#velocity trade capital inc

Explore tagged Tumblr posts

Text

[Image description: The devil versus Jesus meme. Devil's talking baloon is edited to read: "My child will enable the greedy practices of giant corporations by buying into their subpar and expensive online subscription models" While Jesus's talking balloon is a screenshot from MediaFire's website with a download button for GBA Online PC showing. End Description.]

[Plain text: I hate Nintendo Switch Online. I hate the lack of optimization. I hate the expensive subscription service. I hate the lack of games. I hate the limited time releases. I hate that it's never gonna have the level of content that the Wii virtual console had. I hate what capitalism has done to gaming. End plain text.]

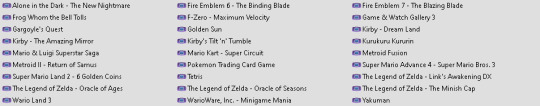

[Image description: three images. The first two are lists of some of the games available on the emulator. They include: Alone in the Dark - The New Nightmare, Frog Whom the Bell Tolls, Gargoyle's Quest, Kirby - The Amazing Mirror, Mario and Luligi Superstar Saga, Metroid II - Return of Samus, Super Mario Land 2 - 6 Golden Coins, The Legend of Zelda - Oracle of Ages, Wario Land 2

Fire Emblem 6 - The Binding Blade, F-Zero - Maximum Velocity, Golden Sun, Kirby's Tilt 'n' Tumble, Mario Kart - Super Circuit. Pokemon Trading Card Game, Tetris, The Legend of Zelda - Oracle of Seasons, WarioWare Inc. - Minigame Mania

Fire Emblem 7 - The Blazing Blade, Game & Watch Gallery 3, Kirby - Dream land, Kurukuru Kururin, Metroid Fusion, Super Mario Advance 4 - Super Mario Bros. 3, The Legend of Zelda - Link's Awakening, The Legend of Zelda - The Minish Cap, Yakuman

Game & Watch Gallery, Kirby's Block Ball! super Mario Land, Advance Wars 2 - Black Hole Rising, F-Zero - Climax! Golden Sun 2 - The Lost Age! Mario Party Advance, Super Mario Advance - Super Mario Bros. 2 USA, The Legend of Zelda - A Link to the Past & Fou…, WarioWare Twisted!, Pokemon Pinball, Super Mario Bros. Deluxe

Game Boy Gallery, Kirby’s Pinball Land, Wario Blast featuring Bomberman!, Advance Wars, F-Zero - GP Legend, Kirby - Nightmare in Dream Land, Mario Tennis Power, Super Mario Advance 2 - Super Mario World, Tomato Adventure, Game & Watch Gallery 2, Pokemon Puzzle Challenge, Tetris DX

Kirby - Dream Land 2, Kirby's Star Stacker, Wario Land - Super Mario Land 3, Fire Emblem 8 - the Sacred Stones, Game & Watch Gallery 4, Mario Golf - Advance Tour, Metroid Zero mission, Super Mario Advance 3 - Super Mario World 2 - Yoshi's Island, Wario Land 4, Ghosts 'n' goblins, Pokemon Trading Card Game 2 - Team GR!, and Wario Land II.

The third image is a set of Tumblr tags that read “#hey OP not to be dramatic on ur post #but I’m in genuine tears of joy here #I do not... get the world of emulating and roms #but my GBA:SP is reaching the end of its life #and kirby nightmare in dreamland is My First Game #and the idea I couldn’t play it again killed me #I was ready to throw every dollar at nintendo.” End description.]

I hate Nintendo Switch Online. I hate the lack of optimization. I hate the expensive subscription service. I hate the lack of games. I hate the limited time releases. I hate that it's never gonna have the level of content that the Wii virtual console had. I hate what capitalism has done to gaming.

This collection includes: All the GBA, GB and GBC games currently available on the Switch!!

+ And a few extra bonus!! Mostly from the same series'seses

Download here for free!!: https://www.mediafire.com/file/pzycxh6zu9b8drf/GBA_Online_PC.rar (405 MB Uncompressed)

They're all ready to be played in HD on PC. Just drag and drop the files on the included program

92K notes

·

View notes

Text

Bottled Water Processing Market Research, Review, Applications and Forecast to 2030

The Insight Partner’s report, titled " Bottled Water Processing Market Share, Size and Trends Analysis| 2030" provides investors with a roadmap for setting up new investment plans in the Bottled Water Processing market. The report covers various aspects, ranging from a broad Bottled Water Processing market forecast to intricate details like Bottled Water Processing market size, both current and projected, market drivers, restraints, opportunities, and trends (DROT). https://www.theinsightpartners.com/reports/Bottled-Water-Processing-Market/ The Bottled Water Processing market report also provides in-depth insights into major industry players and their strategies because we understand how important it is to remain ahead of the curve. Companies may utilize the objective insights provided by this market research to identify their strengths and limitations. Companies that can capitalize on the fresh perspective gained from competition analysis are more likely to have an edge in moving forward. With this comprehensive research roadmap, entrepreneurs and stakeholders can make informed decisions and venture into a successful business. The key companies identified in the Bottled Water Processing market analysis by our research analysts are AXEON Water Technologies, Donaldson Company, Liquid Packaging Solutions, Inc., Nestl?, Norland International, Pall Corporation, Pure Aqua, Inc., SUEZ, The Coca-Cola Company, VELOCITY WATER WORKS . This research further reveals strategies to help companies grow in the Bottled Water Processing market. A market research report, which contains proof of market research and provides the best opportunity for businesses to fulfill their objectives, might serve as the cornerstone of your business strategy. Insights on all significant regions and associations are included in this study, which also provides information on subsegments. This report delves even further into the challenges faced by Bottled Water Processing market enterprises in terms of cost and return on investment, as well as Bottled Water Processing market trends. What are the Main Focal Points Covered in this Report? 1. Bottled Water Processing Market Outlook - Various factors that determine Bottled Water Processing market growth are examined in this section, including opportunities, barriers, challenges, trends, and drivers. Authentic market determinants encourage innovation. This section addresses the distribution of firm activity and the factors that influence development. A comprehensive range of market-specific data is available, allowing investors to conduct an early assessment of the Bottled Water Processing market's capabilities. 2. Competitive Comparison Matrix- The purpose of this segment in the Bottled Water Processing market report is to present organizations with a competitive comparison matrix. This section provides an in-depth assessment of competitors' business strategies and advancements. Businesses can employ detailed market research and target statistics to determine competitors' alternatives. Businesses might discover new market niches and avenues for sales by examining their competitors' offerings. 3. High ROI Trade-Offs- To adequately aid their customers in a competitive Bottled Water Processing market, enterprises must educate themselves on key domains. Streamlining market approaches is an effective application of market research. This study area focuses on product, application, and regional categories. Understanding demographics and high-ROI geographical regions helps entrepreneurs optimize their products.

0 notes

Text

Abaxx Provides Q2 Business Milestone and Regulatory

New Post has been published on https://tattlepress.com/business/abaxx-provides-q2-business-milestone-and-regulatory/

Abaxx Provides Q2 Business Milestone and Regulatory

TORONTO, June 30, 2021 (GLOBE NEWSWIRE) — Abaxx Technologies Inc., (NEO:ABXX) (“Abaxx” or the “Company”), a financial technology (fintech) company, majority shareholder of Abaxx Singapore Pte. Ltd., the Abaxx Commodity Exchange (ACX), and producer of the SmarterMarkets™ Podcast, is pleased to provide an update to shareholders regarding the progress of the company’s road map and milestones in preparation for the launch of Abaxx Commodity Exchange in Singapore, including the Company’s ID++ suite of Abaxx workflow applications and software services.

