#what is bitcoin revolution

Explore tagged Tumblr posts

Text

The Bitcoin Chronicles: From Whitepaper to Digital Gold

The story of Bitcoin is a fascinating journey that began with the release of a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” on October 31, 2008, by an unknown person or group of people using the pseudonym Satoshi Nakamoto. The whitepaper outlined a decentralized digital currency that would operate on a blockchain, a distributed ledger technology. The idea was to create a…

View On WordPress

#Bitcoin#Bitcoin History#Blockchain Technology#BTC#Crypto Adoption#Cryptocurrency Evolution#Decentralized Finance#Digital Currency#Digital Gold#Economic Revolution#Financial Innovation#pros and cons#Satoshi Nakamoto#what is bitcoin

0 notes

Text

Current worlds I'm building on my head:

Biopunk South America: where a biotechnology revolution and a worldwide ecocide changed the world forever, set in Buenos Aires in 2143. Six students set to make a grant project that would bring back the spirit of old biopunk. Inspired by Argentine rock and fútbol, hacker culture, and biopunk of course.

Campoestela: A 'classic' space opera setting, humanity has spread across the stars meeting hundreds of other civilizations, the focus here is on the cultural diversity of countless worlds. An Argentine space trucker finds a cringefail gamer girl from an extinct civilization and they try to cope with this. The theme is travelling but not for adventure but to work, like truckers or bush pilots.

The Alchemists: Set in the historical Republic of Florence in 1491, except the supernatural is very, very real. An alchemist and a witch deal with adolescence and their jobs while uncovering the secrets of Hermes Trismegistus (and eventually travel all the way to Egypt, China and beyond). A magical setting but based, as much as I can, in real historical conceptions of 'magic'.

Space Battleship Aurora: During the twilight years of the Space Roman Empire, the crew of a battleship rebel and they join a communist (not metaphorical, literal) revolution, as things fall apart. Basically a retelling of the Russian Civil War but in fantasy space.

METAL LML: This is just a rule of cool setting where everything that happens in Heavy Metal covers (the magazine and the genre) is real. A bunch of badass characters fly on their spaceship fighting hordes of evil demons with the power of METAL. With a found family, if you actually care about plot or stuff like that.

Argentina post-magiapocalíptica: Somewhere in 2012, the world changed and civilization collapsed with the "return" of magic. Argentina is a vast land full of wonders, all based in popular legends from the pre-columbian to current memes. Argentina-core basically. It has a lobizón and bruja characters too.

América Invicta: In this setting, the Inca and Mesoamerica remain unconquered, but they still have to deal with the contact of Europeans. This is a setting where every myth and legend about the Americas is real and then some. It's an excuse to present more Latin American mythology and legend.

The Greatest Scam: A hard (as it can be) sci-fi setting where the Solar System is turned into a dyson sphere to mine bitcoin, and the Socialist Interstellar roams the galaxy, safeguarding what remains of Earth from the ultimate apotheosis of capitalism

Concordia: (or Star Trek: Rebuild) An optimistic atompunk (but realistic) setting where the US and USSR decided to cooperate and do a joint atomic and space program, and things escalate from there. Humanity reaps the benefits of the peaceful Atomic Age, as ATOMIC ROCKETS explore the stars.

If you see me talking about worldbuilding, or reblogging very specific things, it's about some of these. EL BIOTIPO CINEMATIC UNIVERSE.

#cosas mias#there's also a space gauchos one and another space opera one but I haven't worked on them lately#(by work I mean doing drabbles and imagining stuff)#oh and all the alternate history ones I didn't even mention them#worldbuilding#biotipo worldbuilding

40 notes

·

View notes

Text

The Psychology of HODL: Why Bitcoiners Hold Through Market Cycles

The Ultimate Test of Conviction

In 2011, a single Bitcoin was worth less than a dollar. In 2017, it hit $20,000. By 2022, it had crashed below $16,000—only to roar back past $60,000 in 2024. The world has called Bitcoin dead over 470 times, but the believers? They never wavered. They HODLed. Why? Because Bitcoin isn’t just an asset—it’s a mindset. And understanding that mindset is the key to understanding the future.

The Birth of HODL: More Than Just a Meme

The term "HODL" originated from a legendary 2013 Bitcointalk forum post titled "I AM HODLING." It was a drunken typo that turned into a movement. But HODLing is more than just internet slang—it’s an ethos, a declaration of defiance against the financial system. It represents the philosophy of long-term conviction in a world obsessed with short-term gains.

Traders chase quick profits, institutions time the market, but true Bitcoiners? They accumulate and hold. Why? Because they understand that Bitcoin isn't a get-rich-quick scheme; it's a get-free-slowly revolution.

The Cultural Phenomenon of HODLing

HODLers aren’t just investors—they’re part of a global movement. The Bitcoin community reinforces its ideology through memes, mantras, and unwavering support. Social signaling plays a massive role in the HODL culture. Terms like "diamond hands" vs. "paper hands" define who can endure market downturns and who panics under pressure. The camaraderie strengthens conviction, creating a collective belief that Bitcoin’s future value will overshadow any temporary volatility.

The Economic Logic: Why HODLing Makes Sense

Scarcity & the 21M Cap

Bitcoin’s finite supply of 21 million coins is hardcoded scarcity. Every halving event reduces the rate of new supply entering the market, making Bitcoin inherently deflationary. Unlike fiat currencies, which can be endlessly printed, Bitcoin’s scarcity ensures that long-term holders are rewarded.

Stock-to-Flow & The Digital Gold Thesis

Bitcoin’s scarcity gives it a predictable issuance schedule, much like gold. The stock-to-flow model suggests that as scarcity increases, so does value. Those who HODL through the cycles understand this dynamic and accumulate in anticipation of future scarcity-driven price increases.

Volatility as a Feature, Not a Bug

Newcomers panic when Bitcoin crashes. Veterans see it as an opportunity. The volatility is not a weakness; it’s a mechanism that transfers wealth from the impatient to the patient. Every dip is a stress test—weak hands sell, strong hands accumulate.

The Psychology of HODL: What Keeps People Holding?

Loss Aversion

The fear of losing potential future gains often keeps investors from selling. Many who sold early watched Bitcoin soar and vowed never to make that mistake again.

Sunk Cost Fallacy

The deeper the investment, the harder it is to let go. People who have held Bitcoin for years develop an emotional attachment, reinforcing their commitment.

Confirmation Bias

Bitcoiners surround themselves with reinforcing narratives, filtering out anti-Bitcoin sentiments. This strengthens conviction, even when the market is down.

Delayed Gratification & Low Time Preference

Bitcoiners adopt a low time preference—valuing long-term gains over immediate rewards. This psychological shift allows them to endure short-term losses in pursuit of long-term wealth.

Market Cycles & The Emotional Rollercoaster of HODLing

Bitcoin’s price moves in four-year cycles, driven by the halving events. Each cycle follows a predictable pattern: euphoria, crash, despair, accumulation, and a new all-time high. Understanding these cycles separates HODLers from FOMO-driven speculators.

FOMO & Euphoria: When Bitcoin pumps, the masses rush in, pushing prices higher.

Capitulation: When crashes occur, weak hands sell in panic.

Accumulation: The patient and the wise accumulate cheap Bitcoin while the market loses interest.

Repeat: The cycle starts again, rewarding those who understood the game.

The Future of HODLing: Will It Always Be This Way?

As institutional adoption grows, will HODLing still be necessary? Will Bitcoin’s volatility subside, or will new waves of retail investors continue the cycle? While the future remains uncertain, one truth remains: those who have held through the chaos have reaped the rewards.

💎 Why We HODL

HODLing isn’t just about making money—it’s about rejecting a broken system. It’s about believing in a future where money is sound, where power shifts from central banks to individuals. To HODL is to understand that the road to financial revolution is paved with volatility, but the reward at the end is sovereignty.

The question isn’t whether Bitcoin will survive. The question is: Will you have the conviction to hold through the chaos and come out on the other side?

