#volume indicator in tradingview

Explore tagged Tumblr posts

Text

Trading View Best Indicators

SMRT Algo offers the premier Trading View Best Indicator for, designed to enhance trading strategies with precision and clarity. This innovative tool provides real-time signals, enabling traders to make informed decisions and optimize their market entries and exits. With its user-friendly interface and advanced algorithms, SMRT Algo empowers both novice and experienced traders to navigate the complexities of the financial markets effectively. Elevate your trading experience and achieve your financial goals with the best buy-sell indicator available.

#most accurate buy sell indicator tradingview#volume indicator in tradingview#buy sell indicator tradingview#best indicator in tradingview

0 notes

Text

How to Trade Swing Index: A Comprehensive Guide

Swing trading is a popular strategy among traders who aim to capitalize on short- to medium-term price movements in financial markets. One of the tools that can significantly enhance swing trading strategies is the Swing Index. This comprehensive guide will walk you through everything you need to know about the Swing Index, from understanding its basics to implementing it in your trading…

View On WordPress

#Backtesting#Breakouts#Buy orders#Charting platforms#Commodity Trading#Financial Markets#forex trading#J. Welles Wilder#Market Conditions#MetaTrader#moving averages#NinjaTrader#price action#Relative Strength Index (RSI)#Reversals#Short-selling#stock trading#Stop-loss levels#Swing Index#swing trading#Take-Profit Levels#Technical indicator#trading signals#Trading Strategy#TradingView#Trend Identification#True High#True Low#True Range#Volume indicators

0 notes

Text

without taking any risks and using a consistently successful strategy? What are some strategies or tools that can achieve this?

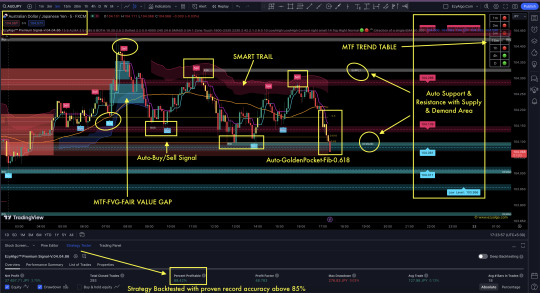

Leverage Key Levels and Signals with (EzyAlgo) Premium Indicator for AUD/JPY Trading Success!-Full Strategy Explained in Details

Key Insights:

Support and Resistance Levels: Support: Key levels where AUD/JPY might find buying interest and halt its decline. Resistance: Levels where selling pressure might emerge, potentially stopping upward movement.

Trend Analysis: Indicates if AUD/JPY is in an upward (bullish), downward (bearish), or sideways (consolidating) trend.

Trading Signals: Buy Signal: Indicates a potential upward movement, suggesting entering long positions.Sell Signal: Indicates a potential downward movement, suggesting entering short positions.

Volatility Insights: Provides information on expected price volatility to help manage risk and position sizes.

Timeframe Consideration: Signals are relevant to specific timeframes (e.g., intraday, daily, weekly) and should align with your trading strategy.

EzyAlgo Premium Indicator Singly Proven & Backtested with above 80–85% accuracy always, regardless of whether the market is sideways or trending. It offers perfect entry after detecting major key levels at confluence points. Here are the rules:

Key Levels:

Buy/Sell Signal must be generated.

Signal must be above Demand Area with POI (Point of Interest) Level.

Identified Swing High/Low to determine the trend.

Wait for Trend Tracker Confirmation with Color change or signal candle closing above Tracker.

Green Dot must be generated nearby within 1–3 candles in our EzyAlgo Trend Oscillator.

Extra Key Levels:

Trendline support.

Auto Golden Pocket Area (-0.618) met in the same place.

If all these conditions are met, it constitutes a 90% accurate signal. Otherwise, no trades are initiated. The indicator also highlights key levels for additional confirmation.

This strategy aims to provide a robust framework for identifying trading opportunities and optimizing trades

Get Access to EzyAlgo indicators: https://ezyalgo.com/Join our Free Telegram Channel: https://t.me/EzyAlgoSolutionsJoin our WhatsApp Channel: https://wa.me/message/HTHBVTMYZRJEO1

#forexsignals#forex trading#forex market#forex education#forex indicators#tradingview#tradingviewindicator#indicator#technical analysis#volume profile#candlestick#stock market

1 note

·

View note

Text

Crypto trading mobile app

Designing a Crypto Trading Mobile App involves a balance of usability, security, and aesthetic appeal, tailored to meet the needs of a fast-paced, data-driven audience. Below is an overview of key components and considerations to craft a seamless and user-centric experience for crypto traders.

Key Elements of a Crypto Trading Mobile App Design

1. Intuitive Onboarding

First Impressions: The onboarding process should be simple, guiding users smoothly from downloading the app to making their first trade.

Account Creation: Offer multiple sign-up options (email, phone number, Google/Apple login) and include KYC (Know Your Customer) verification seamlessly.

Interactive Tutorials: For new traders, provide interactive walkthroughs to explain key features like trading pairs, order placement, and wallet setup.

2. Dashboard & Home Screen

Clean Layout: Display an overview of the user's portfolio, including current balances, market trends, and quick access to popular trading pairs.

Market Overview: Real-time market data should be clearly visible. Include options for users to view coin performance, historical charts, and news snippets.

Customization: Let users customize their dashboard by adding favorite assets or widgets like price alerts, trading volumes, and news feeds.

3. Trading Interface

Simple vs. Advanced Modes: Provide two versions of the trading interface. A simple mode for beginners with basic buy/sell options, and an advanced mode with tools like limit orders, stop losses, and technical indicators.

Charting Tools: Integrate interactive, real-time charts powered by TradingView or similar APIs, allowing users to analyze market movements with tools like candlestick patterns, RSI, and moving averages.

Order Placement: Streamline the process of placing market, limit, and stop orders. Use clear buttons and a concise form layout to minimize errors.

Real-Time Data: Update market prices, balances, and order statuses in real-time. Include a status bar that shows successful or pending trades.

4. Wallet & Portfolio Management

Asset Overview: Provide an easy-to-read portfolio page where users can view all their holdings, including balances, performance (gains/losses), and allocation percentages.

