Link

This blog will continue to feature articles and news releases on the Administration’s proposed budget cuts to the Department of Housing and Urban Development (HUD).

About the Author of this Blog:

Richard Caldwell is a real estate professional and entrepreneur with a B.S. in Real Estate from New York University. He is the Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm focused on sustainable investment in urban transit live-to-work communities.

Follow me on twitter https://twitter.com/RKCInvestment and Facebook

https://www.facebook.com/rkcaldwellinc

0 notes

Link

This blog, features social investing, also known as impact investing and sustainable investing. I am also a real estate entrepreneur that concentrates on emerging real estate markets in the New York and Philadelphia metropolitan sub-markets with a main goal of impact or sustainable real estate investing, "Developing Communities Of Inclusionary Living For All". I came across this post on LinkedIn and wanted to share it on my blog. There are so many great points anyone thinking of real estate investing should take from this. You can also visit www.rkcinvestment.com contact page with any real estate questions on multifamily and commercial real estate.

0 notes

Text

Housing The Most Vulnerable “HUD Must Preserve These Programs”

April 14, 2017

By Richard Caldwell

In the State of New Jersey, a homeless person with a work history is eligible to receive $764.25 a month in social security insurance benefits (SSI). If there is no work history, the person homeless receives no income. Yes, zero income! So how do we provide permanent affordable housing for the nation's most vulnerable! Here is a quick summary:

According to the Department of Housing Urban Development, Permanent Housing is Long-term rental or owned housing, includes permanent supportive housing programs (long-term, community-based housing with supportive services for homeless persons with disabilities); and excludes transitional housing/emergency shelter.

The Department of Housing Urban Development requires that the Continuum of Care Program conduct an annual count of homeless persons who are sheltered in emergency shelter, transitional housing, and Safe Havens on a single night in January. This is referred to as a Point-in-Time (PIT) count of sheltered and unsheltered homeless persons. The annual count takes place during the last 10 days of January in accordance with requirements from the U.S. Department of Housing and Urban Development (HUD).

HUD’s Continuum of Care (CoC) Program is designed to promote communitywide commitment to the goal of ending homelessness; provide funding for efforts by nonprofit providers, and State and local governments to quickly rehouse homeless individuals and families while minimizing the trauma and dislocation caused to homeless.

The Continuum of Care (CoC) Program interim rule in the Federal Register on July 31, 2012, became effective August 30, 2012, establishing the requirements for the CoC Program, including requirements for applying for, and administering, grant funds as well as the regulatory implementation of the Continuum of Care and its responsibilities. Prior to the Trump Administration, consolidation of Shelter Plus Care Program; the Supportive Housing Program; and the Section 8 Moderate Rehabilitation Single Room Occupancy Program occurred.

We now need to advocate the importance of the Continuum of Care Program as well as other federal programs, i.e. Emergency Solutions Grants, Community Development Block Grants, HOME Funds and Low-Income Housing Tax Credits. All programs that directly support the individual and family.

Emergency Solutions Grants provide grants by formula to states, metropolitan cities, urban counties and U.S. territories supporting homelessness prevention, emergency shelter, and related services. If funding is drastically cut or eliminated, what happens to the Point-in-Time census, that's taking annually. Do we ignore the need to continue to fund needed programs and develop much needed safe and quality supportive housing?

For the purpose of this article, I am focusing on Newark, New Jersey, which is the State’s largest City. Statistically, in 2016, Point-in-Time Count increased over 100% since 2015 where other areas or the national average may have been reduced. We also need to take into account the homeless identified as male, female, transgender, and among those with mental and physical disabilities. This will help further understand the type of housing and services that are required in Newark or another region.

After a visit to a homeless shelter, the homeless person enters supportive services, assuming a Housing Choice Voucher or Project-based Voucher is available. In my previous blog, April 9, 2017, 30% of a household's income can be applied towards housing, making housing affordable. A homeless person would be required to spend $229 of $764.25 towards their monthly rent. If there is no income, the homeless person remains in a shelter, until a source of income is identified, costing the tax payers to house the homeless individual on a monthly average of $2,600. With that said, HUD’s fair market 1 bedroom monthly rent in North Jersey’s $1,063 and based on affordability being 30%, rent would need to fall around $980, and that doesn’t include other related housing expenses. Addressing our homeless crises needs should not be ignored. It’s moral responsibility of everyone.

