#urbantransitlivetowork

Explore tagged Tumblr posts

Text

Mixed-Use, Shovel Ready Sustainable Development, Newark, New Jersey

Sponsor and developer R.K. Caldwell Inc. is pleased to announce it reached an agreement with Clay Street Associates for shovel-ready Spring Street Commons, a sustainable development, to be built 96,780 square foot, 5-story mixed-use rental community, at the intersection of Spring Street Route 21/McCarter Highway along the Passaic River situated in the Newark River Public Access Redevelopment Lower Broadway Area.

Development Cost is estimated to be in the neighborhood of $23 million dollars. The project will offer three (3) retail spaces along Clay Street on the ground floor, each with their own entrance from the sidewalk totaling 4,630 square feet. Residence amenities will include a shuttle service, tenant concierge services, fitness center and business center on the ground floor, and a rooftop garden at Spring Street Meadows featuring an outdoor sitting and recreational area. The second through fifth floors are apartments, thirteen (13) one bedrooms and eight (8) two bedrooms per floor for a total of 84 units. The one-bedroom units will range in size from 690 to 840 square feet and the two-bedrooms will range in size from 980 to 1,100 square feet. Each unit has living/dining, bathroom, kitchen, in-unit washer/dryer, and an on-site covered and uncovered parking for the residence and retail tenants.

Spring Street Commons is extremely appealing to renters due to its easy access to New York City by train from the New Jersey Transit Broad Street Station (5-minute walk) and New Jersey Transit bus lines, Rutgers-Newark, Seton Hall Law, New Jersey Institute of Technology, the Gateway downtown Newark business district, and Newark’s Riverfront which includes parks, walking and biking trails, sports fields and courts, a floating boat dock, a riverfront boardwalk, playground and many other settings.

Construction is expected to begin mid-August 2017, marketing and early leasing of the units expected to begin June of 2018

CONCEPTUAL RENDERING PROVIDED BY COMITO ASSOCIATES P.C.

Visit http://www.rkcinvestment.com/contact-1.html and send a message to learn more about this project or visit www.rkcinvestment.com to learn more about R.K. Caldwell Inc.

About the Author of this Blog:

Richard Caldwell is a real estate professional and entrepreneur with a B.S. in Real Estate from New York University. He is the Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm focused on sustainable investment in urban transit live-to-work communities.

Follow me on twitter https://twitter.com/RKCInvestment

0 notes

Text

Northern New Jersey Apartment Market Report

Market Overview

The Northern New Jersey apartment market is comprised of 225,828 units in seven geographic concentrations ranging in size from the 50,233 unit Hudson County submarket to the West Essex County submarket, which accounts for 16,836 units. In the nine-year period beginning in Q1 2007, the Hudson County submarket has experienced the greatest introduction of new inventory, 13,184 units, amounting to 55.0% of all new market rate rentals added to the market.

Asking and Effective Rent

During the fourth quarter of 2016, asking rents rose by 0.2% to an average of $1,817. Mean unit prices in the market are as follows: studios $1,250, one bedrooms $1,596, two bedrooms $2,167, and three bedrooms $3,251. This advance extends the market's run of gains to nineteen quarters, during which asking rents have risen by a total of 17.2%. Since the beginning of Q1 2007, the market as a whole has recorded an annual average increase of 2.5%. Effective rents, which exclude the value of concessions offered to prospective tenants, rose by 0.3% during the fourth quarter to an average of $1,768. During the past four quarters, positive movement in asking rent was recorded in all seven of the market's submarkets.

Competitive Inventory, Household Formations, Absorption

The fourth quarter added 2,450 net new households to the Northern New Jersey MSA. Quarterly movement in the average occupancy level of market rate apartment properties rarely mirrors the period's total household formation or losses, but it is advisable to weigh longer-term economic and demographic trends as factors contributing to current demand. Since the beginning of Q1 2007, household formations in Northern New Jersey have averaged 0.6% per year, representing the average annual addition of 9,600 households. Demand attributable in part to this pace of household formations contributed to the absorption of 1,040 units during the fourth quarter, while new development added 140 units to the metro inventory; the net effect of absorption and construction dynamics caused the vacancy rate to drift downward by 40 basis points to 3.8%. Over the last four quarters, market absorption totaled 3,440 units, 66.4% greater than the average annual absorption rate of 2,067 units recorded since the beginning of Q1 2007. In a long-term context, the fourth quarter vacancy rate is 0.2 percentage points lower than the 4.0% average recorded since the beginning of Q1 2007.

Outlook

Between now and year-end 2018, 12,493 additional units is projected to be introduced to the market inventory. Net new household formations at the metro level over the same period are anticipated to average 0.7% annually, enough to facilitate an absorption rate averaging 4,211 units per year. Because this amount does not exceed the forecasted new construction, the market vacancy rate will increase by 150 basis points to finish 2018 at 5.3%. On an annualized basis through 2017 and 2018, asking and effective rents are expected to advance by 3.1% and 2.9%, respectively, to finish 2018 at $1,933 and $1,873.