Multi-Currency Support: Display a comprehensive list of supported cryptocurrencies. Enable users to transfer between wallets, send/receive assets, and generate QR codes for transactions.

Transaction History: Offer a detailed transaction history, including dates, amounts, and transaction IDs for transparency and record-keeping.

5. Security Features

Biometric Authentication: Use fingerprint, facial recognition, or PIN codes for secure logins and transaction confirmations.

Two-Factor Authentication (2FA): Strong security protocols like 2FA with Google Authenticator or SMS verification should be mandatory for withdrawals and sensitive actions.

Push Notifications for Security Alerts: Keep users informed about logins from new devices, suspicious activities, or price movements via push notifications.

6. User-Friendly Navigation

Bottom Navigation Bar: Include key sections like Home, Markets, Wallet, Trade, and Settings. The icons should be simple, recognizable, and easily accessible with one hand.

Search Bar: A prominent search feature to quickly locate specific coins, trading pairs, or help topics.

7. Analytics & Insights

Market Trends: Display comprehensive analytics including top gainers, losers, and market sentiment indicators.

Push Alerts for Price Movements: Offer customizable price alert notifications to help users react quickly to market changes.

Educational Content: Include sections with tips on technical analysis, crypto market basics, or new coin listings.

8. Social and Community Features

Live Chat: Provide a feature for users to chat with customer support or engage with other traders in a community setting.

News Feed: Integrate crypto news from trusted sources to keep users updated with the latest market-moving events.

9. Light and Dark Mode

Themes: Offer both light and dark mode to cater to users who trade at different times of day. The dark mode is especially important for night traders to reduce eye strain.

10. Settings and Customization

Personalization Options: Allow users to choose preferred currencies, set trading limits, and configure alerts based on their personal preferences.

Language and Regional Settings: Provide multilingual support and regional settings for global users.

Visual Design Considerations

Modern, Minimalist Design: A clean, minimal UI is essential for avoiding clutter, especially when dealing with complex data like market trends and charts.

Color Scheme: Use a professional color palette with accents for call-to-action buttons. Green and red are typically used for indicating gains and losses, respectively.

Animations & Micro-interactions: Subtle animations can enhance the experience by providing feedback on button presses or transitions between screens. However, keep these minimal to avoid slowing down performance.

Conclusion

Designing a crypto trading mobile app requires focusing on accessibility, performance, and security. By blending these elements with a modern, intuitive interface and robust features, your app can empower users to navigate the fast-paced world of crypto trading with confidence and ease.

#uxbridge#uxuidesign#ui ux development services#ux design services#ux research#ux tools#ui ux agency#ux#uxinspiration#ui ux development company#crypto#blockchain#defi#ethereum#altcoin#fintech

2 notes

·

View notes

Text

How to See Resistance and Support in TradingView

In the world of trading, the concepts of resistance and support levels are fundamental to understanding market movements and making informed decisions. TradingView, a popular charting platform used by traders worldwide, offers a comprehensive set of tools and indicators to help traders identify these critical levels. Here's a guide on how to see resistance and support in TradingView:

Step 1: Choose Your Chart First, select the asset you want to analyze on TradingView. You can do this by entering the name or ticker of the asset in the search bar at the top of the platform.

Step 2: Select the Timeframe Choose an appropriate timeframe for your analysis. Timeframes can range from 1 minute to 1 month, depending on your trading strategy. Short-term traders might prefer shorter timeframes, while long-term investors might look at daily or weekly charts.

Step 3: Use Trend Lines To identify resistance and support levels, you can use the Trend Line tool in TradingView. Click on the Trend Line icon (it looks like a diagonal line) in the toolbar on the left side of the screen. Then, draw a line connecting the price highs to identify resistance, and another line connecting the price lows to identify support.

Step 4: Apply Horizontal Lines For more defined levels, use the Horizontal Line tool in the toolbar. Place a horizontal line at a price level where the asset has shown difficulty in moving above (resistance) or below (support). These levels often indicate where buyers or sellers are concentrated.

Step 5: Incorporate Indicators TradingView offers various indicators that can help identify resistance and support levels. The Moving Average, Fibonacci Retracement, and Volume Profile are popular choices. To add an indicator, click on the "Indicators" button at the top of the screen and search for the one you want to use.

Step 6: Analyze Price Action Pay attention to how the price reacts around these levels. Resistance or support is confirmed when the price bounces off these levels multiple times. The more times the price touches these levels without breaking through, the stronger they are considered.

Step 7: Monitor Breakouts or Breakdowns A breakout (price moves above resistance) or breakdown (price moves below support) can signal a potential trend change. Use TradingView's alert system to notify you when the price crosses these critical levels.

Exploring TradingView Alternatives: FastBull

While TradingView is a popular choice among traders, it's always beneficial to explore alternatives. FastBull is an emerging platform that offers a range of features for market analysis. Here's what makes FastBull stand out:

User-Friendly Interface FastBull is designed with simplicity in mind, making it accessible to both novice and experienced traders. Its intuitive interface allows for easy navigation and quick access to essential features.

Advanced Charting Tools FastBull provides advanced charting capabilities similar to TradingView, including a variety of chart types, drawing tools, and technical indicators, enabling comprehensive market analysis.

Real-Time Data and Alerts The platform offers real-time market data and customizable alerts, ensuring traders stay updated with the latest market movements and can react promptly to trading opportunities.

Social Trading Features FastBull incorporates social trading elements, allowing users to follow and interact with other traders. This community aspect can offer valuable insights and foster a sense of camaraderie among users.

Educational Resources For those looking to expand their trading knowledge, FastBull provides a wealth of educational content, including tutorials, articles, and webinars, catering to all levels of experience.

Mobile Accessibility Recognizing the need for on-the-go access, FastBull offers a mobile app that delivers the full functionality of its desktop platform, ensuring traders can monitor the markets and execute trades from anywhere.

Conclusion

while TradingView remains a top choice for many traders, platforms like FastBull are providing compelling alternatives that cater to the evolving needs of the trading community. Whether you stick with TradingView or explore FastBull, the key is to use the tools and resources available to enhance your trading strategy and decision-making process.