Tick. Tock. Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#HODL#CryptoPsychology#FinancialRevolution#BitcoinHODL#BTC#DiamondHands#BitcoinMaximalist#CryptoCommunity#SoundMoney#BitcoinMindset#MarketCycles#Investing#DigitalGold#EconomicFreedom#BitcoinCulture#MoneyRevolution#PsychologyOfMoney#Volatility#CryptoEducation#BitcoinFuture#HODLStrong#BitcoinPhilosophy#blockchain#financial education#finance#digitalcurrency#globaleconomy#financial empowerment#unplugged financial

4 notes

·

View notes

Text

NFTs and TreasureNFT

Unlock the Future of Digital Assets with TreasureNFT: Your Gateway to NFT Earnings.

The global of digital property is evolving swiftly, and TreasureNFT is leading the way in this revolution. If you are curious about NFTs (Non-Fungible Tokens) and how they could transform your monetary destiny, now could be the appropriate time to dive in. TreasureNFT isn’t only a platform—it’s your price tag to coming across the vast potential of NFTs even as earning tremendous rewards. Ready to take manipulate of your virtual future? Let’s discover how TreasureNFT can open new doorways to incomes possibilities!

What Is TreasureNFT?

TreasureNFT is a groundbreaking platform that makes NFTs on hand to absolutely everyone—whether or not you're a seasoned crypto seasoned or just starting. With its user-friendly interface, TreasureNFT permits you to create, buy, promote, and change NFTs resultseasily. Combining the contemporary blockchain generation with an intuitive design, TreasureNFT ensures that you may maximize your profits within the NFT area.

By joining TreasureNFT, you advantage get admission to to a thriving market in which creators and creditors come collectively. It’s extra than just an app—it’s a community where digital art, collectibles, and precise property are traded securely on the blockchain.

Why Are NFTs So Important?

NFTs have taken the digital financial system through storm, and know-how their price is prime to unlocking new opportunities for growth:

Unique Ownership: NFTs are unlike conventional cryptocurrencies like Bitcoin or Ethereum. Each NFT is a one-of-a-kind digital asset with its own proof of possession saved securely at the blockchain.

Diverse Applications: NFTs aren't just for digital art—they're revolutionizing industries consisting of gaming (in-recreation belongings), music (royalty monitoring), real property (virtual land), and greater.

Decentralization: Blockchain guarantees entire transparency and protection in NFT transactions, empowering creators through getting rid of intermediaries.

Cultural Shift: As our global turns into more digital, proudly owning virtual property is more and more as important as owning physical ones.

Future Prospects of NFTs

The NFT marketplace has already visible top notch growth, and this fashion is best set to maintain. Here’s why:

Mainstream Adoption: Big manufacturers like Nike, Adidas, Gucci, and even the NBA are diving into NFTs. As greater groups undertake NFTs, the call for for platforms like TreasureNFT will skyrocket.

Metaverse Integration: The upward push of metaverse systems like Decentraland has created new possibilities for NFTs, from digital actual estate to extraordinary avatars.

Increased Utility: NFTs will soon end up a crucial a part of diverse industries, from schooling (certifications) to healthcare (medical facts).

Economic Opportunities: More people are understanding the economic potential of NFTs—whether with the aid of growing or trading them—leading to huge financial possibilities.

Sustainability: As blockchain generation evolves (e.G., Ethereum’s power-green evidence-of-stake), environmental issues can be reduced, making NFTs even more appealing.

Earning with TreasureNFT

TreasureNFT offers numerous approaches to generate earnings:

Create & Sell Your Own NFTs: If you are an artist or content material creator, you may mint your own creations as NFTs and sell them to a global target market on the market.

Trade Rare Collectibles: For collectors, there are sufficient opportunities to buy low, sell high, and make the most of rare NFTs.

Referral Program Rewards: Invite others to sign up for the TreasureNFT environment the use of your referral link. Earn rewards based on their activity and start building your earnings these days!

Passive Income: Some NFT initiatives provide royalties every time your NFT is resold, that means you can earn habitual profits with out additional attempt.

Staking & Rewards Programs: Lock up funds temporarily to earn attractive returns, making it a terrific manner to grow your portfolio.

How To Get Started with TreasureNFT

Getting started with TreasureNFT is simple and free! Just observe these simple steps:

Click on my referral hyperlink: [Join Now].

Create your account—It’s quick and unfastened to sign up.

Explore the platform: Discover trending collections, mint your first NFT, and more.

Start earning: Trade or refer buddies and earn rewards!

Watch your portfolio grow as you become an lively player on this dynamic ecosystem.

Why Choose TreasureNFT Over Other Platforms?

Unlike other NFT marketplaces, TreasureNFT offers an experience designed for both learners and experienced traders alike. With its smooth onboarding, sturdy incomes opportunities, and focus on accessibility, TreasureNFT would be the move-to platform for NFT fanatics. Plus, it doesn’t require any technical understanding to get started out—just your creativity and willingness to learn.

Conclusion: Join the NFT Revolution with TreasureNFT!

NFTs are here to stay, and structures like TreasureNFT make it easy for all and sundry to participate and gain. Don't miss out in this possibility to liberate financial freedom and creativity. Click the referral hyperlink under and begin your adventure towards achievement these days!

[Click Here To Join Now]

2 notes

·

View notes

Text

Decoding the Decadence: Fiat’s Fall, Gold’s Glory, and the Dawn of the QFS & GESARA-NESARA Era

Dive into a journey that exposes the hidden forces in financial markets and the dark ties to global agendas. Witness the downfall of fiat currency, the empire built to rob your wealth, and discover the promise of GESARA-NESARA and the Quantum Financial System—an era of transparency and equality waiting to emerge. Gold or crypto? Only the truth can guide you through the haze.

In 1913, $100 could buy nearly 5 ounces of gold. Today, that’s barely enough for a week’s groceries. Ask why this shift happened, and the answer stares back—fiat money cannibalized our purchasing power.

Fiat—A Beast Unchained

Fiat currency, a monstrous creation, unleashed upon us, wields unchecked power. Our leaders, entrusted to safeguard us, failed spectacularly. Instead of responsibility, they chose greed, freely printing fiat money at the cost of our future. Look at your dwindling savings; this is the age of predatory policy, and it’s time to wake up.

The Siren’s Song—Gold’s Enduring Allure

Gold, the indestructible guardian against fiat’s poison, has been quietly sabotaged. While we’re drowned in materialism, the elites manipulate gold prices to weaken its true worth as a store of value. They distract us, making sure we ignore what truly safeguards our wealth.

The GESARA-NESARA Revolution

As the fiat chaos spirals, a force rises—GESARA and NESARA. This isn’t fantasy; it’s a real movement pushing for a global economic reset, a world where financial deception is dismantled, and freedom is restored. No more shadowy manipulation by hidden elites. This revolution promises a fairer system for the people.

QFS—The Quantum Shift

Alongside GESARA-NESARA stands the Quantum Financial System (QFS), a seismic change set to dismantle corruption. Immune to central banks’ schemes, QFS is the weapon we’ve been waiting for, an answer to the fiat poison. The promise is here, waiting to be seized.

Crypto vs. Gold—The Ultimate Faceoff

In this financial maze, where do you turn? Cryptos like Bitcoin promise decentralization, shaking up the system. But gold has endured through time, a rock amidst the chaos. Only you can decide your path, but don’t follow the herd—seek the truth yourself.

Fiat’s Fall, Gold’s Glory, and the Quantum Dawn

The decay of fiat isn’t an accident; it’s deliberate, a deception crafted to rob you. But GESARA-NESARA and QFS signal hope—a new age of justice and clarity. Stand at the edge of history and choose wisely: Will it be the fleeting allure of crypto or the enduring stability of gold?

The fog lifts, the truth whispers.

Seek it.

Defend it.