About the Author of this Blog:

Richard Caldwell is a real estate professional and entrepreneur with a B.S. in Real Estate from New York University. He is the Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm focused on sustainable investment in urban transit live-to-work communities.

Follow me on twitter https://twitter.com/RKCInvestment

0 notes

Text

Investing In Live-To-Work Communities, “Why Affordable Housing Matters”

April 9, 2017

By Richard Caldwell

When you’re looking for a place to live, one number rules your world: You should spend no more than 30 percent of your income on housing. You may hear that rule of thumb from a landlord or lender. It’s embedded in online budget calculators and federal policies. There’s just one problem: It’s essentially an arbitrary number, creating more distortions than it actually solves.

If the 30 percent rule ever made sense—which economists contest—it’s almost meaningless now, when almost 51 million U.S. households spend more. Income growth has been tepid, yet home prices are rising and rents have soared, threatening to make cities unaffordable for average earners. In New Jersey Cites, any available reasonably priced housing quickly disappears. The competition at the bottom end is fierce.

The ratio’s roots date to 1969, when Edward Brooke (R-Mass.), the first black senator elected since Reconstruction, pushed through a law to help the poorest of the poor afford shelter. The Brooke Amendment, as it became known, capped rent in public housing at 25 percent of residents’ income. Former Representative Barney Frank (D-Mass.) later called it “one of the greatest acts of compassion ever to pass this body.” Facing a budget crunch in 1981, Congress raised the rent ceiling to 30 percent, and it’s held there ever since. Mortgage giants Fannie Mae and Freddie Mac apply a 28 percent cutoff for home loans they buy from lenders.

Even before the Brooke Amendment became law, economists said the ratio oversimplified the affordability question. In the intervening decades, many have come to favor what’s known as the “residual income” approach, which focuses on whether a family can afford other necessities after paying for housing. If your income is $500,000 a year, you can pay 40 percent and still have money left, but if your income is $20,000 a year, it will be hard to make ends meet if you’re paying 30 percent of your income on rent.

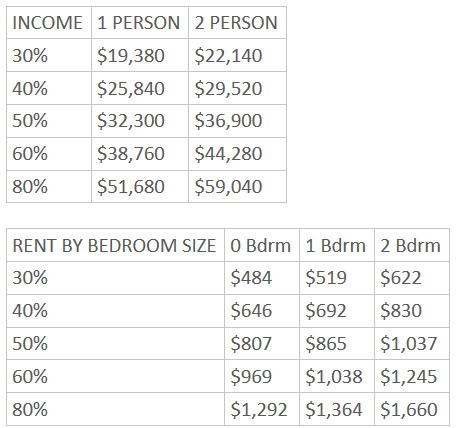

The Department of Housing Urban Development’s 2016 Income Limits and Maximum Rents Area 13 Essex County, New Jersey for affordable housing is highlighted below for a one (1) and two (2) person household and maximum rent cost the tenant pays in an affordable housing unit.

Michael Stone was a professor at the University of Massachusetts at Boston and studied the economic and housing issue of affordable housing and the poor since the 1970s. Stone coined the term “shelter poverty” to describe the condition of people who spend so much on housing that they must cut back on other necessities, such as food and health care. Stone found that the total number of households paying too much for housing according to the 30 percent ratio is roughly the same as under the residual income approach, but the composition of the groups is different. “Families with two incomes and no children can spend more on housing than those with kids, which must pay more for everything from clothes to day care”.

Stone wrote in a 2006 paper that using the residual income approach reveals how “affordability problems for families with children are rather more severe than usually thought.” He proposed that government programs for first-time home buyers provide borrowers with a residual income calculation to help them avoid getting in over their heads.

Most affordable housing rental developments require a combination of Federal rent subsidies, i.e. project based vouchers or tenant-based vouchers, federal subsidies, i.e. Community Development Block Grants (CDBG) and Home Funds with either 4% or 9% Low Income Housing Tax Credits (LIHTC), and property tax abatements, also known as PILOT’s (Payment In lieu of Taxes) to reduce the cost of development, keeping housing costs at 30 percent of income., which has an intended effect: It encourages people to live in cities where housing costs that are higher more affordable and the quality of life is better.