2 notes

·

View notes

Text

Comparing the Top Online Trading Apps: Which One Is Right for You?

The online stock trading app industry has experienced a tremendous surge since the onset of the pandemic in 2020. Thanks to improved internet speeds and the growing interest in financial literacy, mobile-based stock trading has undergone a significant transformation. Each day, more Indians are experiencing the seamless shift towards incredibly smooth and flexible trading options, all available at the touch of a button.

As these apps continue to gain widespread adoption, even beginners can enter the world of trading with ease. These applications not only enable the buying and selling of financial assets but also offer a range of other valuable services. The only requirement is a reliable internet connection to ensure these trading apps operate smoothly.

This article has listed some of the best online trading apps so that you can choose any one of them.

Top Three Online Trading Apps

The list of the best online trading app is as follows.

1. Zerodha Kite

Zerodha boasts over 100 million active clients, contributing significantly to India's retail trading volumes, making up about 15% of the total. This app is highly recommended for both beginners and experienced traders and investors, thanks to its robust technological platform.

Zerodha's flagship mobile trading software, Kite, is developed in-house. The current Kite 3.0 web platform offers a wide array of features, including market watch, advanced charting with over 100 indicators, and advanced order types such as cover orders and good till triggered (GTT) orders, ensuring swift order placements.

Furthermore, users can also utilise Zerodha Kite as a Chrome extension, enabling features like order placement and stock tracking for added convenience.

2. Kotak Securities

Opening a trading account at Kotak Securities comes with the advantage of zero account opening fees. Additionally, there are discounted rates for investors below 30 years of age, making it a cost-effective option. The account setup process is streamlined, with minimal steps involved.

Kotak Securities enables users to engage in a wide range of financial activities, including trading in stocks, IPOs, derivatives, mutual funds, currency, and commodities. Furthermore, it offers opportunities for global investments through its trading app. This app is thoughtfully designed, featuring a user-friendly interface accessible on iOS, Android, and Windows platforms. It also provides valuable extras like margin funding, real-time portfolio tracking, and live stock quotes with charting options.

3. Upstox

Upstox PRO, supported by Tiger Global and endorsed by prominent investors like Indian tycoon Ratan Tata and Tiger Global Management, is a well-known discount broker app. It offers a range of trading and investment opportunities, encompassing stocks, currencies, commodities, and mutual funds. For experienced and seasoned investors, it is an ideal choice, featuring advanced tools such as TradingView and ChartsIQ libraries.

Online trading apps offer a diverse array of financial products and services, consolidating your investment and financial management in one convenient platform. You can engage in activities such as trading equities, participating in IPOs, trading derivatives, investing in mutual funds, placing fixed deposits, dealing in commodities, and trading currency.

2 notes

·

View notes

Text

The Volatility Whisperer: How Historical Volatility Unlocks Swing (2-5 Days) Trading Goldmines Picture this: You open your trading terminal, eyes gleaming with hope like a kid spotting an ice cream truck. You see a juicy currency pair dancing on your screen. You hit 'buy,' thinking you're about to ride the wave. Except the wave smacks you straight into a margin call. Sound familiar? Welcome to the brutal ballet of Forex trading. But what if I told you there’s a little-known metric—historical volatility—that could help you predict market moves like a seasoned pro and turn those 2-5 day swing trades into your personal goldmine? Buckle up (not literally, we don't do clichés here), because we’re about to dig into some ninja-level tactics that most traders overlook. Historical Volatility: The Overlooked Crystal Ball What It Is (Without the Jargon) Historical volatility (HV) measures how much a currency pair's price has fluctuated over a specific past period. Think of it as the market’s mood tracker. When volatility is high, the market’s had too much coffee. When it's low, it’s practically napping. But Here’s Where the Real Magic Happens... Most traders chase volume or RSI, but HV is like finding an unguarded ATM in the woods. It quietly reveals potential breakout zones, optimal entry points, and hidden consolidation phases for short-term swing trades. Why Most Traders Get It Wrong (And How You Can Avoid It) Let’s bust a myth: “Low volatility means the market is dead.” Nope. Low volatility is often the market gathering energy like a sprinter before takeoff. Knowing this gives you an edge. Real-World Example: In June 2023, the GBP/AUD currency pair saw HV drop to its lowest in months. Novice traders ignored it. But smart money knew: low volatility was the quiet before the storm. Sure enough, a 150-pip breakout followed. Lesson? Volatility compression precedes explosive moves. Pro Tip: Use the StarseedFX Economic Indicators tool to correlate HV shifts with upcoming news catalysts. It’s like insider trading, except legal. Check it out here. How Historical Volatility Transforms Swing Trading (2-5 Days) 1. Timing Explosive Breakouts Like a Sniper Think of HV as your pre-breakout radar. When HV is unusually low, brace for impact. Step-by-Step Ninja Playbook: - Check the 14-day HV on your desired pair. - Compare it to the last 6 months' average. (TradingView offers HV indicators.) - If current HV is 20-30% below average, prepare for a potential breakout. - Overlay this with Bollinger Bands. Tight bands + low HV? Breakout is coming. - Set pending buy/sell orders near support and resistance. 2. Spotting Fakeouts Before They Humiliate You Fakeouts are like dating red flags. Spot them early, or suffer later. The Hidden Pattern: When HV spikes suddenly but price barely moves, it’s often a liquidity hunt. Institutions shaking out retail traders. Countermove: - Ignore the noise. - Wait for HV to stabilize. - Enter when price breaks the fakeout range. 3. Identifying Exhaustion Moves Before Everyone Else Ever chased a rally, only to watch it nosedive the moment you buy? Yeah, we’ve all been that guy. HV Hack: - If HV is abnormally high after a strong rally, it often signals exhaustion. - This is the perfect time for a contrarian swing short (2-5 days). Case Study: In October 2023, EUR/USD rallied 200 pips in 3 days. HV spiked 50% above its average. Those who shorted the exhaustion bagged a clean 120-pip retracement. The Hidden Formula Only Experts Use Ever wonder how pros ride trends while you’re stuck panic-selling? Here’s Their Secret: - Combine HV analysis with ATR (Average True Range) for optimal position sizing. - When HV is low, tighten your stop-loss. - When HV is high, widen stops but reduce lot size. Pro Tip: Use StarseedFX’s Smart Trading Tool to automate lot size adjustments based on volatility. Get it here. Expert Insights You Won’t Find on YouTube Dr. Alexander Elder, author of Trading for a Living, says, “Volatility is the heartbeat of the market. Ignore it, and you trade blind.” John Bollinger, creator of Bollinger Bands, adds, “Periods of low volatility beget high volatility. Learn this cycle, and you hold the keys to the market.” Final Game-Changing Tips for Swing Traders - Diversify Your Toolkit: HV works best when paired with sentiment indicators and COT reports. (StarseedFX's free education hub has killer resources. Explore here.) - Don’t Marry Your Trades: In 2-5 day swings, attachment is your enemy. Take profits quickly. - Journal Every Setup: Use the free StarseedFX Trading Journal to track which HV patterns work best for you. Grab yours here. Summary of Elite Tactics: - Monitor historical volatility as your pre-breakout radar. - Use low HV as a launchpad indicator. - Spot exhaustion moves via HV spikes. - Combine HV with ATR for precision lot sizing. - Fakeouts often signal institutional traps; wait for HV stabilization. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