Dear Shareholders,

As we close out the first half of 2021, our primary project activities are progressing toward our previously stated goal of “internal launch readiness” by the end of the June quarter, with most project activities at or near internal completion and awaiting further coordination and completion with external partners, as detailed below. Abaxx is actively engaged in the senior management review phase before the Monetary Authority of Singapore (“MAS”), our primary regulator, as we await our Approved Clearing House (“ACH”) approval in principle (“AIP”) and advance the exchange toward launch in 2H 2021. As of June 30th, all Clearing House application materials including technical-review comment documentation and supplementary requests have been submitted as required for AIP. No assurances can be made as to the final timing of AIP, but Abaxx has advanced discussions with prospective membership launch-partners to begin the final stage of commercial preparedness.

The Company has categorized development activities broadly as regulatory applications and operations ramp up in Singapore; commercial engagement and exchange product development; internal technology development and external technology integration. In addition to these core Exchange development activities, Abaxx Technologies is testing an advanced suite of productivity and workflow applications which are not required for exchange participants, but function symbiotically with the core capabilities of the Exchange and Clearinghouse. The suite is intended to enable Measurement, Verification and Reporting (MVR) activities related to ESG externality-pricing considerations for commodity market participants.

Regulatory and Operations Milestones

Abaxx Exchange is awaiting regulatory approval as a Recognized Market Operator (“RMO”) and Approved Clearing House (“ACH”) in review before the MAS. On September 7, 2020, Abaxx received Approval in Principle of its RMO application, subject to various terms and conditions. The Company is in frequent contact with the MAS and is working toward the completion of the ACH AIP in the near term, though no assurances can be made as to the exact date of the approval.

Abaxx Exchange is evaluating access requirements and preparing necessary filings in secondary jurisdictions including Switzerland, UK and the US, where potentially advantageous.

Abaxx Exchange has successfully recruited the senior executives required for launch and its management team is substantially in place.

Target staff levels in the operations, regulatory, risk and tech departments are on track. Remaining operations staff will be scaled up over coming months as the project progresses towards launch. Senior and middle line leadership have developed and completed the necessary training programs for new staff onboarding.

Commercial Engagement and Exchange Product Development

The Abaxx executive team has extensive experience in organizing markets via various market advisory committees at global commodity exchanges. Abaxx believes the working group approach is the most effective way to form industry consensus and create positive feedback loops to entice market liquidity when launching new products. Abaxx has been leading a global Carbon Neutral LNG Working group since early Q1 and continues to add new participants in each working session.

While the futures contracts being developed for launch are initially focused on global LNG markets, Abaxx is also advancing new working groups and contract standardization development around voluntary carbon offset markets, precious metals, and critical battery metal markets. Outreach and initial engagement in these market segments has been encouraging, and the Company expects to update new development timelines for additional products by late Q3.

Exchange Technology Development

The Abaxx Exchange matching engine and clearinghouse software suite is licenced and developed in partnership with Nasdaq Market Technology. In addition to the deployment and testing of this core marketplace software, Abaxx has built proprietary service enhancements for member account access and management, custom trading APIs, custom Fix Field Mapping to support ESG data management, a dynamic greenhouse gas calculator for commodity trading, and other custom trade and data entry services. These proprietary enhancements are integrated with ID++ and the Abaxx Console Applications (Verifier, Chat, AI/ML service integration, Drive, Vault, Sign) developed by Abaxx Technologies, with an innovative cloud architecture developed in line with the principles of Web3.

Core exchange and clearing software development is complete, with the enhanced services currently in QA and load testing. Abaxx Clearing is preparing for beta testing, and the Company is engaged with Nasdaq and Independent Software Vendors partners to finalize a timeline for all remaining third party software updates, integrations, and additional operational testing and training. The Company expects these final external-vendor milestones to be completed in line with the expected launch timelines following ACH AIP.

ID++ enabled Application Suite and Workflow software services

As described in previous disclosures, the company has developed a blockchain digital-identity based modular, integrated-suite of productivity and workflow applications, with the services built on open Digital Identity standards (WC3 Verified Credentials and DID Resolvers). The functionality includes end-to-end encrypted instant messaging, voice and video with regulatory compliant transcription, document management and collaboration with multi-party digital signature capabilities, secure document and digital contract storage and transfer protocols.

The modular nature of the ID++ tools and services has allowed the Company to develop custom exchange and clearing software enhancements, with an initial application use case of bundling verified ESG data and assets within a traditional commodity-trade workflow. Core development and integration of these services with the Abaxx Exchange trade workflow is complete, and the Company is working towards a live demo and pilot group trade execution in the second half of the year to showcase these new tools and services.

With the June completion of the integration of ID++ tools and services into the Abaxx Exchange, Abaxx has initiated an internal working group to explore B2B and B2C commercialization for the Abaxx Console and applications outside of exchange clients.

Through work with the Carbon Neutral LNG Working Group, Abaxx believes significant opportunity exists to leverage the ID++ technology architecture, and the relationships and network Abaxx has developed, to form new business models for the ESG economy and the energy transition. Initial business plans to be capitalized and potentially spun out of Abaxx are in advanced stages of development.

SmarterMarkets™ Podcast

The weekly SmarterMarkets™ podcast continues to exceed expectations for listener engagement and stakeholder recognition. Recent series titled, “The Role of Digital Innovation in Advancing the ESG Economy”, and the current series, “ An Emerging Energy Framework for the 22nd Century”, have proven to be both prescient and attractive to prospective partners interested in adding their voices and views to the discussions guiding the corporate strategy.

About Abaxx Technologies

Abaxx is a development stage financial software company that has created proprietary technological infrastructure for both global commodity exchanges and the digital marketplace. The Company’s formative technology increases transaction velocity, data security, and facilitates improved risk management for the majority owned, Abaxx Singapore Pte. Ltd. (“ACX”, “Abaxx Commodity Exchange”, or “Abaxx.Exchange”) – a commodity futures exchange that is seeking final regulatory approvals as a Recognized Market Operator (“RMO”) and Approved Clearing House (“ACH”) in review before the Monetary Authority of Singapore (“MAS”). Abaxx is also the owner of the LabMag and KeMag iron ore assets, resulting from the reverse take-over of New Millennium Iron Corp, and the creator and producer of the SmarterMarkets™ podcast.

For more information please visit abaxx.tech, abaxx.exchange and SmarterMarketsPod.com

Media and Investor Inquiries:

Abaxx Technologies Inc. Paris Golab, Head of Investor Relations Tel: +246 243-3390 E-mail: [email protected]

Forward-Looking Statements

This News Release includes certain “forward-looking statements” which do not consist of historical facts. Forward-looking statements include estimates and statements that describe Abaxx or the Company’s future plans, objectives or goals, including words to the effect that Abaxx expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “seeking”, “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to Abaxx, Abaxx does not provide any assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, Abaxx’ objectives, goals or future plans, statements, timing of the commencement of operations and estimates of market conditions. Such factors include, among others: risks relating to the global economic climate; dilution; the Company’s limited operating history; future capital needs and uncertainty of additional financing; the competitive nature of the industry; currency exchange risks; the need for Abaxx to manage its planned growth and expansion; the effects of product development and need for continued technology change; protection of proprietary rights; the effect of government regulation and compliance on Abaxx and the industry; network security risks; the ability of Abaxx to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; and volatile securities markets impacting security pricing unrelated to operating performance. In addition, particular factors which could impact future results of the business of Abaxx include but are not limited to: operations in foreign jurisdictions, protection of intellectual property rights, contractual risk, third party risk; clearinghouse risk, malicious actor risks, third-party software license risk, system failure risk, risk of technological change; dependence of technical infrastructure, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains. Abaxx has also assumed that no significant events occur outside of Abaxx’ normal course of business.

