#what is a bankruptcy trustee

Explore tagged Tumblr posts

Text

Everyone loves a good snack. Regular meals are important for your health, but they are also a tyrannical regime that keeps you from shovelling MSG-laden tortilla chips into your mouth six or seven times a day. In the interest of personal freedom, I took over my cousin's failing food truck business and started serving up schedule-busting goodies all over town.

Admittedly, I didn't really care about feeding the masses. I definitely did not care about cooking for, and cleaning up after, random individuals that I would never meet again. What I got into this business for was the truck, a beaten-up old Isuzu NRR that I thought would make a good vehicle with which to tow. If I held out for long enough, then I could pay myself with the truck in lieu of a paycheque when the company went bankrupt.

Of course, I couldn't just sit on my hands and do nothing. To make things look good for the bankruptcy trustees, I was told, I had to put in a serious effort to craft and sell food across town. Soon I was selling hot dog buns stuffed full of Cheetos for seventeen dollars a pop. Customers lined up around the block. To my surprise and anger, this was the moment in which my natural-born business instincts finally manifested to produce some big-league cheddar. Some even maintained a website dedicated to tracking my every move around town, even commenting on my double-clutching as I tried to maneuver that tricky intersection before the downtown bridge without stopping for the red light.

Money was pouring in from a fanatical customer base, which made it improbable that I could pull off my truck-instead-of-cash trick. Not like I could stop for long enough to change the plate on the thing. I was invited to food festivals, park openings, and even had my own Netflix show for a little while, because they didn't want to pay writers anymore, and filming me for two hours of slinging greaseball fried food out of the window of my truck was cheaper. Don't worry: I made sure to ruin all of their takes by talking randomly about 1980s Korean economy cars, a topic that advertisers absolutely despise.

So what took out my business? It wasn't competition, or even that time I rammed the Mayor's limousine while rushing to the scene of a multi-vehicle accident to serve up hot snacks to the brave firefighters. Ultimately, it was my cousin, who wanted his now-successful business back. Without my brave leadership (and gonzo, irresponsible driving) at the helm, the quality of the food immediately dropped, and he went under. There is good news, however. I did get to keep the truck after all, even though Cousin Neutral had to torch it for the insurance money first.

204 notes

·

View notes

Text

I’m pissed. I am so pissed right now. (Super long, very personal rant below)

I’m an attorney. A lawyer. My job is to advise my clients to the best of my ability of what legal options they have and which acts may be in their best interest. That’s why one of the other names for my job is counselor.

It is not to get more clients. It is not to file more bankruptcies. My job, my ethical obligation, is to provide my professional expertise to clients in relation to pursuing a bankruptcy.

Which means sometimes my ethical duty is to advise clients that filing a bankruptcy is the worse option for their situation and other steps would serve them better to reach their goals.

So when a client who makes less than the median income (which is fairly low, especially with inflation) comes in owning their house in full (meaning lots of value in the house to pay off debts), it is my job, my ethical obligation, to warn her that filing bankruptcy will mean she has to pay every single cent of her debts back. That she will be handing over almost half of her pay every month to the bankruptcy court to pay back her creditors. Or else the bankruptcy trustee has the right to sell her house.

And after discussing her situation with the senior attorney, turns out that it’s actually a better option for her to take out a small home equity loan and negotiate for lower debt payoffs for her credit cards and personal loans. It’s a lower interest rate, she gets a lot more leeway before her house is at risk, it’s quicker, and it will preserve her credit score. In every conceivable way it’s a better option for her.

So I call her to discuss that there are other options for her before I sink hours into preparing her case.

This woman freaks the fuck out. She’s convinced the loan will lead to her losing her house. She demands to know why I would even suggest it. She implies I have no clue what I’m doing and am just trying to take advantage (which is… no? I’m telling you that you’d be better off not using our services). I try to calm her down and ask for a few days to put together the numbers to show her what her options will look like. She agrees to a phone call in two days.

Two days later, she sends me a basic email saying she no longer wants to go forward with the bankruptcy. Silly me thinks that means she’s given thought and realized that a 3.5-5% small loan and negotiating payoffs is better than 5 years at 8-18% interest plus attorney fees.

Wrong! She also emails one of the partners and writes a nasty message about me and how “incompetent” I am! Because I suggested a home equity loan! Because I did my ethical duty! And I found this out because I went to add a note to her file about giving her a refund and found a note from the partner about her complaints about me.

And I do not trust the partners to take my side. I did the right thing. I took the right actions. I know I did. And the Senior attorney will back me up! We literally just had a discussion that legal ethics requires that at times we have to advise clients not to file bankruptcy, even if that means we lose their business.

But I cannot believe that the partners will stand behind my actions. I can’t. Not after the last year. Too many times have they assured me that they have my back only to throw me under the bus the moment they actually have to prove it.

A client is rude and combative to me and my paralegal? Makes me deeply uncomfortable and keeps on insisting on coming into the office so he can attempt to railroad me by physical intimidation into doing what he wants instead of the actual correct legal actions? Partners says he understands and that he’s okay if we turn this client away. Then he calls the client, tells them I’m also on the line, and immediately rolls over because the asshole isn’t rude to him. And I have another month of near constant harassment and arguments and passive aggressive insults.

A client gives off creepy vibes? Again insists on coming into the office for every little thing? Has a criminal record for domestic issues and an active criminal case open against him for pedophilia? Oh well. He paid a lot up front so guess I have no choice but to keep representing him. For the next 5 years.

Client starts being threatening and aggressive to our paralegal before we even meet with him? Demands to be seen and threatens to come into our office even though we are booked all afternoon? Gives the former criminal prosecutor senior attorney bad vibes before she’s even seen him? Meet with him anyway! Oh he just lost his job because he threatened his HR? Has been arrested for domestic violence? Just attempted to physically intimidate his now former boss and had the cops called him? That’s fine! We have security concerns? Oh well, they’ll think about it during the partners meeting next month.

I’d like to take the time to learn how to do post filing work or how to file bankruptcies in the neighboring district that I actually live in? Tough. More front end work for a court that’s literally on the other side of the state! And if that doesn’t keep me occupied, they’ll send me front end stuff from the other side of the country!

So I really don’t trust that when I tell them I was doing my ethical obligation and making my client aware that there are better options that they will take my word over hers. I can’t. They’ve shown me that’s not how they think. It’s being a business first, with being a law practice a distant second, and mentoring new attorneys a far away third. Caring for our staff is barely a blip on the horizon for them.

But I know I did the right thing. And if that client wants to go to another firm and pay most of her paycheck to the trustee every month, fine by me. And if they try to lecture me about how I “handled it poorly” and should have just filed it without saying anything, I can’t guarantee I won’t just walk out.

I’ve got contract work. I’ve been approached by headhunters. One literally emailed me this morning. I like this work, but for once I’m not scared to walk away.

#fury's life#fury’s a lawyer#and I will always be a lawyer before I am a businesswoman#I couldn’t live with myself otherwise#personal#fuck this firm#I thought I was just getting burnt out#and a week off would allow me to come back in better spirits#but this week has sucked#and it’s not burnout that’s making work harder than it has to be#it’s like they’re trying to ruin me for anything but being a replaceable cog in their fast law machine#so I can’t leave#fuck. that.

5 notes

·

View notes

Text

Jon Passantino, Nicki Brown, Oliver Darcy, and Hadas Gold at CNN:

A Texas bankruptcy judge has rejected a proposed liquidation of conspiracy theorist Alex Jones’ company Free Speech Systems, the parent company of Infowars, saying that a denial of the bankruptcy plan was, in his opinion, in the best interest of the creditors. But the judge approved a separate liquidation of Jones’ personal assets.

Judge Chris Lopez said the Infowars bankruptcy process had dragged on and that it needed to stop “incurring costs” and let the families of Sandy Hook victims try to claim what they are owed through state courts. The families have not received payment of the approximately $1.5 billion in damages against Jones that they have won after he lied about the 2012 school massacre. “The right call is to dismiss this case,” Lopez said Friday. Lopez made his ruling in a lengthy decision where he seemed emotional at times, once even noting the timing of this decision being made shortly before Father’s Day. “I think it needed to happen,” he said towards the end of the hearing. “I wish I would’ve picked a better day.” [...]