How to Study Stock Market | Learn Stock Market Effectively

How to Study Stock Market: A Beginner’s Guide

Introduction

The stock market can seem like a mysterious world filled with numbers, charts, and financial jargon. But don’t worry—you don’t need a finance degree to understand it! Learning how to study the stock market is similar to learning a new language. With patience and practice, anyone can grasp the basics and even master the art of investing.

In this guide, we’ll break down the process into simple, actionable steps. Whether you’re a complete beginner or looking to sharpen your knowledge, this article will help you navigate the stock market with confidence.

Want to know how to study stock market? Discover where to learn stock market, effective strategies, and practical steps to become a knowledgeable investor.

What is the Stock Market ?

The stock market is like a giant auction house where people buy and sell ownership (shares) of companies. When you buy a stock, you’re essentially buying a tiny piece of that company. If the company grows, so does your investment. If it struggles, your investment loses value.

Why Should You Study the Stock Market ?

Investing in stocks can help you grow wealth over time, but without proper knowledge, you could lose money. Learning how to study the stock market can:

Help you make informed investment decisions

Reduce risks and avoid scams

Provide financial independence and security

Understanding Stock Market Basics

Before diving into investing, you must understand fundamental concepts such as:

Stock Exchanges: Where stocks are traded (e.g., NYSE, NASDAQ)

Indices: Measures of market performance (e.g., S&P 500, Dow Jones)

Bull vs. Bear Market: Bull means rising prices, Bear means falling prices

Types of Stocks and Investments

Stocks come in different types:

Common Stocks: Ownership with voting rights

Preferred Stocks: Fixed dividends but no voting rights

ETFs & Mutual Funds: Bundles of stocks for diversification

Where to Learn Stock Market?

There are multiple ways to learn stock market investing:

Books: “The Intelligent Investor” by Benjamin Graham

Online Courses: Platforms like Coursera, Udemy, and Khan Academy

Financial News Websites: Bloomberg, CNBC, and MarketWatch

Stock Market Simulators: Virtual trading platforms like Investopedia

How to Read Stock Charts and Indicators

Stock charts help predict trends. Important indicators include:

Candlestick Charts: Show price movement over time

Moving Averages: Trends over a set period

Volume Indicators: How actively a stock is traded

Key Factors Affecting the Stock Market

Stock prices fluctuate due to:

Economic Indicators: Inflation, interest rates, GDP

Company Performance: Earnings reports, management changes

Global Events: Political instability, pandemics, wars

Practical Ways to Study the Market

Follow Market News: Stay updated with financial news

Analyze Stocks Daily: Pick a few stocks and monitor their performance

Join Investment Communities: Learn from experienced investors

Using Virtual Trading to Practice

Many platforms offer paper trading, allowing you to trade with fake money before investing real funds. This helps build confidence without financial risk.

Common Mistakes to Avoid

Emotional Investing: Buying on hype, selling on fear

Lack of Research: Investing blindly

Ignoring Diversification: Putting all money in one stock

Long-Term vs. Short-Term Investing

Long-Term Investing: Holding stocks for years, compounding returns

Short-Term Trading: Buying and selling quickly for small profits

Which is Best? Depends on your risk tolerance and financial goals

Best Resources for Learning

Websites: Investopedia, Yahoo Finance

YouTube Channels: Graham Stephan, Meet Kevin

Podcasts: The Motley Fool, We Study Billionaires

How to Keep Up with Market Trends

Subscribe to Newsletters (e.g., The Wall Street Journal)

Follow Influential Investors (e.g., Warren Buffett, Ray Dalio)

Use Stock Market Apps (e.g., Robinhood, TradingView)

Conclusion and Final Thoughts

Learning how to study stock market isn’t about quick riches—it’s about making smart, informed decisions. The more you educate yourself, the better your chances of making profitable investments. So, take your time, practice, and stay consistent.

FAQs on Stock Market Learning

How long does it take to learn stock market investing ?It depends on your dedication. You can grasp the basics in a few weeks, but mastering it takes years of experience.

Is stock market investing risky ?Yes, but risks can be managed by diversifying, researching, and avoiding emotional decisions.

Can I start investing with little money ?Yes! Many platforms allow fractional investing, so you can start with as little as $5-$10.

What is the best book for beginners ?“The Intelligent Investor” by Benjamin Graham is widely recommended for beginners.

Should I take a stock market course ?If you prefer structured learning, a course can be helpful. Otherwise, free resources online are also a great option.

0 notes

Text

Top Trading Strategies by Alfridah Kgabo Matse for Maximizing Profits

Alfridah Kgabo Matse is a well-known trader in South Africa, recognized for her expertise in financial markets and her ability to develop winning trading strategies. With years of experience in forex, stock trading, and commodities, Alfridah Kgabo Matse has built a reputation for making calculated investment decisions that yield significant returns. In this blog, we will explore her top trading strategies that help maximize profits while minimizing risks.