The storm is here. 🇺🇸✊🏽

#donald trump#bank of america#new york#wells fargo#breaking news#bad government#world news#bank clash#qfs#bank crash

3 notes

·

View notes

Text

Are Cryptocurrency And Bitcoin The Same Thing

Cryptocurrency

Crypto is a digital or virtual currency that uses cryptography for transactions. It’s on a decentralized network based on blockchain, with no central authorities like banks. Examples are Ethereum, Litecoin, USDT, etc.

Bitcoin

Bitcoin is the first and most popular crypto, created in 2009 by Satoshi Nakamoto, an anonymous person or entity. It’s a decentralized digital currency that enables peer-to-peer transactions without intermediaries and is considered the first blockchain. Read More

Bitcoin Was The First Cryptocurrency

Bitcoin, introduced in 2009, changed the finance and tech world by becoming the first crypto. Unlike traditional currencies controlled by governments and central banks, Bitcoin is on a decentralized network based on blockchain. Its creation marked the beginning of a new era in digital finance, with secure, transparent, and peer-to-peer transactions without intermediaries. As the first crypto, Bitcoin laid the foundation for an entire crypto ecosystem that’s still evolving. Understanding “Bitcoin as the first crypto” will give you an insight into its role in reshaping financial systems and its impact on the blockchain revolution. Whether you see it as digital gold, a medium of exchange, or an innovation, Bitcoin’s legacy is unmatched in the ever-growing world of cryptos.

Why Bitcoin Is Often Synonymous With Cryptocurrency

When folks think about cryptocurrency, Bitcoin pops into their heads first. But what makes Bitcoin so closely linked to cryptocurrency? Bitcoin kicked off the whole digital currency scene back in 2009, introducing the blockchain tech that’s now the backbone of all cryptocurrencies. Its groundbreaking take on decentralization and direct transactions between users sparked a financial shake-up. Over time, Bitcoin has grown to be the most well-known and used cryptocurrency, setting the bar for others in the field. Its top spot in market value, news coverage, and investor buzz further ties it to the term “cryptocurrency.” Bitcoin’s lasting impact on new ideas and sway makes sure it stays the face of digital money for loads of people. Getting why Bitcoin holds this position sheds light on its key role in molding the cryptocurrency scene.

youtube

Key Differences Between Cryptocurrencies and Bitcoin

People often use Bitcoin and cryptocurrency as if they mean the same thing, but they don’t. To get the big picture of digital assets, you need to know how cryptocurrency and Bitcoin differ. Bitcoin came out in 2009 as the first and most famous cryptocurrency. It works as digital money that uses blockchain tech. Cryptocurrency, though, covers all digital or virtual money built on networks without central control. Bitcoin is just one of thousands of cryptocurrencies out there, like Ethereum, Ripple, and Litecoin. Bitcoin aims to be a way to store value without anyone in charge. Other cryptocurrencies often do more, like run smart contracts or decentralized apps. When you look at how cryptocurrency and Bitcoin are different, you can see better how they fit into the changing digital money world.

Variety in cryptocurrencies

The range of cryptocurrencies shows how lively and groundbreaking digital finance has become. Bitcoin leads the pack, but others like Ethereum, Binance Coin, and Solana have found their spots. They offer special features, like running smart contracts and decentralized apps. Stablecoins such as USDT keep their price steady, which makes them great to use for payments. Coins that focus on privacy, like Monero, appeal to people who want to stay anonymous. This wide selection of cryptocurrencies lets users and investors find options that fit what they need. They can trade, invest, or get decentralized financial answers. As more types of cryptocurrencies pop up, everyone can find something that works for them in this changing crypto world.

Popularity And Growing Dominance of Bitcoin

The phrase ‘popularity and dominance of bitcoin’ refers to Bitcoin’s status as both the most popular subject and the most dominant coin of the entire crypto community, which can be said to be Bitcoin’s position within the market. It refers to how much Bitcoin is talked about and earned from as a currency, which is defined in the first question of one hundred dollars. It has defined how Bitcoin is perceived at the moment, which is categorized in the topic—Bitcoin and the popularity and dominance of Bitcoin: what is my view?

The First-Mover Advantage

The popularity and dominance of Bitcoin stem from the very first initial purchase of the product. Given that it is the first currency in existence, it makes it the first and most popular currency available. It has influenced people to delve into investing, which has led to the development of the affordability of thousands of other cryptos. Due to this situation, Bitcoin is the first and only cryptocurrency that applies to specific icons such as the bank, finance, etc.

Store of Value and Digital Gold

Just like gold, Bitcoin is also referred to as digital gold due to its limited quantity of 21 million coins. Lots of investors see it as a backup plan, making it a better option for those who are unsure, including people who are not living in the safest part of the world.

Institutional Adoption

The increasing interest from institutional investors and corporations has significantly contributed to Bitcoin’s dominance. Companies like Tesla and MicroStrategy have added Bitcoin to their balance sheets, while financial giants offer Bitcoin trading and custody services. This institutional backing has strengthened its credibility and expanded its use cases.

Network Effect and Brand Recognition

Bitcoin benefits from a strong network effect, with millions of users, miners, and developers contributing to its ecosystem. Its brand recognition as the first and most valuable cryptocurrency gives it unparalleled influence in both the crypto space and mainstream media.

Resilience and Market Share

Despite the emergence of thousands of altcoins, Bitcoin consistently maintains the largest market capitalization. Its resilience during market fluctuations and its role as the base trading pair for most cryptocurrencies underscore its dominance.

Bitcoin’s popularity and dominance remain unmatched, cementing its place as the cornerstone of the cryptocurrency revolution. Its pioneering technology, widespread adoption, and enduring trust continue to define the cryptocurrency market.

How Does Cryptocurrency Work?

Cryptocurrency has revolutionized the way we think about money by introducing a decentralized, digital alternative to traditional currencies. But how does cryptocurrency work? At its core, cryptocurrency operates on blockchain technology—a secure, transparent, and immutable ledger that records all transactions across a decentralized network.

Each transaction is verified by a network of computers, or nodes, through a process called cryptographic consensus. In cryptocurrencies like Bitcoin, this verification is achieved via mining, where miners solve complex mathematical problems to validate transactions and add them to the blockchain. On the other hand, cryptocurrencies like Ethereum utilize smart contracts, self-executing codes that enable automated processes without intermediaries. Read More

#crypto#cryptocurrency#cryptotrading#investing#bitcoin#blockchain#stock market#kucoin#invest in cryptocurrency#future of cryptocurrency#Cryptocurrency And Bitcoin#Youtube

2 notes

·

View notes

Text

Crypto 101: Everything You Need to Know About Bitcoin and NFTs

Cryptocurrency and NFTs (Non-Fungible Tokens) have taken the world by storm, but for many, these concepts are still a mystery. Whether you're interested in investing, understanding blockchain technology, or simply curious about the digital revolution, this Crypto 101 guide breaks down everything you need to know about Bitcoin and NFTs—two of the most talked-about topics in the world of digital finance.

1. What is Bitcoin?

Bitcoin is the first decentralized digital currency created by an anonymous person (or group) known as Satoshi Nakamoto in 2009. Unlike traditional currencies issued by governments (like the US dollar or euro), Bitcoin operates on a peer-to-peer network and is not controlled by any central authority, such as a bank or government.

Key Features of Bitcoin:

Decentralized: Bitcoin transactions are verified by a network of computers (called "nodes") around the world, rather than a central bank.

Blockchain Technology: Bitcoin transactions are recorded on a public ledger called the blockchain, making it secure and transparent.

Limited Supply: There will only ever be 21 million bitcoins in existence, which helps create scarcity and can drive value.

Bitcoin can be used to buy goods and services, traded for other currencies, or held as an investment. Its value can fluctuate significantly, which has made it both an attractive investment and a high-risk asset.

2. How Does Bitcoin Work?

Bitcoin operates through blockchain technology, a decentralized system that records every transaction made with Bitcoin.

Mining: Bitcoin transactions are confirmed by miners, who use powerful computers to solve complex mathematical problems. Once a problem is solved, the miner adds the transaction to the blockchain, earning new bitcoins as a reward (this process is called "mining").