Unanswered questions

The rejection of the bankruptcy plan leaves many questions to sort out in the decision’s wake. Among them: What happens next for Infowars? And what legal avenues remain for the victims’ families to collect the massive sum Jones still owes them?

This judgment could be viewed as a partial victory for Jones, who fought the liquidation proposal – but so too did some families, whose attorneys said they’ll benefit more from the bankruptcy plan’s dismissal by going after Jones’ assets immediately – rather than waiting for a prolonged bankruptcy procedure to play out. That ruling leaves Free Speech Systems to face its creditors outside of bankruptcy in state courts, noted Marie Reilly, professor of bankruptcy law at Penn State University. In a statement, an attorney for the families said they would press on. “Today is a good day. Alex Jones has lost ownership of Infowars, the corrupt business he has used for years to attack the Connecticut families and so many others,” said Chris Mattei, an attorney for the families. “The Court authorized us to move immediately to collect against all Infowars assets, and we intend to do exactly that.” Lopez noted that the case is far from over. The interim trustee, and later the permanent trustee, in Jones’ personal case will ultimately decided Infowars’ fate.

Judge Chris Lopez has rejected the bankruptcy plan that would liquidate far-right conspiracy theorist outlet InfoWars and its parent company Free Speech Systems, but did approve liquidation of right-wing conspiracist Alex Jones’s personal assets.

5 notes

·

View notes

Note

How much do you think Herman lost? It seems like they didnt lose the roof above their heads and luca still had enough to run away. But he had to sell even manuscripts and it still was not enough

Hi anon, I have so many thoughts on this I’m about to write you an essay.

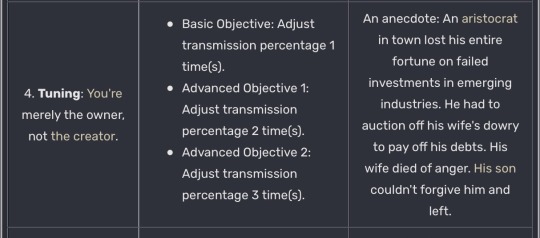

So, Luca’s fourth deduction is framed as an anecdote: someone gossiping about Herman’s financial status in presumably the town the Balsa family lived in. This implies that Herman’s indebtedness was common knowledge among people outside of his family. Now this could be simply a rumor that got out of their household, but I generally choose to interpret it as Herman more or less bankrupted his family, because of how I understand historical bankruptcy procedures and noble indebtedness in the UK to work.

According to this source, while you weren’t as likely to be jailed for bankruptcy after 1869 thanks to a reform law, bankruptcy was still a public and embarrassing ordeal to go through. After the initial filing of bankruptcy was put through by either the bankrupt or his creditors, papers in town had license to publish it and spread it around. This would make a compelling case for Herman’s mishandling of money being public knowledge. And it would mean that everyone in town would know exactly how much they lost (ie “his entire fortune”).

It wasn’t at all uncommon in the Victorian era, according to this source, to carry an amount of debt around, and as long as your payments on that debt didn’t exceed your means to pay it back, hardly anyone took nobles to court over it. But there were notable historical examples, all of which became quite well known and notorious for being that indebted or going bankrupt. Bankruptcy proceedings required a man to disclose all of his assets (including any papers and manuscripts he had produced) in order to see what was even available to be paid back.

Again, from the first source:

“Eventually, once all creditors had been identified and the estate liquidated, notice was given (again in the press) of the amount payable to the creditors. This was given as the amount of money they would receive for every one pound owed. Often the amount paid was minimal, perhaps only a few shillings for every pound (there were twenty shillings to the pound). This meant that at the end of the process, there were no real winners.

Eventually, the debtor would be released from the restrictions of bankruptcy and the trustee. This was typically a year after the initial bankruptcy was declared although it could take considerably longer.”

I think it’s implied that having used up almost all of his own assets, Herman had to dip into his wife’s assets (which he likely did have at last partial control over, but we’re still hers) in order to pay what he could off to his creditors. I don’t think we actually have any evidence he didn’t lose the roof over their heads, or force them to move to cheaper lodging. We also have very little evidence that Luca left with anything more than a stolen manuscript of Herman’s.

(I honestly think that Luca didn’t even leave with his family name. I think with how public the whole affair of near or complete bankruptcy of an aristocrat would have been, I think Balsa may be the name he chose for himself. After all, his bio says “no one knew where he came from, and no one had ever met his family.”)

(On that last point, don’t at me about how Luca calls him Herman Balsa in his second birthday letter. With the theory I’m cooking, I’m inclined to believe idv is just inconsistent between how characters refer to Herman. This is obviously head canon and interpretation + speculation at this point, so I’m taking some liberties.)

16 notes

·

View notes

Text

In good political news today, Toronto elected Olivia Chow as mayor and I'm super stoked to have her back in City Hall.

From this CBC Article:

Olivia Chow was elected Toronto's next mayor in an unexpectedly close race Monday, promising to bring a more progressive approach after more than a decade of conservative leadership at city hall. The former downtown Toronto NDP MP and city councillor bested a record field of 102 candidates that included about a half dozen established contenders. Among those rivals was second-place finisher Ana Bailão — a past deputy to former mayor John Tory, whose shock resignation in February triggered the byelection. Chow, who was born in Hong Kong and came to Toronto at age 13, will become the third woman and first racialized person to serve as mayor in the city's history. She steps into the top spot as it grapples with a massive budget shortfall, an affordability crisis and public safety concerns. "If you ever doubted what's possible together, if you ever questioned your faith in a better future and what we can do with each other, for each other, tonight is your answer," Chow said in her speech to a crowd of cheering supporters. "Thank you to the people of Toronto for the trust you've placed in me and the mandate for change as your new mayor." [...] Among her headline commitments is a pledge to get the city back into social housing development and an annual $100 million investment in a program to purchase affordable homes and transfer them to non-profits and land trusts. [...]

Chow campaigned from the left, promising to boost rent supplements by introducing a "luxury home tax," an expanded land transfer tax on homes sold for $3 million and over. She also said she'll triple the city's existing vacant homes tax to three per cent. Chow will inherit largely untested strong mayor powers, however she has repeatedly said she wouldn't use them to override "majority rule" in council. In theory they would allow Chow to pass budgets with just one-third council support, veto bylaws and unilaterally shape the city's top-level administration. She did not release a fully-costed platform, and repeatedly declined to say by how much she would need to raise property taxes to pay for her suite of commitments — a focal point of criticism from her main rivals throughout the campaign.

The last week of the campaign saw Ontario Premier Doug Ford all but formally endorsed Saunders, warning at an unrelated news conference that a Chow mayoralty would be an "unmitigated disaster" and that she would raise taxes at an "unprecedented rate." Saunders finished third with 8.4 per cent of the total vote share. Ford's pointed attack raises questions about Chow's relationship with Queen's Park as the city faces a $1.5-billion budget hole that will almost certainly require provincial help to fill. In a statement Monday night, Ford struck a conciliatory tone, saying he will "work with anyone ready to work with our government to better our city and province. "Throughout Olivia's life, she has proven her desire and dedication to serving the city that many of us call home. While we're not always going to agree on everything, what we can agree on is our shared commitment to making Toronto a place where businesses, families, and workers can thrive."

Chow has long been a fixture of Toronto politics. She became a school board trustee in 1985, served 12 years on city council representing Trinity-Spadina and eventually became a New Democrat parliamentarian alongside her late husband and former federal NDP leader Jack Layton. Some of her notable policy stances include supporting an anti-homophobia curriculum in the 1980s, helping bring nutrition programs to Toronto schools in the 1990s and fighting against exploitative immigration consultants in the 2000s. For much of the last decade, she has run the Institute for Change Leaders at Toronto Metropolitan University where she trained community organizers.