Abaxx cautions that the foregoing list of material factors is not exhaustive. In addition, although Abaxx has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. When relying on Abaxx forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Abaxx has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Abaxx as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Abaxx does not undertake to update this information at any particular time except as required in accordance with applicable laws. The NEO Exchange does not accept responsibility for the adequacy or accuracy of this press release.

Source link

0 notes

Text

Hybrid Cloud Market Research Report

Growth opportunities in the Hybrid Cloud market look promising over the next six years. This is mainly due to the rising adoption of hybrid cloud in IT service management models, the shift in the preference towards hybrid cloud, followed by the growing need for connectivity and the rising reliance on mobile communications.

Request for a FREE Sample Report on Hybrid Cloud Market

Hybrid Cloud Market Dynamics (including market size, share, trends, forecast, growth, forecast, and industry analysis)

Key Drivers

The growing adoption of hybrid cloud in IT service management models and the increasing preference towards hybrid cloud acts are the major factors that are contributing to the growth of the Hybrid Cloud market share. The hybrid cloud platform is getting popular in the IT industry as it provides benefits, including higher scalability, flexibility, and multi-cloud space while offering security reassurance to organizations. IT players are spending 56% time on maintenance and 24% spend on resolving technical issues through different platforms. In addition to this, this maintenance and working model is time and capital-consuming, which has encouraged businesses to opt for hybrid cloud, thus surging the global hybrid cloud market size.

Various companies are facing a third wave of digital disruption, which is motivated the core forces such as the long-term falling cost of computing, communications, and storage. Surviving in the digital transformation is becoming a challenge in various industry verticals. Other factors such as the evolution in need for connectivity, the increasing reliance on mobile communications, and others have surged the velocity of disruptions, which is projected to create a new hybrid cloud market opportunity. On the other hand, network complications and increasing security concerns are the major factors that are hindering market growth.

End-Use Segment Drivers

Based on the end-use, the BFSI segment is projected to witness a faster CAGR during the forecast period. The growing adoption of cloud services for the storage and management of customer data is a key driver that is surging the growth of the market. Some other factors, which include secure storage, interoperability, and 24×7 uptime, have encouraged the BFSI industry to focus more on customer-centric business models and digitalization of trade and wealth. Moreover, services that include online fund transfer, digital wallets, payment gateways, and unified customer experience are playing an important role in the BFSI sector, therefore surging the growth of the market.

Hybrid Cloud Market’s leading Manufacturers:

· VMware, Inc

· Microsoft

· RACKSPACE TECHNOLOGY

· IBM

· Google

· Amazon

· Hewlett Packard Enterprise Development LP

· CISCO

· Dell Inc.

· Verizon

Hybrid Cloud Market Segmentation:

Segmentation by Service:

· SaaS

· IaaS

· PaaS

Segmentation by Enterprise:

· Large Enterprise

· Small & Medium Enterprise

Segmentation by End Use:

· BFSI

· IT & Telecom

· Retail & Consumer Goods

· Manufacturing

· Energy and Utilities

· Healthcare

· Media & Entertainment

· Government & Public Sector

Segmentation by Region:

· North America

o United States of America

o Canada

· Asia Pacific

o China

o Japan

o India

o Rest of APAC

· Europe

o United Kingdom

o Germany

o France

o Spain

o Rest of Europe

· RoW

o Brazil

o South Africa

o Saudi Arabia

o UAE

o Rest of the world (remaining countries of the LAMEA region)

About GMI Research

GMI Research is a market research and consulting company that offers business insights and market research reports for large and small & medium enterprises. Our detailed reports help the clients to make strategic business policies and achieve sustainable growth in the particular market domain. The company's large team of seasoned analysts and industry experts with experience from different regions such as Asia-Pacific, Europe, North America, among others, provides a one-stop solution for the client. Our market research report has in-depth analysis, which includes refined forecasts, a bird's eye view of the competitive landscape, key factors influencing the market growth, and various other market insights to aid companies in making strategic decisions. Featured in the 'Top 20 Most Promising Market Research Consultants' list of Silicon India Magazine in 2018, we at GMI Research are always looking forward to helping our clients to stay ahead of the curve.

Media Contact Company Name: GMI RESEARCH Contact Person: Sarah Nash Email: [email protected] Phone: Europe – +353 1 442 8820; US – +1 860 881 2270 Address: Dublin, Ireland Website: www.gmiresearch.com

0 notes

Text

GRAPHIC-Take Five: The Good Reflation

While the vaccine distribution rolls on, companies and people should nonetheless cope with the current fall-out from the virus’s unfold. In present times, sensible sensors are extremely adopted, owing to the wider utility in several purposes comparable to diminishing the information communication circulation, energy consumption of the system, simplifying the development of purposes, offering digital knowledge in addition to anticipated data being its capability to detect such easy information with values pre-set by the gadget producer. In regular times, algorithmic boutiques near me -making helps to keep buying and selling situations smooth and ensures tiny gaps between bids and offers for even huge chunks of Treasury bonds. The fairness market presents in shares and shares whereas the derivative market deals in futures and selections (F&O). Each fairness market and by-product market are a part of the overall inventory market. In case you witness market preparations after which make investments, you could not make the a lot of the profit that you would have made in the place. If the monetary system is a house, then Treasuries are its foundations - the safe, solid bedrock on which everything else relies. That meant promoting what is usually easiest to promote: Treasuries.

Policymakers must now grapple with not solely what precipitated such a crucial market to crack, but also how to handle the fragility inside the market that was revealed during this period of indiscriminate selling. Electric automobile-maker Tesla Inc's shares have been set to rise for the 11th day, taking its market capitalization to greater than $800 billion for the primary time ever. Without successes there, the Crown Prince’s technique for 2021, including taking over the workplace of his father, shall be under extreme pressure. Over the past decade, excessive-velocity algorithmic trading companies have turn into increasingly integral in matching buyers and sellers in the Treasury market, with many “primary dealers” - the membership of huge banks that arrange authorities debt sales - copying their techniques. The core trigger was a panicky “dash for cash” by corporations, overseas central banks and funding funds girding themselves for torrential outflows at a time when monetary hubs globally were transitioning to working from house.

0 notes

Photo

Voit’s Q4 2019 OC Office Market Report & 2020 Forecast – Just Released!

New Decade. Same Cycle.

2019 was another good year for the OC office market. A diversified, well-educated employment base continues to keep the office market on firm footing. Consistent demand has kept lease rates and sale prices on an upward trend notwithstanding the significant spike in speculative office development over the past two years. This year technology tenants are expected to dominate leasing, which isn’t surprising because they accounted for 22% of the activity through the first half of 2019. Interest in flexible office space will continue to grow, but at a much slower pace thanks to the recently botched WeWork IPO. Political activity continues to impact the overall CRE outlook. The House has passed the USMCA (NAFTA 2.0) and it is expected to be signed into law in January. Many believe the new law will strengthen U.S. trade with Canada and Mexico. Tax incentives for energy-efficient commercial buildings have been extended, allowing owners to claim a deduction of up to $1.80 /SF for qualifying systems. Of great concern going forward is the California Schools and Local Communities Funding Act, which will likely be on the ballot in November. This controversial initiative would remove Prop 13 protection for most commercial properties. Beginning with the 2021–22 tax year, commercial property would be subject to periodic reassessment to full market value even if it does not change hands. Tenants subject to operating expense pass-through could be forced to absorb huge tax increases, while investors who cannot pass those increases along would see a decline in property values due to lower NOI. Looking ahead, I’m keeping an eye on these key market drivers: #1: Interest rates will remain low. The Fed’s three rate cuts in 2019 made clear its intentions to avoid recession. We expect interest rates to remain stable going forward, which makes 2020 a good year to acquire or refinance office properties. #2: The creative and progressive design trends that have dominated the OC office market since 2015 will continue. The latest iteration is the “outdoor” office and developers have taken note. Employees, predominantly millennials and Gen Z, expect an excellent experience at work, which means spaces with high levels of choice, variety and balance. #3: The alternative investment sector of CRE will remain strong. Data center, self-storage and medical office activity has doubled since 2008, making up approximately 12% of all CRE activity. As this trend continues, expect to see adaptive reuse projects growing in popularity. Old factories, mills, schools, vacant retail boxes and more are being converted into flex space and residential housing. Programs like Opportunity Zones or the Low-Income Housing Tax Credit will further support those efforts. Barring a catastrophic economic disturbance, 2020 should be another solid year for Orange County’s economy and commercial real estate market.