1. Understanding Market Trends

One of the key principles that Alfridah Kgabo Matse follows is staying updated with market trends. The financial markets are highly volatile, and understanding the direction in which they are moving is crucial for making informed trading decisions.

How to Analyze Market Trends:

Use Technical Analysis: Study price movements using indicators like Moving Averages, RSI (Relative Strength Index), and Bollinger Bands.

Monitor Economic News: Global events, economic reports, and political changes impact market trends.

Follow Market Sentiment: Analyzing trader sentiment through volume changes and market indices can provide insights into future movements.

2. Risk Management Strategies

Even the most experienced traders face losses. However, Alfridah Kgabo Matse emphasizes effective risk management to protect capital and sustain long-term profitability.

Risk Management Techniques:

Setting Stop-Loss Orders: Automatically exits a trade when the price reaches a predefined level to limit losses.

Using Position Sizing: Allocating only a percentage of the trading account to each trade to avoid excessive exposure.

Diversification: Investing in multiple asset classes (forex, stocks, commodities) to spread risk.

Avoiding Overtrading: Sticking to a well-planned strategy rather than making impulsive trades.

3. Technical and Fundamental Analysis

A good trader combines both technical and fundamental analysis to make well-informed trading decisions. Alfridah Kgabo Matse integrates both methods to ensure she is trading based on real market conditions rather than speculation.

Technical Analysis Tools:

Candlestick Patterns: Helps predict price movements based on past behavior.

Moving Averages: Identifies trends and potential reversals.

MACD (Moving Average Convergence Divergence): Used to confirm buy or sell signals.

Fundamental Analysis Techniques:

Company Financials: Evaluating the financial health of companies before investing in stocks.

Economic Indicators: Interest rates, inflation, and employment data impact the forex market.

News Events: Global economic shifts and geopolitical tensions can affect market prices.

4. The Power of Discipline and Patience

One of the biggest reasons traders fail is due to emotional decision-making. Alfridah Kgabo Matse strongly advocates for discipline and patience in trading.

How to Develop Trading Discipline:

Follow a Trading Plan: Establish entry and exit points before making a trade.

Stick to a Strategy: Avoid jumping between strategies without proper testing.

Control Emotions: Fear and greed often lead to irrational decisions; stick to logic and analysis.

Learn from Mistakes: Every loss is an opportunity to refine and improve the trading approach.

5. Leveraging Technology in Trading

Technology plays a significant role in modern trading. Alfridah Kgabo Matse uses various tools and software to enhance efficiency and accuracy.

Useful Trading Technologies:

Automated Trading Systems: Uses AI and algorithms to execute trades based on pre-set conditions.

Trading Bots: Helps execute trades faster than manual trading.

Economic Calendars: Keeps track of important financial events and their impact on the market.

Trading Apps: Platforms like MetaTrader 4/5, TradingView, and ThinkorSwim provide real-time data and charting tools.

6. Developing a Strong Trading Psychology

Apart from technical skills, Alfridah Kgabo Matse highlights the importance of mental strength and psychology in trading.

Psychological Traits for Successful Trading:

Patience: Waiting for the right trade setup instead of rushing into trades.

Confidence: Trusting your analysis and not getting influenced by market noise.

Adaptability: Adjusting strategies based on market conditions.

Resilience: Handling losses professionally and staying motivated.

7. Building a Long-Term Investment Mindset

While day trading and short-term trading can be profitable, Alfridah Kgabo Matse also stresses the importance of long-term investments.

Benefits of Long-Term Investing:

Compounding Growth: Reinvesting profits leads to exponential gains.

Lower Trading Costs: Reduced frequency of transactions minimizes fees.

Less Stress: Long-term positions eliminate the need for constant market monitoring.

Better Risk Management: Long-term investments generally experience lower volatility.

Conclusion

Alfridah Kgabo Matse is a name that stands out in the trading community, not just in South Africa but globally. Her trading strategies, focused on market analysis, risk management, and discipline, serve as a blueprint for aspiring traders. By implementing these proven techniques, traders can enhance their chances of maximizing profits while minimizing risks. Whether you are a beginner or an experienced trader, adopting Alfridah Kgabo Matse strategies can help you navigate the complexities of financial markets with confidence and success.

1 note

·

View note

Text

How to Choose the Right Forex Trading Platform: Your Ultimate Guide

Navigating the forex market can be overwhelming. With a staggering daily trading volume exceeding $6 trillion, the options for trading platforms are vast. Choosing the right online forex trading platform in India is crucial for your success, but with numerous choices available, figuring out which one suits you best can be challenging. This guide will simplify the selection process by breaking down the essential features, evaluating broker reliability, understanding cost implications, and more.

Essential Features of a Top-Tier Forex Platform

Trading Platform Functionality

A good trading platform should be user-friendly and efficient. Look for:

Intuitive design: Easy navigation makes trading smoother.

Charting tools: Advanced charts help in analyzing market trends.

Order execution speed: Fast execution minimizes slippage, essential for all trading strategies.

Customization options: Personalization tools help traders to tailor their experience.

Examples of platforms praised for their functionality include MetaTrader 4 and TradingView.

Variety of Asset Classes

Diversifying your trading options is essential. Beyond forex pairs, consider platforms that allow access to:

CFDs (Contracts for Difference)

Indices

Commodities

Statistics show that traders with access to a variety of asset classes tend to perform better, as they can adapt to changing market conditions.

Advanced Trading Tools

Advanced traders seek platforms that offer:

Automated trading bots: These can execute trades on your behalf based on set criteria.

Technical indicators: Tools that analyze price trends help inform trading decisions.

Economic calendars: Keeping track of important events impacts trading strategies.

Evaluating Broker Reliability and Security

Regulation and Licensing

Regulated brokers provide a safety net for your investments. Check if a broker is licensed by reputable bodies, such as:

The U.S. Commodity Futures Trading Commission (CFTC)

The Financial Conduct Authority (FCA) in the UK

Unregulated platforms may expose you to significant risks.

Security Measures

Prioritize platforms with robust security features. Look for:

Data encryption: Protects your personal information.