The city being in basic bankruptcy position that will require provincial bail-out support is going to be contentious because Doug Ford is a nasty piece of work and vindictive as fuck - especially against Toronto Mayors - so we will see what she'll be able to get out of him (if anything). The Federal level will be able to help some, but it's really a municipal-provincial issue.

15 notes

·

View notes

Text

The Dilemma of The Down and Out

People will tell you.

If you can't manage where you are, well get out move on and leave.

But they don't understand the dilemma of what it takes to do that.

Firstly it takes money to move. And resources and people to help. But most people who are financially broke simply don't have the available cash or credit to do that.

Worse, they may no longer have family or friends left to help, particularly if they are Seniors.

It takes money to move. It takes resources. And without subsidized housing, another rental if readily available is likely to be triple the costs of and older place with a modest mortgage and hydro cost.

The availability of subsidized housing in the province of New Brunswick is next to nil and the wait lists over a mile long.

And with bills piling up, and no steady income except for an insulting amount from the province, you soon are in default and the bank and other creditors pile in.

And don't look at bankruptcy - that simply will cost you any tax refund you may have and your hst gst if applicable. And a trustee fee for the lawyers. And don't look to add your house to the bankruptcy - they only will do unsecured debt and not able to put property tax on it.

Can't do that, because that property is for the bank et al.

So financially you can't stay and you can't move without help or subsidized housing.

It's the corner with no exit. No way out.

It's purposely designed that way in my opinion.

They don't want you to succeed. The system doesn't.

Without selling your soul to you know who.

Never!!!!

Their days are numbered. Won't be me judging them.

For myself, I only feel love and forgiveness for all.

Father, forgive them as you have forgiven me so many times.

I love you. In spite of my situation.

The Power and the Glory of God.

Amen.

^^^

My blog and my opinion.

Take that to the bank.

8 notes

·

View notes

Text

Social Security may well prove the belief that taxation is theft. FICA contributions to Social Security and Medicare are not opt-out. The American worker and their employers are legally compelled to pay. You have no choice here unless you choose to work under the table or in some alternative economic market out of the view of the federal government, and woe upon woe to you if the IRS finds out.

To add insult to injury, Social Security is not a retirement savings program. It is a transfer program. Income in the form of FICA contributions is taken from the paychecks of working people and is to be distributed to current beneficiaries of Social Security. That's it in broad, general terms.

The promise to those of us whose income is being taxed is that when it comes our time to draw benefits there will be funds available. Of course, we will need to continue taking money out of the checks of those working even if we have surplus funds available. As the current reports by Social Security Trustees indicate, we don't, and given current projections, we won't. Drastic measures will have to be taken to secure the program for the future if we hope to keep the Boomer Generation and Early Gen-Xers (my demographic) from bankrupting the program out of existence.

I'm 57. I've been making contributions for over 40 years if you take into consideration my fast-food jobs as a teenager. There had better be Social Security when I retire. The chances are, the minimum retirement age will be raised and benefits will be cut to stave shortfalls and prevent insolvency from becoming bankruptcy.

I have acquaintances that mistake my attitude for irony impairment. "Taxation is theft, but keep your hands off my social security," they joke. The answer to both is an unironic, "Yes."

Taxation is theft as I didn't agree to the program or tax on my income in the first place. In fact, these came about some thirty years before I was born. I entered the workforce and had no choice but to agree to these mandates. As stated above, FICA contributions are not opt-out.

Keep your hands off of my Security since you haven't given me the choice to opt-out. I would like to recoup some of the income I lost over my decades in the workforce. In fact, fix the damn program so that my contributions aren't a loss to me and future generations of workers. Now, if you want to refund all of my FICA deductions with interest and adjusted for inflation, okay...do what you want.

Since we know that isn't going to happen, it's time for Congress to get their act together. The GOP would rather we cut Social Security out of the federal budget altogether, while the Democrats seem unwilling to make necessary changes. Both parties are putting American workers on a speeding train to ruin.

So yes, "taxation is theft," and I want my money back, so "keep your hands off of my Social Security."

3 notes

·

View notes

Text

Mt. Gox Transfers $2B Worth of Bitcoin: Potential Impact on BTC Value

Key Points

Defunct exchange Mt. Gox moved over $2 billion in Bitcoin to two addresses on November 10.

The large-scale transfer has led to market speculation on its impact on Bitcoin’s price trajectory.

The now-closed exchange Mt. Gox transferred over $2 billion to two distinct addresses on November 10. This substantial transfer is one of the most significant movements from Mt. Gox’s remaining assets, adding a new dimension to the decade-long restitution process for the exchange’s numerous creditors.

According to data by Arkham Intelligence, a Mt. Gox wallet identified as “1FG2C…Rveoy” moved approximately 27,871 BTC (valued at $2.24 billion) to a new wallet. Concurrently, another transfer of 2,500 BTC (valued at $200 million) was sent to a Mt. Gox cold wallet.

Recent Movements and Speculations

It is worth noting that Mt. Gox still holds an additional 44,378 BTC. The exchange’s wallet activities, which had been inactive for over a month, started showing movement at the end of October. Earlier this month, the exchange transferred a smaller amount of 500 BTC to unknown addresses.

As Bitcoin prices remain near all-time highs, these transfers have led to market observers pondering the possible effects on Bitcoin’s price direction.

The Mt. Gox saga, which started with a security breach in 2014 and subsequent bankruptcy filing, has been one of the most intricate legal and financial dramas in the crypto world. The collapse of the exchange resulted in the loss of 850,000 BTC.

It’s unclear if the recent transfer is directly related to repayments to creditors, but the timing and size of these transactions have sparked speculation. Historical evidence suggests that Mt. Gox’s remaining assets might be directed towards creditor distributions through centralized exchanges such as Bitstamp and Kraken, although this remains unconfirmed.

Delayed Repayments and Market Predictions

The delay in repayment to creditors continues. Last month, Mt. Gox’s trustee extended the repayment deadline by another year, moving it from October 31, 2024, to October 31, 2025. The delay was attributed to several unresolved issues: incomplete repayment procedures on the part of some creditors and an unexpected “system issue” that reportedly caused duplicate deposits for some recipients.

The trustee has contacted affected creditors, asking for the return of any mistakenly distributed funds.

As Bitcoin’s value surges to unprecedented highs, Ki Young Ju, CEO of CryptoQuant, has issued a cautious outlook. He stated that Bitcoin might end the year below $59,000 due to what he described as an overheated futures market.

Bitcoin is currently trading around $80,995, up by over 2.5% in the last 24 hours. The cryptocurrency has also seen a significant increase in its market cap in the past few days, currently sitting around $1.6 trillion.

Ju’s prediction highlights the tension between Bitcoin’s current bullish momentum and the potential for a significant correction. Mt. Gox’s substantial asset movements could heighten volatility in an already sensitive market, with the potential for increased selling pressure if creditor payouts flood the market.

0 notes

Text

Consumer Proposal Winnipeg: A Path to Debt Relief

Financial difficulties can be overwhelming, especially when debt becomes unmanageable. For many Canadians, particularly in cities like Winnipeg, dealing with mounting debts can lead to stress and uncertainty about the future. One effective way to regain financial stability without declaring bankruptcy is through a consumer proposal. A consumer proposal is a legally binding agreement between you and your creditors, allowing you to pay a portion of what you owe over a set period. This debt relief option provides a structured solution, enabling you to manage your debts and avoid the more drastic consequences of bankruptcy. At Caplan Debt Solutions, we specialize in guiding individuals in Winnipeg through the consumer proposal process, helping them secure a fresh financial start.

What is a Consumer Proposal?

A consumer proposal is a formal debt settlement process under the Bankruptcy and Insolvency Act of Canada. It is a legal alternative to bankruptcy that allows individuals to negotiate with creditors to pay back a portion of their debt, typically over a period of up to five years. The primary advantage of a consumer proposal is that it enables you to pay off your debts in manageable installments without having to lose your assets or deal with the severe consequences of bankruptcy.