OC Office Market Overview

The OC office market has stabilized into a relatively strong and stable position. Vacancy remains manageable, but has ticked up slightly in the past year. Technology, Financial Services, and Health Services firms have driven a significant amount of recent leasing activity. However, expanding companies are leveraging new workplace technologies to save money by increasing the number of employees for each square foot of space they lease, and that has had an impact on overall absorption and transaction velocity. Tenants in Class A and B buildings who leased space early in the recovery cycle are getting sticker shock at renewal time, as rent growth, which has moderated in recent quarters, is up substantially over the past 5 years. To mitigate higher per square foot occupancy costs, many tenants are moving down in building class and taking less space by switching to more open workspace designs. The market has seen modest levels of supply additions in recent years compared with previous development cycles, but several of the Class A projects delivered over the past two years are leasing up more slowly than expected. Net absorption, though still in positive territory, has been softening over the past several years. Capital market conditions remain solid, and while sales volume is down from its record level back in 2016 and 2017, it remains robust. Cap rates remain at or near historical lows, especially for high quality Class A and B assets. Vacancy Rates Nearly 1.39M SF of space has been delivered in the OC office market since Q1 2019, expanding the office base by 1.2%. This has contributed to the uptick in overall vacancy. Direct / sublease space (unoccupied) finished the quarter at 11.44%, up 48 basis point year-over-year. North Orange County posted the lowest vacancy rate at 7.17%, while the Airport Area and Central County had vacancy rates greater than 12% at the end of fourth quarter. Higher vacancy in the Airport Area is mainly due to its concentration of new deliveries still in the initial lease-up phase. Lease Rates Rent growth in the OC office market leveled off in 2019. The average asking lease rate in Orange County rose by just 0.37% over the past year compared with 1.7% nationwide. The average asking FSG monthly asking lease rate lost $0.09 in the fourth quarter, ending the period at $2.74. The average quoted rental rate for Class A space was $3.10 per square foot, compared with the Class B asking rate of $2.47 per square foot. Transaction Activity Slow growth in the region’s labor force has resulted in hiring challenges for many firms, and that may be impacting transaction velocity. Orange County’s labor market remains historically tight, with the unemployment rate holding at 2.5%. The total square feet leased and sold in the fourth quarter was approximately 3.4M SF, a significant slowdown from the 5.0M SF of transactions in the fourth quarter of 2018. Downsizing into more open workspace to increase headcount and appeal to younger workers is also a factor. Employment The unemployment rate in the OC office market was 2.5% in November 2019, unchanged from a revised 2.5% in October, and below the year-ago estimate of 2.7%. This compares with an unadjusted unemployment rate of 3.7% for California and 3.3% for the nation during the same period. Local job growth was evident across all subsectors but financial services (up 1,200 jobs) and Government (up 2,200 jobs) led the way as the year ended. Construction Total space under construction in the OC office market ended the year at 795,177 square feet. In Costa Mesa, construction is underway at The Press located at 1375 Sunflower Drive. This former L.A. Times printing facility is being converted into more than 300,000 square feet of creative office space to accommodate the shift in demand from businesses looking to recruit and retain a younger workforce. The Source, located in the Irvine Spectrum, offers a two-building concept with common atrium connectivity and more than 70,000 total square feet of rentable space. Irvine Company’s build-to-suit for Alteryx Inc. at Spectrum Terrace 2 is also in the works. The company will occupy the bulk of the project’s 340,000 square foot second phase. The first phase is fully leased. Absorption Co-working tenants like WeWork have leased millions of square over the past few years and the current slowdown in that sector is partly responsible for the recent decline in new transaction velocity. Orange County office occupancy grew by 167,588 square feet in the final quarter, bringing the year-to-date gain in occupied space up to 707,160 square feet. The Airport Area submarket accounted for 260,089 square feet of that total. By product type, Class A office led the way with a net gain of 314,790 square feet in just the fourth quarter. Notable transactions included: Avanir Pharmaceuticals (103,879 square feet in Aliso Viejo), County of Orange Assessor (69,151 square feet in Orange), and WeWork (71,076 square feet in Irvine). FORECAST: Lease Rates Rent growth may pick up again as the absorption of the remaining first generation space gets leased up. With fewer attractive alternatives in the market, rent growth should return to an annualized rate of 2–3% over the course of the year. Vacancy Rates We anticipate that the overall vacancy rate will remain in the 11–12% range over the next three quarters, but the Class A sector will run somewhat higher due to its higher concentration of first generation space. Overall Signs of a global economic slowdown, concerns over US-China trade relations and a decline in the US GDP growth rate motivated the Fed to cut its benchmark Federal Funds Rate 3 times in 2019. That effort to stimulate consumer spending and business investment seems to be working. Equity markets responded by rising to new highs and the spread between short- and long-term US Treasuries widened again after a dangerous inversion earlier in the year. The latest estimates for domestic GDP growth for 2020 are running in the low 2% range, which should be enough to keep the current economic recovery on track. For more information on the OC office space market and how to capitalize on real estate opportunities to grow your business, contact Stefan Rogers 949.263.5362 / [email protected]. Click HERE to download Voit’s Q4 2019 OC Office Space Market Report.

0 notes

Text

How do i get free imvu credits without downloading anything test today

How To Make IMVU Credits Speedy

Start out by following imvu credits hack. In addition, IMVU can on top of that collect nonpii like the aggregate data described below in the "Aggregate Information and facts" section and such other nonpii as information with regards to machines conducting our software, in order to additional comprehend and improve the user encounter, ads, safety, authorities, and network ethics (avoidance of hacks, unauthorized use, and so forth).

IMVU's early stage mobile technique was driven by higher-velocity user acquisition, aimed at rapid growth. As IMVU VP of Development Lomit Patel puts it, proving mobile was viable was the initial priority.†But as the brand's targets have evolved, retention became increasingly more critical. We try to concentrate on both sides of the coin.†And that they did.

It's not an unfair statement when it really is accurate. IMVU is not catered to older adults. It in no way has been and in no way will be, they knew that from the moment of its inception. Even though anyone can act immature anywhere. It appeals to teens and younger adults additional than anything. So finding immature people today there, is pretty easy. That's not to say 1 can not uncover them in sl. Of course you can. Sl has a wider userbase and considerably bigger environment. There are even particular areas one could go to discover immature persons, of all ages.

IMVU contains its personal economy with a currency method based on IMVU "credits" and "promo credits". A third kind of currency also existed for creators, known as "developer tokens", which have been earned when a user purchases an item with "promo-credits". Credits could be bought on the internet utilizing actual currency directly from IMVU. Credits could also be bought on IMVU gift cards readily available from retail outlets such as department stores. The credits are getting employed by members to obtain virtual things like fashion pieces (hair, clothes, skins, and accessories), pets, and 3D scenes such as properties, clubs, and open landscapes. Furnishings could also be bought the similar way and placed into unlocked rooms, but there were also rooms that have some furniture integrated in them as nicely as locked rooms that include things like furnishings that can't be removed.

