Choosing RupeeChanger means relying on a reputable organization for your currency exchange needs.

Speedy Transaction Processing

Time is of the essence when it comes to currency exchange. RupeeChanger recognizes this and ensures speedy transaction processing. Their efficient systems and streamlined procedures enable swift currency conversion, allowing customers to access their funds promptly. With RupeeChanger, you can expect quick and efficient service every time.

youtube

Click Here For More Details: https://rupeechanger.com Download our App from Google Play: https://bit.ly/RupeeChanger

#rupeechanger #moneyexchange #indiamoneyexchange #currencyexchange #india

#rupeechanger#rupee#indian rupee#rupee vs dollar#digital rupee#free usdt#usdt被骗怎么办#currency#exchange#indian#business#Youtube

0 notes