Wallets: To store Bitcoin, you need a crypto wallet, which is a software application that allows you to send, receive, and store your Bitcoin securely. Wallets use private and public keys—essentially digital passwords that protect your funds.

Security: Bitcoin transactions are secured using cryptography, which makes it difficult to counterfeit or reverse. Once a transaction is recorded on the blockchain, it is nearly impossible to alter.

3. What is an NFT?

NFTs (Non-Fungible Tokens) are unique digital assets stored on a blockchain. Unlike cryptocurrencies like Bitcoin or Ethereum (which are fungible, meaning each unit is identical), NFTs are non-fungible, meaning each one is distinct and cannot be replaced by another.

NFTs are used to represent ownership of digital art, music, videos, collectibles, and more. They have gained massive popularity in recent years, especially in the art world, where artists and creators can sell their work directly to buyers in digital form.

Key Features of NFTs:

Uniqueness: Each NFT has a unique digital signature that makes it one-of-a-kind. No two NFTs are exactly the same.

Ownership: When you purchase an NFT, you're purchasing a certificate of ownership for a specific digital asset. While the file itself (like a digital image) can be copied, the NFT proves that you own the original.

Smart Contracts: NFTs are often built on the Ethereum blockchain and use smart contracts—self-executing contracts with the terms directly written into the code. These smart contracts can include royalty payments to creators whenever the NFT is resold.

4. How Do NFTs Work?

NFTs are bought and sold on marketplaces like OpenSea, Rarible, and SuperRare. To buy an NFT, you'll need to set up a digital wallet and purchase cryptocurrency, usually Ethereum (ETH), as it’s the most widely used blockchain for NFTs.

Minting: This is the process of creating an NFT. When someone creates a digital piece of content (like art), they can "mint" it as an NFT on a blockchain, making it verifiably unique.

Buying & Selling: NFTs are bought and sold through auctions or fixed-price listings. When you buy an NFT, the ownership is transferred to your wallet.

Royalties: Many NFTs are programmed to pay creators royalties every time they are resold, providing a new revenue stream for artists and creators.

5. Why Are NFTs So Popular?

NFTs have exploded in popularity due to their ability to revolutionize the art, gaming, and entertainment industries. Here are a few reasons why NFTs are so attractive:

Digital Art Revolution: Artists now have a way to sell digital creations and ensure they retain ownership. Buyers can prove they own original works of art in the digital space.

Scarcity and Collectibility: NFTs provide a way to create digital scarcity, which makes items more collectible and valuable, much like rare trading cards or limited-edition merchandise.

Access & Community: NFTs often come with perks like access to exclusive content, events, or online communities, creating a sense of belonging and value for collectors.

6. Risks and Challenges of Bitcoin & NFTs

While both Bitcoin and NFTs offer exciting opportunities, they come with risks and challenges:

Bitcoin Risks:

Volatility: The value of Bitcoin can be highly volatile, meaning it can experience dramatic price swings in a short period.

Regulatory Uncertainty: Governments around the world are still figuring out how to regulate cryptocurrencies, which could impact their value and use.

Security: While Bitcoin transactions are secure, cryptocurrency exchanges and wallets can be vulnerable to hacking or fraud.

NFT Risks:

Speculation: Many NFT buyers are purchasing them as speculative investments, hoping to sell at a higher price later. This can create a bubble-like environment.

Environmental Impact: The energy consumption of the blockchain networks used to mint and trade NFTs (especially Ethereum) has raised concerns about their environmental footprint.

Value Uncertainty: Not all NFTs will hold their value over time, and some may become worthless if the market crashes or interest fades.

7. How to Get Started with Bitcoin & NFTs

For Bitcoin:Buy Bitcoin: You can buy Bitcoin on cryptocurrency exchanges like Coinbase, Binance, or Kraken using fiat currency (like USD).Store Bitcoin: Set up a digital wallet to securely store your Bitcoin. Popular wallets include Trust Wallet and Ledger.Start Small: If you're new to Bitcoin, consider starting with a small investment and learning about the technology as you go.

For NFTs:Set Up a Digital Wallet: You'll need a wallet that supports Ethereum (e.g., MetaMask or Coinbase Wallet).Purchase Ethereum: Buy Ethereum on an exchange like Coinbase or Gemini and transfer it to your wallet.Browse Marketplaces: Explore NFT marketplaces like OpenSea or Rarible to find NFTs you're interested in. Ensure you’re comfortable with the market and potential risks before making a purchase.

Conclusion: The Future of Crypto and NFTs

Bitcoin and NFTs are reshaping the digital landscape in 2024, providing new ways to invest, create, and interact with digital assets. Whether you’re drawn to Bitcoin’s potential as a digital store of value or intrigued by the world of NFTs and digital ownership, both offer unique opportunities in the evolving world of cryptocurrency.

Remember to approach both Bitcoin and NFTs with caution, do your research, and only invest what you can afford to lose. The crypto world is still relatively new, and its volatility makes it crucial to stay informed and educated.

Ready to dive into the world of Bitcoin and NFTs? Start by exploring, experimenting, and staying curious about the potential of this exciting digital frontier! Do You Know KVR?

Hashtags: #Crypto101 #Bitcoin #NFTs #Blockchain #Cryptocurrency #DigitalAssets #BitcoinInvesting #NFTCommunity #Ethereum #CryptoRevolution

#Crypto101#Bitcoin#NFTs#Blockchain#Cryptocurrency#DigitalAssets#BitcoinInvesting#NFTCommunity#Ethereum#CryptoRevolution

3 notes

·

View notes

Text

🌟 Bitcoin’s Meteoric Rise: ETF Influx Fuels New Heights! 🌟

🔑 Key Highlights

1️⃣ Bitcoin Soars to $64K: The largest cryptocurrency breaks past its previous peak, reflecting a resurgent market.

2️⃣ BlackRock Leads ETF Revolution: iShares Bitcoin Trust secures a staggering $550 million investment.

3️⃣ ETF Magic: SEC approval of 10 Bitcoin ETFs powers retail and institutional adoption.

4️⃣ Market Recovery: Cryptocurrencies like Ethereum also see sharp value increases, with ETH now trading at $3,500.

5️⃣ Federal Reserve Cuts: Lower interest rates are shifting focus to digital assets.

6️⃣ Halving Event Ahead: Anticipation builds for Bitcoin’s supply cut in April, adding fuel to the rally.

🚀 Crypto Revival: BlackRock’s ETF Boom Shakes the Market!

📊 Numbers Speak

Bitcoin (BTC): $63,933 (up from $42,000 in early 2023).

Ethereum (ETH): Surpasses $3,200, marking significant growth.

BlackRock Bitcoin ETF: Second-highest inflows in U.S. history at $550M.

💡 What’s Driving Growth?

ETFs reduce volatility, offering safer investment routes.

Weakening Dollar Index & controlled inflation enhance crypto's appeal.

Federal Reserve interest cuts boost liquidity in crypto markets.

⚡ Bitcoin Surge 2024: Is This the New Crypto Boom?

�� Why the Surge?

ETF Legitimacy: SEC approval legitimizes Bitcoin ETFs, pushing investor confidence.

Macro Trends: Declining yields in traditional markets drive funds to crypto.

Retail Power: Retail investors dominate the market resurgence.

📉 Challenges Ahead

Network infrastructure struggles to meet demand during peaks.

Volatility risks still linger despite ETF stabilization mechanisms.

Visit - https://www.skrillnetwork.com/blackrocks-bitcoin-etf-sees-record-inflow-as-bitcoin-surpasses-64000-a-sign-of-cryptos-resurgent-boom

2 notes

·

View notes

Text

Escape the Matrix: Create Your Own Crypto and Memecoins to Break Free from the Rat Race

In today’s fast-paced world, many people feel trapped in the proverbial “matrix” of conventional work life — a never-ending grind where the promises of financial freedom and personal fulfillment seem elusive. If you find yourself yearning for a way out, creating your own cryptocurrency or memecoin tokens might be the key to escaping the rat race and paving the way to a brighter, more prosperous future. This blog will explore how you can break free from traditional financial constraints and take control of your financial destiny by delving into the world of crypto and memecoins.