Fund security: Ensure your funds are held in separate accounts.

Segregation of client accounts: Keeps your money safer.

With over a third of forex traders experiencing scams, focus on security.

Customer Support

Reliable customer support is vital. Choose platforms with:

Multiple communication channels (live chat, email, phone)

Quick response times

Comprehensive FAQs and guides

Cost Considerations and Account Types

Spreads and Commissions

Understand how spreads and commissions affect your trading profitability. Different brokers offer various pricing models:

Standard spreads

Fixed spreads

Variable spreads

Evaluate how these fees can impact your overall gains.

Account Minimums and Leverage

Different account types can lead to different experiences. Consider:

Minimum deposit requirements

Levels of leverage offered

For example, a broker offering 100:1 leverage can amplify both profits and losses. Understanding this can mean the difference between opportunity and risk.

Hidden Fees

Stay alert for hidden fees that can eat into your profits. Look out for:

Withdrawal fees

Inactivity fees

Maintenance charges

Always read the fine print before committing.

Choosing a Platform Based on Your Trading Style

Scalping and Day Trading

For high-frequency trading, look for platforms with:

Low latency

Fast order execution

Advanced charting features

An expert once stated, "The right platform can make or break a scalper's strategy."

Swing and Position Trading

If you prefer longer-term strategies, consider platforms that excel in:

Comprehensive chart analysis

Robust order management

Platforms like 5xtrade specifically to these trading styles.

Algorithmic Trading

If you use automated strategies, ensure the platform supports:

APIs for custom bots

Backtesting functionality

Strategy development tools

Demo Accounts and Thorough Research

Utilizing Demo Accounts

Before committing funds, use demo accounts to test various platforms. This helps you understand the environment without the financial risk.

Reading Reviews and Comparing Platforms

Explore independent review sites to get unbiased opinions. Comparing platforms side-by-side will help clarify your options.

Seeking Expert Advice

Consult with experienced traders or financial advisors. Their insights can guide you towards platforms that fit your needs.

Conclusion: Your Path to Forex Trading Success

Choosing the right forex trading platform can significantly impact your trading success. Key takeaways include the necessity of evaluating functionality, considering asset variety, and ensuring broker reliability. Remember to weigh the cost factors and match the platform to your trading style. Regularly review your choice to ensure it remains aligned with your trading goals. The right platform can pave the way for effective trading and fruitful investments. Start your journey today by exploring available options and finding the best fit for you.

#forex trading#forex trading platform#stock trading platform in india#stock trading in india#forex trading in india

0 notes

Text

Why Do We Need a TradingView Alert Management Tool?

TradingView is a favorite among traders and investors, offering excellent indicators and robust alert capabilities. However, as trading strategies grow more complex, managing these alerts efficiently becomes a challenge. This is where a TradingView Alert Management Tool like TVAlertsManager steps in to revolutionize your trading workflow.

Here’s why TVAlertsManager is a must-have for modern traders and investors:

1. Streamline Your Alerts

Managing multiple alerts manually can be tedious and time-consuming. TVAlertsManager simplifies this process, enabling traders to save, load, pause, create, edit, and delete alerts effortlessly. Spend less time on administrative tasks and more on refining your strategy.

2. Handle Unlimited Alerts

For active traders, alert limitations can mean missed opportunities. TVAlertsManager offers unlimited saves and loads of alerts, ensuring you’re always ready to capitalize on trading opportunities.

3. Google Spreadsheet Integration

Imagine managing all your TradingView alerts from a single, organized location. With Google Spreadsheet integration, this tool makes it easy to track and modify alerts in bulk, creating a seamless and efficient workflow.

4. Enhanced Organization & Customization

Organize alerts like never before! You can set custom names for alerts, filter them by name, ticker, or exchange, and maintain clarity even with hundreds of active alerts.

5. Time-Sensitive Efficiency

Speed is crucial in trading. TVAlertsManager enables fast execution times for updating and applying changes to alerts, ensuring you don’t miss out on crucial moments.

6. Empower Non-Premium Users

Non-TradingView Premium users rejoice! TVAlertsManager can automatically extend alert expiration dates, breaking free of subscription limitations.

7. Compatible with Indicators & Automation

The tool works seamlessly with any TradingView indicator and supports automated trading strategies via webhook integrations and spreadsheets—making advanced trading accessible to everyone.

8. Advanced Features for Pro Tools

TVAlertsManager includes a built-in parser for trading tools like 3Commas, CryptoHopper, Wick Hunter, and Profit Trailer. Creating alerts is as easy as copying webhooks, pairs, and naming conventions.

9. Bulk Actions Made Simple

With features like bulk saving, loading, or deleting alerts, managing a high volume of alerts becomes hassle-free, allowing you to focus on strategy over logistics.

10. Lightweight Browser Extension

Secure and convenient, the TVAlertsManager browser extension connects with TradingView via Chrome without requiring login credentials. With its built-in clear cache button, you can maintain peak performance effortlessly.

Upgrade Your Trading Today

In a fast-paced trading environment, tools like TVAlertsManager are indispensable. By enabling seamless alert management, automated trading, and better organization, TVAlertsManager empowers traders to make more informed decisions and act faster than ever before.

Ready to Take Control? Say goodbye to inefficient alert management and unlock the full potential of your trading strategies. Whether you’re managing multiple indicators or integrating advanced automation, TVAlertsManager ensures that you stay ahead in the game.

👉 Try TVAlertsManager now and experience the ultimate TradingView alert management solution!

0 notes

Text

Unlock the Power of Precision: TradingView Indicators with SMRT Algo

In today’s competitive trading environment, the key to success lies in adopting powerful tools that provide you with an edge. TradingView indicators are a fantastic way to analyze markets, but to truly excel, you need to pair them with advanced solutions like SMRT Algo’s cutting-edge tools. Designed to handle the complexities of modern trading, SMRT Algo is revolutionizing the way traders approach market challenges. For more information please visit :https://medium.com/@smrtalgo126/unlock-the-power-of-precision-tradingview-indicators-with-smrt-algo-930af23088c6

#buy sell indicator tradingview#best indicator in tradingview#most accurate buy sell indicator tradingview#volume indicator in tradingview

0 notes

Text

What is a real-time data feed in Forex trading?