In New Jersey, the State determines where low-income housing tax credit allocations go in the State, while the municipal and county economic development agencies decide, what projects receive the federal subsidies, such as Community Development Block Grants or Home Funds. We should account for the fact that in New Jersey, when you pay for housing you are not only paying for the cost of shelter, you are also paying for access to jobs and amenities, since many New Jersian's, commute to work and probably chose to live where housing is cheaper, not factoring in transportation cost. We need to develop a subsidy formula that would account for the extra cost associated with living in desirable cities.

New Jersey Municipalities could use inclusionary zoning for affordable housing, requiring 20% of the project be set-aside for affordable units, providing affordable housing to families and individuals at 50% of the area median income or the developer make a contribution to the municipality’s affordable housing trust fund, providing developers with a choice. This way, market-rate developments are subsidizing affordable housing. Instead, we see affordable housing be subsidies by the federal government in communities that don't need the subsidy; instead, the government should focus the limited funds earmarked for housing aid on struggling regions or urban transit communities where housing cost has soared, and subsidizing mixed-income developments.

For many families, getting to and from work is the second-largest monthly expense, one that’s directly tied to where they live. A house in a far-out suburb may look cheap, but add in gas for an hour-long commute and the cost rises considerably. Developers are increasingly building high-end housing near public transit, which in some cases pushes lower-income families to less convenient locations.

“Live-to-work urban transit communities, we should account for the fact, when you pay for housing you are not only paying for the cost of shelter, you are also paying for access to jobs.”—Richard Caldwell

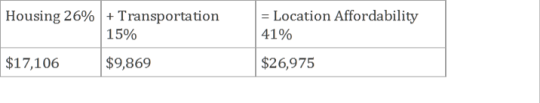

The Department of Transportation and the Department of Housing and Urban Development “location affordability index” shows how housing and transportation costs compare with income in your area. In New Jersey, much of affordable housing developments are created around the state's affordable housing allocation plan, directing low-income housing tax credits away from our New Jersey Urban Transit Cities.

As a developer of both market-rate and affordable housing, I share with many on continued revitalization of housing and quality of life in the City of Newark, New Jersey, and our urban transit communities. I used Newark, New Jersey as the basis of my analysis, because of my commitment to further help create economic growth and believe in mixed-income housing around transit would allow many low-income households to dispense of a car, making a household saving.

For Renters, the median annual Income for a family is $65,791 for a family of four (4) in Newark, New Jersey.

Average Cost as a percent of income in the below chart

On Average, Medium - Income Family Household in Newark, New Jersey would

· Own 1.5 vehicles

· Drive 16,823 miles annually

· Take 603 transit trips annually

Coming up with a practical alternative to the 30 percent rule isn’t easy because many factors influence affordability. The statistical model behind HUD’s location affordability index is the result of almost a decade of research and includes 30 variables. Maybe affordability standards should be on a sliding scale that accounts for other measures such as location, family size, and income. The 30 percent rule’s simplicity may be why it has endured despite decades of criticism. It makes it easy to compare locations and measure housing trends over time.

About the Author of this Blog:

Richard Caldwell is a real estate professional and entrepreneur with a B.S. in Real Estate from New York University. He is the Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm focused on sustainable investment in urban transit live-to-work communities.

Follow me on twitter https://twitter.com/RKCInvestment, http://socialinvesting.tumblr.com, https://www.facebook.com/rkcaldwellinc and visit www.rkcinvestment.com

0 notes

Text

Mixed-Use, Shovel Ready Sustainable Development, Newark, New Jersey

Sponsor and developer R.K. Caldwell Inc. is pleased to announce it reached an agreement with Clay Street Associates for shovel-ready Spring Street Commons, a sustainable development, to be built 96,780 square foot, 5-story mixed-use rental community, at the intersection of Spring Street Route 21/McCarter Highway along the Passaic River situated in the Newark River Public Access Redevelopment Lower Broadway Area.