In Winnipeg and across Manitoba, consumer proposals are a popular choice for individuals who are struggling with debt but have enough income to make partial payments. By filing a consumer proposal, you can consolidate all unsecured debts, including credit cards, personal loans, and tax debts, into a single monthly payment. This option also stops creditor harassment, wage garnishments, and interest accumulation, making it an appealing solution for many.

Benefits of a Consumer Proposal

A consumer proposal offers several benefits over other debt relief options, particularly bankruptcy:

Avoiding Bankruptcy: One of the key advantages of a consumer proposal is that it allows you to avoid declaring bankruptcy, which can have more severe long-term effects on your financial future. A consumer proposal will have less impact on your credit score and doesn’t carry the same stigma as bankruptcy.

Debt Reduction: In a consumer proposal, you negotiate with your creditors to pay only a portion of your total debt. This means that you may end up paying much less than you originally owed, which can significantly reduce your financial burden.

Keep Your Assets: Unlike bankruptcy, where you may be required to surrender certain assets to repay your creditors, a consumer proposal allows you to keep your home, car, and other valuable possessions as long as you continue to meet the agreed-upon payment terms.

Interest Freeze: When you file a consumer proposal, all interest on your unsecured debts is frozen. This makes it easier to pay off your debt without having to worry about accumulating interest charges.

Legal Protection: Filing a consumer proposal provides immediate legal protection from creditors. Once the proposal is filed, creditors are prohibited from contacting you, garnishing your wages, or taking any legal action against you.

Single Monthly Payment: A consumer proposal consolidates all your unsecured debts into one manageable monthly payment. This simplifies your financial obligations and makes it easier to budget for debt repayment.

How Does a Consumer Proposal Work?

The process of filing a consumer proposal in Winnipeg is straightforward, but it requires careful planning and negotiation with creditors. Here's how it works:

Consultation with a Licensed Insolvency Trustee: The first step in filing a consumer proposal is to meet with a Licensed Insolvency Trustee (LIT). A trustee is a federally regulated professional who will assess your financial situation and determine whether a consumer proposal is the right solution for you. At Caplan Debt Solutions, our trustees are experienced in working with individuals in Winnipeg and can guide you through the process.

Proposal Development: Once your financial situation has been assessed, your trustee will work with you to develop a proposal that outlines how much you can afford to repay and the length of the repayment period (typically up to five years). The proposal is then submitted to your creditors for approval.

Creditor Approval: Creditors have 45 days to accept or reject your proposal. If the majority of creditors (by dollar value) accept the proposal, it becomes legally binding on all creditors. If the proposal is rejected, your trustee can help negotiate a revised proposal or explore other debt relief options, such as bankruptcy.

Repayment: Once your proposal is accepted, you will begin making monthly payments to your trustee, who will distribute the funds to your creditors. As long as you meet the terms of the proposal, you will be debt-free at the end of the repayment period.

Completion and Credit Rebuilding: After successfully completing your consumer proposal, you will receive a Certificate of Full Performance, which means you are officially debt-free. While the proposal will stay on your credit report for a period of time, it will have less of an impact than bankruptcy, and you can begin rebuilding your credit.

Who Qualifies for a Consumer Proposal?

To qualify for a consumer proposal in Winnipeg, you must meet the following criteria:

Your total debt (excluding your mortgage) must not exceed $250,000.

You must be insolvent, meaning you are unable to pay your debts as they become due.

You must have some ability to repay a portion of your debts over time.

A consumer proposal is ideal for individuals who have a steady income but are struggling with overwhelming debt. It provides an opportunity to negotiate with creditors and develop a manageable repayment plan without the severe consequences of bankruptcy.

Consumer Proposal vs. Bankruptcy

Both consumer proposals and bankruptcy are formal debt relief options under the Bankruptcy and Insolvency Act, but they have key differences. While bankruptcy may offer a faster route to eliminating debt, it comes with more significant consequences, including the loss of assets and a longer-lasting impact on your credit score. In contrast, a consumer proposal allows you to retain your assets, provides legal protection from creditors, and has a less severe impact on your credit report.

For individuals who are seeking to avoid bankruptcy but still need a structured plan to deal with their debts, a consumer proposal is often the better choice. Consulting with a Licensed Insolvency Trustee can help you determine which option is right for you.

Why Choose Caplan Debt Solutions?

At Caplan Debt Solutions, we understand the stress that comes with financial difficulties. Our team of experienced Licensed Insolvency Trustees in Winnipeg is dedicated to helping individuals and families find the best debt relief solution for their unique situation. Whether you are considering a consumer proposal or need advice on other debt relief options, we are here to help.

We offer personalized, compassionate service and will guide you through every step of the process, ensuring that you have the support you need to achieve financial freedom. Contact us today to schedule a consultation and take the first step toward a debt-free future.

Conclusion

A consumer proposal is an effective and manageable way for individuals in Winnipeg to reduce their debt, avoid bankruptcy, and regain control of their financial future. With the help of a Licensed Insolvency Trustee, you can negotiate with your creditors and develop a repayment plan that fits your budget. If you're struggling with debt, contact Caplan Debt Solutions to explore whether a consumer proposal is the right solution for you.

0 notes

Text

What is the Main Cause of Business Bankruptcy?

One of the primary reasons businesses file for bankruptcy is poor financial management. Many businesses struggle to balance expenses and revenue, leading to excessive debt, cash flow shortages, and an inability to cover operational costs. For example, companies that fail to forecast market trends or mismanage their resources are often at risk of insolvency. The best CPA firm in the Greater Toronto Area, More Than Numbers CPA, can help businesses navigate these challenges by providing strategic financial planning and budgeting support to avoid such missteps.

Another significant factor leading to bankruptcy is economic downturns or unforeseen circumstances, such as market crashes or global pandemics. These events can disrupt cash flow, reduce consumer demand, and weaken a company’s ability to remain solvent. The best CPA firm in the Greater Toronto Area, More Than Numbers CPA, offers expert consultation to help businesses create contingency plans, ensuring financial stability in volatile market conditions.

How Would a Business File for Bankruptcy?

Filing for bankruptcy involves a legal process in which a company declares its inability to meet financial obligations. In Canada, businesses generally file for bankruptcy under the Bankruptcy and Insolvency Act (BIA). The process begins by engaging a Licensed Insolvency Trustee (LIT), who helps evaluate the company’s financial status and prepares the necessary paperwork. The best CPA firm in the Greater Toronto Area, More Than Numbers CPA, can refer businesses to an LIT and provide invaluable accounting support during this complex process.

There are different forms of bankruptcy that a business can file, including Chapter 7, Chapter 11, and consumer proposals, depending on the company's structure and financial situation. Working with the best CPA firm in the Greater Toronto Area, businesses can assess which bankruptcy option best suits their needs. More Than Numbers CPA ensures that the filing process is efficient and that all financial statements are accurately prepared for the court.

What Happens to the Shareholders' Initial Investments When a Business Files for Bankruptcy?

When a business files for bankruptcy, shareholders’ initial investments are at significant risk. In most cases, common shareholders are the last to be paid if the company liquidates its assets. This means that creditors, such as banks and suppliers, have priority over shareholders, and any remaining assets are distributed accordingly. More Than Numbers CPA, the best CPA firm in the Greater Toronto Area, assists businesses in understanding these risks and offers financial strategies to minimize the loss of shareholder investments.

Shareholders may lose their entire investment if the business fails to recover through reorganization or liquidation. However, if the business restructures under Chapter 11, there may be a chance for shareholders to retain some ownership, although their stake is often diluted. The best CPA firm in the Greater Toronto Area, More Than Numbers CPA, offers crucial advice on how shareholders can navigate their positions during bankruptcy proceedings.

Who Has to File the Bankruptcy When a Business Files for Bankruptcy?

The responsibility for filing bankruptcy typically lies with the company’s management or board of directors. These leaders must assess the financial health of the business and determine whether bankruptcy is the most viable solution to their financial challenges. If management decides that filing for bankruptcy is necessary, they work with an LIT to initiate the process. The best CPA firm in the Greater Toronto Area, More Than Numbers CPA, can assist businesses by analyzing their financial records and offering guidance on when bankruptcy might be the right step.