If you want IMVU Credits, far better get them safely. Our sellers present legit credits for a lower price. Consider twice when you see these web-sites who present 'free IMVU credit' or got some sort of cheating approaches, as they are ordinarily phishing your account information. Pick a seller with a fantastic rating in our credit marketplace, or go to the 'CD Keys' tab, exactly where you may come across some good offers for IMVU money card.

IMVU Inc. is an on the internet metaverse and site. IMVU was founded in 2004 and was originally backed by venture investors Menlo Ventures, Allegis Capital, Bridgescale Partners, and Best Get Capital. IMVU members use 3D avatars to meet new folks, chat, build, and play games. IMVU had more than 4 million active customers in 2014. Existing number of active players are unknown, and at the moment the web site has the largest virtual goods catalog of more than 30 million things. The organization was previously positioned in Mountain View, California. It was also recognized as one particular of the leading practitioners of the lean startup strategy.

Our cheat tool is totaly threat-absolutely free and anti-virus protected. This have to have for speed no limits hack will 100% earn far more points and you can win max races. Farmville two Guidelines And Tricks '†Major Beneficial Farmville 2 Hints, Guides, Techniques and Bonuses We will have to meticulously pick what we place on our auto, mainly because if we use a prevalent portion then suppose not being capable to use one of the uncommon we would have gotten just after. Fill in the quantity of Imvu Credits you want to create. In addition, in the races we can bet and depend on how the bets are paid you can get a quite succulent quantity of dollars. We are not responsible for any illegal actions you do with theses files.

Invite other members to stop by your room. It became one of the most preferred game of its category. How to use the hack?. During the procedure of delivering the free credits, this imvu cheat actually protects you by simulating into your account the procedure of acquiring the credits with real money. This only proofs that employing this approach is secure for your account.

Answered: Your Most Burning Issues Regarding IMVU CREDITS

youtube

Nicely, we cannot assure you this that your virtual girlfriend will remain with you forever. but we can guarantee that you will find a new girl within a handful of minutes right after a breakup. Acquiring credits from right here now easier than ever. At the start, we had faced a challenge with imvu. Points got scary when they emailed us and warned about this tool and tool our old web page down. It was painful than a breakup but we did not give up started a new internet site and new tool which now capable to give credits to our Imvu users. This team is delighted then we in a position to make men and women content providing this tool for no cost. you only need to install an app just before you get credits that to take 30 seconds only.

The PlayerAuctions marketplace is the safest place to obtain low cost IMVU credits. We have over ten years of encounter in the digital asset exchange market. We know incredibly effectively how to safeguard your orders. We also have the PlayerGuardian Trading Protections. Thanks to this program all transactions created on our website are protected. As an added security measure, we screen and confirm all gives of cheap IMVU credits ahead of they are permitted onto our internet site. Lastly, all credit orders are confirmed as reputable prior to we release disbursement to sellers.

B: You and your buddy need to have to have set you as a Buddies (pals). Some of the actions in IMVU has its own allocation. You can see that in some of the actions (they are label). If the action isn't label you can do it everytime, if it has „smiley†— person have to have to add you to Buddies. If it has AP symbol (Access Pass) — You and the particular person need to have to obtain from IMVU an erotic content material (it costs 20$).

As you can see an IMVU credits hack 2018 is a lot more than simply a hack. It creates the globe of IMVU so much bigger plus more actual. There are a lot of issues you can do with the credits in IMVU, but my preferred is to make things. There is no stronger feeling than the feeling when providing to others IMVUers. It is so fulfilling that you really feel addicted to sharing things with everybody. If you want to go via the very same degree of joy and pleasure you need to have the IMVU credits cheat. Getting totally free credits without the need of paying a dime is by far a pretty essential thing that can happen to any IMVU player. You could dress nonetheless, you like and talk about any present with buddies and strangers also.

How to earn IMVU Credits Generator hack with the IMVU Credits Generator hack tool? Earning IMVU Credits Generator hack will support you to get a wide variety of advantages which make them extremely valuable. IMVU Credits Generator also gives free of charge hack tool generator for the players. Obtaining IMVU Credits Generator hack from IMVU Credits Generator coin hack tool is quite mCreditsh straightforward. All you need to have to do is to adhere to the methods pointed out under.

This hack is also quite importantwhich most likely no a single has ever believed about.Beside downloading applications and attempting different factors, lucrativeinteraction with other IMVU gamers is very critical to earning good credit. If you feel that you are stuck somewhere andcould not earn credit more, your great interaction with other IMVU users willhelp you get out of this predicament. You can lend from them for some time andthen give them back when you earn enough for oneself.

But for doing all items there is a will need for you to wait for also extended time till the course of action gets completed. But without carrying out all this things also you can capable to get a lot of sources that is when you make use of the imvu hack. This method would act as a greater option for you to do reliable and to enhance its efficiency.

0 notes

Text

Where Can You Find Free IMVU CREDITS Resources

How To Make IMVU Credits Quick

Commence by following imvu credits hack. In addition, IMVU can also gather nonpii like the aggregate info described under in the "Aggregate Information" section and such other nonpii as information concerning machines conducting our software, in order to additional comprehend and improve the user knowledge, advertisements, security, authorities, and network ethics (avoidance of hacks, unauthorized use, and so on).

IMVU's early stage mobile tactic was driven by higher-velocity user acquisition, aimed at rapid development. As IMVU VP of Development Lomit Patel puts it, proving mobile was viable was the initial priority.” But as the brand's targets have evolved, retention became increasingly more vital. We attempt to concentrate on both sides of the coin.” And that they did.

It really is not an unfair statement when it's correct. IMVU is not catered to older adults. It by no means has been and under no circumstances will be, they knew that from the moment of its inception. While any one can act immature anywhere. It appeals to teens and younger adults a lot more than anything. So finding immature men and women there, is quite easy. That is not to say a single can't discover them in sl. Of course you can. Sl has a wider userbase and significantly larger atmosphere. There are even certain locations one could go to come across immature folks, of all ages.

I have been in a position to send 100k per day for awhile on imvu, They not too long ago restricted my account to 10k per day, and yet another is at 15k per day. I was asking yourself how the limits work? How do you get the limits raised? Does sending credits everyday raise the limits more quickly, or does it just go up more than time. If there is any person with any tips on this topic please let me know.

The game has become very well known and obtaining a legit IMVU credits cheat will absolutely help a lot of folks. There are, nonetheless, individuals that simply don't will need a program like this. We are targeting the majority that is obtaining troubles in paying for their each day essential credits. How to get free credits on IMVU is now easy and more quickly than ever. This IMVU Credits Hack tool has the potential to provide unlimited no cost credits in your IMVU account. Our main purpose in beginning this project was to develop a safe system that will not endanger anyone's account. To be able to do this, the IMVU credits cheat has to be operated from virtual servers. For this hack and for other related programs we have our personal network of virtual servers. These servers are situated in a number of areas creating the IMVU credits generator accessible to most of you.

IMVU Inc. is an on-line metaverse and web-site. IMVU was founded in 2004 and was originally backed by venture investors Menlo Ventures, Allegis Capital, Bridgescale Partners, and Ideal Acquire Capital. IMVU members use 3D avatars to meet new persons, chat, produce, and play games. IMVU had over 4 million active customers in 2014. Present quantity of active players are unknown, and currently the web-site has the largest virtual goods catalog of a lot more than 30 million things. The business enterprise was previously situated in Mountain View, California. It was also recognized as one of the major practitioners of the lean startup approach.