Development Cost is estimated to be in the neighborhood of $23 million dollars. The project will offer three (3) retail spaces along Clay Street on the ground floor, each with their own entrance from the sidewalk totaling 4,630 square feet. Residence amenities will include a shuttle service, tenant concierge services, fitness center and business center on the ground floor, and a rooftop garden at Spring Street Meadows featuring an outdoor sitting and recreational area. The second through fifth floors are apartments, thirteen (13) one bedrooms and eight (8) two bedrooms per floor for a total of 84 units. The one-bedroom units will range in size from 690 to 840 square feet and the two-bedrooms will range in size from 980 to 1,100 square feet. Each unit has living/dining, bathroom, kitchen, in-unit washer/dryer, and an on-site covered and uncovered parking for the residence and retail tenants.

Spring Street Commons is extremely appealing to renters due to its easy access to New York City by train from the New Jersey Transit Broad Street Station (5-minute walk) and New Jersey Transit bus lines, Rutgers-Newark, Seton Hall Law, New Jersey Institute of Technology, the Gateway downtown Newark business district, and Newark’s Riverfront which includes parks, walking and biking trails, sports fields and courts, a floating boat dock, a riverfront boardwalk, playground and many other settings.

Construction is expected to begin mid-August 2017, marketing and early leasing of the units expected to begin June of 2018

CONCEPTUAL RENDERING PROVIDED BY COMITO ASSOCIATES P.C.

Visit http://www.rkcinvestment.com/contact-1.html and send a message to learn more about this project or visit www.rkcinvestment.com to learn more about R.K. Caldwell Inc.

About the Author of this Blog:

Richard Caldwell is a real estate professional and entrepreneur with a B.S. in Real Estate from New York University. He is the Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm focused on sustainable investment in urban transit live-to-work communities.

Follow me on twitter https://twitter.com/RKCInvestment

0 notes

Text

Northern New Jersey Apartment Market Report

Market Overview

The Northern New Jersey apartment market is comprised of 225,828 units in seven geographic concentrations ranging in size from the 50,233 unit Hudson County submarket to the West Essex County submarket, which accounts for 16,836 units. In the nine-year period beginning in Q1 2007, the Hudson County submarket has experienced the greatest introduction of new inventory, 13,184 units, amounting to 55.0% of all new market rate rentals added to the market.

Asking and Effective Rent

During the fourth quarter of 2016, asking rents rose by 0.2% to an average of $1,817. Mean unit prices in the market are as follows: studios $1,250, one bedrooms $1,596, two bedrooms $2,167, and three bedrooms $3,251. This advance extends the market's run of gains to nineteen quarters, during which asking rents have risen by a total of 17.2%. Since the beginning of Q1 2007, the market as a whole has recorded an annual average increase of 2.5%. Effective rents, which exclude the value of concessions offered to prospective tenants, rose by 0.3% during the fourth quarter to an average of $1,768. During the past four quarters, positive movement in asking rent was recorded in all seven of the market's submarkets.

Competitive Inventory, Household Formations, Absorption

The fourth quarter added 2,450 net new households to the Northern New Jersey MSA. Quarterly movement in the average occupancy level of market rate apartment properties rarely mirrors the period's total household formation or losses, but it is advisable to weigh longer-term economic and demographic trends as factors contributing to current demand. Since the beginning of Q1 2007, household formations in Northern New Jersey have averaged 0.6% per year, representing the average annual addition of 9,600 households. Demand attributable in part to this pace of household formations contributed to the absorption of 1,040 units during the fourth quarter, while new development added 140 units to the metro inventory; the net effect of absorption and construction dynamics caused the vacancy rate to drift downward by 40 basis points to 3.8%. Over the last four quarters, market absorption totaled 3,440 units, 66.4% greater than the average annual absorption rate of 2,067 units recorded since the beginning of Q1 2007. In a long-term context, the fourth quarter vacancy rate is 0.2 percentage points lower than the 4.0% average recorded since the beginning of Q1 2007.

Outlook

Between now and year-end 2018, 12,493 additional units is projected to be introduced to the market inventory. Net new household formations at the metro level over the same period are anticipated to average 0.7% annually, enough to facilitate an absorption rate averaging 4,211 units per year. Because this amount does not exceed the forecasted new construction, the market vacancy rate will increase by 150 basis points to finish 2018 at 5.3%. On an annualized basis through 2017 and 2018, asking and effective rents are expected to advance by 3.1% and 2.9%, respectively, to finish 2018 at $1,933 and $1,873.