Understanding the Matrix and the Rat Race

Before we dive into how you can create your own crypto and memecoin tokens, it’s important to understand the matrix and the rat race. The matrix represents a system of control and conformity that often dictates our daily lives, while the rat race is the relentless pursuit of success and wealth through conventional means, often leading to burnout and dissatisfaction.

Breaking free from this cycle involves adopting new ways of thinking and exploring alternative financial opportunities. The cryptocurrency revolution offers a pathway to redefine your financial future, allowing you to step out of the traditional financial system and into a world of digital innovation.

The Rise of Cryptocurrencies and Memecoins

1. The Cryptocurrency Revolution

Cryptocurrencies have transformed the financial landscape by offering decentralized alternatives to traditional financial systems. Bitcoin, the first and most well-known cryptocurrency, introduced the concept of blockchain technology — a decentralized ledger that ensures transparency, security, and immutability.

Since Bitcoin’s inception, thousands of cryptocurrencies have emerged, each with unique features and use cases. Ethereum introduced smart contracts, enabling the creation of decentralized applications (dApps) and new tokens. The rise of cryptocurrencies has paved the way for individuals to create their own digital assets, offering opportunities for innovation and financial empowerment.

2. The Memecoin Phenomenon

Memecoins, on the other hand, represent a more playful and community-driven aspect of the cryptocurrency world. Born from internet memes and viral trends, memecoins often gain popularity through social media and online communities. Despite their origins as jokes or experiments, some memecoins have experienced significant price surges and garnered substantial attention.

Notable examples include Dogecoin, which started as a meme but has become a widely recognized cryptocurrency with a strong community backing. The success of memecoins highlights the power of community engagement and the potential for digital assets to capture public interest.

Creating Your Own Cryptocurrency

Creating your own cryptocurrency involves several key steps. Here’s a roadmap to help you get started:

1. Define Your Purpose and Goals

Before diving into the technical aspects, it’s essential to define the purpose and goals of your cryptocurrency. Consider the following questions:

What problem does your cryptocurrency aim to solve?

Who is your target audience?

How will your cryptocurrency differentiate itself from existing options?

Having a clear vision will guide the development process and help you create a compelling value proposition for your digital asset.

2. Choose the Right Blockchain Platform

Selecting the appropriate blockchain platform is crucial for the development of your cryptocurrency. Popular platforms include:

Ethereum: Known for its robust smart contract capabilities, Ethereum is a popular choice for creating custom tokens. Ethereum’s ERC-20 and ERC-721 standards provide a foundation for creating fungible and non-fungible tokens, respectively.

Binance Smart Chain (BSC): BSC offers low transaction fees and compatibility with Ethereum’s tools and infrastructure, making it an attractive option for new projects.

Solana: Renowned for its high throughput and low transaction costs, Solana is suitable for projects requiring scalability and speed.

Evaluate the features and benefits of each platform to determine which best aligns with your project’s needs.

3. Develop Your Cryptocurrency

Once you’ve chosen a blockchain platform, you can begin the development process. This involves creating the token’s smart contract, which defines its properties, such as total supply, distribution, and functionality.

For Ethereum-based tokens, you can use tools like Solidity (a programming language for smart contracts) and development environments like Remix or Truffle. If you’re using BSC or Solana, familiarize yourself with their respective development tools and languages.

4. Test and Deploy

Testing is a critical phase to ensure that your cryptocurrency functions as intended. Conduct thorough testing on testnets (blockchain networks used for testing purposes) to identify and resolve any issues before deploying your token on the mainnet.

Once testing is complete, you can deploy your cryptocurrency on the chosen blockchain platform. Ensure that all smart contract code is secure and has been audited to prevent vulnerabilities.

5. Market and Promote

Creating a cryptocurrency is only the beginning. Effective marketing and promotion are essential for gaining traction and attracting users. Develop a marketing strategy that includes:

Building a website and social media presence

Engaging with online communities and forums

Creating informative content and promotional materials

Leverage the power of social media and influencer partnerships to spread the word about your cryptocurrency and build a supportive community.

Creating Your Own Memecoin

Creating a memecoin follows a similar process to developing a standard cryptocurrency, with an emphasis on community engagement and viral potential. Here’s how to get started:

1. Embrace the Meme Culture

Memecoins thrive on internet culture and humor. To create a successful memecoin, embrace popular memes and viral trends. Consider how your memecoin can tap into existing online communities and trends to generate excitement.

2. Develop a Unique Concept

While memecoins often start as jokes, a unique concept or theme can help your token stand out. Create a compelling narrative or branding that resonates with your target audience and aligns with current meme trends.

3. Build a Community

Community is crucial for the success of a memecoin. Engage with potential users through social media platforms, online forums, and meme communities. Foster a sense of belonging and enthusiasm around your memecoin to drive interest and participation.

4. Launch and Promote

After developing and testing your memecoin, launch it on a blockchain platform and begin promoting it to your target audience. Utilize social media, memes, and viral marketing tactics to generate buzz and attract attention.

The Path to Financial Empowerment

Creating your own cryptocurrency or memecoin offers a unique opportunity to escape the rat race and take control of your financial future. By embracing the world of digital assets, you can potentially unlock new revenue streams, build innovative solutions, and connect with like-minded individuals.

However, it’s important to approach this venture with a clear vision, thorough planning, and a willingness to adapt to the dynamic nature of the cryptocurrency market. Success in the crypto world requires dedication, creativity, and a strategic mindset.

Conclusion

The journey to escaping the matrix and breaking free from the rat race can be transformative and empowering. By creating your own cryptocurrency or memecoin tokens, you can tap into the potential of digital assets and explore new avenues for financial growth and innovation.

And If you are new to solana, Memecoins, what is token and all? Not to worry about this, we founf this amazing platform for you, Visit Solana launcher & Deployment token, Here you can launch your own memecoins token in just less than three seconds without any extesive programming knowledge. And start young and watch your wealth grow!!!

Whether you’re driven by a desire for financial independence or a passion for technology and innovation, the world of cryptocurrencies offers a pathway to redefine your future. Embrace the opportunities, stay informed, and embark on your journey to a brighter and more prosperous tomorrow.

3 notes

·

View notes

Text

What is best time for crypto trading?

There are no general rules about when to buy cryptocurrencies. It's usually not a good idea to buy at the top of a bubble, and it's usually not a good idea to buy when the price is falling. As the wisdom of the merchant goes, never take the knife off. The best time can be when the price is stable at a low level.

Cryptocurrency trading is a broad topic and determining exactly when a crypto bubble is in place and when it will burst is not an exact science. Today it is difficult to answer questions that are easy to see. Sometimes a coin starts to rise and once it crosses a major historical resistance line, many believe that the bubble has peaked when the real recovery is just beginning.

For example, few people buy $1,000 worth of bitcoins or $100 worth of Ether because the price seems too high to them. But after a few years, those prices seem like a bargain that won't hit the market again.

This is definitely not financial advice, but some general guidelines to help you decide when to invest include:

Don't compare the crypto bubble with a traditional bubble in mainstream finance. A ten percent increase or decrease in the value of a cryptocurrency can fluctuate daily. It may be a 100% bubble, but often it's just the beginning. 1000 percent chance it's a bubble, but it's not guaranteed to burst.

Don't buy it just because it's in the water. It can be different, so it takes time to observe the changing situation.

Don't buy it because you're afraid it will explode tomorrow. Be informed and buy when you are sure of your entry point.

Don't fall for reactive selling or "paper hands". Selling too early will ruin your plan and can hurt your ROI. Impose. Diamond hand. The money revolution has just begun.

With Fiordintel you can secure your crypto wallet with our advanced cryptography security solutions. keep your accounts safe from all forms of cyber infiltrations. You can also inform them about any kind of scam related to cryptocurrency and hopefully they will try their best to help you. For more info: go DM me.