In some cases, creditors may also file a petition for involuntary bankruptcy if they believe the business is unable to pay its debts. The best CPA firm in the Greater Toronto Area, More Than Numbers CPA, helps businesses develop debt repayment plans to avoid this situation and maintain control over their financial decisions.

Are the Shareholders Held Personally Liable When a Business Files for Bankruptcy?

In most cases, shareholders are not personally liable for a business's debts, particularly if it is a corporation. Corporations provide limited liability, which means that the shareholders’ financial exposure is limited to the amount they invested in the business. Their personal assets are protected from creditors. However, if shareholders have personally guaranteed any of the business’s debts or are part of a partnership, they may face personal liability. The best CPA firm in the Greater Toronto Area, More Than Numbers CPA, helps business owners and shareholders structure their investments to protect personal assets, even in the case of bankruptcy.

Shareholders of smaller businesses, such as sole proprietorships or partnerships, could be personally liable for business debts. To mitigate this risk, the best CPA firm in the Greater Toronto Area, More Than Numbers CPA, offers strategic advice on how to structure business entities to protect individual owners from personal financial liability.

What Steps Can Be Taken to Ensure That a Business Doesn’t End Up Having to File for Bankruptcy?

There are several steps businesses can take to prevent bankruptcy. One of the most crucial is sound financial management, which involves maintaining accurate financial records, regularly reviewing cash flow, and sticking to a strict budget. Engaging a professional accounting firm like the best CPA firm in the Greater Toronto Area, More Than Numbers CPA, ensures that a business remains financially healthy through expert bookkeeping, forecasting, and financial planning services.

Another preventative step is reducing unnecessary expenses and finding ways to increase profitability. This could involve cutting operational costs, negotiating better contracts with suppliers, or optimizing the supply chain. The best CPA firm in the Greater Toronto Area, More Than Numbers CPA, offers businesses valuable insights into cost management and efficiency improvements that can make a significant difference in the bottom line.

Businesses should also consider building a robust contingency fund. Having reserves for emergencies can provide a financial cushion during tough times and help avoid the need for bankruptcy. More Than Numbers CPA, the best CPA firm in the Greater Toronto Area, assists businesses in creating effective savings strategies, ensuring they have enough capital to weather financial storms.

Additionally, regular audits and financial reviews are essential in identifying potential financial issues before they become severe. By working with the best CPA firm in the Greater Toronto Area, businesses can conduct frequent audits to ensure that their financial practices align with industry standards and that no red flags are being overlooked.

Lastly, businesses should always stay on top of their debt management. Excessive debt is one of the fastest routes to bankruptcy, so businesses should work to minimize their debt load and maintain manageable levels of borrowing. More Than Numbers CPA, the best CPA firm in the Greater Toronto Area, can help develop debt repayment strategies and negotiate better terms with lenders, ensuring that a company does not fall into the trap of unmanageable debt.

Conclusion

Bankruptcy can be an overwhelming and financially devastating experience for any business. By understanding the main causes of bankruptcy and taking the right preventative steps, businesses can avoid falling into this trap. Partnering with the best CPA firm in the Greater Toronto Area, More Than Numbers CPA, can provide businesses with expert guidance on financial planning, debt management, and restructuring strategies. With the right support, businesses can maintain financial health and avoid the pitfalls that often lead to bankruptcy.

0 notes

Text

A year of Texas court chaos: Inside the fall of a powerhouse Houston bankruptcy judge

Usually confident to the point of coming across self-righteous, Houston Bankruptcy Judge David Jones’ voice quivered as he stated repeatedly, “I don’t know. I don’t know. I don’t know what is going to happen next. I just don’t know.”

The chief judge of the U.S. Court of Appeals for the Fifth Circuit had just published notice that it was investigating possible misconduct by Judge Jones over allegations that he had been involved in a multi-year secret romance with a former bankruptcy partner, Elizabeth Freeman, at Jackson Walker.

The Dallas-based firm had been paid more than $20 million — fees often approved by Judge Jones — for its role in dozens of high-profile bankruptcies in which Jones served as judge or mediator.

“I’m going to send a letter tomorrow announcing that I am resigning,” Jones told The Texas Lawbook in an interview one year ago Tuesday.

“I didn’t think my personal life was anyone’s business. We never discussed cases. It never impacted a single decision I made. But I guess I have to resign. I have no idea what I am going to do next.”

Jones, who handled more large corporate bankruptcies from 2019 to 2023 — including North Texas-based companies such as Neiman Marcus and J.C. Penney — than any other judge in the U.S., officially resigned Oct. 15, 2023.

The 365 days since have been pure chaos in the Houston bankruptcy courts, which is one of the three busiest courts in the nation for business bankruptcies.

“The whole thing is a mess, a complete fiasco,” said Royal Furgeson, the former dean at the University of North Texas at Dallas College of Law.

“The stress that Judge Jones and this situation has created for his fellow judges and for the lawyers and law firms is tremendous. The future of some excellent Texas lawyers and law firms is at risk. And it all could have been easily prevented by some simple disclosures and recusals.”

The fallout during the past 12 months has been intense, including:

The U.S. Trustee, the federal watchdog over bankruptcy proceedings, is seeking to force Jackson Walker to return between $18 million to $22 million in legal fees it was paid in 33 different bankruptcy cases involving Freeman in which Jones was either the judge or the mediator.

The case is scheduled to go to trial Dec. 16.

The U.S. Justice Department has opened a criminal investigation into the matter, ordering many of the lawyers and Houston federal court officials involved to preserve their records.

As a result, Jones took the Fifth Amendment against self-incrimination when asked about his relationship with Freeman during a deposition earlier this month.

Two federal lawsuits brought by creditors in cases handled by Judge Jones and that involved Freeman accuse the judge, Freeman, Jackson Walker and the law firm Kirkland & Ellis of a conspiracy to favor debtors at the expense of creditors and to funnel tens of millions of dollars in legal fees to the defendants.

Two investment firms, Fidelity and Apollo Global Management, filed court documents three months ago in Sanchez Energy’s bankruptcy claiming they would not have accepted a 2020 settlement agreement pushed by Judge Jones, who mediated the dispute in which Freeman was a lawyer for the debtor, Sanchez, which is now called Mesquite Energy.

The two lenders want to participate in the claw back of fees against Jackson Walker.

And just three weeks ago, Houston Bankruptcy Judge Marvin Isgur, whom Jones has described as his mentor and best friend, referred Jackson Walker to a federal district judge to consider disciplinary action for ethical breaches that Judge Isgur said “defiled the very temple of justice” by not disclosing the relationship between Freeman and Jones years earlier.

“What we have here is a scandal of epic proportions, all brought about by failures to disclose,” Nancy Rapoport, former dean of the University of Houston Law Center and a bankruptcy law expert, wrote in a law review article for Emory University’s Bankruptcy Law Developments Journal.

“Judge Jones absolutely should have recused himself from cases involving Ms. Freeman. Ms. Freeman should have disclosed the relationship, and she shouldn’t have appeared in cases assigned to her romantic partner. Jackson Walker should have disclosed the relationship once it became aware of it (and it should have done more than take Ms. Freeman’s word for it that the relationship had ended).”

“It’s hard to avoid the conjecture that the lawyers who should have disclosed chose not to do so at least in part because of the financial and strategic benefits of being employed in those cases,” wrote Rapoport, who is now a law professor at the University of Nevada Las Vegas.

10834400

Dallas lawyer Randy Johnston, an expert on legal ethics, said that “the facts in this case are devastating.”

“What happened here are almost certainly clear ethical violations and breach of fiduciary duties by the judge, the lawyers and Jackson Walker,” Johnston said.

“If I was a Jackson Walker lawyer right now, I would need a change of underwear.”

Multiple efforts to seek comments from Jackson Walker, Judge Jones and Freeman were unsuccessful.