Even though I do like both, SL I come across is significantly more open. There is no paid-for access pass for mildly adult content. Actual adult content is allowed on SL but not on IMVU. The avatars on SL are far extra detailed and customizable as properly. On IMVU, shapes come with the clothes you obtain, sort of like mesh clothes on SL, but there is no scaling to physique components, it just replaces that portion of the physique mesh with clothes weighted to it. And for your face, you obtain heads rather of use sliders to customize your appear following placing on a skin. Some heads appear fantastic with some skins, other individuals not so much.

Invite other members to take a look at your area. It became a single of the most common game of its category. How to use the hack?. In the course of the process of delivering the no cost credits, this imvu cheat actually protects you by simulating into your account the approach of acquiring the credits with genuine revenue. This only proofs that making use of this approach is safe for your account.

10 Tactics To help Reinvent Your IMVU CREDITS

Nicely, we can't guarantee you this that your virtual girlfriend will stay with you forever. but we can assure that you will come across a new girl within a few minutes following a breakup. Acquiring credits from right here now less difficult than ever. At the start off, we had faced a dilemma with imvu. Issues got scary when they emailed us and warned about this tool and tool our old web-site down. It was painful than a breakup but we did not give up started a new website and new tool which now capable to give credits to our Imvu customers. This group is delighted then we in a position to make men and women happy giving this tool for cost-free. you only want to set up an app just before you get credits that to take 30 seconds only.

The PlayerAuctions marketplace is the safest spot to buy low-priced IMVU credits. We have over ten years of practical experience in the digital asset exchange business. We know quite nicely how to safeguard your orders. We also have the PlayerGuardian Trading Protections. Thanks to this program all transactions produced on our site are protected. As an added safety measure, we screen and verify all provides of affordable IMVU credits ahead of they are permitted onto our web page. Lastly, all credit orders are confirmed as reputable just before we release disbursement to sellers.

IMVU is an avatar-based social MMORPG game that has the biggest 3D catalog to customize your avatar primarily based on your preferences. It is a Freemium” game that signifies it really is a free-to-play game but has an in-app purchases. In order to acquire avatars and items, you have to have credits. There are two sorts of credits Promotional Credits and Credits. Promotional Credits or promo-credits” are gift credits issued to get new customers or can be obtained by participating in unique contests or events. On the other hand, if you don't want to get credits the tough way, you can basically invest in credits using your personal cash.

youtube

As a 1st step here, put your username or e-mail ID that is associated with IMVU Mobile mobile game for account authentication. Fill in the amount of Imvu Credits you want to generate. Verify if you want to add - Unlock Vip Club Membership function. Double-verify your e-mail or username to make sure you wrote it effectively. If you are totally certain all information inserted is correct, click produce to start with the cheating. IMVU Mobile generator will commence instantaneously. Adhere to the instructions given to get limitless Imvu Credits.

You can use credits in the game to purchase costly garments and such other stuff with ease. If you don't want to end up spending too a great deal cash then attempt to remain selective and picking the appropriate garments of need to have. It can be carried out by different strategies. You have lots of dresses to opt for from. In case, you don't have how to hack imvu credits a adequate number of credits to buy new dresses then you can use IMVU credits hack and get rid of such issues way effusively. It is a extensively preferred system, and it is way more reliable than others.

The game keeps on finding tricky with the levels as quickly as the gamer reaches the highest point. The user absolutely cannot commit lot and lot of true cash to acquire credits for playing the game and get on the internet gaming experience. The strongest backup plan is to get a hacking tool and purchasing no cost imvu credits. With this plan, one particular can conveniently play the game and attain higher levels without having spending considerably of real revenue on on the web gaming. Having totally free credits with the support of hack generator make it tremendously feasible, time-saving and economical to play the game competently without the need of any delays in success.

But for carrying out all items there is a want for you to wait for too lengthy time till the approach gets completed. But devoid of undertaking all this issues also you can able to achieve a lot of resources that is when you make use of the imvu hack. This strategy would act as a improved choice for you to do trustworthy and to boost its efficiency.

0 notes

Text

Defense market a safe haven for space companies during pandemic

https://sciencespies.com/space/defense-market-a-safe-haven-for-space-companies-during-pandemic/

Defense market a safe haven for space companies during pandemic

With the global economy in the grip of the coronavirus crisis, investments are grinding to a halt, creating deep uncertainty for a commercial space sector that has seen more than $25 billion in venture capital pour in over the last decade.

Since the pandemic hit, Pentagon contracts have been a lifeline for companies in the space industry, said Chris Quilty, president of Quilty Analytics. “The Department of Defense has gone out of its way to cultivate commercial relationships and to leverage the investment in talent that exists in the commercial domain,” he told SpaceNews. “In the current emergency, the Pentagon is supporting the industry from a financial perspective through contracting practices and accelerated payment terms.”

It is somewhat ironic, said Quilty, that many commercial space companies and investors have shown a bias against the government or the military for being too slow to make decisions and award contracts. In today’s reality, Quilty said, “many companies have discovered the government in some cases has the ability to move faster than commercial entities.”

Josh Hartman, a partner at the venture firm The Flying Object, described the current business climate as a “very shaky time.”

Right before the pandemic took hold, Hartman was working to raise funds for a small company in the space sector that had drawn interest from strategic national security investors. A deal was in the works but investors pulled back, and that is happening across the board, Hartman told SpaceNews. “When the entire economy is overshadowed by something like this, all companies become lower value. It’s much more difficult to raise money.”

Hartman, who also is a senior executive at Geost Inc., a supplier of electro-optical sensors to the U.S. military, said measures taken by DoD to soften the blow to the industry puts contractors in a stronger position to weather the crisis than companies that only rely on venture capital or commercial sales.

To keep money flowing to suppliers, the Pentagon on March 20 ordered contracting officers to increase the rate of progress payments from 80 percent to 90 percent for large companies, and to 95 percent for small businesses. The payments are for work already performed, so what DoD is doing is accelerating the cash back to companies. To date, DoD said, the boost in progress payments has injected $3 billion into the defense supply chain.

Another key move intended to avert layoffs was to allow for “equitable adjustments” so contractors are not penalized for poor performance caused by the pandemic. This means companies can request adjustments to contract schedules and costs, Hartman said.

This is going to help a lot of small businesses, he said. Inevitably schedules will slow down and that will drive up overhead costs. By offering to make adjustments, said Hartman, DoD is providing a safety net to companies that, without that kind of aid, would default on their obligations and likely go out of business.

DOD’S STAKE IN COMMERCIAL INDUSTRY

In key technology sectors including space, DoD has a huge stake in the health of commercial suppliers, said Tara Murphy Dougherty, CEO of the data and analytics firm Govini.

“The picture continues to look bleak across the board,” Murphy Dougherty told SpaceNews. The economic fallout on commercial business, she said, “could undermine progress DoD has made building bridges to the small business and startup community. Those bridges I don’t think are cemented in place yet.”

Organizations like the Defense Innovation Unit and the U.S. Space Force’s Space and Missile Systems Center have been working to bring more nontraditional suppliers into the defense sector but only the companies that have actual DoD contracts have a financial safety net right now, said Murphy Dougherty.

When DoD issued a memo March 20 identifying defense contractors as “critical infrastructure” that needed to keep working during the pandemic it sent a huge message, she said. “The biggest benefit was reducing uncertainty for industry and creating some financial security.”

Despite these government actions, the long-term outlook is still blurry, Murphy Dougherty said. “Until we have a vaccine, we’ll still have to absorb the impact on operations and on the workforce, even for mission-critical companies.”