2 notes

·

View notes

Text

Buy Verified Cash App Accounts For Sale

Buy Verified Cash App Accounts.Purchasing ensures secure transactions and streamlined money management. Buy Verified Cash App Accounts. Navigating the digital economy requires trustworthy financial tools, and verified Cash App accounts stand out as a top choice for seamless online transactions. Users gain peace of mind, With a verified status, account holders can unlock higher transaction limits and access a broader range of services, making it a must-have for those who prioritize financial security and convenience in the digital space. This advantage is essential for both personal and business users looking to optimize their online payment experience. As digital payments become the norm, having a verified Cash App account is not just a luxury—it’s a necessity for staying ahead in today’s fast-paced financial world.

Buy Verified Cash App Accounts

24 Hours Reply/Contact Email:- [email protected] WhatsApp: +44 7365-263508 Skype:- usatopvcc Telegram:- @usatopvcc

Buy Verified Cash App Accounts

Cash App Account is a digital wallet that allows users to send and receive money online. In today’s digital age, having a digital wallet has become a necessity for many people. The Cash App Account is a popular choice for its ease of use and accessibility. It allows users to quickly and securely send and receive money, as well as make payments for various services and products. Additionally, the Cash App offers a variety of features such as the Cash Card, which can be used to make purchases online and in-store, Overall, the Cash App Account is a reliable and convenient option for managing one’s finances.

The Rise Of Digital Wallets The digital wallet revolution is changing how we handle money. More people are choosing digital wallets for their convenience and security. This shift is reshaping the financial landscape, making physical wallets less necessary. Buy Verified Cash App Accounts.

Real-world Success Stories Curious about how Cash App Account has transformed lives? Dive into these Testimonials from Savvy Users and find Inspiration for Financial Growth.

Introduction To Cash App Are you tired of carrying cash around or dealing with the hassle of writing checks? Enter Cash App, the digital wallet that’s revolutionizing the way people handle their money. In this section, we’ll explore the basics of Cash App and why it’s becoming increasingly popular.

Future Of Digital Wallets And Cash App Digital wallets are becoming increasingly popular due to their convenience and ease of use. Cash App, a popular digital wallet, is expected to continue to grow in popularity as more people embrace the benefits of cashless transactions. With its user-friendly interface and innovative features, Cash App is poised to become a major player in the future of digital wallets. The Cash App has become a prominent player in the realm of digital wallets, offering users a convenient and efficient way to manage their finances. As we look towards the future of digital wallets and the Cash App, it’s essential to explore the emerging trends and predictions for its evolution.

What Is Cash App? Cash App is a peer-to-peer payment app that allows users to easily send and receive money from friends, family, or even businesses. It also offers a range of other features, including the ability to buy and sell Bitcoin, invest in stocks, and even get a debit card for making purchases.

Rising Popularity Of Digital Wallets The rise of digital wallets like Cash App is no surprise, given the convenience and security they offer. With digital wallets, users can make payments, manage their finances, and even store loyalty cards and tickets all in one place. As more people embrace digital transactions, the popularity of digital wallets continues to soar.

Setting Up Your Cash App Account Setting up your Cash App account is a straightforward process that allows you to quickly and easily start sending and receiving money. Whether you’re new to the app or looking to create a new account, the following steps will guide you through the account creation process and help you link your bank account for seamless transactions.

Cash App’s Place In The Market Cash App leads in this digital movement. It stands out by offering more than simple transactions. Users can buy, sell, and invest in cryptocurrencies too. This versatility attracts a broad user base, from young adults to seasoned investors.Buy Verified Cash App Accounts

Instant money transfers Investment options in stocks and Bitcoin Unique features like “$Cashtag” for easier payments Understanding Cash App Boosts Cash App Boosts are a valuable feature that can help users save money and get cashback on their purchases. In this section, we will delve into what Cash App Boosts are and how to activate them, so you can take full advantage of this money-saving tool.

What Are Cash App Boosts? Cash App Boosts are special rewards offered to Cash App users, providing them with discounts and cashback offers at select merchants. These boosts are designed to help users save money on everyday purchases, making it a valuable feature for anyone looking to stretch their budget.

Transition From Traditional Banking Traditional banks often involve long processes and high fees. Cash App offers a refreshing alternative. With instant transactions and lower costs, it’s becoming a preferred choice.

Sign up in minutes Minimal fees for transactions User-friendly interface What Are Verified Cash App Accounts? Verified Cash App accounts offer enhanced features. They stand out from regular accounts. Users complete a verification process. This unlocks higher transaction limits and additional services. Trust and security are central to these accounts.Buy Verified Cash App Accounts

Verification Process Verification involves confirming identity. Users provide personal information. This includes Social Security Number (SSN). A government-issued ID might be needed. The process is straightforward. It ensures safety for all users.

Benefits Of Being Verified Increased Limits: Send and receive more money weekly. Direct Deposit: Get paychecks and tax returns faster. Bitcoin Trading: Buy and sell Bitcoin effortlessly. Why Purchase A Verified Cash App Account? Exploring the digital financial world brings us to a pivotal question: Why purchase a verified Cash App account? Understanding the reasons can help you navigate the sea of online transactions with confidence.

Ease Of Access Verified Cash App accounts offer unparalleled ease of access. Users enjoy quick setup and immediate use. With verification, there’s no limit to what you can achieve. This includes sending and receiving money or investing in stocks and Bitcoin. Let’s break down the benefits:

Instant transactions: Send and receive money in moments. Direct deposits: Get paychecks up to two days early. Full features: Access all that Cash App offers without restrictions. Risks Of Unverified Accounts Understanding the risks associated with unverified Cash App accounts is crucial for users. These accounts come with potential pitfalls that can affect both your financial flexibility and security. Buy Verified Cash App Accounts.

Limitations And Restrictions Unverified Cash App accounts face several limitations:

Lower sending limits: You can send only up to $250 within any 7-day period. Receiving restrictions: You can receive up to $1,000 every 30 days. Withdrawal caps: The withdrawal limit for unverified users is restricted. Verified users enjoy higher limits and fewer restrictions, making verification a smart move for active users.

Buy Verified Cash App Accounts Buy Verified Cash App Accounts

Vulnerability To Fraud Unverified accounts are more susceptible to fraud. Here’s why:

Limited protection: Verified accounts have additional security features. Target for scammers: Scammers often target unverified accounts. No ID verification: This makes it easier for fraudsters to remain anonymous. Stay safe by verifying your account, which adds a layer of protection against potential threats.

Choosing A Reliable Seller Finding a reputable seller for verified Cash App accounts is crucial. This guide ensures you pick the best.

Research And Reviews Start by researching the seller’s reputation. Look for online feedback from other buyers. Read reviews carefully. They reveal the seller’s reliability and account quality. Check for patterns in feedback. Multiple negative reviews are a red flag. Positive reviews should be consistent and recent.

Secure Payment Methods Always ensure the seller offers secure payment options. Reliable sellers use trusted payment gateways. These protect your financial information. Look for sellers that accept credit cards or PayPal. These services offer buyer protection. Avoid sellers insisting on wire transfers or cryptocurrency payments. These are often untraceable and risky. Buy Verified Cash App Accounts.

The Legal Landscape The legal landscape surrounding financial transactions online is intricate. Buy Verified Cash App Accounts play a crucial role in ensuring seamless, secure transactions. Understanding the nuances of legality ensures users stay within the bounds of the law.

Compliance With Regulations Verified Cash App accounts must adhere to strict regulations. Financial institutions are governed by laws to prevent fraud and money laundering. Verified accounts comply with these regulations.

KYC protocols – Know Your Customer checks confirm user identity. AML standards – Anti-Money Laundering measures track suspicious activity. Transaction monitoring – Regular scrutiny of transfers for illegal activities. Setting Up Your Purchased Account Ready to take control of your finances with a verified Cash App account? Setting up your purchased account is simple. Follow these straightforward steps to start managing your money like a pro.