Jones has argued that he has judicial immunity from all legal claims.

Jackson Walker has claimed that Freeman lied to them about her relationship with the judge and that it did nothing wrong.

Jackson Walker has also argued that if the U.S. Trustee or attorneys in that office knew of the relationship before it was publicly reported and failed to act, it cannot now try to claw back Jackson Walker’s legal fees.

Legal experts say the questions in nearly all of the related cases come down to this:

When did the lawyers know about the relationship between Jones and Freeman, and what, if anything, did they do about it?

The entire scandal came to light when Michael Van Deelen, who owned 30,000 shares of McDermott stock when the company filed for bankruptcy in 2020, filed a lawsuit last October accusing Judge Jones and Freeman of having a secret relationship.

He accused the defendants of a “sprawling tapestry of ethical lapses” that led to his stock being worthless and Jackson Walker and Kirkland — debtor’s counsel for McDermott — of profiting millions of dollars from the alleged conspiracy.

He’s claiming mental anguish and financial loss.

The case was transferred to Western District of Texas Chief District Judge Alia Moses, who dismissed the lawsuit in August on grounds that Van Deelen did not have legal standing.

“None of the foregoing discussion redeems Jones’ misconduct,” Chief Judge Moses wrote.

“The Jones-Freeman relationship presented a glaring appearance of impropriety. Whether through hubris, greed, or profound dereliction of duty, Jones flouted these statutory and ethical requirements by presiding over dozens of cases from which he was obviously disqualified.”

In September, Judge Isgur dealt Jackson Walker a potentially devastating blow when he signed a five-page finding of facts that stated,

“It appears that Jackson Walker breached its own ethical duties after it learned of the relationship. Breaches by the firm itself defiled the very temple of justice.”

“Throughout, it is apparent that Jackson Walker concluded that it had no duty of candor to this court,” Judge Isgur wrote, in referring the case to the chief judge of the Southern District of Texas for possible sanctions against the firm and its lawyers.

“It is intolerable that Jackson Walker protected the Jackson Walker firm to the exclusion of its inherent professional responsibilities.”

Southern District of Texas Chief Judge Randy Crane has appointed U.S. District Judge Lee Rosenthal to handle the ethics inquiry.

“There is no question but that the entire Southern District bench is under scrutiny on how it handles this,” said University of Texas law professor Jay Westbrook.

“It is hard to know how far this goes, but it is well within Judge Rosenthal’s reach to suspend or even disbar specific lawyers from practicing law in the Southern District, which would be potentially devastating for Jackson Walker.”

“I believe there is going to be some disciplinary measures taken,” he noted.

Johnston, the Dallas lawyer, agrees.

“There is no question that the rules of ethics require the judge, the lawyer and the firm to disclose this relationship or recuse themselves, and none did,” he said.

“I cannot imagine that the State Bar of Texas is not going to be investigating and bringing its own disciplinary proceedings.”

Furgeson, who is also a retired federal judge, said it is difficult to understand “how it could all go this sideways” for Jones, Freeman and Jackson Walker.

“Judge Jones must have just had a blind spot,” Furgeson said.

“I don’t know why it did not occur to him that he was in so much jeopardy here. It is all very sad.”

At a glance

Key developments in the Southern District of Texas bankruptcy court scandal

2011: David Jones leaves Houston law firm Porter Hedges after 19 years as a corporate bankruptcy lawyer to become a bankruptcy judge in the Southern District of Texas. Jones later hires Porter Hedges bankruptcy associate Elizabeth Freeman as his law clerk.

2012: Jones and Freeman each file for divorce.

2015: Jones is selected chief bankruptcy judge for the SDTX.

2016: Jones begins implementing a series of substantive reforms to create a special two-judge panel in the SDTX to handle the biggest and most complicated corporate restructurings, to provide parties increased access to court officials and to make procedures more transparent and predictable. The idea is to create a structure to convince larger businesses to file their complex bankruptcies and restructuring in Texas instead of New York or Delaware.

2018: Freeman leaves the employ of Jones and the SDTX to join Jackson Walker as a lawyer in its bankruptcy practice. She is promoted to equity partner Jan. 1, 2021.

2018: Kirkland & Ellis, widely regarded as the nation’s leading corporate bankruptcy law firm, chooses Dallas-based Jackson Walker to be its primary local counsel in more than 40 large business bankruptcies filed in Texas.

March 2020: The Covid-19 pandemic hits. Stay-at-home orders are implemented. Business revenues plummet. Oil and gas prices collapse. Scores of large businesses, including Neiman Marcus, J.C. Penney Company and CEC Entertainment (parent company of Chuck E. Cheese), file for bankruptcy protection in Houston. The Texas Lawbook publishes an article crediting Jones with saving the business bankruptcy law practice in Texas.

March 6, 2021: Jackson Walker receives a tip that Freeman is in a romantic relationship with Jones. Freeman confirms prior relationship with Jones but denies a current relationship.

March 8, 2021: Jackson Walker informs Jones of the allegation.

Feb. 1, 2022: A Jackson Walker partner learns that Jones-Freeman relationship is ongoing.

March 29, 2022: A Jackson Walker partner confronts Freeman, who admits the relationship is active.

December 2022: Freeman leaves Jackson Walker to start her own law firm.

Oct. 4, 2023: Michael Van Deelen, a shareholder who lost everything in the McDermott International bankruptcy handled by Jones, files a federal fraud and breach of fiduciary duties lawsuit accusing Jones and Freeman of being involved in a secret romantic relationship. Jackson Walker and Kirkland & Ellis are subsequently added as defendants in the conspiracy allegation.

Oct. 5, 2023: In an interview with The Texas Lawbook, Jones acknowledges the relationship with Freeman, saying he kept it private because he “thought it was no one’s business.” He also claims the relationship had no impact on any official decisions he made.

Oct. 13, 2023: Fifth Circuit Chief Judge Priscilla Richman announces the court was conducting an ethics probe into allegations against Jones, stating that he “ran roughshod over several canons of the Code of Conduct for U.S. Judges.”

Oct. 15, 2023: Jones resigns.

Nov. 3, 2023: U.S. Trustee announces 26 bankruptcy cases tainted by Jones’ relationship with Freeman. That number has now grown to 33 cases. The Trustee states it may demand Freeman’s old law firm, Jackson Walker, pay back millions of dollars it was paid in legal fees in those cases.

Nov. 13, 2023: Jackson Walker claims Freeman misled the firm about her relationship with Jones.

March 4, 2024: U.S. Trustee files official documents seeking to claw back at least $18 million in legal fees paid to Jackson Walker, claiming the firm acted in “bad faith.”

March 8: Jackson Walker claims there that there is zero evidence that any bankruptcy decisions were impacted by Jones’s relationship with Freeman.

March 24: Jackson Walker files in court an internal firm memo from 2021 showing that Freeman lied to firm leaders about her relationship with Jones.

July 11: Jones files a motion to dismiss, claiming he had judicial immunity for all his official acts and duties.

July 18: SDTX Chief Judge Eduardo Rodriguez swears in former Weil Gotshal partner Alfredo Perez as Houston’s newest bankruptcy judge, replacing Jones.

Aug. 15: Two investment firms, Fidelity and Apollo Global Management, file documents in the Sanchez Energy bankruptcy claiming they would not have accepted a 2020 settlement agreement pushed by Jones, who mediated the dispute in which Freeman was a lawyer for Sanchez, which is now called Mesquite Energy. The two lenders say the settlement agreement cost them hundreds of millions of dollars, and they want to participate in the claw back of fees against Jackson Walker.

Aug. 16: Western District of Texas Chief District Judge Alia Moses dismisses lawsuit brought by Van Deelen, ruling that he does not have legal standing to bring the lawsuit. But she described the conduct of Jones, Freeman and Jackson Walker as “egregious.” The judge states that, “Litigants should not have to wonder whether the judge overseeing their case stands to gain from ruling against them: but in Jones’s courtroom, they did.”