“If you look at the airline industry as a proxy from a timeline perspective, after the 9/11 terrorist attacks it took two and a half years for air travel to reach the level that existed prior to 9/11,” she said. “It’s not a perfect analogy by any means but I think we need to start thinking of compounding delays and impact that could last years.”

RISK OF FOREIGN INVESTMENT

With many U.S. businesses facing financial distress, the influx of foreign capital to companies that develop technologies for national security is a major concern, Murphy Dougherty said.

“It is hard to identify what those vulnerable companies are without really good data,” she said. “If a company is publicly traded, there’s a lot of high quality data.” With non-publicly traded companies, it’s more difficult to identify their sources of funding but not impossible.

The Pentagon is anticipating that foreign capital will target cash-strapped U.S. technology firms during and after the coronavirus crisis, Ellen Lord, undersecretary of defense for acquisition and technology, told reporters March 25.

A member of the California Air National Guard’s 216th Space Control Squadron sorts pears at a food bank in early April. Meanwhile, the Pentagon is using its contract authorities to provide a different sort of aid to space companies hit hard by the coronavirus pandemic. Credit: U.S. Space Force

The Defense Innovation Unit is watching this issue closely, said Brig. Gen. Steven Butow, who oversees the space portfolio at DIU and works with many startups in the sector.

DIU was created in 2015 to speed up the adoption of commercial technology across DoD. In addition to space, its other key areas of focus are artificial intelligence, autonomy, cyber and human systems.

Even before the pandemic, DIU had been working to identify what commercial businesses might be targeted by foreign investors, particularly from China. “The current state of affairs caused by COVID-19 does not affect this process,” Butow said in a statement to SpaceNews. “DIU has proactively engaged with our partner companies to determine how COVID-19 is affecting them and their ability to meet deliverables under current contracts.”

It’s too soon to say what the ultimate impacts might be, Butow said. “DIU continues to actively open new solicitations and execute new agreements in support of our mission to accelerate commercial technology for national security.”

CONTRACT AWARDS HELP PRIVATE FUNDING

Quilty said DoD contract announcements can make a huge impact during distressed times. For a commercial entity that is venture funded or private-equity backed, the news of a contract award, even if it hasn’t yet been executed or funded, is a major boost, he said. “If you’re an investor or a prospective investor, the fact that the company has been awarded a government contract gives you confidence to put in place bridge financing or go out for another round of fundraising.”

U.S. Air Force and Space Force procurement officials said they plan to do what they can to support suppliers. The commander of the Space and Missile Systems Center, Lt. Gen. John Thompson, told SpaceNews March 25 that SMC is issuing contracts and accelerating awards as much as possible. “Many of our nontraditional small contractors have commercial solutions that we want to try to bring into the defense acquisition ecosystem,” said Thompson. “It’s definitely a priority for us to keep those innovative small companies in play as much as possible with the available budget we have.”

The senior acquisition executive for the Department of the Air Force, Will Roper, told reporters March 27 that he worries about small businesses that have developed important technologies for national security and are now struggling.

The Air Force in recent years stood up venture-style programs aimed at attracting small businesses that have technologies applicable to national security. “We’ll continue to award every SBIR [Small Business Innovation Research] we have available,” Roper said.

Industry consultant Jo-Anne Sears, a partner at Velocity Government Relations, said many venture-funded companies in the space sector develop cutting-edge technologies that the Pentagon needs to stay ahead of rivals like China. If these companies die, the implications would be significant because of their talented workforce, she said.

Sears credited the Air Force for stepping up “out-of-cycle” SBIR projects during the coronavirus pandemic. “This program was designed to rapidly fund meaningful national security projects focused on space, hypersonics and an assortment of technical challenges,” she said. This is one way to help prevent some of these critical companies from throwing in the towel.

Hartman, the venture fund partner, said there is a chance that the landscape in the space sector will be permanently changed.

“I’m fearful that COVID-19 on the heels of a couple of bad news stories like OneWeb and Bigelow will stop the flow of capital that has sparked the space boom we have seen of late,” Hartman said. “We’ve already seen that capital is drying up but I hope it comes back within months. Otherwise, we’ll see the end of the renaissance era.”

This article originally appeared in the April 13, 2020 issue of SpaceNews magazine.

#Space

0 notes

Text

cryptocurrency trade says it cannot get right of entry to a hundred ninety million after ceo all at once died

An engineering organization that should convert Also fathom apparently each issue in the world, that energy may be blurring pretty rapidly.

Blockchain, the underlying innovation organization that forces cryptocurrencies including Bitcoin, maybe getting its last customs perused during those Invest: NYC meeting done new York, the place hundreds from claiming crypto true-believers need to be assembled Tuesday should examine the most recent patterns in the still-nascent advanced possessions business.

Read More Those decentralized innovation records and verifies transactions What’s more need been adjusted Eventually Tom’s perusing organizations including Walmart inc. What’s more Microsoft corp. Yet all the following just A decade for use, A percentage would recently state it’s perishing.

“Blockchain will be dead,” Meltem Demirors, Head venture officer about CoinShares Group, said on the sidelines of the gathering to times square. “After two, three a considerable length of time for investing a considerable measure from claiming cash looking into this and a considerable measure for financing dollars setting off under this, i think the greater address Similarly as a mogul is: What’s those versatile income model and will be there value quality that’s made for these businesses? Furthermore, seemingly those address is: not yet. ”. Tune in on the article. 3:58. Impart this article. Impart. Tweet. Post. Email. In this article. WMT. WALMART inc. 118. 87USD-1. 78-1. 48%. MSFT. MICROSOFT corp. 149. 97USD+1. 91+1. 29%. For evidence, Demirors focuses on the right on time adapters including R3, advanced advantage property What’s more Chain, which she says need aid pivoting under new business models. “Most of the organizations that brought up huge sums about capital for 2016, 2017 should raise blockchain, they don’t exist any longer or they’ve pivoted under cryptocurrency Also tokenization,” she said.

Likewise, cryptocurrencies found shoot Previously, 2017 What’s more punctual 2018, An pontoon of organizations – including stogie Makers What’s more sports-bra makers – got the money for On on the market’s relationship for those underlying blockchain technology, frequently utilizing those record Likewise a cure for dull stock returns. Yet the sudden demise pops frequently all the didn’t most recent long Furthermore Numerous for them lost steam Similarly as the value about Bitcoin What’s more other advanced advantages consequently crashed.

Information patterns Additionally indicate that blockchain’s been losing its bubble. An enormous turnaround from quite some time prior, those stream of trade under blockchain start-ups need to be dropped, as stated by information aggregated Eventually Tom’s perusing CB Insights. Organizations centering on the blockchain would for pace withdraw $1. 6 billion this year, down starting with a record $4. 1 billion In 2018, the firm said as of late.

Here’s the thing that others would say. Advanced stakes information. Mike Alfred, co-founder Furthermore CEO officer.

“Enterprise blockchain, this thought that each share of the organization will be setting off with the need to bring a blockchain, that thought could a chance to be temporarily on the ropes, Be that blockchain will be the establishment about the thing that makes the whole biological community fill in. Bitcoin’s blockchain needs to be been running for more than 10 a considerable length of time without interference. Not the slightest bit is that dead,” he said. “The current state – it has an inclination that fatigue, it has an inclination that exchanging fatigue, it has an inclination that a considerable measure for kin need aid tired in light of we’ve been in this space Furthermore everyone may be sitting tight for those space on developing dependent upon and for great things with happen. What’s more, it’s simply bringing longer over A large portion people normal Yet not the slightest bit can that imply that space is dead. ”. BitGo. Mike Belshe, CEO of the supplier of caretaker services. “We haven’t seen this clear rise of a prevailing solid player to a non-Bitcoin cryptocurrency possession – something once blockchain. Blockchain needs a considerable measure about the promise, Anyway, I imagine that blockchain’s been overhyped. Mossycup oak individuals can’t address that inquiry of The point when would you use a blockchain Furthermore The point when would you use A database,” he said.