About the Author of this Blog:

Richard Caldwell is a real estate professional and entrepreneur with a B.S. in Real Estate from New York University. Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm focused on urban transit live-to-work communities.

Follow me on twitter https://twitter.com/RKCInvestment or visit www.rkcinvestment.com.

0 notes

Text

Housing For An Inclusive “Brick City”

By Richard Caldwell

As an advocate for affordable housing, the question remains, how does local government set policy that’s financially adequate for the developer and the future housing market conditions?

As a real estate entrepreneur and CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., I’m constantly examining public policy aspects of land use and how it impacts housing development projects.

On February 1, 2017, the City of Newark, New Jersey passed its Inclusionary Zoning for Affordable Housing. The zoning change requires market rate housing developments with 30 or more residential units to provide 20% of the units as affordable for low to moderate income persons earning 50% or below area Essex County Median Income (AMI).

The goal is to have market-rate units that are being developed “cross-subsidizing” the affordable units in the same building. Such a program can work, as long as market-rate development continues—without the need for any direct expenditure from the City of Newark's subsidy dollars and rents continue to climb and construction, operating and land cost don't increase.

The policy also allows the developer the option to comply by providing a direct subsidy contribution of $100,000 per unit for off-site affordable housing or by writing a check, to the City’s affordable housing trust fund.

Let’s take a look at a scenario:

A 72 unit residential rental project, requires 14 units set aside as affordable housing in the building. Keep in mind, the affordable housing units are deed restricted units for as many as 30 years. Often matching the property tax abatement period. Here are the developer’s three options.

Option 1 - write a check to the City of Newark’s Affordable Housing Trust Fund in the Amount of $1,400,000;

Option 2 - Provide $1,400,000 to an off-site affordable housing development project in the municipality; and

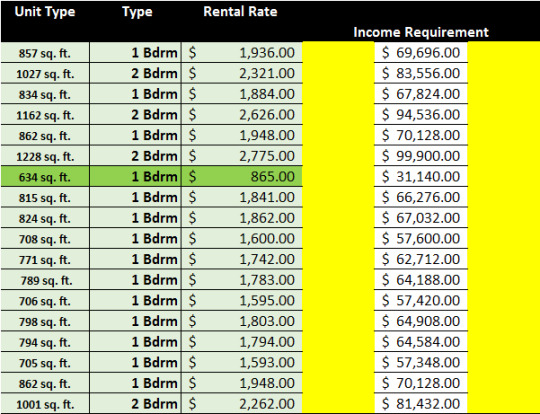

Option 3 - Have 14 deed restricted units in the property, greatly reducing monthly and annual income, say 100% in the best housing sub-market where in-place rents are between $1.97 to $2.26 per square feet. See the illustration below! The unit highlighted in green indicates 1, affordable unit, on one floor.

In the above illustration, and assuming it’s a 5-story mid-rise, with 13 additional affordable units spread out on each floor, the building contains a range of market types, designing such a program that can work city-wide is admittedly complexed.

If Newark wants to encourage continued development of both market-rate and affordable units, it must consider how its policy may influence the choices that developers and landowners make. Most of these types of housing developments are FHA construction to permanent financed, to originate, underwrite can take anywhere from 8 to 12 months, market conditions could change prior to construction commencing.

In neighborhoods where in-place rents are high enough to support new mid-rise development, and with additional density alone, creating the cross-subsidy needed to support the creation of more affordable units while still allowing developers to earn what we understand to be a commonly expected return on investment. (using the stabilized net operating income of the first full year of operation divided by the total development cost, that includes hard cost, soft cost, and land). The higher the rents, the higher the percentage of the added units that can be affordable without diminishing the developer’s overall return.

Most of the sub-markets in Newark, rents are not high enough to spur cross-subsidies in development projects in the first place, even if the land were free. Adding additional density alone will not spur development in these neighborhoods and so development in these areas will still need to be subsidized by the City of Newark. The inclusionary zoning for affordable housing provides the needed subsidy, and the inclusionary zoning should apply in the stronger housing sub-markets or wards of Newark, not the undervalued sub-markets or wards of Newark.

Congratulations to the Honorable Mayor Ras Baraka, City Council and the Department of Economic & Housing Development! This will spur needed housing revitalization in sub-markets or wards of Newark and help develop permanent housing for the most vulnerable population while putting old dilapidated housing stock back into productive use.

About the Author:

Richard Caldwell is a 20-year real estate professional and entrepreneur with a B.S. in Real Estate from New York University. Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm and RKC Real Estate Investment LLC., a private real estate fund focused on urban transit live-to-work communities.

Follow and share on twitter, facebook or visit us at www.rkcinvestment.com to learn more.

0 notes