Sept. 20: SDTX Bankruptcy Judge Marvin Isgur, stating that Jackson Walker “breached its own ethical duties” and “defiled the very temple of justice” when it hid the romantic relationship between Jones and Freeman, refers the matter to SDTX Chief Judge Randy Crane for possible disciplinary proceedings against Jackson Walker lawyers. Chief Judge Crane assigns the disciplinary inquiry to U.S. District judge Lee Rosenthal of Houston. In a five-page memo, Isgur states that Jackson Walker partners knew about Freeman’s relationship with Jones in 2021 but made no disclosures to its clients or opposing counsel as required.

Sept. 24: Kirkland files its first Chapter 11 for a debtor in the SDTX since Judge Jones’ resignation but uses Bracewell — not Jackson Walker — as local counsel in the Vertex Energy bankruptcy.

Oct. 11: SDTX complex bankruptcy case manager Albert Alonzo, who worked for Jones for nearly a decade, tells the U.S. Trustee during a deposition that he knew about the Jones-Freeman relationship before it became public in October 2023.

Dec. 16: The U.S. Trustee’s case seeking a claw back of legal fees against Jackson Walker is scheduled to start trial.

0 notes

Text

The Benefits of Hiring a Local Bankruptcy Attorney

Navigating bankruptcy can be a daunting and complex process. If you find yourself in a financial crisis and considering bankruptcy, hiring a local bankruptcy attorney can make a significant difference in your experience. From understanding the legal system to ensuring your rights are protected, a local attorney brings a wealth of benefits to the table.

Expertise in Local Laws

One of the primary advantages of hiring a local bankruptcy attorney is their expertise in local laws. Bankruptcy laws can vary significantly by state and even by local jurisdictions. An attorney familiar with the specific regulations in your area, such as a bankruptcy lawyer in Tyrone, GA, can provide invaluable insights and guidance. They can help you navigate the complexities of the legal system and ensure you meet all local requirements. This local knowledge is particularly crucial in understanding exemptions and procedures that could impact your case.

Personalized Service

When you work with a local attorney, you benefit from personalized service. Unlike large law firms that may treat you like just another case number, a local attorney can offer more tailored support. They take the time to understand your unique financial situation, goals, and concerns. This personalized approach allows them to develop strategies that are specifically designed for you. Whether you're facing overwhelming debt or considering alternatives to bankruptcy, having someone who understands your circumstances can be a tremendous relief.

Accessibility and Communication

Accessibility is another significant advantage of hiring a local bankruptcy attorney. Being able to meet face-to-face can facilitate better communication and understanding. Whether you have questions about your case, need clarification on legal terms, or want to discuss strategies, having an attorney nearby means you can have these discussions more freely. This accessibility can also speed up the process, as you can schedule meetings or consultations without the delays that may come with working with a distant firm.

Local Connections

Local bankruptcy attorneys often have established connections with local courts, trustees, and other legal professionals. These relationships can be beneficial during your bankruptcy proceedings. An attorney with local connections may know how specific judges typically handle bankruptcy cases or have insights into what trustees may prioritize. This knowledge can help shape your case strategy and potentially improve your outcomes.

Understanding Community Resources

A local bankruptcy attorney is also familiar with community resources that may assist you during this challenging time. They can guide you to financial counseling services, credit repair agencies, or support groups that are available in your area. By connecting you with these resources, your attorney can help you develop a plan for financial recovery that goes beyond just filing for bankruptcy.

Emphasis on Long-Term Solutions

While bankruptcy can provide relief from overwhelming debt, it’s important to think about your long-term financial health. A local bankruptcy attorney can help you explore your options beyond bankruptcy, such as debt settlement or financial management plans. They can also assist you in understanding the long-term implications of filing for bankruptcy, including how it will affect your credit score and financial future. This holistic approach ensures that you are making informed decisions that align with your overall financial goals.

Cost-Effectiveness

Hiring a local bankruptcy attorney can also be cost-effective. Many local attorneys offer flexible payment plans and may have lower fees than larger firms. While you might be tempted to handle the bankruptcy process on your own to save money, doing so can lead to costly mistakes. A local attorney can help you avoid common pitfalls, ensuring that your bankruptcy is filed correctly and efficiently, potentially saving you money in the long run.

Peace of Mind

Filing for bankruptcy can be an emotional and stressful experience. Knowing that you have a knowledgeable advocate on your side can provide peace of mind during this challenging time. A local bankruptcy attorney can reassure you that you are taking the right steps to regain control of your financial situation. They will handle the legal aspects of your case, allowing you to focus on other important areas of your life.

Conclusion

In summary, hiring a local bankruptcy attorney can offer numerous benefits, from expertise in local laws to personalized service and accessibility. If you're considering bankruptcy in Peachtree City or Tyrone, GA, having an attorney who understands the local legal landscape can be invaluable. They can provide you with the support and guidance you need to navigate the bankruptcy process successfully and emerge on the other side with a clearer path to financial stability. By leveraging their local knowledge, connections, and resources, you can make informed decisions that align with your goals and help you regain control of your finances. Remember, you don’t have to face this challenging journey alone—reach out to a bankruptcy attorney in peachtree city who can guide you every step of the way.

0 notes

Text

Relieve Your Excessive Debt with Chapter 7 Bankruptcy Services

Are you overwhelmed by debt and searching for a way out? Freedom Legal Team’s Chapter 7 bankruptcy services might be the lifeline you need to regain control of your finances and secure a future free from debt. Chapter 7 bankruptcy can offer relief from burdensome debts, allowing individuals and businesses to start fresh. In this article, we’ll explore what Chapter 7 bankruptcy is, how it works, and how Freedom Legal Team can help you achieve fiscal independence.

What Is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, often referred to as "liquidation bankruptcy," is designed to help individuals who are unable to repay their debts. It provides the opportunity to eliminate most unsecured debts, such as credit card bills, medical expenses, and personal loans. In most cases, Chapter 7 allows debtors to discharge their debts without having to repay them. This is in contrast to Chapter 13 bankruptcy, which requires a repayment plan based on your income.

How Does Chapter 7 Bankruptcy Work?

When you file for Chapter 7 bankruptcy, a court-appointed trustee reviews your financial situation and may liquidate (sell) some of your assets to repay creditors. However, many assets are exempt under state and federal laws, meaning you may not have to give up your home, car, or personal belongings. Once the trustee completes the process, most of your unsecured debts will be discharged, offering you a clean slate to rebuild your financial future.

Who Qualifies for Chapter 7?

To qualify for Chapter 7 bankruptcy, you must pass the “means test.” This test evaluates your income and expenses to determine if your financial situation qualifies for debt relief. If your income is below the median level for your state, you are more likely to qualify for Chapter 7. However, even if your income exceeds the median, you may still qualify if your allowable expenses outweigh your income.

Benefits of Filing for Chapter 7 Bankruptcy

Filing for Chapter 7 bankruptcy can provide several benefits, including:

Debt Relief: Most unsecured debts are discharged, meaning you no longer have to worry about paying them.

Immediate Relief from Creditors: Once you file, creditors must stop collection activities, including phone calls, wage garnishments, and lawsuits. This immediate relief allows you to focus on rebuilding your financial life.

Fresh Start: With your debts discharged, you have the opportunity to rebuild your credit and work toward financial stability.

Speedy Process: Chapter 7 is often quicker than other forms of bankruptcy, typically taking 3 to 6 months to complete.

Protection of Exempt Assets: In most cases, you can keep important assets such as your home, car, and retirement accounts, allowing you to maintain stability while eliminating debt.

How Freedom Legal Team Can Help You

Navigating the complexities of bankruptcy can be overwhelming. This is where Freedom Legal Team comes in. Our experienced bankruptcy attorneys specialize in Chapter 7 cases and can guide you through the process with ease, ensuring you understand your options and rights.

Expert Consultation

We begin with a free consultation to assess your financial situation. Our team will explain the benefits and drawbacks of filing for Chapter 7 bankruptcy and help you determine if it's the right choice for your circumstances. During this process, we also evaluate your eligibility for Chapter 7 through the means test and explore alternative solutions if necessary.