Arca. Hassan Bassiri, a portfolio administrator In the Los Angeles-based advantage manager.

“In 2017 What’s more 2018 Throughout blast bust cycles, Everybody thought that blockchain might be the solution for virtually All that As far as mechanical transformation innovation, benefit issuance, trading, supply chain, protection operator – All that. Also gradually what individuals would begin with acknowledging maybe that blockchains are fundamentally state-funded ledgers Also it’s not a proficient framework. Really, there are not many things that have a place with respect to An open blockchain,” he said on the sidelines of the gathering. “Anything that needs effectiveness or velocity working Presumably doesn’t have a place on the blockchain. Furthermore, it’s crypto thus All that dives through An buildup cycle Also we Frequently place those trucks in front of the steed. ”.

The post cryptocurrency trade says it cannot get right of entry to a hundred ninety million after ceo all at once died appeared first on .

The post cryptocurrency trade says it cannot get right of entry to a hundred ninety million after ceo all at once died appeared first on .

from WordPress https://ift.tt/32TWNX4 via IFTTT

0 notes

Text

Deal Memo for Trella Technologies

As promised, here is my Deal Memo for Trella Technologies. Hopefully, this provides a good example of how to do one, while also giving you insight into how a evaluate start ups.

Deal Memo for: Trella Technologies

Does it fit the Thesis “Invest in software-based technology startups that provide a platform for disruptive change in an industry?”

- Yes and no, by automating the training of crops, it is allowing the hardware and labor to be taken up by software and managed by the backend software platform. However, they will need to sell hardware to spread their platform. It fits the thesis, but the hardware component means it has an additional amount of friction in implementation.

Overview. Trella produces automated crop training devices that are tied to a backend for data collection and analysis. They produce devices for residential and commercial spaces.

Market & Background.

- Vertical indoor farming market size to reach $4.1B by 2020

o Indoor farming is growing as urban populations are growing, crops need year-round production, and there is an increase in risks to crops from natural catastrophes

- Initially targeting the Cannabis market with a size to reach $57B in 2027

o Legalization of cannabis is on the rise globally, meaning commercial grows will be trying to find the most efficient methods to compete

o Regulations for residential growers are based on plant count, thus they are also trying to find the most efficient methods to keep costs down, but keep yield up.

- The market is already using training methods, but they are all manual in nature, and time-consuming. The automation of plant training will be a huge disruptor in the cannabis space, and other agriculture spaces that use plant training

- C: The how part of farming is coming under fire in current culture, which means the carbon footprint and resource usage of farming is being scrutinized. By providing a way to increase yield and decrease resource usage, it is an easy purchase for growers. Cannabis is the first market they are targeting and since it is becoming more socially acceptable and legalized, the market is primed for rapid expansion with the growers who use the most efficient methods going to be the clear winners

- T: The technology is now at a place where automated systems are easy to develop and cheap enough to sell at scale. With machine learning, it will allow automated systems to run themselves and provide more cost saving through decrease labor costs. This could be the “Technology S-Curve” jump for indoor growing and training that will shift how crop growing is done.

- E: The agriculture market has mainly seen automation adoption in the field, with indoor farming automation being a very large capital expensive projects that are built to a specific need. Trella’s solution is scalable and is at a price point that democratizes automation to smaller growers while allowing larger growers to take advantage of the lower capital expense, while also reaping from lower labor costs due to the automation and machine learning of the product. The “Technology S-Curve” jump will bring along other economic advantages to the space that can only be guessed at right now.

Founding Team.

Aja, Nicole Atwood, CEO & Co-Founder

- 15 years in the engineering industry, Mech Eng

- Eng Consulting and specialist in catastrophe risk engineering

- Started 2 companies, BAH Trading Solutions (Founder/owner), Everblume LLC (Cofounder/CTO)

- Why: Has an ethos of success comes from creating innovative technologies that can be shared with communities that need them the most. Has some founder experience

Andres “Dre” Chamorro III

- 15 years of engineering experience for devices in the medical industry

- 39 patents pending, 24 issued patents

- Seasoned manager

- On the founding team at Cambridge Endoscopic Devices, inc

- Why: Has project management experience, is a creator at heart, was part of a founding team before and the product he helped create was successful when it hit the market

Business Model & Strategy.

- Has 3 model types. 2 standard models and 1 model that is customized. The 2 standard are recommended for Residential and Commercial. The customized model is for commercial only.

- They are tackling the traditional farming in the fields, by providing an automated solution for indoor farming. The products have the ability to scale very easily as the backend control systems can be scaled.

- Product has clear advantages to other indoor methods as it is the only automated system that trains plants using Low-Stress Training. Seeing an increase of 25% crop yield

- The business model is through hardware sales, and a SAAS based app to help track and optimize the output

- There is a clear vacuum in the industrial indoor farming space. This has the potential to fill that void. There are other automated systems, but the ability to train the plants gives this product a clear advantage in resource usage per yield

- Based on the current business model, this will allow the company to maintain revenue through SAAS based app. This could be priced per number of machines being connected to the backend. This would allow the company to get around the one time revenue generation that is inherent with hardware-based companies.

Competition.

- Current training methods, low threat, high resource, and labor costs with less yield

- Large Scale Automated Growing Houses, medium-high threat, high capital expense, not as flexible or scalable

- Other Automated methods that do not train, low thread, similar cost but lower yield

Investment Positives

- The team has lots of experience, and this is a passion project. The team is running on a mission, not greed

- Other automated plant training and growing solutions do not exist

- This represents a technological leap in the indoor growing space

- This is a platform that can scale on the customers’ requirements

- Ability to license out the technology

- They have first to market advantage

Investment Concerns.

- This does not get the traction needed in order to hit the break-even revenue point due to manufacturing costs

- An incumbent sees this product and shifts their offerings to include a way to train plants, or comes out with another product to increase yield and decrease labor costs

- Automation is getting cheaper to do, a flood of products could drown out Trella

Exit Scenarios.

- Currently, the founders have voiced a wanted to be a strategic acquisition by a larger company with the capacity for global distribution.

- If they fail, at the very least they can sell off their patents to a company for liquidation

Home Run Scenario:

- The home run scenario is that this company becomes a large key player in the Agriculture Technology space with an IPO and continued market valuation increase. Possible if they have can hit escape velocity and can be introduced to a partner who can give them access to a global distribution network.

#Trella#cannabis#agtech#agriculture#technology#deal memo#startups#startup guide#advice#strategy#consulting#entrepreneur#vc#venture capital#Angel investing#learning#investing#innovation#grit#networking#mentorship#mentor#mentee

0 notes

Text

Leatt Corp Announces First Quarter 2019 Results

CAPE TOWN, South Africa, May 13, 2019 /PRNewswire/ — Leatt Corporation (OTCQB: LEAT), a leading developer and marketer of protective equipment and ancillary products for many forms of sports, especially extreme high-velocity sports, today announced financial results for the first quarter ending March 31, 2019. All financial numbers are in U.S. dollars.

First Quarter 2019 Highlights

Revenues increased by 11%, to $6.1 million

Knee brace sales volume increased by 49%

Helmet revenues increased by 9%; strong demand continues

Other Products, Parts and Accessories category increases by 99% on strong demand for new line of goggles

Successful global launch of Leatt Velocity 6.5 line of goggles; awarded product of the month in April 2019 by Descend Mountain Bike