About the Author of this Blog:

Richard Caldwell is a real estate professional and entrepreneur with a B.S. in Real Estate from New York University. Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm focused on urban transit live-to-work communities.

Follow me on twitter https://twitter.com/RKCInvestment or visit www.rkcinvestment.com.

0 notes

Text

Housing For An Inclusive “Brick City”

By Richard Caldwell

As an advocate for affordable housing, the question remains, how does local government set policy that’s financially adequate for the developer and the future housing market conditions?

As a real estate entrepreneur and CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., I’m constantly examining public policy aspects of land use and how it impacts housing development projects.

On February 1, 2017, the City of Newark, New Jersey passed its Inclusionary Zoning for Affordable Housing. The zoning change requires market rate housing developments with 30 or more residential units to provide 20% of the units as affordable for low to moderate income persons earning 50% or below area Essex County Median Income (AMI).

The goal is to have market-rate units that are being developed “cross-subsidizing” the affordable units in the same building. Such a program can work, as long as market-rate development continues—without the need for any direct expenditure from the City of Newark's subsidy dollars and rents continue to climb and construction, operating and land cost don't increase.

The policy also allows the developer the option to comply by providing a direct subsidy contribution of $100,000 per unit for off-site affordable housing or by writing a check, to the City’s affordable housing trust fund.

Let’s take a look at a scenario:

A 72 unit residential rental project, requires 14 units set aside as affordable housing in the building. Keep in mind, the affordable housing units are deed restricted units for as many as 30 years. Often matching the property tax abatement period. Here are the developer’s three options.

Option 1 - write a check to the City of Newark’s Affordable Housing Trust Fund in the Amount of $1,400,000;

Option 2 - Provide $1,400,000 to an off-site affordable housing development project in the municipality; and

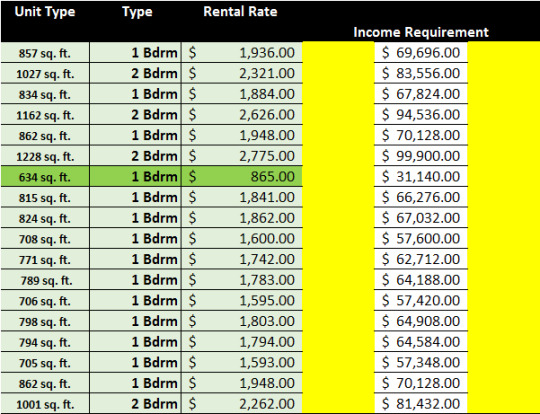

Option 3 - Have 14 deed restricted units in the property, greatly reducing monthly and annual income, say 100% in the best housing sub-market where in-place rents are between $1.97 to $2.26 per square feet. See the illustration below! The unit highlighted in green indicates 1, affordable unit, on one floor.

In the above illustration, and assuming it’s a 5-story mid-rise, with 13 additional affordable units spread out on each floor, the building contains a range of market types, designing such a program that can work city-wide is admittedly complexed.

If Newark wants to encourage continued development of both market-rate and affordable units, it must consider how its policy may influence the choices that developers and landowners make. Most of these types of housing developments are FHA construction to permanent financed, to originate, underwrite can take anywhere from 8 to 12 months, market conditions could change prior to construction commencing.

In neighborhoods where in-place rents are high enough to support new mid-rise development, and with additional density alone, creating the cross-subsidy needed to support the creation of more affordable units while still allowing developers to earn what we understand to be a commonly expected return on investment. (using the stabilized net operating income of the first full year of operation divided by the total development cost, that includes hard cost, soft cost, and land). The higher the rents, the higher the percentage of the added units that can be affordable without diminishing the developer’s overall return.

Most of the sub-markets in Newark, rents are not high enough to spur cross-subsidies in development projects in the first place, even if the land were free. Adding additional density alone will not spur development in these neighborhoods and so development in these areas will still need to be subsidized by the City of Newark. The inclusionary zoning for affordable housing provides the needed subsidy, and the inclusionary zoning should apply in the stronger housing sub-markets or wards of Newark, not the undervalued sub-markets or wards of Newark.

Congratulations to the Honorable Mayor Ras Baraka, City Council and the Department of Economic & Housing Development! This will spur needed housing revitalization in sub-markets or wards of Newark and help develop permanent housing for the most vulnerable population while putting old dilapidated housing stock back into productive use.