Activation Process Begin by activating your Cash App account. Here’s how:

Open the Cash App on your device. Enter the required details, such as your name and email. Verify your identity to ensure account security. Set a strong password to protect your account. Maximizing Savings With Boosts When it comes to maximizing savings with Cash App, one of the most effective tools at your disposal is Boosts. These are special discounts that can be applied to purchases made with your Cash Card. By strategically using Boosts, you can save money on everyday expenses and make the most of your budget.

Linking To Financial Institutions Next, link your account to your bank:

Select ‘Link Bank’ in the app menu. Use your bank’s login credentials to connect. Confirm the bank account you wish to link. Check for successful linkage in the app’s banking section. Buy Verified Cash App Accounts Buy Verified Cash App Accounts

Protecting Your Investment Protecting Your Investment when buying verified Cash App accounts is crucial. Smart account management and security measures help you safeguard your funds. With the right steps, you can ensure that your transactions remain secure and your financial data stays protected.

Regular Monitoring Regularly checking your Cash App account activity is essential. Quick detection of any unusual transactions can prevent potential losses. Set up alerts to receive instant notifications for all account activities. This way, you keep a vigilant eye on your funds. Buy Verified Cash App Accounts.

Secure Transactions Secure transactions are the backbone of any financial application. Always use strong, unique passwords for your Cash App account. Enable two-factor authentication for an added layer of security. Stick to trusted networks when making transactions to keep your data safe.

Use strong passwords: Mix letters, numbers, and symbols. Two-factor authentication: A must-have for extra security. Trusted networks only: Public Wi-Fi can compromise your account. Tracking Your Savings Keeping track of the savings you accrue through Boosts is essential for understanding the impact of these discounts on your overall spending. By monitoring how much you save on individual purchases and over time, you can gain valuable insights into your spending habits and make informed decisions to further optimize your savings.

Frequently Asked Questions How To Get A Verified Cash App Account? To verify your Cash App account, provide your full name, date of birth, and the last four digits of your SSN. Complete any additional verification steps as prompted by the app to increase your transaction limits.

Can You Buy A Cash App Account? No, you cannot buy a Cash App account legally. Creating a new account using your own details is required by Cash App’s terms of service.

How Much Can A Verified Cash App Send? A verified Cash App user can send up to $7,500 per week. This limit refreshes every seven days, allowing for regular transactions.

Does Cash App Have Commercial Accounts? Cash App currently does not offer commercial accounts; it’s designed for personal use only. Businesses should consider alternative platforms for commercial banking needs.

Conclusion Wrapping up, opting for a verified Cash App account is a wise move for seamless transactions. It boosts security and ensures credibility in your financial dealings. Remember, a trusted account is your gateway to worry-free payments and transfers. Secure one today and experience the difference in your digital finance management. Buy Verified Cash App Accounts.

2 notes

·

View notes

Text

Why Bitcoin is So Polarizing: The Digital Revolution That Divides the World

Few innovations have sparked as much debate as Bitcoin. Some see it as the financial revolution of the century, while others dismiss it as a speculative bubble or a tool for criminals. But why does this digital asset evoke such extreme reactions? The answer lies in the fundamental way Bitcoin challenges long-held beliefs about money, power, and control.

A Currency or a Cult?

Bitcoin isn’t just another form of money—it’s an idea. And like all powerful ideas, it disrupts the status quo. Those who believe in its potential see it as a lifeboat in a financial system built on debt, inflation, and central bank intervention. Those who oppose it see it as a threat to stability, a reckless experiment that could end in disaster. The divide isn’t just about numbers on a screen; it’s about worldviews, trust, and who gets to define what money really is.

The True Believers

To Bitcoin’s supporters, the flaws of traditional finance are obvious. Central banks print money endlessly, inflating away savings. Banks fail, requiring taxpayer bailouts. Entire economies crumble under the weight of mismanaged monetary policies. Bitcoin offers an escape—a fixed supply, a trustless system, and financial sovereignty for anyone with an internet connection. It’s the antidote to the problems people didn’t realize they had until Bitcoin exposed them.

For many, Bitcoin represents personal empowerment. It allows people to be their own bank, store value outside the reach of governments, and participate in a truly global financial network. In places suffering from hyperinflation or economic collapse, Bitcoin isn’t just a speculative asset—it’s survival.

The Critics and Skeptics

On the other side, skeptics argue that Bitcoin is nothing more than a digital mirage. Volatility makes it unreliable for everyday transactions. Its price swings wildly, making some rich overnight while leaving others devastated. Regulators see it as a financial Wild West, where scams and illicit activities thrive. Governments eye it warily, knowing it undermines their control over monetary policy.

Then there’s the environmental argument. Bitcoin mining requires massive computational power, leading to criticisms about energy consumption. Detractors claim it’s wasteful, though supporters counter that Bitcoin incentivizes renewable energy and is far more efficient than the existing financial system when considering the energy consumption of banks, ATMs, and data centers worldwide.

The Establishment vs. The Disruptors

At its core, Bitcoin represents a philosophical battle between centralization and decentralization. Governments and financial institutions exist to maintain control, stability, and regulation. Bitcoin, by design, removes the need for these intermediaries, shifting power from the few to the many. This redistribution of control is unsettling for those who benefit from the current system.

Wall Street once scoffed at Bitcoin, yet now institutions are quietly accumulating it. Countries like El Salvador embrace it as legal tender, while others scramble to regulate or even ban it. The lines between acceptance and resistance are constantly shifting as Bitcoin’s influence grows.

Cognitive Dissonance and the Fear of Change

Bitcoin forces people to confront uncomfortable truths. It reveals that money, as we know it, is not backed by anything tangible—it’s a system of trust. It challenges the notion that inflation is necessary or that governments should have unchecked control over currency issuance. These are difficult concepts to grapple with, and for many, it’s easier to dismiss Bitcoin than to question the foundation of the financial system they’ve always known.

Change is always met with resistance. Just as the internet was once ridiculed and dismissed as a fad, Bitcoin faces the same scrutiny. But history has a pattern—disruptive technologies are mocked, fought, and eventually, adopted.

The Future: Adoption or Rejection?

Bitcoin’s path is still uncertain. It could become the backbone of a new financial era, or it could remain a niche asset, misunderstood and feared. But one thing is clear—Bitcoin is not going away. Its network continues to grow, its principles of decentralization and sound money continue to attract converts, and its existence continues to challenge the global financial order.

In the end, the polarization surrounding Bitcoin is a testament to its significance. Ideas that don’t matter are ignored. Ideas that threaten the foundations of power are fought. Whether you see Bitcoin as salvation or speculation, it demands attention. And as more people wake up to the reality of our current financial system, the question isn’t whether Bitcoin will survive—but whether the world can afford to ignore it.

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Crypto#FinancialRevolution#Decentralization#Money#FutureOfFinance#SoundMoney#DigitalGold#Blockchain#CryptoNews#BitcoinAdoption#BitcoinFixesThis#CryptoCommunity#Economy#Investing#DisruptTheSystem#TechRevolution#Philosophy#Freedom#Hyperbitcoinization#financial education#finance#digitalcurrency#globaleconomy#unplugged financial#financial empowerment#cryptocurrency#financial experts

3 notes

·

View notes

Text

There are FEW (FEW) people I never met I would take at face value almost every single time. He's one of them.

"Edward Snowden @Snowden Prediction: A national government will be revealed this year to have been buying Bitcoin—the modern replacement for monetary gold—without having disclosed that fact publicly."

And this goes inline with what I was saying: our currency/banking system is about to DIE, and we get TWO (and only 2) choices>

The great reset. We go back to 'normal' where 'we can't even get people clean drinking water.

or

The great revolution.

Cuz this won't be just a USA or 1st worlds thing. This will be worldwide.

Even tho you want to be scared and feel powerless, and make excuses: it's YOUR voice. Do not let them speak on behalf of you cuz they will always be speaking in praise of their own inflection.