In Forex trading, a real-time data stream gives traders access to the most recent market information, enabling them to make well-informed judgments. This data feed contains important details like:

Current buying (bid) and selling (ask) prices for currency pairs are known as the bid and ask prices.

Market depth is a measure of the volume of interest at various price points that indicates market liquidity.

Price Changes: Traders can monitor trends and volatility with real-time data on price movements.

Economic Indicators: Real-time updates on pertinent economic data releases, including GDP, inflation, and unemployment rates.

News Updates: Current events, such as central bank announcements or geopolitical developments, that may have an impact on currency markets.

Real-time data is crucial in forex.

Making Well-Informed Decisions: When implementing methods like scalping or day trading, when timing is crucial, traders rely on the most recent data.

Algorithmic Trading: In order for many trading algorithms to operate properly and execute split-second trades, real-time data is necessary.

Risk management: Current information aids traders in efficiently establishing and modifying take-profit and stop-loss settings.

Competitive Edge: In the ever shifting Forex market, having access to timely and reliable data can be a big advantage.

Real-time data sources for broker platforms: The majority of Forex firms provide live feeds via their trading interfaces.

Market Data Providers: Expert-level data is offered by specialized providers such as TradingView, Thomson Reuters, and Bloomberg.

1 note

·

View note

Text

Surge in Ethereum Active Addresses: Is $4000 ETH Price Next?

Key Points

Ethereum’s active addresses have risen by 36%, indicating strong network activity and organic demand.

Breaking the $4,100 resistance could send Ethereum towards its all-time high of $4,891.

Ethereum [ETH] saw a significant boost earlier this month, breaching the $4,000 level before entering a phase of consolidation. Despite the recent cooling off in price action, analysts remain hopeful, citing strong signs that Ethereum’s bullish momentum is far from finished.

Ethereum’s Price Movement After US Elections

Post the US elections on November 5th, ETH has recorded an impressive 70% price increase. This increase is attributed to organic demand, as evidenced by a substantial increase in active addresses.

The surge, which is driven by actual network activity, implies that Ethereum’s rally could be sustainable, with potential for continued growth in the future.

The asset’s price trajectory following the US elections has been explosive, with a 70% rally since November 5th. The market sentiment shifted with the breakout above the $3,500 resistance, fuelled by increased institutional activity and a resurgence in DeFi. Data from TradingView shows solid volume accumulation alongside bullish price action, as indicated by a rising OBV metric.

Active Addresses and Ethereum’s Role

Since the November 5 elections, Ethereum’s network activity has seen a significant rise, with active addresses growing by over 36% to 417,000. This increase reflects a rise in investor interest and broader blockchain usage. This metric, often seen as a proxy for real network activity, supports the current Ethereum rally as being based on strong fundamentals.

Analysts suggest this growth could signal a continued upward trajectory, especially with Ethereum’s expanding role in DeFi and NFTs, reinforcing its position as the leading altcoin in a changing market landscape.

The $4,000 Consolidation Phase

Ethereum’s consolidation phase at $4,000 has sparked mixed sentiments about its next move. While some predict a potential pullback, others remain hopeful, citing healthy fundamentals.

Breaking the $4,100 resistance could propel Ethereum towards its all-time high of $4,891. Key indicators, such as rising active addresses and sustained volume accumulation, suggest bullish momentum remains intact.

However, the $4,100 level presents a psychological barrier. Analysts also highlight the possibility of external factors, like macroeconomic conditions or regulatory developments, influencing Ethereum’s trajectory.

For long-term investors, Ethereum continues to be profitable, with gains of over 39% in the past month, positioning it as a cornerstone of the altcoin rally.

Ethereum’s increasing institutional adoption is apparent from the rising inflows into spot ETFs, which now boast a cumulative net inflow of $1.41 billion. The timing of these inflows aligns with Ethereum’s recent rally, amplifying bullish sentiment around the asset.

0 notes

Text

Bitcoin’s Value Dips to $95K as Exchange Reserves Hit Multi-Year Low

Key Points

Bitcoin reserves on trading platforms have hit the lowest levels in years.

Bitcoin’s price struggles to maintain above $97,000 amidst a decrease in buying pressure.

Bitcoin reserves on digital asset trading platforms have reached their lowest levels in years, according to data from blockchain analysis platform CryptoQuant. At the same time, the leading digital asset has struggled to maintain its price above the $97,000 mark, indicating a decrease in buying pressure for a sustainable rally towards the anticipated $100,000 price point.

As per CryptoQuant data, there has been a significant transfer of 171,000 BTC from digital asset trading platforms following the 2024 United States presidential elections, which saw pro-crypto candidate Donald Trump emerge victorious. Trump’s pro-crypto promises during his campaign speeches have instilled a bullish sentiment within the sector.

Decrease in Bitcoin Exchange Reserves

Bitcoin exchange reserves have been on a downward trend since the beginning of the year. At the start of 2024, there were 3 million BTC on exchanges, but the year is ending with 2.64 million BTC on trading platforms.

This decrease in exchange reserves is seen as a positive sign, as it suggests that many Bitcoin holders are moving their coins from exchanges to private wallets in anticipation of long-term gains under the Trump administration. This could result in less selling pressure for Bitcoin, which is currently trading at $95,744.51, according to CoinMarketCap data.

The $100,000 Psychological Barrier

For Bitcoin to break above the psychological barrier of $100,000, a significant surge in buying volume is required. However, in the past 24 hours, Bitcoin’s trading volume has dipped by 15.5% to $59.74 billion. This suggests that investors are shifting their focus to other cryptocurrencies as altcoins have remained bullish over the past 24 hours.

The accumulation of Bitcoin continues to rise, as indicated by the chart provided by TradingView. With the A/D line continuing to print higher highs, investors can expect a slight distribution in the short term before Bitcoin potentially surges above the $97,000 mark.

Furthermore, the Relative Strength Index (RSI) reads a value of 62.05, indicating that the bulls currently have control over Bitcoin’s price trajectory. The RSI line is back from the overbought levels, suggesting that the price correction is nearing its end and a sideways consolidation could lead to Bitcoin moving towards its all-time high of $99,655.50.