About the Author:

Richard Caldwell is a 20-year real estate professional and entrepreneur with a B.S. in Real Estate from New York University. Founder, CEO & Head of Direct Investments In Real Estate for R.K. Caldwell Inc., a real estate development, asset management, and fund management firm and RKC Real Estate Investment LLC., a private real estate fund focused on urban transit live-to-work communities.

Follow and share on twitter, facebook or visit us at www.rkcinvestment.com to learn more.

0 notes

Text

Housing The Most Vulnerable

R.K. Caldwell Inc. is teaming up with the City of Newark's Economic and Housing Development, Division of Housing Assistance to renovate two buildings into 55 permanent housing units with supportive services for the most vulnerable homeless in Newark, New Jersey.

According to the Newark Downtown District homeless count data collected in 2013 and 2015, 245 people lived unsheltered in six specific areas of downtown Newark: Penn Station, Broad, and Market Streets, underpass of Interstate 280 and McCarter Highway. Of those identified, 75% are male, 24.4% female, and 6% transgender. Among those with disabilities, 46.4% have a physical disability and 42.2% have a diagnosed mental illness. According to the 2016 Point-In-Time Count (PITC), the unsheltered homeless count has increased over 100% since last year, with a high concentration living in Newark.

R.K. Caldwell, Inc., seeks architects, engineers, licensed contractors and other related professional services, priority will be given to Newark, New Jersey-based companies. If interested in joining this social impact development project, please contact Richard Caldwell at 201-800-2927 or send me an email at [email protected], reference Hillside Community II Urban Renewal.

0 notes

Text

Cross Subsidies for Mixed-Income Rental Developments

February 25, 2016

R.K. Caldwell is sponsoring the development of a two phase 95+ mixed-income rental development set to break ground this year. Using profits from market-rate rentals to subsidize the costs of the affordable ones while using cross subsidies from public sources.

Cross subsidies use income from market-rate units to help finance affordable housing. Technically speaking, RKC will not directly finance the affordable units, rather use public subsidies; merely making the overall development more financially feasible by incorporating the market rate units, and therefore less reliant on public subsidies. The term "cross subsidies" relays the concept that mixed-income developments can use the market to effectively subsidize and finance the gap created by renting housing at below-market rates. Depending upon the ratio of market-rate to affordable units established and the strength of the market, many of these developments may still require some direct or indirect public subsidies. An example of a cross subsidized development would be a development project with market-rate condominium units or market rate rental units and affordable for-sale or rental units that uses the profits from the sale of the market rate condominiums or rentals to fill the financing gap that is created by selling or renting the affordable units below their market value. RKC will be banking on a healthy demand for the market-rate units, since a market with significantly lower rents makes the use of cross-subsidies more challenging. For cross-subsidies to be effective, RKC may need to combine other approaches. Private/Public long-term land leases, where publicly owned land is made available for little or no cost, or increasing the allowable density of the planned development - often an incentive used to provide greater opportunity for RKC greater opportunity for profits on the market rate units, offsetting the costs of the affordable units. RKC’s planned developments are located in the Southward of Newark, New Jersey, and will require significant public subsidies to close the financing gap on the affordable units. Determining the right ration of affordable to market-rate units and the right incentives will require a thorough understanding of the market and establishing a comprehensive neighborhood revitalization plan of vacant dilapidated housing stock around planned developments in the Southward.

About the Author: Richard Caldwell is a 20 year real estate professional and entrepreneur with formal education in real estate; and extensive experience in real estate finance, real estate development, asset management, and construction. A Co-Founder of several successful real estate investment and development start-ups and ventures between 2000 and 2010. Richard Caldwell is Founder and CEO, of R.K. Caldwell Inc. and RKC Real Estate Investment LLC. Follow and share on twitter, facebook or visit us at www.rkcinvestment.com to learn more.

b�I�i�N�

0 notes

Text

Transitioning Our Homeless to Permanent Housing

January 22, 2016

R.K. Caldwell Inc. is launching its Social Impact Multi-Asset Fund I to bring transitional and permanent housing to homeless families, couples, and single men and woman in transit-hubs across Northern New Jersey. The Social Impact Multi-Asset Fund was established from RKC’s Private Equity Groups initiative #RevampingNewarkNJ,

Accredited Investors can invest and receive market rate returns, at the same time helping a growing homeless population move from transitional shelters to permanent housing through RKC’s Multi-Asset Fund I “Rapid Re-Housing Plan”

To learn more and be part of RKC’s investor community complete RKC’s investor qualification questionnaire or contact the investor relations department at [email protected].