3 notes

·

View notes

Text

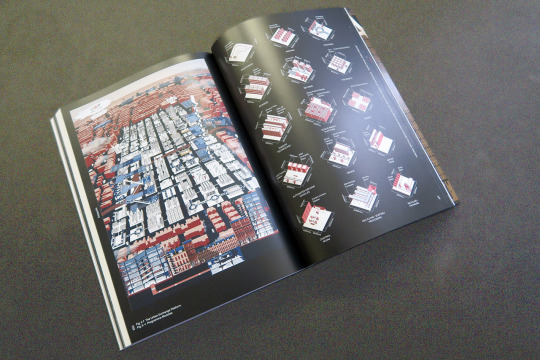

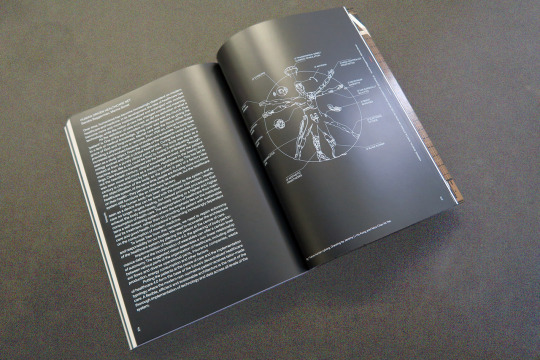

P. Cournet & N. Sanaan Bensi: Datapolis

Datapolis, Exploring the Footprint of Data on Our Planet and Beyond by Paul Cournet & Negar Sanaan Bensi (ed.); nai 010 Publishers, Rotterdam 2023

Architecture is not only a few historical landmarks in our city centres, spectacular masterpieces from starchitects or engineering feats to build the highest tower ever in the desert. It has also always been about vernacularity, everyday life in anonymous places and favouring use towards aesthetics. (Just think of shopping malls or most of the airports you ever visited.) But if the Industrial revolution of the 19th century saw the birth of amazing train-cathedrals of steel and glass that are now listed as monuments, the 21st century has seen the development of the digital world to such an extent that the heavy industry has moved towards anonymous (and discreet) data centres, bitcoin mining facilities that requires satellites, computers and portable devices.

The book Datapolis is an in-depth research on a world where we cannot be offline more than a few hours anymore, where our smartphones contain our train ticket, bank payments, private images and favorite music, agenda and work, maps and recipes for the x-mas dinner. But all those 0 and 1, those bits, kilobits, megabits, gigabytes and terabytes of information are not in our machines anymore. We get our favourite songs and films from streaming companies, we store our entire lifestyle in so-called clouds, we work on shared documents. Basically we depend on infrastructure made of data centres, submarine cables and antennas, that stay out of sight for most of us.

This amazing publication is making the invisible (the infrastructure of clouds, the technical machines processing digital information) visible. It doesn’t only show those places, but also explains to us the environmental impact of digital objects. Not only we need resources from the ground (rare metal and so on), they also consume electricity to function on a daily basis — and this energy has to be, somehow, produced.

The essays – who could be totally nerdy or impossible to understand for readers that are not familiar with the vocabulary of technology – are super accessible and makes the book an easy (but always inspiring and instructive) reading. Between the text pages, one finds amazing graphics, diagrams and photographs that reveal the reality behind the theory. One finds a lot of architecture here, but it’s not our next destination for cultural holidays.

We, of course, have all seen The Matrix (1999). A science-fiction film about the digitisation of every life till it blurs the boundaries between the virtual and real life. The book explores that world, not from a fictive way, but a real one – and this makes it a must read: because what it shows us is even crazier than the imagination of film-makers. Obviously, we already live in the future! But, like all good science fiction story, Datapolis makes us think about our world as it is now, and what we should do to save it from becoming a nightmare. I will not spoil the last double page of the book (will just say it’s about iPhones), but, just for that one, you need to get that publication in your hands.

-

Thibaut de Ruyter

4 notes

·

View notes

Text

sorry to continue being woman screams at clouds about the most overexposed topic of late but because i’ve spent the past few days dealing with ai relentlessly (even moreso than usual, which is really saying something) at work it’s at the forefront of my mind (and a lot of us in an impacted field, which, being honest, is most of them).

here’s the thing. i get why those who aren’t in a creative field or simply haven’t been touched or impacted by it yet don’t understand the animosity towards it. i understand their confusion. i understand why they ask, isn’t this a good thing? doesn’t this make art more accessible? isn’t this a valuable tool? because it absolutely fucking should be. it should be a valuable tool. some forms of it have been; the automatic spelling and grammar checks in word processing software is the most obvious example. and yes, that’s genuinely helpful in a lot of respects. but only to a point; it will still misunderstand context, it will still try to substitute in the most common misspelling of a word because that’s what it’s been trained to believe is the correct one, it won’t catch errors that could be correct used differently, it will try to make verbs agree with the wrong nouns. so, certainly, it can and should be helpful — but again. to a point.

the same could be said of most forms. ai could, theoretically, be a useful resource for artists to find references. it could be a useful form of generating rudimentary plot ideas to be built upon by writers. it’s been used, in its most basic forms, for both of these things for a long time — even software like writeordie will pop up with a madlibs-style “write a blank about blank who blank” prompt upon opening it.

but here’s the thing. ai, as it presently is being used, as it is increasingly being promoted to use, is not about accessibility. it’s not about being a useful tool for human creatives to inspire and improve and promote versatility in their work. the reason artists hate it, the reason we’re offended by it, the reason it is actively hurtful and frightening, isn’t only about our jobs. yeah, that’s part of it. obviously it’s part of it. no one has ever liked being used without their consent to train their replacement, and we like it even less when data mining is being used to attempt to replace entire fields. but on a more personal level, it’s not simply because ai in its present form eyes eventually being able to replace us in the workforce. that isn’t really a new fear, and it’s certainly not one limited to creatives.

but the way ai is actually used? the way it’s promoted by techbro bitcoin musklites? it comes from a place of active disdain for us. it comes from a place of genuine malice towards artists and human creativity. it comes from a place of, if we’re being honest, ego fragility — oh, you think you have a talent i don’t? watch this. and where it leads is, ultimately, the hope to make us irrelevant, not merely because they don’t want to cut us a check, but because our existence is threatening to them. if humans are not the ones creating art, then art is the result of trained formulas. and those are a hell of a lot easier to direct and control in their messaging. those are hard-pressed to communicate much of anything at all. if art is meaningless, if it’s simply entertaining or a pleasing combination of words, then humanity’s longest standing outlet of protest, revolution, criticism, and straight up fucking empathy is gone.

i don’t say this from a place of doom and despair. i don’t think there’s any merit in that. the fastest way to ensure artists are exterminated is to communicate to artists that there’s no point in pursuing it and we should all pack up and go home now, so, no, there’s nothing helpful in wailing about our inevitable demise, particularly because it is absolutely not inevitable. look how well bitcoin shaped up. that lacked the fundamental issue with ai taking over creative endeavors, which is that it’s literally formulaic — it functions on an if x then y basis, and good luck capturing the human experience in that. good luck ignoring the fundamental fact that humans do not create for profit, or out of obligation, but because it is literally what keeps us sane and alive. we’re going to continue creating whether we’re getting paid or not, and yeah, there will continue to be a disparity in what’s being produced, and yes, that will be visible, and no, we’re not going anywhere.

but that doesn’t change the fact that it’s fucking horrifying and infuriating that people want us gone and are self-congratulatory about the fact they believe they have the eventual means to do so while trying to sell the public on the idea we’re the ones trying to gatekeep creativity.

9 notes

·

View notes

Text

The Tech Odyssey:Navigating the Digital Age

In an era where technology is at the forefront of our lives, it's almost impossible to imagine a world without its profound influence. From the gadgets we carry in our pockets to the complex systems that power industries, technology is the driving force behind innovation and progress. In this blog, we'll dive into the ever-evolving world of technology, exploring its impact, trends, and the possibilities it holds for the future.

The Digital Revolution