Professional Guidance

Once you decide to move forward with Chapter 7, Freedom Legal Team will handle all the paperwork, ensuring it’s filed correctly and on time. We represent you in meetings with creditors and trustees, providing professional guidance at every stage of the bankruptcy process.

Personalized Financial Planning

Achieving financial independence doesn’t stop with debt relief. After your bankruptcy is finalized, our team provides personalized financial advice to help you rebuild your credit and avoid future debt problems. We’ll work with you to create a long-term financial plan tailored to your goals and needs.

Why Choose Freedom Legal Team?

At Freedom Legal Team, we understand that financial challenges can be emotionally and mentally draining. Our mission is to provide compassionate, expert legal services that empower you to regain control of your life. With years of experience in bankruptcy law, our attorneys are dedicated to achieving the best possible outcomes for our clients.

Here’s why you should choose us:

Experience: We have a proven track record of helping individuals and businesses navigate Chapter 7 bankruptcy.

Transparency: We provide clear, upfront information about the Bankruptcy Lawyers near Las Vegas process and our fees, so you always know what to expect.

Compassion: We treat every client with dignity and respect, understanding the stress that comes with financial difficulties.

Results-Oriented: Our goal is to help you achieve lasting financial freedom by eliminating debt and setting you on the path to fiscal health.

Achieve Financial Independence Today

If you’re feeling crushed under the weight of debt, Chapter 7 bankruptcy could be the solution that helps you regain control of your finances. Don’t let debt control your future—allow Freedom Legal Team to assist you in achieving fiscal independence.

With our guidance and expertise, you can relieve your excessive debt and begin a new chapter in your financial life. Contact Freedom Legal Team today for a free consultation, and let us help you take the first step toward a debt-free future.

0 notes

Text

Debt Ease Solutions Can Assist Canadians in Achieving Debt Relief

Harness Canada’s Leading Debt Relief Network for Your Financial Freedom

At Debt Ease Solutions, we specialize in helping you find the most effective debt relief program tailored to your needs, enabling you to escape the burden of debt while conserving both time and money.

Discover How Debt Ease Solutions Can Assist Canadians in Achieving Debt Relief

Debt Ease Solutions is your trusted partner in navigating debt challenges in Canada. We recognize that individuals may find themselves in financial distress due to various uncontrollable circumstances—be it job loss, reduced income, unexpected medical expenses, or the escalating costs of family life. When overwhelmed by a substantial amount of consumer debt, it’s common to feel hopeless about ever settling your debts. High interest rates, late fees, and penalties can make the road to financial stability seem impossible.

That’s why we strive to inform our clients of all available debt relief options, allowing you to save money and time while working towards becoming debt-free. With a variety of debt relief programs accessible, the right choice for you will depend on factors such as your total debt amount, monthly budget, credit score, personal goals, and even your province or territory.

We excel in helping individuals assess these considerations to determine the most suitable program. Whether you require credit counseling, debt forgiveness, or discharge services, we can connect you with a qualified team ready to assist you.

Understanding Debt Relief in Canada

Canadian debt relief programs operate under the principle of affordability. If you're struggling financially due to debt, the law states that you're only obligated to repay what you can realistically afford. Many Canadians remain unaware that creditors are frequently willing to negotiate debt forgiveness once an agreement is reached with a debtor. Why endure years trying to repay a principal debt of $15,000, along with mounting penalties and interest, when you might settle for as little as $6,000 or less?

Our debt relief solutions are tailored for individuals burdened by high credit card debt and other unsecured obligations. Once we align you with the appropriate program, we will connect you with a service provider. The professionals in our network are licensed by both federal and provincial or territorial governments and will negotiate with creditors on your behalf, helping you save significant time and money as you work toward financial freedom.

With the Right Debt Solution, You Could:

Consolidate multiple bills into one manageable monthly payment

Lower or eliminate interest and halt penalties

Achieve debt freedom in as little as 24-48 months

Receive forgiveness for a portion of your outstanding balances

Become debt-free without resorting to bankruptcy

Begin rebuilding your credit score

Regain Financial Stability While Safeguarding Your Assets

Most debt relief programs in Canada are designed to protect your most valuable assets as you pay down debt. The objective is to settle unsecured debts—those without collateral. Even in bankruptcy cases, most Licensed Insolvency Trustees will inform you that losing your assets is uncommon.

Debt relief programs that help you avoid bankruptcy concentrate solely on unsecured debts, including:

Credit card debt

Personal loans

Lines of credit

Debt collections

Secured loans—loans backed by collateral—do not qualify for these programs. This includes:

Mortgages

Home Equity Lines of Credit (HELOCs)

Auto loans

Certain types of specialized unsecured debt may also be eligible for relief programs, such as:

Student loans over six years old

CRA income tax debt

Compassionate Support and Comprehensive Solutions

At Debt Ease Solutions, we understand the mental and emotional strain that comes with financial challenges. We’re here to listen to your concerns and provide practical solutions tailored to your situation. Our mission is to ensure you are informed about all available options, empowering you to make the best decision for your financial health.

We offer a wide range of solutions, all from one convenient source. Based on your unique circumstances, we will connect you with the right accredited, licensed service provider to assist you. Our extensive debt relief network includes lenders, credit counselors, and Licensed Insolvency Trustees with proven success in helping clients regain their financial footing.

At Debt Ease Solutions, we are not focused on pushing a single solution. Instead, we aim to help you discover the best path to becoming debt-free as swiftly as possible.

Take the First Step Towards Financial Freedom

Your journey begins with a quick, complimentary consultation with a debt relief professional at Debt Ease Solutions. Call us at 1-888-529-5649 to speak with someone right away, or complete the form above to provide us with some details about your situation, and we will reach out to you.

The consultation is confidential, straightforward, and efficient. You will discuss your debts, budget, credit, and goals with an expert who will evaluate your options for relief and address any questions you may have. Together, you will identify the most suitable relief program for you, and we will connect you instantly with an accredited and licensed service provider. It’s that simple. So, what are you waiting for? You have everything to gain by eliminating your debt!

0 notes

Text

What is Chapter 13 Bankruptcy Plan Confirmation in Raleigh, NC?

If you're considering filing for Chapter 13 bankruptcy in Raleigh, one of the most important steps is getting your repayment plan approved by the court. This process, known as plan confirmation, can seem intimidating, but understanding what to expect can help you navigate it more easily.

As a bankruptcy attorney serving the Raleigh area, I want to explain the plan confirmation process, including what our local trustees look for and the common objections you might face.

What is Chapter 13 Bankruptcy Plan Confirmation?

When you file for Chapter 13 bankruptcy, you propose a repayment plan (see sample) outlining how you'll pay back a portion of your debts over a 3-5 years. This plan must be approved or "confirmed" by the bankruptcy court before it can take effect.

During confirmation, the court, trustee, and creditors review your plan to ensure it meets legal requirements.

Once your plan meets all requirements and objections are resolved, the court confirms it at a hearing. Once the plan is confirmed, the Chapter 13 Trustee distributes funds to creditors according to the plan's terms.

Getting Your Chapter 13 Plan Approved

The court will schedule a confirmation hearing after you file your Chapter 13 petition and propose your repayment plan. This usually happens within about 45 days of your 341 meeting, where the Trustee can ask questions about your case.

During this time, the Chapter 13 Trustee assigned to your case will review your plan to make sure it conforms to all the requirements under bankruptcy law.

In Raleigh, Trustees want to see that your plan:

#bankruptcy#ncstatuteoflimitationsondebt#chapter13bankruptcy#chapter13dismissedcarloan#chapter13limits#debtlimitsforchapter13#bankruptcychapter7nc#bankruptcyinraleigh#crosscollateralclause#debtsettlementattorney

0 notes

Text

Mt. Gox Faces Legal Action from Irate Investor Over Denied Bitcoin Claims

Key Points

An investor intends to sue Mt. Gox for not honoring his Bitcoin claims.

The investor alleges that Mt. Gox liquidated his account without proper notification.