About the Author:

Richard Caldwell is a 20 year real estate professional and entrepreneur with formal education in real estate; and extensive experience in real estate finance, real estate development, asset management, and construction. A Co-Founder of several successful real estate investment and development start-ups and ventures between 2000 and 2010; before Founding, R.K. Caldwell Inc. in 2010.

Richard Caldwell is Founder and CEO, of R.K. Caldwell Inc. and RKC Real Estate Investment LLC., a making real estate investments, and providing asset management and investor relations.

Follow and share on twitter, facebook or visit us at www.rkcinvestment.com to learn more.

0 notes

Text

Will Title III Play A Role In Social Impact Investing

This blog talks about Social Investing, also known as impact investing, and is not meant for any legal interpretation of the discussion. For those of you not familiar, Social impact refers to “investments", made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return.

Impact investments can be made in both emerging and developed markets, and target a range of returns, depending upon the circumstances. Impact investing tends to have roots in either social issues or environmental issues, and has been contrasted with microfinance. Impact investors actively seek to place capital in business, harnessing the positive power of enterprise. Well socially minded investors, welcome to the new American Capital Formation ecosystem.

What is Title III? Title III is “Regulation Crowdfunding”, permitting individuals to invest in securities - based crowdfunding transactions subject to certain investment limits. The rules also limit the amount of money an issuer can raise using the crowdfunding exemption. The three core rules covered under Title III are Rules 147 and 504, and requiring Funding Portals to register with the Financial Industry Regulatory Authority.

How can Title III have a social impact? Issuers could use Title III rule 504 of Regulation D, also known as the “seed capital exemption”, as a bridge in the capital formation process, helping start-ups and small businesses seed a 506 (b) or (c) of Regulation D, or a Regulation A later stage Offering. Rule 504 can also help seed community based real estate developers on projects spurring economic revitalization in communities across the country.

Under rule 147 “intrastate crowdfunding”, is a federal exemption of securities only offered and sold to person residents within a single state or territory, where the actual sale was made, not where the offer was made, and now allows an issuer only to have its principal place of business in the state of the offering. Under Rule 147 an issuer could raise a maximum of $5 million in a twelve-month period, using rule 505.

Until October 30, 2015 only “accredited investors”, defined as individuals who own more than $1 million in assets, excluding their primary residence, or have maintained an income of more than $200,000 for at least two years to invest freely in Regulation D offerings and with no restrictions on the issuer.

The new rules under Title III allow people with modest income to invest, with limits in start-ups, small businesses and real estate projects raising not more than $1 million dollars over a 12 month period under rule 504. People with annual income or net worth less than $100,000 will be able to invest a maximum of their yearly income or net worth, or $2,000 if that is greater. Those with higher income can invest up to 10%, with a cap of $100,000 over a 12 month period.

Issuers raising up to $1 million dollars under rule 504 crowdfunding capital raise per year will have to provide investors details about their businesses, how they’ll use the money, a list of officers and directors, and disclose anyone who owns at least 20 percent of the company.

The House passed several bills aimed at economic revitalization November 2011, which included Small Company Capital Formation (H.R. 1070), Entrepreneur Access to Capital (H.R. 2930), and Access to Capital for Job Creators (H.R. 2940). On April 5, 2012, “The Jump Start Our Business Start-Up Act”, was signed into law. Title II 506 b and c, went into law September 2013, Access To Capital For Job Creators, Title IV, the new Regulation A, also known as the Small Company Capital Formation became effective September 2015, and Title III, Crowdfunding, which was passed by the Securities Exchange Commission October 30, 2015 becomes effective around May 6, 2016.

Sure most investors are looking for the next Facebook, Walmart or Home Depot, many will be looking to make that social impact investment. Community based real estate operators’ developing a project, and small businesses providing economic stimulation to communities may now use Title III as part of the issuer’s capital formation, and may plan for a Title II or Title IV capital raise if so choose.