It has been reported that once profit-booking cools down, investors can expect Bitcoin to skyrocket. This is due to major institutions like MicroStrategy and MARA making significant investments in the leading digital currency.

0 notes

Text

API Bridges Work in Algo Trading

API Bridges are a crucial part of algorithmic trading, which allows trading platforms, brokers, and custom trading algorithms to work seamlessly together. They provide real-time data transfer and order execution, thus making the trading strategy more efficient, faster, and accurate. In this article, we will explain how API bridges work in algo trading and further explore their importance for traders and developers, especially in India.

What is algorithmic trading? Algorithmic trading is the use of computer algorithms to automatically execute trades based on pre-defined criteria such as market conditions, technical indicators, or price movements. Unlike manual trading, algorithmic trading allows traders to make faster decisions and execute multiple orders simultaneously, minimizing human error and maximizing potential profits.

Understanding API Bridges in Algo Trading API bridges are the connector layer between different software platforms through which they can communicate with each other. In algo trading, an API bridge is used to bridge your trading algorithm running from platforms like Amibroker, MetaTrader 4/5, or TradingView to the broker's trading system for automated execution of orders.

Important Functions of API Bridges in Algorithmic Trading Data Feed Integration: API bridges enable direct access to live market data by the algo trader, such as current stock prices, volumes, and order books, from the broker's system. This will serve as the basis of information that the algorithm should interpret for better decision-making. Once the algorithm determines a suitable trading opportunity, the API bridge sends the buy or sell order directly to the broker’s trading system. This process is automated, ensuring timely execution without manual intervention.

Backtesting: API bridges enable traders to backtest their algorithms using historical data to evaluate performance before executing real trades. This feature is particularly useful for optimizing strategies and reducing risks.

Risk Management: An effective API bridge helps implement the risk management protocol in trading algorithms, for example, stop-loss or take-profit orders. When specific conditions are met, such orders are automatically entered to eliminate emotional decision-making and loss. Trade Monitoring: The API bridge continuously monitors trade execution with real-time updates on orders, positions, and account balances. The traders stay informed and make adjustments in their algorithms.

ALSO READ

Why API Bridges are the Need of Algo Trading? Speed and Efficiency: API bridges allow high-frequency trading (HFT), which enables traders to execute thousands of trades per second with minimal delay. This speed is very important in fast-moving markets where timing is everything to profitability.

Customization: With custom-built algorithms interacting with a multitude of brokers through the API bridge, traders can personalize their strategies, thus being able to implement advanced trading strategies that otherwise would not be possible to manually implement.

Integration is smooth. API bridges enable traders to connect their favorite platforms, such as Amibroker or TradingView, with brokers like Angel One, Alice Blue, or Zerodha. In other words, traders can continue using the software they are familiar with while availing of the execution capabilities of the broker's platform.

Cost-Effective: In comparison to hiring a dedicated team of traders or using expensive proprietary systems, API bridges are more cost-effective for algo traders. They allow traders to use the power of automation without the high overhead costs. Improved Risk Management: By automating risk controls, such as setting limits for loss and profits, the algorithmic system ensures that the trades are executed with minimal risk, thus helping traders in India and worldwide to manage the risk exposure better.

API Bridges Working with Popular Trading Platforms Amibroker: Amibroker is a more popular software used by algo traders for technical analysis and backtesting. The integration of Amibroker with API bridge enables traders to execute a strategy in real-time against their preferred broker's interface, which enriches trading experience.

MetaTrader MT4/MT5: MetaTrader is also a widely used platform for algorithmic trading. Through an API bridge, traders can link their trading robots (Expert Advisors) to brokers supporting the MT4 or MT5 platforms to automatically execute trades based on their algorithms.

TradingView: The most renowned trading view is a charting platform famous for its user-friendly interface and powerful scripting language called Pine Script. With an API bridge, users can send real-time trading signals to their brokers for the broker to execute.

The Best API Bridges for Algo Trading in India are by Combiz Services Pvt. Ltd.: Combiz Services Pvt. Ltd. provides customized API solutions that ensure seamless integration between brokers and trading platforms. Their API bridges support a wide range of trading platforms such as Amibroker, MetaTrader, and TradingView, which makes it a good option for Indian traders seeking flexibility and speed in algorithmic trading.

AlgoTrader: AlgoTrader provides an advanced algorithmic trading platform that supports integration with various brokers through API bridges. It is known for its scalability and high-speed trading capabilities, making it a favorite among professional traders.

Interactive Brokers API: Interactive Brokers offers a robust API that allows traders to link their algorithms directly to their trading platform. With a rich set of features such as market data feeds and execution capabilities, the Interactive Brokers' API bridge is highly regarded by the algo traders.

How to Set Up an API Bridge for Algo Trading

Select a Trading Platform and Broker: You may select Amibroker or MetaTrader as the trading platform. Then, go for a broker who gives access to APIs, such as Zerodha or Alice Blue. Connect API: Once you have made a selection of the above-mentioned platforms and broker, you must connect the API bridge with your algorithm in relation to the broker's system. In this step, generally, it involves configuration settings and keys of the APIs. Create or Select Algorithm: If you are a new algo trader, you can make use of pre-built strategies or create your own using programming languages like Python or AFL (AmiBroker Formula Language).

Backtest and test the algorithm: Before you deploy the algorithm, backtest it with historical data to ensure it performs as expected.

Monitor and Adjust: After you have deployed the algorithm, monitor its performance and make adjustments according to the changing market conditions.

Conclusion API bridges are a must-have tool in the world of algorithmic trading, providing smooth integration, faster execution, and improved risk management. Using Amibroker, MetaTrader, or TradingView platforms, API bridges make sure that your trading strategy is executed efficiently and effectively. The power of API bridges enables traders to stay ahead in the competitive world of algo trading and maximize opportunities in the Indian stock market.

For someone seeking a robust and highly customizable solution for algo trading needs, Combiz Services Pvt. Ltd. has the best API bridge services that guarantee seamless integration and faster trade execution.

0 notes