I hope Funding Portal Company’s establish educational platforms and become advocates and promoters of what the Jobs Act intended for issuer’s, “access to capital” and to give all investors the opportunity to make a difference in this new American Evolution of the capital formation industry.

Funding Portal’s should also consider educational forums to provide free no cost education, helping stakeholders both small businesses and investors become real contibuting members to our new capital formation industry, and build communities and economies.

About the Author:

Richard Caldwell is a 20 year real estate professional and entrepreneur with formal education in real estate; and extensive experience in real estate finance, real estate development, asset management, and construction. A Co-Founder of several successful real estate investment and development start-ups and ventures between 2000 and 2010; before Founding, R.K. Caldwell Inc. in 2010.

Richard Caldwell is Founder and CEO, and is working with an experienced team, re-launching its vision in 2014, as a corporate real estate service company providing real estate investments, asset management and an investor and funding portal.

R.K. Caldwell’s Funding and Investors Portal is set to open January 2016. The Company will provide continued education on capital formation using Title II, Title III and Title IV to investors and interested issuers.

Follow and share R.K. Caldwell Inc. on twitter, facebook or visit us at www.rkcaldwell.com to learn more.

0 notes

Photo

#RevampingNewarkNJ Technology advancement brings live imagery into the planning room. Being examined is existing conditions of area/height, as we plan development of a 5 story new construction building.

0 notes

Photo

Working with team members of R.K.Caldwell, development planning at its best in the City of Newark #RevampingNewarkNJ #socialimpactinvesting.

0 notes

Text

Thanks to the “Jobs Act”, no need to be stultified by traditional sources!

Real estate investing is central to community revitalization, economic development and job creation. More than 10 years, I’ve been involved as an advocate, promoter and developer of community revitalization and economic development projects. As a real estate developer, I worked in conjunction with various municipal agencies for the purpose of revitalizing communities and neighborhoods for safe and clean housing, and commercial districts.

The Jobs Act was born April 5, 2012 giving control to the people! Thanks to section 401 (Title IV) Regulation A of the Jump Start Your Business Start Ups Act (JOBS), adding section 3(b) (2) to the Securities Act of 1933 really transformed capital formation. Title IV was finally adopted March 25, 2015, and Implemented June 19, 2015, social impact investing no longer had to be stultified by traditional forms of financing not wanting to invest needed equity capital or small businesses carrying such burden gaining access to capital.

Title IV increased the flow of capital through Regulation A to real estate operators and small businesses from $5 million to a two Tier system, Tier 1 $20 million offering in a twelve-month period to accredited investors only, and Tier 2 $50 million in a twelve-month period to both non-accredited and accredited investors. Non-accredited investors are limited to 10% of the greater of the annual income and net worth for individuals or 10% of revenue or net assets for business entities.

About the Author:

Founder and CEO of R.K. Caldwell Inc. continues to advocate and promote social impact investing. “Our Real Estate Private Equity will continue to seek investment opportunities in housing, retail, and office, while fostering jobs”.

You can subscribe to our mailing list by clicking on http://eepurl.com/bA_1qz to be informed of our Regulation A “mini-public offering” or to subscribe to RKC’s equity crowdfunding community.

Follow us and share us on Facebook, Twitter or www.rkcaldwell.com

0 notes

Photo

R.K. Caldwell acquisition to be part of redevelopment in Newark NJ #revampingnewarknj

0 notes

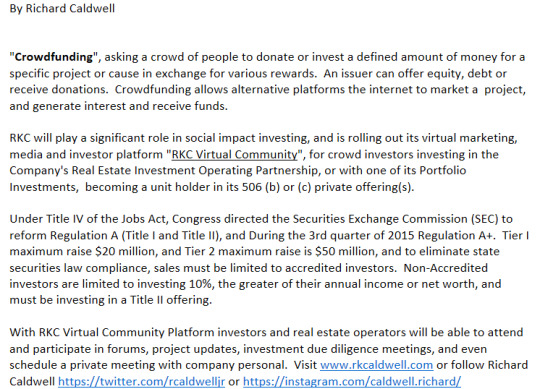

Text

What is Crowdfunding, and How is R.K. Caldwell using it as a direct issuer?

0 notes